XM is a forex and CFDs broker with a platform for trading foreign exchange currency pairs, stocks, metals CFDs, energies CFDs, indices CFDs, and commodities CFDs.

XM was founded in 2009 and launched the website trading-point.com. In 2013, after acquiring XEMarkets.com, it changed its trading name to XM.com. The broker is licensed in Australia by ASIC.

This review of XM gives you an overview of the account types, trading fees, tradable instruments, trading platforms, customer support and deposits/withdrawal options available on the platform.

| XM Review Summary | |

|---|---|

| Broker Name | Trading Point of Financial Instruments Pty Limited |

| Establishment Date | 2009 |

| Website | www.xm.com |

| Address | Trading Point of Financial Instruments Pty Limited, Level 13, 333, George Street, Sydney, NSW 2000, Australia |

| Minimum Deposit | AUD 8 |

| Maximum Leverage | 1:30 |

| Regulation | ASIC, CySEC, DFSA |

| Trading Platforms | XM WebTrader, XM App, MT4 and MT5 available on PC, Mac, Web, Android, & iOS, |

| Visit XM | |

XM Pros

- XM is regulated by ASIC

- Offers free deposits and withdrawals

- Offers commission-free trading

- Supports MT4 and MT5 trading platforms

- Relatively fast processing of deposits/withdrawals

XM Cons

- Does not have 24/7 customer support

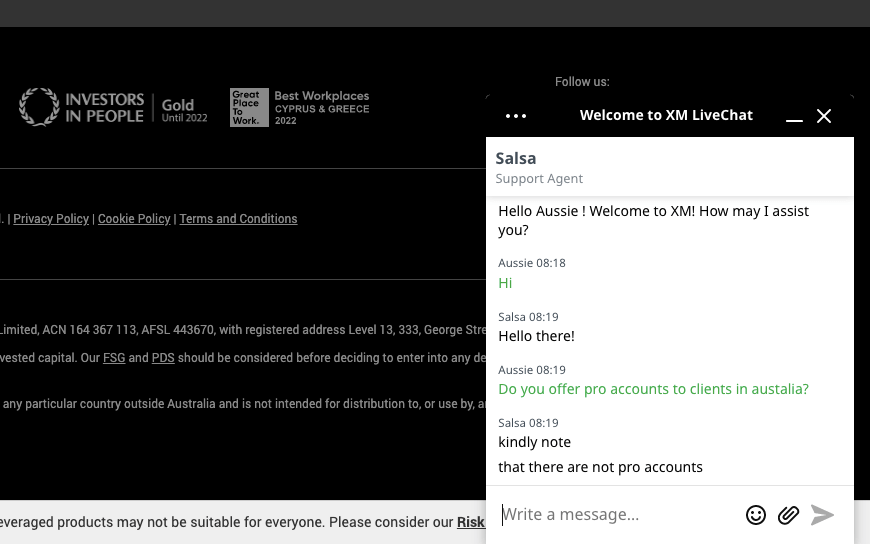

- Does not offer professional account

- Charges dormant account fees

- Relatively few tradable instruments available

Can I trust XM?

XM is the trading name of Trading Point Holdings Ltd, which is regulated under different names by various Tier-1 and Tier-2 financial regulators.

Here are some of the jurisdictions in which XM is regulated.

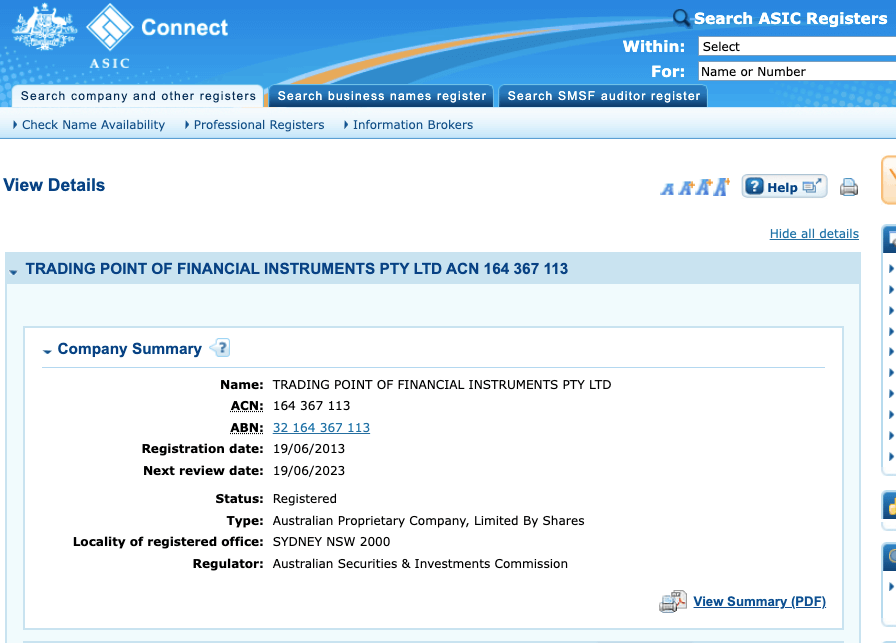

1) Australian Securities & Investments Commission (ASIC): XM is regulated in Australia as Trading Point of Financial Instruments Pty Limited with ACN (Australian Company Number) 164-367-113 since 2013 and is licensed to provide financial services in Australia.

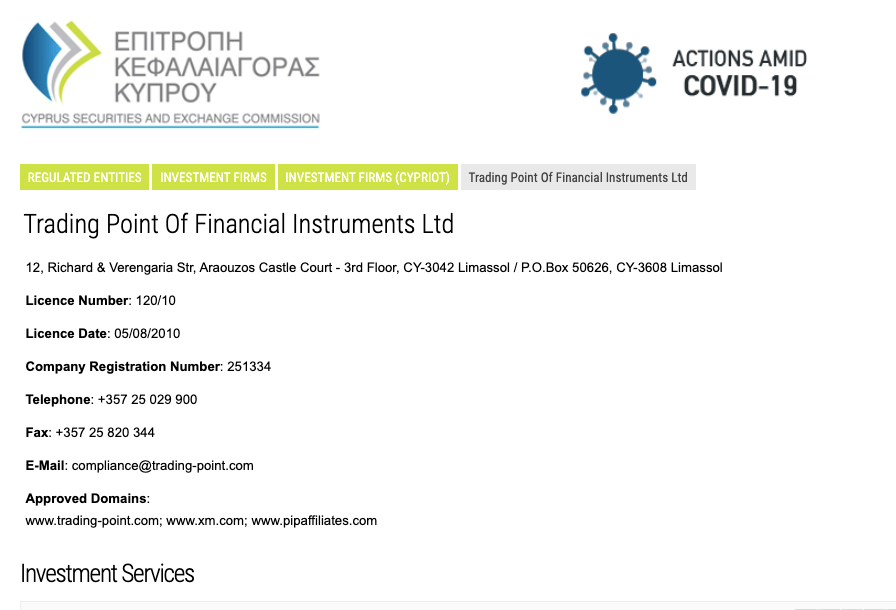

2) Cyprus Securities and Exchange Commission (CySEC): XM is regulated in Europe by CySEC as Trading Point Of Financial Instruments Ltd and authorized to offer investment service, with license number 120/10 issued in 2010.

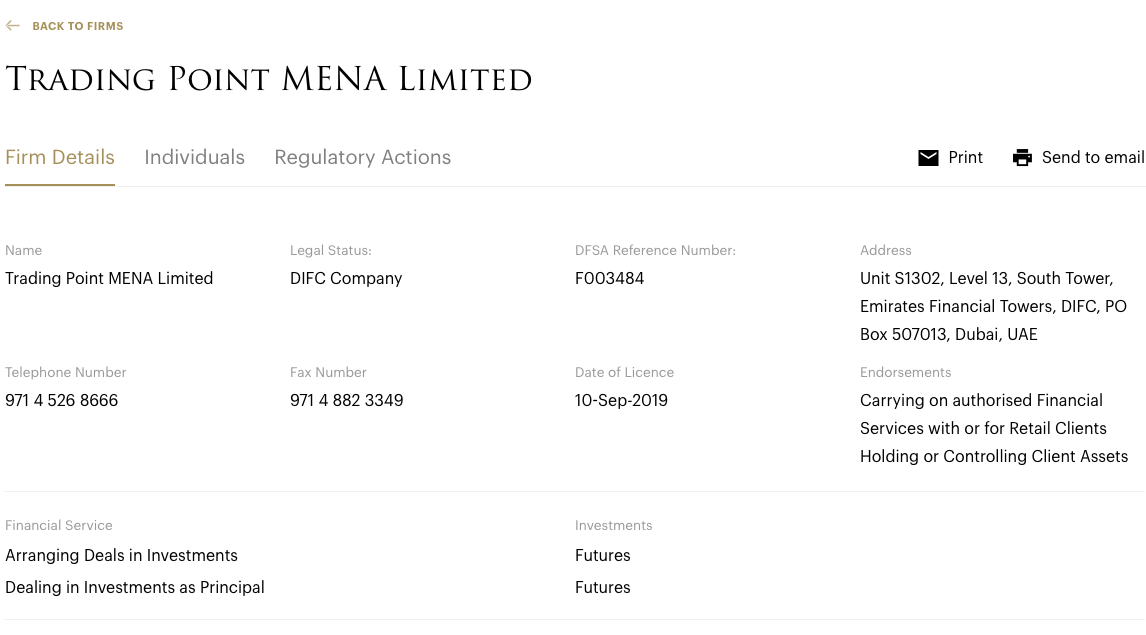

3) Dubai Financial Services Authority (DFSA): XM is regulated in Dubai, UAE as Trading Point MENA Limited, DFSA Reference Number: F003484, authorized to carry on financial services in 2019.

4) Financial Services Commission (FSC), Belize: XM is licensed in Belize as ‘XM Global Limited’ with license number 000261/309. Traders in Kenya are registered under this regulation.

5) Financial Conduct Authority: XM holds a UK license as well. They used to hold a temporary license. Now they are permanently regulated under the name Trading Points of Financial Instruments. Their FCA number is 705428 with an office in London.

XM Leverage

The leverage on XM varies, depending on the instrument you are trading. The maximum leverage on XM is 1:30, which applies to major forex pairs, other instruments have lower leverage limits of 1:20 for minor forex pairs, major indices and gold, 1:10 for minor indices, agriculture commodities, energies and silver, and 1:5 for stocks.

With leverage of 1:30, you can open a trade position worth 30 times your deposit. For example, if you deposit $1,000 you can place a trade worth $30,000.

It is important that you do not use all the leverage available as this would increase the risk of losing your money. It is best to avoid trading forex and other leveraged products, unless you understand them and have experience.

XM Account Types

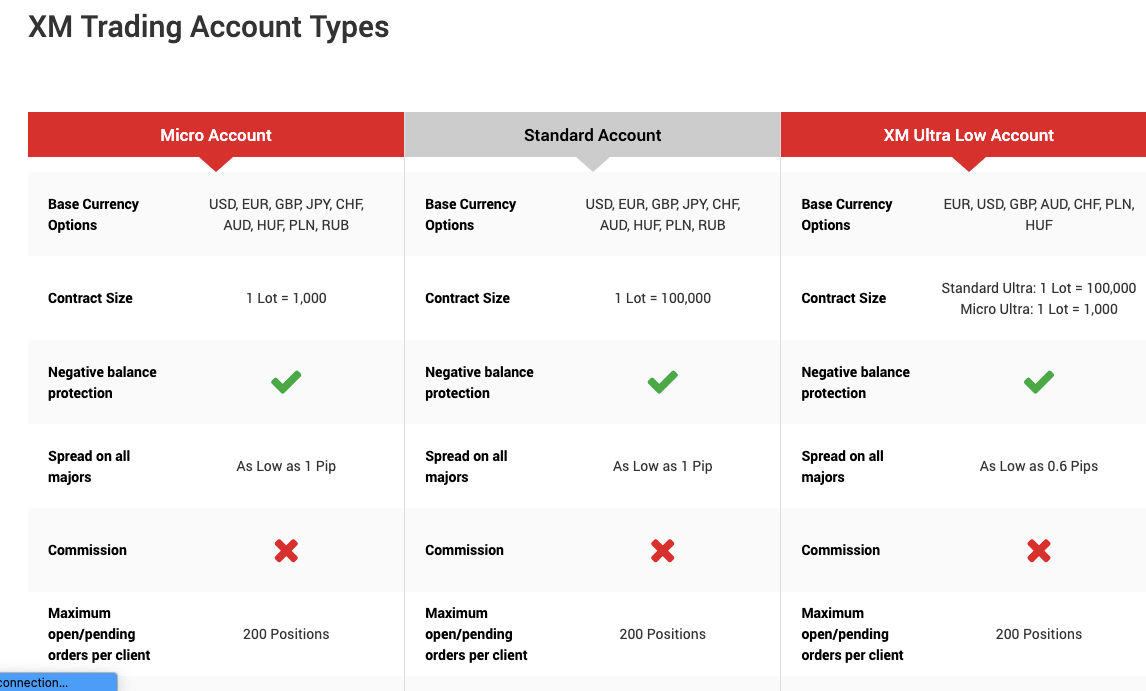

XM offers 3 types of trading accounts for retail clients: Micro, Standard, and XM Ultra Low Accounts. XM does not offer Professional Accounts, although you can request Islamic Accounts or open demo accounts to practice trading on the platform.

Below are details of the various account types currently available on XM and their features:

1) Standard Account: The XM Standard Account is available on MT4 and MT5 platforms and lets you trade Forex and CFDs on indices, energies, stocks, metals, and agriculture commodities.

This account does not charge commission fees for opening or closing trade positions. Spreads start from 1 pip for major pairs and you pay swap fees for keeping a position open overnight on the Standard Account.

The contract size for this account is 100,000 for 1 lot, with a required minimum deposit of USD 5 (AUD 8), and a minimum trade lot size of 0.01. The maximum number of open positions on the Standard Account is 200 with a leverage limit of 1:30.

You have negative balance protection with this account, which means that you cannot lose more than the money you deposit. If you make a loss on a trade position, your account cannot run into a negative balance.

2) Micro Account: The XM Micro Account is also available on MT4 and MT5 platforms and lets you trade Forex and CFDs on indices, energies, stocks, metals, and agriculture commodities.

This account is spread only and charges no commission for opening or closing trade positions. Spreads start from 1 pip for major pairs and you pay swap fees for keeping a position open overnight on the Standard Account.

The contract size for this account is 1,000 for 1 lot, with a required minimum trade lot size of 0.01, a maximum of 200 open positions and leverage of 1:30.

The minimum deposit on this account is USD 5 (AUD 8) and you also have negative balance protection.

3) XM Ultra Low Account: The XM Ultra Low Account is available on MT4 and MT5 platforms and offers lower spreads. You can open a Micro Ultra Low or Standard Ultra Account.

Spreads on this account start from 0.6 pips for major pairs, no commission fees are charged for opening or closing trade positions, but you incur pay swap fees if you keep a trade position open overnight.

The contract size for this account is 100,000 per 1 lot for Standard Ultra and 1,000 per 1 lot for Micro Ultra. The minimum trade lot size is 0.01, and the maximum number of open positions is 200 with a leverage limit is 1:30.

This account also requires a minimum deposit of USD 5 (AUD 8) and you have negative balance protection.

4) Islamic Account: XM offers an Islamic Account that is swap-free for Muslim traders who want to adhere to the sharia law of no-riba.

To avoid paying swap fees, Islamic Accounts on XM pay commissions for every trade.

You can convert a Micro, Standard, or Ultra Low Account to Islamic status, and the same features will apply, except that the Islamic Account does not pay any swap fees.

If you want an Islamic account, first open a Standard, Micro or Ultra Low Account, then contact customer support to convert your account to the swap-free status. Note that you will have to agree to the terms of conditions of the Islamic Account.

XM Base Account Currency

Base account currencies supported on XM are AUD – Australian Dollar, USD – United States Dollar, EUR – Euro, GBP – British Pound (Sterling), JPY – Japanese Yen, CHF – Swiss Franc, HUF – Hungarian Forint, PLN – Polish Złoty, and RUB – Russian Ruble.

Your trades, deposits, withdrawals, profits and losses are measured in your account base currency. Note that some account types cannot have some currencies.

XM Fees

Fees on XM Australia vary based on instruments traded and account type. Find an overview of XM fees here:

Trading fees

1) Spreads: XM charges spreads whenever you trade instruments, which is the difference between the bid and ask prices. The lowest spreads start at 0.6 pips for XM Ultra Low Account and 1 pip for the Micro and Standard Accounts. Here are the average spreads on XM:

| Instrument/Pair | Micro/Standard Account | Ultra Low |

|---|---|---|

| EUR/USD | 1.6 pips | 0.6 pips |

| GBP/USD | 1.9 pips | 0.6 pips |

| EUR/GBP | 1.8 pips | 0.7 pip |

| Gold | 25 pips | 12 pips |

2) Commission fees: XM offers commission-free trading for all account types. This means that you will not pay any commission when you open or close trade positions on the platform. To avoid paying swap fees, Islamic Accounts on XM pay commissions for every trade depending on the instrument being traded.

3) Swap fees: If you keep a trade position open past the closing time of the market which is 22:00 GMT, the trade rolls over to the next day and you incur a rollover fee also called overnight funding cost or swap fee, this is applicable to all account types on XM except Islamic Accounts.

The swap fees depend on the instrument you are trading, the leverage used, the spread, and whether your position was long (buy) or short (sell).

Islamic Accounts are swap-free and do not pay any swap fees for holding a position overnight.

Non-trading fees

1) Deposit and Withdrawal fees: XM does not charge any fees for deposits and withdrawals on all payment methods which applies to all account types. Although, all deposits and withdrawals below 200 USD processed via international bank wire transfer incur a fee of AUD 23 per transaction.

Some international banking institutions may charge independent fees.

2) Account Inactivity charges: If you do not perform any trade on your account or log in for 90 days, your account is considered inactive, and will be charged USD 5 (AUD 8) every month as inactive account fees on any funds in the account. If you have no funds in it, no fees will be charged.

How to Open XM Account in Australia?

To start trading on XM, follow these steps to open an account.

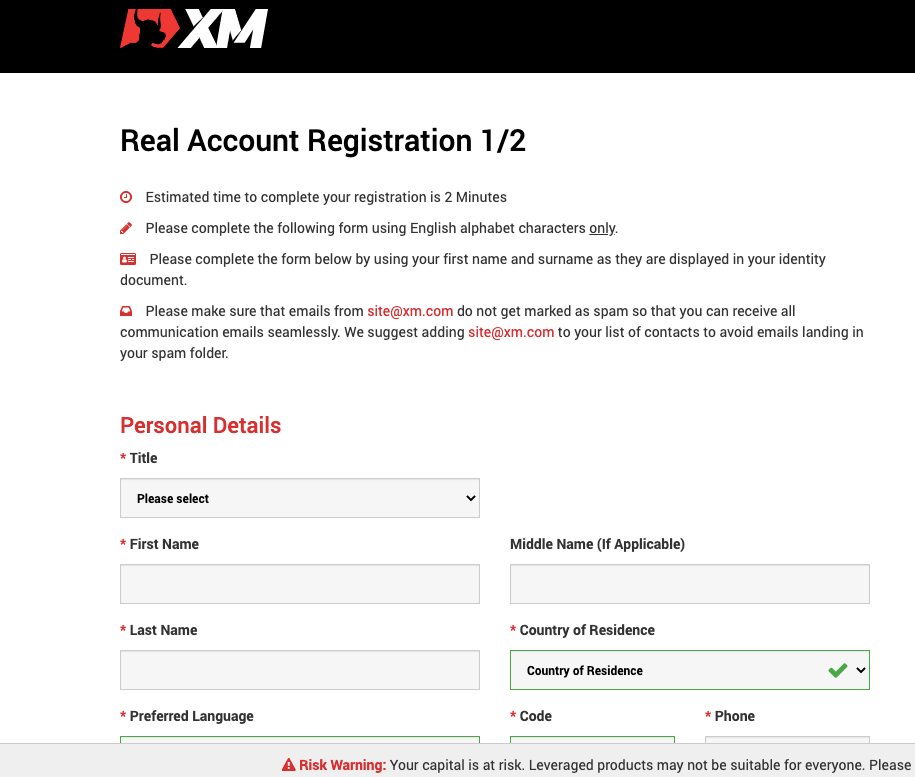

Step 1) Visit the XM website homepage at www.xm.com and click on ‘OPEN AN ACCOUNT’

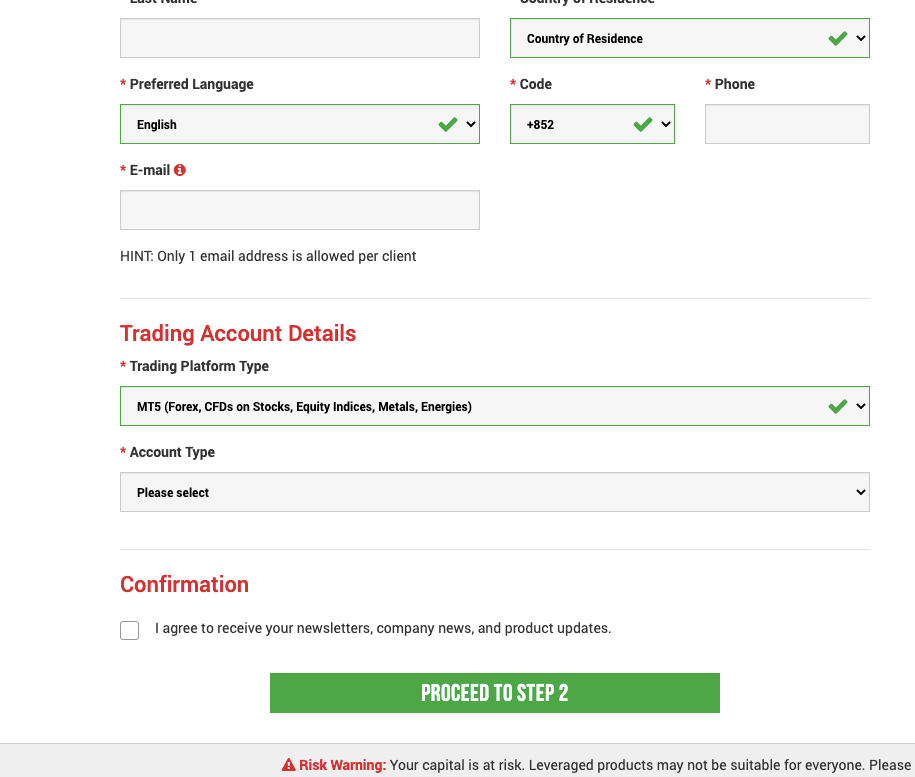

Step 2) Fill out your name, email, and phone number on the form that appears. Select your country of residence, preferred trading platform and account type, check the box below ‘Confirmation’ to receive newsletters then click the ‘PROCEED TO STEP 2’ button.

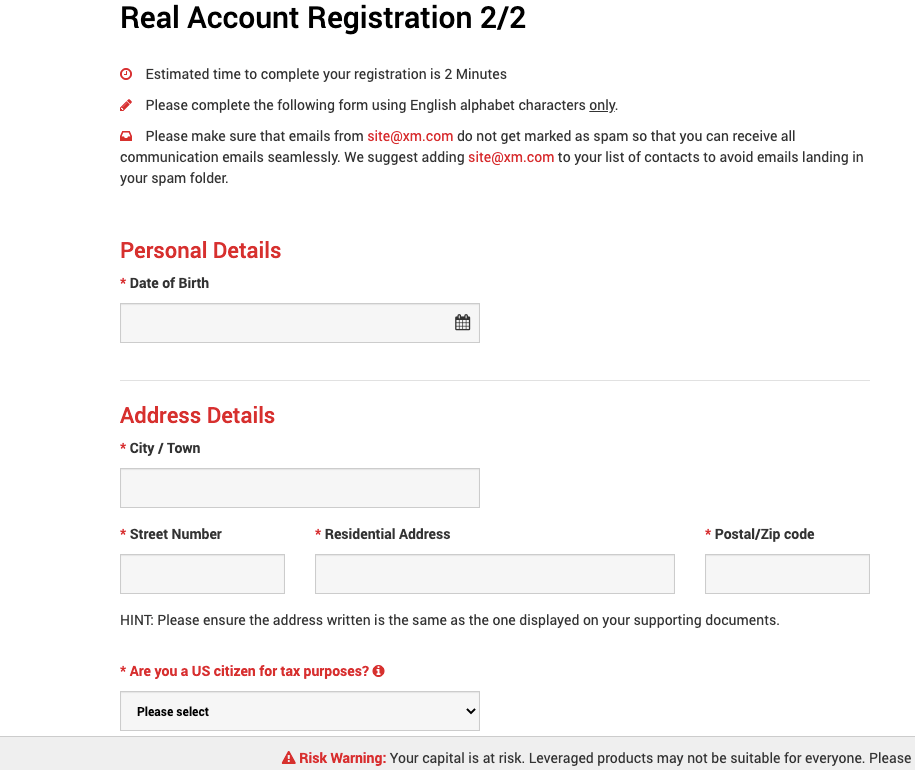

Step 3) Provide your date of birth and address, and choose whether you are a US citizen or not.

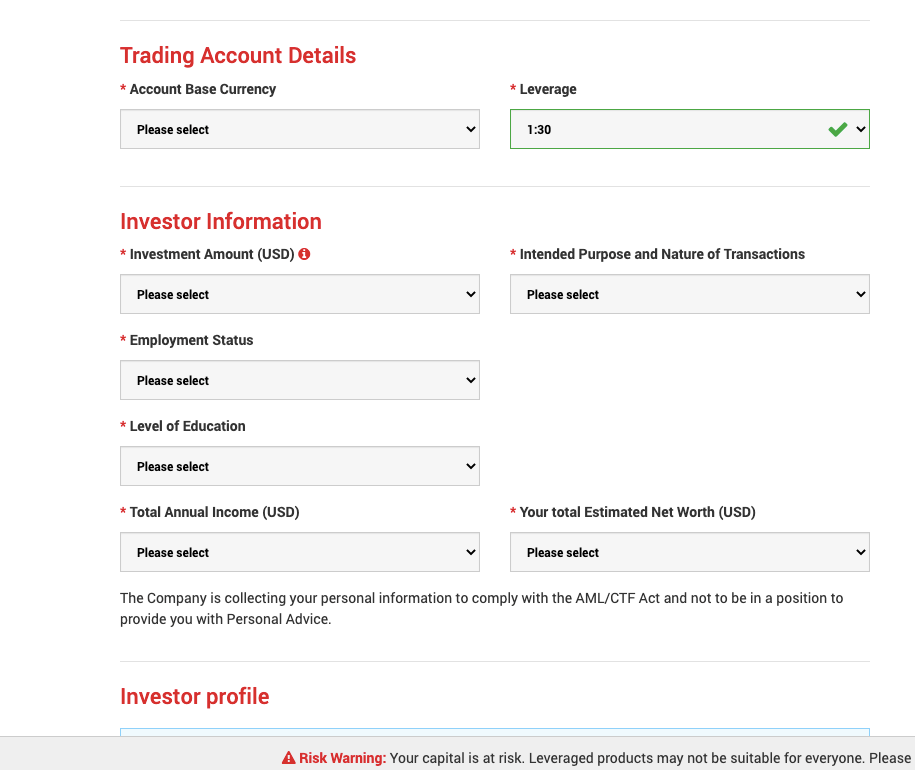

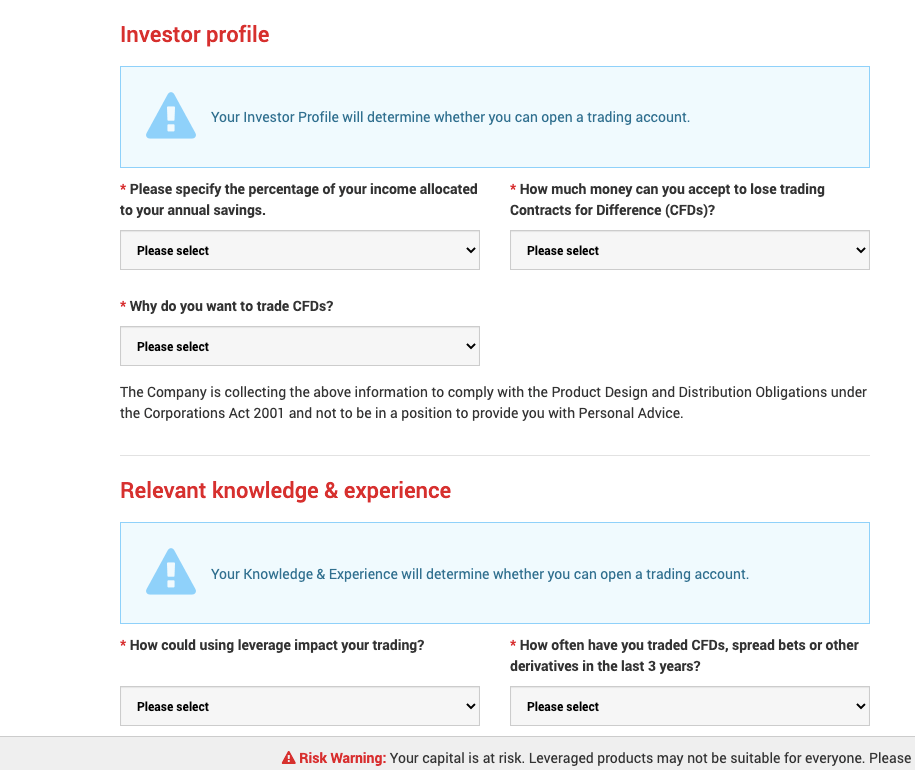

Step 4) Select your preferred base account currency and answer questions about your financial, employment, and education background and knowledge/experience as an investor.

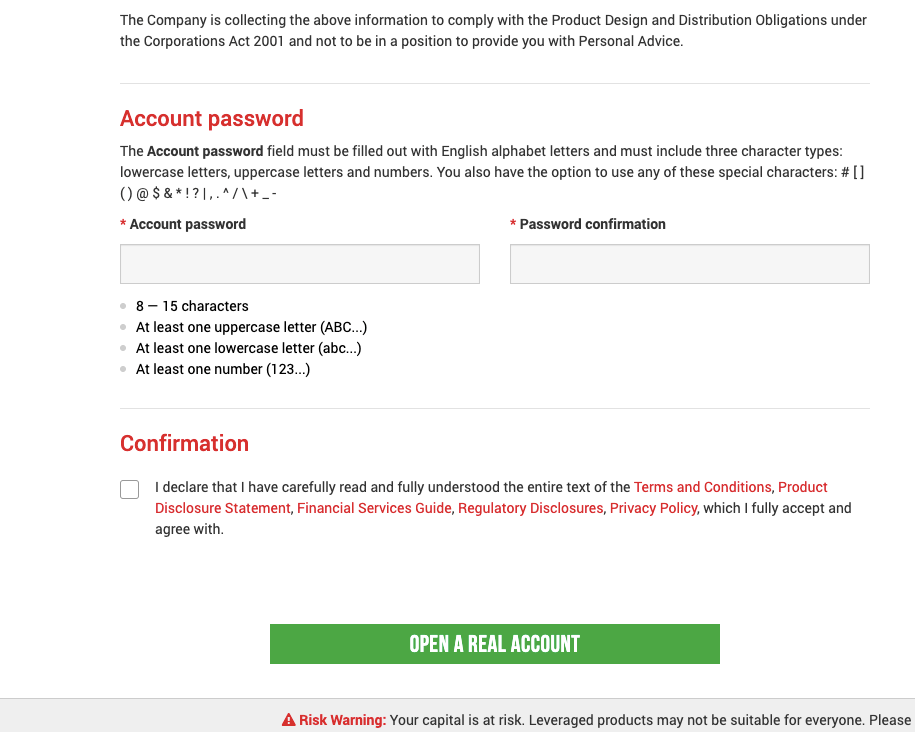

Step 5) Create a password, check the confirmation box to agree to the terms and conditions, then click ‘OPEN A REAL ACCOUNT’.

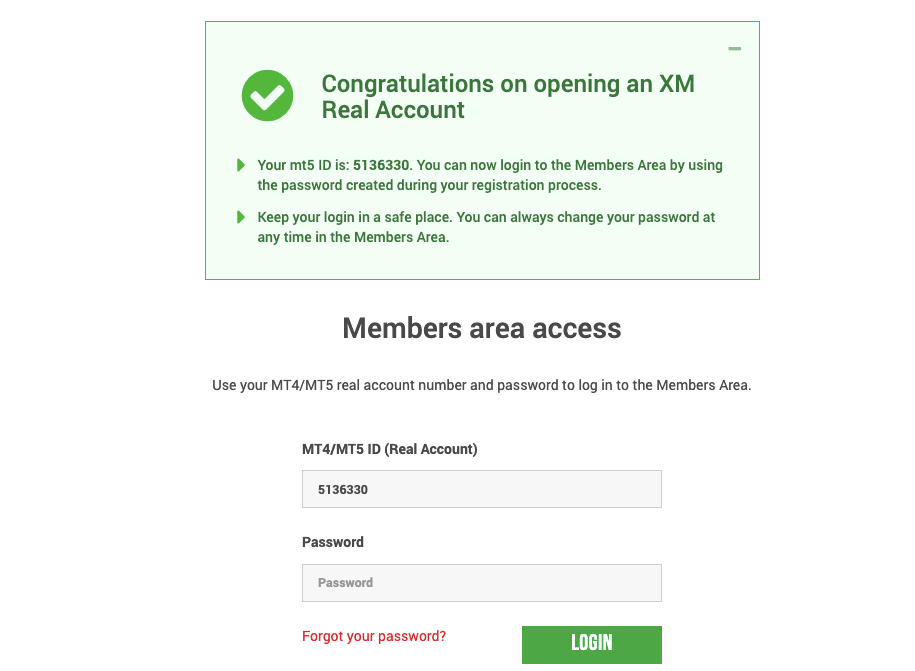

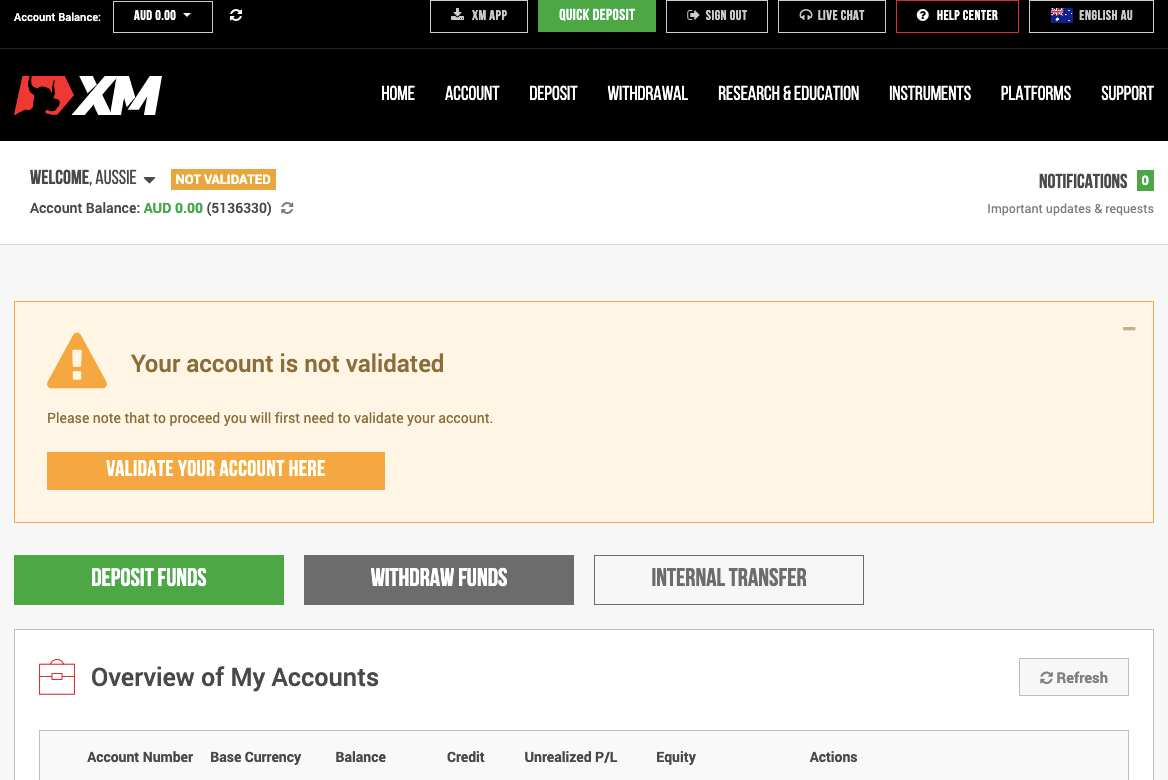

Step 6) Got to your email inbox and click the verification link sent, then log into the XM dashboard (Member Area)

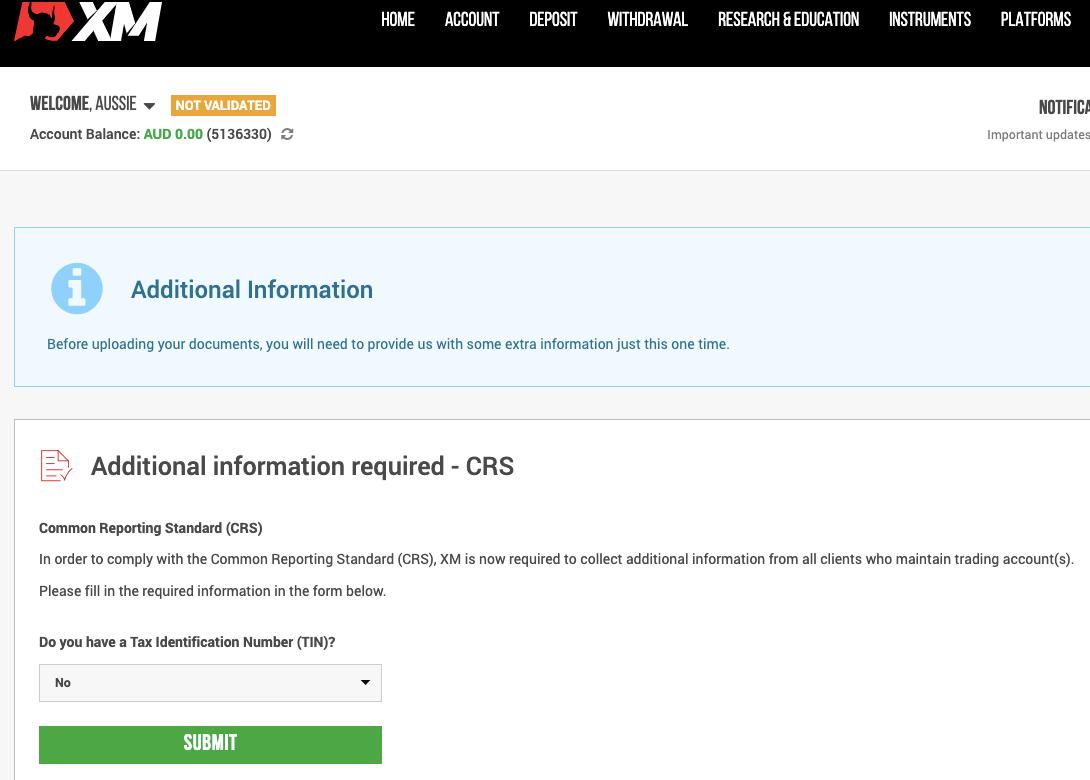

Step 7) On the dashboard, click on VALIDATE YOUR ACCOUNT HERE, then provide your Tax Identification Number (TIN) and click Submit.

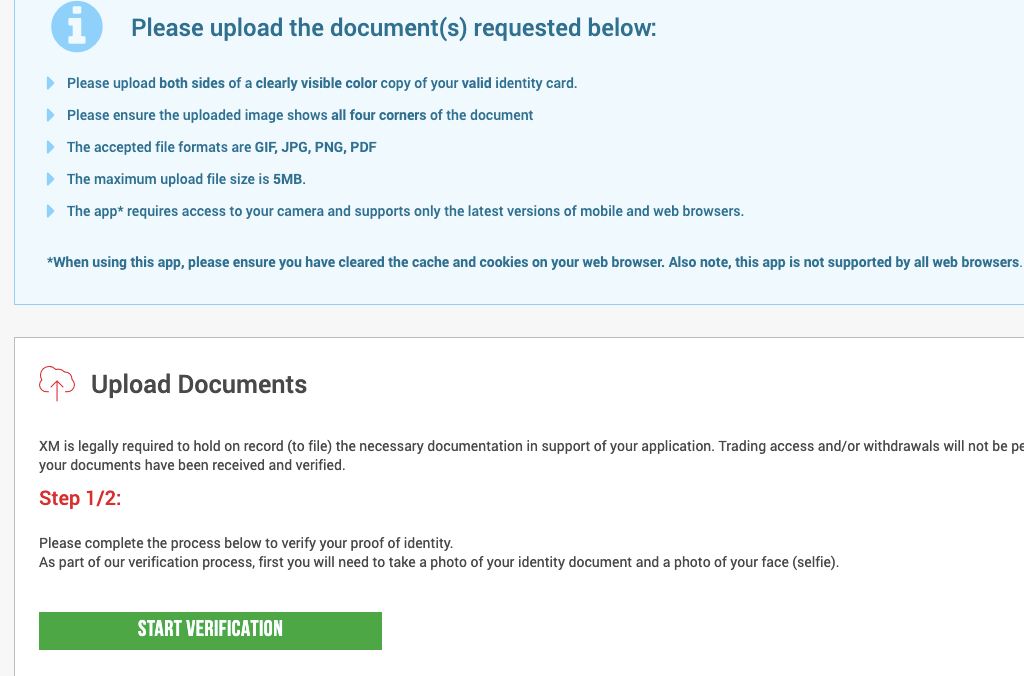

Click on START VERIFICATION to upload a government-issued ID card or utility bill to verify your identity and address.

Note that until your account is verified, you cannot place trades or initiate withdrawals.

XM Deposits & Withdrawals

Payment methods accepted for deposits and withdrawals on XM include cards, e-wallets (Skrill, Neteller), and bank wire transfers.

Learn about the minimum amount and the time it takes to process deposits and withdrawals from XM below:

XM Deposit Methods

Here is a summary of payment methods accepted by XM for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Transfer | Yes | Free (AUD 23 for transactions below 200 USD) | 2-5 business days |

| Cards | Yes | Free | Instant |

| E-wallet | Yes | Free | Instant |

XM Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on XM Trading.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Wire Transfer | Yes | Free (AUD 23 for transactions below 200 USD) | 2-5 business days |

| Cards | Yes | Free | 2-5 business days |

| E-wallets | Yes | Free | 24 hours |

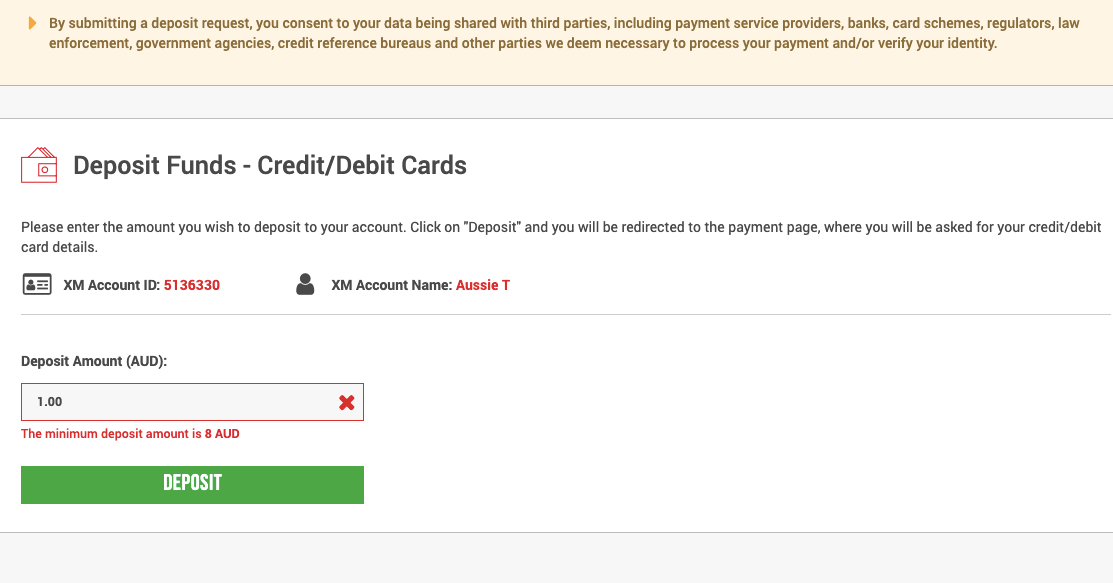

What is the minimum deposit for XM?

The minimum deposit on XM is AUD 8 (USD 5) for all payment methods which applies to all account types.

How do I put money in my XM account?

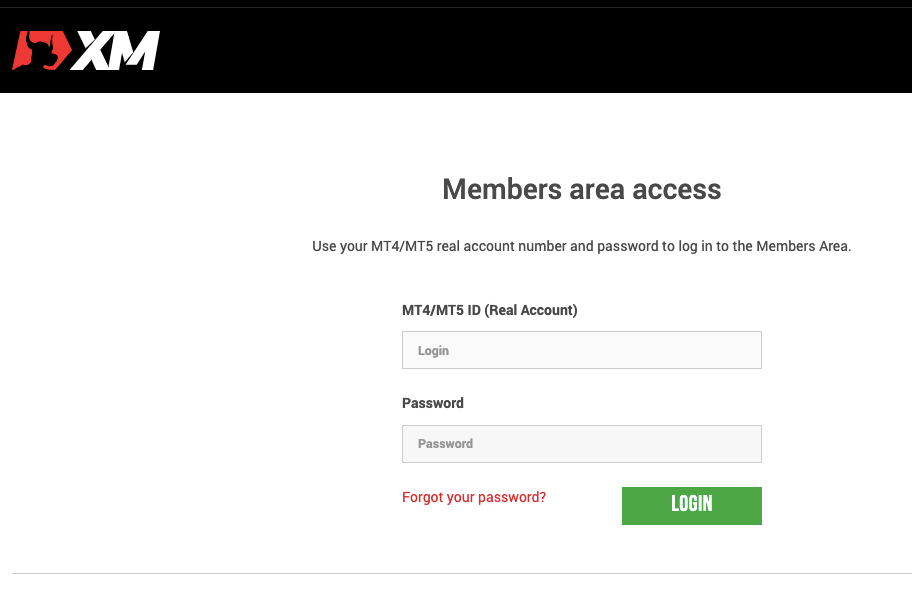

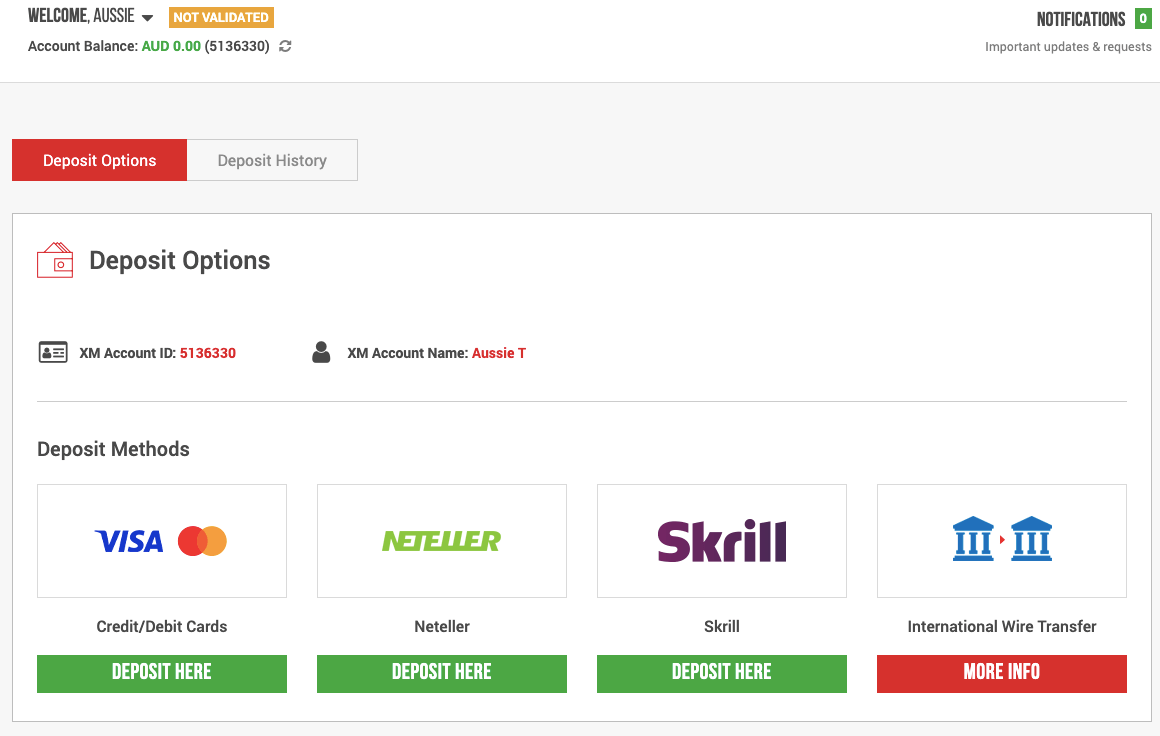

Step 1) Log in to your XM Memeber Area through the XM website or by visiting my.xm.com/au/member/.

Step 2) Click on the DEPOSIT FUNDS tab on the dashboard and select the payment method you would like to use.

Step 3) Enter the amount you want to deposit, click DEPOSIT, and follow the on-screen instructions to complete the deposit.

What is the XM minimum withdrawal?

The minimum withdrawal on XM Australia is AUD 5 and all withdrawals are processed within 24 hours.

How can I withdraw from XM?

You can follow these steps to withdraw your money from XM.

Step 1) Log in to your XM Member Area (dashboard).

Step 2) Click on the WITHDRAW FUNDS tab.

Step 3) Select a withdrawal method and the trading account you wish to withdraw from, enter the amount you want to withdraw and follow the on-screen instructions to complete your funds’ withdrawal on XM.

XM Trading Instruments

Below are financial instruments that can be traded on XM

| Instrument | Availability | Number |

|---|---|---|

| Forex CFDs | Yes | 55 currency pairs on XM |

| Commodities CFDs | Yes | 8 Agriculture commodities on XM (Cottons, Coffee, and others) |

| Indices CFDs | Yes | 31 Equity Cash and Futures indices on XM (AUS200, UK100, EU50, and others) |

| Metals CFDs | Yes | 5 Precious Metals on XM (Spot and Futures on Gold, Silver, Palladium and Platinum) |

| Energies CFDs | Yes | 8 Cash and Futures Energies on XM (Oil, NatGas and others) |

| Stocks CFDs | Yes | 1,300 stocks on XM (US, Europe shares and others) |

XM Trading Platforms

Trading platforms supported by XM are:

1) XM WebTrader: XM offers a web trader that can be accessed online on any device. The web trader is owned by the XM Group.

2) XM App: The proprietary XM Trading mobile app (XM App) is also available for traders on Google Play Store and Apple App Store for mobile devices.

3) MetaTrader 4 and MetaTrader 5: The MT4 & MT5 trading applications are supported by XM and integrated for trading financial markets offered by XM. You can access the platforms via the web, desktop, and mobile devices (Android & iOS).

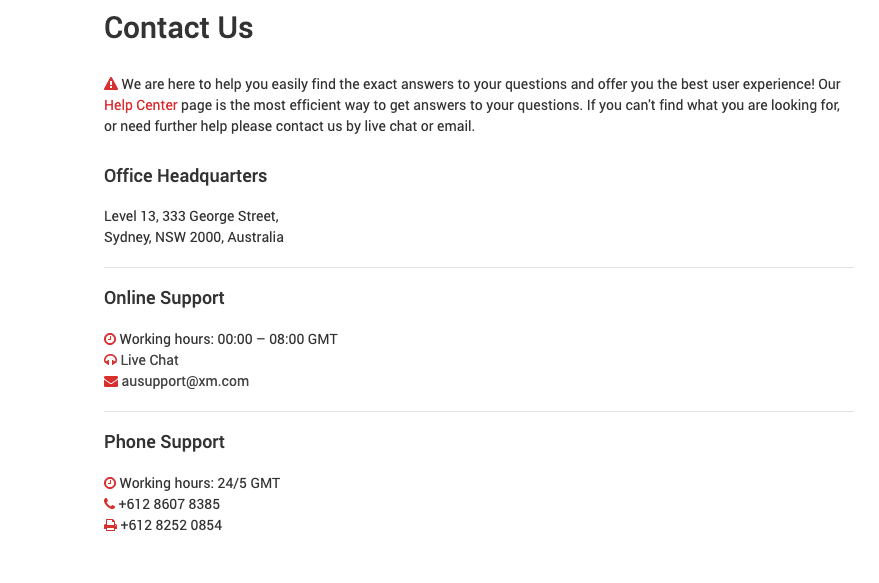

XM Australia Customer Service

XM offers online customer support to clients via the following channels.

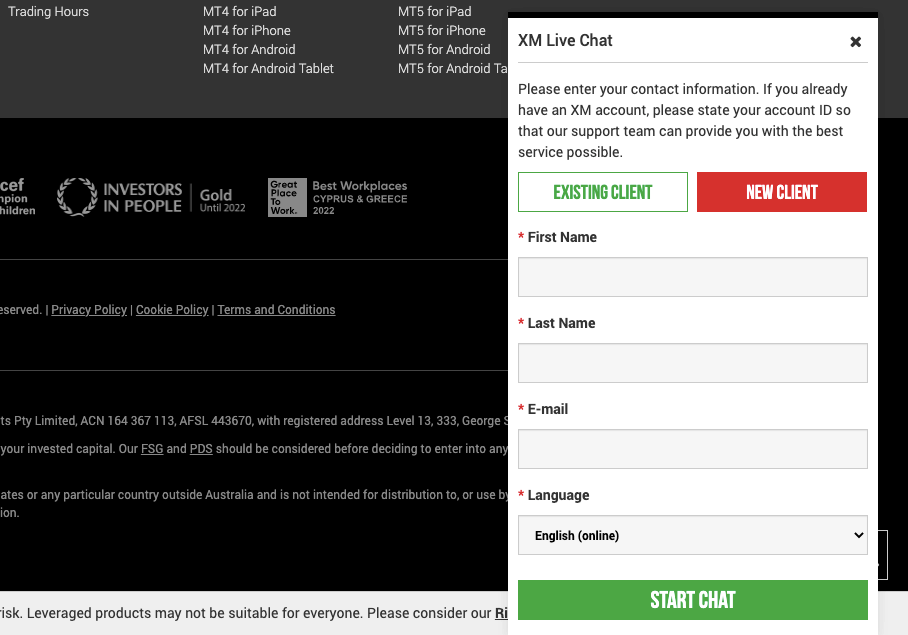

1) Live chat support: The XM live chat is available during working hours from Monday to Friday for client enquiries and can be accessed on their website.

When our team tested, there was no wait time before an agent joined the chat and the answers provided were relevant. You will need to provide your email and name to start the chat.

2) Email support: XM offers email support for clients, you can find the email on the contact page of their website. The XM email address for enquiries is [email protected].

When our team tested their email support, we got a response after about 8 hours and the answer to our questions was correct. Email support is available during working hours (00:00 – 08:00 GMT) during business days.

3) Phone support: XM offers phone support for clients in Australia that is also available during working hours, Monday to Friday. The XM phone number is +612 8607 8385 or +612 8252 0854.

Do we Recommend XM Australia?

XM is licenced by ASIC which is a Tier-1 financial regulator as well as CySEC and DFSA which are Tier-2 financial regulators, these regulations mean they are mandated by the laws of Australia to protect your funds and you can seek redress legally in the event of default.

XM Markets have moderate fees, as they offer commission-free trading on all accounts with competitive spreads, and offer free deposits/withdrawals. They also process deposits and withdrawals relatively faster than some brokers. They charge dormant account fees of USD 5 (AUD 8) after only 90 days of inactivity.

The customer support of XM is fair, as their live chat is responsive during working hours and the email and phone are also active, although the email support is slow.

Although the website of XM is easy to navigate and has details about the account types, fees, trading conditions, and other information that clients might need, note that they do not offer professional accounts, so you will have to look for another broker if you want to trade with higher leverage than 1:30.

We recommend that you check out XM website to confirm their offering and chat with their support to answer any questions you have to help you make up you .

XM Australia FAQs

How much does XM charge for withdrawal?

XM does not charge any fees on deposits or withdrawals on all payment methods including local bank transfers. XM charges AUD 23 per withdrawal or deposit processed via international bank wire transfer.

Is XM forex regulated?

XM is regulated under different names by various Tier-1 and Tier-2 financial regulators. XM is available in Australia and regulated by Australian Securities & Investments Commission (ASIC), Cyprus Securities and Exchange Commission (CySEC), and Dubai Financial Services Authority (DFSA).

How long do XM withdrawals take?

All withdrawals are processed within 24 hours and it takes about 2-5 days to receive funds for card and local bank withdrawals, while e-wallets withdrawals can receive funds the same day.

Is XM good for beginners?

XM is considered good for beginners because they have a demo account option that beginners can use to get familiar with the platform trading with virtual money before putting their real money. They also have educational materials for beginners.

XM does not charge commission fees, has negative balance protection, offers Ultra Low accounts with lower spreads, and the maximum leverage is 1:30, with a minimum deposit of 5 USD or 8 AUD. These features are simple for beginners and do not expose them to very high risks.

Does XM accept Bitcoin?

XM currently does not offer trading of cryptocurrencies to clients in Australia, so XM Australia does not accept Bitcoin.

Note: Your capital is at risk