| eToro Minimum Deposit Summary | |

|---|---|

| eToro Minimum Deposit | $50 (AUD 80) |

| Deposit Methods | Bank Transfer |

| Account Types | One Retail Account and One Islamic Account |

| Deposit Fees | No Fees |

| Account Base Currencies | USD |

| Withdrawal Fees | All withdrawals from eToro attracts $5 transaction fees |

| Visit eToro | |

eToro’s minimum deposit in Australia is $50 (AUD 80). It does not matter if you are trading or investing. That is all you need to open a retail account with eToro.

eToro also have a professional account with different minimum deposit requirements. In this article, we will be covering eToro’s trading accounts briefly to see their trading conditions.

How Much is eToro Minimum Deposit in Australia?

In Australia, you need $50 (AUD 80). However, it might also vary by account type. eToro has three distinct account types that you can open. We covered these accounts extensively in our eToro review.

Here is a brief summary.

1) Retail Account

The minimum deposit for eToro’s retail account is $50 (AUD 80).

This is the default account you open with eToro. It is for CFD trading. The retail account allows you to trade different markets like currency pairs, stock CFDs, ETF CFDs, commodities, and indices.

Thought eToro offers crypto CFDs, it is not available for retail CFD trading in Australia. You will not pay any extra commission when you open or close your positions.

For major FX pairs, the spread begins at 1 pip.

2) Professional Account

This is an account for traders who are seasoned and trade in high volumes. All CFDs are available for this account including cryptocurrencies.

You can hold a Professional Account if you meet certain requirements listed below:

-You must have worked in the financial services sector for a minimum of 1 year.

-Your financial portfolio must be more than €500,000 or the AUD equivalent.

-You must have completed at least 10 high volume trades each quarter during the last 12 months.

If you meet at least two of these three conditions, you can upgrade to a professional account if you hold a retail account.

eToro’s professional traders do not have to pay any commissions.

3) Islamic Account

eToro offers an Islamic account that complies with the Shariah law. The minimum deposit for eToro’s Islamic Account is $1000 (AUD 1,518).

On this account, you will not pay or receive interests in accordance with the Islamic faith. Instead of paying overnight fees, your overnight positions will be subjected to administrative fees.

You will not pay any fees or commissions on account management.

Other than the higher minimum deposit and zero swap, all trading conditions including spreads remain the same.

Note: CFD trading is risky

4) eToro Demo Account

This account has no minimum deposit. It is to help you practise and hone your trading skills. eToro gives you $100,000. This account will be your virtual portfolio and you can switch between it and your real portfolio.

eToro Deposit Methods and Required Fees

eToro supports only USD base account currency. You can fund your account in non-USD currencies (e.g. AUD). However, you will have to pay eToro’s conversion fee.

Here are the funding methods supported by eToro for Aussie traders. You will not pay deposit fees for any of these methods.

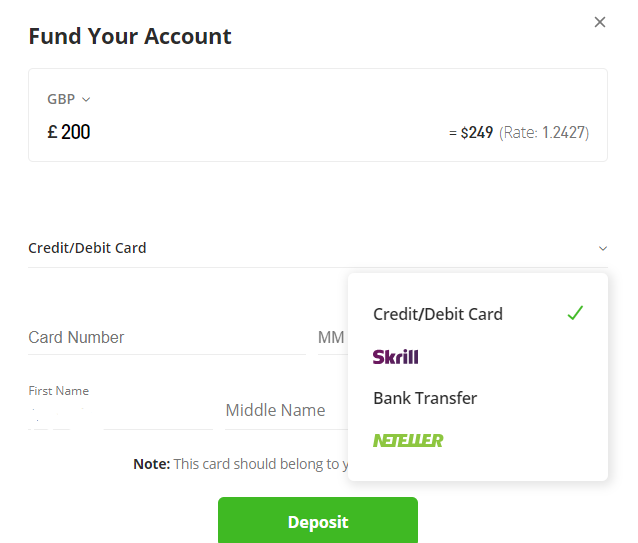

1) Credit/Debit card:eToro accepts credit/debit cards issued by MasterCard, Visa, and Maestro. Your funds should reflect in your eToro account within minutes. If your funding is not accepted, eToro will send a notification to your email.

2) Bank transfer: eToro allows deposit from banks. You will be required to send a screenshot of your transaction receipt to eToro’s customer care to confirm your payment. Your deposit will be credited to your account in 4-7 days.

3) E-wallets: Skrill, Neteller, and PayPal are the only electronic wallets supported by eToro. Your trading account will be credited within minutes.

Note: All withdrawals from eToro attracts $5 transaction fees from the broker. For deposits, intermediary banks or card issuer might charge a commission when you fund your account. eToro charges zero deposit fees.

eToro Deposit Terms

There are different information needed for each deposit method. Here is what you should know about funding via cards:

1) eToro only accepts debit cards that can receive funds and have a CVV code.

2) The credit/debit card must belong to you. eToro will not accept third-party payments.

For bank transfer, here is what you should know:

3) Your trading account will be credited when eToro’s bank confirms your deposit.

4) If you fund your account in a non-USD currency, your funds will be converted based on eToro’s conversion rate for the day.

5) Your funding might not be approved via e-wallets for different reasons. In this case, you will be notified by eToro via email.

How to Deposit Money Into Your eToro Account

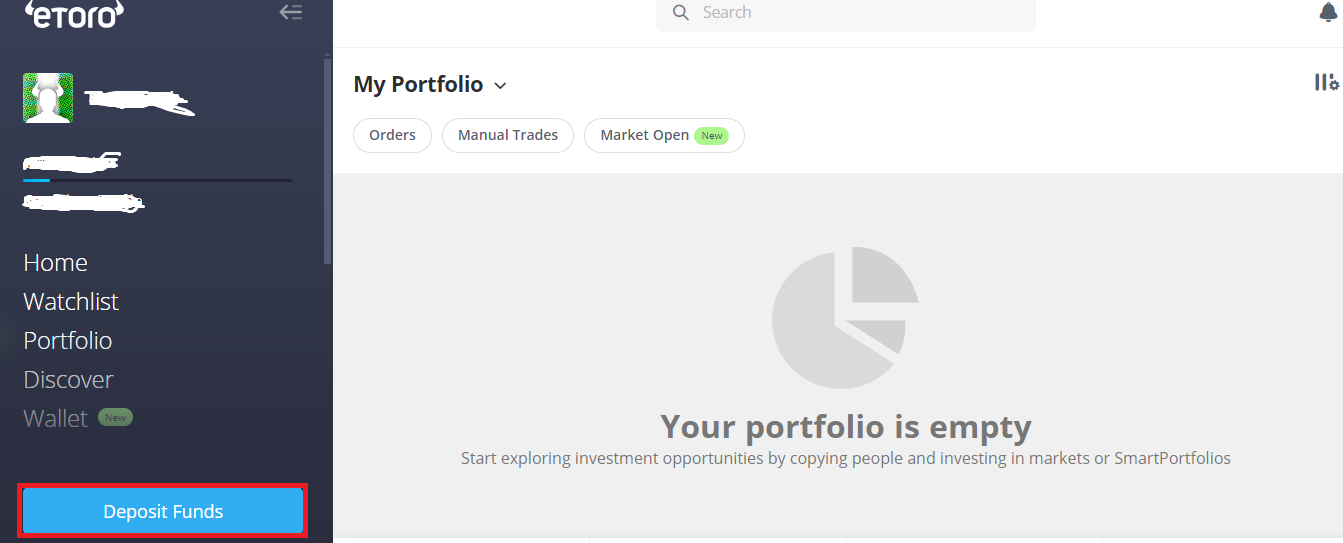

1) Log in to your eToro investment platform.

2) Click ‘Deposit Funds’ on the left hand side (highlighted red).

3) Enter the amount and your preferred currency. eToro will automatically convert your AUD deposit into USD on your trading account.

4) Select the method of payment from the dropdown menu.

Comparison Of eToro Minimum Deposit With Other Brokers

Here is how eToro fares when you compare their minimum deposit with other selected forex brokers that accepts Australian traders.

| Broker | Minimum Deposit |

|---|---|

| eToro | $50 (AUD 80) |

| FXCM | AUD 50 |

| CMC Markets | AUD 0 |

| Vantage Markets | AUD 200 |

| AvaTrade | AUD 100 |

| OANDA | AUD 0 |

What is eToro Recurring Minimum Deposit?

eToro allows you to create an automatic system where you regularly add money to your eToro investment account. You can make customized payments through your credit/debit card.

You determine your deposit amount, frequency, currency, and the day you want to deposit. You can only create one recurring deposit plan. To make any changes, you will need to cancel your initial plan.

Note: CFD trading is risky

What are the base currencies accepted by eToro?

eToro’s platform runs on USD only. You can fund your account in your local currency and it will be converted to USD in your trading/investment account.

What is the minimum withdrawal for eToro?

You need to have at least US$30 of available free cash in your account to withdraw from eToro. If you do not have enough funds in your account, you can free up funds in pending orders or open positions.

Frequently Asked Questions

What is the minimum deposit on eToro Australia?

The minimum deposit for eToro Australia is $50 (AUD 80). Islamic Account has a minimum deposit of $1000 (£795). The pound equivalent may change based on eToro’s exchange rate.

How much can I deposit on eToro?

Transaction limit is determined by your funding method. For debit cards as example, you cannot exceed $40,000 per transaction. All deposits via Bank Transfer must be at least US $500 (AUD 758).

Can I invest $10 in eToro?

Investing with eToro begins from $100. In Australia, you need $50 to open a trading account.

How much does eToro deposit cost?

eToro charges zero deposit fees. But intermediary banks, card issuers, or e-wallet providers might charge a fee every time you fund your account

How safe is eToro Australia?

eToro is licensed with the Australian Securities and Investments Commission. Their registered name is ETORO AUS CAPITAL LIMITED.

Note: Your capital is at risk