| FBS Minimum Deposit Summary | |

|---|---|

| FBS Minimum Deposit | $5 (UGX18,340) |

| Deposit Methods | Mobile Money, Cards |

| Account Types | Standard Account, Islamic Account |

| Deposit Fees | 3.5% for mobile money |

| Account Base Currencies | UGX, USD, EUR |

| Withdrawal Fees | 2.5% + 1,664.8 UGX for mobile money |

| Visit FBS | |

FBS minimum deposit is $5 (UGX18,340)

This review is a breakdown of FBS minimum deposit requirements in Uganda, supported payment methods, associated fees, and how FBS’s minimum deposit compares to other CFDs and forex brokers in Uganda. Let’s find out how much you need to get started with FBS.

What’s the minimum deposit for FBS?

FBS offers only 1 trading account for all traders and the minimum deposit for the FBS account is $5 (UGX18,340). However, the actual minimum deposit on FBS in Uganda depends on the payment method you are using.

Mobile money payment (Airtel) require a minimum deposit of 11,000 UGX while cards require a minimum deposit of 6 EUR.

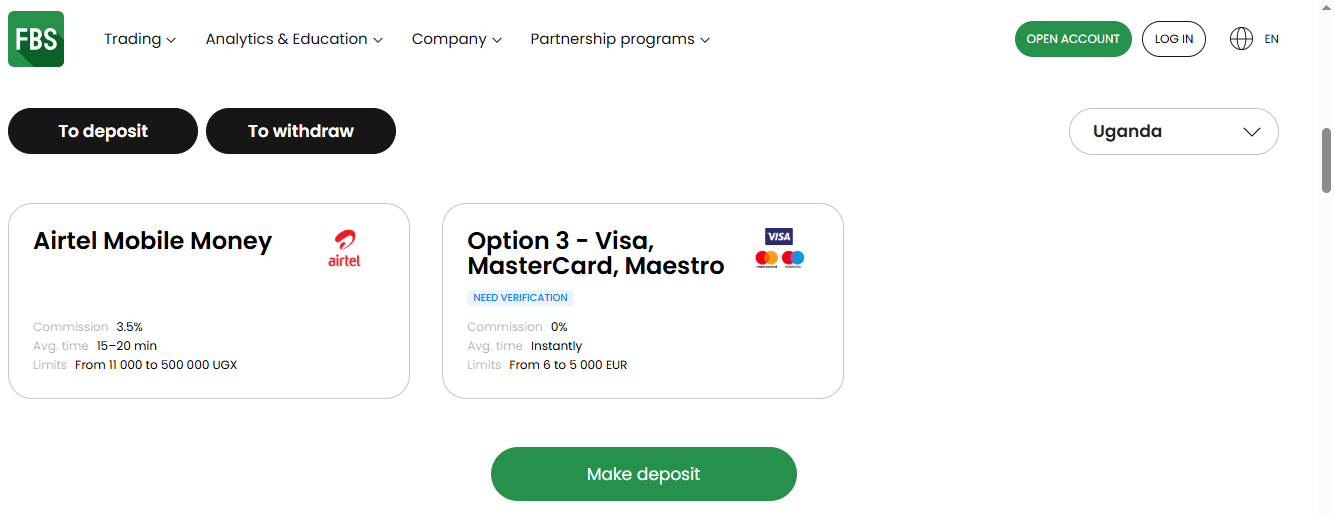

Accepted Deposit Methods on FBS Uganda

FBS offers a range of ways to deposit into your trading account:

1) Mobile Money Payment (Airtel Money): FBS accepts deposits via local mobile money payment, only Airtel is supported for deposits. The minimum amount when depositing via mobile money is UGX 11,000, it takes about 15-20 minutes for funds to be credited to your trading account. FBS charges deposit fees of 3.5% of the deposit amount per transaction for deposits via mobile money in Uganda.

You can also withdraw to your mobile money account from FBS, MTN and Airtel are supported for withdrawal. Minimum withdrawal amount is UGX 10,000, which is processed with 15-20 minutes for you to the receive the funds and can take up to a few days if there is a delay. FBS does charges a fee of 2.5% + 1,664.8 UGX per transaction for withdrawals to mobile money in Uganda.

2)Credit/Debit Cards (Visa, Maestro): FBS accepts deposits via cards. The minimum deposit when using cards on FBS is €6, funds are generally credited instantly to your trading account. FBS charges zero fees for deposits via cards.

FBS also supports withdrawal to cards, the minimum withdrawal amount on FBS for card withdrawals is €5. It takes about 15-20 minutes for the withdrawal to be processed and can take up to 7 days to receive the funds. FBS charges withdrawal fees, starting from €2 per transaction.

Note: CFD trading is risky

FBS Deposit Methods Table

The table below summarizes the deposit methods accepted by FBS for deposits.

| Deposit Methods | Availability | Minimum Deposit | Fees | Processing time |

|---|---|---|---|---|

| Internet banking/bank transfers | Yes | UGX 11,000 | 3.5% | 15-20 minutes |

| Cards | Yes | €6 | Free | Instant |

| Cypto (Bitcoin and USDT) | Yes | $1 | Free | 15-20 minutes |

FBS Deposit Rules

1. Deposit Fees: FBS charge deposit fee when you are depositing funds using the mobile money payment option in Uganda. The fee is 3.5% for deposits via Airtel. Although FBS offers free deposits for payment methods like cards. Note that your bank, card issuer or payment processor may charge an independent fee.

2. Deposit Time: You can make deposits to your FBS trading account at anytime. Deposits via cards (Maestro/Visa) are credited instantly.

3. Payment Source: Deposits must come from accounts (banks and cards) held in your own name. You will be required to verify your account before you can deposit using cards. You will need to provide your ID and proof of address to verify your account. You will also be required your phone number.

How do I deposit money into my FBS account?

Step 1: Access your FBS dashboard.

Step 2: Navigate and click on ‘Deposit’ then select for your preferred payment method for deposit.

Step 3: Input the desired amount to add to add to your trading account, then click the ‘Deposit’ button. Follow the prompts to finalize your deposit transaction.

Comparison Of FBS Minimum Deposit With Other Brokers

Here is a comparison of FBS minimum deposit with that of their competitors.

| Broker | Minimum Deposit |

|---|---|

| FBS | $5(UGX18,340) |

| Exness | UGX 36,680 ($10) |

| HF Markets | UGX 20,000 |

| IC Markets | UGX 733,400 ($200) |

Note: CFD trading is risky

What base currencies are accepted by FBS?

FBS lets you fund your account in any currency. You can fund your account in any currency but it will be converted to your account’s base currency in USD or EUR.

FBS Minimum Deposit Uganda FAQs

What is the minimum amount to start trading with FBS?

UGX 11,000 is the minimum amount you can deposit on FBS to start trading. This applies if you are depositing via mobile money (Airtel) in Uganda. The minimum amount when depositing with card is €6.

What is the minimum withdrawal from FBS trader?

UGX 10,000 is the minimum withdrawal amount from FBS in Uganda. This applies if you are withdrawing funds to mobile money account (MTN and Airtel). The minimum withdrawal for cards is €5.

How long do FBS withdrawal take?

Withdrawals on FBS are processed 15-20 minutes for mobile money, however, it can take up to 7 days for you to receive the funds in your card. It takes 72 hours for bank accounts and e-wallets (Neteller) to receive the funds.

How long does FBS deposit take?

It takes 15-20 minutes for deposits via Uganda mobile money payments to be credited to your trading account, while cards deposits are credited instantly.

Can I deposit in FBS without verification?

You cannot deposit on FBS without verification. You must first verify your identity and address to activate your account. You will need to submit proof of address and government issued ID card as well as verify your phone via a code.

How much is the deposit fee on FBS

3.5% is the deposit fee on FBS if you are using mobile money in Uganda. FBS offers free deposits when you use cards. However, your payment processor, bank or card may charge an independent fee.

Can I deposit $1 on FBS?

No, there is no deposit method on FBS that has a $1 minimum deposit

Does FBS have a UGX account?

No, FBS does not offer a trading account in UGX currency, however, you can make deposits in UGX and it will be converted to your trading account currency which is either USD or EUR.

Note: Your capital is at risk