OANDA is a CFD broker that offers trading services for spread betting and CFDs (Contract for Differences) on forex (foreign exchange), indices, bonds, metals, oil, and agricultural commodities.

Onda was established in 1996 in the United States of America, and the broker is regulated by the Investment Industry Regulatory Organization of Canada (IIROC) and by other top-tier financial regulators.

In our review of OANDA, we assess the trading conditions of the broker, fees, deposit/withdrawal options, available tradable instruments, supported trading platforms, and customer support.

| OANDA Review Summary | |

|---|---|

| 🏢 Broker Name | OANDA (Canada) Corporation ULC |

| 📅 Establishment Date | 1997 |

| 🌐 Website | www.oanda.com/ca-en/ |

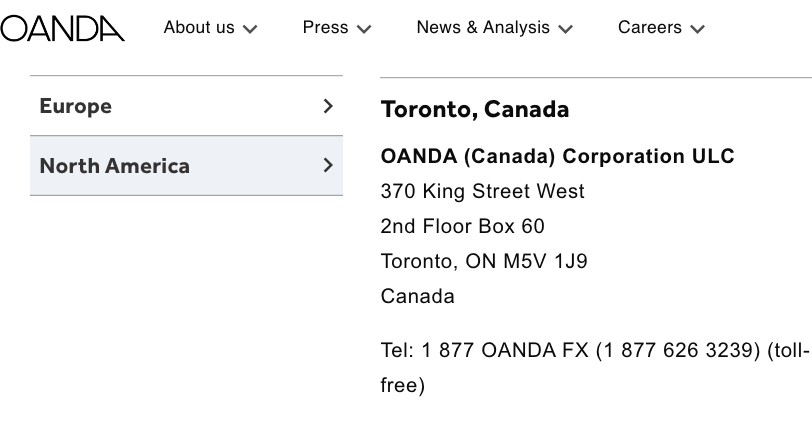

| 🏢 Address | OANDA (Canada) Corporation ULC, 370 King Street West 2nd Floor, P.O. Box 60 Toronto ON M5V 1J9, Canada |

| 🏦 Minimum Deposit | $0 |

| ⚙️ Maximum Leverage | 1:50 |

| 📋 Regulation | IIROC, ASIC, FCA, MAS, Malta FSA |

| 💻 Trading Platforms | MT4 and OANDA Trader available on PC, Mac, Web, Android, & iOS |

| Visit OANDA | |

OANDA Pros

- Regulated by IIROC

- Offers 24/7 customer support

- Offers commission-free trading for all accounts

- No mandatory minimum deposit

- Simple account opening process

- Offers free deposits and processes them quickly

- Has responsive customer support

OANDA Cons

- Has few tradable instruments

- Charges dormant account fees

- No negative balance protection

- Does not support MT5 trading application

Is OANDA a good broker?

OANDA is a trading name of OANDA Corporation, which is incorporated in Delaware, USA. OANDA Corporation is registered with the Commodity Futures Trading Commission (CFTC) and National Futures Association in the USA.

The broker is regulated by Tier-1 and Tier-2 financial regulators around the world under different names. Find some of the regulations of OANDA in various jurisdictions below:

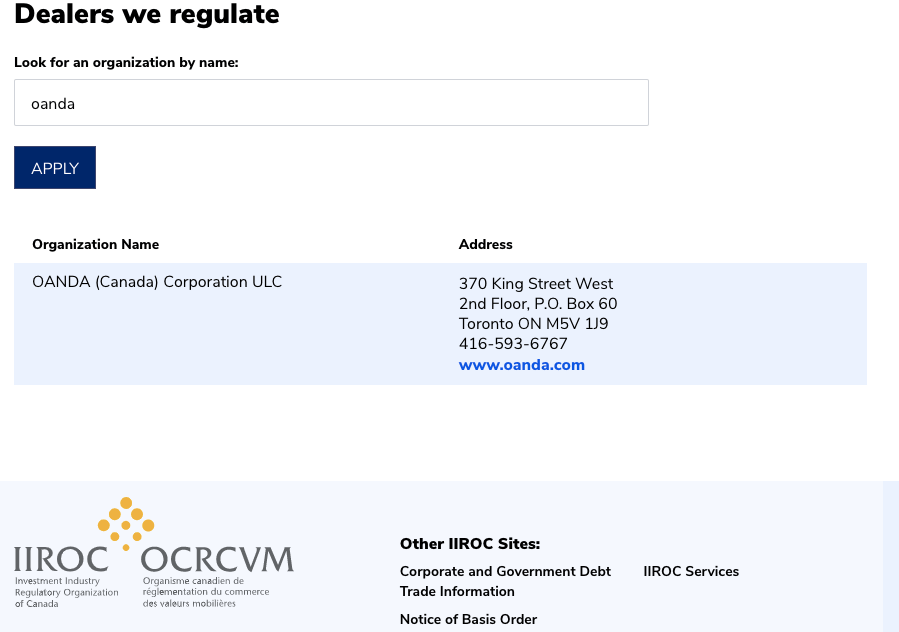

1) Canadian Investment Regulatory Organization (CIRO): Oanda is regulated with the CIRO in Canada as Oanda (Canada) Corporation ULC. They are authorized to offer CFD trading in Canadian districts. Clients under this regulation are also protected by the Canadian Investor Protection Fund (CIPF)

OANDA is registered with the Canadian Investor Protection Fund (CIPF). The CIPF works to ensure that any asset or investment owed to you by a regulated broker is given back up to $1 million.

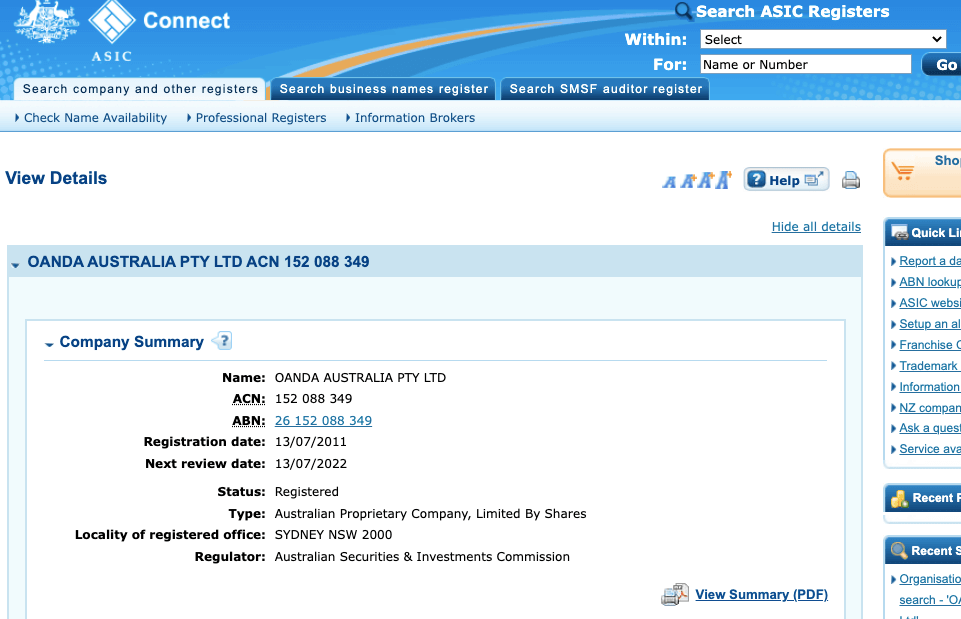

2) Australian Securities & Investment Commission (ASIC): OANDA is regulated in Australia by ASIC as OANDA Australia Pty Ltd and licensed to offer financial services with Australian Company Number (ACN) 152 088 349, issued in 2011.

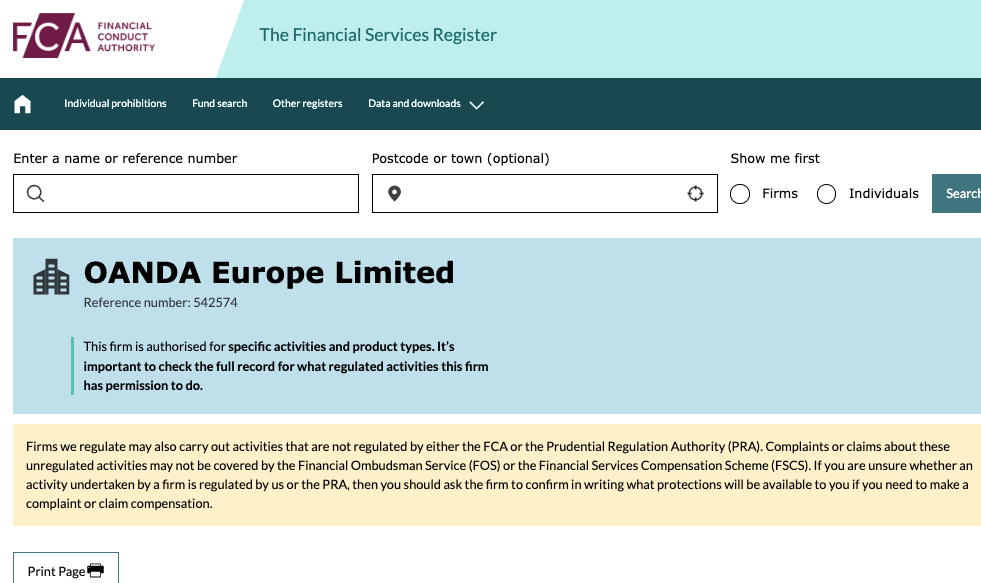

3) Financial Conduct Authority (FCA): OANDA is regulated in the UK by the FCA and authorised to offer financial services under the name ‘OANDA Europe Limited’ with reference number 542574, issued in 2011.

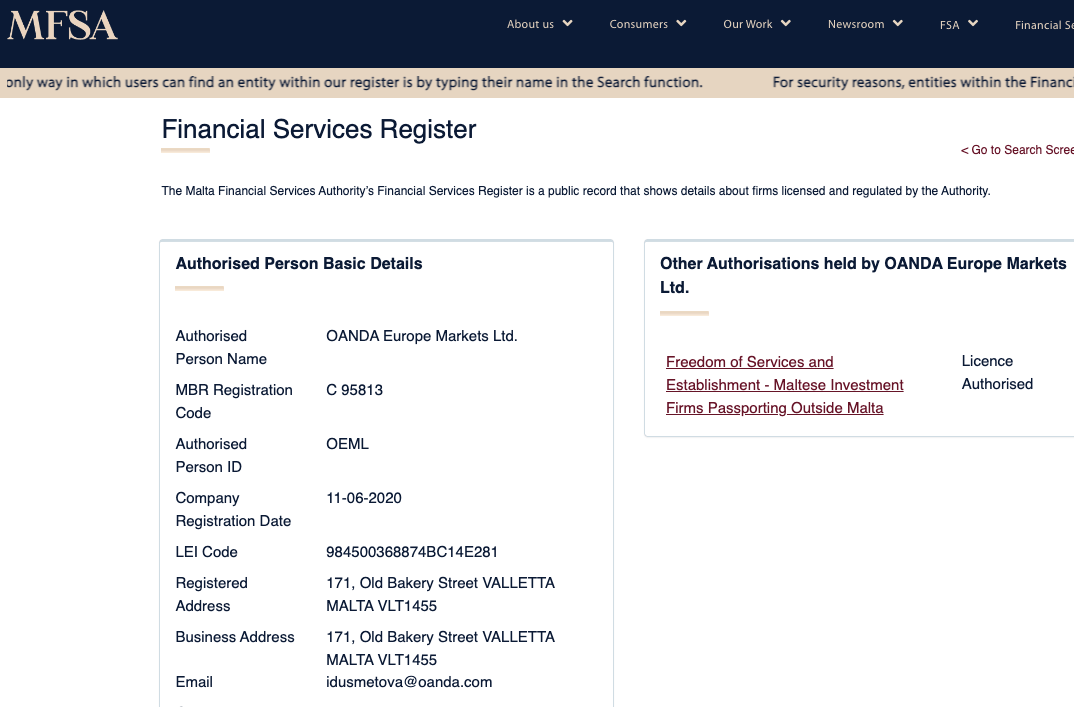

4) Malta Financial Services Authority (MFSA): OANDA is licensed in Europe as ‘OANDA Europe Markets Ltd’ by the FSA in Malta with registration C 95813, issued in 2020. OANDA serves residents of the EEA (European Economic Area) with this license.

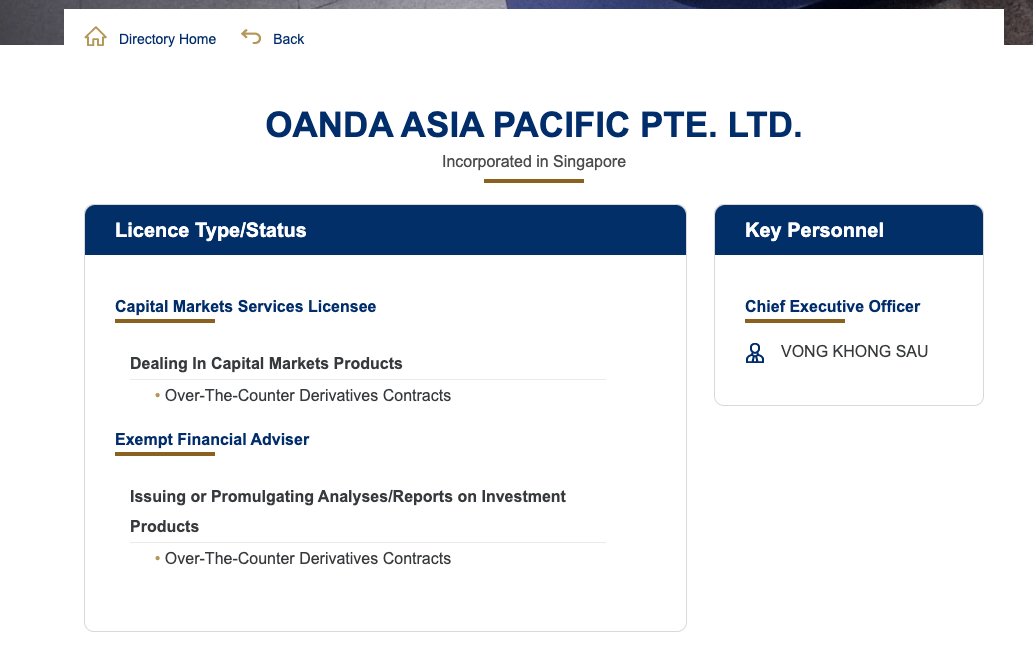

5) Monetary Authority of Singapore (MAS): OANDA is regulated in Asia by the Monetary Authority of Singapore as ‘OANDA Asia Pacific Pte Ltd’ and licensed to deal in capital market products.

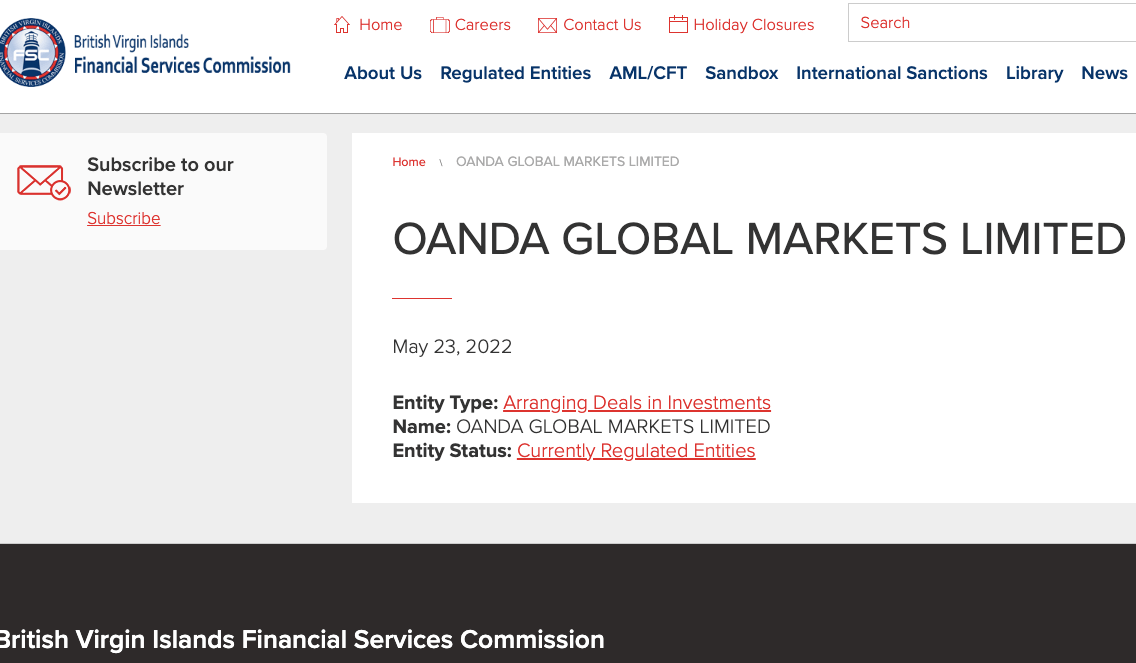

6) Financial Services Commission (FSC), British Virgin Islands: OANDA is registered in the British Virgins Islands as OANDA Global Markets Ltd and Regulated by the FSC with license number SIBA/L/20/1130 issued in 2022. Traders in Malaysia are registered under this regulation.

OANDA Investor Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| UK | £85,000 | Financial Conduct Authority (FCA) | OANDA Europe Limited |

| Australia | No Protection | Australian Securities and Investments Commission (ASIC) | OANDA Australia Pty Ltd |

| Canada | $1,000,000* | Canadian Investment Regulatory Organization (CIRO) | Oanda (Canada) Corporation ULC |

| Malaysia | No Protection | Financial Services Commission (FSC), British Virgin Islands | OANDA Global Markets Limited |

This amount is the maximum amount covered by the CIPF in Canada.

OANDA Leverage

Leverage on OANDA depends on the instrument you are trading and whether you are a retail or professional client. The maximum leverage on OANDA for retail clients is 1:50, which means that you can open a trade position worth up to 50 times the value of your deposit.

For example, with a deposit of $100, you can open a trade position of $5,000 to increase your profit potential. Note that it also exposes you to more risk.

The maximum leverage of 1:50 is for some major forex pairs, other instruments have lower leverage limits.

OANDA Account Types

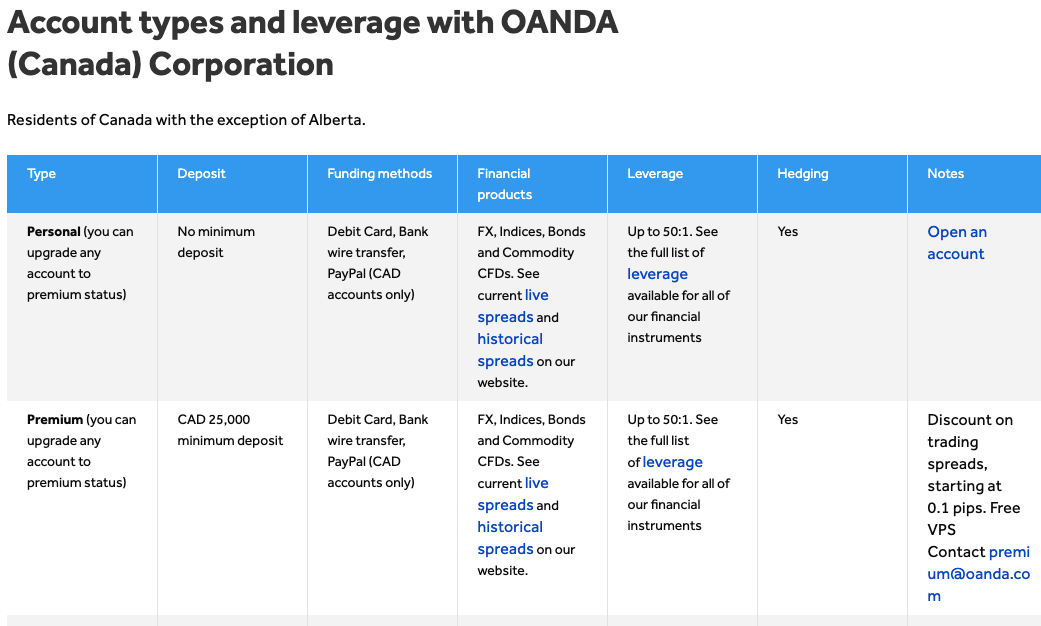

OANDA offers 2 main account types for retail clients, Personal Account and Premium Account. You can open an account on OANDA as an individual, a partnership (joint account) or as a business entity (corporate account).

OANDA offers Islamic Accounts to traders under the OANDA Global Markets regulation in the British Virgin Islands, Canadian traders currently cannot apply for Swap-free Accounts under the regulation by the IIROC. You can open a demo account on OANDA and practice trading with virtual money before putting in your real money.

Find an overview of the account types on OANDA Canada below:

1) Personal Account: The OANDA Personal Account is the regular account on OANDA that is designed for beginners and traders with some experience. The account can be accessed on the MetaTrader 4 and OANDA trading platforms and allows you to trade Forex pairs, indices, bonds, agriculture commodities, oil, and metals.

Spreads for Personal Account on OANDA start from 1 pip for major pairs, you do not pay commission fees for opening or closing trade positions, but incur swap fees whenever you keep a trade position open past the market’s closing time with this account.

There is no mandatory minimum deposit with this account type, a minimum lot size of 0.01, and you have a maximum leverage of 1:50. This account does not have negative balance protection which means you can lose more than the money you deposit if you suffer a loss on a trade and will be required to deposit more money to clear the negative balance.

2) Premium Account: The OANDA Premium Account is designed for experienced traders who want to trade large volumes of financial assets. This account type is part of the Advanced Trader Program on OANDA and is classified based on your minimum balance and the volume of trade into Tier 1, Tier 2, and Tier 3.

The requirement for OANDA Premium Account is to maintain an account balance of C$25,000 for Tier 1, or US$100 million in notional trade value for Tier 2 or US$500 million for Tier 3. first, create a Retail Account, then contact the customer support team to upgrade your account to professional status.

With a Premium Account on OANDA, you have a dedicated account manager, priority support, and a reduction of spreads on forex pairs, starting from 0.1 pip to 0.3 pips, depending on your account tier. Note that you can you need to first open a regular Personal Account before you can upgrade to Premium Account upon meeting the requirement.

OANDA Base Account Currency

Account base currencies available on OANDA are Canadian Dollar – CAD, Australian Dollar – AUD, British Pound sterling – GBP, Euros – EUR, United States Dollars – USD, Swiss Franc -CHF, Japanese Yen – JPY, Honk Kong Dollar – HKD, and Singapore Dollar -SGD.

Your deposits, trades, withdrawals, and fees are measured in your OANDA account currency.

OANDA Overall Fees

OANDA charges different fees depending on the instrument you trade size and whether you are a retail or professional client. Here’s an overview of the broker’s trading and non-trading fees.

Trading fees

1) Spreads: When you trade a financial instrument on OANDA, the price you pay includes a markup that goes to your broker. The spread is the difference between the bid and asks prices for a trade. The size of the spread depends on the instrument you are trading, your account type, and whether you are a professional or retail client.

OANDA operates a variable spreads system, which means that the spreads will fluctuate during the day to reflect market movements. The minimum spread for majors like EURUSD is 1 pip, but this changes as well.

2) Commission fees: OANDA offers commission-free trading in Canada on all instruments which apply to all account types. This means that you will not pay any commission fees for opening or closing trade positions on the platform.

3) Swap fees: If you open a trade position and you do not close it before the closing time of the market, which is 5 PM ET (New York Time), it will roll over to the next trading day, and you will be charged a rollover fee also call overnight financing cost or swap fees.

The fees will be added to your profit or loss when you eventually close the position. The fee is calculated based on the volume of your trade, the instrument you were trading, the leverage, and whether it was a long swap (buy) or a short swap (sell).

If your position was a long swap and the trade is successful, you gain swap interest, which is added to your profit.

4) Currency conversion fees: Whenever you trade a financial instrument that is not paired with the currency of your account, you incur currency conversion fees when you close the trade position.

For example, if your base account currency is CAD, and you trade USD/JPY, any profit or loss you make will be converted to your base account currency and charged a currency conversion fee because the pair you traded is not in the currency of your account.

The currency conversion fee on OANDA is 0.5% of the mid-point price at the time of conversion, applied to the profit or loss realized from the trade.

Here is the trading fess of some popular CFDs that OANDA provides.

| CFD | Spread | Commission | Swap |

|---|---|---|---|

| GBP/USD | 1.0 | None | -$2.82(short), -$4.17 (long) |

| Brent Crude Oil | 3.0 | None | -$2.40(short), -$3.63(long) |

| US Nas 100 | 2.1 | None | $1.35(short),- $3.74(long) |

| Gold | 1.0 | None | -$1.38(short), -$0.25 (long) |

Swaps are subjected to change daily. Click here to find OANDA’s updated daily swap charges.

Non-trading fees

1) Deposit and Withdrawal fees: OANDA charges zero fees for deposits for all payment methods, which means you don’t pay any fees for depositing funds to your trading account on OANDA, although your payment processor may charge an independent fee.

OANDA offers free withdrawals to cards and PayPal. Bank transfers attract a fee of C$20 for the first withdrawal initiated in a month and $40 on subsequent withdrawals in the month.

2) Account Inactivity charges: If you do not perform any trading activity on your account for 12 months, your account will be categorized as inactive and any funds in it will be charged C$10 each month.

If you do not have any money in your account, you will not accrue a negative balance.

| Fee | Amount |

|---|---|

| Inactivity fee | CAD10 |

| Deposit fee | None |

| Withdrawal fee | None* |

Withdrawals via bank transfer attracts a fee from OANDA. The amount charged depends on your account currency and how many other bank transfer withdrawals you have made within the same calendar month.

How to Open OANDA Account in Canada?

Follow these steps to open a trading account on OANDA.

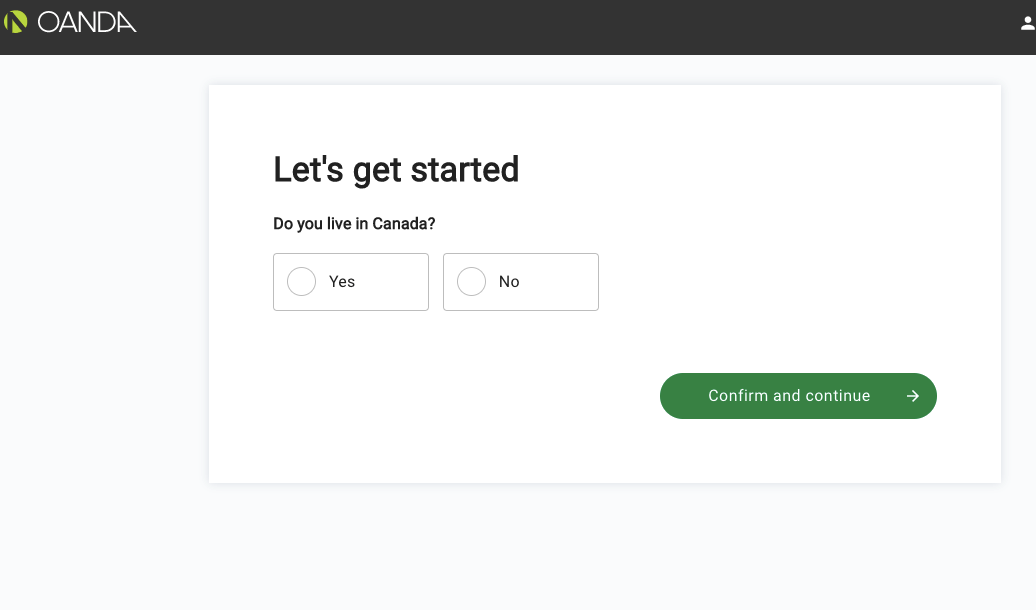

Step 1) Visit the OANDA Canada website via www.OANDA.com, scroll down and click on the ‘See our CFD markets’ button highlighted in blue. Then click on the ‘Create account’ or ‘Start trading’ buttons on the next page.

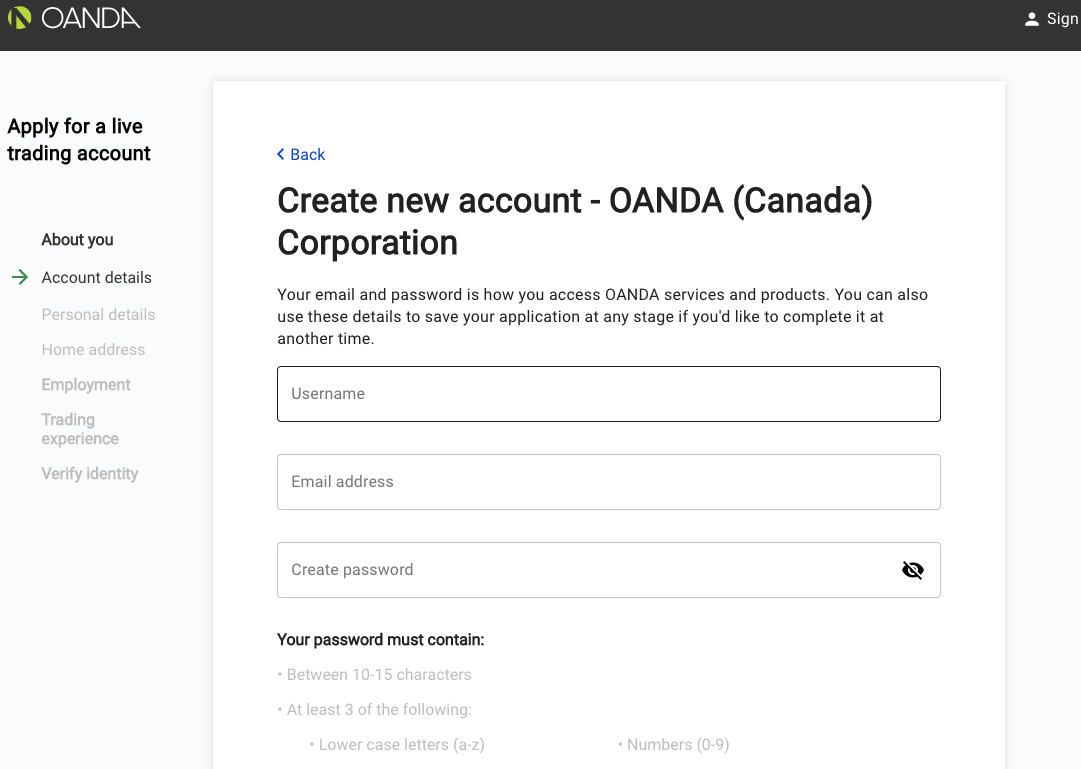

Step 2) Confirm that you live in Canada, enter your email address, create a username and password then click ‘Confirm and continue’.

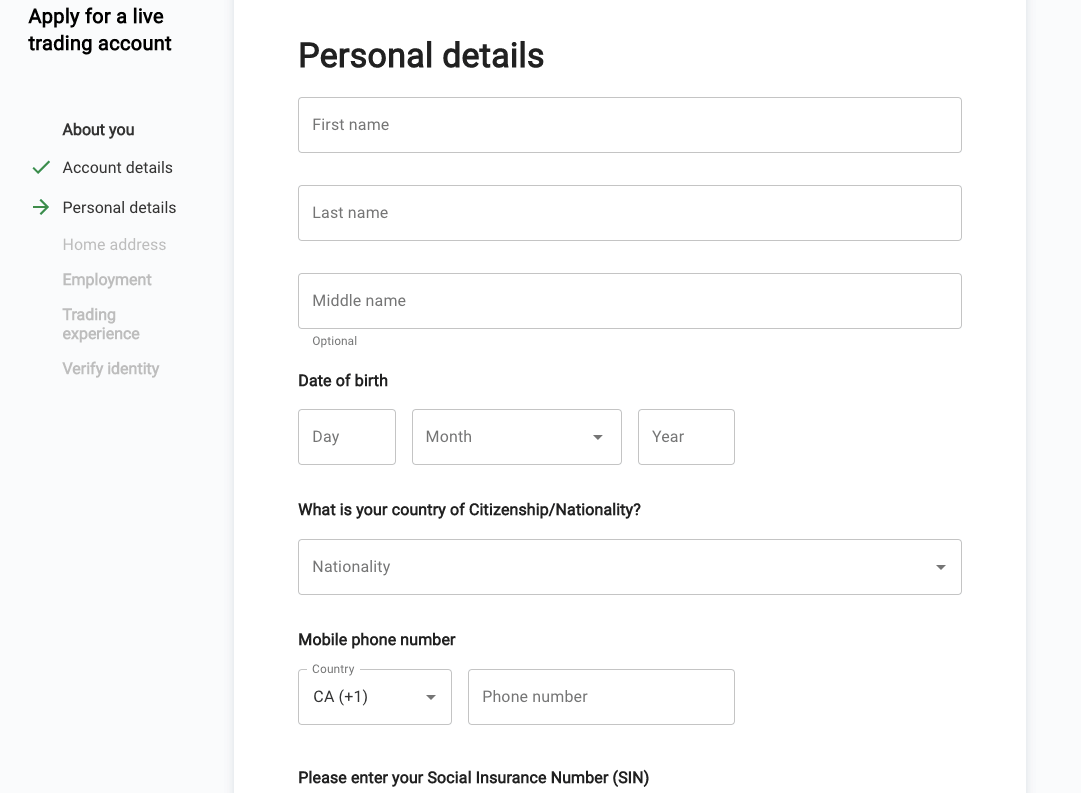

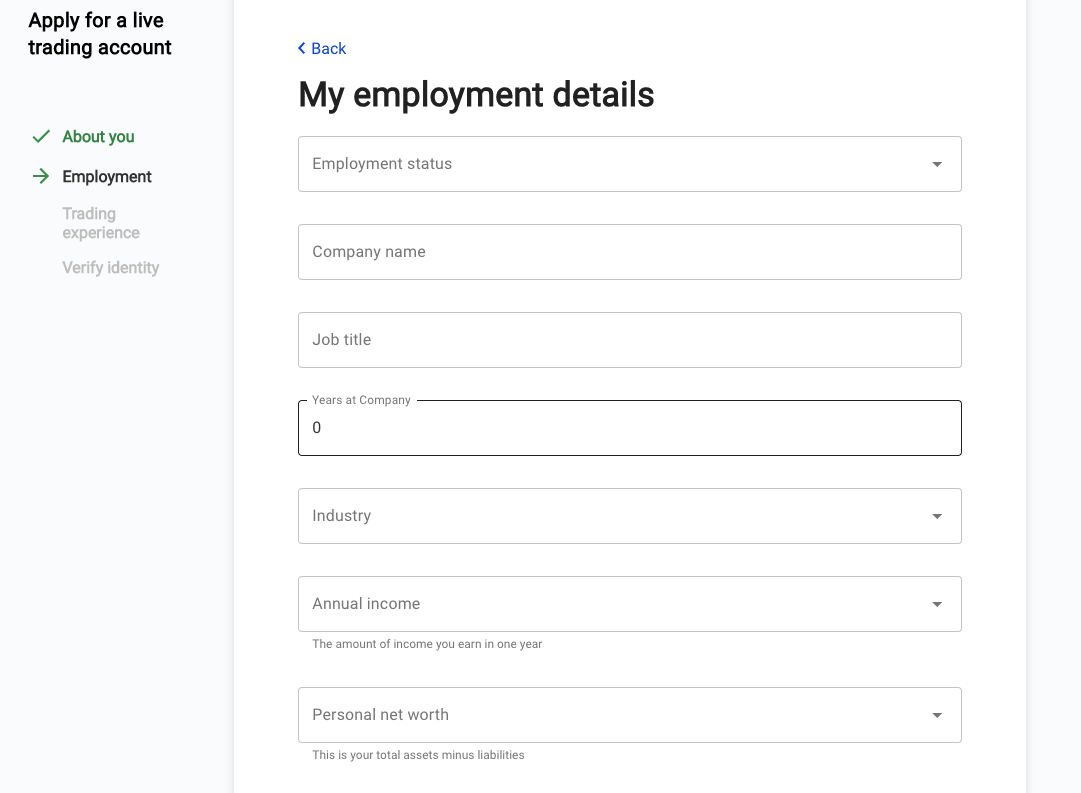

Step 3) Provide your full name, date of birth, phone number, social insurance number, and home address then click ‘Confirm and continue’.

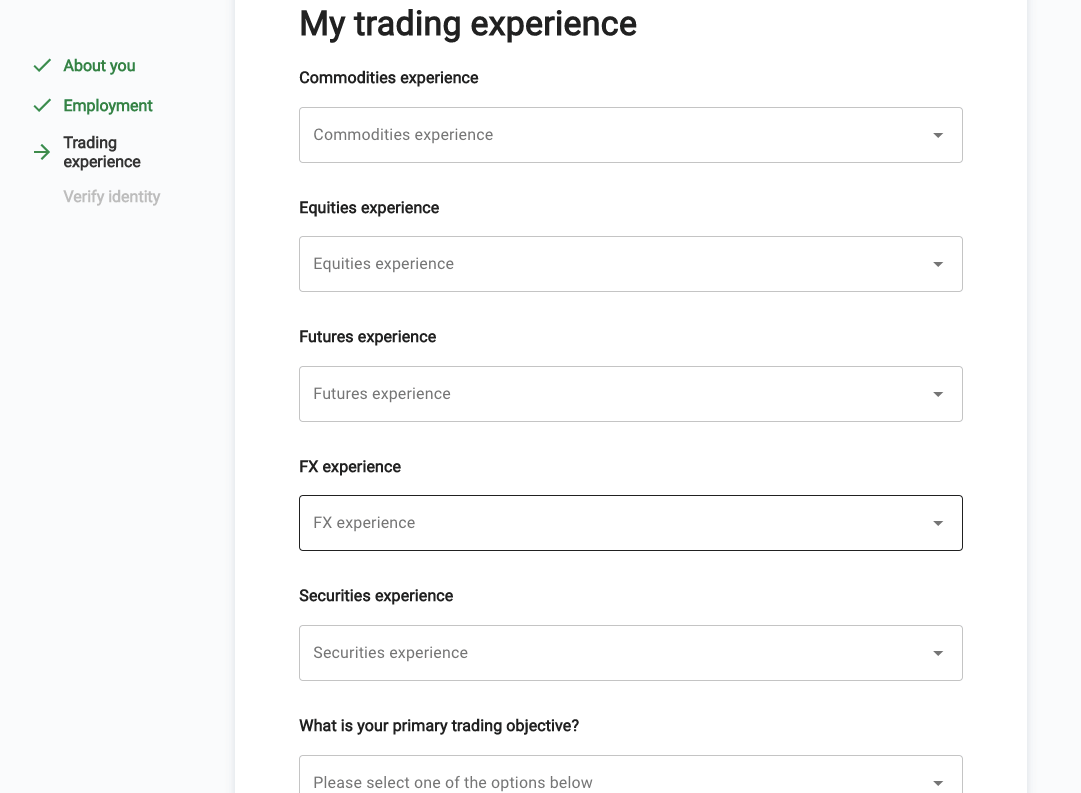

Step 4) Answer some questions about your employment and financial status, then some questions about your knowledge of financial instruments and trading experience, then click ‘Confirm and continue’.

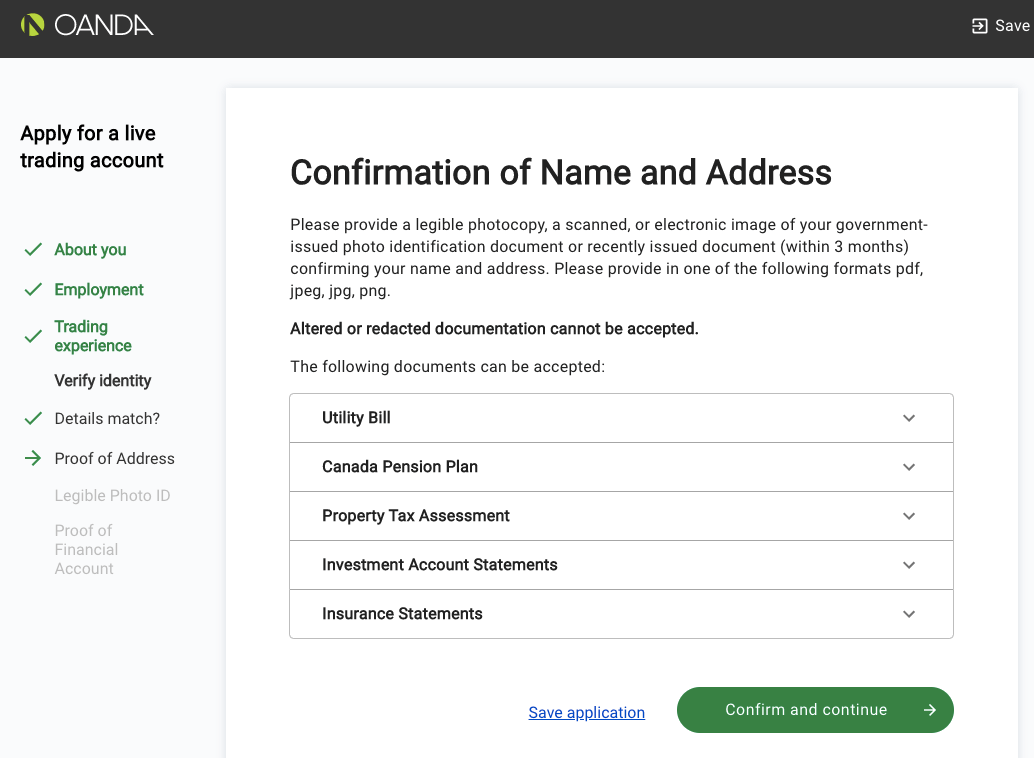

Step 5) Upload verification documents to confirm your identity, finances and address.

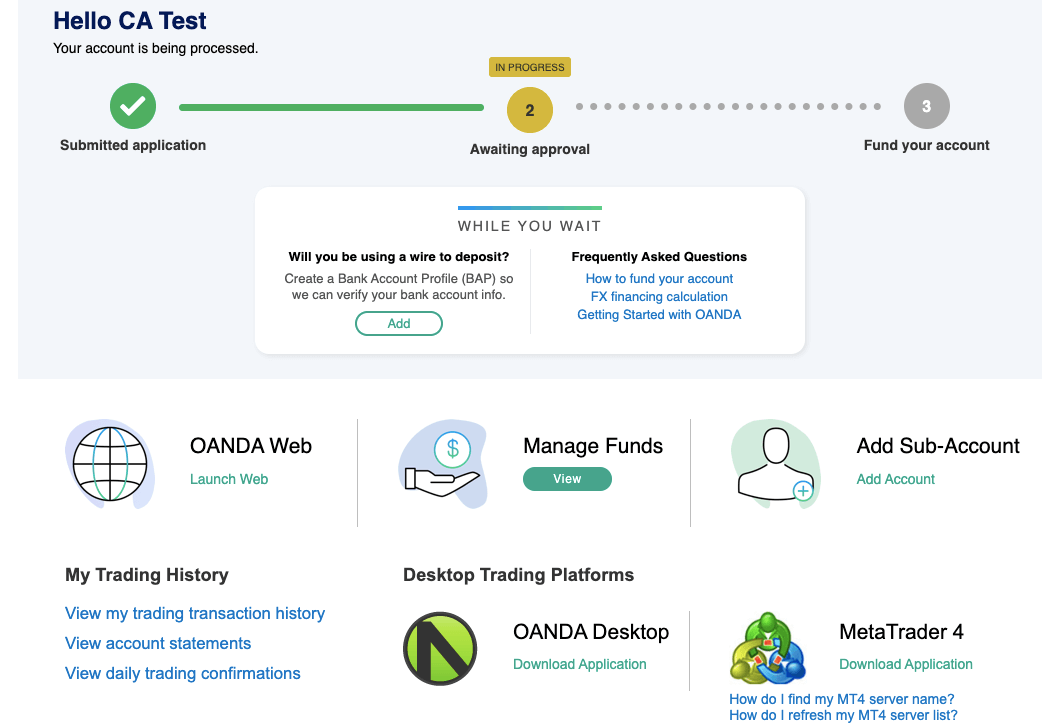

Step 6) Confirm your email address by clicking the link sent to your inbox, which will log you into the trading account.

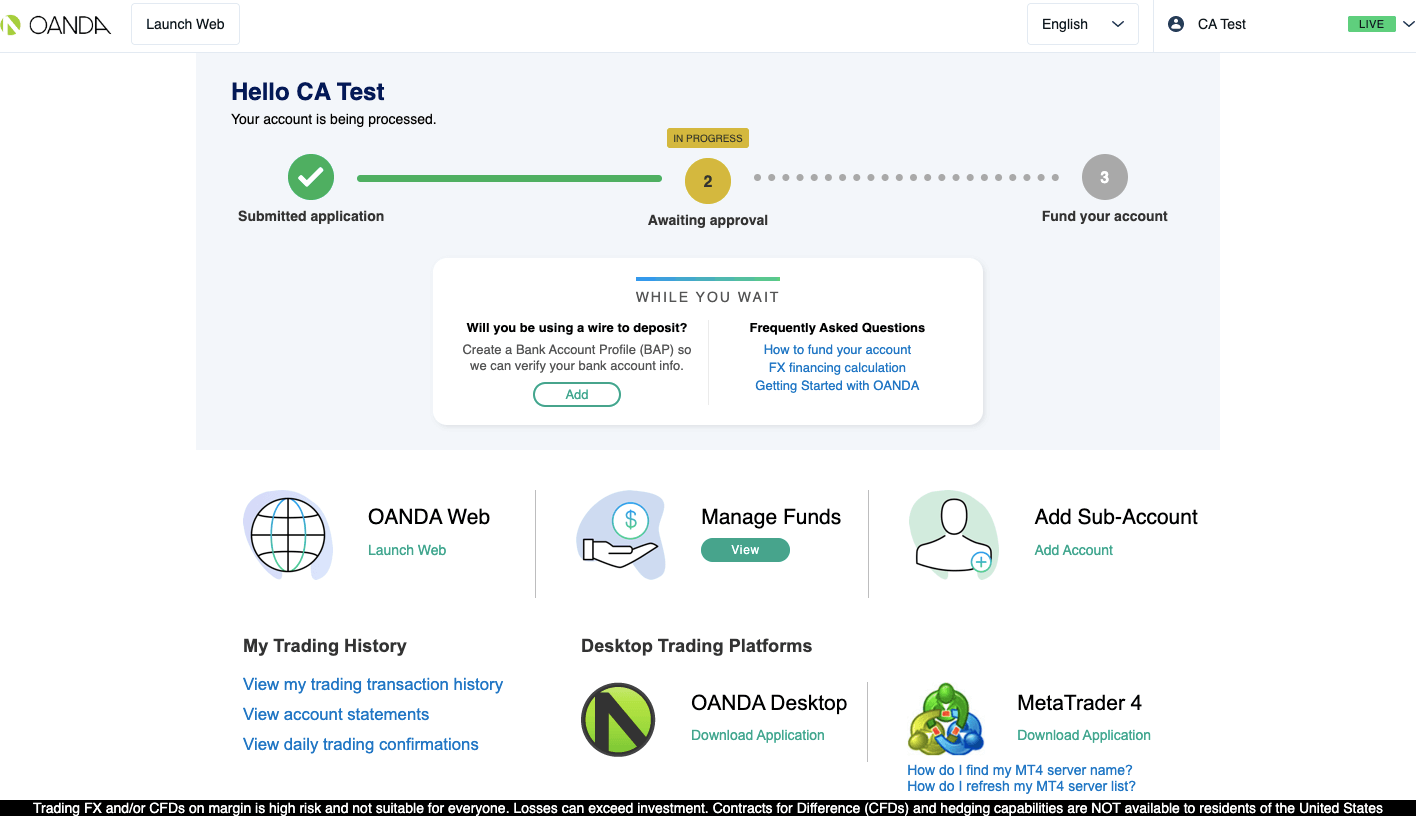

After uploading the relevant documents, it takes up to 24 hours for your account to be approved. Until your account is approved, you will be unable to deposit funds, withdraw or trade.

OANDA Deposits & Withdrawals

Payment methods supported by OANDA for deposits and withdrawals are bank transfers and cards. Here is the summary of the deposits and withdrawal options on OANDA Canada.

OANDA Deposit Methods

Here is a summary of payment methods accepted by OANDA for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Internet Banking/Bank Transfer | Yes | Free | 1-3 business days |

| Cards | Yes | Free | Instant |

| E-wallet | Yes (PayPal) | Free | 5-7 business days |

OANDA Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on OANDA.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Internet Banking/Bank Transfer | Yes | $20-$40 per transaction | 2-5 business days |

| Cards | Yes | Free | 1-3 business days |

| E-wallets | Yes (PayPal) | Free | 1 business day |

What is the minimum deposit for OANDA?

There is no mandatory minimum deposit on OANDA, you can deposit any amount that you want with any payment method of your choice.

How do I deposit money into OANDA?

Follow these simple steps to deposit funds into your OANDA Account:

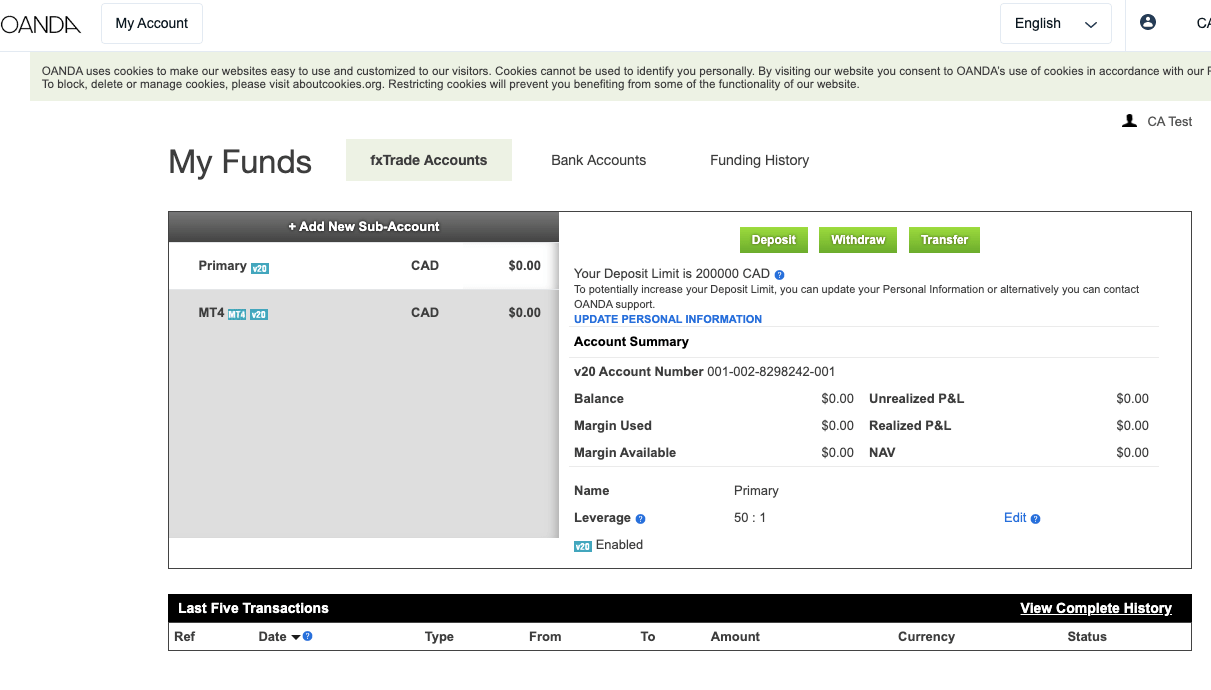

Step 1) Log in to your OANDA trading account via www.OANDA.com/account/login.

Step 2) On your dashboard, click on the ‘View’ under ‘Manage Funds’ tab.

Step 3) Select ‘Deposit’ and follow the on-screen instructions to add funds to your account.

What is the OANDA Minimum withdrawal?

There is also no compulsory minimum withdrawal on OANDA and you can withdraw any amount, this applies to all payment methods.

How to Withdraw Funds from OANDA

Follow these simple steps to withdraw money from your OANDA Account:

Step 1) Log in to your OANDA dashboard via www.OANDA.com/account/login.

Step 2) Once your dashboard loads, click on ‘View’ under the ‘Manage Funds’ tab.

Step 3) Select ‘Withdraw’ and follow the on-screen instructions to withdraw funds from your account.

OANDA Trading Instruments

You can trade the following financial instruments on OANDA:

| Instrument | Availability | Number |

|---|---|---|

| Forex | Yes | 68 currency pairs on OANDA (including majors and minors) |

| Commodities | Yes | 9 commodities on OANDA (Including il, agriculture, palladium, and platinum) |

| Precious Metals | Yes | 21 pairs of Metals on OANDA (pairs of Gold and Silver to USD, EUR, and others) |

| Indices | Yes | 19 indices on OANDA (US Nas 100, UK100, Europe 50, and others) |

| Bonds | Yes | 6 bonds on OANDA (UK 10Y Gilt, US 5Y T-Note, Bund, and others) |

OANDA Trading Platforms

Trading platforms supported by OANDA are:

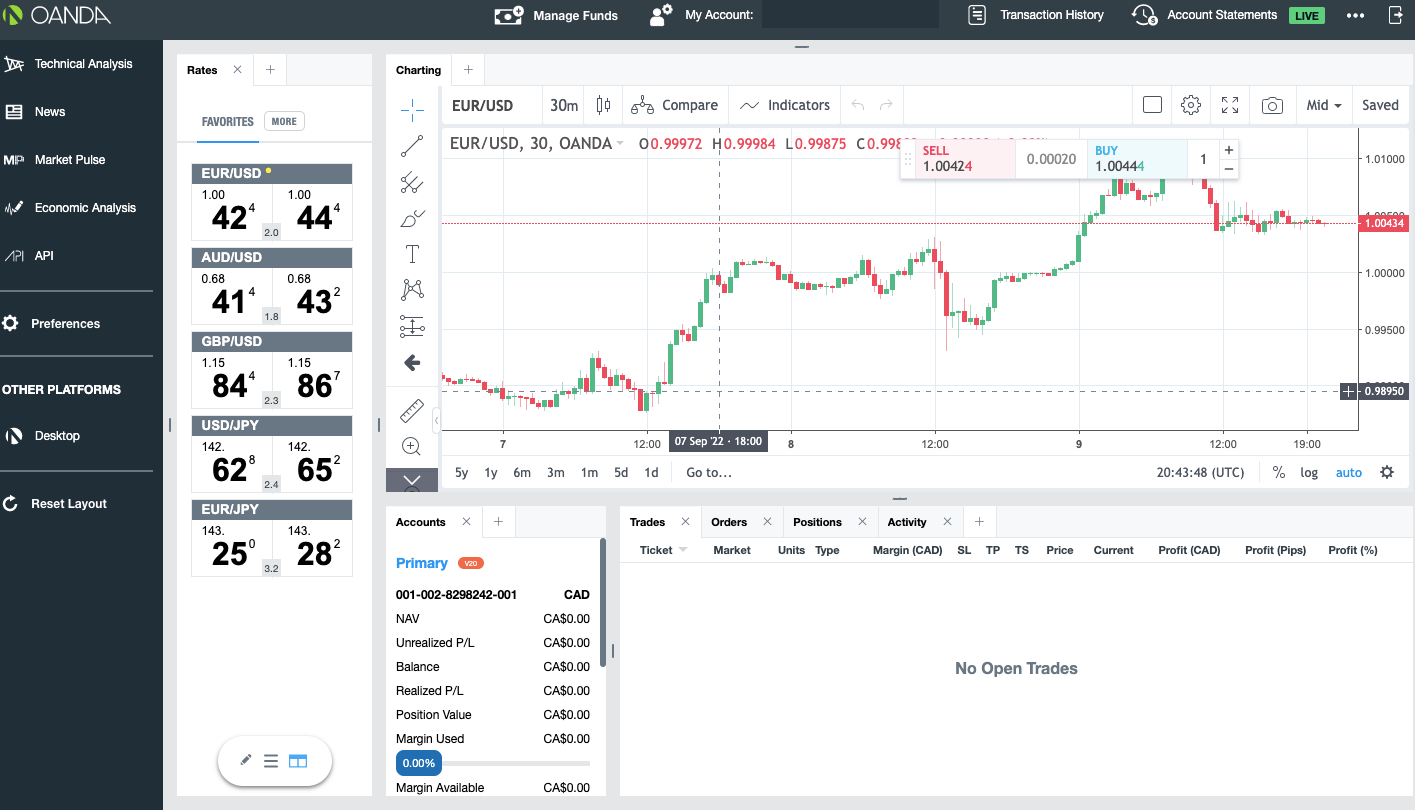

1) MetaTrader 4 OANDA supports the MT4 trading application which is available on the web, desktop, and mobile devices (Android & iOS).

2) OANDA Trader: OANDA offers trading via a proprietary trading platform developed by OANDA and can be accessed via the web, or desktop or downloaded from the Google Play Store or Apple App Store.

OANDA Trading Tools

Advanced charts: TradingView provides these charts. You can access them via OANDA trading platform. Via the chart, you can use more than 65 popular indicators including Moving Averages, MACD, Bollinger Bands, Stochastics, Ichimoku Cloud, Volume, Aroon, Balance of Power and Donchian Channels.

If you want to compare two CFDs, you do not need to move from one tab to another. You can put the two CFDs side by side and compare them on one screen. To enjoy all of these and more, you have use the OANDA trading platform.

Economic overlay: This is like an economic news side bar. As you trade, you can follow the news on key economic events, announcements, and global economic overview.

MetaTrader premium indicators: This is a combination of advanced tools. You can use them on MT4 and MT5 by downloading the upgrade on OANDA’s website. The other tools that come with this upgrade include mini-terminal, session map, stealth orders, tick chart order, correlation matrix, alarm manager, sentiment trader, and correlation trader.

Does OANDA have a mobile app?

Yes, OANDA has a mobile trading app. It is called OANDA mobile. It has over 1 million downloads on the Google Play Store. It is rated 3.4 stars out of 5 from 6000 reviews.

OANDA Canada Execution Policy

OANDA Canada strives to achieve the best execution and prices for traders. In order of importance, OANDA’s execution factors are price, costs, speed, and likelihood of execution.

For the price, OANDA (Canada) Corporation ULC obtains the price for CFDs from companies within the OANDA Group. These companies get their prices from several external market participants. The final price displayed on trading platforms is an average of the pricing received from these third parties. This is OANDA’s way of having an objective view of bid and offer prices to ensure you get the best execution. In addition, OANDA adds their spread

to the final price displayed as mark up.

Costs are more straightforward. OANDA Canada operates a spread pricing model with commissions on certain accounts. If there are any extra fees to pay, they will be disclosed in your transaction history report, disclosures, and the trading platform.

We didn’t find much information on the speed. OANDA’s legal documents only state that trades can be executed poorly if your internet service, mobile apps, and trading platforms are not working well. However, all trades are executed on an automated basis. This means the likelihood of execution is high.

Finally, OANDA does not aggregate your trade/order with any other customer during execution. They are one of the few brokers that do not aggregate.

OANDA Canada Education and Research

Here is a breakdown of OANDA’s education section.

Getting Started: This section is a basic introduction to trading. You are first introduced to OANDA as a company, then the main learning begins. There are three sub-sections you will be exposed to — trading essentials, order types, and price patterns.

Trading essentials cover basic definitions like currency pairs, bid/ask prices, spreads, pips, opening/closing your orders, and partial closing of orders. Beyond definitions, these trading concepts are explained with examples. A video is also added to help you learn visually. It is about 5 minutes long.

The second sub-section is order types explain the market order, limit orders, take profit, stop loss, and trailing stop loss. These are key foundations to trading successfully.

Price and chart patterns is the most detailed sub-section. The section opens by explaining the different chart styles that you will see on a forex trading platform and how to identify them. You also get to learn about candlesticks, candlestick formation, and how to interpret them. What makes this section interesting is the combination of texts and images.

Finally, the section covers how to combine candlestick formations with indicators to create a trading strategy A brief explanation of support and resistance is also added.

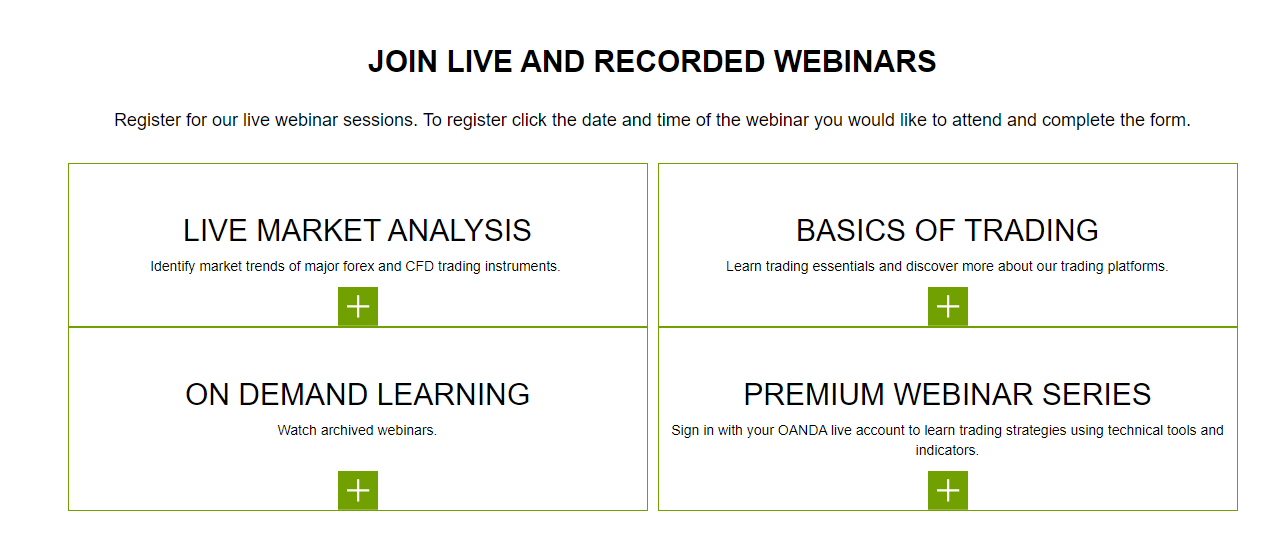

Webinars: Oanda’s webinars and free and you can build up your knowledge with them. They have archived webinars that you can watch on-demand at your own pace. There are also scheduled live market analyses. All you need to do is register and pick your preferred time slot. Finally, there are the premium webinars. They are available for traders with an OANDA live account only.

OANDA Canada Customer Service

OANDA offers 24/5 online customer support to traders via the following channels:

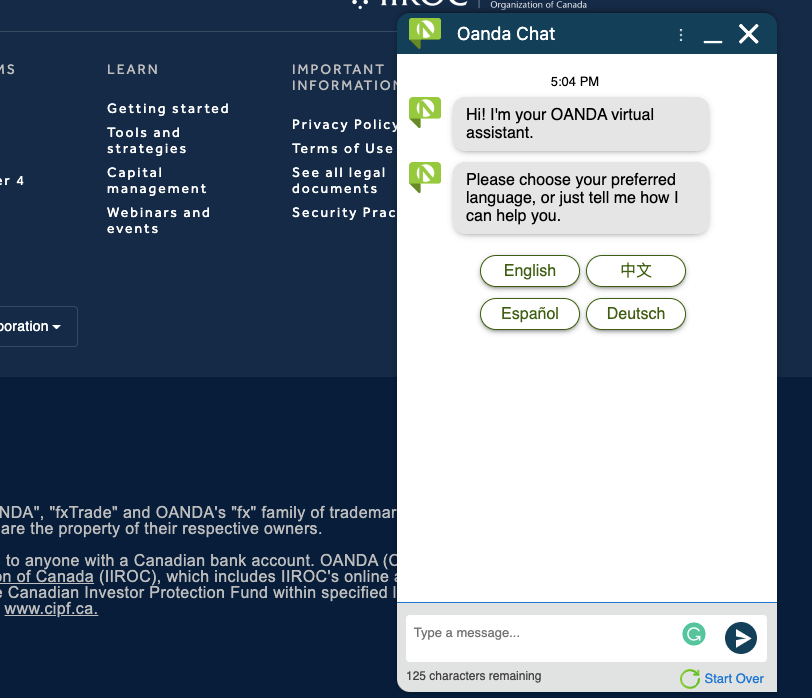

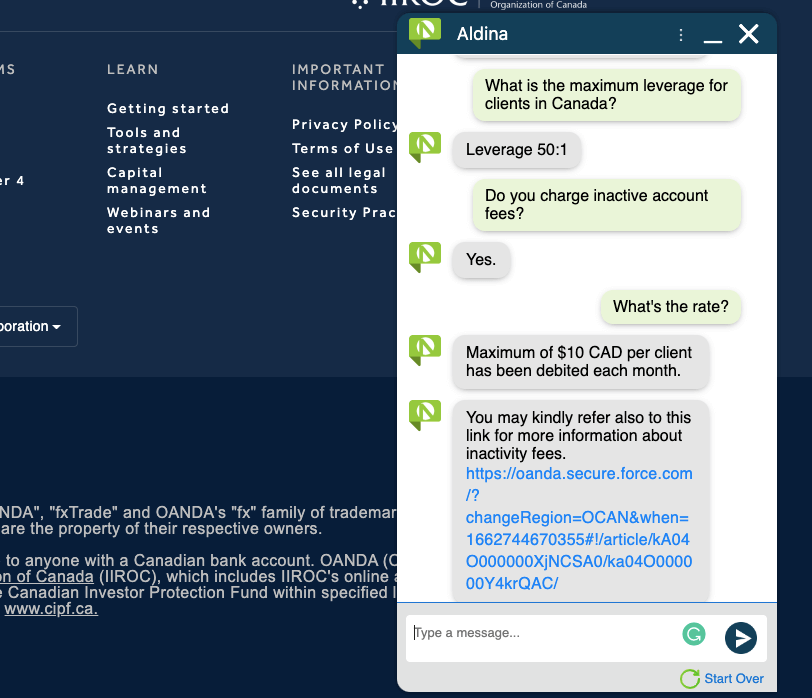

1) Live chat support: OANDA offers live chat support to clients that can be accessed through the support page of their website and is available 24/7 to chat with the Virtual Assistant, while live agents are available when the markets are open, which is from 05:00 PM on Sunday to 05:00 PM on Friday.

When our team tested the OANDA live chat, there was no wait time as the agent was connected immediately. When you start the live chat, the chatbot will suggest some quick answers to you based on what you type.

To transfer to a live agent, type ‘Live chat agent’, then it will request your email and connect you to a live agent that is online. Although it will request for a code sent to the email, we didn’t get any, so we clicked resend code, then ‘I didn’t get email’ and were connected to an agent.

The answers we received to our questions were relevant and we were sometimes directed to some articles that answered our questions.

2) Email support: OANDA also offers email support for traders and is available 24/5. When our team tested the OANDA email support, we got a response 20 minutes later and the answers were relevant.

The OANDA email address for customer support is [email protected].

3) Phone support: OANDA has a phone line for customers to call and make inquiries and is available 24/5. The OANDA phone number is 1 877 626 3239 (This is Toll-free).

Do we Recommend OANDA Canada?

We recommend that you try out OANDA because they are regulated in Canada by CIRO, and the broker is considered safe as they are obliged to take measures to protect client funds based on the various regulations they have.

OANDA offers 2 account types to traders, including joint and corporate account options. You can also use the demo account option to learn more about the platform and trading in general.

Fees on OANDA are moderate, as they offer a spread-only trading with zero commission for opening and closing trade positions, the spreads are also competitive, they only charge withdrawal fees for bank transfers, while all deposits are free of charge. A downside to their fees is the currency conversion fees and dormant account fees after 1 year which you can avoid if you have no funds in the account.

The OANDA customer support is responsive and available 24/7. The website is also informative and the registration process is easy. Although OANDA offers few tradable instruments, you can check out the broker’s website and probably chat with the live support to help decide if you want to trade on the platform.

OANDA Canada FAQs

Is OANDA a good broker?

OANDA is considered a good broker because they are regulated by Top-Tier financial regulators, offers negative balance protection for retail clients, and commission-free trading account. Their customer support is also responsive.

Who is OANDA owned by?

OANDA is owned by OANDA Corporation which is incorporated in the United States of America and is regulated in Canada, the United Kingdom, Australia, Europe, and Asia.

How long do OANDA withdrawals take?

All withdrawal requests are processed within one business day by OANDA, and it may take up to 3 business days to receive funds for cards, 1 business day for PayPal and up to 5 business days for bank transfers.

Does OANDA have a minimum deposit?

OANDA does not have a compulsory minimum deposit amount. You can deposit any amount you want depending on the trade you want to place.

Can OANDA trade stocks?

Currently, OANDA does not offer stocks/shares trading.

Note: Your capital is at risk