EasyMarkets is a CySEC and ASIC registered broker that has been operational since 2001. This broker has also gained popularity around the world. They pride themselves in their long years of existence and regulations.

However, before choosing to trade with EasyMarkets, you still need to carry out some in-depth research about the broker and carefully decide if they suit your trading style. This article should be of help.

| Easy Market Review Summary | |

|---|---|

| Broker Name | easyMarkets |

| Establishment Date | 2001 |

| Website | https://www.easymarkets.com/int/en-ca/ |

| Address | EF Worldwide Ltd, Trinity Chambers, Road Town, Tortola, PO Box 4301, British Virgin Islands |

| Minimum Deposit | CAD 25 |

| Maximum Leverage | 1:500 |

| Regulation | ASIC, CySEC, Seychelles |

| Trading Platforms | MT4, MT5 |

| Visit Easy Markets | |

Easy Markets Pros

- Fast execution

- No inactivity fee

- Special features like Freeze rate

- 24/7 customer service

- Availability of risk management tools

- De-Cancellation features

Easy Markets Cons

- Fixed spread

- Limited availability of tradable assets

- Not all features work with MetaTrader 4

Is Easy Markets safe for traders from Canada?

Easy Market is regulated by some of the top-tier regulatory authorities around the world.

1) Cyprus Securities and Exchange Commission: They are one of the first firms to be regulated by Cyprus Securities & Exchange Commission “CySEC” with license number 079/07.

2) Australia Securities and Investments Commission “ASIC”: EasyMarkets is registered with ASIC under license number 246566.

3) Financial Services Authority of Seychelles “FSA”: In the Republic of Seychelles, Easy Market is regulated by the Financial Services Authority of Seychelles “FSA”, with the license number SD056.

4) Financial Service Commission: This broker is also regulated by the Financial Services Commission “FSC” with license number SIBA/L/20/1135.

Although EasyMarkets is regulated, it’s not as highly regulated as some other brokers who have as many as five regulatory bodies regulating them.

EasyMarkets Trading Platform

As an easy market user, there are five different trading platforms that you can choose from. You may want to choose a platform that suits your trading style. Here are some things to know about each platform;

EasyMarkets App

This broker has a user-friendly mobile app that is available for Android and IOS users.

The mobile app has analytical tools integrated into it and performs exactly the same function as the web platform.

DealCancellation and Free Guaranteed Stop Loss and Take Profit are some of the major unique features of EasyMarket app.

EasyMarkets Web Platform

EasyMarket prides itself on its web platform being well-packed with trading tools and features.

This platform offers analytical tools, zero slippage, deal cancellation, Freeze Rate, Free Guaranteed Stop Loss and Take Profit, access to over 275 instruments, and a freeze rate.

EasyMarkets TradingView

This platform gives you access to advanced trading tools, deep market insights, and easy trade execution. One of its unique features is the social components which allow users to interact with each other.

Other features of this platform include; negative balance protection, Free Guaranteed Stop Loss, and analytical tools.

MetaTrader 4

MetaTrader4 is one of the most popular trading platforms that EasyMarkets offers. This platform allows you to view and use your trading accounts from other brokers aside from EasyMarkets.

Some of the features of this platform include; a customizable interface, access to news and market analysis, and negative balance protection.

MetaTrader 5

MetaTrader5 has become the go-to trading app for traders who enjoy the use of MT4.

This is because MT5 has more advanced tools compared to MT5, like advanced chart indicators, and faster processing speed, to mention but a few.

Some other reasons why some traders may prefer trading with MT5 include; its customizable interface, expert advisors, and variable spread from 0.3.

EasyMarkets Products

One of the earlier stated demerits of EasyMarkets is the limited availability of tradeable. However, this broker deals with some of the most popular assets, some of which include;

Easy Markets Trading Instruments for Canadian Traders

| Assets | Quantity |

|---|---|

| CFD | 275+ |

| Forex | 95+ Pairs |

| Cryptocurrencies | 4+ |

| Metals | 5 |

| Commodities | 10+ |

| Indices | 12+ |

| Shares | 50+ |

1. Forex

EasyMarkets is one of the first brokers to offer online Forex trade to traders. This broker offers over 95 currency pairs for you to trade with. These currencies include major, minor and exotic currencies.

2. Shares

You can trade over 275 CFD stocks and shares on EasyMarkets. EasyMarkets offers EU shares, AU shares,

HK shares, US shares, and JA shares.

3. Metals

You can trade gold, platinum, palladium, copper, and silver on EasyMarkets. You can trade metals as CFDs. This way even without owning the metals you can profit from the change in price. However keep in mind that CFD trading comes with so much risk.

4. Commodities

Commodities like natural gas, agricultural produce, copper, and crude can be traded on EasyMarkets.

5. Indices

You can trade indices like GLOBAL INDICES S&P 500, FTSE, NIKKEI, DAX, and NASDAQ on EasyMarkets. Some of these world popular indices are made up of blue chip stock like; apple, Microsoft, Amazon, Johnson and Johnson.

EasyMarkets Fees

One of the major fees that EasyMarkets charges are the fixed spread. This means that irrespective of the current market conditions, EasyMarket’s spread does not change.

However, this spread differs from one instrument to another, and trading platform. Here is the minimum spread:

Easy Markets Spreads

| Assets | Easymarkets App, Web and TradingView | MetaTrader 4 | MetaTrader 5 |

|---|---|---|---|

| Forex | 0.8 | 0.7 | 0.3 |

| Commodities | 4 | 3 | 1 |

| Metals | 40 | 35 | 15 |

| Indices | 1 | 0.75 | 0.005 |

| Cryptocurrencies | 0.0005 | 0.0005 | 0.0003 |

| Shares | 0.02 | 0.02 | 0 |

Account Types

Easy market has three account types that folks from Canada can choose from. Each of these accounts comes with different terms and conditions. They include:

VIP Account

The minimum transaction size is 0.01. The spreads are fixed unless you’re using the MT5 trading platform. They offer negative balance protection. They do not charge a commission under this type of account.

Premium Account

The spreads are fixed unless you’re using the MT5 trading platform. Traders can take advantage of negative balance protection. They do not charge a commission under this type of account. The Premium account can be used with any trading platform offered by Easy Markets.

Standard Account

The minimum transaction size is 0.01. The spreads are completely fixed except for MT5. Slippage occurs when using the MT4 or the MT5. You can use a trading central indicator. Easy Markets does not charge any commission when trading. The maximum leverage is 1:500.

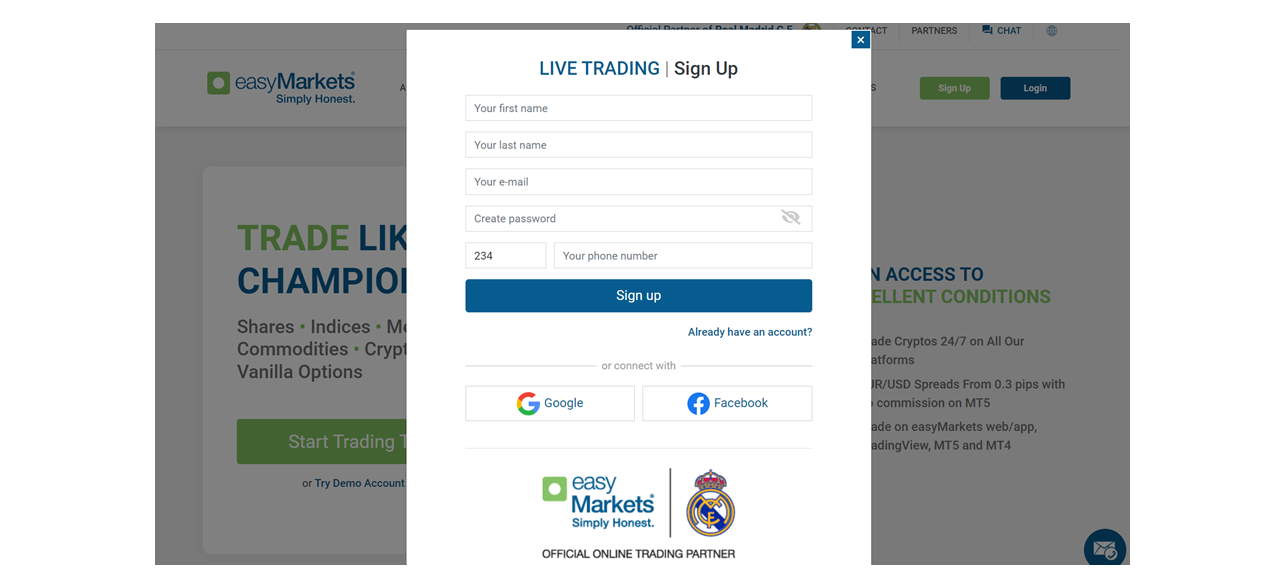

How to Open an Easy Markets Account?

1. Visit the official EasyMarket website.

2. Click on the sign up button at the top right corner of the website.

3. A short form will be displayed on your screen. Enter your name, email, password and mobile number.

4. Confirm the country where you pay your tax and reside, then start trading.

Deposit and Withdrawals

Depositing and withdrawing with EasyMarkets is quite a straightforward process and there are a variety of ways to go about it like;

1. Online banking

Online banking deposit and Withdrawal are free, however the third party bank may charge you. It takes between 3-5 working days for the transaction to be successful.

2. E-wallet

You can deposit and withdraw on EasyMarkets using e-wallet platforms like Skrill, neteller, web money and perfect money. E-wallet deposits and withdrawals may be instant or can take up to 1 or 2 working days.

3. Debit Cards/Credit Cards

You can use debit or credit cards like MasterCard, Visa card, astro pay. However, only users in Europe can use MasterCard and Maestro cards. Card deposits and withdrawals are instant.

EasyMarkets does not charge any fee for deposit or withdrawal.

However to withdraw from your EasyMarkets account, you will need to present documents like; your passport or ID card and proof of residence.

Depending on your account activities, EasyMarkets may also request for your credit card statement before permitting you to withdraw.

It is important to add that withdrawal from EasyMarkets takes a minimum of two days to reach your specified destination. However, it may take up to 3-10 working days depending on your bank’s processing speed.

You should also know that if you are withdrawing to a bank account, the minimum withdrawal is $50, but to a credit/debit card or e-wallet, there is no minimum withdrawal amount.

Customer Service

EasyMarkets’ has made it possible for customers with complaints or feedback to reach them through a wide variety of means. Here are the available contact options:

Just like you chat with friends on WhatsApp, you can also speak with an EasyMarkets’ customer service agent on WhatsApp. However, you should ensure that you get the right WhatsApp number from EasyMarkets website to avoid scam.

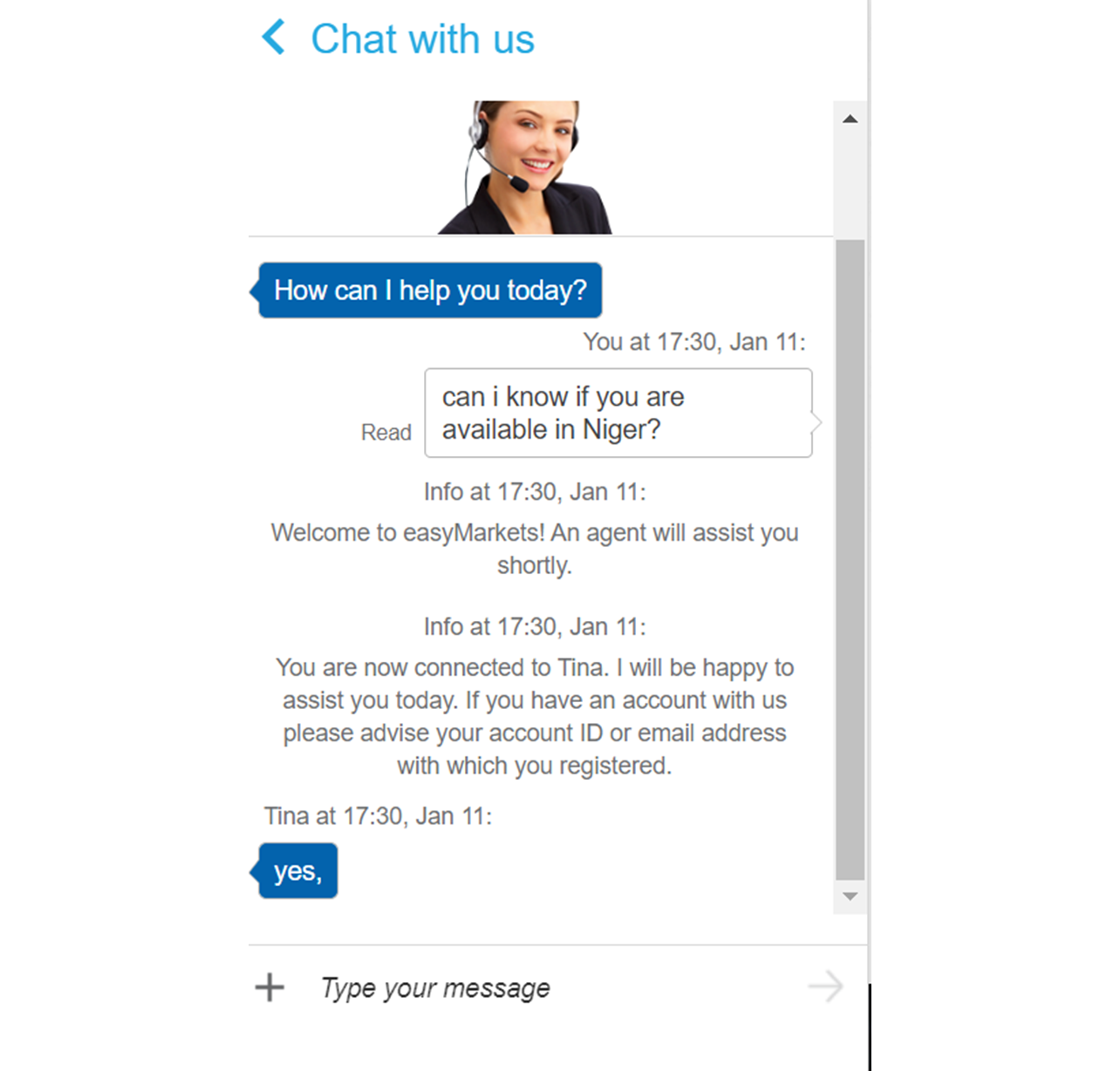

● Live chat

EasyMarkets love chat gives you access to chat with a customer service agent from EasyMarkets website or app. When we tested the live chat to see how fast they responded, it didn’t take up to 30 seconds to get a response.

● Viber

Viber users can also chat with this broker on the app. Just like in the case of WhatsApp, you will need to do you due diligence to avoid chatting with the wrong number and being scammed.

● Facebook messenger

Chatting with EasyMarkets’ customer service on Facebook messenger is similar to the WhatsApp chat. Customer service takes less than 30 seconds to respond.

You can reach EasyMarkets via three different emails depending on your need. They include; [email protected], [email protected], and [email protected]

All of the above-listed methods are only available for 24 hours, Monday to Friday.

It is noteworthy to add that EasyMarkets has a 4.8-star rating on Trustpilot, and some of the positive reviews have to do with customer service.

Education

EasyMarkets provides a demo account for beginners to learn how to trade. Aside from that, there are also several trading courses on the platform for beginners and professionals as well.

To gain access to these courses, you will have to sign up to EasyMarkets and after watching all the courses, in each segment or class, you will be required to take a test.

Research

As an EasyMarket user, you have access to research tools like financial calendar, market news, live currency rates, and trading charts.

You should know that the market news spans across geopolitical events and even rumours, so many want to do proper research before using the information to make trading decisions.

FAQs on Easy Markets Canada

What Is The Minimum Deposit For EasyMarket?

The minimum deposit for EasyMarkets is $10,000 but for MT4, it’s $25.

Is EasyMarkets a Market Maker?

Yes, the easy market is a market maker.

Is EasyMarket Safe?

EasyMarket is considered an averagely safe broker.

Note: Your capital is at risk