You can trade forex in Tanzania. It is totally legal. However, there are a few things you should be aware before venturing into trading.

The most important is the fact that forex trading is not regulated in Tanzania. Though the country has the Capital Markets and Securities Authority (CMSA), the CMSA does not oversee the activities of forex brokers in Tanzania.

It is highly recommended that you trade with tier-1 regulated forex brokers only. This ensures that your funds are protected. FCA and ASIC are tier-1 regulators.

The next thing to consider after regulation are different factors related to a forex broker. Is their trading fees high or low? What are their trading platforms? What CFD instruments do they provide?

The brokers on our list were selected based on these criteria & other key factors.

Show More

Comparison of Best Forex Brokers in Tanzania

| Broker |

Regulations |

EUR/USD Spread (pips) |

Min. Deposit |

Visit |

HF Markets

|

CySEC, FSCA, FCA, FSA, DFSA, CMA, St. Vincent & the Grenadine

|

1.4 (Premium Account)

|

$0 (0TZS)

|

Visit Broker

|

FP Markets

|

ASIC, CySEC, FSCA, FSA

|

1.1

|

$100 (262,500TZS)

|

Visit Broker

|

FBS

|

FSCA, FSC, CySEC, ASIC

|

0.9

|

$5 (13,125TZS)

|

Visit Broker

|

AvaTrade

|

ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA

|

0.9

|

$100 (262,500TZS)

|

Visit Broker

|

Exness

|

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

|

1.0

|

Depends on trading account

|

Visit Broker

|

Best Forex Brokers in Tanzania

According to our review, these are the seven best forex brokers in Tanzania for 2024.

- HF Markets – Overall Best Forex Broker in Tanzania

- FP Markets – CFD Broker with ECN Account

- FBS – Forex Broker with Local Payment Methods

- AvaTrade – Multiple Regulation Broker

- Exness – Tanzania Broker with Social Account

- XM – Regulated Broker with Micro Account

- Pepperstone – Forex Broker with Multiple Platforms

The essence of this article is to help you choose the forex broker you believe is right for you. Here is a brief review of the best forex brokers in Tanzania.

#1 HF Markets – Overall Best Forex Broker in Tanzania

EUR/USD Benchmark:

1.4 pips

Trading Platforms:

MT4, MT5, HFM Platform

Account Minimum:

$0 (0TZS)

HF Markets is licensed with & regulatory bodies globally. Only their FCA license in the UK is tier-1. In Africa, they are regulated with the CMA in Kenya, FSA in Seychelles, FSC in Mauritius, and FSCA in South Africa.

Account Types: HF Markets has six account types. Cent, Zero, Pro, Pro Plus, Premium, and Top-up bonus account. None of the accounts is TZS-based.

Fees: HF Markets charges a spread on all of their CFDs. The spreads are different for each of HFM’s accounts. You will only pay commission on forex pairs for the Zero Account only. Overnight fees also apply. For EUR/USD, the swap is 8.1 for bullish trades.

No deposit fees except for bank wire transfer. Withdrawal is also free except for payments made via crypto platforms.

Trading Conditions: HF Markets minimum deposit is $0 for for four of their six accounts. Only the Pro and Pro Plus Accounts have a minimum deposit of $100 and $250 respectfully. You can fund/withdraw your funds via Skrill, NETELLER, Perfect Money, Credit/Debit cards, and alternative crypto payment methods.

These methods have their own minimum deposits and withdrawals.

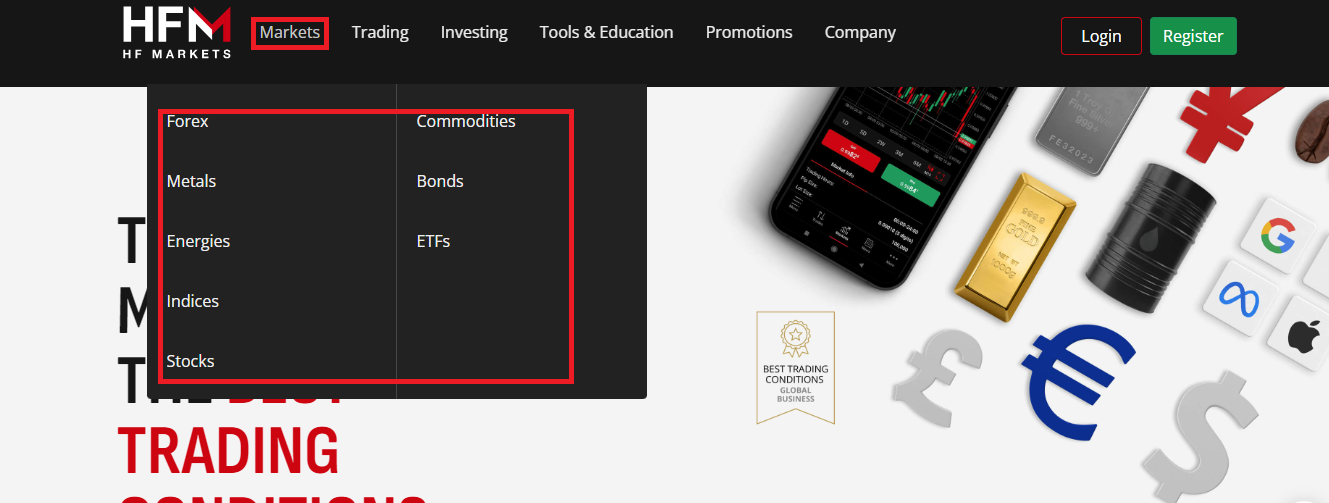

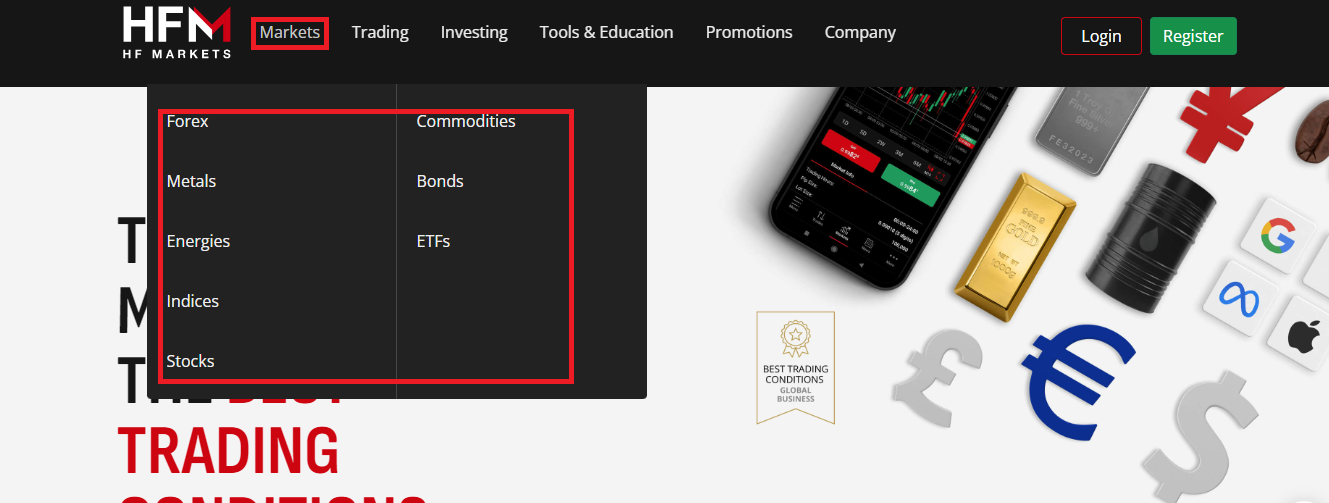

Tradable Instruments: You can trade 50+ currency pairs, 6 metals, 2 energies, 12 indices, 195 stocks, 4 commodities, 3 bonds, and 24 ETFs. All of these instruments are CFDs.

However, your account type and trading platform determines how much of these CFDs you can access.

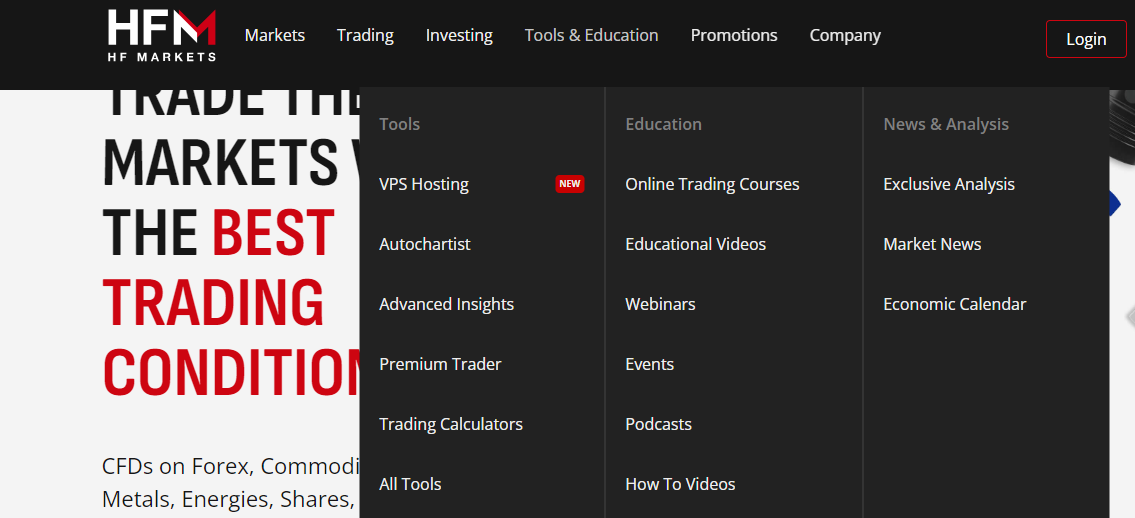

Trading Platforms: You can trade CFDs with HFM on MT4 and MT5. HFM’s MT5 have more CFDs than the MT4. You can also use HFM’s proprietary trading platform.

Customer Support: HFM has good customer support. You can contact them via email and live chat. We tested the live chat and got a response within two minutes. HFM’s support is available 24/5.

HF Markets Pros

- Top-tier FCA regulation

- Multiple accounts with low minimum deposit

- Quick customer support

- Wide market range

- Zero commission on fx pairs for most accounts

- Islamic Account

HF Markets Cons

- No TZS-based account

- Complex spread system

- No CMSA regulation

- No physical office in Tanzania

#2 FP Markets – CFD Broker with ECN Account

EUR/USD Benchmark:

1.1 pips

Trading Platforms:

MT4, MT5, cTrader, TradingView, FP Markets App

Account Minimum:

$100 (262,250TZS)

FP Markets is not regulated by the CMSA. They hold a tier-1 ASIC license and tier-2 CySEC license. In Africa, they are licensed with the FSA in Seychelles and the FSCA in South Africa.

Account Types: FP Markets provides two accounts: Standard Account and Raw Account. You can also open an Islamic version of these two accounts.

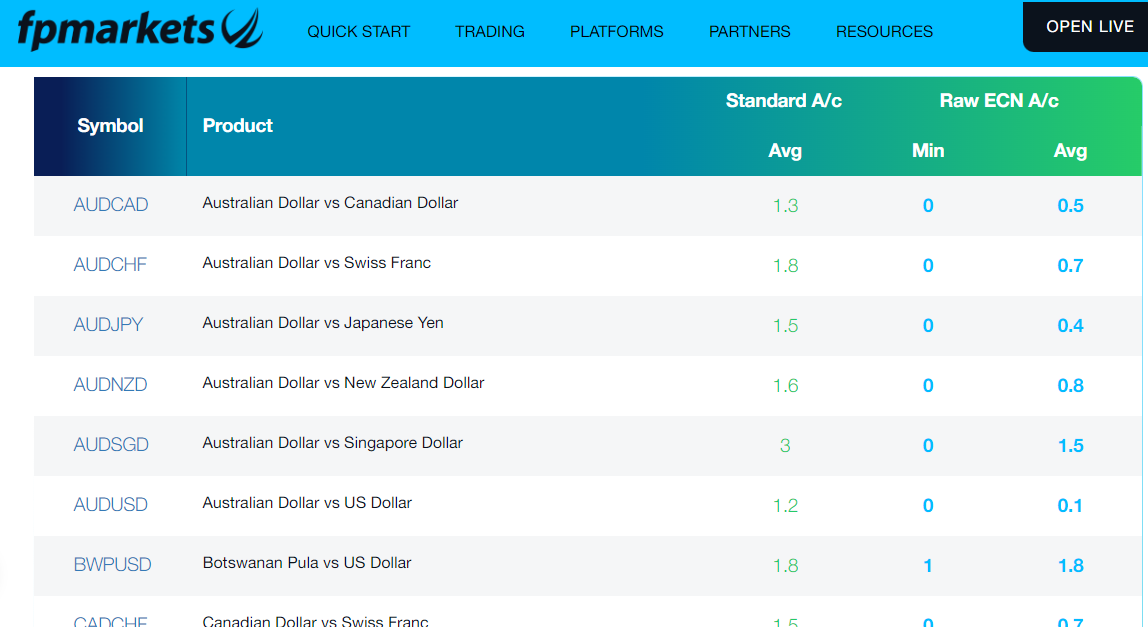

Fees: FP Markets spread varies by trading account. The spread for EUR/USD on the Raw Account is 0.1 pips. You will also pay a commission. Commission for all CFDs is built into the spread on the Standard Account. For the Raw Account, the fee is $3 per standard lot for forex and metals.

Commissions for commodities, indices, shares, and cryptocurrencies are built into the spread. FP Markets also charge their traders swap but no fees for deposits and account inactivity. Some withdrawal methods attracts fees from FP Markers.

Trading Conditions: FP Markets minimum deposit for their two accounts is $100 (262,250TZS). You can fund/withdraw funds from your account through bank transfer, crypto payments, debit/credit cards, NETELLER, Skrill, and Perfect Money.

Tradable Instruments: FP Markets offers the following CFDs: 70+ currency pairs, 10,000+ shares, 17 metals, 12 commodities, 18 indices, 12 digital currencies, 2 bonds, and 48 ETFs.

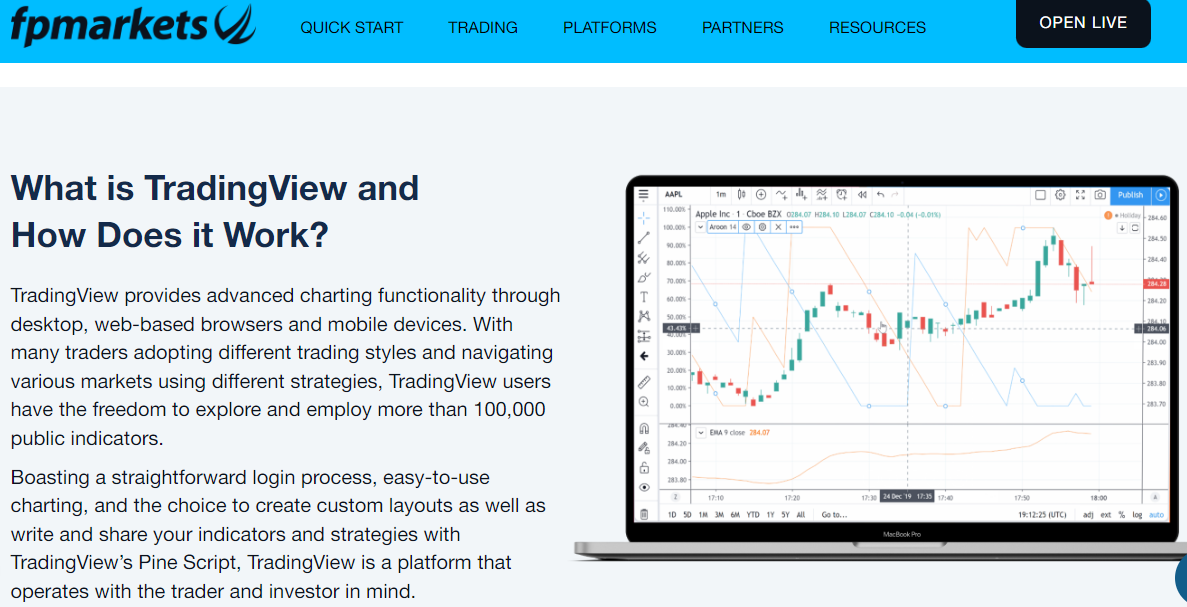

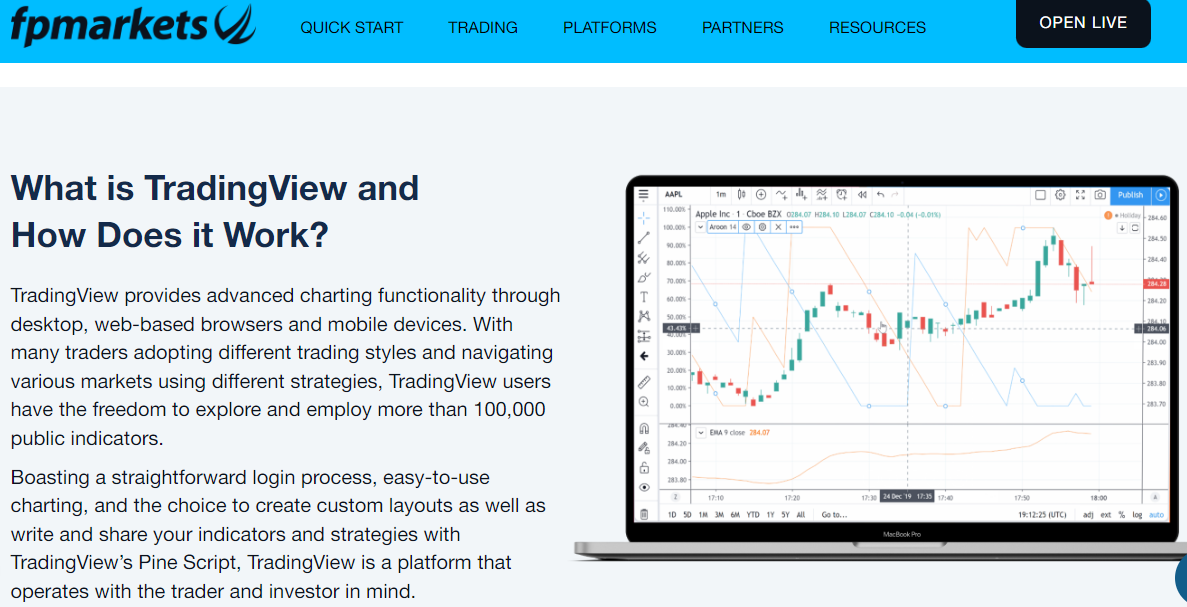

Trading Platforms: You can execute your trades with MT4, MT5, cTrader, TradingView, and FP Markets App.

Customer Support: FP Markets can be contacted via call back, live chat, and email. We got a response within a minute when we tested their email support. The only downside is that customer support is not 24/7.

FP Markets Pros

- Tier-1 regulations and Africa regulations

- TradingView and cTrader are available

- 24/7 customer support

- No inactivity fee

- No deposit charges

FP Markets Cons

- No TZS-based account

- High spreads on Standard Account

- No local regulation

#3 FBS- Forex Broker with Local Payment Methods

EUR/USD Benchmark:

0.9 pips

Trading Platforms:

MT4, MT5

Account Minimum:

$5 (13,125TZS)

FBS is not locally regulated in Tanzania. However, they hold a top-tier license with ASIC in Australia. In Africa, they are regulate with the FSCA in South Africa.

Account Types: FBS has one trading account only. No multiple account.

Fees: FBS offers floating spread that starts from 0.7 pips and they charge no commission per standard lot. You will also pay no fees for deposits and withdrawals.

Though you can open a swap-free Islamic account, FBS charges a swap when for all of your trades. A buy trade on EUR/USD will cost you -5.46. If you go short, you get paid 0.61. FBS charges no inactivity fees.

Trading Conditions: FBS minimum deposit is $5 (13,125TZS). Your account can be denominated in USD or EUR. It all depends on you. Though you can open an account with little money, FBS recommends you start trading with $100 (262,250TZS).

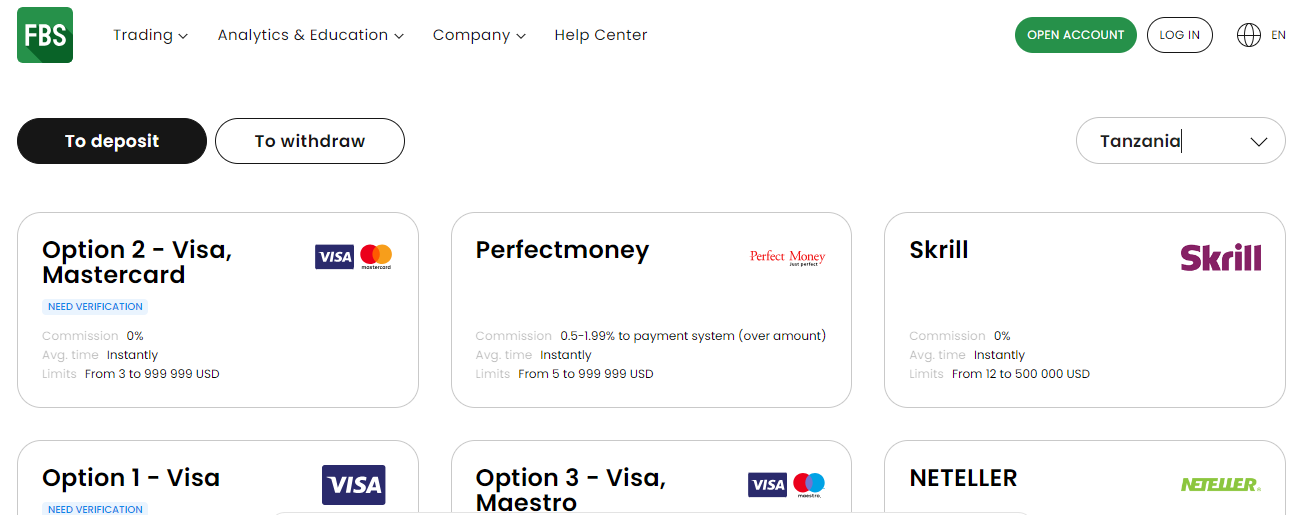

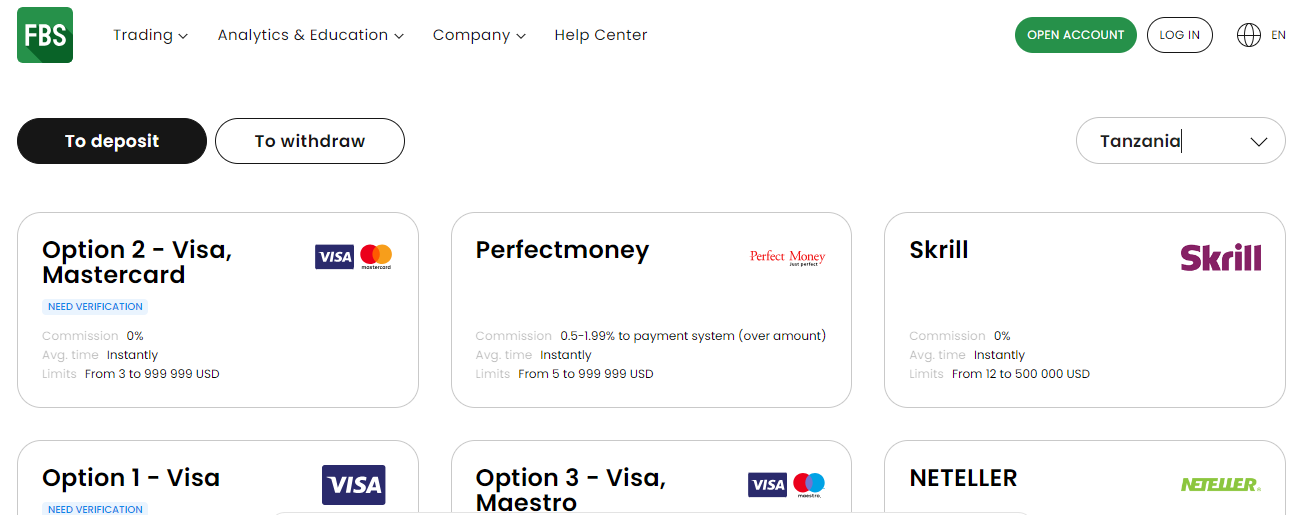

You can fund your account via SticPay, NETELLER, Skrill, Perfectmoney, Visa, MasterCard, and Maestro. The same options are available for withdrawal.

Tradable Instruments: FBS offers CFDs on 72 forex pairs, 8 metals, 11 indices, 3 energies, and 100+ stocks.

Trading Platforms: MT4 and MT5 are the platforms supported. They are available on Android, iOS, macOS, Windows, and Web.

Customer Support: You can contact FBS customer support via live chat or call back. Customer support agents are available 24/7. There was a long queue of about 5 minutes every time we tried FBS live chat. However, the customer support was good.

FBS Pros

- Tier-1 regulation

- Low spreads

- 24/7 customer support

- Zero inactivity fee

- No deposit and withdrawal charges

FBS Cons

- No TZS account

- No other platform than MT4/MT5

- Local banks are not supported for payment

- Not regulated in Tanzania

#4 AvaTrade – Multiple Regulation Broker

EUR/USD Benchmark:

0.9 pips

Trading Platforms:

MT4, MT5, AvaTrade App

Account Minimum:

$100 (262,500TZS)

AvaTrade have tier-1 ASIC license and tier-2 CySEC license. They are also regulated the FSCA in South Africa.

Account Types: Only a single trading account is available. This one account also have an Islamic version.

Fees: CFD Trading at AvaTrade cost zero commission with no deposit or withdrawal fees. Spread accounts are fixed with a competitive spread (0.9 pips for pairs like EUR/USD). However, their swaps are quite high.

AvaTrade clients will also pay inactivity fees after three months of no trading activity. The fee is $50 and it is recurrent after every 3 months of inactivity.

Trading Conditions: The maximum leverage on AvaTrade is 1:400 but this figure might change depending on the instruments you are trading.

Ava Trade’s minimum amount of deposit is $100 or TZS262,500. You cannot open an account in TZS. The option is not available. You can fund your account via bank transfer, credit/debit cards, and e-wallets.

Tradable Instruments: AvaTrade offers over 600 instruments including CFDs on 55 currency pairs, 616 stocks, 20 cryptocurrencies, 31 indices, 54 FX options, and 19 commodities.

Trading Platforms: AvaTrade provides various platforms for trading including MT4, MT5, AvaTrade App, AvaOptions, AvaSocial, DupliTrade, and Webtrader.

Customer Support: AvaTrade provides support via live chat and email. You can also take advantage of their FAQs to get quick answers to your questions. If the FAQ does not satisfy you, then you can use the live chat.

AvaTrade Pros

- Top-tier ASIC and CySEC regulation

- Zero commissions

- Multiple trading platforms

- No deposit/withdrawal charges

- Islamic Account

AvaTrade Cons

- Not regulated in Tanzania

- High inactivity fee/li>

- No Tanzania shillings account

- High swap

What is a Forex Broker?

A forex broker offers brokerage services to retail and professional traders who want to speculate on currency pairs & other markets as CFDs, by going long (buy) or short (sell). Through a forex broker, your profit or loss from trading CFDs is cash settled in a brokerage account you have opened with the broker.

A forex broker could be a market maker which means they could be taking the opposite sides of your trades. A market maker also stands to make profit when you lose a trade so there is a little conflict of interest.

A forex broker could also be a no-dealing desk broker that connects you to buyers/sellers through their liquidity providers via computerized networks.

How to choose Best Forex Broker in Tanzania

Forex traders in Tanzania face a dilemma over the choice of a brokerage firm to trade with. Although getting started in forex trading is easy as one just needs to register and fund an account with a broker. What constitutes a problem is finding the right broker.

Probably the most important of all factors to consider after regulation is trading fees. Some brokers charge high fees for almost every transaction carried out by the trader. Such numerous and exorbitant trading fees can eat into a trader’s profit or even his capital. A trader must choose a broker that has low or minimal trading fees.

Here is a detailed layout of the factors you should consider when choosing a forex broker.

1) License and Regulation:

Forex trading in Tanzania is regulated with the Capital Markets and Security Authority (CMSA). Most of the brokers in this review accept traders from Tanzania though they have no local license.

So what do you do? Well, the absence of a local license should not stop you from choosing a broker. What you should do is to check if the broker has a top-tier license with a regulatory body outside Tanzania. The broker you choose should have at least an FCA (UK) license or an ASIC (Australia) license. Some brokers have both.

In addition, you can check for a tier-2 license with CySEC (Cyprus). All the brokers in our review have a tier-1 license and licenses in other African countries.

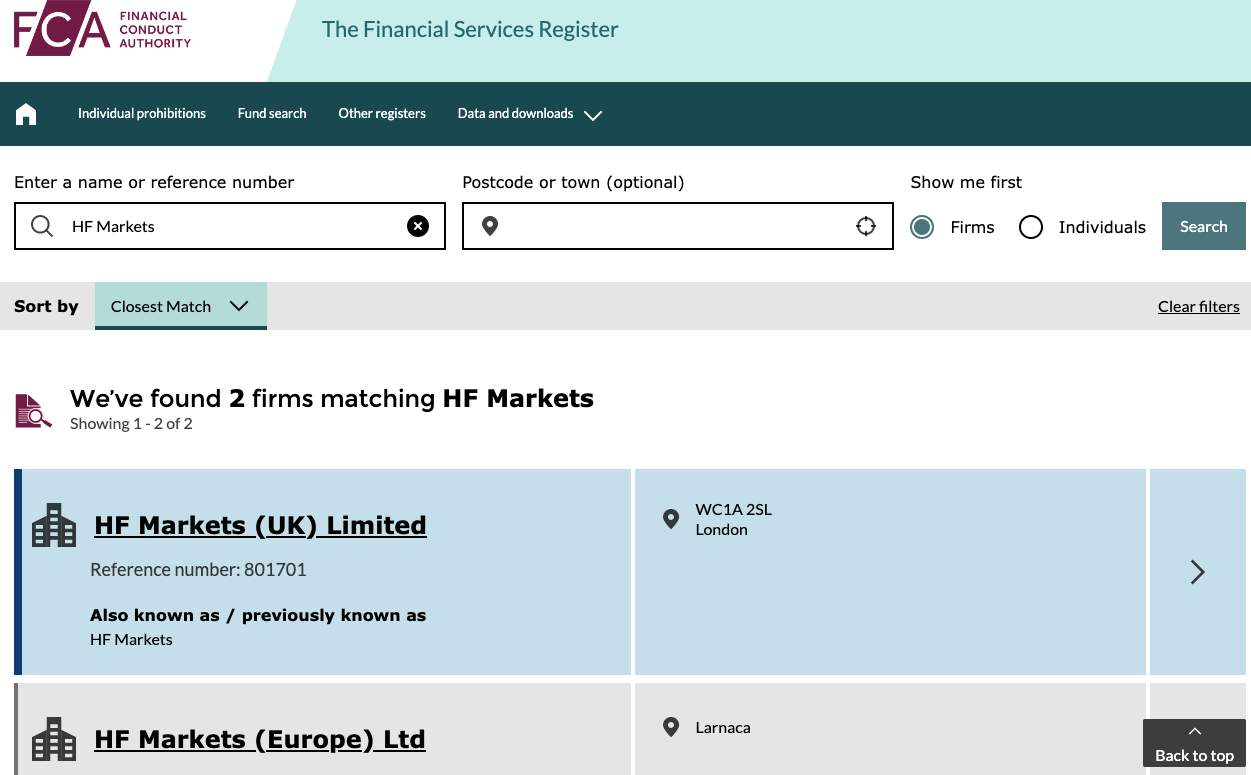

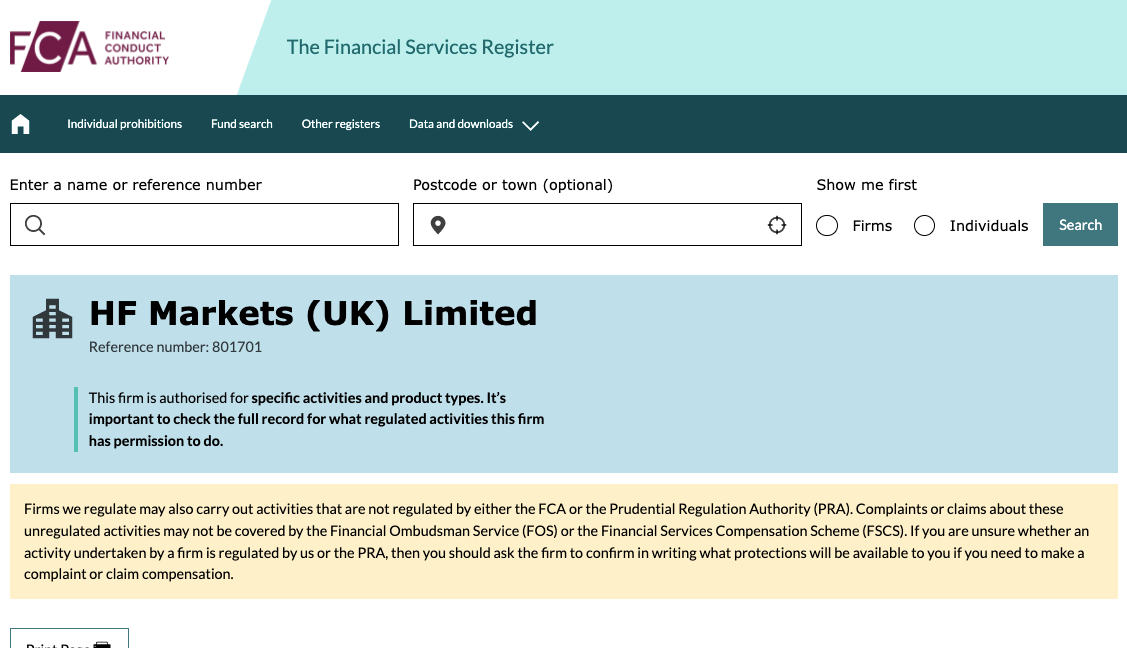

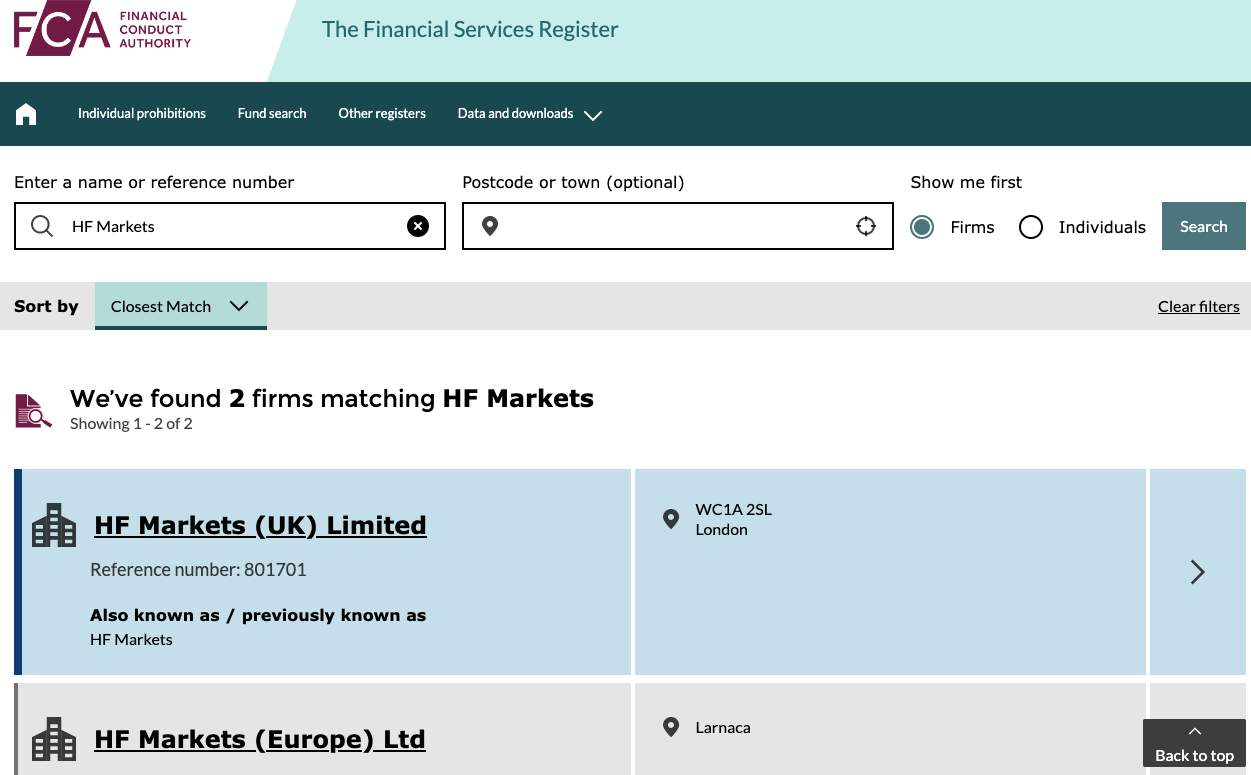

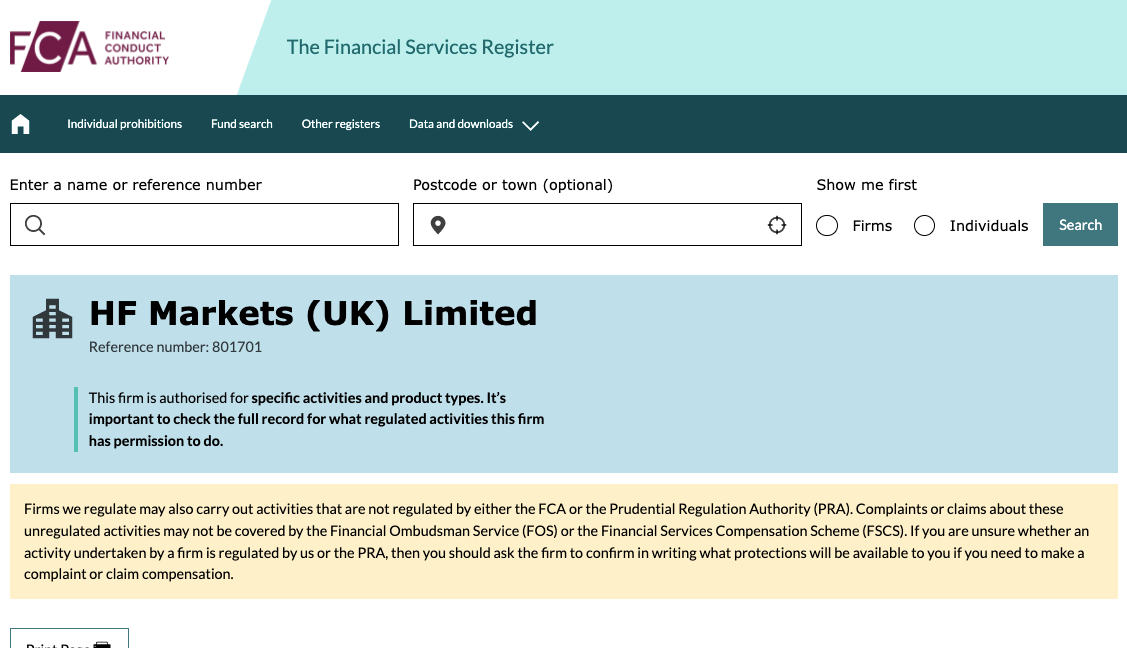

After confirming your broker’s regulation, you can then proceed to verify the license. Here is an example with HF Markets’ FCA license.

1) Go to the FCA Register.

2) Check for the presence of the firm on the FCA register.

3) Click the name of the broker for more details.

4) From the image, you can see HF Markets’ registered name and reference number. For final verification, compare the reference number on the FCA register with the one on HF Markets (UK) website. If the numbers match, then the license is valid.

2. Is the Trading Fees Low?

You should also look into the overall trading fees, which include the spreads, commission charged by your broker. Extremely high fee can eat deeply into one’s funds and profits.

Some brokers also charge for inactive trading accounts between 3-6 months.

We break down the fees charged by forex brokers in Tanzania into 2 components:

a. Trading Fees: These are the fees that you will have to pay for actual trading. It includes the spread and commissions per lot.

Depending on your Account type, you may be charged commissions. For example, if you are trading via Premium Account at HF Markets, there are no extra commissions per lot. The only fee you will be charged is the variable spread. This depends on the instrument that you are trading.

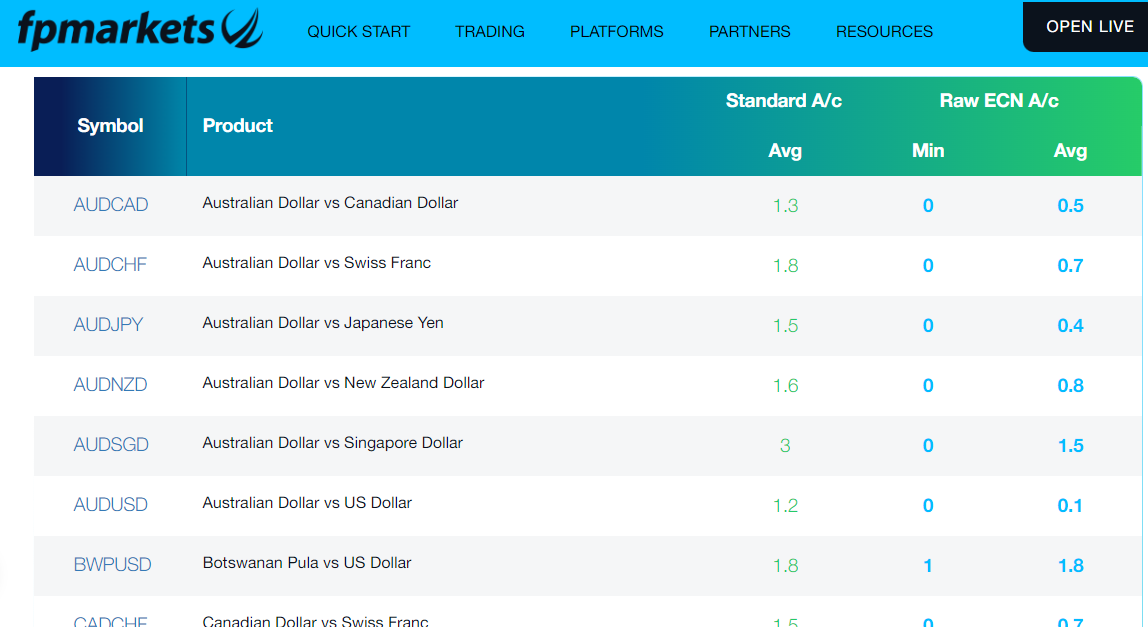

For example, on average, FP Markets charges 1.1 pips spread for majors like EUR/USD with their Standard Account type. But FP Markets also has a Raw Account type, with which you pay much lower spreads, but there is an extra commission of $3/lot for currency pairs.

Here is an example of the spread for some currency pairs at FP Markets with their various account types.

Understanding pricing structure help you choose the best account for you. Do you want a low spread account with commissions or a high spread account with zero commissions?

b. Non-Trading Charges: These include other charges like withdrawal fees and inactivity fees. Some brokers can charge a lot of money with these fees. Some brokers do not charge for them at all. The ideal broker is one with low charges for these fees.

If a forex broker does not charge them at all, it is even better.

3. Number of Instruments

Before making a deposit to your broker, you need to know the number of instruments available for you to trade. As usual, you should go through the broker’s instrument page to see what they are offering you. Currency pairs, CFDs, indices, and commodities are important instruments for a broker to have.

Check the exact number of asset classes being offered & the total trading fees (spread, commission & swap fees) for each instruments under every asset class. For example, if you want to mainly trade major currencies like EUR/USD, GBP/USD etc. then you should look at the fees for these exact instruments.

To check, you should visit the broker’s website & see the instruments page. Generally, you will find under sections like ‘markets’. FP Markets for example mention their asset classes under this section & you can check every asset class like this.

Here is a table showing spreads of certain classes of CFDs on HF Markets’ website.

4. Choice of trading platforms

Metatrader 4 (MT4) and Metatrader 5 (MT5) are the most popular trading platforms. Not all brokers have them though. What you want to pay attention to here are platform-specific features.

Some brokers have more instruments on their MT4 platform than MT5 like HF Markets. There could even be differences in swaps and commissions across the two platforms. So make sure to look this up on the broker’s website.

The availability of copy trading is another important thing to check. You will find this on the broker’s website if it is available. For example, AvaTrade has AvaSocial and HF Markets have HF Copy.

Many forex brokers also support more third-party trading platforms like TradingView, and cTrader. FP Markets recently added TradingView to their list of platforms

(FP Markets TradingView)

Furthermore, some forex brokers also have their proprietary forex trading platforms. These platforms are developed by the company for the company. Traders hardly use these platforms for varying reasons.

However, brokers have greatly improved their platforms over the years with good trading conditions that may or may not be available on their third-party platforms.

5. Customer Support

Brokers should always have a reliable support system as traders will always have complaints and problems. This system should be fast as in some cases, money is on the line.

One way for traders to know the effectiveness of the broker’s support system is by trying them before registering. Test the live chat, send an email to the customer support. This lets you have a feel of how effective your broker’s support will be.

6. Other trading conditions

a. Order types: Varying order types help give you options in the market. Limit and stop orders can come in handy in entering the market at the right time and price. Your chosen broker must have these orders available on their platform.

Guaranteed stop-loss orders close your trades at specified prices. This order is executed regardless of market conditions. It is important your broker has this service in place because it is key for risk management. In addition, GSLOs are not free. So check with your broker to know if they have it, and much they charge for it.

b. Negative balance protection: Without negative balance protection, you can lose more than the funds in your trading account. There is no local regulatory body that mandates forex brokers to offer negative balance protection in Tanzania. However, if the broker is regulated by African regulators like the FSCA (South Africa) and CMA (Kenya), they likely offer it.

You can even confirm with your broker if they provide negative balance protection. By contacting their support, you can verify. However, some brokers have FAQs on their websites. You can use it to verify if they have this risk management tool without waiting for an email or live chat response.

Here is an example on FP Markets website

c. Deposit/Withdrawals: Quick processing, multiple deposit/withdrawal methods, and low charges are the factors to keep a close eye on here. You should also be able to deposit and withdraw through your local bank. Most forex brokers do not charge extra fees for deposits/withdrawals. However, you can incur charges from your bank or e-wallet providers. Your broker does not receive any of these fees.

Summarily, what you want here is a broker with fast processing with little to no fees. Here is a screenshot of FBS deposit/withdrawal methods for Tanzania.

As you can see, FBS combines low fees, multiple local payment methods, and quick processing for deposits. Withdrawals can take 15-20 minutes which is quick compared to other brokers.

Another factor you might want to consider here is minimum withdrawals. This is not common but you should speak with your broker’s support to know if they have minimum withdrawals.

d. Education: Education is key. A forex broker should be friendly to beginners. Structured online courses, webinars, articles, and free research tools a forex broker should offer.

These should be offered free of charge without extra costs.

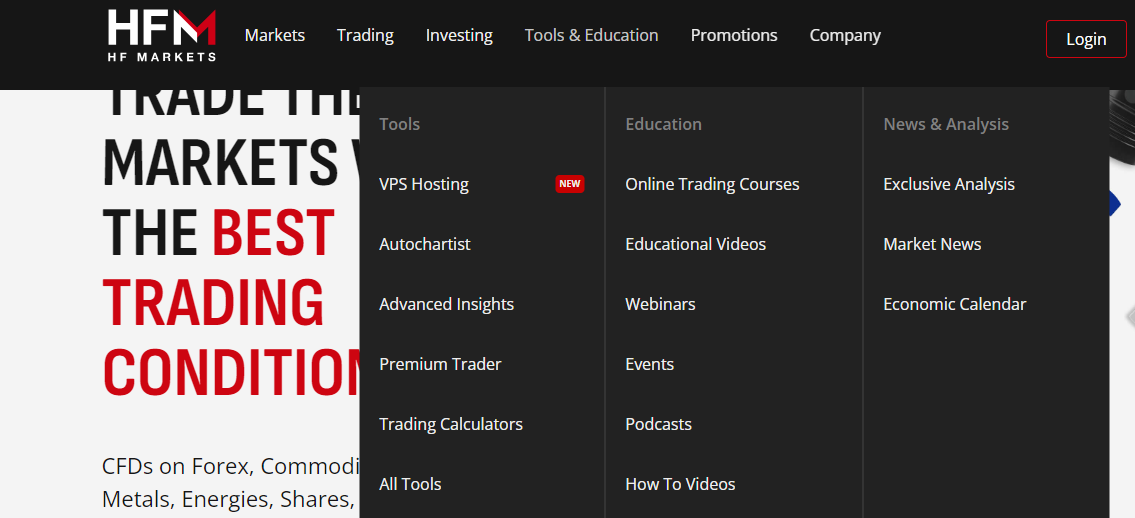

Finding a broker’s education is easy. It is usually on their homepage. With few clicks, you can access quality courses for your learning. Let us show you how you can do this (HF Markets is our example). On HF Market’s homepage, click on ‘Tools & Education’. Here is an illustration below.

From the image, you can see that HF Markets has webinars, podcasts, courses etc. You can use any of these tools to expand your knowledge about forex and CFD trading.

Is forex trading legal in Tanzania?

Yes, forex trading is legal in Tanzania. There are no locally regulated in Tanzania. However, forex traders can trade CFDs through tier-1 brokers that accept traders based in Tanzania.

Who is a forex broker?

A Forex broker, also known as a foreign exchange broker or FX broker, acts as a middleman between you and the massive, global market for trading currencies.

Here’s what they do:

They provide access to the Forex market:

Think of them as your gateway to buying and selling different currencies.

They offer trading platforms where you can execute your trades and monitor currency prices.

They facilitate currency exchange:

You don’t directly interact with other traders. The broker matches your buy orders with sell orders from other clients or directly fulfills them (depending on the broker type).

They ensure smooth and secure transactions, eliminating the need to worry about counterparty risk.

They make money through fees:

They typically charge spreads (the difference between the buy and sell price of a currency pair) or commissions on your trades.

Do I need a broker for Forex Trading in Tanzania?

Yes, you need a forex broker to trade in the foreign exchange market. They act as an intermediary between you and the interbank market where currencies are actually traded.

Here’s why:

1) Access to the Market: Retail traders like you and me can’t directly access the interbank market.

Forex brokers have the licenses and relationships to do so, and they provide you with a platform to place your buy and sell orders. For example, on the backend, the access different providers to get the prices.

2) Order Execution: Your broker takes your order and finds a counterparty to match it with on the interbank market. They handle the execution of the trade, ensuring it’s done efficiently and at the best available price.

You can see this process play out on their forex trading platforms.

The brokers have access to liquidity providers, or a market maker may act as the counterparty themselves to your trades.

Let’s understand through an example. Let’s assume that you want to buy GBP/USD. First of all you need quote (Bid & Ask prices), which you can check on the broker’s platform. When you place a ‘market order’, the broker finds the fill for you by send it to their liquidity providers or directly acting as the counterparty.

All of this happens in real time within a few micro seconds. Without a forex broker, retail or professional traders cannot trade currencies directly.

What account types have the lowest fees?

Forex brokers have different account types. There are accounts that cater to retail traders and there are accounts for professional traders.

For retail traders, brokers have different names for their accounts. However, there are usually standard accounts. These accounts have high spreads with little or no commission. The next popular account is a trading account with raw spreads. The advantage of this account is that the spreads are low (almost zero).

Because the spreads are low, you will pay more in commission. So which account has the lowest fees? The truth is forex brokers will make money through trading fees. There is no way around that. It depends on your choice. Do you want a high spread/zero commission account or vice-versa.

You can also use a calculator to see your projected trading cost. There are forex brokers with trading calculator on their websites.

For professional traders, it is entirely different. You will hardly find the fees for professional accounts on your forex broker’s website. When you successfully open a professional account, you will have access to all the fee and other charges that come with it.

Please note that a Pro Account does not mean a professional trading account. There are many forex brokers who have retail accounts name Pro Account. Make sure you contact your broker for more details.

How much money do I need to begin forex trading?

There is no specific amount that applies to every trader or forex brokers. The minimum deposit for forex trading is a decentralized phenomenon. No regulatory body enforces minimum deposit. It all depends on how each broker wants to operate. This is the first factor.

Some brokers have trading accounts with no minimum deposit. There could also be accounts with low minimum deposits requirement like $5 (13,125 TZS). There are a few brokers with minimum deposits as high as $500 or more. So when it comes to the money you need to begin trading, your forex broker is a key factor.

The second factor is you. You need to consider your risk tolerance, trading goals, and financial state. How much are you willing to lose trading? How much is your gross monthly income? Why am I trading? These are pivotal questions you need to ask yourself. The answers to these questions will affect how much you put in your trading account.

How do you choose the amount to begin forex trading? A good consideration of the two factors above will help you make the right choice. After determining how much you are willing to risk in trading, then you need to choose your ideal broker.

If your risk tolerance is low, then you might have to choose brokers with zero minimum deposit account or low minimum deposit account like $5 (13,125 TZS)-$10 (26,250 TZS). Though this little money, you can trade more positions with it using leverage. However, you should note that you can lose all of your money with leveraged CFD trading.

Even if your risk tolerance is high or you have enough money to trade CFDs, we caution that you do not put too much money in CFD trading because it is very risky.

What are the most popular forex business models?

Not all forex brokers operate the same way. There might be few similarities in some things. But when it comes to business models, the differences are usually clear.

Here are the most common forex business models:

DD: DD means dealing desk brokers. They are also known as market makers. This means they are counterparties to your trades. In other words, they take the opposite side of your trading positions. DD brokers can have different pricing models, some are fixed spread brokers, while others have variable spreads.

Also, some market market maker brokers offer instant order execution, but there may be slippage if the price is moving fast.

NDD: NDD means non-dealing desk brokers. Unlike DD brokers, NDD brokers are mediators. They connect their clients to interbank markets. Instead of a dealing desk, your trades are sent straight to banks and liquidity providers.

The direct market access offered by NDD brokers prevents requoting because prices are updated in real time. NDD brokers are further divided into ECN and STP brokers.

Here is a breakdown of the two:

ECN: ECN means Electronic Communication Network. ECN brokers are a liquidity hub. They have different liquidity providers, banks , and hedge funds that are connected. Your trades are sent electronically into this hub. There is no price manipulation and every participant has access to the price feed.

STP: STP means Straight-Through-Processing. STP brokers route your trades directly to liquidity providers who act as counterparties to your trades. STP brokers also add a mark up to spreads received by liquidity providers. That is one of the ways they make their money.

What is the best trading platform for beginners in the Tanzania?

The issue of the best trading platform for beginners is a subjective matter. Forex traders differ in preference and opinions as to what they want in a trading platform.

However, some general criteria can help you if you are beginner. Here are some of them.

License: Your trading platform should be well regulated. There is no local regulatory oversight over forex brokers in Tanzania. So, it is advisable you choose a broker regulated with ASIC or FCA.

TZS-base Account: Choosing a trading platform with your local currency account is good. As a beginner, you want to avoid excess charges like conversion fees. If you want to go the conventional way, you can open a USD trading account. However, it is very difficult to find a broker with TZS as base currency.

Tanzania friendly payment methods: Bank wire transfers and debit cards should be supported. More payment options like Skrill, Neteller, and other e-wallets help lets you enjoy a degree of flexibility. E-wallets are not available everywhere especially if you prefer a certain company.

So, the bare minimum is payment via your Tanzanian bank and your debit card.

Diverse account types: A forex broker will likely have at least two trading accounts. There is usually a Standard Account and an ECN Account. Not all account types are suitable for beginners. A Standard Account might be a good place to start.

Free Demo account: Beginner traders need a demo account. An unlimited demo account that does not expire is preferable. This is helpful for practice of trading strategies. You are also able to trade objectively since there is no fear or greed to make money.

Properties of Common Forex Trading Accounts

You will find varying accounts with different forex brokers. Most of these accounts have a thing or two common to them.

This list is not executive by any means. However, you will find it helpful as you research forex brokers and choose a trading account.

1) Demo Account: The main property of this account is zero risk. You use virtual money on this account to practice trading and test your strategies. All forex brokers offer a demo account (whether for a limited or an unlimited period).

2) Islamic Account: The key attribute of this account is sharia-compliance. This ensures those of the Muslim faith can trade forex without violating the principles of Sharia Law in Islamic Finance. This account is usually swap-free.

3) Standard Accounts: Most Standard Accounts have a basic trading operation because the broker serves as a counterparty to your trade. The spreads for trading CFDs on this account is usually high but you will likely pay no commission.

4) ECN Accounts: ECN Accounts are for brokers looking for lower spread costs. The spread of CFDs on this account is tight but you will pay commissions as your trading fee. The commission can be as high as $3.5 per standard lot.

Note: The essence of this section is not necessarily about the names of the account. It is about the properties and that is what you should look out for. A forex broker might name their account a Pro Account but has ECN properties. So the properties of the account is superior to whatever the account is named.

When can I best trade forex in Tanzania?

The best time to trade forex is when there is high liquidity and trading volume. Here is a breakdown of when to trade forex in Tanzania:

London Session: This is the best time to trade pairs like GBP/USD, EUR/USD, and USD/GHS. Uganda’s time zone is on GMT+3 so the country is three hours ahead of London. This session runs from 11am to 7pm (Tanzanian local time). Pairs like GBP/USD and EUR/USD see massive price movement this period.

New York Session: The New York session runs from 4pm to 12 midnight (Tanzanian local time). The London session overlaps with the New York session for about 4 hours during this period. So, there is more liquidity in the market. It is the best time to take advantage of USD pairs.

FAQs on Best Forex Brokers in Tanzania

Is forex trading legal in Tanzania?

Yes, forex trading is legal in Tanzania and is regulated by the Capital Markets and Securities Authority.

Is Exness regulated in Tanzania?

Exness is not locally regulated in Tanzania. However, they are regulated with some African regulatory bodies

How to start forex trading in Tanzania?

Research brokers that accept Tanzanian traders, assess their trading conditions, and regulations, open a trading account and fund it.