Most forex & CFD brokers in Australia support the MetaTrader 4 Trading Platform. It is the most popular trading platform in the world. It was developed in 2005 by MetaQuotes and is still one of the most popular platforms for charting & placing orders with traders after 15+ years.

In this guide, we will cover the MT4 brokers in the UK that we consider to be safe. In addition, we will answer some frequently asked questions about these MetaTrader 4 brokers.

To gather the list of these MT4 brokers, we looked at different factors such as the number of instruments offered, execution speed, and trading costs. We also considered their regulation with ASIC to know if they are safe to trade with or not.

Comparison of Best MT4 Brokers in Australia

| Forex Broker | Regulation | Maximum Leverage | Minimum Deposit | |

|---|---|---|---|---|

| Pepperstone |

ASIC, FCA

|

1:30

|

AUD 0

|

Visit Broker |

| FP Markets |

ASIC, CySEC

|

1:30

|

AUD 100

|

Visit Broker |

| IG Markets |

ASIC, FCA

|

1:30

|

AUD 10 (BPAY)

|

Visit Broker |

| AvaTrade |

ASIC, FSCA, FSA, FSC

|

1:30

|

AUD 100

|

Visit Broker |

| Capital.com |

ASIC, FCA, CySEC, NBRB, FSA

|

1:30

|

AUD 20

|

Visit Broker |

5 Best MT4 Brokers Australia

Here are the five brokers that made our list of best MT4 brokers in Australia for 2023:

- Pepperstone – MT4 Broker with Low Spreads

- FP Markets – Regulated MT4 broker with Raw ECN Account

- IG Markets – Reputed CFD Broker with MetaTrader 4 Platform

- AvaTrade – Best MT4 Broker with Zero Commissions

- Capital.com – Best MT4 Broker for Beginners

Now we’ll go ahead and review these MT4 brokers in detail.

#1 Pepperstone – MT4 Broker with Low Spreads

With Pepperstone deposits are immediate except for bank transfers, which can take up to 3 working days. Withdrawal via bank transfer can take up to 3-5 working days.

Regulation: Pepperstone is regulated with ASIC as Pepperstone Group Limited with AFSL number 414530. They are currently authorized to accept traders from Australia. and they hold a current licence. We consider Pepperstone a low-risk broker.

Minimum deposit: Pepperstone recommends a minimum deposit of AUD 200 for traders to open a forex trading account. However, they do not enforce this.

Spreads for major pairs: Pepperstone offers 0.77 pips average spread for EUR/USD. For AUD/USD, the average spread is 0.84 pips. This spread is for the Standard Account

The number of instruments: With Pepperstone, You get to trade 60+ currency pairs, 20+ stock indices, 900+ stocks, 100+ ETF CFDs, 20+ commodities, and 3 currency indices.

Leverage for forex: Retail traders get maximum leverage of 30:1 for forex trading. Professional traders are offered up to 500:1 leverage.

Deposit/Withdrawals: Pepperstone has four deposit methods: Visa, Mastercard, POLi, Bank transfer, BPay, PayPal, Neteller, Skrill, and Union Pay. Withdrawals via bank transfer can take up to 3-5 working days. Also, unexpected circumstances can extend withdrawal time.

Pepperstone Pros

- You can build and run your EAs on MQL4

- Autochartist is available. This tool helps you identify key price structures on your charts.

- Hedging is available

- Pepperstone’s Smart Trader Tools helps you access more indicators and EAs.

- No inactivity fees

Pepperstone Cons

- Shares CFDs are not offered on Pepperstone MT4

#2 FP Markets – Regulated MT4 broker with Raw ECN Account

FP Markets offer a Raw ECN Account and a Standard Account. Both accounts are available on MetaTrader 4.

Regulation: FP Markets is regulated with ASIC as First Prudential Markets Pty. Limited with AFSL number 286534. Their license is current so they accept Australia-based traders. We consider FP Markets low risk to trade with.

Minimum deposit: FP Markets’minimum deposit is AUD 100. This applies to their Raw ECN and Standard Accounts.

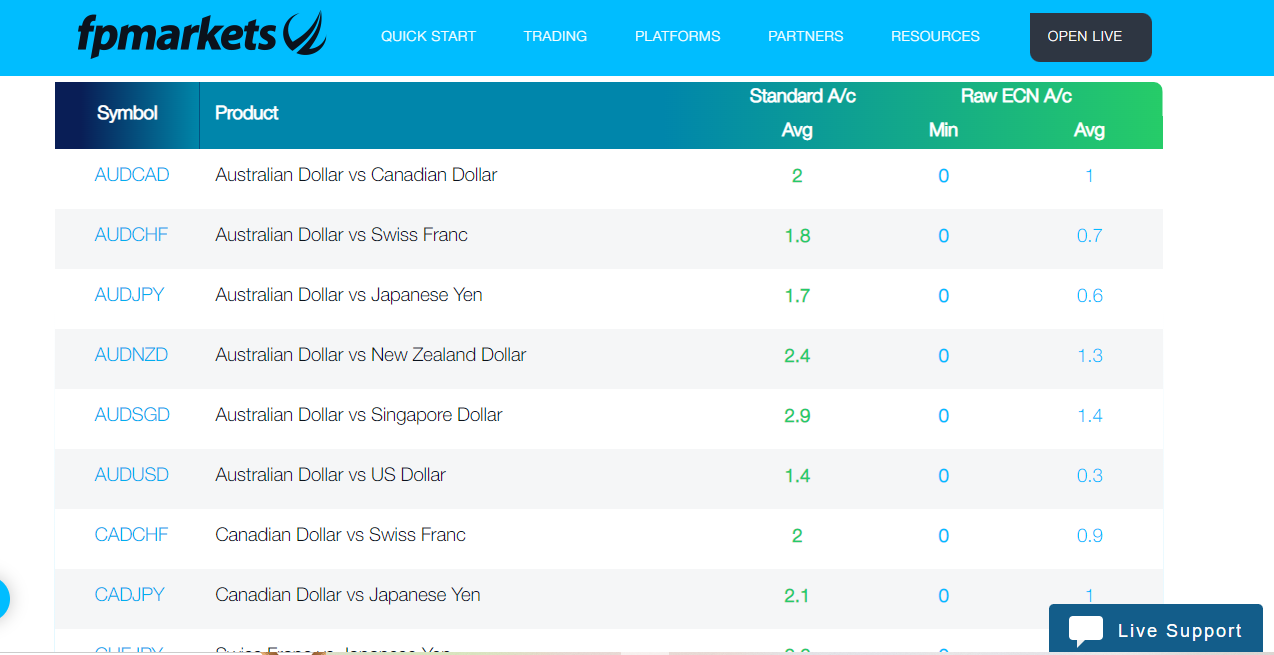

Spreads for major pairs: FP Markets offer 1.3 pips average spread for EUR/USD. For AUD/USD, the average spread is 1.4 pips. This spread is for FP Markets’ Standard Account

The number of instruments: With FP Markets, you get to trade 60+ currency pairs, 13 indices, 63 shares, 6 metals, 11 commodities, and 11 crytocurrencies. All are offered as CFDs

Leverage for forex: Retail traders get maximum leverage of 30:1 for forex trading. Professional traders are offered up to 500:1 leverage.

Deposit/Withdrawals: You can deposit/withdraw funds via credit/debit card, bank transfer, Neteller, Skrill, and dragonpay. Funding is instant. Withdrawals can take up to 1-5 days depending on the method you choose

FP Markets Pros

- Execution model on MT4 is ECN pricing

- Fast execution (under 40 milliseconds)

- There is Autochartist for identifying real-time setups

- FP Markets’ MT4 Traders Toolbox helps you access valuable market insights.

- You can connect your MT4 to Myfxbook for copy trading. This is enabled via myfxbook.com’s AutoTade system.

FP Markets Cons

- Limited number of shares CFDs

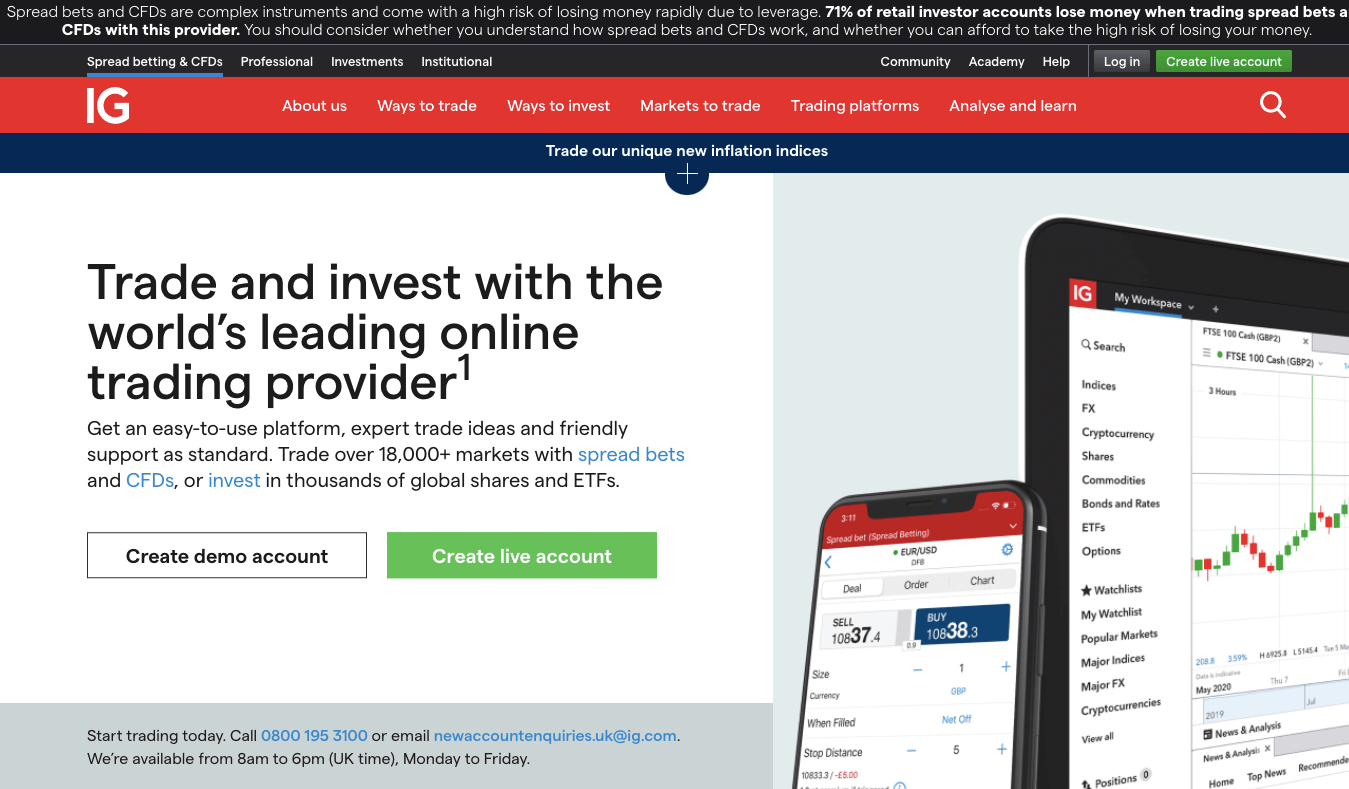

#6 IG Markets – Reputed CFD Broker with MetaTrader 4 platform

With IG Markets PayPal transactions are usually within one working day for withdrawals. Card and bank transfers can take up to 3-5 working days.

Regulation: IG Markets are regulated with ASIC as IG Australia Pty Limited. Their AFSL number is 515106 and their licence status is current. We consider IG Markets low-risk for Aussie traders.

Minimum deposit: It all depends on your deposit method. If you use BPAY, the minimum deposit is AUD 10. For PayPal and credit/debit card, AUD 450. No minimum deposit is enforced for EFT and international transfers.

Spreads for major pairs: IG Markets offer 1.01 pips and 1.00 pips as the average spreads for AUD/USD and EUR/USD respectively.

The number of instruments: IG Markets lets you trade up to 17000 markets. You get to trade

50+ currency pairs, 6 commodities, 8 stock indices, and a whopping 13000+ shares. Other markets include ETFs, bonds, options, and interest rates.

Leverage for forex: Maximum leverage for retail traders is 30:1. Pro Traders can leverage up to 500 times.

Deposits/Withdrawals: You can deposit your funds using any of these three methods: credit/debit card, PayPal, BPAY, and EFT. For withdrawals: credit/debit card, bank wire transfer, PayPal, and EFTs. The minimum withdrawal for cards, PayPal, and bank transfers is AUD 200. If your balance is less than AUD 200, you can withdraw any available amount.

IG Markets Pros

- You can build and run your EAs on MQL4

- Automated trading is available

- Autochartist is supported.

- 12 free add-ons. It includes correlation trader, sentiment trader, etc.

- Guaranteed stop loss orders

IG Markets Cons

- Shares CFDs are not available on IG Markets MT4

#4 AvaTrade – Best MT4 Broker with Zero Commissions

AvaTrade processes withdrawals within 24-48 hours with cards and e-wallets. Bank transfer can take up to 10 business days to reflect in your account. Credit/debit cards can take up to 5 business days

Regulation: AvaTrade is regulated with ASIC as Ava Capital Markets Australia Pty Ltd. Their licence status is current with AFSL number 4066840. AvaTrade is low-risk to trade with

Minimum deposit: You can open an AvaTrade account with a minimum of AUD 100.

Spreads for major pairs: AvaTrade’s spread for AUD/USD and EUR/USD are 1.1 pips and 0.9 pips respectively.

The number of instruments: You get to trade 55 currency pairs, 18 commodities, 5 energies, 17 commodities, 600+ stocks, 32 stock indices. Some of these CFDs are not available in MT4. For example, only 20 stock indices are available on MT4 out of 32.

Leverage for forex: Maximum leverage for forex trading is 30:1.

Deposit/withdrawals: AvaTrade allows deposit/withdrawal via credit/debit cards, Skrill, Neteller, POLi, and bank wire transfer. E-payments are processed within 24 hours while bank transfers can take up to 10 business days. The same applies for withdrawals except for cards (5 business days).

AvaTrade Pros

- MT4 is available on multiple devices

- Algorithmic trading via Expert Advisors

- Hedging is permitted

- AvaTrade MT4 has Guardian Angel that helps improve your trading skills. It is free.

- MT4 is available on old windows versions like Vista.

AvaTrade Cons

- Inactivty fee

- Limited number of indicators

#5 Capital.com – Best MT4 Broker for Beginners

Capital.com offers MetaTrader 4 with education for beginners, intermediate, and advanced traders.

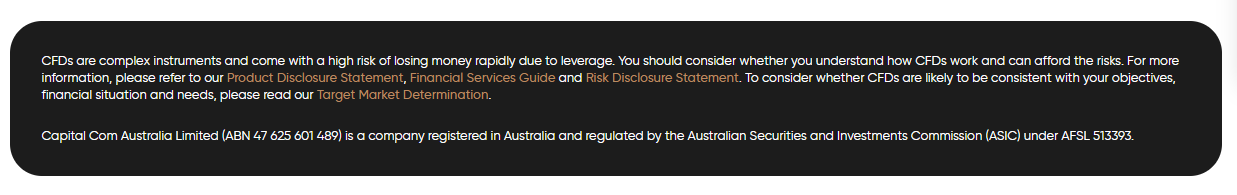

Regulation:Capital.com is regulated with ASIC as Capital Com Australia Limited. They are licenced to accept Australia-based traders with AFSL number 513393. We consider Capital.com low risk to trade with.

Minimum deposit: You can open a trading account with a minimum of £AUD 20.

Spreads for major pairs: Capital.com’s spread for AUD/USD and EUR/USD is 0.6 pips.

The number of instruments: 138 currency pairs CFDs, 33 commodities CFDs, 37 indices CFDs, 115 ETFs CFDs, and 27 crypto CFDs are offered by Capital.com

Leverage for forex: Maximum leverage for forex trading is 30:1.

Deposit/withdrawals: You can deposit/withdraw funds via POLi, bank transfers, Apple Pay. The minimum withdrawal amount is AUD 10 except for bank cards.

Capital.com Pros

- Low minimum deposit

- Automated trading is available

- Market trading signals are supported

- Deposit/withdrawal fees are covered

Capital.com Cons

- No add-ons on Capital.com’s MT4

What is MetaTrader 4?

MetaQuotes developed the MetaTrader 4 in 2005. It is designed for futures and Forex trading. MetaTrader 4 allows a trader to analyze the financial markets and use expert advisors. It also supports copy trading.

The platform has a good trading system that supports instant execution and market orders. It also supports buy limit order, sell limit order, sell stop order, buy stop order, 2 stop orders, and trailing stop loss. The combination of these functions allows you to be flexible with your trading strategies.

MetaTrader 4 also supports tools that help your technical analysis. These tools, which include 30 indicators and 24 graphic objects, are built-in. You do not need to install them, Moving averages, relative strength index, stochastic, trendlines, Fibonacci tools, and more are available for thorough technical analysis.

Most MT4 brokers offer a trading platform across different devices and operating systems. You can download your broker’s MT4 platform and install it on your PC. You can also use the platform on your mobile phone (android or iOS). In addition to these, there is also the MT4 web trading platform that you can access via your broker’s website.

What are MetaTrader 4’s Best Features?

The platforms we have discussed above use MT4 as a third-party platform. They integrate well with it. However, it is important to know why most of these brokers chose to integrate with MT4.

Timeframes: MT4 has multiple timeframes. They range from 1 minute to a month. This makes it suitable for different traders and trading strategies (swing trading or day trading).

Multiple Devices: MT4 is available for use on desktops (software or web trader), mobile phones (as apps on Android or iOS), and tablets too. The advantage here is that you can be flexible. You can check your trade on the go via mobile apps. Furthermore, you can use the desktop version if you want a better view of the market for better analysis.

Indicators: MT4 is loaded with indicators that you can use for technical analysis. There are trend indicators and oscillators that help you predict future price movements. Even better, you can edit the properties of these indicators and customize them to your trading strategies.

Expert Advisors: Also known as EAs, expert advisors are trading robots. They were developed by MetaQuotes in MetaQuotes Language 4m(MQL4). You can use these robots to ultimate your analysis and opening/closing of your trades.

Price Alerts: You can adjust the settings on MT4 so you can receive price alerts. This feature comes in handy if you’d love to check your charts at a specific price point. The alert feature also helps you stay updated on latest happenings in the market.

Customizable interface: MT4 allows users to personalize their workspace by adding custom indicators, templates, and other add-ons.

Charting: MT4 offers a comprehensive set of technical analysis tools and indicators, allowing users to analyze market trends and make informed trading decisions.

Order execution: MT4 supports various order types, including market orders, limit orders, and stop-loss orders, providing traders with greater control over their positions.

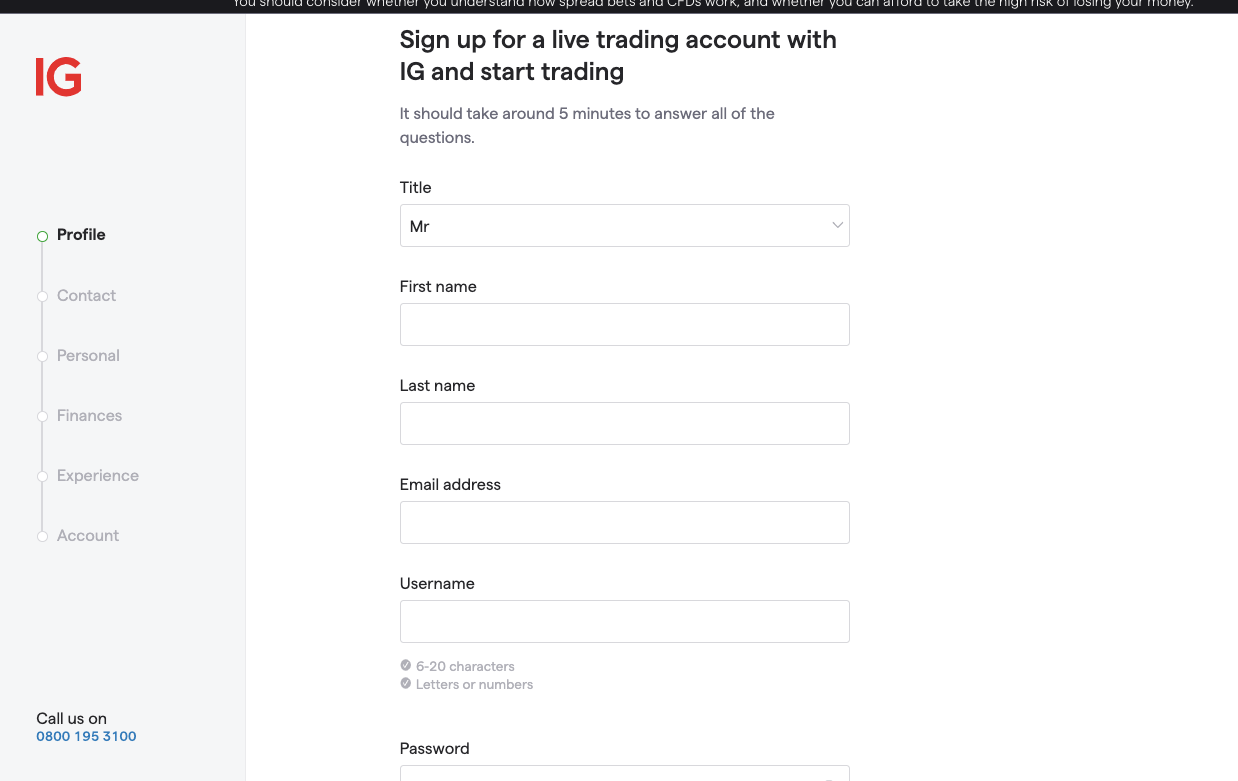

How To Sign Up with an MT4 Broker

This section covers how you can start with an MT4 broker in easy and simple steps. We will be using IG Markets as our example. You can expect all MT4 brokers in the UK to have similar steps. Let’s go.

1. Go to IG’s website and click on ‘create live account’ at the top right corner of the homepage.

2. A form will appear on the next page. Enter your name and email address. You will also create your username and password. Click on ‘Next’ when you have done this.

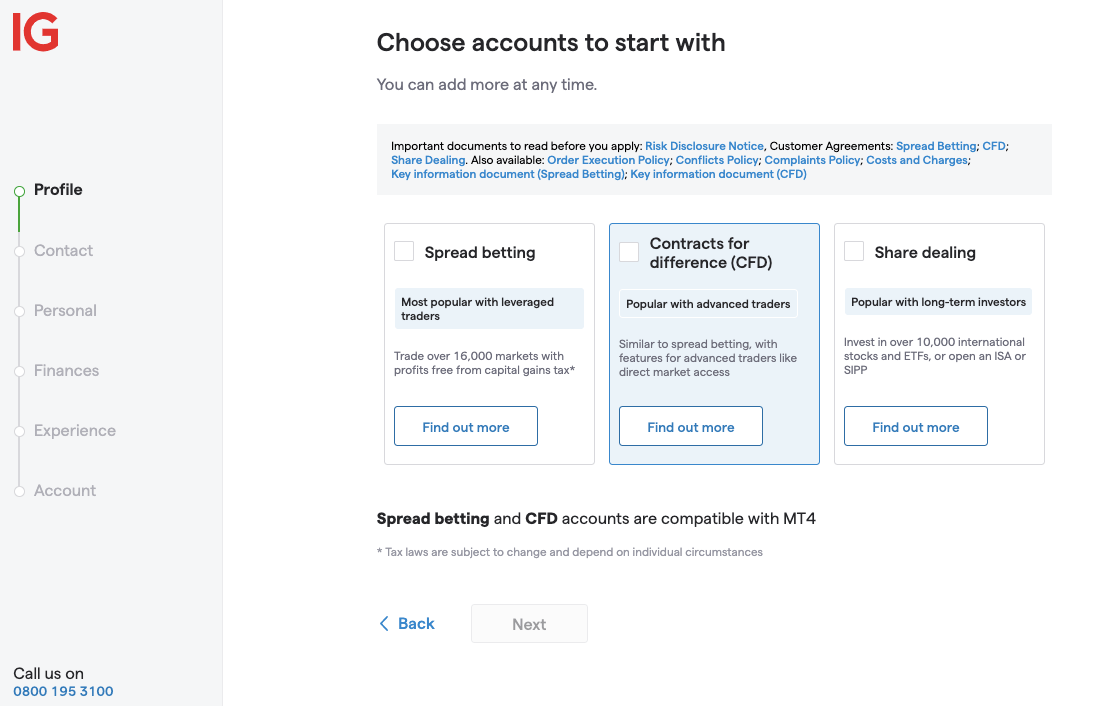

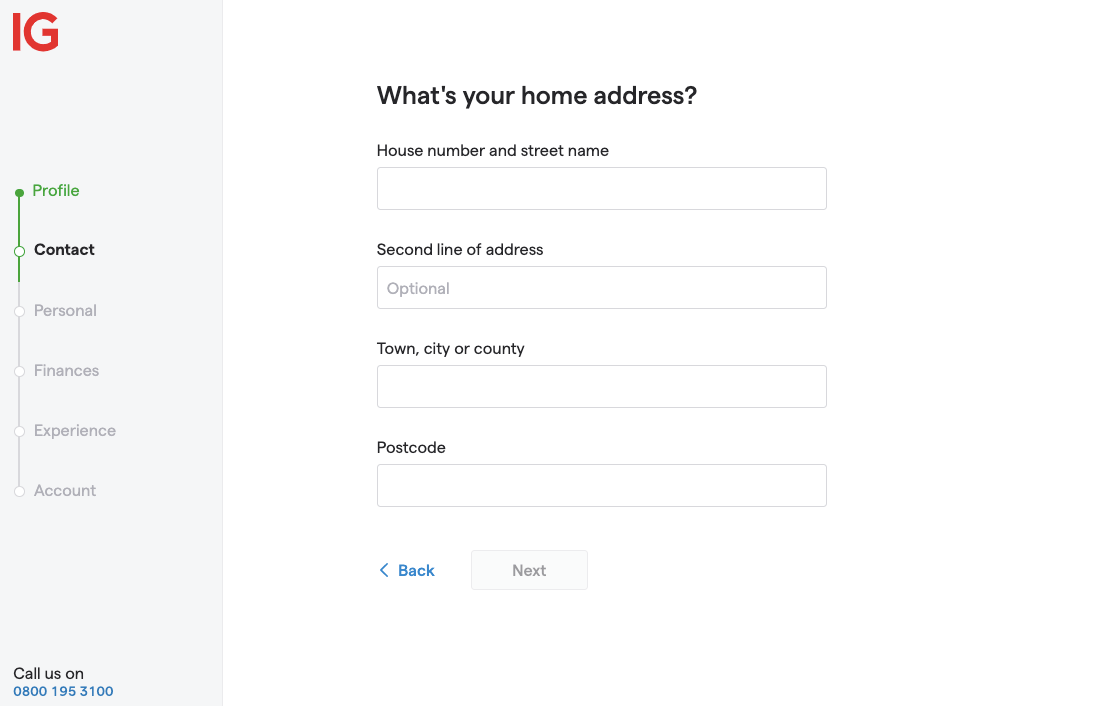

3. Select your account type and click on ‘Next’ to proceed

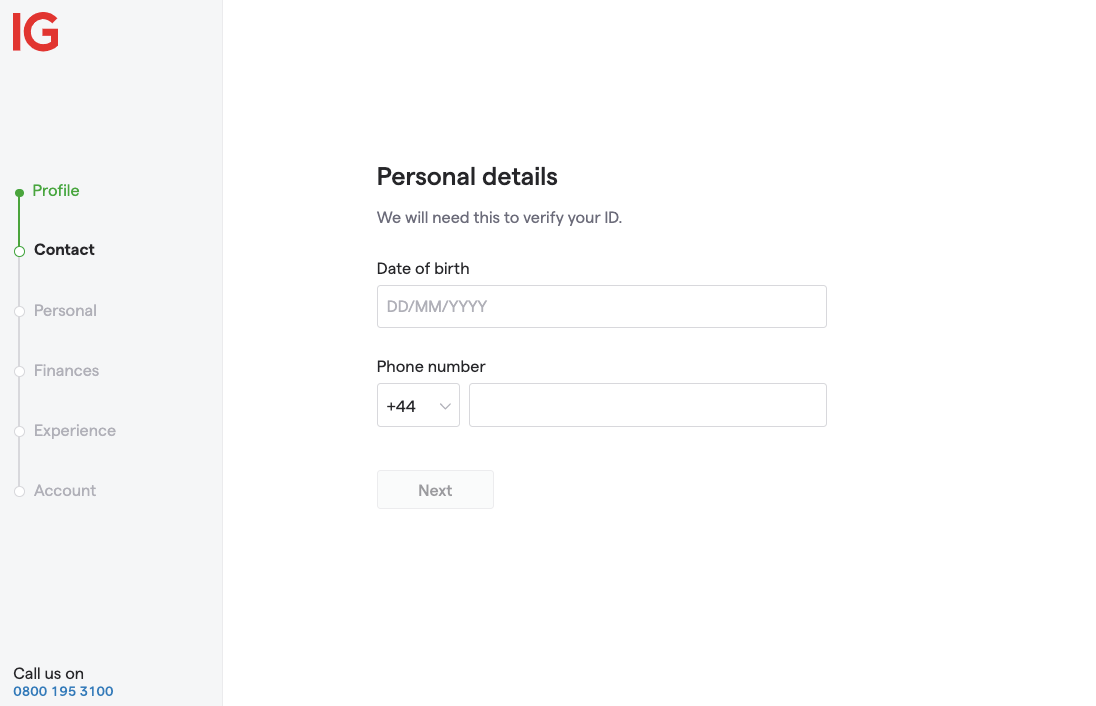

4. Supply more personal details. Your date of birth, address, nationality, and national insurance number will be required here. Then click ‘Next’.

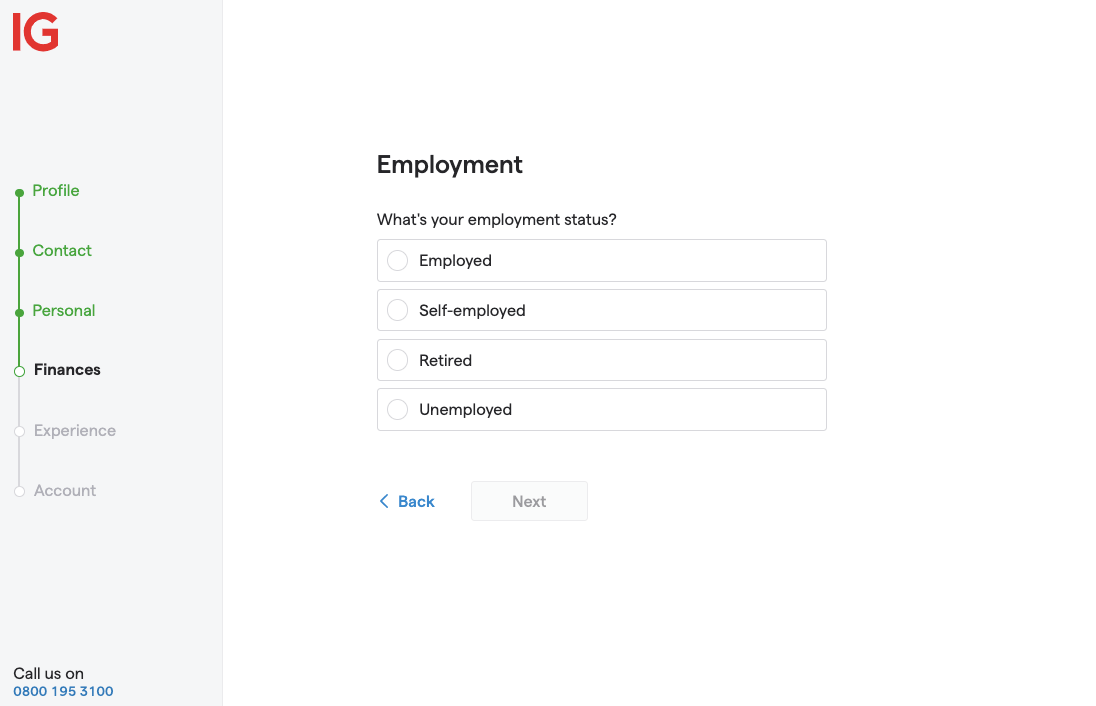

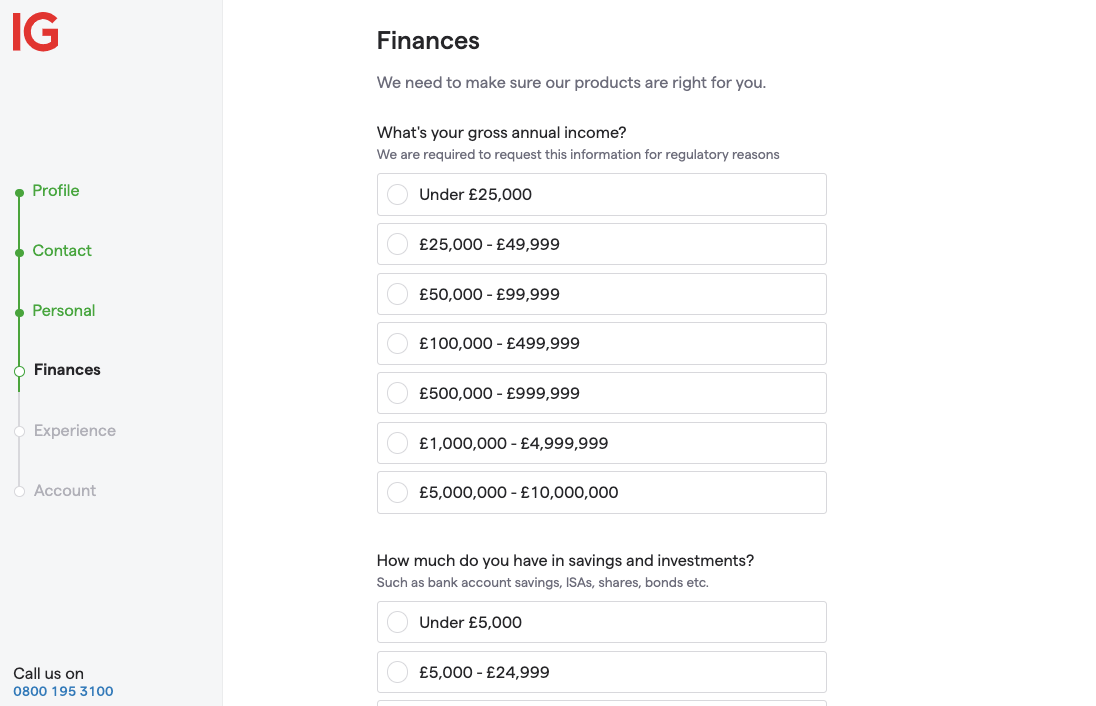

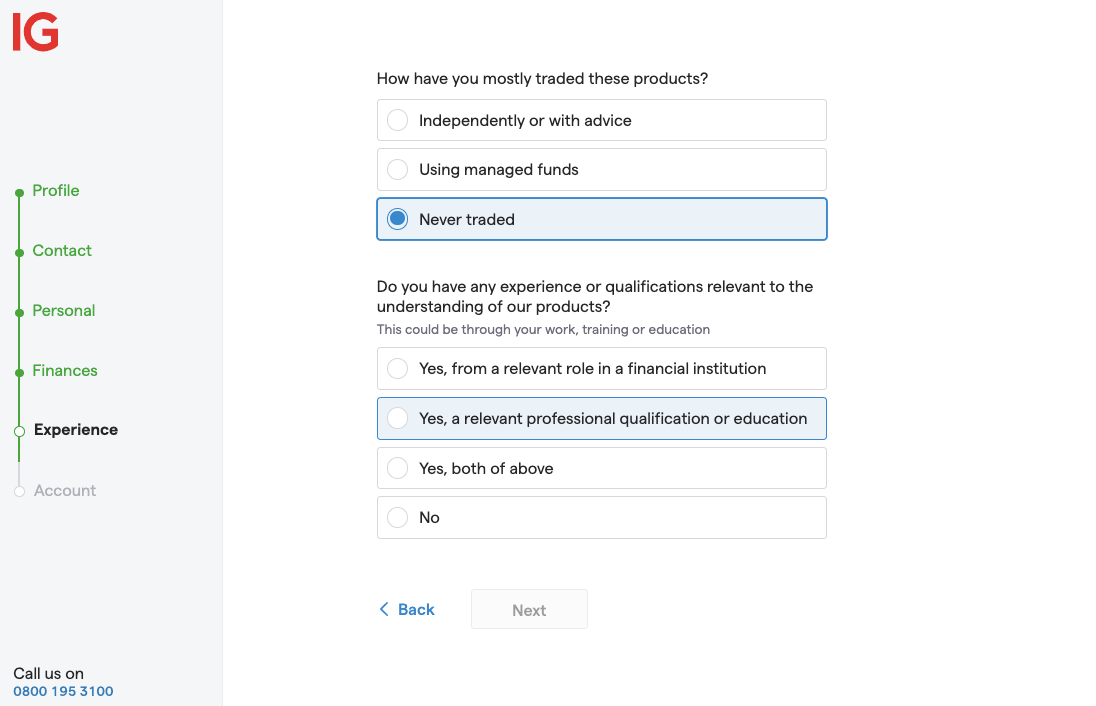

5. Answer all the questions that follow. They are based on your employment, financial status, and trading experience. Click on ‘Next’ when you have answered all questions.

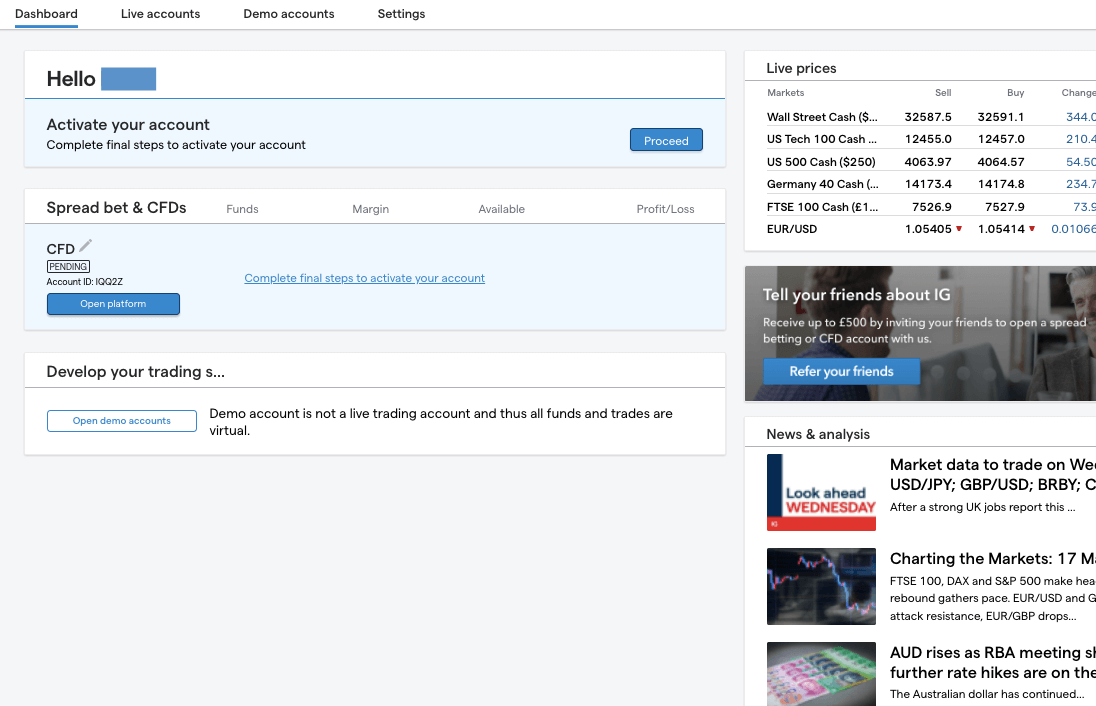

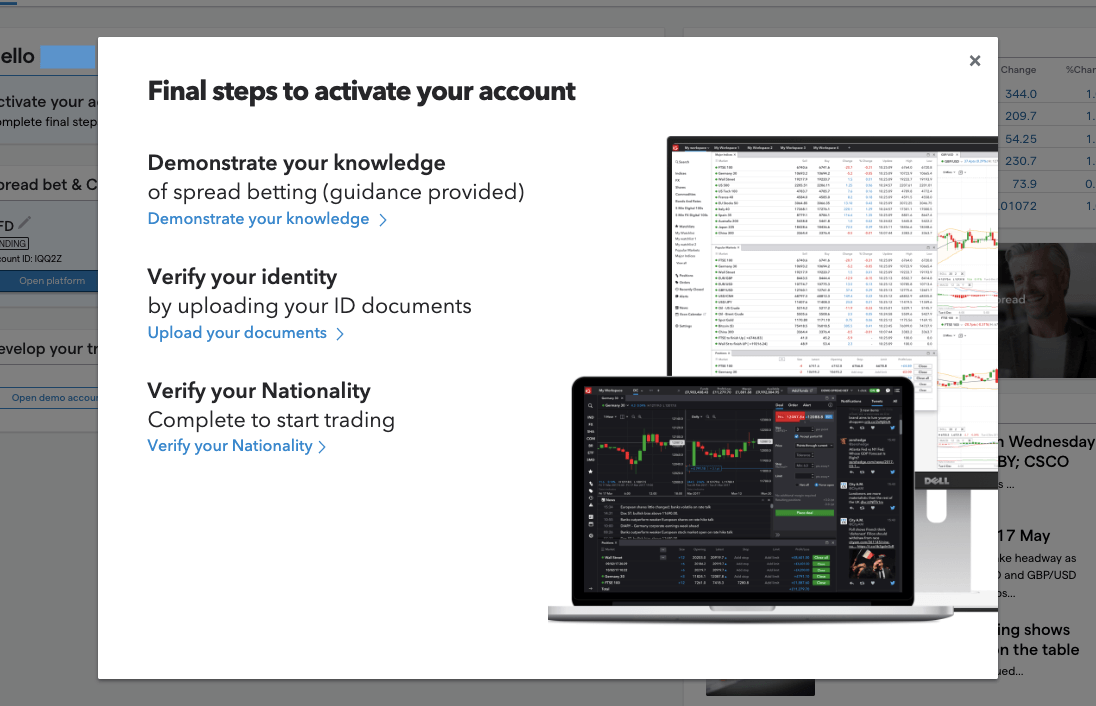

6. Check the terms and conditions box to confirm your agreement. Click on ‘Get Started Now’ on the next page. You will be redirected to the IG dashboard to proceed with your registration.

7. Click on ‘Proceed’ to complete the final steps and activate your account. Once, your account is activated, you can upload the required documents for your KYC verification.

How Do You Choose the Best MetaTrader 4 Brokers?

Since most forex brokers offer MT4, you need to know the factors that separate the best from the rest. These factors should be considered and carefully researched before choosing an MT4 broker, In this section, we will discuss the factors and how you can research them on your own.

1) Is the broker licensed to accept Australiabest mt4 broker-based traders

The Australian Securities and Investments Commission (ASIC) licenses brokers that cater to UK traders. ASIC licenses all the brokers in this review. It is important that you only trade with ASIC-regulated brokers. This is the only way to guarantee the safety of deposited funds. After you have confirmed a broker offer MT4, you should go ahead and verify if they hold an ASIC licence.

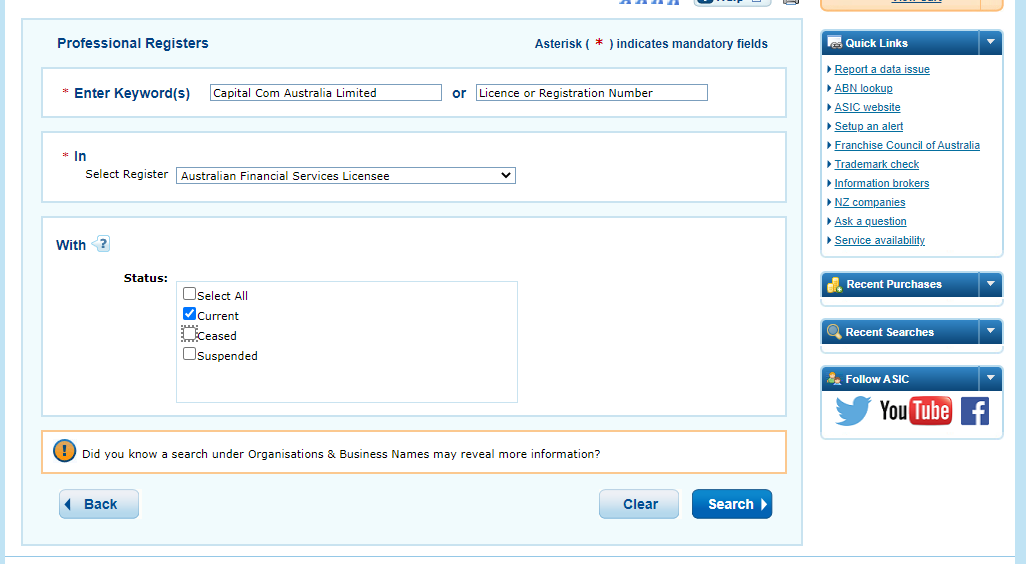

Here is how you to confirm it. Capital.com is our example. First, go to the broker’s website and scroll down to the footnote. You should find their regulation statement. What you should look out for here are their registered name and AFSL number.

From the image, you can see that the registered name is Capital Com Australia LImited with AFSL number 513393. These are the details you have to confirm with ASIC.

To do this, visit ASIC’s professional register You will arrive at the image below. Enter the broker’s name, select ‘Australia Financial Services License’, and ‘Current’ as displayed below. Click on ‘Search’

Your search result will bring multiple options but the broker’s name will stand out. Click on the broker’s name and you will arrive at the final result displayed below.

From the final result, you can see that the registered name and AFSL number are the same as displayed on Capital.com’s website. This is how you verify the regulation of any MT4 broker.

2) Trading Fees

Brokers make money off commissions, swaps, and spreads. Some brokers charge commissions on trades while some do not. Spreads can be high or low. The same thing applies to rollover charges (swaps).

Do not choose an MT4 broker without knowing the trading costs attached to the instruments you want to trade. Trading fees determine your final profits or losses. High trading fees lower profits and increase losses.

Go to your broker’s website or contact their support to know about trading costs. Ask as many questions as possible about their different fee types.

On the broker’s website, the trading costs of instruments are usually stated clearly. The table below shows FP Markets spread for some currency pairs.

Similarly, other CFD brokers will have similar pages where they list their spread, Swap (both Long & Short), commission, and other fees for every instrument.

3) Ease of Withdrawals & the Costs

It is important to consider the availability of local withdrawals with the attending costs. The MT4 brokers in this review allow you to withdraw funds to your account via bank transfer. Typically, you get your money between 3-5 business days. Only AvaTrade has a long duration (10 business days) for bank withdrawals.

In addition, they do not charge withdrawal fees. If you incur transaction fees when withdrawing, they will likely come from your bank or e-wallet vendor.

4) Number of Instruments

Generally, brokers will display the total number of CFDs they offer on their websites. However, not all of these CFDs are available on all trading platforms, especially MT4. For example, Pepperstone and IG Markets do not offer shares CFDs on their MT4. FP Markets have over 10.000 shares CFDs but offer only 63 on their MT4. For AvaTrade, their total number of indices is 32 but only 20 are available on MT4.

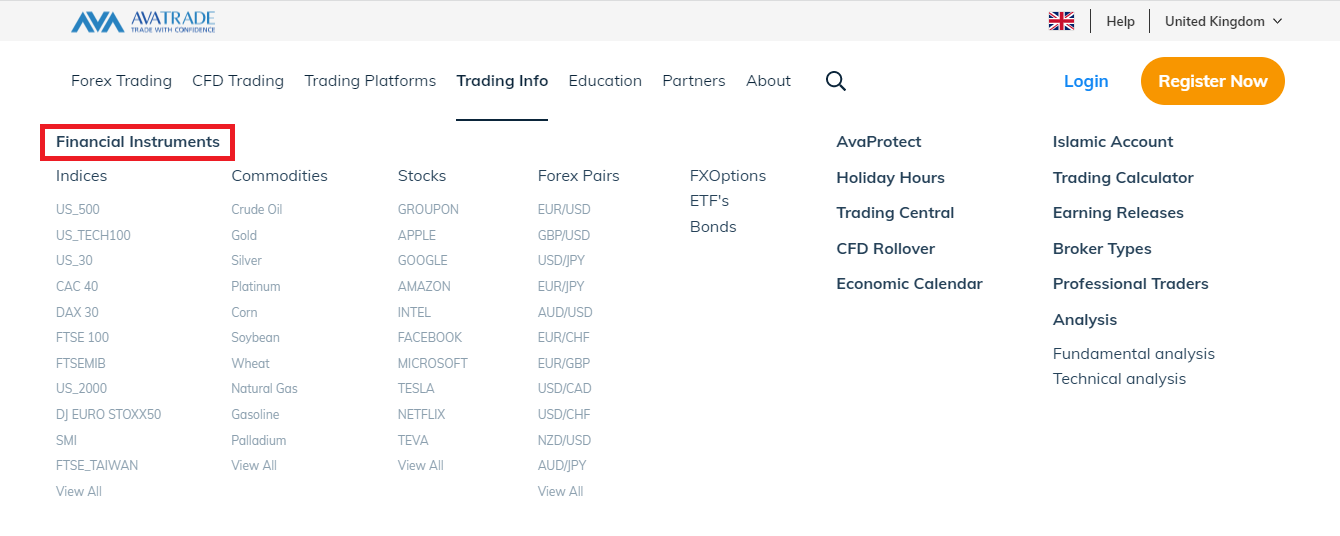

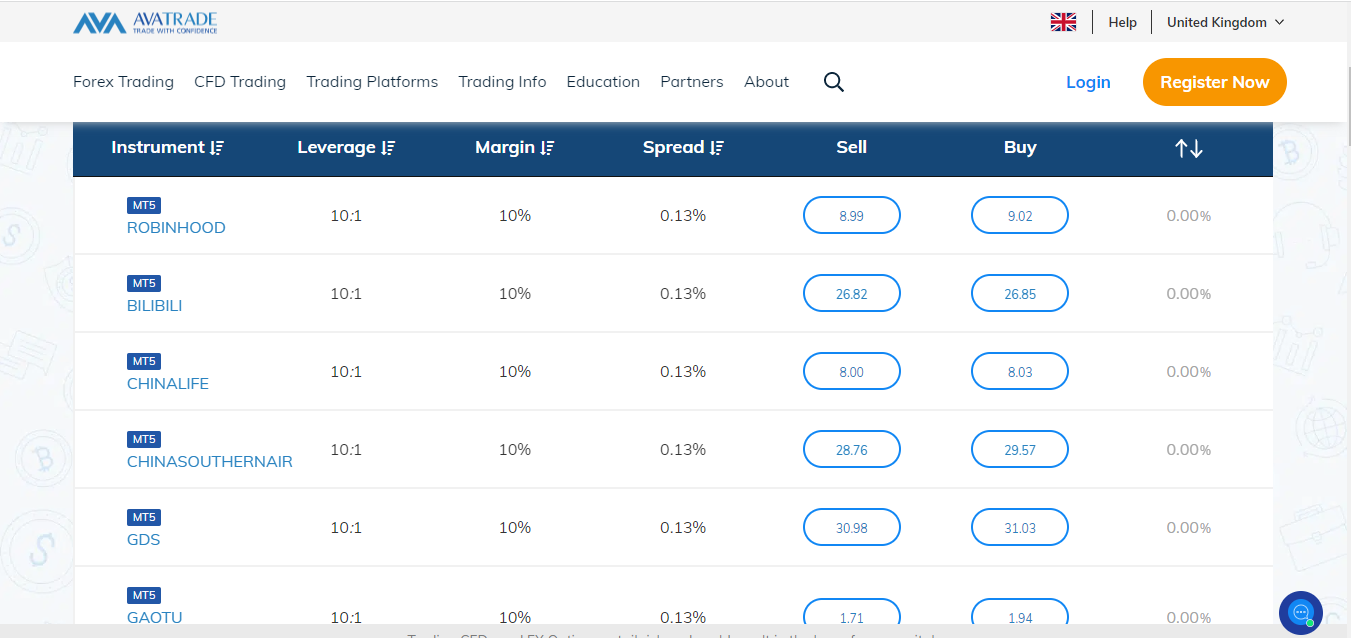

This is why it is important that you check the number of instruments offered in connection with MT4. Let us show you how you can check this with AvaTrade as an example. On AvaTrade’s Australian website, go to ‘Trading info’ and click on ‘Financial Instruments’ (in the red box).

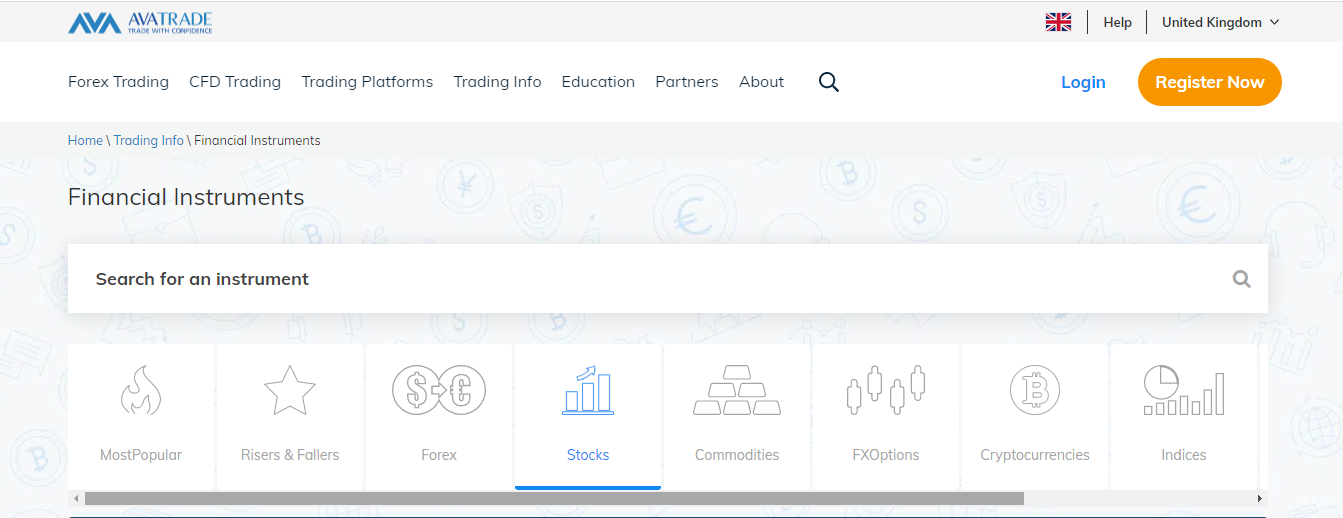

The first step will lead you to the page below. It is a tab displaying the range of CFDs offered by AvaTrade. On the tab, click on stocks.

After clicking on stocks, scroll down the page and look through the shares CFDs offered. You will discover some of them are labeled as available on MT5 only. You will not be able to trade these stocks on MT4.

Some brokers have this info under their ‘trading platforms’ section or other parts on their websites. So it might be faster if you spoke to your customer’s support for more information about this.

5) Execution

Execution method and speed are essential factors to consider. The execution speed sometimes depends on the execution method. If your preferred broker uses instant execution, the speed might be faster since you are likely trading against your broker.

On the other hand, market execution is slower because your broker will transmit your order to a third-party. Because the execution method affects execution speed, it is important to check the kind of execution on your trading account.

6) Plug ins

Some brokers occasionally offer extra plug-ins and tools that can help your trading experience. These tools are usually free. For example, Pepperstone MT4 has Autochartist that filters and scans the market for good trading opportunities. It also has Smart Trader Tools which contains 28 indicators and a number of expert advisors (EAs).

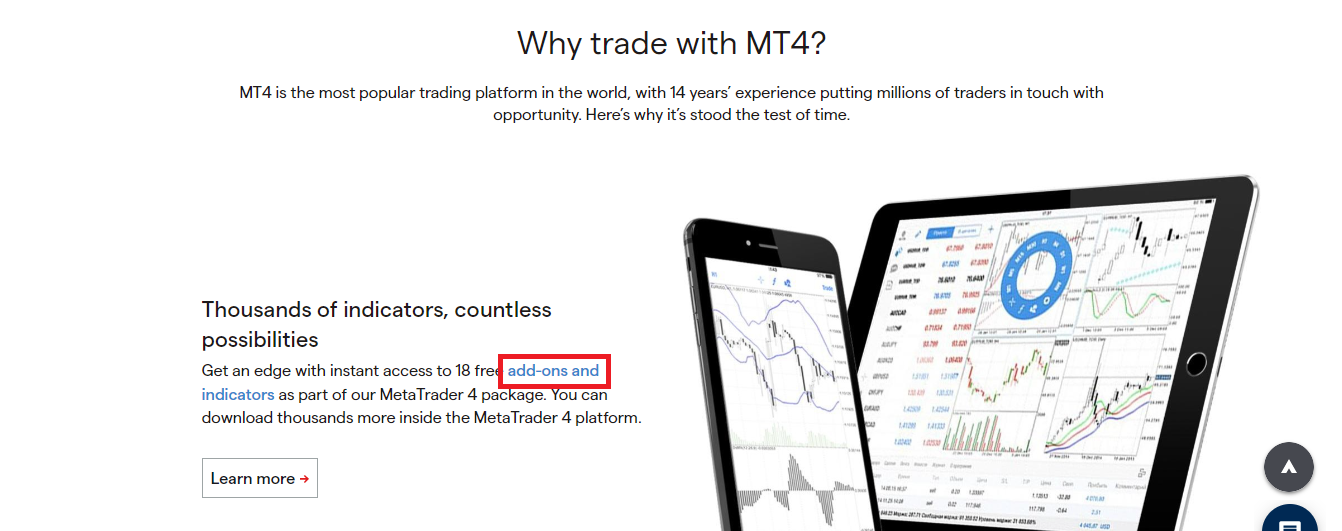

IG Markets’ MT4 has a good number of add-ons. One of them is the signal center. The signal center uses AI technology and in-depth market research to deliver concise trade ideas. Clear target levels and continuous updates from the signal center help you time the entry and exit of your trades.

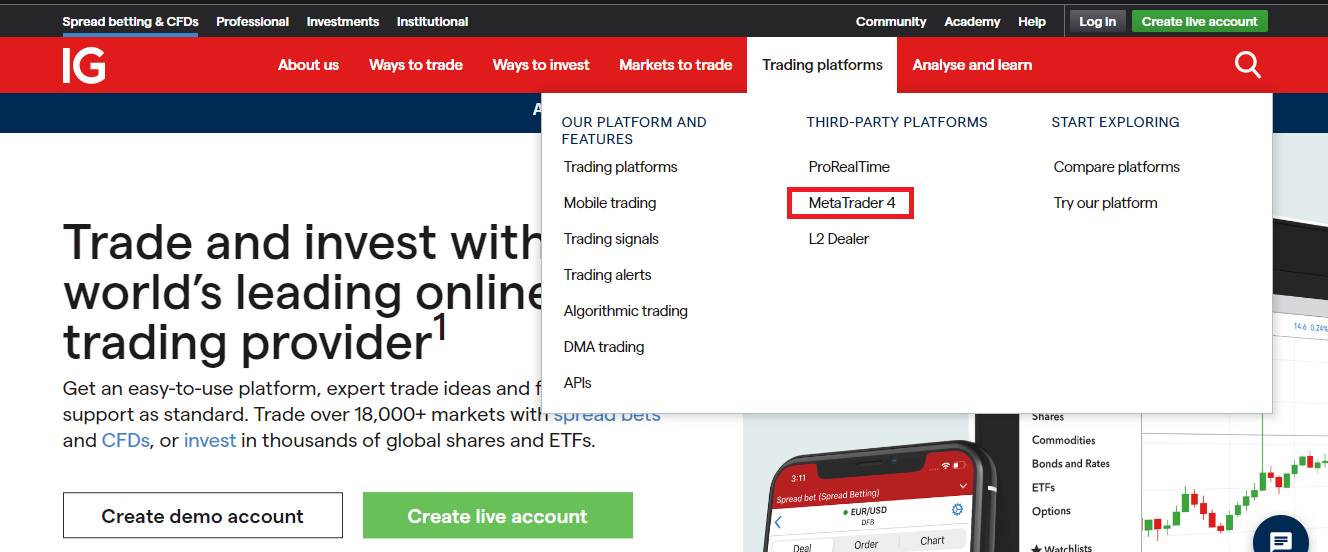

Here is how you can find these plug-ins on IG’s website. Click ‘Trading Platform’, then click ‘MetaTrader 4’

There is a lot of text on the page that follows. So you need to scroll down till you find the add-ons link displayed below. To find it quickly, focus on the left side of the page. When you find the link, click it.

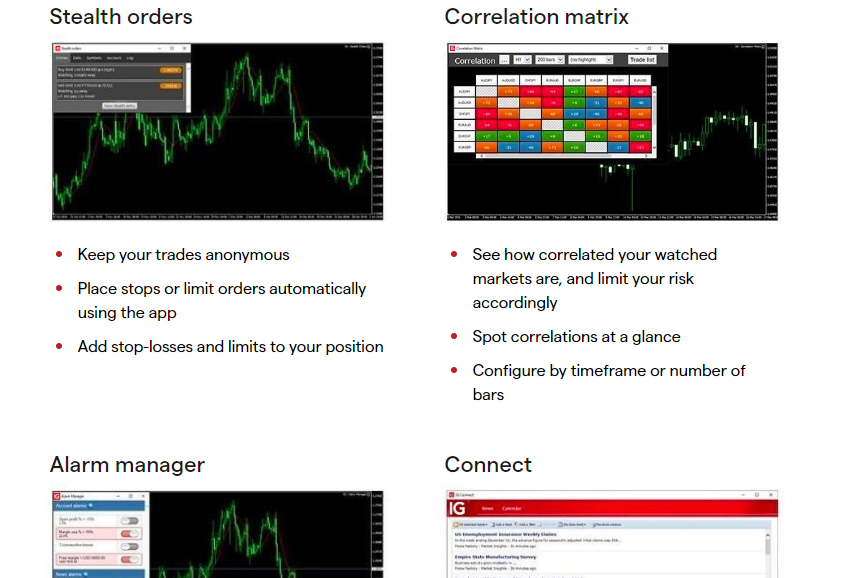

Scroll down the page to find IG Markets’ free MT4 tools as shown below.

From the image, you can see the names of the tools and their respective functions. There are about 12 of them with their functions clearly listed. These tools and plug-ins are usually free. Most forex brokers do not charge an extra fee to use them. This makes them even more appealing to use because they can be quite helpful.

7) MT4-specific Education

Forex brokers generally have education materials. They are usually about trading basics, courses, and podcasts. However, it should not stop there. For beginners, installing MT4 and operating it can be daunting.

So you should check if your broker has tutorials about MT4. Preferably, they should be in video format. This makes it easier to learn because you can see how to use the platform. AvaTrade has one of the best MT4 education among of all the brokers in this review.

This how their platform tutorial page looks like.

You can see the tutorials are available in different media (articles and videos). You can also go through them systematically depending on your level (beginner, intermediate, or advanced). Here are some interesting topics available.

You might find tutorials on other AvaTrade platforms as well. But the MT4 tutorials stand out by topic.

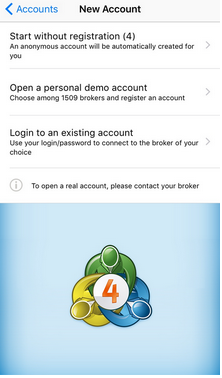

8) Demo Account

MT4 has a number of good features that will help you trade better. With a demo account, you can use this features in a risk-free environment. Demo accounts are provided by brokers so traders can practice and experiment with zero risk.

You will not lose any money using a demo account. Instead, your broker gives you virtual money so you can trade in a simulation. You can explore MT4 as long as you want if your broker supports a demo account on the platform. Also, you need to ensure that the demo account is not one that expires permanently.

Once you verify these two factors, you can proceed to open an MT4 demo account with your broker.

9) Support

MetaQuotes have their own support for traders. However, the desktop versions of MT4 are tailored to different brokers. This makes your broker’s support more important. Check if they have a local phone number and a responsive e-mail.

You can even test a broker’s support before signing up so you can know how quick they respond and how well they respond to potential customers.

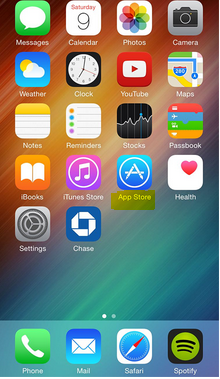

How to Get MT4 on iPhone After Ban

MT4 was removed from the Apple App store on September 23,2022. According to the company the app did not comply with review guidelines. After about six months, MT4 was reinstated on the App Store March 6, 2023. Now you can get MT4 on your iphone now that the ban is no longer in place.

How to Get MT4 on iPhone

1. Go to App store on your phone by clicking on the App store icon. (highlighted yellow)

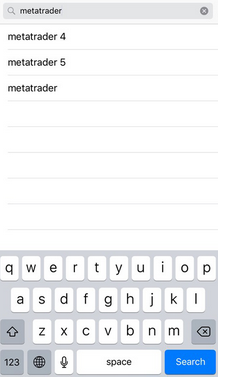

2. Search for MetaTrader 4 in the search window. The App store will give show you an option to click.

3. When you click the option, you will arrive at the MT4 page. It will look like the image below. Note the image and the logo of MT4. In addition, the name of the company is important. In the image, you can see the manufacturer’s name which is MetaQuotes Software Corp. Download the app by clicking ‘GET’.

5. When the download is complete, install the app on your iPhone.

6. Open the app when installation is complete. Find your broker’s server and enter log in details if you have an existing trading account. If you don’t have one, you can open a default MT4 demo account or a demo account from your broker.

7. If you follow this process, then you are ready to start using MT4 and trading CFDs. You can customize the colors and display on the chart if you want.

Do I Need a Broker for MT4?

Yes, you need a forex broker to access live market rates and updates on MT4. If you download MT4 on your mobile phone, you can access a demo account offered by MetaQuotes. It is automatic and you do not need a broker for this demo account.

However, it is better that you sign up with a broker instead. This allows you open a demo account from your broker and assess their trading conditions. Then you can proceed to open a live account by searching for your broker’s server and entering your log in details.

For a more easy process, it is advisable that you download MT4 from your broker’s website. It will likely be customized and made for your broker. You will not have to carry out a long search to find your broker’s server.

Placing your first MT4 trade

Here is how you go about placing your first trade on MT4.

1) Open the chart of a any trading instrument by right-clicking in the Market Watch window.

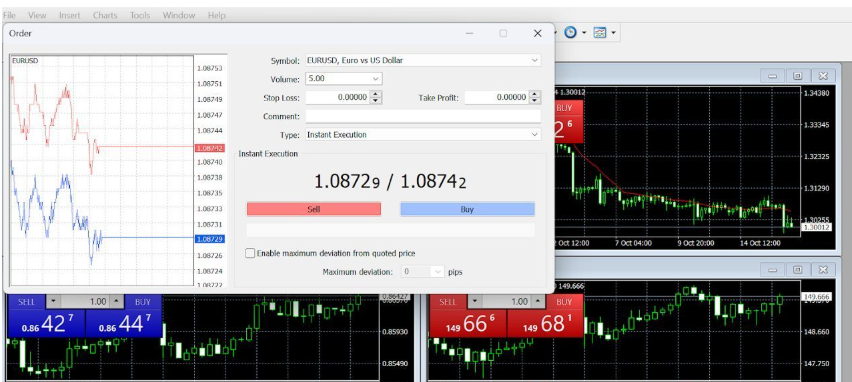

2) Click New Order to bring up the trading window. Here is what the trading window looks like.

3) On the window, select your order type and set other parameters like take profit or stop loss. After this, click Buy or Sell.

Will you incur any fees for using MT4?

MT4 is provided for free by forex brokers to their clients. This makes the trading platform easily accessible. You will not pay any fees. Rather, your broker pays the licensing cost to use the software to the developer (MetaQuotes).

While your use of MT4 is free, your trading is not. Depending on the broker you choose, you will incur charges for trading CFDs. These fee are not charged by MT4 or MetaQuotes but by your broker. These fees could be in form of spreads, commissions, and rollover charges (a fee charged when you hold a position overnight).

Furthermore, you might incur more charges if you want to use third-party tools and services. These tools include Expert Advisors (EAs), customized indicators, data feeds, and VPS.

Does MT4 have risk management tools?

Yes, MT4 has risk management tools. Stop loss and take profit orders are the most common. You us them to exit a trade at a profitable or losing position. All you need to do is set them when placing your trades.

It is possible for a stop-loss order to fail. This means you might lose more money than you calculated. Forex brokers offer guaranteed stop loss order(GSLO); an advanced risk management tool to mitigate this risk.

We reviewed IG Markets in this research. They are one of the brokers with GSLO.

Trailing stop and margin alerts are also part of MT4’s risk management tools. Trailing stops adjust your stop-loss level as the market moves in the favor of your position. This ensures you secure your gains are protected. Margin alerts lets you know when your open positions are at risk due to insufficient margin.

Does MT4 support backtesting?

Backtesting is a crucial tool for forex traders. Traders use it to assess their trading strategy by using historical data. MT4 supports two type of backtesting — manual and automatic. Automatic backtesting is not enabled as a default setting on MT4. You have to enable it from the”View” sub-menu. Once you do this, you can test your EAs or indicators.

FAQs on Best MT4 Brokers in Australia

Can I use MT4 without a broker?

Yes, you can. The only issue is you will only get MetaQuotes default demo account. For a better experience, you need to choose a broker. That way, you can get a demo account directly from the broker. When you are ready, you can open a live account as well.

What is the minimum deposit for MT4?

MT4 does not have a minimum deposit. It is determined by the broker you choose. You can read our review of ASIC regulated brokers for more.

Can I use MT4 in Australia?

You can use MT4 in Australia via ASIC regulated brokers that support it.

How can I trade via MT4?

You can trade via MT4 following these simple steps:

1. Sign up with a broker that offers MT4.

2. Complete your know-your-client (KYC). Here, you will be required to submit ID documents and proof of address documents. It could be your passport, utility bill, or driver’s license. It all depends on the MT4 broker’s requirements.

3. Download MT4: MT4 brokers usually supply a download link for their MT4 trading platform. For more flexibility, you can also download the mobile version of MT4 so you can check your trades on the go.

4. Fund your trading account.

5. Start trading.