If you live in Ghana and want to engage in online forex trading, there are some key things you should know about online forex brokers and trading forex from Ghana.

First, online forex trading is currently unregulated in Ghana by neither the Securities and Exchange Commission nor the Bank of Ghana. Although many online forex brokers offer their services to clients in Ghana, trading with them is at your own risk because no authority in Ghana can offer you any form of protection.

Because trading safely is important, we have compiled a list of the best forex brokers to guide you on which to trade with. Firstly, never trade with an unregulated broker. You could lose all of your money.

We have reviewed several forex brokers in Ghana, examining their regulatory status, trading and non-trading fees, account types and available trading instruments.

We now present the best of these brokers with a summary of their pros/cons. Read on to learn more about them so that you can make an informed decision when choosing your broker.

Show More

Comparison of Best Forex Brokers Ghana

Best Forex Brokers Ghana

Here are the Best Forex Brokers in Ghana that we have reviewed based on 10+ trust Factors:

- Octa – Best Forex Broker in Ghana

- XM – Forex Broker with Wide Range of Instrument

- Tickmill – Broker with fast execution

- Fusion Markets – Broker with low trading fees

- Exness – Good Forex Broker with Multiple Account Types

For more information, we now cover below the detailed breakdown of features like safety, fees, trading conditions, support & more of each above listed broker one by one for comparison.

#1 Octa- Best Forex Broker in Ghana

EUR/USD Benchmark:

1.0 pips

Trading Platforms:

Octa Trader, MT4, MT5

Account Minimum:

$50 (GHS 760)

Octa is regulated by the Cyprus Securities and Exchange Commission (CySEC) as Octa Markets Cyprus Ltd and licensed to operate as an investment firm in the European Area. Octa is also registered in Saint Lucia as Octa Markets Incorporated, they serve clients Outside the EU through this registration.

Total Fees: For trading fees, Octa charges spreads on trade, no commissions are charged on trades and Octa does not charge swap fees for overnight positions. For non-trading fees, Octa does not charge any deposit or withdrawal fees and no dormant account charges either.

Trading Conditions:

Account types: Octa offers three account types based on the trading platforms they support – Octa Trader, MT4, and MT5 accounts. The minimum deposit for these accounts as recommended by the broker is $100 (GHS 1,520), although when depositing funds, the minimum amount is dependent on the deposit method and starts from $50 (GHS 760) for Skrill and Neteller. Spreads for major currency pairs are low.

| Major Currency Pairs |

Spread |

| EUR/USD |

1.0 |

| USD/JPY |

2.0 |

| GBP/USD |

1.1 |

| USD/CHF |

1.20 |

| USD/CAD |

1.40 |

| AUD/USD |

1.0 |

| NZD/USD |

1.20 |

Commissions: Octa offers commission-free trading on all instruments and account types, so, you do not have to pay any commissions to open or close trade positions.

Instruments: Tradable CFDs instruments on Octa are 52 currency pairs, 2 metals (gold and silver), 10 stock indices, 3 energies, 150 stocks, 34 cryptocurrencies, and 26 intraday assets.

Leverage: These are the maximum leverages for various instruments on Octa.

| Instruments |

Leverage |

| Forex CFDs |

1,000:1 |

| Index CFDs |

400:1 |

| Metals CFDs |

400:1 |

| Energies CFDs |

400:1 |

| Crypto CFDs |

200:1 |

| Stocks CFDs |

40:1 |

| Intraday Assets CFDs |

1,000:1 |

Risk management tools: Octa offers negative balance protection to ensure you do not lose more than the money in your trading account. They also have stop-loss order feature.

Funding/Withdrawal methods: You can deposit via e-wallets (Skrill and Neteller) and crypto. You can withdraw via these means too. E-wallets deposits are credited instantly while it takes about 30 minutes for deposits via crypto to be reflected on your trading account.

Trading platforms: Octa Trader, MetaTrader 4, and MetaTrader 5 are the platforms available with this broker. These platforms are available on different devices (Android, iOS, Web, Windows and Mac).

Support: Octa offers 24/7 online customer support to traders via live chat. The live chat has a chatbot but you can get a live agent to respond by requesting that the chatbot transfers you. When we tested it, the wait time was under 2 minutes for a live agent to respond.

Octa Pros

- Low trading fees

- No commission fees

- Multiple trading platforms

- Free deposits and withdrawals

- No dormant account fees

Octa Cons

- No Tier-1 regulation

- Recommended minimum deposit is high

- High leverage for forex

- Limited payment methods for deposit and withdrawals

#2 XM Trading- Forex Broker with Wide Range of Instrument

EUR/USD Benchmark:

1.6 pips

Trading Platforms:

MT4, MT5, XM Mobile App

Account Minimum:

$5 (GHS 76)(

XM is regulated by the International Financial Services Commission (IFSC) of Belize as XM Global Limited, this is the entity traders in Ghana are registered under. They are also licensed by the Australian Securities and Investment Commission (ASIC) as Trading Point of Financial Instruments Pty Limited.

Total Fees: XM charges spreads, commissions and swaps on trades, depending on your trading account. However, while the broker ordinarily does not charge any fees for adding funds or withdrawing from your account, they charge $10 per month on dormant accounts after 90 days of inactivity.

Trading Conditions:

Account types: XM has 4 account types, Standard, Micro, Ultra-Low Standard and Shares Accounts. All accounts require a minimum deposit of $5 (GHS 76) except shares account which requires a minimum deposit of $10,000. Below are typical spreads of major instruments on XM

| Major Currency Pairs |

Spread (Typical) |

| EUR/USD |

1.6 |

| USD/JPY |

2 |

| GBP/USD |

1.8 |

| USD/CHF |

1.9 |

| USD/CAD |

2.3 |

| AUD/USD |

2.3 |

| NZD/USD |

2.7 |

Commissions: XM does not charge commissions on trades, this applies to all instruments and all accounts except the Shares Account.

Instruments: XM offer a good range of instruments. You get to trade 55 currency pairs, 31 equity indices, 6 thematic indices, 58 cryptocurrencies, 1,300 stocks, 5 precious metals, 7 turbo stocks, 8 energies, 8 agriculture commodities, an 99 shares.

Leverage: The leverages for the CFDs instruments on XM is dependent on the size of your equity/trade. Here is a breakdown:

| Total Equity |

Maximum Leverage |

| $5 – $40,000 |

1,000:1 |

| $40,001 – $80,000 |

500:1 |

| $80,001 – $200,000 |

200:1 |

| $200,001+ |

100:1 |

Note that as your trade volume increases, your leverage is reduced and some instruments like Cryptocurrencies operate a dynamic margin model.

Risk management tools: XM offers negative balance protection to ensure you do not lose more than the money in your trading account, they also have Stop Loss and Take Profit orders feature.

Funding/Withdrawal methods: XM supports 4 deposit/withdrawal methods: credit/debit card, bank transfer, mobile money, or e-wallets. Card and e-wallet deposits are credited instantly, mobile money deposits can take up to 24 hours, while it takes take 3-5 working days for bank transfers. Withdrawals to cards and bank accounts take 5 working days for you to receive funds, its instant for e-wallets and 3 working days for mobile money.

Trading platforms: You can trade with MetaTrader 4, MetaTrader 5, or their proprietary mobile trader (XM App). XM MT4 and MT 5 is available on Web, Mac and Windows. Also, you can download their mobile trader on Google Play Store and Apple App Store.

Support: XM offers 24/7 online support via live chat on their website. When we tested it, it took less than 2 minutes for a chat agent to respond and the answers were helpful.

XM Pros

- Has Tier-1 regulation

- Zero commissions on trades

- Wide range of trading instruments

- No deposit and withdrawal charges

- Low minimum deposit

XM Cons

- Inactivity fee

- High leverage

#3 Tickmill – Broker with fast execution and low spreads

EUR/USD Benchmark:

0.1 pips

Trading Platforms:

MT4 & MT5

Account Minimum:

$100 (GHS 1,520)

Tickmill is regulated by the Financial Conduct Authority (FCA) in the UK as Tickmill UK Ltd, the entity that serves Ghana traders is licensed by the Seychelles Financial Services Authority (FSA) as Tickmill Ltd.

Total Fees: Tickmill charges spreads, commissions and swaps, depending on the account type. The broker offers free deposits and withdrawals for all payment methods, although you have to deposit above $5,000 via bank transfers for the fees to be covered. Tickmill does not charge inactive account fees but if your trading account is dormant for 60 days with less than $50 balance, the account will be disabled and you cannot reactivate it.

Trading Conditions:

Account type: Tickmill offers 2 main account types – Classic, and Raw Accounts. Both accounts require a minimum deposit of $100 (GHS 1,520). When your account balances reaches $50,000, your account will be upgraded to VIP status and you get to enjoy some benefits.

Here are the typical spreads for select instruments

| Major Currency Pairs |

Spread (Typical) |

| EUR/USD |

0.1 |

| USD/JPY |

0.1 |

| GBP/USD |

0.3 |

| USD/CHF |

0.4 |

| USD/CAD |

0.2 |

| AUD/USD |

0.1 |

| NZD/USD |

0.3 |

Commission: Tickmill offers commission-free trading with the Classic Accounts. The Raw Accounts pay commission on trades, starting $3 (GHS 46) per side which is $6 (GHS 92) for round turn.

Instruments: Tickmill offers limited instruments compared to other brokers on this list. You get to trade 62 currency, CFDs on 9 cryptocurrencies, 20 stock indices, 4 bonds, and 15 commodities (oil, agriculture, metals).

Leverage by instruments:

| CFD Instruments |

Maximum Leverage |

| Forex CFDs |

1,000:1 |

| CFDs on Stock Indices |

100:1 |

| CFDs on Commodities |

100:1 |

| CFDs on Metals (Gold and Silver) |

1,000:1 |

| Bonds CFDs |

100:1 |

| Crypto CFDs |

200:1 |

Risk management tools: You can use a stop-loss order and trailing stops. They also offer negative balance protection. However, Tickmill does not offer guaranteed stop-loss orders and the negative balance protections are not guaranteed either.

Funding/withdrawals: You can deposit and withdraw funds through bank transfer, credit/debit card, Neteller, and Skrill, sofort, dotpay, and crypto. For all of these channels, you cannot withdraw below $25 (GHS 380).

Also, deposits are instant except bank transfers that take 1 working day. All withdrawals are processed within 1 working day and can take up to 8 working days to receive it depending on the payment method.

Trading platforms: Tickmill offers the MetaTrader 4 and 5 platforms. They also have a Metatrader Web platform. Tickmill’s MT4 & MT4 mobile platforms are available for Android & iOS.

Support: They offer customer via live chat on their website. The response time is fast.

Tickmill Pros

- Has Tier-1 regulation

- No deposit and withdrawal charges

- Fast execution speeds

- Has commission-free account

- Low spreads

Tickmill Cons

- Inactive account disablement

- Instruments are limited in number

- Stop loss and negative balance protection are not guaranteed

#4 Fusion Markets – Broker with low trading fees

EUR/USD Benchmark:

0.08 pips

Trading Platforms:

MT4, MT5, cTrader, TradingView

Account Minimum:

$10 (GHS 152)

Fusion Markets is regulated by the Australian Securities and Investments Commission (ASIC). They are also licensed in Vanuatu as Gleneagle Securities Pty Limited, they serve the clients in Ghana via this registration.

Total Fees: Fusion Markets charges spreads, commissions and swap fees, depending on your trading account type. The broker offers free deposits and withdrawals. Fusion Markets does not charge inactive account fees.

Trading Conditions:

Account type: Tickmill offers 2 main account types – Classic, and Zero Accounts. They also have swap free and demo accounts. The minimum deposit for the accounts depend on the payment method you are using and this starts from $10 (GHS 152).

Here are the average spreads for select instruments on Fusion Markets

| Major Currency Pairs |

Spread (Average) |

| EUR/USD |

0.08 |

| USD/JPY |

1.1 |

| GBP/USD |

0.23 |

| USD/CHF |

0.34 |

| USD/CAD |

0.23 |

| AUD/USD |

0.13 |

| NZD/USD |

0.19 |

Commission: There are no commissions on currency pairs when trading with the Classic Account. However, the Zero Account has commission charges from $2.25 (GHS 34) per side per standard lot which makes it $4.5 (GHS 68) for a round turn.

Instruments: You can trade over 2100 instruments on Fusion Markets. They offer 90+ currency pairs, 15 indices, 7 metals, 3 energies, 1,000+ stock CFDs, 11 agriculture commodities and 13 cryptocurrencies CFDs.

Leverage by instruments: The maximum leverage is 500:1. Find the breakdown below:

Leverage by instruments:

| CFD Instruments |

Maximum Leverage |

| Forex CFDs |

500:1 |

| CFDs on Indices |

100:1 |

| CFDs on Metals |

500:1 |

| Bonds CFDs |

100:1 |

| Crypto CFDs |

10:1 |

Leverage by equity:

| Total Equity |

Maximum Leverage |

| $5 – $50,000 |

500:1 |

| $50,001 – $100,000 |

200:1 |

| $100,001 – $250,000 |

100:1 |

| $250,001-$500,000 |

50:1 |

Risk management tools: Fusion Markets has stop loss order feature and you can set it to limit your losses if a trade is not going as expected.

Funding/withdrawals: You can make deposits to Fusion Markets via bank transfers, cards (Visa/Mastercard) and e-wallets (Skrill and Neteller). You can also withdraw via these methods. Deposits via cards and e-wallets are credited instantly while bank transfers take 1-5 business days for the funds to be reflected in your trading account. Withdrawals to e-wallets are instant but take 1-5 business days for cards and bank transfers.

Trading platforms: Trading platforms supported by Fusion Markets are MetaTrader 4, MetaTrader 5, cTrader, and TradingView. They are available on web, desktop and mobile apps (iOS and Android)

Support: The broker offers 24/7 online customer service through live chat on their website. The response time we tested it was under 2 minutes.

Fusion Markets Pros

- Tier-1 regulation

- Low trading costs

- 24/7 live chat

- Supports multiple trading platforms

- No deposit and withdrawal fees

- No inactive account fees

Fusion Markets Cons

- No negative balance protection

- No proprietary trading platform

#5 Exness – Good Forex Broker with Multiple Account Types

Trading Platforms:

Exness Trader, TradingView, MT4

Account Minimum:

$10 (GHS 152)

Exness is regulated by the Financial Conduct Authority (FCA) in the UK and the the Financial Services Authority (FSA), Seychelles as Nymstar Limited, through which they serve international clients, including Ghana traders.

Total Fees: Exness charges spreads and swaps on all accounts as well as commission on some accounts. Exness does not have charges on deposits and withdrawals an no dormant account fees applies for inactivity.

Trading Conditions:

Account type: Exness offers 5 account types broken into Standard Accounts (Standard and Standard Cent) and Professional Accounts (Pro, Raw Spread and Zero). The minimum deposit for Standard Accounts is $10 (GHS 152) while Professional Accounts require a minimum deposit of $500 (GHS 7,627).

Here are the average spreads on the Standard Account for some instruments:

| Major Currency Pairs |

Spread |

| EUR/USD |

1 |

| USD/JPY |

1.1 |

| GBP/USD |

1.2 |

| USD/CHF |

1.4 |

| USD/CAD |

2.2 |

| AUD/USD |

1.4 |

| NZD/USD |

Commission for major pairs: There are no commissions when trading with the Standard Accounts and Pro Accounts, whereas commission starts at $0.05 per lot side for Zero Account and up to $3.5 (GHS 53.5) per lot (which makes it $7 (GHS 107) for a round turn) on Raw Spread Account.

Instruments: You can trade; 99 currency pairs, 98 CFDs on stocks and 10 indices assets, 35cryptocurrencies, 10 metals, and 3 energies.

Leverage by equity balance:

| Total Equity |

Maximum Leverage |

| $0 – $999 |

Unlimited |

| $1,000 – $4,999 |

2,000:1 |

| $5,000 – $29,999 |

1,000:1 |

| $30,000+ |

500:1 |

Note: All instruments on Exness trade at a maximum leverage of 1:200 during weekends and holidays.

Risk management tools: Exness offers negative balance protection to ensure you do not lose more than the money in your trading account.

Funding/withdrawals: Traders can instantly fund their accounts via online bank transfers and cards. Online bank transfer deposits are credited within 5 hours while withdrawals can take 24 hours. Deposits via cards are credited within 5 business days and withdrawals can take up to 10 business days.

Trading platforms: Exness supports the MT4 & MT5 trading applications which are available on the web, desktop, and mobile devices (Android, tablets, & iOS) and Exness Trader App is available for mobile devices and their proprietary Exness Terminal is only available on the web.

Support: Exness offers 24/7 customer support to clients via live chat on their website. The response time is under 5 minutes.

Exness Pros

- Tier-1 regulation

- Offers 24/7 online support

- Offers commission-free trading.

- No account inactivity fee

- Offers wide range of financial instruments

Exness Cons

- High leverage options

- Commissions on Raw Spread and Zero accounts

- Long processing time for deposits/withdrawals via cards

What is a Forex Broker?

A forex broker offers brokerage services to retail and professional traders who want to speculate on currency pairs & other markets as CFDs, by going long (buy) or short (sell).

Through a forex broker, your profit or loss from trading CFDs is cash settled in a brokerage account you have opened with the broker.

A forex broker could be a market maker which means they could be taking the opposite sides of your trades or a no-dealing desk broker that connects you to buyers/sellers through their liquidity providers via computerized networks.

How to Choose the Best Forex Broker in Ghana

Forex trading in Ghana is unregulated & it is carried out through online platforms. Today, a broker is just a click away. This situation has led to the proliferation of Forex brokers consisting of the good, the bad, and the outright scam brokers.

If we rope the scam Forex brokers with those that abide by the rules, we commit a fallacy of generalization. Hence, we have carefully created this list of questions that you must ask when choosing a Forex Broker.

1. Is the Forex Broker regulated by multiple Top-Tier Regulators?

As Ghana online forex trader, one understanding you must have is that no rules and regulations are guiding the activities of online Forex brokers in Ghana. The average Ghanaian forex trader is not protected by any government agency in case of any dispute with unlicensed brokers.

This brings us to the idea of international regulators and registration. We have global Tier-1, Tier-2, and Tier-3 regulators.

Global Tier-1 regulatory licenses such as the ASIC, FCA, CFTC, etc are more complex and expensive to acquire, hence are more important and offer greater protection than others.

Tier-2, Although still important, is not compared to those Tier-1. These include regulations like FSCA, DFSA, CMA (Kenya), etc.

Tier-3 usually deals with offshore countries in the Caribbean such as Belize, St. Vincent & Grenadines, etc where financial laws are very lax.

An online trader needs to ensure the broker is registered with at least a Tier-1 regulator to protect his/her investment. Else, the losses might not come from your ignorance of the instrument traded or market dynamics but from an unregulated broker.

It is not enough for a broker to post on their website they’re registered with this and that regulator. Some might manufacture a number and use such to hoodwink gullible investors.

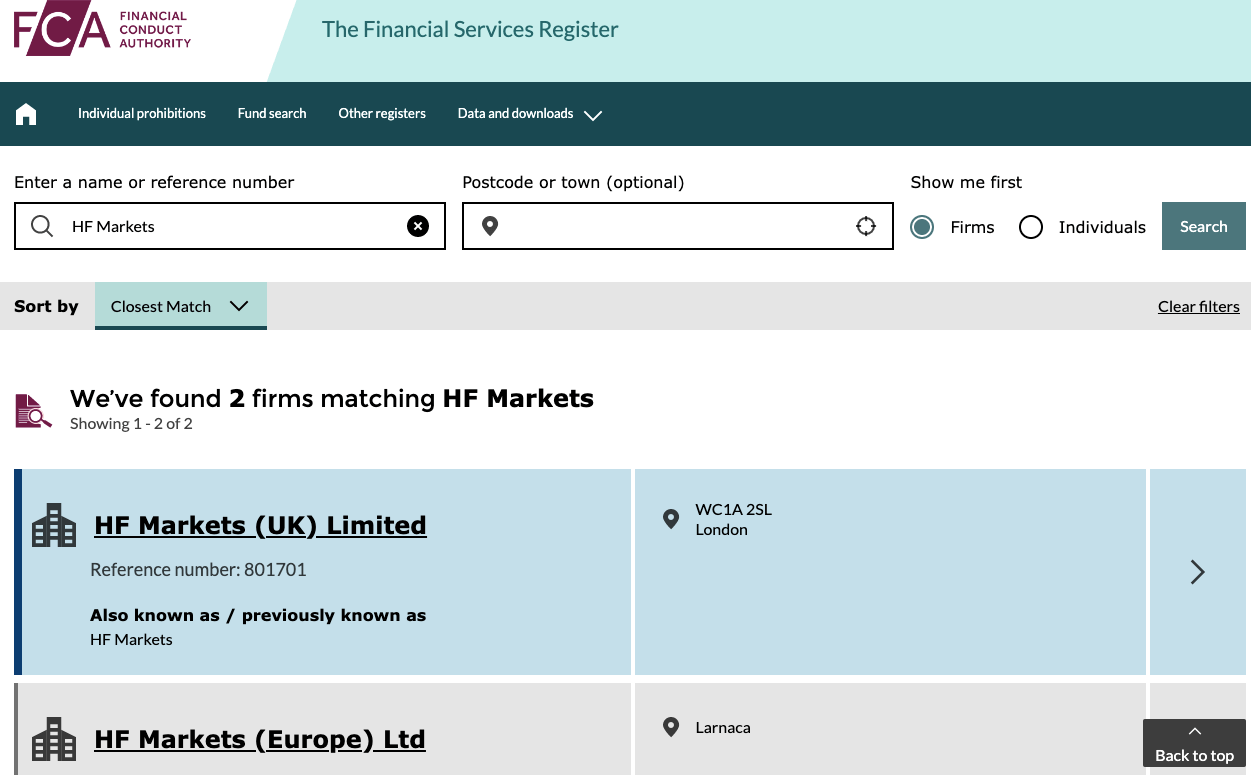

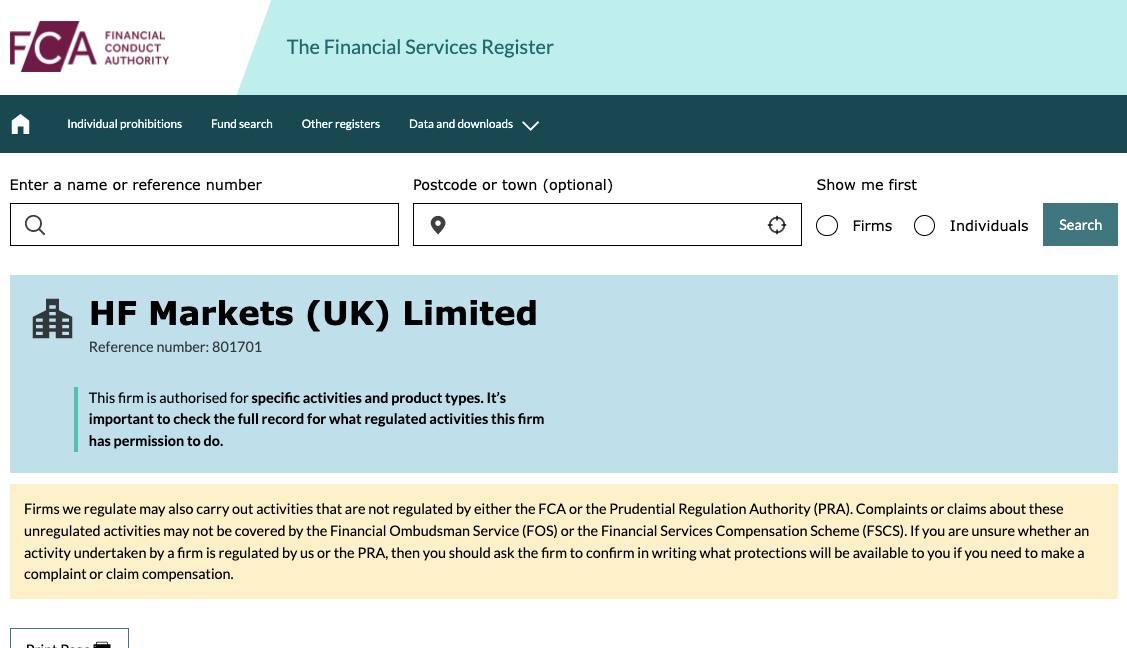

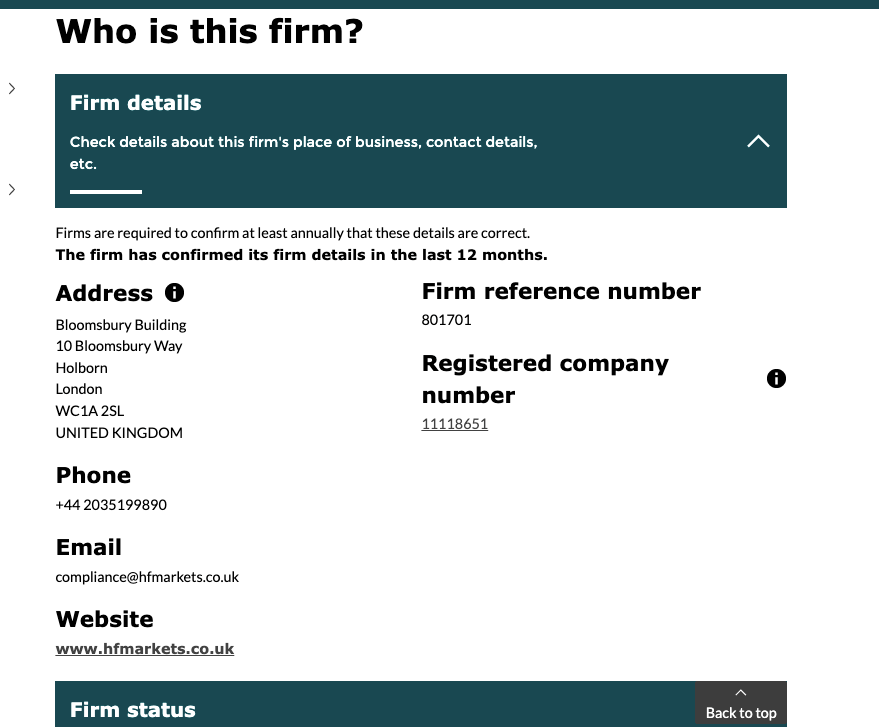

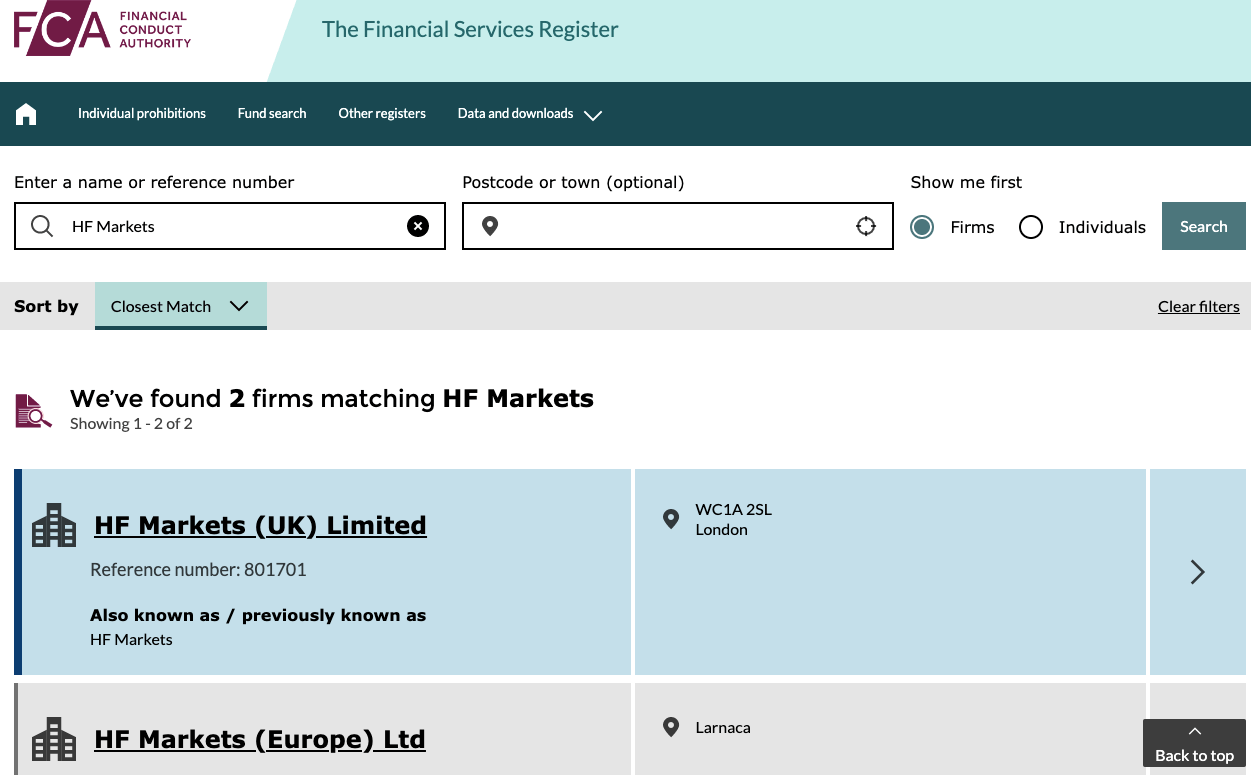

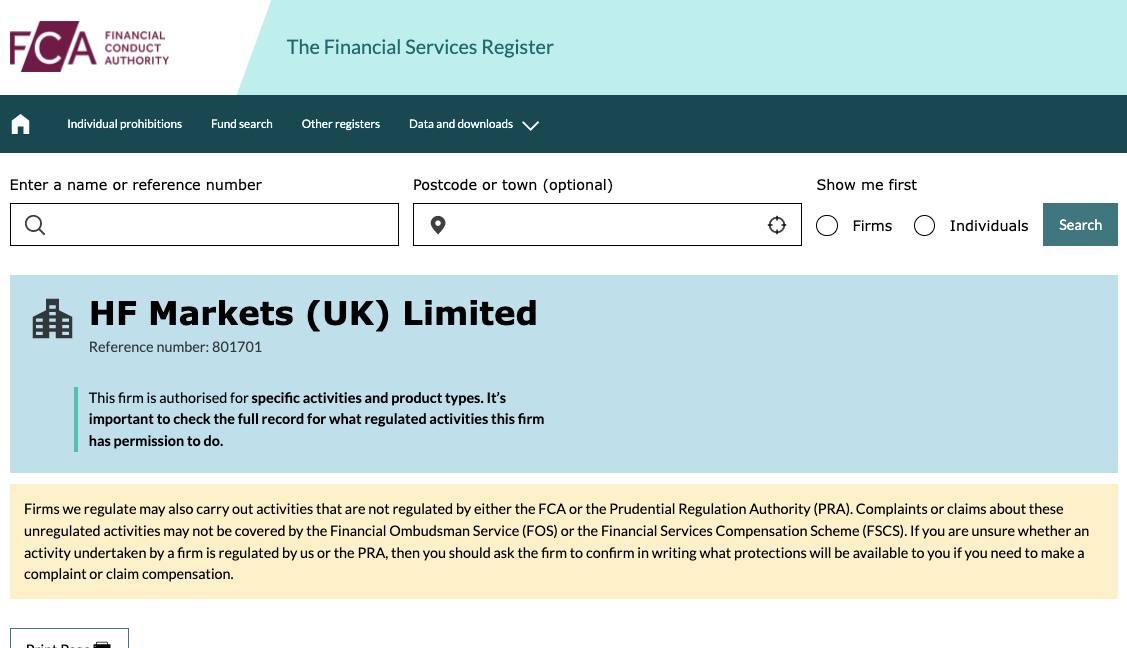

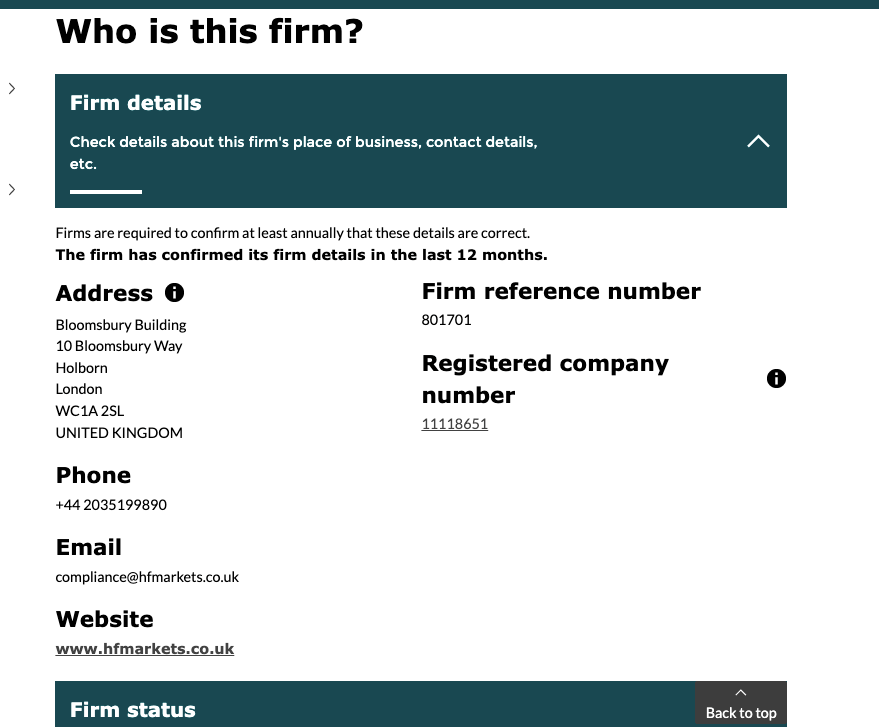

There is a way to verify if truly these brokers are registered under the regulator they claim. In this example, we will verify the broker’s regulation with FCA.

Let’s see the general steps involved.

Go to the website of the financial service register of the financial conduct authority. There they have a list of all financial service activities and the firms that are registered with them.

You can also search for yourself to confirm, from the FCA Register for example.

Below is a step-by-step guide to confirming the status of your forex broker.

-

- Check for the presence of the firm on the FCA register at .fca.org.uk/s/

-

- Confirm if the firm has the same right to offer the services you are offered.

-

- Confirm the contact details on the register and those on their website if they match especially the broker’s license number.

- Check whether you’re protected by the service being offered.

Above is an example of verification of “HF Markets (UK) Ltd.” which is the company of HF Markets Group. Similarly, you can verify the license no. of the broker with other regulatory bodies.

All the regulators have a public search to verify the license number.

Since there is no regulation for retail forex brokers in Ghana, make sure to choose a broker that multiple top-tier regulators authorise. This will ensure that your funds are protected.

Here is an extra note of caution. If you are checking a forex broker’s regulation on the FCA website, you want to make sure you note clone firms. Clone firms tend to use details close to the original broker’s details. Clone brokers are scammers and can dupe unsuspecting traders.

2. Overall Fees

Fees are divided into non-trading and trading fees.

a. Non-Trading Fees: Non-trading fees include inactivity fees, withdrawal/deposit fees, and currency conversion charges. You can check the broker’s FAQ sections to check for non-trading fees. If you are not satisfied with what you find there, you can reach out to the broker via email, live chat, or a phone call. Here is how our brokers compare in terms of non-trading fees

| Broker |

Deposit Fees |

Withdrawal Fees |

Inactivity Fees |

| Octa |

$0 |

$0 |

$0 |

| XM |

$0 |

$0 |

$10 |

| Tickmill |

$0 |

$0 |

$0 |

| Fusion Markets |

$0 |

$0 |

$0 |

| Exness |

$0 |

$0 |

$0 |

b. Trading Fees: Trading fees include swaps, commissions, and spreads. How much of these you are charged depends on the type of account you choose to open with a broker. So you have to go to the broker’s website and determine the spreads and commissions attached to them. Some accounts even carry non-trading charges.

Most brokers give an overview of the different accounts they offer. Take your time to go through these accounts and see the fees attached to them.

3. Number of Instruments

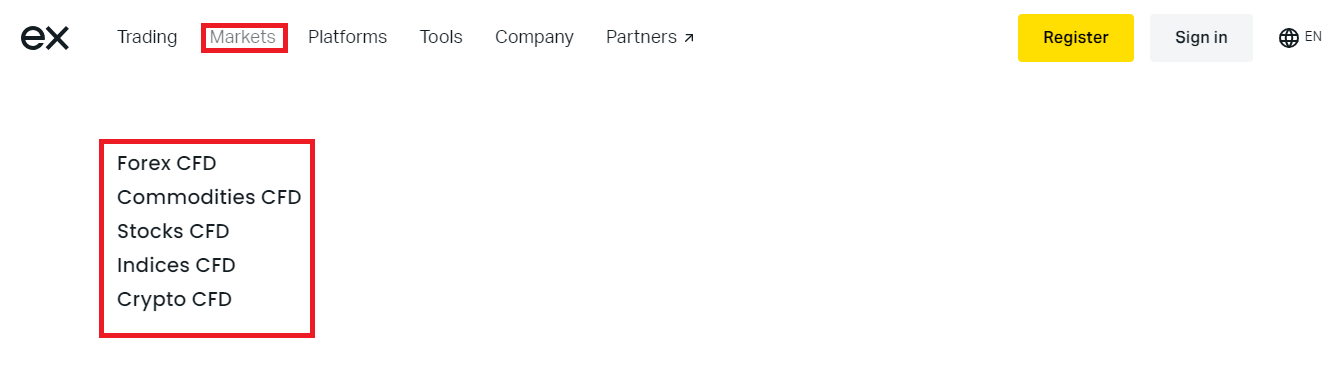

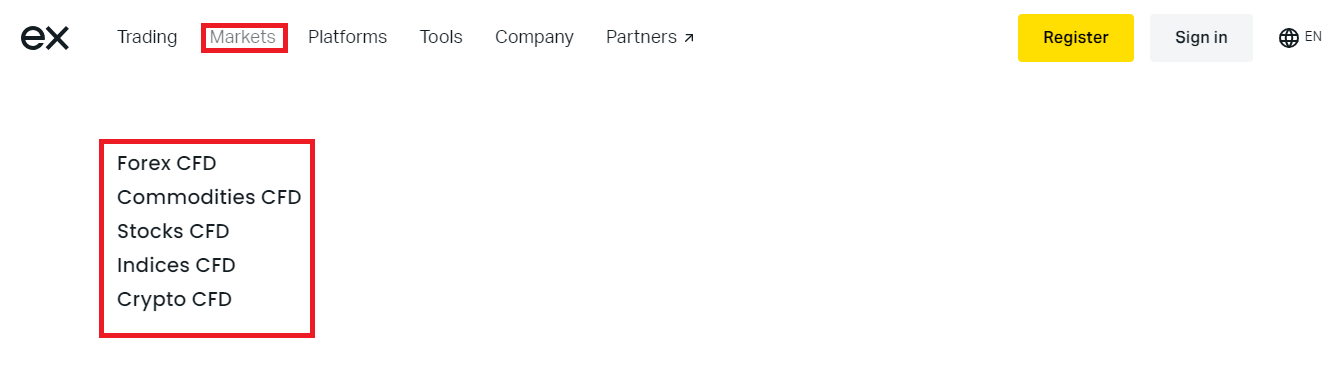

Before making a deposit to your broker, you need to know the number of instruments available for you to trade. As usual, you should go through the broker’s instrument page to see what they are offering you. Currency pairs, CFDs, indices, and commodities are important instruments for a broker to have.

Check the exact number of asset classes being offered & the total trading fees (spread, commission & swap fees) for each instruments under every asset class. For example, if you want to mainly trade major currencies like EUR/USD, GBP/USD etc. then you should look at the fees for these exact instruments.

But also in addition to this, check for the trading charges attached for trading other CFDs, stock indices, and commodities. This is because it will give you a general idea of the fees the broker is charging. They take up a portion of your profits and can add to your loss.

To check, you should visit the broker’s website & see the instruments page. Generally, you will find under sections like ‘markets’. Here is an example from Exness website.

4. Account types

Brokers usually give a breakdown of account types on their websites. You will also find in this breakdown key features of the accounts. You want to look for an account with low spreads and low commissions. This is a major factor to consider when choosing your trading account.

Having multiple account types can offer you the flexibility to trade, and generally brokers have different fees structures for different account types.

Let’s understand this with an example. Forex brokers generally have Pro accounts (for Professional traders) & Standard Accounts (for Retail traders). The difference can be in terms of leverage & lower fees for large volume traders.

The Standard accounts are basic account types with standard fees structures, generally as spreads. Although some brokers also have Standard accounts with low spreads, but some commission involved for each trade (depending on your lot size).

5. Choice of trading platforms

Metatrader 4 (MT4) and Metatrader 5 (MT5) are the most popular trading platforms. Not all brokers have them though. What you want to pay attention to here are platform-specific features.

Some brokers have more instruments on their MT4 platform than MT5 or their proprietary trading platform. There could even be differences in swaps and commissions across the various platforms. So make sure to look this up on the broker’s website.

The availability of copy trading is another important thing to check. You will find this on the broker’s website if it is available. On some brokers website, it is referred to as social trading.

You can find it by clicking on the platforms tab on their website.

Is forex trading legal in Ghana?

Yes, forex trading is legal in Ghana. There are no locally regulated in Ghana. However, forex traders can trade CFDs through tier-1 brokers that accept traders based in Ghana.

Who is a forex broker?

A Forex broker, also known as a foreign exchange broker or FX broker, acts as a middleman between you and the massive, global market for trading currencies.

Here’s what they do:

They provide access to the Forex market:

Think of them as your gateway to buying and selling different currencies.

They offer trading platforms where you can execute your trades and monitor currency prices.

They facilitate currency exchange:

You don’t directly interact with other traders. The broker matches your buy orders with sell orders from other clients or directly fulfills them (depending on the broker type).

They ensure smooth and secure transactions, eliminating the need to worry about counterparty risk.

They make money through fees:

They typically charge spreads (the difference between the buy and sell price of a currency pair) or commissions on your trades.

Do I need a broker for Forex Trading in Ghana?

Yes, you need a forex broker to trade in the foreign exchange market. They act as an intermediary between you and the interbank market where currencies are actually traded.

Here’s why:

1) Access to the Market: Retail traders like you and me can’t directly access the interbank market.

Forex brokers have the licenses and relationships to do so, and they provide you with a platform to place your buy and sell orders. For example, on the backend, the access different providers to get the prices.

2) Order Execution: Your broker takes your order and finds a counterparty to match it with on the interbank market. They handle the execution of the trade, ensuring it’s done efficiently and at the best available price.

You can see this process play out on their forex trading platforms.

The brokers have access to liquidity providers, or a market maker may act as the counterparty themselves to your trades.

Let’s understand through an example. Let’s assume that you want to buy GBP/USD. First of all you need quote (Bid & Ask prices), which you can check on the broker’s platform. When you place a ‘market order’, the broker finds the fill for you by send it to their liquidity providers or directly acting as the counter party.

All of this happens in real time within a few micro seconds. Without a broker, retail or professional traders cannot trade currencies directly.

How much money do I need to begin forex trading?

There is no specific amount that applies to every trader or forex brokers. The minimum deposit for forex trading is a decentralized phenomenon. No regulatory body enforces minimum deposit. It all depends on how each broker wants to operate. This is the first factor.

Some brokers have trading accounts with no minimum deposit. There could also be accounts with low minimum deposits requirement like $5 (GHS 76). There are a few brokers with minimum deposits as high as $500 or more. So when it comes to the money you need to begin trading, your forex broker is a key factor.

The second factor is you. You need to consider your risk tolerance, trading goals, and financial state. How much are you willing to lose trading? How much is your gross monthly income? Why am I trading? These are pivotal questions you need to ask yourself. The answers to these questions will affect how much you put in your trading account.

How do you choose the amount to begin forex trading? A good consideration of the two factors above will help you make the right choice. After determining how much you are willing to risk in trading, then you need to choose your ideal broker.

If your risk tolerance is low, then you might have to choose brokers with zero minimum deposit account or low minimum deposit account like $5 (GHS 76)-$10 (GHS 152). Though this little money, you can trade more positions with it using leverage. However, you should note that you can lose all of your money with leveraged CFD trading.

Even if your risk tolerance is high or you have enough money to trade CFDs, we caution that you do not put too much money in CFD trading because it is very risky.

What are some red flags to watch out for when choosing a forex broker?

Its best to trade with forex brokers that offer some form of safety for your funds. Here are some red flags to avoid when choosing a forex broker:

1) Unregulated Brokers: Do not trade with forex brokers that are not regulated. Only trade with brokers who are regulated by a reputable authority.

2) Hidden Fees: Another sign to avoid a broker is high fees or commissions. Make sure you know and understand all the costs associated with trading before you open an account with any broker.

3) Absence of risk management tools: Because the forex market is risky, you should avoid brokers that do not have risk management tools or features, such as stop loss order.

What account types have the lowest fees?

Forex brokers have different account types. There are accounts that cater to retail traders and there are accounts for professional traders.

For retail traders, brokers have different names for their accounts. However, there are usually standard accounts. These accounts have high spreads with little or no commission. The next popular account is a trading account with raw spreads. The advantage of this account is that the spreads are low (almost zero).

Because the spreads are low, you will pay more in commission. So which account has the lowest fees? The truth is forex brokers will make money through trading fees. There is no way around that. It depends on your choice. Do you want a high spread/zero commission account or vice-versa.

You can also use a calculator to see your projected trading cost. There are forex brokers with trading calculator on their websites.

For professional traders, it is entirely different. You will hardly find the fees for professional accounts on your forex broker’s website. When you successfully open a professional account, you will have access to all the fee and other charges that come with it.

Please note that a Pro Account does not mean a professional trading account. There are many forex brokers who have retail accounts name Pro Account. Make sure you contact your broker for more details.

What are the most popular forex business models?

Not all forex brokers operate the same way. There might be few similarities in some things. But when it comes to business models, the differences are usually clear.

Here are the most common forex business models:

DD: DD means dealing desk brokers. They are also known as market makers. This means they are counterparties to your trades. In other words, they take the opposite side of your trading positions. DD brokers can have different pricing models, some are fixed spread brokers, while others have variable spreads.

Also, some market market maker brokers offer instant order execution, but there may be slippage if the price is moving fast.

NDD: NDD means non-dealing desk brokers. Unlike DD brokers, NDD brokers are mediators. They connect their clients to interbank markets. Instead of a dealing desk, your trades are sent straight to banks and liquidity providers.

The direct market access offered by NDD brokers prevents requoting because prices are updated in real time. NDD brokers are further divided into ECN and STP brokers.

Here is a breakdown of the two:

ECN: ECN means Electronic Communication Network. ECN brokers are a liquidity hub. They have different liquidity providers, banks , and hedge funds that are connected. Your trades are sent electronically into this hub. There is no price manipulation and every participant has access to the price feed.

STP: STP means Straight-Through-Processing. STP brokers route your trades directly to liquidity providers who act as counterparties to your trades. STP brokers also add a mark up to spreads received by liquidity providers. That is one of the ways they make their money.

What is the best trading platform for beginners in Ghana?

The issue of the best trading platform for beginners is a subjective matter. Forex traders differ in preference and opinions as to what they want in a trading platform.

However, some general criteria can help you if you are beginner. Here are some of them.

License: Your trading platform should be well regulated. There is no local regulatory oversight over forex brokers in Ghana. So, it is advisable you choose a broker regulated with ASIC or FCA.

GHS-base Account: Choosing a trading platform with your local currency account is good. As a beginner, you want to avoid excess charges like conversion fees. If you want to go the conventional way, you can open a USD trading account. However, it is very difficult to find a broker with GHS as base currency.

Ghana friendly payment methods: Bank wire transfers and debit cards should be supported. More payment options like Skrill, Neteller, and other e-wallets help lets you enjoy a degree of flexibility. E-wallets are not available everywhere especially if you prefer a certain company.

So, the bare minimum is payment via your Ghanaian bank and your debit card.

Diverse account types: A forex broker will likely have at least two trading accounts. There is usually a Standard Account and an ECN Account. Not all account types are suitable for beginners. A Standard Account might be a good place to start.

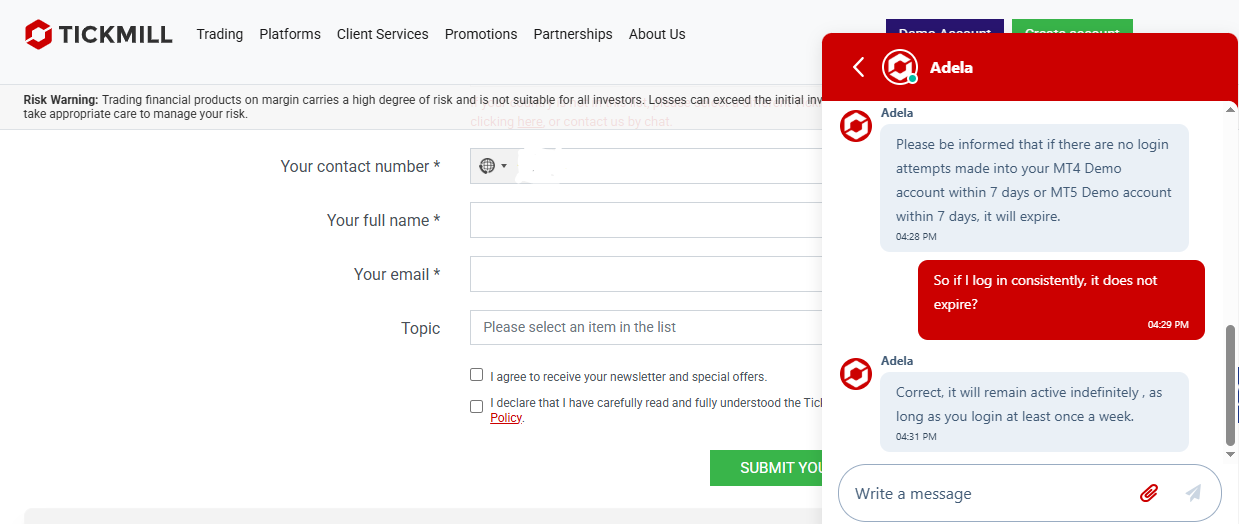

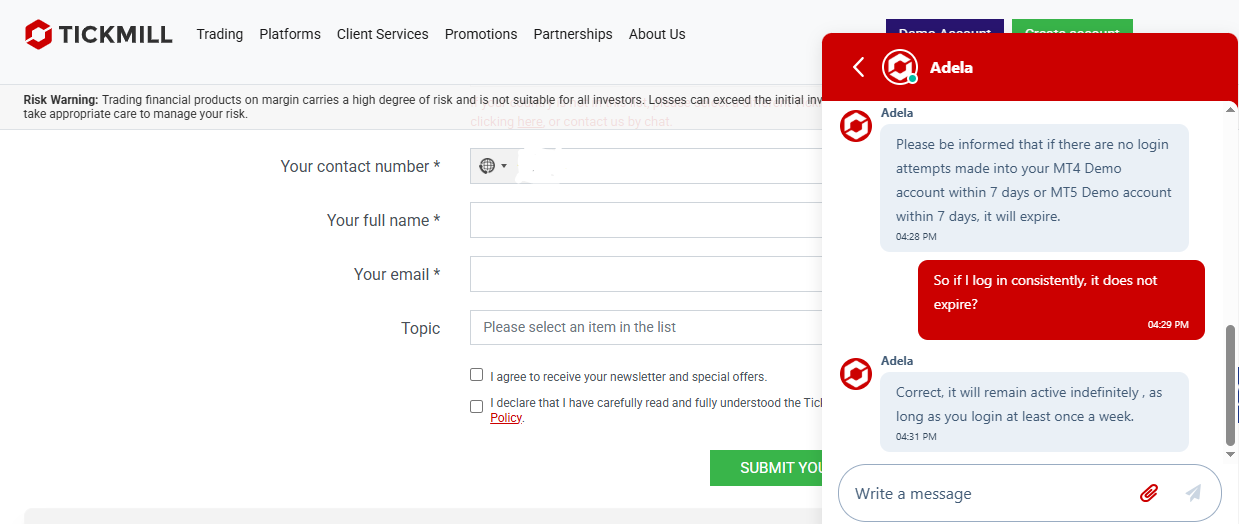

Free Demo account: Beginner traders need a demo account. An unlimited demo account that does not expire is preferable. This is helpful for practice of trading strategies. You are also able to trade objectively since there is no fear or greed to make money.

Tickmill is one of the brokers in this review with a demo account that does not expire. We reached out to their customer care agent. Their response is displayed below:

Properties of Common Forex Trading Accounts

You will find varying accounts with different forex brokers. Most of these accounts have a thing or two common to them.

This list is not executive by any means. However, you will find it helpful as you research forex brokers and choose a trading account.

1) Demo Account: The main property of this account is zero risk. You use virtual money on this account to practice trading and test your strategies. All forex brokers offer a demo account (whether for a limited or an unlimited period).

2) Islamic Account: The key attribute of this account is sharia-compliance. This ensures those of the Muslim faith can trade forex without violating the principles of Sharia Law in Islamic Finance. This account is usually swap-free.

3) Standard Accounts: Most Standard Accounts have a basic trading operation because the broker serves as a counterparty to your trade. The spreads for trading CFDs on this account is usually high but you will likely pay no commission.

4) ECN Accounts: ECN Accounts are for brokers looking for lower spread costs. The spread of CFDs on this account is tight but you will pay commissions as your trading fee. The commission can be as high as $3.5 per standard lot.

Note: The essence of this section is not necessarily about the names of the account. It is about the properties and that is what you should look out for. A forex broker might name their account a Pro Account but has ECN properties. So the properties of the account is superior to whatever the account is named.

When can I best trade forex in Ghana?

The best time to trade forex is when there is high liquidity and trading volume. Here is a breakdown of when to trade forex in Ghana:

London Session: This is the best time to trade pairs like GBP/USD, EUR/USD, and USD/GHS. Ghana’s time zone is on the GMT so the country has the same time zone as London. This session runs from 8am to 4pm (GMT). Pairs like GBP/USD and EUR/USD see massive price movement this period.

New York Session: The New York session runs from 1pm to 9pm (GMT). The London session overlaps with the New York session for about 4 hours during this period. So, there is more liquidity in the market. It is the best time to take advantage of USD pairs.

FAQs on Best Forex Brokers Ghana

Which broker is the best in Ghana?

Octa, XM, Tickmill, Fusion Markekts and Exness are the best forex brokers in Ghana as per our research. Any forex broker that is regulated with Tier-1 and Tier-2 regulation is considered safe for trading. The best forex broker in Ghana depends on your individual trading needs and trading goals.

Is forex trading legal in Ghana?

Yes, forex trading is legal in Ghana as it has not been banned. However, it is important for you to note that online forex trading is currently unregulated by the Bank of Ghana or the Securities and Exchange Commission (SEC) of Ghana. Trading with online brokers is at your own risk.

Is Exness legal in Ghana?

Since Exness accepts traders from Ghana, you can create an account with them if you are based in Ghana.