Interactive brokers is a financial service provider that is operational in Singapore and regulated Monetary Authority of Singapore as well as other top-tier regulatory bodies like IIROC, and ASIC

In this article, we have carefully put together detail information about the basic things you should know about this broker before decided to trade with them.

Some of the things that have been discussed include; interactive brokers products, account types, platforms, and regulation.

| Interactive Brokers Review Summary | |

|---|---|

| 🏢 Broker Name | Interactive Brokers Singapore Pte Ltd |

| 📅 Establishment Date | 1977 |

| 🌐 Website | https://www.interactivebrokers.com/en/home.php |

| 🏢 Address | 8 Marina View, #40-02A Asia Square Tower 1, Singapore 018960 |

| 🏦 Minimum Deposit | $1 |

| ⚙️ Maximum Leverage | 1:2 |

| 📋 Regulation | MAS, CBH, FCA, IIROC, ASIC, SEC |

| 💻 Trading Platforms | IBKR, TWS |

| Visit Interactive Brokers | |

Interactive Broker Pros

- Spreads are low.

- Offers good research and educational materials

- Offers contemporary trading platform

- Wide variety of trading instruments

- Several technical indicators

- No commissions on stocks and ETFs

Interactive Broker Cons

- Account opening process is long and tedious

- Customer support is below average

- The user interface of the trading platforms are poor

Is Interactive Brokers a safe brokerage?

Yes, interactive brokers are safe in Singapore. Aside from being regulated by Singapore’s regulatory authority, they also have regulation from top-tier regulatory bodies.

1) Monetary Authority of Singapore (MAS): In Singapore, interactive brokers are regulated by the Monetary Authority of Singapore under the license number CMS100917.

2) Central Bank of Hungary: IB is registered and granted a license in central Europe by the Magyar Nemzeti Bank, the Central Bank of Hungary.

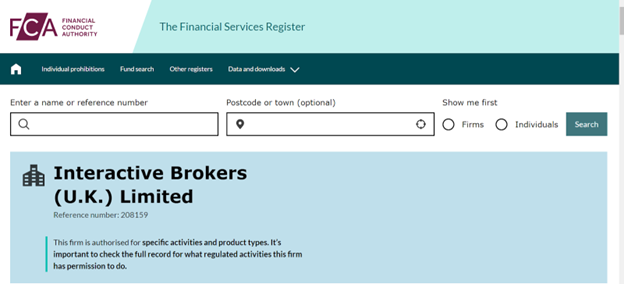

3) Financial Conduct Authority (FCA): The Financial Conduct Authority (FCA) oversees interactive brokers in the UK under license number 208159.

4) Investment Industry Regulatory Organization of Canada (IIROC): The Investment Industry Regulatory Organization of Canada oversees interactive brokers in Canada (IIROC).

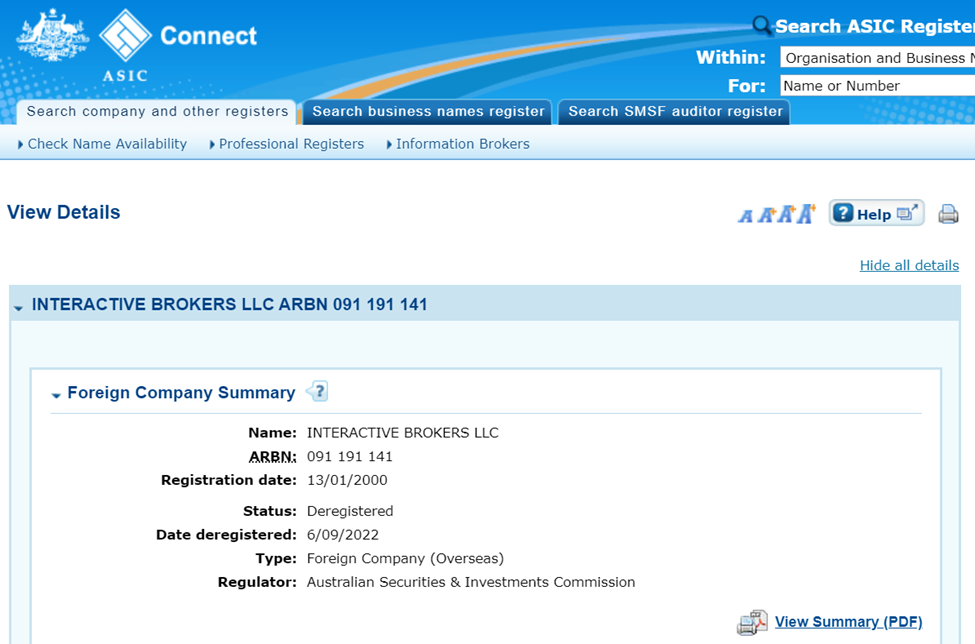

5) Australian Securities and Investment Commission (ASIC) IB is subject to Australian Securities and Investments Commission regulation under license number AFSL: 453554.

Interactive Brokers is also regulated by US SEC, CFTC and is one of the members of the Luxembourg Investor Compensation Scheme and the SIPC Compensation Scheme.

Notwithstanding, you should keep in mind that regulations is one out of other factors you need to consider when choosing a broker.

Interactive Brokers Accounts

Interactive brokers offer accounts to both individuals and institutions. There are two accounts for individuals and 11 for institutions. Here are the basic things to know about these accounts.

For Individuals

Individual, Joint or IRA and Family Advisors are the two accounts Interactive brokers have to offer you as an individual.

Individual, Joint or IRA

This includes three account types.

First, the individual account is for single account holders, the assets held in the account is believed to belong to the single account holder and he/she has access to all the functions and on the account.

However, with a power of attorney the single account holder can add additional users. Cash Reg T and portfolio margin are available on this account.

Second, the joint account is for two account holders and the assets held in the account is believed to be for the two account holders. Both accounts holders also have access to all the functions of the account and they can add additional users with a power of attorney. Cash Reg T and portfolio margin are available on this account.

Third, the Individual Retirement Account (IRA) is similar to the individual account, but it does not permit currency borrowing and cannot have a debit balance or short stock. It is noteworthy to add that withdrawals are only permitted to be in USD.

Family Advisors

This type of account is for an individual who is a family advisor. It has a master account linked to several client accounts, while the family manager can access all or some accounts and functions.

However, each client account is individually margined. Cash, Reg T and Portfolio Margin are available.

For Institutions

Interactive brokers have more account types for institutions than they have for individuals.

Registered Investment Advisors

This type of account is for Individual or Organization Registered Advisor. These target customers are people who manage clients’ wealth and administration.

The account has a master account linked to several Individual or organisation client accounts. The master account in this case is used for trade allocation and fee collection. However, each client account is individually margined.

Proprietary Trading Groups

The proprietary trading groups account is subdivided into the account types which includes; Pool and separate trading limit..

First, the pool account is for corporation, partnership, limited liability company or unincorporated legal structure. One or more users can be in control of this account.

The pool account is a single account where the assets in the account are owned by the entity account holder.

The separate trading limit account is also for corporation, partnership, limited liability company or unincorporated legal structure.

This account type consists of multiple accounts linked together in the name of a single entity. Each account can have its own trading strategy and limit.

Master users of the separate trading limit account may have access to all account and trading functions, while sub account users only have access to a single account.

Hedge Funds and VCCs

This type of account is managed by an investment manager(s). The investment manager(s) have access to the master account. Then, the master account is linked to multiple accounts.

Each fund account is owned by a separate legal entity and is managed and funded separately.

Introducing Brokers

The introducing brokers account is headed by a master account linked to an individual or organisation client account, and Proprietary Account for Broker-Dealers.

In the type of account, the broker is responsible for providing clients with marketing and customer service.

Brokers can also carry out trades for themselves using the Proprietary Account for Broker-Dealers.

Family Offices

Just like most of the accounts in the Interactive Brokers institution accounts, Family officer account is also managed by a master account that is linked to an individual or organisation client account.

Clients users of this account have some sort of access to view account statements, trade, and fund the account.

Compliance Officers

This type of account is for organisations that seek to monitor their employees’ trading activities. The compliance officer or user has access to the employees’ accounts and his/her sole purpose is to monitor trading.

Small Businesses

In this type of account, one or more user have access to manage a single account.

This account may be a Corporations, Partnerships, Limited Liability Companies, or Unincorporated Legal Structures account.

Money Managers

In this type of account, wealth managers or professional advisors take up the responsibility of

gathering clients’ assets, while money managers are responsible for executing trades on clients’ accounts.

However, money managers are not permitted to add new client accounts or set client fees, only professional advisors have such access.

Fund Administrators

The fund Administrators’ account is a single account linked to multiple accounts for the purpose of providing administrative functions and reports.

The fund Administrators do not have access to trading platforms and are not permitted to carry out trades.

Educators

The educators’ account helps high school teachers and even college lecturers to use real live trading experience to teach their students. This can replace some classworks.

This type of account has a student lab that is full to use. Each student is given a paper trading account that comes with all relevant trading tools.

Interactive Brokers Fees

When trading with an interactive broker, you expect both trading and non trading fees. These fees may vary from person to person depending on your account type, trading platform and the product you are trading.

Trading fees are fees that are directly related to opening a position, keeping an open position and closing a trade. It includes fees like spread and commission.

Spread

Spread is the difference between the cost at which you purchase a product from a broker and the cost at which the broker is willing to purchase the product back from you.

Interactive broker uses variable spread. This means that the spread for each product changes from time to time depending on the current market situation.

Commission

Brokers charge a commission for letting you use their trading platform. Interactive brokers also charge commission.

The commission you will be charged for trading on interactive brokers depends on the product you are trading. For options, commission ranges from $0.15 to $0.65 per contract. While for Event Contracts, commission is $0.10 per contract.

Trade-Related Fees

Some other trade related fees you have to deal with when trading with interactive brokers include;

- Cancel or modify orders

- Trade Bust/Adjustments

- Telephone orders closing positions

- Cancel/Modify Futures/Options Orders

Non-trading fees are fees that are not directly associated with trading.

Withdrawals & Physical Cash Deposits

Interactive brokers only permit one free withdrawal each month; any additional withdrawals will incur fees. For residents of Singapore, you will be charged 15.00 SGD for withdrawal.

Some other fees you will be charged include;

● Prime brokerage fees

● Stock Loan

● Corporate Actions & Dividend Processing

● Exposure fees for high-risk accounts

● Account maintenance and reporting fee

● Interactive BrokersDebit Mastercard®

Interactive Brokers Leverage

The maximum leverage you can trade with an interactive broker is 1:2. This means that you will have to deposit at least 50% of the trade volume into your margin account before you can open a position.

For example, to open a position of $100,000, you need to deposit $50,000 into your margin account and an interactive broker will loan the remaining $50,000 to you.

Please keep in mind that trading with leverage helps you open larger positions and in turn make more profit, but if the trade goes against you, you loss will also be more than it would have been if the trade was not leveraged.

Interactive Brokers Trading Platforms

Here are the basic things you should know about interactive brokers’ trading platforms.

IBKR GlobalTrader MOBILE

You can trade products from up to 90 different stock markets on IBKR GlobalTrader Mobile. The trading platform is available on both IOS and Android.

Interactive brokers prides over the fact that this trading platform is used by up to 2 million people across the globe

Client Portal WEB

This is a beginners friendly platform. It has an easy to use interface that makes it easy for even novice traders to navigate through the platform.

This trading platform comes with tools like advanced charting tools and Portfolio performance to mention but a few.

IBKR Mobile

The IBKR mobile trading platform is available on Android. It gives you access to trade assets from up to 150 markets across the world.

The platform gives you access to trading tools like option spread grid.

Trader Workstation (TWS) DESKTOP

This trading platform is for intermediate and advanced traders. TWS gives users access to tools like; market data, news, real-time monitoring tools, over 100 order types, etc as well as 150 markets across the world.

IBKR APIs DESKTOP

IBKR APIs is an interactive brokers’ proprietary, open-source API for advanced traders.

It gives you access to 150 markets across the world. You can even customize the app to suit your preferred look.

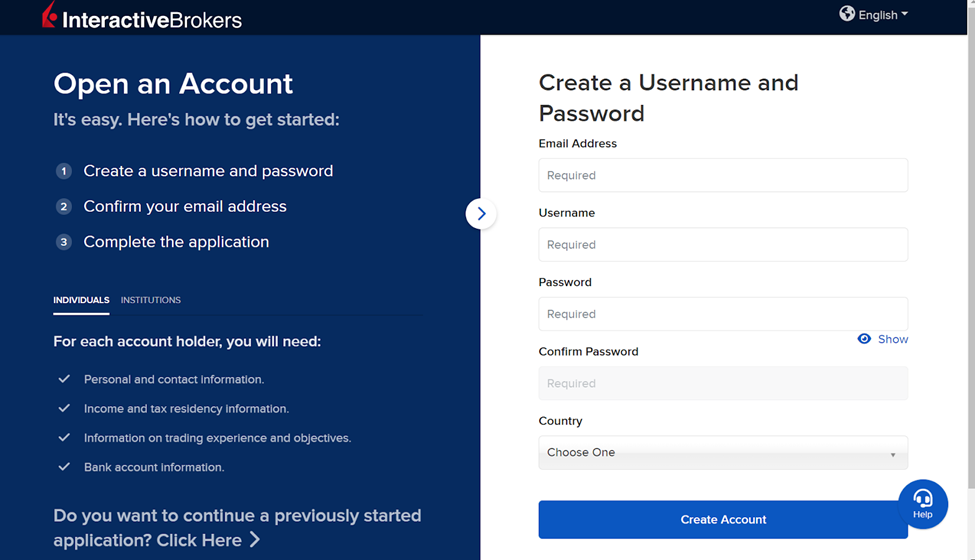

How to Open Interactive Brokers Account in Singapore?

Follow these steps to open a trading account on OANDA.

Opening an account with interactive brokers can be a stressful process. However, you will need to provide documents like your proof of identity and address, as well as your tax ID.

If you have all the required documents available, here are the steps you need to follow to open an account with interactive brokers:

- Visit IBKR’s official website

- Click on the red “Open an account” button at the top right corner of the website

- Full the short form that is displayed on your screen. Do ensure to provide accurate information

- A verification email will be sent to your phone

- Open the email and click on the link in the email to carry on with the account opening process

- Create a user name and password then follow the prompts to successfully complete the process

Interactive Brokers Trading Instruments

Interactive brokers gives you a variety of products to trade from, they include:

Stocks/ETFs

Users of interactive brokers have access to trade equities on more than 90 different stock exchanges worldwide. You do not have to worry about transaction fees for NFT programs for EFTs.

Options

Users of Interactive Broker have access to more than 30 market centers from which they can trade options.

Advanced options trading tools including option analytics, volatility lab, rollover option tools, option trader, probability lab, options strategy builders etc. are also available from this broker.

Futures/FOPs

From more than 30 market centers, you can trade Futures/FOPs on interactive brokers. The asset class for commodity futures when trading with this broker includes Equity Indices, Interest Rates, Currencies, Softs, Agriculture, Fixed Income, Energy, Metals, Volatility Indices, etc.

Event Contracts

Event contracts such as those for energy, commodities, foreign currency futures markets, and equity index are all available for trading on interactive brokers.

Spot Currencies

On Interactive Brokers, you may trade more than 100 currency pairs from 17 of the biggest Forex dealers in the world.

The spread when trading spot currencies starts at 0.1 pip. However, nn order to calculate the commission for a trading spot currencies the deal size is multiplied by 0.08 to 0.20 bps.

US Spot Gold

The minimum commission for trading IS Spot gold on interactive brokers is USD 2.00 per trade. It is noteworthy to add that you can trade with as small as one ounce of gold.

Bonds

When trading bonds on with interactive brokers, you have access to trade up to 1 million bonds including government and cooperate bond.

You can use the bond search option on the interactive brokers trading platforms to compare the available yields.

Mutual Fund

IBKR has no proprietary funds. However, On interactive brokers, you can trade more than 46,000 mutual funds, 18,000 or more of which are fee-free.

Hedge Fund

Through Interactive Brokers’ online hedge fund market, you can trade hedged funds. This hedge market allows you to view performance data for independent hedge funds, and private placement memorandum and subscription information.

When trading hedge funds on interactive brokers, you can use a secure, password-protected area on their website. This broker also give you the offer to directly contact a hedge fund or to request that a hedge fund contacts you.

Interactive Brokers Deposit and Withdrawal

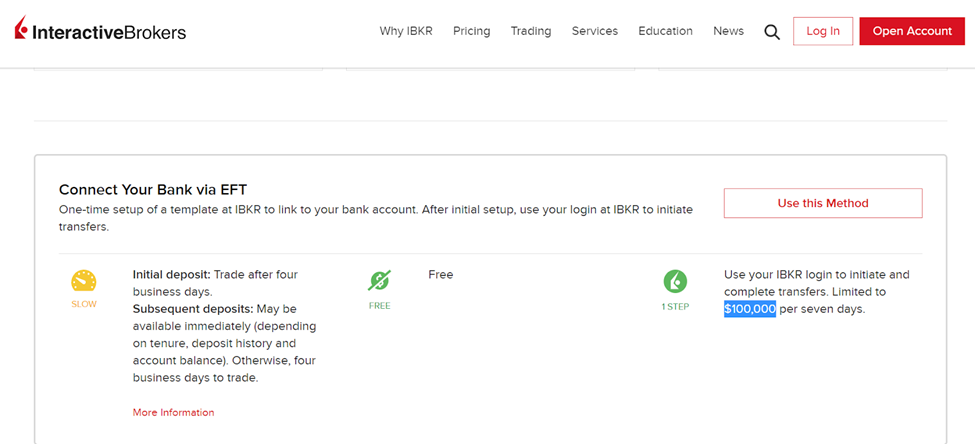

You can deposit and Withdrawal money using online bill pay, bank wire or electronic fund transfer. Here are some of the basic things to know about each of these methods

Bank Wire: deposit or withdrawal transactions using bank wire may cost you extra charges. These charges are not from interactive brokers, but from your bank. You should also know that bank wire transactions take up to one working day to be successful.

Online Bill Pay: this method of deposit and Withdrawal may also cost you some charges from the third party platforms. It can take up to six working days for the transaction to compete.

Electronic Fund Transfer: Transfer using EFT may take up to four working days to be completed.

Interactive Brokers Customer Service

You can contact interactive brokers’ customer service using either of the following methods;

Phone calls: Putting a call through to interactive brokers’ customer service is one of the fastest ways to reaching them. The customer service line is available for up to 24 hour every business day.

Email: Interactive Brokers may take up to 24hrs to respond to emails. As such, if you have an emergency, you may want to put a call through.

Interactive Brokers Research and Education

Interactive brokers offers its users access to advanced research tools like; InvestorAi Research Feed, and Billionaire’s Portfolios to mention but a few. However, not all these research tools are free to use.

You should also know that the Interactive Brokers’ official website has a news section were you can stay updated with recent happenings that may influence the market.

Interactive brokers have education tools for training novices, amateurs and even professionals. These training materials come in form of webinars, blog post, video trainings and even podcasts.

Do we Recommend Interactive Brokers Singapore?

Yes, interactive brokers is a recommended broker for traders in Singapore.

This is because this broker has been in existence since 1978 and has stood the test of time. We have brokers come and go, but interactive brokers have expanded its influence around the globe.

Another reason why interactive brokers are recommended for traders in Singapore is because they are regulated by a good number of top tier regulatory bodies. They also offer a variety of account types and platforms to trade with.

Notwithstanding, you may want to carry out further research about this broker and even use their demo account to see for yourself and ensure that their trading policies match your trading style.

Interactive Brokers Singapore FAQs

Is Interactive Brokers good Singapore?

Yes, interactive brokers is considered a good broker in Singapore. This is because they are regulated by the Monetary Authority of Singapore.

The company’s track record is another thing that speaks for them. Seeing that they have been busy to stay in business since 1977 is another reason why they are considered good.

Notwithstanding, ensure to carry out detailed reports for yourself before trading with interactive brokers.

How Long Does IBKR Withdrawal Take Singapore?

The duration of deposit or Withdrawal with interactive brokers in Singapore will depend on the methods of transaction.

For wire transfer 24 working hours is enough, but for a method like online bill pay, you may have to wait for up to six working days.

Note: Your capital is at risk