FBS is an online Forex and CFDs broker offering trading services for financial markets such as foreign exchange (forex) currency pairs, indices, cryptocurrencies, metals, stocks, and commodities.

FBS was founded in 2009. The broker is regulated in Australia, Cyprus, South Africa, and Belize.

This review of FBS will examine the fees, trading instruments, account opening process, customer support, deposit/withdrawal options, and trading platforms offered by the broker.

| FBS Review Summary | |

|---|---|

| 🏢 Broker Name | Intelligent Financial Markets Pty Ltd |

| 📅 Establishment Date | 2009 |

| 🌐 Website | www.fbsaustralia.com |

| 🏢 Address | Intelligent Financial Markets Pty Ltd., Suite 409, 350 George St, Sydney, NSW 2000, Australia |

| 🏦 Minimum Deposit | 50 AUD |

| ⚙️ Maximum Leverage | 1:30 |

| 📋 Regulation | ASIC, CySEC, FSCA, FSC Belize |

| 💻 Trading Platforms | MT4 and MT5 available on PC, Mac, Web, Android, & iOS |

| Visit FBS | |

FBS Pros

- Regulated in Australia by ASIC

- Offers commission-free trading

- Does not charge dormant account fees

- Has negative balance protection for all accounts

FBS Cons

- Few tradable instruments available

- Customer support is not available 24/7

- Charges high withdrawal fees on all payment methods

Is FBS good broker?

FBS is the trading name of the FBS brand which is licensed in various countries by Top-Tier financial regulators under different names, including Australia. The multiple regulations of FBS means they are committed to following rules of financial authorities.

Here are the various jurisdictions in which FBS is authorized:

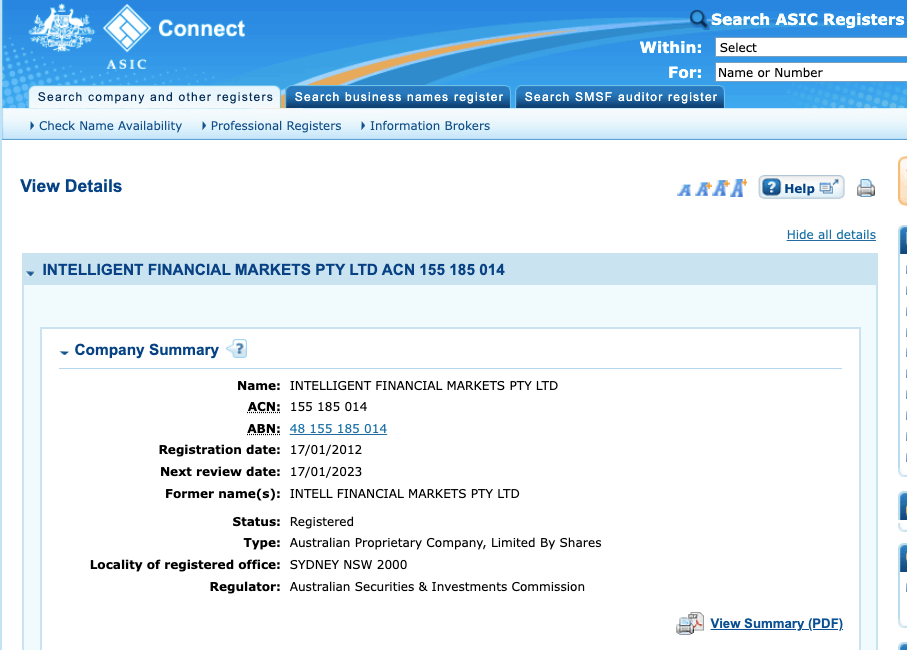

1) Australian Securities & Investments Commission (ASIC): FBS is regulated in Australia by ASIC as ‘Intelligent Financial Markets Pty Ltd’, and licensed to offer financial services, with ACN (Australia Company Number) 155 185 014, issued in 2012. The broker uses ‘FBS Oceania’ as a trading name in Australia.

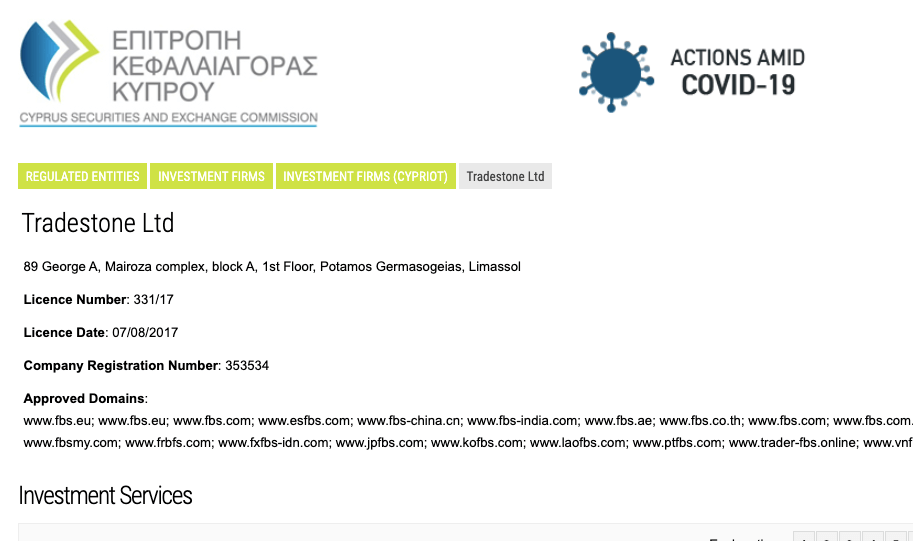

2) Cyprus Securities and Exchange Commission (CySEC): FBS is regulated in Europe by CySEC and licensed to offer investment services under the name ‘Tradestone Ltd’, with license number 331/17, issued in 2017. FBS serves clients in the EU area through this license.

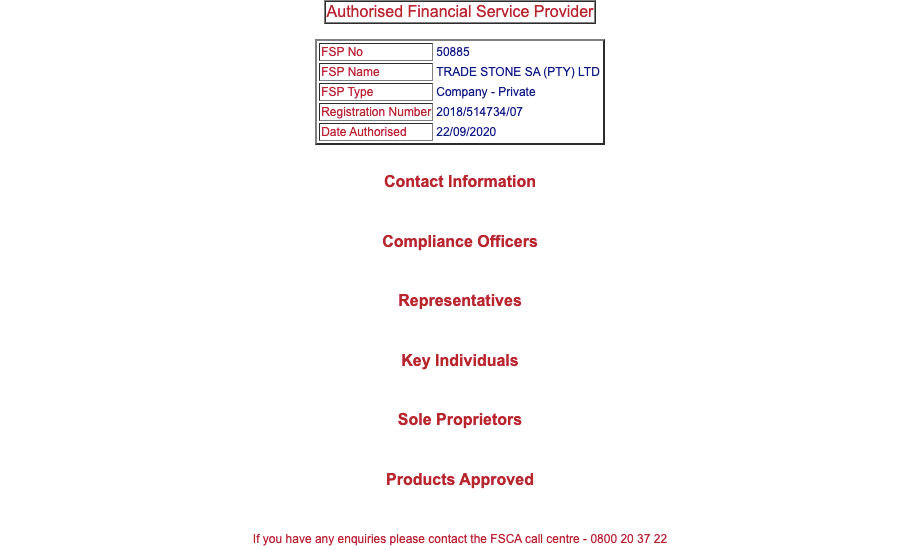

3) Financial Sector Conduct Authority (FSCA), South Africa: FBS is regulated in South Africa by FSCA as ‘Trade Stone SA (Pty) Ltd’ and authorized to provide financial services, with FSP (Financial Services Provider) number 50885, issued in 2020.

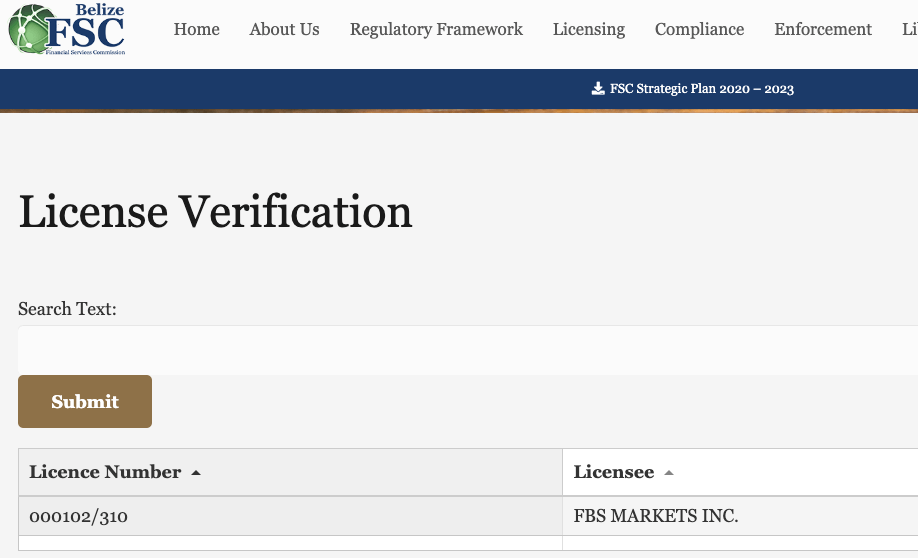

4) Financial Services Commission (FSC), Belize: FBS is also licensed in Belize as ‘FBS Markets Inc.’ with license number 000102/310.

FBS Investor Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| Australia | $20,000 | Australian Securities & Investments Commission (ASIC) | Intelligent Financial Markets Pty Ltd |

| Cyprus (European Union Area) | €20,000 | Cyprus Securities and Exchange Commission (CySEC) | Tradestone Ltd |

| South Africa | No compensation | Financial Sector Conduct Authority (FSCA), South Africa | Trade Stone SA (Pty) Ltd |

| Other countries | No protection | Financial Services Commission (FSC), Belize | FBS Markets Inc. |

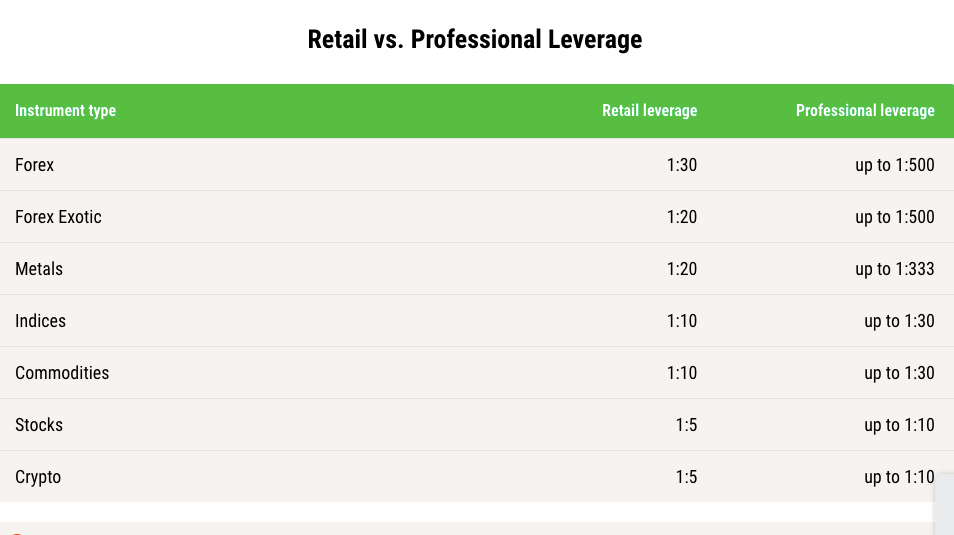

FBS Leverage

The leverage on FBS depends on whether you are a retail or professional trader and the instrument you are trading. The maximum leverage on FBS for retail clients is 1:30, which applies to major forex pairs, other instruments have lower leverage limits.

With a leverage of 1:30, you can open a trade position worth 30 times your deposit. For example, if you deposit $1,000 you can place a trade worth $30,000.

Professional clients on FBS can access higher leverage of up to 1:500.

Note that trading CFDs involves risk and you can lose your money. Only engage in it if you understand it and have experience. It is also best not to use all the leverage that is available.

FBS Account Types

FBS offers 3 account types to retail traders in Australia with different features. You can request a Professional Account to get higher leverage or an Islamic Account if you do not want to pay swap fees. You can also open a demo account on FBS to practice trading with virtual money before putting in your real money.

Here is an overview of the various account types on FBS.

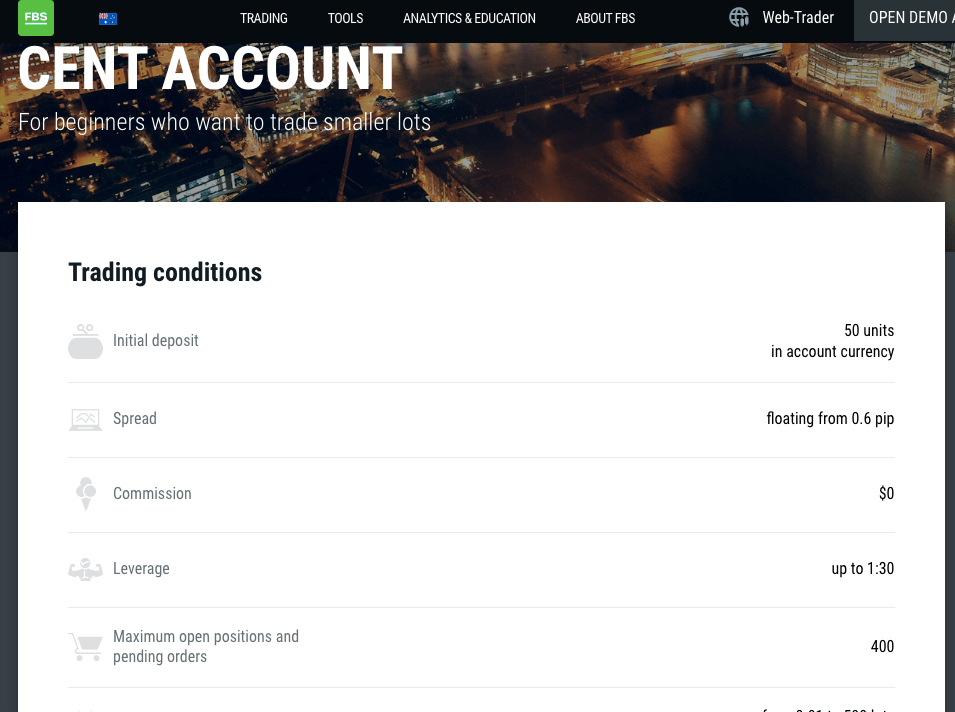

1) Cent Account: The FBS Cent Account is designed for beginners who are new to trading and trade small lots. The account is accessible on the MT4 and MT5 trading platforms. You can open a demo version of this account type for practice.

Spreads on the Cent Account start from 0.6 pips, with zero commission charges for opening and closing trade positions, and you pay swap fees whenever you keep a trade position open past the market’s closing time.

This account requires a minimum deposit of 50 AUD, with a minimum trade size of 0.01 lots and maximum leverage of 1:30 for major forex.

The account balance in the Cent Account is displayed in cents. For example, a deposit of $10 will be shown in your trading account balance as 1,000 cents.

This account has negative balance protection, which means that if a trade position is unsuccessful and you make a loss, any negative balance on your account will be reset to zero and you don’t have to deposit additional funds to clear it.

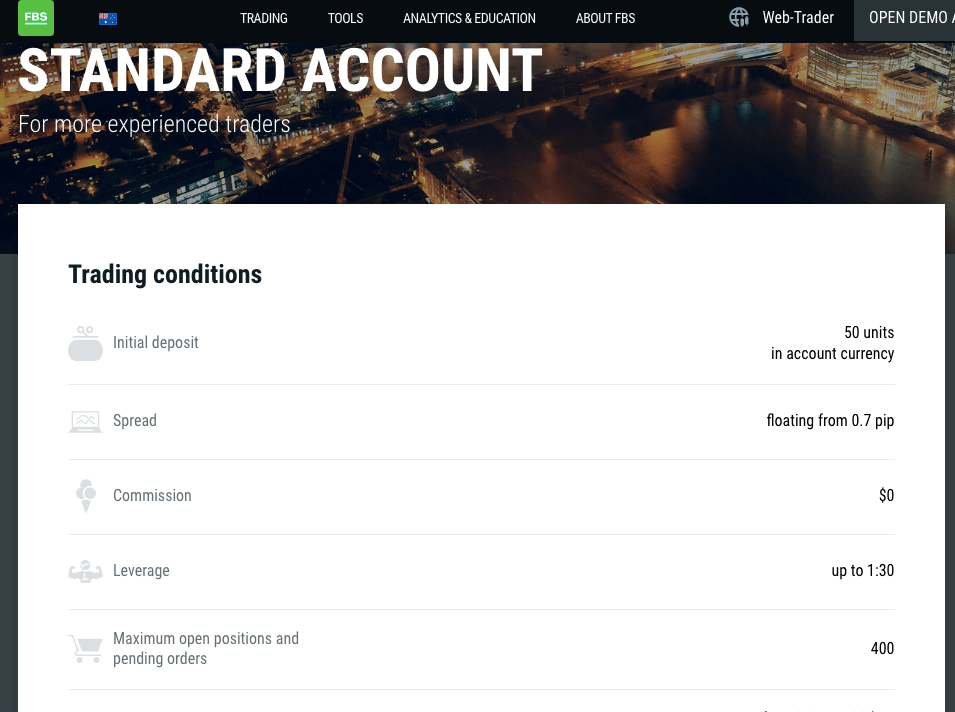

2) Standard Account: The FBS Standard Account is designed for more experienced traders who trade large lots of instruments and is accessible on the MT4 and MT5 trading platforms.

This is the default account you get when you first sign up on FBS and you can also open a demo version of this account type for practice.

Spreads on this account start from 0.7 pips, you do not pay commission charges for opening and closing trade positions, but pay swap fees if you keep a trade position open past the market’s closing time.

This account requires a minimum deposit of AU$50, with a minimum trade size of 0.01 lots and maximum leverage of 1:30 for major forex. This FBS account also has negative balance protection.

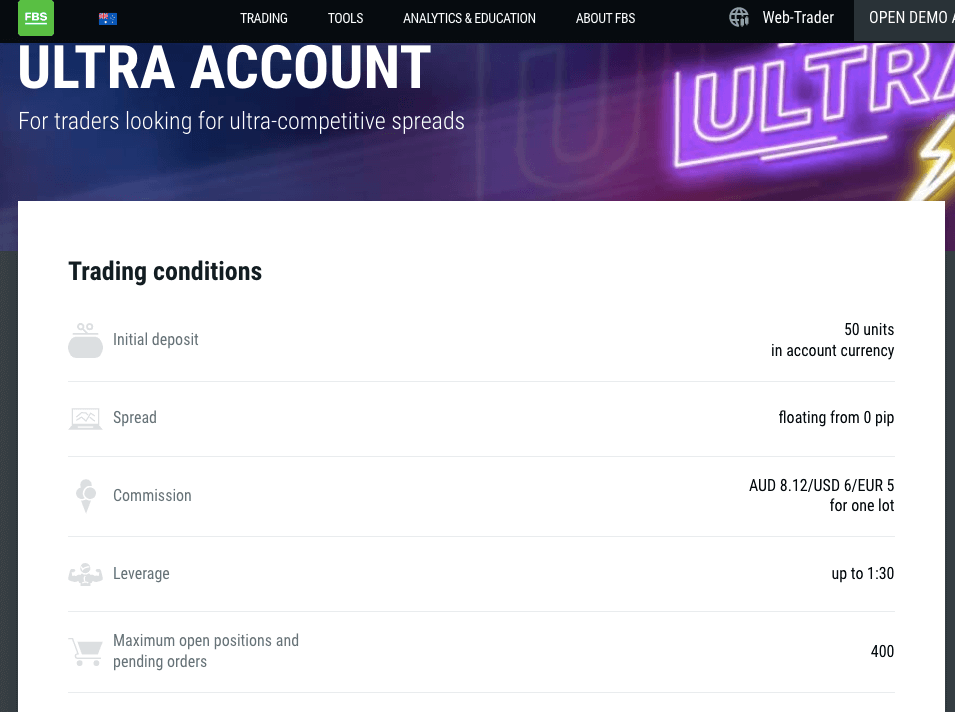

3) Ultra Account: The FBS Ultra Account is designed for experienced traders who trade large volumes of financial instruments and want to pay little spreads. The account is accessible on the MT4 and MT5 trading platforms, but you cannot open a demo version of this account type for practice.

Spreads on the Ultra Account start from 0.0 pips, you pay commission charges for opening and closing trade positions starting from AU$8.12 per lot traded, and you also pay swap fees whenever you keep a trade position open past the market’s closing time.

The Ultra account also requires a minimum deposit of AU$50, with a minimum trade size of 0.01 lots and maximum leverage of 1:30 for major forex. This account has negative balance protection as well.

4) Professional Account: The FBS Professional Account is designed for experienced traders who trade large volumes of financial instruments and want to access higher leverage for trading. You cannot open a demo version of this account type for practice.

You can upgrade any retail account type to professional status, and the same spreads, commission and swap fees will apply.

With the Professional Account on FBS, you get priority service, access to market analytics, higher leverage of up to 1:500 for forex majors, and negative balance protection.

To get a Pro Account on FBS, first create a retail Cent, Standard or Ultra Account, verify your profile then contact the customer support team via email or live chat to upgrade your account.

You must meet 1 of the following criteria with the proof before your application is approved.

1) Wealth Criteria:

- You have net assets of AU$2.5 million or annual gross revenue of AU$250,000 for the past 2 financial years.

2) Sophisticated Investor Criteria:

- You have experience working in the financial services sector and have annual revenue of at least AU$100,000 or net assets of AU$500,000..

3) Business Criteria:

- You have a corporate account and need professional services for a business that is not a small business.

4) Professional/Wholesale Investor Criteria:

- You are a Financial Services Licensee and control an investment portfolio of more than US$10 million or you are a wholesale investor.

As a Professional client on FBS, you also request for your account to be converted to a retail status.

Note that although higher leverage increases your chances for profit, it also exposes you to a higher risk of losing your capital.

5) Islamic Account: FBS offers Swap-free Islamic Accounts to traders in Australia. The account is designed for Muslim traders who want to abide by the sharia law of no-riba.

You can convert any account type to an Islamic status by sending a message to the customer support team and supplying the relevant documents required to approve your request.

The swap-free account on FBS does not charge any swap fees or interest for keeping a trade position open past the market’s closing time. Other fees depend on the type of account held before the conversion.

Although the FBS Swap-Free account is available to both retail and professional clients, you cannot trade forex exotics, cryptocurrencies, and some CFD instruments like indices with the swap-free account.

FBS Base Account Currency

FBS offers 3 account base currencies for you to choose from when creating an account on the platform. They are Australian Dollars – AUD, Euros – EUR, and United States Dollars.

All your deposits, trades, profits, losses, and withdrawals are measured in your chosen account currency.

FBS Overall Fees

Fees on FBS Australia depend on the account type you have, and the instrument you are trading. Find a summary of the trading and non-trading fees on FBS below:

Trading fees

1) Spread: Whenever you trade an instrument on FBS, the broker adds a markup to the market (ask) price of the instrument. This markup is called spread, it is the difference between the ask (sell) price and bid (buy) price of financial instruments and is measured in pips.

The spreads you pay on FBS depend on your account type, the instrument you are trading, and the size of your trade. Find the typical spread you will pay for major instrument pairs on FBS Australia per standard lot (trade size of 100,000 units) below:

2) Commission fees: FBS charges commission fees per standard lot whenever you open and close a trade position on the Ultra Account, this is to compensate for the low spreads charged on the account. The commissions start from AU$8.12 per standard lot traded.

Cent and Standard Accounts on FBS do not pay commission fees.

FBS Trading fees Table

Here is a summary of the typical fees (minimum spread) FBS charges on some instruments:

| CFD instrument | Spread (Cent & Standard Account) | Spread (Ultra Account) | Commission (Ultra Account) |

|---|---|---|---|

| EUR/USD | 1.1 pips | 0.0 pips | AU$8.12 per lot |

| GBP/USD | 0.9 pips | 0.5 pips | AU$8.12 per lot |

| AUD/USD | 0.8 pips | 0.3 pips | AU$8.12 per lot |

| Gold | 23 pips | 23 pips | AU$8.12 per lot |

| Oil (UK Brent) | 5 pips | 0.8 pips | AU$8.12 per lot |

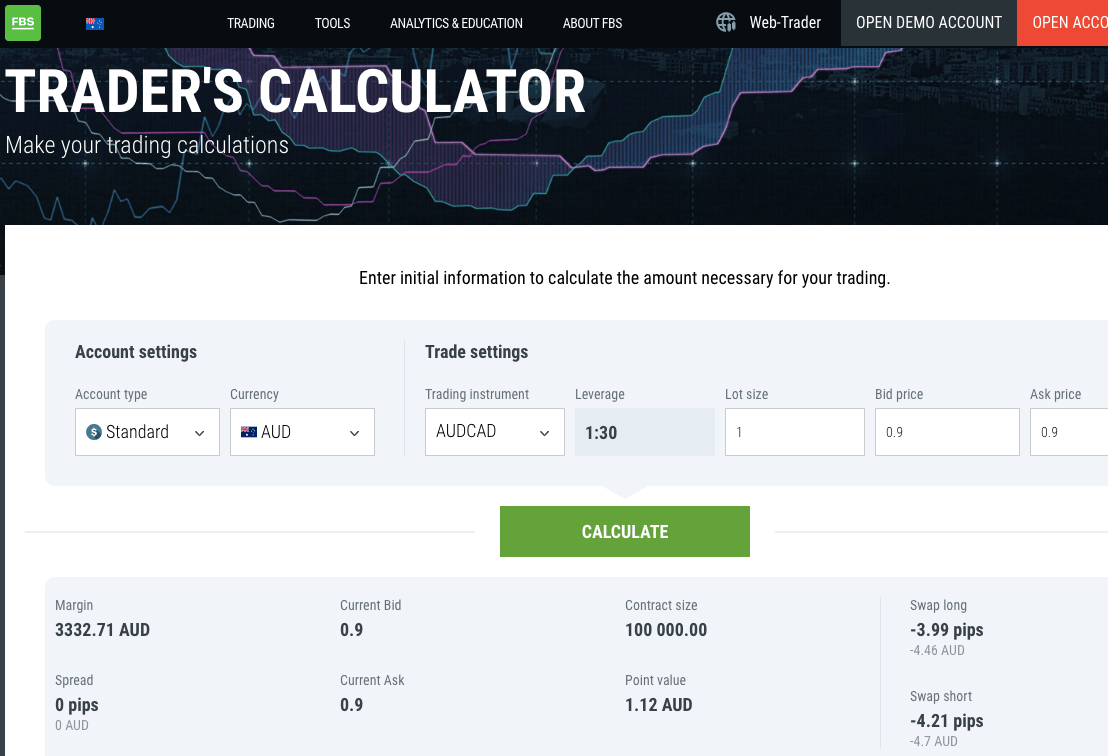

3) Swap fees: The closing time of the market on FBS is 11:59 PM trading platform time which is GMT+3, if you keep a trade position open past the closing time, the trade will roll over to the next day and you will incur overnight funding costs also called rollover fees or swap fees.

The swap fees will depend on the instrument you are trading, the size of the trade, the spread, leverage, and whether your trade position is a long swap (buy) or short swap (sell). Islamic Accounts do not pay swap fees, because they are swap-free.

You can use the Trader’s Calculator on the FBS website to calculate the likely swap fees you will pay on a trade.

Non-trading fees

1) Deposit and Withdrawal fees: FBS offers free deposit on all payment methods when you deposit above the minimum deposit. For deposits below the minimum deposit of 50 AUD, you pay a deposit fee of 4.9% plus US$0.29 when using e-wallets.

Withdrawal fees on FBS are €0.5 per transaction for cards, 4.99% for e-wallets (Skrill & Neteller) and cannot be less than US$1, while bank transfer withdrawal charges can be seen when you are about to withdraw on the portal, based on the amount.

2) Account Inactivity charges: FBS does not charge inactive account fees. If you do not log in to your account or do not perform any trade, no fees will be incurred, and any funds in your account will not be touched.

FBS Non-Trading fees Table

| Fee | Amount |

|---|---|

| Inactivity fee | None |

| Deposit fee | Free |

| Withdrawal fee | 4.99% per transaction for e-Wallets, €0.5 for cards |

*Note that your payment processing company may charge some independent transaction fee.

How to Open FBS Account in Australia?

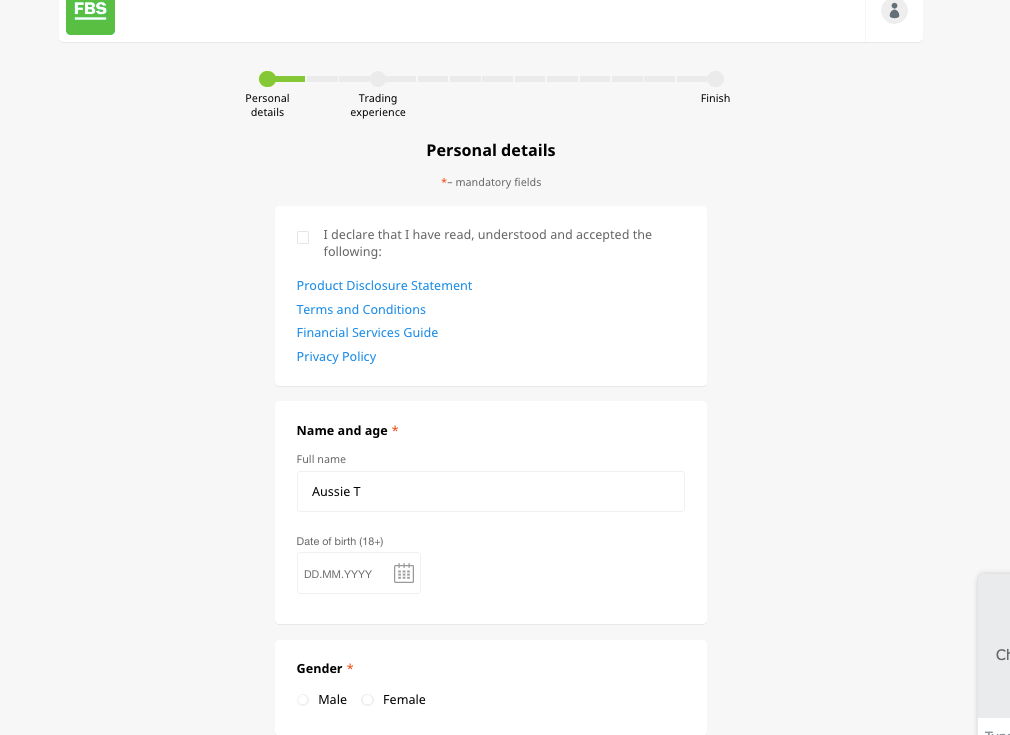

Follow these steps to open a trading account on FBS.

Step 1) Go to the FBS website at www.fbsaustralia.com and click on the ‘OPEN ACCOUNT’ button highlighted in green or red.

Step 2) Enter your full name and email on the form that appears, check the boxes to agree to the terms and conditions and privacy policy, then click ‘Register’.

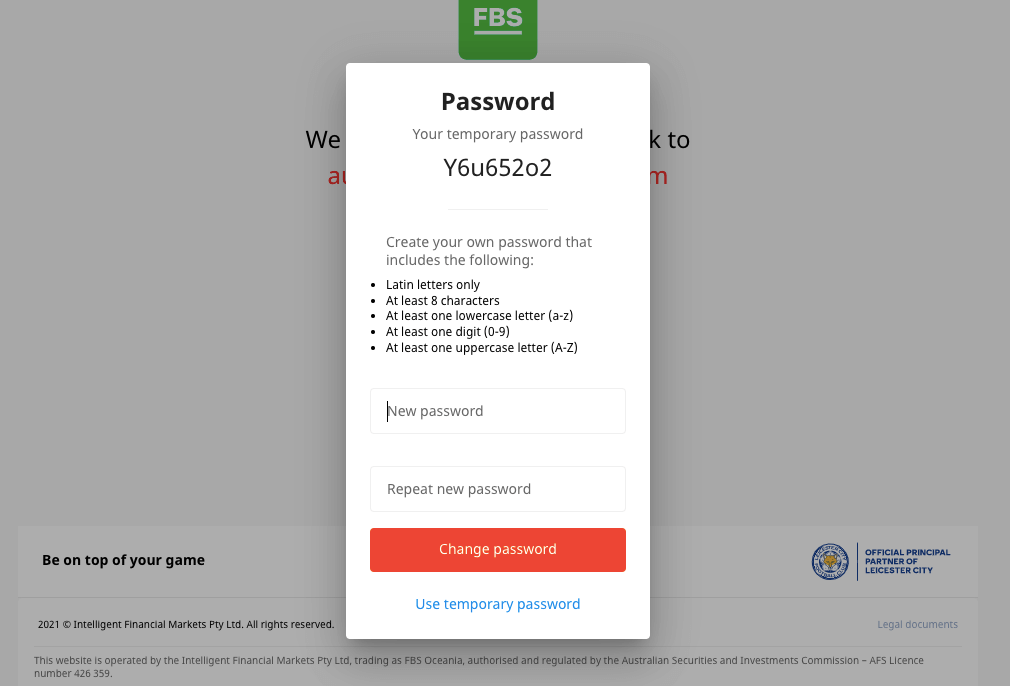

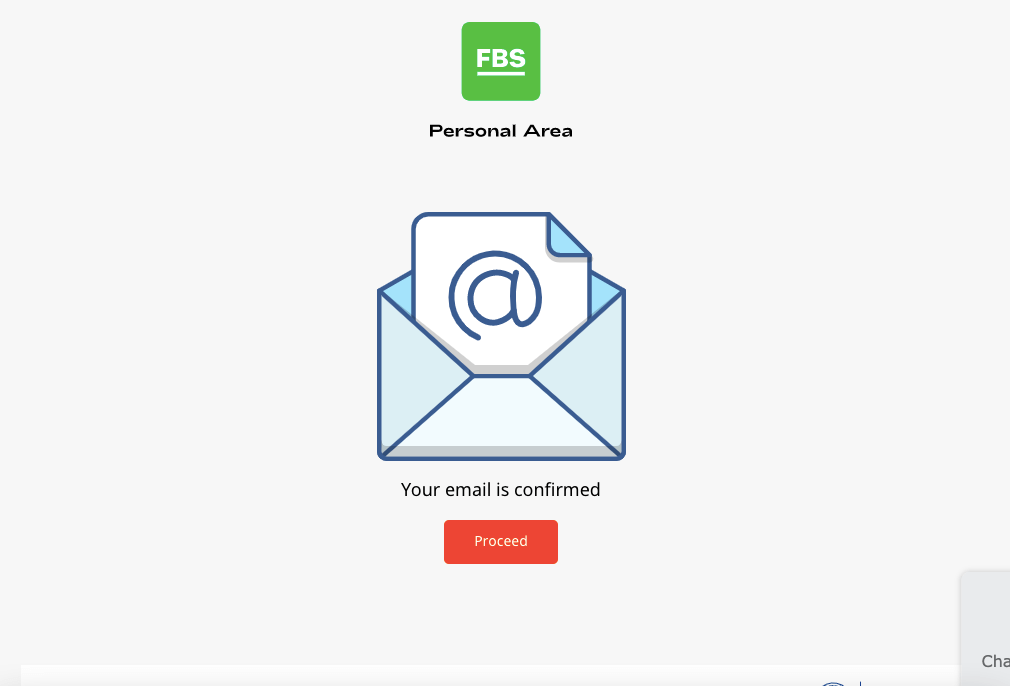

Step 3) Create a password for your account and click ‘Change password’, then go to your email inbox and click the verification link sent.

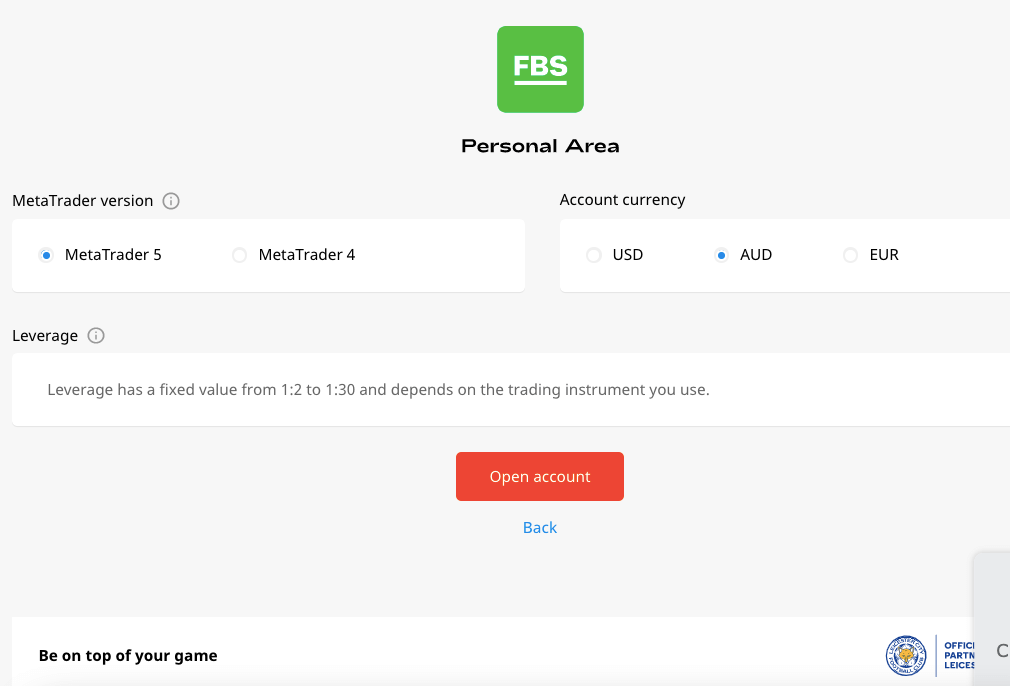

Step 4) After confirming your email, click ‘Proceed’ on the page that appears, choose your preferred trading platform (MT4 or MT5) and account currency, then click ‘Open account’.

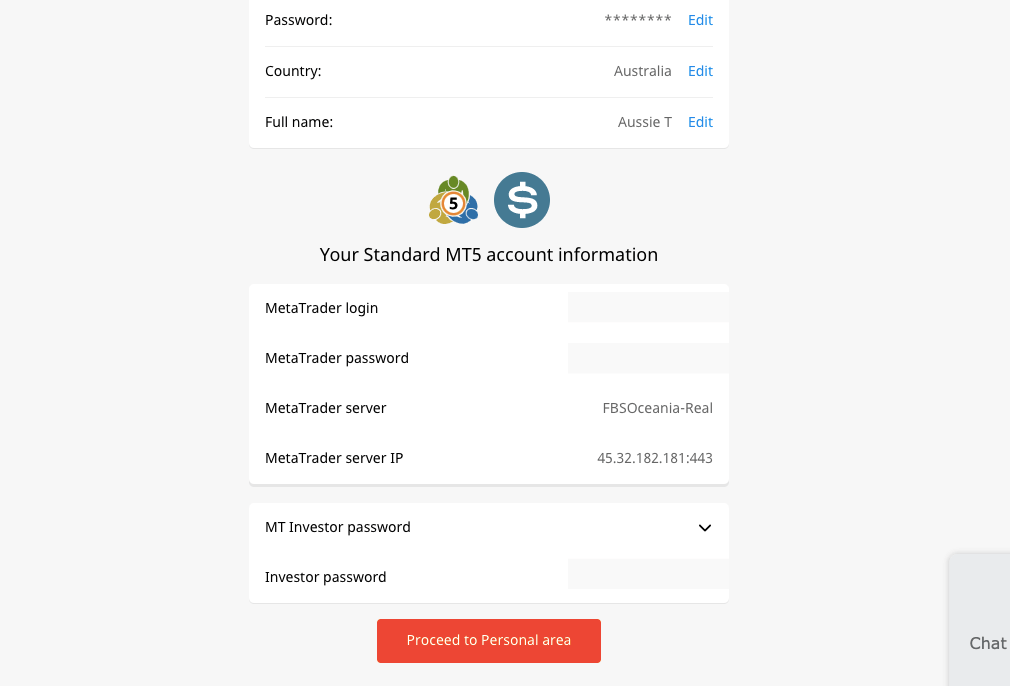

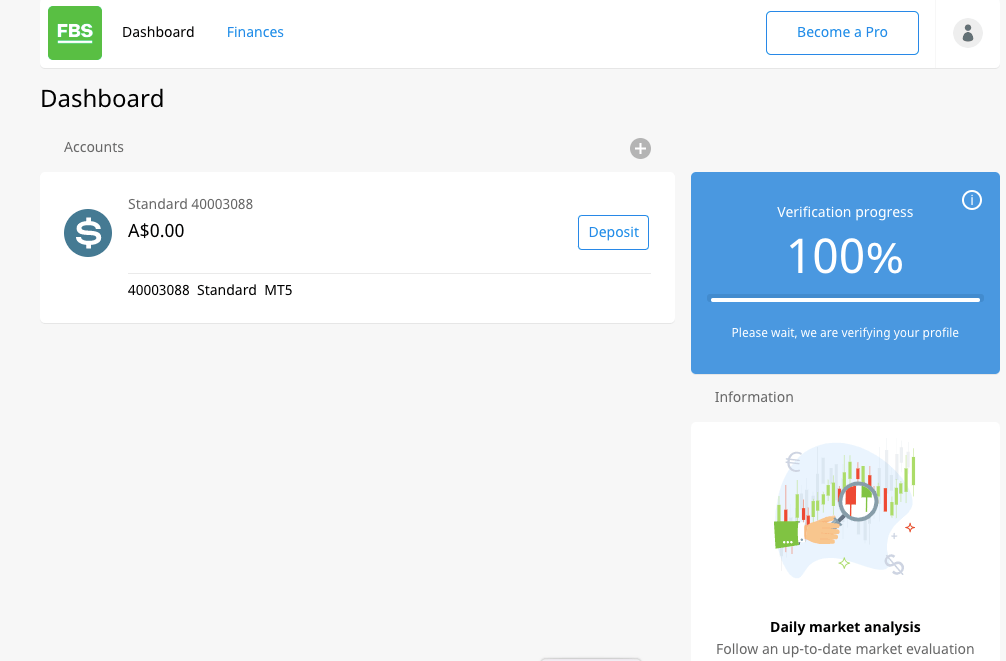

Step 5) Confirm the information you have supplied and click ‘Proceed to Personal area’ to access the dashboard.

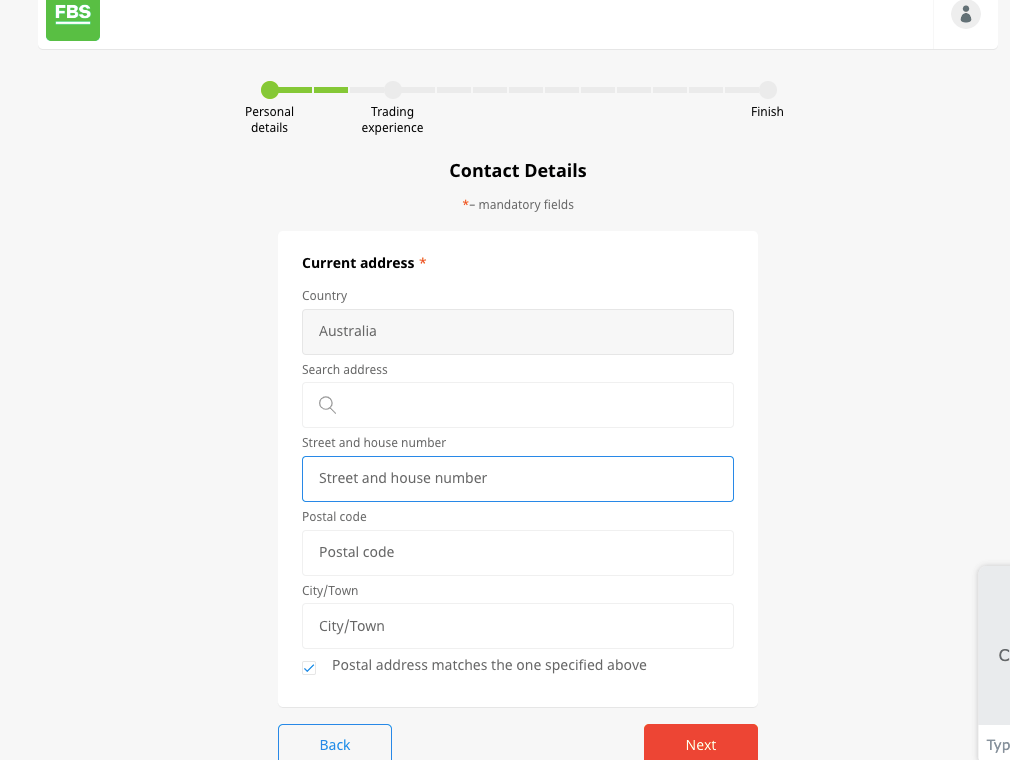

Step 6) Provide your date of birth and check the boxes to agree to the terms and conditions and prove you are not a US citizen then click ‘Next’. Provide your address and click ‘Next’.

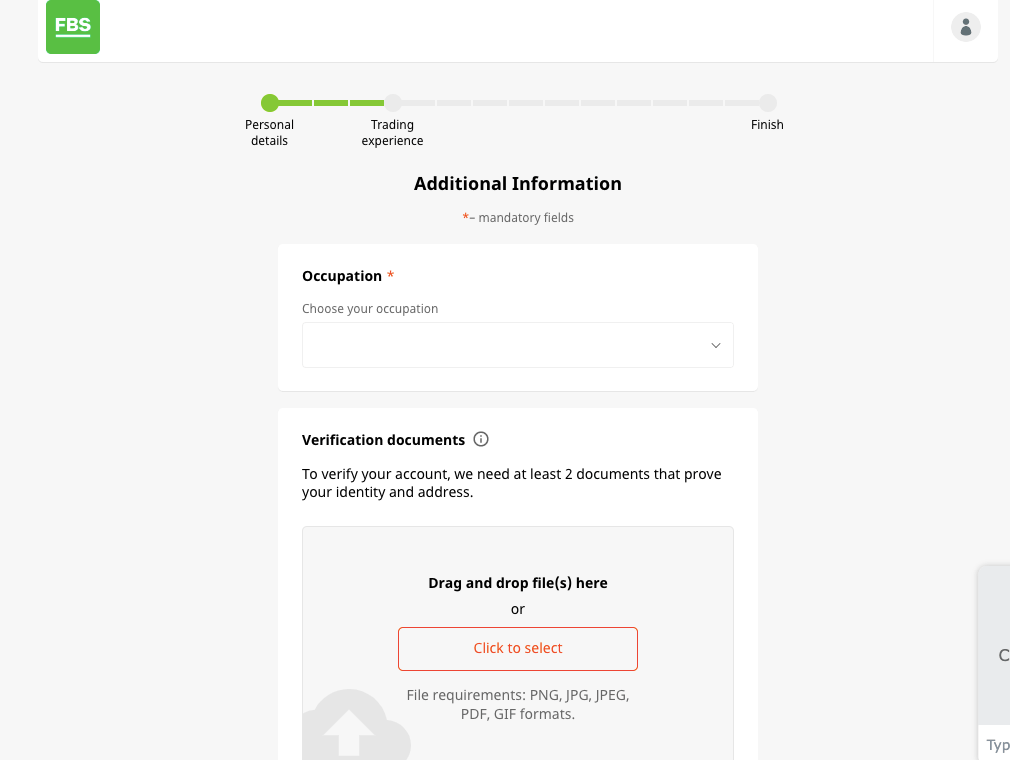

Step 7) Answer some questions about your occupation and upload documents to verify your identity and address, then click ‘Next’.

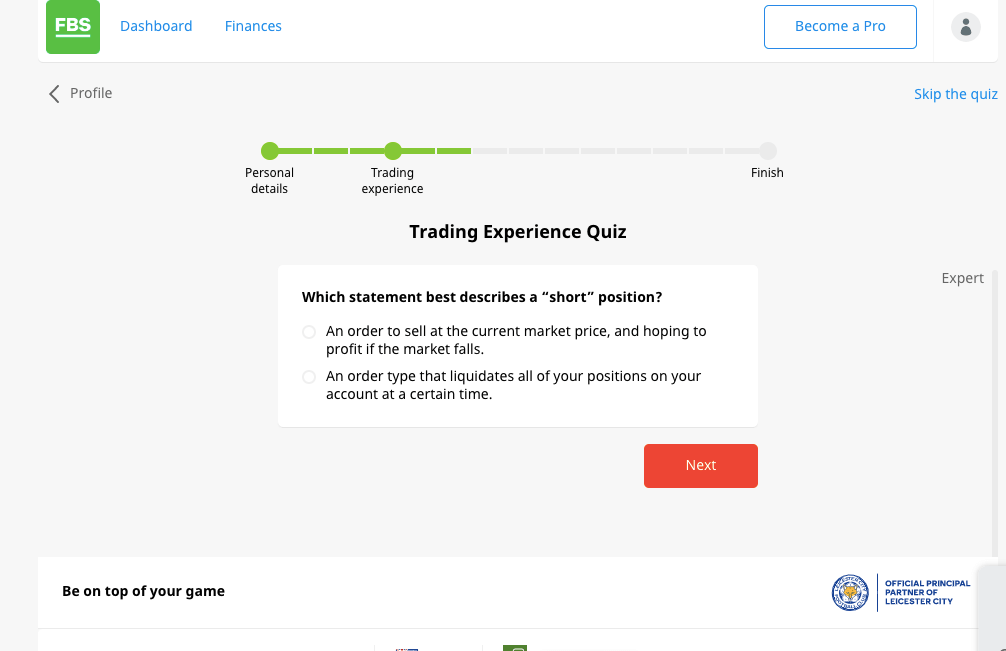

Step 8) Answer some questions to prove your trading experience, then click ‘Next’ and you will be logged into the FBS dashboard where you can deposit funds to start trading.

Note that you need to answer all questions, upload the required documents and wait for your account to be approved before you can start trading, although you can deposit funds before the approval.

FBS Deposits & Withdrawals

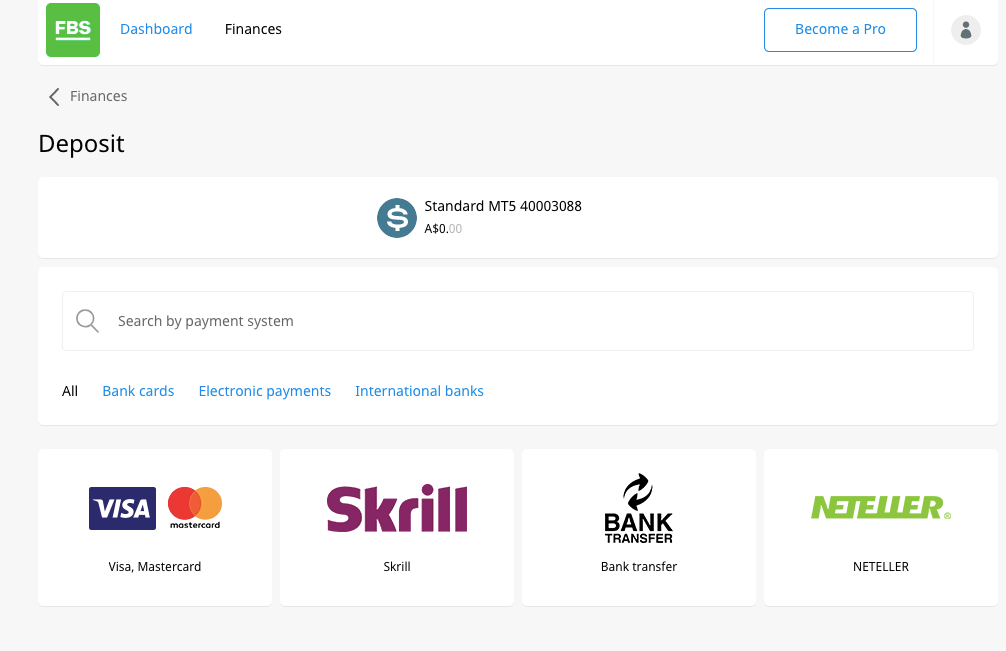

Payment methods supported by FBS for deposits and withdrawals are bank transfers (local and international), cards, and e-wallets (Skrill & Neteller). The account/card used for deposit and withdrawal must have the same name as the one on your FBS trading account.

Here is the summary of the deposits and withdrawals on FBS Australia.

FBS Deposit Methods

Here is a summary of payment methods accepted by FBS for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Transfer | Yes | Free | 15-20 minutes and up to 48 hours |

| Cards | Yes | Free | Instant |

| E-wallet | Yes | Free | Instant |

FBS Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on FBS.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Wire Transfer | Yes | Seen on withdrawal page | 20 minutes to 48 hours |

| Cards | Yes | €0.5 per transaction | 2-7 business days |

| E-wallets | Yes | 4.99% per transaction and not less than $1 | Instant |

What’s the minimum deposit for FBS?

The recommended minimum deposit on FBS is AU$50 for all payment methods. Although you can deposit less than this amount, you will incur deposit fees of about 4.9% + 0.29 USD for amounts less than AU$50 via e-wallets.

How do I deposit money into FBS?

Follow these steps to add money to your FBS account

Step 1) Log into your FBS dashboard via www.fbsaustralia.com/cabinet/login

Step 2) Click ‘Deposit’ on the dashboard and choose the payment method you want to use.

Step 3) Enter the amount you want to deposit and follow the on-screen instructions to complete your deposit.

What is FBS Minimum withdrawal?

The minimum withdrawal amount on FBS starts from 1 AUD and varies depending on the payment method you are using.

How much can I withdraw from FBS?

To withdraw funds from Trade Nation, follow these steps.

Step 1) Log into your FBS dashboard via www.fbsaustralia.com/cabinet/login

Step 2) Click ‘Finance’ on the dashboard, then ‘Withdraw’ and choose the payment method you want to use.

Step 3) Enter the amount you want to withdraw and follow the on-screen instructions to complete your withdrawal.

FBS Trading Instruments

You can trade over the following financial instruments on FBS:

| Instrument | Availability | Number |

|---|---|---|

| Forex CFDs | Yes | 37 currency pairs on FBS (28 majors and 9 Forex Exotics) |

| Commodities CFDs | Yes | 3 spot commodities on Broker (Brent, Crude, NatGas) |

| Metals CFDs | Yes | 2 pairs of Metals on FBS (Gold and Silver) |

| Indices CFDs | Yes | 11 spot indices on FBS (AU200, UK100, US30, and others) |

| Stocks CFDs | Yes | 81 stocks on FBS (US stocks) |

| Cryptos CFDs | Yes | 5 pairs of cryptocurrencies on FBS (BTC, ETH, and others) |

FBS Trading Platforms

Trading platforms supported by FBS are:

1) MetaTrader 5: FBS supports MT5 trading applications as platform for trading the financial markets. You can access the platform via the web, and download it on desktop (Windows and Mac) and mobile devices (iOS and Android).

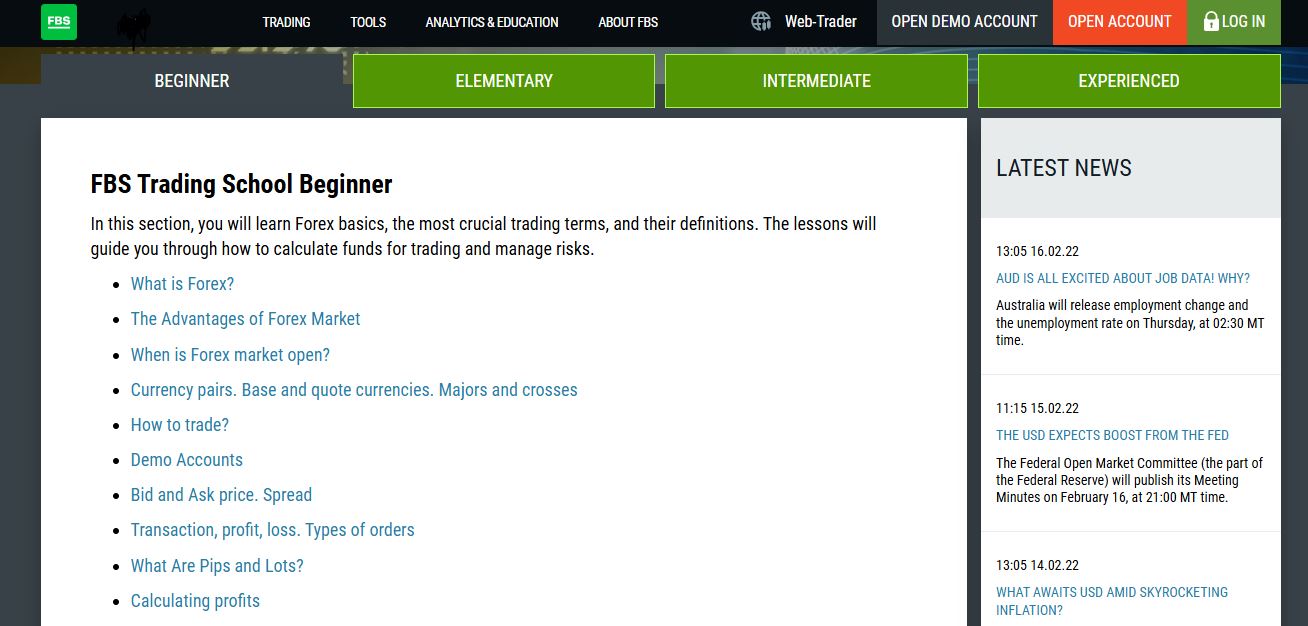

FBS Education

1) Forex guidebook: The forex guidebook is a comprehensive forex trading course. The course has 4 levels: Beginner, Elementary, Intermediate and Experienced. The materials are well structured and you can learn systematically.

It covers the definition of forex, technical analysis, fundamental analysis, terminologies, how to calculate your profit, etc.

FBS Trading Tools

Economic Calendar: The economic calendar is one of FBS’ trading tools. It has a smart filter that allows you to zero in on the specific news you want. From the filter, you can select date, currency, and the impact level of news. The filter is a time saver that helps you remove the noise and focus on important news only.

FBS economic calendar covers news on AUD, CAD, CNY, GBP, MXN, SGD, USD, BRL, CHF, EUR, JPY, NZD, TRY, and ZAR.

Trading Calculator:Input your trading parameters like account types, currency, lot size, bid/ask price, and leverage to see your trading fees. Costs like spread and swaps are displayed in the result of your calculation.

Currency Converter: This tool works out basic currency conversions for you. You can convert one currency to another. 18 currencies are available on the converter. You can choose any of the 18 and convert, as you want.

FBS Australia Customer Service

FBS offers customer support to traders via the following channels:

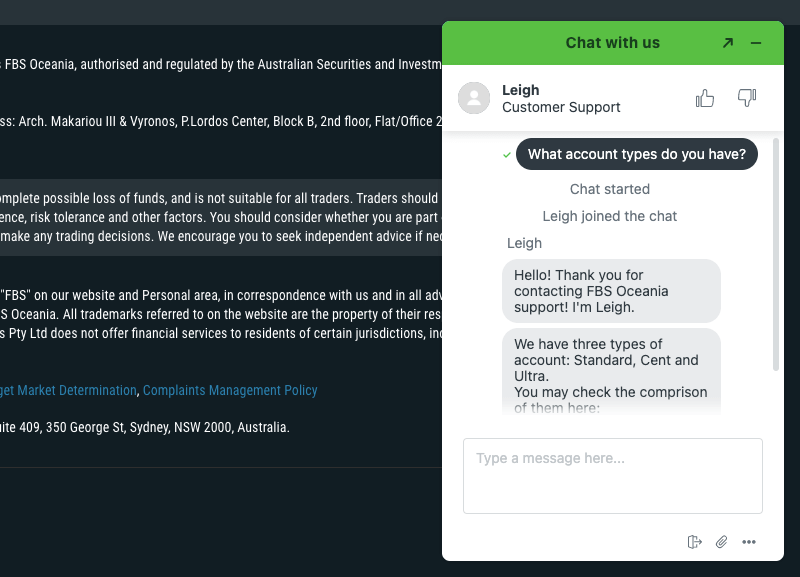

1) Live chat support: The FBS live chat is available from 6 AM to 10 PM, Monday to Friday Australian time, and can be accessed on the broker’s website.

When our team tested the live chat on the FBS website, the wait time was under 2 minutes before a live agent responded to our chat and the answers to our questions were relevant and prompt. You will be required to submit your email and name to start the chat.

2) Email support: FBS also offers email support to clients in Australia. The email is available from 6 AM to 10 PM Monday to Friday, Australian time. We sent an enquiry to the FBS email support and got a reply in less than 20 minutes. The answer we got was relevant.

The FBS email address for enquiries in Australia is [email protected].

3) Phone support: FBS has a phone line for client support in Australia that is available during working hours Monday to Friday. The FBS phone number for support in Australia is 1300 735 125.

Does FBS Allow Scalping?

Yes, FBS permits Scalping. FBS is an Electronic Communication Network (ECN) broker, which implies that they connect buyers and sellers using electronic communication networks. This feature enables them to offer a tight spread and fast execution speed.

To commence scalping on FBS, they suggest using the ECN account available on MT4. However, it’s essential to remember that scalping is risky, and you must have robust risk management strategies to avoid or mitigate losses.

Do we Recommend FBS Australia?

FBS is regulated in Australia by ASIC and 2 other Tier-2 financial regulators. This means the broker is obliged to protect clients’ funds. FBS also offers negative balance protection for all clients.

The fees on the platform are moderate as they offer commission-free trading on 2 accounts and competitive spreads, although the broker charges withdrawal fees, you can choose to use payment methods that do not have high fees.

FBS offers a variety of account types to choose from, including Retail, Professional and Islamic Accounts. This means both beginners and expert traders can sign up on the platform and find an account that is right for them. Although they offer few tradable instruments.

FBS customer support is good, as they respond fast to inquiries via all channels. Although they are not available 24/7.

We recommend that you try FBS after reviewing the instruments available on the platform to be sure they have the assets you want to trade. Otherwise, there are other brokers regulated in Australia that have more instruments with friendly features too.

FBS Australia FAQs

What is the minimum deposit for FBS?

The minimum deposit on FBS is 50 AUD or 50 units of the base account currency.

Is FBS regulated in Australia?

FBS is regulated in Australia as ‘Intelligent Financial Markets Pty Ltd’ by ASIC (Australian Securities and Investment Commission), since 2012.

How long does FBS withdrawal take?

FBS withdrawal takes 2 days max for bank transfers, 5-7 days for cards and is processed instantly for e-wallets.

Does FBS take commission?

FBS charges commission fee of 8.12 AUD per lot traded on the Ultra Account only. Other account types are commission-free.

Does FBS charge inactivity fee?

FBS does not charge account inactivity fee. If you do not log into your account or perform any trade for any amount of time, no fees will be charged to the funds in your account.

Note: Your capital is at risk