| CMC Markets Minimum Deposit Summary | |

|---|---|

| CMC Markets Minimum Deposit | SGD 0 |

| Deposit Methods | NETS, MEPS, Bank Transfer, PayNow, FAST Transfer |

| Account Types | Next Gen, MT4 Account, FX Active Account |

| Deposit Fees | PayNow, Fast transfer, and Bank Transfer have no fees |

| Account Base Currencies | USD, SGD |

| Withdrawal Fees | Some withdrawal methods attract a fee |

| Visit CMC Markets | |

CMC Markets’ minimum deposit is SGD 0. There is no minimum deposit required for all account types. Four live CFD trading accounts are offered by CMC Markets apart from their professional and institutional accounts.

The minimum deposit for the professional accounts are definitely higher. It is important that you know this. In this article, we provide a guide on CMC Markets trading accounts and how you can fund your your account.

How Much is CMC Markets Minimum Deposit in Singapore?

CMC Markets Singapore have no minimum deposits.

However, their trading accounts come with separate trading conditions. These conditions are essential to know as they affect your trading costs. So beyond minimum deposit, let us look at these accounts briefly.

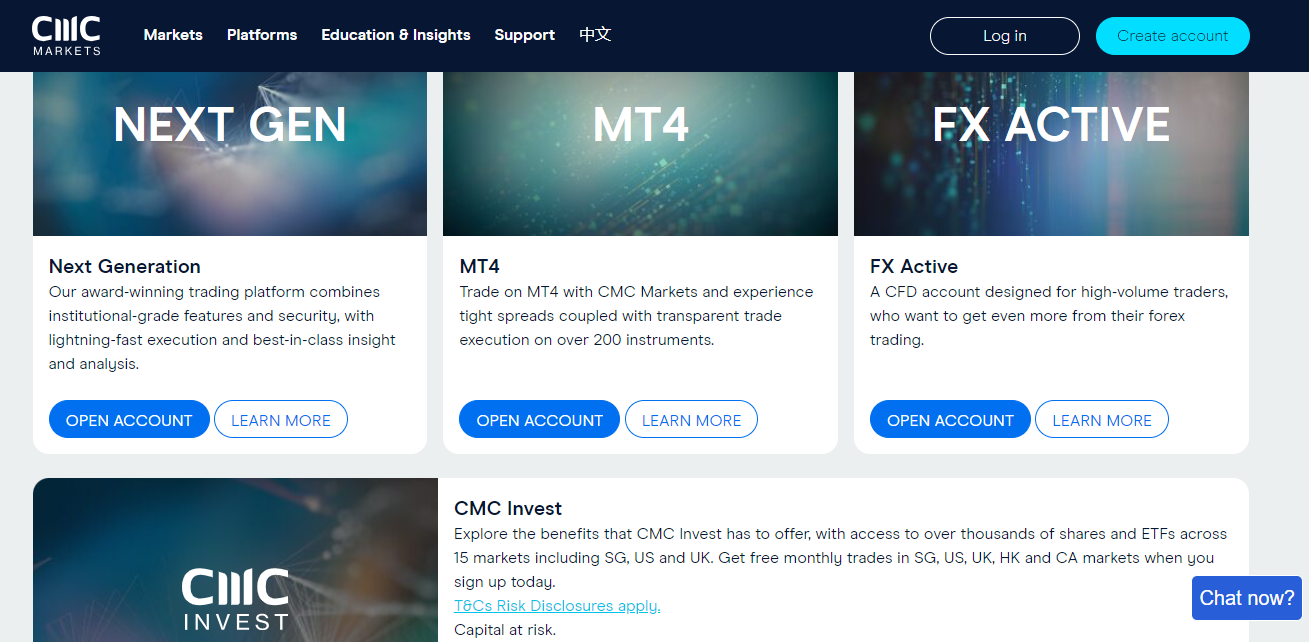

1) Next Gen Account

Minimum deposit for the account is SGD 0. This account allows you to go long or short on forex, indices, commodities, shares, and treasuries. It is available only on CMC Markets Next Gen trading platforms.

Spreads begin from 0.0 pips and you will pay a minimum commission. The commission applies to shares CFDs only and it begins from SGD 10 for Singaporean shares and $10 for US shares.

You can open a demo account to practice and premium guaranteed stop loss order (GSLO) is available at a fee. It the order is not triggered, all of the fee will be refunded.

The Next Gen account also supports advanced trading order

2) MT4 Account

The minimum deposit for the MT4 Account is SGD 0 . As the name implies, you can only open this account on MT4.

This account does not offer all of CMC Markets’ range of CFDs in Singapore. Only 200+ trading instruments which include forex pairs, indices, commodities, and cryptos are available.

Spreads are tight, beginning from 0.0 pips. Shares CFDs are not available on this account. Added to this account are advanced tools that help you manage risk and trade better.

Such tools include correlation matrix, alert manager, mini terminal, correlation trader, sentiment trader, etc.

3) FX Active Account

You need SGD 0 to open the FX Active Account.

Do you love to trade CFDs with pure price action? If yes, this account is designed for you. With low spreads beginning from 0.0 pips, you can trade the same instruments on the standard CFD Account.

Normal spread pricing applies to EUR/USD, GBP/USD, AUD/USD, NZD/USD, USD/CAD, and USD/JPY. On all other forex pairs, the spread is reduced by 25%.

You will pay zero commission on all instruments except for shares CFDs. The minimum commission is $10 and SGD 10 for US and Singaporean shares respectively.

Singapore traders can open the FX Active Account on MT4 and the Next Gen trading platform.

GSLO premium fee is refunded if it the order is not triggered.

Note: CFD trading is risky

4) CMC Invest

There is no minimum deposit for a CMC Invest Account.

CMC Invest allows you to trade and invest in shares on a single platform. You will have access to global markets like USA, Canada, UK, Germany, Switzerland, France, Belgium, Netherlands, Spain, Sweden, Denmark, Japan, and New Zealand.

You will also be able to trade or invest in local shares via Singapore and Hong Kong stock market. There are no hidden fees. CMC Invest charges zero fees for platform, custody, maintenance or inactivity.

Finally, CMC Markets’ share trading platform allows you analyze the stock market on TradingView, giving you access to advanced charts and indicators.

Here is a general overview of CMC Markets trading accounts in Singapore.

Does CMC Markets have a Recommended Minimum Deposit?

Though CMC Markets have no minimum deposit, they do suggest that you fund your account with at least SGD 100 to cover for margin requirements.

CMC Markets Deposit Methods and Required Fees

CMC Markets do not only have SGD-based account. They also allow you fund your account in Singaporean Dollar (SGD). There are nine deposit methods supported by CMC Markets.

Here is a brief breakdown of these methods.

1) FAST Transfer: Available for all fast participating banks. Funding is immediate after to normal system checks. No extra fees.

2) Credit and Debit Card: Cards are accepted via MasterCard and Visa. Processing time is immediate and 2% transaction fees will be levied.

3) PayNow: Processing depends on the time you fund your account. No transaction fees.

4) Bank Transfer: POSB and DBS account holders can fund their account via local banks without extra cost.

5) MEPS (SGD$): If you fund your account via this method before 4pm, your money will show in your account on the same day. For charges, refer to remitting bank.

6) Bill Payment: DBS Account holders can fund their account using this method without extra fees. Processing takes time is one working day.

7) ATM (Transfer): You transfer funds from the ATM to your trading account for free. On weekdays, transfer done between 8am-4pm takes 2 hours to process. On Weekends and public holidays, 9am the next working day.

8) Network for Electronic Transfer (NETS): You can use this method at CMC Markets’ office in Singapore without extra charges. No cash deposit is allowed.

9) Inward Telegraphic Transfer: This method is suitable if you are making your deposit from overseas. DBS Bank charges of SGD 10.

If you want to fund your account in USD, you can use credit/debit cards, UOB Telegraphic Transfer, Non-UOB Telegraphic Transfer, DBS (Over the Counter Transfer), Non-DBS Telegraphic Transfer, and Cheque.

Note: There might be extra fees charged by your payment service provider when you fund your account. These fees are separate from the ones charged by CMC Markets.

CMC Markets Deposit Terms

1) CMC Markets does not accept cash or cheque payments. They are also unable to accept American Express or Diners Club.

2) Fund your account with card or bank accounts that is in your name. CMC Markets will reject payments from third party sources.

3) CMC Markets charges for some deposit methods.

4) If there is a difference between the deposit amount in your trading account and the amount you transferred, reach out to your payment service provider first.

5) All funding methods have their unique instructions. Ensure you deposit your money accordingly.

How to Deposit Money Into Your CMC Markets Account

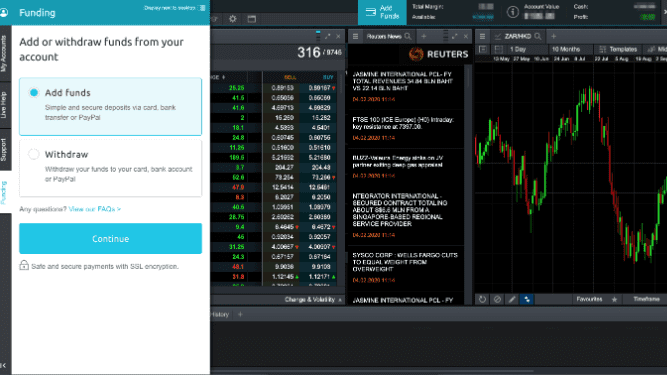

1) On CMC Markets platform or mobile app, log in to your client area.

2) Look for the Funding tab on the left and click it.

3) Select your preferred funding method.

4) Enter necessary details and make sure they are correct.

5) Complete the funding of your account.

Comparison Of CMC Markets Minimum Deposit With Other Brokers

Here how other broker’s minimum deposit compare with that of CMC Markets.

| Broker | Minimum Deposit |

|---|---|

| CMC Markets | SGD 0 |

| Plus500 | SGD 200 |

| IG Markets | SGD 450 |

| OANDA | $0 (SGD 0) |

| AvaTrade | $100 (SGD 133) |

| City Index | SGD 150 |

Note: CFD trading is risky

What base currencies are accepted by CMC Markets?

In Singapore, CMC Markets supports USD and SGD as base currencies

What does SGD mean in money?

SGD in money terms mean the Singaporean Dollar.

Frequently Asked Questions

What is the minimum deposit for CMC Markets Singapore?

CMC Markets Singapore have no minimum deposit. You need SGD 0 to open an account.

Is there a deposit limit for CMC Markets?

CMC Markets does not have a deposit limit. But your bank or payment service provider might have.

Is CMC Invest good for beginners?

Your capital is at risk when you invest. Make sure you have sufficient knowledge before going into it.

Can CMC Markets be trusted?

CMC Markets operate in Singapore under MAS license. They also hold other top-tier licenses.

Can you withdraw money from CMC Markets?

Yes, you can withdraw your funds by using the Funding tab.

Note: Your capital is at risk