Interactive brokers is a financial service provider established in 1977. Top-tier regulatory authorities regulate this broker like the Investment Industry Regulatory Organization of Canada (IIROC) and the Financial Conduct Authority (FCA).

This broker deals in products like Forex, options, bonds, ETFs, and stocks to mention but a few. They also charge both trading and nontrading fees.

In this article, we have put together the basic things to know about interactive brokers’ products, platforms, fees, regulations, account types, and many more.

| Interactive Brokers Review Summary | |

|---|---|

| Broker Name | Interactive Brokers |

| Establishment Date | 1977 |

| Website | https://www.interactivebrokers.com/en/home.php |

| Address | One Pickwick Plaza, Greenwich, CT 06830 USA |

| Minimum Deposit | 0 |

| Maximum Leverage | 1:2 |

| Regulation | CIRO, FCA, ASIC, MAS, CBI, etc. |

| Trading Platforms | IBKR GlobalTrader |

| Visit Interactive Brokers | |

Interactive Brokers Pros

- Low share pricing

- Advanced trading platform

- Wide range of products

- Stocks and ETFs are commission free

- Good research tools

Interactive Brokers Cons

- Web platform has poor user interface

- Below average customer service

- Account opening is not straightforward

Is Interactive Brokers safe for traders from Canada?

Yes, interactive brokers are considered safe brokers in Canada. This is because top-tier regulatory authorities regulate it.

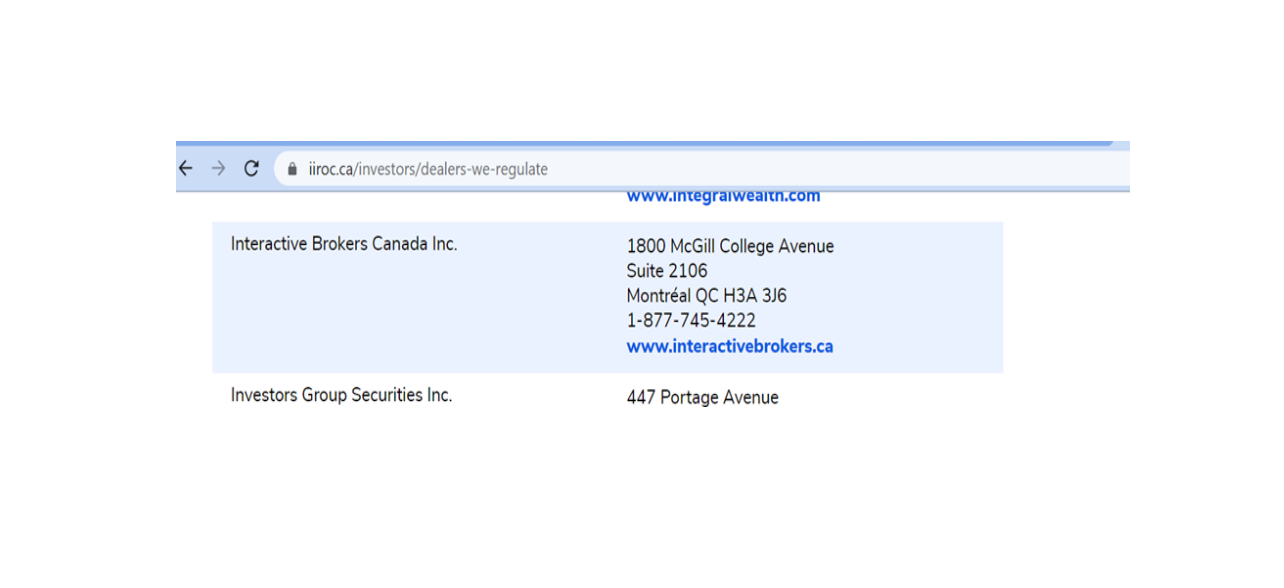

● In Canada, interactive brokers are regulated by the Investment Industry Regulatory Organization of Canada (IIROC).

● In the UK, interactive brokers are regulated by the Financial Conduct Authority (FCA) with the license number 208159.

● This broker is a member of the SIPC compensation scheme and Luxembourg investor compensation scheme.

● In Australia IB is regulated by the Australian Securities and Investments Commission with license number AFSL: 453554.

● In central Europe, IB is registered and licensed by the Central Bank of Hungary (Magyar Nemzeti Bank) with license number H-EN-III-623/2020.

IB is also regulated by the US SEC, CFTC, the Monetary Authority of Singapore, and the Central Bank of Ireland (CBI).

When considering how safe a broker is, regulations are one of the major factors to consider and it is safe to say IB is well-regulated.

Notwithstanding, aside from regulations there are other factors to put into consideration like their track record and policies.

Interactive Brokers Account Types

Interactive brokers offer several account types for users to choose from. They include:

● Individual, Joint, Trust, IRA and UGMA/UTMA Accounts

● Non-Pro Advisor Accounts

● Family Office Accounts

● Small Business Accounts

● Advisor Account

● Money manager accounts

● Broker & FCM Accounts

● Proprietary Trading Group Accounts

● Hedge & Mutual Fund Accounts

● Compliance Officers

● Administrators

● Institutional Hedge Fund Investors

All of these accounts are further divided into IBKR Lite and IBKR Pro accounts.

First, the IBKR lite account offers zero commission on ETF and IS stock listed trades.

Second is the IBKR Pro account is for advanced and active traders. It helps them seek the best price for stocks and options.

Interactive Brokers Fees

Interactive brokers charge several fees depending on your trading portfolio and the products you are trading. Here is what you need to know about the trading and non-trading fees to expect from this broker.

1. Spread

Spread is the difference between the price you buy a product from a broker and the price, the broker is willing to buy back the product from you. It is simply the difference between the bid and the asking price.

When trading with interactive brokers, you will have to deal with spreads. The spread charged depends on the products you are trading with. This broker operates with a variable spread, so the spread may change depending on current market situations.

2. Commission

Commission is a fee charged by brokers for allowing you to use their platform to trade. The commission you will be charged will vary depending on the product.

3. Trade-Related Fees

Interactive brokers charge some other trade-related fees that are not commission or spread. Some of these fees include:

● Cancel or modify orders

● Cancel/Modify Futures/Options Orders

● Trade Bust/Adjustments

● Telephone orders closing positions

4. Withdrawals & Physical Cash Deposits

Interactive brokers allow only one free withdrawal per month, after which, you will be charged. The fee charged for withdrawal and deposit depends on your country and the withdrawal method. The deposit fee is for users in Mexico.

5. Security Transfer Fees

Interactive brokers charge a fee of USD 10.00 per ISIN for north and southbound security transfers for users in the USA and Canada.

This broker charges other fees like

● Prime brokerage fees

● Stock Loans

● Exposure fees for high-risk accounts

● Account maintenance and reporting fee

Interactive Brokers Trading Platforms

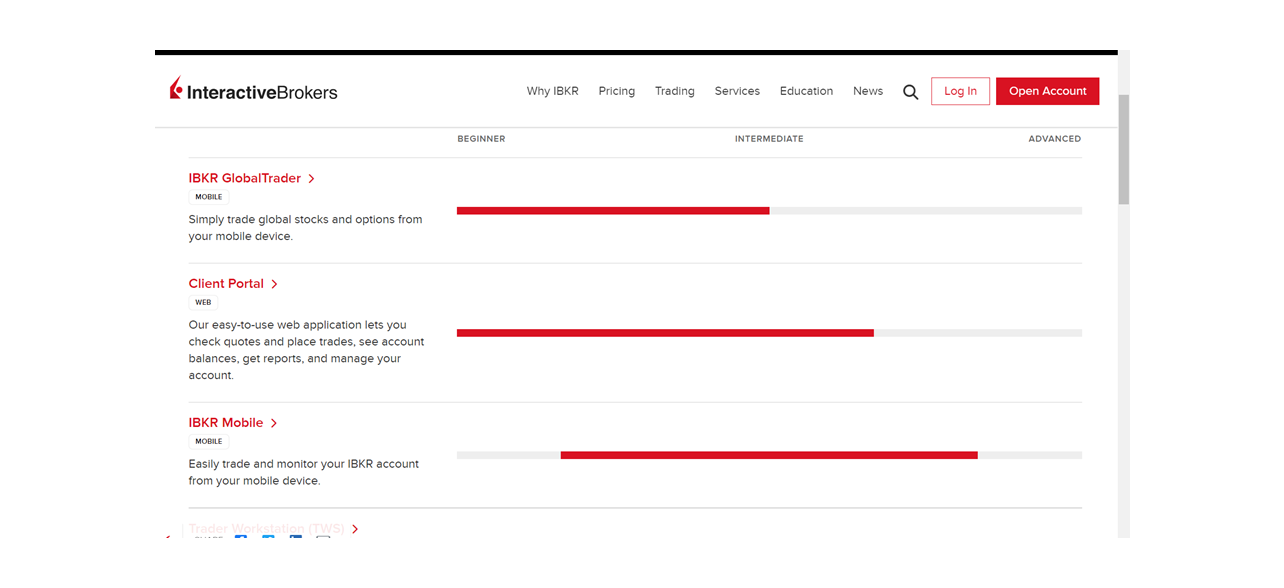

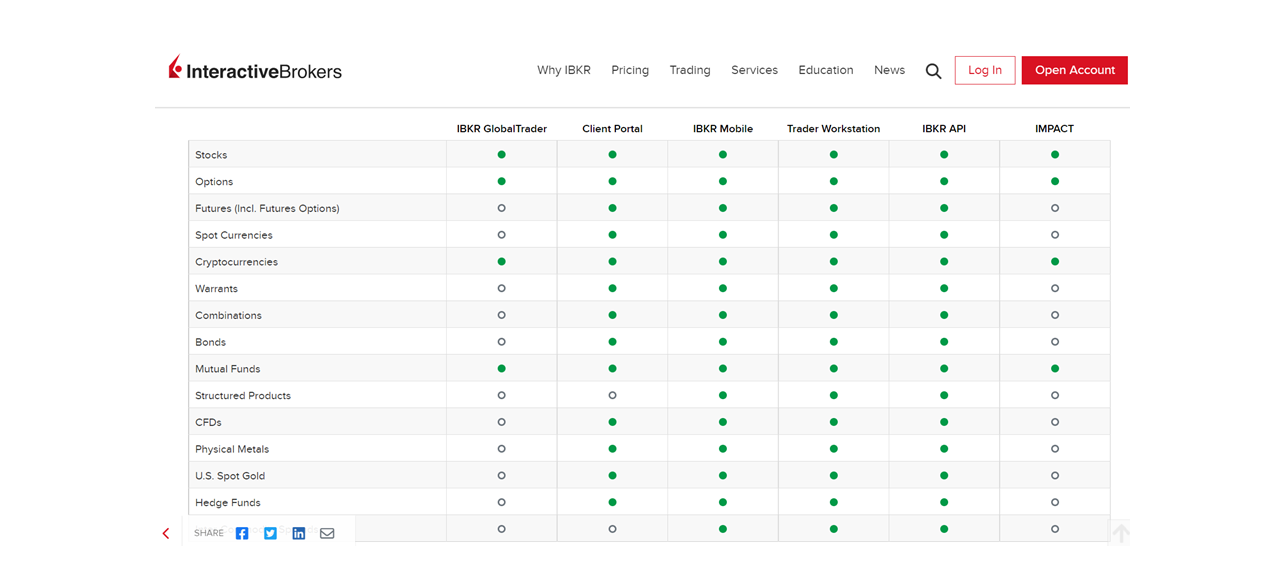

Interactive brokers offer you and other users the choice to choose from five different types of trading platforms. Here are some things to know about each platform:

1. IBKR GlobalTrader MOBILE

The IBKR GlobalTraders gives you access to trade on stocks across over 90 stock markets across the globe.

According to IBKR, this platform is currently used by up to 2 million users in over 200 countries. This platform is available for Android and IOS users. It is noteworthy to add that the platform is a better option for beginners.

2. Client Portal WEB

The client portal platform is a beginner’s platform that gives you access to tools like; advanced charting, news, Net Liquidation Value, and portfolio performance.

3. IBKR Mobile

The IBKR mobile app is an interactive brokers’ offer to intermediate traders. This platform gives you access to tools like; advanced quote and research tools. This platform is available on Android.

4. Trader Workstation (TWS) DESKTOP

Interactive Brokers Trader Workstation is for intermediate and advanced traders. This platform gives users access to tools like; market data, news, real-time monitoring tools, over 100 order types, etc.

5. IBKR APIs DESKTOP

IBKR APIs is an interactive brokers’ offer to advanced traders, it is IBKR’s proprietary, open-source API. Some of the amazing features of this platform include:

● Customize trading applications

● Build commercial trading software

● Access to over 150 markets

Interactive Brokers Trading Instruments

Interactive brokers deal on products like currencies, options, commodities, metals, bonds, and ETFs. Here is what to know about these products.

1. Stocks/ETFs

Interactive brokers offer their users access to trade stocks from more than 90 stock markets across the world. Users trading with IBKR lite do not have to worry about commissions for US-listed stocks and ETFs.

2. Options

Interactive broker offers its users access to trade options from over 30+ market centers. Commission for trading options ranges from $0.15 to $0.65 per contract. This broker also has advanced options trading tools like; option analytics, Rollover option tools, OptionTrader, probability lab, etc.

3. Futures/FOPs

You can trade Futures/FOPs from 30+ market centers. Commissions for Futures range between $0.25 to $0.85 per contract. The commodity Futures asset class on interactive brokers include

● Equity Indices

● Fixed Income

● Interest Rates

● Currencies

● Energy

● Metals

● Softs

● Agriculture

● Cryptocurrency

● Volatility Indices

4. Event Contracts

You can enter trades in event contracts like; energy, metals, Foreign currency futures markets, and Equity index. As of the time of writing this, event traders charge a fixed commission of $0.10 per contract.

5. Spot Currencies

You can trade over 100 currency pairs with a spread that starts from 0.1 pip. Commission for Forex trade is calculated by multiplying the trade size by 0.08 to 0.20 bps.

6. US Spot Gold

When trading US Spot Gold on interactive brokers, you can trade as low as one ounce of gold. You can also request physical delivery of your gold position from interactive brokers.

7. Bonds

Interactive brokers give its users access to the over 1M available bonds around the world including government bonds, corporate bonds, municipal securities, etc.

8. Mutual Fund

There are over 46,000 mutual funds that you can trade on interactive brokers and 18,000+ of these funds are transaction fee-free. IBKR has no proprietary funds.

9. Hedge Fund

Interactive brokers have an online hedge market where hedge fund traders can trade. This online hedge market allows you to view performance data for independent hedge funds, and private placement memorandum and subscription information.

How to Open an Interactive Brokers Account?

When opening an account with interactive brokers you will need the following information and documents:

● Social security number Proof

● Details about your employers

● Date of birth

● Principal place of business

● Tax ID

● Account number

● Proof if identity

● Proof of address

● Proof of the authority of the trust to trade on margin

● Proof of identity and address of grantor

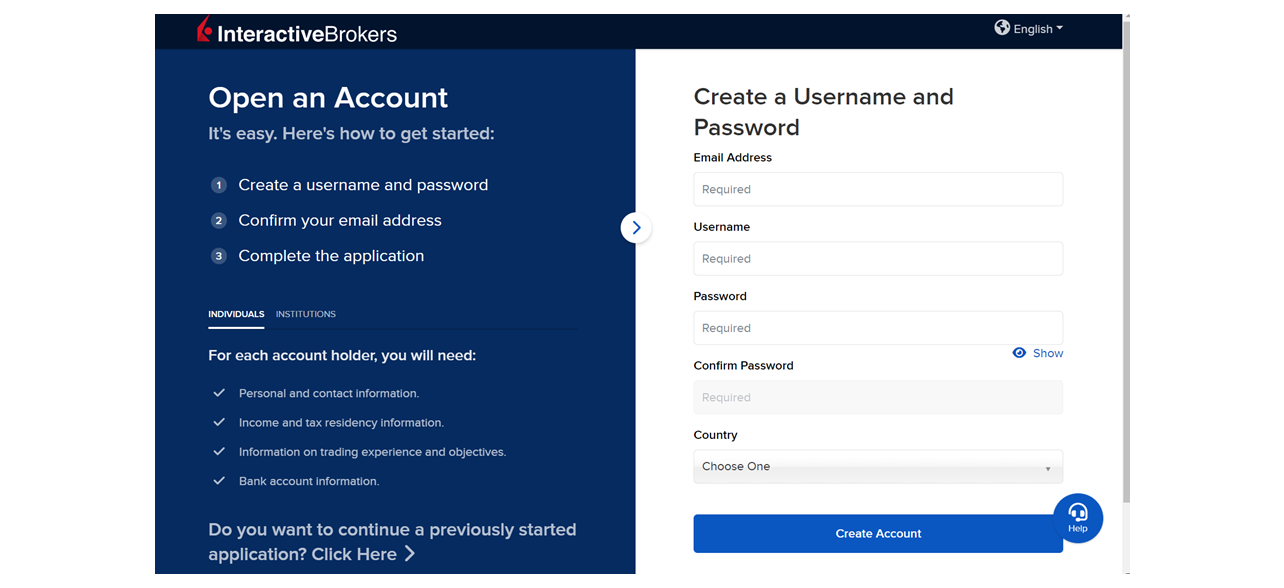

1. Visit IBKR’s official website

2. Click on “Open account” at the top right corner of the website

3. A short form will be displayed on your screen. Enter your email address, username, password, and country.

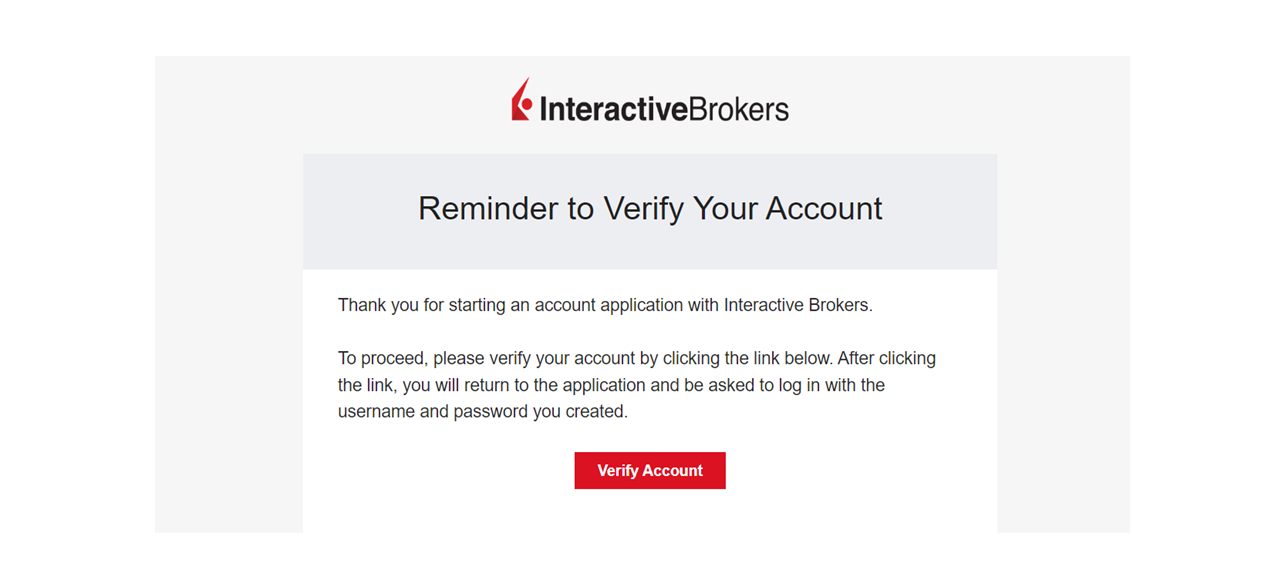

4. A verification email will be sent to you. Open the mail, and click the link on the mail to continue your registration.

5. Enter your username and password.

6. Follow the prompts to continue the registration process.

Deposit and Withdrawals

Depositing and withdrawing from interactive brokers is quite a straightforward process and can be done through processes like;

● Bank Wire: Bank transfer takes about one working day to be completed. Your bank may charge you some fees for the transaction.

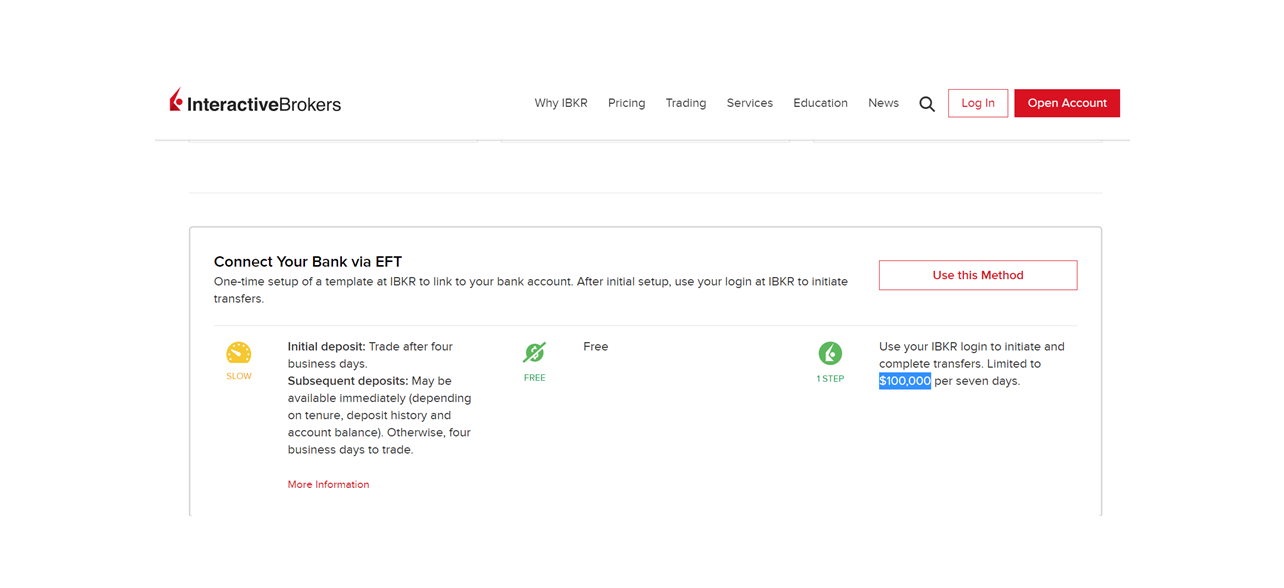

● Electronic fund transfer; Transactions using electronic fund transfer takes up to 4 working days. You should know that you are limited to a maximum transaction limit of $100,000 per week.

● Online Bill pay; Transactions with online bill pay may take as long as six working days to be completed. Although EasyMarket does not charge any fee, the third-party platform may charge you for each transaction.

The time it takes, and the minimum deposit or withdrawal depend on the method you decide to use.

Customer Service

You can contact interactive brokers using different means like

● Phone Calls: interactive brokers’ customer service line is available 24 hours every business day. Issues relating to passwords, login, and security can only be resolved via phone calls.

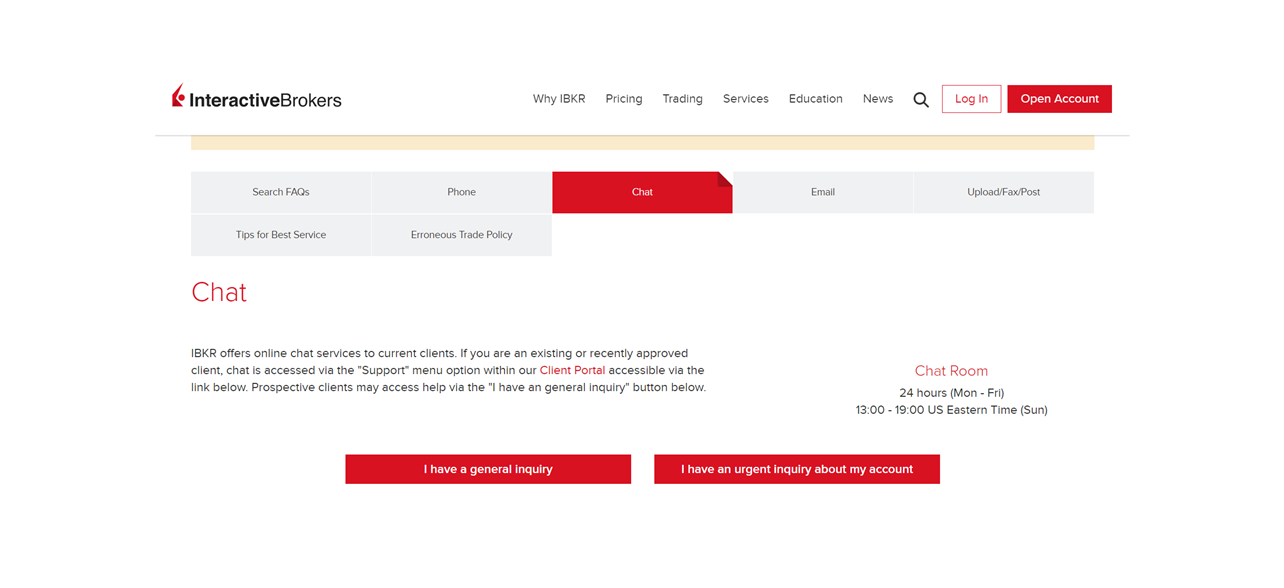

● Chat: interactive brokers chat room is an initiative from this broker to help customers reach customer service. The chat room is open 24 hours from Monday to Friday.

● Email: inquiries sent via email to interactive brokers are usually responded to within 24 hours. Email is not one of the fastest ways to reach this broker.

Research

Interactive brokers also offer their users tools for carrying out research. However, not all of these tools are free to use. Some of them include:

● Pro Perspectives

● Billionaire’s Portfolios

● Stockcalc Research – Commercial

● InvestorAi Research Feed etc

Most of these research tools are from third-party partners.

Education

This broker has educational tools for trading with both novice and advanced traders. Some of these tools include

● Webinars

● Podcast

● Trader’s insight

● Free online courses

These educational tools contain both beginners and advanced courses.

FAQs on Interactive Brokers Canada

Is IBKR Trusted?

Yes, IBKR is considered a safe broker. This is mostly because this broker has been in existence since 1977 and is still functioning. Another reason is that IBKR is regulated by some of the biggest regulatory bodies.

Is Interactive Brokers Safe In Canada?

Yes, Interactive brokers are considered safe in Canada. This is because this broker is regulated by the Investment Industry Regulatory Organization of Canada (IIROC).

Why Are Interactive Brokers So Cheap?

It is believed that Interactive brokers charge cheap spread and commission because they make money by adding a fee to some of the other services they provide, like the monthly subscription fee for their research tools.

Note: Your capital is at risk