ECN Type brokers offer Raw Spread Trading Accounts. Before opening a trading account with an ECN broker, you need to check if the Australian Securities and Investments Commission (ASIC) regulates them. ASIC is Australia’s financial conduct watchdog. Trading with ECN (Electronic Communication Network) brokers licensed by ASIC guarantees the safety of your funds. Never trade with an unlicensed broker. You might lose all of your funds.

Not all forex brokers in Australia are ECN type.

Comparison of ECN Brokers in Australia

| Forex Broker | AUD/USD Spread | Minimum Deposit | |

|---|---|---|---|

| Pepperstone |

0.24 pips (Raw Spread Account)

|

$0

|

Visit Broker |

| IC Markets |

0.17 pips on Raw Spread Account

|

$200

|

Visit Broker |

| FP Markets |

0.3 pips on Raw ECN Account

|

$100

|

Visit Broker |

| IG Markets |

1.01 pips

|

$450

|

Visit Broker |

| AxiTrader |

1.4 pips

|

$5 (POLi)

|

Visit Broker |

Best ECN Brokers Australia

In this review, we have gathered the best ECN brokers in Australia for you.

- Pepperstone – Best ECN Broker in Australia

- IC Markets – Australian Broker with Raw Spread Account

- FP Markets – Australian broker with Raw ECN account

- IG Markets – Largest foreign ECN broker

- AxiTrader – Best ECN Broker with low trading fees

- GO Markets – Best ECN Broker with no inactivity fees

Now let’s elaborate on these ECN Australian Brokers using key points like regulation, trading fees, trading platform, and pros & cons.

#1 Pepperstone- Best ECN Broker in Australia

Pepperstone is a safe broker and has been licensed in Australia since 27/01/2010. They have a Raw Spread Account with ECN pricing.

Regulation: Pepperstone is regulated with ASIC. They are licensed with ASIC under the company name Pepperstone Group Limited with license number 414530.

75.8% of retail investors lose their money when trading with this CFD broker

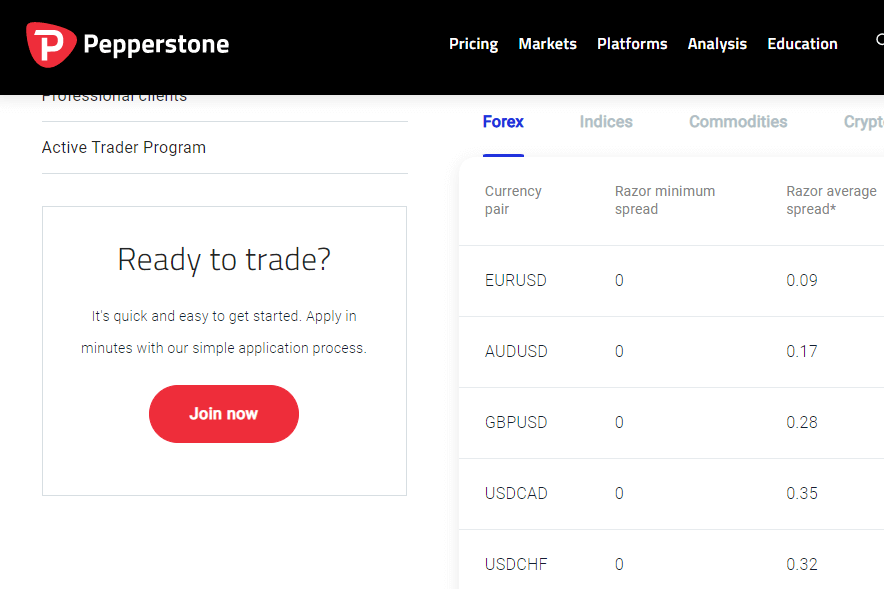

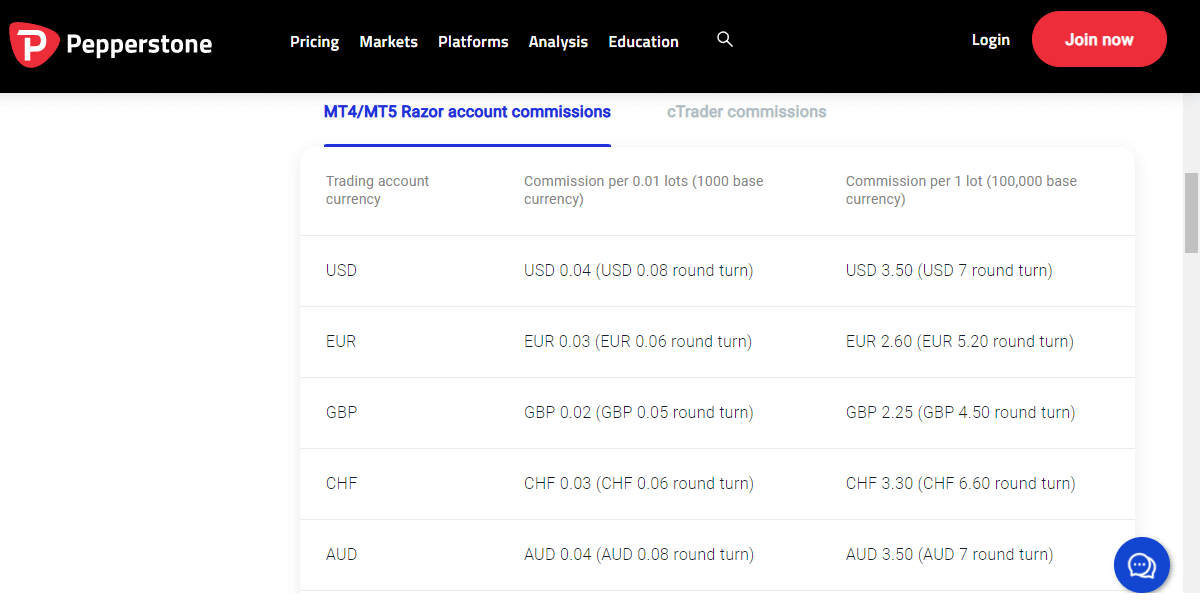

Fees: The table below shows Pepperstone’s spread for their Raw Spread Accounts and commissions for AUD/USD. EUR/USD and GBP/USD.

| Currency Pairs | Spread | Commission (Round-turn per standard lot) |

|---|---|---|

| AUD/USD | 0.24 pips | AUD 7 (for AUD base account) |

| EUR/USD | 0.17 pips | AUD 7 (for AUD base account) |

| GBP/USD | 0.59 pips | AUD 7 (for AUD base account) |

Available CFD instruments: You get to trade 62 currency pairs, 23 index CFDs, 21 dividends for index CFDs, 32 commodity CFDs, 100 ETF CFDs, 600+ share CFDs, 11 dividends for shares CFDs, 22 cryptocurrency CFDs, and 3 currency index CFDs.

Platforms: You can trade with Pepperstone’s Razor Account on MT4 and MT5.

Risk management tools: Pepperstone does not offer guaranteed stop-loss orders but offers negative balance protection.

Funding/Withdrawal: Australian traders can deposit/withdraw funds with credit/debit cards, and bank transfers.

Alternative payment methods such as POLi, BPay, PayPal, Skrill, Neteller, and Union Pay are available. Withdrawal through bank transfer takes 3-5 business days.

Customer service: You can reach Pepperstone via email and live chat. You can also call their AU toll-free line – 1300-033-375. Their customer support email is [email protected].

Pepperstone Pros

- Regulated by ASIC

- Local mobile number is available

- Their Razor Account is available on both Metatrader platforms

- No inactivity fee

- Negative balance protection

Pepperstone Cons

- Pepperstone charge commissions

- There is no guaranteed stop loss

- You cannot access their rollover charges until you download their trading platforms

#2 IC Markets – Australian Broker with Raw Spread Account

IC Markets have held ASIC license since 2/01/2007. They are registered with the regulatory body as International Capital Markets Pty Ltd. They also have an Raw Spread Accoutn with ECN pricing.

Regulation: Their license number is 335692. We consider IC Markets a low-risk ECN broker.

74.32% of retail investors lose their money while trading with IC Markets.

Fees: IC Markets’ spreads for AUD/USD, EUR/USD, and GBP/USD are shown in the table below. You can see the commission clearly stated as well.

| Currency Pairs | Spread | Commission (Round-turn per standard lot) |

|---|---|---|

| AUD/USD | 0.17 pips | AUD 7 |

| EUR/USD | 0.02 pips | AUD 7 |

| GBP/USD | 0.23 pips | AUD 7 |

They charge a fixed $6 commission for Raw Spread Accounts on cTrader.

Available CFD instruments: IC Markets offer a good range of financial instruments. You have access to over 62 currency pairs, 22 commodities, 23 indices, 18 bonds, 18 digital currencies, 1600+ stocks, and 4 global futures.

Platforms: IC Markets offer a Raw Spread Account on cTrader and Metatrader platforms.

Risk management tools: IC Markets do not offer guaranteed stop-loss orders. However, they have negative balance protection.

Funding/Withdrawal: You can deposit/withdraw your funds via credit/debit cards, PayPal, Neteller, Neteller VIP, Skrill, UnionPay, Wire transfer, BPay, Broker to Broker, and POLi. All deposit methods are instant except for bank transfer, which takes 3-5 business days. Withdrawing by bank transfer takes 1 business day. Other withdrawal methods are instant.

Customer service: For enquiries, you can reach IC Markets via live chat. They also have two toll-free numbers: +1300-600-644 and +61 (0)2- 8014-4280. For specialized enquiries, you can contact IC Markets via these emails:

Client Relations: [email protected]

Support: [email protected]

Accounts: [email protected]

Marketing: [email protected]

IC Markets Pros

- Regulated by ASIC

- Local mobile number is available

- Specialized customer service emails

- Negative balance protection

IC Markets Cons

- IC Markets charge a commission

- Inactivity fees

- No guaranteed stop loss

#3 FP Markets – Australian broker with raw ECN account

With FP Markets all deposits are processed instantly except for bank transfers and broker-to-broker, which takes 1 business day. Withdrawals are processed within one business day.

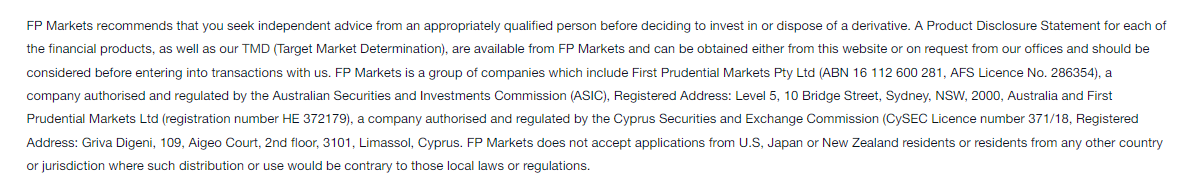

Regulation: FP Markets are licensed with ASIC under the name First Prudential Markets Pty Ltd. With license number 286534, they have been licensed in Australia since 21/01/2005. You can trade safely with FP Markets.

71% of retail investors lose their money with this forex broker.

Fees: AUD/USD, EUR/USD, and GBP/USD spreads on their Raw ECN Account are shown in the table below. We included the commissions too.

| Currency Pairs | Spread | Commission (Round-turn per standard lot) |

|---|---|---|

| AUD/USD | 0.3 pips | $6 |

| EUR/USD | 0.2 pips | $6 |

| GBP/USD | 0.4 pips | $6 |

Available CFD instruments: FP Markers offer a wide market range: 63 currency pairs, over 10,000 shares, 6 metals, 5 commodities, 17 indices, 11 cryptocurrencies, and 2 bonds.

Platforms: You can also trade with FP Markets’ Raw ECN Account on MT4 and MT5.

Risk management tool: FP Markets do not offer guaranteed stop-loss orders but there is negative balance protection.

Funding/withdrawal: You can fund and withdraw from your account via Neteller, Skrill, bank transfer, broker-to-broker, cryptocurrencies, and dragonpay. FP Markets support credit/debit cards for AUD deposits.

Customer Service: FP Markets is available via live chat 24/7. Their Australian mobile number is +61 (2) 8252 6800. You can reach them via email at [email protected].

FP Markets Pros

- Regulated by ASIC

- No inactivity fees

- Wide market range

- Negative balance protection

FP Markets Cons

- No guaranteed stop loss

- AUD/USD spread is high

- FP Markets does not support credit/debit cards for AUD withdrawals

#4 IG Markets – Largest foreign ECN broker

IG Markets was extablished & available in market since 1974. They are offering negative balance protection to their traders. They have wide range of trading platforms and their spread start from 0.6 pips on EUR/USD currency pair.

Regulation: IG Markets are regulated with ASIC as IG Markets Limited. They are registered as a foreign company with license number 220440. IG Markets have been licensed since 22/01/2002 and are safe to trade with.

Fees: Charges for AUD/USD, EUR/USD and GBP/USD is shown below

| Currency Pairs | Spread | Commission (Round-turn per standard lot) |

|---|---|---|

| AUD/USD | 1.01 pips | N/A |

| EUR/USD | 1.00 pips | N/A |

| GBP/USD | 1.66 pips | N/A |

Available CFD instruments: IG Markets offer up to 17000 markets. You get to trade over 50 currency pairs, 6 commodities, 8 stock indices, and over 13000 shares.

Platforms: Metatrader 4 is available. IG Markets also offer a mobile trading platform.

Risk management tools: IG Markets offer guaranteed stop-loss orders and negative balance protection

Funding/withdrawal: You can deposit/withdraw your funds using any of these three methods: credit/debit card, PayPal, and bank wire transfer. Deposits are processed within 3 business days. Credit/ debit card withdrawals take 2-5 business days. Bank withdrawals can take 1-3 business days.

Customer Service: For account opening, you can contact +61 3 9860 1799 or [email protected]. If you are an existing client, you can call +61 3 98601734.

IG Markets Pros

- Regulated by ASIC

- Negative balance protection

- Guaranteed stop loss order

- No commission

- Over 13,000 stocks

IG Markets Cons

- High inactivity fees

- No MT5 trading platform

- Spread is high

#5 AxiTrader – Best ECN Broker with low trading fee

AxiTrader was established in Sydney in 2007 by AxiCorp. They are regulated by ASIC with their multifaceted operations spanning six regions globally.

Regulation: AxiTrader is regulated with ASIC as Axicorp Financial Services Pty Ltd. Their AFSL number 318232 was issued on 21/12/2007 and is still valid. We consider AxiTrader low risk to trade with.

Fees: Charges for AUD/USD, EUR/USD, and GBP/USD are shown below

| Currency Pairs | Spread | Commission (Round-turn per standard lot) |

|---|---|---|

| AUD/USD | 1.4 pips | N/A |

| EUR/USD | 1.3 pips | N/A |

| GBP/USD | 1.6 pips | N/A |

All fees valid for Axi Standard Account only

Available CFD instruments: AxiTrader has more than 130 CFDs that you can trade. The CFD classes available include forex, shares, precious metals, commodities, indices, and cryptocurrencies.

Platforms: Axi supports MetaTrader 4 only. You can trade with Axi MT4 on multiple devices. The web trader version is also available.

Risk management tools: AxiTrader offer negative balance protection

Funding/withdrawal: You can deposit/withdraw your funds using any of these three methods: credit/debit card, POLi, and bank wire transfer. Axi supports credit cards from Visa, MasterCard, and JCB. Only visa and MasterCard are accepted for debit cards.

Deposits show up in your account instantly except for bank transfers (1-3 days). The same applies to withdrawals. No extra fees are charged for deposits/withdrawals.

Customer Service: You can reach AxiTrader’s customer support via email and live chat. You can also call their Australian line on 1300 888 936.

AxiTrader Pros

- ASIC regulation

- Low minimum deposit

- No deposit/withdrawal charges

- No commission on retail trading accounts

- You can use your JCB credit card

Axitrader Cons

- Only MT4 is available

- Limited number of CFDs

What is an ECN Broker?

An ECN broker is a type of broker without a dealing desk. When you place a trade, you are either buying or selling. An ECN broker takes your trades and connects your order to buyers or sellers in the market. Computerized systems are used to connect your orders to buyers or sellers. These systems also provide current ask and bid prices. They are programmed to show the highest bid prices and lower ask prices. This means you get to buy or sell a currency pair at the best prices available.

Dealing desk brokers are the opposite of ECN brokers. They typically take the opposite side of your trades. This means they sell to you when you place a buy order and vice-versa. If they do not do this, your trades are passed on to a market maker. This can lead to slow trade execution.

With an ECN broker, you get speedy trade executions, favorable spreads, and a flat commission rate.

History of ECN Brokers?

The roots of ECN technology go back to 1969, when Instinet was launched. It let institutions trade directly, bypassing traditional brokers. The term “ECN” became more common in the 1970s as the US Securities and Exchange Commission promoted electronic systems to share and execute orders, influencing NASDAQ, the first fully electronic stock market. Early players included Island and Archipelago.

While ECNs first transformed stock trading, they entered forex later. In 1999, Matchbook FX became the first ECN broker for online currency trading, letting banks and other users post prices and act as price makers.

By the early 2000s, ECNs had grown popular for their lower costs, faster trades, greater transparency, and anonymity. Today, many brokers use only ECN execution to link clients to the interbank market, while some dealing-desk brokers offer ECN accounts as an option.

ECN Broker vs Market Maker

A forex broker can be either an ECN or a market maker. The two are different. ECN brokers do not operate a dealing desk. They connect your trades directly to buyers and sellers in the market through computerized systems. These systems provide current and best bid and ask prices. They offer you the highest bid and lower ask prices so you buy or sell a currency pair at the best prices.

Market makers operate a different system entirely. They purchase large positions from a liquidity provider and requote the bid and ask price to traders. Market makers quote these prices intending to make money off the bid-ask spread. Most times, the prices quoted are not favorable to traders.

In addition, Market Makers offer fixed spreads. Unlike ECN brokers, they control the bid and ask prices of trading instruments. So they are able to keep it fixed. ECN brokers give your direct market access (multiple buyers and sellers) via computerized networks so their spreads are variable.

ECN Broker vs STP Maker — What is the Difference?

ECN and STP brokers are the most common type of CFD brokers. While they both facilitate trades in the Forex market, there are distinct differences between them. As you already know, they connect you to liquidity providers like other banks and other traders.

On the other hand, STP brokers, while also connecting traders to liquidity providers, may use a dealing desk to execute trades. This might lead to conflict of interest because your broker might act as a counterparty. The only edge STP brokers might have over ECN brokers is faster execution speeds.

Pros of ECN Brokers

1) There is no conflict of interest. ECN brokers do not make money from your losses. ECN brokers only act as intermediaries. They pass on wholesale prices directly to you without trading against you.

2) Overall low trading fees. ECN brokers connect you directly to the electronic communications network. The bid and ask price is determined by the market independent of your broker. Consequently, you get low spreads but you might still pay a commission which is not that high either.

3) Fast execution speed because of high liquidity. ECN is used by large financial institutions so you have access to premium liquidity. You will not have challenges opening and closing your trades even for exotic currency pairs.

4)Since ECN brokers make money via the size of transactions rather than your losses, they allow all trading methods including scalping.

5) Your trades are routed through liquidity providers so you can place big orders.

Cons of ECN Brokers

1) ECN brokers charge a commission for all of your transactions. These fees usually increase trading costs and affect profits.

2) You need a high minimum deposit for an ECN account. ECN brokers usually require these high deposits which maybe too much for you.

3) ECN offers direct market access (DMA) which has its own advantage. However, this type of access can expose you to high volatility and price swings which can bring losses.

4) Though ECN spreads are tight, they may widen significantly in times of low liquidity that can affect your trade execution.

How to identify an ECN broker?

ECN brokers connect you to buyers and sellers without being intermediaries. It is not enough for forex brokers to refer to themselves as ECN brokers. As a trader, you should do your due diligence to confirm if a forex broker is truly ECN. Here are a few things to check for confirmation:

1) An ECN broker will disclose clearly if they are a true ECN. You can check their terms and conditions, FAQs, or even speak with them. You must see a clear disclosure.

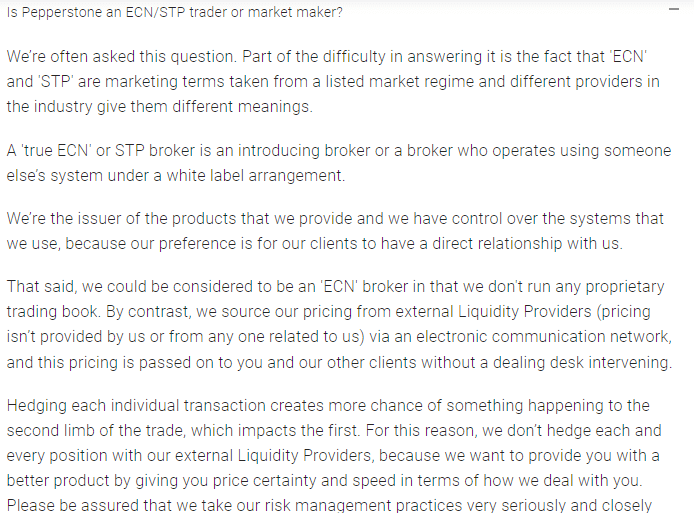

For example, Pepperstone on their FAQs page mentions that they consider themselves to be an ECN Broker as they don’t operate any dealing desk.

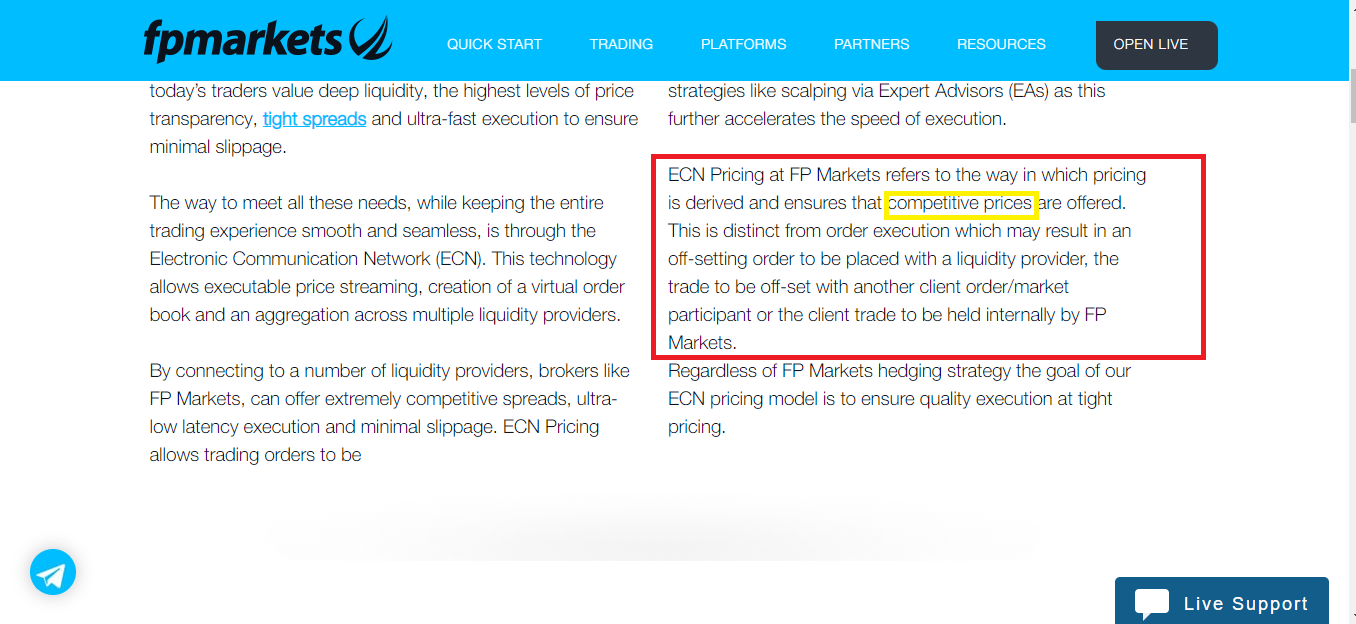

2) An ECN broker offers variable spreads. Fixed spreads are a pointer that a forex broker is not a true ECN. It is Market Makers that offer variable spreads. Since ECN brokers quote prices from liquidity providers, their spreads cannot be fixed. In addition, ECN pricing targets securing the best price quotes for you. This is another reason ECN brokers cannot have fixed spreads. Look at this image about ECN pricing from FP Markets

You can see as stated that they target offering competitive prices. Because of this, spreads will always fluctuate.

3) Check the forex broker’s slippage performance. If only negative slippages affect their clients’ trades, they are not ECN. Why is this important? Negative slippage means that your trades are executed at worst price levels compared to your chosen price level

4) You should also check for restrictions on the number of orders you can place. True ECN brokers let you place as many trades as possible. There is no restriction on lot sizes. A good way to confirm this is to download the forex broker’s platform. If you place more than 5 standard lots trade and it is rejected, then you are not dealing with a true ECN broker.

Furthermore, you should be able to trade any currency pair with the lowest lot size. The lowest lot size in forex trading is 0.01. A true ECN broker must allow flexibility in lot size.

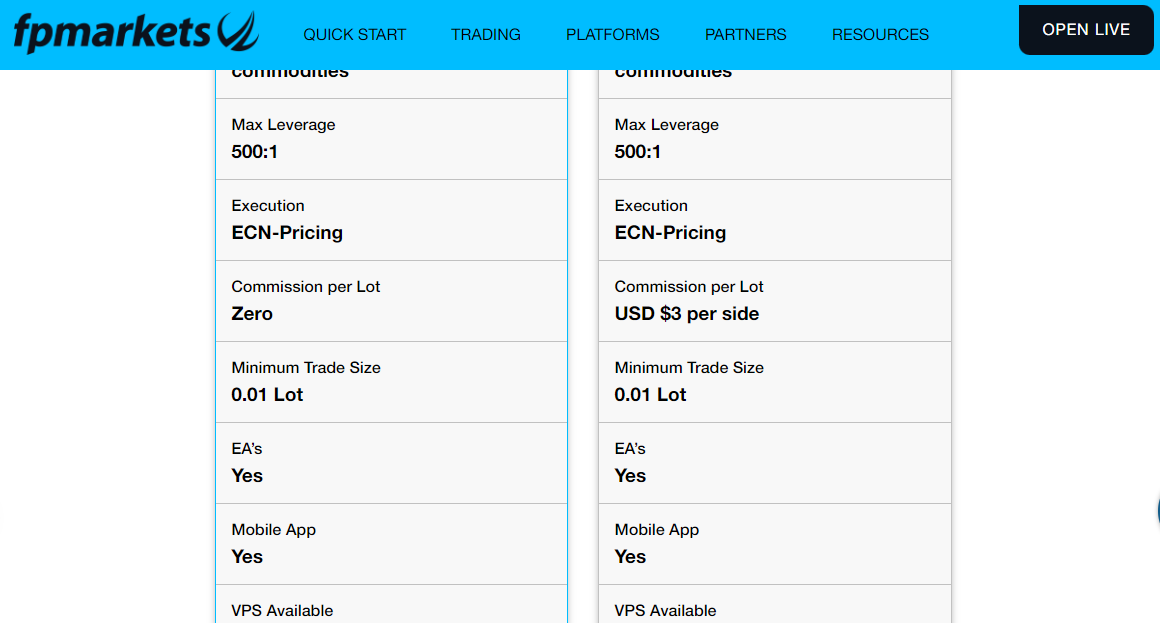

This image is from FP Markets website showing their account types. You can see that the execution is ECN and you can trade minimum lot size.

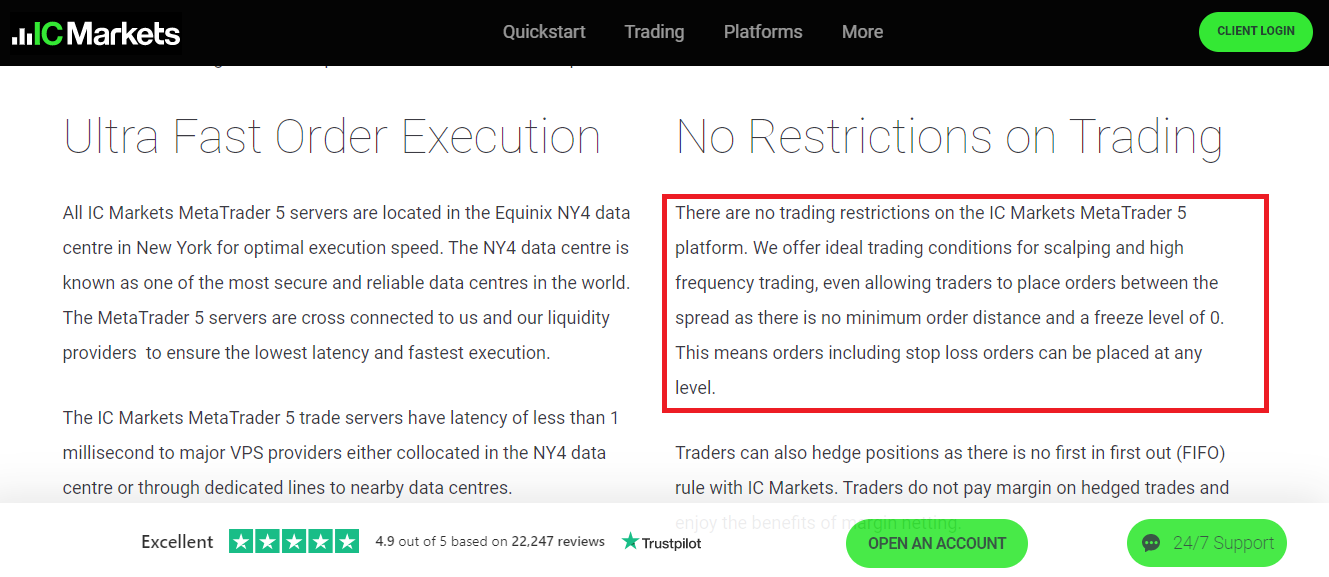

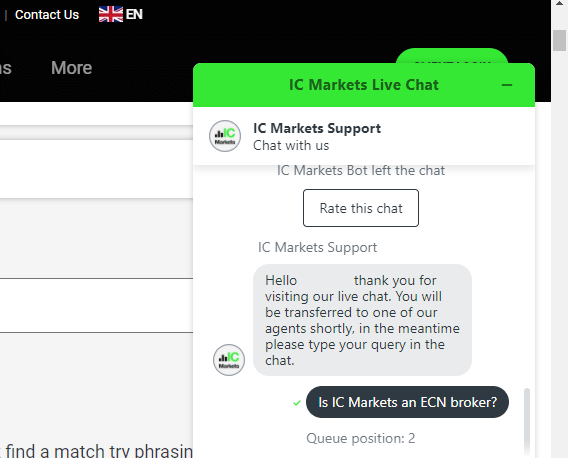

5) True ECN brokers allow you to place your “stop-loss” and “take profit” orders at any price you desire. Non-ECN brokers tend to set restrictions on where you maximize your profits or limit your losses. Here is an example from IC Markets:

6) Apart from clear disclosure about being ECN or not, true ECN brokers operate the no-dealing desk (NDD) model. Forex brokers state this clearly in their clients’ agreement by the forex broker. You can check the FAQs or speak to customer support.

Technically, a forex broker might not be ECN but offer account types with similar conditions, which include raw spreads and low commissions. You should look out for these conditions.

Let us show you how to find them. We will be using Pepperstone as an example:

Step 1) Enter on your browser pepperstone.com/en-au/. You should arrive at the picture below

Step 2) Click on pricing, then select “spreads, commissions, and swaps”. Scrolling down the page, you will find Pepperstone’s Razor Account with raw spreads and low commissions.

Shown below is the commission for Pepperstone’s Razor Account

Apart from looking out for Raw Spread Account types, you can also calculate trading costs to confirm if it is high or low. For example, trading a standard lot of AUD/USD on an AUD base currency account will cost only AUD 8.7. Here is how you can calculate the cost:

Currency pair: AUD/USD

Spread: 0.17

Lot size: 1 standard lot

Lot value = AUD 10 per point

Round turn commission: AUD 7

Trading cost = (Lot value x Spread) + round turn commission

= (10x 0.17) + 7

= 1.7 + 7

= AUD 8.7

Finally, you can also speak with customer service via their different contacts. It could be live chat, email, or local phone number. Below is the screenshot of a live chat.

7)A true ECN broker will not promise you some bonus or discount for opening an ECN trading account. They make their money off commissions from your trade – whether you win or lose. To avoid brokers that bait with promos, sign up with ASIC regulated brokers only. In Australia, it is illegal to use promos and bonus offers to convince traders to sign up.

How Do ECN Brokers Make Money?

Here is how ECN brokers typically generate revenue:

1)Commission: ECN brokers will charge you a commission for each trade executed. This fee is usually a small amount per lot that you trade and can be found on your broker’s website. The commission model ensures that your broker makes money directly from your trades.

2)Spreads: ECN brokers offer tight spreads. This means that the difference between the bid and ask prices can be very low. Though it may be little, your broker will still make some money from the tight spreads.

3)Data Fees: As a retail trader, you will have access to real time market data. However, your broker might offer a premium data service for some traders that need the most recent data within a certain time period. This will come at an extra cost to such traders.

4)Private Server Fees: An ECN broker may offer VPS (Virtual Private Server). This server ensures that you trade with low latency. It also grants you a good connection with trading servers. Hosting your trading on VPS might attract some fees, generating money for your broker.

It’s important to note that the transparency and direct market access provided by ECN brokers align their interests with yours, since they do not profit from your losses. You should carefully review the fee structure of any ECN broker before opening an account.

How We Compared the Best ECN Brokers in Australia

1) ASIC Regulation: Before choosing an ECN broker, you need to be sure the broker is regulated with ASIC. The safety of your funds is only guaranteed if your broker is regulated. ASIC assigns a unique AFSL number to all brokers which can be found on the broker’s website. You can verify this number on ASIC’s website to determine of your broker’s regulation is valid.

Here is how you can determine this using FP Markets as an example. First, go to the Australian version of the broker’s website and scroll down to the footer. You will find the broker’s registered name and AFSL number. Look at the illustration below

From the image above, you can see that FP Market’s registered name is First Prudential Markets Pty Ltd. Their AFSL number is 286354.

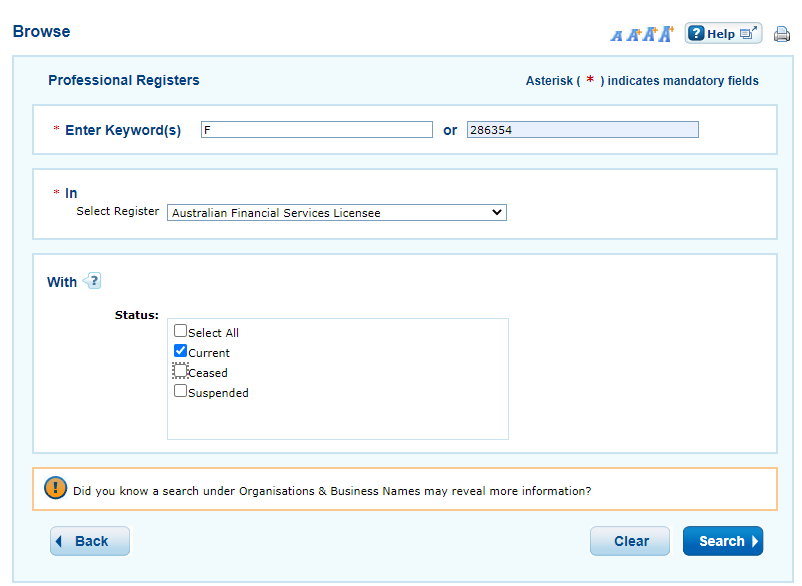

The next step is to verify if these details are the same as the details on ASIC’s register. You do this by visiting ASIC’s professional register. Enter the AFSL number (from the broker’s website), select the ‘Australian Financial Service License’ register, and select ‘current’ under status. Here is a picture of this step

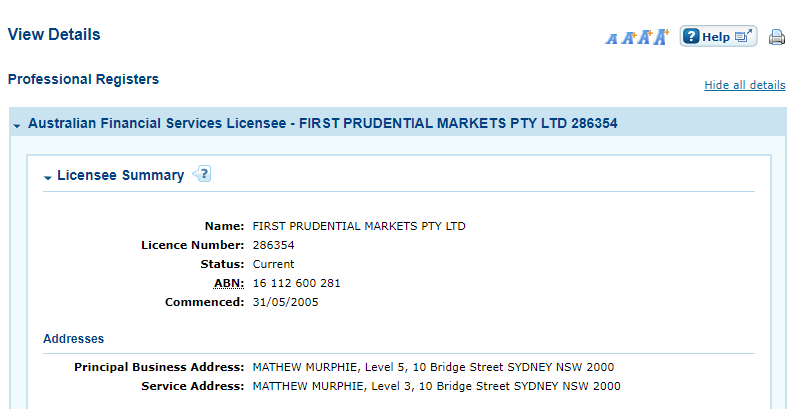

After you have done this, click ‘search’. The full regulation details of the broker will be displayed as shown below

From the image above, you can see that the name and the AFSL number correlate with what we found on FP Markets’ website. You can repeat these steps for any ECN broker in Australia.

2) Overall fees with ECN account: You must know the total fees involved with a broker. Spreads, swaps, and commissions are trading fees you need to pay attention to. They affect your final profit and loss over a period of time. There could also be non-trading fees like currency conversion fees, deposit/withdrawal fees, and inactivity fees.

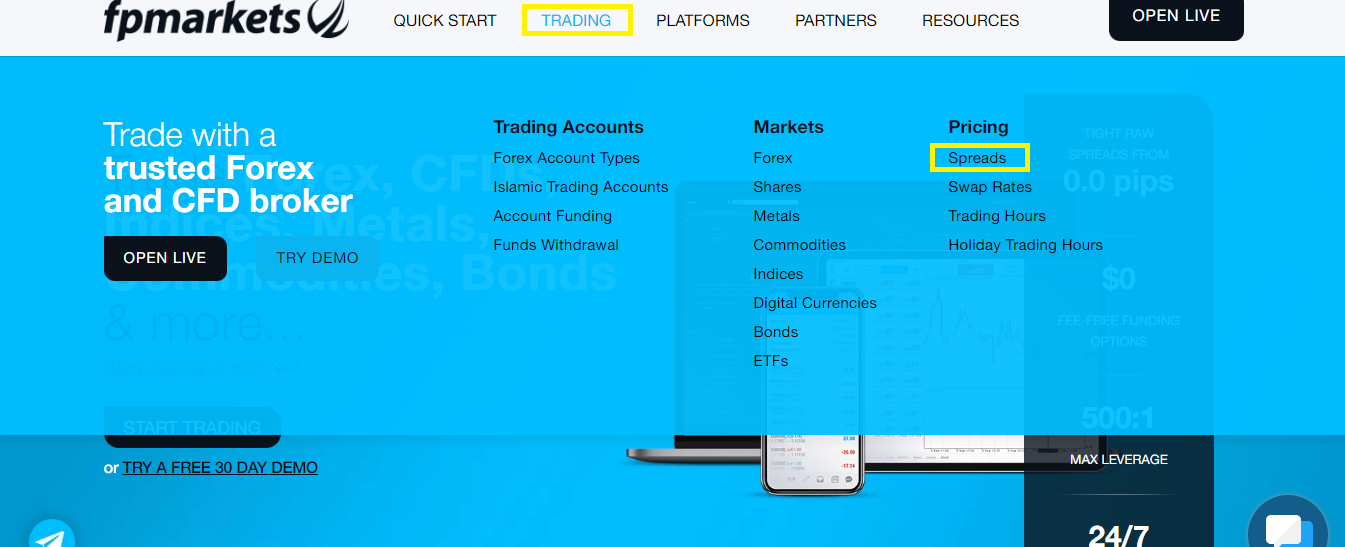

These fees vary for different brokers. Some brokers do not have them so you have to check. Here is how you can check for the fees on your broker’s ECN Account. We will use FP Markets as our example. You begin by going to their homepage at fpmarkets.com. On the homepage click ‘TRADING’ (in the yellow box). The page will show you a dropdown with different options. Under ‘Pricing’, click ‘Spreads'(in the yellow box)

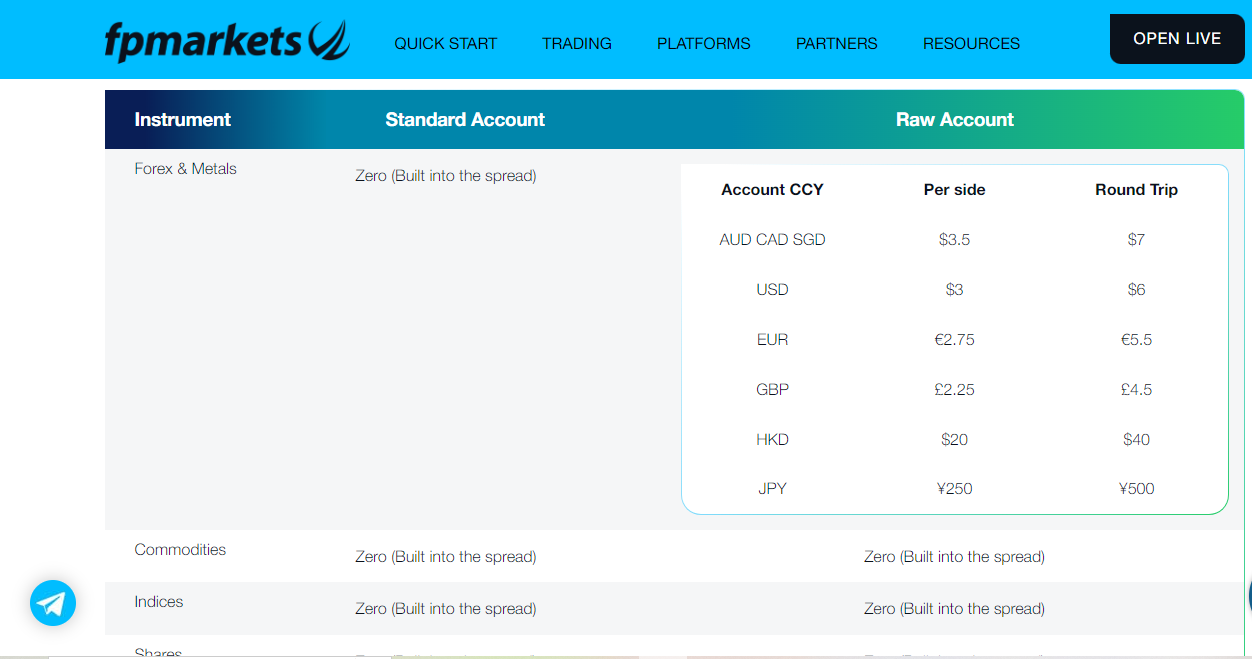

If you do this correctly, you should arrive at the page where FP Markets’ fees are (spreads and commission). The only issue is that you will not see them immediately due to some texts in there. Once you get past the texts by scrolling down the page, you will find first the commissions for FP Markets’ Raw ECN Account as shown below

From the picture, you can see FP Markets’ commission depends on your account’s base currency. If you are using AUD, your commission is fixed at $7 (round-turn) for currency pairs and metals. For other CFDs, the commission is built into the spread.

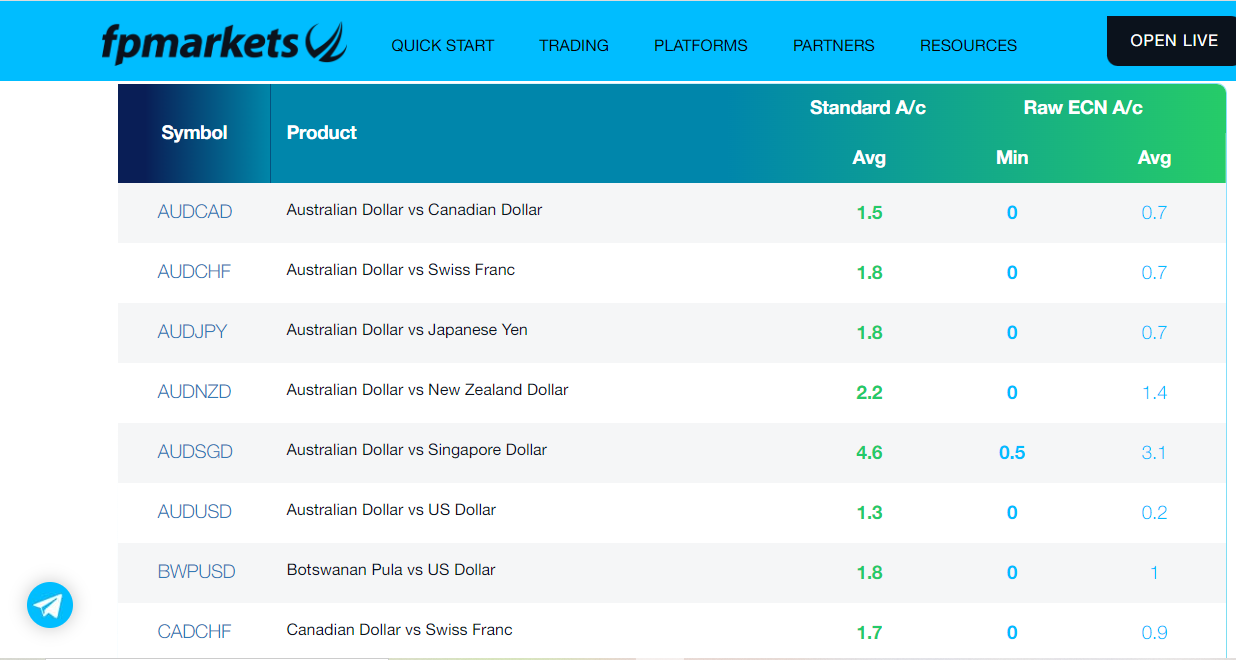

Scrolling further down, you will find the spreads for the ECN Account

You can see the average spreads for currency pairs on the far right side of the table. For other CFDs’ spreads, you will find them if you continue scrolling down the page.

3) Platforms: Metatrader 4, Metatrader, and cTrader are popular trading platforms. Your preferred broker should offer them. It is important to check if these platforms are available as PC software and mobile phone apps.

PC software gives you a full outlay of price movements. However, you might have to check your trades on the go. This is why you must have these trading platforms as apps on your phone.

4) Range of CFD Instruments: You should be able to trade as many instruments as you desire. Beyond currency pairs, you should check if your broker offers commodities, metals, stocks, etc. You get exposed to different markets and trading instruments when your broker has a good range of markets.

5) Deposit/Withdrawal methods: Transaction speed varies with deposit/withdrawal methods. Bank transfers usually take the most time. Deposit/withdrawals through Skrill and Neteller are faster. Transaction fees also vary. This is why your broker must give you various options for deposits/withdrawals.

Before choosing a funding or payment method, you should check if there are extra fees that come with it. Banks and e-wallet providers have their own independent fees. However, your broker might also add their own fees so it is important you check it.

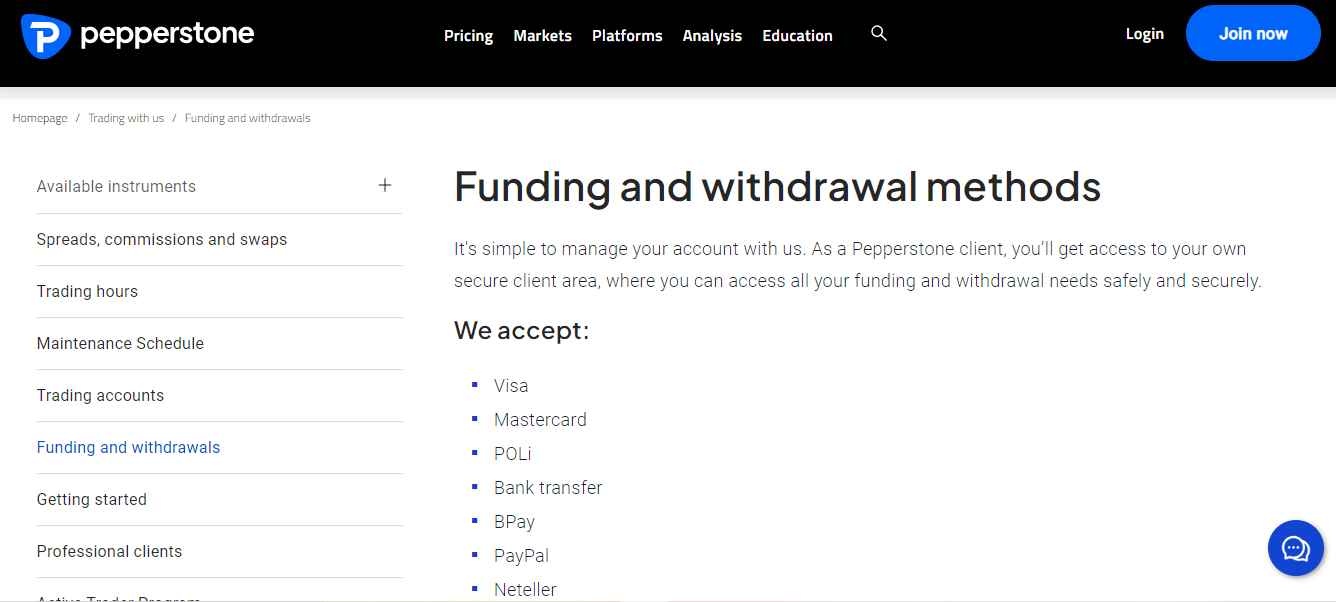

Let us see an example with Pepperstone Australia.

They have popular funding/withdrawal methods like credit/debit cards and bank transfer. With these, they also support local methods like POLi, BPay, and UnionPay. All of these methods are free and Pepperstone does not add any extra charges.

6) SSL Security: When you open a trading account, you have to give some sensitive details to your broker. Your address, utility bills, financial statement, etc. These are details you do not want in the wrong hands.

So you want to be sure your ECN broker is able to protect your data. The first thing to do is read your broker’s privacy policy. You want to be sure they are not sharing your data with third parties.

After that, you want to check if your broker has a secure sockets layer (SSL) encryption. The essence of this security apparatus is to make sure your hackers and illegal data brokers don’t get your information.

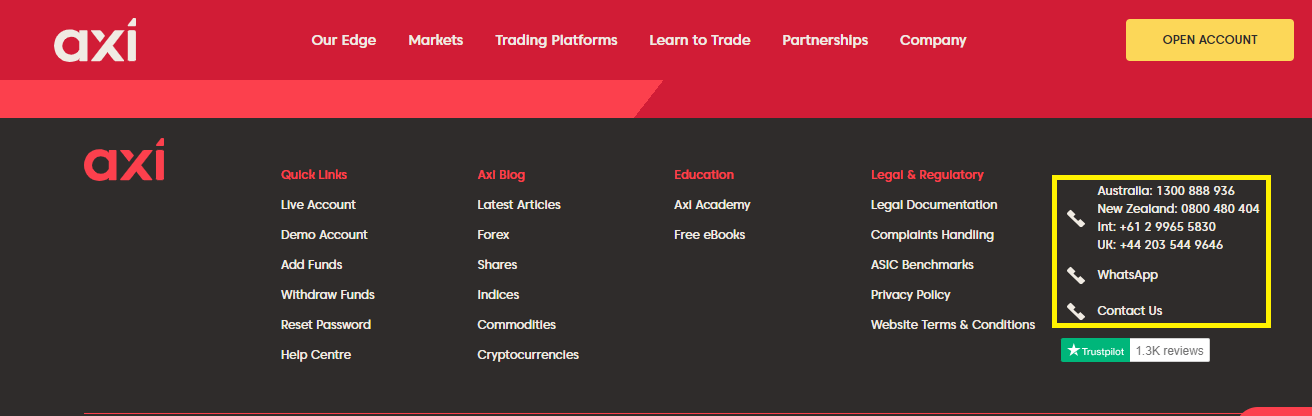

7) Customer Support: Good customer support guarantees speedy answers to enquiries and complaints. Your preferred broker should be easy to reach. Live chat features and emails are prominent these days. A local mobile phone number should also be available. Here is an example with AxiTrader Australia.

As shown above, Axi’s customer support is all-round. There is a dedicated phone line for Australian traders and you can reach them on WhatsApp too. If you click ‘Contact Us’, you will find the link to send them Axi an e-mail.

What are Execution Venues?

If you take time to read the execution policy of ECN brokers, you will find the phrase execution venue(s) appear a number of times. knowing what this mean will help you understand how ECN brokers work.

ECN brokers do not act as counterparty (that is, they do not trade against you). Instead, they use their electronic network to connect your trades to third parties. These third parties are your broker’s execution venues. They are the reason ECN brokers are able to offer competitive prices

How so?

ECN brokers usually have more than one execution venues. When you place a trade, the execution venues submit bid/ask price to your broker. Then your broker gives you the best price. Without multiple execution venues competing for your trades, you will not get the best prices for your trades.

Should I open an ECN Account as a beginner?

ECN Accounts can be good for beginners. With an ECN account, your trading fees are lower due to lower spreads, fast execution speed. This allows you to have more capital to trade with.

However, you will pay a commission on every trade. This might end up swallowing your profits, especially, if you are a beginner. Therefore, it is better you open a Standard Account. ECN Accounts are designed for frequent traders who have enough capital.

Are ECN brokers in Australia safe?

Before a forex broker can operate in Australia, they need to hold an ASIC license. The process to obtain this license involves stringent compliance with ASIC rules. These rules include:

– covering losses of retail traders under ASIC’s compensation scheme if the broker goes bankrupt

– broker must be a member of AFCA

-offering negative balance protection

This list is not exhaustive. It is to let you see that there is a framework for protection of traders in the Australia.

Can I use ECN Account on MT4?

MT4 is suitable for all kinds of brokers including ECN brokers. MT4 is popular among and it sis the go-to platform for most traders., It has 9 timeframes, 30 indicators, and 23 drawing tools. Expert advisors and automated trading are allowed as well,

FAQs on Best ECN Brokers in Australia

What does ECN mean?

ECN means Electronic Communication Network. An ECN broker offers Direct Market Access & there is no dealing desk.

Are there ECN brokers in Australia?

Yes. There are ECN-type brokers in Australia. A few regulated forex brokers Pepperstone, IG Markets, FP Markets, and IC Markets offer Raw Spread Account with low spread.

Who is the best ECN broker in Australia?

According to our review, Pepperstone, IG Markets, FP Markets, and IC Markets are reputable ECN brokers in Australia. They are regulated with ASIC and offer an ECN-type account.

How do I Identify a true ECN broker?

You should look out for important factors such as; no dealing desk model (NDD), variable and Raw spreads, no order restriction, and so on. Ask the broker if you have doubts.

The most important is to trade with a regulated broker to ensure that your funds are safe.