Automated Trading platforms allow you to use algorithms and expert advisors (EAs) to execute automated trades based on predetermined entry and exit conditions.

Most forex trading platforms in Australia support automated trading and you can use scripts even on the Metatrader platform. You or others can create these trading scripts, and you can run them on your platform.

Some proprietary platforms also support Social Trading where you can copy other traders. But automated and social trading platforms have risks.

It is important for you to make sure that your funds are protected. To ensure this, only open accounts with brokers that support automated trading and are regulated by the Australian Securities and Investments Commissions (ASIC).

Comparison of Best Automated Trading Australia

| Forex Broker | Regulation | Maximum Leverage | Minimum Deposit | |

|---|---|---|---|---|

| eToro |

ASIC, FCA

|

1:30

|

$50

|

Visit Broker |

| AvaTrade |

ASIC, FSCA

|

1:30

|

AUD 100

|

Visit Broker |

| Pepperstone |

ASIC, FCA

|

1:30

|

AUD 0

|

Visit Broker |

| IG Markets |

ASIC, FCA

|

1:30

|

AUD 10 (BPAY)

|

Visit Broker |

4 Best Automated Trading Platforms in Australia for 2024

Below is the list of the best automated trading platforms in Australia:

- eToro – Best Automated Trading Platform for Beginners

- AvaTrade – Best Automated Trading Platform for Robots

- Pepperstone – Best Automated Trading Platform with Low Spreads

- IG Markets – Reputed Broker with Automated Trading

Now read the brief of all the above-listed automated trading platforms for your comparison.

#1 eToro – Best Automated Trading Platform for Beginners

With eToro, bank transfer and credit card transactions are quite difficult. They can take up to 10 business days.

Regulation: eToro is regulated with ASIC as eToro AUS Capital Ltd. Their reference number is 583263. eToro are a low risk because they are regulated and your money is safe with them.

Trading fees: eToro offer both GBP/USD and EUR/USD at 1 pip while EUR/GBP is offered at 1.5 pips. They charge no commission on these pairs.

eToro also offers Gold and Nasdaq too. Here are their trading fees:

| Instruments | Spread | Commission |

|---|---|---|

| Gold | 4.5 pips | N/A |

| Nasdaq (NSDQ100) | 2.4 pips | N/A |

Available platforms: eToro offer their own proprietary trading platform. The platform offers CopyTrader which supports automated trading.

Funding/withdrawal: eToro supports two deposit/withdrawal methods, PayPal, and bank wire transfer. The shortest way to deposit is PayPal because transactions are completed in 2 business days.

Customer support: We had a good support experience. Their live chat is only available for active traders. In addition, we got an email response within three minutes.

#2 AvaTrade – Best Automated Trading Platform for Robots

AvaTrade is regulated with ASIC as Ava Capital Markets Australia Pty Ltd

Regulation: They hold a current licence with AFSL number 4066840.We consider AvaTrade low-risk for Australia-based traders.

Trading Fees: AvaTrade’s spread for GBPUSD, EURUSD, and EURGBP are 1.6 pips, 0.9 pips, and 1.5 pips respectively. You are not charged any commission when you trade these pairs.

Trading fees for Gold and Nasdaq are shown below:

| Instruments | Spread | Commission |

|---|---|---|

| Gold | 0.29 pips | N/A |

| Nasdaq (US_TECH 100) | 1.00 pips | N/A |

Available platforms: AvaTrade supports MetaTrader 5, ZuluTrade, and DupliTrade. Automated trading is possible on the three trading platforms. MetaTrader 5 supports algorithm trading while ZuluTarade and DupliTrade are automated trading platforms.

Funding/withdrawal: AvaTrade allows deposit/withdrawal via credit/debit cards, Skrill, Neteller, and bank wire transfers. Deposits reflect in your accounts instantly except for bank transfers. If you use a bank wire transfer, it can take up to 7 days for deposited funds to reflect in your account.

Withdrawals are processed within 24-48 hours for cards and e-wallets. Bank transfer withdrawals can take up to 10 business days to reflect in your account.

Customer Support: We had a good customer service experience. We contacted with AvaTrade via WhatsApp and email. We got instant replies with no holding time.

#3 Pepperstone – Best Automated Trading Platform with Low Spreads

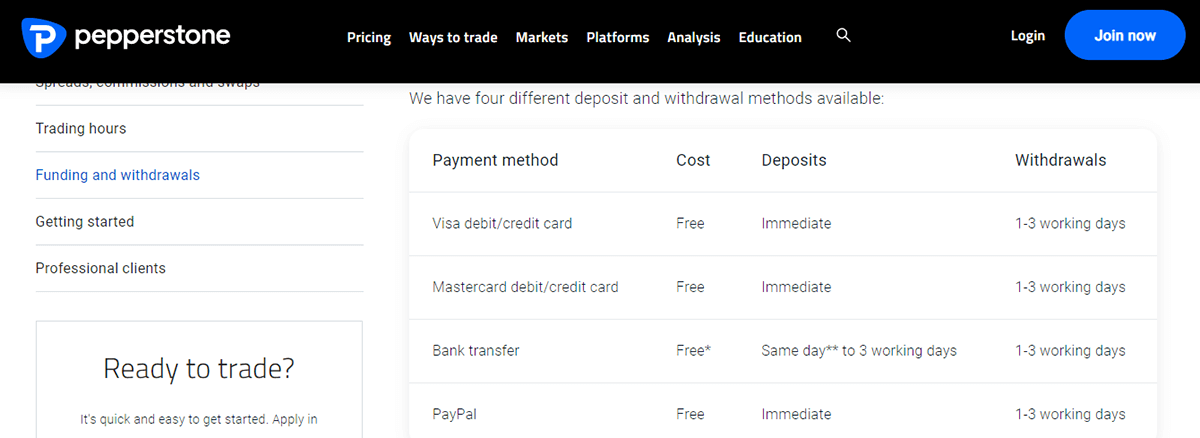

With Pepperstone deposits are immediate except for bank transfers, which can take up to 3 working days. All withdrawal methods take 1-3 working days.

Regulation: Pepperstone is regulated with ASIC as Pepperstone Group Limited. Their reference number is 414530 and are low-risk for Aussie traders.

Trading fees: Pepperstone’s spread for GBPUSD, EURUSD, and EURGBP are 0.59 pips, 0.17 pips, and 0.40 pips respectively. In addition, you will pay a round-turn commission of AUD 3.50 for every standard lot you trade.

Below are the trading fees for Gold and Nasdaq:

| Instruments | Spread | Commission |

|---|---|---|

| Gold | 0.13 pips | N/A |

| Nasdaq (NAS 100) | 1.0 pip | N/A |

Available platforms: Pepperstone supports MT4, MT5, cTrader, and DupliTrade. DupliTrade is their social trading platform. Automated trading is possible on all of these platforms.

Funding/withdrawal: Pepperstone support four deposit/withdrawal methods: Visa, Mastercard, POLi, Bank transfer, BPay, PayPal, Neteller, Skrill, and Union Pay.

Customer Support: Speaking with their live chat agents, we had a 3-minute holding time. We also waited for 2 hours to get an email response. Overall customer support is good.

#4 IG Markets – Reputed Broker with Automated Trading

IG Markets PayPal transactions are usually within one working day for withdrawals. If you are carrying out your withdrawal transaction via cards or bank transfer, it might take 3-5 days for it to be processed.

Regulation:IG Markets is regulated with ASIC as IG Australia Pty Limited. Their AFSL number is 515106 and they hold a current licence. We consider IG Markets low-risk for those who want to trade forex in Australia.

Trading fees: IG Makrtet’s spread for GBPUSD, EURUSD, and EURGBP are 1.66 pips, 1.00 pips, and 1.71 pips respectively. In addition, IG Markets charge no extra commission per standard lot of FX pairs traded.

Below are the trading fees for Gold and Nasdaq:

| Instruments | Spread | Commission |

|---|---|---|

| Gold | 0.3 pips | N/A |

| Nasdaq (US Tech 100) | 2.0 pips | N/A |

Available platforms: IG Markets supports MT4, ProRealTime, IG Mobile App. For automated trading, IG Market is in partnership with MT4, and ProRealTime to provide automated trading to their clients. With the latter, there are creation tools you can use to build your algorithm. You can also code from scratch if you want.

You can also backtest your strategies using 30 years of historical data.

Funding/withdrawal: You can fund your funds via: credit/debit card, PayPal, BPAY, and EFT. For withdrawal of funds, credit/debit cards, bank wire transfers, PayPal, and EFTs are the available channels. You cannot withdraw below AUD 200 for cards, bank transfers, and PayPal.

Customer Support: We had a 2-minute holding time speaking with their live agents. We also found their FAQs resourceful. Overall customer support is good.

What is Automated Trading?

Automated Trading platforms allow you to use algorithms and expert advisors (EAs) to execute automated trades based on predetermined entry and exit conditions. It focuses on conducting research that enables easy entry and exit of trades.

Most automated trading platforms support multiple CFD instruments – cryptocurrencies, forex, shares, and indices. In addition, they are also available on demo accounts. This means you can test your automated trading system and EAs.

Here are some of the advantages of automated trading:

Faster Execution: Automated trading improves the entry of your orders. Since the criteria for entry and exit of trades are already set, orders can be registered quickly. This is much faster than you entering trades manually.

Also, your take profit and stop-loss levels are set immediately after a trade is registered. This is key because the market moves quickly. This is common among extremely volatile CFDs like NAS100. Seeing the price hitting your profit or stop loss level before you even place a trade can be frustrating. This is why automated trading is advantageous.

Increased Discipline: Developing a trading strategy is as important as the psychological side of trading. Emotions can get the best of you in trading – especially fear and greed. These emotions can lead to breaking your trading rules. You can enter a bad trade because of greed and miss out on a good one because you don’t want to lose money.

Automated trading helps with this. With your trading rules programmed in a robot, your emotions are out of the way. Trades will only be registered based on the parameters you have set.

Diversification: There is an unwritten rule in trading. It states that you do not put all your ‘eggs’ in one basket. In other words, you cannot bet all of your capital on one instrument. You should spread your risk by trading different CFDs across different asset classes. With automated trading, you can have automatic diversification without time consuming research.

Backtesting: Automated trading methods like EAs and robots make use of absolute rules to trade the markets. Because these rules are absolute, the computer does not make guesses or multiple interpretations. To know if these rules will be profitable, you can take these rules and test them on historical market movements. This helps you assess the risks and long-term profitability of your auto trading rules.

Disadvantages of automated trading platforms in Australia

In forex trading, nothing is 100% guaranteed. As helpful as automated trading platforms are, they come with their own risks. Here are some of them.

Inaccurate Predictions:There is a chance that a prediction made by an automated trading platform might be wrong. The financial markets are volatile. Even the most advanced algorithms might not be able to accurately tell where prices will head. This means there is the possibility of losses thereby increasing risk.

To mitigate this risk, you have to monitor your trades and the market. This is crucial because automated systems does not change with price movement in real time. Furthermore, automated systems and strategies do get obsolete and outdated. This is usually due to the dynamism of the forex market. So monitor your trades and take your money out of your trading account if the system is not profitable.

Software Bugs: Trading algorithms are in codes. Sometimes, these codes might have bugs or errors in them. This can lead to undesired trading results. You can minimize this risk by conducting a thorough debugging of your trading algorithms.

Overdependency: It is possible to rely on your automated trading system without personal oversight. The forex market is unique and price movements can be greatly altered by different economic events. You increase the risk of trading if you don’t combine your personal judgement with your automated trading strategies.

Excessive Optimization: This risk has more to do with the trader than the system itself. The risk of over-optimization is common with forex traders who backtest historical data. A strategy can be profitable on historical data but give poor results in a live market situation.

In essence, it means you can want a good result so bad that you tweak your strategy to be profitable based on historical data you test it with. This usually produce unrealistic expectations like 100% profitability and zero drawdowns. In an ideal trading situation, this scenario is impossible and a can lead to losses of real money.

Mechanical Issues: Generally, it is believed that automated trading requires no monitoring. You set up your the trading rules and the computer does the rest. However, you are dealing with technology. Nothing is 100% guaranteed. You might experience loss of internet connection, your computer might crash, you orders might not get sent to a the server, etc.

Black Box Trading Risk: In automated trading, it is possible for you to purchase a pre-built trading algorithm. Therefore, you can be tempted to start trading with the algorithm without knowing the trading rules and the logic behind it.

This is the phenomenon known as back box trading. It is as good as manual trading with your eyes closed. If the algorithm fails, you won’t be able to trace the cause because you know nothing about the algorithm.

Automated trading is not a perfect system. You must make sure you are available to monitor your technological infrastructure to prevent losses.

Do Automated Trading Platforms Work?

Automated trading platforms are often powered by algorithms and have become popular in the financial markets. They execute trades on your behalf based on criteria that you pre-defined. There are different views on the effectiveness of automated trading platforms

Because of little to no human involvement, emotional bias is reduced greatly. In addition, your trades are executed swiftly and the system can trade for you round the clock. Furthermore, the algorithm is able to backtest your strategy with past data to increase effectiveness.

However, the forex market is volatile so automated trading does not mean guaranteed success. Also, past performance does not guarantee future success in trading. You will likely use historical price movement to test your strategy. The issue with that is the test cannot factor in the future so you are relying solely on the past.

Due to the unpredictability of the market, your strategy can become obsolete. To be consistent, you will have to continuously optimize your underlying algorithm to improve its quality.

Automated trading platforms can work well for certain strategies and under specific market conditions. You need to carefully choose or develop algorithms, monitor their performance, and be ready to adapt when needed. Don’t just automate your trade. Add some personal oversight so you can navigate the market with care

Common Automated Trading Systems and Strategies

There are different systems and strategies for automated trading. It is important to have an understanding of these different systems to know which suits you. There is no one size fits all. Any system you choose should align with your trading goals.

Let us have a look at these strategies in detail.

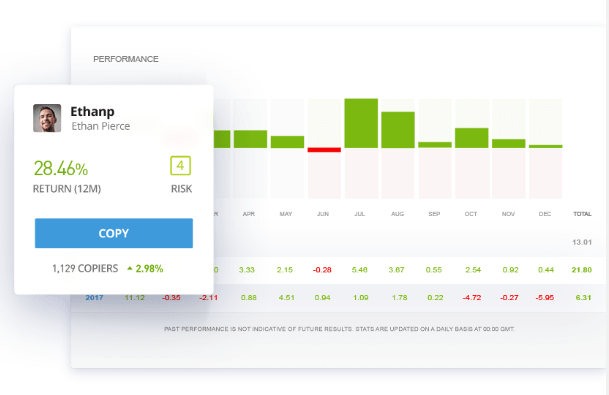

1. Automated Copy Trading: This is the most popular form of automated trading. It involves copying the trades of successful traders in an automated fashion. It is generally called copy trading but can be referred to as social trading with some brokers.

With this strategy, you get access to successful traders and their risk scores to determine if you want to copy them or not.

2. Semi-Automated Trading: This is a strategy that gives you more control. Why is it semi-automated? It is because you have a role to play. This system involves choosing an automated trading platform that offers trading signals. They carry out the analysis give you the entry price, stop loss, and take profit. All you have to do is place the trades yourself.

3. Expert Advisors: EAs for short, expert advisors are robots with pre-programmed software and scripts. The scripts contain certain conditions that must be met before the robot can place a trade. This strategy is effective and can scan the market for opportunities as long as it is open.

The challenge with this strategy is that it works with historical price movements. It cannot predict price movements due to fundamental events.

How to choose the Best Automated Trading Platform?

Automation is not enough. Do not choose a forex broker because they support automated trading only. There are other essential factors you should consider. In this section, we will cover the factors and how you can check them yourself.

1) Is the platform regulated in Australia?

Safety is the most important factor to consider before choosing a platform. The Australia Securities and Investments Commission regulates automated trading platforms in Australia. Registering with a trading platform regulated with ASIC guarantees the safety of your funds.

How is this possible? It is possible because ASIC has put strict rules in place to ensure that you do not become a victim of fraudulent brokers. Never choose an unregulated trading platform. Your funds are safe only if you are registered with a regulated platform,

If you choose Pepperstone for example, you can access the external dispute resolution provider Australian Financial Complaints Authority (AFCA). In case there is an issue with your broker, the AFCA is an authority to make sure they play by the rules.

Let us take you through how you can check Pepperstone’s (example broker) ASIC regulation. First, scroll down to the footer of their website. Find their AFSL number and registered name in Australia. If you do this correctly, you should have the picture below

From the image above, you can see that Pepperstone’s FCA AFSL number is 414530. And their registered name is Pepperstone Group Limited.

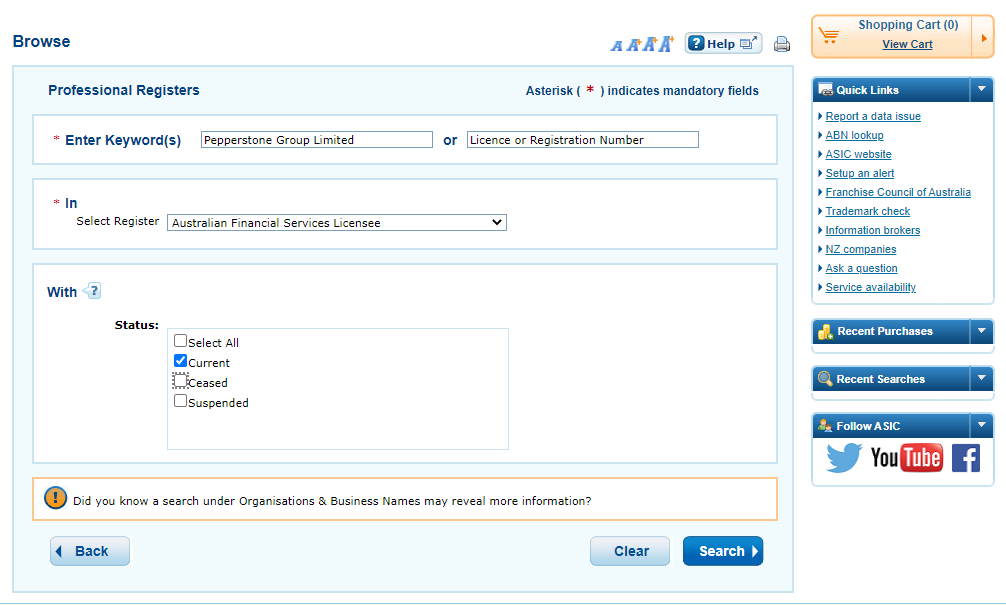

We just concluded the first step. For the second step, you will have to verify the two details match the ones on ASIC’s professional register. When you arrive at the website, you will see the image below. Enter the broker’s registered name in Australia, select ‘Australia Financial Services Licensee’, and ‘Current’ as displayed below. Click on ‘Search’

Your search result will bring multiple options. Most of them will be similar. This happens because the company might have other businesses in Australia that also bear the name Pepperstone. However, the forex broker’s name will stand out if you enter the name from the broker’s website.

From the options, click on the broker’s name and you will find Pepperstone’s ASIC regulation page.

If you repeat these steps for any automated trading platform, you will accurately verify their ASIC regulation.

2) Are the overall fees high or low?

Overall fees include trading and non-trading fees. Trading fees include charges such as spreads, swaps, and commissions.

Non-trading charges include inactivity fees, currency conversion charges, and deposit/withdrawal fees. You must check your chosen platform’s pricing and fees to know how much you are paying to your broker in total fees. It is important to check because these fees affect your profits and increase losses if they are too high.

Most automated trading platforms have their fees on their websites because they use third-party platforms. You can check their fees by going to their websites.

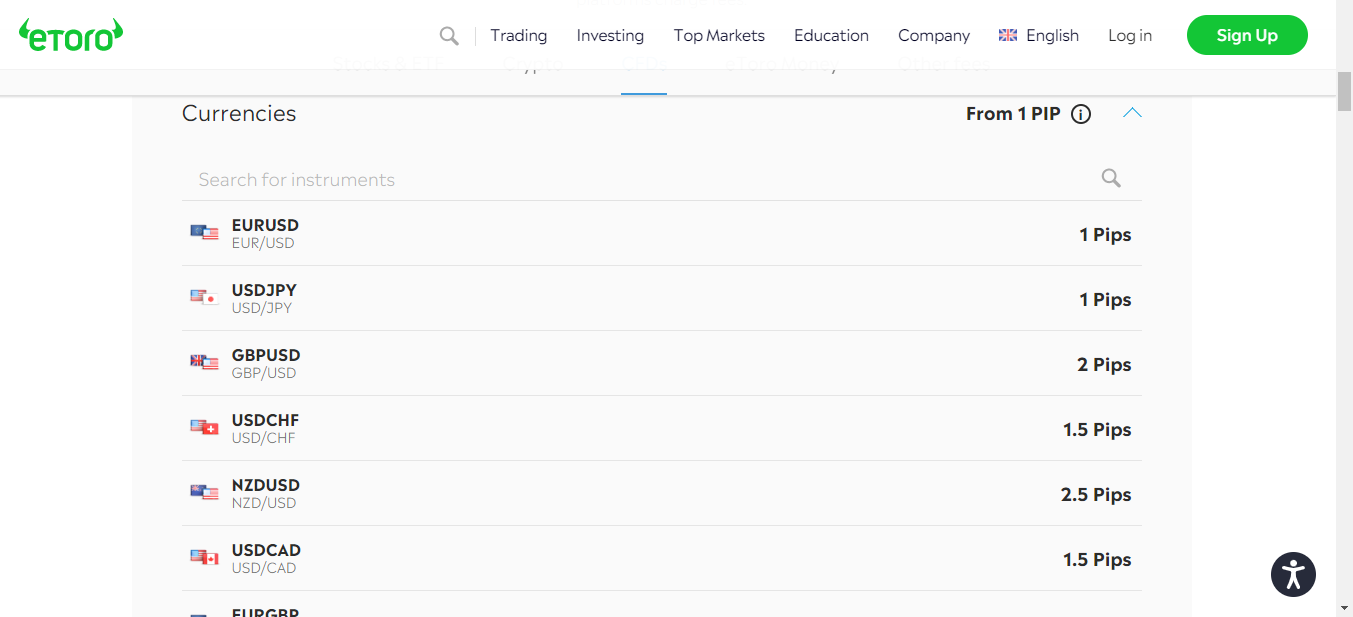

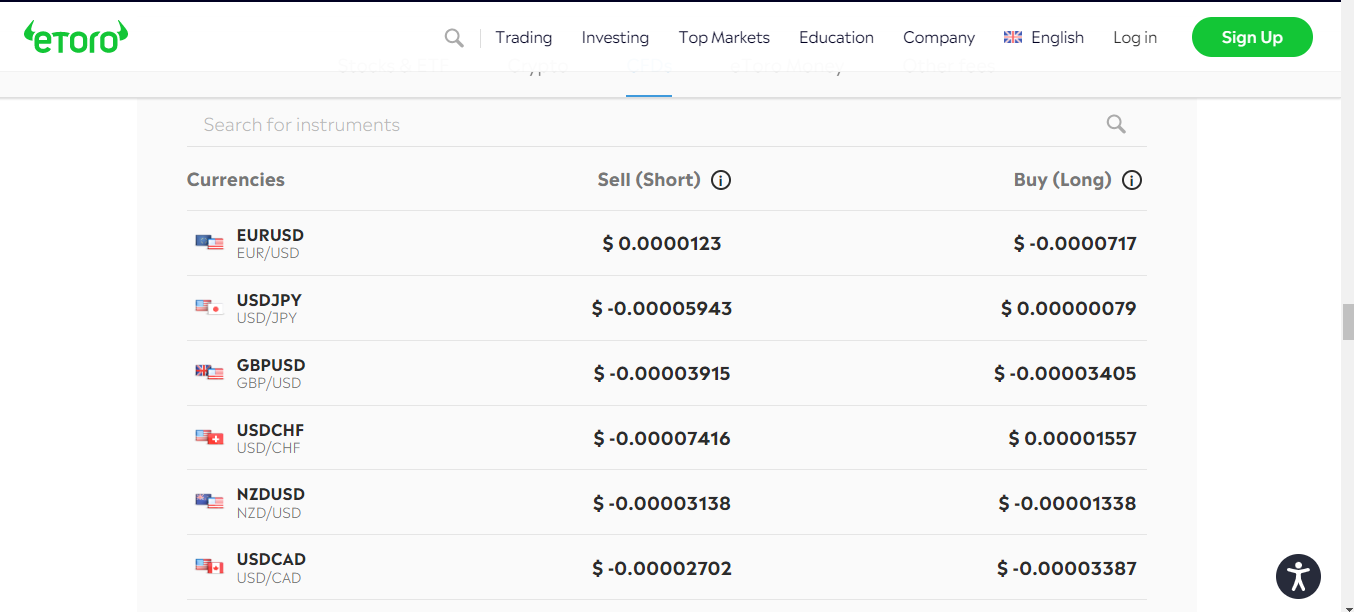

If you want to check eToro’s spreads, for example, you can go to etoro.com and click on ‘Trading’. You will see a dropdown. In the dropdown, select ‘fees’. You will find all trading fees on this page. You will find the spreads first as shown below.

When you scroll further down, you’ll find the overnight fees (swaps)

This is how you check the fees for automated trading platforms. You should also know this. Some brokers might have their own proprietary platform for automated trading. You should speak with your broker’s support to know if there are extra fees for such platforms.

3) How easy are funding and withdrawals?

You need to choose an automated trading platform that allows for easy deposit and withdrawal of funds. Popular payment methods such as credit/debit cards should be available. You should also be able to deposit and withdraw funds via bank transfer.

Your transactions are easier if your chosen platform supports these methods. In addition, you should check how long it takes to get withdrawn funds.

The picture below shows Pepperstone’s funding and withdrawal methods with time:

4)Are results verifiable?

Most automated trading platforms tend to make claims of high profitability. This is usually done because of sales so you cannot take their word for it. You need to verify if these claims are true and credible. This is easy to do but it depends largely on the type of automated trading platform you choose.

If they make the data that verifies their claim available, you can sift through it and make your own independent judgment. eToro is an example of such a platform. Their Copytrader gives you access to crucial data. Examples include historical performance, risk rating, most traded CFDs, drawdowns, etc.

With this data, you can make a sound choice without falling into a marketing trap. Here is an example of transparent data from eToro’s website.

Let us break down the data. First, you can see a healthy risk score of 4. This is so because eToro scores the traders out of a total of 5. You can also see their return/profit percentage and the number of copiers. In the background, there is a graph that shows month-on-month performance. You get to see how often the trader has drawdowns.

Not all automated platform present their data like this. But there must be some degree of transparency from them. The data made available is essential for choosing the right automated trading strategy.

5)How about your favorite CFDs?

You might not want to trade all the CFDs available on your automated trading platform. Therefore, you need to make sure that your preferred CFDs are offered. First, check the CFD classes available. Their market range must be wide including forex, indices, shares, and precious metals.

Other classes like ETFs and commodities might be essential too. Once you confirm the classes, you can go ahead and check for your CFDs in each class. Do not assume the CFDs you want to trade will be available. There is no rule that regulates whether brokers have a CFD or not. So make sure you do your due diligence.

6) Is the customer service good?

How do you know if your chosen platform has good customer support? It is simple. Test them yourself.

Call the broker’s Australia phone number if it is available. Send them an email and use their live chat feature too. This way, you get first-hand experience with the quality of their customer service.

You should look out for clarity in answers to your inquiries. Also, check how long the trading platform responded to your inquiries.

Do you have to wait for over 24 hours to get an answer via email on a weekday? Or is chat support not available on trading days? Such a broker should be avoided.

How to Begin with an Automated Trading Platform

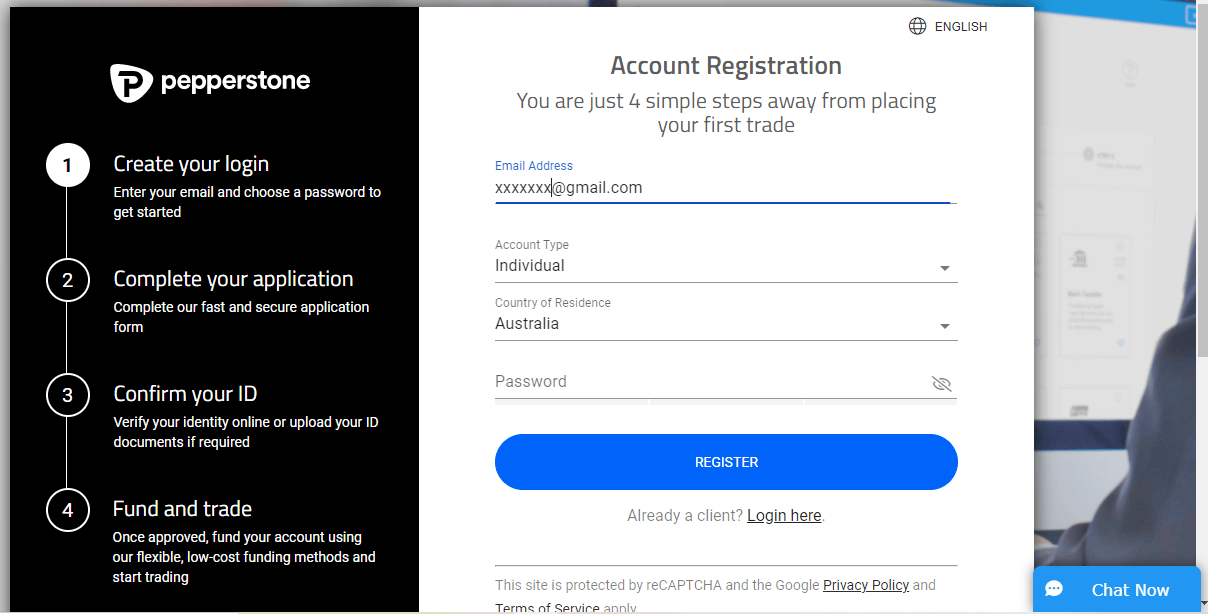

Here is how you can open a trading account with an automated trading platform in the UK. We have chosen Pepperstone as an example broker.

1) Go to the Australia version of Pepperstone’s website. And click ‘JOIN NOW’. It is in the yellow box at the top right corner of the image below

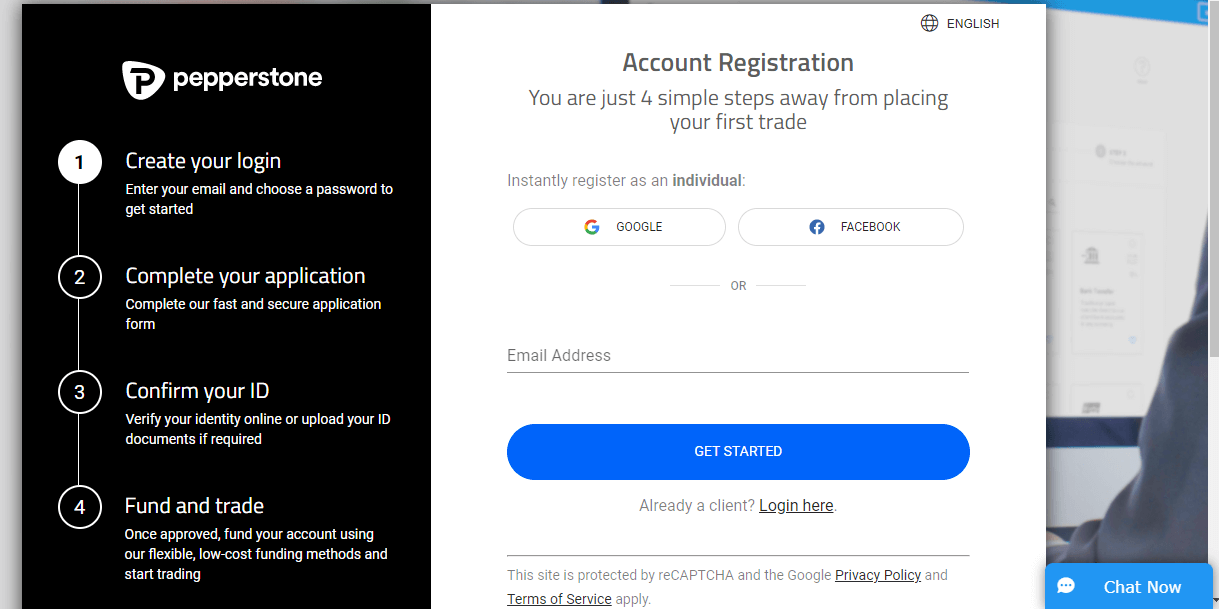

2) Fill in your email and click ‘GET STARTED’.

3) Enter your email address again and create your password. It is at this step you also choose your preferred account type.

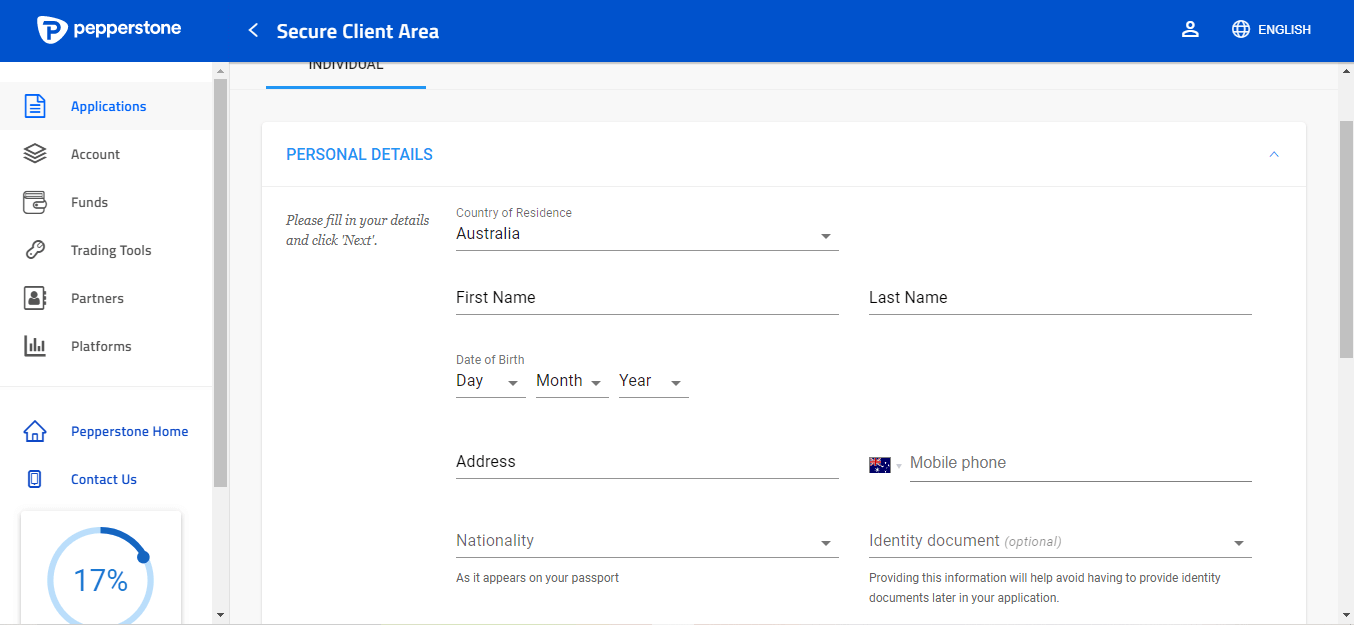

4) At this step, you have access to your ‘Secure Client Area’ where you will be required to fill in more details

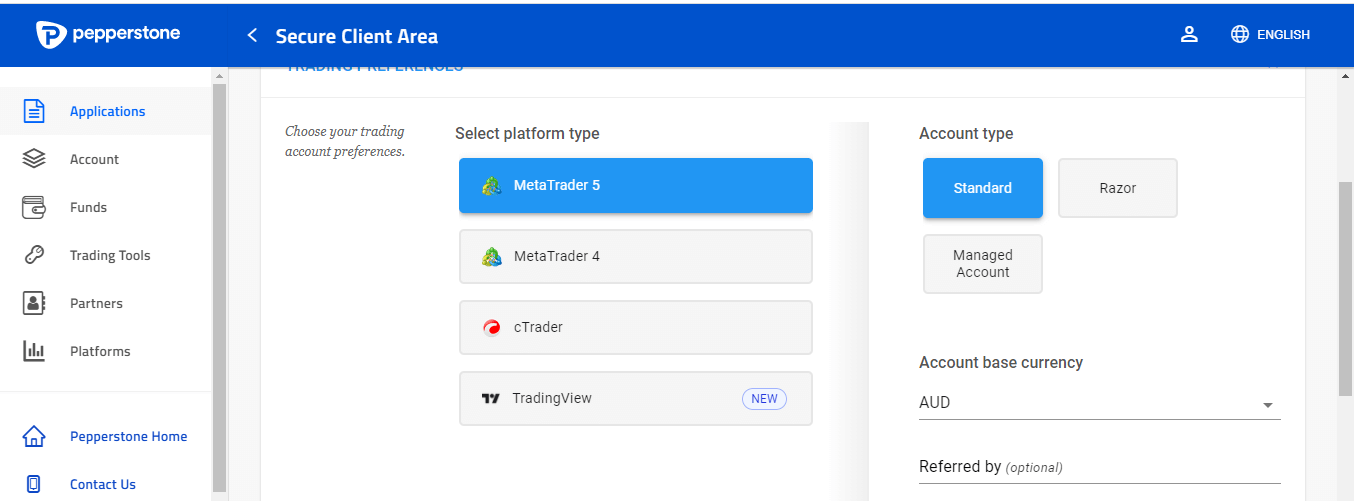

5) Still in your client area, scroll down and choose your trading platform, account base currency, etc.

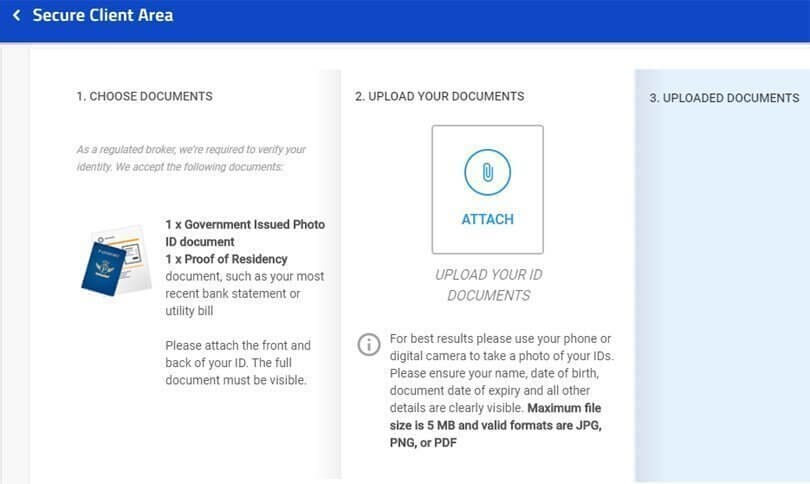

6) Submit your ID document and declare your source of income. You will also declare your employment status.

7) Once you complete your KYC, you can fund your account and begin trading.

How to avoid automated trading scams

Unfortunately, fraudsters and scammers always try to defraud unsuspecting traders. Automated trading also comes with the risk of being scammed out of your money. Here are some steps you can take to avoid being a victim:

1) Before you make payment for any system or robot, be a little bit skeptical. Ask questions that will clear your doubts before you pay any money.

2) Check for social proof. Are there testimonials from people who have used the system before? You can even check third party websites like truspilot to get reviews.

3) A true automated trading system will allow trial periods. You should be given some time to test the system before you pay. If this is not allowed, the system is likely a scam.

Is AI trading better than automated trading

Artificial Intelligence (AI) is developing rapidly. The use case of AI is penetrating almost every field. The financial markets have not been left out of the AI revolution.

Simply put, it is possible to trade with AI. You might be wondering, what the difference between AI trading and automated trading?

The key difference is in AI trading’s ability to evolve. Automated trading is not flexible. You have predefined set of rules that is followed to the letter by Expert Advisor trading robots. But, AI trading goes beyond this.

Apart from following trading rules that you have predefined, AI trading will adapt to ever changing market conditions and improve over time. An AI trading software will not only trade CFDs like currency pairs and stock on your behalf. It will keep adjusting to the flexibility of the market, to make better trading decisions.

How does AI trading software improve your trading? All trading platforms have large amount of trading data (historical and present). An AI trading software, through processes like predictive analysis and machine learning, analyses these data.

This ability in the software allows it identify price movements and patterns that you might not spot. So an AI software is able to optimize data and trends to improve its trading decisions.

Is Automated Trading Safe?

Automated trading is safe as long as you are trading with a broker licensed with the FCA. Trading CFDs comes with a risk of losing your money. But opening a trading account with a regulated broker protects you from unethical corporate practices and fraud.

Which markets are auto trading software suitable for?

Auto trading software is suitable for all markets. However, the there is not one auto trading approach for all the markets. You must understand the market you want to trade and the best auto trading solution that fits it to minimize losses.

Currency pairs, crypto CFDs, and indices CFDs are the most common markets among auto traders.

Choosing the best pricing model

Automated trading is not free. Though it might be helpful for trading, you should also consider the cost. Any platform you choose must fit your budget. You don’t want to overspend.

Some automated trading platforms have a subscriptions pricing model. You will have to make payment within certain a certain time (mostly monthly). Other platforms require that you pay a fee for every transaction (per transaction basis). You must compare the two models to determine what works for you.

In addition to these fees, you need to factor the fees charged by your forex broker too. Commission, spread, deposit and withdrawal fees, charges on currency exchange, inactivity fees, etc. For the best trading experience, your auto trading platform have favorable trading conditions plus affordability.

What is the future of automated trading?

The current automated trading systems have been helpful to traders. However, technological advancement is not stagnant. Looking forward, you can expect major advancements in automated trading. This is due to major progress in artificial intelligence (AI), machine learning, and algo strategy development.

Currently, algorithms execute your trades by following predefined rules. This eliminates the emotional bias that comes with trading CFDs. In addition, it leads to consistent strategy implementation in a very volatile market.

So, what might the future look like? You can expect smarter trading systems. Currently, algorithms react to price movement to execute trades. The systems coming in the future will be able to this and more. They will be able to incorporate social media trends, market sentiment, news, and economic indicators with execution of trades.

AI driven bots have the ability to learn from market data and optimize your trading strategies real time. This means future systems will be only get better and better at adapting to the market without human intervention.

In conclusion, these new system will improve automated trading experience. However, it does not change the fact that forex trading is risky. Advanced systems can only reduce trading risk. They cannot eliminate it. Market anomalies and infrastructure failures can still affect performance

Can trading robots and expert advisors lose trades?

Trading robots and Expert Advisors (EAs) can be very crucial to trading. However, they are not perfect and losses are possible. For example, if you use an automated trading software that trades within a certain range. That is, you have target for the number of pips you want. A trading software might meet this target.

This means you can make profit even if it is within a restricted time period. However, the risk of losses increase if the market moves in an unpredictable way. The risk is even higher if you do not use a stop loss. It is possible for your trading software to lose money when there is a lot of uncertainty in the market.

Can beginners use algorithmic trading?

If you are a beginner, it is your choice to make whether to use algorithmic trading or not. Apart from your preference, it also depends on your skills. To work well with algo trading, you need to know some coding. You will also need to develop your trading strategy.

All of these might be too much for you as a beginner. Though algo trading prevents bias and emotional trading, it is better you trade manually first. You can always develop yourself to use algo trading as time goes by.

Can automated trading software develop a fault?

No technology is 100% perfect. There are rare occasions where an automated trading software might fail to open or even close an order. However, most platforms that allow for developing this software allow you to test and debug any failures you spot.

Do I need coding for automated trading?

Not always. Some auto trading platforms allow you set up your bots without codes. Some even allow automated trading via simple settings on their software. However, you need a knowledge of coding if you are using advanced bots. This is essential for customizing and backtesting your trading strategies.

FAQs on Best Automated Trading Platforms Australia

Is automated trading legal in Australia?

Automated trading is legal in Australia. There are ASIC regulated brokers that provide platforms that allow you to create your algorithms and backtest them too. Only choose ASIC-regulated brokers for automated trading to reduce the risk of fraud.

Is automated trading profitable?

Automated trading is not the holy grail of trading, and there are major risks. You can be profitable or lose your money. It all depends on your scripts and the strategy that it is built upon. Back test the script to check how it performed in various market conditions.

In addition, avoid automated systems that claim 100% profit. They are frauds.

Which automated trading platforms the best in Australia?

According to our review, IG Markets has good automated trading conditions compared to other brokers. Their ProRealTime platform lets you create algorithms or build from the scratch. It also supplies 30 years of market data for backtesting your strategies.