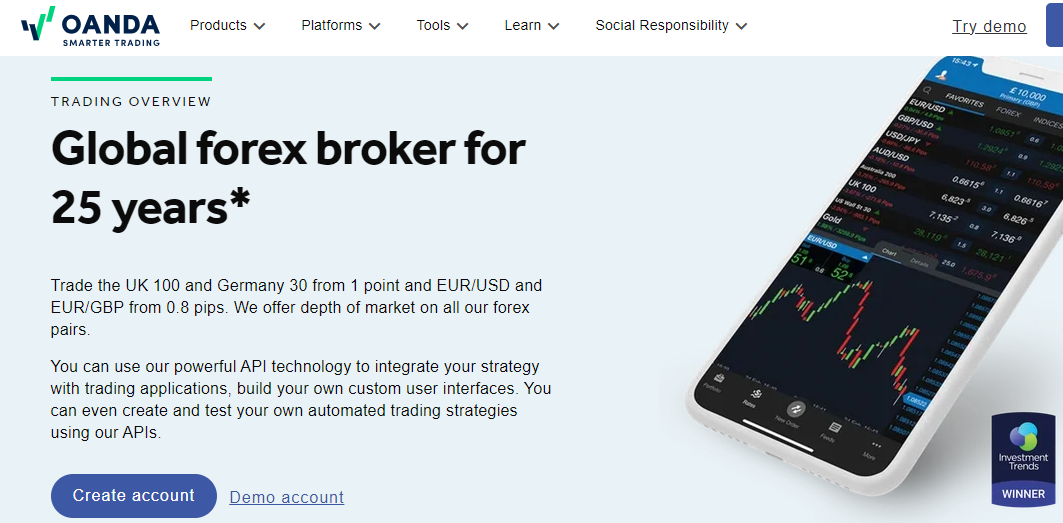

OANDA is a forex and CFD broker that offers trading services for forex (foreign exchange) currency pairs and CFDs indices, shares, metals, oil, cryptocurrencies and agricultural commodities.

OANDA was established in 1996 in the United States of America (USA), and the broker is licensed in multiple jurisdictions by top-tier financial regulators.

In our review of OANDA, we look at the trading conditions of the broker, fees, deposit/withdrawal options, available tradable instruments, supported trading platforms and customer support.

| OANDA Review Summary |

| 🏢 Broker Name |

OANDA Global Markets Ltd |

| 📅 Establishment Date |

1996 |

| 🌐 Website |

www.oanda.com |

| 🏢 Address |

OANDA Global Markets Ltd, Kingston Chambers, PO Box 173, Road Town, Tortola, British Virgin Islands |

| 🏦 Minimum Deposit |

$0 |

| ⚙️ Maximum Leverage |

1:200 |

| 📋 Regulation |

FSC BVI, ASIC, FCA, MAS, Malta FSA |

| 💻 Trading Platforms |

MT4, MT5 and OANDA Trader available on PC, Mac, Web, Android, & iOS |

|

Visit OANDA

|

OANDA Pros

- Regulated in multiple jurisdictions

- Offers 24/7 customer support

- Offers commission-free trading for all accounts

- No mandatory minimum deposit

]

- Offers free deposits and processes them quickly

OANDA Cons

- Has few tradable instruments

- Charges dormant account fees

- Charges currency conversion fees

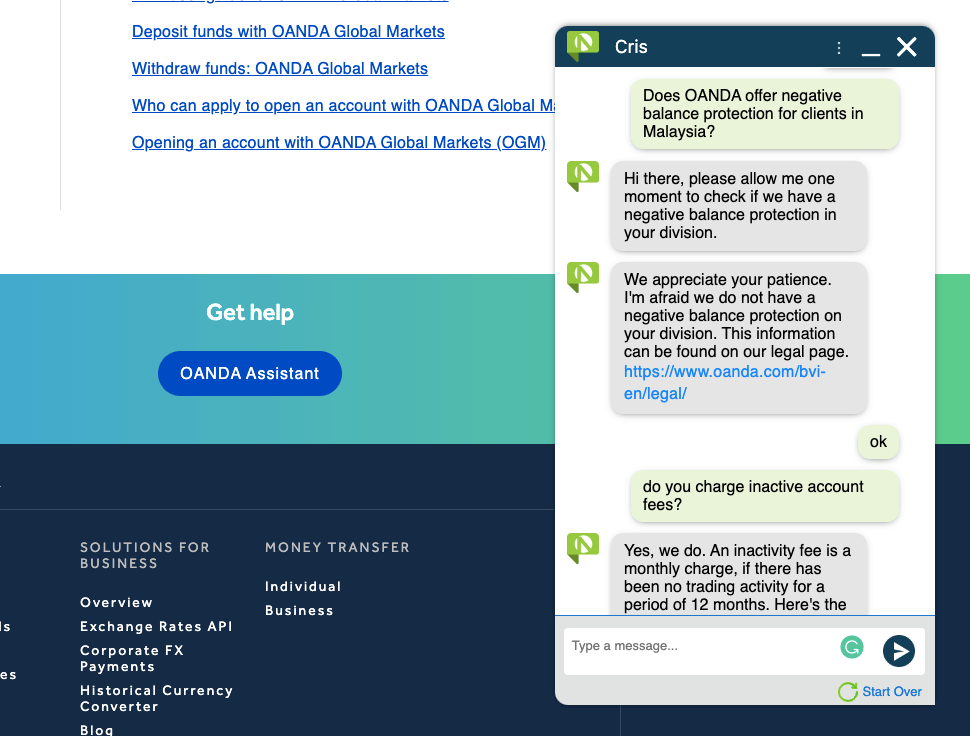

- Does not have negative balance protection

Is OANDA a good brokerage?

OANDA is a trading name of OANDA Corporation, which is incorporated in Delaware, USA. OANDA Corporation is registered with the Commodity Futures Trading Commission (CFTC) and National Futures Association in the USA.

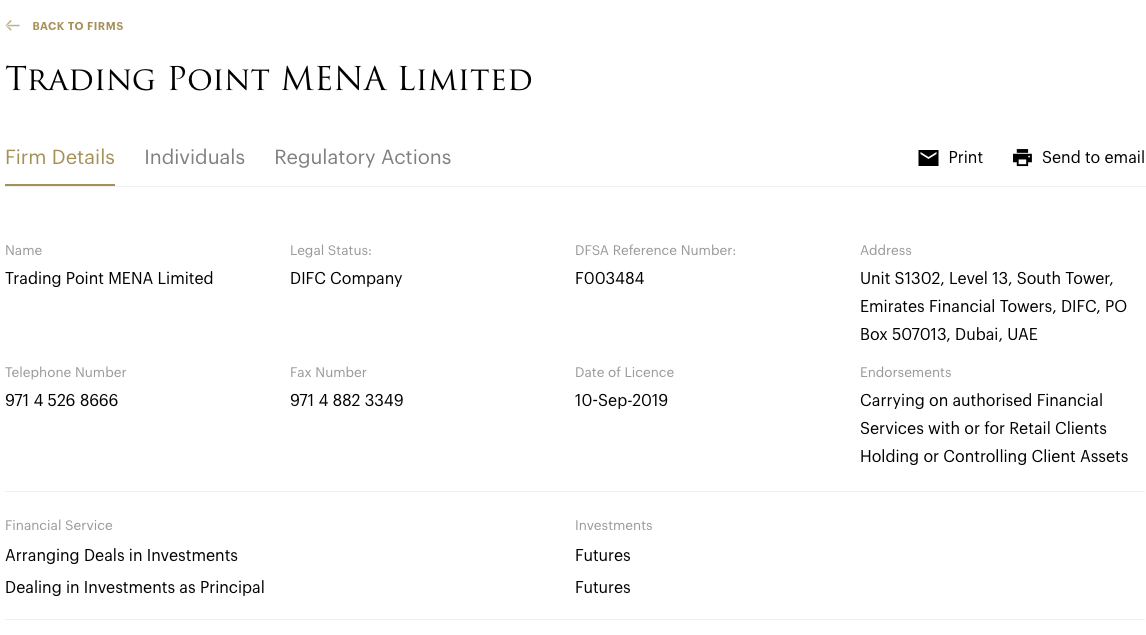

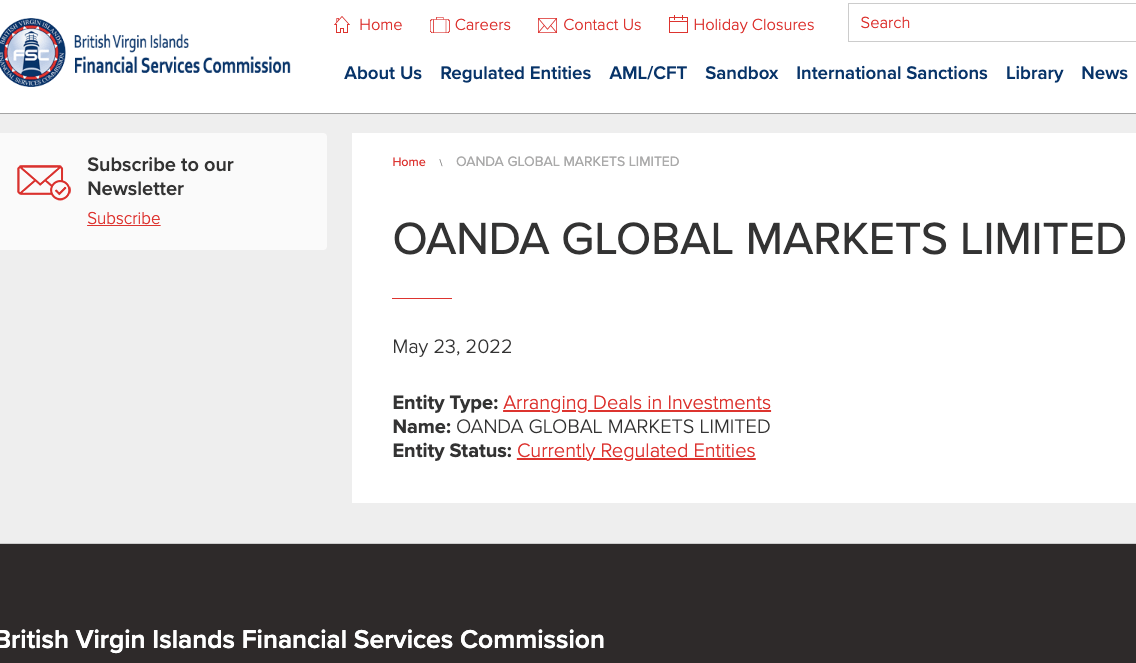

The broker is regulated by Tier-1 and Tier-2 financial regulators around the world under different names. Find some of the regulations of OANDA in various jurisdictions below:

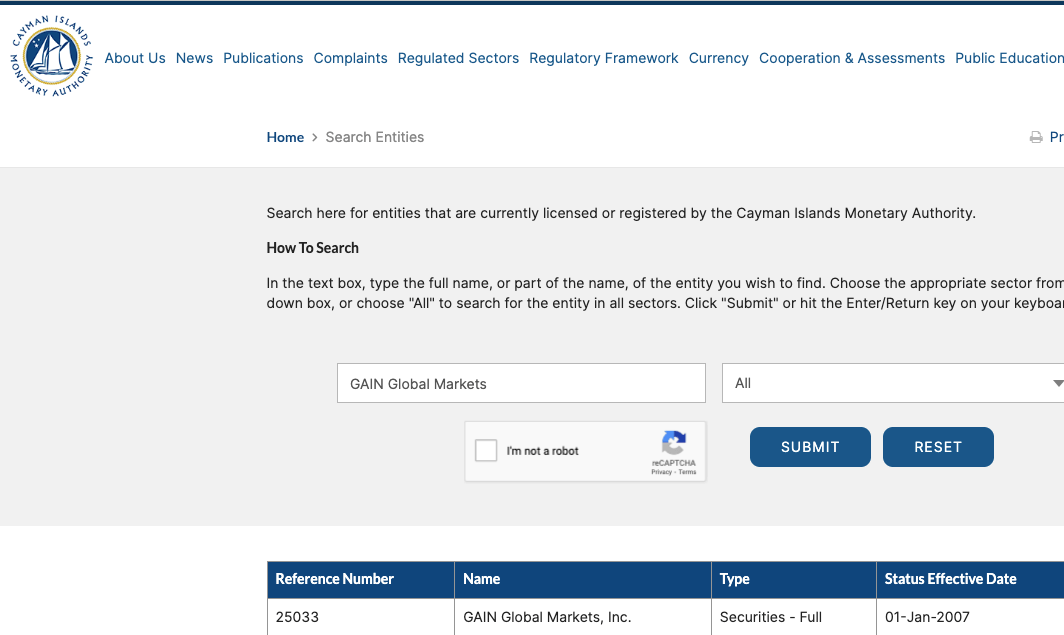

1) Financial Services Commission (FSC), British Virgin Islands: OANDA is registered in the British Virgins Islands as OANDA Global Markets Ltd and Regulated by the FSC with license number SIBA/L/20/1130. Traders from the Philippines are registered under this regulation.

Note that forex trading is not regulated in the Philippines and the broker is not licensed in the Philippines, this means that Philippine traders are trading at their own risk as the foreign regulations may not apply/cover you in the event of a dispute.

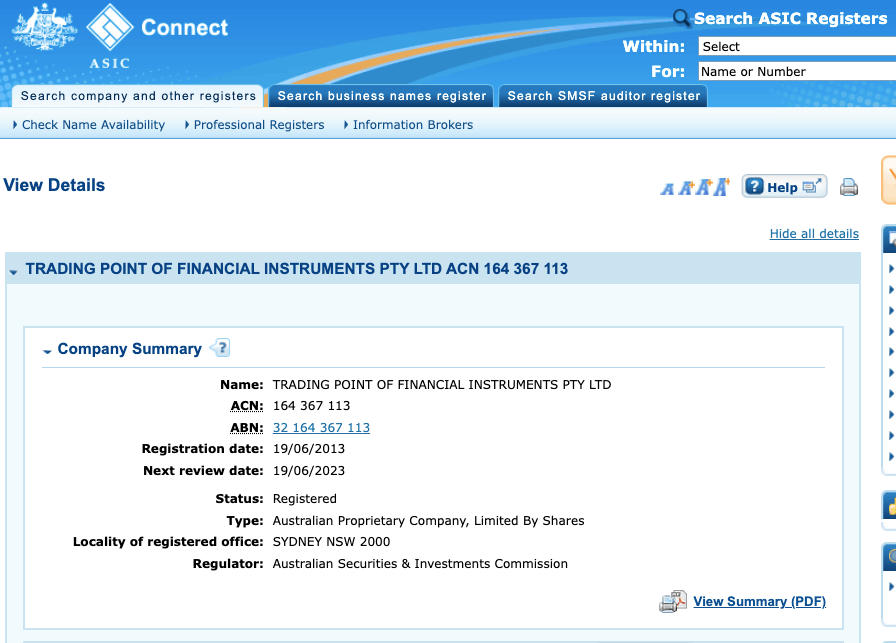

2) Australian Securities & Investment Commission (ASIC): OANDA is regulated in Australia by ASIC as OANDA Australia Pty Ltd and licensed to offer financial services with Australian Company Number (ACN) 152 088 349, issued in 2011.

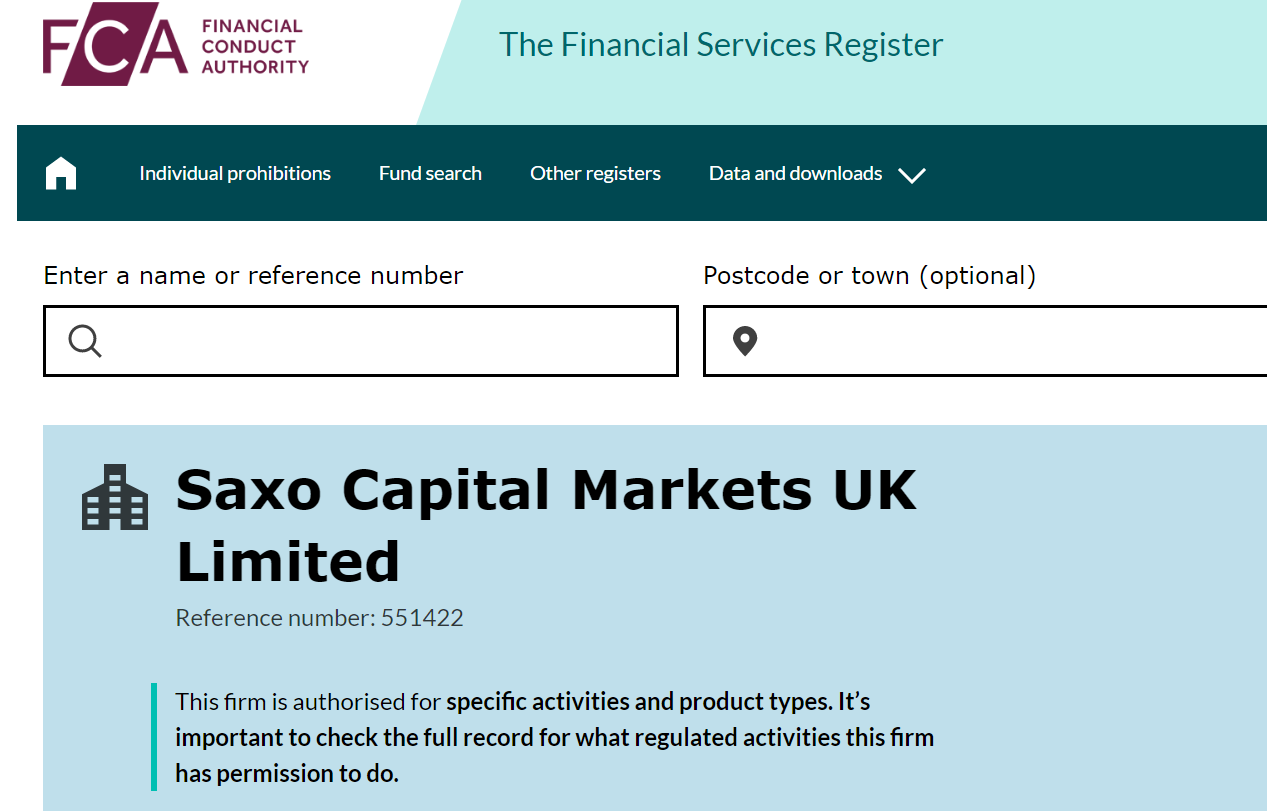

3) Financial Conduct Authority (FCA): OANDA is regulated in the UK by the FCA and authorised to offer financial services under the name ‘OANDA Europe Limited’ with reference number 542574, issued in 2011.

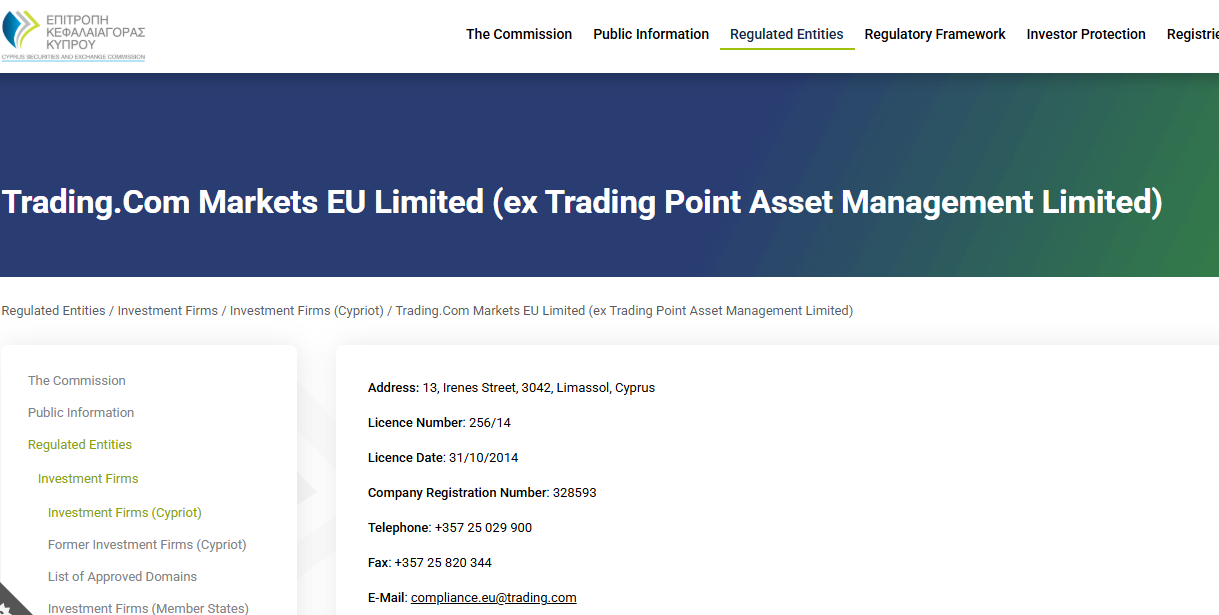

4) Malta Financial Services Authority (MFSA): OANDA is licensed in Europe as ‘OANDA Europe Markets Ltd’ by the FSA in Malta with registration C 95813, issued in 2020. OANDA serves residents of the EEA (European Economic Area) with this license.

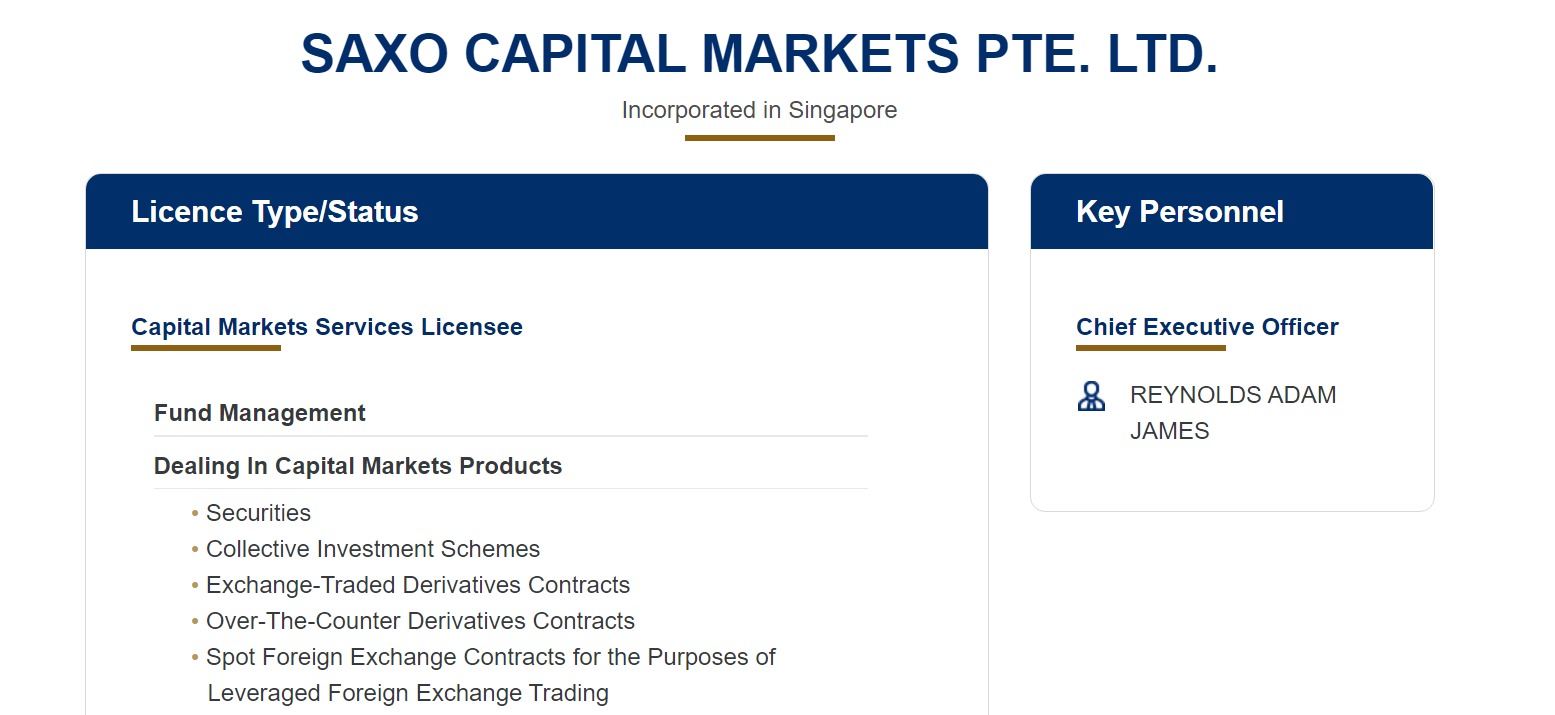

5) Monetary Authority of Singapore (MAS): OANDA is regulated in Asia by the Monetary Authority of Singapore as ‘OANDA Asia Pacific Pte Ltd’ and licensed to deal in capital market products.

| Client Country |

Protection |

Regulator |

Legal name |

| UK |

£85,000 |

Financial Conduct Authority (FCA) |

OANDA Europe Limited |

| Australia |

No Protection |

Australian Securities and Investments Commission (ASIC) |

OANDA Australia Pty Ltd |

| Canada |

$1,000,000 |

Canadian Investment Regulatory Organization (CIRO) |

OANDA (Canada) Corporation ULC |

| Malaysia |

No Protection |

Financial Services Commission (FSC), British Virgin Islands |

OANDA Global Markets Limited |

| Philippines |

No Protection |

Financial Services Commission (FSC), British Virgin Islands |

OANDA Global Markets Limited |

Leverage on OANDA depends on the instrument you are trading and the size of your trade. The maximum leverage on OANDA is 1:200, which means that you can open a trade position worth up to 200 times the value of your deposit.

For example, with a deposit of $1000, you can open a trade position worth up to $200,000 to increase your profit potential. Note that it also exposes you to more risk.

The maximum leverage of 1:200 is for forex majors, other instruments have lower leverage limits. Also, note that the leverage becomes lower as the size of your trade increases.

1:200 applies to trades under US$2 million, 1:100 applies to trade above US$2 million but under US$5 million, 1:20 applies trades between US$5 million and US$50 million. Trades above US$50 million have a leverage limit of 1:5.

Note that trading with leverage exposes your capital to risk and you can lose all your money. It is best to avoid trading CFDs unless you understand it. It is important not to use all the leverage as it increases your risk.

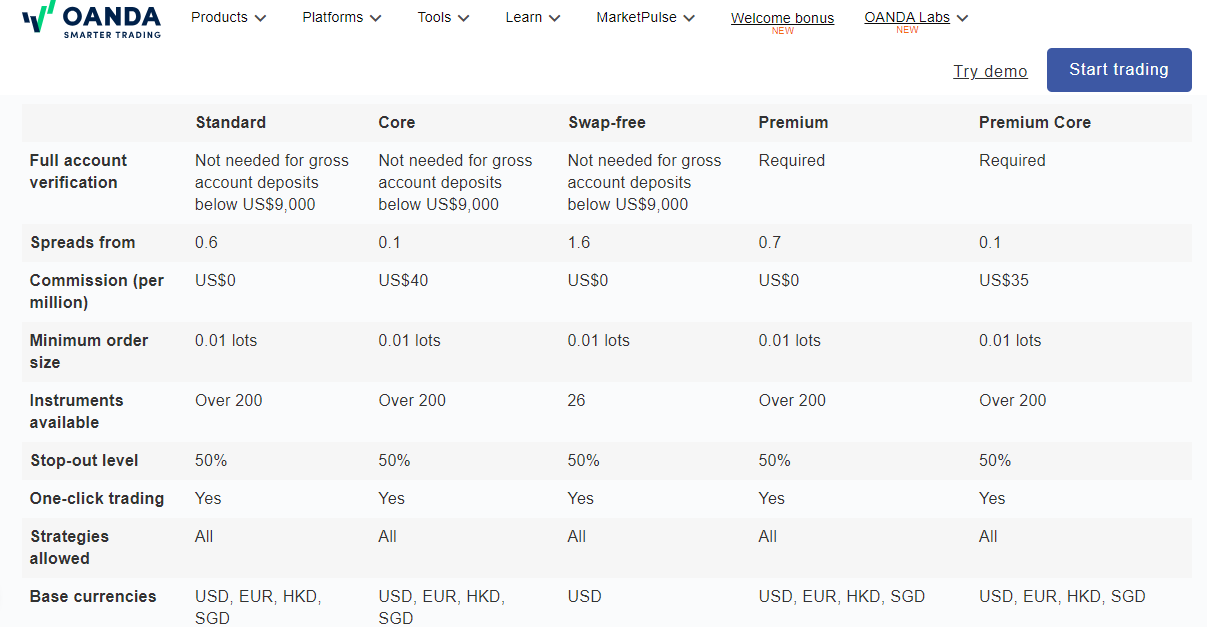

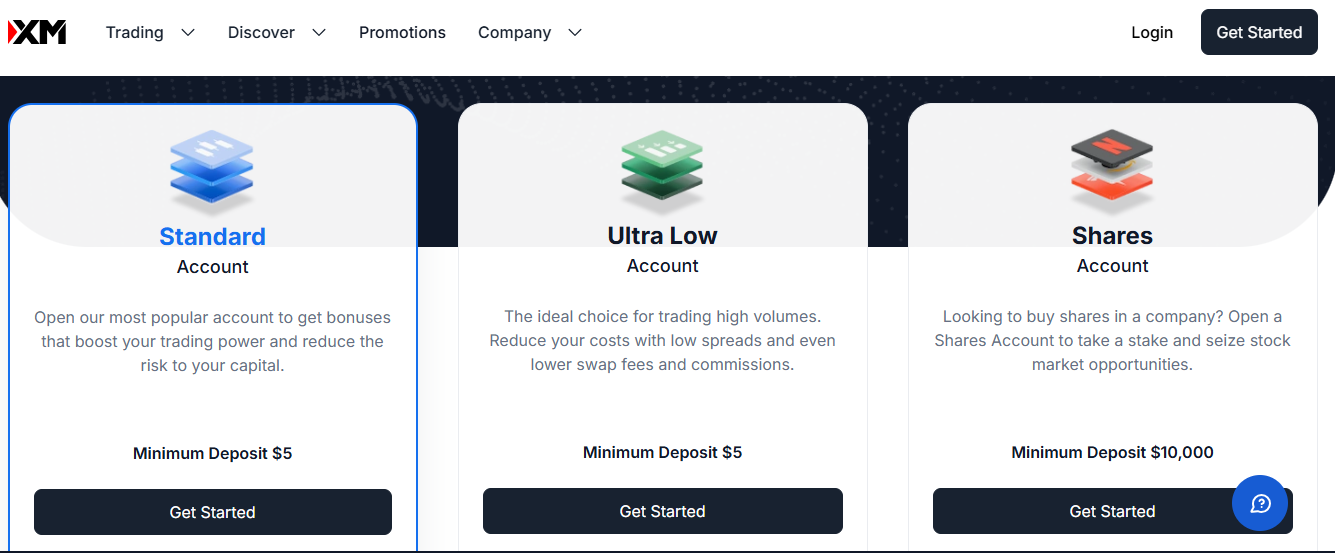

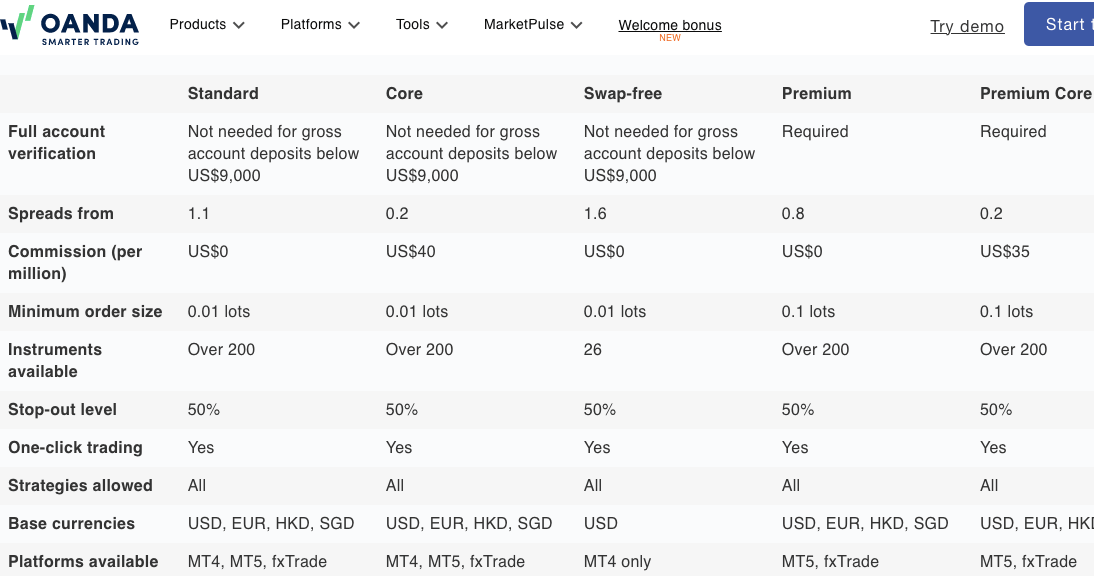

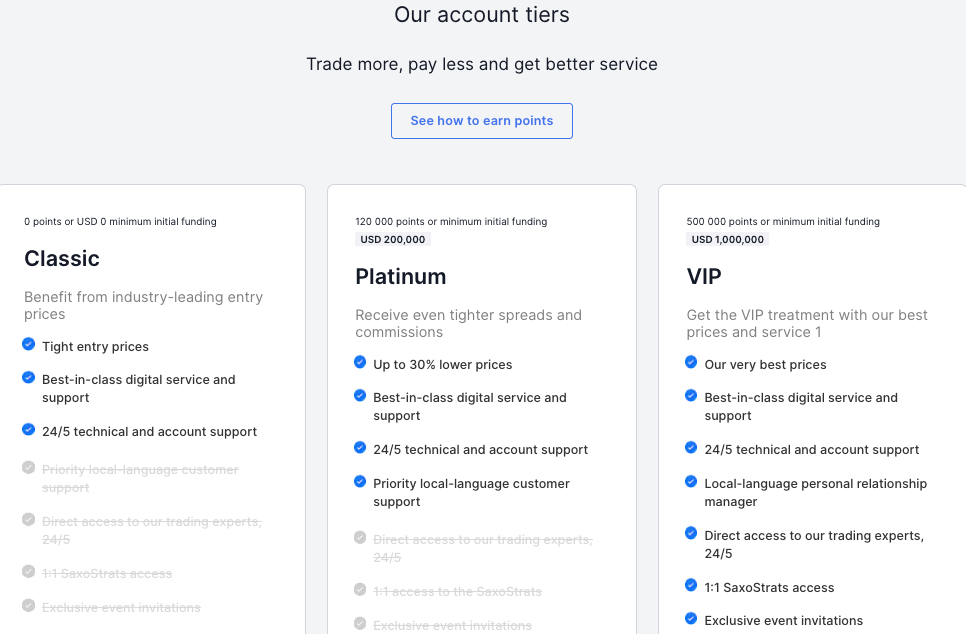

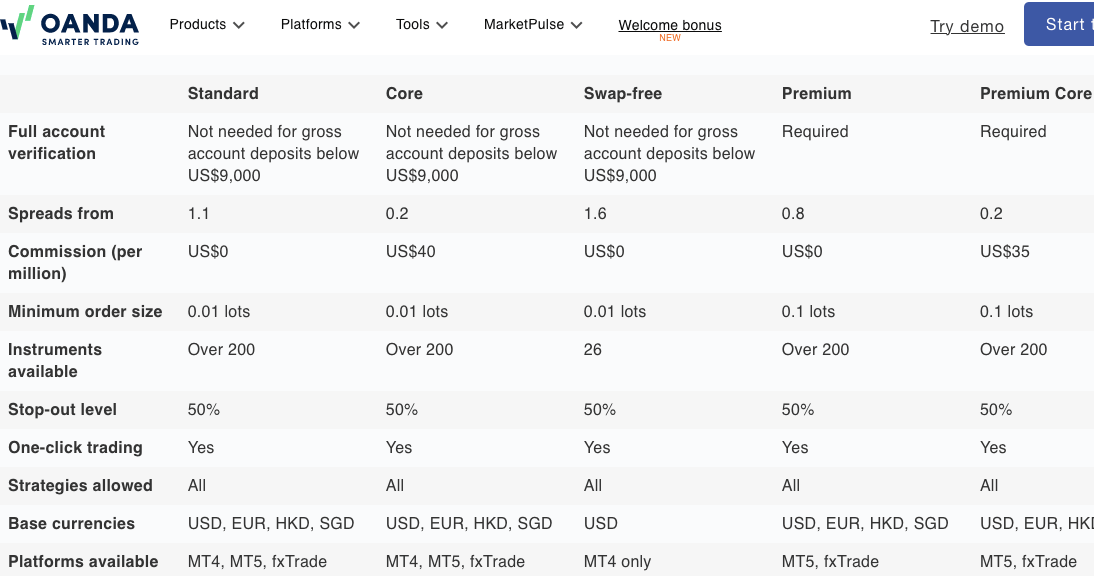

OANDA offers 5 account types for clients from the Philippines, depending on your trading experience level, the volume of your trades, and the fees you are comfortable paying.

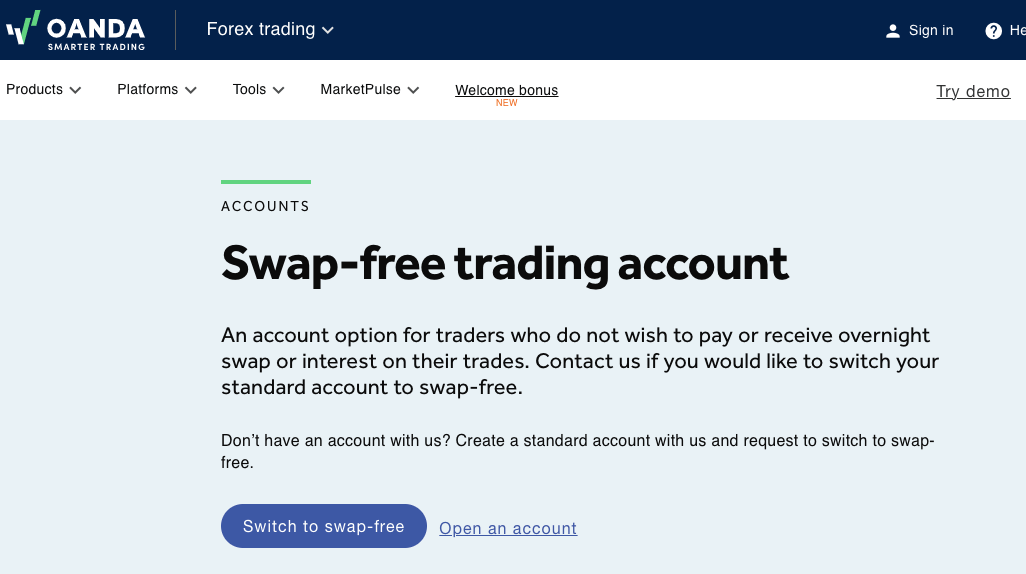

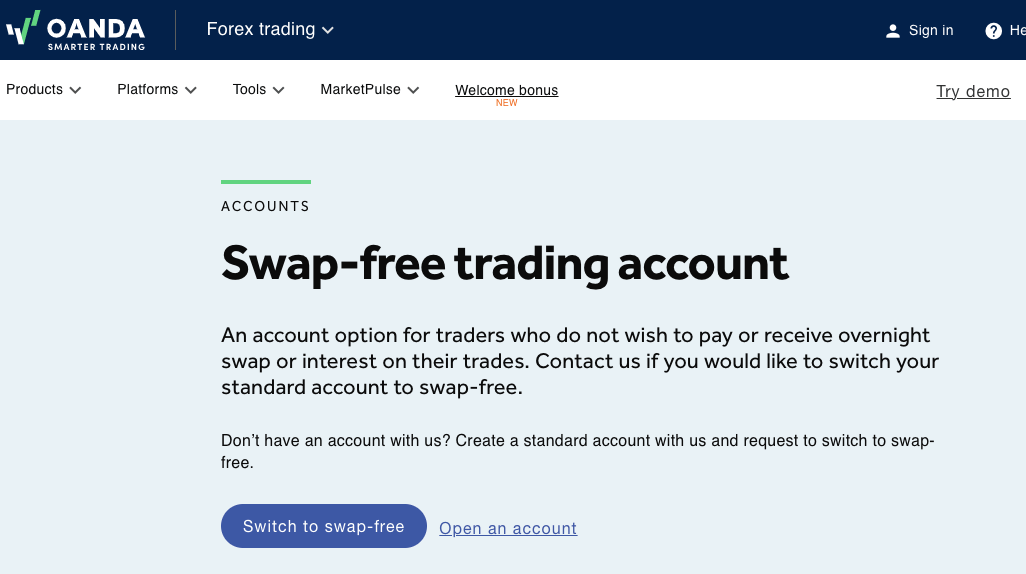

You can request an Islamic Account that is swap-free or open a demo account on OANDA to practice trading with virtual money before putting your real money.

You can open an account on OANDA as an individual, a partnership (joint account) or as a company (corporate account).

Find an overview of the account types on OANDA Philippines below:

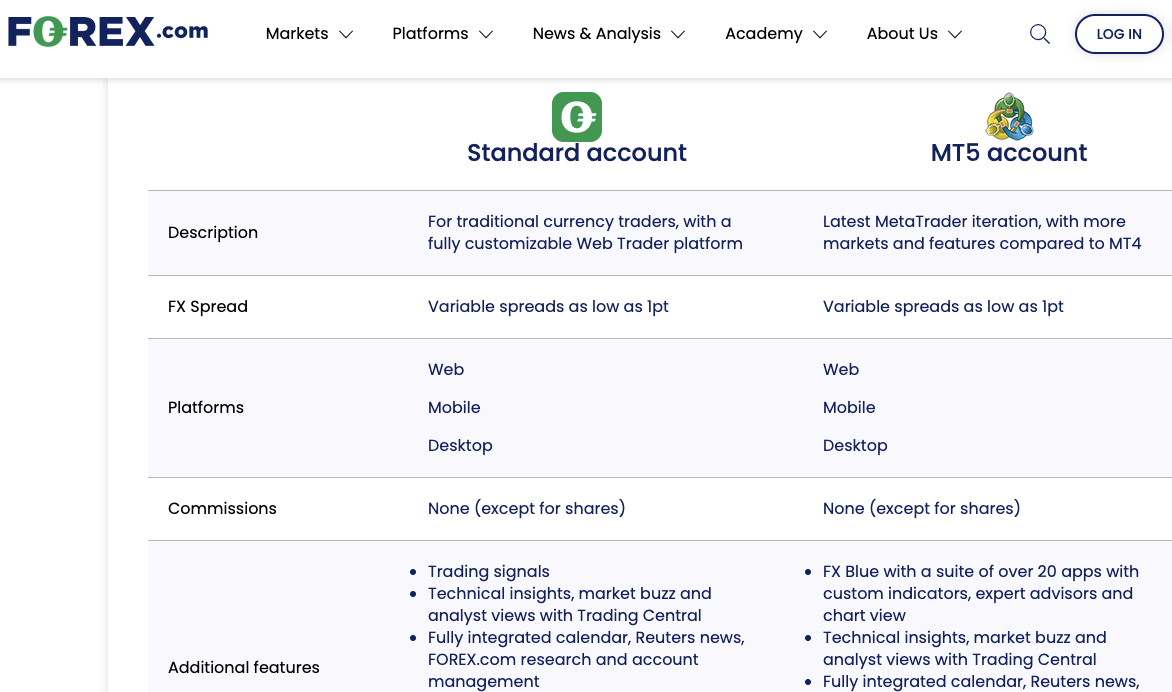

1) Standard Account: The OANDA Standard Account is designed for all categories of traders, both beginners and experts. The account can be accessed on the MT4, MT5 and OANDA trading platforms. With this account, you can trade Forex pairs, indices, shares, cryptocurrencies, agriculture commodities, oil, and metals.

Spreads for the Standard Account on OANDA start from 1.1 pips for major pairs like EURUSD, you pay zero commission fees for opening and closing trade positions but will incur swap fees whenever you keep a trade position open past the market’s closing time.

There is no mandatory minimum deposit with this account type, a minimum lot size of 0.01 is required with maximum leverage of 1:200.

The Standard Account does not require full account verification if your deposits are below US$9,000 (PHP 5,06,470).

2) Core Account: The OANDA Core Account is designed for traders with more experience, who want to use EAs (Expert Advisors), and trade frequently. You can operate this account on the MT4, MT5 and OANDA trading platforms and trade Forex pairs, indices, shares, cryptocurrencies, agriculture commodities, oil, and metals.

Spreads for the Core Account on OANDA start from 0.2 pip for major pairs like EURUSD, you pay commission fees of US$40 (PHP 2,250) per 1 million trade volume that you place. You will also incur swap fees whenever you keep a trade position open past the market’s closing time with this account.

There is no mandatory minimum deposit with this account type, a minimum trade lot size of 0.01 is required with maximum leverage of 1:200.

The Core Account does not require full account verification if your deposits are below US$9,000 (PHP 5,06,470).

3) Swap-free Account: The OANDA Swap-free Islamic Account is designed for Muslim traders who do not want to pay any interest on trade. The account can be accessed on the MT4 trading platform only. With this account, you can only trade 26 instruments, comprising some forex pairs and indices.

Spreads for the Swap-free Account on OANDA start from 1.6 pips for major pairs like EURUSD, you pay zero commission fees for opening and closing trade positions and will not incur any swap fees whenever you keep a trade position open past the market’s closing time during the grace period.

OANDA allows swap-free account holders a grace period of 5 days in which any trade kept open past market closing time does not incur swap fees. After the 5 days elapses, and a trade position is kept open past market closing time, you will incur a fixed admin fee of up to US$7 (PHP 393) per day.

There is no mandatory minimum deposit with this account type, a minimum lot size of 0.01 is required with maximum leverage of 1:200.

To get the OANDA Swap-free Account, you have to first open a Standard Account, and then contact the customer support team to convert your account to swap-free status.

This account also does not require full account verification if your deposits are below US$9,000 (PHP 5,06,470), and you can only have the USD as an account currency.

4) Premium Account: The OANDA Premium Account is a spread-only account designed for high-volume traders and can be accessed on the MT5 and OANDA trading platforms. With this account, you can trade Forex pairs, indices, shares, agriculture commodities, cryptocurrencies, oil, and metals.

This account is commission-free, spreads start from 0.8 pips for major pairs like EURUSD, and you pay swap fees whenever you keep a trade position open past the market’s closing time.

To get the Premium Account on OANDA, you must obtain full account verification, maintain an account balance of US$20,000 (PHP 11,25,610) and trade more than US$10 million (PHP 56,28,05,000) in notional value per month.

With the Premium Account, you are assigned a dedicated account manager, you have free deposits and withdrawals, and any bank charges are reimbursed. You also get priority support and a free VPN.

A minimum trade size of 0.01 lot is required with maximum leverage of 1:200.

5) Premium Core Account: The OANDA Premium Core Account is also designed for high-volume traders and can be accessed on the MT5 and OANDA trading platforms. With this account, you can trade Forex pairs, indices, shares, agriculture commodities, cryptocurrencies, oil, and metals.

This account charges commission fees of US$35 per 1 million trade volume you place, spreads start from 0.2 pips for major pairs like EURUSD, and you pay swap fees whenever you keep a trade position open past the market’s closing time.

To get the Premium Core Account on OANDA, you must obtain full account verification by submitting relevant documents like passport number and bank account statement, maintain an account balance of US$20,000 (PHP 11,25,610) and have a trade of more than US$10 million (PHP 56,28,05,000) in notional value per month.

With the Premium Account, you are assigned a dedicated account manager, you have free deposits and withdrawals, and any bank charges are reimbursed. You also get priority support and a free VPN.

A minimum trade size of 0.01 lot is also required with maximum leverage of 1:200.

OANDA Base Account Currency

Account base currencies available on OANDA are Euros – EUR, United States Dollars – USD, Honk Kong Dollar – HKD, and Singapore Dollar -SGD.

Upon signing up, you are assigned the USD and can change it. Although the Swap-free Account can only use the USD and is not allowed to change it.

Your deposits, trades, withdrawals, and fees are measured in your OANDA account currency.

OANDA charges different fees depending on the instrument you trade size and whether you are a retail or professional client. Here’s an overview of the broker’s trading and non-trading fees.

Trading fees

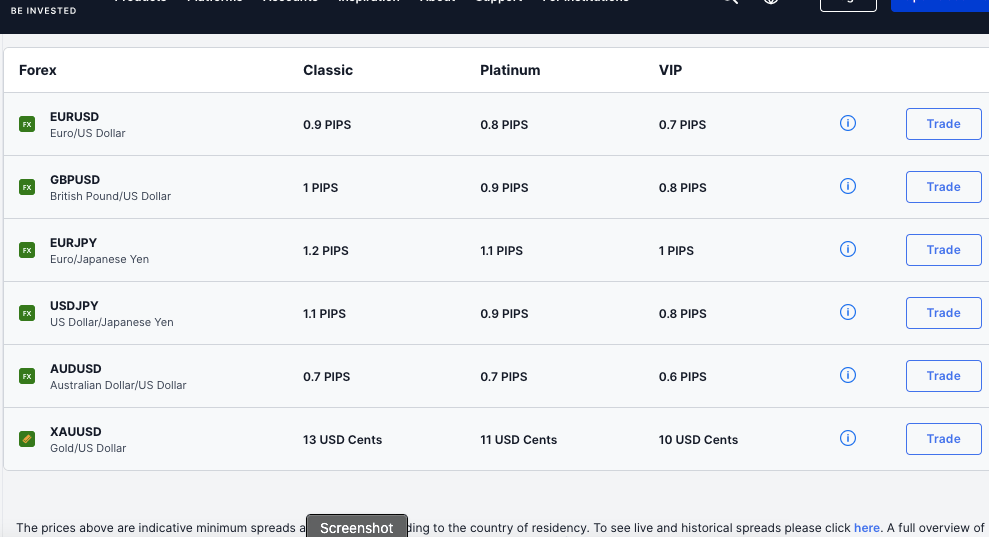

1) Spreads: When you trade a financial instrument on OANDA, the price you pay includes a markup that goes to the broker, the markup is called a spread. The spread is the difference between the bid and asks prices for a trade. The size of the spread depends on the instrument you are trading and your account type.

OANDA operates a variable spreads system, which means that the spreads will fluctuate during the day to reflect market movements. The minimum spread for majors like EURUSD is 1.1 pips for the Standard Account, but this changes as well.

2) Commission fees: OANDA offers commission-free trading in Philippines for Standard, Swap-free, and Premium Accounts which means that you do not pay any fees when you enter or exit a trade position. While Core and Premium Core Accounts pay a commission fee of US$35 and US$40 (PHP 2250) per 1 million trade volume.

3) Swap fees: If you open a trade position and yo do not close it before the closing time of the market, which is 5 PM ET, it will roll over to the next trading day, and you will be charged a rollover fee or overnight funding cost also called swap fees.

The fees will be added to your profit or loss when you eventually close the position. The fee is calculated based on the volume of your trade, the instrument you were trading, the leverage, and whether it was a long swap (buy) or a short swap (sell).

If your position was a long swap and the trade is successful, you gain swap interest, which is added to your profit.

Swap-free Accounts do not pay any swap fees for the grace period of 5 days, and they do not gain swap interests too.

4) Currency conversion fees: Whenever you trade a financial instrument that is not paired with the currency of your account, you incur currency conversion fees when you close the trade position.

For example, if your base account currency is USD, and you trade EUR/GBP, any profit or loss you make will be converted to your base account currency and charged a currency conversion fee because the pair you traded is not in the currency of your account.

The currency conversion fee on OANDA is 0.5% of the mid-point price at the time of conversion, applied to the profit or loss realized from the trade.

Here is the trading fess of some popular CFDs that OANDA provides.

| CFD |

Spread |

Commission |

Swap |

| GBP/USD |

1.0 |

None |

-$2.82(short), -$4.17 (long) |

| Brent Crude Oil |

3.0 |

None |

-$2.40(short), -$3.63(long) |

| US Nas 100 |

2.1 |

None |

$1.35(short),- $3.74(long) |

| Gold |

1.0 |

None |

-$1.38(short), -$0.25 (long) |

Swaps are subjected to change daily. Click here to check OANDA’s daily updated overnight charges

Non-trading fees

1) Deposit and Withdrawal fees: OANDA charges zero fees for deposits for all payment methods, which means you don’t pay any fees for depositing funds to your trading account on OANDA, although your payment processor may charge an independent fee.

OANDA offers free withdrawals to cards, e-wallets (Skrill & Neteller), and local bank transfers. In contrast, international bank transfers attract a fee of US$20 (PHP 1,125) per withdrawal.

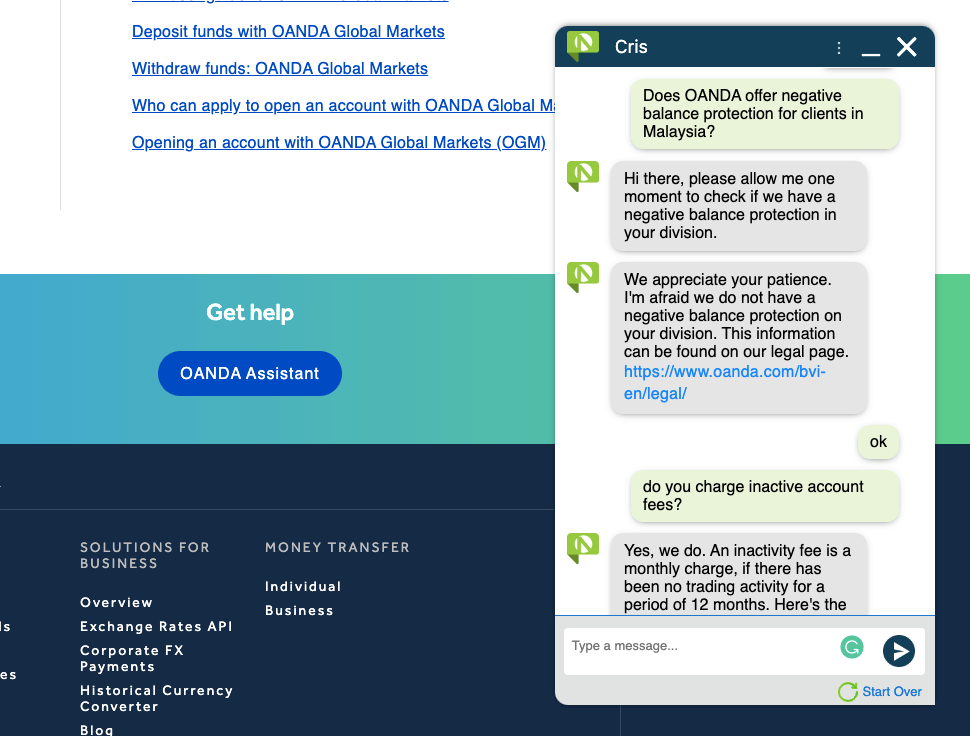

2) Account Inactivity charges: If you do not perform any trading activity on your account for 12 months, your account will be categorized as inactive and any funds in it will be charged US$10 (PHP 562) each month.

If you do not have any money in your account, you will not accrue a negative balance.

| Fee |

Amount |

| Inactivity fee |

$10 |

| Deposit fee |

None |

| Withdrawal fee |

None* |

*OANDA charges $20 per withdrawal transactions. Other withdrawal methods are free though you might be charged by your service provider.

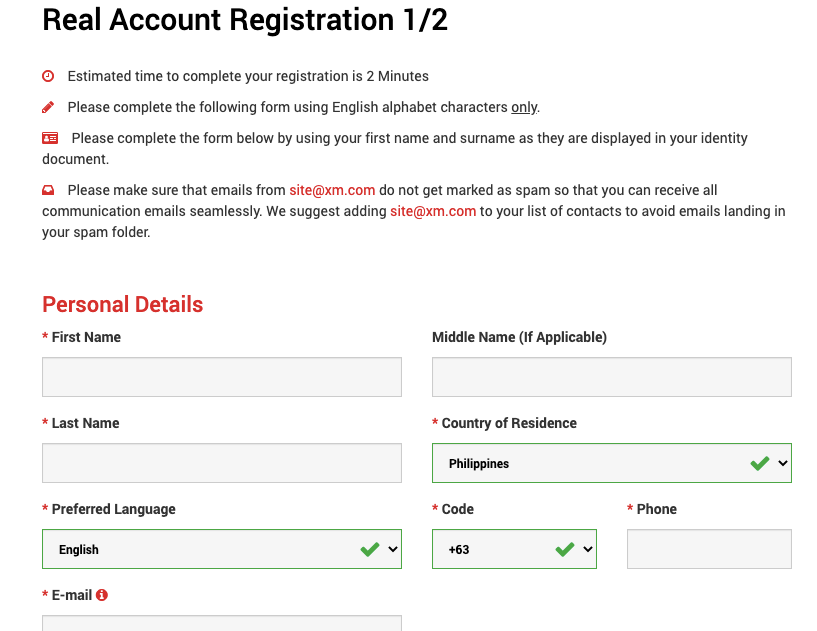

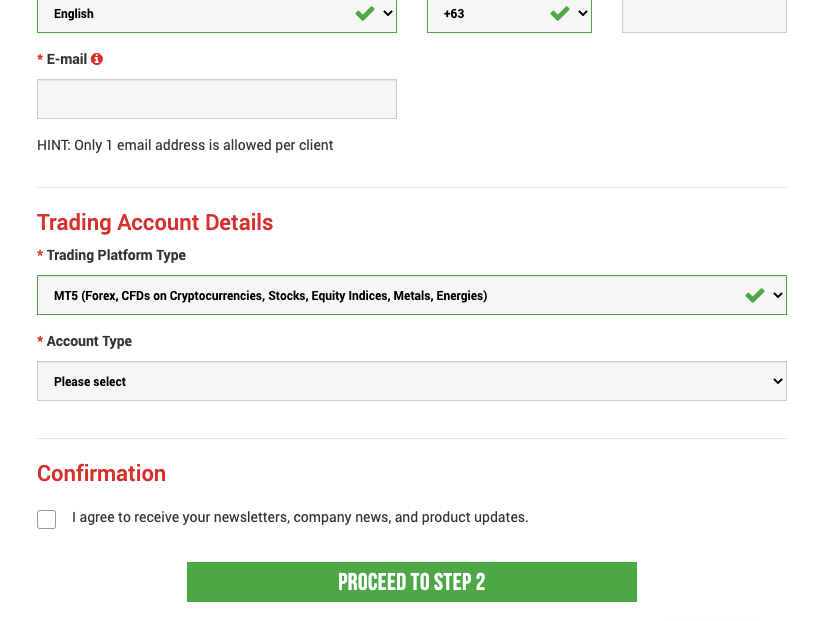

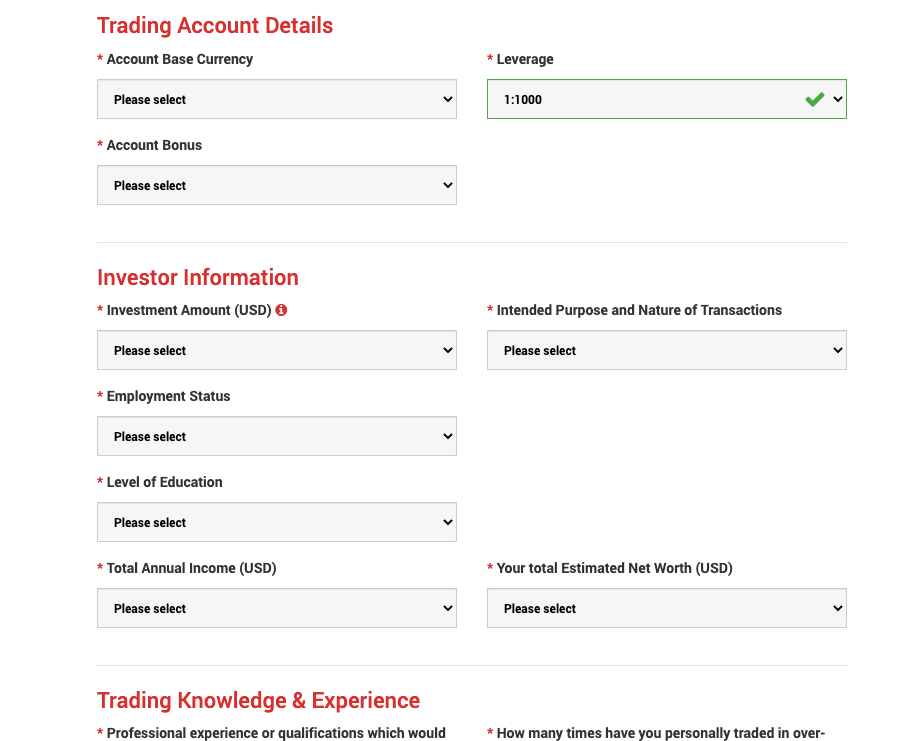

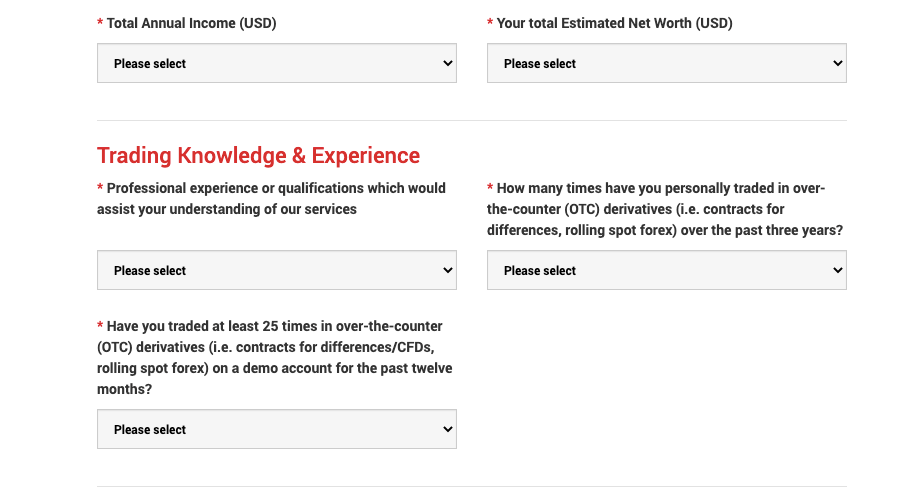

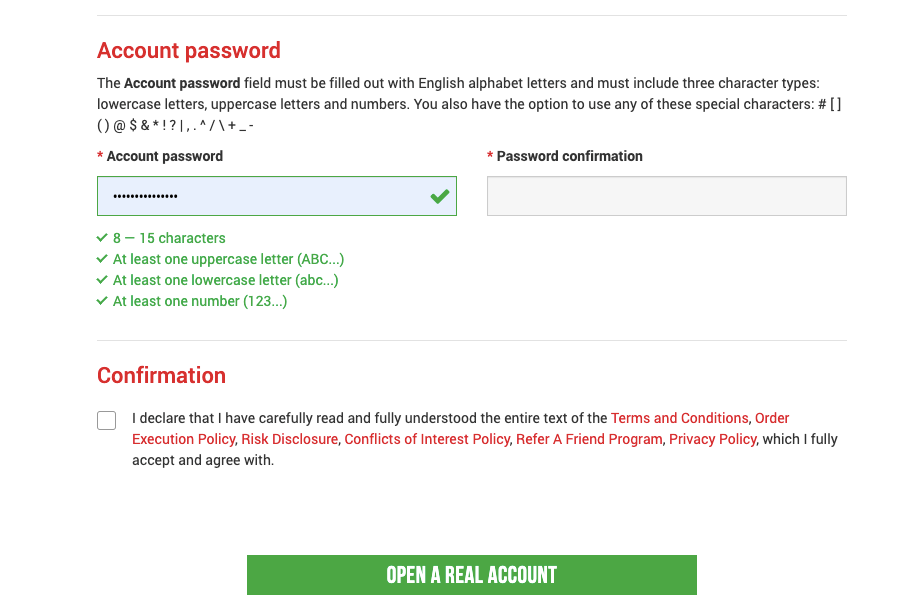

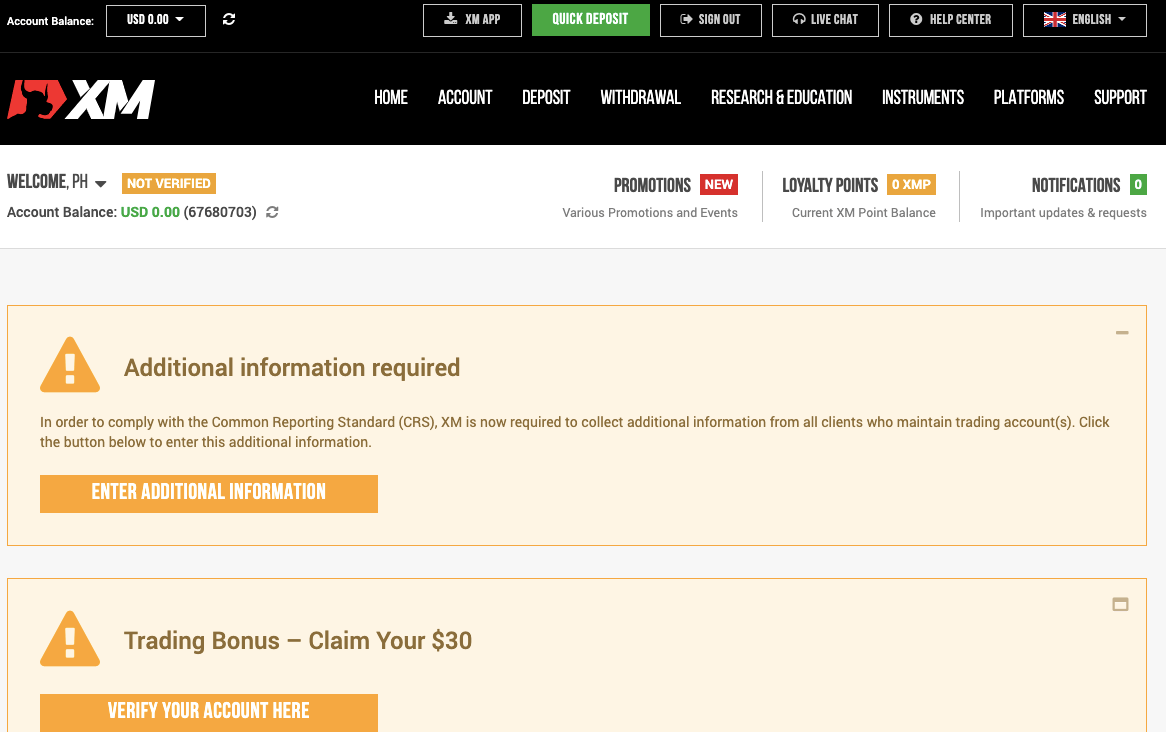

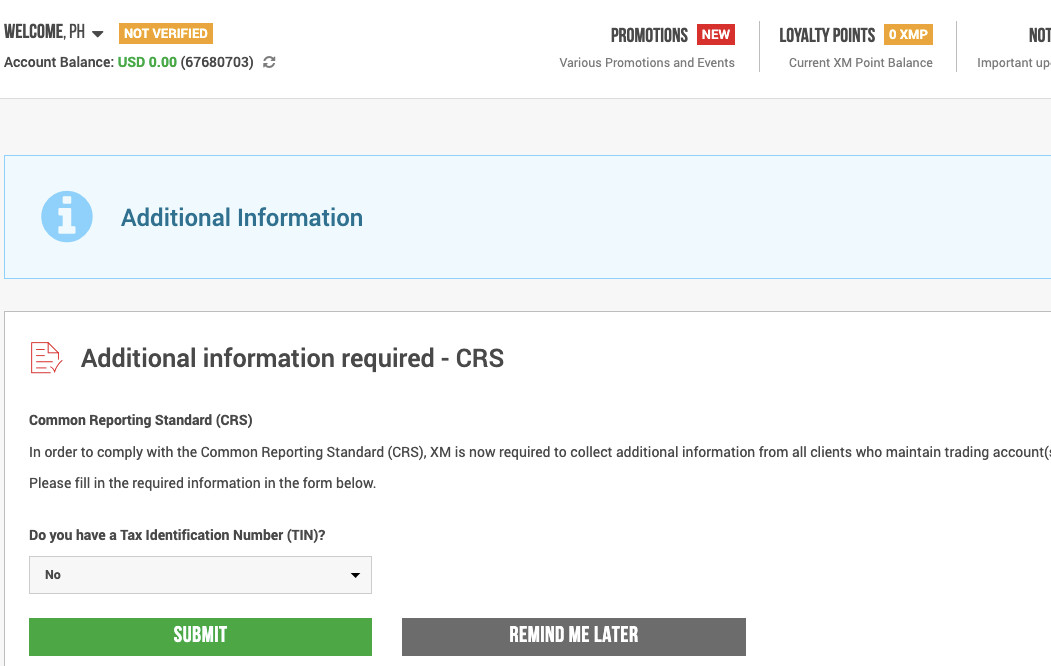

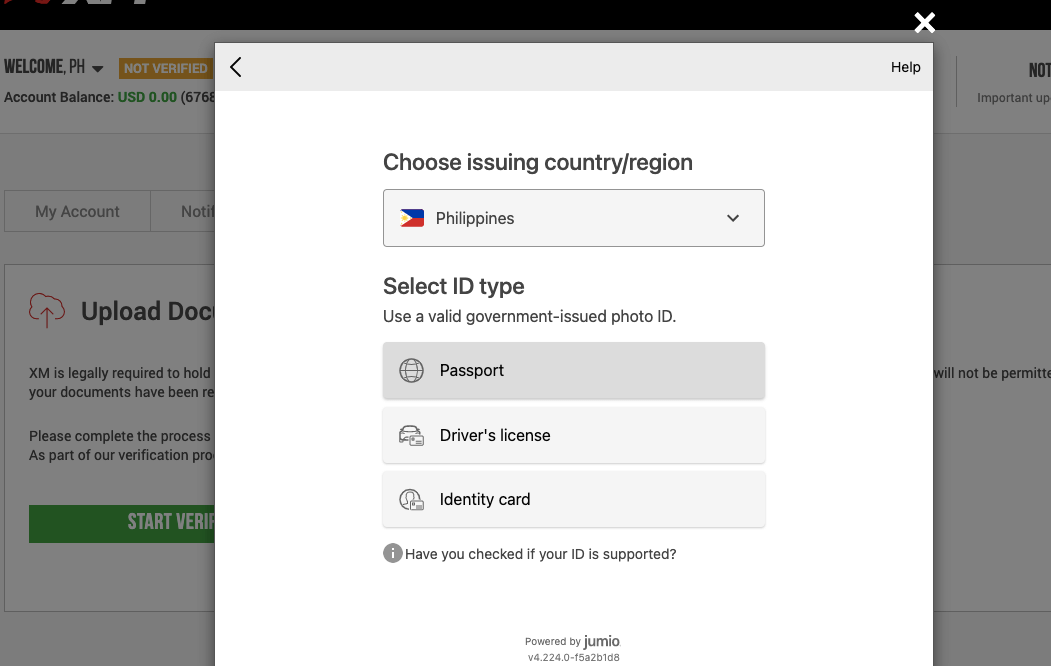

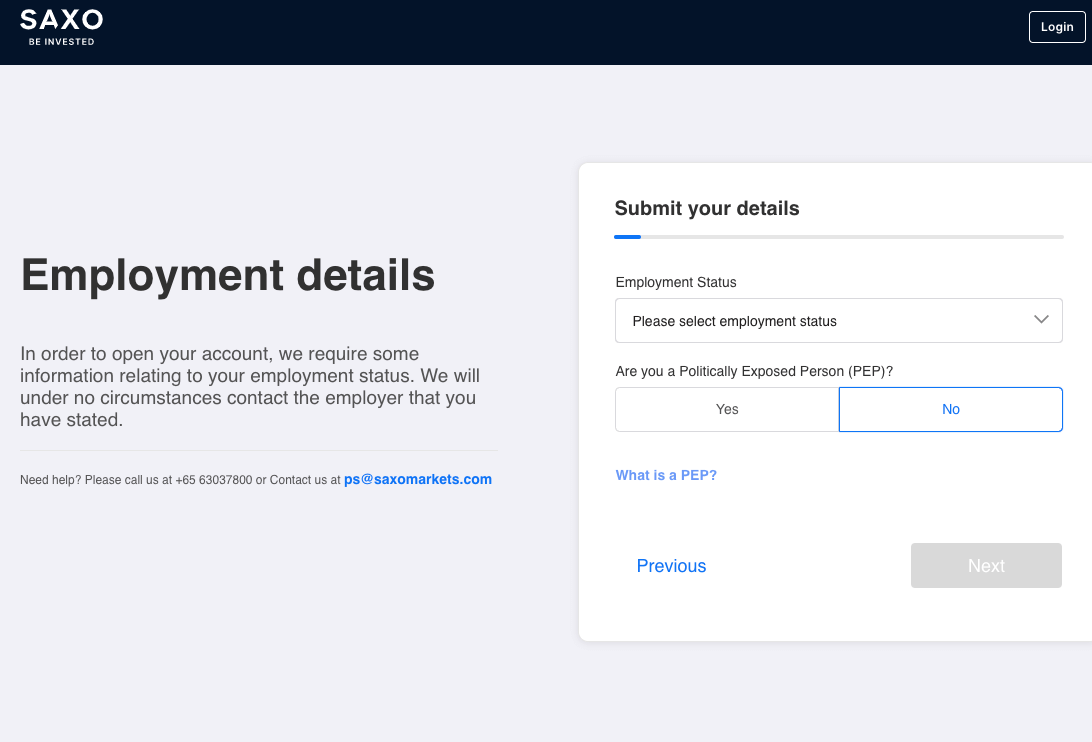

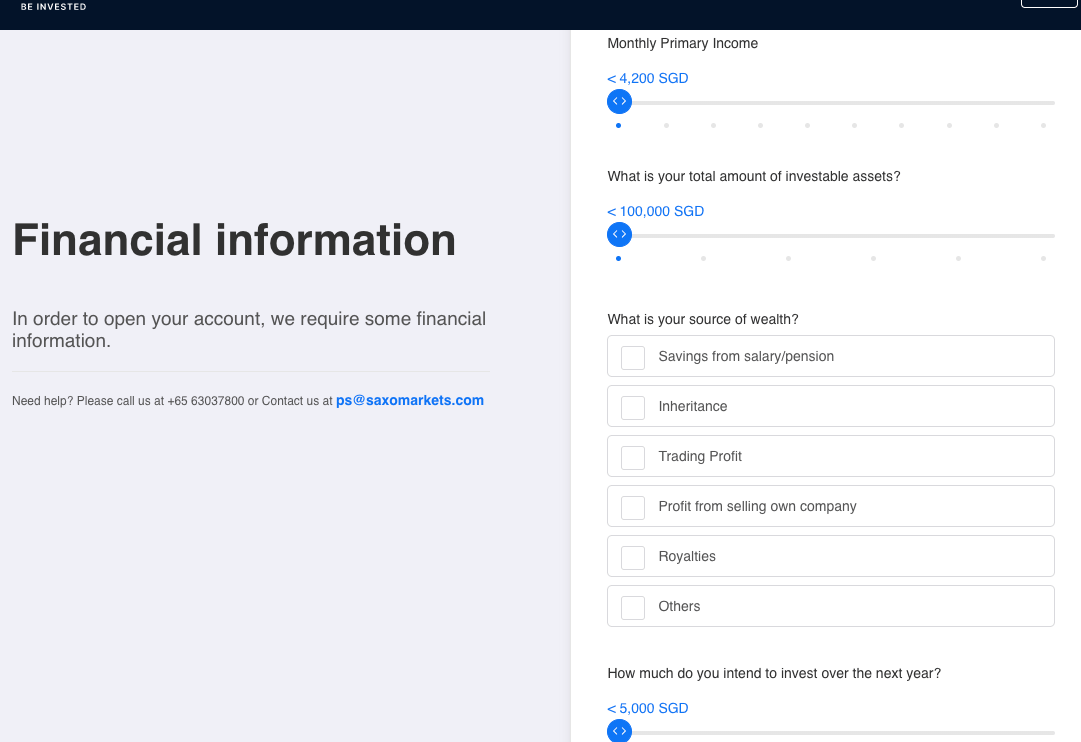

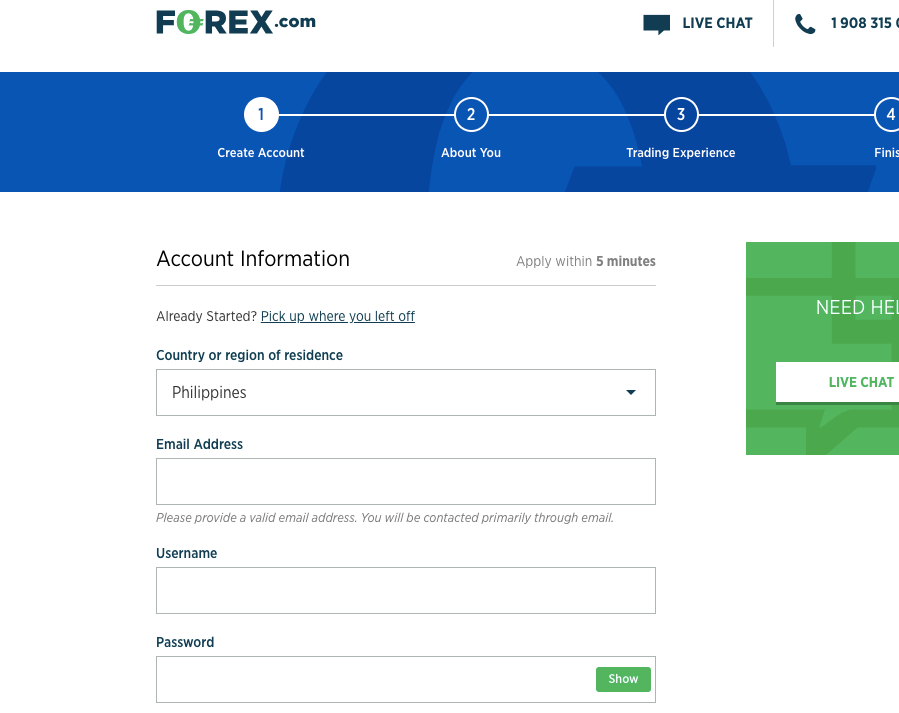

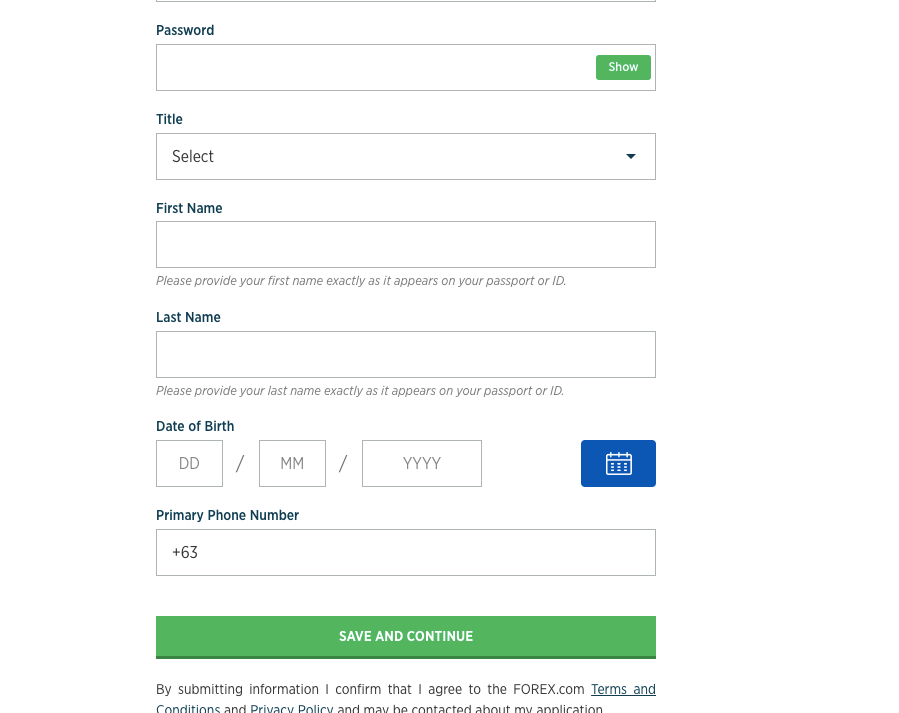

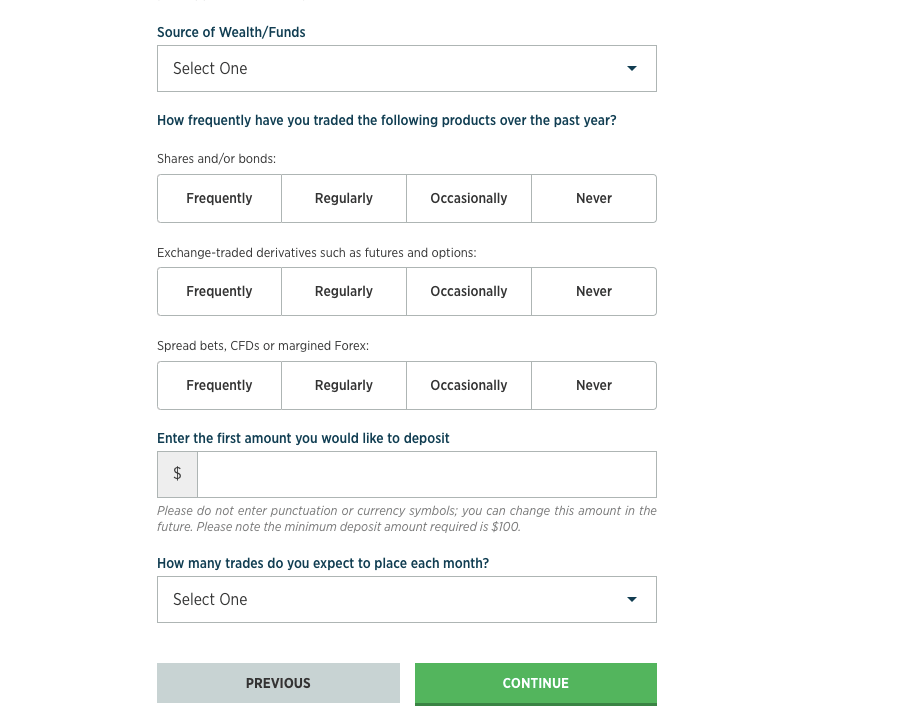

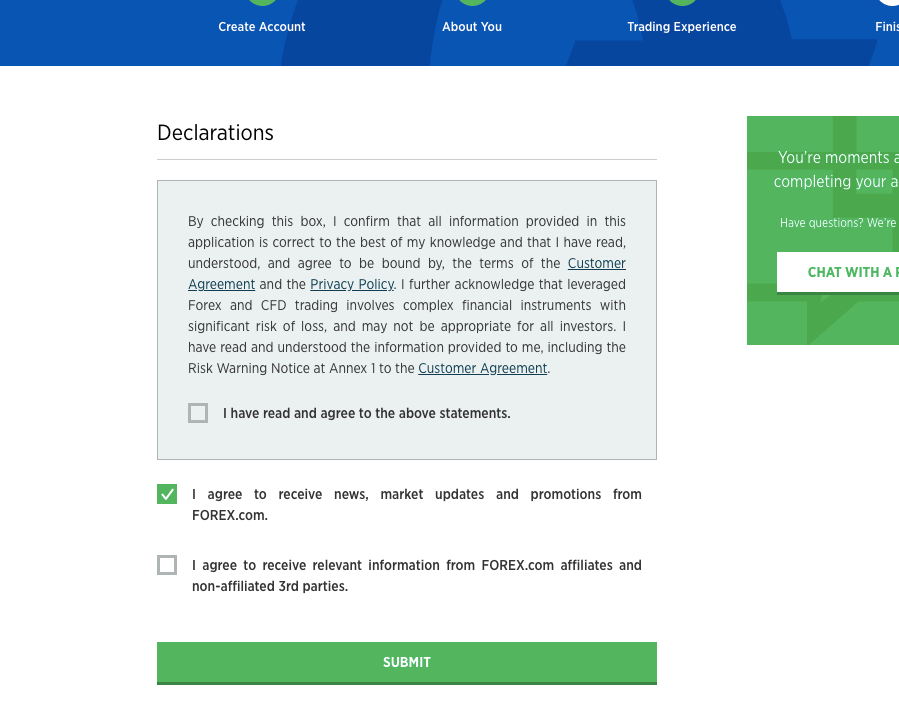

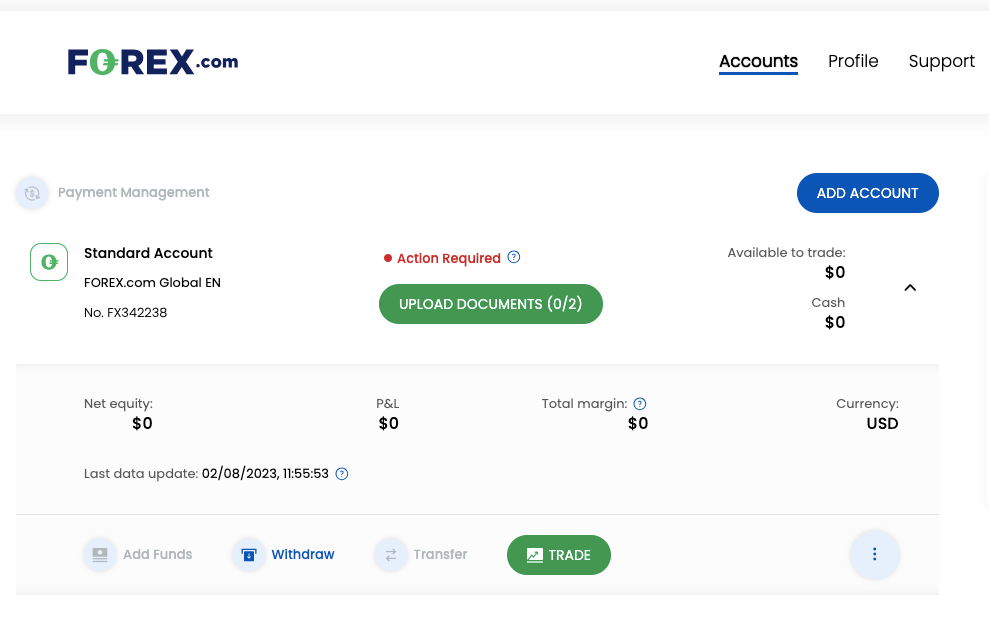

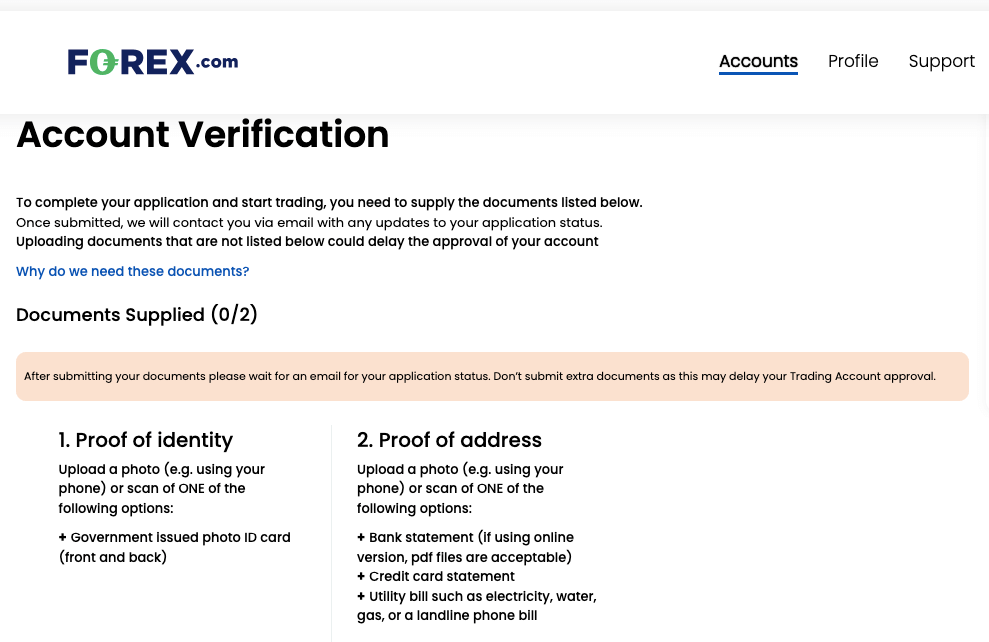

How to Open OANDA Account in Philippines?

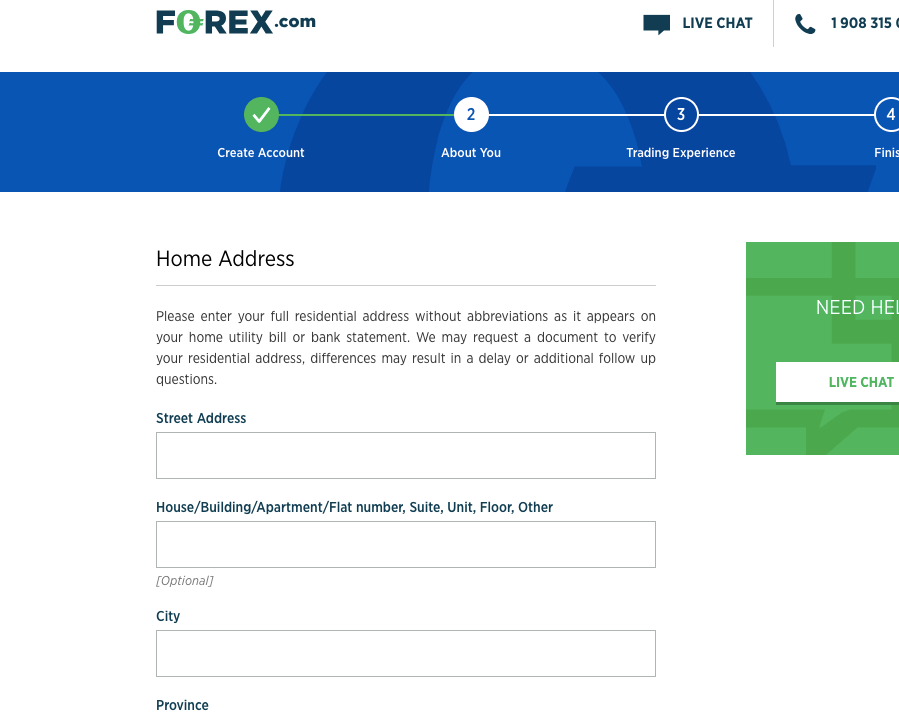

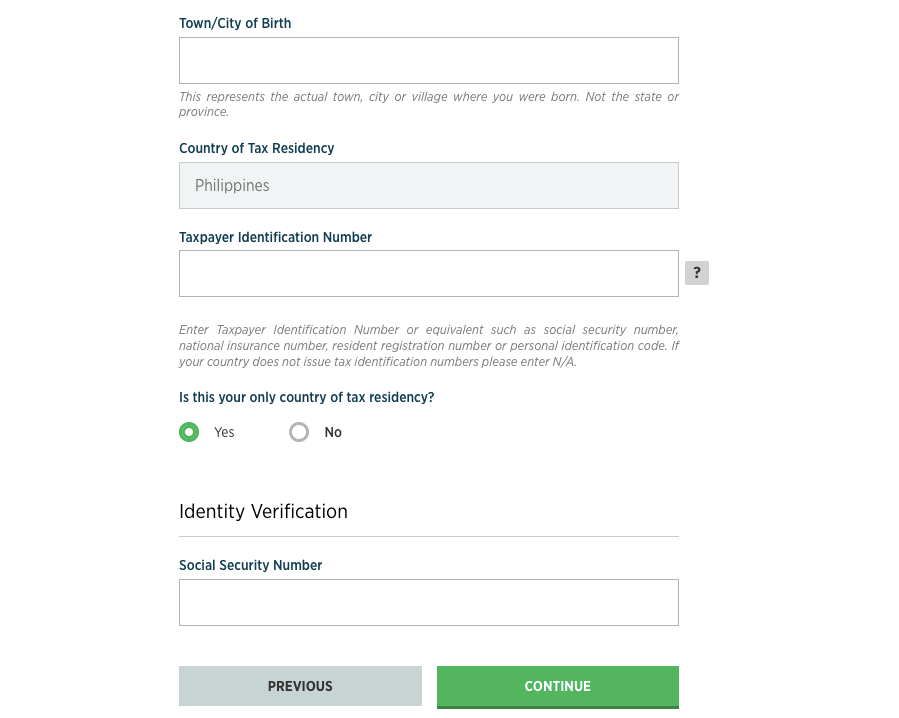

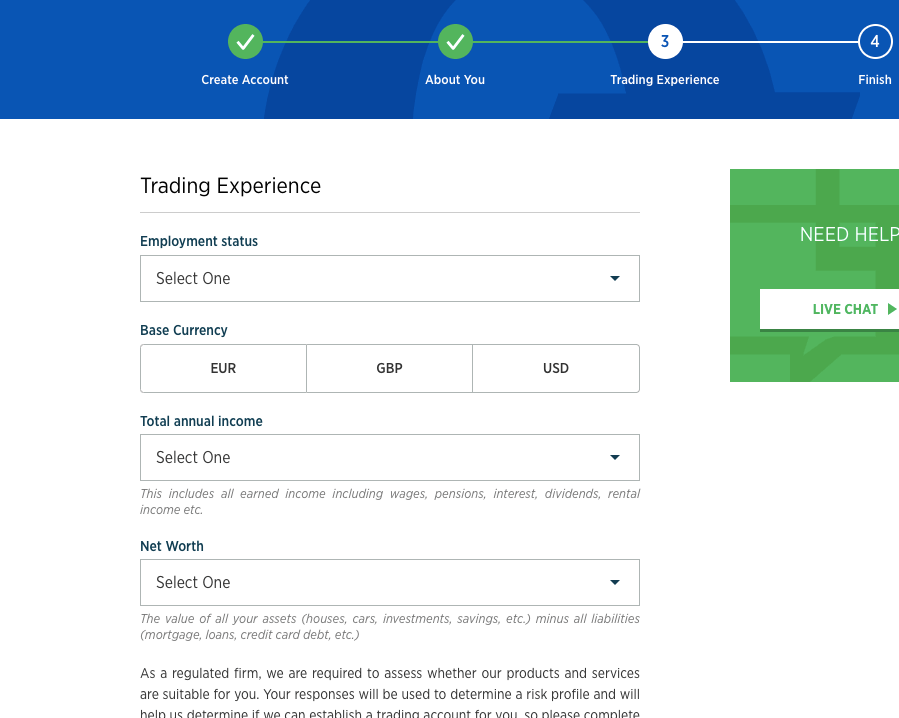

Follow these steps to open a trading account on OANDA.

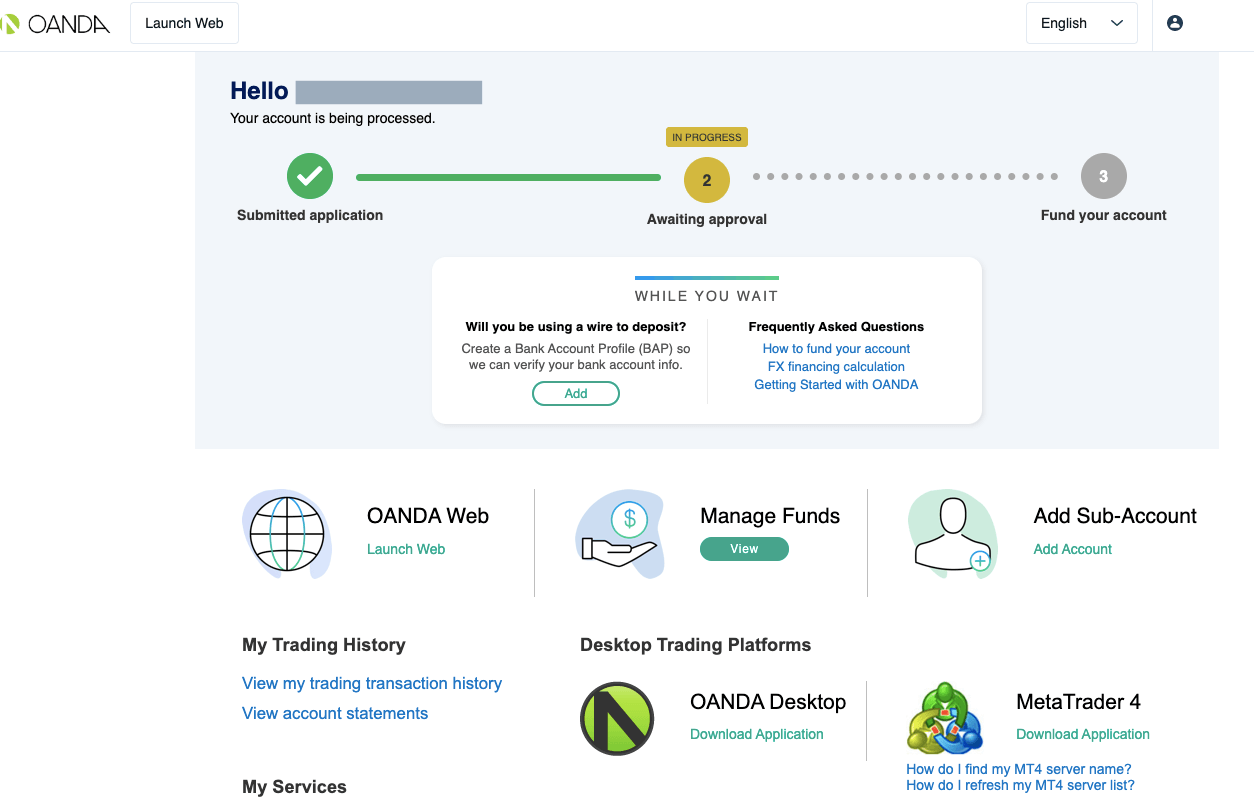

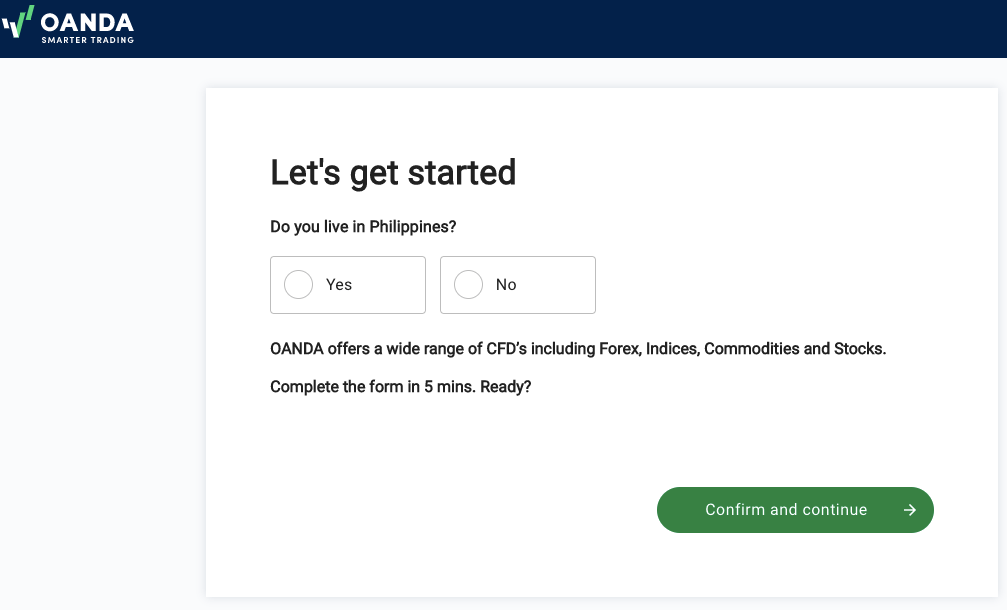

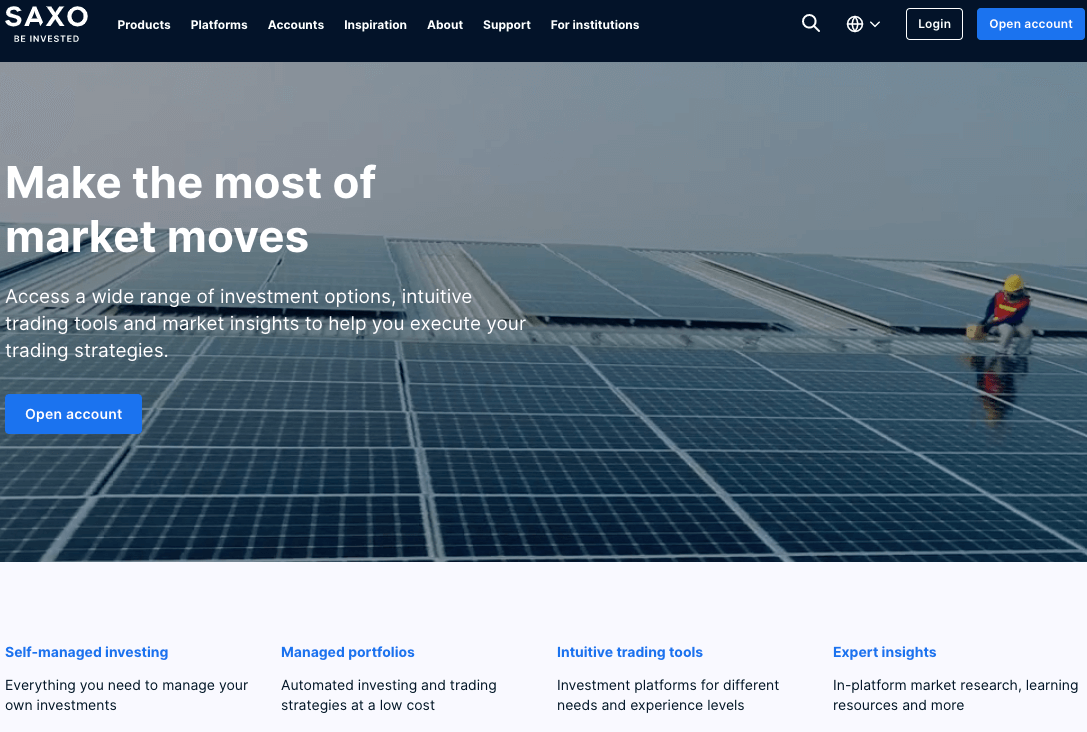

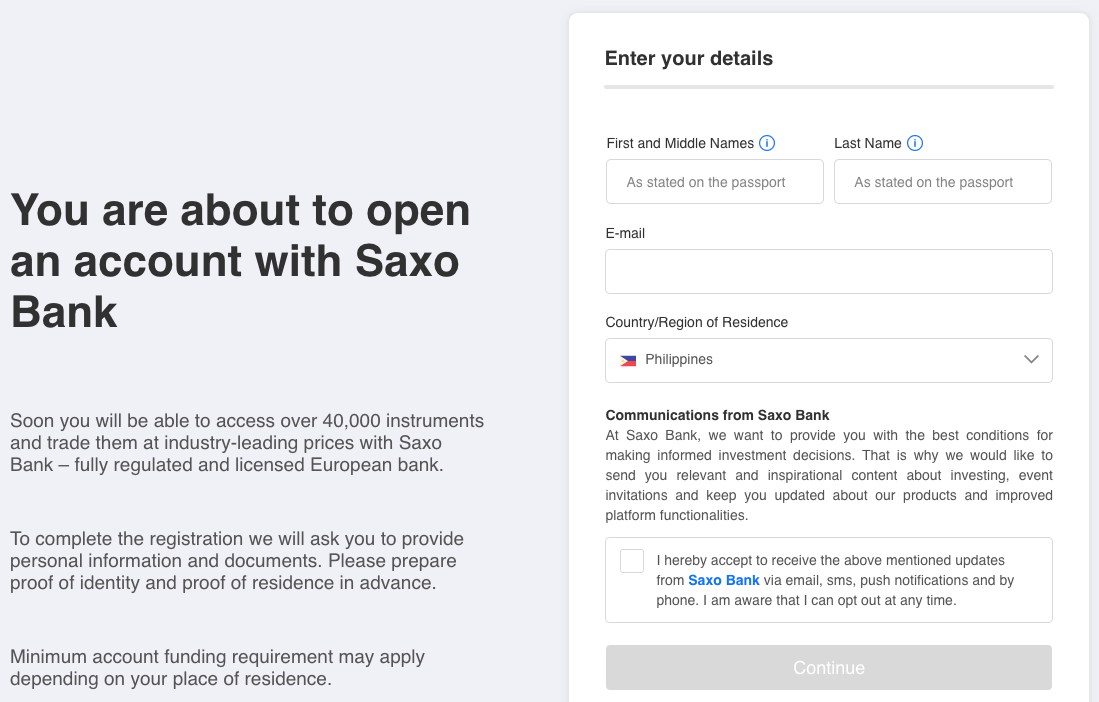

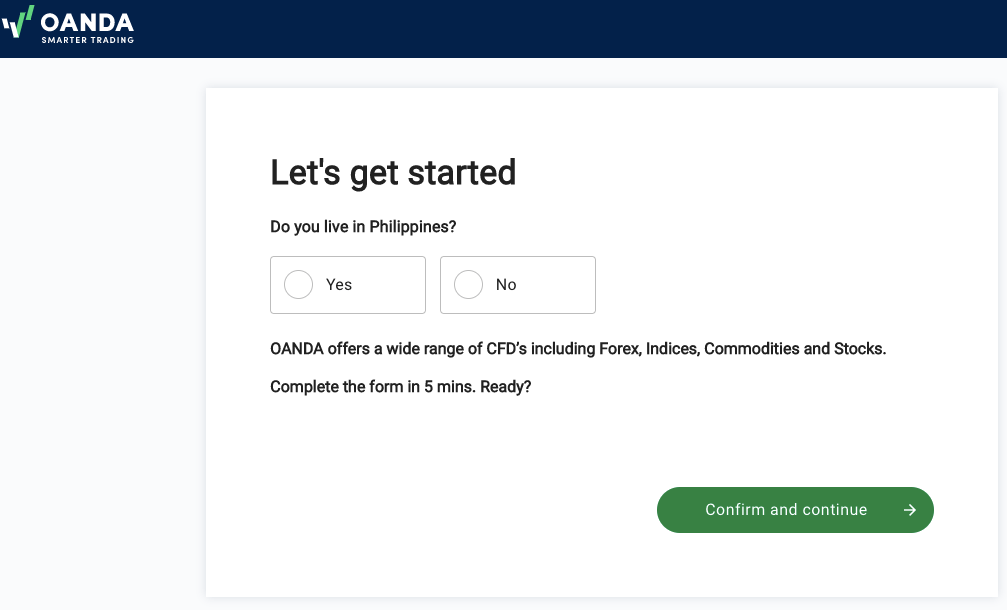

Step 1) Visit the OANDA Philippines website via www.OANDA.com, scroll down and click the ‘Create account’ or ‘Start trading’ buttons.

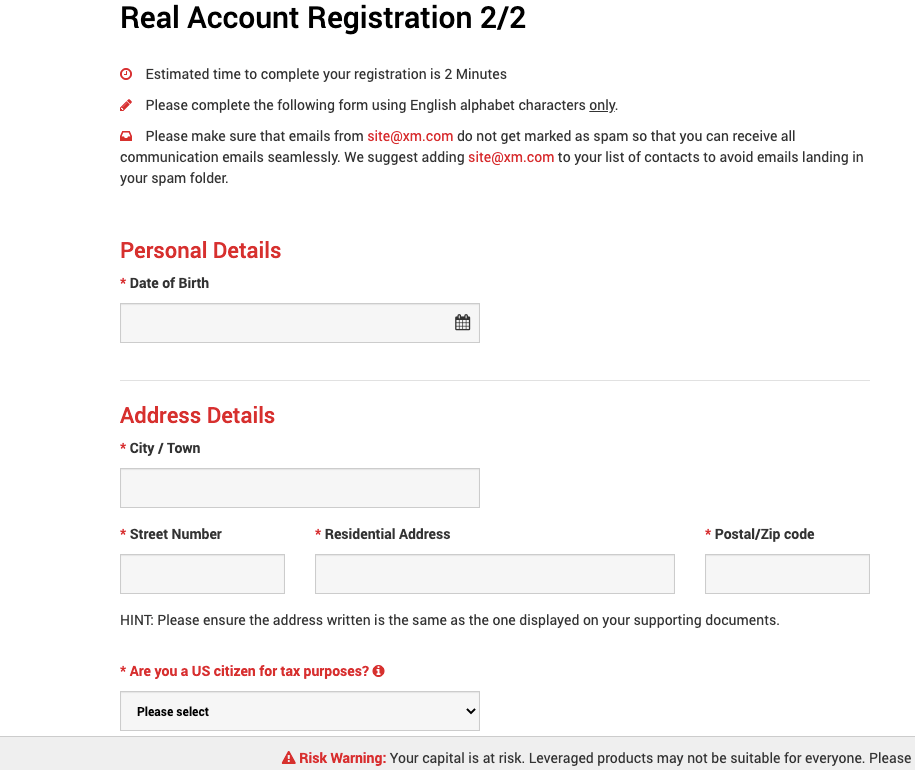

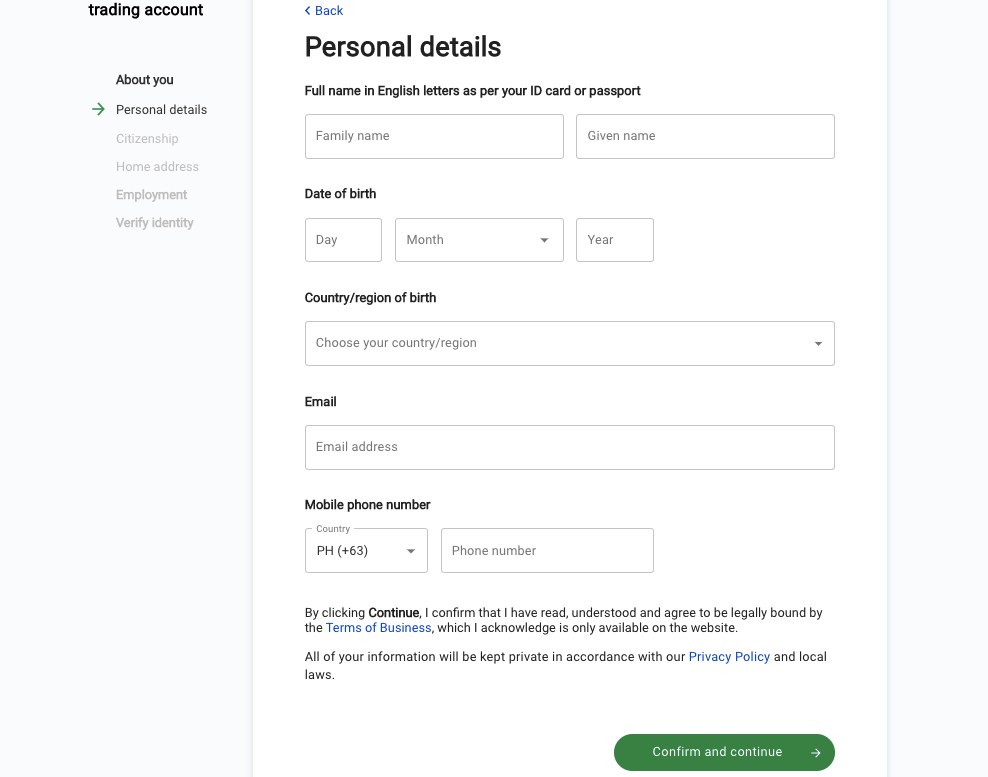

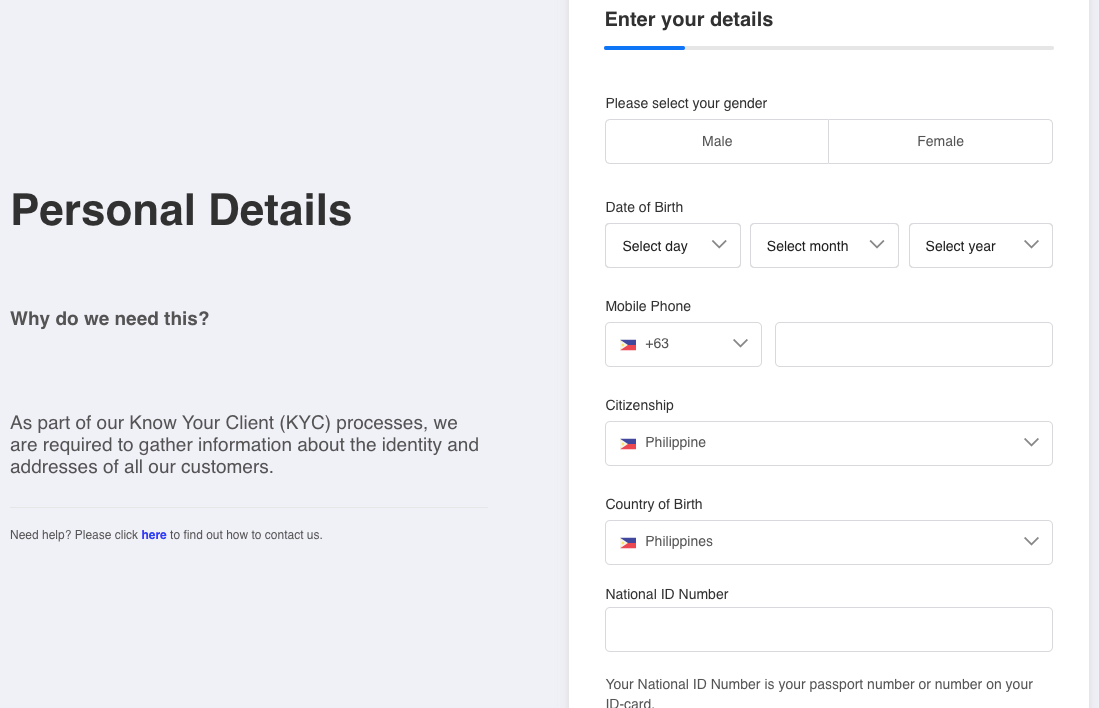

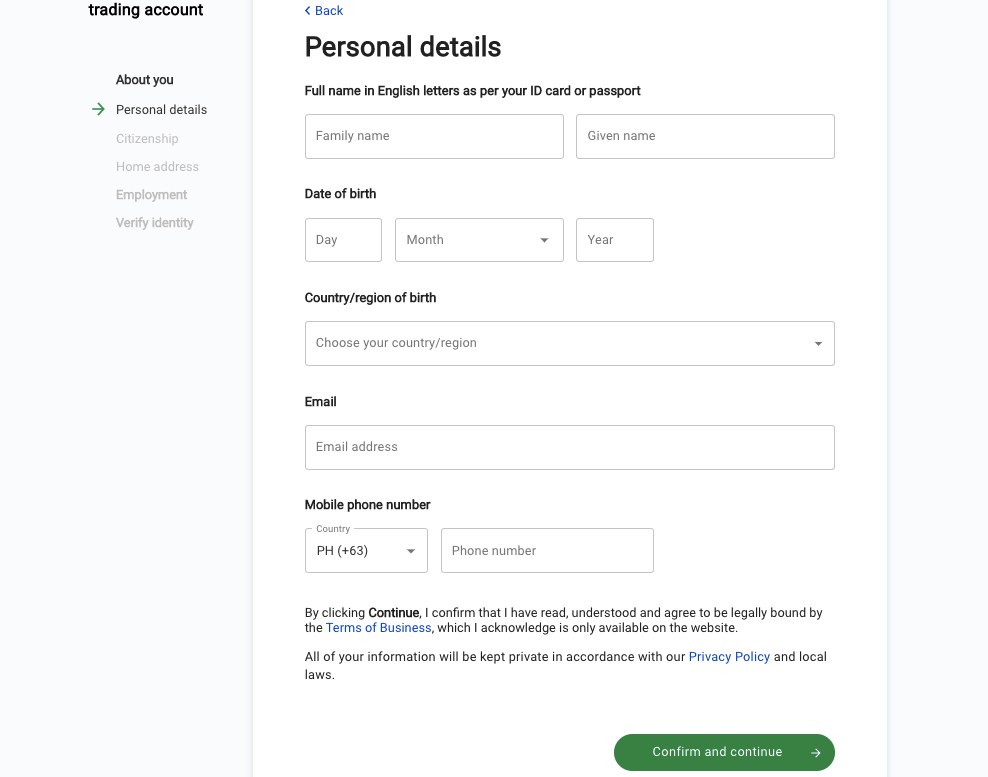

Step 2) Confirm that you live in Philippines, provide your full name and date of birth, select your country of birth, enter your email address, and phone number, then click ‘Confirm and continue’.

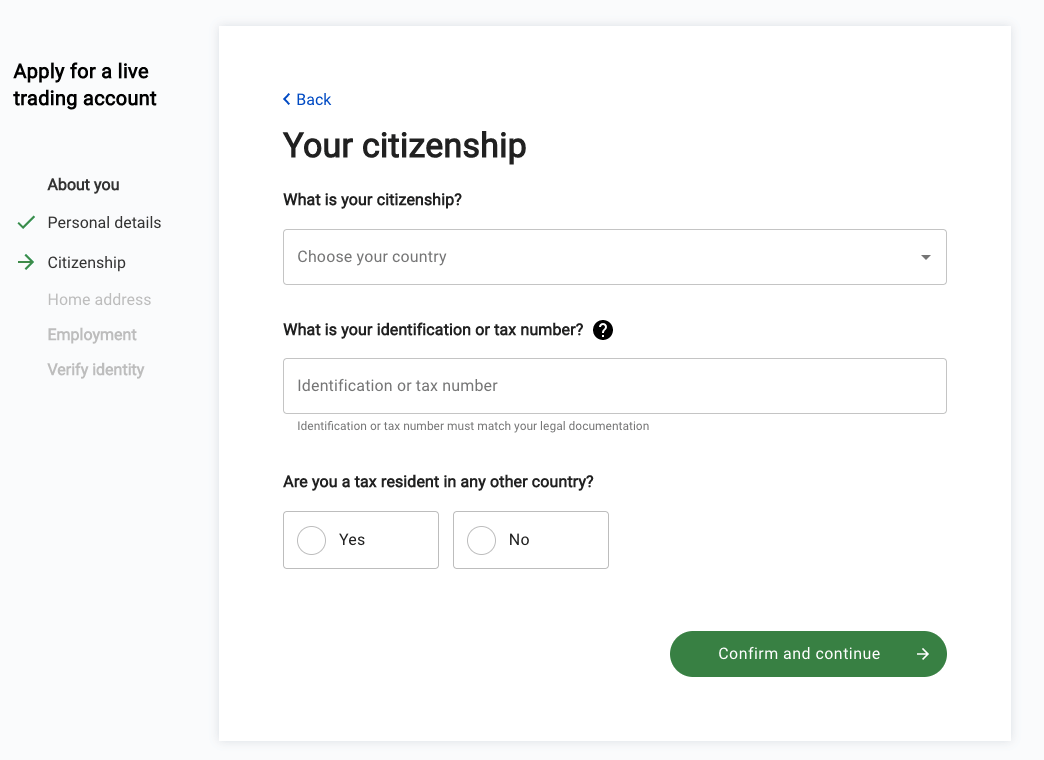

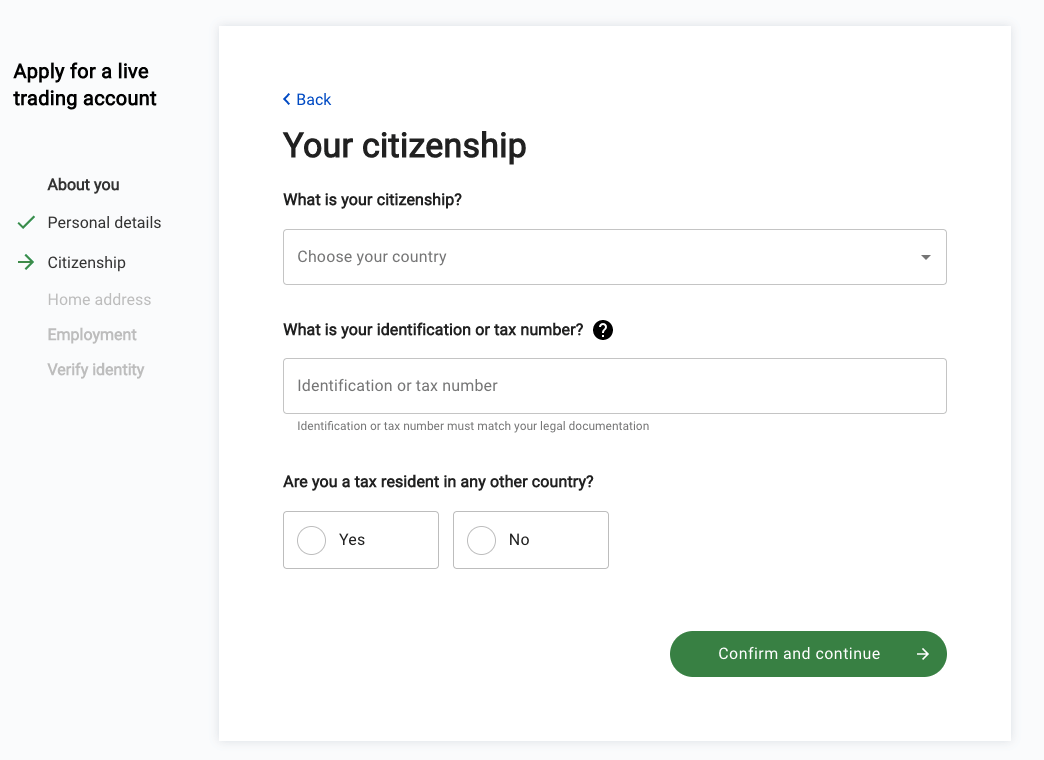

Step 3) Select your citizenship and enter your tax number then click ‘Confirm and continue’.

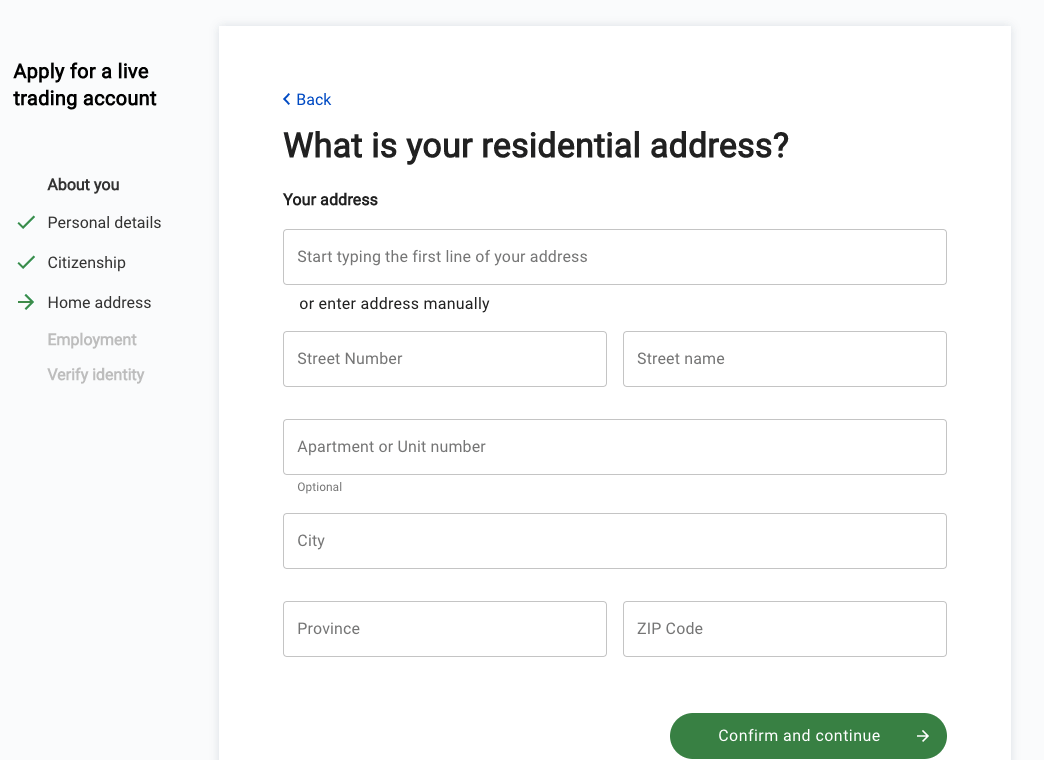

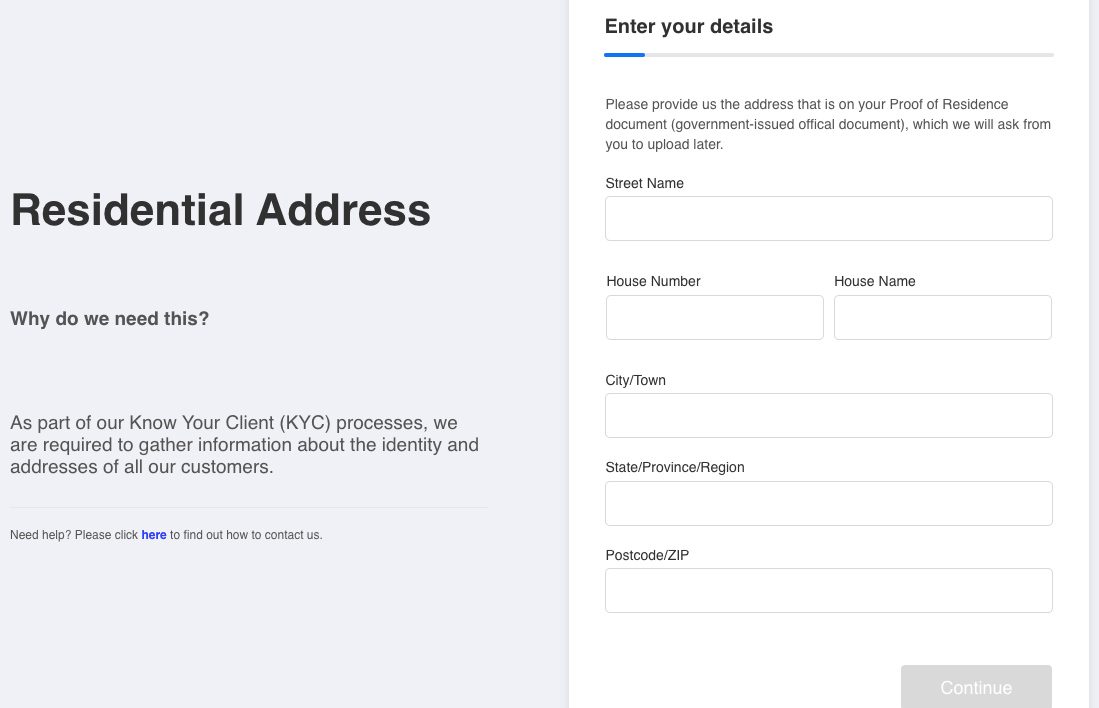

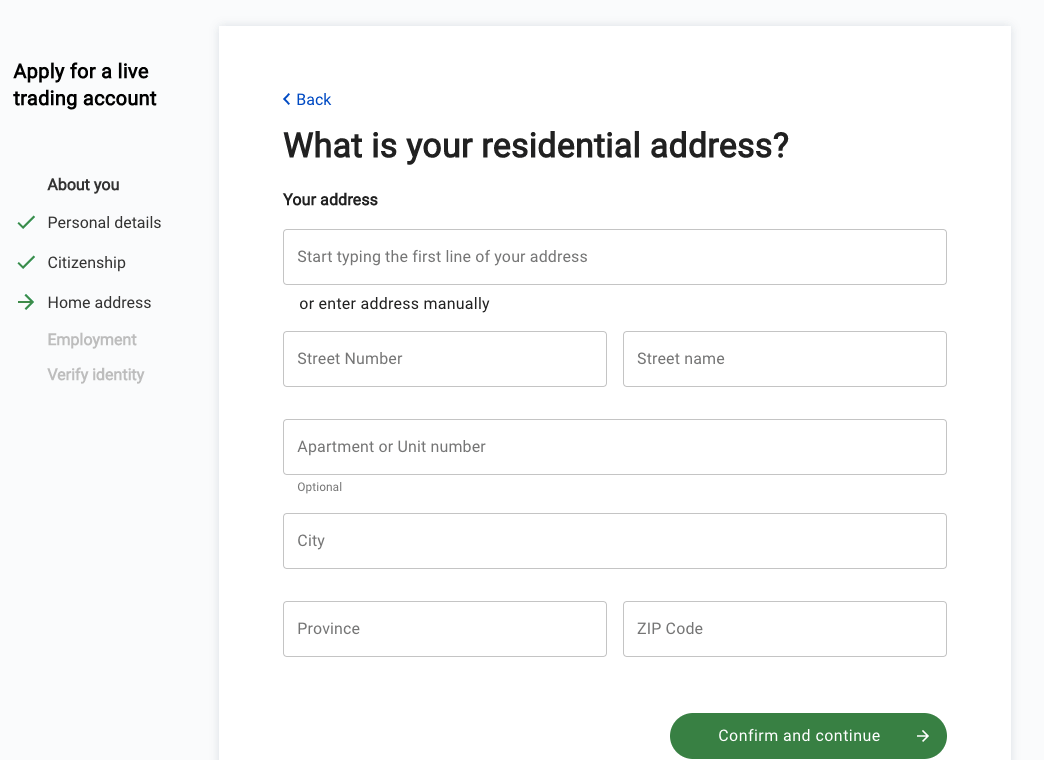

Step 4) Provide your residential address then click ‘Confirm and continue’.

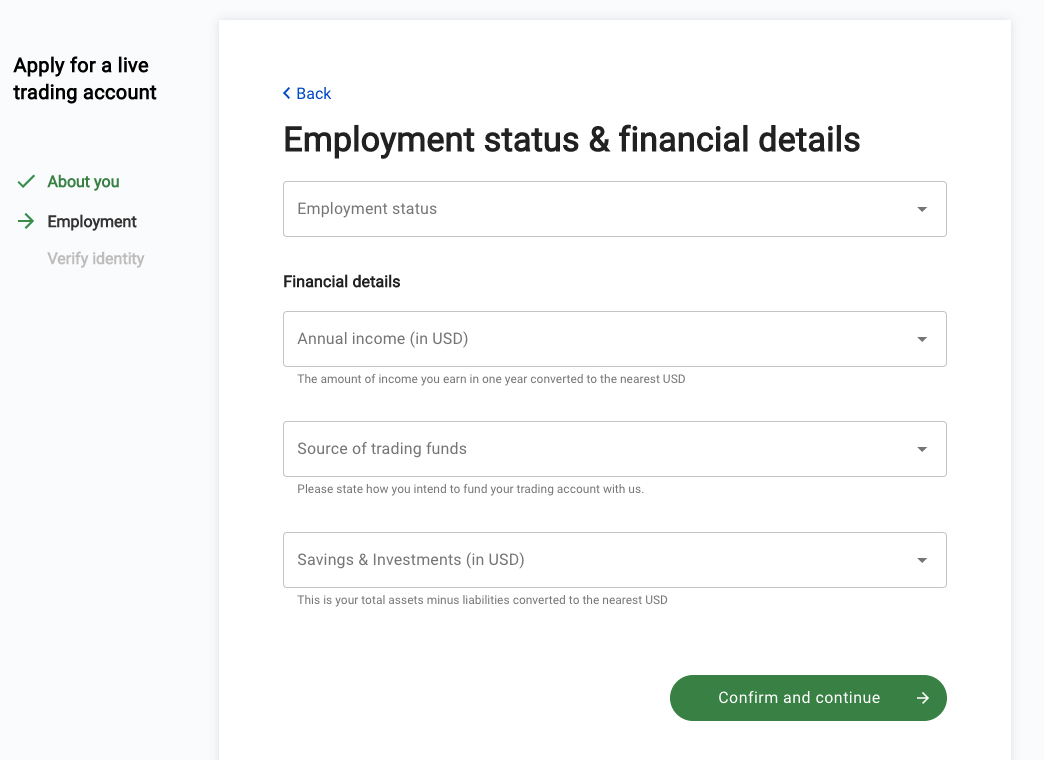

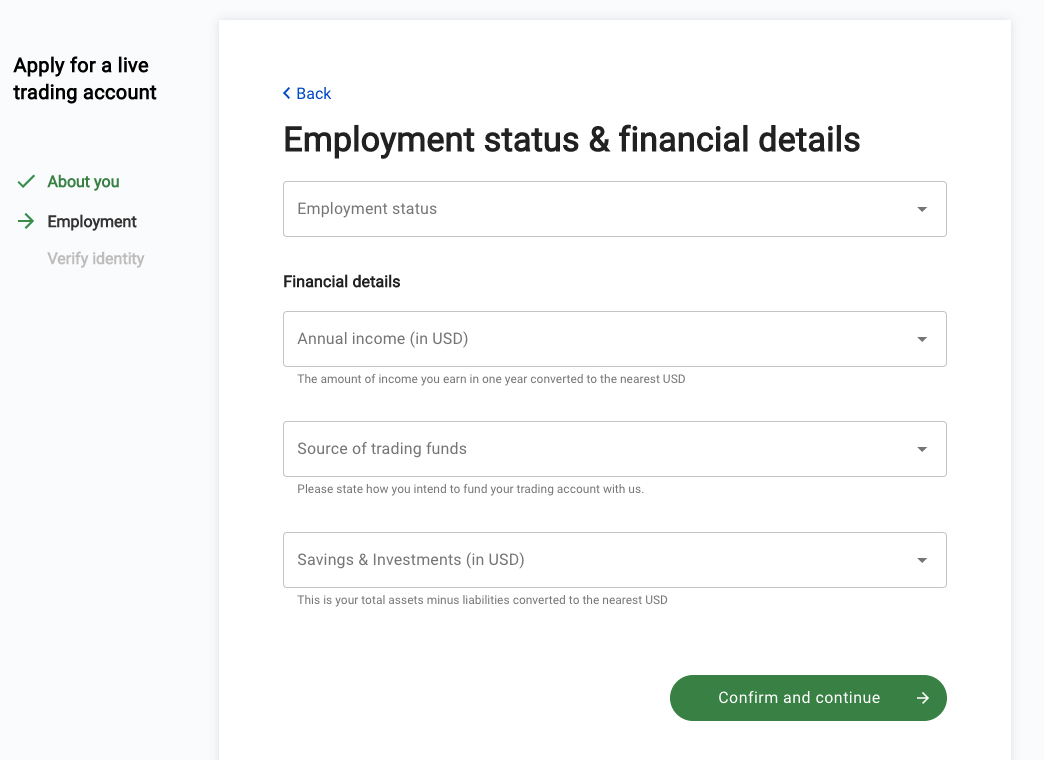

Step 5) Answer questions about your employment and financial status then click ‘Confirm and continue’.

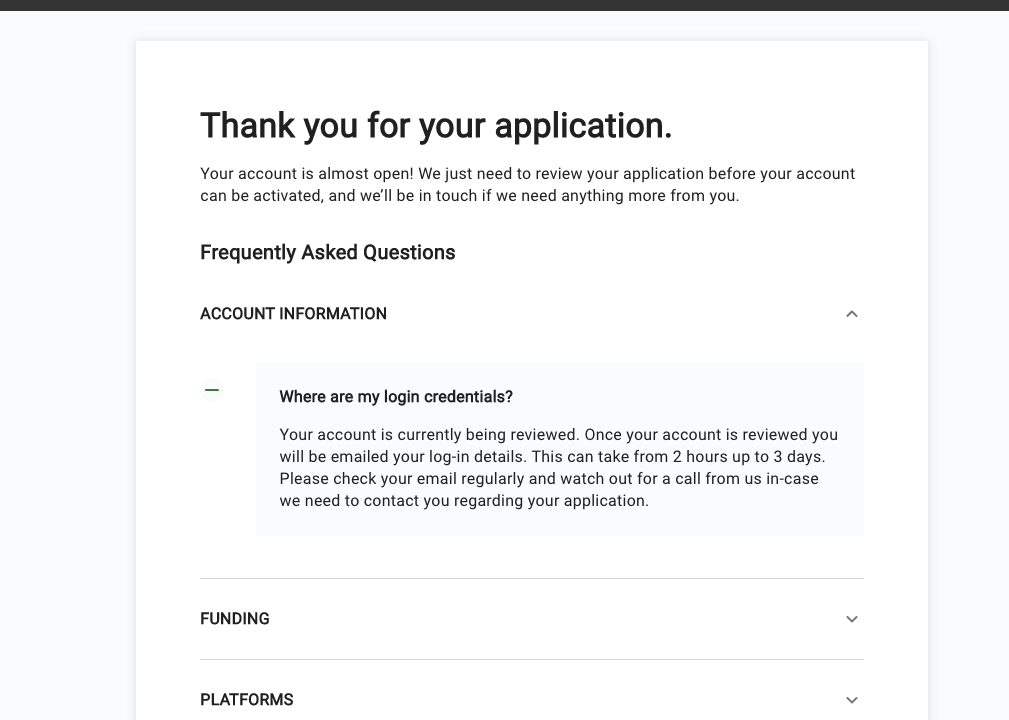

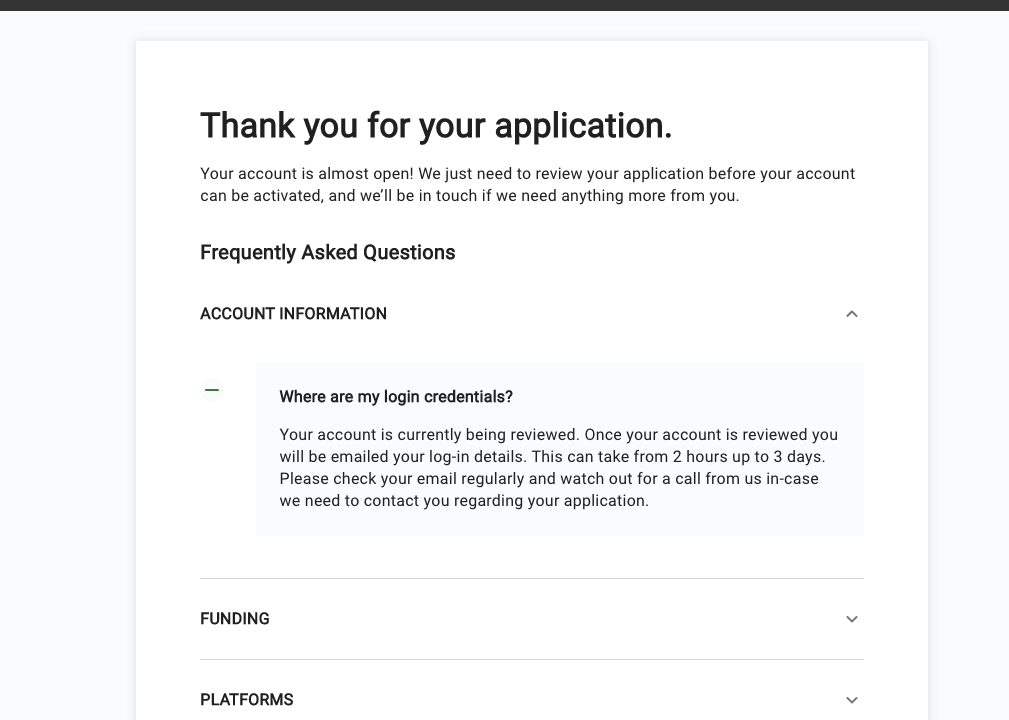

Step 6) You will be shown a notification stating that your account application request has been received and will be processed. You can then find some FAQs about the platform.

It takes up to 2 business for your account to be approved. Until your account is approved, you will be unable to deposit funds, withdraw or trade.

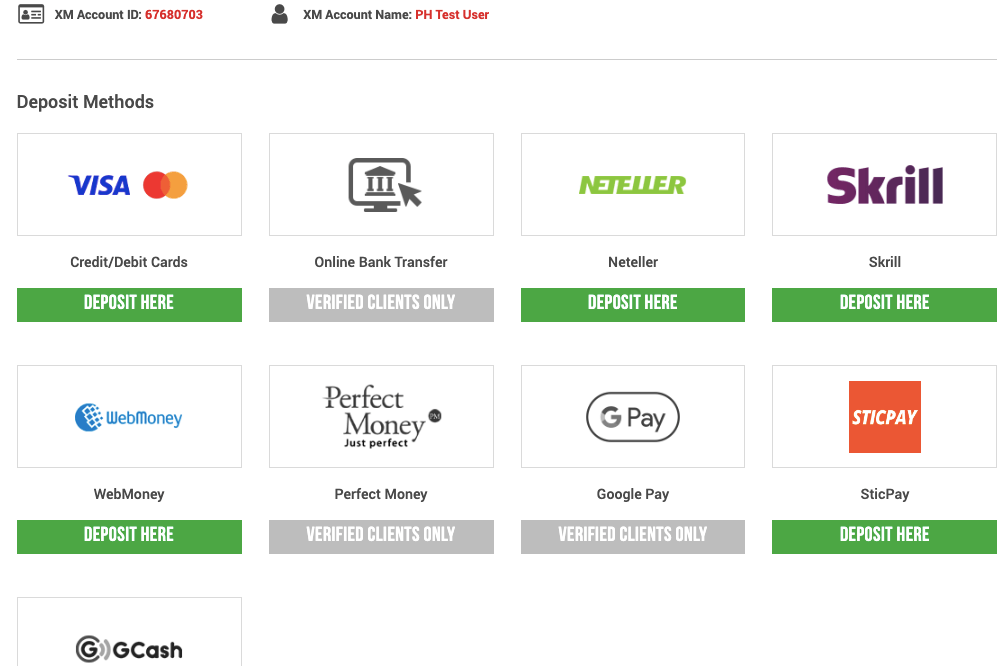

OANDA Deposits & Withdrawals

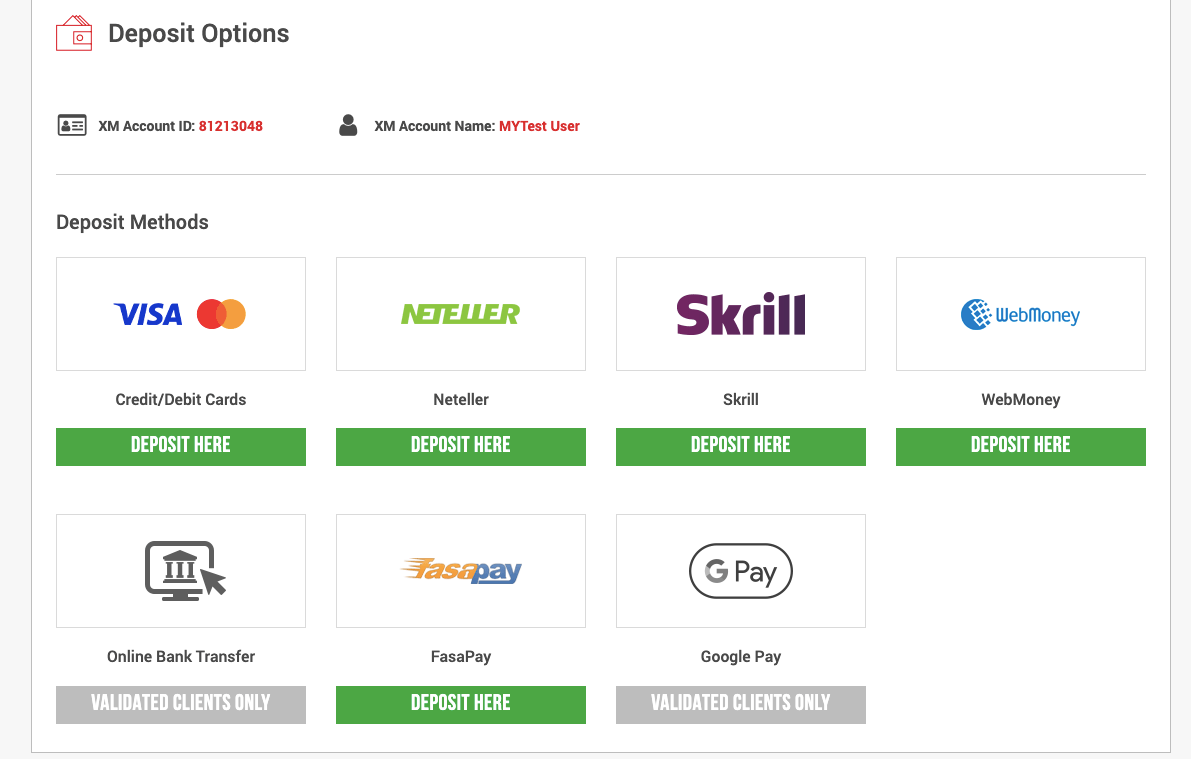

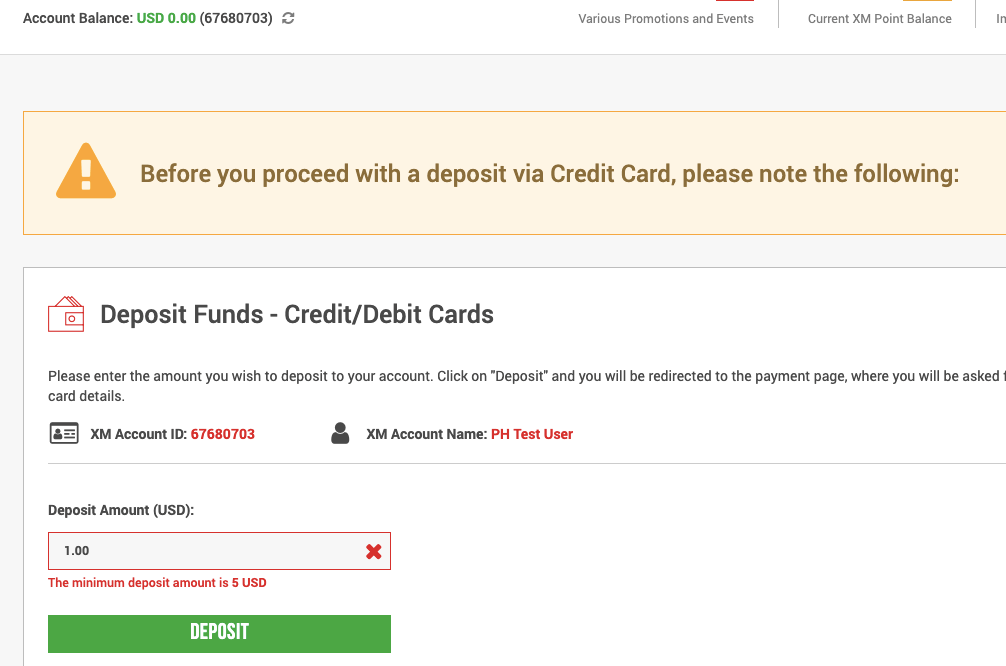

Payment methods supported on OANDA are cards (debit/credit), e-wallets (Skrill & Neteller), and bank transfers (local/international). The bank account or card used to deposit or withdraw funds must have the same name as the name on your trading account. Find an overview of the deposit and withdrawal on OANDA below:

OANDA Deposit Methods

Here is a summary of payment methods accepted by OANDA for deposits.

| Deposit Methods |

Availability |

Charges |

Processing time |

| Internet Banking/Online Bank Transfer |

Yes |

Free |

3-5 business days |

| Cards |

Yes |

Free |

Instant |

| E-wallet |

Yes (Skrill & Neteller) |

Free |

1 business day |

OANDA Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on OANDA.

| Withdrawal Methods |

Availability |

Charges |

Processing time |

| Internet Banking/Online Bank Transfer |

Yes |

US$20 per transaction |

2-5 business days |

| Cards |

Yes |

Free |

1-3 business days |

| E-wallets |

Yes (Paypal) |

Free |

1 business day |

What is the minimum deposit for OANDA?

There is no mandatory minimum deposit on OANDA, you can deposit any amount that you want with any payment method of your choice. You only need to deposit enough to cover the trades you want to place.

Note that to deposit more than $9,000 (PHP 5,06,524) you will have to provide the required documents for full account verification.

How do I deposit money into OANDA?

Follow these simple steps to deposit funds into your OANDA Account:

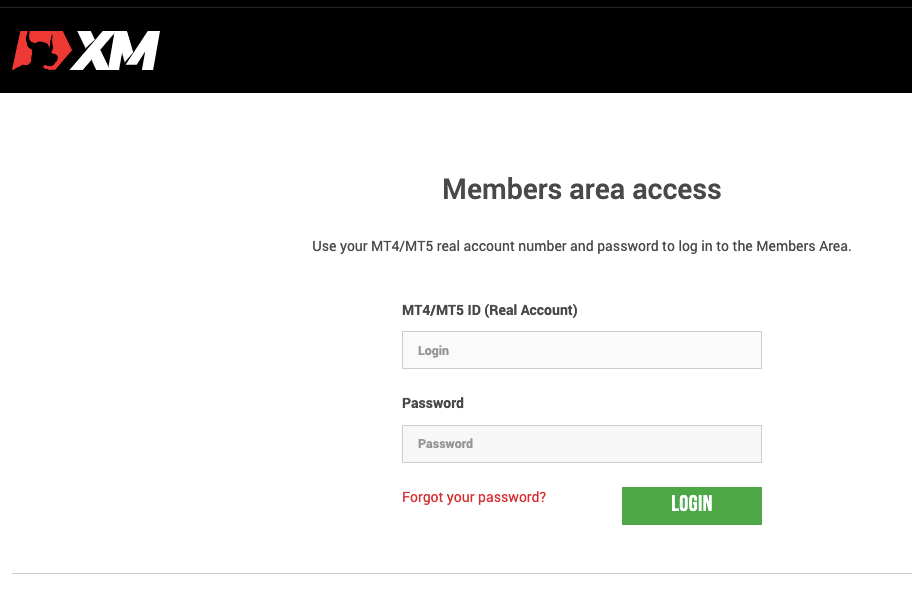

Step 1) Log in to your OANDA trading account via www.OANDA.com/account/login.

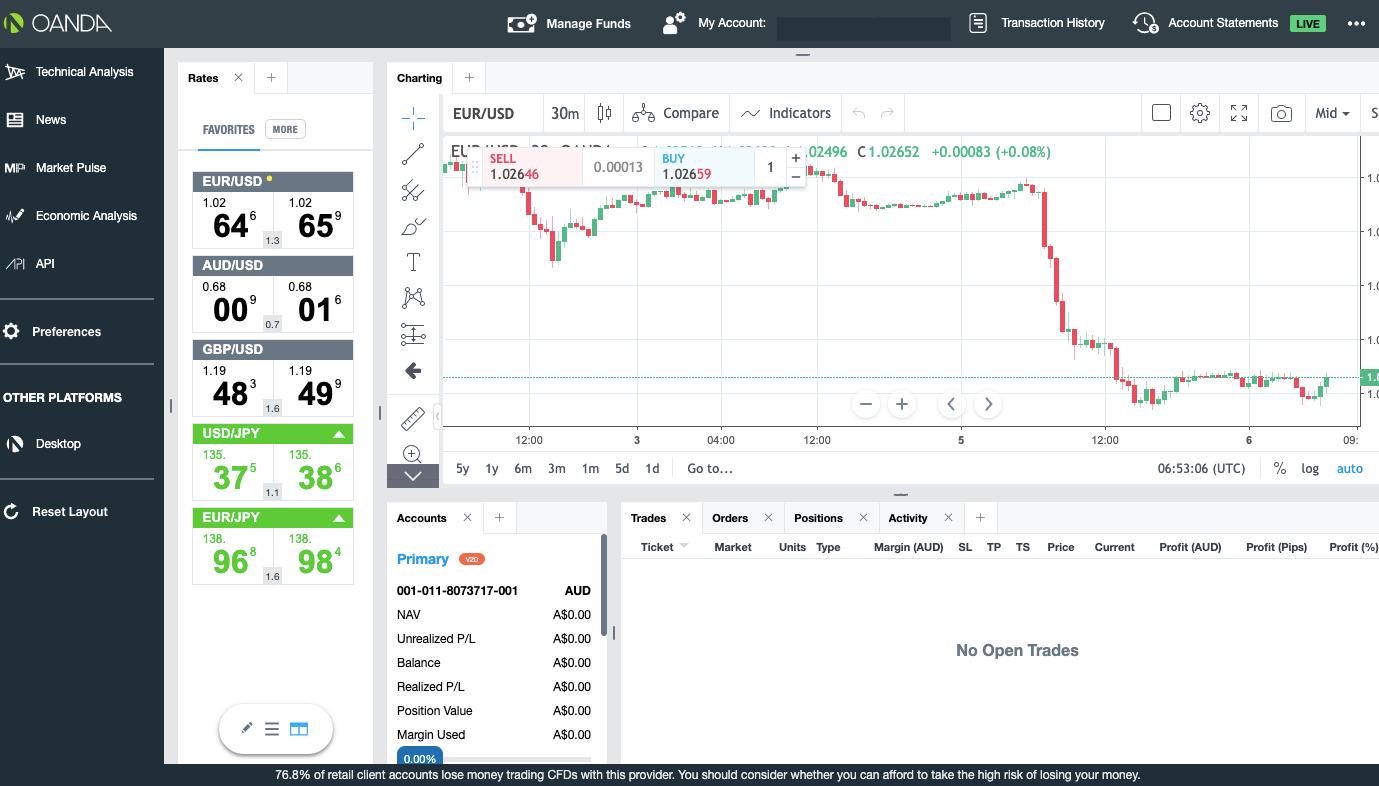

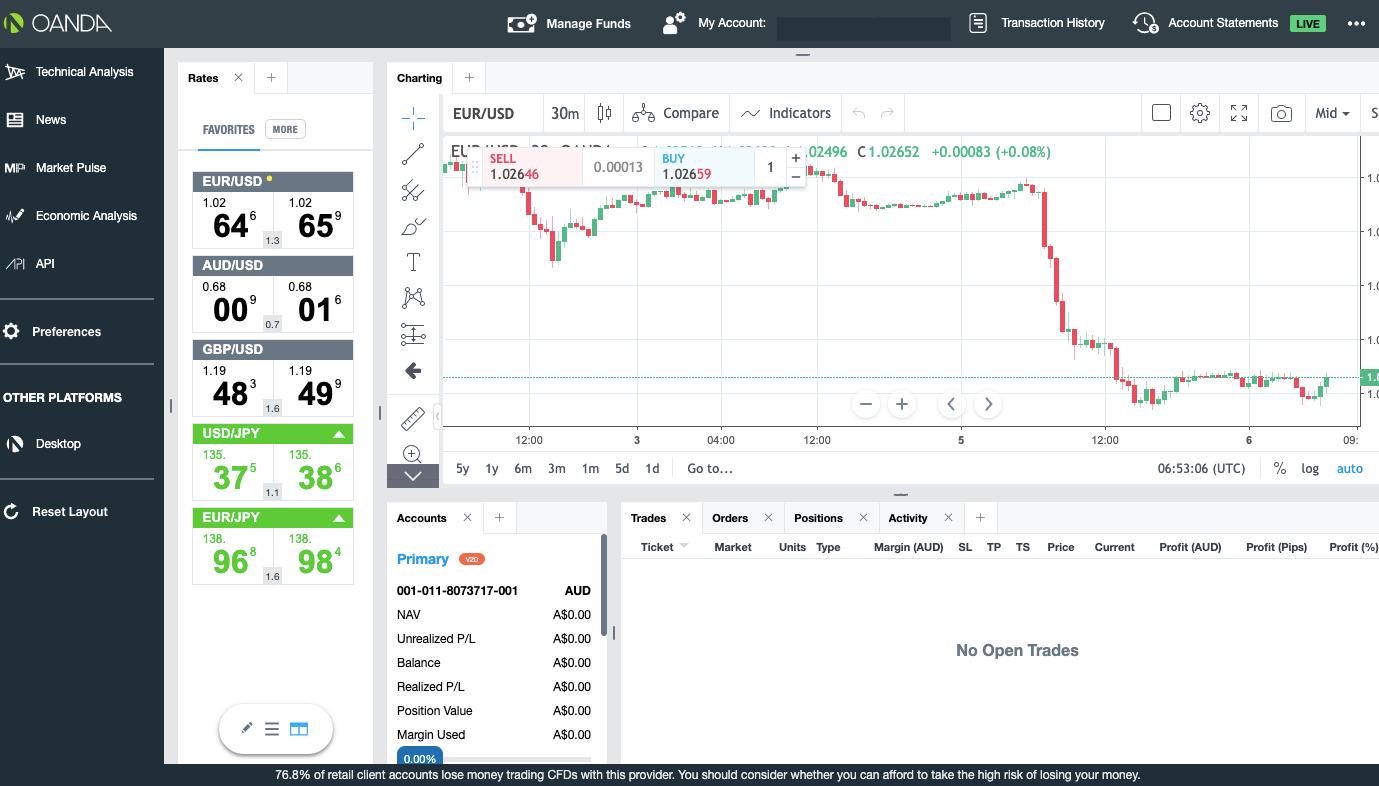

Step 2) Once your OANDA portal (dashboard) loads, click on the ‘View’ under ‘Manage Funds’ tab.

Step 3) Select ‘Deposit’ and follow the on-screen instructions to add funds to your account.

What is the OANDA Minimum withdrawal?

There is also no compulsory minimum withdrawal on OANDA and you can withdraw any amount, this applies to all payment methods. All withdrawal requests are processed within one business day by OANDA, and it may take up to 3 business days to receive funds for cards and up to 5 business days for bank transfers.

How to Withdraw Funds from OANDA

Follow these simple steps to withdraw money from your OANDA Account:

Step 1) Log in to your OANDA dashboard via www.OANDA.com/account/login.

Step 2) Once your dashboard loads, click on ‘View’ under the ‘Manage Funds’ tab.

Step 3) Select ‘Withdraw’ and follow the on-screen instructions to withdraw funds from your account.

OANDA Trading Instruments

You can trade the following financial instruments on OANDA:

| Instrument |

Availability |

Number |

| Forex CFDs |

Yes |

48 currency pairs on OANDA (including majors, minors, and exotics) |

| Commodities CFDs |

Yes |

8 commodities on OANDA (Including 3 oil and 4 agriculture) |

| Metals CFDs |

Yes |

4 metals on OANDA (Including gold and silver) |

| Indices CFDs |

Yes |

18 indices on OANDA (US Nas 100, UK100, Europe 50, and others) |

| Shares CFDs |

Yes |

228 shares on OANDA (Europe shares including Germany, France and others) |

| Crypto assets CFDs |

Yes |

18 Cryptocurrencies on OANDA (BTC, ETH, and others paired with the USD) |

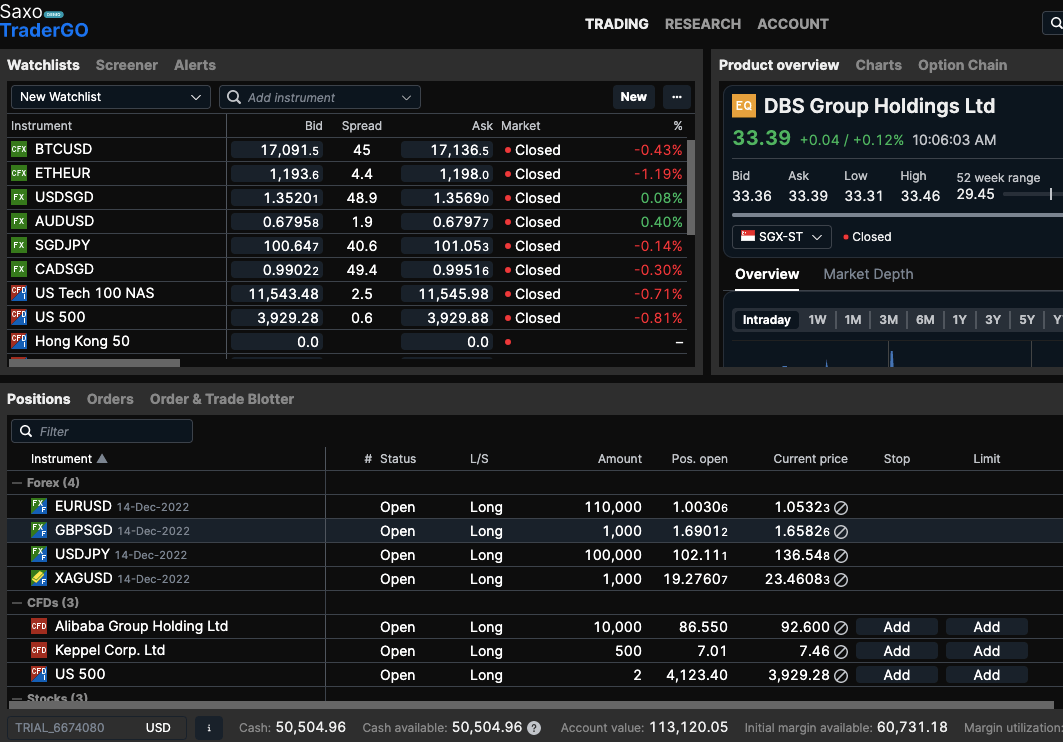

Trading platforms supported by OANDA are:

1) MetaTrader 4 & MetaTrader 5: OANDA supports the MT4 & MT5 trading application which is available on the web, desktop, and mobile devices (Android & iOS).

2) OANDA Trader (fxTrade): OANDA offers trading via a proprietary trading platform developed by OANDA and can be accessed via the web, or desktop or downloaded from the Google Play Store or Apple App Store.

Advanced charts: TradingView provides these charts. You can access them via OANDA trading platform. Via the chart, you can use more than 65 popular indicators including Moving Averages, MACD, Bollinger Bands, Stochastics, Ichimoku Cloud, Volume, Aroon, Balance of Power and Donchian Channels.

If you want to compare two CFDs, you do not need to move from one tab to another. You can put the two CFDs side by side and compare them on one screen. To enjoy all of these and more, you have use the OANDA trading platform.

Economic overlay: This is like an economic news side bar. As you trade, you can follow the news on key economic events, announcements, and global economic overview.

MetaTrader premium indicators: This is a combination of advanced tools. You can use them on MT4 and MT5 by downloading the upgrade on OANDA’s website. The other tools that come with this upgrade include mini-terminal, session map, stealth orders, tick chart order, correlation matrix, alarm manager, sentiment trader, and correlation trader.

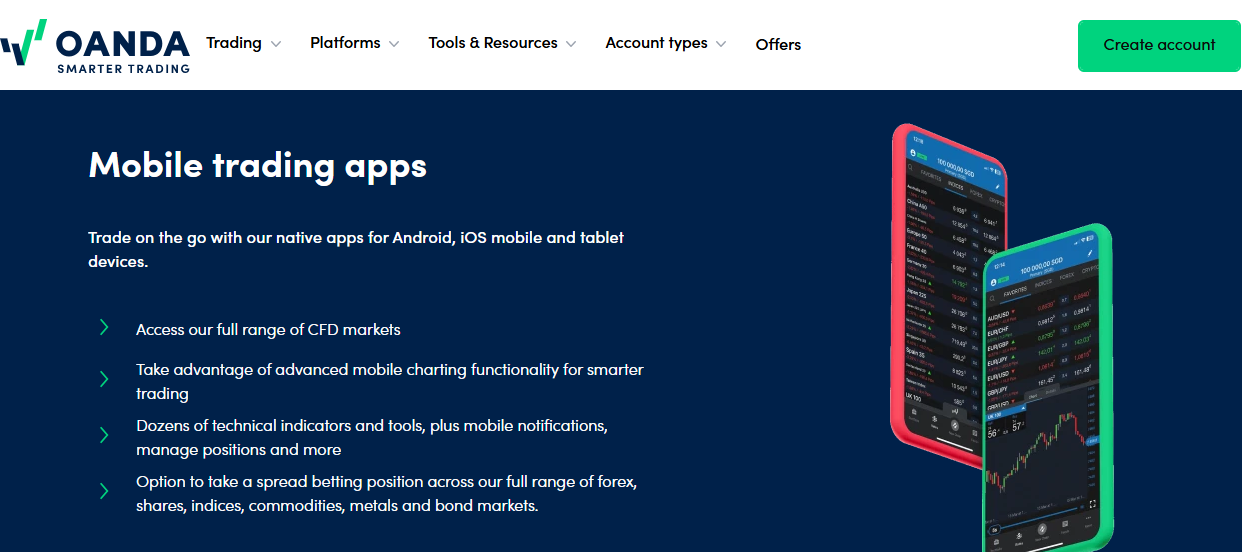

Does OANDA have a mobile app?

Yes, OANDA has a mobile trading app. It is called OANDA mobile. It has over 1 million downloads on the Google Play Store. It is rated 3.4 stars out of 5 from 6000 reviews.

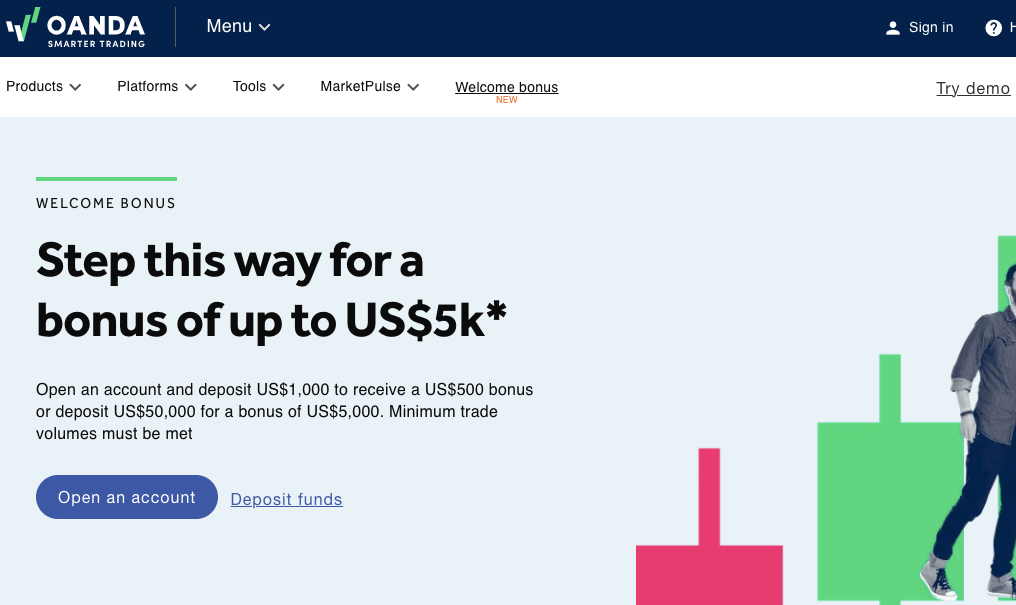

1) OANDA Welcome Bonus: OANDA offers a welcome bonus to clients registered under the OANDA Global Markets Ltd. The bonus is 50% of your first deposit, with a required minimum deposit of $25 (PHP 1,407). The welcome bonus on OANDA is capped at a maximum of $5,000 (PHP 2,81,402).

You can only use this bonus to trade as there is no cash alternative. You can withdraw profits from trades.

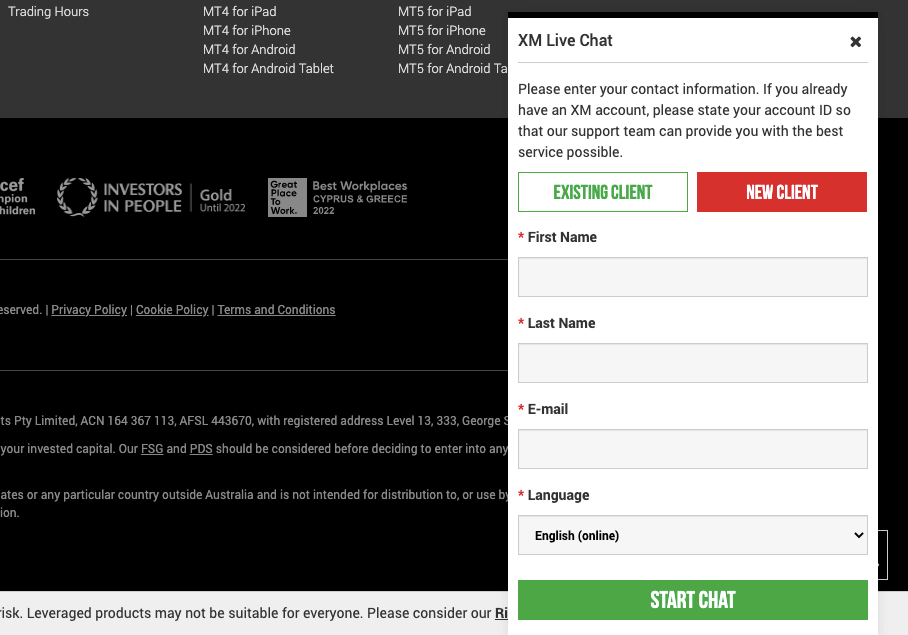

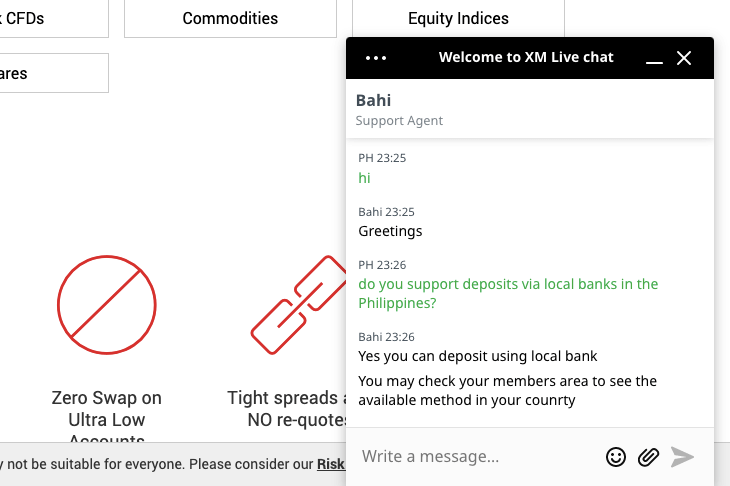

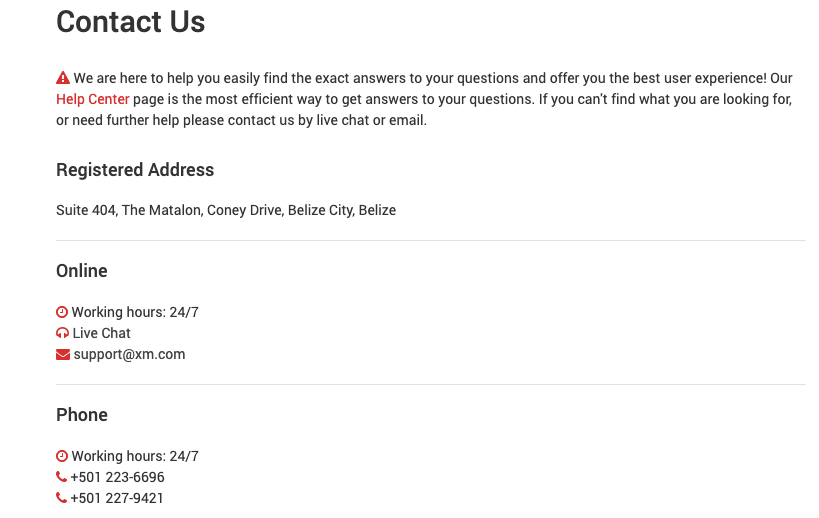

OANDA Philippines Customer Service

OANDA offers 24/7 online customer support to traders via the following channels:

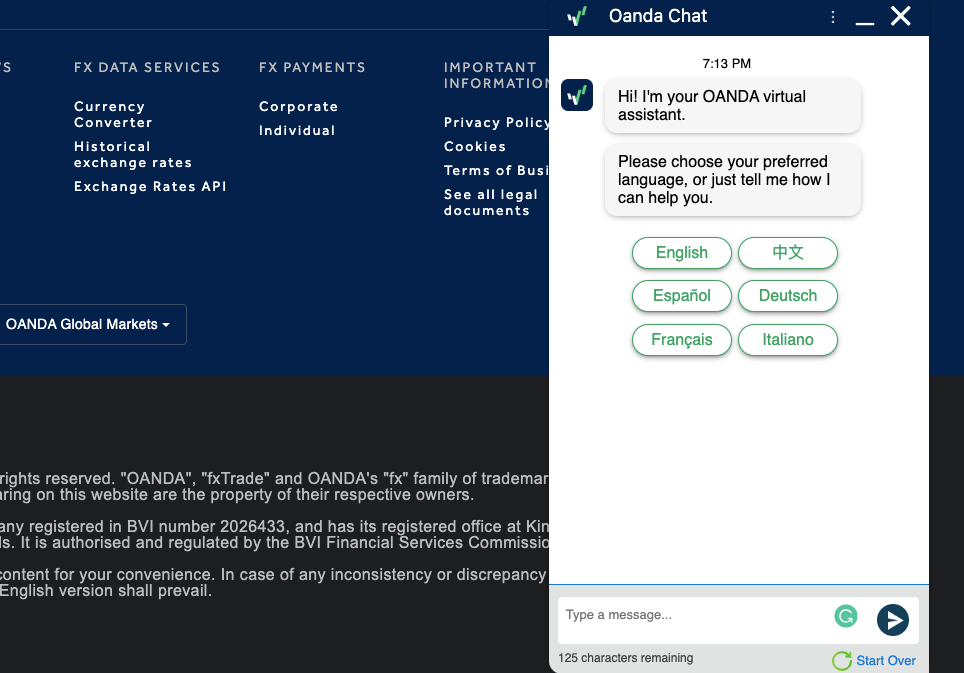

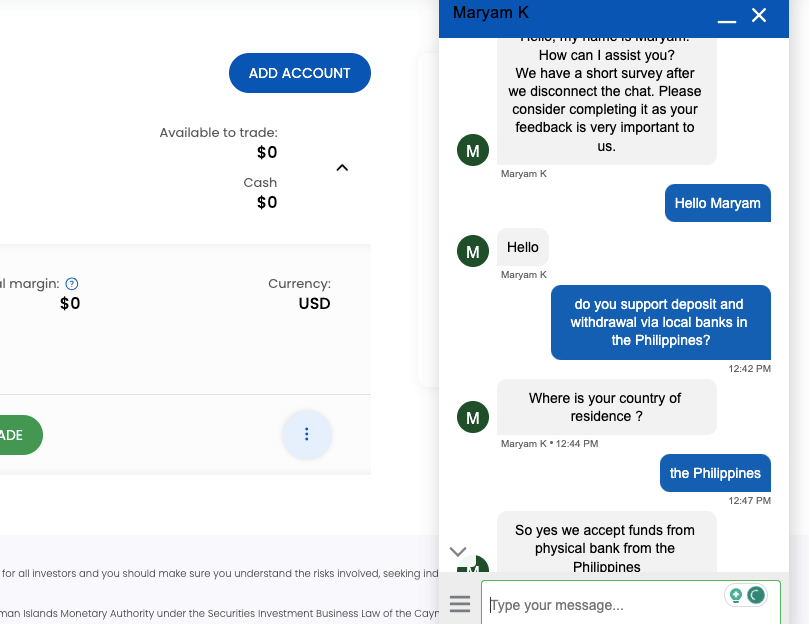

1) Live chat support: OANDA offers live chat support to clients that can be accessed through the support page of their website and is available 24/7 to chat with the Virtual Assistant, while live agents are available from 04:00 PM on Sunday to 06:00 PM on Friday ET (New York time).

When our team tested the OANDA live chat, there was no wait time as the agent was connected immediately. When you start the live chat, the chatbot will suggest some quick answers to you based on what you type.

To transfer to a live agent, type ‘Live chat agent’, then it will request your email and connect you to a live agent that is online. Although it will request for a code sent to the email, we didn’t get any, so we clicked resend code, then ‘I didn’t get email’ and we were connected to an agent.

The answers we received to our questions were relevant and we were directed sometimes to some articles that answered our questions.

2) Email support: OANDA also offers email support for traders and is available 24/5 as well. When our team tested the OANDA email support, we got a response 20 minutes later and the answers were relevant.

The OANDA email address for customer support is [email protected].

3) Phone support: OANDA currently does not offer local phone support for traders in the Philippines. You can reach OANDA Global Markets international number on + 1 855 257 7413 for support.

Do we Recommend OANDA Philippines?

OANDA is regulated in multiple jurisdictions by top-tier financial regulators, this means the broker is obliged to take measures to protect deposited client funds based on the various regulations.

OANDA offers several account types to traders, including commission-free, swap-free accounts and Premium Accounts to provide access to both beginners and experienced traders. You can also use the demo account option to learn more about the platform and trading in general.

Fees on OANDA are moderate, as they offer spread-only trading accounts with zero commission for opening and closing trade positions, the spreads are also competitive, they only charge withdrawal fees for bank transfers, while all deposits are free of charge.

A downside to OANDA Philippines is that they do not have negative balance protection, which means that if a trade position results in a loss, you can lose more than the money deposited into your account and will be required to deposit more money to clear the negative balance. They charge currency conversion fees and dormant account fees after 1 year, although you can avoid the dormant account charges if you have no funds in the account.

The customer support is responsive and available 24/7. The website is informative although the account registration process is easy, although it takes longer for your account application to be approved.

Although OANDA offers few tradable instruments, you can check out the broker’s website and probably chat with the live support to help decide if you want to trade on the platform.

OANDA Philippines FAQs

Is OANDA a good broker?

OANDA is considered a good broker because they are regulated by Top-Tier financial regulators, offers negative balance protection for retail clients, and commission-free trading account. Their customer support is also responsive.

Who is OANDA owned by?

OANDA is owned by OANDA Corporation which is incorporated in the United States of America and is regulated in the United Kingdom, Australia, Europe, and Asia.

How long does OANDA withdrawal take?

All withdrawal requests are processed within one business day by OANDA, and it may take up to 3 business days to receive funds for cards and up to 5 business days for bank transfers.

What can I trade with OANDA?

You can trade Forex currency pairs, indices, agriculture commodities(sugar, corn, wheat, and soybeans), cryptocurrencies, oil, metals (gold, copper and silver), and shares

Is OANDA safe?

Oanda is a well-regulated and credible broker with a strong track record. The broker is licensed by tier-1 forex authorities such as the FCA of the UK and the ASIC of Australia. Overall, we consider Oanda to be low risk broker for traders from Philippines. However keep in mind the risks of trading and avoid trading if you do not understand CFDs well enough.