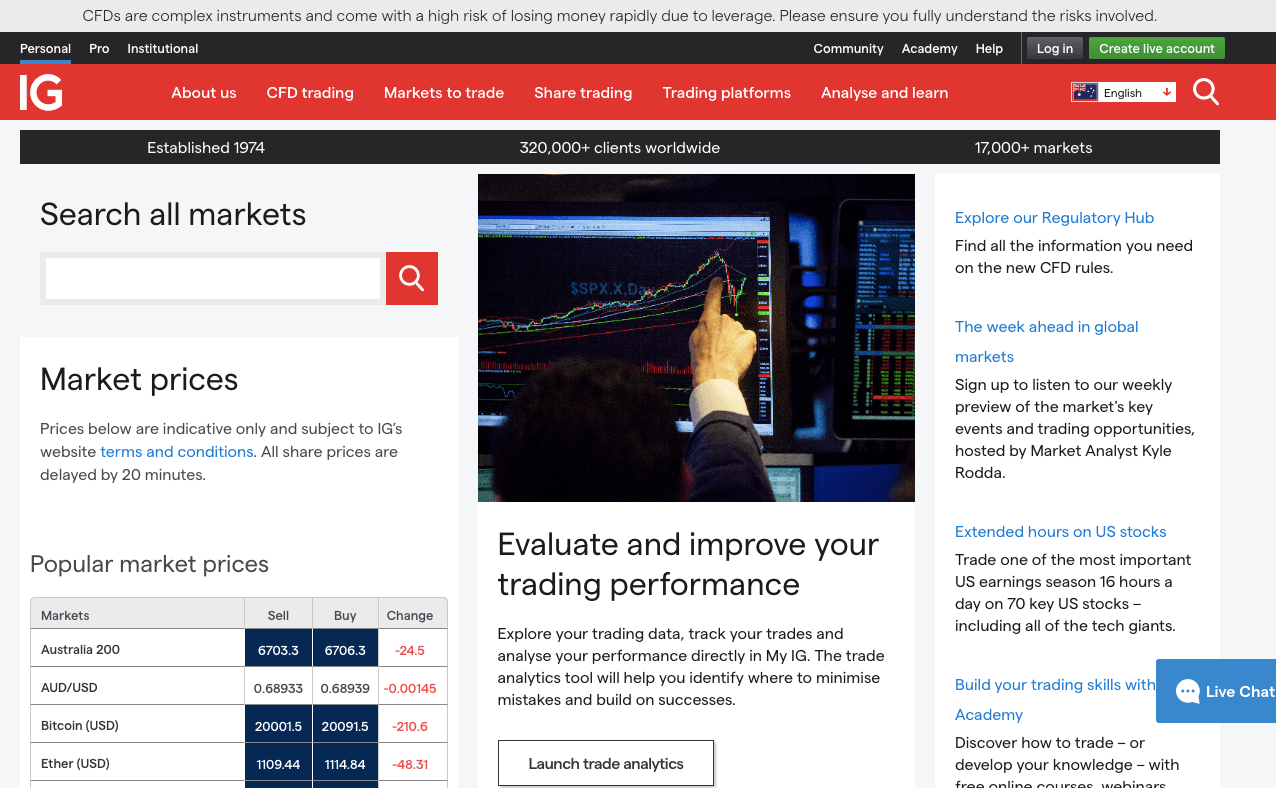

IG Markets is an online provider of services for shares trading and CFDs (Contract for Differences) trading. IG offers expert traders as well as beginners an accessible platform on which you can trade in financial markets such as forex, indices, commodities, ETFs, bonds, cryptocurrencies, and shares.

IG Markets was founded in 1974 in London and is authorized in Australia, the United Kingdom, Europe, Asia, America, and Africa.

In our review of IG Markets, we examine the broker’s trading conditions, fees, account types and features, account opening process, trading platforms, tradable instruments deposit/withdrawal, and customer support.

| IG Markets Review Summary | |

|---|---|

| Broker Name | IG Markets Limited |

| Establishment Date | 1974 |

| Website | www.ig.com |

| Address | IG Australia Pty Ltd., Level 15, 55 Collins Street, Melbourne VIC 3000, Australia |

| Minimum Deposit | $450 |

| Maximum Leverage | 1:30 |

| Regulation | ASIC, FCA, FSCA, MAS, BaFin |

| Trading Platforms | ProRealTime web-trader and MT4 available on PC, Mac, Web, Android, & iOS |

| Visit IG Markets | |

IG Markets Pros

- Regulated by ASIC

- Supports MT4 platform

- Offers commission-free trading

- Free deposits and withdrawals

- Offers a wide range of instruments

- No mandatory minimum deposit for bank transfers

IG Markets Cons

- Customer support is not available 24/7

- Charges inactive account fees

- Charges currency conversion fees

- Does not support MT5 platform

Can I trust IG Markets?

IG Markets is considered safe for traders and scores low on the risk of funds because they are regulated in Australia and other jurisdictions by Top-Tier financial regulators.

Here are the various regulations of the trading IG Markets in different countries:

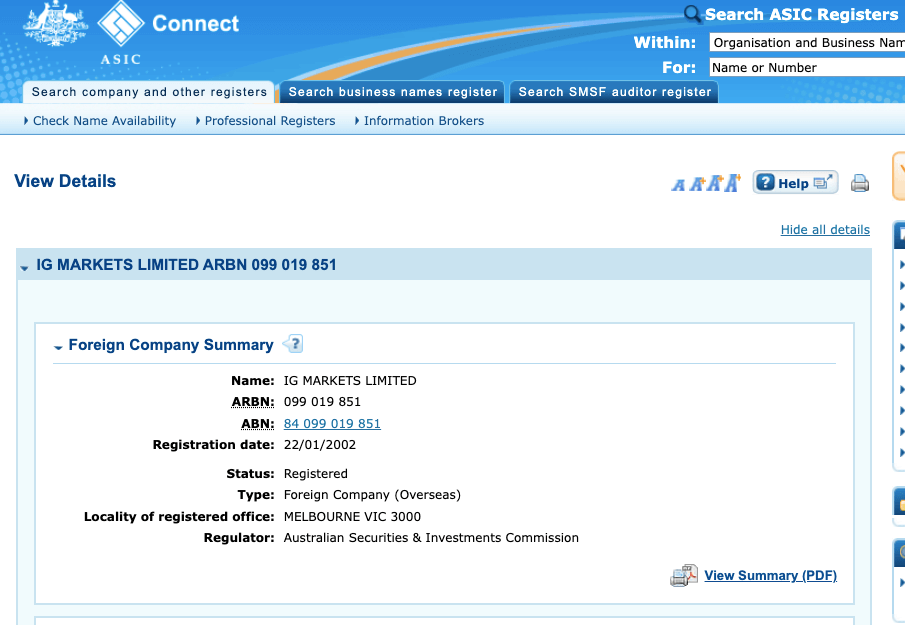

1) Australian Securities & Investments Commission (ASIC): IG Markets Limited is registered in Australia by ASIC and licensed to offer financial services, with ARBN (Australian Registered Body Number) 099019851, issued in 2002.

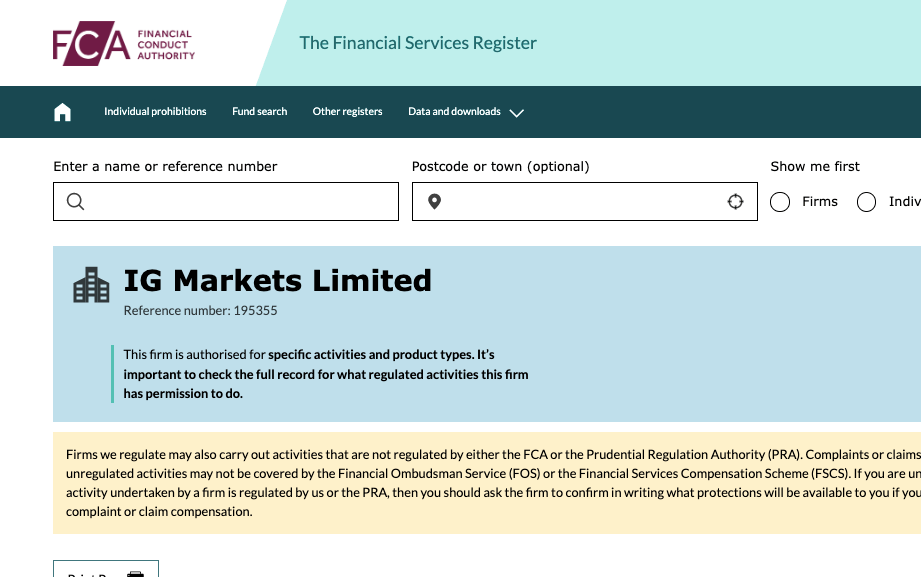

2) Financial Conduct Authority (FCA): IG Markets Limited is regulated by the FCA and authorized to offer financial services in the UK, with reference number 195355, issued in 2001.

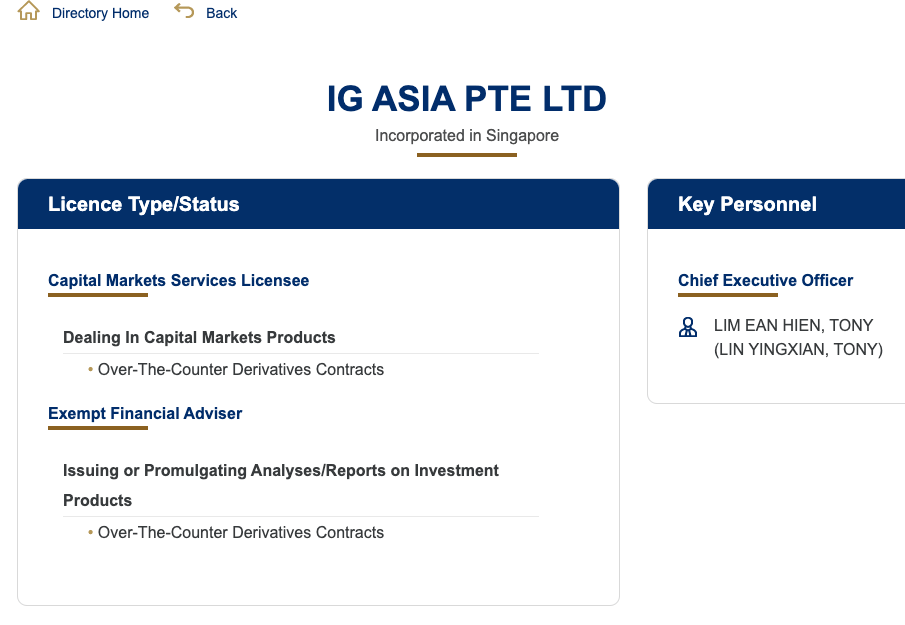

3) Monetary Authority of Singapore (MAS): IG Asia Pte Ltd is registered in Singapore as a financial institution and authorized to deal in capital markets products.

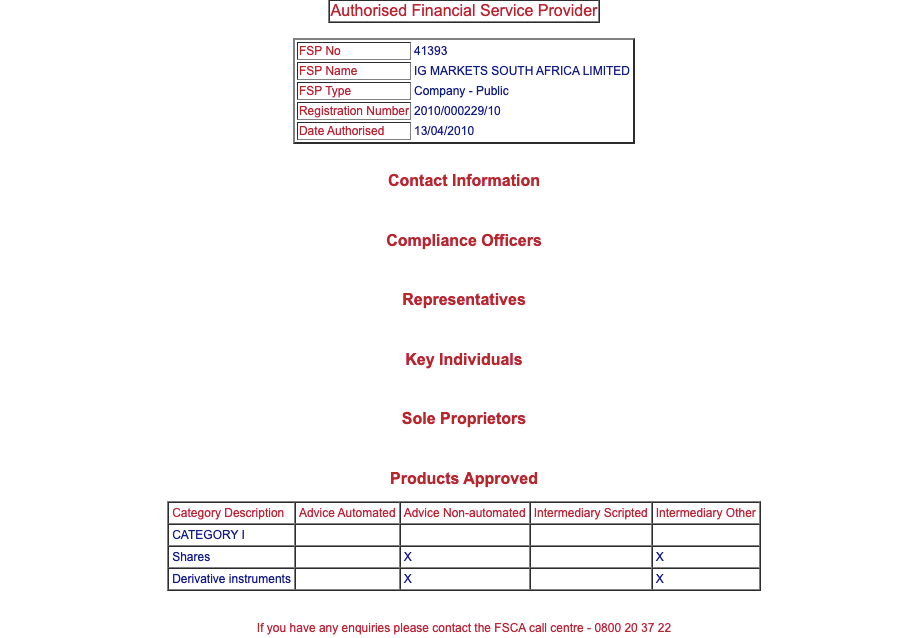

4) Financial Sector Conduct Authority (FSCA), South Africa: IG Markets South Africa Limited is authorized by the FSCA to provide financial services in South Africa, with FSP (Financial Services Provider) Number 41393, issued in 2010.

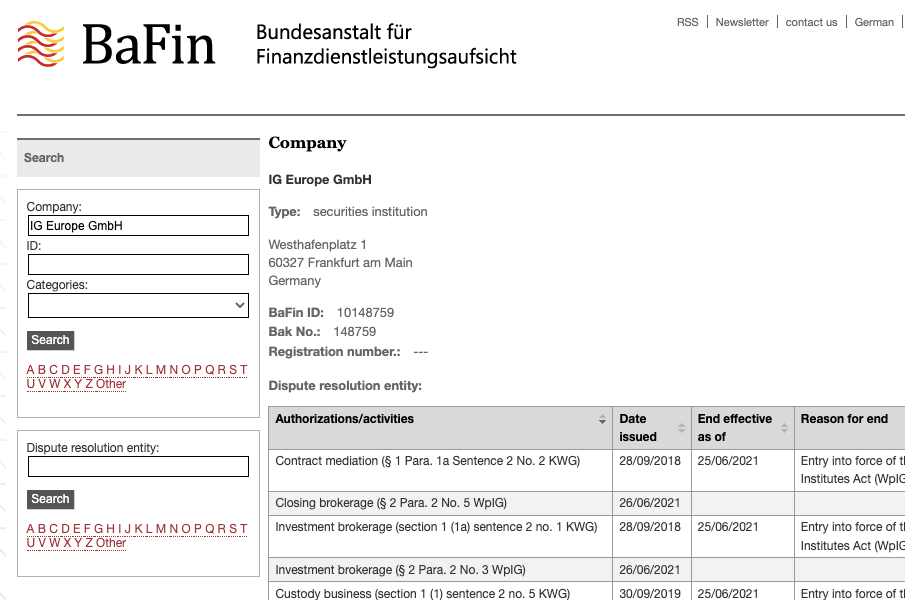

5) Federal Financial Supervisory Authority, Germany: IG Markets is authorized in Germany as ‘IG Europe GmbH’, with an office in Frankfurt. IG Markets serve European clients through this license in the EEA.

IG Markets Investor Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| Australia | $20,000 | Australian Securities & Investments Commission (ASIC) | IG Markets Limited |

| UK | £85,000 | Financial Conduct Authority (FCA) | IG Markets Limited |

| Singapore | No fixed compensation | Monetary Authority of Singapore (MAS) | IG Asia Pte Ltd |

| South Africa | No Protection | Financial Service Conduct Authority (FSCA) | IG Markets South Africa Limited |

IG Markets Leverage

The maximum leverage on IG Markets is 1:30 for retail traders. This means that you can place a trade worth 30 times the size of your deposit.

For example, if you deposit $1,000, you can open a trade position worth $30,000. Although this maximum leverage applies to forex and other instruments have lower leverages.

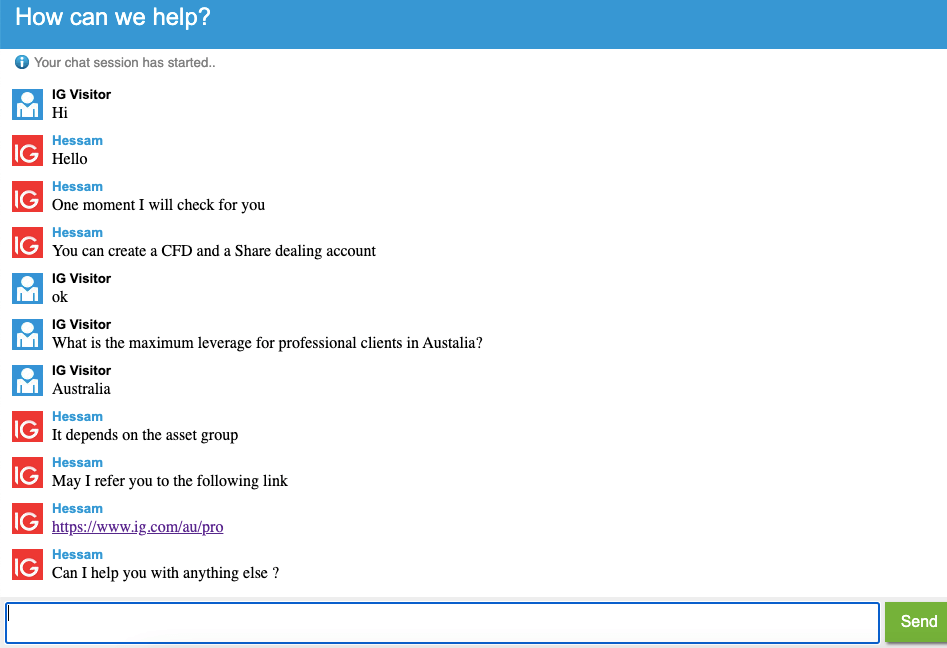

IG Markets’ maximum leverage for professional clients is 1:250.

It is best to avoid trading leveraged products as you can lose your capital in the process. Only engage in trading if you understand how they work and have experience. It is recommended that you do not use all the leverage available as it increases the risk of losing your capital.

IG Markets Account Types

IG Markets offers 2 account types for both retail and professional traders, they are Shares Trading Account and CFD Trading Account. Your account type determines the instruments you can trade, fees, and leverage you can access. You can open a personal account as an individual, a joint account with a partner or an institutional account as a corporate entity.

IG Markets Does not offer Islamic Accounts, although you can create a demo account to practice with virtual money before putting your real money.

Here is an overview of the account types on IG Markets:

1) CFD Trading Account: The IG Markets CFD Trading Account is designed for retail clients and can be accessed on the MT4 trading platform. You can trade CFDs on forex, indices, shares, cryptocurrencies and commodities with this account.

Spread fees on this account start from 0.6 pips for major pairs like EURUSD and you do not pay any commission fees on your trades except when trading shares. You also pay swap fees for keeping a position open past the closing time of the market.

This account requires a minimum deposit of $450. Account inactivity fees apply after 24 months, but you will have negative balance protection, so you won’t lose more money than you deposit if your trade position is unsuccessful.

The leverage on this account is 1:30 for major forex pairs, 1:20 for major indices, minor forex pairs and gold, 1:10 for other commodities and minor indices, 1:5 for shares, and 1:2 for cryptocurrencies.

2) Shares Trading Account: The IG Trading Account is designed for clients who want to engage in trading shares and can be accessed on the MT4 trading platform. This is not a leveraged trading account.

No spread fees or swap fees are charged on this account, you pay only commission fees on your Australian shares trades of up to $5 per trade for active traders and $0 for US shares.

Less active traders who trade less than $8,000 average trade size per quarter pay commission fees of up to $8 for Australian shares. Less active traders also pay a quarterly subscription fee of $50.

This account requires a minimum deposit of $250. No inactive account fees are charged and your account cannot run into a negative balance.

3) IG Professional Account: This account is designed for experienced CFD traders who trade large sizes of financial markets. You can access the account on the MT4 trading application and trade CFDs on forex, indices, cryptocurrencies, and commodities.

Spread fees on this account also start from 0.6 pips for major pairs like EURUSD and you only pay commission fees when trading shares. You also pay swap fees for keeping a position open past the closing time of the market.

This account requires a minimum deposit of $450 and account inactivity fees apply after 24 months. The IG Professional Account does not have negative balance protection. If your trade is unsuccessful, you can lose more than your deposit and will need to deposit more funds to clear the negative balance.

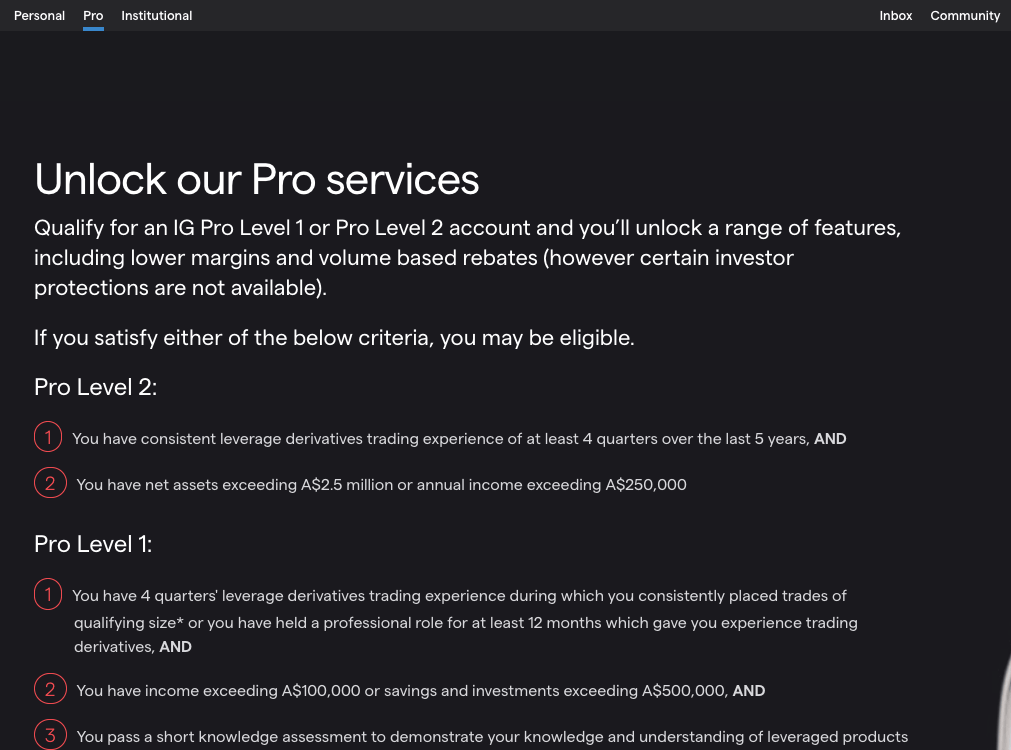

There are 2 levels of Professional Accounts on IG Markets; Pro Level 1 and Pro Level 2. Both levels have access to collateral, which enables you to use the value of your holdings to cover margins instead of cash. Although Pro Level 1 traders have negative balance protection, if you use the collateral option, you forfeit negative balance protection.

The Professional Account offers more leverage of up to 1:250 for Pro Level 2 and 1:100 for Pro Level 1. To get the Professional Account you can apply to customer support to upgrade your account if you meet certain conditions with proof and pass an online assessment on your knowledge of leveraged products.

To get Pro Level 1, you need to meet the following conditions:

- Have traded leveraged products of qualifying size of more than AU$100,000 opening notional size each quarter, over the last 4 quarters consecutively

- Have annual income of more than AU$100,000 or investments of more than AU$500,000

- Have worked in a professional role for at least one year that gave you experience in trading derivatives

To get Pro Level 2, you need to meet the following conditions:

- Have traded leveraged products of qualifying size of more than AU$100,000 opening notional size each quarter, over the last 5 years consecutively

- Have annual income of more than AU$250,000 or net assets of more than AU$2.5 million

Upon application, you will be required to submit verification documents like bank statements and trading account statements before your application can be approved.

IG Markets Base Account Currency

When you create an on IG Markets, by default you are assigned the Australian Dollar – AUD as your account base currency. You can decide to change this and choose from 5 other base account currencies on IG Markets which are British Pound sterling – GBP, Euros – EUR, United States Dollar – USD, Singapore Dollar – SGD, and Hong Kong Dollar – HKD.

Your trades, fees, and deposits/withdrawals are measured in the base currency of your account.

IG Markets Fees

Fees on IG Markets depend on the instruments you are trading, the size of the trading, your account type, and how long you keep the trade open. Find an overview of the trading and non-trading fees on IG Markets below:

Trading fees

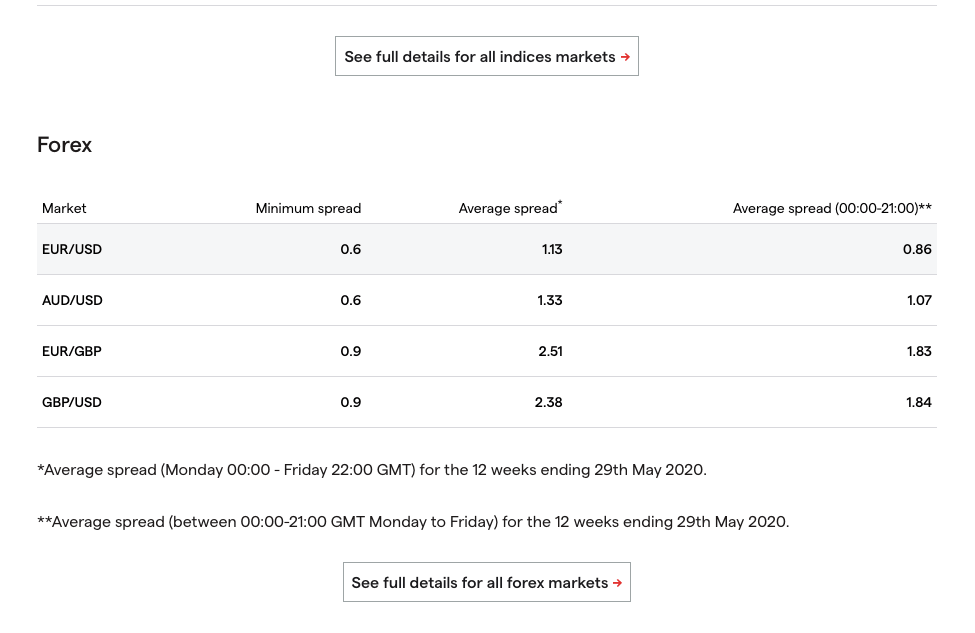

1) Spreads: You pay spread fees on IG Markets whenever you place a trade. The spread is the difference between the bid and asks prices, called pips, and this varies based on the instrument you are trading and market movement. Spread fees apply to all CFD trades except when you trade shares.

You do not pay spread on shares CFDs trade, you pay commission fees instead. Find the average spreads of major instruments with the IG Trading Account below:

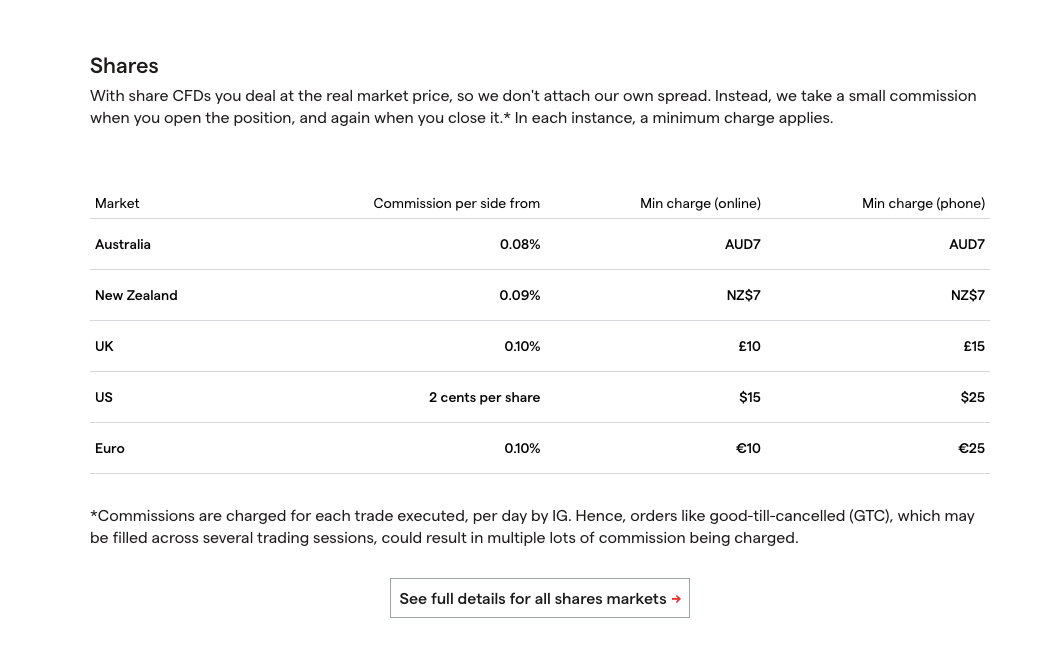

2) Commission fees: IG Markets offers commission-free trading for all instruments except shares. This means that you do not have to pay commissions for opening or closing trade positions on most instruments.

Only shares or shares CFDs trades incur commission fees and no spread are charged on them. The commission fees on shares vary based on the country whose shares you are trading and whether you are using a mobile trading app or web.

For AU shares, the fee starts from 0.0.8% per side or a minimum of AU$7 per round turn for web CFDs shares trading and AU$5 for regular shares trading.

IG Markets Trading fees Table

Here is a summary of the average fees IG Markets charges on some instruments:

| CFD instrument | Spread | Commission |

|---|---|---|

| EUR/USD | 1.13 pips | None |

| GBP/USD | 2.38 pips | None |

| EUR/GBP | 2.51 pips | None |

| XAU/USD (Gold) | 0.3 pips | None |

| Crude oil (Brent) | 2.8 pips | None |

| Wall street | 2.4 pips | None |

| US 500 | 1.5 pips | None |

3) Swap fees: Whenever you keep a trading position open past the closing time of the market, which is 10 PM UK time or 7 AM Australian time, you incur an overnight funding cost also called swap fees or rollover fees. This fee is based on the size of your trade and whether your position is long (buy) or short (sell).

The swap fees are added to your profit or loss when you close the trade. In some cases, if you are holding a long position open, you gain interest instead of a fee.

4) Currency Conversion fees: Whenever you make a CFDs trade in a currency other than the base currency of your account, IG Markets will charge a currency conversion fee.

For example, if your account base currency is AUD and you place a trade on GBP/USD, IG Markets will charge a currency conversion fee of 0.7% of the transaction value.

Non-trading fees

1) Deposit and Withdrawal fees: IG Markets offers free deposits and withdrawals for debit cards and bank transfers, while PayPal incurs a deposit cost of 1%, credit cards incur 1% fees for Visa cards and 0.5% for MasterCards. Withdrawals are free on IG Markets.

2) Account Inactivity charges: If you do not place any trade with your IG Markets Account for 2 years, you will be charged a dormant account fee of AU$18 every month, which will be deducted from any money in your account.

If you do not have any money in your account, you will not be charged, thus the account will not accrue a negative balance.

IG Markets Non-trading fees

| Fee | Amount |

|---|---|

| Inactivity fee | AU$18 per month |

| Deposit fee | 0.5%-1% for credit cards and PayPal |

| Withdrawal fee | Free* |

*Note that your payment processing company may charge some independent transaction fee.

How to Open IG Markets Account in Australia?

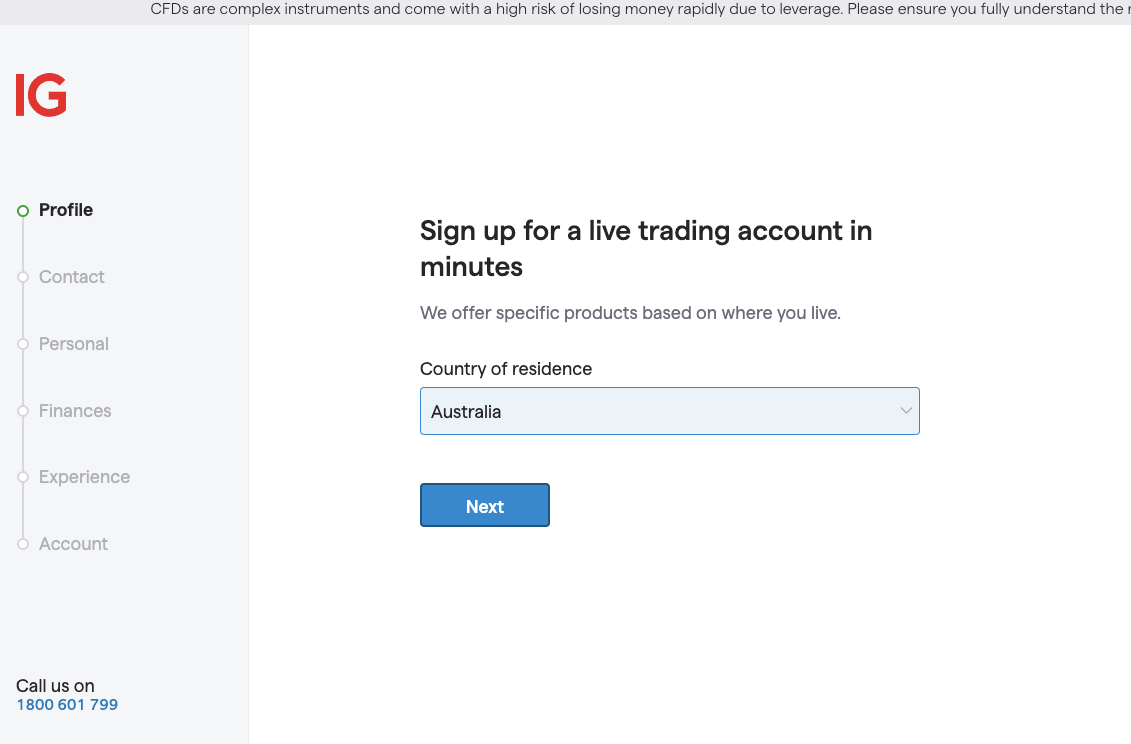

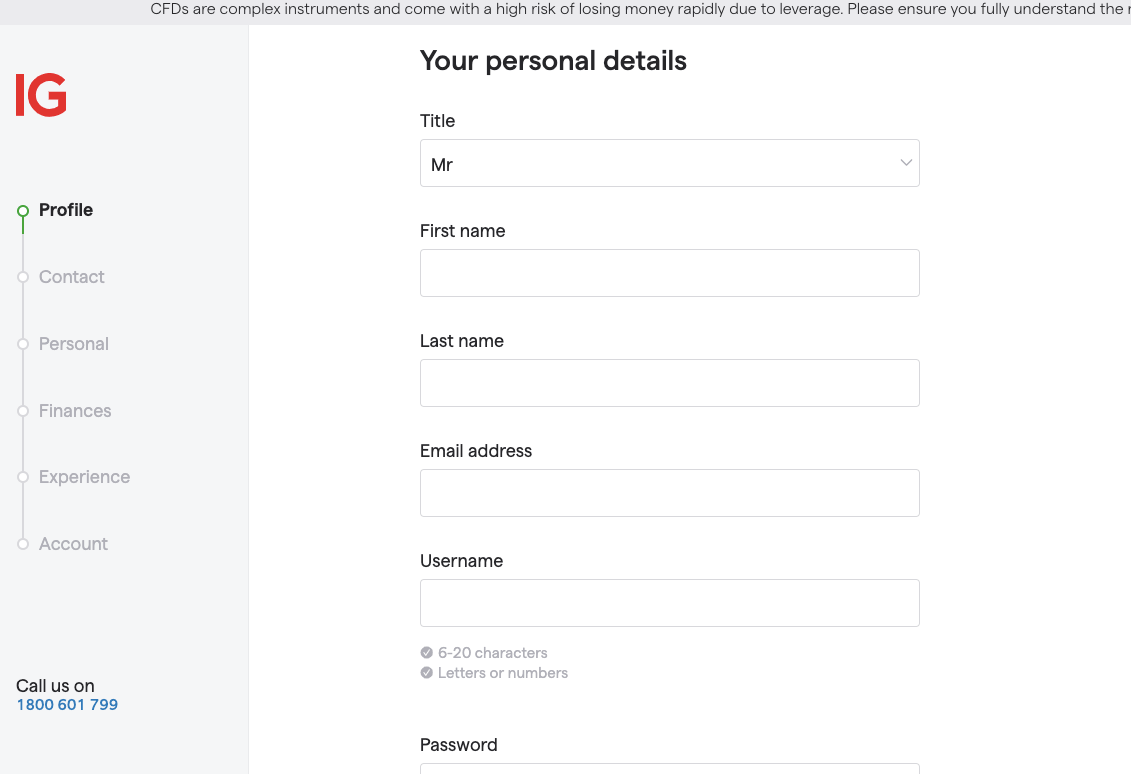

Follow these steps to open a trading account on IG Markets.

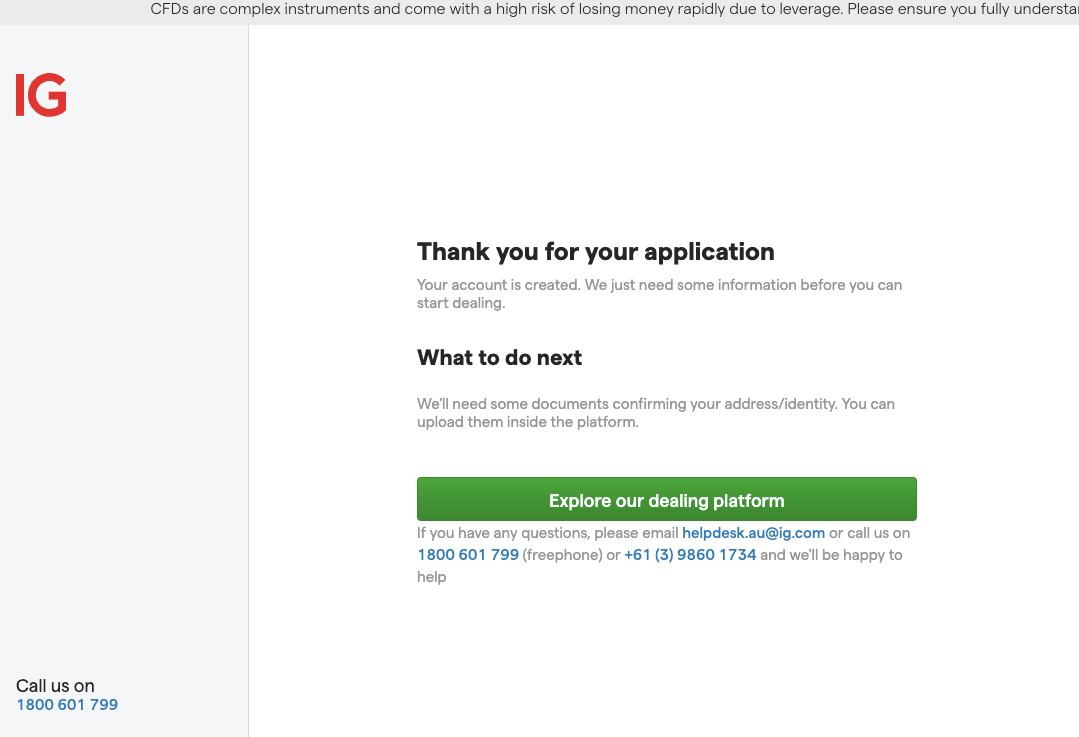

Step 1) Go to the IG Markets website at www.ig.com and click on ‘Create live account’, then click on ‘Create a personal account’ on the page that appears.

Step 2) Select country of residence (Australia will be selected by default). On the form that appears, fill out your name and email, create a username and password then click on ‘Next’.

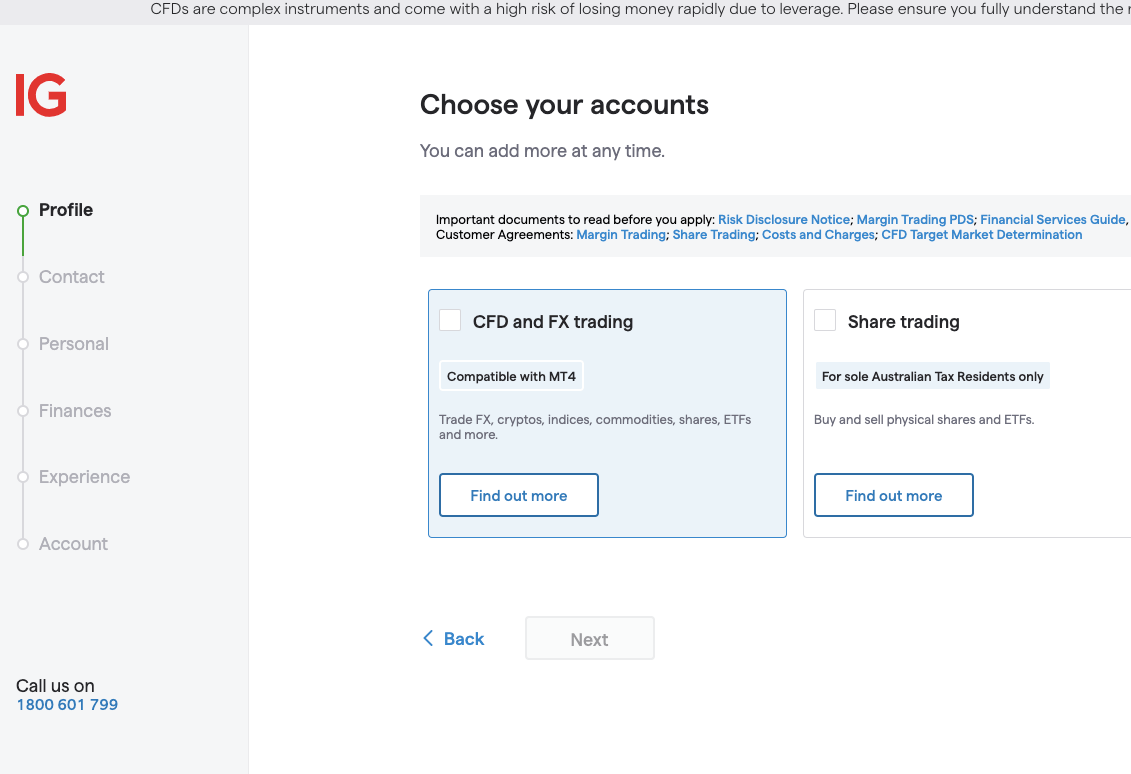

Step 3) Select the type of account you want to start trading with, then click ‘Next’.

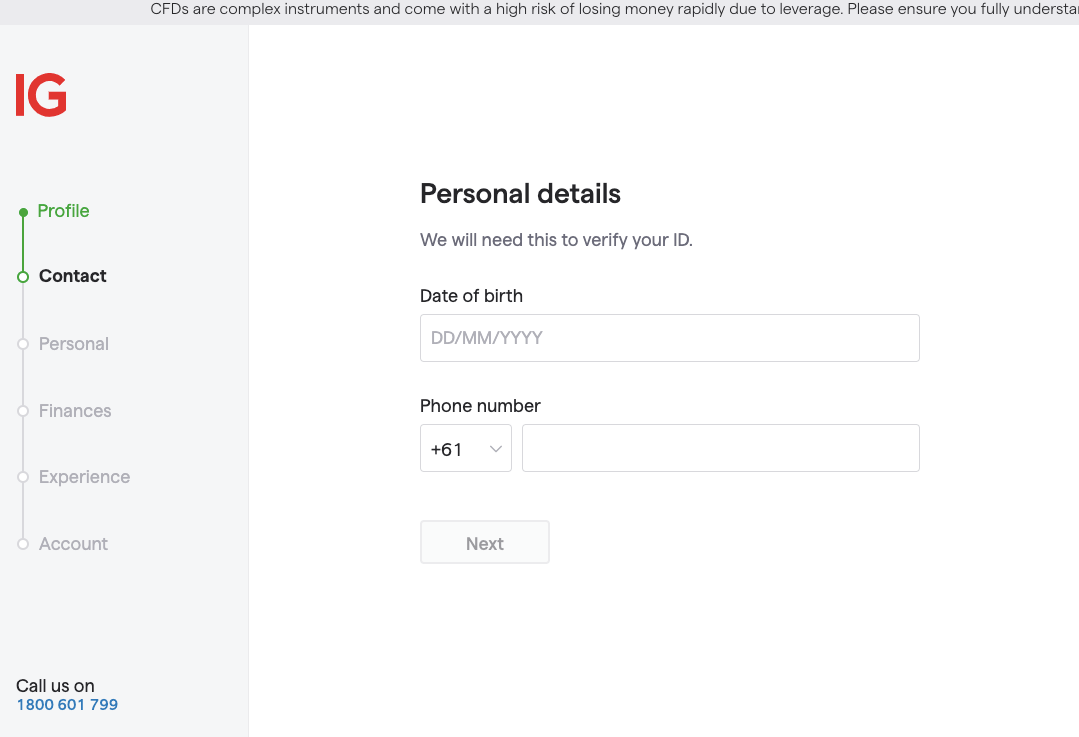

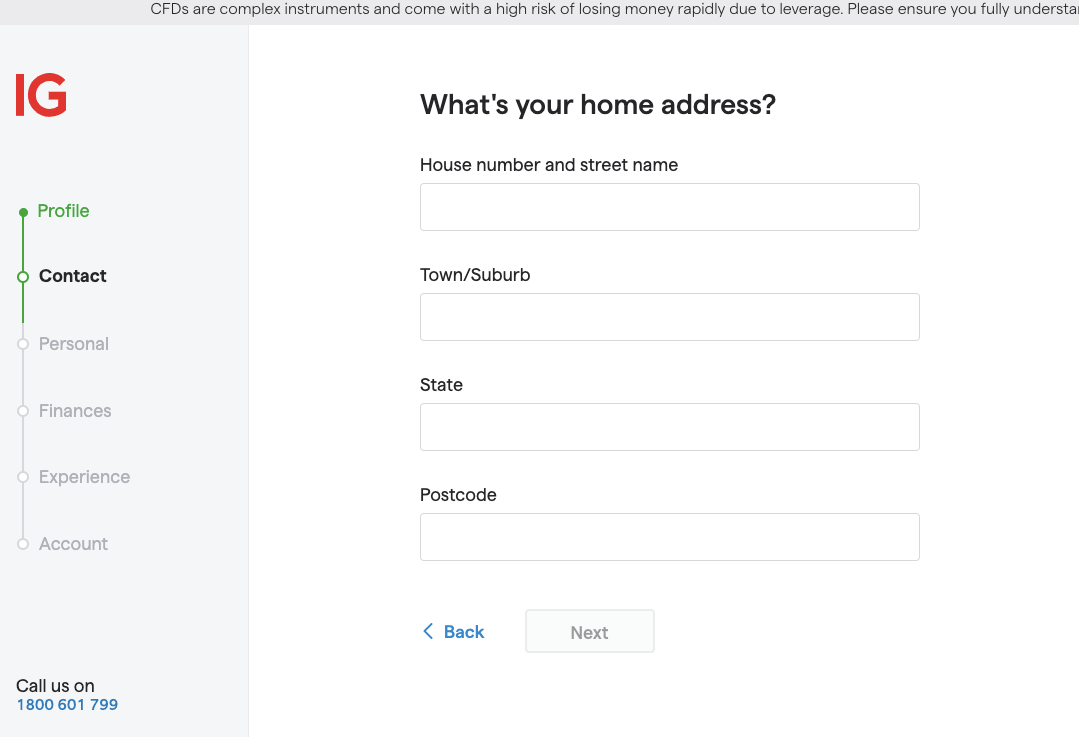

Step 4) Supply your date of birth, phone number, and address, then click ‘Next’.

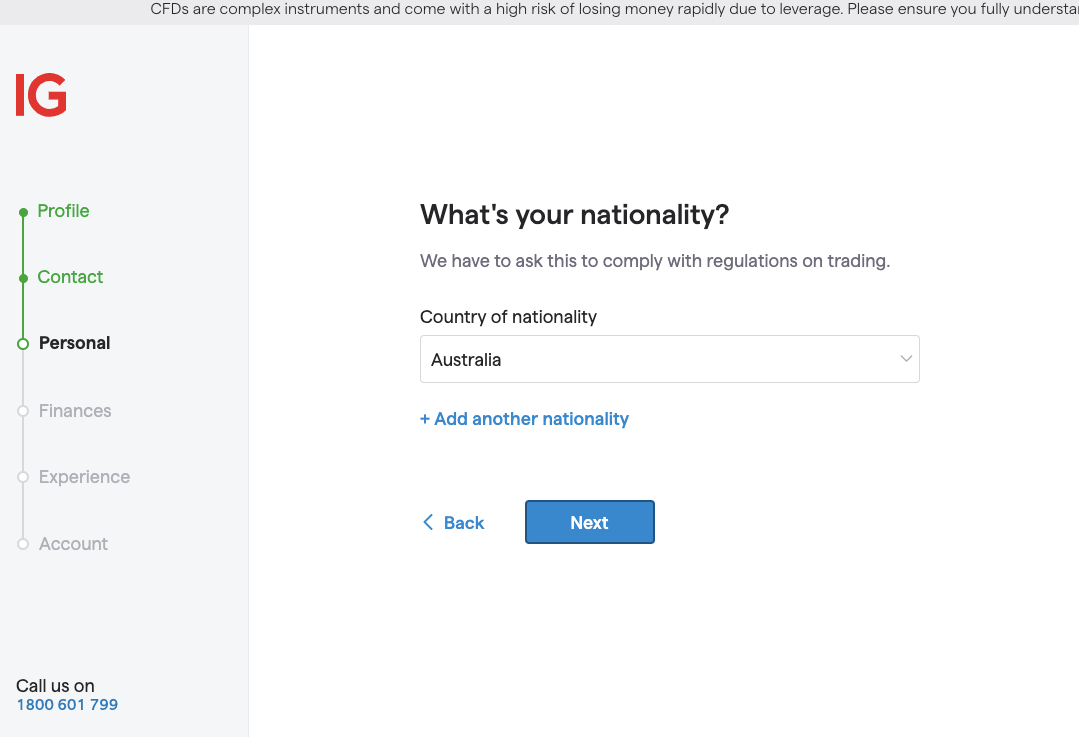

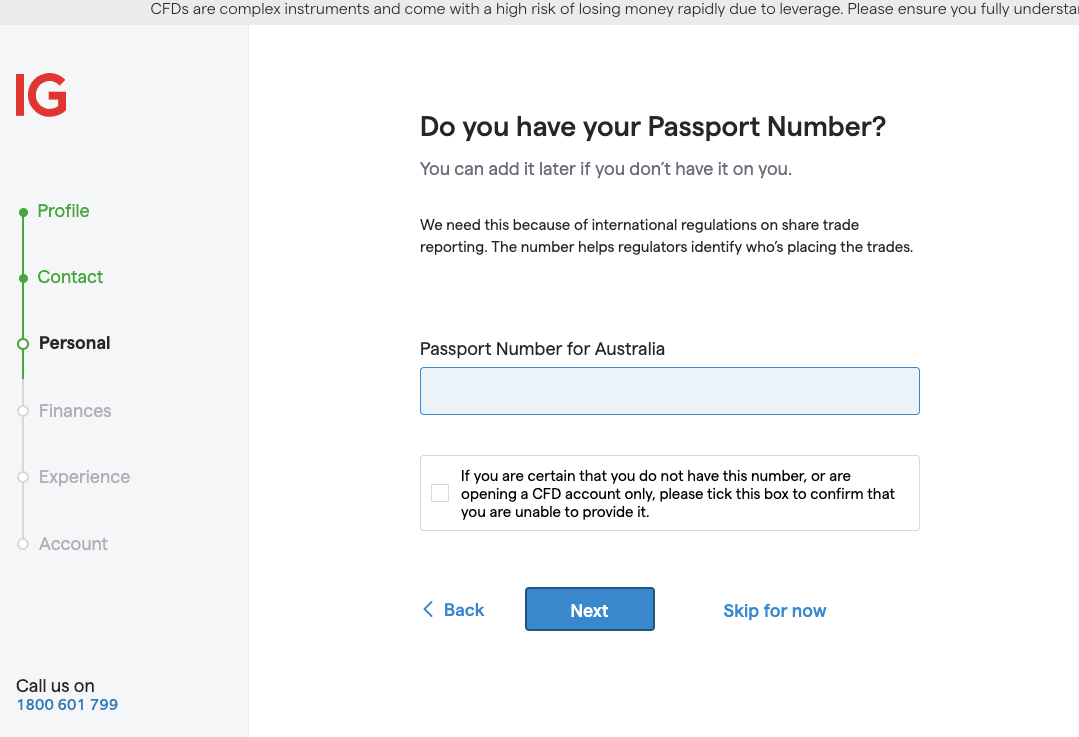

Step 5) Select your nationality and provide your Australian Passport Number ‘Next’.

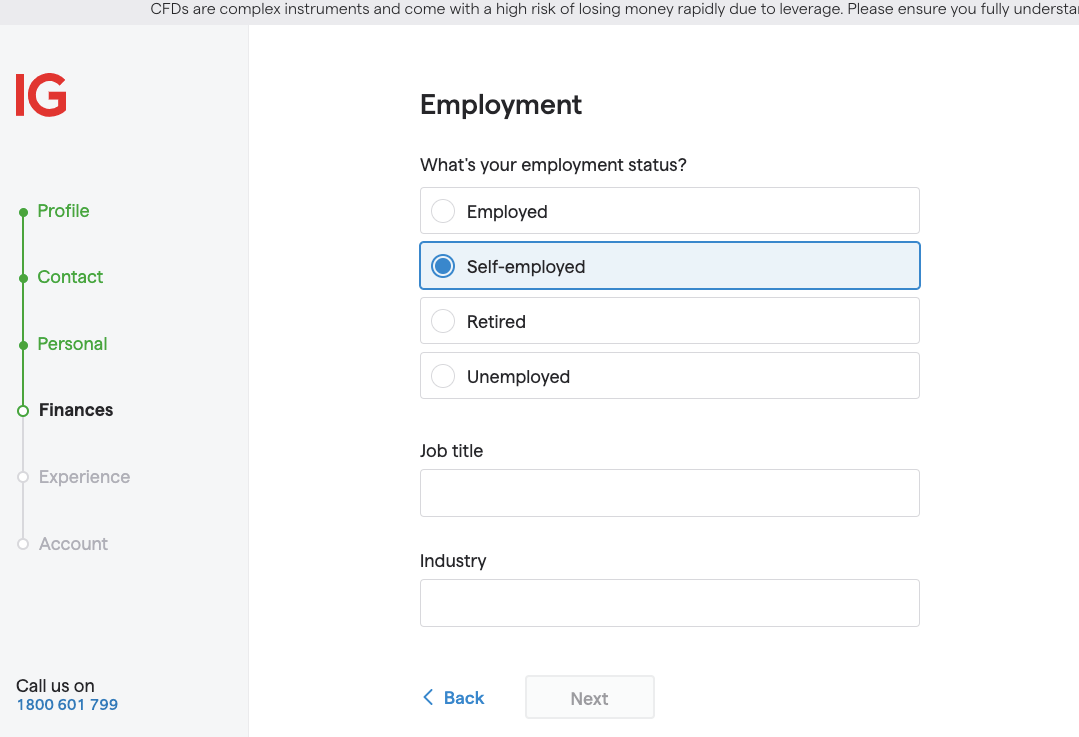

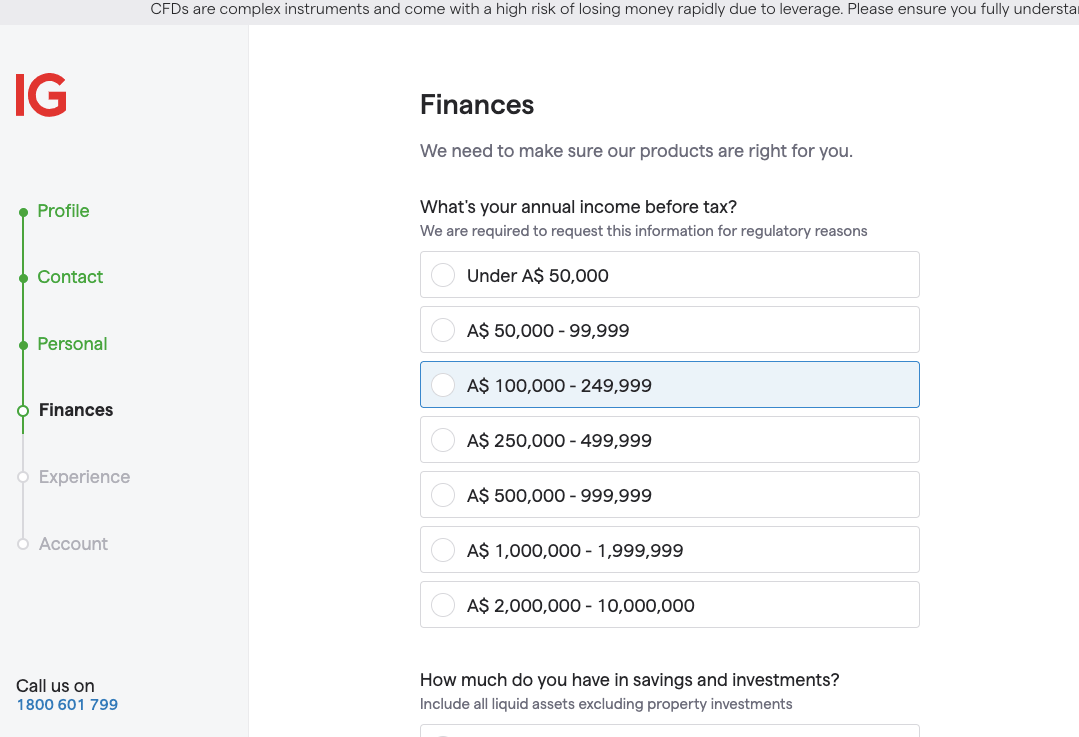

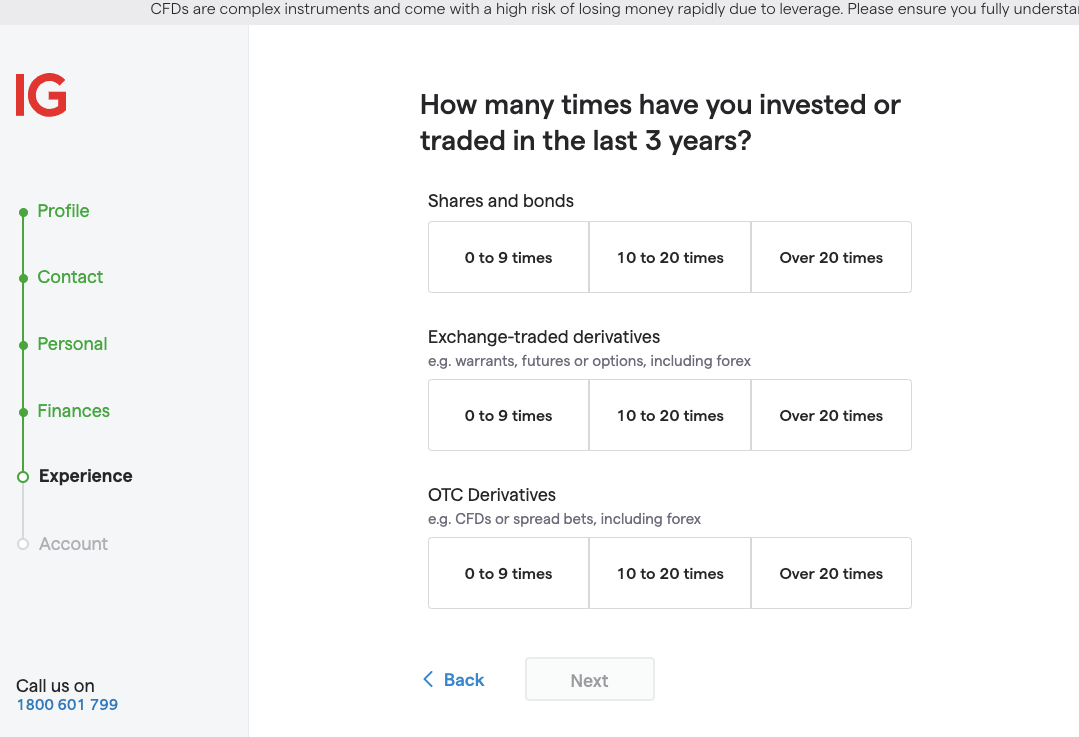

Step 6) Answer questions relating to your employment, financial status and trading experience, then click ‘Next’.

Step 7) Check the box to agree to the terms and conditions and click ‘Next’, choose whether you want to open a Domestic CFDs Account or International CFDs Account, on the page that appears then click the ‘Explore our dealing platform’ button and you will be redirected to the IG Markets dashboard to continue with your registration.

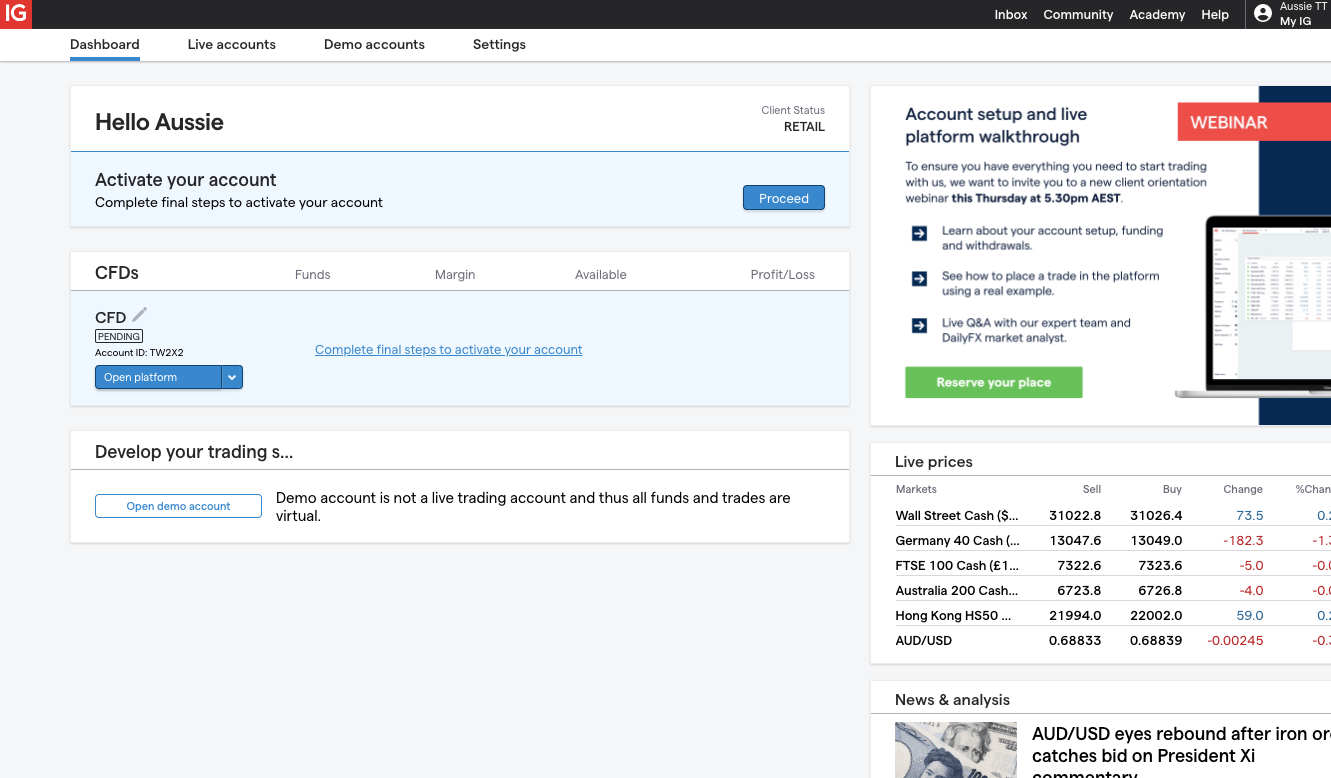

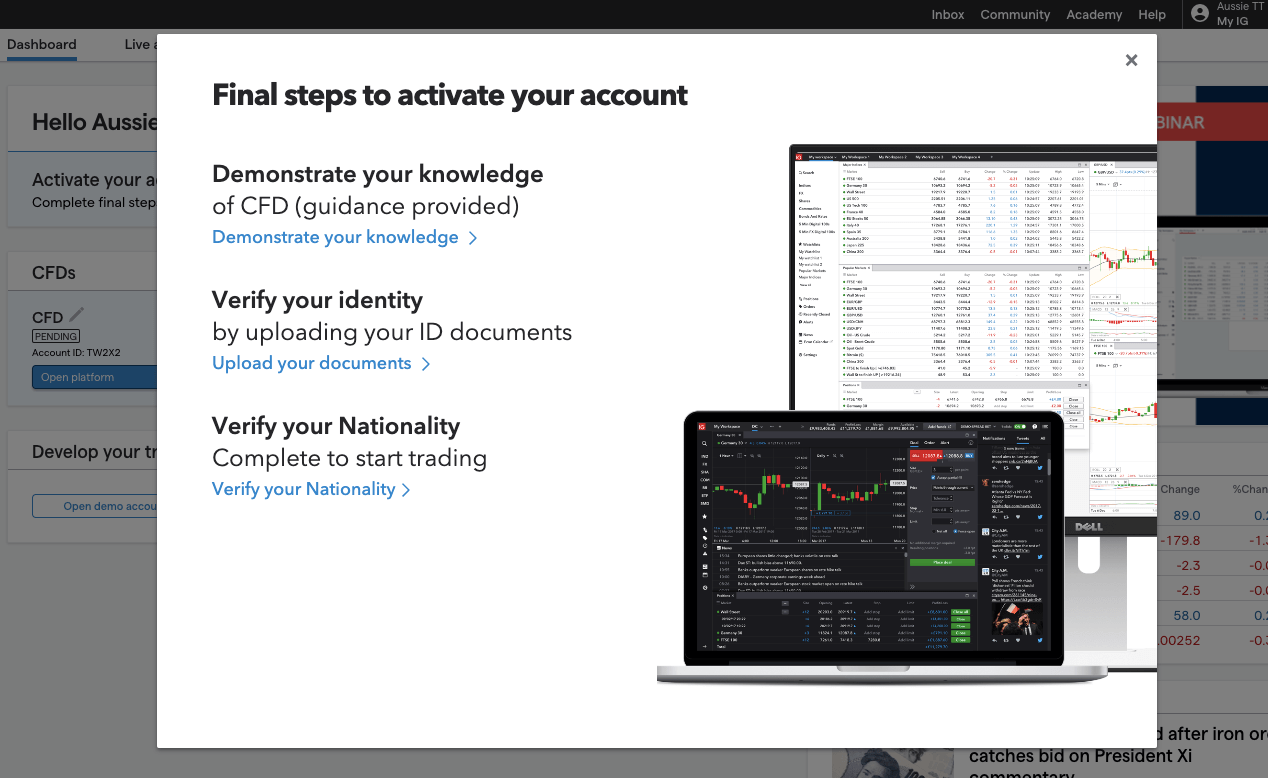

Step 8) On the dashboard, click on ‘Proceed’ to activate your account and upload the required verification documents.

After your account is activated, you can make deposits, place trades and withdraw funds from it.

IG Markets Deposits & Withdrawals

Payment Methods accepted on IG Markets are bank transfers, cards (credit/debit), and PayPal. Find details about deposits and withdrawals on IG Markets below:

IG Markets Deposit Methods

Here is a summary of payment methods accepted by IG Markets for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Wire Transfer | Yes | Free | Up to 3 business days |

| Cards | Yes | 0.5%-1% for credit cards | Instant |

| E-wallet | Yes (PayPal, BPAY) | 1% for PayPal | Instant |

IG Markets Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on IG Markets.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Wire Transfer | Yes | Free | 3 business days |

| Cards | Yes | Free | 2-5 business days |

| E-wallets | Yes (PayPal, BPAY) | Free | 1 business day |

What is the minimum deposit for IG Markets?

The minimum deposit on IG Markets is $450 using cards and PayPal. Bank transfers have no mandatory minimum deposit amount while the BPAY minimum deposit is $10.

The maximum deposit per transaction is $50,000 for cards, $1 million for BPAY, and $30,000 for PayPal while bank transfers have no maximum amount.

How do I add money to my IG trading account?

Follow these steps to deposit funds into your IG Markets trading account:

Step 1) Log in to your IG Markets Account via www.ig.com/au/login.

Step 2) Click on the ‘Live Accounts’ tab and select the trading account you want to deposit funds into.

Step 3) Select ‘Deposit funds’, choose a payment method and follow the on-screen instructions to complete your deposit.

IG Markets Minimum Withdrawal

The minimum withdrawal on IG Markets is $200 for PayPal and bank transfers. Although if your account balance is less than $200, you can withdraw the available amount.

You can only withdraw a maximum of $35,000 per day to cards, while $7,500 is the maximum you can withdraw per transaction on PayPal with unlimited withdrawal times in a day, EFT (Electronic Funds Transfer)and bank transfers have no maximum withdrawal amount.

How do I withdraw money from IG trading?

Follow these steps to withdraw money from your IG Markets:

Step 1) Log in to your IG Markets Account.

Step 2) Click on the ‘Live Accounts’ tab and select the trading account you want to withdraw money from.

Step 3) Select ‘Withdraw funds’, choose a withdrawal method and follow the on-screen instructions to complete your withdrawal.

How long do IG withdrawals take?

The time it takes to receive funds after requesting withdrawals on IG Markets depends on your payment method. Withdrawals to bank accounts are received the same day if you submit your request before 11 AM AEST, otherwise, you get it on the next business day.

While PayPal withdrawals are received instantly or within 1 business day, card withdrawals take 3-5 business days for you to receive the funds. If you use Westpac and submit a withdrawal request before 11 AM AEST, you get the on the same day.

IG Markets Trading Instruments

You can trade over 16,000 financial instruments on IG Markets, find a breakdown of the instruments below:

| Instrument | Availability | Number |

|---|---|---|

| Forex | Yes | 99 currency pairs on IG Markets |

| Energy | Yes | 8 Energies on IG Markets |

| Metals | Yes | 5 Metals on IG Markets |

| Commodities | Yes | 21 soft (agriculture) commodities on IG Markets |

| Indices | Yes | 34 indices on IG Markets |

| Shares | Yes | 16,000+ shares on IG Markets |

| Bonds | Yes | 12 Bonds on IG Markets | ETFs | Yes | 17 ETFs on IG Markets | Cryptocurrencies | Yes | 15 Cryptocurrencies on IG Markets |

IG Markets Trading Platforms

Trading platforms supported by IG Markets are:

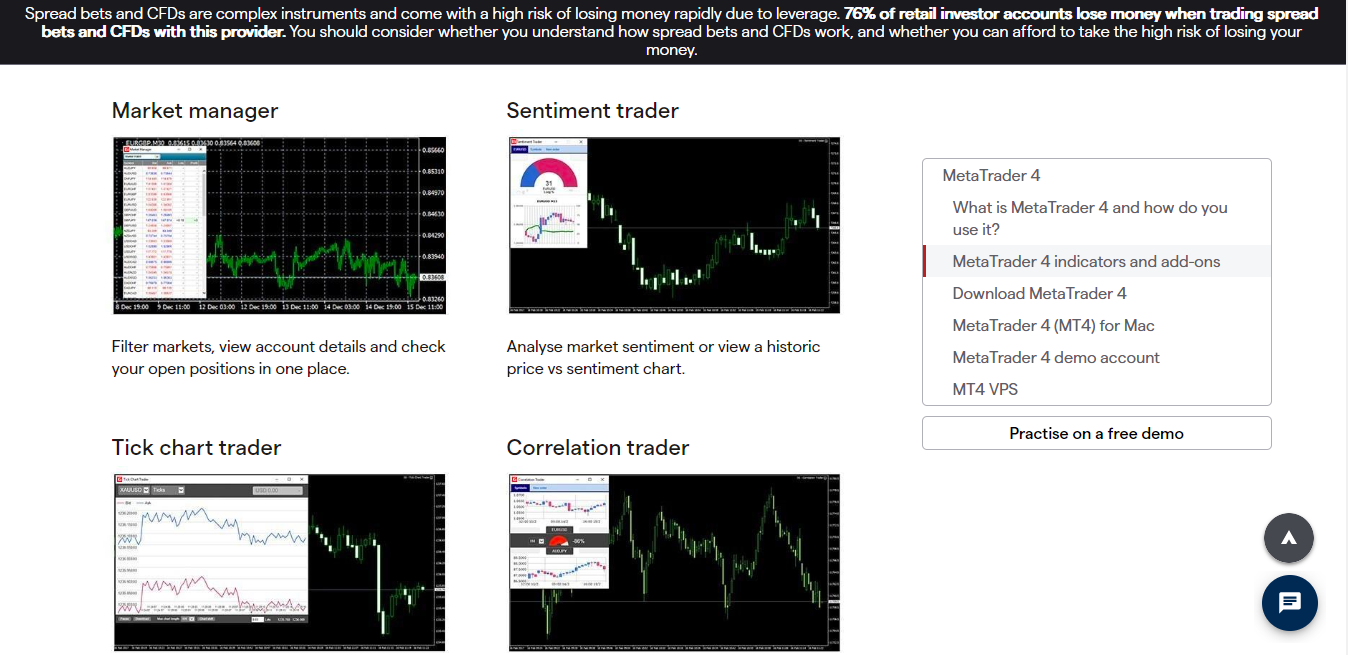

1) MetaTrader 4: You can trade financial markets with IG Markets on the MT4 trading application which is available on the web, desktop (macOS & Windows), and mobile devices (Android & iOS). IG’s MT4 comes with 18 add-ons. These add-ons help you customise the platform and tailor it to your trading needs.

The add-ons have different functions. The best way to maximize them is to combine them to help you create a good strategy. Some of these add-ons include a mini terminal, trade terminal, stealth orders, sentiment trader, market manager, correlation trader, etc.

2) IG Mobile App: IG’s trading app is user-friendly and easy to use. It comes with a customisable chart and a range of technical indicators. Real-time market prices and data are provided as well. Advanced orders like ‘good till cancelled’ and ‘good till date’ are also supported on the app.

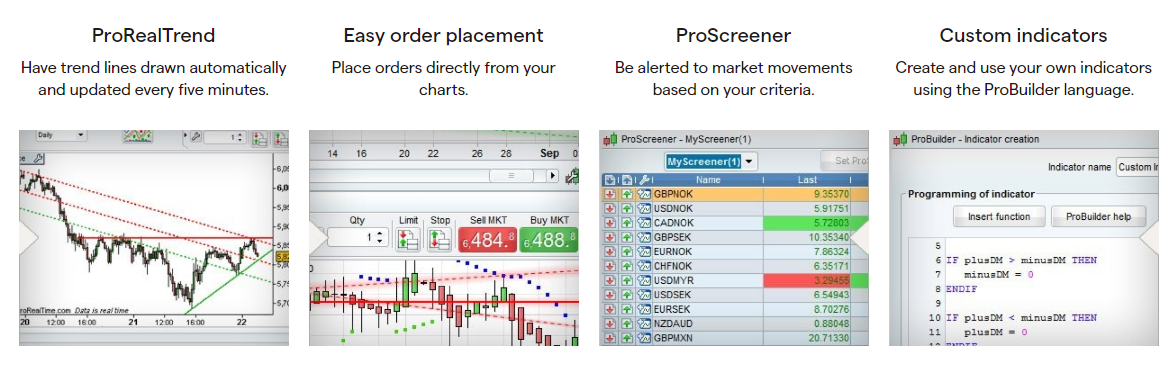

3) ProRealTime: You can also access IG Markets trades via the ProRealTime trading application which is only available for web-based trading. ProRealTime is an advanced charting software useful for technical analysis and trading. It is integrated with IG’s platform so you do not need to use it separately.

ProRealTime lets you use advanced technical analysis via 100 indicators and unlimited timeframes. You can also automate your dealings by building your algorithm. The algorithm can run for 24 hours on its own. Here are some of the tools on ProRealTime.

ProRealTime also allows you to customise your user interface so it reflects what you want to see. This platform is very useful and only IG offers it to UK traders at the time of those writing.

4) TradingView: Ig is one of the many brokers that have partnered with TradingView. TradingView is a strong trading platform. Its strength is in its powerful charting and advanced drawing tools. TradingView should suit you if you technical analysis is your style. TradingView has over 400 indicators and more than 100 drawing tools.

Beyond technical analysis, TradingView also gives you access to a wide trading community. TradingView is also available as a mobile app on Google Play Store and the App Store.

IG Markets Trading Tools

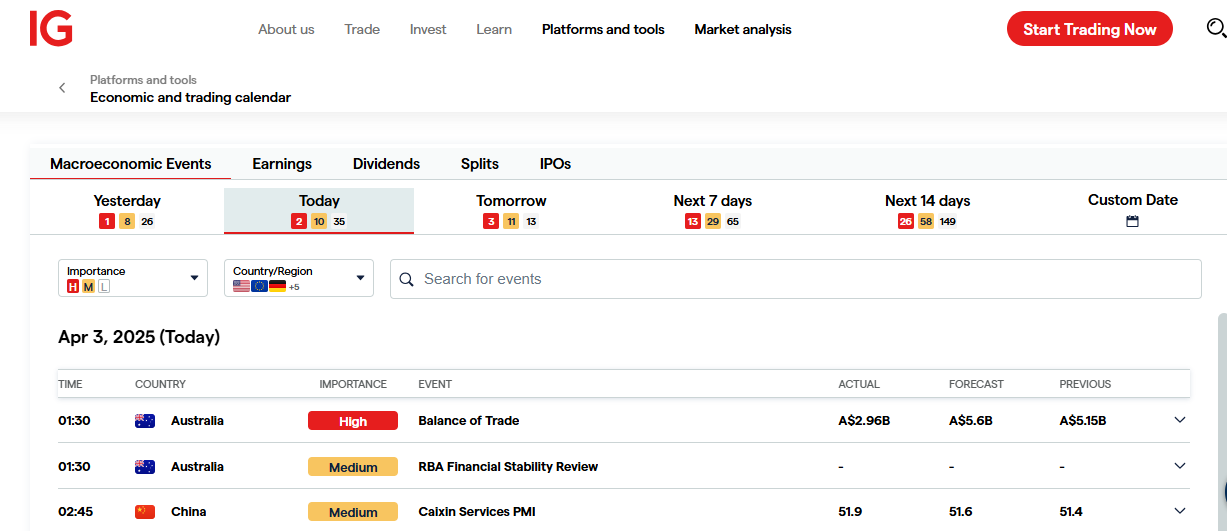

Economic and trading calendar: IG’s economic trading calendar has a smart outline. It is also very easy to use. It covers macroeconomic events, earnings, dividends, splits, and IPOs.

You can use the filter settings to select the data you want and the date. It also also allows you to filter out the noise, focusing on highly importance events only. There is a mini-tutorial on how to use the calendar on IG’s website.

Trade analytics tools: Track your trade statistics and analyse your trades directly on IG’s platform. You can utilize matrices like the return rate, win rate, and profit/loss ratio.

The analytics tools also have a mistake diagnosis section. You get tips on your recently closed trades. You will also receive suggested steps tailored to your trading.

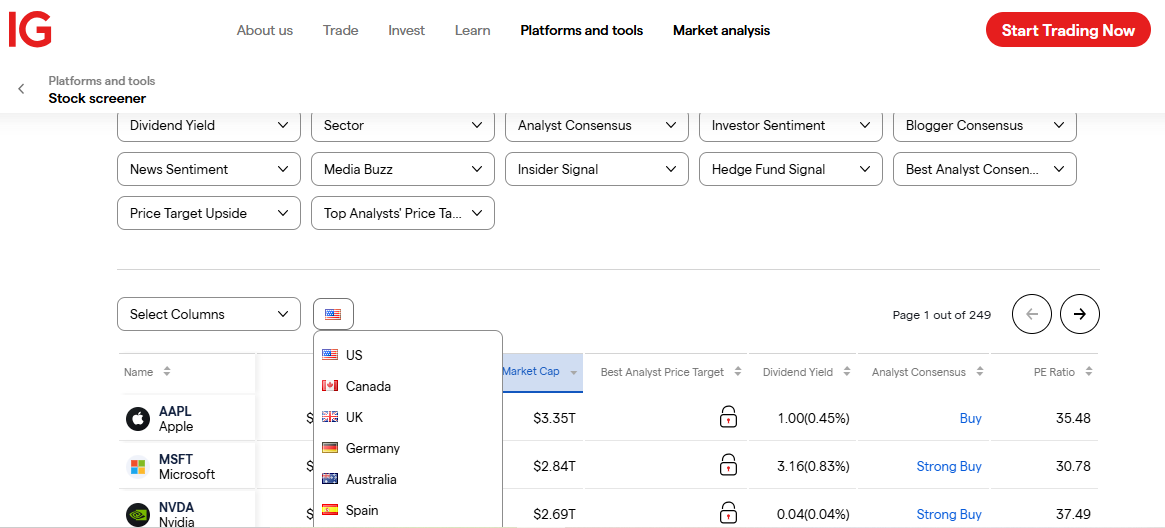

IG’s stock screener: In our research, we discovered IG’s stock screener is one of the best out there. You can screen a stock based on 13 different criteria. The 13th criteria is region/ country. This helps you choose and screen stocks from 8 different countries.

Trading alerts: With IG’s trading alerts, you get free and automatic notifications. You can customize these notifications so only get the alerts you want. The notification covers price alerts and macroeconomic events.

IG Markets Trading Signals

Trading excellently consumes a lot of time. Picking the CFDs to trade, carrying out your analysis, and monitoring your trades can be quite demanding. If you want to trade without having to go through the hassle, you can try IG trading signals.

These signals are buy and sell suggestions based on emerging chart patterns and fundamental analysis. With this service, you will see key support zones, key resistance zones, and entry/exit points. You will also see the provider’s confidence level in the signal so you can decide if you are willing to take the risk.

IG’s trading signals are provided by Autochartist and PIA-First. Autochartist provides automated chart pattern recognition. PIA-First has been in the service of providing trading strategies for over 45 years. There seasoned professionals analyzes charts and set signals in a more fundamental context.

Also, you won’t be paying any fees to access these services. IG Trading signal is free.

IG Financial Freedom Hub

Financial Freedom Hub is an initiative by IG to help traders with financial literacy. There is no financial freedom without knowing how to manage and invest your money. Other than trading CFDs, you can also take advantage of IG’s financial freedom hub to learn about personal finance and how to invest.

The hub is divided into three sections as displayed below

If you click ‘learn more’, you can take a deep dive into all the lessons in the three sections. IG does not charge extra fees for access to the hub. It is free of charge.

IG Markets Execution Policy

According to their execution policy document, IG is a market maker. They act as a principal and execute your trades on your behalf. This means IG is the sole execution venue for clients orders. In other words, traders will deal directly with IG and not the underlying market.

Like every market maker, IG have their own in-house dealing desk and price book. This is major challenge traders have with market makers. However, IG has a system to ensure fair prices are offered to traders. They pay due regard to the market price for the underlying reference CFDs you want to trade. IG has access to different data sources for pricing. With this, they are able to maintain an unbiased view of bid/ask prices for the CFDs they offer.

Finally, IG has different order execution revenues. They regularly assess these venues to make sure their costs and execution policy is best for their clients. Also, IG aims to reduce transaction costs by hedging their risks for all trades in the underlying markets.

IG Markets Education and Research

In this section, we cover IG Markets’ education and research section. Here is what they offer for all levels of trading experience.

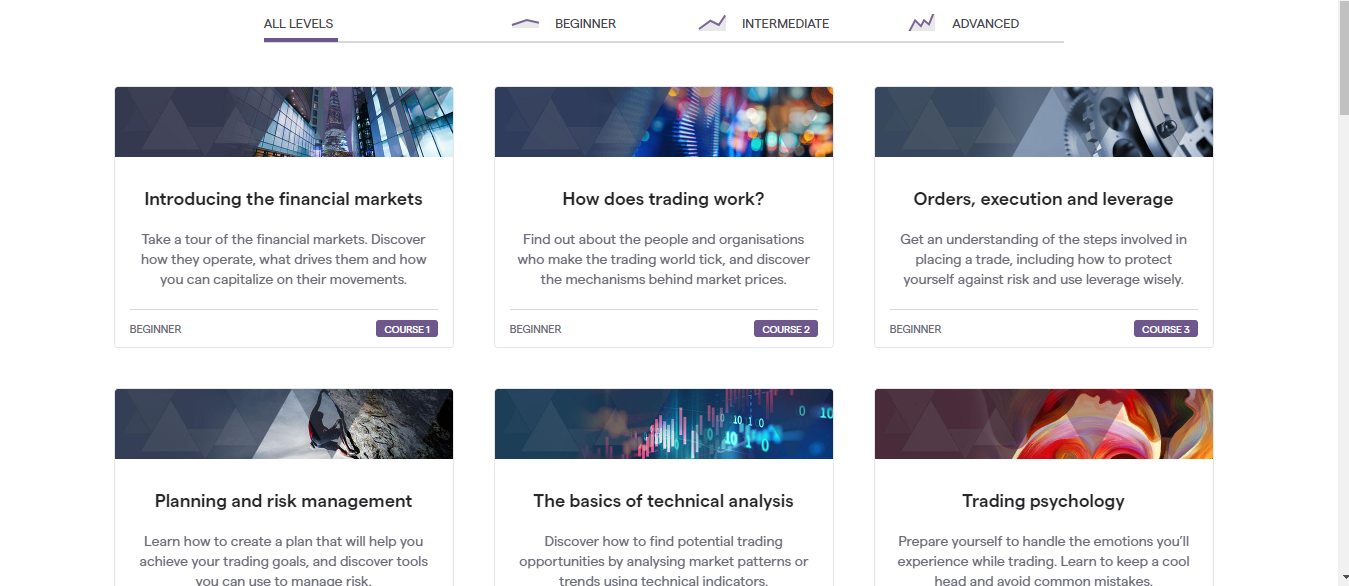

Online Courses: You can find the online courses under IG Markets Academy. The courses are divided into three trading experience levels – beginner, intermediate, and advanced. There are seven courses for beginners, two for intermediates, and three for advanced traders. This brings the total number of online courses to twelve.

The topics covered in the online courses include an introduction to the financial markets, risk and reward, trading strategy, trading psychology, etc.

This image from IG’s website shows the courses for all levels. However, you can click ‘BEGINNER, INTERMEDIATE, or ADVANCED to access courses tailored to your level.

Live Sessions: Apart from online courses, the IG Academy also has live sessions where you can listen to experts. The date and time are usually there. If there’s no live session, however, you can go to the webinar library. The library contains recordings of previous webinars that you can go through at your own pace. The library is also divided into beginners, advanced, and intermediate. At the time of this writing, there are 20 webinars in the library. The sessions are hands-on and applicable.

IG Trading Podcasts: The IG Trading Podcast is available on Spotify, Apple Podcasts, Google Podcasts, and Deezer Podcasts. You can also listen on TuneIn and Stitcher. The IG Trading Podcasts cover a range of topics on current market trends. They are structured into sequential series that you can follow systematically.

IG Analysis: This is an advanced tool for market analysis. Unlike other brokers’ tools, IG Analysis is instrument specific. It has a finder tool that lets you search for specific trading instruments. The search result shows you videos, analysis, and data concerning that instrument. This is very beneficial for beginners that trade a small number of CFDs.

Analytics Tools: These are trading tools that help you analyze your performance as a trader. You can analyze your trading history, track individual trades, and how the market moved relative to your trades. You also get to diagnose trades that go against you.

In addition, you do not need to monitor your success mathematically. One of the features of these tools is to calculate your win rate, return rate, and profit/loss ratio.

Another interesting feature of these tools is the suggestion of useful tips that help you avoid repeating mistakes. Trade updates also come with this package. You can get them on your email or on the trading platform.

IG Special Reports: IG special reports help you develop your trading knowledge and learn about the financial market in an unconventional way. The special reports cover forex, indices, psychology, and economics as shown below.

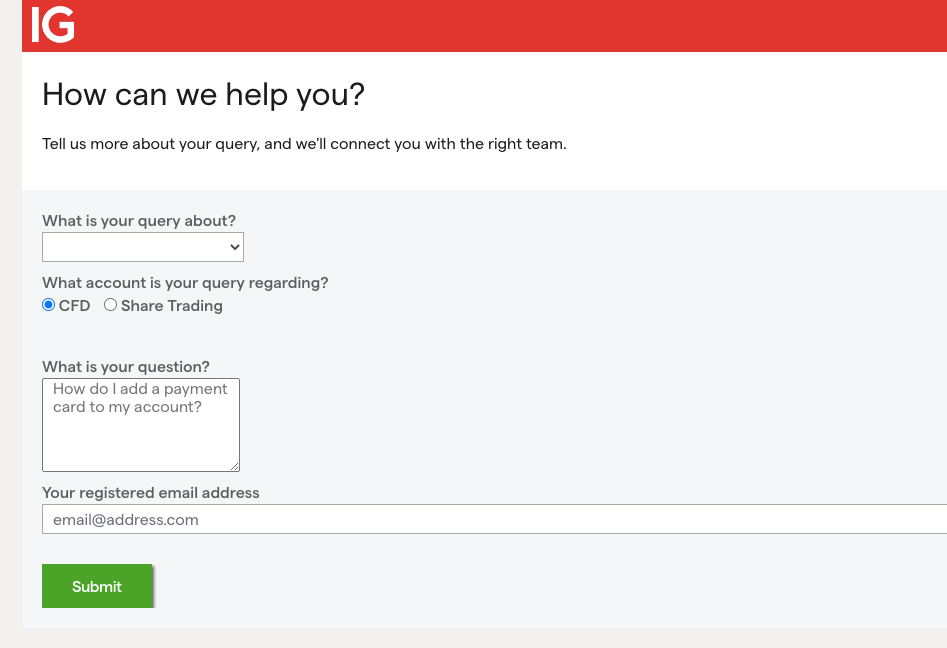

IG Markets Australia Customer Service

IG Markets Australia offers 24/6 online customer support to traders via the following channels:

1) Live chat support: The IG Markets live chat support is available 24 hours every day except 7 AM to 6 PM on Saturdays AEST, and can be accessed via their website.

When our team tested, we got a live chat agent to respond to our inquiries within 2 minutes, although the chat was slow afterward as the agents took the time to find the information we needed. The answers to our questions were relevant and satisfactory.

You will be required to provide an email before starting the chat.

2) Email support: IG Markets offers email support to both existing and new clients which is available 24/5. The IG Markets email address for support is [email protected] or [email protected].

When our team tested we got an auto-response acknowledging receipt of our inquiry and showing links to FAQs answers about our inquiries. A customer representative replied after about 90 minutes and the answers to our enquiry were satisfactory.

3) Phone support: IG Markets offers phone support to traders in Australia. IG Markets’ phone numbers are 1800 601 799 and are available during working hours on business days.

4) IG Community: IG Markets maintain a forum of traders where you can ask questions and other traders provide answers. Sometimes, IG Markets administrators answer the questions. You can search and read up on some frequently asked questions here.

You need to have an IG Markets Account, then sign up for an account in the community to join the conversations.

Can I Trade Nasdaq on IG?

Yes, you can trade Nasdaq 100 on IG Markets. Nasdaq, also known as the US Tech 100 on IG Market’s platform, is one of the most popular indices. It provides exposure to the stock of major tech companies such as Microsoft, Tesla, and Meta.

You can trade Nasdaq on IG Markets 24 hours a day, from Monday to Friday. You have the option to trade Nasdaq as US Tech 100 (based on Nadaq 100), Nasdaq 100 ETF, or Nasdaq 100 shares on IG Markets.

US Tech 100: This is an exclusive product on IG Markets. It is based on the performance of the Nasdaq 100 and can be traded as a CFD with leverage. CFD allows you to trade on underlying assets without owning them, and there is no commission on CFD trading.

Nasdaq 100 ETF: In addition to trading the index directly, you can also trade as Exchange-Traded-Funds (ETFs). This gives you access to the entire index without trading the individual stocks. However, keep in mind that ETFs may have lower liquidity and charge higher spread.

Nasdaq 100 Shares: Alternatively, you can trade specific companies within the NASDAQ 100 such as Tesla and Meta. You can use CFDs to trade NASDAQ shares on leverage, enabling you to go long or short. Note that share CFDs on IG Markets attract a minimum commission of $15.

Do we Recommend IG Markets Australia?

IG Markets is considered trustworthy and clients’ funds are safe because of their regulation by ASIC in Australia and other Top-Tier financial regulators. They also offer a wide range of instruments to choose from.

The fees on IG Markets are moderate, as they offer commission-free trading on all instruments except shares, and offer shares trading without the spreads. The spreads on IG Markets are competitive.

Although it takes about 2 years before they start charging dormant account fees, they charge currency conversion fees and there are brokers regulated in Australia who does not charge such fees. The minimum deposit of AUD450 is relatively high.

IG Markets customer support is responsive, the live chat and email support are available 24/6 and live agents respond to inquiries which means that you can easily resolve any issues you might have with your account.

We recommend that you can signup with IG Markets. With the overview we provided in this review, you can visit the broker’s website to see more information and compare it with others regulated in Australia to choose the platform that is best for you.

IG Markets Australia FAQs

Is IG market good for beginners?

New traders can signup on IG Markets Demo accounts to get familiar with trading and the platform before they put in their real money. The broker offers negative balance protection for retail clients and do not charge inactive account fees until after 2 years. Beginners can benefit from this.

The minimum deposit of $450 might be too high for some beginners. The broker has some educational materials for beginners and you can always contact support via email or live chat to resolve any issues you might have.

What markets does IG offer?

You can trade over 17,000 financial market instruments on IG Markets including forex, indices, stocks, bonds, cryptocurrencies and ETFs.

How much does IG charge per trade?

IG Markets charges commission fees of up to $5 per trade for Australian shares which applies to active traders with Shares Trading Account. Less active traders pay about $8 dollars per trade.

For CFDs on shares, IG charges $7 per trade with no spread. Commission fees apply only when you trade shares, other instruments are commission-free.

What is the minimum deposit for IG trading?

The minimum deposit to start trading on IG Markets is $450. You can use local bank transfers, cards, or PayPal to make this deposit.

Note: Your capital is at risk