Saxo Bank is an international forex and CFD broker that has been in operation since 1992. Saxo Bank does not have a physical presence in the Philippines and is not regulated by the Securities and Exchange Commission (SEC) of the Philippines.

However, Saxo is a highly reputed broker that has catered to almost a million clients around the world and executes 270,000 trades on a daily basis.

Group companies of Saxo Bank are regulated by the best tier-1 and tier-2 financial authorities around the world including the FCA of the UK and the ASIC of Australia. Since the group companies of Saxo are so well-regulated, they are considered to be legit broker to trade through for Philippines residents, even though they are not locally regulated in the Philippines.

To traders from the Philippines, Saxo offers a wide range of forex and CFD instruments including currency pairs, shares, metals, bonds, ETFs, and cryptocurrencies.

Saxo offers both leveraged products as well as investment products to its clientele.

You can get in touch with Saxo through phone call or email though they do not have a live chat option for non-registered traders.

In this review, we’ll discuss everything you need to know about Saxo to make an informed decision about trading with them.

| Saxo Review Summary | |

|---|---|

| 🏢 Broker Name | Saxo Bank A/S |

| 📅 Establishment Date | 1992 |

| 🌐 Website | https://www.home.saxo/ |

| 🏢 Address | Saxo Bank A/S (Headquarters), Philip Heymans Alle 15, 2900 Hellerup, Denmark |

| 🏦 Minimum Deposit | USD 0 |

| ⚙️ Maximum Leverage | 1:30 |

| 📋 Regulation | FSA Denmark, FCA, ASIC, MAS |

| 💻 Trading Platforms | SaxoTraderGo, SaxoInvestor, SaxoTraderGoPRO for web, desktop and mobile devices |

| Start Trading with Saxo | |

Saxo Pros

- They have a dedicated website for international traders including the Philippines

- Deposits through debit cards and credit cards

- Negative balance protection

- Supports investing as well as trading

- Offers wide range of instruments

- Available on all devices, web, desktop, android, and iOS

- Real-time price data available on their trading platform

Saxo Cons

- Their live chat option is slow and unavailable for those who haven’t opened an account with Saxo

- They charge a high number of hidden fees.

- The required minimum deposit is high for the Platinum and VIP accounts.

- They do not provide educational material that are suitable for beginners.

Is Saxo Legit?

As mentioned earlier, Saxo is not regulated by the SEC of the Philippines which means that residents of the Philippines will not be able to initiate legal proceedings against Saxo in case of any malpractice. Trading with Saxo Markets is at your own risk as you can lose all your money. However, the likelihood of any malpractice is relatively low since group entities of Saxo are regulated by global tier-1 and tier-2 financial authorities such as the FCA of the UK and the ASIC of Australia.

Saxo Bank is a highly reputed international bank based in Europe, which makes Saxo Markets (the broker) score low on risk.

Further, Saxo provides negative balance protection as well as segregation of funds. These are just two of the ways in which Saxo protects the trader’s interests.

1) FSA of Denmark: Saxo Bank A/S is incorporated in Denmark and regulated by the Financial Supervisory Authority (FSA) through license number 15731249. The company provides full-scale banking and financial services in Denmark. Traders from the Philippines are subject to Danish laws when trading through Saxo Bank.

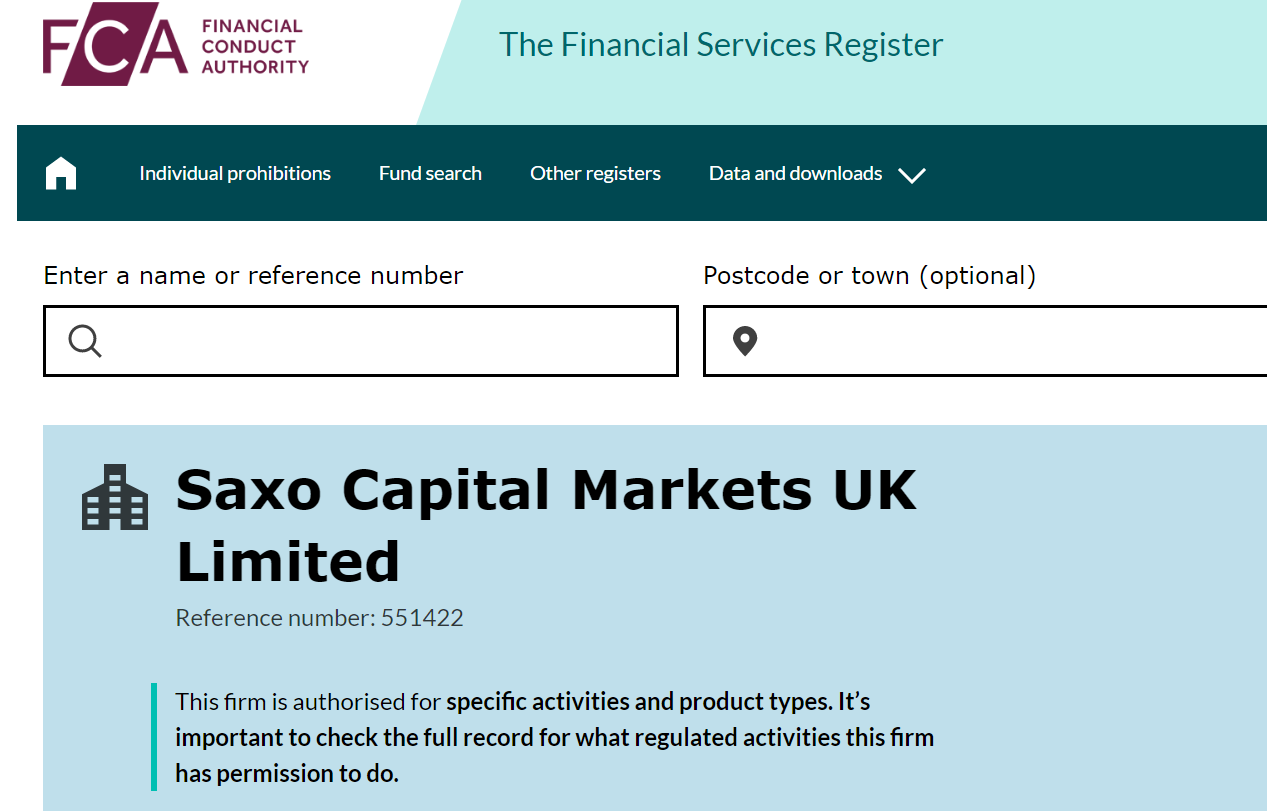

2) FCA of the UK: Saxo Capital Markets UK Limited is incorporated in the United Kingdom and regulated by the Financial Conduct Authority with license number 551422. They provide forex broking and CFD trading services in the UK.

3) ASIC of Australia: Saxo Capital Markets (Australia) Limited is incorporated in Australia and regulated by the Australian Securities and Investment Commission (ASIC) under license number 32 110 128 286. This entity provides brokerage and related capital markets services in Australia.

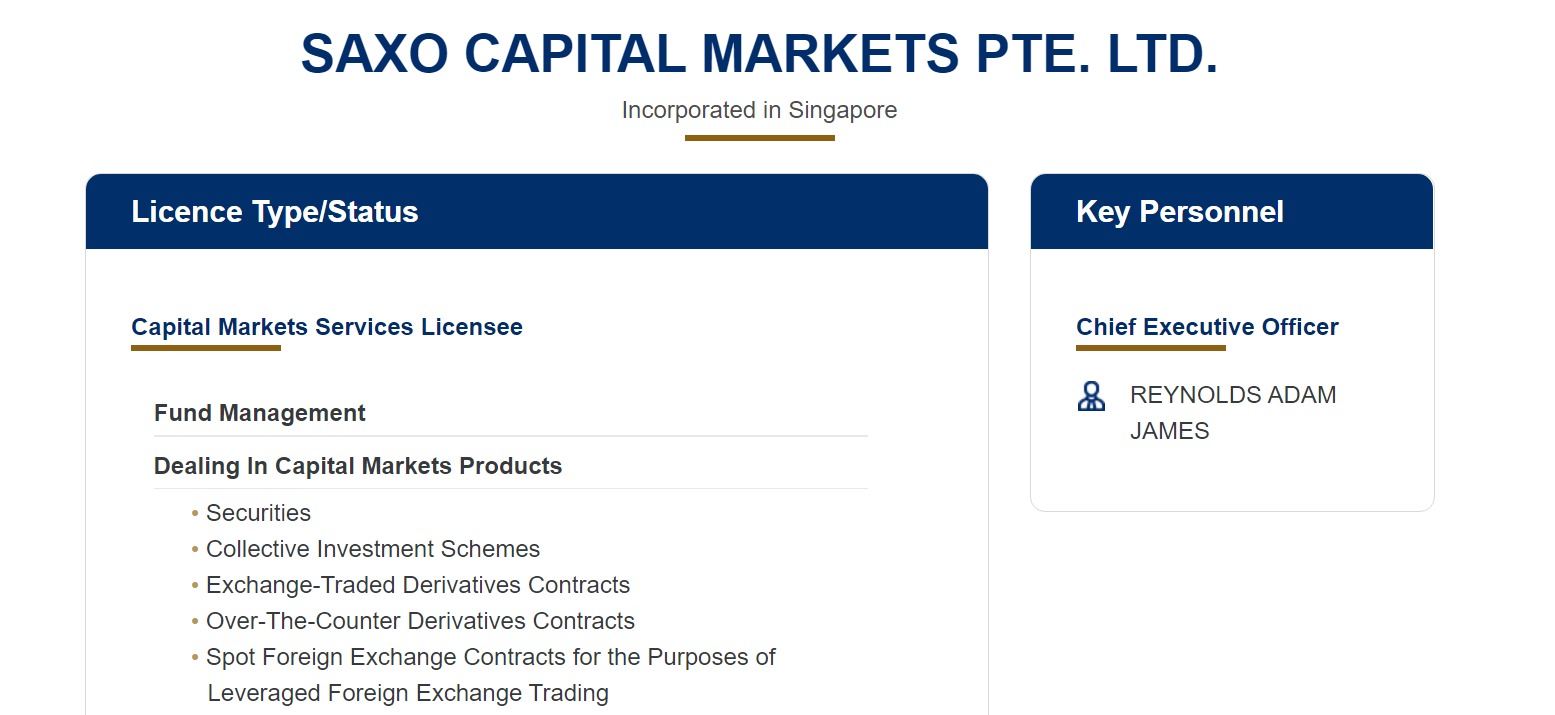

4) MAS of Singapore: Saxo Capital Markets Pte. Ltd. Is incorporated in Singapore and regulated by the Monetary Authority of Singapore with the license number 200601141M. Their license allows them to provide capital markets solutions and services in Singapore.

5) FSA of Japan: Saxo Bank Securities Limited is regulated by the Japan Financial Services Authority (FSA) under the license number 0104 – 01 – 082810. The company provides banking and financial services in Japan.

6) SFC of Hong Kong: Saxo Capital Markets HK Limited is regulated by the Securities and Futures Commission in Hong Kong. The company has been accorded license number 1395901. This Saxo entity is authorized to provide capital markets-related services in Hong Kong.

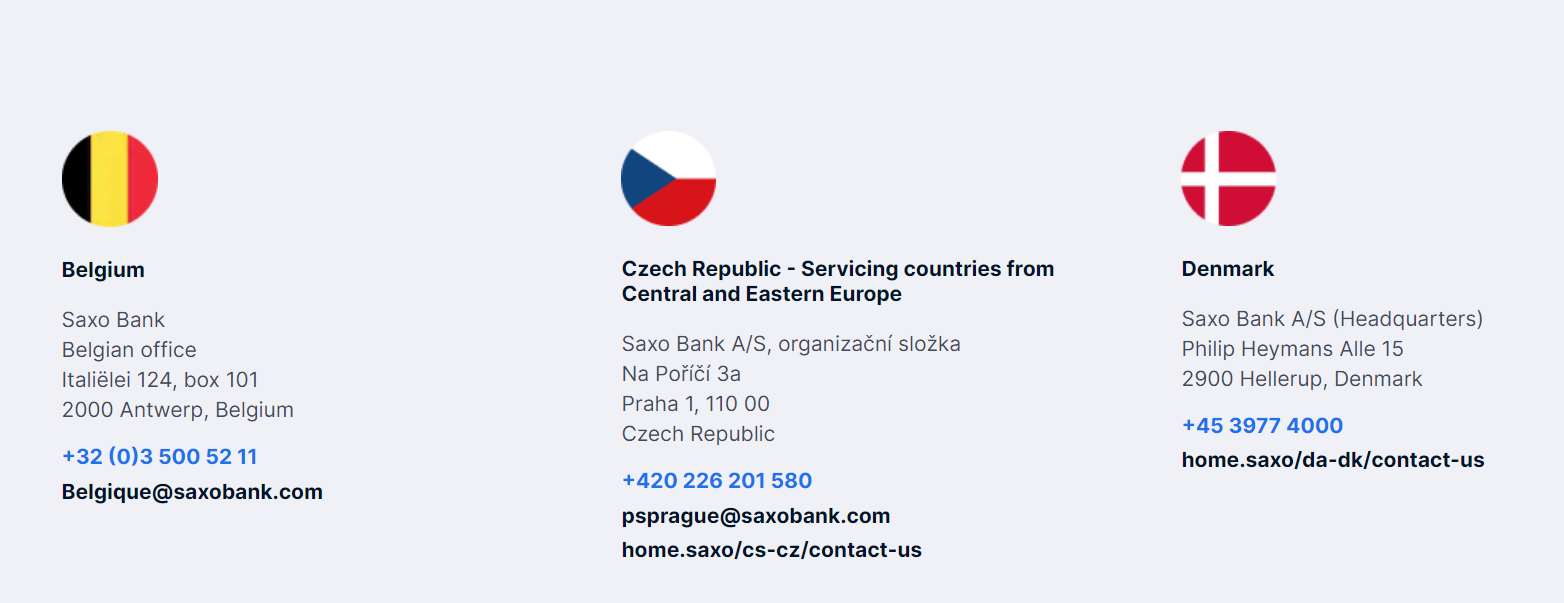

In addition to the licenses listed above, Saxo group entities are authorized and licensed in several other countries which are UAE, Brazil, Czech, Switzerland, Italy, Netherlands, France, and Belgium.

It is clear that Saxo has a global presence (not just online, but in physical offices as well). The company is highly credible and has been providing stellar services for decades since 1992.

Saxo Leverage

Leverage on Saxo depends on whether you are a retail or professional client and the instrument being traded. The broker offers leverage ranging from 1:5 to 1:30 for retail clients while professional clients have leverage from 1:5 to 1:50.

With a leverage of 1:30, you open a trade position worth 30 times the value of your deposit. For example, if you deposit $1,000, you can open a $30,000 trade position.

Note that the maximum leverage limit applies to major forex pairs and other instruments have lower leverage limits.

It is important not to trade with all the available leverage as it increases your risk and you can lose all your money. Do not engage in leverage trading if you don’t understand it or ready to bear the risks.

Saxo Account Types

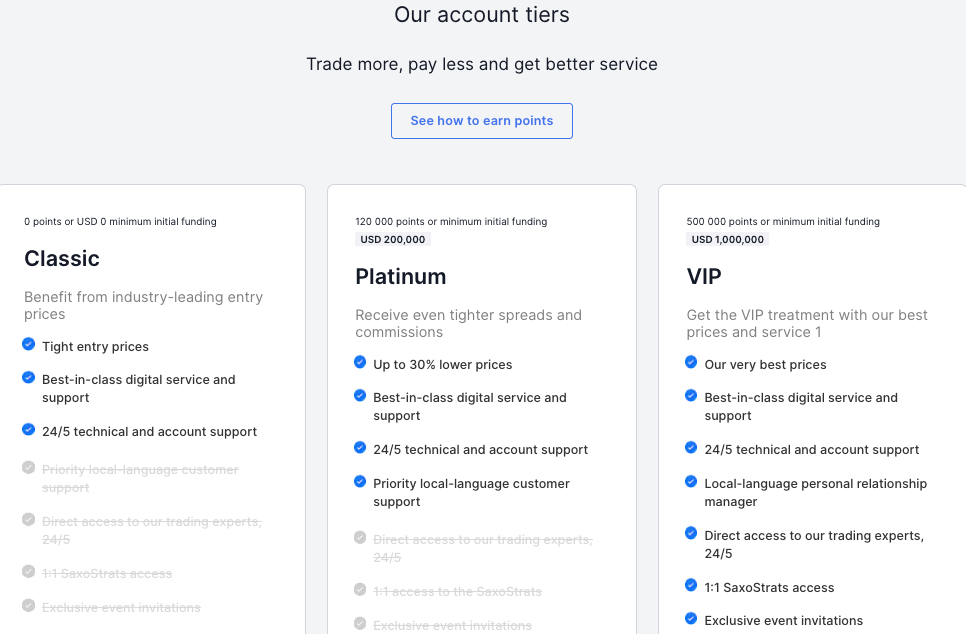

Saxo Capital Markets offers three primary types of accounts in the Philippines. Each of the account types differs in terms of commission and minimum deposit along with value-added features.

1) Classic Account – The Saxo Classic account is the most basic account offered by Saxo. This is the account you get by default when you first signup with the broker.

There is no mandatory minimum deposit required for this account. Users of this account type will be charged $200 for adding new instrument to their trading portfolio.

2) Platinum – The Platinum account can be opened by making a minimum deposit of US$200,000. This type of account allows traders to trade with 30% lower transaction fees.

Further, users can gain access to priority local-language customer support. Users of Platinum account on Saxo Markets will be charged $200 for adding new instrument to their trading portfolio.

3) VIP – The VIP account can be opened by making a minimum deposit of US$1,000,000.

If you have a VIP account, you can trade with the best prices offered by Saxo. Further, you gain access to a dedicated trading advisor. You will also be invited to exclusive events hosted by Saxo.

In addition to these Saxo accounts, users can also sign up for a Joint Account (which allows you traders to create an account with a family member), a Corporate Account (which allows traders to benefit from a professional-grade platform), and a Professional Account (which allows users to be classified as an Elective Professional client which comes with a range of benefits.

Saxo Markets also has negative balance protection for all accounts for up US$100,000. If you suffer a loss during a trade and lose all your deposits, any negative balance will be reset to zero.

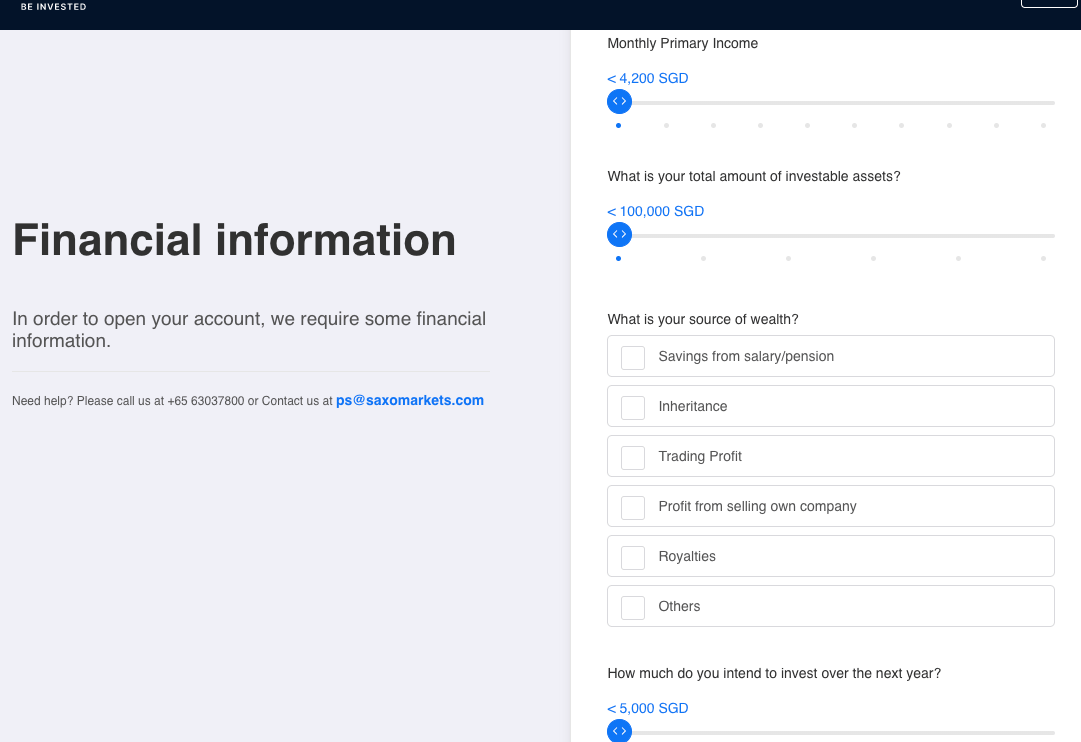

Saxo Fees

Fees on Saxo depend on the instruments you are trading, the size of the trading, your account type, and how long you keep the trade open. Here is an overview of the trading and non-trading fees on Saxo.

Trading fees

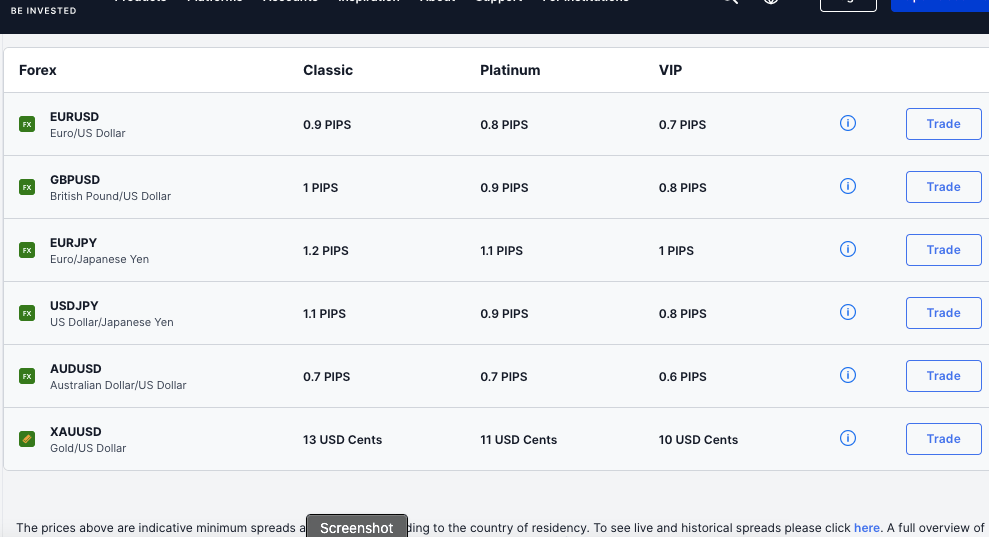

1) Spread – Saxo charges spreads when you trade financial instruments on the platform. The spread is a markup on the market prices of the instrument, starting from about 0.7 pips on the VIP Account. Find the average spreads for major currency pairs in the image below:

2) Commission – Saxo charges a high commission based on your account type. The fee associated with a trade depends largely on the type of instruments being traded. Commissions start from $1 for stocks and 0.5% for bonds.

3) Custody Fee – Saxo also charges a custody fee. This custody fee can range from 0.09% per annum to 0.15% per annum, depending on the type of instrument being traded and the type of account being held by the user.

4) Currency Conversion Fee – Saxo charges a currency conversion fee when you open a trade in a currency different from the base currency of your account. The currency conversion fee is based on the forex exchange rate plus interest rates starting from 0.50% and can be up to 1%, depending on the instrument type you are trading.

5) Swap Fee – If you keep a trade position open past the market closing time on Saxo, the trade rolls over to the next trading day and you incur rollover fees or overnight funding costs also called swap fees. This fee is determined based on the instrument being traded, spread, leverage, and the number of nights the position is kept open.

Non-Trading fees

1) Deposit and Withdrawal Fee – Saxo allows traders based in the Philippines to deposit and withdraw funds in a variety of ways. Saxo does not charge any deposit fees, however, a fee may be charged by the payment service provider.

2) Inactivity Fee – Saxo bank charges any dormant account fees. If you do not log into your account for 6 months Saxo Markets charges an inactive account fee of US$100.

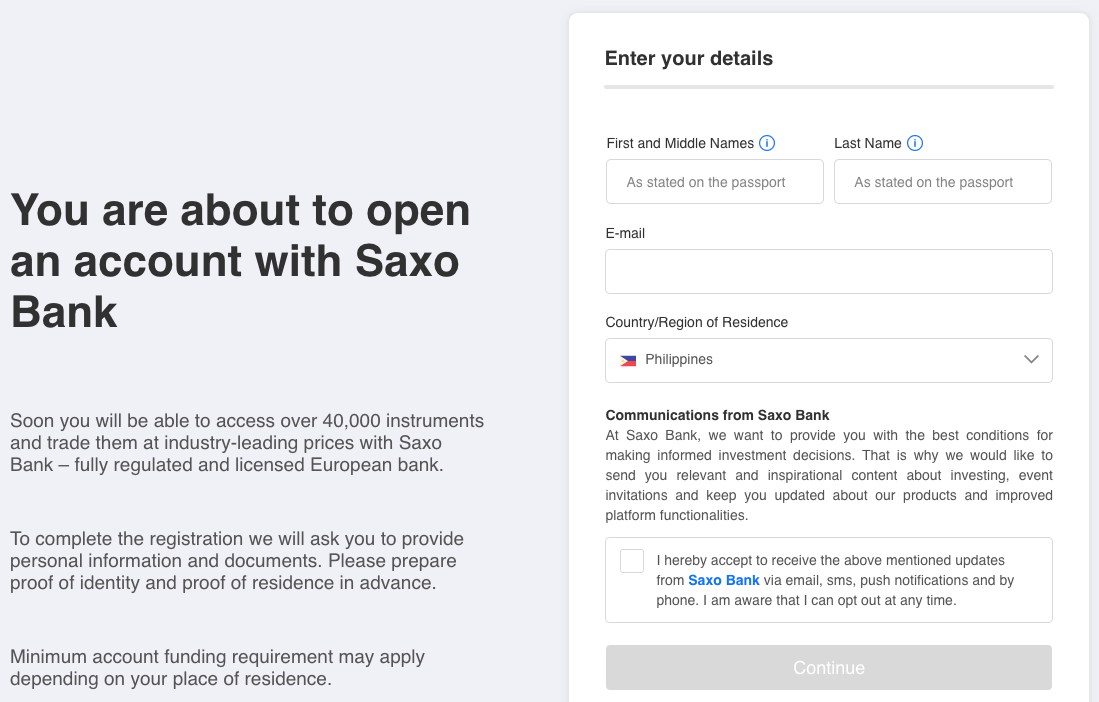

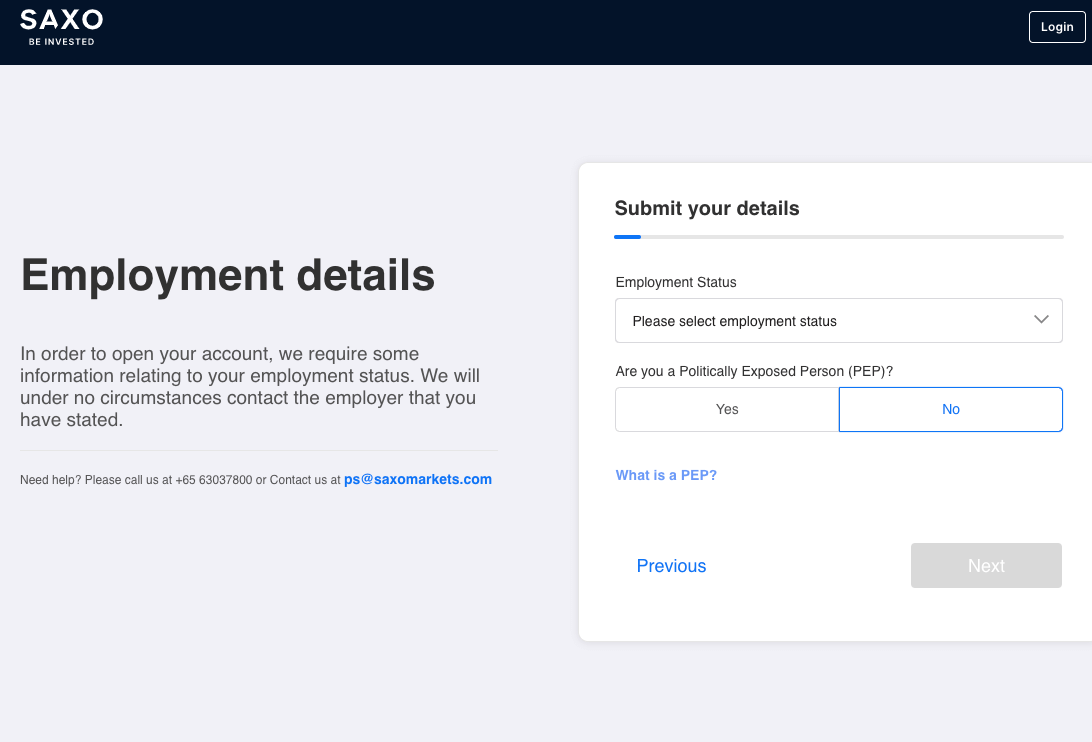

How to Open Saxo Account in Philippines?

Follow these steps to open a trading account on Saxo Markets.

Step 1) Go to the Saxo Markets website at www.home.saxo and click on ‘Open account’.

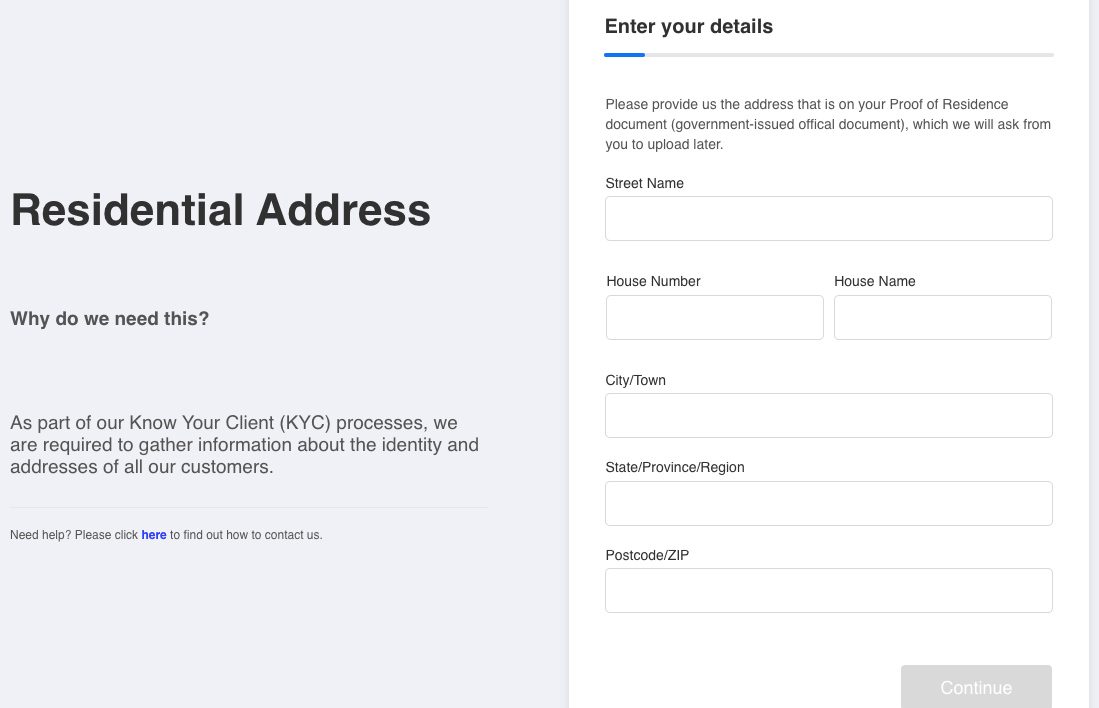

Step 2) On the form that appears, fill out your name, email, and phone number, create a password, select your country of residence (the Philippines will be selected by default), and then click on ‘Continue’. You can also choose to fill this out with Myinfo by Singpass. Fill out your address information and click ‘Continue’.

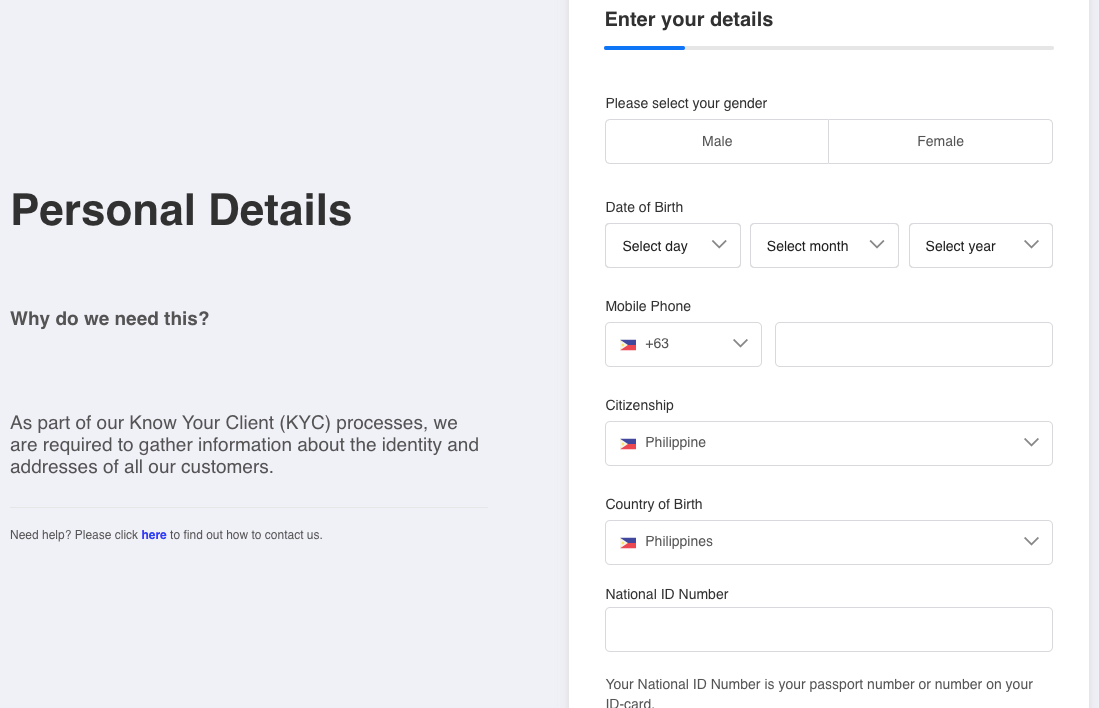

Step 3) Supply your date of birth, and gender, select nationality, check the box to indicate if you have another citizenship and provide your National ID Number then click ‘Continue’.

Step 4) Answer questions relating to your employment, financial status, trading experience and knowledge, then click ‘Continue’.

Step 5) Submit your tax information, confirm you are not a US citizen and click ‘Continue’. You will be required to confirm the information you have supplied, then click ‘Next’.

Step 6) Confirm the information you have supplied, then click ‘Next’. Then accept the terms and conditions and click ‘Continue’.

Step 7) Upload the required verification documents (identity and address proof documents) to verify your account.

After your account is activated, you can make deposits, place trades and withdraw funds from it.

Saxo Deposits and Withdrawals

Saxo allows traders based in the Philippines to deposit and withdraw funds in a variety of ways.

Saxo Markets Deposit Methods

Here is a summary of payment methods accepted by Saxo Markets for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Bank Wire Transfer | Yes | Free | 1-2 business days |

| Cards | Yes | up to 2.88% per transaction | Instant |

| E-wallet | Yes | Free | Within minutes |

Saxo Markets Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on IC Saxo.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Bank Wire Transfer | Yes | Free | 0-2 business days |

| Cards | No | N/A | N/A |

| E-wallets | No | N/A | N/A |

What is the Saxo Markets Minimum deposit?

The recommended minimum deposit on Saxo Markets Platinum Account is US$200,000, for the VIP account, the minimum deposit is US$1,000,000, while the Classic account has no mandatory minimum deposit. This applis to all payment methods which apply to the Classic Account.

What is the Saxo Markets Minimum withdrawal?

There is no mandatory minimum withdrawal on Saxo Markets in the Philippines.

You can initiate deposits and withdrawals by logging into your account, and on the Saxo client area or dashboard, click on deposit or withdrawal on the left side menu.

Saxo traders can only withdraw money from their Saxo trading account directly into their bank account. Their website contains detailed information on how to withdraw funds from your trading account to your bank account. A withdrawal fee of US$50 may be applied in case you use the manual form for processing your withdrawal.

Saxo Trading Instruments

Saxo offers a very wide range of investment and trading products. Below are financial instruments that can be traded on Saxo Markets

| Instrument | Availability | Number |

|---|---|---|

| Forex | Yes | 197 currency pairs on Saxo Markets |

| Forex Options | Yes | 40 forex options pairs on Saxo Markets |

| Commodities | Yes | 19 commodities on Saxo Markets |

| Bonds | Yes | 5,000+ bonds on Saxo Markets |

| Stocks | Yes | 22,000+ stocks on Saxo Markets |

| Futures | Yes | 300+ futures on Saxo Markets |

| ETFs | Yes | 6,700+ ETFs on Saxo Markets |

| Mutual Funds | Yes | 250 Mutual Funds on Saxo Markets |

| Listed Options | Yes | 3,100+ Listed Options on Saxo Markets (including equities, energy and others) |

| CFDs | Yes | 9,000+ CFDs on Saxo Markets (including indices, options and others) |

| Cryptos | Yes | 117 cryptocurrencies on Saxo Markets |

Further, Saxo also offers managed portfolios for investors who need expert advice and help managing their investments. To traders from the Philippines, they offer cryptocurrency ETNs as well.

Overall, the range of instruments offered by Saxo is quite impressive and significantly above average.

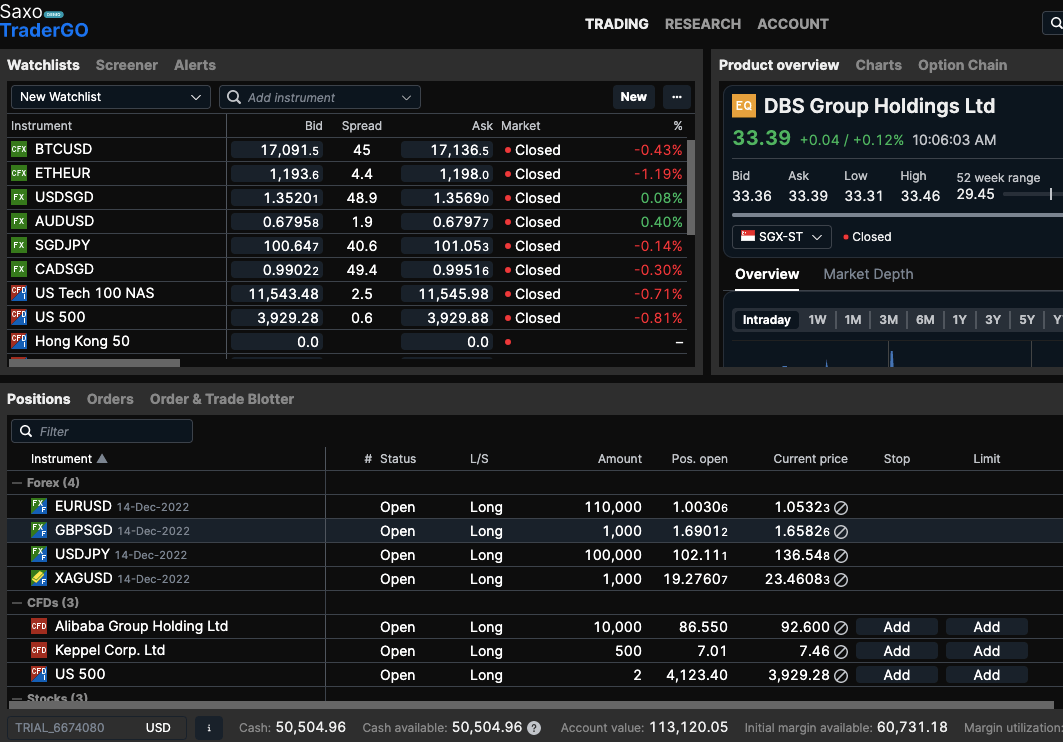

Saxo Markets Trading Platforms

Trading platforms supported by Saxo Markets are owned by the broker.

1) SaxoInvestor: This is a proprietary trading application owned by Saxo Markets which is available on the web, desktop (macOS & Windows), and mobile devices (Android & iOS). You can only trade stocks, mutual funds, ETFs, bonds and managed portfolios with this platform.

2) SaxoTraderGo: This is another proprietary trading application owned by Saxo Markets and is available on desktop and mobile devices. You can trade stocks, mutual funds, ETFs, bonds, forex, CFDs, futures, commodities, forex options, listed options and managed portfolios with this platform.

3) SaxoTraderGoPRO: This is another proprietary trading application owned by Saxo Markets and is available only on desktop (PC and MAC). You can trade stocks, mutual funds, ETFs, bonds, forex, CFDs, futures, commodities, forex options, listed options and managed portfolios on this platform.

Overall, the range of instruments offered by Saxo is quite impressive and significantly above average.

Saxo Educational Materials and Research

Saxo offers basic educational materials to its traders for free. This material covers the basics of fundamental and technical analysis but does not go into detail. The educational material also comprehensively covers Saxo’s trading platform and products, so that any new trader can quickly understand Saxo’s offerings.

The educational material provided by Saxo is in line with their unstated goal of attracting sophisticated investors and traders who are already familiar with the markets.

Further, Saxo dedicates a lot of manpower to providing accurate and timely research to its users. Saxo has several in-house analysts which provide regular updates on the market along with commentary.

Saxo Customer Support

Customers can get in touch with Saxo through phone calls or email. Saxo does not have a local office in the Philippines, so residents cannot directly visit them.

1) Phone Call – Users can get in touch with Saxo through phone calls. Their phone call option is available at all times from Monday to Friday.

2) Email – Contacting them through email is excellent for anyone who needs a record of their complaint. Emails also allow customer support teams to provide a detailed response. You can get in touch with Saxo at any time through email.

3) Live Chat – Saxo does not offer customer support through live chat to non-registered visitors. They do offer chat support through their trading platform to registered users, however, this support is only available in English.

4) Chatbot – Saxo has a chatbot but with extremely poor functionality. Saxo also has an extensive FAQs page that can help solve several issues and doubts, however, the search function could be more accurate.

Do We Recommend Saxo for Philippines Traders?

Saxo is a broker that is meant for high net worth traders and investors. Their accounts are more suitable for those who can pay a high monthly fee in exchange for lower trading accounts. Their educational and research materials are also geared towards sophisticated traders.

Further, Saxo provides a very wide range of trading instruments which could be highly attractive to an active trader looking for exposure to a variety of instruments and portfolio diversification.

However, there are a few downsides to the services provided by Saxo as well. Saxo’s customer support is not user-friendly and it takes time and effort to get in touch with them. They only provide live chat support to users that have already opened an account with them. This can leave out prospects who want

to know more about their services before opening an account.

Overall, we recommend Saxo to traders based in the Philippines who are already experienced and want to trade in high volumes.

Saxo Bank Philippines FAQs

How Reliable is Saxo?

Saxo is highly highly regulated by top-tier financial authorities, this means they have an obligation to protect client funds. The parent company of Saxo Markets is a Danish Bank which is listed on the public stock exchange, this indicates a strong backup for the broker. However traders from the Philippines trade at their own risk as the broker is not regulated in the Philippines and they may not be protected by the foreign regulations. This is because they are a highly credible broker that is regulated by tier-1 and tier-2 financial authorities and

Is SaxoTraderGO good?

SaxoTraderGO is the proprietary trading platform offered by Saxo. This trading platform comes with a wide range of features which are suitable for both beginners and advanced traders. The platform also offers a variety of trading instruments. You can use this platform through almost any kind of device including Android or iOS smartphones.

Is Saxo good for investing?

Saxo is a broker for trading purposes. If you want to trade forex instruments or CFD instruments, then you should check out Saxo’s services on their website. They offer trading services to both individuals and corporate organisations, they also accept traders from the Philippines.

How much is the minimum deposit for Saxo market?

The recommended minimum deposit on Saxo Markets Platinum Account is US$200,000, for the VIP account, the minimum deposit is US$1,000,000, while the Classic account has no mandatory minimum deposit. This applis to all payment methods which apply to the Classic Account.

Is Saxo good for beginners?

Saxo is more suitable for advanced traders rather than beginners. Their trading accounts are geared towards high-volume traders and their fee structure is more suitable for traders with a high net worth. Further, Saxo’s research material for traders requires a solid grounding in the basics of trading before you can make use of them.

Note: Your capital is at risk