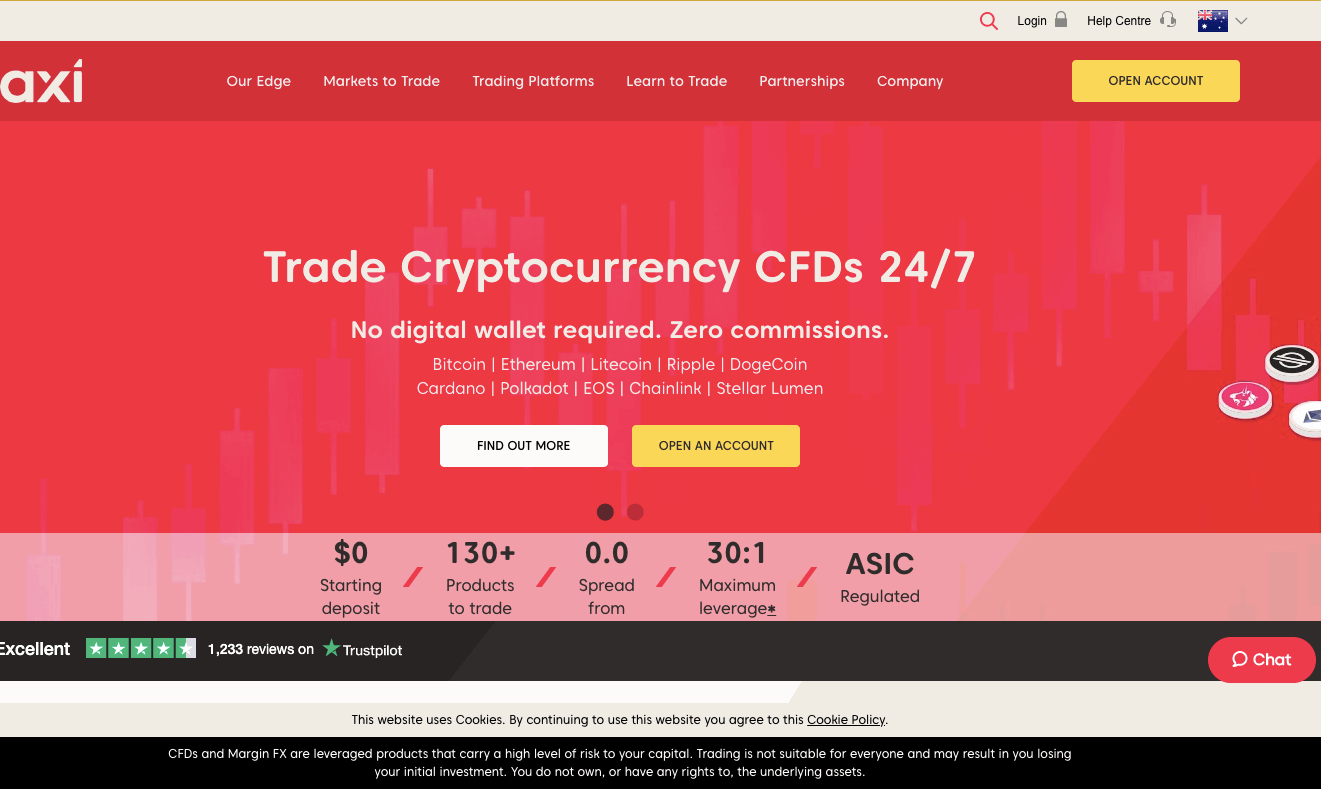

Axi is a forex and CFD trader, offering trading services for foreign exchange currencies (forex) and CFDs on shares, indices, commodities, oil, metals, and cryptocurrencies via their platform.

Axi was founded in Australia in 2007, and has an office there, as well as in the UK, and Dubai. In each of these locations, Axi is licensed to offer its services.

We will examine the safety and regulation of Axi, their account types and tradable instruments, supported trading platforms, deposit/withdrawal options, account opening process, and customer support in this review.

| Axi Review Summary | |

|---|---|

| Broker Name | AxiCorp Financial Services Pty Ltd |

| Establishment Date | 2006 |

| Website | www.axi.com/au |

| Address | AxiCorp Financial Services Pty Ltd, Level 13, 73 Miller Street, North Sydney, NSW 2060 Australia |

| Minimum Deposit | $0 |

| Maximum Leverage | 1:30 |

| Regulation | ASIC, FCA, DFSA, FMA |

| Trading Platforms | MT4, available on PC, Mac, Web, Android, & iOS |

| Visit Axi | |

Axi Pros

- Axi is regulated in Australia

- Responsive live chat available 24/5

- Offers commission-free trading account

- Free deposits and withdrawals

- Fast deposits processing

Axi Cons

- Charges dormant account fees

- Supports only MT4

- Has few instruments to trade

- Customer support is not available 24/7

Is Axi broker regulated?

Axi is the trading name of AxiCorp Limited, which is licensed in multiple jurisdictions by Top-Tier financial regulators under different names. This means that clients’ funds are safer and the risk and the broker can be trusted.

Find the various regulations of Axi in different countries below:

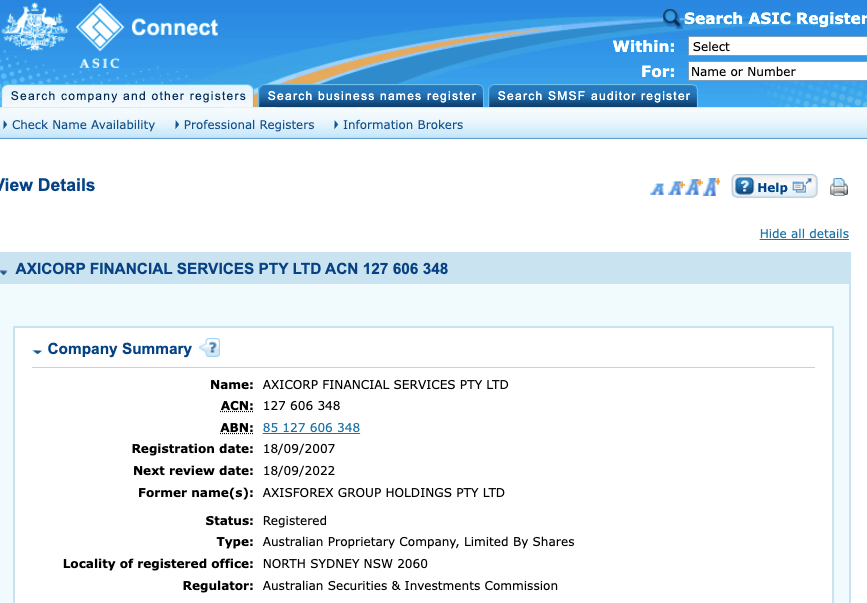

1) Australian Securities & Investments Commission (ASIC): Axi is regulated in Australia as AxiCorp Financial Services Pty Ltd with ACN (Australian Company Number) 127-606-348 since 2007 and is licensed to provide financial services in Australia.

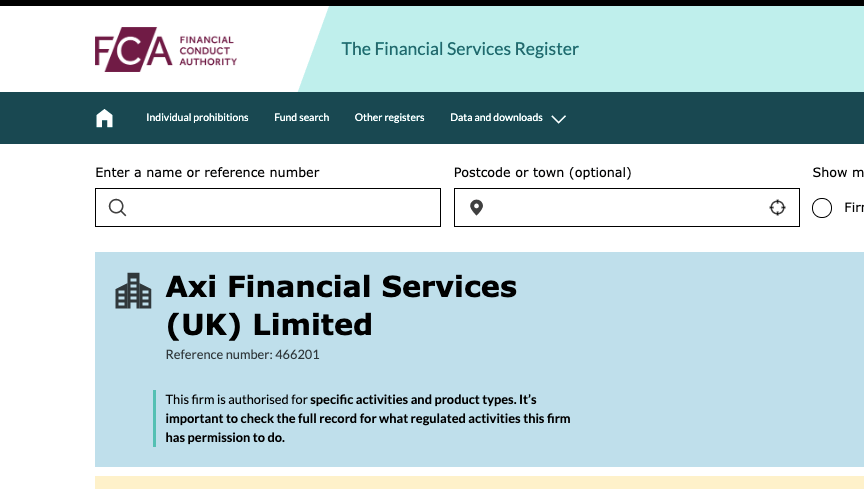

2) Financial Conduct Authority (FCA), United Kingdom: Axi is regulated by the FCA as ‘Axi Financial Services (UK) Limited’ and authorised to offer financial services in the UK, with reference number 466201, issued in 2007.

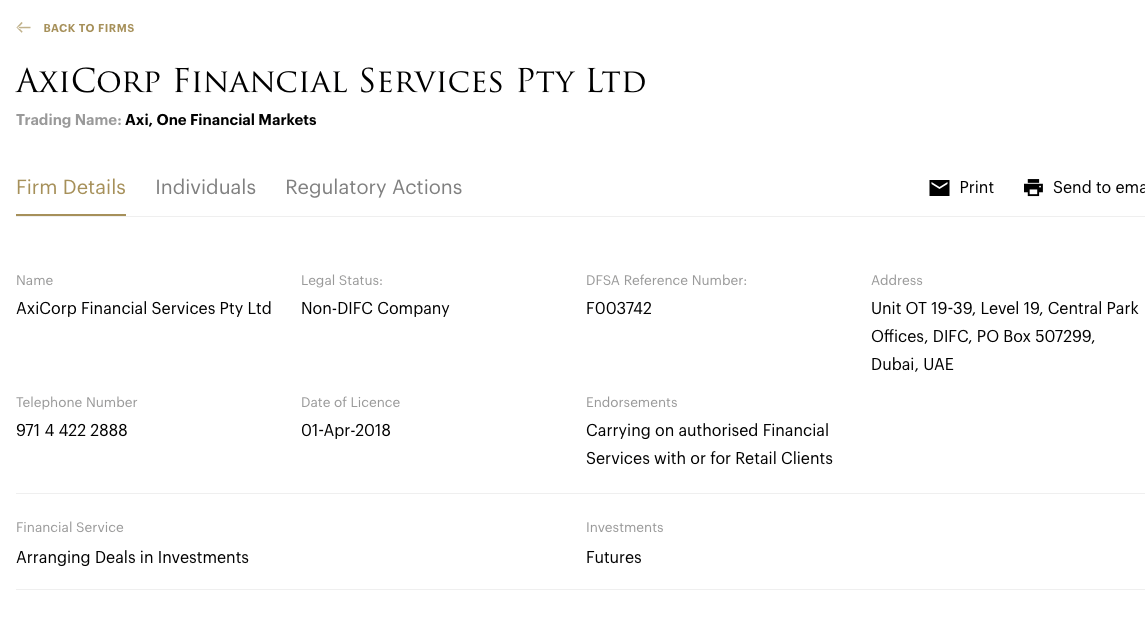

3) Dubai Financial Services Authority (DFSA): Axi is regulated in Dubai, UAE as ‘AxiCorp Financial Services Pty Ltd’, DFSA Reference Number: F003742, authorized to carry on financial services in 2018.

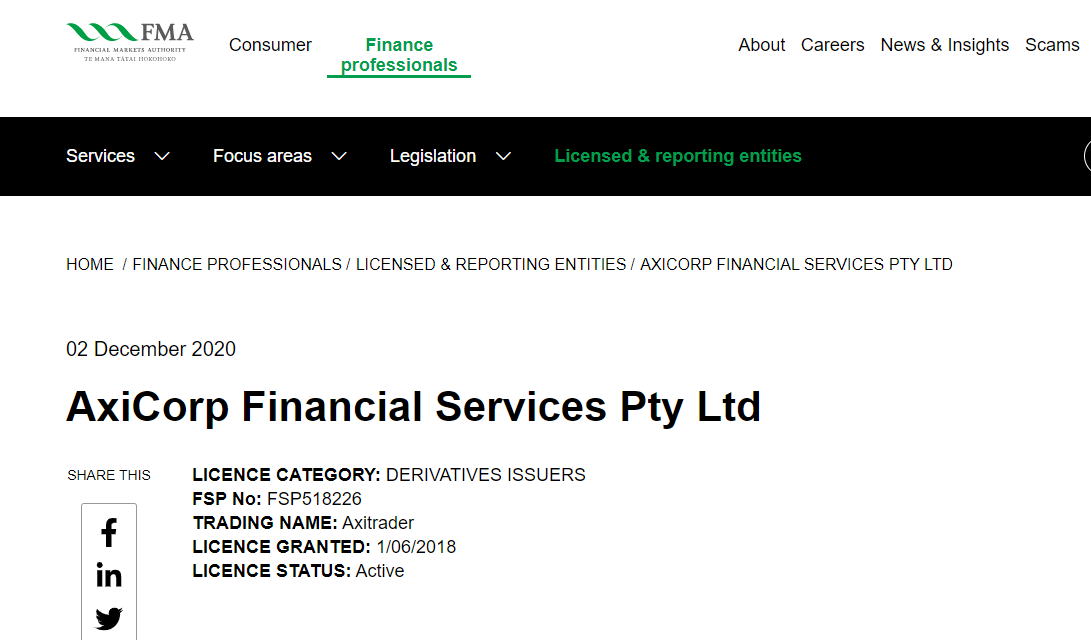

4) Financial Markets Authority (FMA): Axi is regulated with the Financial Markets Authority in New Zealand as ‘AxiCorp Financial Services Pty Ltd’. The company’s trading name is AxiTrader. Their license status is active since it was granted in 2018.

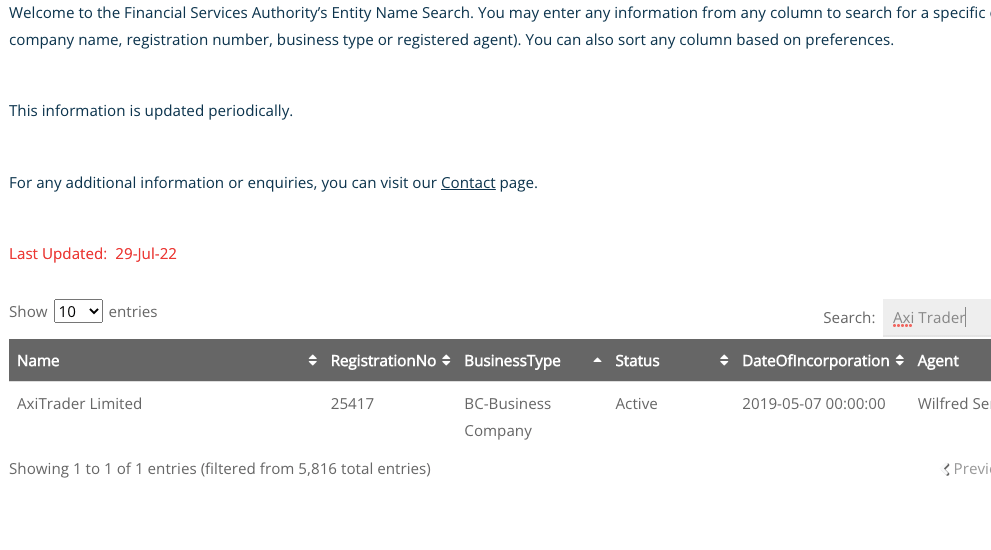

5) Financial Services Authority of St Vincent and the Grenadines (SVGFSA): Axi is incorporated in SVG as ‘AxiTrader Limited’ with registration Number 25417, issued in 2019. Traders in Malaysia are registered under this regulation.

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| UK | £85,000 | Financial Conduct Authority (FCA) | Axi Financial Services (UK) Limited |

| Australia | No Protection | Australian Securities and Investments Commission (ASIC) | Axicorp Financial Services Pty Ltd |

| Malaysia | No Protection | St Vincent and the Grenadines Financial Services Authority (SVGFSA) | AxiTrader Limited |

Axi provides negative balance protection to all retail clients. If you lose more than your trading capital, your account balance will not become negative. The ASIC as a form of protection for traders requires this. Furthermore, ASIC will also investigate any breach by a broker and prosecute them if found guilty.

Axi Leverage

Leverage on Axi depends on the instrument you are trading and whether you are a retail or professional client.

Retail clients on Axi have a maximum leverage of 1:30 for major forex pairs, 1:20 for minor forex pairs, gold, and major indices, 1:10 for minor indices, energies, and metals, 1:5 for shares, and 1:2 for cryptocurrencies.

With a leverage of 1:30, you open a trade worth 30 times the size of your deposit. For example, if you deposit $1,000, you can place a trade of $30,000.

The maximum leverage on Axi for Professional clients is 1:400, which is for major forex pairs, other instruments have lower leverages.

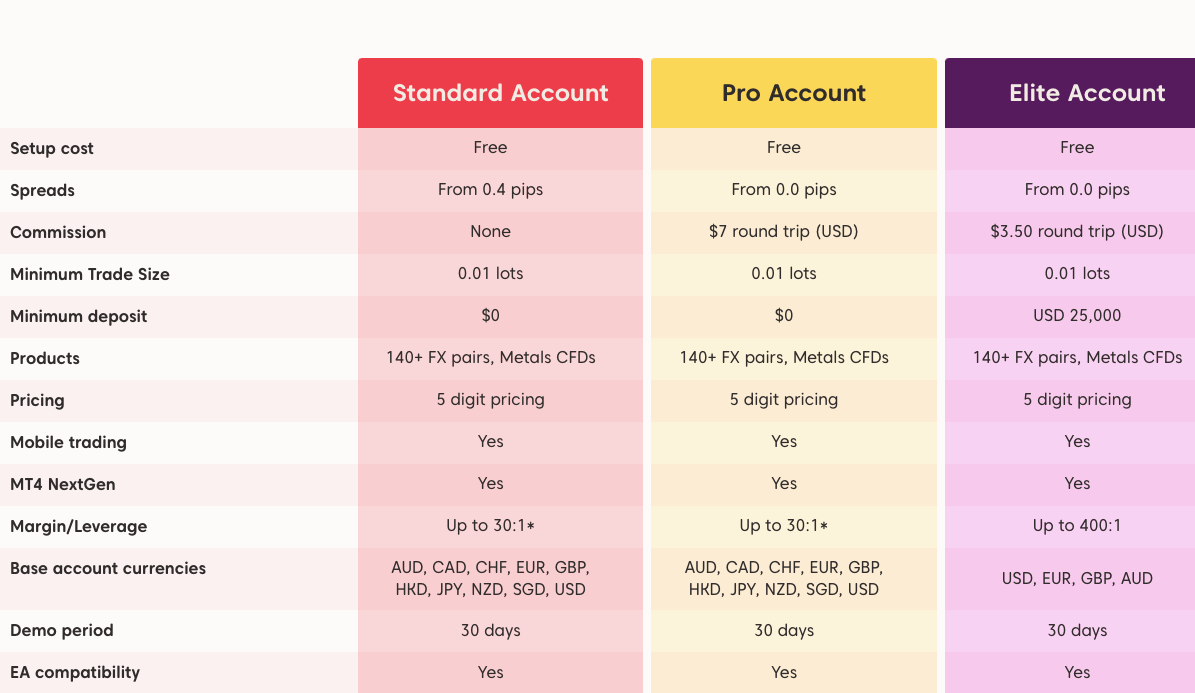

Axi Account Types

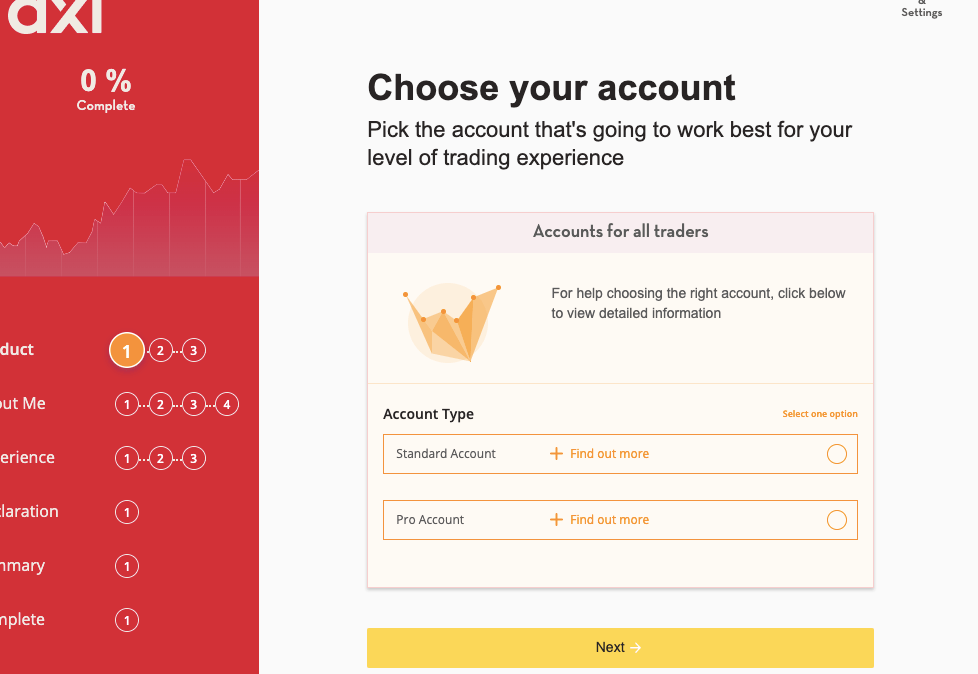

Axi offers 3 account types; Standard, Pro, and Elite Accounts. Axi also offers Swap-free Islamic Accounts available for Muslim traders, and beginners can open demo accounts to practice trading before putting real money on the line. You can open an account as an individual or corporate body.

Find an overview of the various account types on Axi below:

1) Standard Account: The Axi Standard Account is designed for retail clients who are new to trading. This account allows you to trade forex and CFDs on shares, indices, commodities, oil, cryptocurrencies, and metals.

This account is spread only and you do not pay any commissions when you open or close trade positions. Spreads start from 0.4 pips for major forex pairs and you pay swap fees whenever you keep a trade position open past the closing time of the market.

This account has no mandatory minimum deposit requirement, and the minimum trade size is 0.01 micro-lots, with a maximum leverage of 1:30.

You have negative balance protection with this account, which means you cannot lose more than the amount of money in your trading account. If a trade position is unsuccessful and you have a loss, any negative balance on your account will be reset to zero.

2) Pro Account: The Axi Pro Account is designed for retail clients who want to pay lower spreads. This account allows you to trade forex and CFDs on shares, indices, commodities, oil, cryptocurrencies, and metals.

This account charges commissions of $7 (round turn) when you open or close a trade position. Spreads start from 0.0 pips for major forex pairs and you also pay swap fees whenever you keep a trade position open past the closing time of the market.

This account has no mandatory minimum deposit requirement. The required minimum trade size is 0.01 micro-lots, with a maximum leverage of 1:30, and has negative balance protection as well.

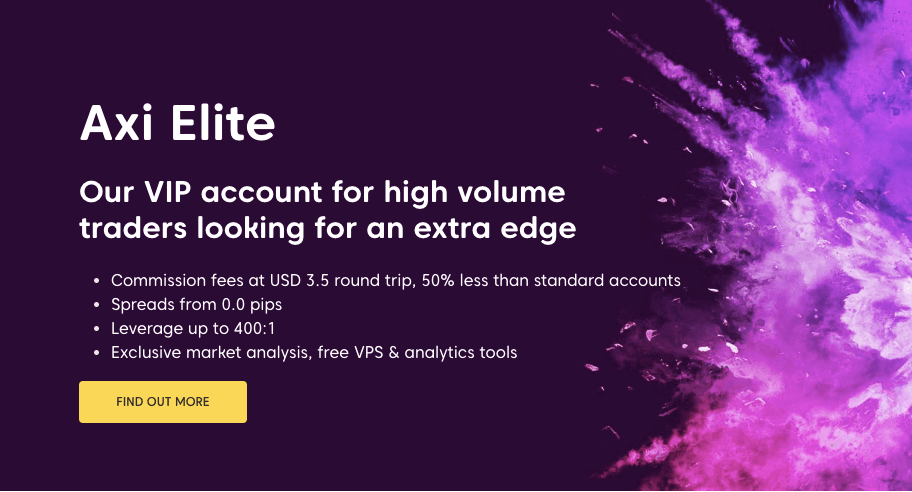

3) Elite Account: The Axi Elite Account is designed for professional clients who are experienced traders and want to access higher leverage. This account allows you to trade forex and CFDs on shares, indices, commodities, oil, metals, and cryptocurrencies.

The Elite Account on Axi charges commissions of $3.50 (round turn) when you open or close a trade position. Spreads start from 0.0 pips for major forex pairs and you also pay swap fees whenever you keep a trade position open past the closing time of the market.

Professional Accounts on Axi require a minimum balance of US$25,000. The required minimum trade size is 0.01 micro-lots, with a maximum leverage of 1:400 which applies to forex majors, other instruments have lower limits.

Professional traders on Axi do not have negative balance protection, which means you can lose more than the money in your account if you suffer a loss, and will be required to deposit more money to clear any negative balance.

To get a professional account, first, create a retail account, then apply to customer support and fill out the application form to be classified as a non-retail client on Axi.

To qualify for an Elite Account, you need to meet at least 1 of the 3 conditions below with proof that:

1) Wealth Test (Wholesale Client):

- You have net assets of at least AU$2.5 million or annual gross revenue of at least AU$250,000 for the past 2 financial years.

2) Sophisticated Investor Test:

- You placed at least 20 trades each quarter for any 4 quarters in the past 3 years with a notional value of at least AU$500,000 in each of those quarters or have worked in the financial services sector for at least one year in a role that required experience in trading CFDs/margined FX.

3) Professional Investor Test:

- You are an Australian Financial Services licensee or you control gross assets of at least AU$10 million.

4) Islamic Account: Axi offers Islamic Accounts to Muslim traders that are in compliance with sharia law. These accounts are swap-free (interest-free), which means you do not pay any swap fees for keeping a trade position open past the closing time of the market.

This account is a swap-free specific account, and you can only trade forex majors, forex minors, and precious metals. You do not pay commissions, as this is a spread-only account with maximum leverage of 1:30.

To get a swap-free Islamic Account on Axi, first, create a standard account then contact the Axi Client Service (custom support) team to convert your account to a swap-free status. You can also get an Elite Swap-free Account status.

Axi Base Account Currency

Your trades, deposits, profits, losses, and withdrawals on the platform are measured in your base account currency.

The available account base currencies on Axi are Australian Dollars – AUD, Canadian Dollars – CAD, British Pound sterling – GBP, Swiss Franc – CHF, Euros – EUR, Japanese Yen – JPY, Polish zloty – PLN, Hong Kong Dollar – HKD, New Zealand Dollar, Singapore Dollar, and the United States Dollar – USD.

Axi Overall Fees

Axi charges different fees depending on your account type, the instrument you are trading, and the size of your trade. Here is an overview of Axi trading and non-trading fees.

Trading fees

1) Spreads: Axi adds a markup to the ask prices of instruments traded on their platform, this markup is the difference between the ask and bid prices of the tradeable instruments, it is called ‘Spreads’ and measured in pips which serves as revenue for the broker.

Axi operates a variable spreads system, which means that the spreads will fluctuate during the day to reflect market movements. The spreads on Axi depend on the instrument you are trading and your account type.

Average spreads during peak trading hours for majors like EURUSD is 1.4 pips on the Standard Account and 0.3 pips on the Pro Accounts, but this changes as the market moves.

2) Commission fees: Axi offers commission-free trading for all instruments on the Standard Account, while the Pro and Elite Accounts pay a round turn commission of $7 and $3.50 respectively, whenever they open and close trade positions.

The commission fees can be higher, depending on the instrument you are trading and the size.

3) Swap fees: The market closing time on Axi is 5 PM New York time. If you keep a trade position open past this time, you will incur rollover fees also called swap fees or overnight funding costs. This fee will be added to your profit or loss when you close the position.

Swap fees on Axi are calculated based on the size of your trade, the spread cost of the trade, the prevailing swap rate, the number of days you keep the trade open, and whether your trade position is a buy (long) or sell (short).

Islamic Accounts do not pay swap fees. Here is the trading fees for select CFDs on Axi’s Standard Account.

| CFD | Spread | Commission |

|---|---|---|

| GBP/USD | 1.2 | None |

| UKOIL | 3 | None |

| USTECH | 50 | None |

| US500 | 125 | None |

Swaps are calculated in relation to the counter currency and are converted to and applied in your trading account currency. Swaps are subject to change and are available within the trading platform.

Non-trading fees

1) Deposit and Withdrawal fees: Axi offers free deposits and withdrawals. You do not pay any fees when you deposit funds to your account or withdraw from it. This applies to all account types and payment methods.

Note that you will incur a deposit fee of 3% if your deposits exceed the limit of $50,000 in a month. For withdrawals below $50, you may incur a withdrawal fee of $25.

2) Account Inactivity charges: If you do not perform any trade on your account for 12 months, your account will be categorized as inactive and any balance in your account will be charged a $10 or 10 units of your account currency monthly.

If you do not have any funds in your account, no negative balance will accumulate on the account.

| Fee | Amount |

|---|---|

| Inactivity fee | A$10 |

| Deposit fee | None* |

| Withdrawal fee | None* |

*Withdrawals are free if they are above $50 or your full account balance. Otherwise, an administration fee of US$25 may apply. For deposits, only bank transfer is completely free. Cards and other funding methods attract 3% if you exceed monthly deposit limit of $50,000

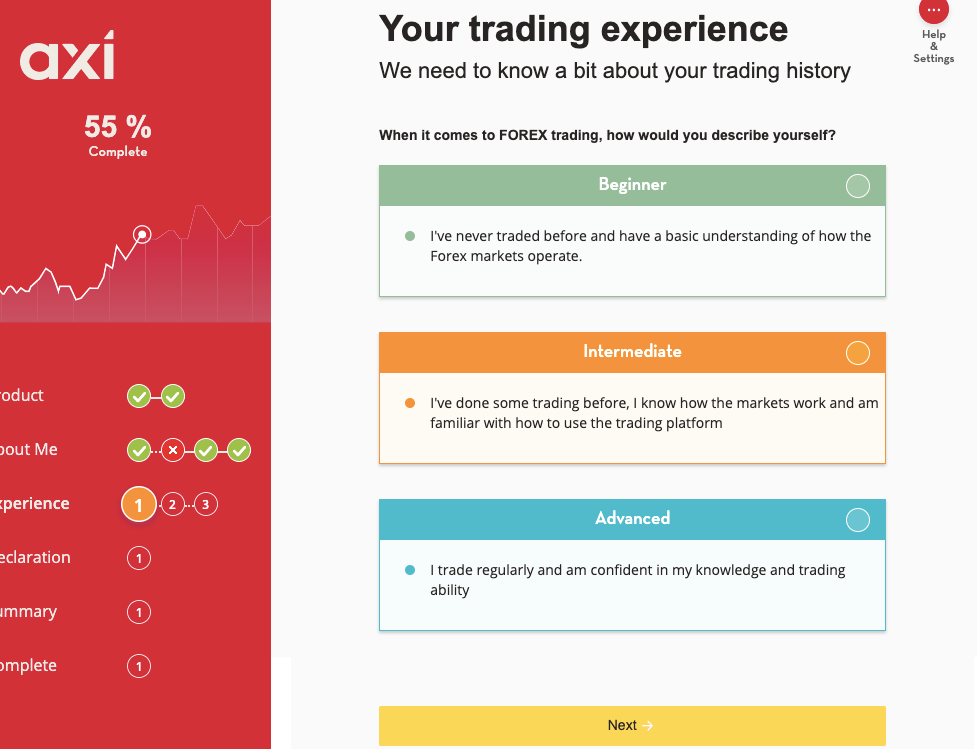

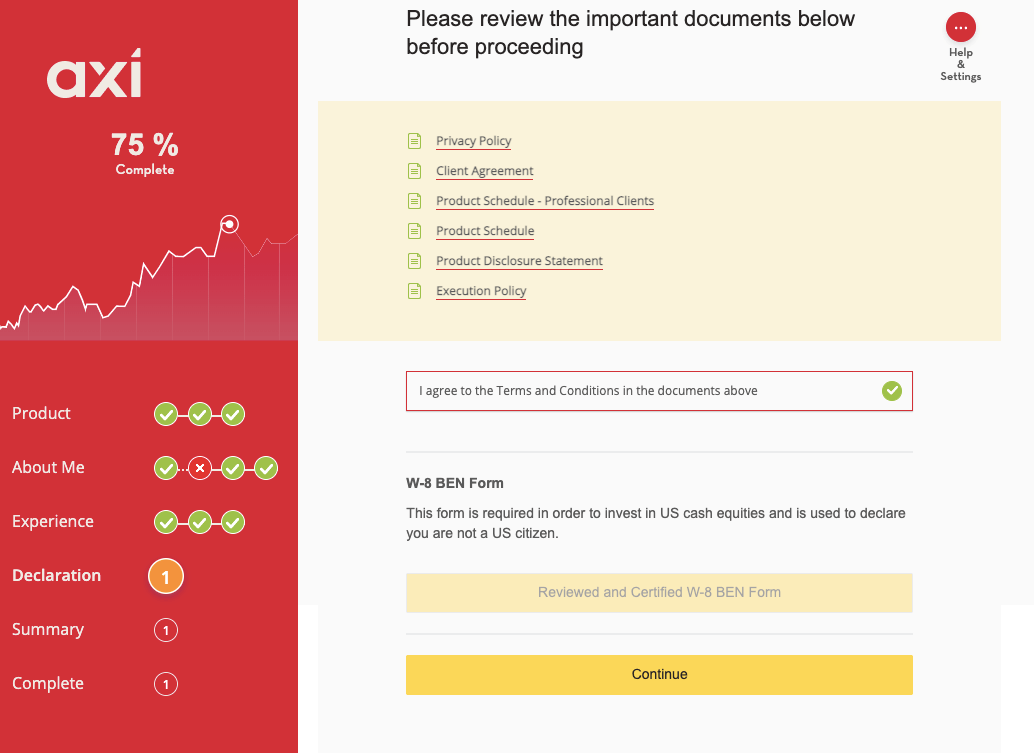

How to Open Axi Account in Australia?

Follow these steps to open a trading account on Axi.

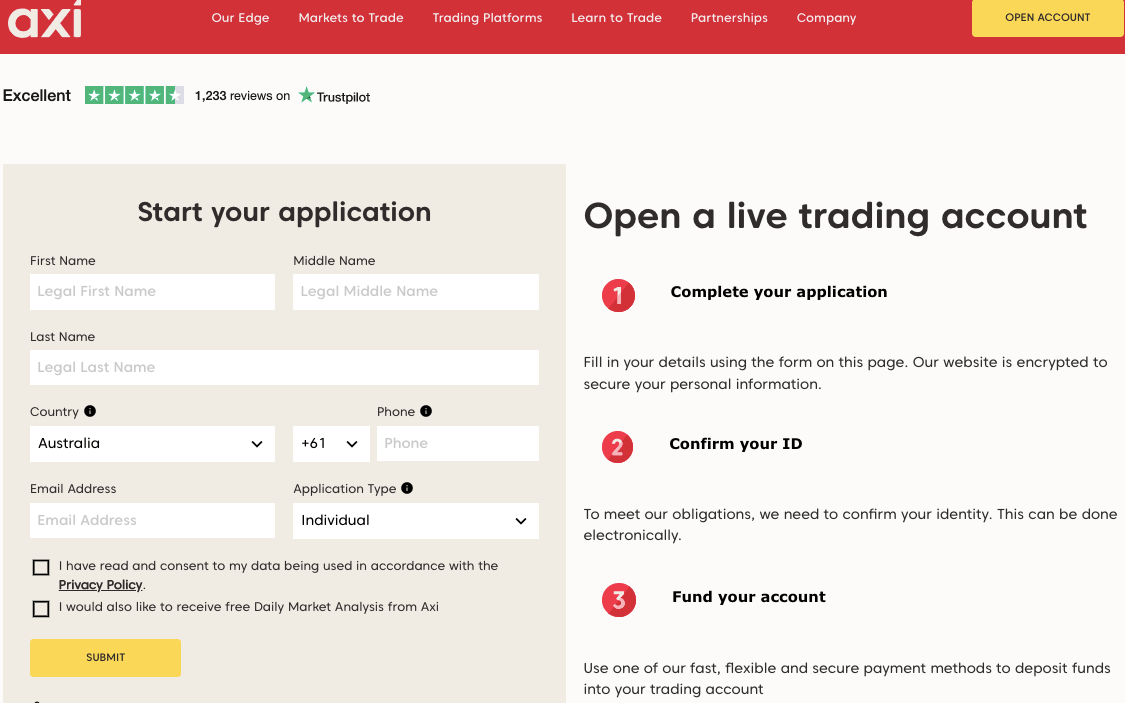

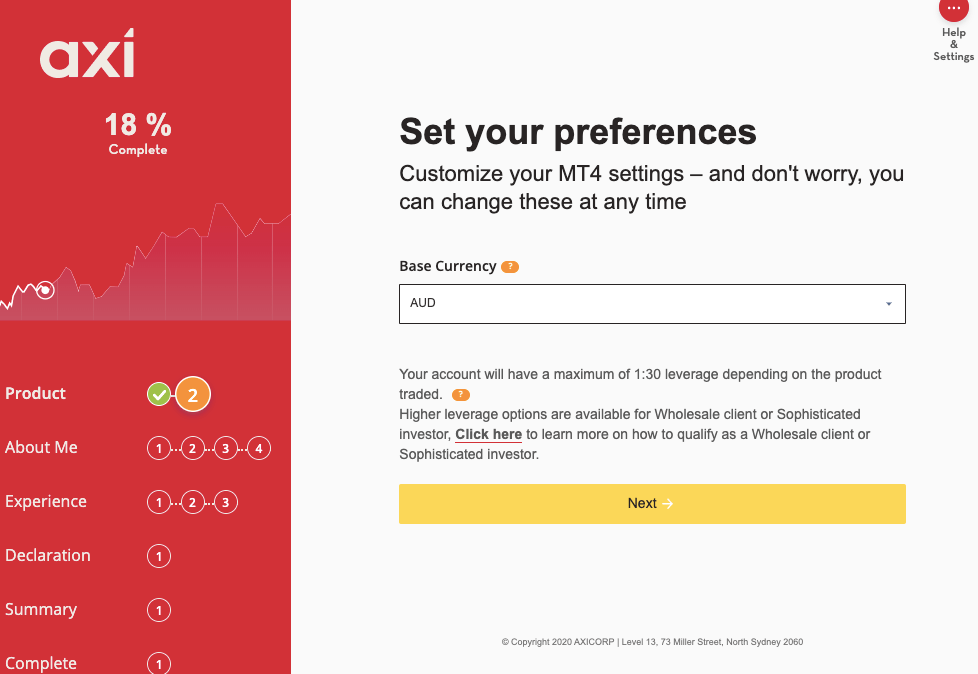

Step 1) Visit the website of Axi at www.axi.com and click on the ‘OPEN AN ACCOUNT’ button.

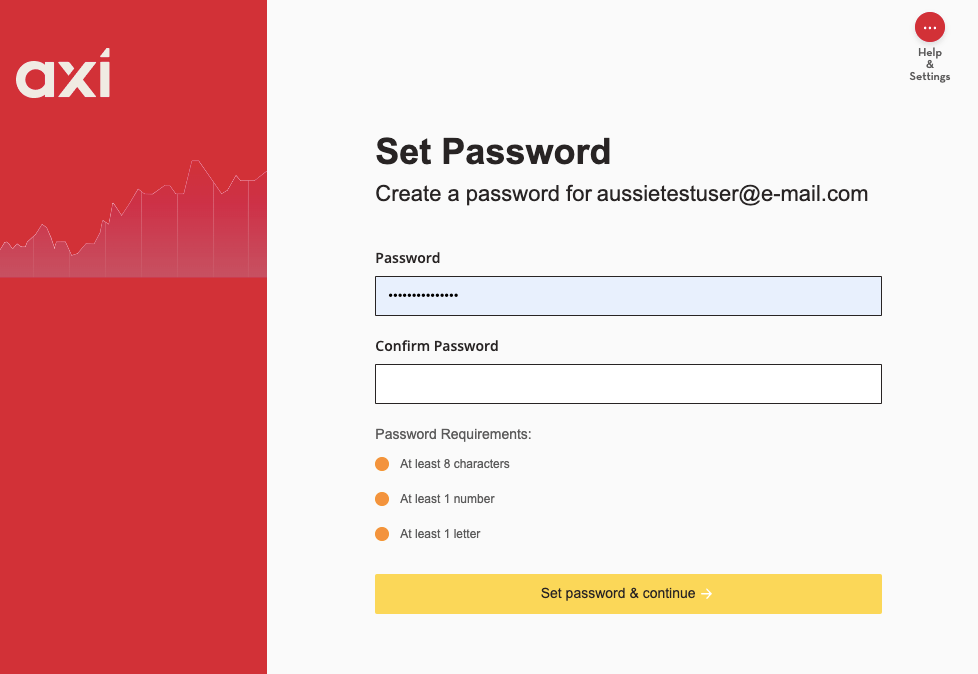

Step 2) Fill out your name, phone number, and email, then check the boxes to agree to the Privacy Policy, click ‘SUBMIT’, then create a password and click ‘Continue’

Step 3) Choose an account type and select your preferred account currency, then click ‘NEXT’.

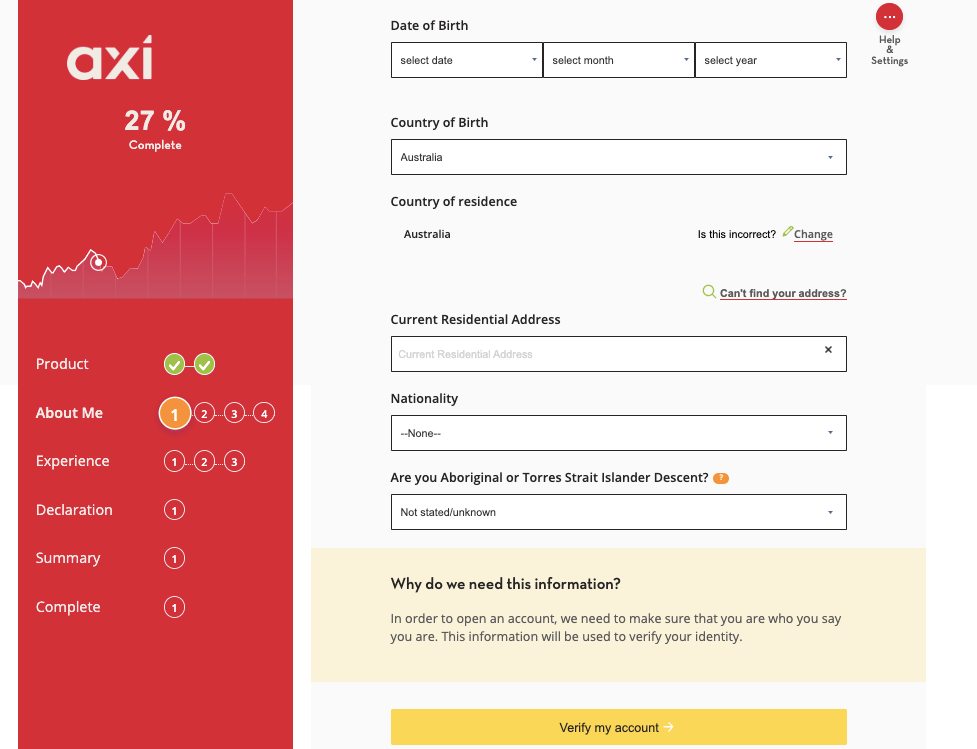

Step 4) Provide your date of birth, residential address, and nationality, then click ‘Verify my account’.

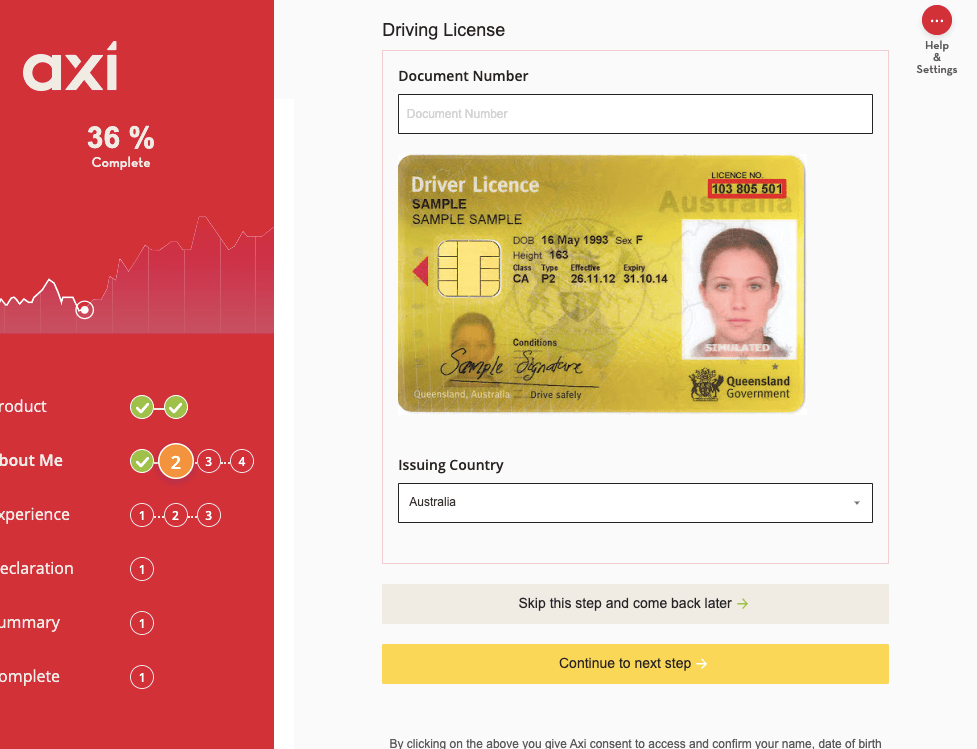

Step 5) Upload verification documents like your ID Card to verify your identity and a utility bill or bank statements for your address. This will enable the broker to verify your account.

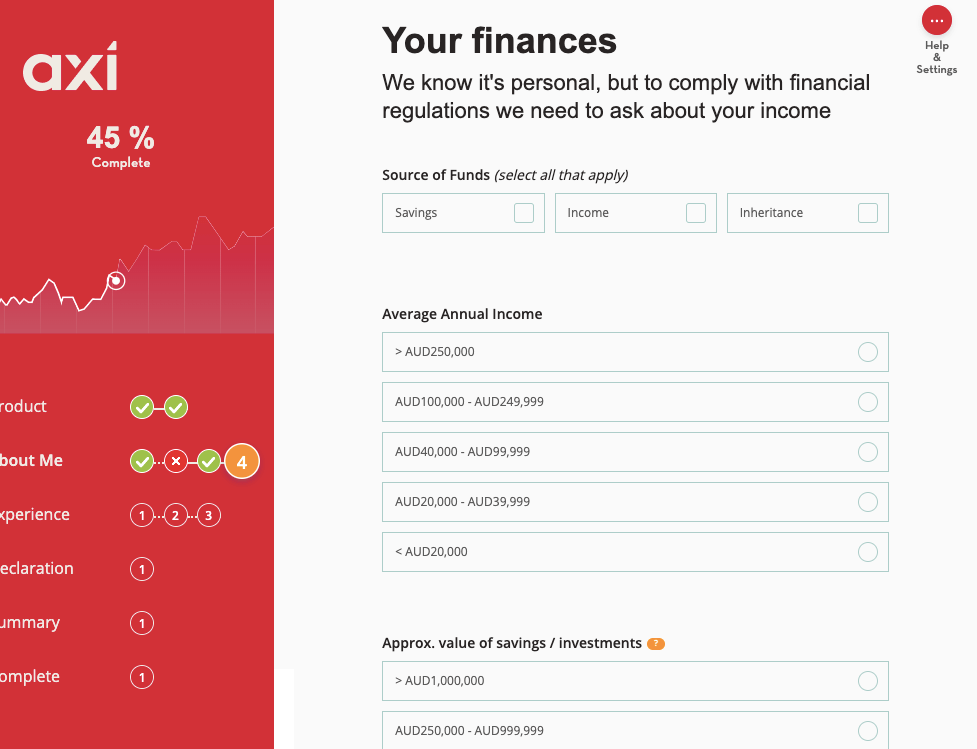

Step 6) Answer questions about your employment, finances and trading experience then click NEXT.

Step 7) Agree to the terms and conditions then click ‘Continue’, review the information you have provided and click ‘Submit Application.

Axi Deposits & Withdrawals

Payment methods accepted on Axi for deposits and withdrawals are bank transfers, e-wallets (Skrill, Neteller, etc.), and Credit/Debit cards. Find an overview of deposits and withdrawals on Axi Australia below:

How much is the minimum deposit to Axi?

There mandatory minimum deposit on Axi is US$5 for cards and e-wallets, while bank transfers have no mandatory minimum deposit amount.

Although the broker recommends a minimum deposit of $200 to enable you to open larger trade sizes, you can deposit less than this amount.

Cards and e-wallets deposits are credited instantly while it can take 1 to 3 business days for bank transfer deposits to be credited to your account.

How do I deposit money into Axi?

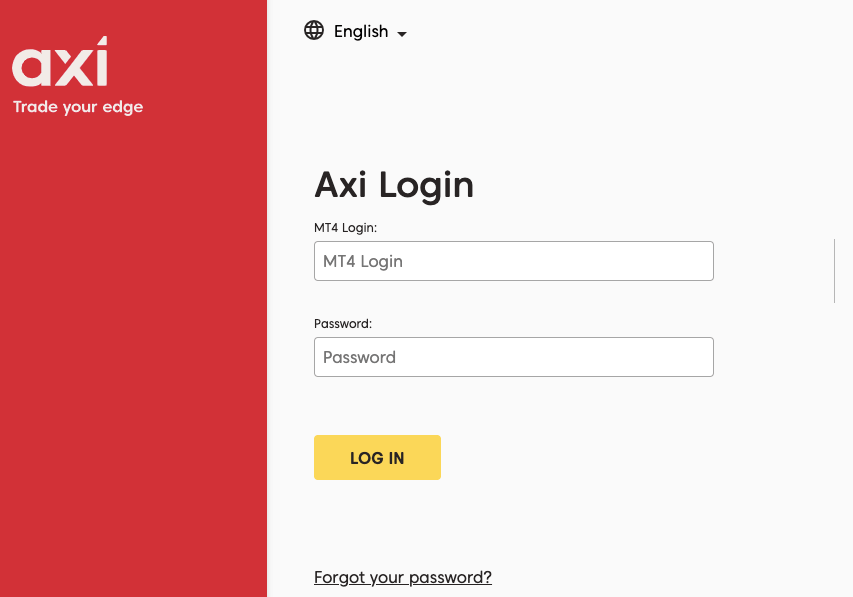

Step 1) Log in to your Axi Client Portal (dashboard) via clientportal.axi.com.

Step 2) Click on the ‘Accounts and Billing’ tab on the left side menu, then select ‘Deposit and Withdrawal’.

Step 3) Choose a payment method and follow the on-screen instructions to complete your deposit.

What is the Axi Minimum withdrawal?

The minimum withdrawal amount on Axi is US$50 for bank transfers and US$5 for e-wallets. Note that withdrawals less than US$50 dollar will attract withdrawal fees of about US$25 and Axi currently does not support withdrawals to cards.

Withdrawal requests on Axi are processed within 1-2 business day and may take up to 5 days to receive funds for withdrawals to local bank accounts, while e-wallets receive funds immediately after it is processed.

How do I withdraw from Axi?

Follow these simple steps to withdraw money from your Axi Account:

Step 1) Log in to your Axi Client Portal (dashboard) via clientportal.axi.com.

Step 2) Click on the ‘Accounts and Billing’ tab on the left side menu, then select ‘Deposit and Withdrawal’.

Step 3) Choose a payment method and follow the on-screen instructions to complete your withdrawal request.

Axi Trading Instruments

You can trade the following financial instruments on Axi:

| Instrument | Availability | Number |

|---|---|---|

| Forex | Yes | 65 currency pairs on Axi (majors, minors, and exotics) |

| Commodities | Yes | 11 Cash and futures commodities on Axi (Agriculture, Metals, Oil, and NatGas) |

| Precious Metals | Yes | 7 pairs of Metals on Axi (including Gold, Palladium, and Silver) |

| Indices | Yes | 31 Cash and futures index on Axi (USTECH, UK100, FRA40, and others) |

| Shares | Yes | 49 shares on Axi (US, UK, EU shares, and others) | Crypto assets | Yes | 35 Pairs of cryptocurrencies on Axi (BTC, ETH, DOG, and others paired to USD) |

Axi Trading Platforms

1) MetaTrader 4: MT4 is the only trading application supported by Axi for trading financial markets. This is available on the web, desktop, and mobile devices (Android & iOS). You can also use EAs as professional clients or other tools.

2) MetaTrader 5: Axi also support MT5. It comes with multi-thread strategy tester, advanced charting, economic calendar, and technical indicators. A webtrader version is also available. You will have to connect with your login and password.

Does Axi have a mobile app?

Yes, Axi has a trading app for copy trading only. But the app is not available for traders based in Australia at the time of this writing.

Axi Trading Tools

Autochartist: The Autochartist is an MT4 plug-in. It is very useful for technical analysis. The Autochartist scans the market on your behalf.

You can easily find key support and resistance levels. In addition, the Autochartist also lets you identify price patterns on your charts. Double bottoms, head and shoulders, and other price formations can found easily.

If used properly, Autochartist can really be a time saver.

Trading central: Trading central is a tool with premium and powerful indicators. There are adaptive candlesticks that help you see supply and demand dynamics in the market. You will also easily locate candlestick patterns (e.g. the doji) that signify trend continuation and reversal.

Trading calculators: Axi has four trading calculators. You can use the required margin calculator to determine the margin required for your trading position. The profit/loss calculator helps you know the potential losses of your trading position.

The pip calculator is a simplified profit calculator. You can use it to calculate your potential profit/loss per pip. The final calculator is the currency converter. You can use it to convert currencies with real time currency rates.

Axi AU Execution Policy

Axi is the sole execution venue of your trades and deals with you as principal. This means the broker acts as a market maker and you are not dealing with the underlying exchange. Also, your orders are not executed at any external execution venue.

For retail clients, the best possible execution result is based on total consideration. The total consideration sees price as the most important factor of all execution criteria. It is a combination of the price of the CFD you are trading and the cost of execution.

Here are the criteria considered by Axi when determining the best way to execute your trades:

Classification: Axi takes into consideration your expectation and characteristics to determine if you are a retail client or a professional trader.

Price: As much as possible, Axi will try to execute your order at the requested price. In rare occasions, they might even execute it at a better. However, this is not guaranteed. If there is a slippage or an error in price, your order may be filled at an unfavorable price.

Speed: Poor internet connection can cause delayed execution. This can lead to latency and erroneous pricing. Axi will reject your order if this happens or fill it at a different price.

Size: There may be restrictions on the ability of Axi to fill your order depending on the size. If the size is too large, your order will be rejected. This is because Axi does not issue partial fills except for futures. However, there is a minimum and maximum deal size for CFDs so you can work with their limit.

Hours: Your orders and trades will only be filled when the underlying market is open. There is an exception only if Axi is quoting a grey market for the CFD you want to trade.

Slippage: The market can gap for different reasons. It could be due to a huge macroeconomic event, news, or during opening hours. Slippage might cause your orders to be filled at a different price. With Axi, your stop orders might be filled at a worse level. But limit orders might be filled at an improved level.

Aggregation: Axi will not aggregate your trades with other clients if it will be disadvantageous to you.

Axi Australia Education

Axi Academy: Axi Academy is a combination of comprehensive trading courses. These courses are developed by traders for traders. Axi Academy is free and you can gain essential trading knowledge by taking these courses. They are also available 24/7 so you can learn at your own pace. Here is a breakdown of the courses in Axi Academy:

Forex Trading Course: The forex trading course is divided into three sections: forex 101, forex trading fundamentals, and forex trading strategies. Under each section, key topics are covered. Some of them include trading psychology, risk management, forex jargon, technical analysis, etc.

<strong>Gold Trading Course: This is also divided into three sections with different topics covered. You will learn how the value of gold is calculated, the difference between gold and other commodities, and gold as a safe haven. You might also want to pay attention to the section that discusses the factors that move the price of gold.

Shares Trading Course: The key thing you will learn here is the difference between stocks and shares, how to trade the stock market, how to create a winning strategy, and managing your risk.

These courses are delivered as videos and written content. They also contain quizzes.

MT4 Video Tutorials: Axi has videos that beginners can use to get familiar with MT4. The tutorial is divided into 9 sections as shown below.

Each section is further divided into sub-sections explaining everything you need to use MT4.

Free ebooks: if you are an avid reader, Axi has free ebooks for you. You do not need to pay any fees. You only need to sign up. Then you can download them. The books cover trading strategies, psychology, MT4, and other important trading concepts.

Trading Glossary: Axi’s glossaries help you get familiar with common terminologies in forex trading. For easy navigation, the terminologies have been arranged in alphabetical order. This makes it easy to find the definition of a terminology among the many terminologies defined.

Axi glossary also has a navigation panel that makes your user experience better. The panel is displayed below.

Here is how the panel works. If you click on letter N for example, you will be taken to the section that contains all terminologies beginning with letter N. In few seconds, the navigation is complete.

Axi blog: Axi blog covers educative articles on forex, shares, indices, commodities, and other CFDs. You can also find the latest new about Axitrader on their blog. Though some of the trending articles are outdated, you will find the educational content very helpful.

Axi Australia Customer Service

Axi offers 24/5 online customer support to traders via the following channels:

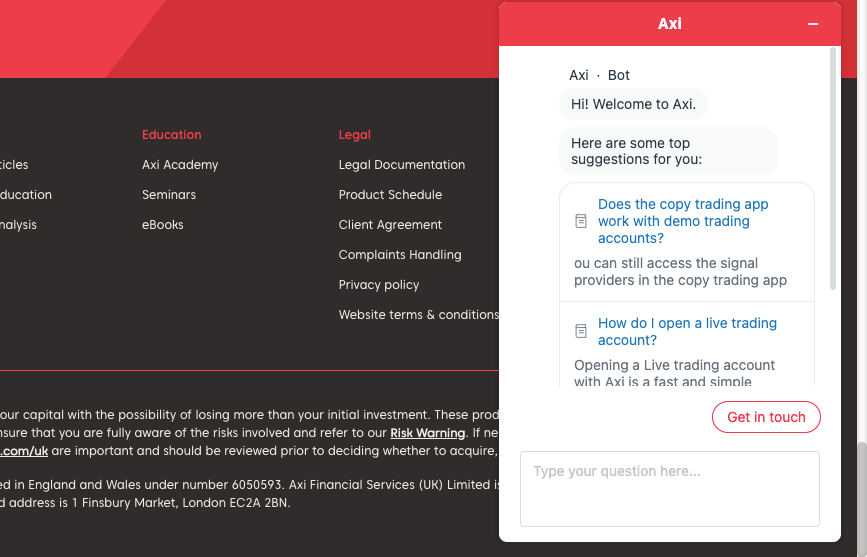

1) Live chat support: The Axi live chat can be accessed via an icon on every page of their website and is available 24/5 Monday to Friday. When our team tested the online live chat support, we got a response as soon as we started the chat and there was no wait time and the answers to our questions are relevant.

Axi uses has a chatbot that suggests articles and possible answers to your questions when you first initiate a chat. To transfer to a live agent, click on ‘Get in touch’. you will be required to provide your email address and name to chat with the live agent.

2) Email support: Axi offers email support to traders in Australia. When we tested the Axi email support, we got an autogenerated reply acknowledging receipt of our inquiry but did not get any feedback from a live agent after several hours.

The Axi email address for inquiries is [email protected].

3) Phone support: Axi offers phone support to traders in Australia and you can speak to them during working hours on business days.

Axi’s phone number in Australia is 1300 888 936 and the international number is +61 2 9965 5830. Axi also has WhatsApp support via +61 448 090 530.

Do we Recommend Axi Australia?

Axi is considered safe in terms of clients’ funds because they are regulated in Australia by ASIC and are also regulated by the FCA, in the UK, which is a Tier-1 financial regulator.

The fees on Axi are moderate as you can trade commission-free with the Standard Account or with low spreads on the Pro Account. You can also apply for a professional account to access more leverage.

Axi customer service is not so good as they respond only on the live chat, while the email support is not responsive. The broker’s website is easy to navigate and contains up-to-date information about the company and their trading conditions.

The broker is also good for beginners as you have negative balance protection, with a low minimum deposit of $5, and they charge inactive account fees only after 12 months. Note that they also offer relatively few tradable instruments.

We recommend that you try Axi if you want to start trading financial assets. You can visit their website to read up more about them and chat with a customer support agent to help you make up your mind.

You should also check out the available instruments to ensure they have the markets you want to trade.

Axi Australia FAQs

Is Axi a regulated broker?

Axi is a regulated broker in multiple jurisdictions including the Australian Securities & Investments Commission (ASIC), the Financial Conduct Authority (FCA), the United Kingdom, and Dubai Financial Services Authority (DFSA).

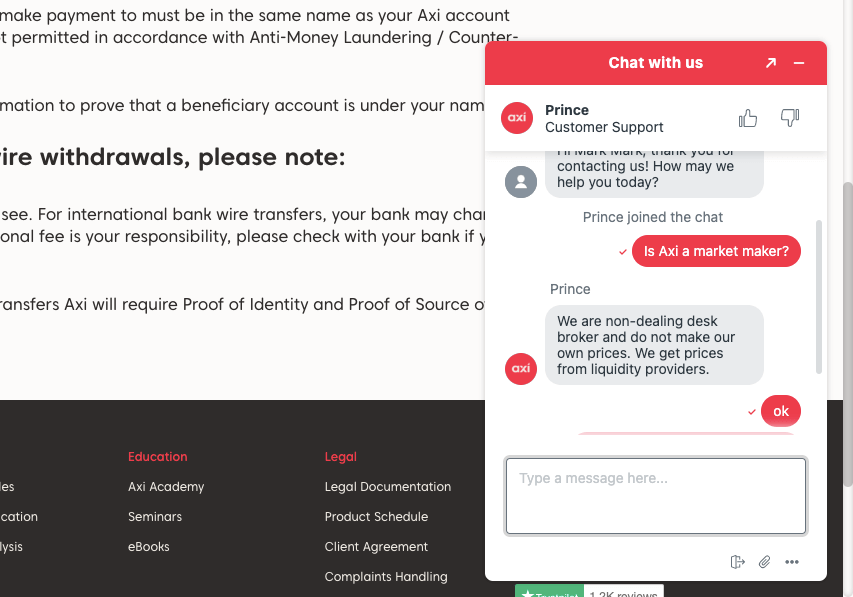

Is Axi a market maker?

Axi is a non-dealing desk broker and does not make their own prices, they get prices from liquidity providers, thus, Axi is not a market maker.

How long does it take to withdraw from Axitrader?

Withdrawal requests on Axi are processed within 1-2 business days and may take up to 3 to 5 days to receive funds for withdrawals to local bank accounts, while e-wallets receive funds immediately it is processed. Axi currently does not process withdrawals to cards

Does Axi allow scalping?

Yes, Axi allows scalping. Scalping is a trading style that specializes in profiting off of small price changes by holding trades for a brief period.

Scalping requires a trader to have a strict exit strategy because one large loss could eliminate the many small gains the trader worked to obtain.

Note: Your capital is at risk