CMC Markets has been in operation since 1989. It was founded in the UK and caters to clients from across the world. CMC Markets provides CFD trading services which includes forex. It offers a wide range of trading instruments (more than 10,000) covering forex, indices, shares, commodities, ETFs, and treasuries.

CMC Markets has its own proprietary trading platform called Next Generation (NGEN). Traders can also use the commonly used and highly popular MetaTrader 4 (MT4) trading platform.

CMC Markets is regulated by the Financial Markets Authority (FMA) of New Zealand along with the tier-1 financial authorities Financial Conduct Authority (FCA) of the United Kingdom and the Australian Securities and Investment Commission (ASIC) of Australia.

In this review, we will deep-dive into CMC Markets services along with the pros and cons and independent analysis.

| CMC Markets Review Summary | |

|---|---|

| Broker Name | CMC Markets NZ Limited |

| Establishment Date | 1989 |

| Website | https://www.cmcmarkets.com/en-nz/ |

| Address | Level 25, 151 Queen Street, Auckland, New Zealand |

| Minimum Deposit | NZD 0 |

| Maximum Leverage | 1:500 |

| Regulation | FMA, ASIC, FCA, BaFin, IIROC, MAS, DFSA |

| Trading Platforms | MetaTrader 4, Next Generation |

| Visit CMC Markets | |

CMC Markets Pros

- Regulated in New Zealand

- Offers negative balance protection and segregation of funds to all clients.

- Offers a wide range of instruments to trade

- Has NZD account currency

- Offers commission-free trading on CFD account

- Does not charge any fees for deposits or withdrawals.

CMC Markets Cons

- No customer support through live chat.

- Does not offer bonds or ETFs as trading instruments.

- Very high commission for trading shares

Is CMC Markets trusted?

We consider CMC Markets to be safe for traders from New Zealand because they are locally regulated in the country by the FMA of New Zealand. Being locally regulated means that the operations of the broker in the country are legal and they can be held accountable by the courts of the country. Further, their operations are subject to the regulations implemented by the FMA.

Further, CMC Markets is regulated by both the tier-1 regulatory authorities in the world which are the FCA of the UK and the ASIC of Australia.

CMC Markets also implements safety practices such as negative balance protection and segregation of funds. Segregation of funds ensures that your money is safe even if CMC Markets goes into liquidation.

Further, negative balance protection ensures that you do not lose more money than you have deposited into your trading account.

Here is a breakdown of the licenses held by CMC Markets and its group entities:

1) Financial Markets Authority: CMC Markets NZ Limited is regulated by the Financial Markets Authority of New Zealand and holds the company registration number 1705324 as a Financial Services Provider.

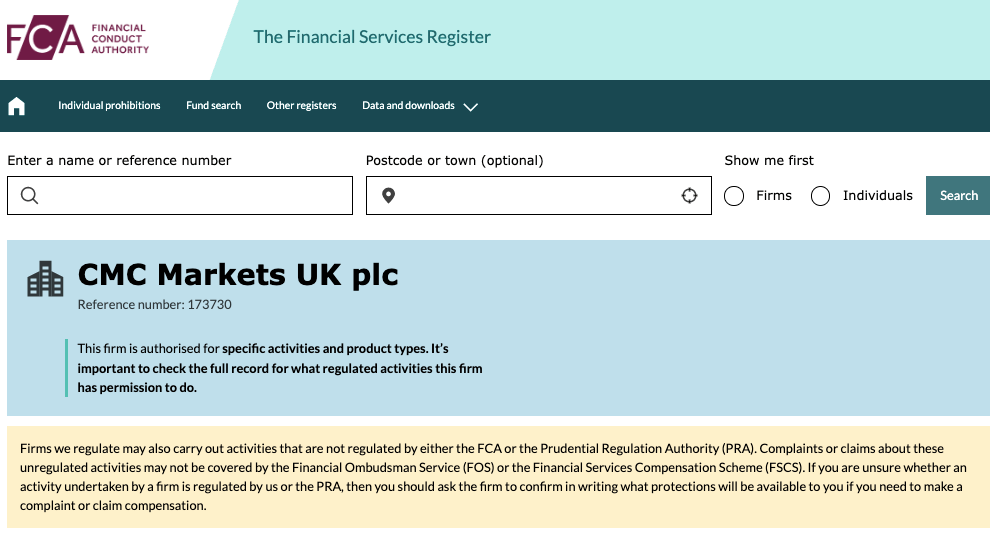

2) Financial Conduct Authority: CMC Markets UK PLC and CMC Spreadbet PLC are authorized by the Financial Conduct Authority (FCA) of the UK and hold the license numbers 173730 and 170627 respectively.

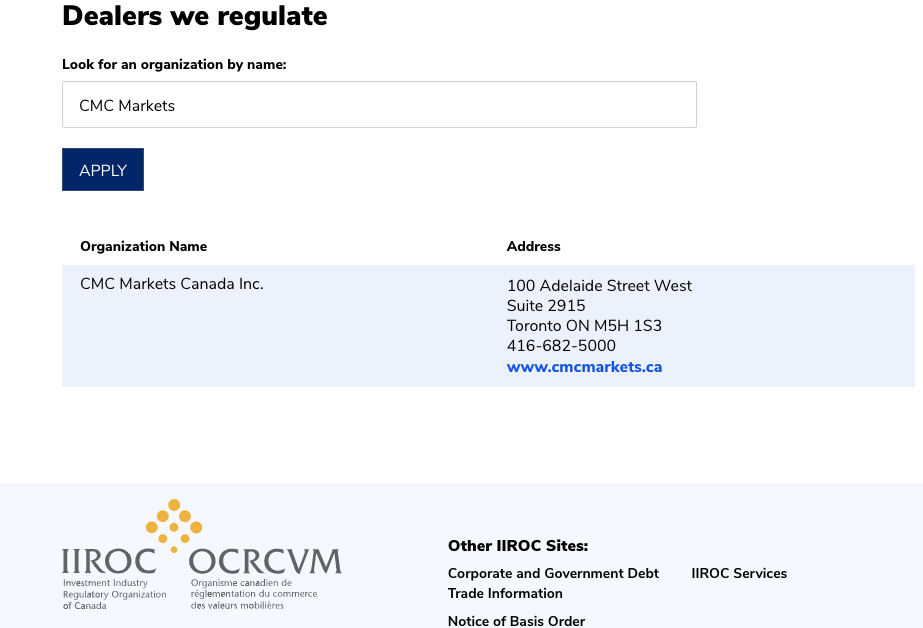

Additionally, CMC Markets is also regulated by the ASIC of Australia, the BaFin of Germany, the IIROC of Canada, the MAS of New Zealand, and the DFSA of the UAE. Here is more details about these regulations

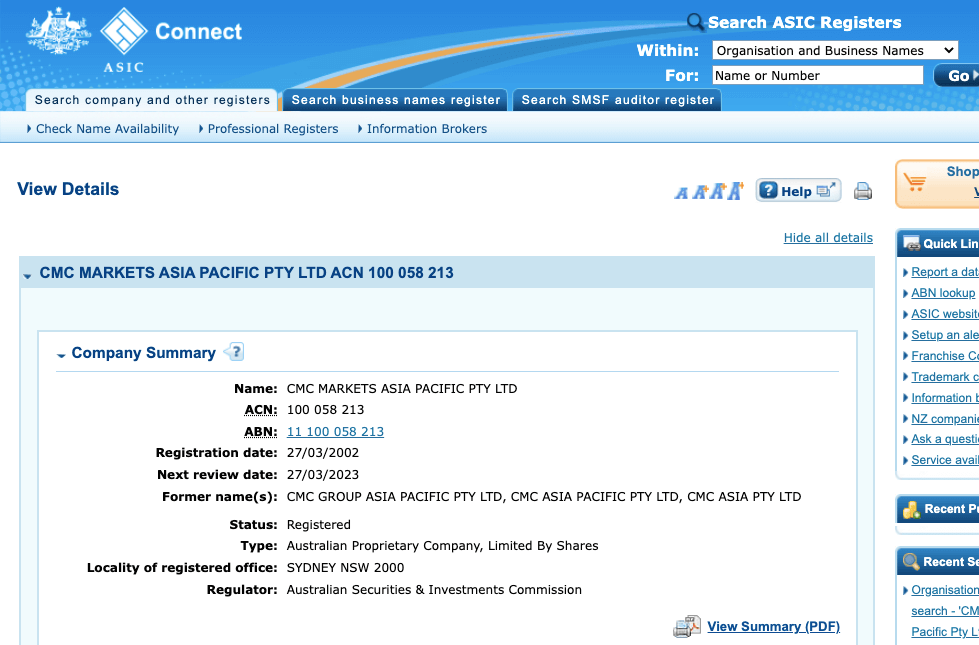

3) Australian Securities & Investments Commission (ASIC): CMC Markets is licensed in Australia by ASIC as ‘CMC Markets Asia Pacific Pty Ltd’ to offer financial services with ACN 100058213, issued in 2002.

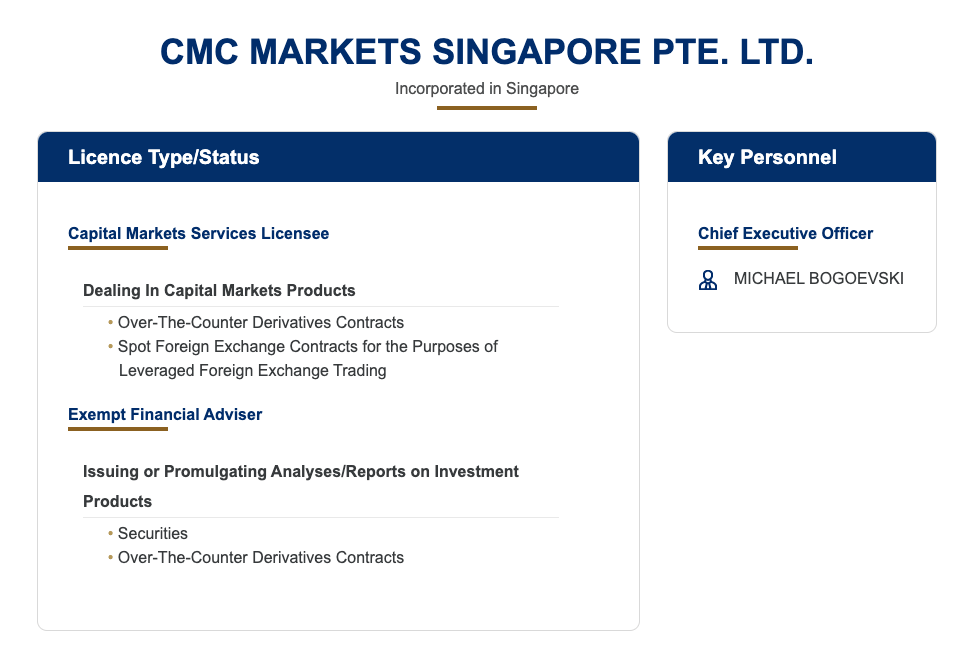

4) Monetary Authority of Singapore (MAS): CMC Markets is regulated in Singapore as ‘CMC Markets Singapore PTE. Ltd.’, and licensed to provide capital market services.

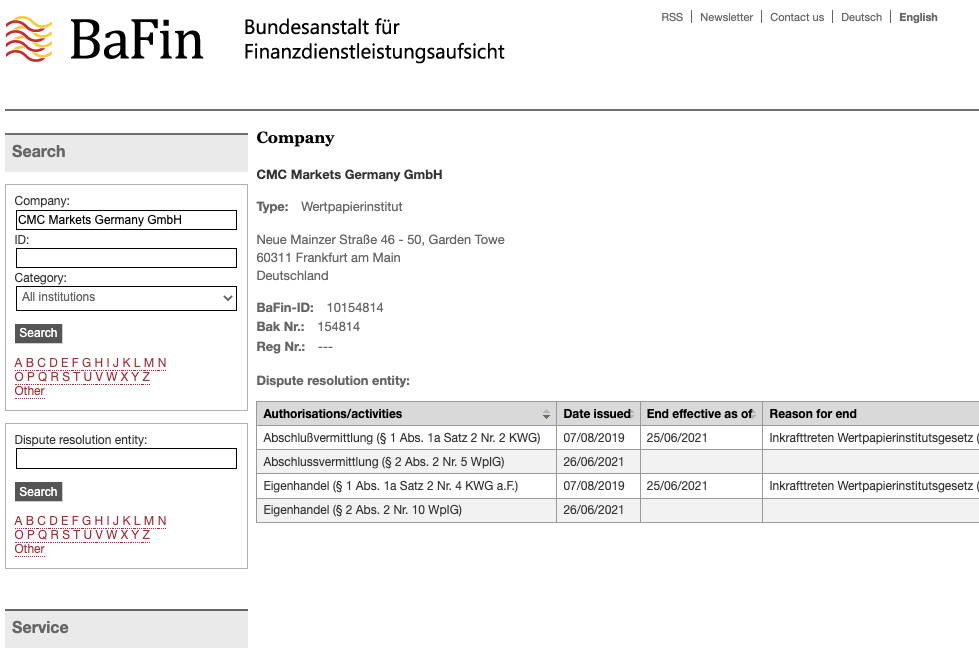

5) Federal Financial Supervisory Authority, Germany: CMC Markets is authorised in Germany as ‘CMC Markets Germany GmbH’, with an office in Frankfurt. They serve European clients through the license in the EEA.

6) Canadian Investment Regulatory Organization (CIRO): CMC Markets is regulated in Canada by CIRO as ‘CMC Markets Canada Inc.’ as an investment dealer, and is registered with Canada Securities Administrators (CSA) with NRD (National Registration Database) Number 12570, issued in 2009.

CMC Markets is registered with the Canadian Investor Protection Fund (CIPF). The CIPF works to ensure that any asset or investment owed to you by a regulated broker is given back up to $1 million.

CMC Markets Investor Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| UK | £85,000 | Financial Conduct Authority (FCA) | CMC Markets UK Plc |

| Australia | No Protection | Australian Securities and Investments Commission (ASIC) | CMC Markets Asia Pacific Pty Ltd |

| Singapore | No Protection | CMC Markets Singapore Pte. Ltd. | AxiTrader Limited |

| Canada | $1,000,000 | Canadian Investment Regulatory Organization (CIRO) | CMC Markets Canada Inc |

| New Zealand | No Protection | Financial Markets Authority (FMA) | CMC Markets NZ limited |

Negative balance protection is available in New Zealand via Shield mode. You can activate it on request.

CMC Markets Leverage

The leverage offered by CMC Markets depends on the type of instrument being traded. The maximum leverage allowed by CMC Markets is 1:500 which is quite decent when compared to other similar brokers.

However, trading with low leverages is recommended since it can reduce the risk associated with your trades and is highly suitable for beginners.

CMC Markets offers a leverage of 1:500 for trading currency pairs, 1:500 for trading indices, 1:200 for trading gold, 1:100 leverage for trading silver, 1:400 for trading treasuries, and so on.

A leverage of 1:500 means that you can trade instruments worth $500,000 while only investing $1,000 of your own money.

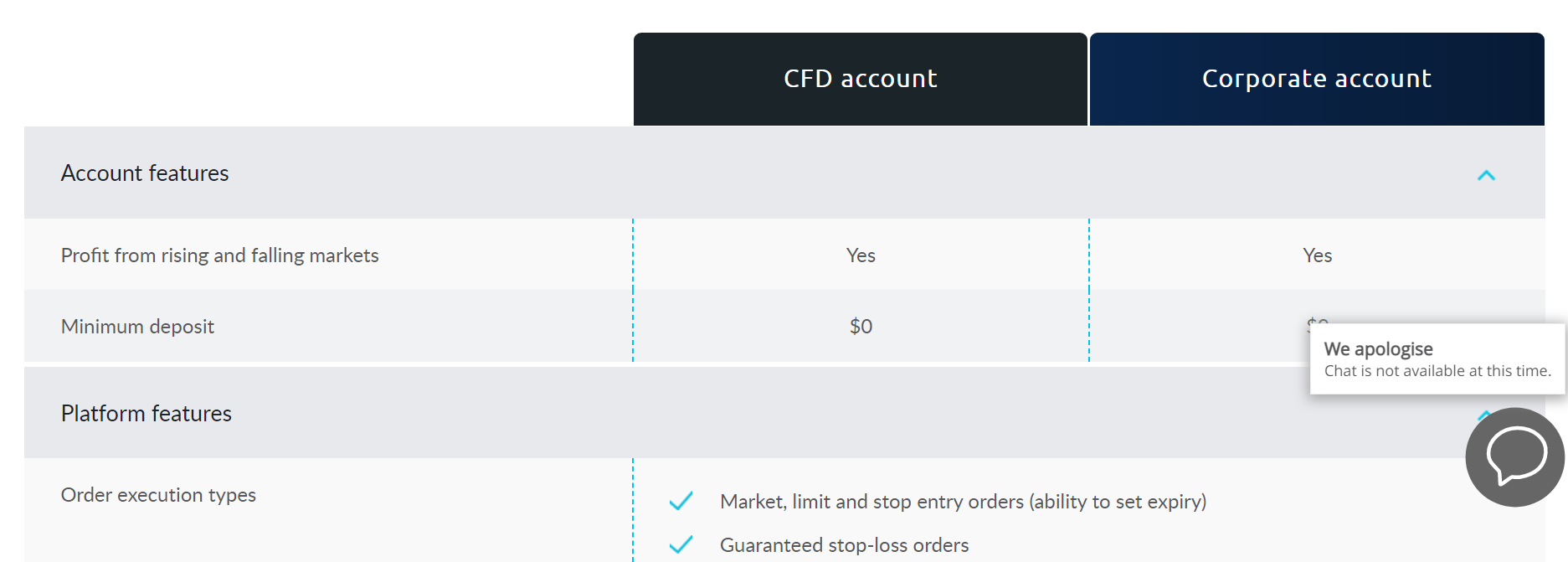

CMC Markets Account Types

CMC Markets offers two primary types of accounts along with a premium service known as ALPHA.

1) CFD Account: The CFD account does not require a minimum deposit from traders. You can open an account for free. The maximum leverage is 1:500. The minimum spread is 0.3 pips which is quite low when compared with other similar brokers. They only charge a commission when trading shares. The commission is a minimum of $7 per trade per lot. Traders can use New Zealand Dollar as a base account currency when using this account. This account is meant for retail traders.

2) Corporate Account: The CFD account does not require a minimum deposit from traders. You can open an account for free. The maximum leverage is 1:500. The minimum spread is 0.3 pips which is quite low when compared with other similar brokers. They only charge a commission when trading shares. The commission is a minimum of $7 per trade per lot. Traders can use New Zealand Dollar as a base account currency when using this account. This account is meant for corporate or institutional traders.

3) ALPHA Account: The ALPHA account is a premium account offered by CMC Markets. This account has range of additional features such as a dedicated account manager, access to exclusive events and conferences, competitive rebates, in-depth market insights and reports, and a transparent pricing ladder.

In order to use this account type, you will need to meet a minimal monthly trading volume in at least one asset class offered by CMC Markets ranging from forex to cryptocurrencies to shares.

4) Demo Account: CMC Markets offers a demo account which mimics the CFD account. This type of account can be used by beginners to practice trading without using real money. It can also be tried by traders to understand CMC Market’s services and their trading platform.

What are the Base Currencies offered by CMC Markets?

CMC Markets offers only three base currencies. These are NZD, USD, and HKD. You will need to choose between the three as your account currency.

The base currency is the currency in which your trading account will be denominated. All your profit and loss will be based on this currency. When you deposit money into your account, your funds will be converted into the base currency unless you’re depositing in the same currency as your base currency.

For example, if you’re trading the EUR/USD currency pair and your base account currency is NZD, then the NZD will be converted into EUR in order for you to make the trade. Remember that you will have to pay currency conversion charges every time your currency is converted.

CMC Markets Overall Fees

Here is a breakdown of the trading and non-trading fees charged by CMC Markets for their services.

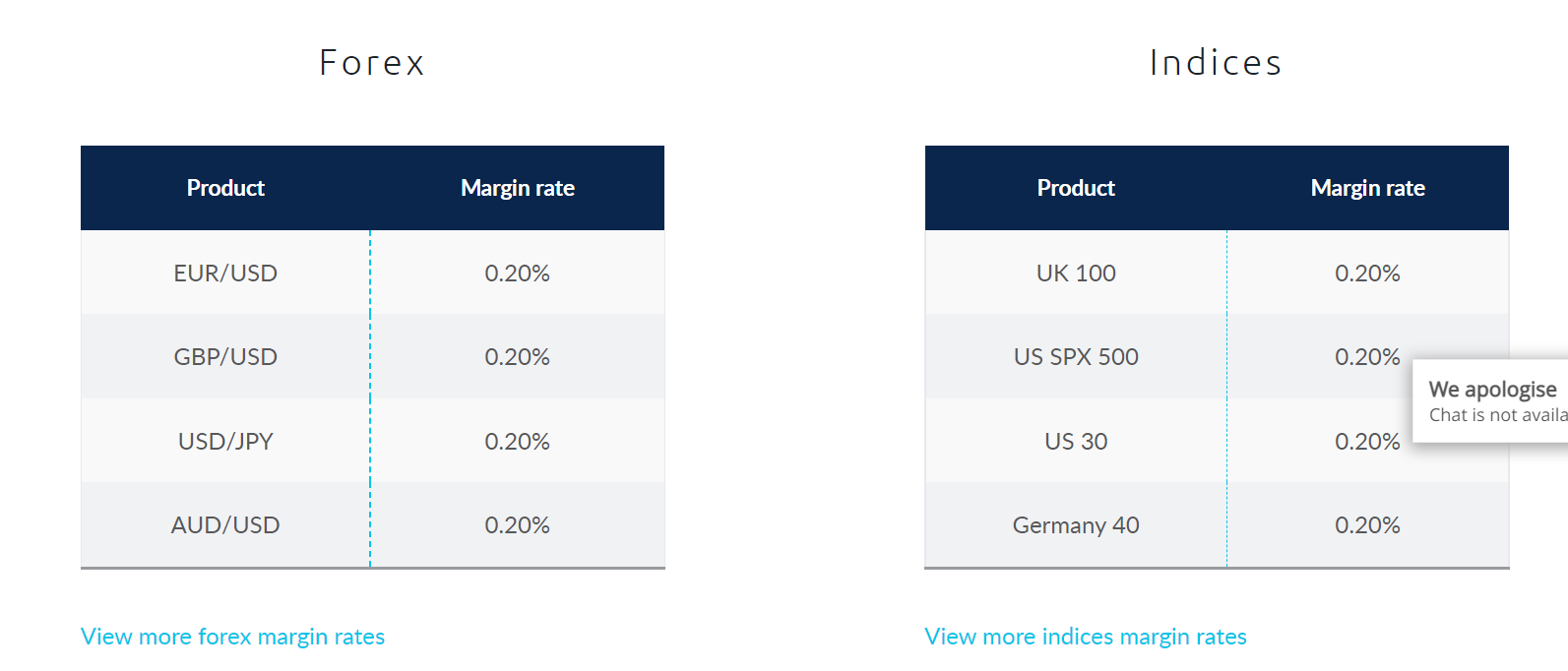

1) Affordable Spreads: The spreads charged by CMC Markets starts from 0.3 pips from both CFD account and Corporate account. The starting spread is quite low when compared to other brokers. Usually, the minimum spread clocks in at around 0.7 pips.

The exact spread charged by CMC Markets depends on the timing of the trade and the trading instrument.

You can check the spread of your trade before trading on the trading platform (which can NGEN or MT4).

2) High Commission: CMC Markets only charges a commission for trading stocks. The minimum commission is $7 per trade per lot. This commission is quite high and can even go higher depending on the stock being traded. Even though the spread will be very tight, we do not recommend trading shares through CMC Markets even for high-volume traders.

3) Swap Fees: CMC Markets charges a swap fee (also known as rollover interest) which is a fee incurred when holding an open trade overnight. If you do not close out your trade on the same day, you will be charged a swap-fee by the broker.

Here are the minimum spreads for some CFDs on CMC Markets:

| Instrument/Pair | Spreads |

|---|---|

| EUR/USD | 0.70 pips |

| GBP/USD | 0.90 pip |

| EUR/GBP | 1.10 pip |

| Gold | 0.3 pips |

CMC Markets does not offer Islamic account to its traders.

4) No Deposit and Withdrawal Fees: CMC Markets does not charge a deposit fee or a withdrawal fee. However, you may be charged a fee or commission by your payment service provider. We will cover deposits and withdrawals in more detail in the next section in this review.

Overall, we consider CMC Markets to charge average fees when compared with other brokers. Their minimum spreads are quite low through both the CFD account and the Corporate account. However, their fees for trading shares or stocks is too high and we recommend using a different broker to trade shares.

CMC Markets Non-Trading Fees

CMC Markets offers very limited ways of making a deposit or a withdrawal.

The initial deposit into your trading account must be made via bank transfer or through POLi which is a payment service provider. Once an initial deposit has been made, further deposits can be made through bank transfer, debit cards, or credit cards. They only accept Visa or Mastercard.

They do not accept deposits or withdrawals through payment wallets or through wire transfer.

They do not charge a fee for making a deposit or a withdrawal. However, your payment service provider may charge a fee especially if the transfer is being made internationally.

For traders from New Zealand, a fee may be charged by their bank since CMC Market’s account is held in Australia.

CMC Markets does not require a minimum deposit at the time of account opening. This means that an account can be opened without the need for making a deposit.

| Fee | Amount |

|---|---|

| Inactivity fee | NZD15 |

| Deposit fee | None |

| Withdrawal fee | None |

CMC Markets Trading Instruments

CMC Markets offers a very wide variety of trading instruments. You can gain exposure to more than 10,000 trading instruments (most of them are stocks).

They offer an extremely high number of currency pairs (more than 330 pairs), 113 indices, 9000 global shares, most of the major commodities, treasuries, cryptocurrencies, and share baskets.

If you’re looking for access to a wide variety of instruments, then trading through CMC Markets may be one of the best options for you. They also offer cryptocurrencies and treasures which is rare for CFD brokers. However, they do not offer ETFs or bonds.

CMC Markets Trading Platforms

CMC Markets offers two trading platforms for traders to choose from.

1) MetaTrader 4 (MT4): The MetaTrader 4 is one of the most popular trading platforms in the world. It is used by traders across the globe. This trading platform is quite easy to use and is beginner friendly without compromising on functionality. The MT4 can be used on Windows, MacOS, iOS, and Android devices. It can also be accessed directly through any web browser (including Google Chrome and Safari).

2) Next Generation (NGEN): The Next Generation trading platform has been developed by CMC Markets. This platform is meant to be used while on the move. The trading app works well on Android, iOS, and iPad. You can also use it on your desktop or laptop. This trading platform offers a variety of charting tools, more than 40 technical indicators, a customizable dashboard, and a range of notification types.

CMC Markets Execution Policy

After reviewing the broker’s documents, here is what we found on their execution policy. CMC Markets has processes in place that assess the quality of execution delivered to traders. The quality of execution depends on factors like price, cost, speed, and likelihood of execution. Execution quality is overseen by a committee known as TCF (Treating Customer Fairly).

Prices shown on the platform are generated electronically. They are sourced from top data vendors and liquidity providers in the industry. Data feeds and internal pricing mechanisms are continuously monitored by the support and dealing team to ensure quality pricing. In certain conditions, CMC Markets can generate price manually like a market maker. An example of this is when you try to trade an instrument outside market hours. CMC Markets will generate the price manually so you can have access to liquidity. However, the broker tries to provide a fair price when this is done.

For costs, CMC Markets keep trading costs low by sourcing the best prices from liquidity providers. They also review fees from their equities and futures brokers to make sure they are not too high. CMC Markets speedily executes all trades except on rare occasions when orders are rejected. The absence of manual intervention also makes your order execution faster.

Furthermore, there is a high likelihood that your trades will be executed. Why? Because your trades are executed against the broker’s liquidity. CMC Markets via their New Generation Platform provide more liquidity than the underlying market of a trading instrument. The higher volume of liquidity reduces the chances of your orders getting rejected.

CMC Markets New Zealand Customer Service

CMC Markets offers customer support through phone call or email. Their customer support team is responsive at all times, including weekends.

1) Phone Call: They have a toll-free number for traders from New Zealand to call. This phone line is available at all times (24/7).

2) Email: They have a dedicated email address for solving customer issues. Writing to them is recommended if you have complex queries or long-standing issues.

They do not provide customer support through live chat. This is a major drawback in their customer support service. However, they do have an extensive FAQs section where traders can find the answers to a number of queries.

Do we Recommend CMC Markets New Zealand?

Yes, we recommend CMC Markets to traders from New Zealand.

CMC Markets is a highly reputed broker with a very long track record. They are not only regulated in New Zealand but also by top-tier financial authorities such as ASIC of Australia and FCA of the UK. This makes them quite safe to trade through and they can be trusted. Make sure that you register with their genuine websites and avoid any fake websites.

CMC Markets also offers a very wide range of trading instruments. Their forex currency pairs offering is the widest that we have ever come across from any global CFD broker. Further, they also offer cryptocurrencies and treasuries trading which may appeal to younger traders.

CMC Markets charges reasonable fees for CFD trading apart from shares. Their shares trading is extremely expensive with a minimum commission of $6 per lot per trade.

There are some drawbacks to trading through CMC Markets as well. They do not have a live chat option for customer support. They do not offer the MT5 as a trading platform. Further, they do not offer ETFs or bonds as trading instruments.

CMC Markets New Zealand FAQs

Can I trust CMC Markets?

Yes, CMC Markets is a highly reputed broker with a very strong track record. They have been operating for decades with a global presence. They are also regulated by top-tier regulators such as the ASIC of Australia and the FCA of the UK.

How long does it take to withdraw from CMC Markets?

The time taken for withdrawal depends on your method of withdrawal. Usually, withdrawals are processed within two to three days.

Who owns CMC Markets?

CMC Markets is a UK-based company that is owned by Peter Cruddas.

Note: Your capital is at risk