| CMC Markets Minimum Deposit Summary | |

|---|---|

| CMC Markets Minimum Deposit | AUD 0 |

| Deposit Methods | Credit Card, Online Banking, Local Bank Transfer, PayPal |

| Account Types | CFD Trading Account, FX Active Account |

| Deposit Fees | No fees |

| Account Base Currencies | AUD, USD |

| Withdrawal Fees | PayPal attracts a 1% commission fee |

| Visit CMC Markets | |

CMC Markets’ minimum deposit is AUD 0. There is no minimum deposit required for all account types. Three live CFD trading accounts are offered by CMC Markets apart from their professional accounts.

The minimum deposit for the professional accounts are definitely higher. It is important that you know this. In this article, we provide a guide on CMC Markets trading accounts and how you can fund your your account.

How Much is CMC Markets Minimum Deposit in Australia?

CMC Markets have no minimum deposit. However, there trading accounts come with separate trading conditions. These conditions are essential to know as they affect your trading costs. So beyond minimum deposit, let us look at these accounts briefly.

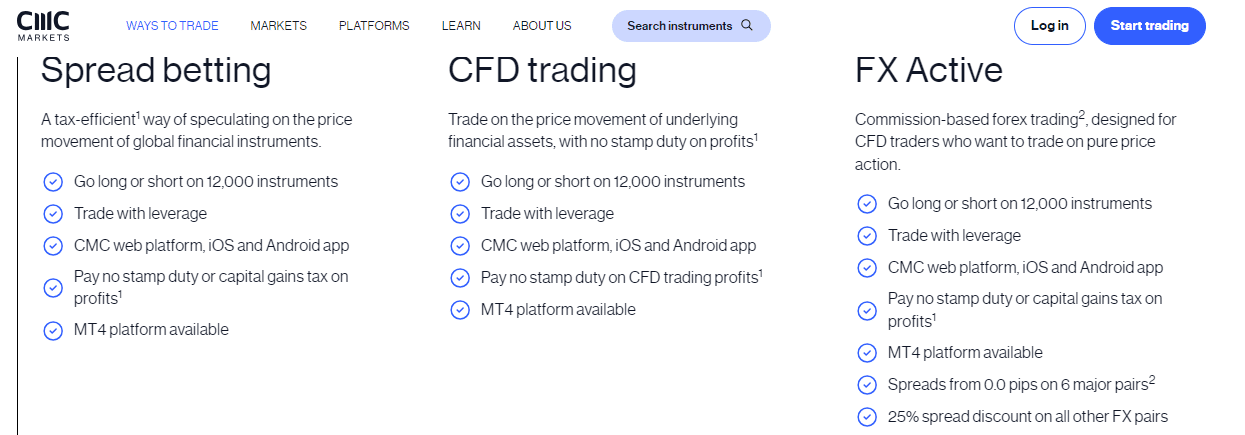

1) CFD Trading Account

Minimum deposit for the account is AUD 0. This account allows you to go long or short on forex, indices, commodities, shares, and treasuries.

Spreads begin from 0.0 pips and you will pay a minimum commission. The commission applies to shares CFDs only and it begins from AUD 7 for Australian shares and $10 for US shares.

You can open a demo account to practice and premium guaranteed stop loss order (GSLO) is available at a fee. It the order is not triggered, all of the fee will be refunded.

The CFD trading account also supports options trading.

2) Spread Betting Account

This account also have a AUD 0 minimum deposit. This account allows you to speculate on the price of over 12,000 trading instruments.

The spreads are low starting from 0.0 pips and your trading on spreads is not by notional value or lot size. It is on a pounds per point basis. Read our article on spread betting to understand this better.

You will pay zero commission for spread trading on all instruments including Australia and US shares. You will also get access to market data with no cost.

Finally, premium GSLO is available if you want it. If the order is not triggered, your money will be refunded.

Spread betting Account is available only in the UK

3) FX Active

You need AUD 0 to open the FX Active Account.

Do you love to trade CFDs with pure price action? If yes, this account is designed for you. With low spreads beginning from 0.0 pips, you can trade the same instruments on the standard CFD Account.

Normal spread pricing applies to EUR/USD, GBP/USD, AUD/USD, NZD/USD, USD/CAD, and USD/JPY. On all other forex pairs, the spread is reduced by 25%.

You will pay zero commission on all instruments except for shares CFDs. The minimum commission is $10 and AUD 7 for US and Australian shares respectively.

GSLO premium fee is refunded if it the order is not triggered.

Here is a general overview of CMC Markets trading accounts.

4) Corporate Account

Minimum deposit for CMC Markets Corporate Account is £0

The CMC Markets Corporate Account enables businesses to register and trade CFDs on the platform as a corporate entity. With this account, you gain access to various financial instruments including forex, shares, indices, commodities, and treasuries.

Commission fees are not applicable for most trades with this account, except when trading CFDs of shares, where commission fees start from $10 for US shares. For Australia shares it is AUD 7.

In addition, spreads on the Corporate Account begin at 0.3 points. It’s important to note that holding a trade position open for more than 24 hours may incur swap fees.

Note: CFD trading is risky

5) CMC Invest

This is not a CFD trading account but an investment account. For CMC Invest, there is no minimum amount required to start investing.

You can access over 45,000 international stocks and ETFs available, you’ll be able to invest in in any brand you want all from one account.

Finally, CMC Invest does not offer fractional shares. In Australia, you can sign up for CMC Invest via CMC Markets’ share trading plan.

Does CMC Markets have a Recommended Minimum Deposit?

Though CMC Markets have no minimum deposit, they do suggest that you fund your account with at least AUD 100 to cover for margin requirements.

CMC Markets Deposit Methods and Required Fees

All of CMC Markets trading accounts have the Australian Dollars (AUD) as one of the base currencies. So, you can fund and withdraw from your account in AUD. All of the deposit methods also allow funding in AUD.

1) Credit/debit cards: Visa/MasterCard cards are supported by CMC Markets. There is an extra fee charged by CMC Markets for funding via cards. Debit card funding attracts 0.6% merchant fee, while the fee for credit card deposits is 1%

2) Online banking: You can connect to your online bank for secure payments. You can do this through the web-based platform or mobile app.

3) Local bank transfer: CMC allows you to transfer funds from your local bank to your trading account without extra fees.

4) PayPal: You can deposit money into your trading account via PayPal. It attracts a 1% commission fee

Note: There might be extra fees charged by your payment service provider when you fund your account. These fees are separate from the ones charged by CMC Markets.

CMC Markets Deposit Terms

1) CMC Markets does not accept cash or cheque payments. They are also unable to accept American Express or Diners Club.

2) Fund your account with card or bank accounts that is in your name. CMC Markets will reject payments from third party sources.

3) CMC Markets charges fees for deposits.

4) If there is a difference between the deposit amount in your trading account and the amount you transferred, reach out to your payment service provider first.

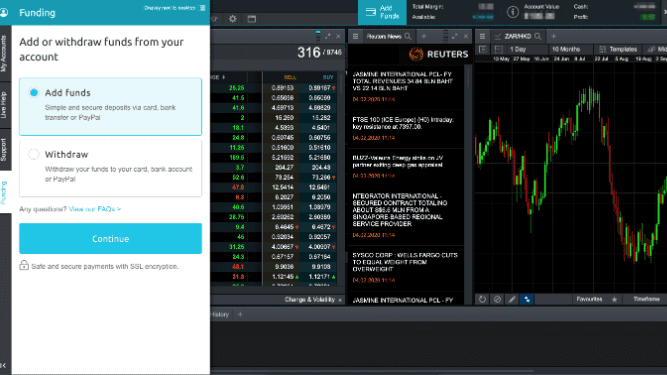

How to Deposit Money Into Your CMC Markets Account

1) On CMC Markets platform or mobile app, log in to your client area.

2) Look for the Funding tab on the left and click it.

3) Select your preferred funding method.

4) Enter necessary details and make sure they are correct.

5) Complete the funding of your account.

Comparison Of CMC Markets Minimum Deposit With Other Brokers

Here how other broker’s minimum deposit compare with that of CMC Markets.

| Broker | Minimum Deposit |

|---|---|

| CMC Markets | AUD 0 |

| AxiTrader | AUD 0 |

| Vantage Markets | AUD 200 |

| FxPro | AUD 100 |

| AvaTrade | AUD 100 |

| IC Markets | AUD 300 |

Note: CFD trading is risky

What base currencies are accepted by CMC Markets?

In Australia, CMC Markets supports USD and AUD as base currencies

What is CMC Markets’ maximum withdrawal?

CMC Market’s withdrawal limit is $40,000 or its equivalent in your account’s base currency.

Frequently Asked Questions

What is the minimum deposit for CMC Markets Australia?

CMC Markets Australia have no minimum deposit. You need AUD 0 to open an account.

Is there a deposit limit for CMC Markets?

CMC Markets does not have a deposit limit. But your bank or card provider might have.

Is CMC Invest good for beginners?

Your capital is at risk when you invest. Make sure you have sufficient knowledge before going into it.

Can CMC Markets be trusted?

CMC Markets operate in Australia under the license of ASIC.

Can you withdraw money from CMC Markets?

Yes, you can withdraw your funds by using the Funding tab.

Note: Your capital is at risk