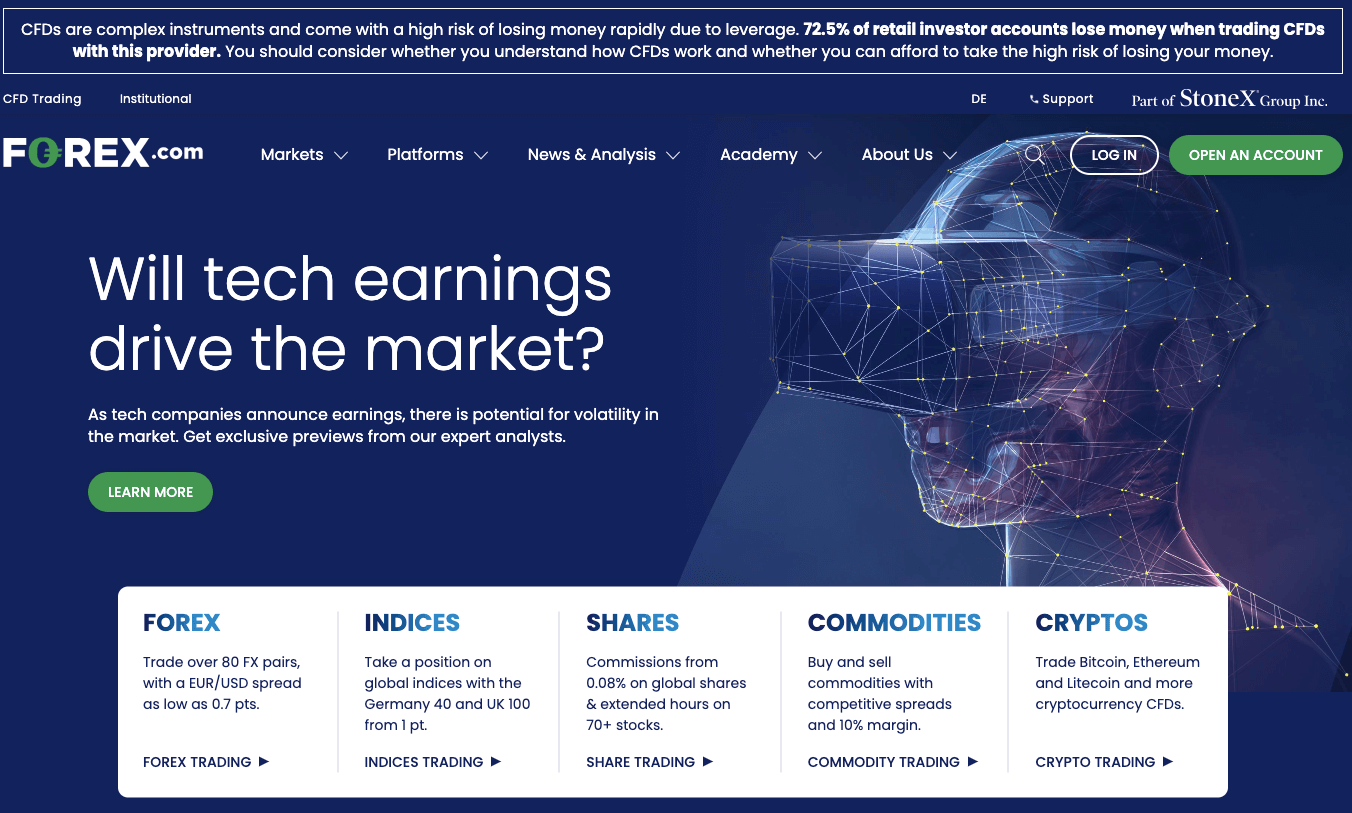

City Index Philippines, also known as forex.com, is forex broker & CFD broker, and their parent company is StoneX Group, which is listed on NASDAQ.

They are licensed by the Cayman Islands Monetary Authority (CIMA) along with multiple Tier-1 & Tier-2 regulatory bodies and offer a good range of CFDs. However, forex is trading is not regulated in the Philippines. Hence, traders from the Philippines are trading at their own risk.

Their CFD markets include indexes, shares, forex, oil, commodities, metals, and bonds. Apart from trading CFDs, City Index also offers spread betting on these instruments.

Traders from the Philippines can open a CFD trading account at City Index. You can fund your account via wire transfer, Neteller, Skrill, and credit/debit card. You can only deposit in USD, GBP, or EUR. City Index does not have a local office in Philippines.

| City Index Review Summary | |

|---|---|

| 🏢 Broker Name | GAIN Global Markets Inc. |

| 📅 Establishment Date | 2001 |

| 🌐 Website | https://www.forex.com/en/ |

| 🏢 Address | C/O Walkers Corporate Limited, Cayman Corporate Centre, 27 Hospital Road, KY1-9008, George Town, KY | Cayman Islands. |

| 🏦 Minimum Deposit | USD 100 (PHP 5600) |

| ⚙️ Maximum Leverage | 1:50 |

| 📋 Regulation | FCA, ASIC, CySec, and MAS |

| 💻 Trading Platforms | MT4, MT5 |

| Start Trading with City Index | |

City Index Pros

- They have a dedicated website for international traders from the Philippines

- Several deposit options available

- Negative balance protection

- City Index supports MT4 and MT5.

- Customer service is available 24/7

- Available on all devices, web, desktop, android, and iOS

City Index Cons

- City index charges account inactivity fee.

- The forex broker does not have a local office in the Philippines.

- They do not accept PHP as a base currency

City Index Video Review

Is City Index Legit?

As we said earlier, City Index (or forex.com) is not locally regulated in the Philippines since forex trading is not expressly legal in the country. Hence, traders from the Philippines are forex trading at their own risk. Such traders should trade through reputable foreign brokers that are regulated by top-tier foreign regulators, which are the FCA of the UK, the ASIC of Australia, and the CySEC of Cyprus. Here is a closer review of City Index’s regulations and licenses.

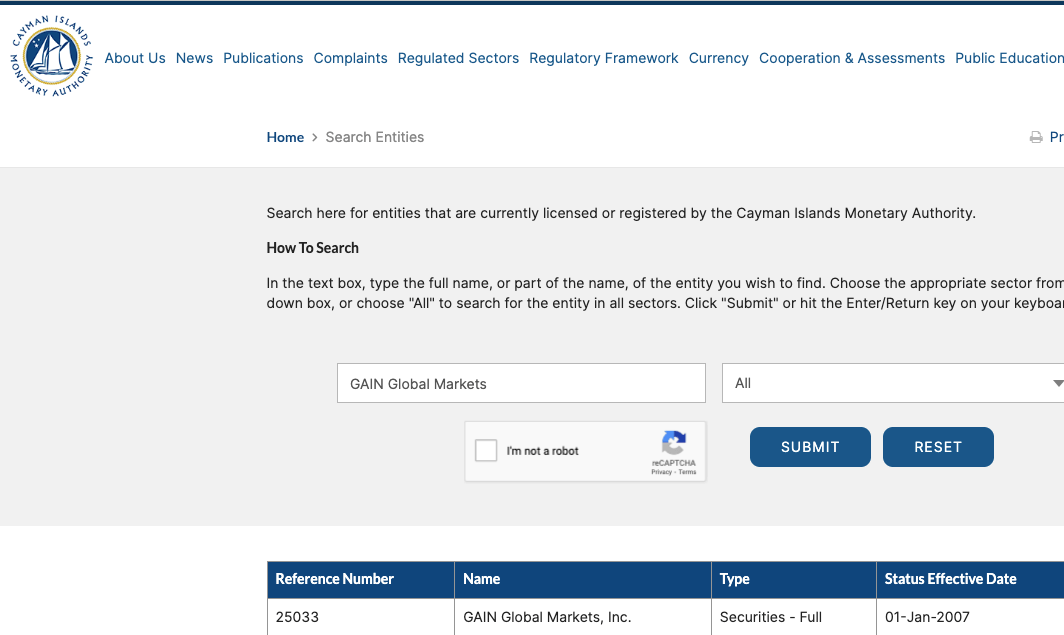

1) CIMA: City Index is licensed by the Cayman Islands Monetary Authority as GAIN Global Markets, Inc. with the trading name Forex.com. The broker was licensed in 2007 with reference number 25033. Traders from the Philippines are registered under this license.

This might be risky for local traders because this is an offshore regulation with rules that are not too strict.

2) ASIC: City Index is licensed with ASIC as Sotnex Financial Pty.Ltd. All financial services providers in Australia are issued an Australian Financial Services License (AFSL) Number. City Index’s AFSL number as seen on ASIC’s website is 345646.

3) MAS: MAS is the Monetary Authority of Singapore. City Index is incorporated in Singapore as StoneX Financial Pte. Ltd.

4) CySec: CySec is Cyprus Securities and Exchange Commission. City Index is regulated with CySec as StoneX Europe Ltd. The company registration number is 409708 with license number 400/21.

5) FCA: The Financial Conduct Authority (FCA) is the United Kingdom’s financial services regulator.City Index is licensed with the FCA as Stonex Financial Limited. Their FCA reference number is 446717.

City Index Investor Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| United Kingdom | £85,000 | Financial Conduct Authority (FCA) | StoneX Financial Limited |

| Cyprus (EU) | €20,000 | Cyprus Securities and Exchange Commission (CySEC) | StoneX Europe Ltd |

| Singapore | No compensation | Monetary Authority of Singapore (MAS) | StoneX Financial Pte. Ltd. |

| Philippines | No protection | Cayman Islands Monetary Authority (CIMA) | GAIN Global Markets, Inc. |

City Index Leverage

The maximum leverage at City Index for trading currency pairs is 400:1 for traders from the Philippines. This means that you can place a trade worth 400 times the value of your deposit.

For example, if you deposit $100, you can place worth $40,000. Note that this maximum leverage on City Index of 1:400 applies only to forex major pairs and other instruments have lower leverage limits. These leverage can be checked through the trading platform while trading.

Note that trading leveraged products are risky, and you can lose your money. It is best to avoid it. Only trade if you have experience or understand them.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

It is important that you do not trade with all the leverage available, because this will increase your risk and you can lose all your money.

City Index Account Types

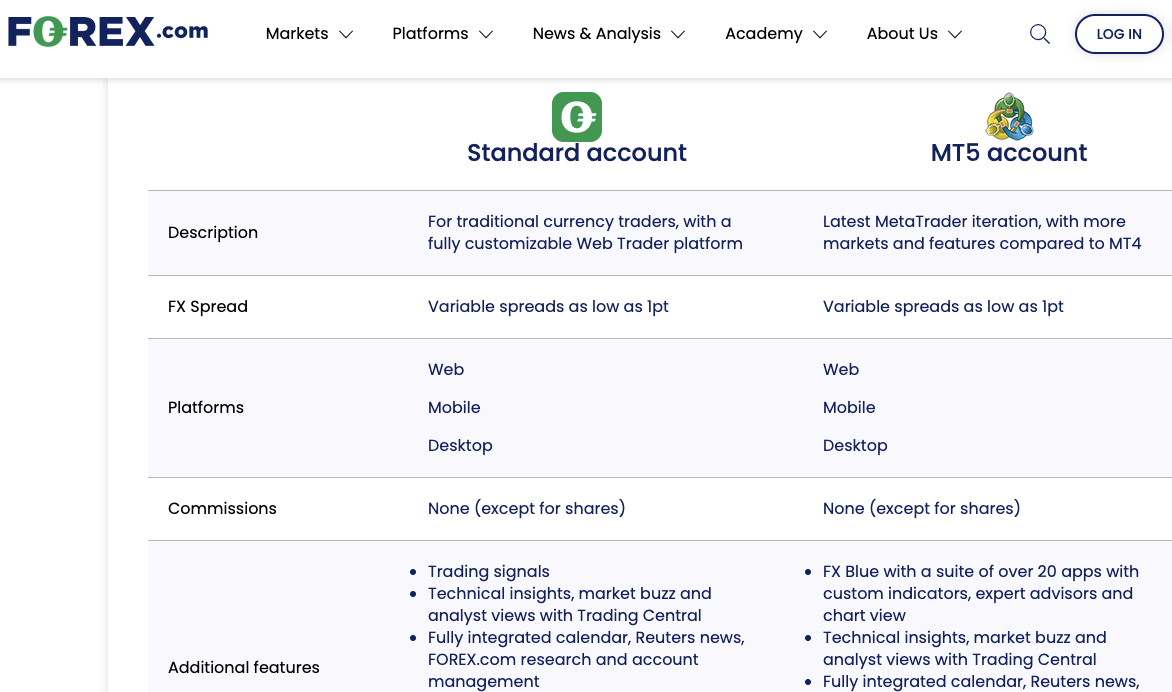

City Index offers four primary types of accounts to traders from the Philippines. Find a summary of the account types below:

1) Standard Account – The Standard account is the most basic type of account offered by City Index.

The City Index Standard Account is designed for retail clients and can be accessed on the City Index proprietary trading platform on the web and mobile devices. The trading platform has features such as SMART Signals, performance analytics, research portal for fundamental and technical analysis, integrated news feed within trading platform.

Spreads on this account start from 0.8 pips for major pairs and you do not pay any commission fees on your trades except when trading shares from 0.05% to 0.15%. You also pay swap fees for keeping a position open past the closing time of the market.

This account requires a minimum deposit of $100. If you don’t use your account for 12 months, there’s a $15 monthly charge that applies. City Index does not have negative balance protection which means you can lose more money than you deposited if your trade position is unsuccessful.

2) MT5 Account – The MT4 account is best suited for those looking to trade only currency pairs and indices. This account comes with several expert advisors to help you make trading decisions along with research material for both fundamental and technical analysis.

The City Index MT5 Account is on the MetaTrader trading platform on the web, desktop and mobile devices.

Spreads on this account start from 0.8 pips for major pairs and you do not pay any commission fees for trades, except when trading shares. You also pay swap fees for keeping a position open past the closing time of the market.

This account requires a minimum deposit of $100. If you don’t use your account for 12 months, there’s a $15 monthly charge that applies. City Index does not have negative balance protection which means you can lose more money than you deposited if your trade position is unsuccessful.

3) Corporate Account – The Corporate Account is meant for corporations, as the name suggests. You can add multiple users to the same trading account for collaborative trading. This account provides access to more than 6,000 markets.

4) DMA Account – The DMA Account stands for Direct Market Access. The trading prices under this account are sourced directly from liquidity providers, so the costs are lower. The commissions are also lower if you make more trades through this account.

The City Index DMA Account is designed for clients who trade large volumes of instruments and requires a minimum deposit of $25,000.

City Index Base Account Currency

When opening an account on Fore.com you can choose from 3 currencies to serve as your base account currency including Great Britain Pound – GBP, Euros – EUR, and the United States Dollar – USD.

All your trades, deposits/withdrawals will be measured in your base account currency.

City Index Fees

Philippine traders can find City Index’s spread, commissions, and other non-trading charges on their website. Here is a simplified view of their charges:

1) Spread: City Index offers the same spreads for their CFD Trading Accounts. The typical spread for major currency pairs is a little bit high. For example, they charge a typical spread of 0.8 pips to trade the benchmark EUR/USD currency pair. The minimum spread for major currency pairs on City Index are shown below.

2) Commission: City Index does not charge a commission when trading through their Standard and MT5 accounts, except when trading shares and the commissions can range from 0.05% to 0.15%. However, they do charge a commission through the DMA account.

City Index Trading fees Table

Here is a summary of the minimum spread fees and commission City Index charges on some instruments on the Standard Account:

| CFD instrument | Spread (Standard Account) | Commission |

|---|---|---|

| EUR/USD | 0.7 pips | None |

| GBP/USD | 1.1 pips | None |

| EUR/GBP | 1.1 pips | None |

| XAU/USD (Gold) | 0.3 pips | None |

| Crude oil | 2.5 pips | None |

| UK 100 | 2.0 pips | None |

| US Tech 100 | 1.0 pips | None |

3) Swaps: Whenever you keep a trade position open past the market closing time, you pay swap fees, which is calculated based on the trade size, leverage, spread and how long the position is kept open.

4) Non-trading Fees: City Index does not charge a deposit or withdrawal fee (however, the payment service provider may charge a fee). They do charge a small inactivity fee in case your account has been lying dormant for a prolonged period of time.

| Deposit fees | Withdrawal fees | Inactivity charges | GSLO Fees | Currency Conversion Fees |

| No* | No* | Yes | Yes | Yes |

*Note that your payment processing company may charge some independent transaction fee.

How to Open an Account with City Index?

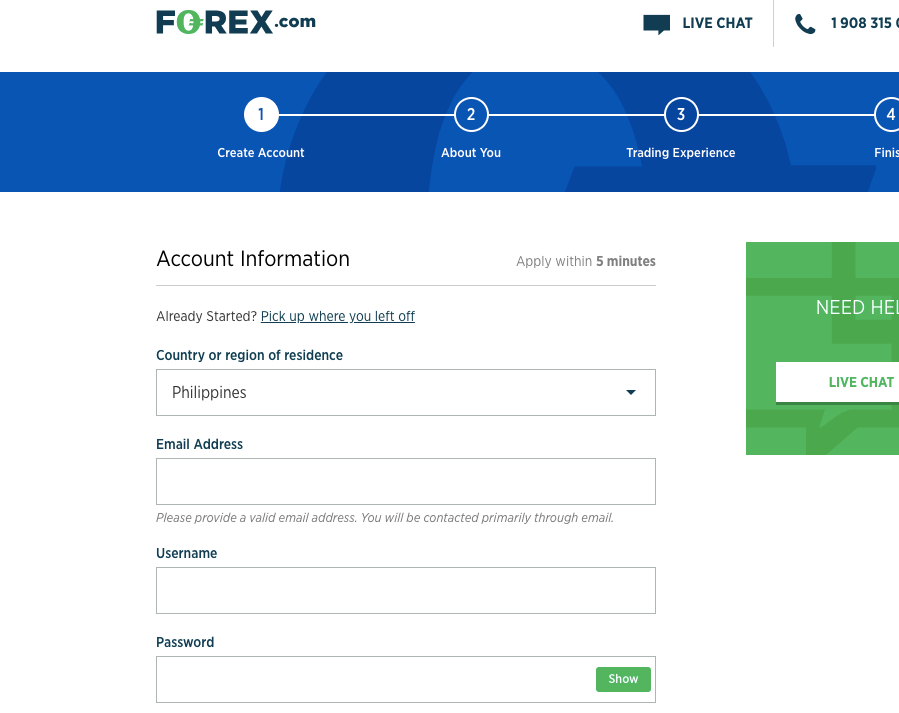

Here is how to sign up with City Index in basic steps:

Step 1) Go to City Index’s website for traders from Philippines at https://www.forex.com/en/ and click on the ‘OPEN AN ACCOUNT’ button at the top right side of the page.

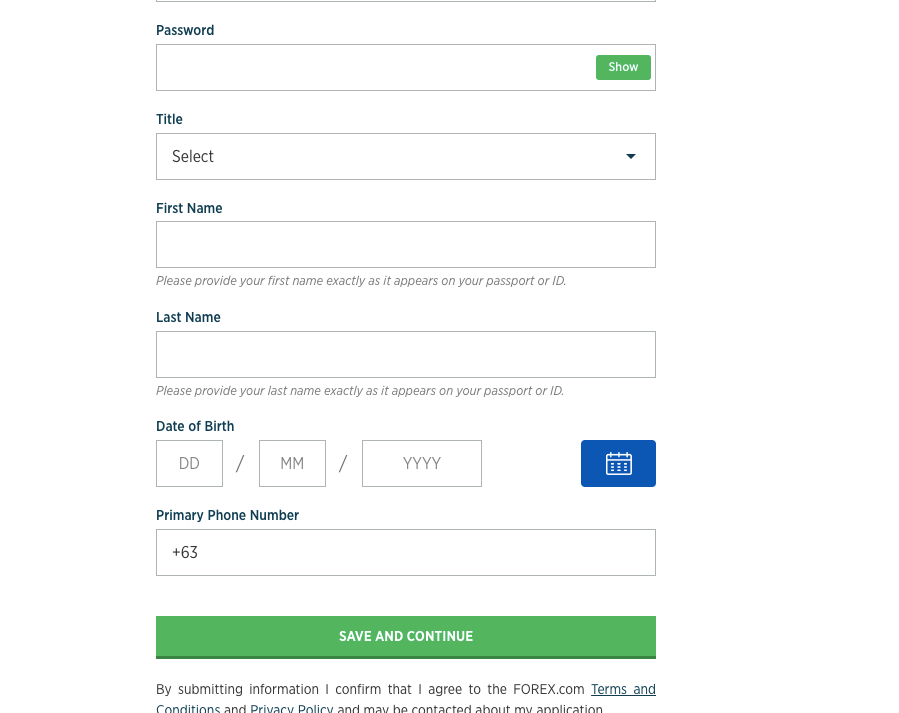

Step 2) Enter your email address, create a username and password, fill out your name, password, date of birth and phone number then click ‘SAVE AND CONTINUE’.

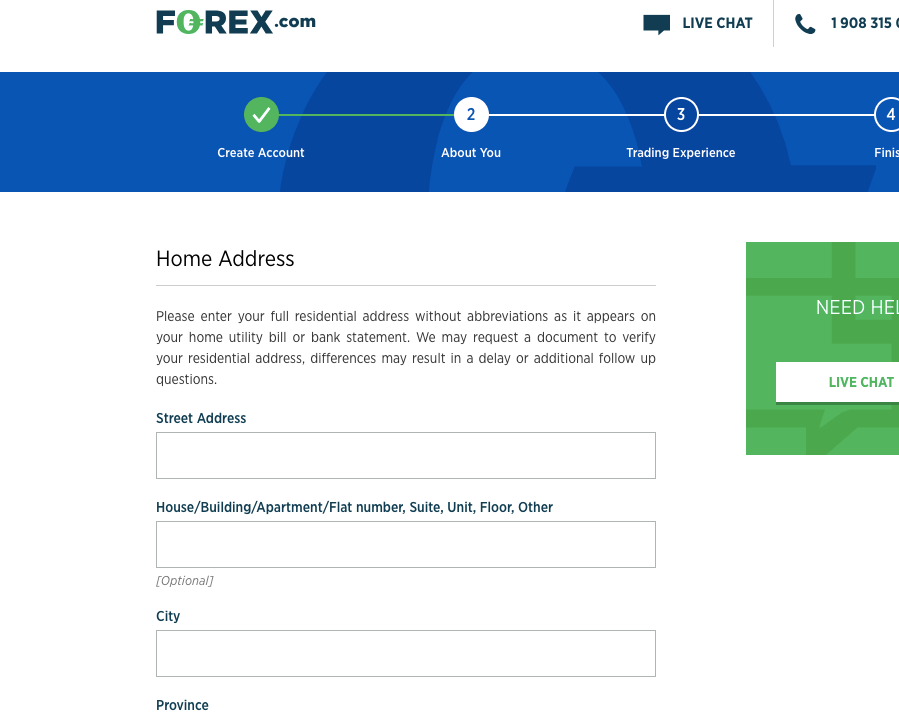

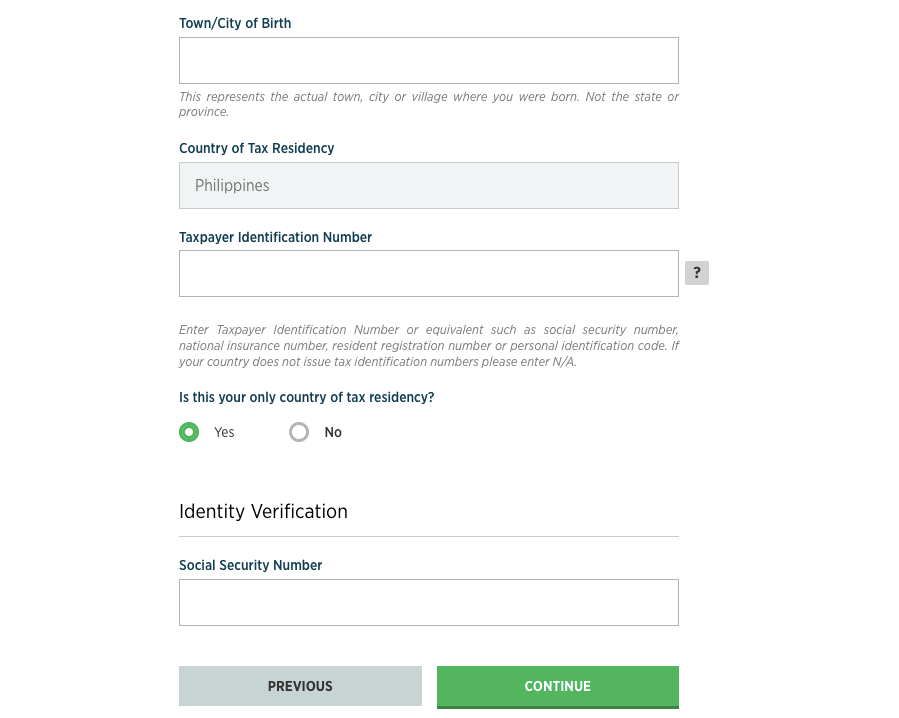

Step 3) Next provide your home address and identity details then click ‘CONTINUE’.

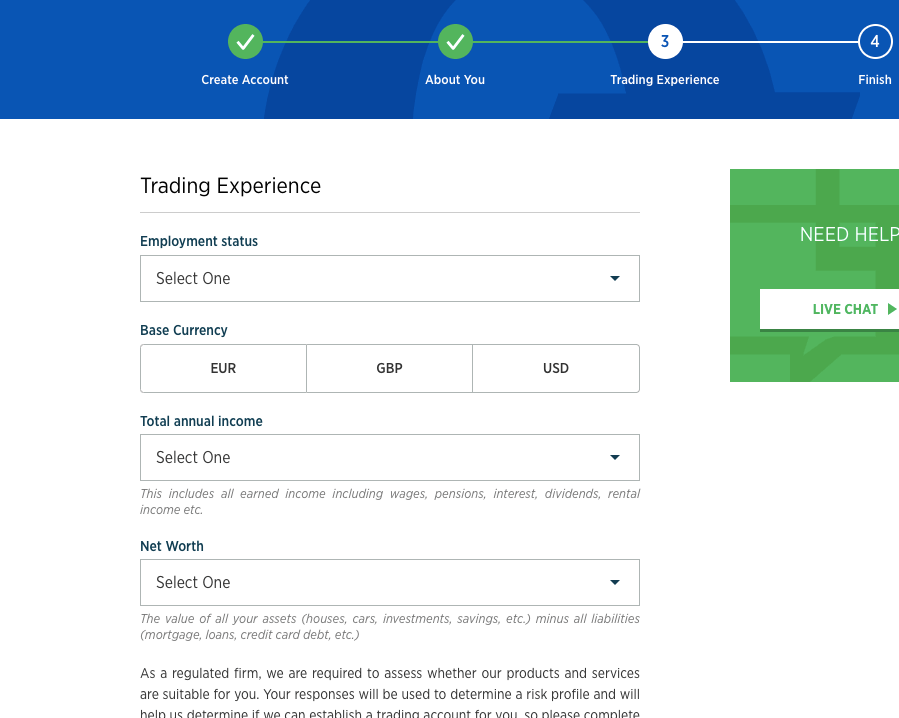

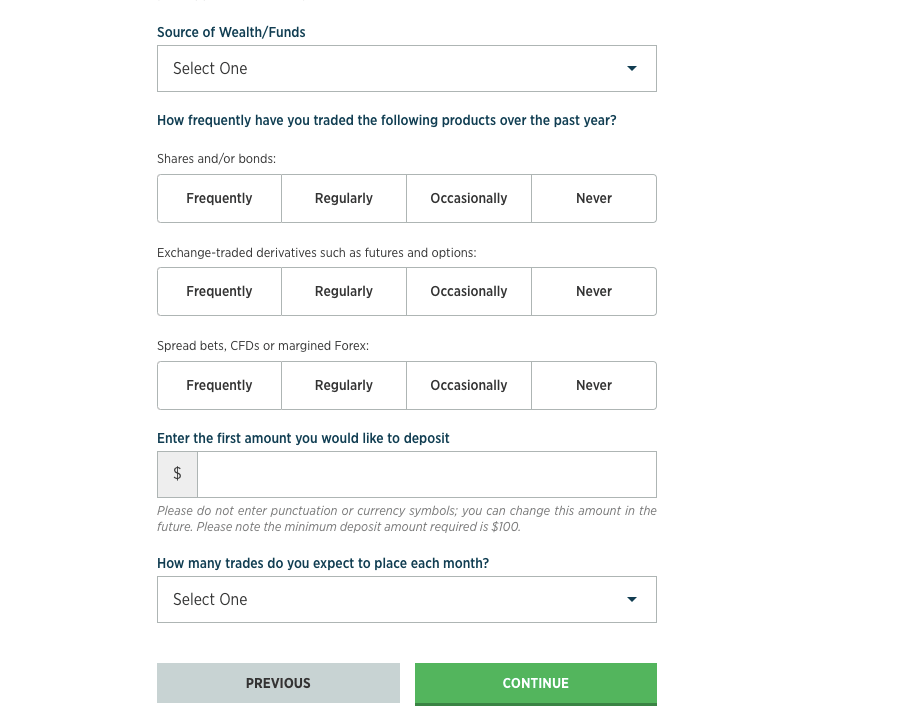

Step 4) Select your preferred base account currency, answer questions about your employment, income and trading experience, then click ‘CONTINUE’.

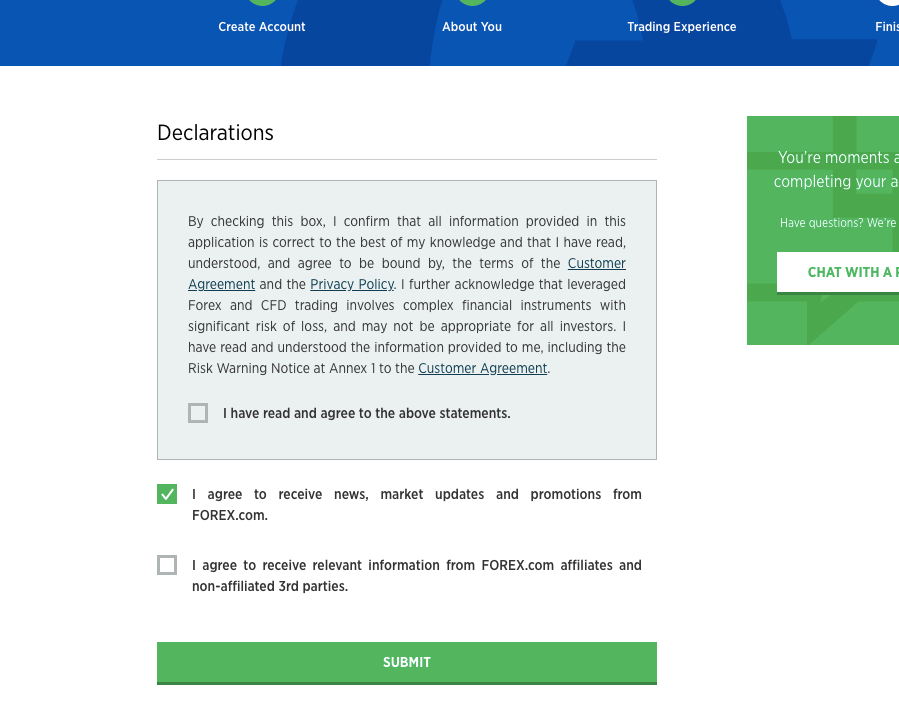

Step 5) Check the boxes o agree to the terms and conditions then click ‘SUBMIT’.

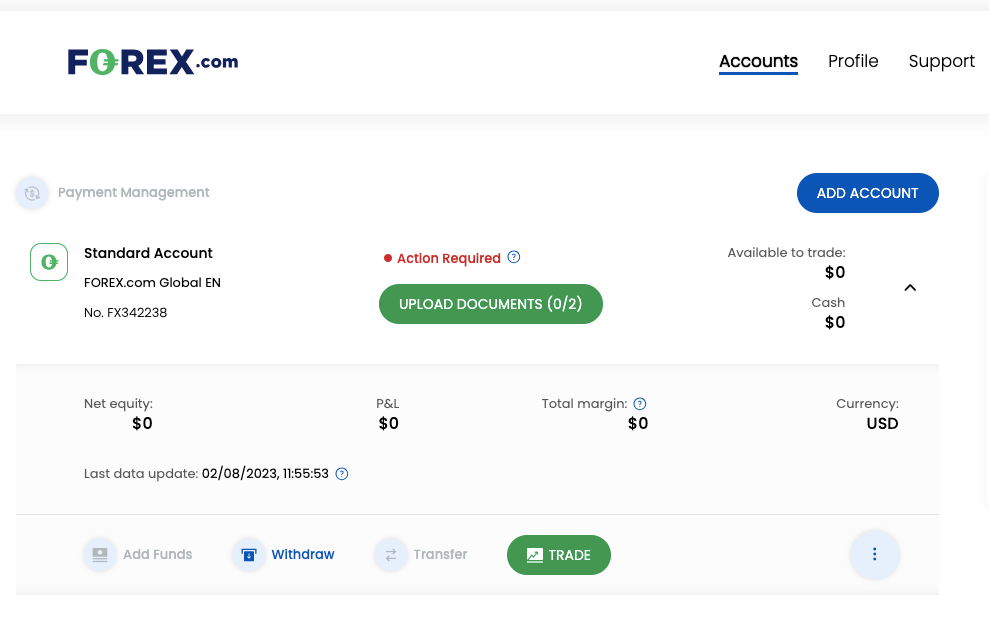

Step 6) You will be redirected to the dashboard and required to upload some documents to verify your account

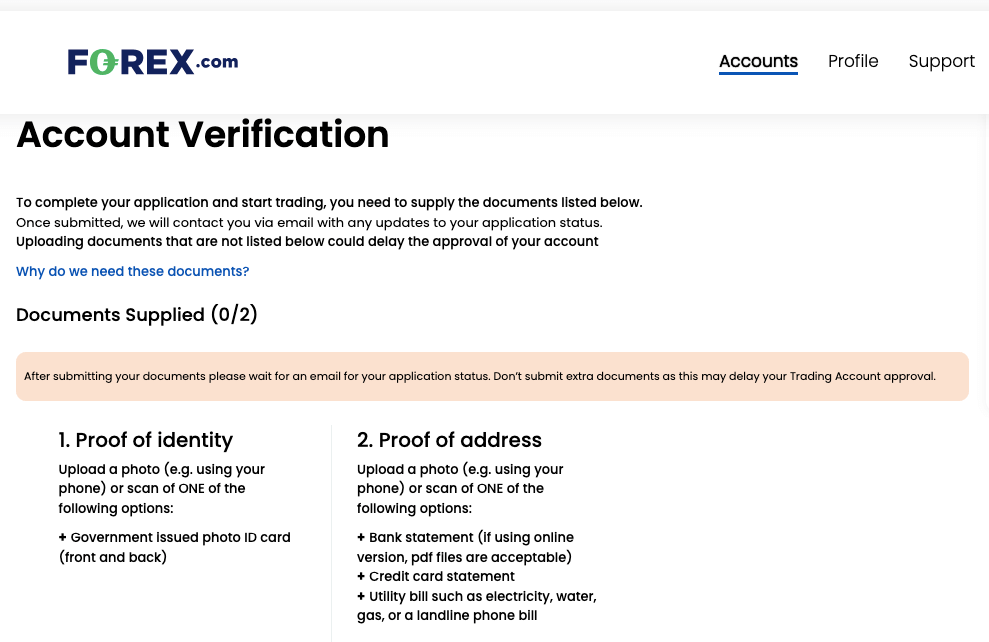

Step 7) Click on UPLOAD DOCUMENTS, then upload your proof of identify and address documents. Verification takes about 2 days, and the broker will reach out to you with their decision.

City Index Deposits and Withdrawals

There are several ways in which a trader from the Philippines can make a deposit into their trading account:

City Index Deposit Methods

Here is a summary of payment methods accepted by City Index (Forex.com) for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Bank Transfer | Yes | Free | 1-2 business days |

| Cards | Yes | Free | Instant |

| E-wallet | Yes (FAST, PayNow) | Free | Instant |

City Index Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on City Index.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Bank Wire Transfer | Yes | Free | Up to 3 business days |

| Cards | Yes | Free | 24 hours and up to 10 business days |

| E-wallets | No | N/A | N/A |

What is the City Index Minimum deposit?

The minimum deposit on City Index (Forex.com) is $100 for all payment methods.

What is the City Index Minimum withdrawal?

The minimum withdrawal on City Index in the Philippines is $100.

You can initiate deposits and withdrawals by logging into your account, and on the City Index area or dashboard, click on deposit or withdrawal on the left side menu.

City Index Trading Instruments

City Index (Forex.com) provides a very wide range of trading instruments to traders from Singapore. They offer a selection of over 12000 instruments, depending on the type of trading account being used by the trader. Below is a breakdown of the various instruments offered by the broker.

| Instrument | Availability | Number |

|---|---|---|

| Forex CFDs | Yes | 84 currency pairs on City Index |

| Indices CFDs | Yes | 21 Indices on City Index CFDs |

| Commodities CFDs | Yes | 25 commodities on City Index (oil, coffee, and other agriculture instruments) |

| Metals CFDs | Yes | 2 metals on City Index (Gold and Silver) |

| Stocks CFDs | Yes | 4,500+ shares on City Index (US, UK, Europe and other shares) |

| Cryptos CFDs | Yes | 8 Cryptocurrencies on City Index (BTC, ETH, Ripple and others) |

City Index Educational Materials and Research

On City Index’s homepage, you can find the different ways to learn under ‘Academy’. Here are the channels of learning with City Index.

1. Demo Account: City Index offers a demo account for retail traders. The only issue is the account expires in 30 days. Traders can re-apply for another demo account. However, the account will be as good as new. All settings will go back to default and you might not be able to track how well you are doing in the long term.

2. Courses: City Index’ courses are divided into basic, intermediate, and advanced levels. Each level has different courses and each course contains at least 3-4 lessons. The lessons are in text form and can take up to 5 minutes to read. There is also a progress bar that helps you track how far you have gone with the courses.

3. Glossary: Glossaries are good for getting the definition of terms quickly. City Index has a glossary for definition of terms and some financial instruments. In addition, the glossary is easy to navigate and arranged in alphabetical order. This saves you time and helps you search quickly.

4. News: This section covers economic events and information that traders can use for research. Events or information that affects forex, commodities, shares, and indices are shared and analyzed by top professionals and market analysts.

City Index Customer Support

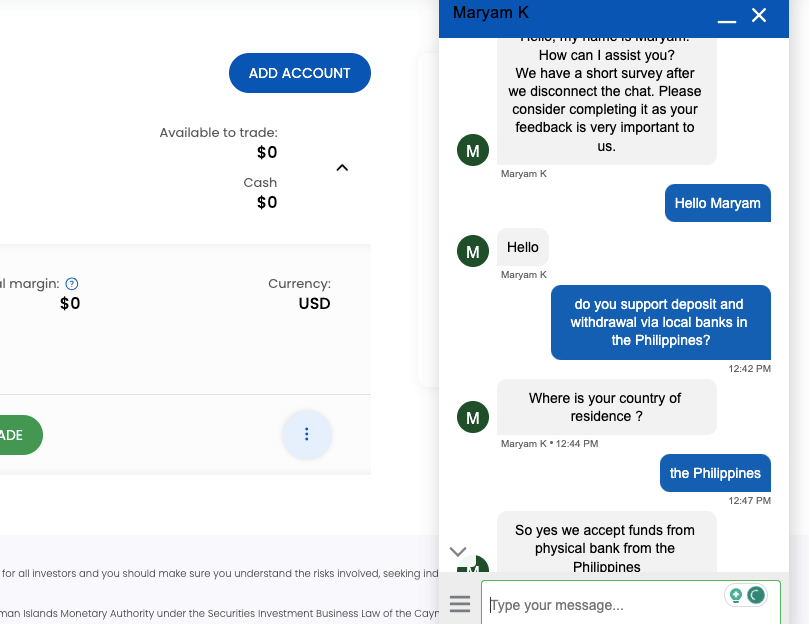

The support at City Index is good & we found it easy to talk to them via chat.

Good customer service is important. As a trader choosing a forex broker, you might have questions and inquiries. This is why we have reviewed City Index’s customer support in the Philippines.

1) Good Live chat: Forex.com has a live chat that is available from 10PM on Sundays to 10PM on Fridays. City Index has a live chatbot. It will be the first to respond to you on the live chat. When you start the chat, it will request your name and email address to connect you to a customer service representative. to transfer to a live agent, type “Chat Agent”. When we got connected to the customer service representative, we had a few seconds of holding time. We got quick responses to our answers (within two minutes). The answers were simple and relevant to our questions.

2) Phone number support: City Index have a phone number on their website that is available for calls from 10 PM on Sunday to 10 PM on Friday, GMT. It is under their ‘contact us’ section so clients. The internal Forex.com phone number is +357 220 900 62.

3) Email Support: Potential and existing customers can also reach City Index through email. They have separate email addresses available for different purposes. We tried one of their email addresses, [email protected], we got an auto-generated acknowledgement email, but no support staff responded to the email after several hours.

Is City Index a market Marker?

Yes, City index is a market maker. This means that City Index takes the opposite side of your trade, when you buy, City Index sells to you and when you sell, they buy from you.

As a market maker, City Index profits from the difference in the bid/ask price. On City Index trading platforms, you may notice that the ask price is always higher than the bid price. For example, they may display the bid/ask price of Tesla shares as 250/250.5

This means that City Index will buy Tesla shares at 250 from sellers but sell at 250.5 to buyers.

Do We Recommend City Index for Traders from Philippines?

Overall, yes.

City Index (or forex.com) is highly regulated by foreign top-tier regulators. The company has a highly credible lineage and is part of the well-known StoneX group. This means that trading through forex.com is relatively safe for traders from the Philippines.

Further, forex.com charges relatively low fees and they provide decent trading conditions such as a maximum leverage of 1:50.

There are a few downsides to trade through City Index as well. They do not have any local offices in the Philippines. Further, the range of trading instruments offered by them is quite limited with the exception of currency pairs. Essentially, they are a broker specialising in forex trading rather than other types of CFD trading.

City Index Philippines FAQs

What leverage does City Index offer?

To traders from the Philippines, City Index offers a maximum leverage of 400:1 This means that you can place a trade worth 400 times the value of your deposit.

For example, if you deposit $100, you can place worth $40,000. Note that this maximum leverage on City Index of 1:400 applies only to forex major pairs and other instruments have lower leverage limits. These leverage can be checked through the trading platform while trading.

Is forex.com an ECN broker?

That depends on the type of account being held by the trader. If you have a Standard account or a Commission account, then forex.com is a market maker. However, the STP Pro account provides STP trading services.

Is City Index a good broker?

City Index is a popular CFD broker in and are regulated by the tier regulators like the FCA in the UK. They provide CFD trading on various instruments and spread betting services with zero commission for currency pairs.

Can you use MT4 platform on forex.com?

Yes, the MetaTrader 4 and MetaTrader 5 trading platforms are available for traders using the Standard Account on forex.com

Note: Your capital is at risk