Saxo Capital Markets is a forex and CFD broker whose parent company is Saxo Markets which is a Danish investment bank that has been in operation since 1992. Saxo Capital Markets is registered in Singapore and is regulated by the Monetary Authority of Singapore (MAS).

Saxo is a highly reputed broker that has catered to almost a million clients around the world and executes 270,000 trades on a daily basis.

Group companies of Saxo Markets are regulated by the best tier-1 and tier-2 financial authorities around the world including the FCA of the UK and the ASIC of Australia.

To traders from Singapore, Saxo offers a wide range of forex and CFD instruments including currency pairs, shares, metals, bonds, ETFs, and cryptocurrencies.

Saxo offers both leveraged products as well as investment products to its clientele.

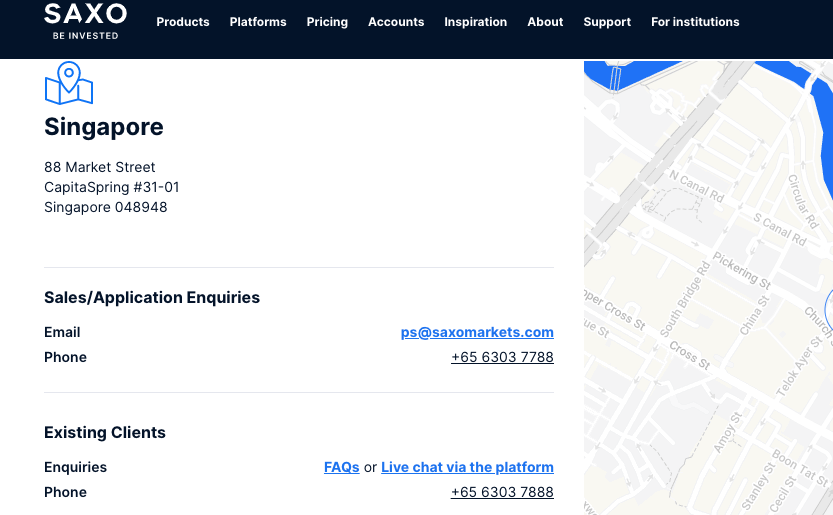

Saxo is not just any CFD broker with only an online presence in Singapore. They have a regional office located in Singapore and you can get in touch with them at their local office, through email, or through phone call.

In this review, we’ll discuss everything you need to know about Saxo to make an informed decision of trading with them.

| Saxo Review Summary | |

|---|---|

| 🏢 Broker Name | Saxo Capital Markets Pte. Ltd. |

| 📅 Establishment Date | 1992 |

| 🌐 Website | www.home.saxo/en-sg |

| 🏢 Address | 88 Market Street, CapitaSpring #31-01, Singapore – 048948 |

| 🏦 Minimum Deposit | SGD 3,000 |

| ⚙️ Maximum Leverage | 1:20 |

| 📋 Regulation | MAS, FCA, ASIC, FSA Denmark |

| 💻 Trading Platforms | SaxoTraderGo, SaxoInvestor, SaxoTraderPRO for web, desktop and mobile devices |

| Start Trading with Saxo | |

Saxo Pros

- Regulated in Singapore by MAS

- Local bank transfer options available

- Supports investing as well as trading

- Offers wide range of instruments

- Available on all devices, web, desktop, android, and iOS

- Real-time price data available on their trading platform

Saxo Cons

- Their live chat option is slow and unavailable for those who haven’t opened an account with Saxo

- They charge a high number of hidden fees.

- They do not provide educational material for beginners.

- Requires high minimum deposit.

- Does not have negative balance protection.

Is Saxo Legit?

Saxo is a legit CFD broker. Saxo is regulated by the MAS in Singapore, the group entities of Saxo are regulated by global tier-1 and tier-2 financial authorities such as the FCA of the UK and the ASIC of Australia.

Saxo Markets is a highly reputed international bank based in Europe, which makes Saxo Capital Markets (a Singapore-based subsidiary of Saxo Markets) quite credible.

Further, Saxo provides negative balance protection as well as segregation of funds. These are just two of the ways in which Saxo protects the trader’s interests.

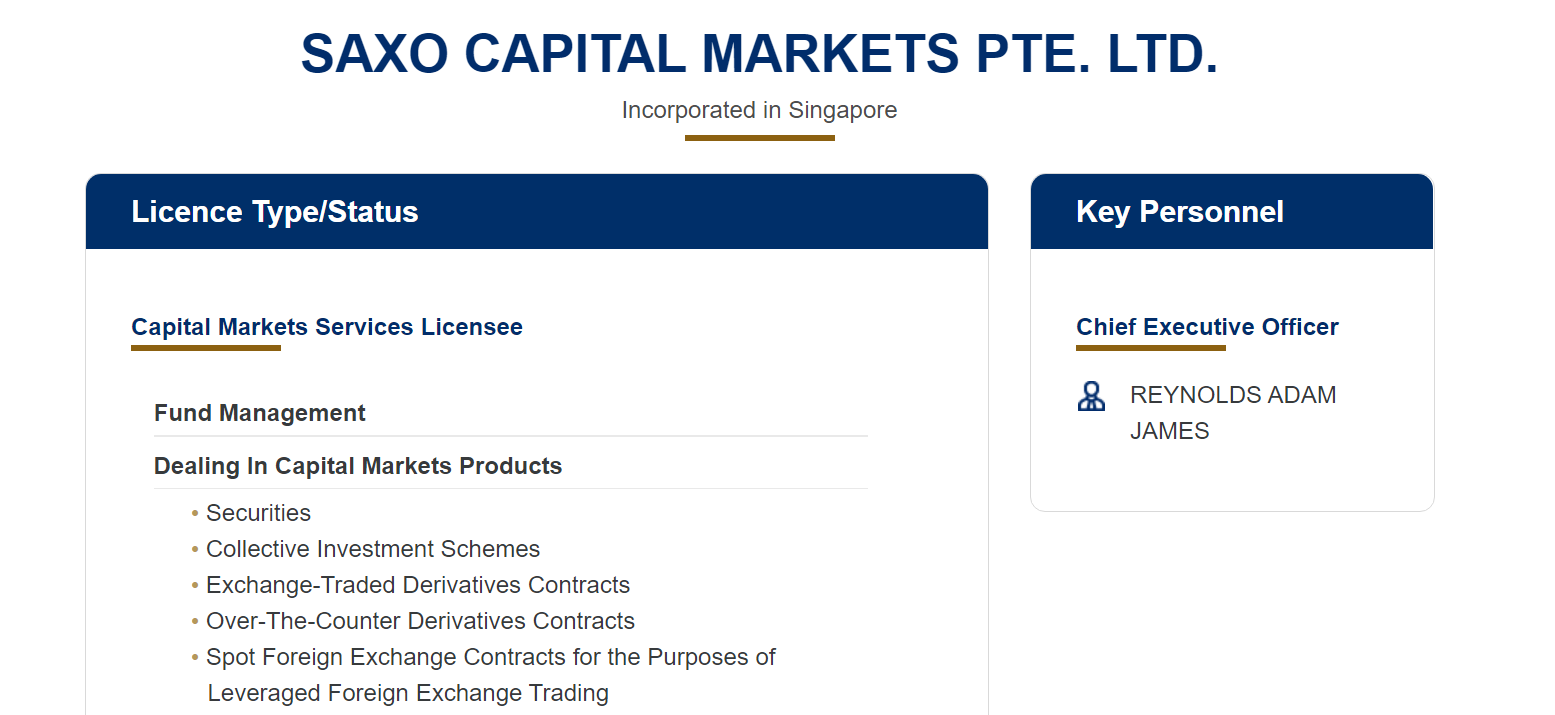

1) MAS of Singapore: Saxo Capital Markets Pte. Ltd. is incorporated in Singapore and regulated by the Monetary Authority of Singapore with the license number 200601141M. Their license allows them to provide capital markets solutions and services in Singapore.

2) FCA of the UK: Saxo Capital Markets UK Limited is incorporated in the United Kingdom and regulated by the Financial Conduct Authority with the license number 551422. They provide forex broking and CFD trading services in the UK.

3) ASIC of Australia: Saxo Capital Markets (Australia) Limited is incorporated in Australia and regulated by the Australian Securities and Investment Commission (ASIC) under the license number 32 110 128 286. This entity provides brokerage and related capital markets services in Australia.

4) FSA of Denmark: The parent company Saxo Bank A/S is incorporated in Denmark and regulated by the Financial Supervisory Authority (FSA) through the license number 15731249. The company provides full-scale banking and financial services in Denmark.

5) FSA of Japan: Saxo Bank Securities Limited is regulated by the Japan Financial Services Authority (FSA) under the license number 0104 – 01 – 082810. The company provides banking and financial services in Japan.

6) SFC of Hong Kong: Saxo Capital Markets HK Limited is regulated by the Securities and Futures Commission in Hong Kong. The company has been accorded the license number 1395901. This Saxo entity is authorized to provide capital markets related services in Hong Kong.

In addition to the licenses listed above, Saxo group entities are authorized and licensed in several other countries which are UAE, Brazil, Czech, Switzerland, Italy, Netherlands, France, and Belgium.

It is clear that Saxo has a global presence (not just online, but physical offices as well). The company is highly credible and has been providing stellar services over decades since 1992.

Saxo Leverage

Saxo offers decent leverage on its leveraged products such as forex and CFDs. The broker offers leverage ranging from 1:5 to 1:20 depending upon the instrument being traded. The maximum leverage of 1:20 applies to retail clients.

For example, with a leverage of 1:20 for trading the benchmark EUR/USD currency pair. You can place a EUR/USD trade worth SGD 20,000 with a deposit of SGD1,000. That is the 20 times the value of your deposit.

Accredited investors, that is professional clients can trade with maximum leverage of 1:50.

The low leverage offered by Saxo ensures that they are in line with the regulatory requirements imposed by the MAS (Monetary Authority of Singapore). Further, this level of leverage helps traders trade in a safer environment with the relatively low risk associated with each trade.

It is important not to trade with all the available leverage as it increases your risk and you can lose all your money. Do not engage in leverage trading if you don’t understand it or ready to bear the risks.

Saxo Account Types

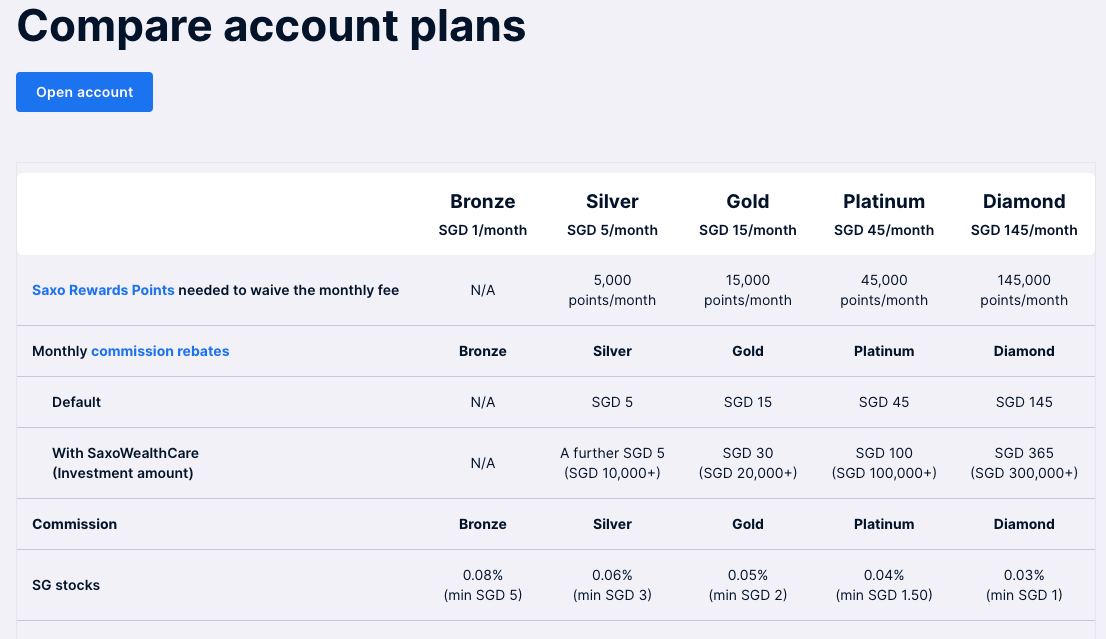

Saxo Capital Markets offers five primary types of accounts in Singapore. Each of the account types differs in terms of commission, monthly fee, and minimum deposit.

1) Bronze: The Bronze account is the most basic account offered by Saxo. This is the account you get by default when you first signup with the broker.

You need to make a minimum deposit of SGD 3000 at the time of account opening. This amount must be maintained within the account at all times. The Bronze Account can be opened by paying a monthly fee of SGD 1 or you can pay zero fees if you invest in SaxoWealthCare (minimum investment or SGD 30,000) or SaxoSelect (minimum investment of SGD 2,000).

The Bronze account charges a minimum commission of SGD 5 for trading Singapore stocks, USD 4 for trading US stocks, and USD 3 for trading US stock options. The transaction fee can also be in the form of a spread, depending on the instrument being traded.

2) Silver: The Silver account can be opened by paying a monthly fee of SGD 5. This account type allows you to maintain an account without any minimum deposit.

The Silver account charges a minimum commission of SGD 3 for trading Singapore-listed stocks, USD 3 for trading US-listed stocks, and USD 2 for trading US stock options.

You are required to invest at least SGD 10,000 in SaxoWealthCare as a Silver Account holder.

3) Gold: The Gold account can be opened by paying a monthly fee of SGD 15. The Gold account does not require any minimum deposit.

If you have a Gold account, you will be charged a minimum commission of SGD 2 for Singapore-listed stocks, USD 2 for US-listed stocks, and USD 1 for trading US stock options.

You are required to invest at least SGD 20,000 in SaxoWealthCare as a Gold Account holder.

4) Platinum: The Platinum account is the second-most premium account offered by Saxo. This account can be opened for a monthly fee of SGD 45 which is a big step up from previous account types.

This account charges a minimum commission of SGD 1.5 for trading Singapore-listed stocks, USD 1.5 for trading US-listed stocks, and SGD 0.8 for trading US-based options.

You do not need to maintain any account balance in order to use this account.

You are required to invest at least SGD 100,000 in SaxoWealthCare as a Platinum Account holder.

5) Diamond: The Diamond account is the most premium account offered by Saxo. This account type comes with a price tag of SGD 145 per month. Since the monthly cost is so high, they offer a wide range of benefits to users.

The Diamond account charges a minimum commission of SGD 1 for trading Singapore stocks, USD 1 for trading US-based stocks, and SGD 0.65 for trading US-based stock options.

Further, users of this account do not have to pay any custody fees as long as they have opted into securities lending. They also get free real-time price data of US stocks, BATS, Singapore-based stocks, and Hong Kong based stocks.

You are required to invest at least SGD 300,000 in SaxoWealthCare as a Diamond Account holder.

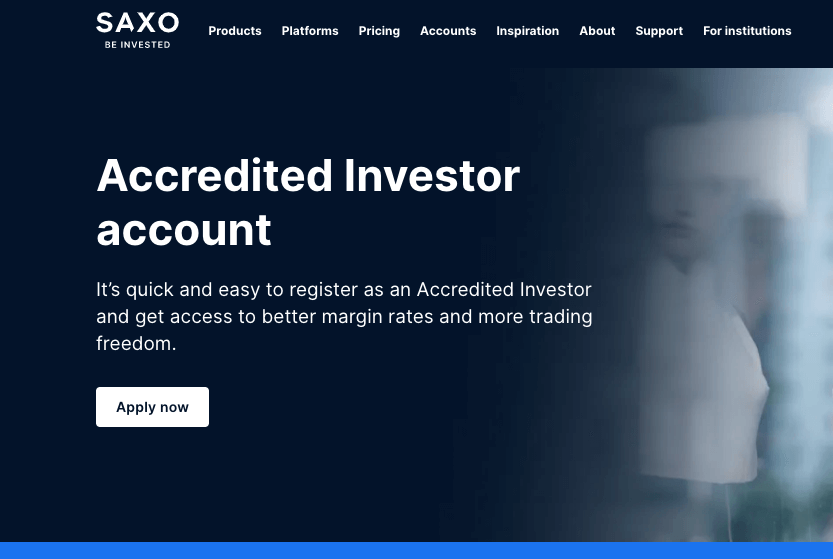

6) Accredited Investor (AI) Account: an Accredited Investor Account allows traders to be classified as an Elective Professional client which comes with a range of benefits.

Some of the benefits of this account is that it gives you access to higher leverage, you can skip the annual suitability checks by the broker, you can trade more products, get early access to new products and features, and you also get exclusive access to private equity products.

To be classified as an Accredited Investor on Saxo, you need to first open a standard account either bronze or others, then apply by filling an online form and submitting some verification documents after meeting the at least one of the following creteria.

- You have net financial assets of more than SG$1 million; or

- You have net personal assets of more than SG$2 million; or

- You have an annual income of at least SG$300,000 in the last 12 months

In addition to these Saxo accounts, users can also sign up for a Joint Account (which allows you traders to create an account with a family member), a Corporate Account (which allows traders to benefit from a professional-grade platform).

Note that Saxo does not offer negative balance protection, which means that you can lose more than your deposited amount if you suffer a loss from an unsuccessful trade position and will be required to deposit additional money to clear any negative balance that accrues.

Saxo Fees

Fees on Saxo depend on the instruments you are trading, the size of the trading, your account type, and how long you keep the trade open. Here is an overview of the trading and non-trading fees on Saxo.

Trading fees

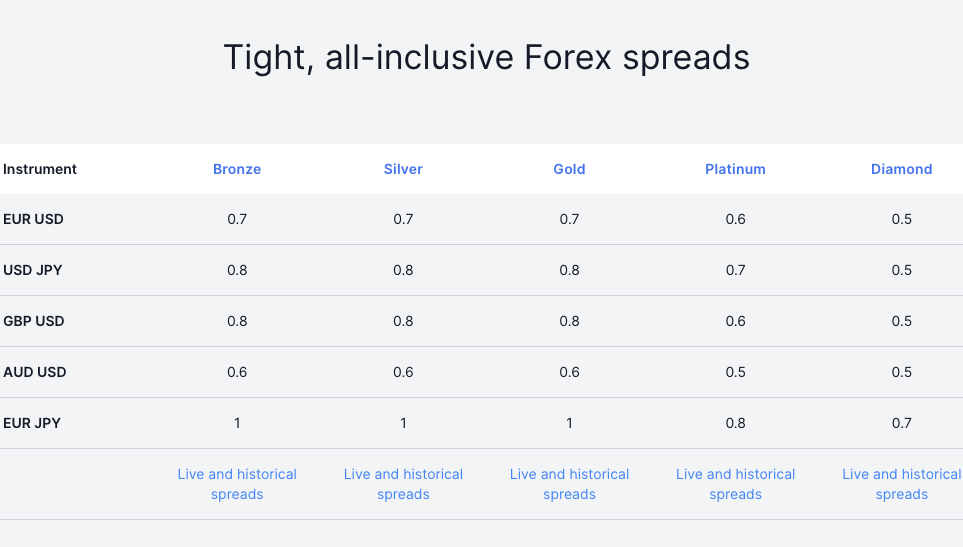

1) Spread – Saxo charges spreads when you trade financial instruments on the platform. The spread is a markup on the market prices of the instrument, starting from about 0.5 pips on the Diamond Account. Find the average spreads for major currency pairs on the image below:

2) Commission – Saxo charges a high commission based on your account type. The fee associated with a trade depends largely on the type of instruments being traded.

For example, if you want to trade a stock which is listed on the NASDAQ through a Bronze account, then you will have to pay a minimum commission of 7 USD.

3) Custody Fee – Saxo also charges a custody fee. This custody fee can range from 0.15% per annum to 0% per annum, depending on the type of instrument being traded and the type of account being held by the user.

4) Currency Conversion Fee – Saxo charges a currency conversion fee when you open a trade in a currency different from the base currency of your account. The currency conversion fee is based on the forex exchange rate plus interest rates starting from 0.10%, with an average of 0.30% and can be up to 0.75%, depending on the instrument type you are trading.

5) Swap Fee – If you keep a trade position open past the market closing time on Saxo, the trade rolls over to the next trading day and you incur rollover fees or overnight funding costs also called swap fees. This fee is determined based on the instrument being traded, spread, leverage, and the number of nights the position is kept open. The fees can start from 0.50% and up to 1.50%

Non-Trading fees

1) Deposit and Withdrawal Fee – Saxo allows traders based in Singapore to deposit and withdraw funds in a variety of ways. Saxo does not charge any deposit fees for local bank transfers and e-wallets, however, a fee may be charged by the payment service provider. Card deposits have a fee of 2.94% per transaction.

2) Inactivity Fee – Saxo bank does not charge any inactive account fees. Whether you log into your account or not, any funds in your account will not be charged.

How to Open Saxo Account in Singapore?

Follow these steps to open a trading account on Saxo Markets.

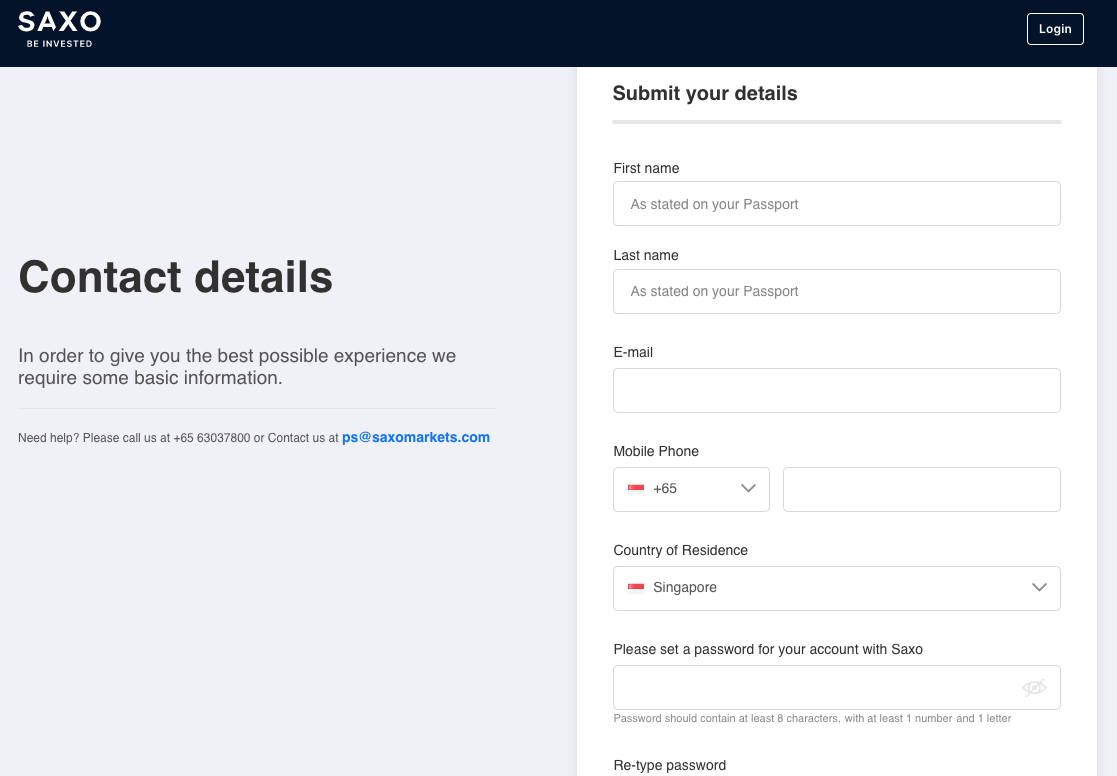

Step 1) Go to the Saxo Markets website at www.home.saxo and click on ‘Open account’.

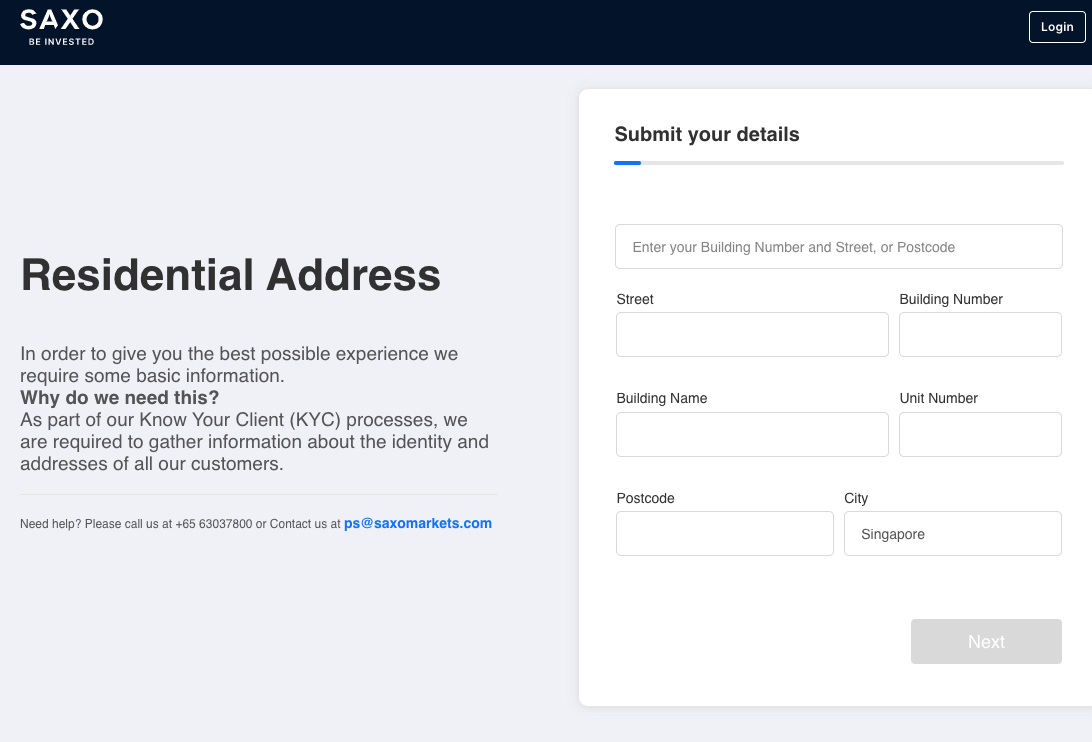

Step 2) On the form that appears, fill out your name, email, and phone number, create password, select your country of residence (Singapore will be selected by default), and then click on ‘Next’. You can also choose to fill this out with Myinfo by Singpass. Fill out your address information and click ‘Next’.

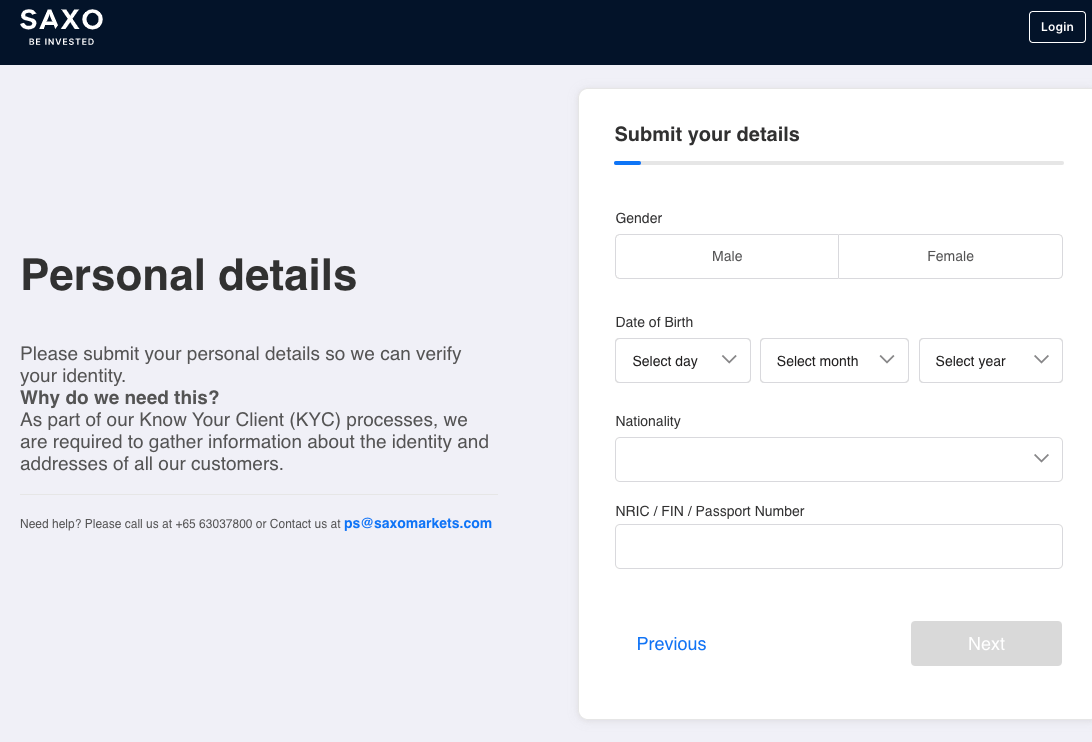

Step 3) Supply your date of birth, gender, select nationality, check the box to indicate you are not a US citizen and provide your NRIC Number or FIN then click ‘Next’.

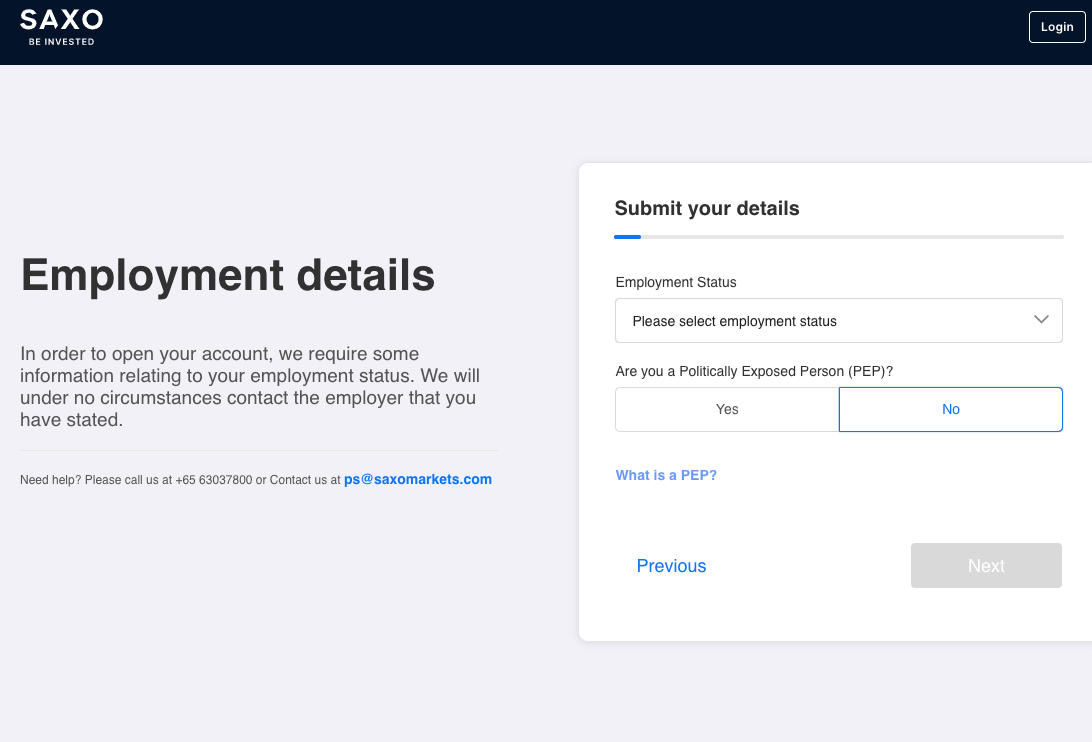

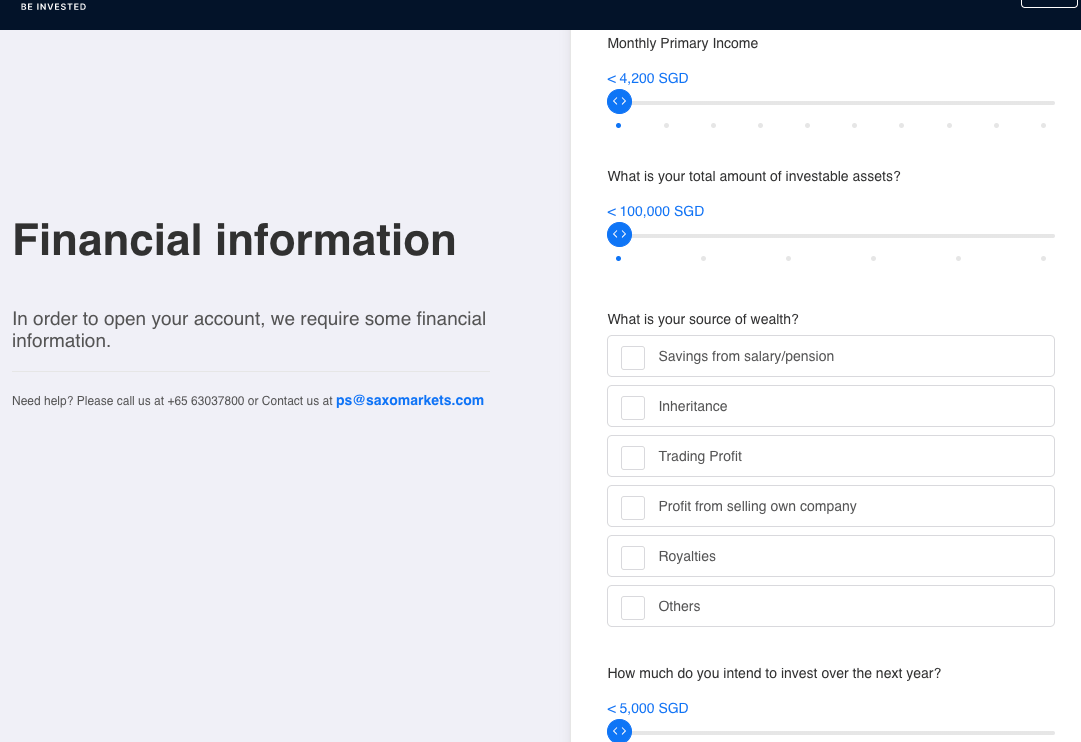

Step 4) Answer questions relating to your employment, financial status, trading experience and knowledge, then click ‘Next’.

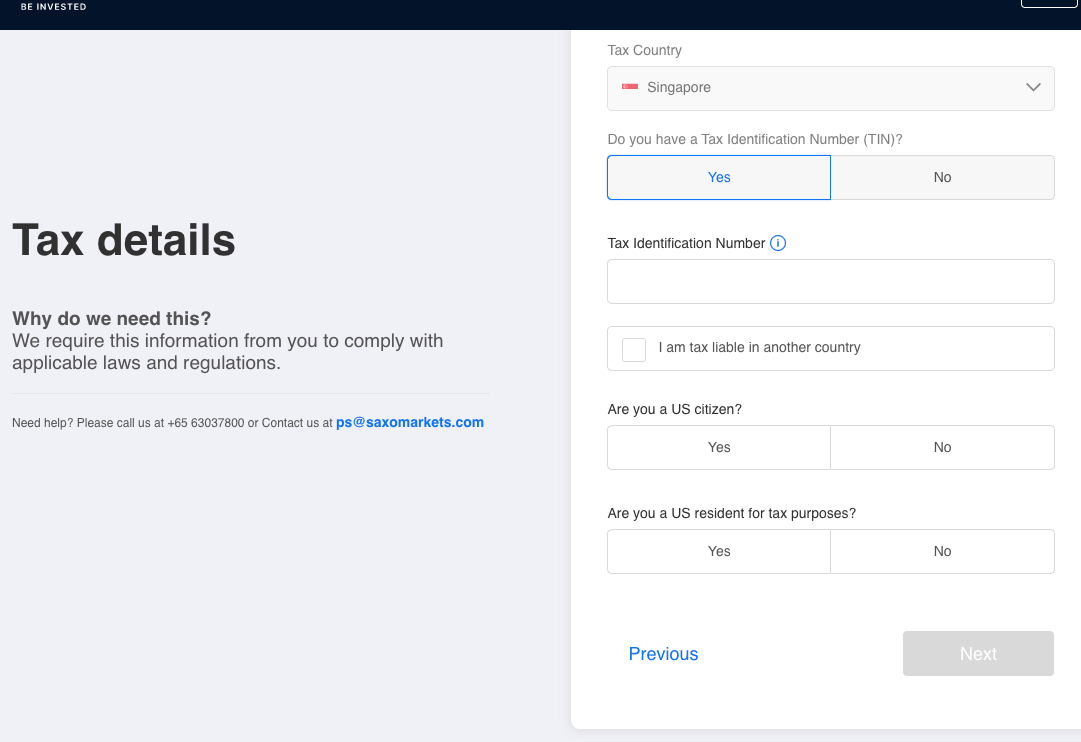

Step 5) Submit your tax information, confirm you are not a US citizen and click ‘Next’. You will be required to confirm the information you have supplied, then click ‘Next’.

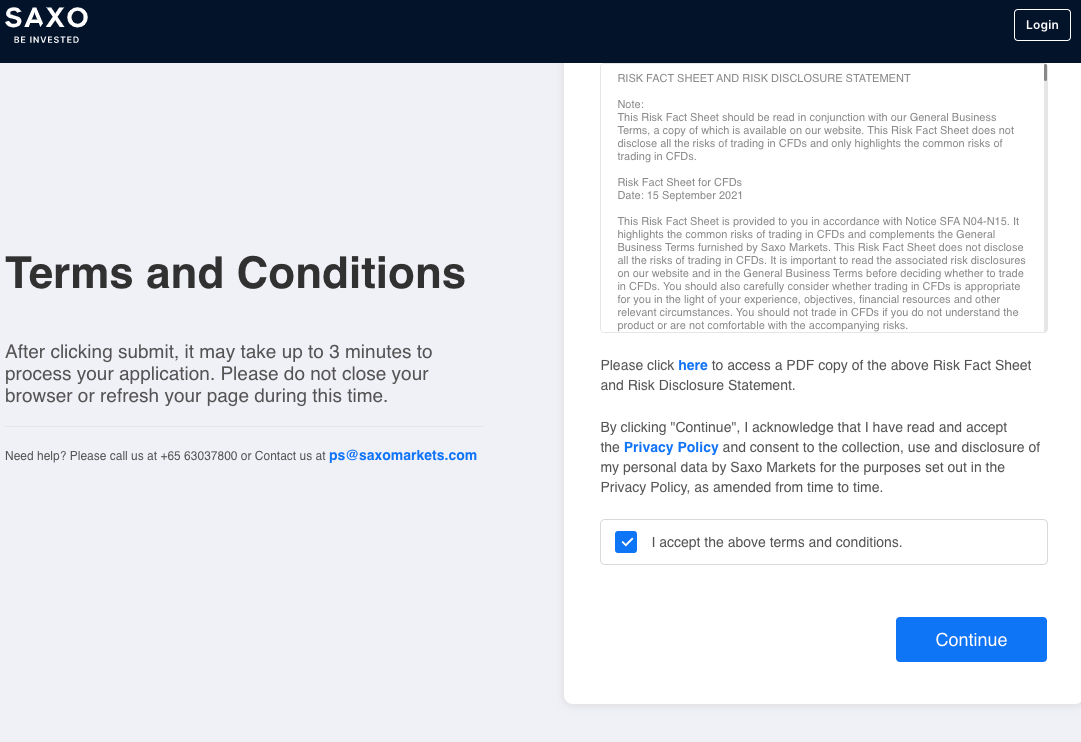

Step 6) Confirm the information you have supplied, then click ‘Next’. Then accept the terms and conditions and click ‘Continue’.

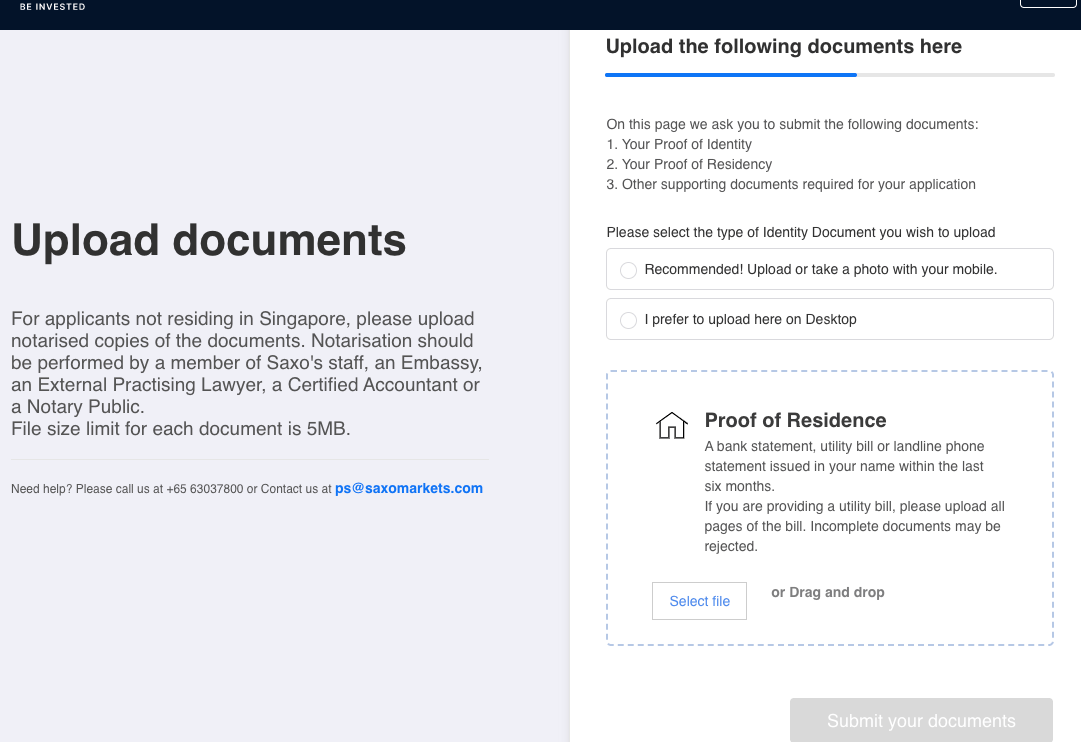

Step 7) Upload the required verification documents (identity and address proof documents) to verify your account.

After your account is activated, you can make deposits, place trades and withdraw funds from it.

Saxo Deposits and Withdrawals

Saxo allows traders based in Singapore to deposit and withdraw funds in a variety of ways. For making a local deposit in SGD, Saxo accepts payments through FAST, PayNow, and MPS.

Saxo Markets Deposit Methods

Here is a summary of payment methods accepted by Saxo Markets for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Bank Wire Transfer | Yes(MEPS – SGD) | Free | 1-2 business days |

| Cards | Yes | 2.94% per transaction | Instant |

| E-wallet | Yes (FAST, PayNow, eGIRO) | Free | Within minutes |

Saxo Markets Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on IC Saxo.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Bank Wire Transfer | Yes (MEPS) | Free | 0-2 business days |

| Cards | No | N/A | N/A |

| E-wallets | No | N/A | N/A |

What is the Saxo Markets Minimum deposit?

The recommended minimum deposit on Saxo Markets Singpore is SG$3,000 for all payment methods which applies to the Bronze Account. Other account types do not have mandatory minimum deposit amount, although you will have to pay a monthly account maintenance fee from SG$5 and up to SG$145.

What is the Saxo Markets Minimum withdrawal?

There is no mandatory minimum withdrawal on Saxo Markets in Singapore.

You can initiate deposits and withdrawals by logging into your account, and on the Saxo client area or dashboard, click on deposit or withdrawal on the left side menu.

Saxo traders can only withdraw money from their Saxo trading account directly into their bank account. Their website contains detailed information on how to withdraw funds from your trading account to your bank account. A withdrawal fee of SGD 50 may be applied in case you use the manual form for processing your withdrawal.

Saxo Trading Instruments

Saxo offers a very wide range of investment and trading products. Below are financial instruments that can be traded on Saxo Markets

| Instrument | Availability | Number |

|---|---|---|

| Forex | Yes | 182 currency pairs on Saxo Markets |

| Forex options | Yes | 140 forex forward options on Saxo Markets |

| Commodities | Yes | 19 commodities on Saxo Markets |

| Bonds | Yes | 5,000+ bonds on Saxo Markets |

| Stocks | Yes | 19,000+ stocks on Saxo Markets |

| Futures | Yes | 200+ futures on Saxo Markets |

| ETFs | Yes | 6,700 ETFs on Saxo Markets |

| Mutual Funds | Yes | 250 Mutual Funds on Saxo Markets |

| Listed Options | Yes | 3,100+ Listed Options on Saxo Markets (including equities, energy and others) |

| CFDs | Yes | 9,000+ CFDs on Saxo Markets (including indices, options and others) |

| Cryptos | Yes | 117 cryptocurrencies on Saxo Markets |

Further, Saxo also offers managed portfolios for investors who need to expert advise and help to manage their investments. To traders from Singapore, they offer cryptocurrency ETNs as well.

Overall, the range of instruments offered by Saxo is quite impressive and significantly above average.

Saxo Markets Trading Platforms

Trading platforms supported by Saxo Markets are owned by the broker.

1) SaxoInvestor: This is proprietary trading application owned by Saxo Markets which is available on the web, desktop (macOS & Windows), and mobile devices (Android & iOS). You can only trade stocks, mutual funds, ETFs, bonds and managed portfolios with this platform.

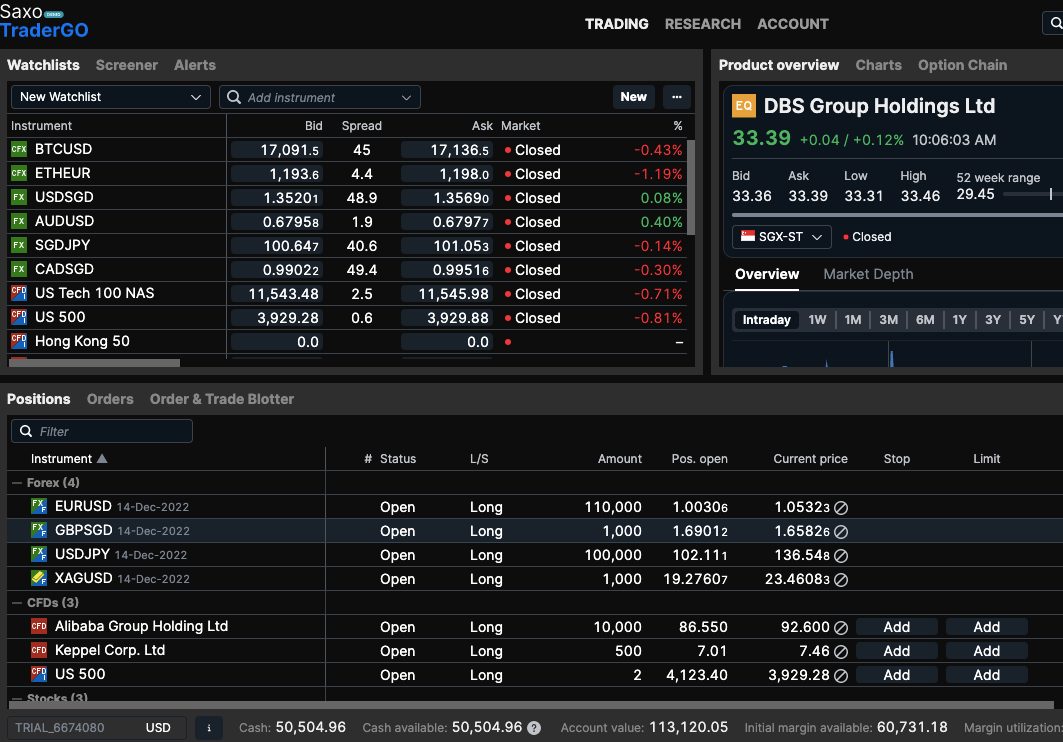

2) SaxoTraderGo: This is another proprietary trading application owned by Saxo Markets and is available on desktop and mobile devices. You can trade stocks, mutual funds, ETFs, bonds, forex, CFDs, futures, commodities, forex options, listed options and managed portfolios with this platform.

3) SaxoTraderPRO: This is another proprietary trading application owned by Saxo Markets and is available only on desktop (PC and MAC). You can trade stocks, mutual funds, ETFs, bonds, forex, CFDs, futures, commodities, forex options, listed options and managed portfolios on this platform.

Saxo Educational Materials and Research

Saxo offers basic educational materials to its traders for free. This material covers the basics of fundamental and technical analysis, but does not go into detail. The educational material also comprehensively covers Saxo’s trading platform and products, so that any new trader can quickly understand Saxo’s offerings.

The educational material provided by Saxo is in line with their unstated goal of attracting sophisticated investors and traders who are already familiar with the markets.

Further, Saxo dedicates a lot of manpower in providing accurate and timely research to its users. Saxo has several in-house analysts which provide regular updates on the market along with commentary.

Saxo Customer Support

Phone Call and Email – Customers can get in touch with Saxo through phone call or email. The saxo phone number for support is +65 6303 7788 while the Saxo email address for clients in Singapore is [email protected].

Saxo also has a local office in Singapore, so residents can directly visit them.

Live Chat – Saxo does not offer customer support through live chat to non-registered visitors. They do offer chat support through their trading platform to registered users, however, this support is only available in English.

Chatbot – Saxo has a chatbot but with extremely poor functionality. Saxo also has an extensive FAQs page that can help solve several issues and doubts, however, the search function could be more accurate.

Do We Recommend Saxo for Singapore Traders?

Saxo is a broker that is meant for high networth traders and investors. Their accounts are more suitable for those who can pay a high monthly fee in exchange for lower trading accounts. Their educational and research materials are also geared towards sophisticated traders.

Further, Saxo provides a very wide range of trading instruments which could be highly attractive to an active trader looking for exposure in a variety of instruments and portfolio diversification.

However, there are a few downsides to the services provided by Saxo as well. Saxo’s customer support is not user-friendly and it takes time and effort to get in touch with them. They only provide live chat support to users that have already opened an account with them. This can leave out prospects who want

to know more about their services before opening an account.

Overall, we recommend that you register on Saxo, only if you are already experienced and want to trade in high volumes.

Saxo Markets Singapore FAQs

Is Saxo any good?

Yes, Saxo is licensed by the MAS which can hold Saxo legally accountable in case of any malpractice. Further, Saxo provides a very wide range of instruments to traders from Singapore. They offer convenient deposit and withdrawal methods along with local language support and a dedicated website.

Is Saxo free?

No, Saxo is not a free trading platform and broker. They charge fees in the form of spreads and commission. They also required a minimum deposit to be made when you open an account with them.

Is Saxo Trustable?

Yes, Saxo is a highly trustworthy broker for traders from Singapore. The company is regulated by the MAS which is the financial regulatory authority of Singapore. Further, group companies of Saxo are world renowned and are regulated by tier-1 and tier-2 foreign regulators.

How much do you need to open a Saxo account?

You need SGD 3,000 to start trading on Saxo Markets Singapore, which is the recommended minimum deposit and applies to the Bronze Account.

Is Saxo Trader Expensive?

Saxo is not meant for beginners. The goal of the company is to cater to the needs of advanced and sophisticated investors and traders. Accordingly, the company charges relatively higher fees, however, they ensure that their service is one of the best-in-class.

Does Saxo Markets Trade Singapore Stocks?

Yes, Saxo Markets offers the trading of Singapore stocks. Their platform offers access to a wide range of stock trading options, including over 23,500 stocks from over 50 global markets.

It’s important to note that stocks on major US exchanges like Nasdaq are available for trading on Saxo Markets during pre-market hours and after-trading hours.

Note: Your capital is at risk