IC Markets is a CFD broker that offers trading services for currencies, commodities, bonds, digital currencies, indices and stocks.

IC Markets was established in 2007 and is regulated in Australia and other Top-Tier jurisdictions. They are mainly popular for their Raw spread trading account.

In this review, we take a look at the trading fees (spreads, commissions & more), deposit and withdrawal options, account opening process, customer support and safety of IC Markets.

| IC Markets Review Summary | |

|---|---|

| 🏢 Broker Name | International Capital Markets Pty Ltd |

| 📅 Establishment Date | 2007 |

| 🌐 Website | www.icmarkets.com.au |

| 🏢 Address | International Capital Markets Pty Ltd, Level 4, 50 Carrington Street, Sydney, NSW 2000, Australia |

| 🏦 Minimum Deposit | AUD 300 |

| ⚙️ Maximum Leverage | 1:30 |

| 📋 Regulation | ASIC, CySEC, FSA Seychelles |

| 💻 Trading Platforms | MT4, MT5 and cTrader available on PC, Mac, Web, Android, & iOS |

| Visit IC Markets | |

IC Markets Pros

- Regulated in Australia

- No inactive account fees

- Offers commission-free trading

- No fees for deposit/withdrawals

- Online customer support available 24/7

IC Markets Cons

- Few products available for trading

- No funds compensation for non-EU clients

Is IC Markets a good broker?

IC Markets is a legitimate because of their licensing by Tier-1 and Tier-2 financial regulators especially in Australia.

Below are the major financial authorities with which IC Markets is regulated in different countries.

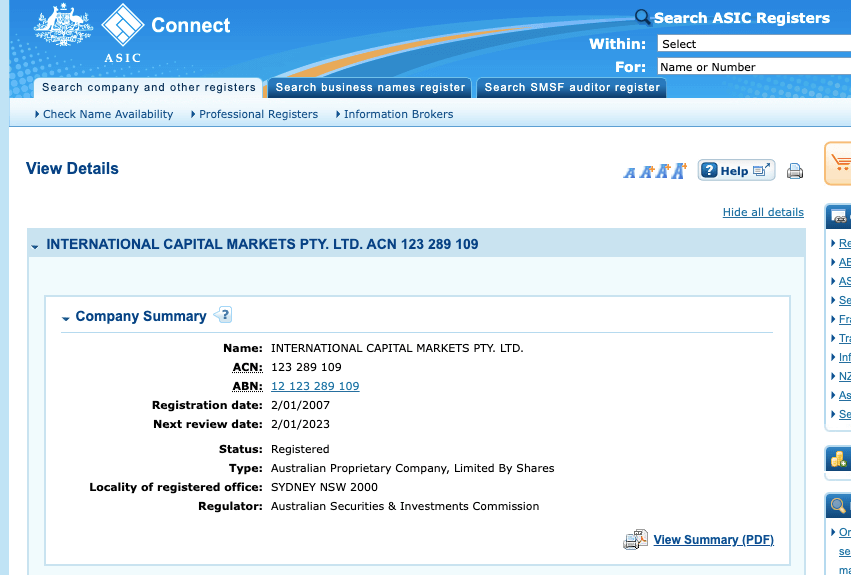

1) Australian Securities & Investments Commission (ASIC): IC Markets is registered in Australia as International Capital Markets Pty Ltd with ACN (Australian Company Number) 123-289-109 since 2007 and is regulated by ASIC.

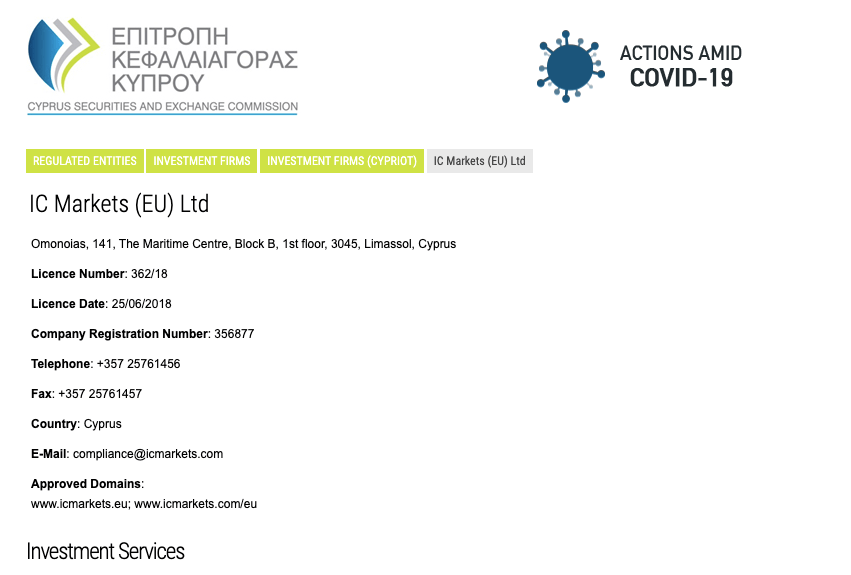

2) Cyprus Securities and Exchange Commission (CySEC): IC Markets is also regulated in Europe by CySEC as IC Markets (EU) Ltd and authorized to offer investment service, license number 362/18 issued in 2018. The broker serves European clients through this license and a dedicated website, www.icmarkets.eu.

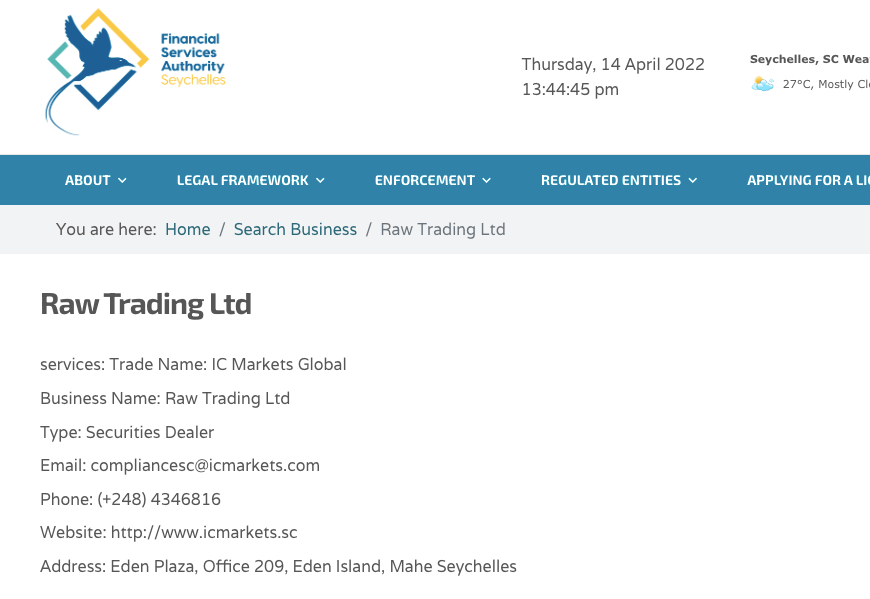

3) Financial Services Authority (FSA), Seychelles: IC Markets is incorporated in Seychelles as Raw Trading Ltd and is regulated by the FSA with license number SD018, authorized as a securities dealer in 2020.

They operate under the trading name IC Markets Global with a dedicated website www.icmarkets.sc.

IC Markets Investor Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| Australia | No Protection | Australian Securities and Investments Commission (ASIC) | International Capital Markets Pty Ltd |

| EU Countries | 20,000 | Cyprus Securities Exchange Commission (CySEC) | IC Markets (EU) Ltd |

| Seychelles | No Protection | Financial Services Authority (FSA) | IC Markets Global |

| South Africa | No Protection | Financial Sector Conduct Authority (FSCA) | International Capital Markets Pty Ltd |

Negative balance protection is available for traders resident in Australia. However, there is no compensation fund for CFD trading

IC Markets Leverage

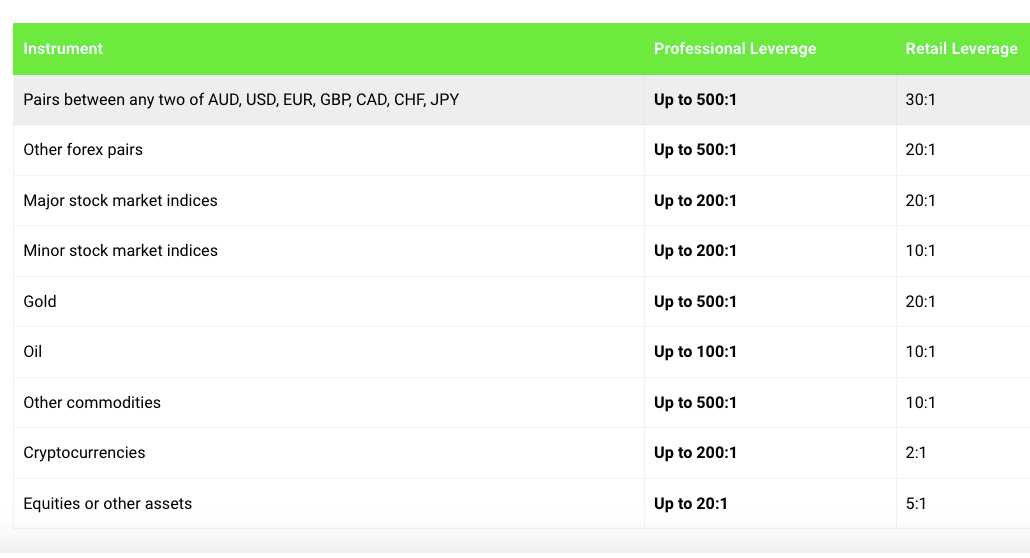

The leverage on IC Markets Varies for retail and professional clients and based on the instrument you are trading. The maximum leverage on IC Markets for retail clients is 1:30, which applies to major forex pairs, other instruments have lower leverage limits.

With leverage of 1:30, you can open a trade position worth 30 times your deposit. For example, if you deposit $1,000 you can place a trade worth $30,000.

Professional clients on IC Markets can access higher leverage of up to 1:500.

It is important to know that trading leveraged products involves risk and you can lose all your money. It is best to only trade if you understand it and do not use high leverage.

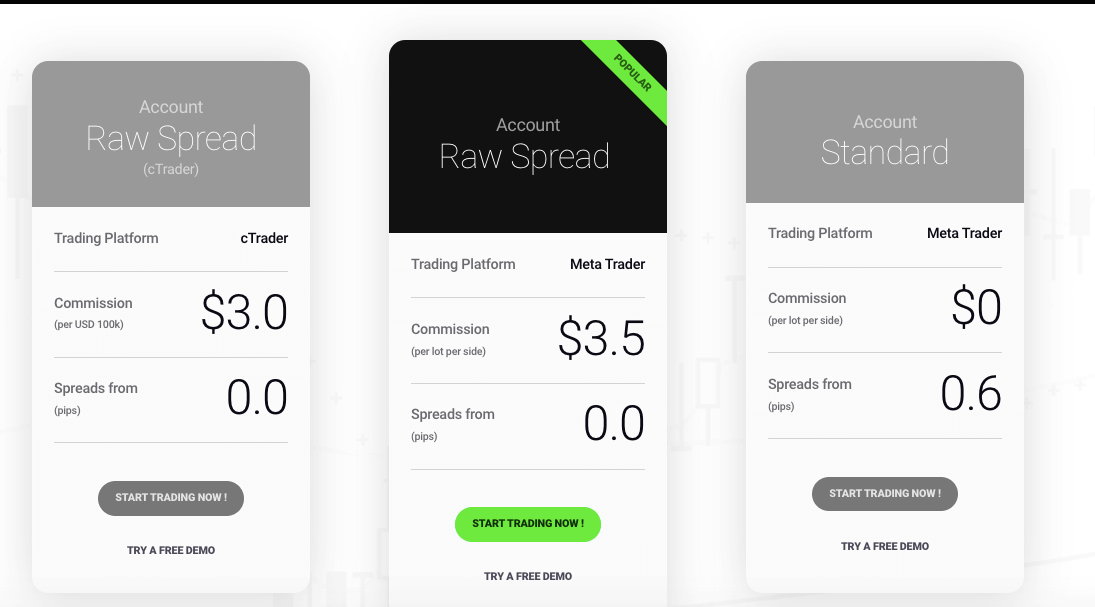

IC Markets Account Types

IC Markets offer two main types of trading accounts for retail clients: Raw Spread and Standard Accounts. The Raw Spread Account is available on cTrader and MetaTrader. If you are opening a Standard Account, only MetaTrader is available.

They also offer Professional Accounts for experienced traders, Islamic Accounts for Muslim traders that are swap-free and demo accounts to help beginners get familiar with the platform.

Below are details of the various account types currently available on IC Markets and their features:

1) Standard Account: The IC Markets Standard Account is available exclusively on the MetaTrader platform and lets you trade CFDs on Forex, indices, bonds, cryptocurrencies, commodities, and stocks.

This account is spread only and charges no commission for opening or closing trade positions. Spreads start from 0.8 pips and usually have a markup because you pay no commissions. You also pay swap fees for keeping a position open overnight on the Standard Account.

The minimum deposit for this account is US$200, with a trade lot size of 0.01, to trade on this account. The maximum number of open positions is 200 and the leverage limit is 1:30.

You have negative balance protection with this account, which means that you cannot lose more than the money you deposit. If you make a loss on a trade position and your account balance becomes negative, the negative balance will be reset to zero.

2) Raw Spread Account (MetaTrader): The IC Markets Raw Spread Account (MetaTrader) is designed for traders who want to use EAs. It is only available on the MetaTrader trading application and allows you to trade CFDs on Forex, indices, bonds, cryptocurrencies, commodities, and stocks.

This account attracts a commission of up to $3.50 per side of the standard lot traded, which amounts to $7 for a round turn. Spreads on this account start from 0.0 pips, and swap fees are applied for keeping a position open overnight.

This account requires a minimum deposit of US$200 with a minimum trade lot size of 0.01, a maximum number of open position orders of 200, and maximum leverage of 1:30.

You also have negative balance protection with this account.

3) Raw Spread Account (cTrader): The IC Markets Raw Spread Account (cTrader) is designed for day traders and scalpers. It is only available on the cTrader platform and allows you to trade CFDs on Forex, indices, bonds, cryptocurrencies, and commodities.

A commission of up to $3 per side lot traded is charged on this account, which amounts to up to $6 for a round turn. Spreads start from 0.0 pips, and swap fees are applied for keeping a position open overnight.

The minimum deposit for this account is US$200, with a minimum trade lot size of 0.01. The maximum number of open positions is 2,000 and the maximum leverage is also 1:30.

You also have negative balance protection with this account.

4) Professional Account: IC Markets offers Professional Account status to experienced clients who want to trade with higher leverage. You can apply to upgrade your account to the professional status, and you will have higher leverage of 1:500, while other features will remain the same, depending on whether you upgraded from a Raw Spread or Standard Account.

With the IC Markets Professional Account, you are not assured of certain protections, like negative balance protection.

To get a Pro Account on IC Markets, first, create a retail Standard or Raw Spread Account, then contact the support team to upgrade your account. Before your application is approved, you must pass the wealth test or the sophisticated investor test, based on the criteria below.

1) Wealth Test:

- You have net assets of at least AU$2.5 million or annual gross income of AU$250,000+ for the last 2 years;

2) Sophisticated Investor Test:

- You have experience working in financial services for at least 12 months in a professional position or show proof of trading leveraged FX or CFDs at least 20 times (with a notional value of AU$500,000) per quarter, for at least 4 quarters over the last 2 years.

After passing either of the tests above, you will still need to take an online test, to prove your knowledge of leverage trading.

5) Islamic Account: The Islamic Account at IC Markets is a swap-free account for Muslim traders who want to adhere to the sharia law of no-riba.

This account is similar to the Raw Spread & Standard Accounts, with the same spreads, commission fees, leverage, and minimum deposit, except that it does not charge swap fees.

Note that you will pay a flat rate financing fee starting from US$5 which can be up to US$80 per day if you keep the trade position open for more than one night. The fee depends on the instrument you are trading.

If you want an Islamic account, you will have to select the Islamic Account Option while creating your account or contact customer support to convert your account to the swap-free status after creation. Note that the Islamic Account on IC Markets can only trade on the MetaTrader platform.

IC Markets Base Account Currency

Base account currencies supported on IC Markets are AUD – Australian Dollar, USD – United States Dollar, EUR – Euro, GBP – British Pound (Sterling), CAD – Canadian Dollar, SGD – Singapore Dollar, NZD – New Zealand Dollar, JPY – Japanese Yen, HKD – Hong Kong Dollar, and CHF – Swiss Franc.

You can select any of these during account registration, but cannot change it once the account is opened.

IC Markets Overall Fees

IC Markets fees vary based on currencies traded, account type, and trading instruments. Find an overview of IC Markets fees here:

Trading fees

Spreads: IC Markets charges spreads whenever you trade instruments, which is the difference between the bid and ask prices. The lowest spreads start at 0.0 pips for Raw Spread Account and 0.8 pips for the Standard Account. Here are the average spreads on IC Markets for Raw Spread & Standard Accounts:

| Instrument/Pair | Raw Spread Account | Standard Account |

|---|---|---|

| EUR/USD | 0.02 pips | 0.80 pips |

| GBP/USD | 0.23 pips | 0.80 pips |

| EUR/GBP | 0.27 pips | 1.27 pips |

| Gold/USD | 0.0 pips | 1.083 pips |

Commission fees: IC Markets offers commission-free trading for Standard Accounts while Raw Spreads accounts incur commission fees for opening and closing trade positions. The Raw Spreads (MetaTrader) round-turn commission fee is $7 and Raw Spread (cTrader) is $6.

Swap fees: If you keep a trade position open overnight past the market’s closing time, the position rolls over into the next trading day and you pay a swap fee also referred to as rollover fee or overnight funding cost. This is applicable to all account types on IC Markets except Islamic Accounts.

Typical swap fees for major pairs like EURUSD on MetaTrader are $-3.93 for long (buy) swap and $2.45 short (sell).

Islamic Accounts are swap-free and won’t pay any swap fees for holding a position overnight. However, if you hold the position open for more than one night, you will start to pay a flat financing fee based on the instruments you are trading.

Non-trading fees

Deposit and Withdrawal fees: IC Markets does not charge any fees for deposits and withdrawals on all payment methods which applies to all account types.

Some international banking institutions may charge independent fees.

Account Inactivity charges: IC Markets does not charge inactive account fees, which means that you will not be charged anything if you don’t log into your account or trade. Any funds in your account will be untouched.

| Fee | Amount |

|---|---|

| Inactivity fee | None |

| Deposit fee | None |

| Withdrawal fee | None |

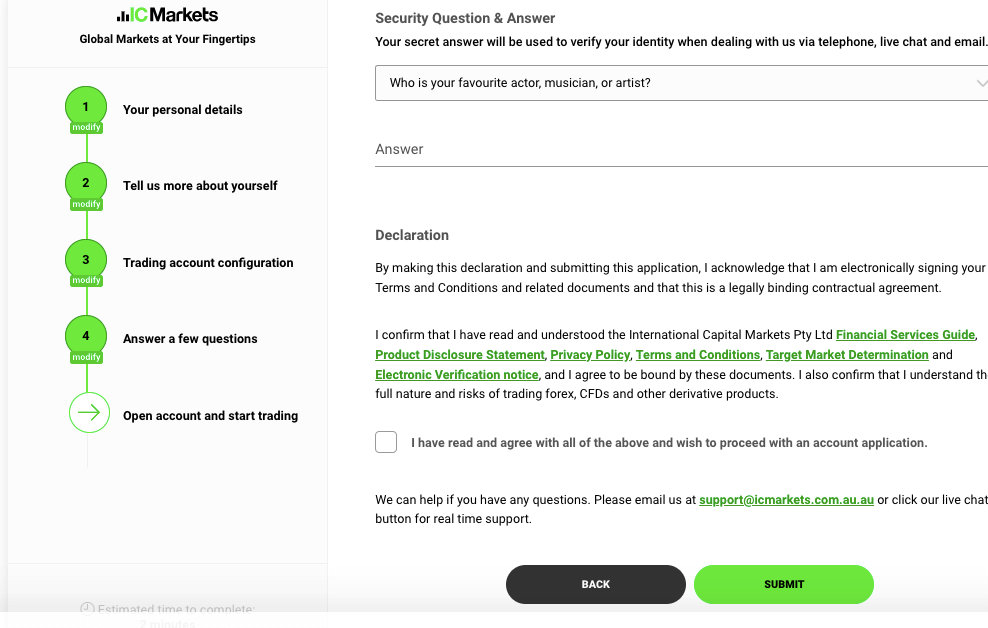

How to Open IC Markets Account in Australia?

To start trading on IC Markets, follow these steps to open an account.

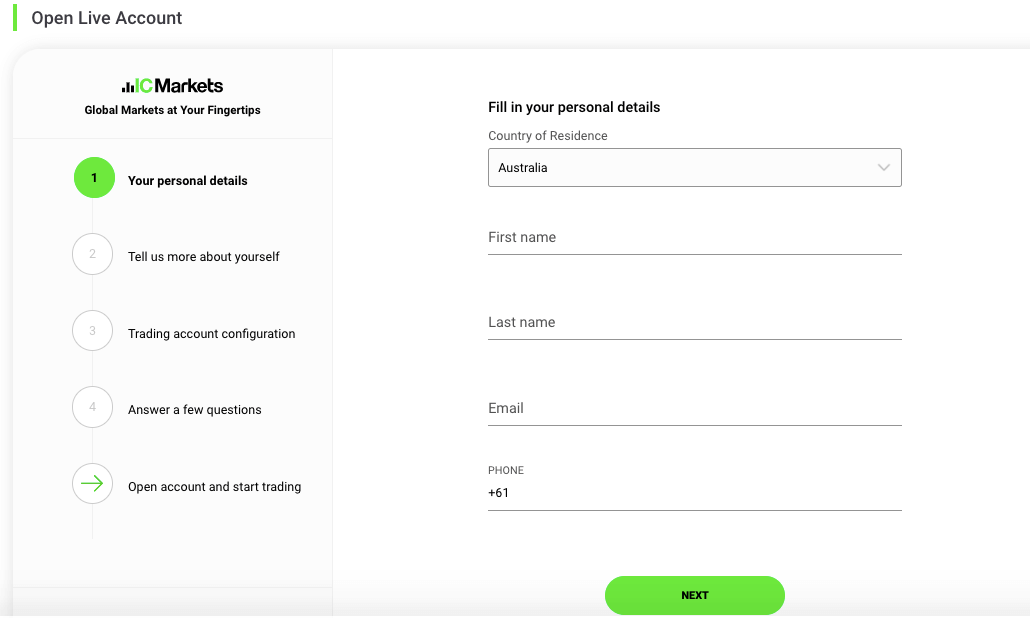

Step 1) Visit the IC Markets website homepage at www.icmarkets.com.au and click on ‘Start Trading Now’.

Step 2) Fill out your name, email, and phone number on the form that appears and click the ‘NEXT’ button.

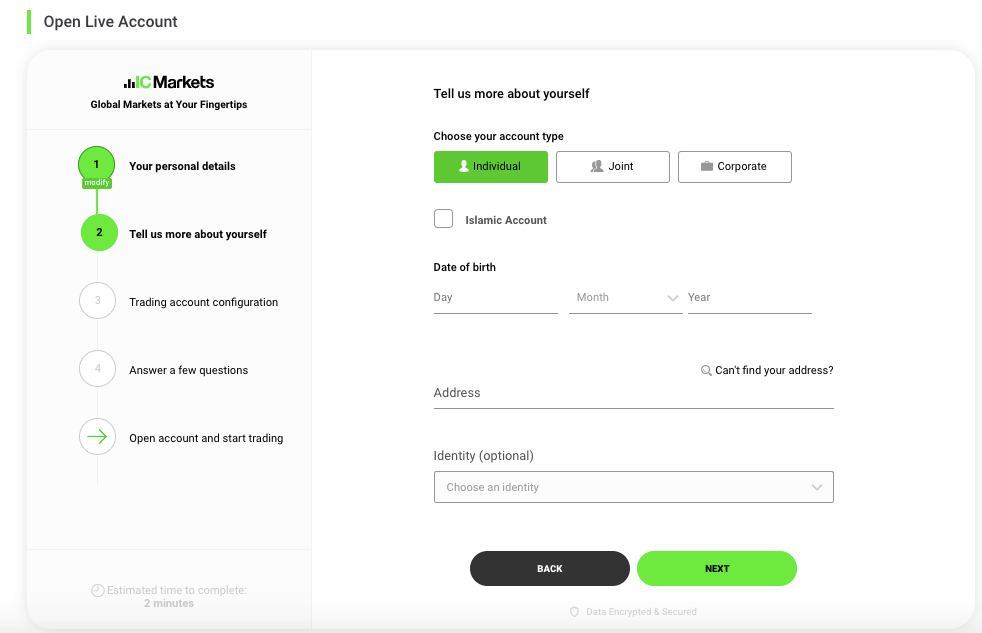

Step 3) Select whether you are opening an individual, joint or corporate account, and check the box beside Islamic Account, if you want a swap-free account, then provide your date of birth and fill in your address. Check the referral box if you were referred and click on ‘NEXT’.

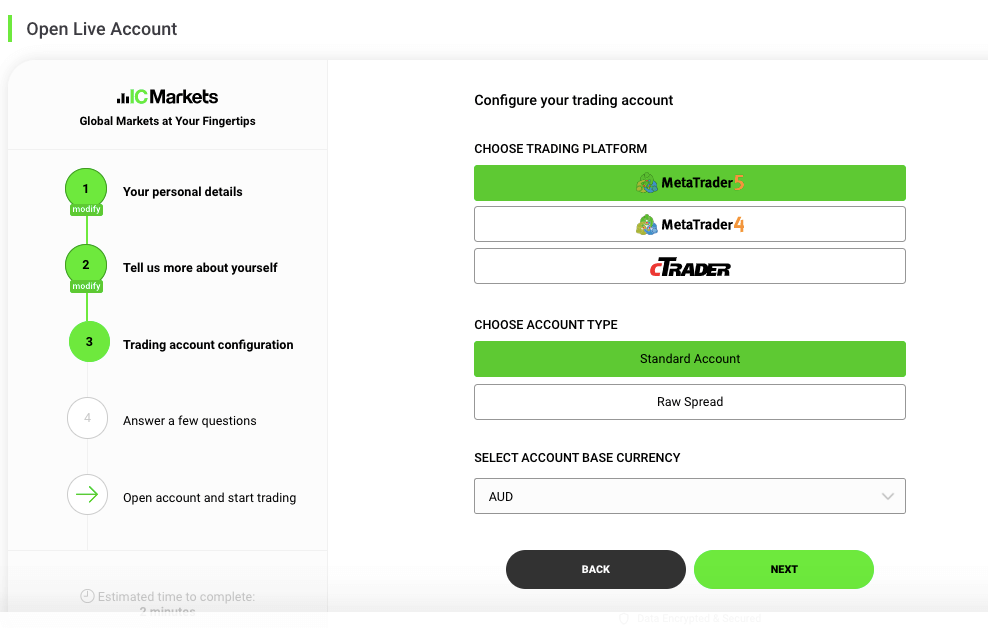

Step 4) Choose your preferred trading platform and the account type you want, select a base account currency, then click on ‘NEXT’ to proceed.

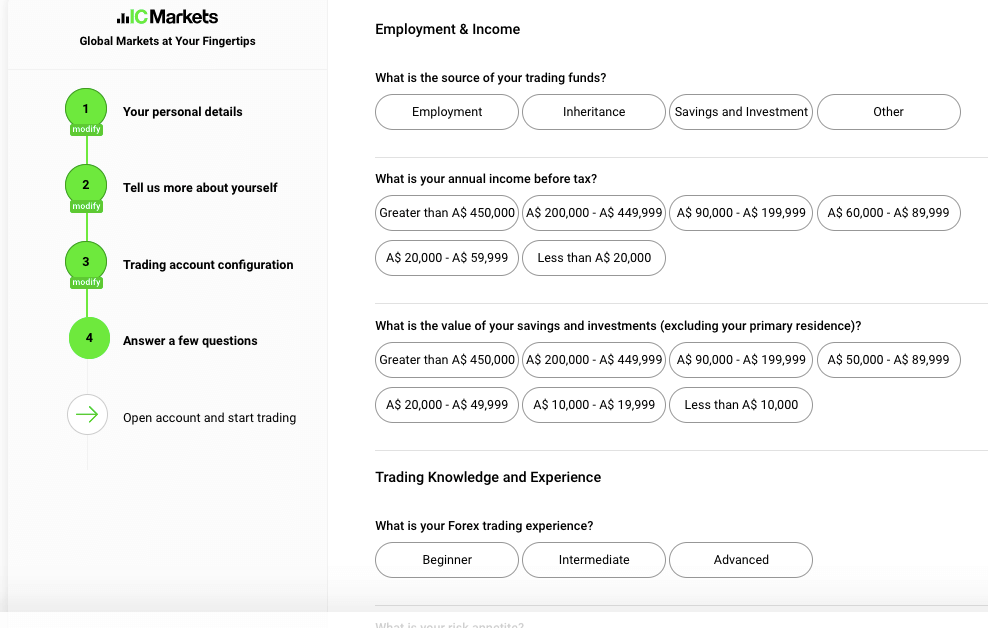

Step 5) Answer questions about your employment status, income, and trading experience then click ‘NEXT’.

Step 6) Set a security question and the answer. After that, check the box to show you have read and agree with the terms and conditions, then click ‘SUBMIT’.

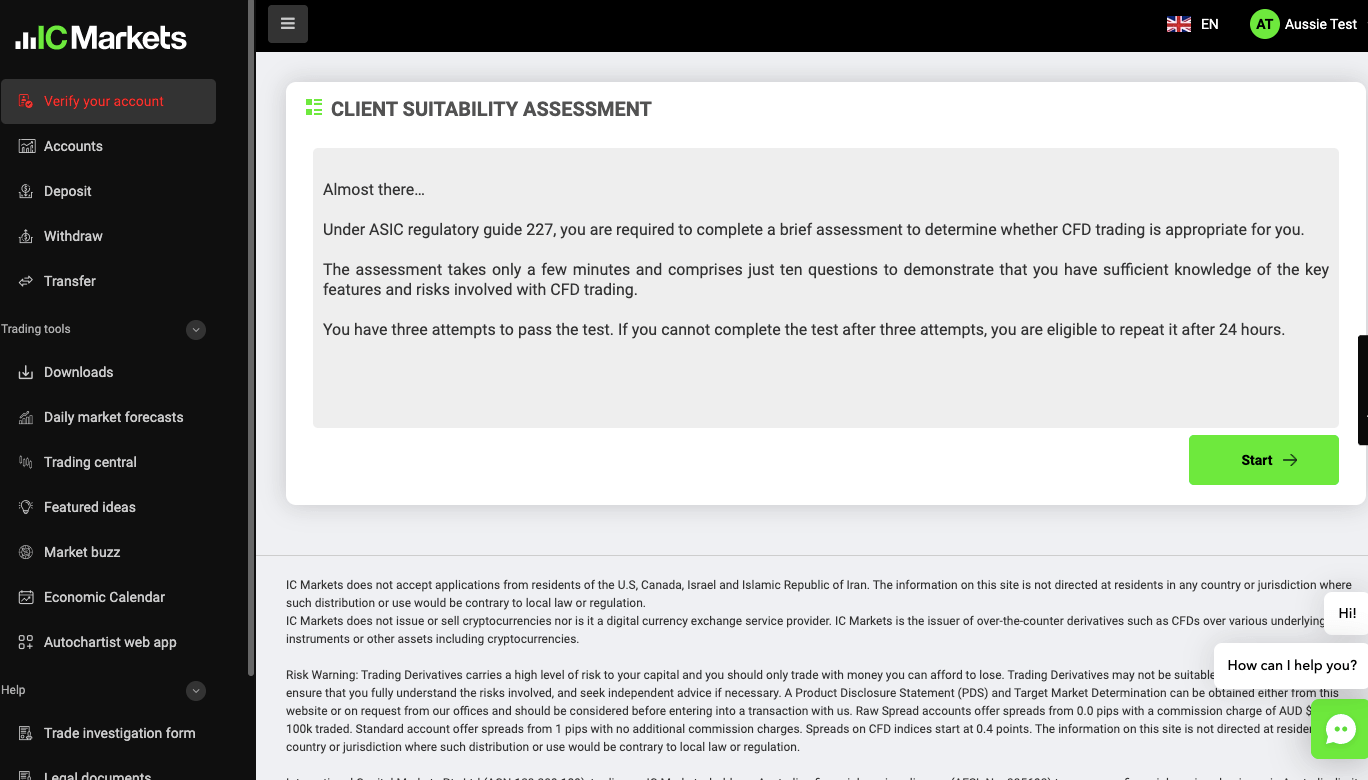

You will be redirected to the IC Markets Secure Client Area and required to take a suitability test.

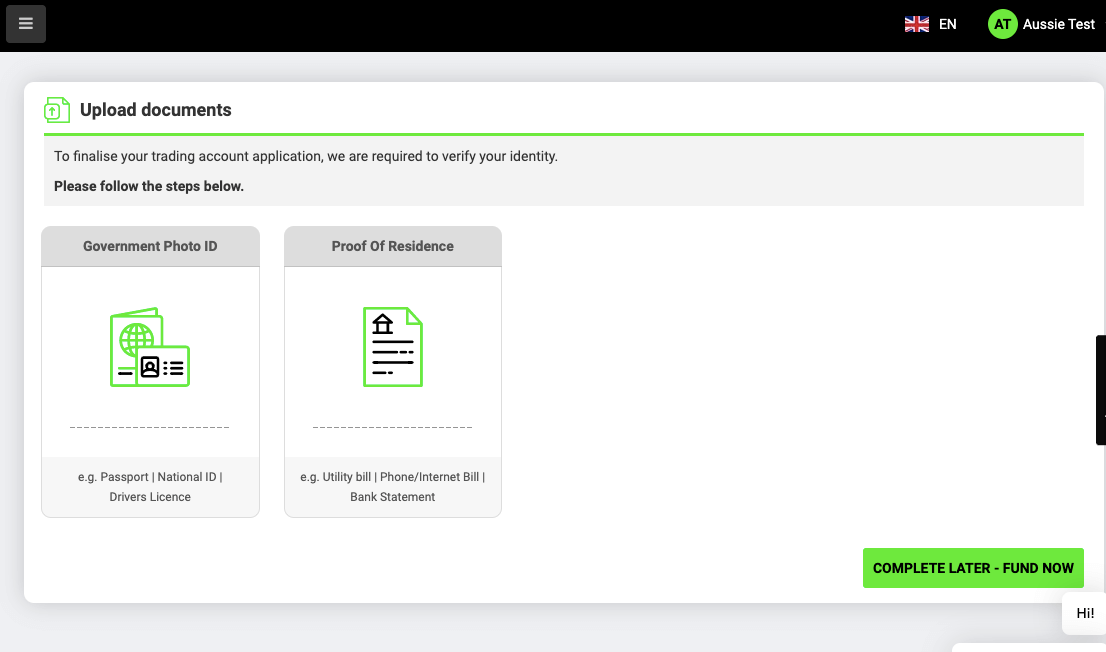

Step 7) Upload your identity and address documents to verify your account. You can choose to do this later and fund your account instead.

IC Markets Deposits & Withdrawals

Payment methods supported by IC Markets for deposits and withdrawals are cards (debit or credits), e-wallets (Skrill, Neteller, PayPal, and others), and bank wire transfers.

Learn about the minimum amount and the time it takes to process deposits and withdrawals from IC Markets below:

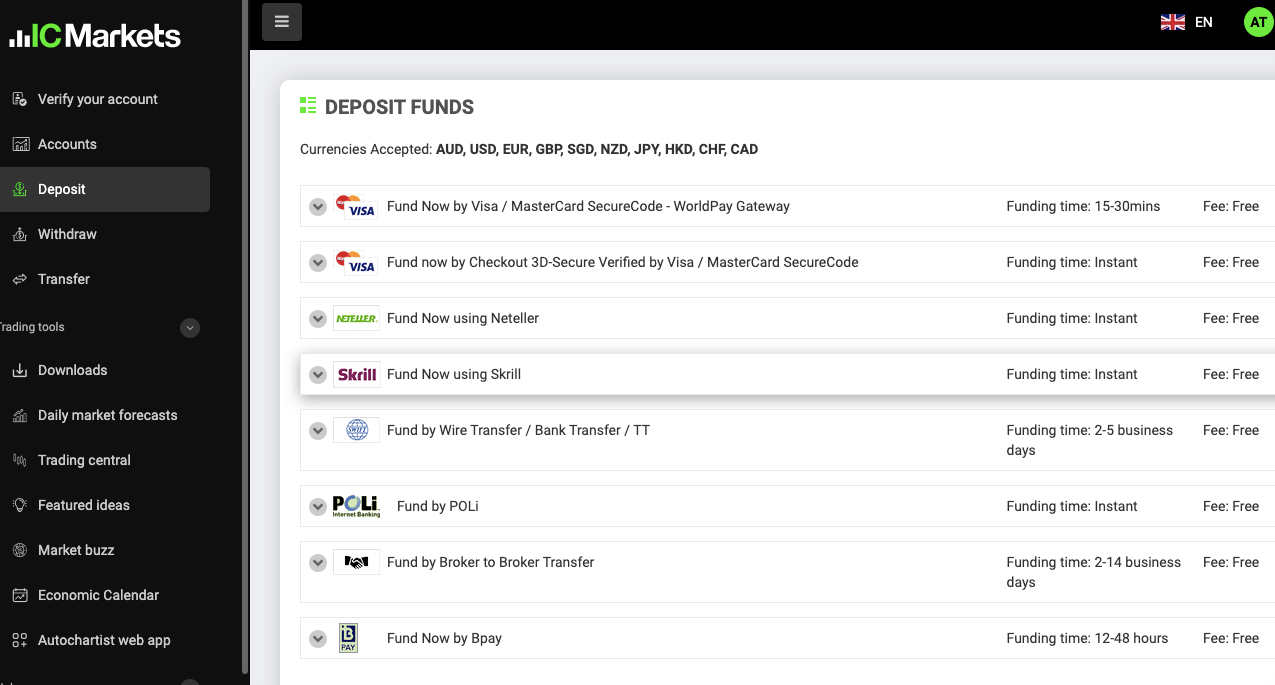

IC Markets Deposit Methods

Here is a summary of payment methods accepted by IC Markets for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Wire Transfer | Yes | Free | 2-5 business days |

| Cards | Yes | Free | Instant |

| E-wallet | Yes (PayPal, Skrill, Neteller, Bpay) | Free | Instant |

IC Markets Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on IC Markets.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Wire Transfer | Yes | Free | 1 business day |

| Cards | Yes | Free | 3-5 business days |

| E-wallets | Yes (PayPal, Skrill, Neteller) | Free | Instant |

What is IC Markets minimum deposit?

The recommended minimum deposit on IC Markets is US$200 (300 AUD) for all payment methods. You may make a deposit of less than 200 USD, but this may limit the types of trades you can execute and the volume you can trade.

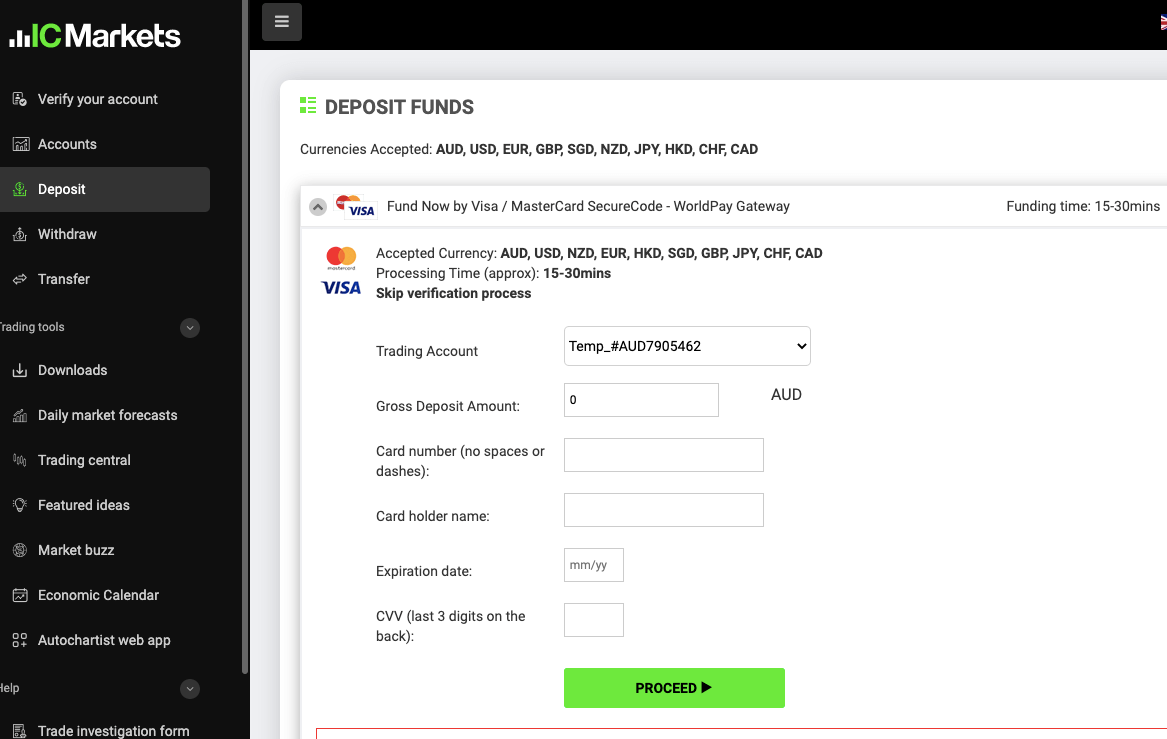

How do I deposit money into IC market?

Step 1) Log in to your account Client Area through the IC Markets website or by visiting secure.icmarkets.com.au, type in your email as username, and enter the password that was sent to your email after registration, then click ‘Login’.

Step 2) Once you are logged in, click on Deposit on the left side menu and select a payment method you would like to use for your deposit.

Step 3) Enter the amount you want to deposit and provide other information required then click ‘PROCEED’ and follow the on-screen instructions to complete the deposit.

What is the IC Markets minimum withdrawal?

The minimum withdrawal on IC Markets is $1 for cards and e-wallets while bank transfers require a minimum withdrawal amount of $50.

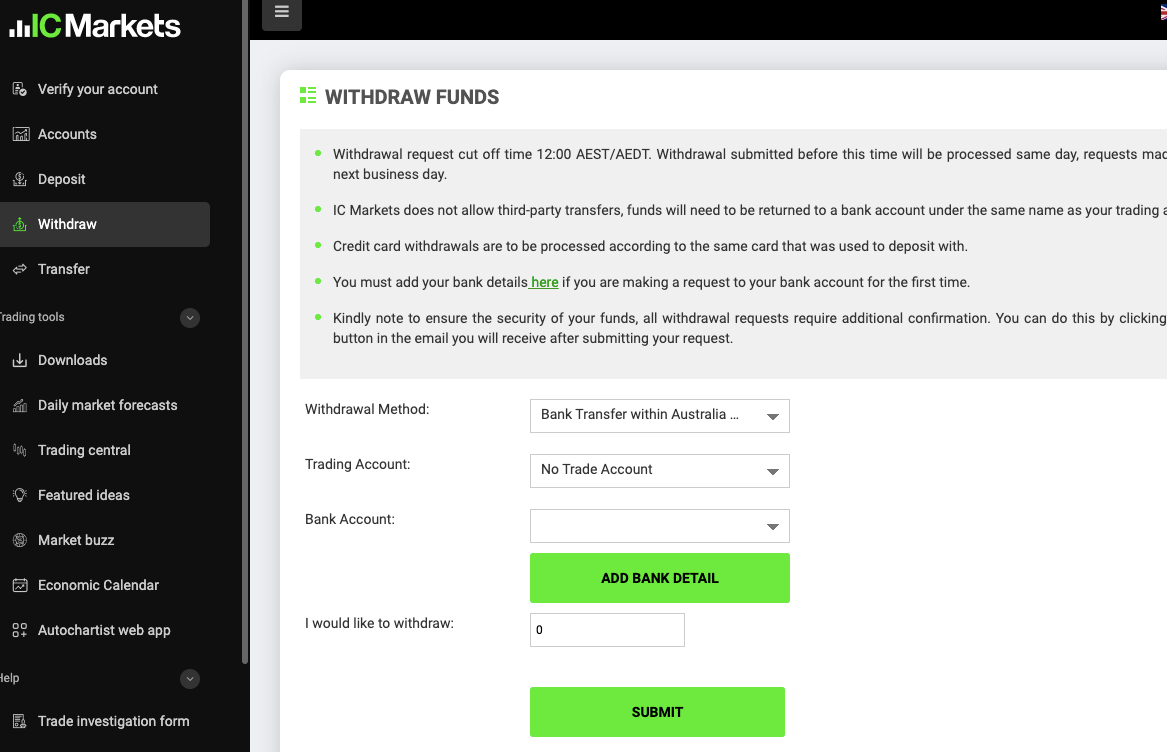

How can I withdraw money from IC market?

You can follow these steps to withdraw your money from IC Markets.

Step 1) Log in to your IC Markets clients area (dashboard).

Step 2) Click on withdraw on the left side menu.

Step 3) Select a withdrawal method and the trading account you wish to withdraw from, enter the amount you want to withdraw, click on ‘SUBMIT’ and follow the on-screen instructions to complete your funds’ withdrawal on IC Markets.

IC Markets Trading Instruments

Below are financial instruments that can be traded on IC Markets

| Instrument | Availability | Number |

|---|---|---|

| Forex CFDs | Yes | 61 currency pairs on IC Markets (6 majors, 21 minors and 34 exotics) |

| Commodities CFDs | Yes | 24 spot commodities on IC Markets (Energy, Metals, Agriculture) |

| Indices CFDs | Yes | 25 spot indices on IC Markets (AUS200, UK100, DE40, and others |

| Bonds CFDs | Yes | 9 bonds on IC Markets (EURBOBL, EURBUND, UKGB, and others) |

| Stocks CFDs | Yes | 2,100+ stocks on IC Markets (ASX, Nasdaq & NYSE and others) |

| Cryptocurrencies CFDs | Yes | 21 cryptocurrencies on IC Markets (Bitcoin, Litecoin, Dogecoin and others) |

| Futures CFDs | Yes | 4 Futures on IC Markets |

IC Markets Trading Platforms

Trading platforms supported by IC Markets are:

1) MetaTrader 4 and MetaTrader 5: The MT4 & MT5 trading applications are supported by IC Markets for trading and can be accessed via the web, desktop, and mobile devices (Android & iOS).

The MetaTrader is supported for The Raw Spread and Standard Account.

2) cTrader: IC Markets supports cTrader for trading using only the Raw Spread Account. The cTrader is available on the web, desktop (Windows & macOS) as well as Google Play Store and App Store.

The cTrader copy trading app is also supported on IC Markets.

IC Markets Trading Tools

IC Insights: IC Insights is an investment research and analysis platform. You will data on it that will help your trading decision. It is focused majorly on stocks.

You can catch all the news at once and track trending stocks. You get to keep up with stocks that analysts are focusing on. In addition, you will also get investment insights from experts and pros. These insights are backed by thorough research.

Finally, IC Insights has a community called Crowd Wisdom. You can connect with fellow traders and identify opportunities together.

Trading Central: Trading Central has seven features. Economic calendar, Alpha generation, Newsletter, Featured ideas, TC videos, Technical view, and Market buzz.

Market buzz is the most exciting of these tools. Instead of having information overload, market buzz creates data visualisations that improve your trading decisions.

With Alpha Generation, you get three innovative indicators. These indicators capture market psychology. The indicators are integrated with MT4/MT5. They help you identify trading opportunities with potential entry and exit points.

Does IC Markets have a mobile app?

No, IC Markets does not have a proprietary mobile trading app. However, there is IC Social for copy trading. IC Social is powered by Pelican Trading and it is available on the Play Store and App Store.

IC Markets Execution Policy

IC Markets is not a market maker. They are the issuers of CFDs they offer and do not have a proprietary trading book. This means they do not determine the bid-ask prices of trading instruments. Since we have established this, the question is – what type of broker is IC Markets?

IC Market is an ECN broker. Their pricing model is ECN as well. This is made clearer with their Raw Spread Account. The average spreads on the account are raw and low. The prices they stream to traders are from IC Market’s liquidity providers with no price manipulations or requotes.

Furthermore, their execution model ensures fast execution speed. IC Markets achieve this by not hedging each of your positions with their hedge counterparties. In simple words, they do not open the opposite side of your trades with counterparties. Consequently, your trades are executed quickly.

IC Markets Education and Research

IC Markets have different education channels. We look at them in detail below:

1. Demo Account: IC Markets, like many forex brokers, have a demo account. It is free to open with zero risk. You will get an account with virtual funds that support all IC Markets account types, products, and platforms.

You can use the account to backtest your strategy, and get acquainted with the trading platforms, and the trading fees. In addition, IC Markets’ demo account does not expire so it is easy tracking your progress.

2. Video Tutorials: IC Markets’video tutorials are largely about trading platforms. We found 17 videos that cover all about how to use and log in on the trading platforms, how to place an order, upload a credit card, and much more.

3. IC Markets’ Blog: There are a lot of educational articles on the broker’s blog. The blog is well structured with a good user interface. At a glance, you can see the technical analysis section and fundamental analysis section.

Also, there is an ‘education section’ with topics like trading psychology, risk management, and how to develop a trading plan.

4. Podcast: This is good for you if you are interested in understanding macroeconomics. The podcast is hosted by Pamela Ambler, Head of Investor Intelligence & Strategy, Asia Pacific at JLL. Different guests are invited to talk about economic movements in different companies and how it might affect the forex market. Old episodes are also available if you want to watch them again

IC Markets Australia Customer Service

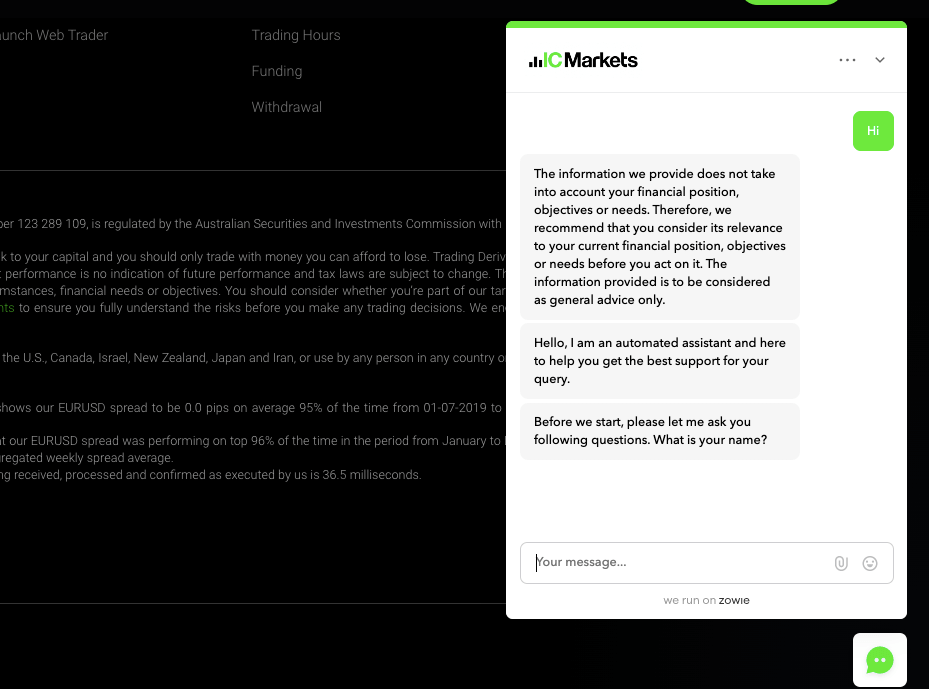

IC Markets offers 24 hours a day, 7 days a week online customer support to clients via the following channels.

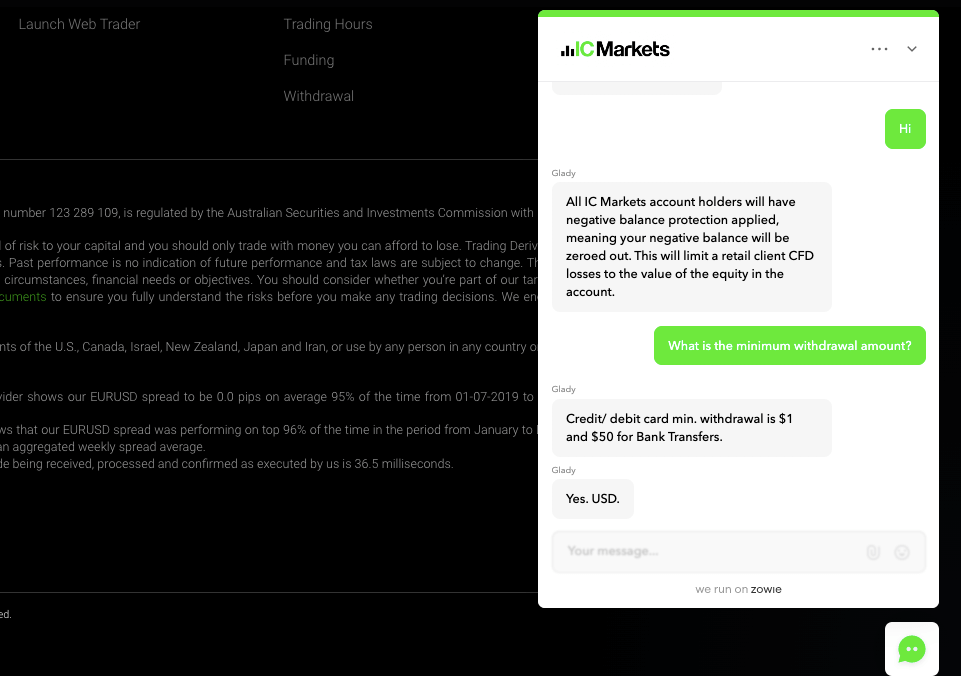

1) Live chat support: The IC Markets live chat is available 24/7 for client enquiries and can be accessed on their website. The IC Markets chatbot will respond first and show you quick option answers to some questions when you start the live chat.

You can switch to a live agent by typing ‘chat with an agent in the chat, and the bot will show you options that will connect you to a live support agent.

When our team tested, the wait time for a live agent to connect was under 2 minutes and the answers provided were relevant. Although the live agent seemed to have delays of up to 2 minutes before answering some questions.

You will need to provide your email and name before being connected to a live agent.

2) Email support: IC Markets offers email support for clients, you can find the email on the contact us page of their website. You can fill in an enquiry to send them a message or type a message in your email app and send it to the IC Markets email address at [email protected].

When our team tested their email support, we got a response in 10 minutes and the answer to our questions were correctly answered. The email support is available from 10:00 PM on Sundays to 10:00 PM on Fridays (GMT).

3) Phone support: IC Markets offers phone support for clients that is also available from 10:00 PM on Sundays to 10:00 PM on Fridays (GMT). The IC Markets phone number is +61 (0)2 8014 4280.

Do we Recommend IC Markets Australia?

IC Markets is licensed in Australia by ASIC which is a Tier-1 financial regulator as well as CySEC a Tier-2 financial regulator, these regulations mean the broker is mandated to protect deposited client funds and clients can take legal actions in the event of a default.

IC Markets have moderate spreads and swap fees, offers commission-free trading on some account, and charges zero dormant account fees. They also process deposits relatively faster than some brokers.

The customer support of IC Markets is good, they have 24/7 live chat and responsive email and phone support for 6 days (Sundays to Fridays).

The website of IC Markets is easy to navigate and has details about the account types, fees, trading conditions, and other information that clients might have. The FAQ section of their website is highly informative.

We recommend that you visit their website to see if the conditions match your needs, you can also chat with their support to answer any questions you have. Remember that trading CFDs involves risk and only experienced traders should engage in it.

IC Markets Australia FAQs

What is the meaning of IC Markets?

The meaning of IC in IC Markets is ‘International Capital’. The broker is regulated in Australia as International Capital Markets Pty Ltd.

Is IC Markets an Australian broker?

Yes, you can use IC Markets in Australia. IC Markets is regulated in Australia by ASIC and you can create an account on their website and start trading on their platform.

How long does it take to withdraw from IC Markets?

All withdrawals on IC Markets are processed within 24 hours and it takes about 3-5 days to receive funds for card withdrawals, sometimes up to 10 business days.

E-wallets withdraws are processed instantly, domestic bank wire transfers are received in the next business day, while international transfers take up to 14 business days to receive funds.

What is the minimum deposit for IC Markets?

The suggested minimum deposit for IC Markets is US$200 (AUD 300) on all accounts. You can deposit a smaller amount, but this may limit the types of trades you can execute and the volume you can trade.

Note: Your capital is at risk