| CMC Markets Minimum Deposit Summary | |

|---|---|

| CMC Markets Minimum Deposit | NZD 0 |

| Deposit Methods | Bank Transfer, POLi, Credit/debit card, PayPal |

| Account Types | Next Gen, MT4 Account, FX Active Account |

| Deposit Fees | PayPal, POLi, and Bank Transfer have no fees |

| Account Base Currencies | USD, NZD |

| Withdrawal Fees | Some withdrawal methods attract a fee |

| Visit CMC Markets | |

CMC Markets’ minimum deposit is NZD 0. There is no minimum deposit required for all account types. Four live CFD trading accounts are offered by CMC Markets apart from their professional and institutional accounts.

The minimum deposit for the professional accounts are definitely higher. It is important that you know this. In this article, we provide a guide on CMC Markets trading accounts and how you can fund your your account.

How Much is CMC Markets Minimum Deposit in New Zealand?

CMC Markets have no minimum deposit.

However, their trading accounts come with separate trading conditions. These conditions are essential to know as they affect your trading costs. So beyond minimum deposit, let us look at these accounts briefly.

1) Next Gen Account

Minimum deposit for the account is NZD 0. This account allows you to go long or short on forex, indices, commodities, shares, and treasuries. It is available only on CMC Markets Next Gen trading platforms.

Spreads begin from 0.0 pips and you will pay a minimum commission. The commission applies to shares CFDs only and it begins from NZD 7 for New Zealand shares and $10 for US shares.

You can open a demo account to practice and premium guaranteed stop loss order (GSLO) is available at a fee. It the order is not triggered, all of the fee will be refunded.

The Next Gen account also supports advanced trading order

2) MT4 Account

The minimum deposit for the MT4 Account is NZD 0 . As the name implies, you can only open this account on MT4.

This account does not offer all of CMC Markets’ range of CFDs in New Zealand. Only 200+ trading instruments which include forex pairs, indices, commodities, and cryptos are available.

Spreads are tight, beginning from 0.0 pips. Shares CFDs are not available on this account. Added to this account are advanced tools that help you manage risk and trade better.

Such tools include correlation matrix, alert manager, mini terminal, correlation trader, sentiment trader, etc.

Here is a general overview of CMC Markets trading accounts in New Zealand

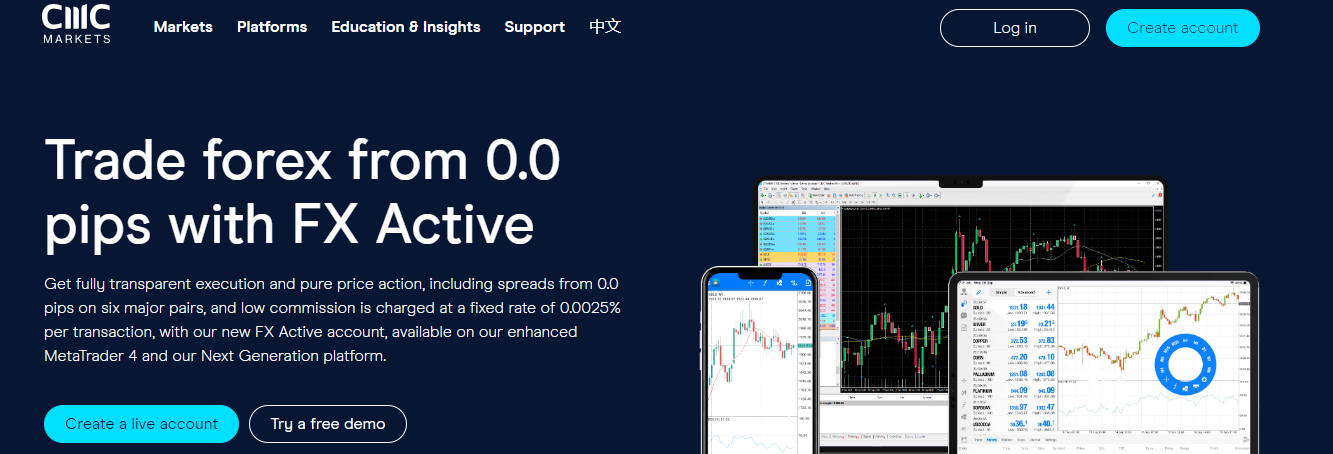

3) FX Active Account

You need NZD 0 to open the FX Active Account.

Do you love to trade CFDs with pure price action? If yes, this account is designed for you. With low spreads beginning from 0.0 pips, you can trade the same instruments on the standard CFD Account.

Normal spread pricing applies to EUR/USD, GBP/USD, AUD/USD, NZD/USD, USD/CAD, and USD/JPY. On all other forex pairs, the spread is reduced by 25%.

You will pay zero commission on all instruments except for shares CFDs. The minimum commission is $10 and NZD 7 for US and New Zealand shares respectively.

New Zealand traders can open the FX Active Account on MT4 and the Next Gen trading platform.

GSLO premium fee is refunded if it the order is not triggered.

Note: CFD trading is risky

Does CMC Markets have a Recommended Minimum Deposit?

Though CMC Markets have no minimum deposit, they do suggest that you fund your account with at least NZD 100 to cover for margin requirements.

CMC Markets Deposit Methods and Required Fees

CMC Markets does not only have NZD-based account. They also allow you fund your account in New Zealand Dollar (NZD). There are four deposit methods supported by CMC Markets.

1) Bank transfer: You cannot fund your account with other methods without an initial deposit via your bank. This is how it works in New Zealand. No extra fees for deposits.

2) POLi: POLi is also available for funding without commission on the transaction

3) Credit/Debit Card: CMC Markets accept cards from Visa and MasterCard for New Zealand traders. There is a 1.5% charge for both credit and debit card payments

4) PayPal: You can get money to your account via PayPal without extra commission.

CMC Markets Deposit Terms

1) CMC Markets do not accept deposit requests over the phone. Exception will be made only if your account is approaching margin call.

2) CMC Markets does not accept AMEX or Diners cards.

3) Ensure that any payment you make to fund your account is from a card or account in your name. Payments from third party sources are not accepted. They will be returned.

4) CMC Markets does not accept cheque or cash deposits.

5) Transaction charges will be deducted from the amount you send. Net proceeds will be transferred to your trading account.

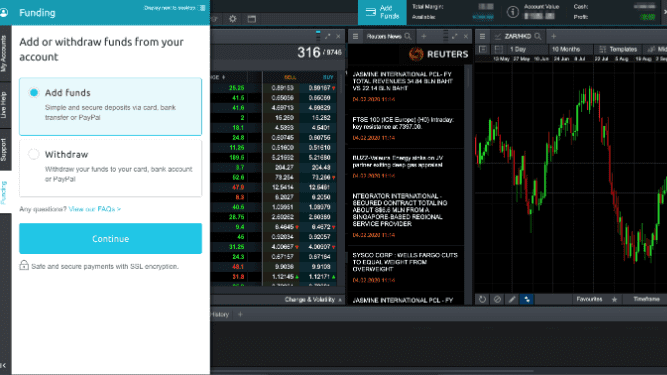

How to Deposit Money Into Your CMC Markets Account

1) On CMC Markets platform or mobile app, log in to your client area.

2) Look for the Funding tab on the left and click it.

3) Select your preferred funding method.

4) Enter necessary details and make sure they are correct.

5) Complete the funding of your account.

Comparison Of CMC Markets Minimum Deposit With Other Brokers

Here how other broker’s minimum deposit compare with that of CMC Markets.

| Broker | Minimum Deposit |

|---|---|

| CMC Markets | NZD 0 |

| Plus500 | NZD 200 |

| BlackBull Markets | $0 (NZD 0) |

| TMGM | NZD 100 |

| IG Markets | $450 (NZD 731) |

Note: CFD trading is risky

Frequently Asked Questions

What is the minimum deposit for CMC Markets New Zealand?

CMC Markets New Zealand have no minimum deposit. You need NZD 0 to open an account.

Is there a deposit limit for CMC Markets?

CMC Markets does not have a deposit limit. But your bank or payment service provider might have.

Is CMC Invest good for beginners?

Your capital is at risk when you invest. Make sure you have sufficient knowledge before going into it.

Can CMC Markets be trusted?

MC Markets is regulated by the Financial Markets Authority of New Zealand. In addition, CMC Markets is licensed with tier-1 regulators too.

Can you withdraw money from CMC Markets?

Yes, you can withdraw your funds by using the Funding tab.

Note: Your capital is at risk