Admiral Markets is an online Forex and CFDs broker that allows you to trade foreign exchange currency pairs, and CFDs (Contract For Difference) on metals, shares, energies, indices, bonds, ETFs (Exchange-Traded Fund), and agriculture commodities.

Admiral Markets was launched in 2001, they are registered in Australia and authorised by ASIC (Australian Securities & Investments Commission).

Our Admiral Markets review looks at the trading conditions, leverage, fees, deposit/withdrawals, and customer support offered by the platform.

| Admiral Markets Review Summary | |

|---|---|

| Broker Name | Admiral Markets Pty Ltd |

| Establishment Date | 2001 |

| Website | www.admiralmarkets.com |

| Address | Admiral Markets Pty Ltd, 1/17 Castlereagh Street Sydney NSW 2000, Australia |

| Minimum Deposit | A$100 |

| Maximum Leverage | 1:30 |

| Regulation | ASIC, FCA, CySEC, FSCA, EFSA, JSC |

| Trading Platforms | MT4, MT5 and Admirals Mobile App available on Android & iOS |

| Visit Admiral Markets | |

Admiral Markets Pros

- Admiral Markets is regulated in Australia

- Offers a wide range of trading instruments

- Supports MT4 and MT5 Platforms on multiple devices

- Low minimum deposit/withdrawals for bank transfers

- Negative balance protection for retail clients

- Fast deposit/withdrawal processing

Admiral Markets Cons

- Charges account inactivity fees

- Customer support is not available 24/7

- Charges deposit fees on some payment methods

- Offers only 1 free withdrawal per month for each payment method

Are Admiral Markets regulated?

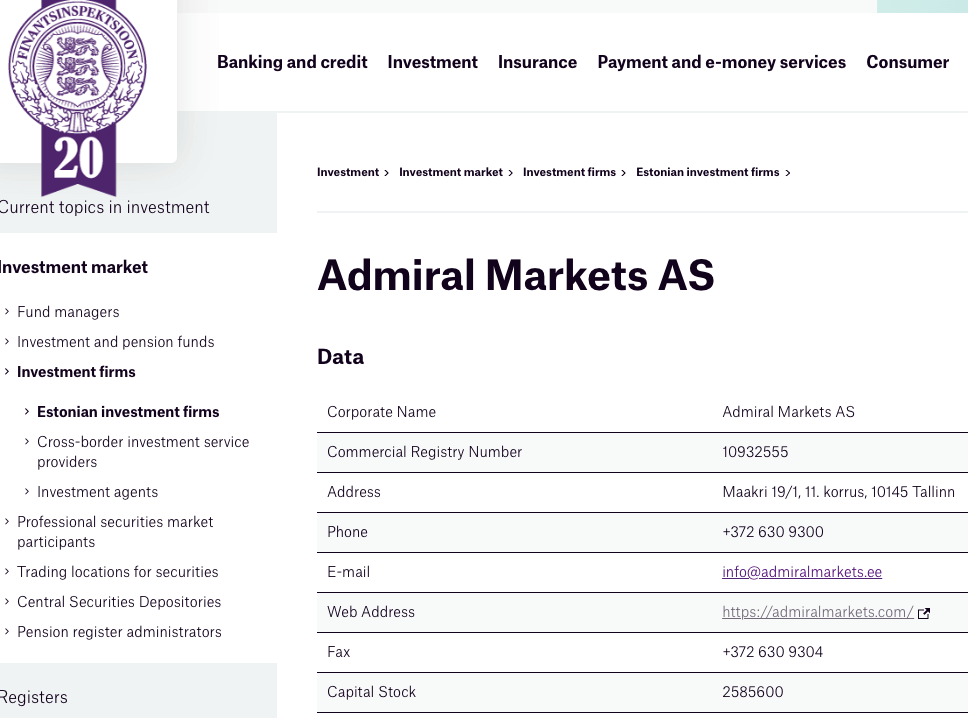

Admiral Markets is the trading name of Admiral Group AS, registered and regulated in the Republic of Estonia, where they have their headquarters. The company is currently on a rebranding campaign to change their trading name from ‘Admiral Markets’ to ‘Admirals’

The company is regulated in other jurisdictions by Top-Tier financial regulators. Find details of the various regulations of Admiral Markets below:

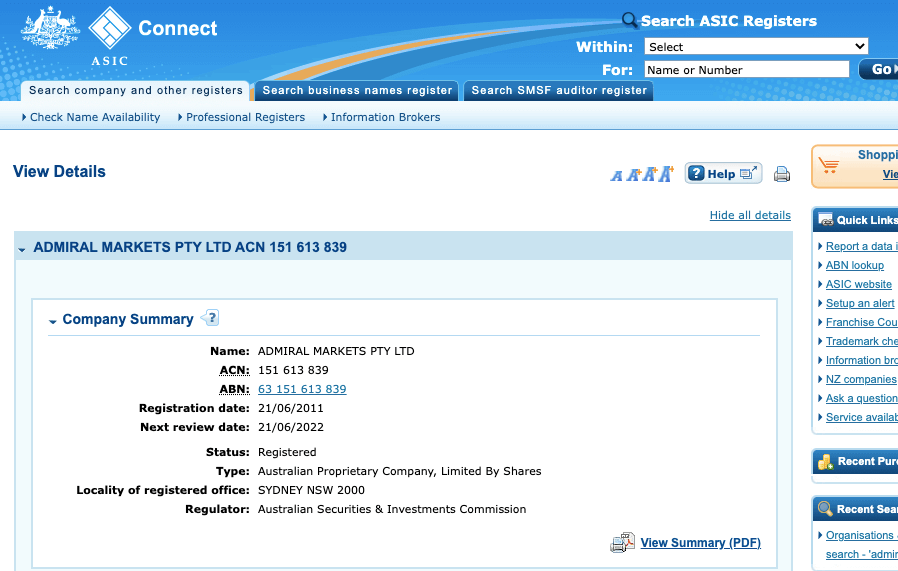

1) Australian Securities & Investments Commission (ASIC): Admiral Markets Pty Ltd is licensed in Australia by the ASIC to offer financial services, with ACN (Australian Company Number) 151613839, issued in 2011.

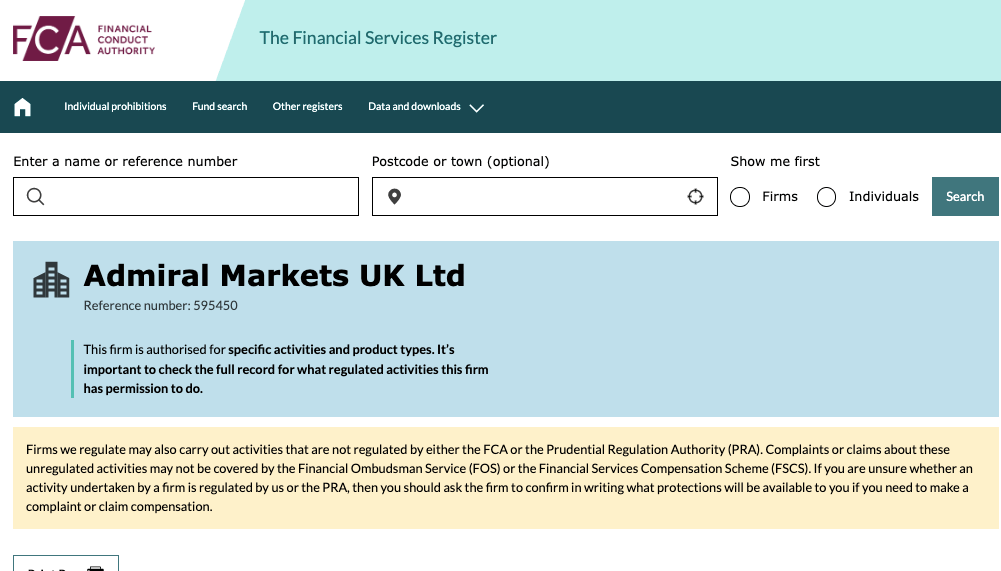

2) Financial Conduct Authority (FCA): Admiral Markets UK Ltd. is regulated by the FCA and authorized to offer financial services in the UK with reference number 595450, issued in 2013.

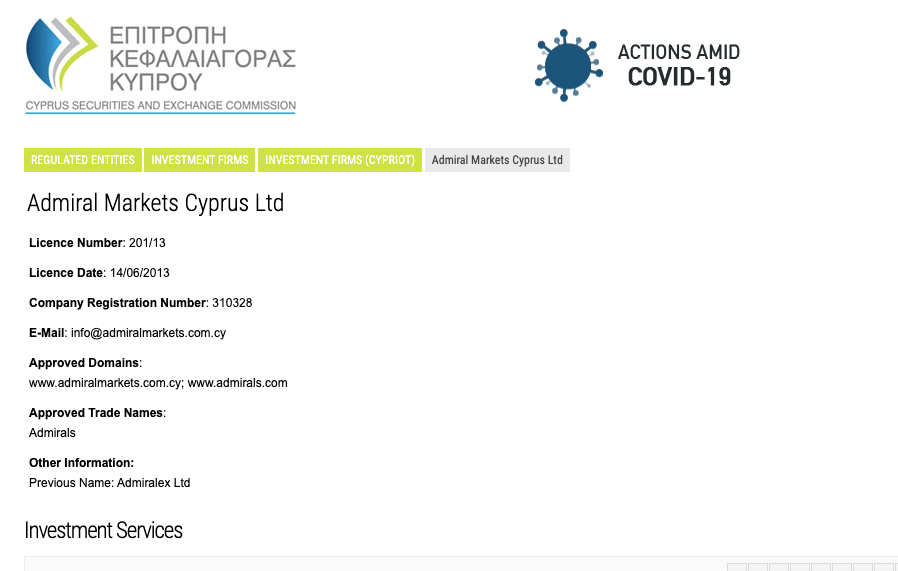

3) Cyprus Securities and Exchange Commission (CySEC): Admiral Markets Cyprus Ltd is licensed by CySEC to offer investment services in Cyprus, under the trading name Admirals, with license number 201/13, issued in 2013.

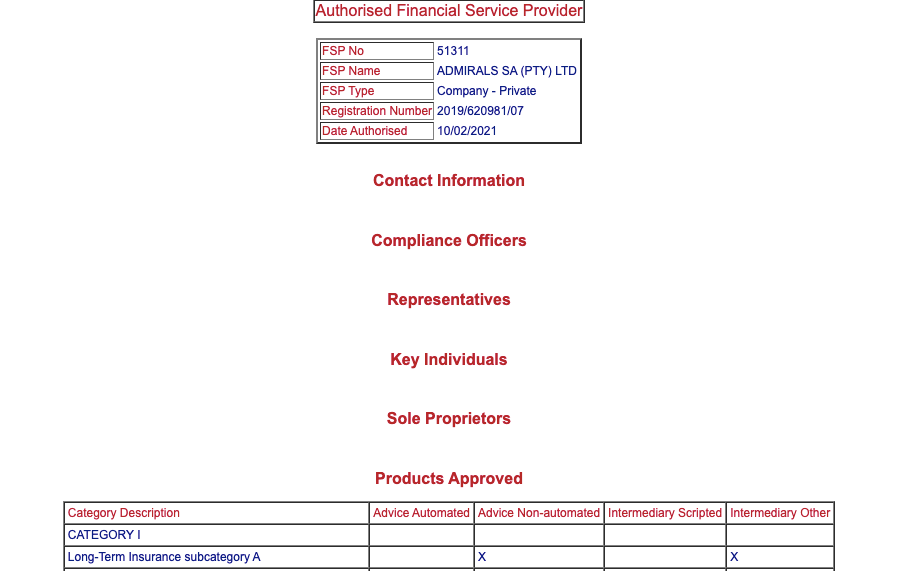

4) Financial Sector Conduct Authority (FSCA) in South Africa: Admirals SA (Pty) Ltd is authorized in South Africa by the FSCA to provide financial services with FSP (Financial Services Provider) Number 51311, issued in 2021.

5) Estonian Financial Supervision Authority (EFSA): Admiral Markets AS is licensed in Estonia as an investment firm by the EFSA. This license was issued in 2009 and permits them to offer their services to European Economic Area (EEA).

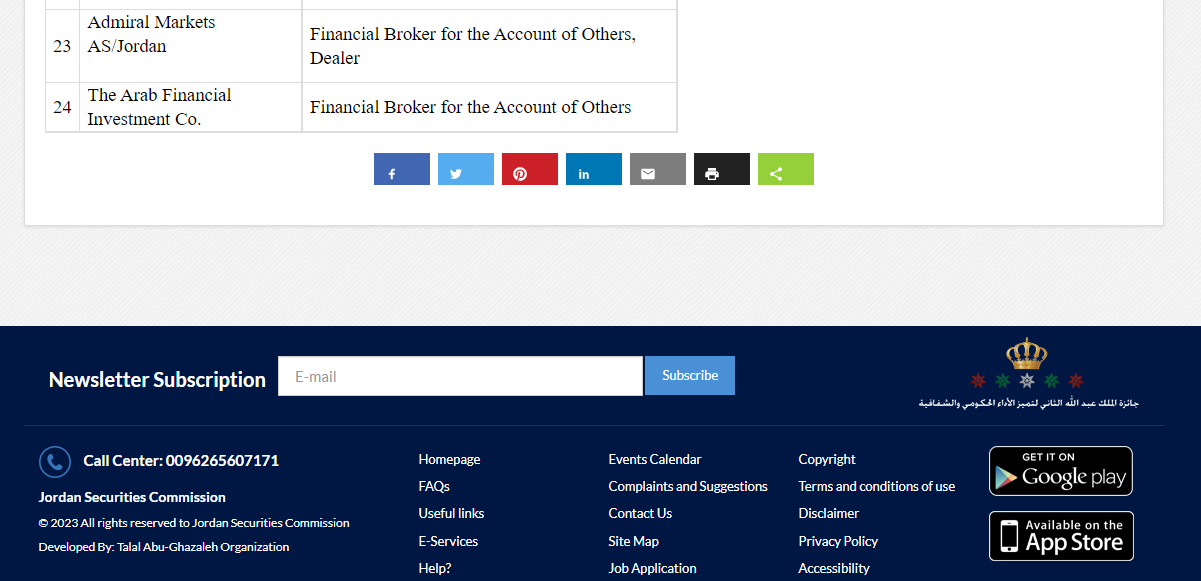

6) Jordan Securities Commission (JSC): Admiral Markets is also authorised and licensed to conduct business in Jordan as Admiral Markets AS Jordan Ltd. Their registration number is 57026 and the company is regulated in the Hashemite Kingdom of Jordan

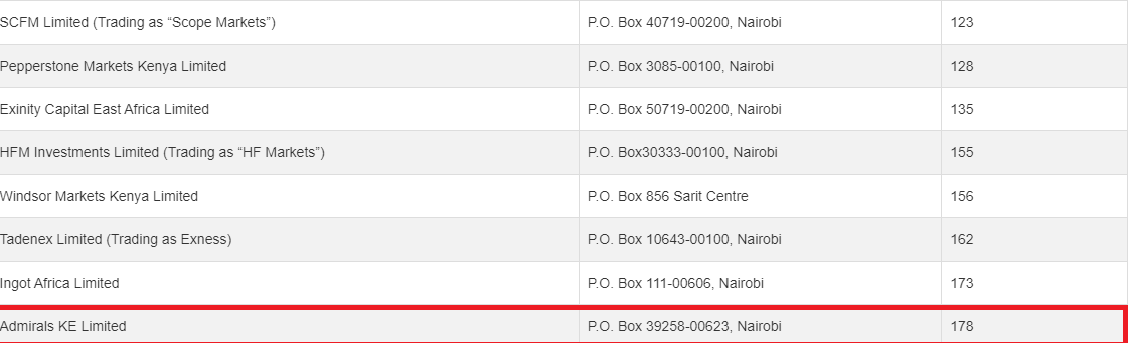

7) Capital Markets Authority (CMA): Admiral Markets have also added CMA regulation to their license. This allows them to provide financial services to traders based in Kenya as non-dealing online foreign exchange broker. Their registered name is Admirals KE Ltd with license number 178.

Admiral Markets Investor Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| UK | £85,000 | Financial Conduct Authority (FCA) | Admiral Markets UK Ltd |

| Australia | No Protection | Australian Securities and Investments Commission (ASIC) | Admirals AU Pty Ltd |

| EEA Countries | €20,000 | St Vincent and the Grenadines Financial Services Authority (SVGFSA) | Admiral Markets Cyprus Ltd |

All clients of Admiral Markets have protection from negative balance. ASIC protects Australian traders since Admiral Markets is regulated in Australia. However, there is no investor compensation plan that covers CFDs for now.

Admiral Markets Leverage

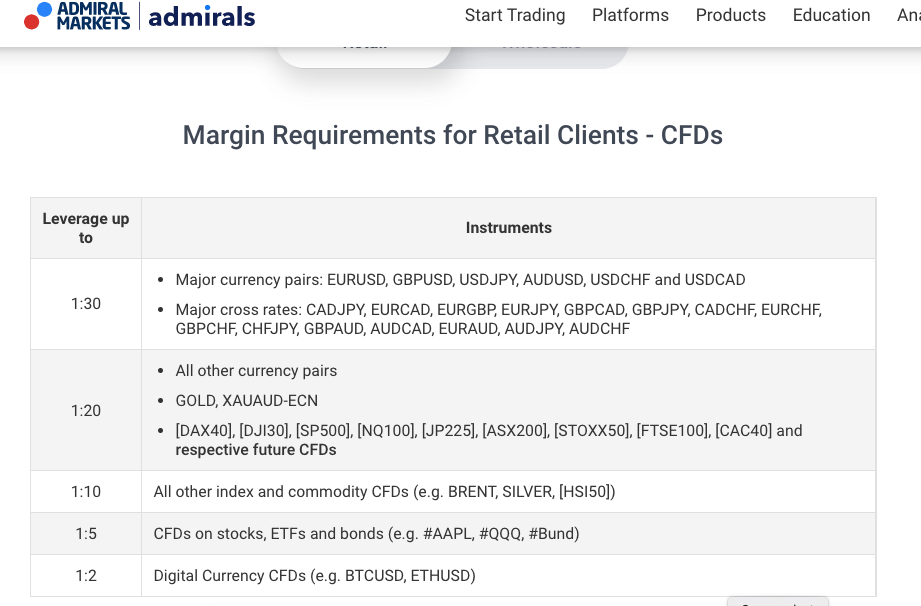

With a variable leverage system, the maximum leverage on Admiral Markets is 1:30 for retail clients, which means that you can open a position 30 times the size of your deposit.

For example, if you have a $1,000 deposit, you can open positions valued at up to $30,000 for Forex majors. The leverage is lower for other trading instruments.

If you want to trade with higher leverage, you can request to become a professional client and will be able to trade with higher leverage of up 1:500.

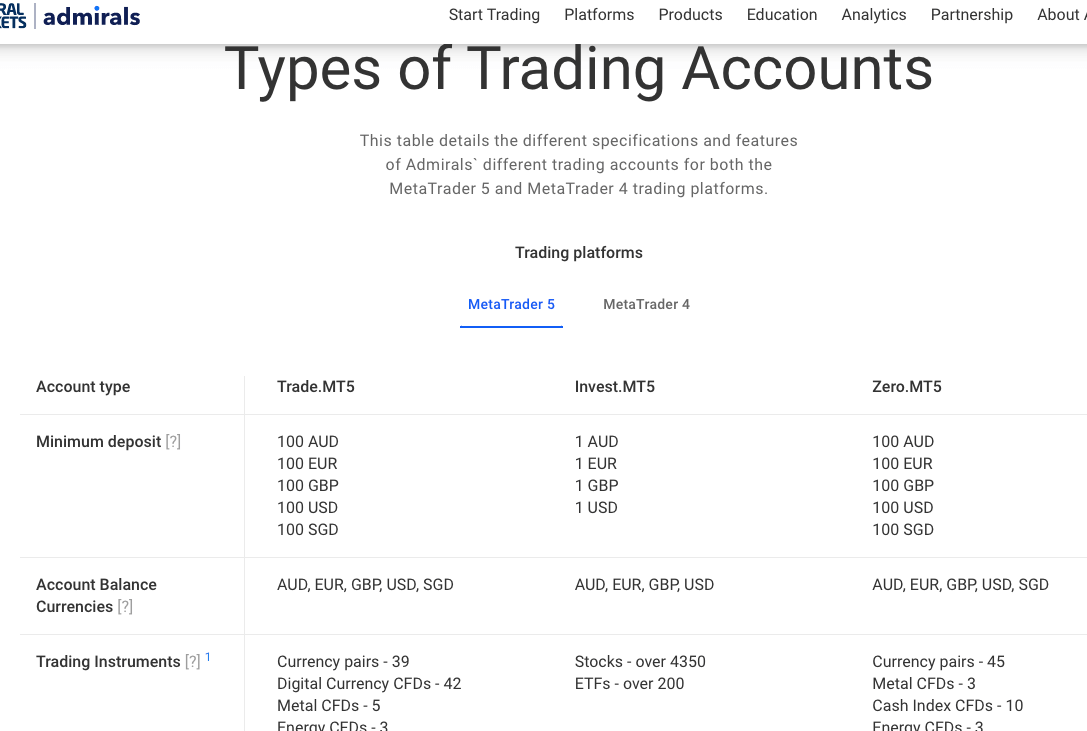

Admiral Markets Account Types

Admiral Markets offers 5 main account types with varying features depending on the trading platform you use and whether you are a retail trader or a professional trader.

When you first create an account on Admirals, you get assigned a retail account status by default, except you meet the criteria for a professional account. After registration, you can apply for an account upgrade to professional account status.

They also offer Islamic Accounts features to Muslim traders and demo accounts for new traders who are not yet familiar with the trading platforms.

Here is an overview of the account types on Admirals and their features.

1) Trade.MT5 Account: The Admirals Trade.MT5 is designed for the MetaTrader 5 trading application and holders of this account can trade currency pairs and CFDs on indices futures, cash index, commodities futures, metals, ETFs, bonds, energies, agriculture, cryptocurrencies and stocks.

This account does not pay any commission fees for opening or closing trade positions except when trading CFDs on shares and ETFs, in which case you will pay commission fees starting from $0.02.

Spreads on the Trade.MT5 Accounts start from 0.5 pips for major pairs and you pay swap fees for holding a position open overnight.

This account requires a minimum deposit of AU$100, with a minimum trade lot size of 0.01, a maximum number of open and pending orders capped at 500, and maximum leverage of 1:30

You have negative balance protection with the Trade.MT5 account, which means you cannot lose more than the money deposited into your trading account, even if a trade position is unsuccessful and you have a loss.

2) Zero.MT5 Account: The Admirals Zero.MT5 is also designed for the MetaTrader 5 trading application. This account allows you to trade currency pairs and CFDs on cash indices, metals, and energies.

Commission fees for opening or closing trade positions start from US$0.5 and can be up to US$3 per side lot, making it US$6 for a round turn. Spreads on the Zero.MT5 Accounts start from 0.0 pips and you pay swap fees for holding a position open overnight.

This account requires a minimum deposit of AU$100, with a minimum trade lot size of 0.01, a maximum number of open and pending orders capped at 500, and maximum leverage of 1:30.

You also have negative balance protection with the Zero.MT5 account, which means you cannot lose more than the money deposited into your trading account, even if a trade position is unsuccessful and you have a loss.

3) Invest.MT5 Account: The Admirals Invest.MT5 Account is designed for the MetaTrader 5 trading application. With this account, you can only trade ETFs and stocks.

Commission fees for opening or closing trade start from US$0.02 on Invest.MT5 Account spreads start from 0.0 pips and you pay swap fees for holding a position open overnight.

This account requires a minimum deposit of A$1, with a minimum trade lot size of 0.01, a maximum number of open and pending orders capped at 500, and maximum leverage of 1:30.

You do not have negative balance protection with the Invest.MT5 account, which means that if a trade position is unsuccessful and you have a loss, your trading account balance can run into a negative, and will be required to deposit some money to clear the negative balance.

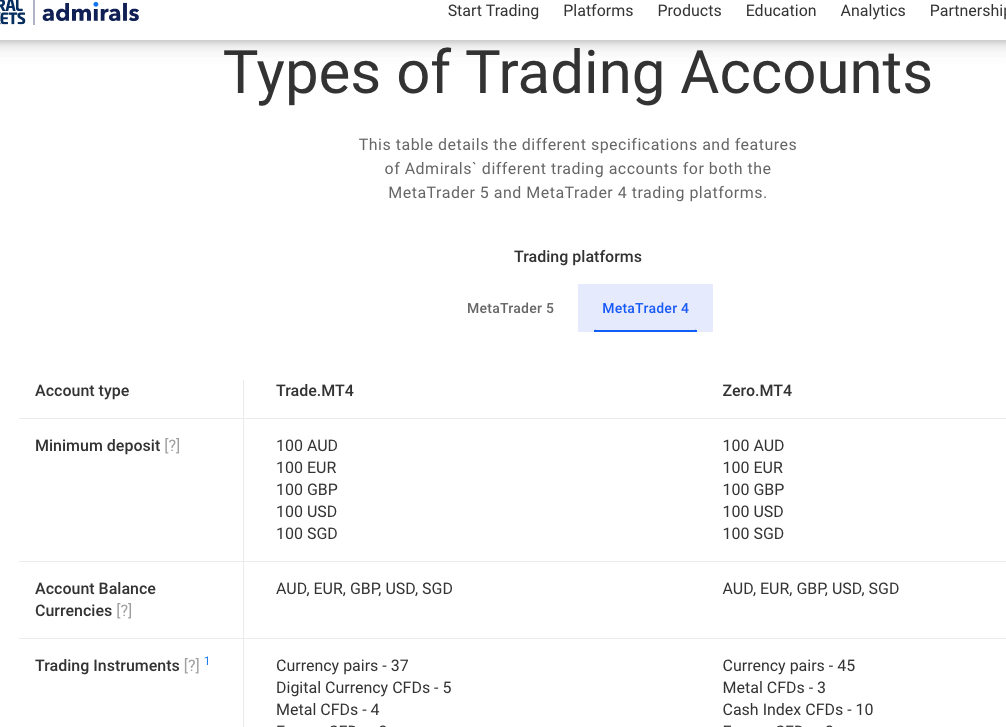

4) Trade.MT4 Account: The Admirals Trade.MT4 is designed for the MetaTrader 4 trading application and you can trade currency pairs, and CFDs on digital currencies, metals, energy, index futures, cash index, stocks, and bonds with this account.

This account does not pay any commission fees for opening or closing trade positions except when trading CFDs on shares and ETFs, in which case you will pay commission fees starting from US$0.02.

Spreads on the Trade.MT4 Accounts start from 0.5 pips and you pay swap fees for holding a position open overnight.

This account requires a minimum deposit of A$100, with a minimum trade lot size of 0.01, a maximum number of open and pending orders capped at 200, and maximum leverage of 1:30

You have negative balance protection with the Trade.MT4 account, which means you cannot lose more than the money deposited into your trading account, even if a trade position is unsuccessful and you have a loss.

5) Zero.MT4 Account: The Admirals Zero.MT4 is designed for the MetaTrader 4 trading application. This account allows you to trade currency pairs and CFDs on cash indices, metals, and energies.

Commission fees for opening or closing trade positions start from US$0.5 and up to US$3 per side. Spreads on the Zero.MT4 Accounts start from 0.0 pips for major pairs and you pay swap fees for holding a position open overnight.

This account requires a minimum deposit of A$100, a minimum trade lot size of 0.01, a maximum number of open and pending orders capped at 200, and maximum leverage of 1:30.

You also have negative balance protection with the Zero.MT4 account, which means you cannot lose more than the money deposited into your trading account, even if a trade position is unsuccessful and you have a loss.

6) Admirals Pro Account: The Admirals Pro Account is designed for professional traders who have experience trading financial instruments and trade large-size portfolios. You can signup for a Professional Account with Admirals during registration or request to have your retail account upgraded.

All account types offered on Admirals can be upgraded to professional status and you can access the professional traders’ features, such as higher leverage of up to 1:500, cash rebates and other bonuses, and negative balance protection is limited to AU$100,000.

To get an Admirals Pro Account, you must qualify as a Wholesale Client or Sophisticated Investor under the following criteria.

1) Wholesale Client:

You have to meet at least one of the conditions below to qualify for a Professional Account as a Wholesale Client.

- You have a net assets of at least AU$2.5 million;

- You have had an annual gross income of AU$250,000+ for the last 2 years.

- Prove knowledge of leveraged products via an online assessment.

2) Sophisticated Investor Conditions:

The following conditions have to be met for you to qualify for a Professional Account as a Sophisticated Investor.

- You have an annual gross income of AU$100,000 or savings & investments portfolio of more than AU$250,000.

- You have experience working in the financial services for at least 12 months in a professional position position or show proof of placing at least 20 qualifying trades (with notional value of AU$20,000 for equities and AU$50,000 for forex) per quarter over the last 5 years.

If you meet the conditions, contact the customer support team to upgrade your account. You will be required to submit additional documents to prove your claims before your application is approved.

7) Islamic Account: Admirals offers swap-free Islamic Accounts to Muslim traders who want to abide by the sharia law in their trading. The Islamic Forex Account is only available on Trade.MT5 account type, accessible on the MetaTrader 5 application only.

Both retail and professional traders can have Islamic Accounts and will be able to trade all instruments available for the Trade.MT5 Account with no increased spreads or commission fees.

Admirals Islamic Account holders will not be required to pay any swap fees for keeping a position open overnight for up to 3 days, after which they will be charged a flat administration fee each day. The administration fees vary according to the instrument traded, starting from $0.01 and up to $113.

Note that digital and exotic currencies have only one-day swap-free before you start paying administrative fees.

To open an Islamic Account on Admiral Markets, first signup a retail Trade.MT5 Account, then contact support to apply for the Islamic Account status. You will be required to submit additional verification documents upon your application.

Admiral Markets Base Account Currency

When opening a trading account with Admirals, you choose from up to 5 currencies to serve as your trading account base currency, they are Australian Dollar – AUD, British Pound Sterling-GBP, Euros-EUR, United States Dollars-USD, and Singapore Dollar – SGD.

Your trades, deposits, withdrawals, and account balance will be measured in your chosen account currency.

Admiral Markets Overall Fees

The fees on Admirals depend on the account type you have and the trading platforms. Find an overview of the trading and non-trading fees on Admiral Markets below:

Trading fees

1) Spreads: Admirals charge spread fees for trades which are the difference between the Ask and Bid price of instruments. Spreads are referred to as pips.

Spread fees vary depending on the instrument pair traded. Typical spreads on major pairs on Admirals are shown below:

| Instrument/Pair | Trade.MT5/MT4 Account | Zero.MT5/MT4 Account |

|---|---|---|

| EUR/USD | 0.6 pips | 0.1 pips |

| GBP/USD | 1 pip | 0.6 pips |

| EUR/GBP | 1 pip | 0.6 pips |

| Gold | 0.20 pips | 0.15 pips |

2) Commission fees: Admirals charge commission fees for opening and closing trade positions on all account types. Although the Trade.MT5 and Trade.MT4 charges commission fees for only CFDs on shares and ETFs, while other instruments on the accounts are commission-free.

Commission fees on Admirals start from $0.02 to $3 per 1 standard lot of trade.

3) Swap fees: Whenever you hold a trade position open for more than 24 hours or overnight, that is 11:59 PM UK time, you are charged a swap fee which is added to your profit or loss on your trade whether a short (sell) position or you trade was a long (buy) position.

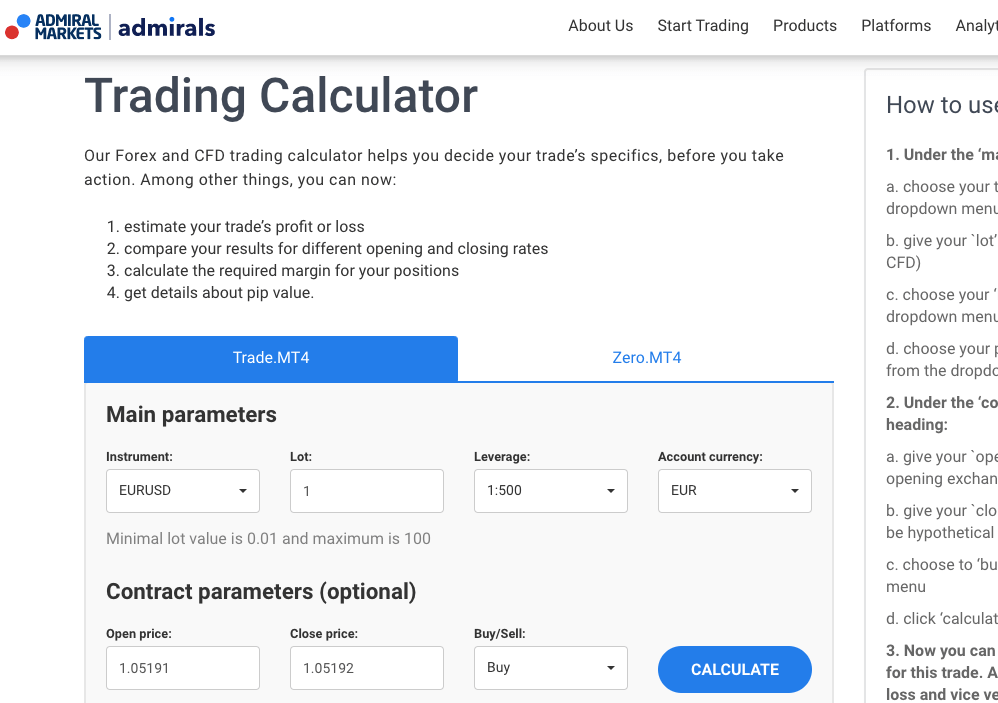

Islamic Accounts do not pay any swap fees, and you can calculate your swap fees using the calculator on the Admirals website.

Non-trading fees

1) Deposit and Withdrawal fees: Admirals offers free deposits for all payment methods. Admirals offer 1 free withdrawal each month for all payment methods, after which subsequent withdrawals to bank accounts attract a fee of AU$15 per transaction and AU$1 for e-wallets (Skrill & Neteller).

2) Account Inactivity charges: Admirals charge inactive account fees if you do not trade or log in to your trading account for 24 months (2 years), a dormant account fee of €10 per month will apply.

If you do not have any funds in the account, no fees will be charged, so you won’t accrue a negative balance.

| Fee | Amount |

|---|---|

| Inactivity fee | €10 |

| Deposit fee | None |

| Withdrawal fee | None* |

*After your first withdrawal in month, which is free, there is 1% commission for subsequent withdrawal requests. This applies to Skrill, and Neteller. For bank transfers, it is A$15 for subsequent withdrawals.

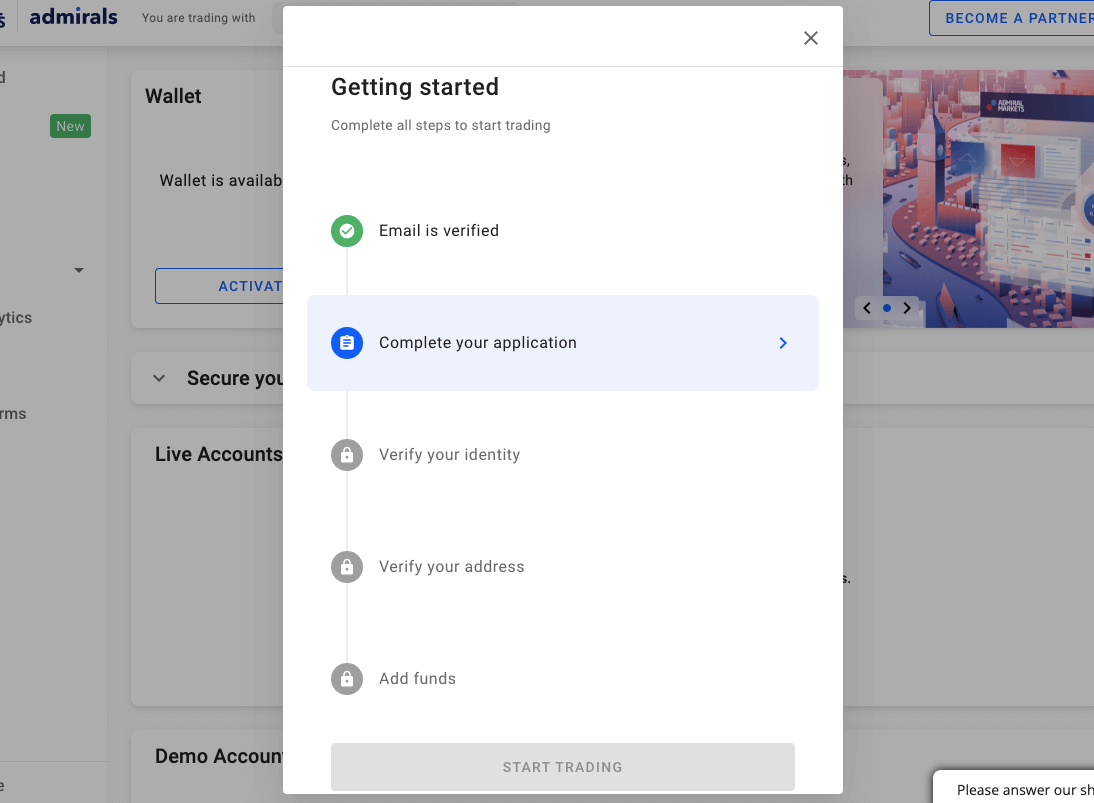

How to Open Admiral Markets Account in Australia?

Follow these steps to open a trading account on Admiral Markets.

Step 1) Go to the Admiral Markets website homepage at www.admiralmarkets.com and click on the blue ‘Trade now!’ button at the page center or the green ‘REGISTER’ button at the top right corner of the page.

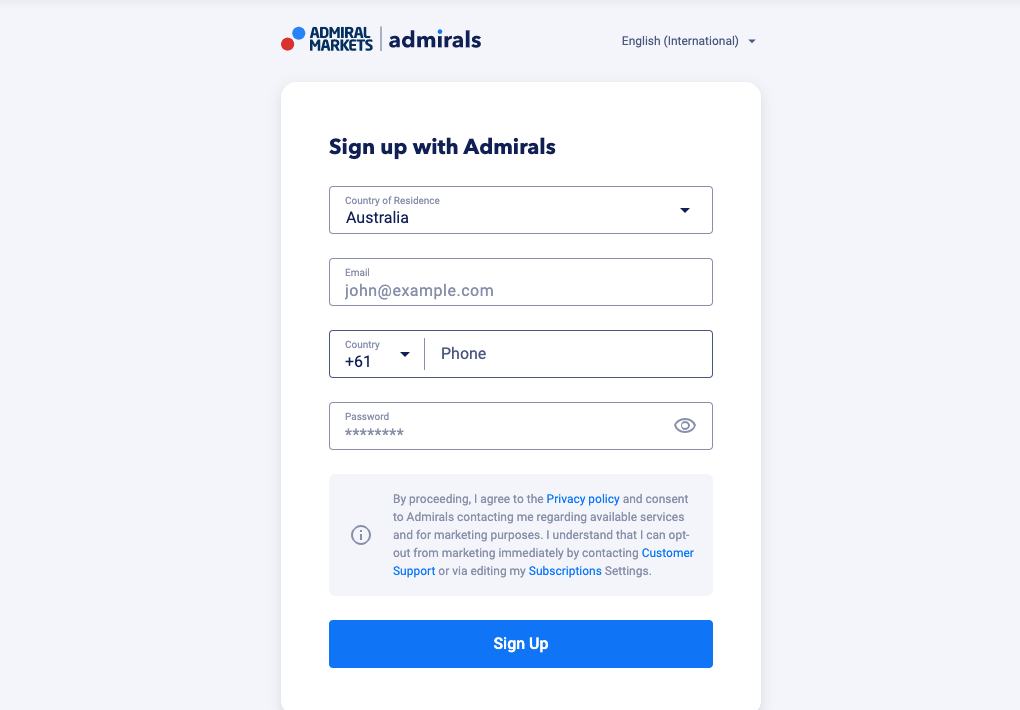

Step 2) Fill out your email address and phone number, create a password then click on ‘Sign Up’.

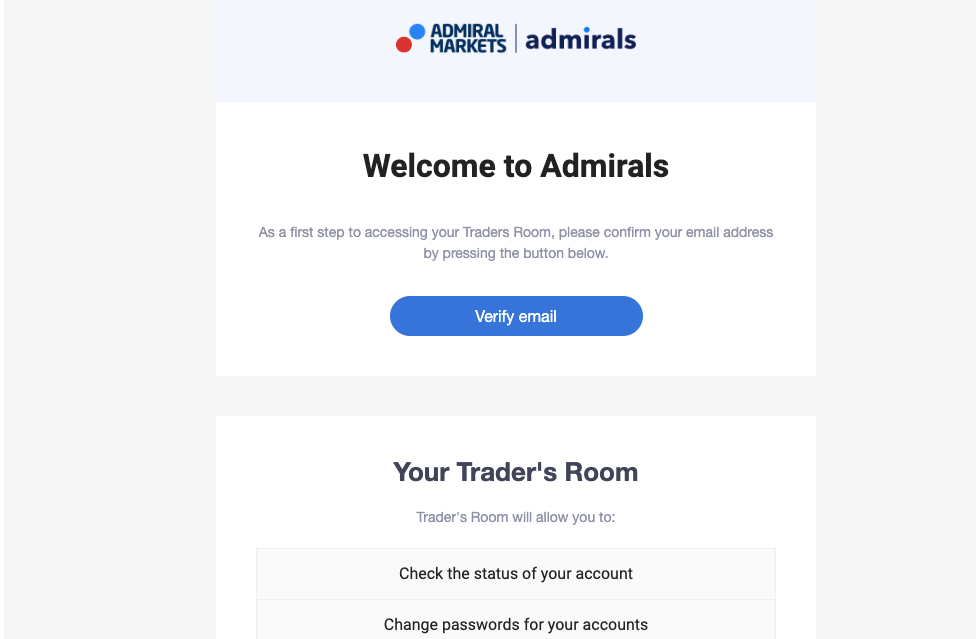

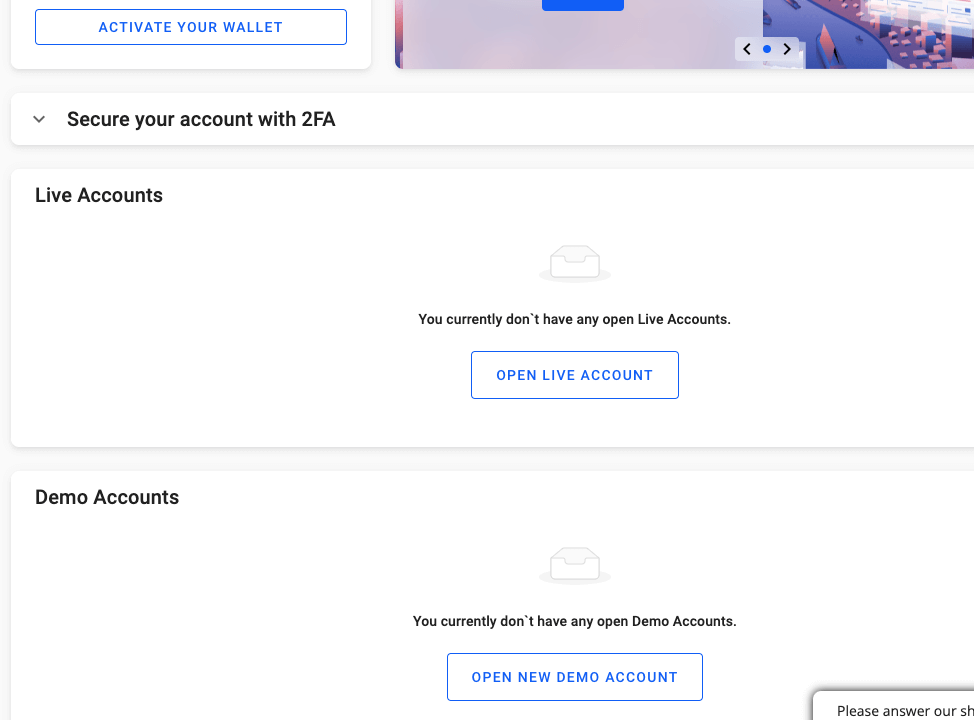

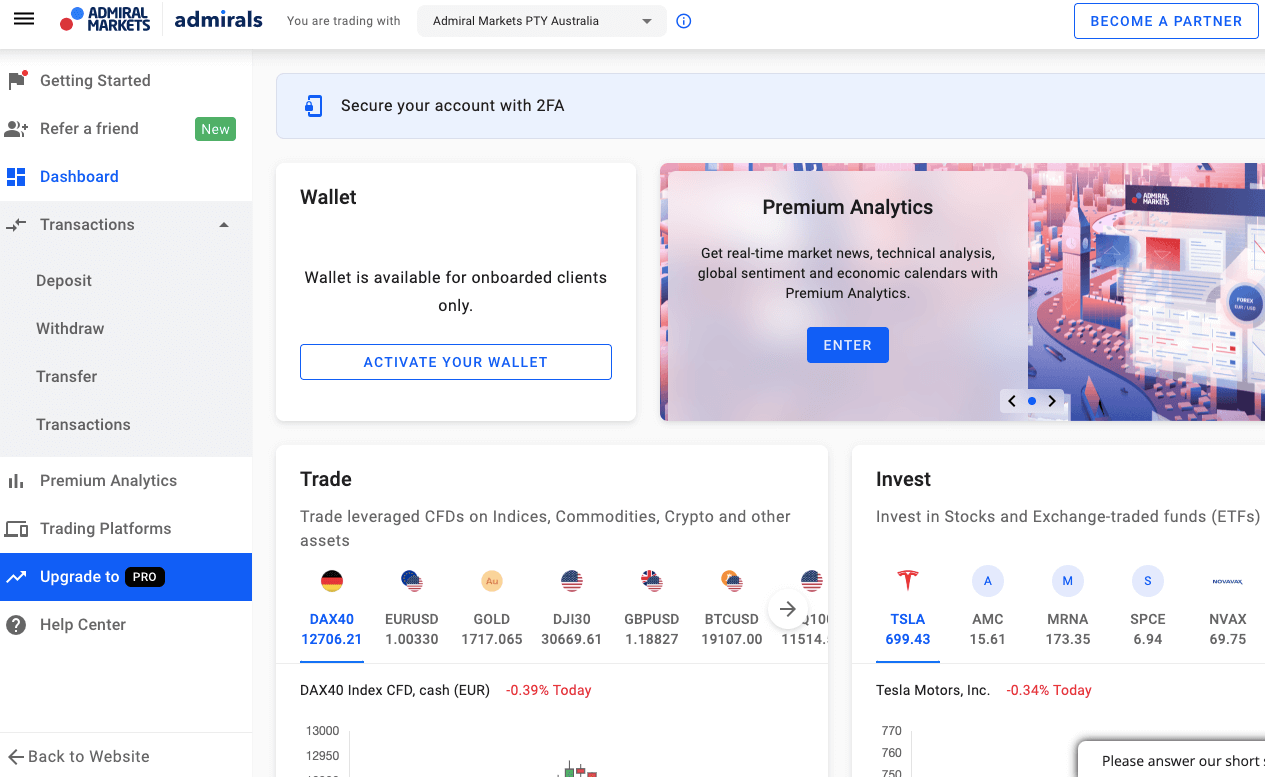

Step 3) Go to your email inbox and click on ‘Verify email’ in the email from Admirals. This will take you to the Admiral dashboard.

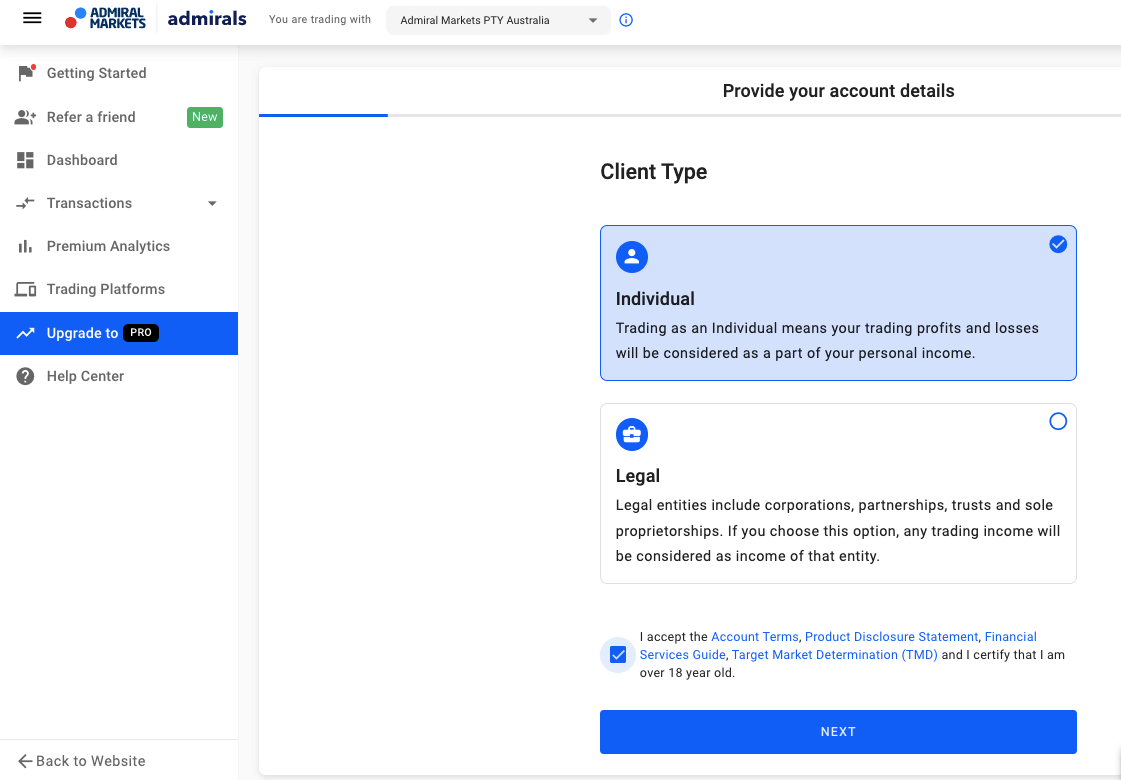

Step 4) On the dashboard, click on ‘Complete your application’, and select your preferred account type whether the individual account or joint account (legal), then check the box to agree to the terms and conditions and click ‘NEXT’

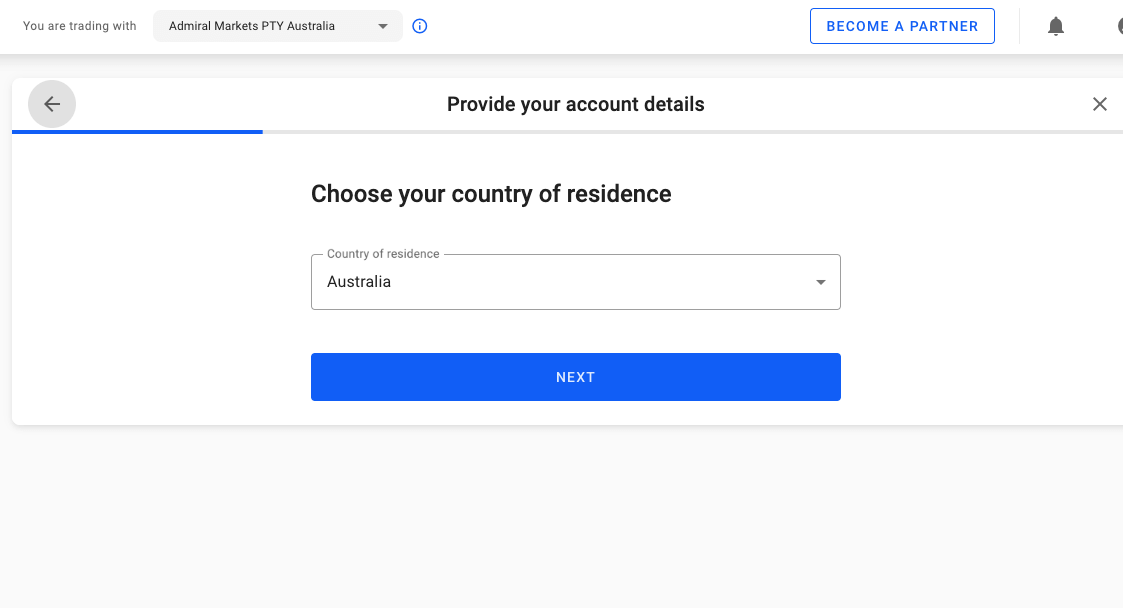

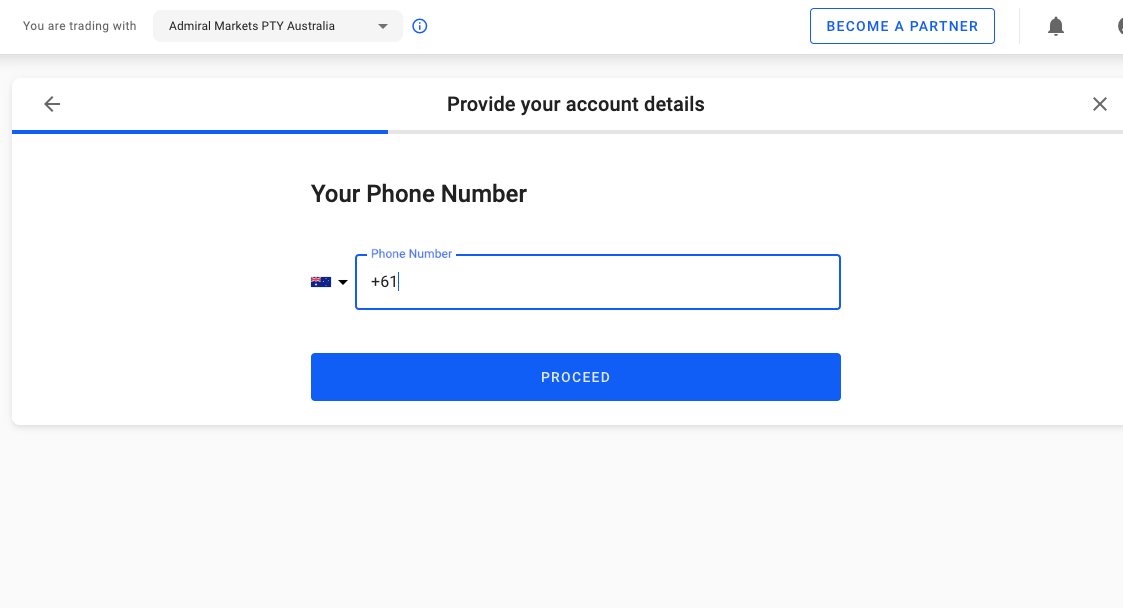

Step 5) Select your country of residence and click ‘NEXT’ then Confirm your phone number and fill out your full name, address, and date of birth.

Step 6) You will need to answer some questions about your trading experience, financial status and employment status.

Step 7) You will need to activate your wallet by uploading identity and address documents.

Step 8) Create a live trading account, then make deposits and you can start trading. You can also choose to create a demo account at this stage and get familiar with the trading platform.

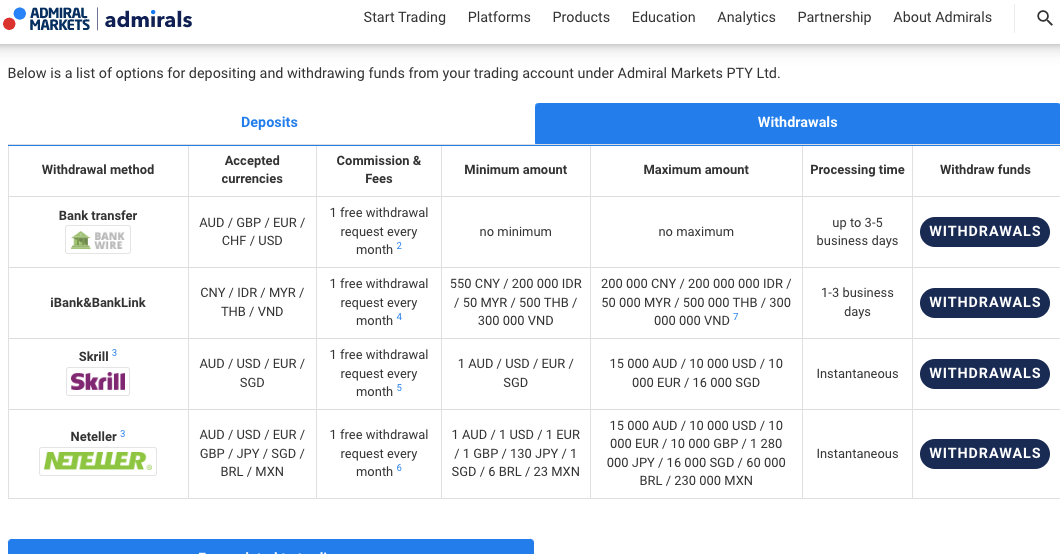

Admiral Markets Deposits & Withdrawals

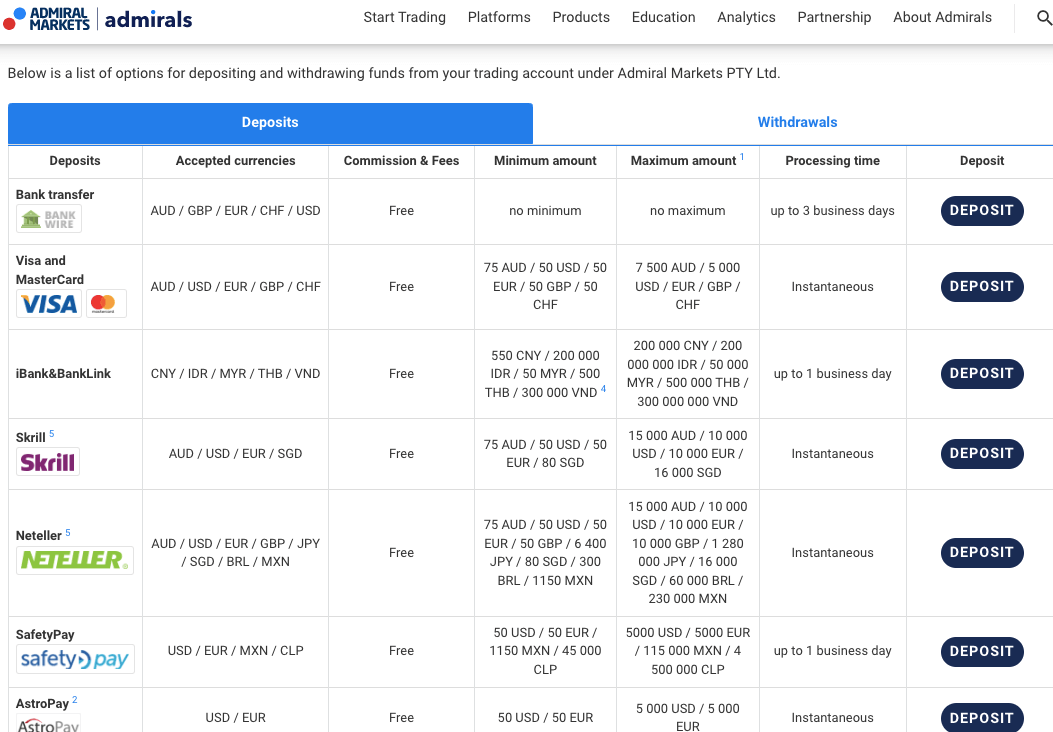

Admirals’ payment methods for deposits and withdrawals are bank transfers, cards, and e-wallets (Skrill, Neteller, and Poli).

Find details of the deposits and withdrawals on Admiral Markets below.

Admiral Markets Minimum Deposit

The minimum deposit on Admirals is dependent on your account type and payment method. Although the recommended minimum deposit is AU$100, bank transfers have no minimum deposit and the minimum deposit is AU$75 with cards and e-wallets.

Deposits via cards and e-wallets are credited instantly while it takes about 3 business days for bank transfers to be credited.

How do I deposit money into Admiral Markets?

Follow these simple steps to deposit funds into your Admirals Account:

Step 1) Log in to your Admirals Trading Room (dashboard) via www.admiralmarkets.com/login.

Step 2) Once your dashboard loads, click on the ‘Transactions’ tab on the left side menu, then select ‘Deposit’ and follow the on-screen instructions to complete your deposit.

Admiral Markets Minimum Withdrawal

The minimum withdrawal amount on Admirals is A$1 for cards and e-wallet withdrawals which are processed instantly. Bank transfers have no minimum amount, and withdrawals to local bank accounts are processed within 3-5 business days.

How to withdraw money from Admiral Markets

Follow these simple steps to withdraw funds from your Admirals Account:

Step 1) Log in to your Admirals Trading Room (dashboard) via www.admiralmarkets.com/login.

Step 2) Once your dashboard loads, click on the ‘Transactions’ tab on the left side menu, then select ‘Withdraw’ and follow the on-screen instructions to complete your withdrawal.

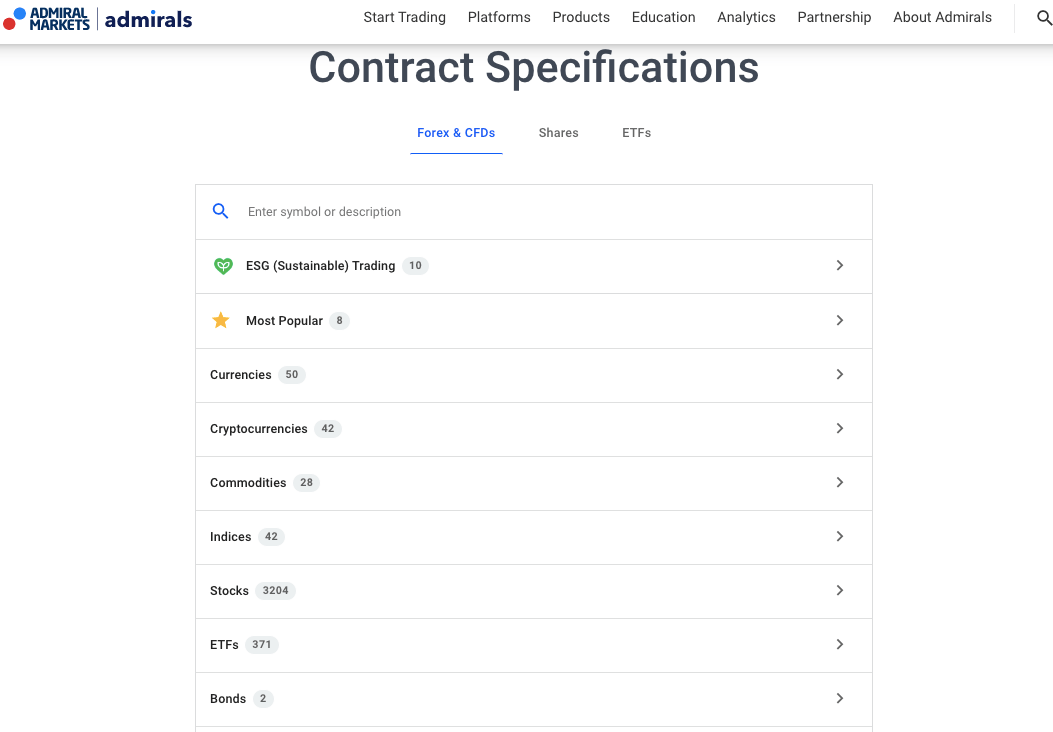

Admiral Markets Trading Instruments

You can trade over 3,000 instruments on Admiral Markets, depending on the account type and trading platform you choose. Here is a breakdown of the financial instruments on Admirals.

| Instrument | Availability | Number |

|---|---|---|

| Forex | Yes | 50 currency pairs on Admiral Markets (5 majors, 23 minors, and 22 exotics) |

| Commodities | Yes | 28 commodities on Admiral Markets (Energies, Metals, Agricultures and futures) |

| ETFs | Yes | 371 ETFs on Admiral Markets (Germany (Xetra), UK (LSE), and others) |

| Indices | Yes | 42 cash and futures indices on Admiral Markets (DAX40, NQ100, SP500, UK100, and others) |

| Stocks | Yes | 3,204 stocks on Admiral Markets (US(NASDAQ), UK(LSE), France(Euronext), and others) |

| Bonds | Yes | 2 Bonds Futures on Admiral Markets (10-year Germany bund and US 10Yr T-Note) |

| ESG (Sustainable) Trading | Yes | 10 ESGs on Admiral Markets (Vanguard ESG, NVIDIA Corp, and others) |

| Cryptocurrencies | Yes | 42 cryptocurrency pairs on Admiral Markets (Including BTC, XRP, ETH, and others) |

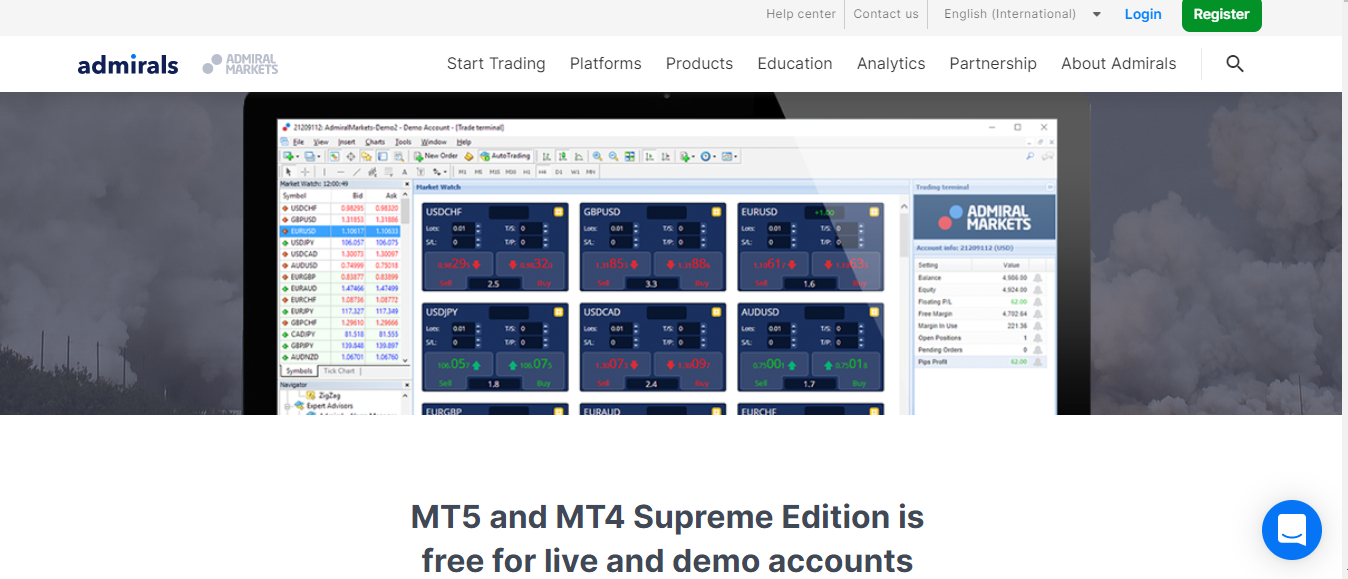

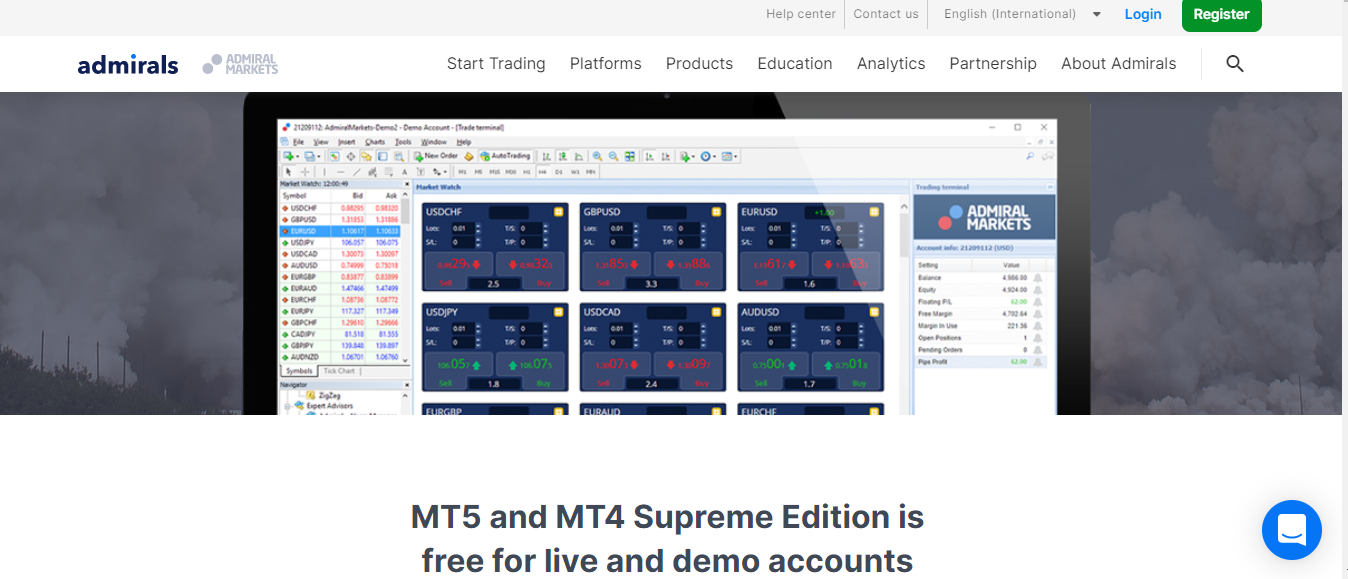

Admiral Markets Trading Platforms

Trading platforms supported by Admirals are:

1) MetaTrader 4 and MetaTrader 5: Admirals support the MT4 and MT5 trading platforms and you can trade on them via webtrader, desktop, and mobile devices (android & ios). Admiral Markets also developed a MetaTrader Supreme Edition that is available for MT4 and MT5

This version of MetaTrader is indeed supreme because of the free trading tools added to it which are not available on the normal MT4 and MT5. These tools are very useful and can help your trading in different ways. For example, the Supreme Edition is connected to Trading Central which automatically identifies popular chart patterns.

There is also the global opinion widget that you can use to determine general market sentiment (bearish or bullish) in a glance.

2) Admirals Mobile App: Admirals has their own proprietary mobile app for trading Forex and CFDs that you can download from the Apple App Store, Google Play Store, or Huawei App Gallery.

Admiral Markets Trading Tools

1) StereoTrader: StereoTrader is a MetaTrader trading panel. It comes with advanced functions that increases trading efficiency. It accommodates all trading styles thereby making it cross-functional. Its tools are not limited to any trading strategy.

When you open a live account with Admiral Markets, you get monthly access to StereoTrader without extra charges.

2) MetaTrader Supreme Edition: The MetaTrader Supreme Edition has advanced trading tools for better trading experiences. It is available on Admiral Markets’ MT4 and MT5. Even better, you can use the plugin on both live and demo accounts.

This advanced MetaTrader contains tools like the global opinion, mini-terminal, trade terminal, tick chart trader, and the indicator package. All of these tools also have sub-tools under them.

i) The global opinion contains widgets that help you maximize subtle but significant changes in the market. It reduces the times you spend on research, and gives you a perspective of global sentiments.

ii) The tick chart trader is an application that shows tick charts in different chart styles. Unlike normal charts, it does not show historical data or price movement. It only shows price movement from the time you open it.

The tick chart allows you to place trade faster with your keyboard or your mouse. The five chart styles available on the tick chart trader.

iii) The indicator package is a group of 8 advanced indicators. These include candle countdown, chart group, day session, free-hand drawing, high-low, order history, pivot points, and renko chart.

These indicators are exciting to use. For example, the candle countdown shows you a countdown of when the next candle on your chart will be formed, depending on your timeframe.

3) Virtual Private Server: Known as VPS for short, the virtual private server allows you to access a Windows environment on any device. You can use it to run Windows on any device of your choosing regardless of time and location.

How does this help your trading? It is simple. Virtual access to windows gives you quick access to newest editions of MT4 and MT5.

To get the VPS, you must sign up with Admiral Markets with a minimum of €5000 in your live trading account.

Admiral Markets Copy Trading

You can join Admiral Market copy trading as a provider or a subscriber. Providers offer signal services to subscribers. As a subscriber, you get to follow the most profitable for a fee. You also get to join a community of traders and investors so you can get a lot of support.

Admirals also have a unique risk management in their copy trading service. You can set your stop loss, take profit, and copy ratio limits. With these, you do not have to worry about the risks that might come from the provider you are copying.

Admiral Markets’ Order Execution Policy

In obtaining the best outcome for traders, Admirals exercise their judgment based on different factors. The first factor is total consideration. This factor considers the sum of all the costs incurred in executing trades. The main thing to note here is that Admirals ensure that there is due regard to the market price of the underlying product of the CFDs you trade.

Another factor considered is the speed of execution. Admirals ensure that the speed of execution by their liquidity providers and other execution venues is consistent. Slow execution increases the probability of slippage beyond minimum levels. To tackle this, Admirals stop using any liquidity provider with persistently delayed execution.

Another factor connected to the speed of execution is price improvement and slippage symmetry. This factor involves you getting a better price even if the market has moved against your order at the requested price. To make sure that you benefit from this, Admirals make sure they only use liquidity providers that do not offer price improvement. Furthermore, liquidity providers with persistent asymmetric slippage(that is, the price that has moved against your order) problems are no longer considered for use.

The likelihood of execution is also a key factor in Admirals’ policy. This factor is about the rejection of trades. Execution venues and liquidity providers might not execute trades at the first request. This may lead to issues like requotes of price. Admirals stop using liquidity providers with high rejection rates that are not addressed in a timely manner.

Admirals are straight-through-processing (STP) broker. They transmit your orders to third parties for execution. Though the conditions with the third party may not align with their execution policy, Admirals ensure the best execution of trades for their clients. However, the best execution is not guaranteed for every brokered trade.

Admiral Markets Education

Here are the learning channels provided by Admirals

1. Courses: Admirals offer two courses – Forex 101 and Zero to Hero. Forex 101 is the most recent of the two. It is divided into beginner, intermediate, and advanced levels. The training course contains videos, notes, and quizzes for effective learning.

Zero to Hero is a 20-day course. It contains 20 videos on forex trading that takes up from set-up to execution. It begins with technical and fundamental analysis and ends at application to real trade. There are also Q and A with live sessions.

These two courses are offered by Admirals free of charge.

2. Articles and Tutorials: This section contains articles for different levels of trading expertise and tutorials. Trading tips, psychological tricks, currency market analysis, strategies, etc can be found here. Forex basics, indicators, and ETFs are one of the many topics covered.

3. Glossary: Admirals have a glossary that is easy to navigate. The glossary is organized in alphabetical order with a search bar for easy navigation. It covers the definition of terms that you need to understand in forex trading.

4. Forex and CFD Webinars: Admirals’ webinar section is well structured. At first glance, you will see all the upcoming webinars, the topics, and when they will take place in your local time. Renowned and successful traders are the major speakers on these webinars.

5. E-book: Admiral Markets have one e-book under their education section. The book is titled ‘Blockchain Basis’ by Alexander Tsikhilov. He is the co-founder and President of the international Admiral Markets Group. The book explains blockchain technology in a clear and concise manner. The history and description of the technology are also covered. To get the book, you will need to have a real trading account with Admiral Markets.

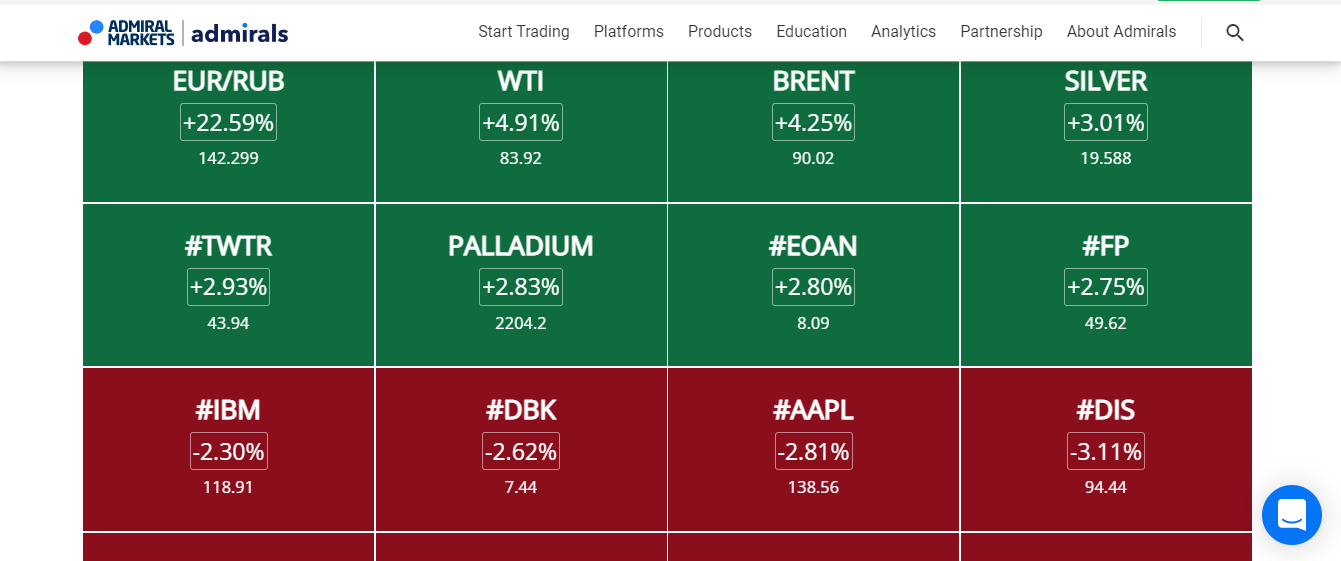

6. Analytics: Admirals Analytics aims to help traders in research. It contains a forex calendar for tracking fundamental events, weekly trading podcasts, and trading news. There are also helpful tools like the Market Heat Map displayed below. It shows the direction of financial instruments coupled with graphs and data analysis.

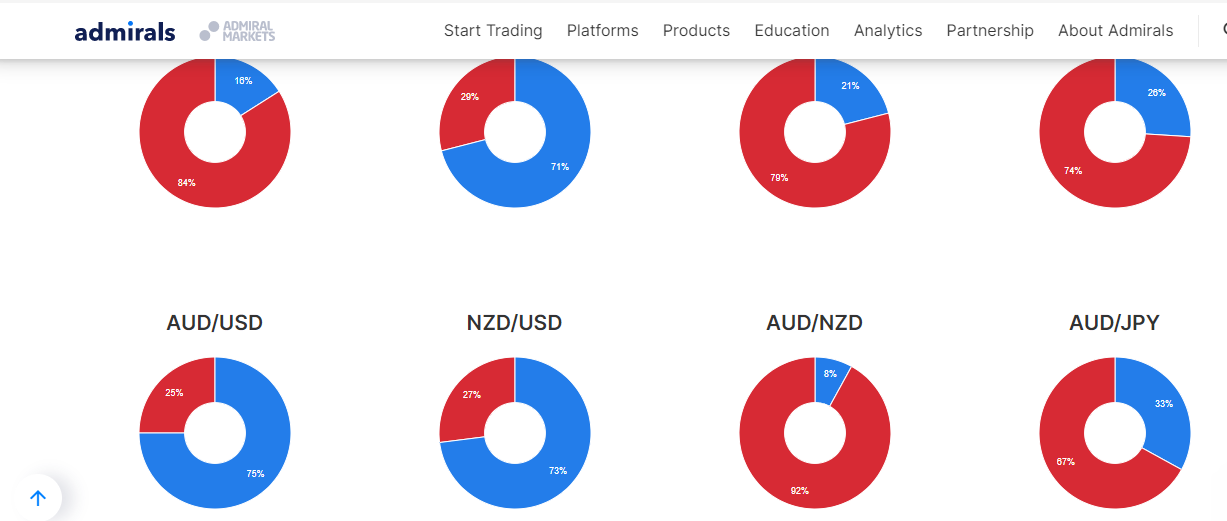

In addition, there is a tool that helps you monitor the bias of traders in the market. It is called Market Sentiment. Admiral Markets uses data gathered from multiple trading providers in partnership with FXBlue to create charts. These charts show if buyers or sellers are dominating a particular currency pair. Here is how it looks.

You can use this tool on major, commodities, and even minor currency pairs. However, you have to note that the sentiments are only indicative. They are not trading advice though they are updated in real-time.

7. Webinars: Admiral Markets webinars are designed by experts to develop your trading skills. The webinar library covers a wide range of forex trading topics that will make you a better trader. From Admiral Markets website, there is a link that leads to past webinars so you do not miss a thing. The link will lead you to Admiral Markets’ YouTube channel where past webinars are uploaded.

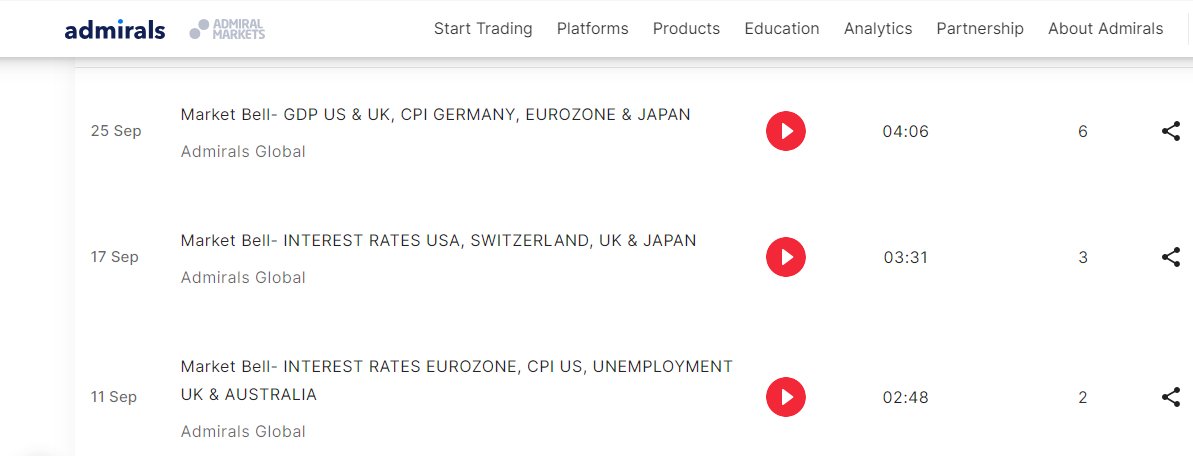

8. Weekly Trading Podcasts: You will be able to listen to engaging podcasts on a weekly basis on Admirals podcast channel. Trading news and analysis are also available when possible. New podcasts are available weekly (every Monday) covering different topics, economic events, and trading strategies.

Admiral Markets Australia Customer Service

Admirals offer online customer support to traders via the following channels:

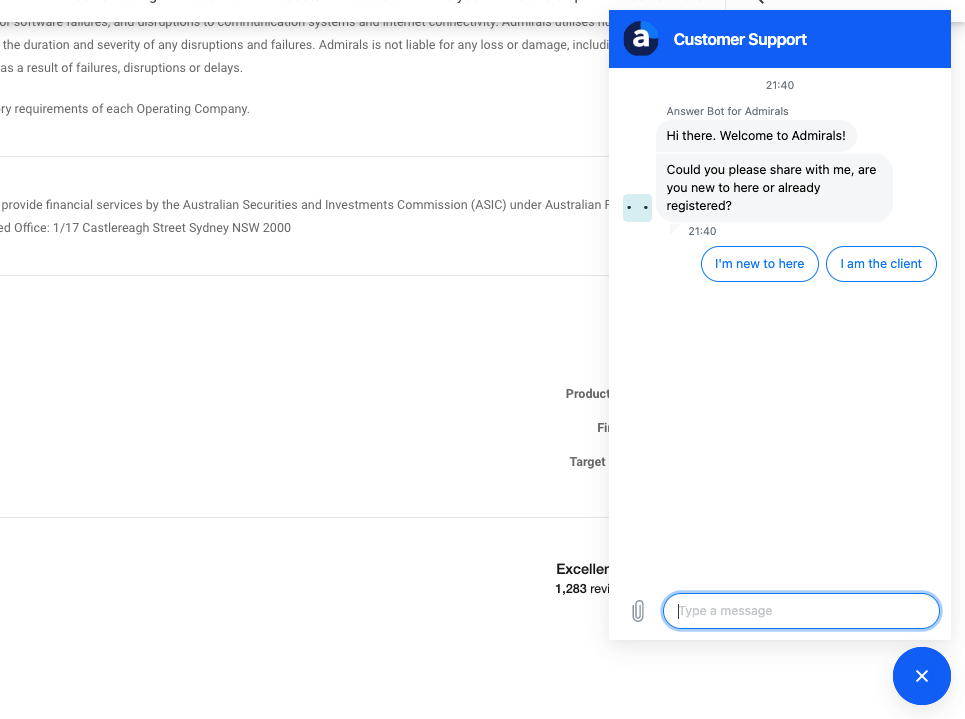

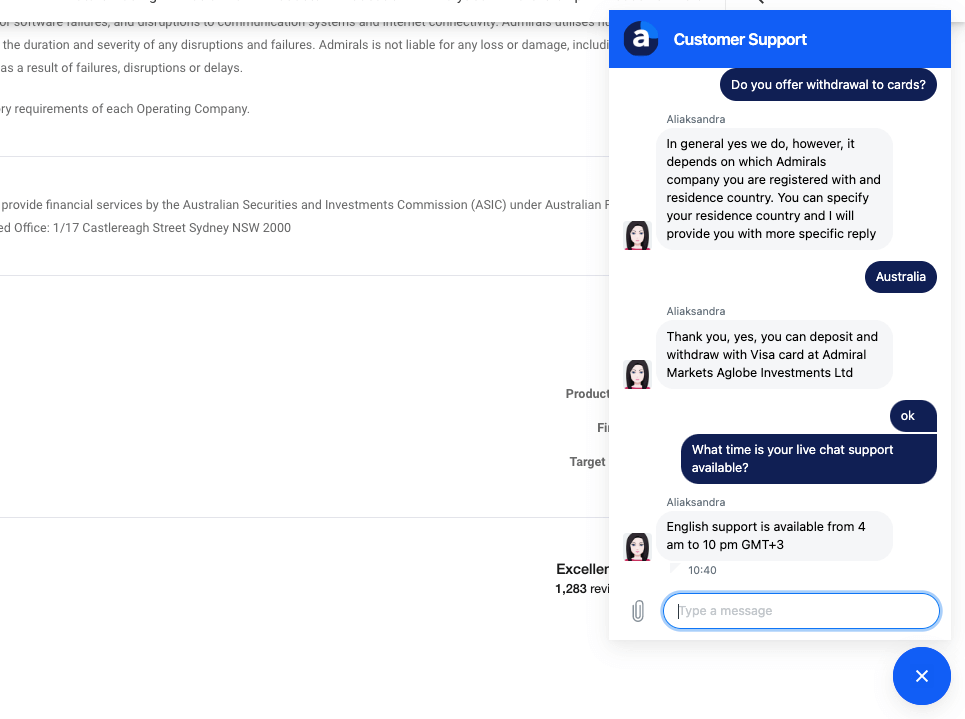

1) Live chat support: Admirals’ live chat support can be accessed via their website and is available during business hours from Monday to Friday (4 am to 10 pm GMT+3).

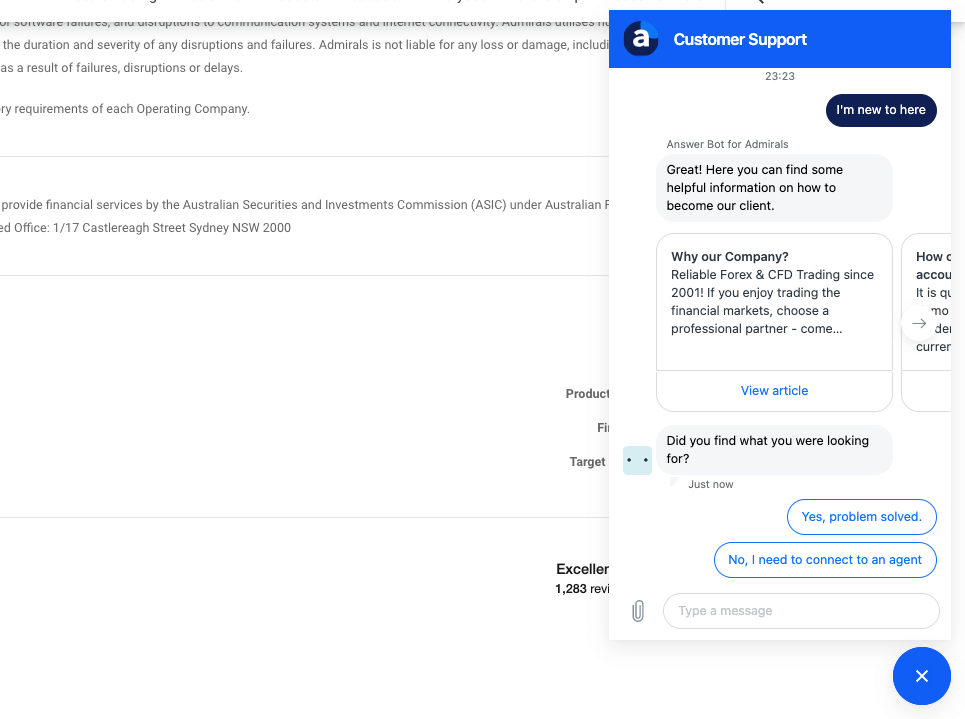

When our team tested it, the wait time was under 2 minutes and the answers to our questions were relevant. When you first click on the live chat button, you can type in your question, and the chatbot (Answer Bot for Admirals) will suggest related articles with possible answers.

To chat with a live agent, select the suggestion that says connect to an agent, then supply your name and email to start chatting with a live agent.

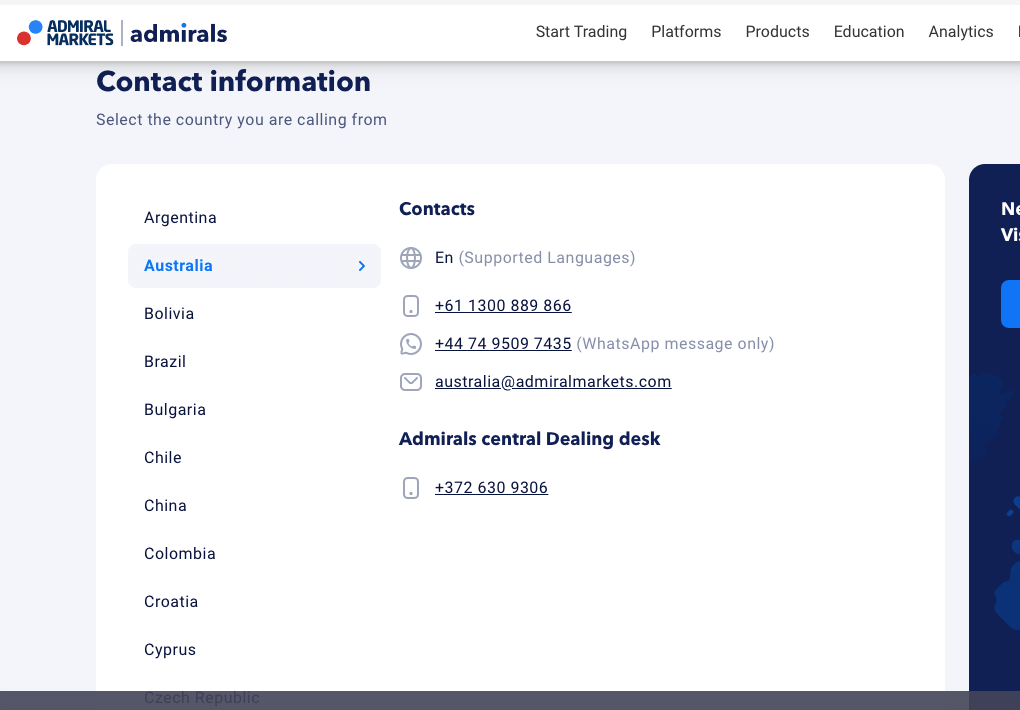

2) Email support: Admirals offers email support to clients which is available during working hours. The email address for Admirals customer service in Australia is [email protected] or [email protected].

Our team tested the Admirals’ email support, and we got a response after more than 90 minutes and the answers to our questions were relevant.

3) Phone support: Admirals offers phone support to Australian traders, with a dedicated phone line that is available during working hours on business days. The Admirals Australia phone number for customer support is +61 1300 889 866.

You can also reach Admiral Markets WhatsApp support via +44 74 9509 7435 or call the international phone support line on +372 630 9306.

Do we Recommend Admiral Markets Australia?

Admiral Markets is regulated in Australia by ASIC and by other Top-Tier financial regulators like the UK FCA, CySEC in Europe, and FSCA in South Africa, this makes them low-risk and safe for trading as they are compliant with rules to protect clients’ funds.

The broker offers multiple account types for you to choose from including the professional status and swap-free Islamic Account. You also have access to a relatively wide range of tradable instruments depending on your account type.

The fees on Admiral Markets are moderate, although there are some brokers that offer commission-free trading and unlimited free deposits and withdrawals. They also charge inactive accounts only after 24 months and you can avoid this by withdrawing all the funds in your account

The customer support of Admirals is not so good, as they are not available for 24 hours on any day, and their email support is relatively slow. The account opening on Admirals is a bit complicated, although they make up for this with a detailed website and FAQ section that answers many questions through articles.

We recommend that you try Admiral Markets after reading this review and checking the website to see if it meets your trading needs.

Admiral Markets Australia FAQs

How long does Admiral Markets withdrawal take?

The time it takes to receive funds after requesting a deposit depends on the payment method used. On Admirals, it takes 3-5 business days to receive withdrawals to local bank accounts while cards and e-wallet withdrawals are processed instantly.

Can you trade stocks on Admiral Markets?

You can trade stocks on Admiral Markets, including 3,204 stocks of US (NASDAQ and NYSE), UK (LSE), France (Euronext), and others.

What is the minimum deposit for Admiral Markets?

The minimum deposit depends on your account type and base currency. Australian-based can deposit a minimum of AU$75 using cards or e-wallets (Skrill and Neteller). This figure might vary for per account type and payment method.

Where is Admiral Markets from?

Admiral Markets (now known as Admirals) is a Talinn-based broker from Estonia. They are regulated by top-tier bodies.

Note: Your capital is at risk