Vantage FX is a regulated broker offering trading services for CFDs (contract for differences) on (forex) foreign exchange, indices, metals, energies, cryptocurrencies, commodities, and shares.

Vantage was first founded in Australia in 2009 and has been regulated by ASIC (Australian Securities & Investments Commission) since 2012.

In this review, we assess the trading conditions, account types, deposit/withdrawal options, account opening process, and customer support on the Vantage FX platform.

| Vantage FX Review Summary | |

|---|---|

| Broker Name | Vantage Global Prime Pty Ltd |

| Establishment Date | 2009 |

| Website | www.vantagemarkets.com |

| Address | Vantage Global Prime Pty Ltd, 7 Level 29, 31 Market Street Sydney NSW 2000 Australia |

| Minimum Deposit | AUD 50 |

| Maximum Leverage | 1:30 |

| Regulation | FCA, ASIC, VFSC, CIMA |

| Trading Platforms | MT4, MT5 and Vantage FX ProTrader available on PC, Mac, Web, Android, & iOS |

| Visit Vantage FX | |

Vantage FX Pros

- Vantage FX is regulated by ASIC

- Supports MT4 & MT5 trading platforms

- Responsive customer support

- Fast processing of deposits

- Offers commission-free trading account

- Simple account opening process

- Does not charge dormant account fees

- Have negative balance protection for retail and pro clients

Vantage FX Cons

- Does not offer 24/7 customer support

- Relatively high minimum deposit

- Few instruments available for trading

Is Vantage FX Legit?

Vantage FX is legit because they are regulated by 2 Tier-1 financial regulators and 1 Tier-3 regulator. This makes them score low on risk as they are bound by law to comply with the regulations.

Here are the jurisdictions in which Vantage FX is regulated.

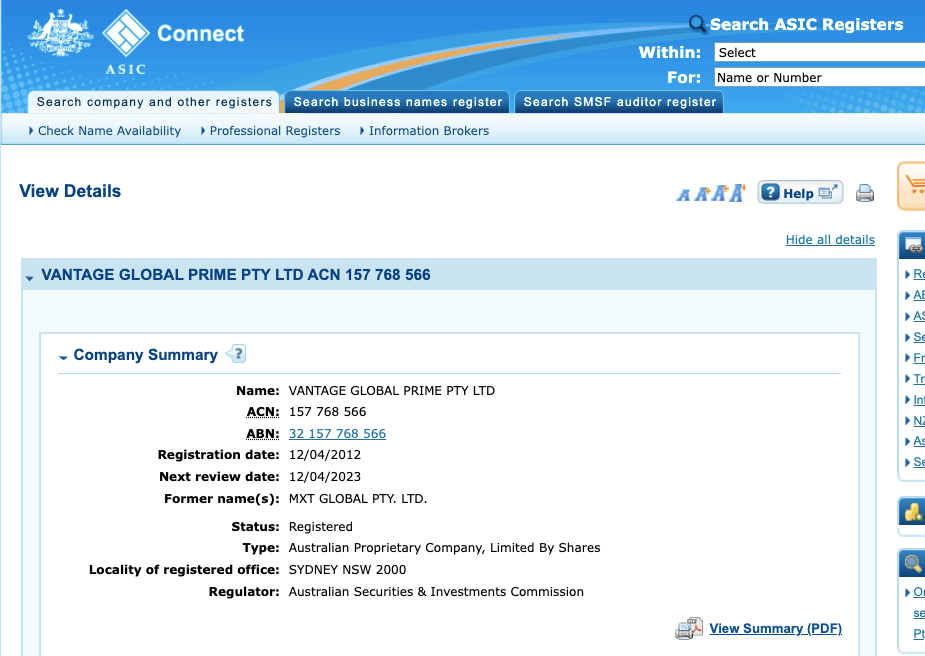

1) Australian Securities & Investments Commission (ASIC): Vantage FX is regulated in Australia by ASIC as ‘Vantage Global Prime Pty Ltd.’ and licensed to offer financial services with Australian Company Number (ACN) 157-768-566, issued in 2012.

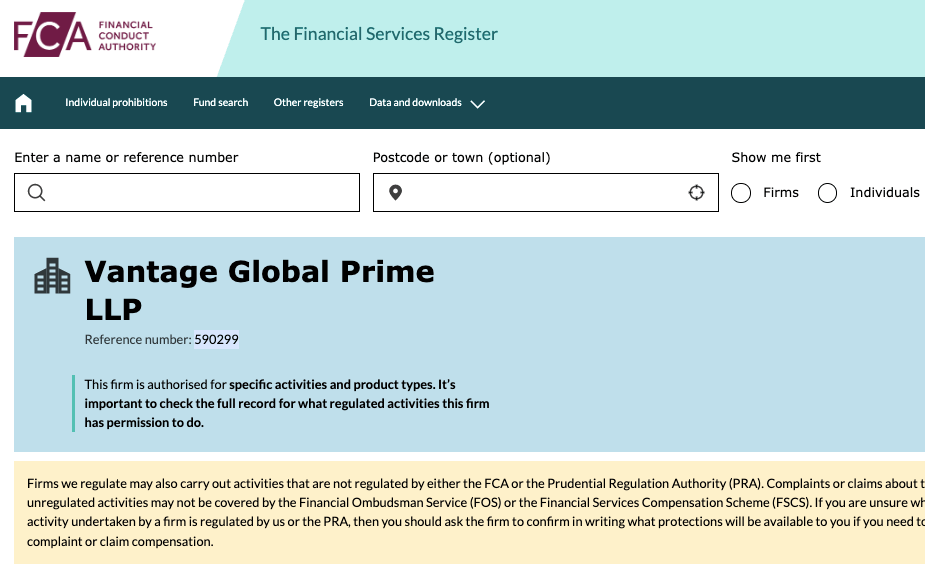

2) Financial Conduct Authority (FCA): Vantage FX is regulated by the FCA as Vantage Global Prime LLP and authorized to offer financial services in the UK with reference number 590299, issued in 2013.

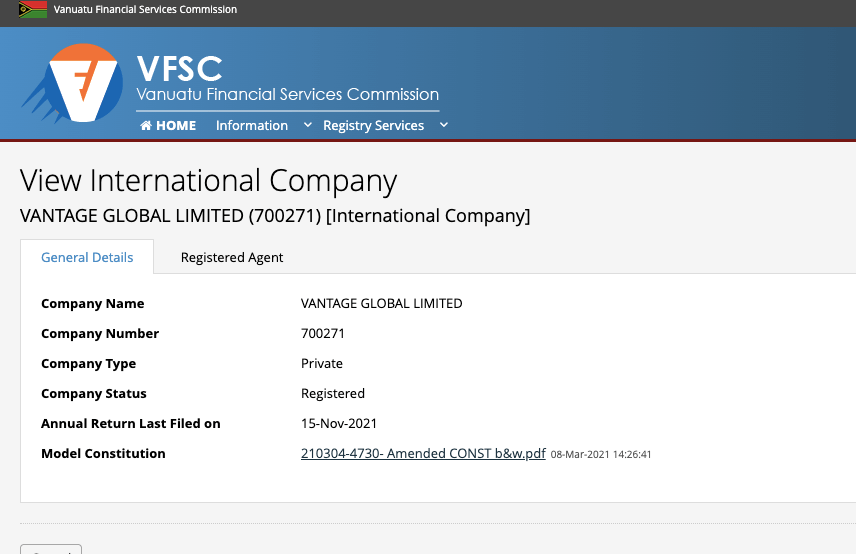

3) Vanuatu Financial Services Commission (VFSC): Vantage FX is also regulated in Vanuatu, by the VFSC as ‘Vantage Global Limited’ which is registered as an international company, with company number 700271, issued in 2019.

This is an offshore regulation.

4) Cayman Islands Monetary Authority (CIMA): Vantage FX has another offshore regulation in the Cayman Islands as Vantage International Group Limited. Their Securities Investment Business Law (SIBL) number is 1383491. The license was issued and recognised in 2018.

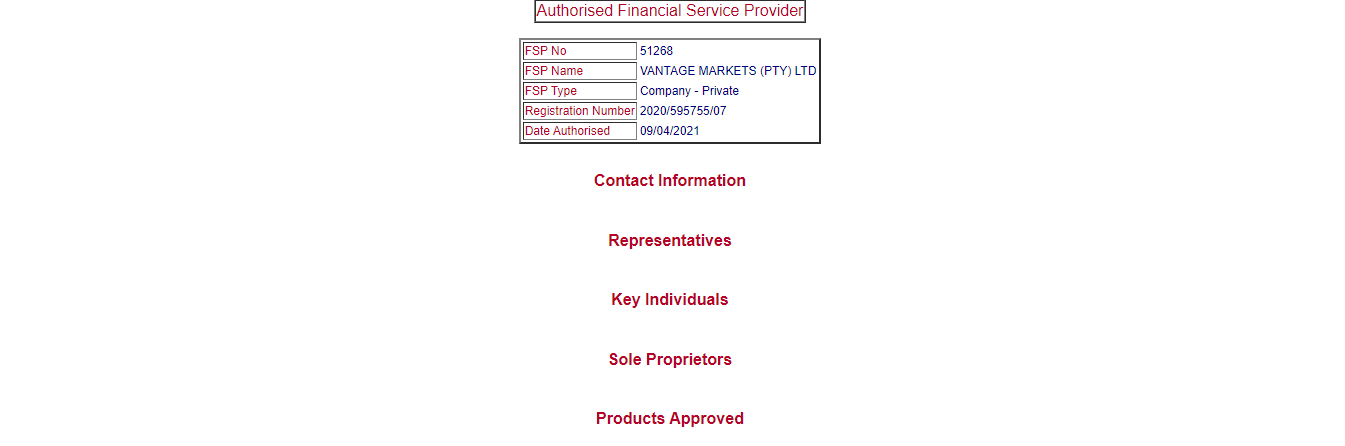

5) Financial Sector Conduct Authority (FSCA): Vantage FX is also licensed as a financial service provider in South Africa. They are registered with the FSCA under the name Vantage Markets (Pty) Ltd. Their FSP number is 51268.

Vantage Markets Investor Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| UK | £85,000 | Financial Conduct Authority (FCA) | Vantage Global Prime LLP |

| Australia | No Protection | Australian Securities and Investments Commission (ASIC) | Vantage Global Prime Pty Ltd |

Negative balance protection is available for all Vantage Markets’ traders. There is no investor compensation fund for CFD trading in Australia. However, there are other provisions within ASIC regulations that protects traders.

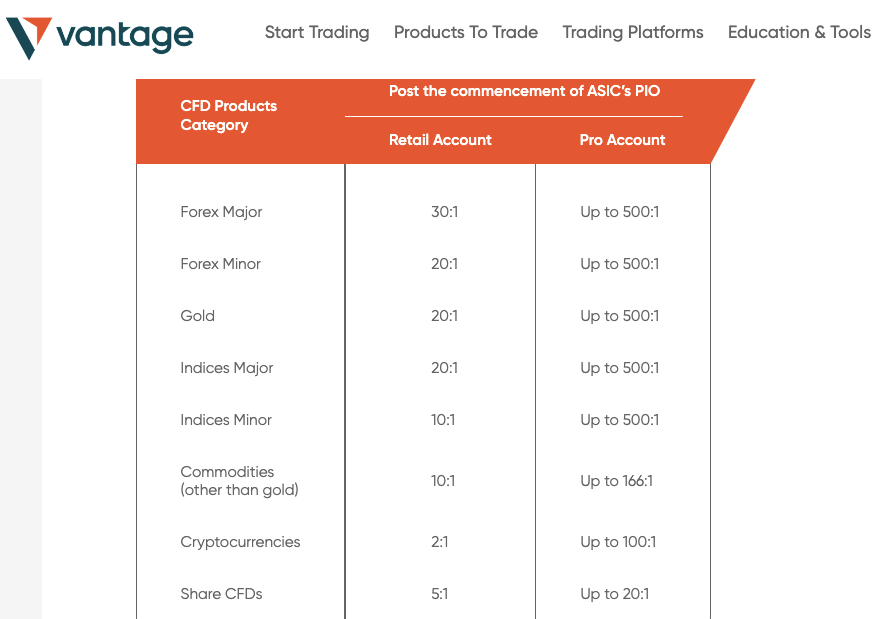

Vantage FX Leverage

Leverage available to traders depends on the instrument you are trading and whether you are a retail or professional client. For retail clients, the maximum leverage on Vantage FX is 1:30, which applies to major forex currency pairs.

A leverage of 1:30 means you can open a trade worth 30 times the size of your deposit. For example, if you deposit $1,000, you can place a trade of $30,000.

Professional clients on Vantage FX can access higher leverage of up to 1:500.

Vantage FX Account Types

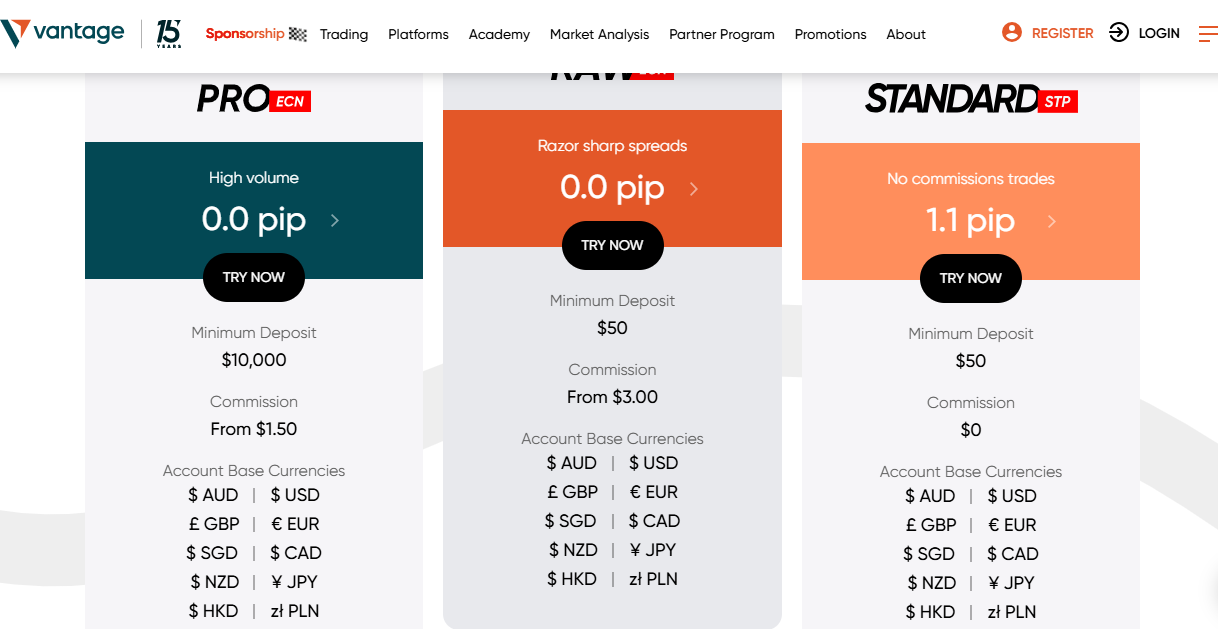

Vantage FX offers 3 main account types to traders with different features, fees, and market conditions. They do not offer Islamic Accounts for clients in Australia but have demo accounts for beginners who want to first get familiar with the platform before they start live trading.

Here is an overview of the account types on Vantage FX:

1) Standard Account: The Vantage FX Standard Account is designed for new traders and retail clients. This account allows you to trade currency pairs and CFDs on indices, shares, and commodities with instant order execution.

Holders of this account do not pay commission fees when they enter or exit trade positions. Spreads start from 1.1 pips for major pairs like EURUSD, and you pay swap fees for keeping a position open overnight.

This account requires a minimum deposit of A$50 and a minimum trade size of 0.01 with maximum leverage of 1:30.

You have negative balance protection with this account, which means that you cannot lose more than the money deposited in your trading account. If you suffer a loss during trading and your account runs into a negative, the balance will be reset to zero.

2) Raw Account: The Vantage FX Raw Account is designed for experienced traders and retail clients who want lower spreads. This account allows you to trade currency pairs and CFDs on indices, shares, and commodities with instant order execution.

With Raw Account, you pay commission fees whenever you enter or exit trade positions starting from $1 per side lot and can be up to A$6 per round turn of trade. Spreads start from 0.0 pips, and you also pay swap fees for keeping a position open overnight.

This account requires a minimum deposit of A$50 and a minimum trade size of 0.01 with maximum leverage of 1:30.

You also have negative balance protection with the Raw Account.

3) Pro ECN Account: The minimum deposit for the Pro ECN Account is A$10,000. Commission per round turn is $1.50. This is lower than the commission for the Raw ECN Account but minimum deposit is way higher.

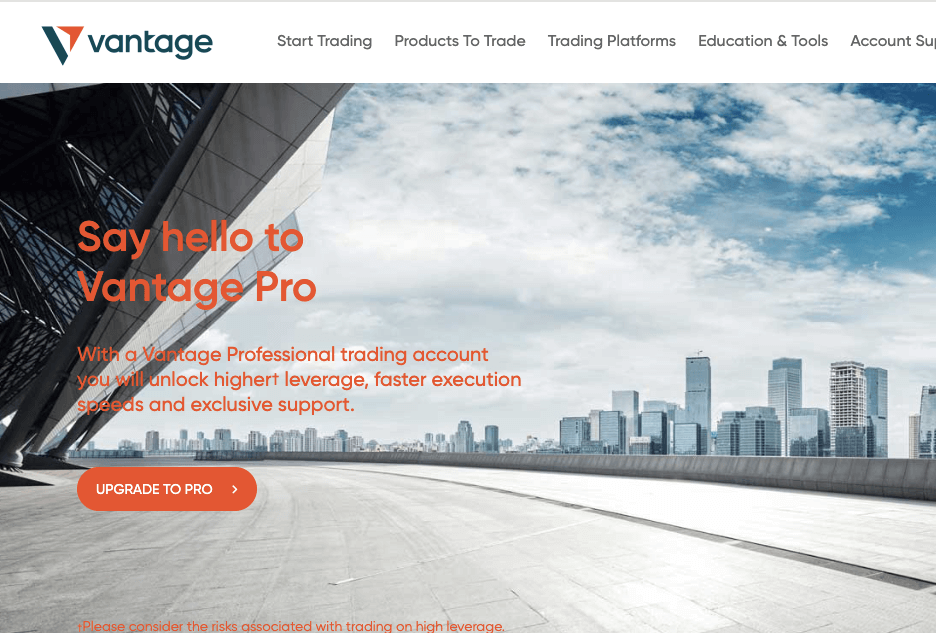

4) Vantage Pro Account: The Vantage Pro Account is designed for experienced traders who trade large volumes of financial instruments and want to trade with higher leverage.

You can upgrade either a Standard or Retail Account to Professional status, and the same features will apply, except for the higher maximum leverage of 1:500.

Although you also have negative balance protection as a Professional client on Vantage FX and get priority support, you lose some protections that the retail clients have.

Note that you can only apply for the Professional Account on Vantage FX after passing the wealth or sophisticated investor test:

1) Wealth Test:

You must meet at least one of these 2 criteria to pass.

- You have net assets of AU$2.5 million or an annual gross income of at least AU$250,000 for the last 2 years consecutively.

You will be required to provide an Accountant’s Certificate to prove the above.

2) Sophisticated Investor Test:

You can qualify as a sophisticated investor by meeting these criteria:

- Demonstrate your knowledge of trading leveraged products by taking an online quiz

- Show proof of placing at least 20 trades each quarter for any 4 quarters over the last 3 years with a notional value of AU$500,000 for each of the 4 quarters

To get a Professional Account, first, open a Standard or Raw Account, then apply to customer support via email to upgrade your account, if you meet the requirement, your account will be upgraded to Professional Account status.

5) Unlimited Demo Account: Vantage Markets offers a demo account to all of their clients. However, not all clients enjoy the unlimited version. A standard 30-day demo account is issued if you want to open a demo account. If you have a live account, you will get a demo account that does not expire.

Vantage FX Base Account Currency

Vantage FX offers 2 account base currencies that you can choose from. They are the Australian Dollar – AUD, and United States Dollar – USD.

Your trades, deposits, withdrawals, and fees are measured in this currency on the platform.

Vantage FX Overall Fees

Fees on Vantage FX depend on the account type, the instrument traded, and your trade size. Here is an overview of the trading and non-trading fees on Vantage FX.

Trading fees

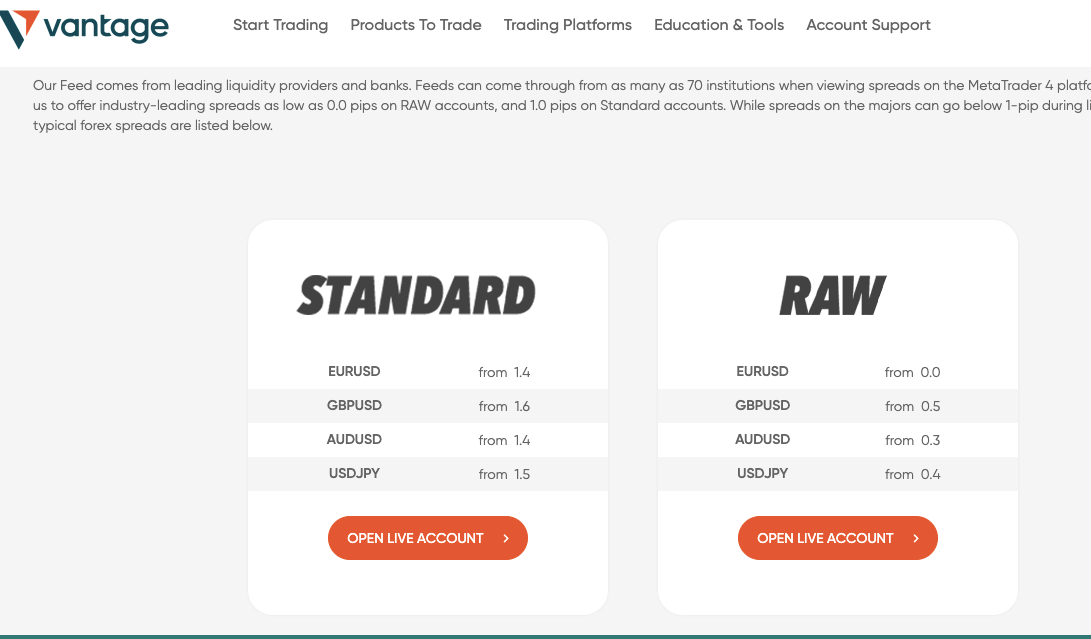

1) Spreads: You pay spread fees whenever you trade an instrument on Vantage FX, which is the difference between the bid and ask price. Basically, it is a markup on the prices of the markets. Spreads depend on the instrument you are trading and your account type.

Spreads can be from 0.0 pips for Raw Accounts, while Standard Account spread fees start from 1 pip. Find the average spread for major market pairs on the Vantage Raw Account below:

| Instrument/Pair | Spreads |

|---|---|

| EUR/USD | 0.3 pips |

| GBP/USD | 0.5 pips |

| EUR/GBP | 0.4 pips |

| XAU/USD (Gold) | 16 pips |

2) Commission fees: Vantage FX charges commission fees whenever you open a trade position and when you close the position. The commission fees on Vantage FX start from $1 for each lot side (open or close), which equals $2 for a round turn (open and close).

Commission fees can be up to $6 for a round turn on some instruments. Note that only the Vantage Raw Accounts pay commission fees. The Standard and Professional Accounts do not pay any commission fees for placing trades.

3) Swap fees: Whenever you keep a trading position open past the closing time of the market, you incur rollover fees also called swap fees. Swap fees on Vantage FX are based on a percentage and depend on the size of your trade and whether your position is long (buy) or short (sell).

The swap fees are charged at 00:00 hours of the platform time and all accounts pay swap fees.

Non-trading fees

1) Deposit and Withdrawal fees: Vantage FX offers free deposits for all payment methods applicable to all account types.

While local bank transfers and cards have unlimited free withdrawals for the whole month, Vantage FX charges a processing fee for international bank transfer withdrawal of $20 per withdrawal, after the first withdrawal of the month, which is free of charge.

2) Account Inactivity charges: If you do not log into your account or place any trade for any amount of time, Vantage FX will not charge any inactive account fees. Any funds in your account will be untouched.

Note that your account will be archived if there are no funds or activity for over 90 days. Once archived you will need to contact support to reactivate it.

| Fee | Amount |

|---|---|

| Inactivity fee | None |

| Deposit fee | None |

| Withdrawal fee | None |

Vantage does not charge any fees for deposit or withdrawals. However, payments to and from international banking institutions may attract charges. These charges are not from vantage but from the bank and you will have to cover them.

How to Open Vantage FX Account in Australia?

Follow these steps to open a trading account on Vantage FX.

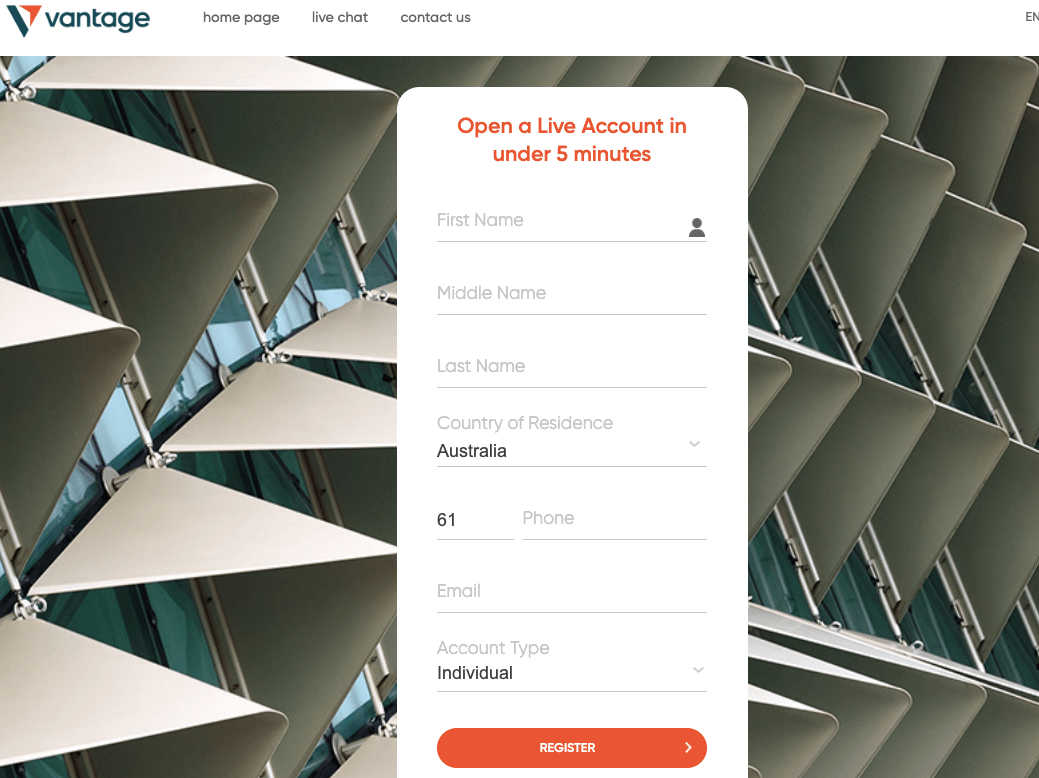

Step 1) Go to the Vantage FX website homepage at www.vantagemarkets.com, and click on the ‘CREATE LIVE ACCOUNT’ button.

Step 2) On the form that appears, fill out your name, select your country of residence, type in your email, and select the type of account you want, then click on ‘Register’, and you will be taken to the Vantage dashboard.

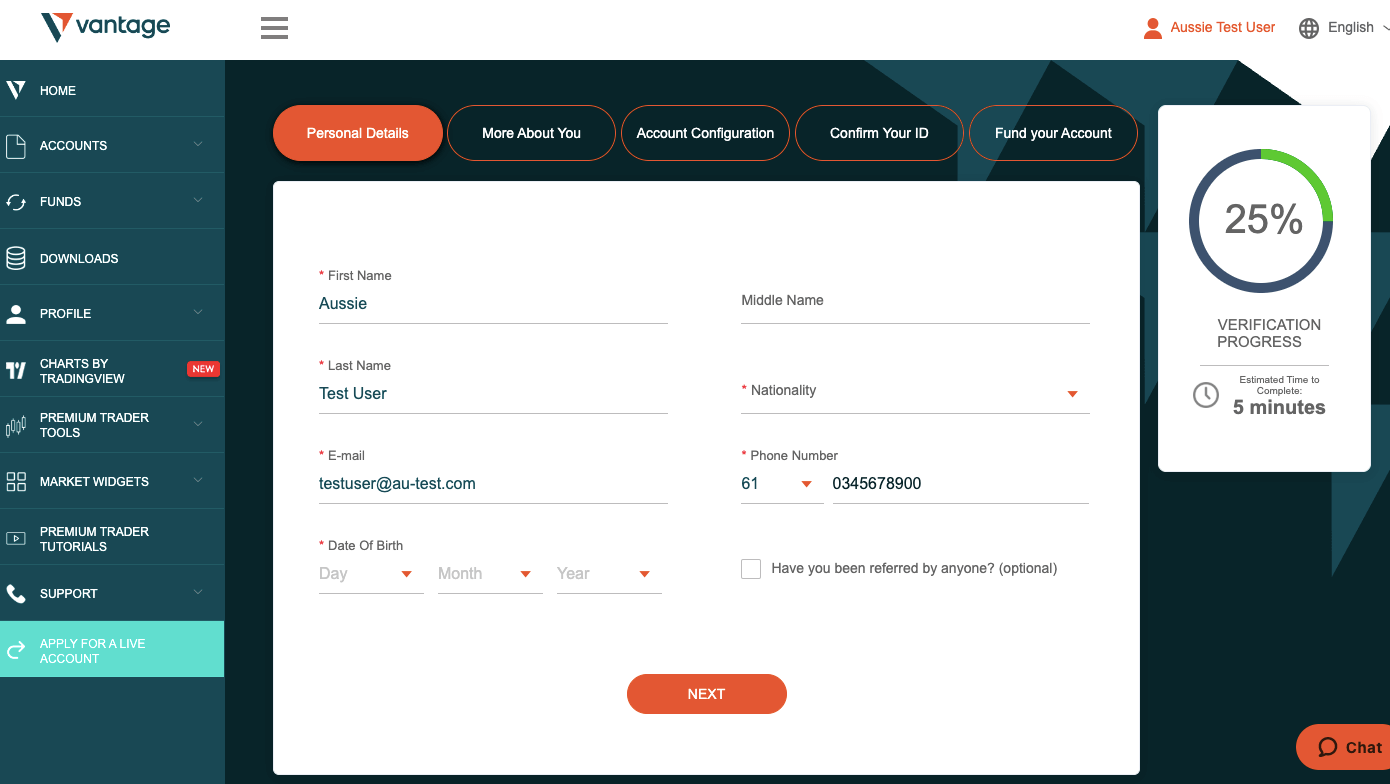

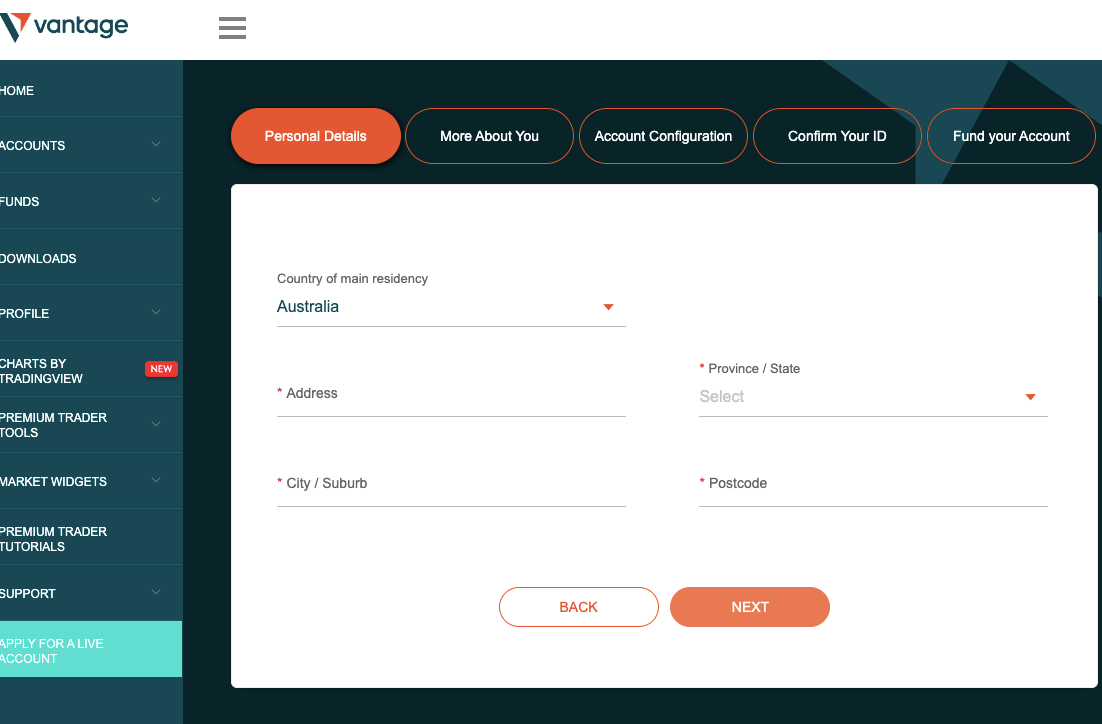

Step 3) On the dashboard, provide your date of birth, address, and select your nationality then click ‘Next’.

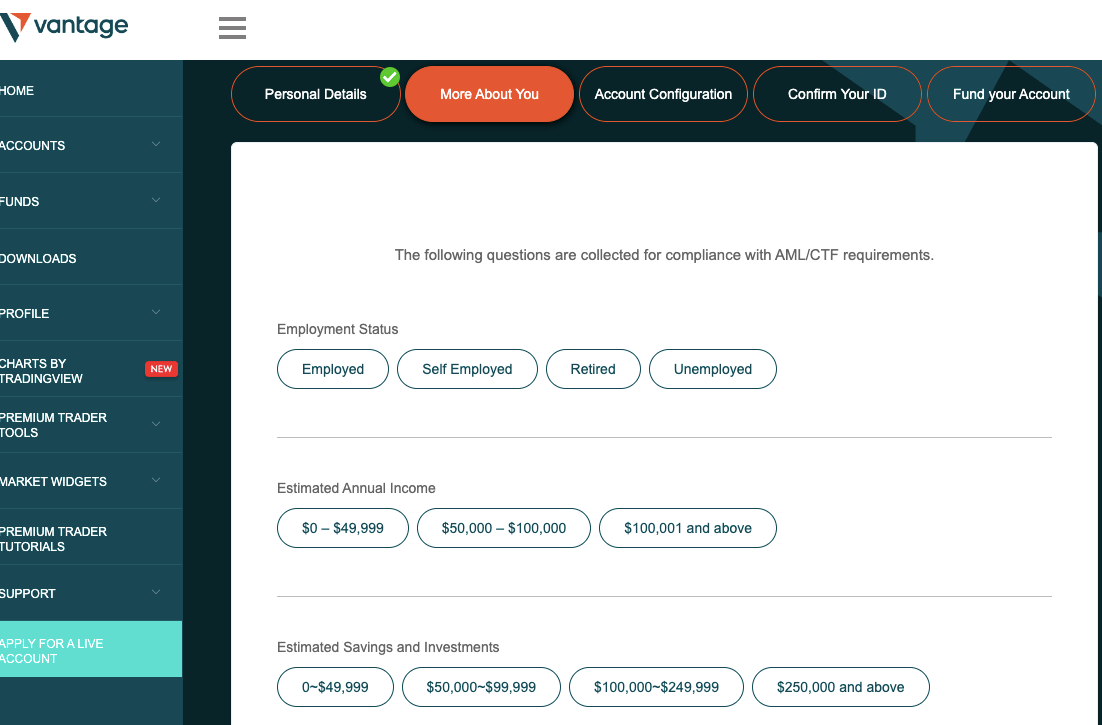

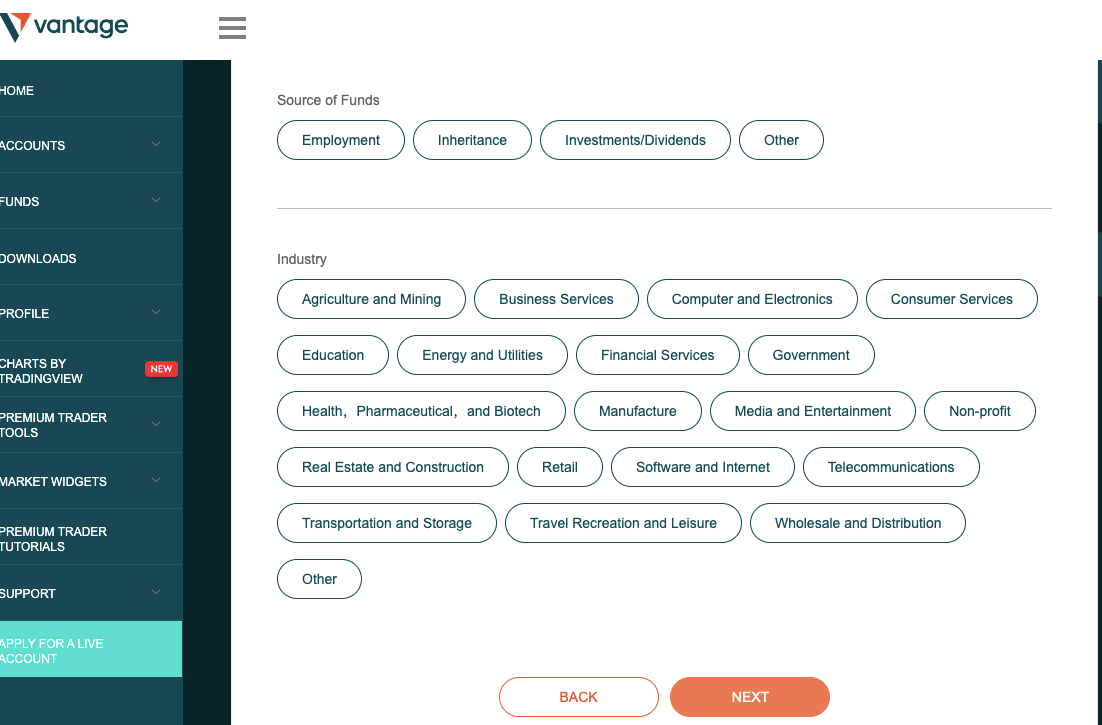

Step 4) Answer the questions about your employment and financial status, and your knowledge/experience with trading financial assets, then click on ‘NEXT’.

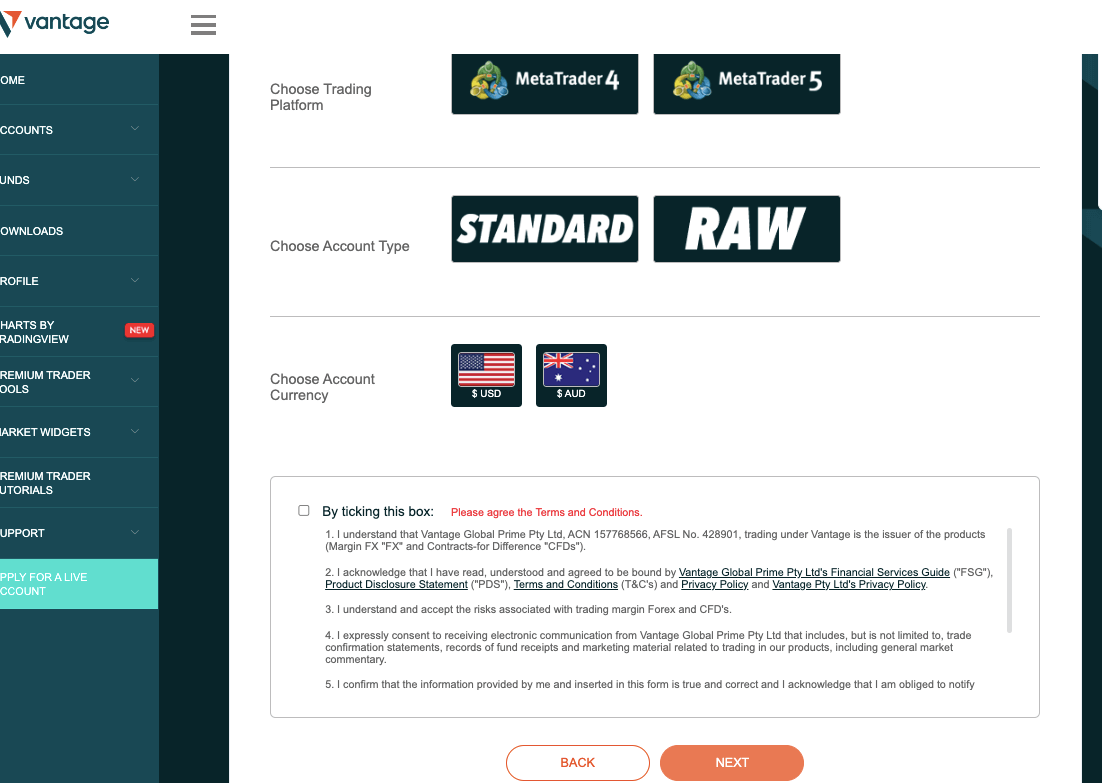

Step 5) Select your preferred account type, trading platform and base account currency. Check the Terms and Conditions box, then click ‘NEXT’ to proceed.

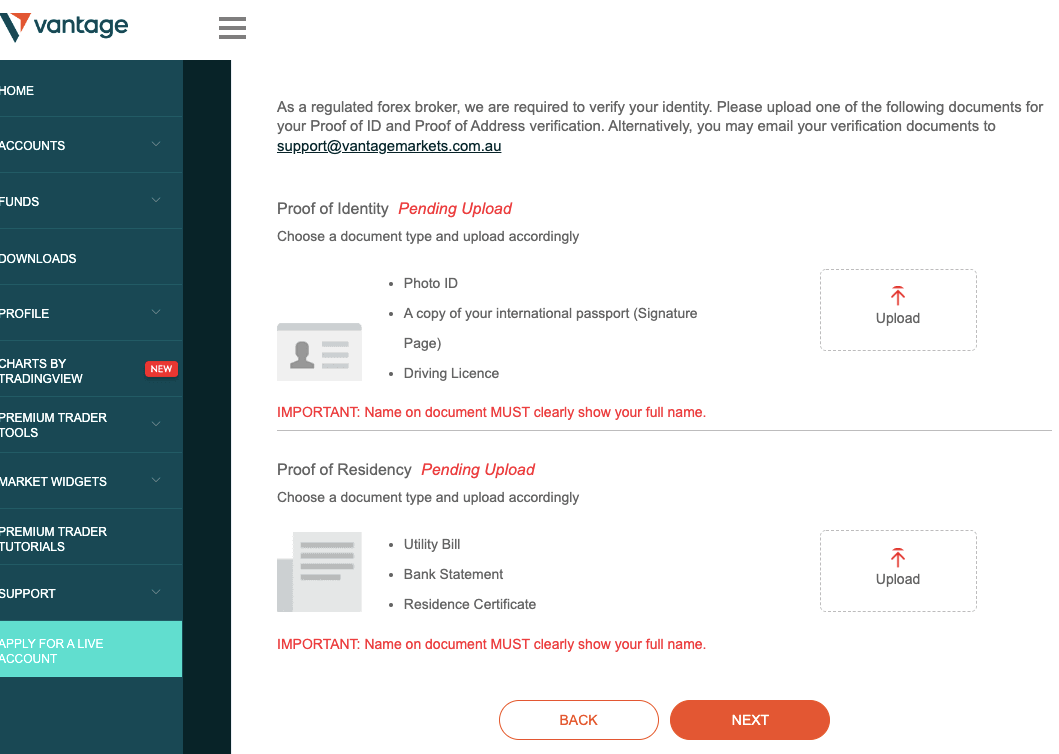

Step 6) Upload your Identity and Address verification document to verify your account. On the dashboard, you will also be required to take a suitability test to test your knowledge/experience of leveraged trading.

Note that you can only make deposits, place trades, and initiate withdrawals after your account application is approved.

Vantage FX Deposits & Withdrawals

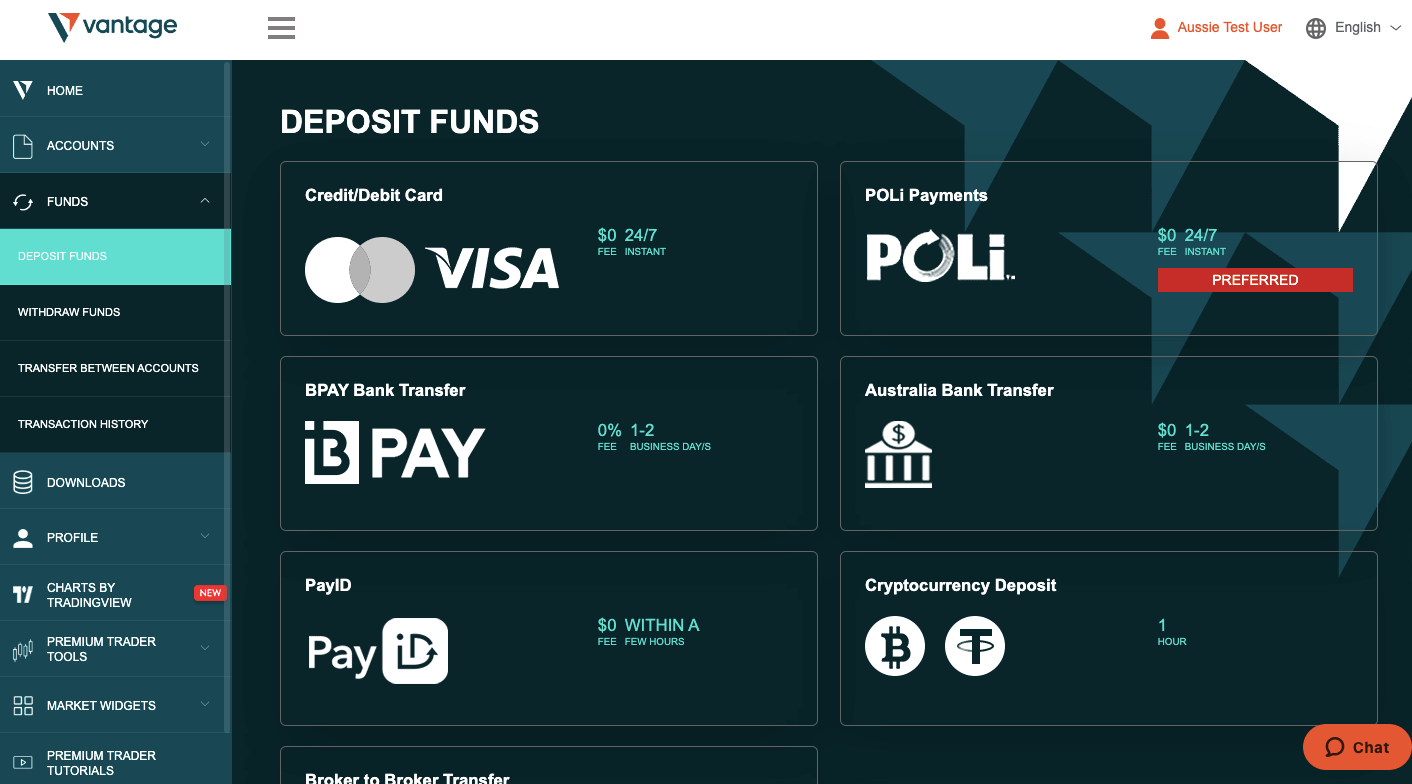

Payment methods accepted on Vantage FX for deposits and withdrawals are bank transfers, cards, e-wallets (POLi & PayID), and cryptocurrencies. Find details of the deposits/withdrawal options on Vantage FX below:

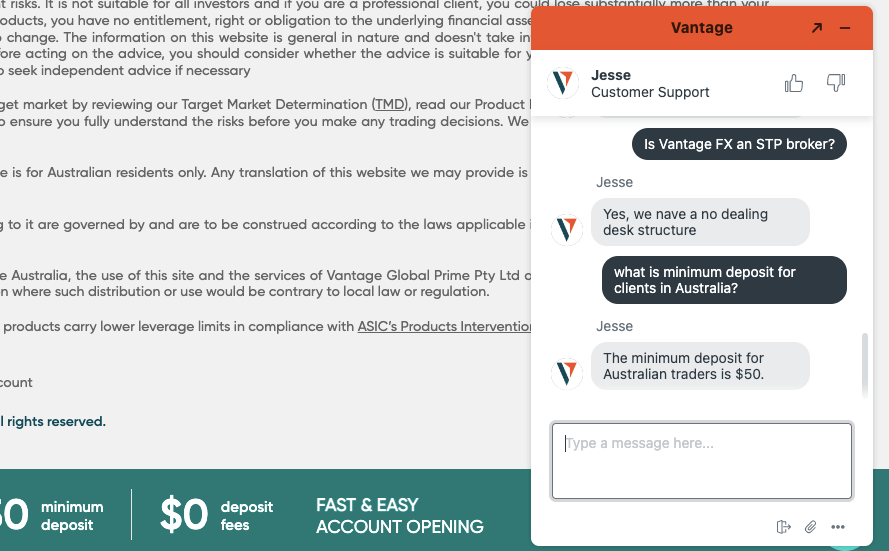

What is the Vantage FX minimum deposit?

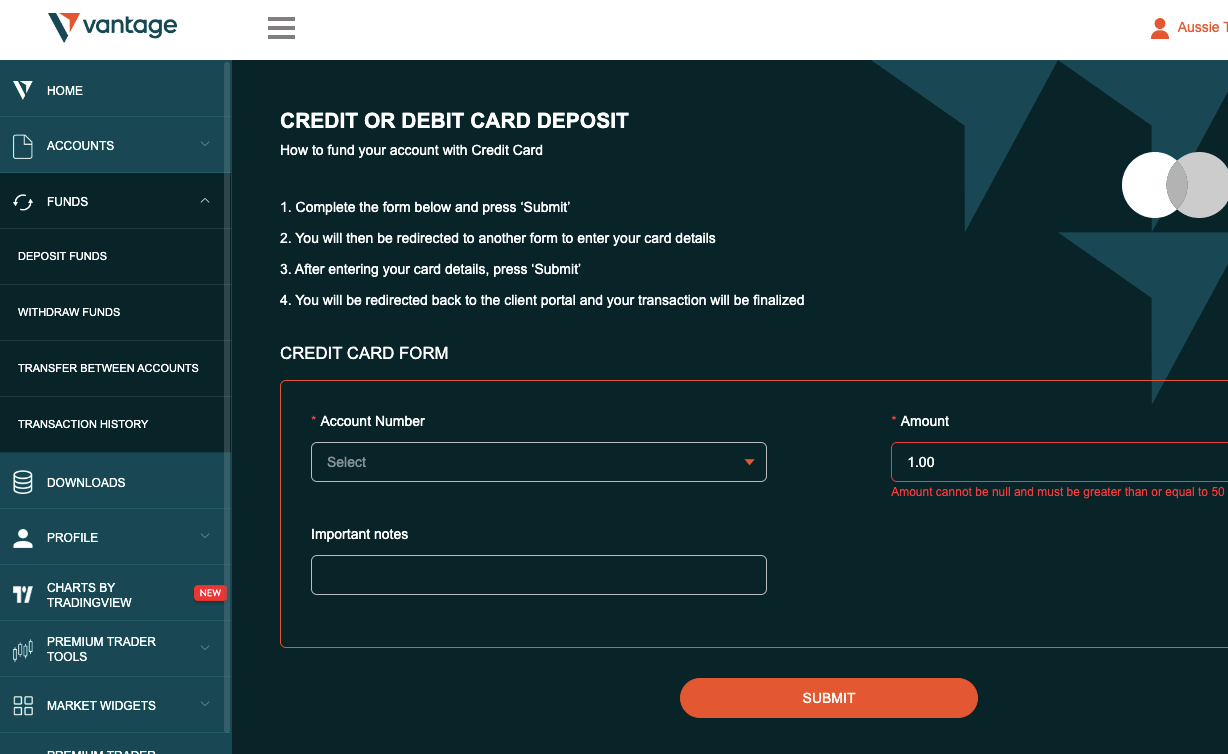

The minimum deposit on Vantage FX is A$50. Although the recommended minimum deposit based on account types is $200 and $500 for Standard and Raw Accounts respectively.

Cards and e-wallet deposits are credited instantly, while deposits via local bank transfers are processed within 1-2 business days. Cryptocurrency deposits are credited within 1 hour.

How do I deposit Vantage FX?

Follow the steps below to deposit to Vantage FX.

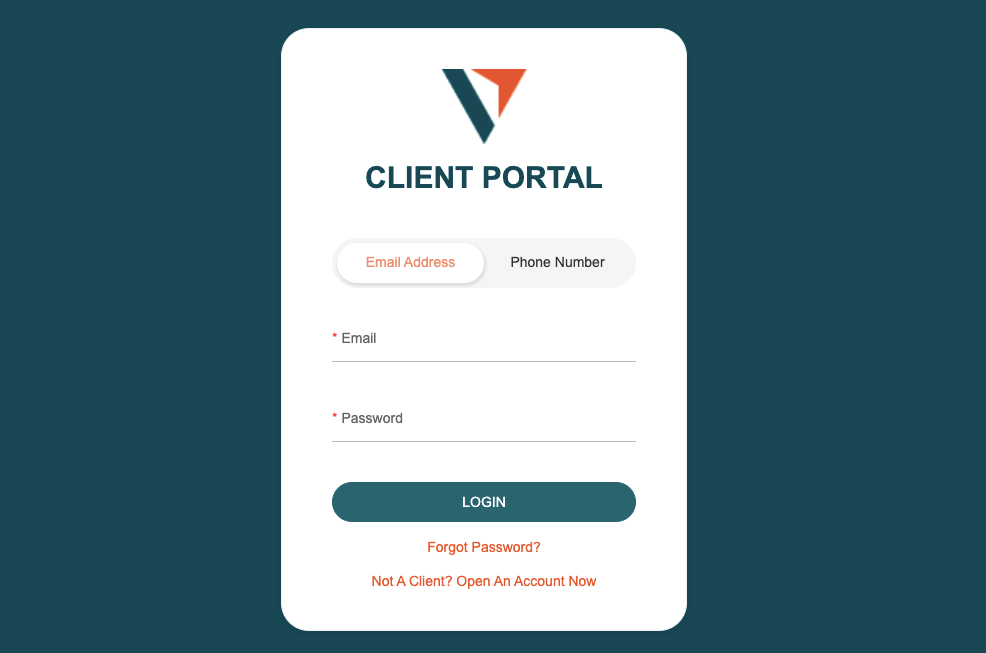

Step 1) Log in to your Vantage Client Portal with your email and the password via secure.vantagemarkets.com/login.

Step 2) On the menu, click on ‘FUNDS’, then ‘DEPOSIT FUNDS’, and select your preferred deposit method.

Step 3) Enter the amount you want to deposit, click ‘SUBMIT’ and the on-screen prompts to complete the deposit.

How much can I withdraw from Vantage FX?

The minimum withdrawal amount on Vantage FX is A$30. After you submit your withdrawal request, it usually takes one business day to be processed internally.

How long is the Vantage FX withdrawal time?

Once the request is processed, it takes from 3-5 business days for the funds to reach your account for card withdrawals on Vantage FX. Bank transfer withdrawals on Vantage FX may also take up to 5 business days for you to receive funds.

How do I withdraw from Vantage FX?

Step 1) Log in to your Vantage Client Portal with your email and the password via secure.vantagemarkets.com/login.

Step 2) On the menu, click on ‘FUNDS’, then ‘WITHDRAW FUNDS’, and select a withdrawal method you want to use.

Step 3) Enter the amount you want to withdraw, and follow the on-screen instructions to complete your withdrawal.

Vantage FX Trading Instruments

You can trade the following financial instruments on Vantage FX:

| Instrument | Availability | Number |

|---|---|---|

| Forex | Yes | 49 currency pairs on Vantage FX |

| Soft Commodities | Yes | 7 Agriculture commodities on Vantage FX (Cocoa, Sugar, and others) |

| Indices | Yes | 24 cash & futures indices on Vantage FX (US SP500, UK FTSE , HK50 and others) |

| Shares | Yes | 226 shares on Vantage FX (US, UK, AU and Hong Kong stocks) |

| Metals | Yes | 8 pairs of Precious Metals on Vantage FX of Gold, Copper, and Silver to USD & EUR |

| Energy Commodities | Yes | 7 oil on Vantage FX (NatGas, GASOIL-C, and others) |

| Crypto assets | Yes | 43 pairs of cryptocurrencies on Vantage FX (BTC, ETH, LRC, and others to USD) |

Vantage FX Trading Platforms

Trading platforms supported by Vantage FX are:

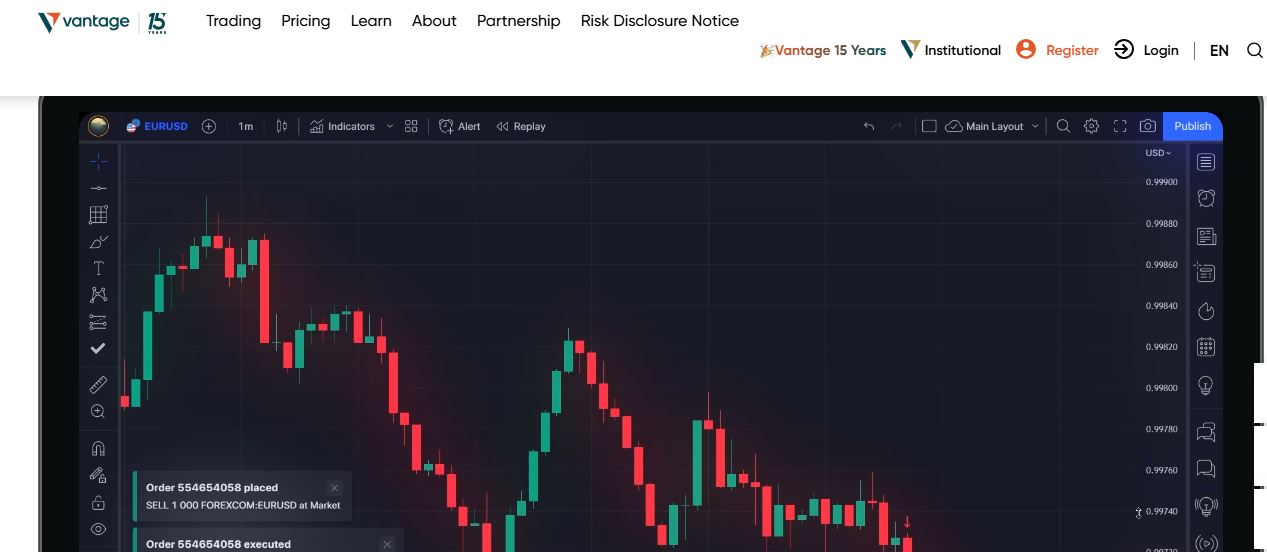

1) Vantage ProTrader: This is a proprietary trading platform by Vantage FX that is powered by TradingView. This platform is available for web trading only.

ProTrader accommodates all trading styles (scalping, swinging, etc). The charting is precise, adding 12 different chart styles to the conventional candlestick style. Other styles on the platform include Renko, Kagi, etc.

You can also take advantage of the built-in market news and headlines. It helps you monitor updates on over 300 currency pairs. With the tools on Vantage ProTrader, you can effectively combine technical and fundamental analysis

2) MetaTrader 4 and MetaTrader 5: Vantage FX supports the MT4 and MT5 trading application for trading financial assets, which is available for web trading, desktop, and mobile devices (Android & iOS). Vantage FX’s MT4 comes with some smart trade tools. These tools are free and can only be used if you choose the MT4 trading platform.

The nine smart trade tools are alarm manager, correlation matrix, correlation trader, excel RTD link, market manager, mini terminal, sentiment trader, session map, and trade terminal. These tools have specific uses and Vantage FX has a video guide for each of them. If you prefer texts, the guides are also available in word document format for you to download.

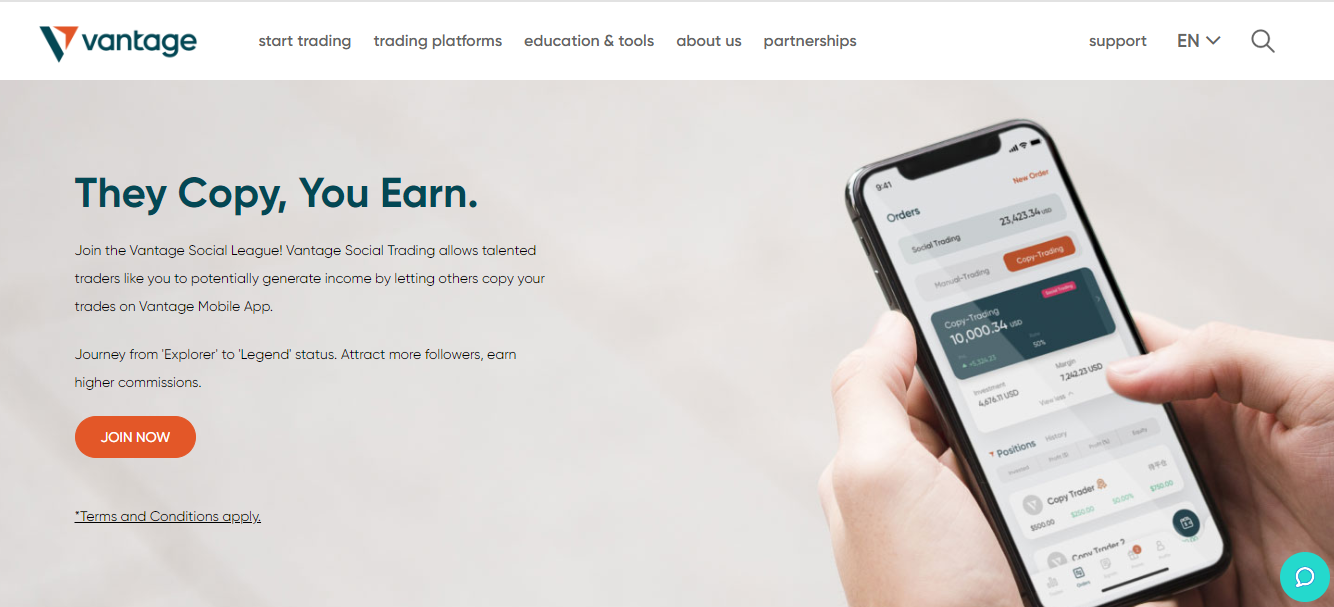

3) Vantage FX Social Trading: Vantage FX offers copy trading via the V-Social app which is available on both Android and iOS devices.

Vantage V-Social app connects traders in a network in which they can ask other traders in the community and decide to copy their trades. You can also offer your trades as a service. Other traders can copy your orders while you earn a commission.

4) TradingView: TradingView is a charting and analytical tool. It is almost on the same level of popularity as MT4/MT5. Over 50 million traders use it globally. It has 15+ chart types and over 90 drawing tools. Watchlists, screeners, and live news are just beside the charts. You don’t need to leave the chart to monitor major news.

5) VWT: VWT stands for Vantage Web Trading. It is a platform that lets you access all your trades and positions in one browser. You only need to log in once to manage all your trading accounts. If you are a new user, open a live account and access VWT through your client portal.

Vantage Markets Trading Tools

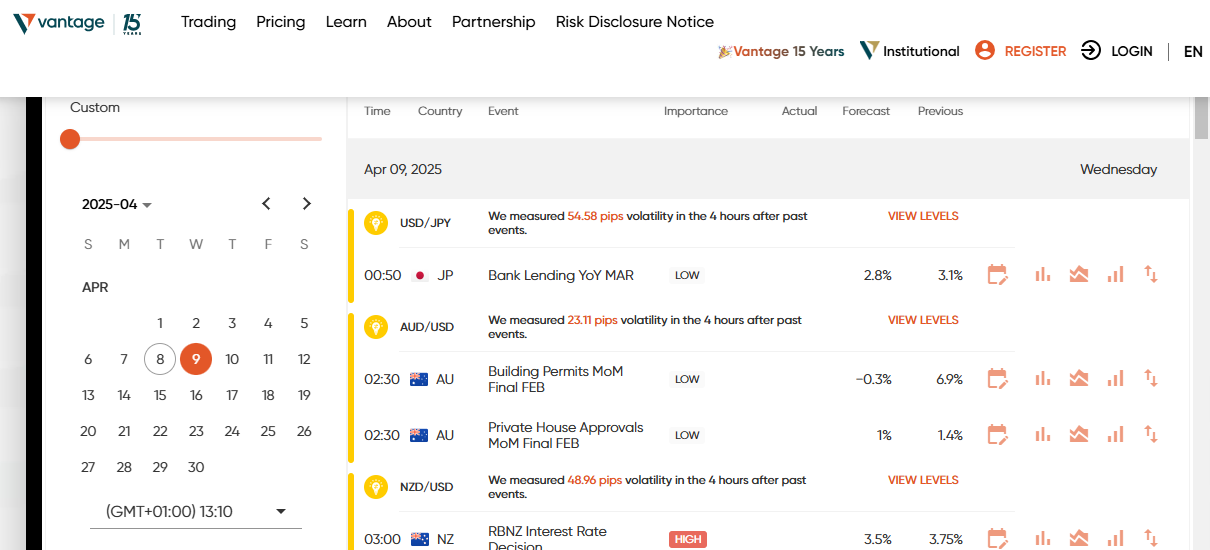

Economic calendar: Vantage Markets’ economic calendar provides information about economic data, releases, and events. You can use it to stay informed about upcoming events and their likely impact on the market.

On the calendar, you will see the event, the country, previous data, and the impact of the news. Here is how it looks below:

Market analysis and news: The forex market is vast. There is too much moving parts. Having access to good analysis and key news can be helpful. Vantage Markets has a combination of analysis on different CFDs and news. They cover daily and weekly news ranging from central banks info and specific currencies like BTC, USD, and GBP.

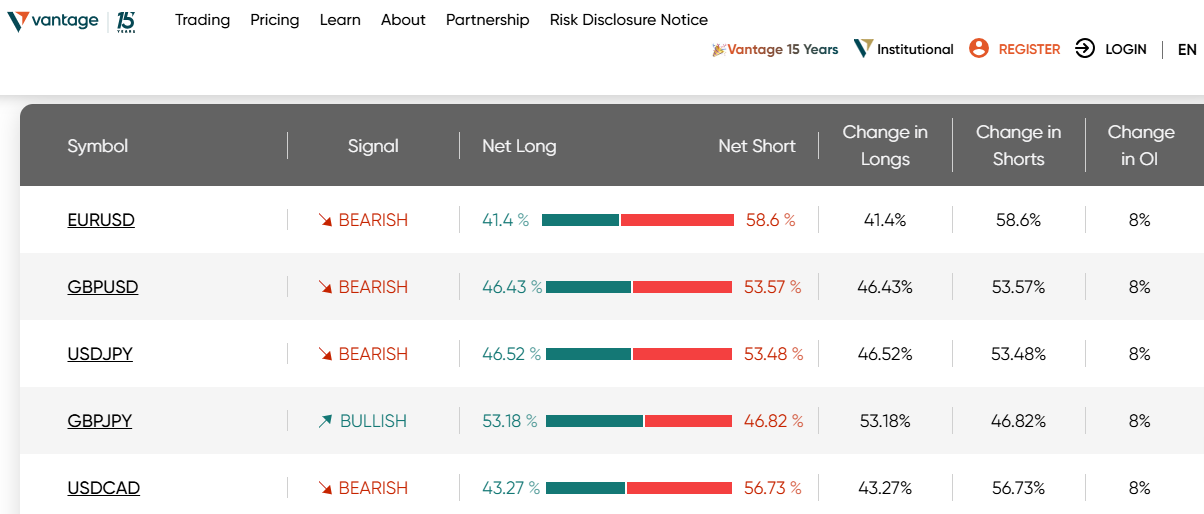

Client sentiment: The market sentiment tool can give you insight into buying and selling opportunities. Vantage Markets has sentiment indicators that allows you see where majority of traders are heading. Are they going bullish or bearish?

Here is how the indicator looks:

Vantage FX Execution Policy

Vantage FX is an STP broker with STP execution on their Standard STP Account. On this account, they act as an intermediary and execute your trades for you. Your trades are electronically transmitted to liquidity providers for execution so there is no dealing desk.

Vantage FX is also an ECN broker with ECN execution on their Raw ECN Account. On this account, your trades are not executed on your behalf. Instead, computerized communication networks connect you directly to other market participants (buyers or sellers). There is no dealing desk intervention too.

Vantage FX considers factors such as price, speed, the likelihood of execution, cost, and size of the order to provide traders with the best execution results. These factors do not carry the same level of importance. Vantage exercises their discretion to determine the most important ones for execution. If you feel any of these factors are important to your trades, you can give an expression to the firm.

Price is generally considered to have a higher importance by Vantage FX. However, other factors such as speed and likelihood might be given more importance depending on the nature and characteristics of the CFDs you trade.

For liquid CFDs, speed is considered a crucial execution factor. Liquid CFDs have high trading volumes and their prices tend to change rapidly. This is why the execution of orders on such CFDs must be as fast as possible. Also, t will be helpful if you trade such CFDs with a strong internet connection.

The likelihood of execution and settlement has precedence over price and speed for illiquid CFDs. This is because the trading volume of illiquid CFDs is quite low. Also, their prices do not move rapidly like liquid CFDs. Vantage FX will focus more on making sure that your order is connected to a buyer/seller when you are trading illiquid CFDs. It is not really about how fast they can get it executed.

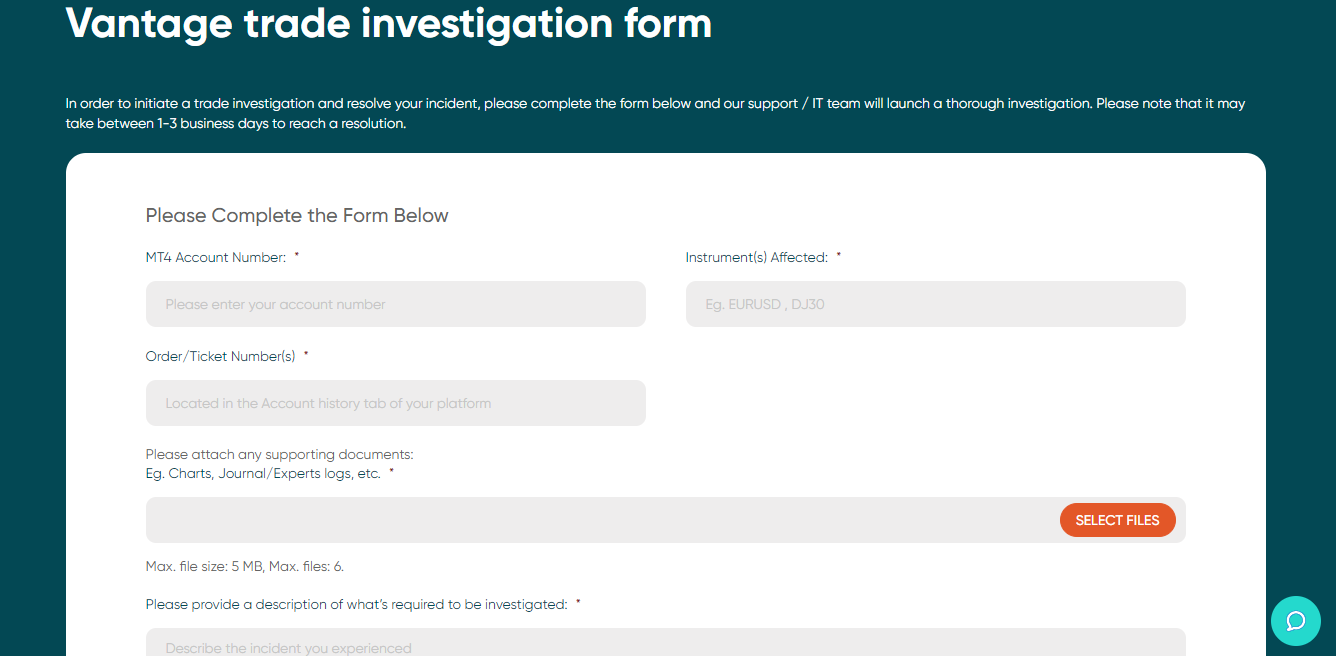

Vantage Trade Investigation

Vantage Markets have a standard execution policy. However, they have gone a step further to create a trade investigation form. if you are not satisfied with how a trade was executed, you can open an inquiry for the broker to consider. Here is the form below.

After submitting the form, Vantage’s IT team will begin the investigation. It can take 1-3 business days before you get a response.

Vantage FX Education and Research

Vantage FX’s education center is full of useful resources for beginners and experts. Here are some of them.

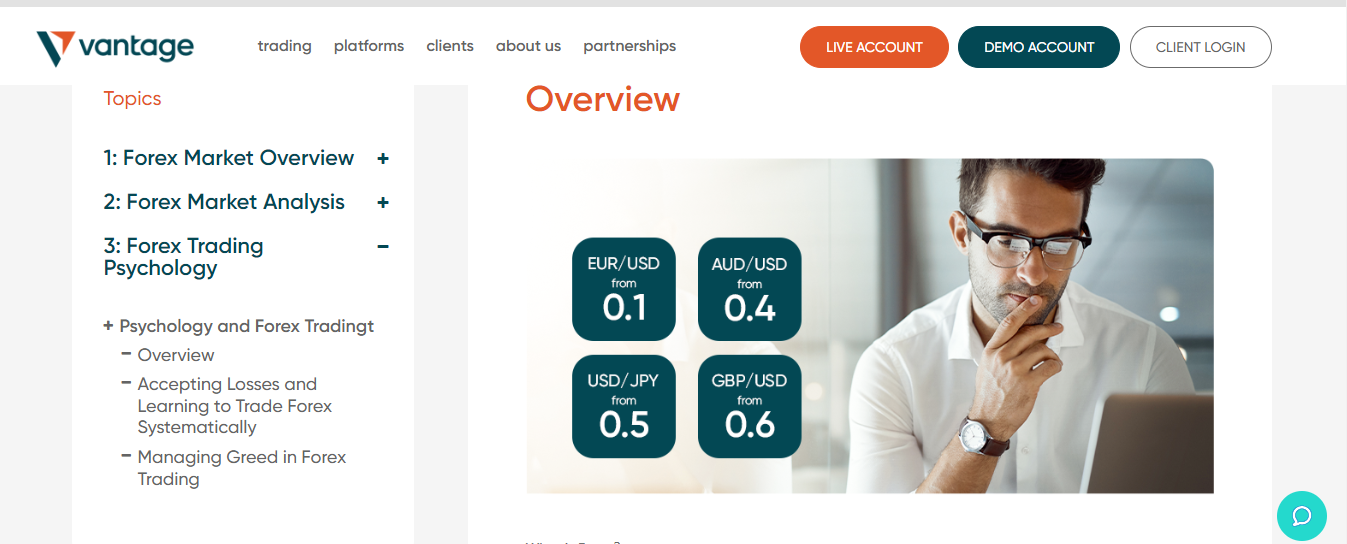

Vantage FX Academy: This is the latest on Vantage FX’s education list. The academy contains informative content on forex, indices, shares, and commodities. It is great for beginners. The forex section has the most content for now. However, we expect others to be updated because the academy is still in progress.

Learn Forex: Learn forex is a more specific part of the CFD broker’s education centre. It is for fx trading knowledge only. The learn forex section is divided into three parts. The first part is Forex Market Overview while the second and third part covers Forex Market Analysis and Forex Trading Psychology respectively.

MT4 Manual: MT4 is a popular trading platform. However, it might be a little complex for beginners. The MT4 manual is very useful for learning. You get to learn how to install it and the extra features that have been added to it. For better understanding, the Manual covers MT4 generally, MT4 for Mac, and Vantage FX’s MT4.

Pro Trader Videos: These are exclusive videos that cover advanced areas of forex and stock trading. They are over 130 in number. It also includes an introduction and a complete guide on MT4/MT5. Candlestick patterns, technical indicators, Fibonacci, and chart formation patterns are one of the many topics in the Pro Trader videos.

As loaded as this course is, it has a downside. You cannot access the over 130 videos without a funded live account. A minimum of $1000 is required to unlock the course.

Smart Trader Tools Videos: Smart Trader Tools is an extra add-on that come with MT4/MT5. It is usually added by forex brokers. This tool is very powerful but you cannot maximize it if you do not know how to use it. Vantage FX has a tutorial that solves this problem. It has 8 videos with a few notes attached. There are no fees required to access these videos.

Daily Market Updates: This is a combination of news and technically analyzed charts. The news focuses on a particular CFD. This is then combined with historical price movements and technical analysis for future price movements.

Though this is helpful, you should not rely on the work done by others only. You should read the news and try to analyze the charts independently too. Here is how Vantage FX sets up daily markets update.

Can you see the news about the S&P 500? Can you see the trendlines and market structures too? This simple analysis can save you lots of time.

Featured Trade Ideas: You can access trade setups for currency pairs and shares CFD with featured trade ideas. These trades are analysed with technical tools and chart patterns and you can access 10+ signals daily.

The setups are flexible and suit any trading style. Scalpers and swing traders can tailor them to their preferred entries and exits.

Vantage FX Australia Customer Service

Vantage offers 24/5 customer service to clients via the following channels:

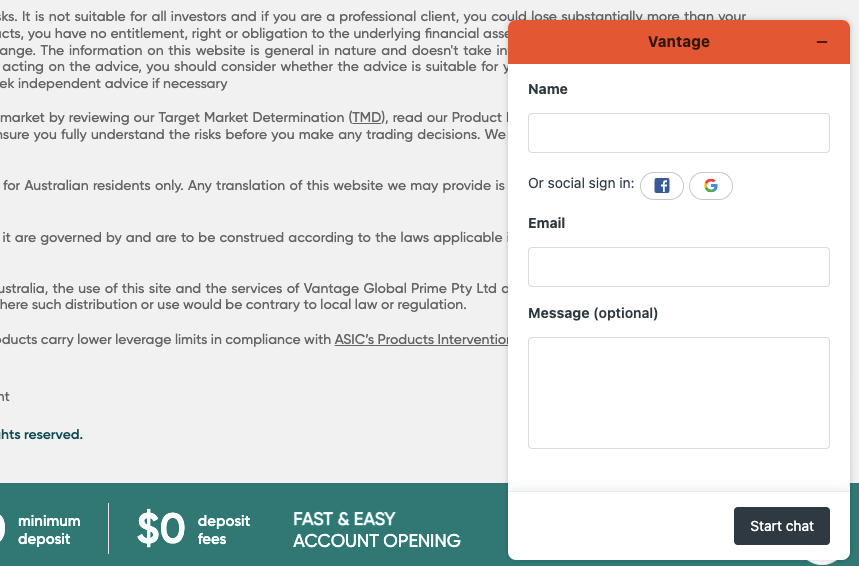

1) Live chat support: The Vantage FX live chat is available from 10 PM on Sundays to 10 PM on Fridays for customer support. When our team tested, the wait time was under 1 minute and the answers to our questions were relevant.

You will be required to submit an email and your name to begin the chat. The live chat button is available on every page of the Vantage FX website and is easy to use.

2) Email support: Vantage offers email support to clients 24/5. When our team tested the Vantage FX email support, we got a reply after about 20 minutes.

The Vantage FX email address for support is [email protected].

3) Phone support: You can reach the Vantage FX Phone support via 1300 945 517, which is available during business hours from Monday to Friday.

Do we Recommend Vantage FX Australia?

Based on the regulations of Vantage FX, the broker is considered trustworthy for Australian traders, because they are regulated by the ASIC. Vantage FX offers negative balance protection for both retail and professional traders.

The fees on Vantage FX are moderate, and you can choose the commission-free Standard Account or low spreads Raw Account. You can also trade as a professional client if you need more leverage, although they have fewer instruments available for trading.

Overall, the customer support of Vantage FX is fair, as the live chat responds fast and the email support is also prompt on business days and the account opening process on Vantage is fast and simple.

Although there are other brokers who offer 24/7 support in Australia, they are regulated by ASIC and offer fair trading conditions.

We recommend that you check out the Vantage Markets website and probably chat with customer support to ask any questions you might have to decide if the platform is right for you.

What Countries is Vantage FX Banned in?

Vantage FX’s services and products are not offered in countries such as China, Canada, Romania, Singapore, and the United States.

In addition, counties on the Financial Action Task Force (FATF) list cannot access Vantage FX’s services. The FATF is a body formed by countries in the G7 to fight money laundering. Democratic People’s Republic of Korea, Iran, and Myanmar are countries on the FATF’s blacklist. Traders in these countries cannot use Vantage FX.

A few other countries are still being monitored.

Finally, Vantage FX is not accessible to countries on the EU or UN sanction lists.

Vantage FX Australia FAQs

How long Does Vantage FX withdrawal take?

It takes from 3-5 business days for the funds to reach your account for card withdrawals on Vantage FX. Bank transfer withdrawals on Vantage FX may take up to 5 business days for you to receive funds.

Does Vantage FX accept Paypal?

Vantage FX currently does not accept PayPal as a payment method for deposits or withdrawals.

Is Vantage FX an STP broker?

Vantage FX is an STP broker, as they have a no dealing desk structure.

Note: Your capital is at risk