Australia is one of the world’s hubs for forex trading. According to the Bank For International Settlements, the foreign exchange turnover of AUD/USD rose from $359 billion to $381 billion between April 2019 and April 2022.

AUD/USD had the second-highest turnover between 2004 and 2019. So what does this mean? It means forex trading has had a steady growth in Australia. More growth could signify more money being put into the market or more traders joining the market.

If you are a trader joining the market in Australia, you’ll need a trading platform to open and close your positions. This review is about the best forex trading platforms in the country.

We have reviewed these forex trading platforms based on certain factors. Like regulation, account types, total fees, and so on.

Here is how they compare below

Comparison of the Best Forex Trading Platforms in Australia

| Broker | ASIC Regulation | Metatrader | cTrader | Visit |

|---|---|---|---|---|

| IC Markets | Yes |

Yes

|

Yes

|

Visit Broker |

| Pepperstone | Yes |

Yes

|

Yes

|

Visit Broker |

| eToro | Yes |

No

|

No

|

Visit Broker |

| CMC Markets | Yes |

Yes

|

No

|

Visit Broker |

| IG Markets | Yes |

Yes

|

No

|

Visit Broker |

Warning: Only trade with ASIC regulated forex trading platforms. This is the only way you can be sure your funds are safe.

Best Forex Trading Platforms in Australia

Here are 2022’s best forex trading platforms in Australia:

- IC Markets – Overall Best Forex Trading Platform in Australia

- Pepperstone – Forex trading Platform with ASIC Regulation

- eToro – Forex Trading Platform with CopyTrader

- CMC Markets – Zero Commission Forex Trading Platform

- IG Markets – Forex Trading Platform with ProRealTime

#1 IC Markets – Overall Best Forex Trading Platform in Australia

IC Markets are regulated with ASIC. We consider them low risk. Registered as International Capital Markets Pty Ltd, they have been licensed since the year 2009. This means they have over a decade presence in Australia

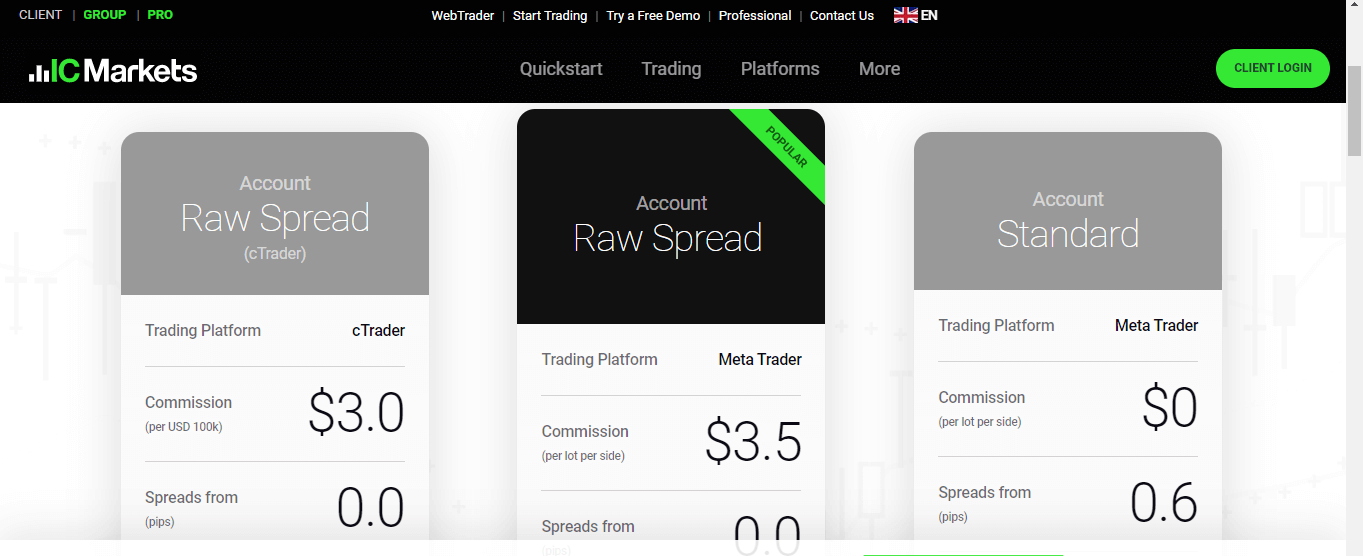

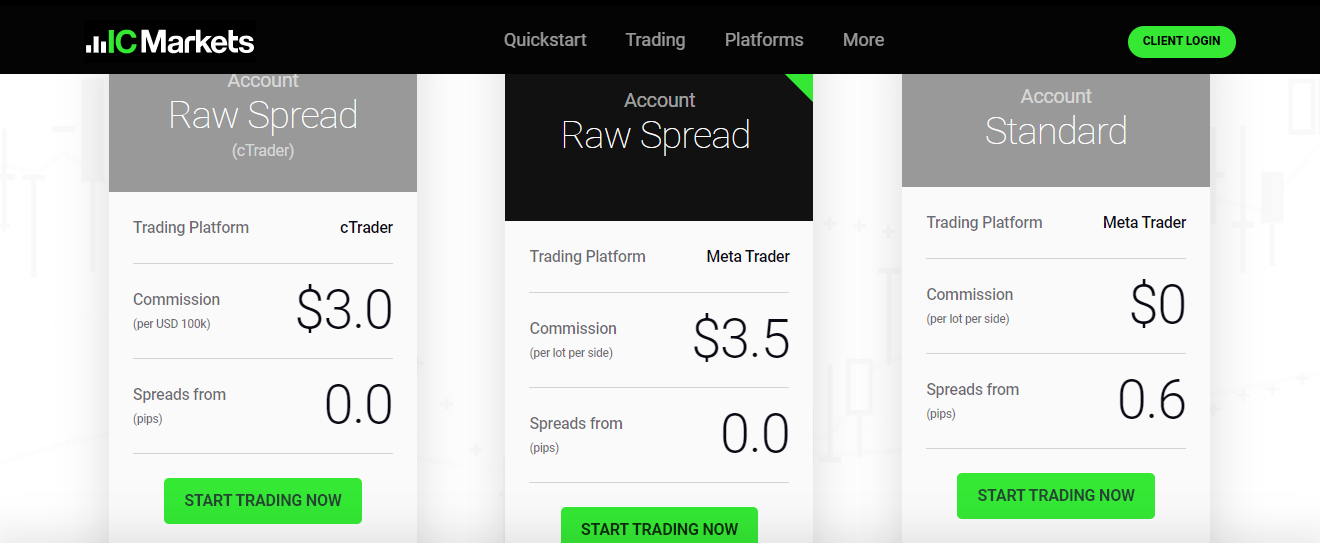

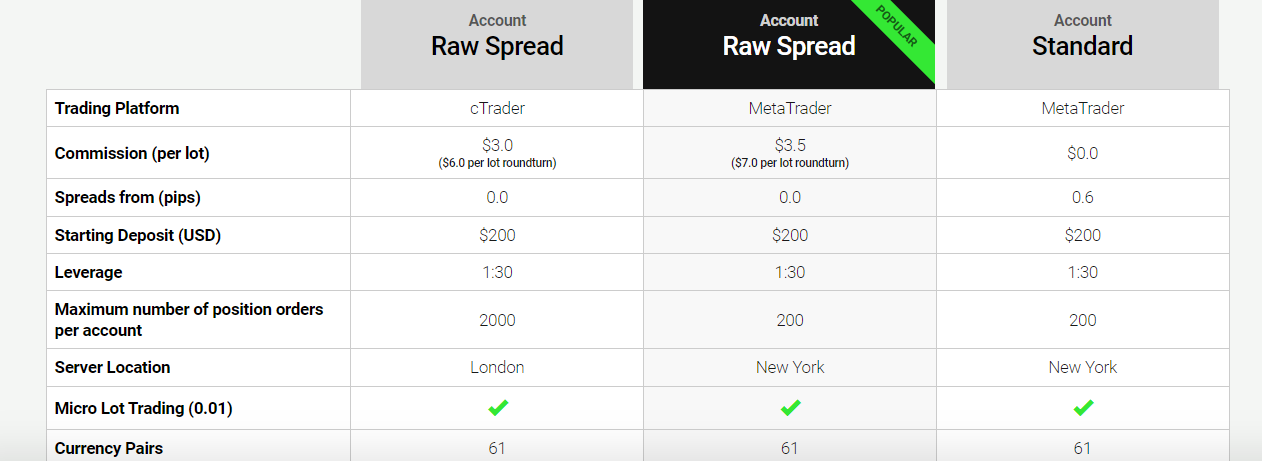

Before we go into the trading platforms, let us look at the account types available with IC Markets. There are two accounts basically. A Raw Spread Account with ECN-like pricing. This is a low spread account with spreads beginning from 0.0 pips. The second account is the Standard Account. The spreads on this account are higher, beginning from 0.6 pips.

Now that you know the accounts available, you might be wondering how much to open an account with IC Markets. Well, all you need is AUD 200 and you can trade forex with 30:1 leverage. Other CFDs such as commodities (20+), indices (23), digital currencies (23), and stocks (1800+) are also offered.

IC Markets do not have a proprietary trading platform. They support MT4, MT5, and cTrader. Now it is important you understand these platforms because they connect with the choice of account you make. And this choice affects your trading fees.

If you are opening a Standard Account, you can only use MetaTrader. While the Raw Account is available on MetaTrader and cTrader. This is key because IC Markets charge no extra commission per lot on the Standard Account.

However, there is a round-turn commission of AUD 7 on the Raw Spread Account for Metatrader. For Raw Spread Account on cTrader, the round-turn commission is USD 6. The overnight charges are pretty much the same.

All the trading platforms are available as WebTrader (MT WebTrader and cTrader Web). They are also available on different devices (Android and iOS). If you love automated trading, there is the cTrader cAlgo which you will be able to download in your secure client area. You can also use the cTrader cAlgo for demo trading to test it.

Copytrading is available on the cTrader Copytrader.

The MetaTrader platforms have fast execution with no restrictions on trading. The servers are located in the Equinix NY4 data centre in New York and are connected to liquidity and pricing providers. This is why the execution of trades is fast.

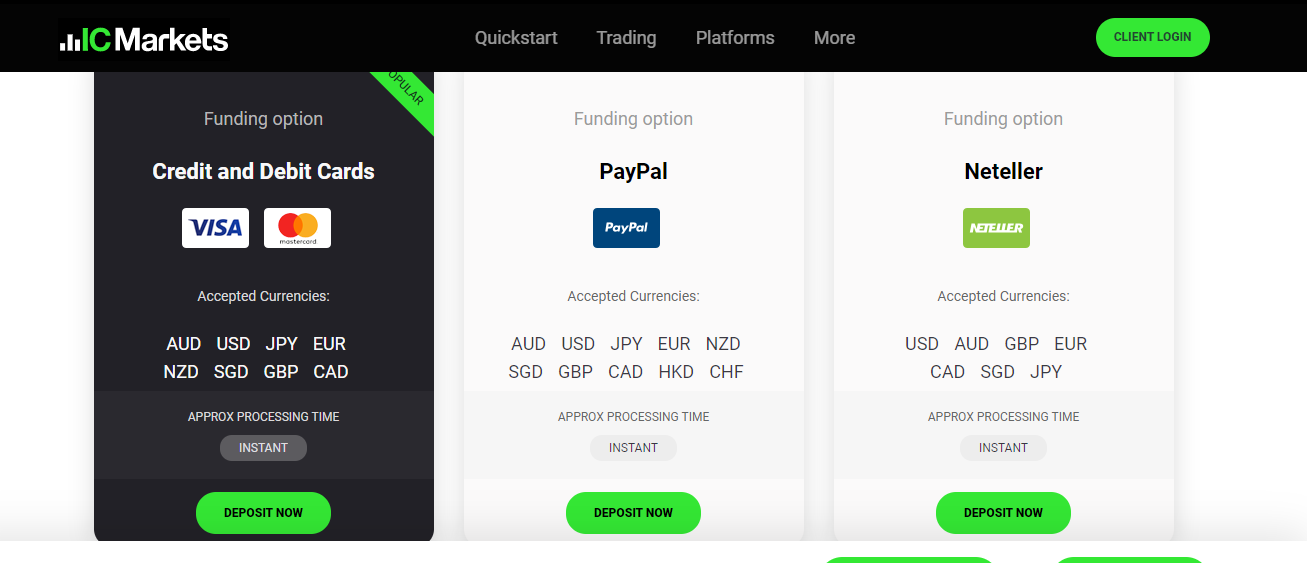

Funding and withdrawal methods are convenient with credit/debit cards, Skrill, wire transfers, Neteller, FasaPay, China Union Pay, Bpay, and broker-to-broker transfer.

We’ve compiled detailed info on the broker on our IC Markets Review..

IC Markets Pros

- You can trade on MT4, MT5, and cTrader

- No dealing desk so execution is fast

- You can write your own codes

- You can hedge your trades

IC Markets Cons

- Minimum deposit is high

- No guaranteed stop loss

#2 Pepperstone – Forex trading Platform with ASIC Regulation

Pepperstone is regulated in Australia so we consider them low risk. The forex broker was licensed in Australia in 2013. They are registered under the name Pepperstone Group Limited.

For general trading conditions, it is important you know that Pepperstone offers two accounts in Australia (Razor and Standard Accounts). Let’s go deeper into the accounts. The Razor Account has low typical spreads with spreads beginning from 0.0 pips.

You can guess why – the Razor Account is ECN type so the pricing is different from the Standard Account. The Standard Account has spreads beginning from 0.6 pips so the spreads are higher. Pepperstone does not require a specific minimum deposit. But they recommend AUD 500 as the first initial deposit.

You can trade different markets with Pepperstone. Forex, shares, indices, commodities, and cryptocurrencies are all available as CFDs. The max leverage you can get is 30:1. Only professional traders have access to higher leverage. To know more about this, please check our Pepperstone Australia review.

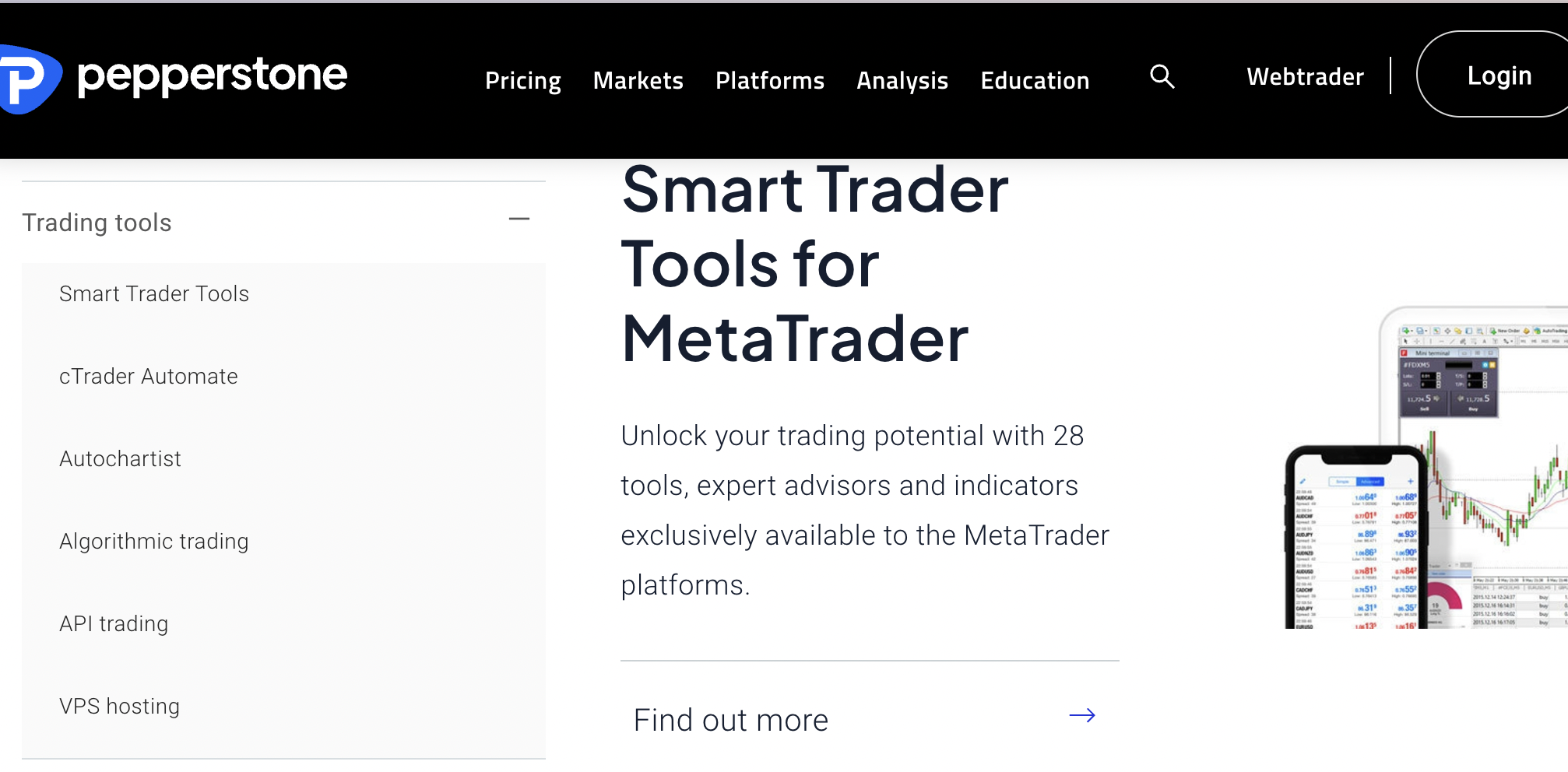

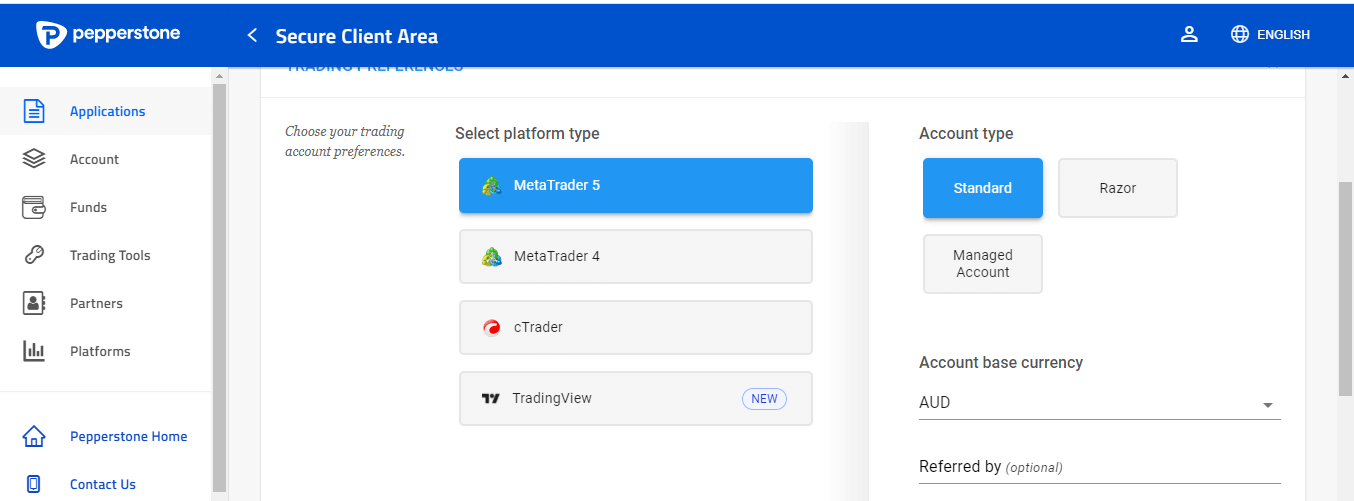

Now, on to the platforms. Pepperstone supports four forex trading platforms. MetaTrader 4, MetaTrader 5, cTrader, and TradingView. TradingView is not owned by Pepperstone. But you can connect your trading account to TradingView. This gives you access to top-charting tools and a community of traders.

MT4 and MT5 are available on Windows and MacOS for desktop versions. cTrader can only be used on windows. For copytrading, you can use MT4, MT5, and cTrader. The only downside is that shares CFDs are available on MT5 alone.

Commissions are also connected to your choice of trading platform. Pepperstone charges an extra commission on the Razor Account alone. However, the amount varies for MT4/MT5 and cTrader. The round-turn commission for MT4/MT5 Razor Account is AUD 7. For cTrader, it is a USD 6 round-turn.

Read the Pepperstone Review. by our team to see other features of the Pepperstone platform.

Pepperstone Pros

- MT4, MT5, and cTrader are supported

- Social trading is supported vis DupliTrade

- Extra tools for technical analysis

- Algorithm trading is supported

- Hedging is supported

Pepperstone Cons

- No guaranteed stop loss

#3 eToro – Forex Trading Platform with CopyTrader

eToro are considered low risk because of ASIC Regulation. They are registered under the company name eToro AUS Capital Limited. eToro has been licensed since 2017 so they have been operating in Australia for five years.

No account types here. All you need to do is sign up and you are ready to go. Pending your KYC verification of course. You can begin trading with an initial deposit of $50. If your account’s base currency is in AUD, your money will be converted to AUD. You will incur a currency conversion fee for this.

With max leverage of 30:1 eToro offers currency pairs, commodities, indices, stocks, ETFs, and cryptocurrencies. (all as CFDs). There is no extra commission per standard lot. The only fees you are charged for trading forex are the swap and spreads.

There are also non-trading fees like the account inactivity ($10) fee and withdrawal fee ($5). Another thing eToro is known for is their social trading services. You can use their CopyTrader to copy the strategies of successful traders. This, however, might be risky because you are trusting the trader you copy with your account indirectly.

In addition, the CopyTrader gives you access to a community of traders and their opinions. You can learn from other traders this way.

Read our eToro Review. for detailed info on the broker’s offering.

eToro Pros

- Low minimum deposit

- No commissions on CFDs

- Social trading is available without extra fees

eToro Cons

- No MT4, MT5, or cTrader

- No guaranteed stop loss

- Withdrawal fee of $5

- You cannot withdraw below $30

- No extra management fees for copy trading

#4 CMC Markets – Zero Commission Forex Trading Platform

We consider CMC Markets low risk because of ASIC regulation. They are registered under the name CMC Markets Asia Pacific Pty Ltd. They have almost two decades of operation in Australia. They were licensed in 2004.

CMC Markets have no minimum deposit for their CFD and Corporate Accounts. You can also choose any of these base currencies if you want – GBP, EUR, USD, CAD, NOK, NZD, PLN, SEK, or SGD. The spread for both accounts begins from 0.3 pips with zero commission for forex trading.

Any of the accounts grants you access to 10,042 CFDs. No forex trading platform in this review has more CFDs than CMC Markets. Let us break it down. Forex (over 300), indices (over 100), commodities (over 100), cryptocurrencies (over 10), shares (over 9000), treasuries (over 50).

Now unto the platform. You have two trading platforms available – the Next Generation trading platform and Metatrader 4. The former is CMC Market’s proprietary platform. It is available on desktops, mobile phones, and tablets.

Apart from fast execution (99.9% fill rate) and transparent pricing, this platform also gives you access to top news about the markets via Reuters (without charge). There is also the client sentiment tracker. A trading tool that allows you to know whether fellow traders are bullish or bearish on CFDs.

Another important thing about this tool is that you can choose the sentiments you want to track. Whether the general client base or CMC Markets’ top traders. The risk with this is that you end up trusting other people’s analyses and decisions over your own.

The MetaTrader 4 is also available and it allows you to use Expert Advisors (EA) that you can program to trade for you. You can trade all CFDs on it except for shares CFDs.

If you are interested in knowing more about their trading conditions, read our CMC Markets Review..

CMC Markets Pros

- MT4, MT5 are supported

- Guaranteed stop loss

- Their New Generation platform is easy to use

- Good education with podcasts and webinars

- Regulated by ASIC

CMC Markets Cons

- No cTrader

- No copy trading

#5 IG Markets – Overall Best Forex Trading Platform in Australia

IG is regulated with ASIC as IG Australia Pty Ltd. Their AFSL number, 515106 was issued on 02/06/2020 and is still valid at the time of this writing.

Before considering why we chose IG Markets, let us look at some of their trading conditions. You will need a minimum deposit of AUD 10 (BPay) to open a trading account. If you are funding your account via credit/debit cards or PayPal, the minimum deposit is AUD 450. No minimum deposit for EFT and international transfers.

IG also accepts deposits in GBP, NZD, EUR, USD, and HKD. The average spread for AUD/USD is 0.74 pips on their MT4 Account. Other CFDs available with IG are indices, shares, commodities, options, and futures.

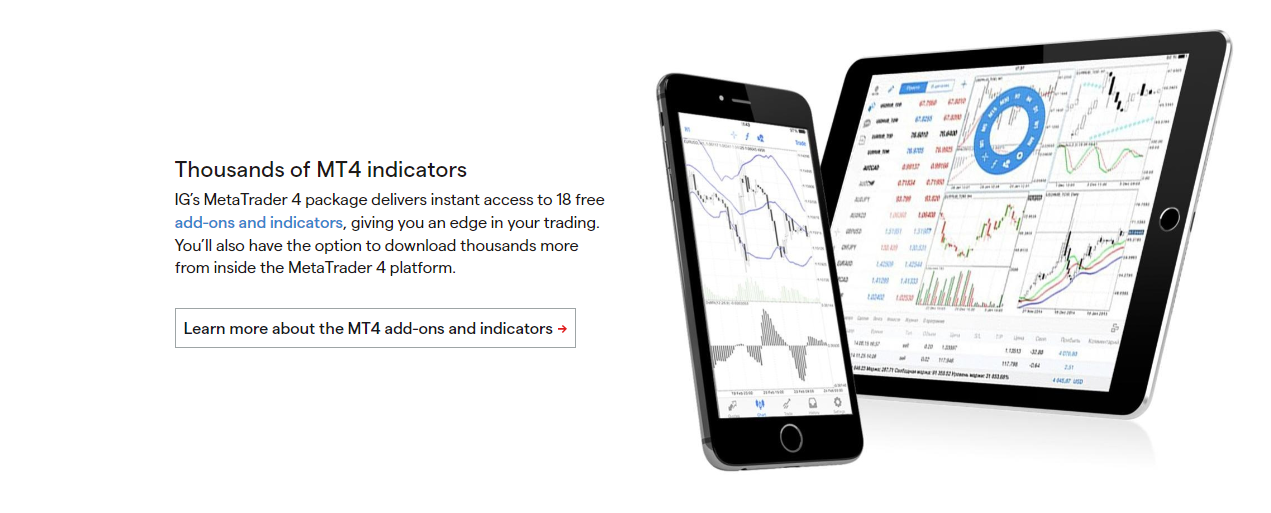

We chose IG Markets because they have multiple platforms. There is MT4, ProRealTime L2 Dealer, and IG trading app. L2 Dealer is a share trading platform. It is free and offers direct market access (DMA) with top-notch price alerts and movements. When you open a share trading account, IG will send you a link to download L2 Dealer.

ProRealTime is an advanced platform that is very useful for technical analysis. You can have trendlines drawn and updated automatically. The fact that this can be done every five minutes makes it more effective. With ProBuilder language, you can create and use your own custom indicators. There are many benefits you can enjoy from ProRealTime. The only downside is that you will have to pay for it if you are not trading forex at least four times a week.

Find out more about the broker on our detailed IG Markets Review..

IG Markets Pros

- Dedicated platform for share trading

- ASIC regulation

- Multiple trading platforms

- 18 add-ons on MT4 plus Autochartist

IG Markets Cons

- No MT5 and cTrader

- ProRealTime is not free

- High minimum deposit via debit/credit cards and PayPal

More on Forex Trading Platforms

A forex trading platform begins with regulated brokerage companies. These companies have a system of accepting traders and connecting them to the forex market. A Trading platform is a major way forex brokers let traders access the markets.

Once you are registered and your trading account is activated, you can then use the trading platforms to trade forex. Trading platforms are broadly divided into two — third-party platforms and proprietary platforms. Other companies develop the former for forex brokers. Examples of third-party platforms include MT4/MT5 (from MetaQuotes) and cTrader (from Spotware Systems).

On the other hand, proprietary platforms are developed by brokerage companies. They are designed and built by brokerage companies. eToro, FxPro, and City Index are examples of brokers with their own platforms. Some brokers support both types of trading platforms. However, there are few brokers like XTB who only support their proprietary platforms.

What is the Difference Between Dealing Desk and Non-Dealing Desk Platforms

Forex trading platforms can be divided into dealing desk and non-dealing desk (NDD) platforms. Dealing desk platforms are market makers. They take the opposite sides of your trades. In simple terms, when you buy a currency pair, they are selling it to you and vice-versa.

Most dealing desk brokers usually have an in-house price book so they set the price of trading instruments. Because of this, there’s likely to be a conflict of interest where the broker stands to benefit from your trades. This does not mean dealing desk brokers should be avoided. You can review their legal documents to see how they deal with conflicts of interest.

NDD brokers, on the other hand, do not take opposite sides of your trades. They have no dealing desk and in-house price book. an NDD broker could be an ECN or STP broker. ECN brokers give direct market access. They connect you directly to buyers and sellers in their market.

STP brokers connect you to buyers/sellers through their liquidity pools which could be banks or other financial institutions.

Finally, there are hybrid brokers that combine the features discussed above. The important point is to know how they handle conflict of interest. You can ask your forex trading platform for their conflict of interest document to know how they handle it.

How to Choose the Best Forex Trading Platforms in Australia

Choosing a forex trading platform is not something you should do casually. Forex trading is risky. If you sign up with the wrong platform, you can end up losing all of your money. There are a few things you should consider. More like a checklist.

If you pay attention to these factors, you should be able to make a good decision.

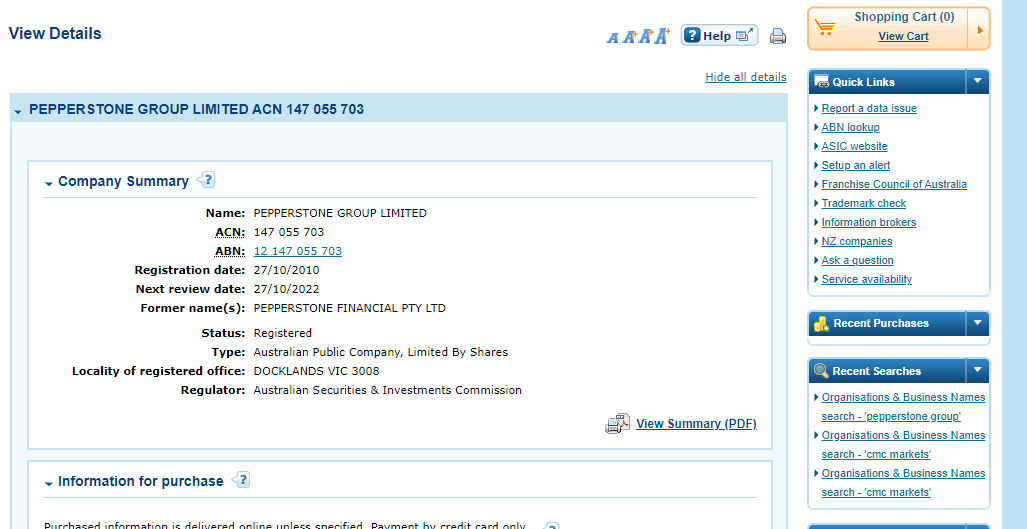

1) Regulation: The reason you should consider regulation is because of the safety of your funds. There are fraudulent forex brokers that can scam you. This is why you should only sign up with forex trading platforms that are regulated with ASIC.

ASIC assigns a number called Australia Financial Services License (AFSL) Number. Two forex trading platforms can’t have the same AFSL number which is a major distinguishing factor.

You can check a forex trading platform’s regulation in Australia by going to https://asicconnect.asic.gov.au. On this website, you are able to search the ASIC registers and find the regulation details of a forex trading platform.

The outcome of the search looks like this:

Furthermore, choosing an ASIC regulated forex trading platform lets you settle external disputes with your broker via the Australian Financial Complaints Authority (AFCA)

2) Trading Fees: The cost of trading (commissions in particular) is usually connected to account type. But as we have seen in this review, it can be dependent on trading platforms too. Let’s use IC Markets as an example. They have two accounts. An extra commission is charged per standard lot on their Raw Account only.

However, it varies between MT4 and cTrader. Even the currency unit is different as shown below.

To confirm the difference in commission, you can check for account types on the forex broker’s website. These details are usually there.

3) Multiple Accounts: Forex trading platforms usually have more than one account. You should consider this factor because it helps you with pricing flexibility. Usually, forex brokers will have a standard trading account. This account will have high average spreads with zero commissions per standard lot.

The other account(s) have a low typical spread but you are charged a round-turn commission on your trades. Because account types affect the structure of trading fees, it is better you go for a trading platform with at least two accounts.

In addition, account types might also affect your minimum deposit. A forex broker may have an account with no fixed minimum deposit. This allows you to trade with little money. However, some accounts do have a specific minimum deposit. Do you see why you have to consider a platform with multiple accounts?

Here is an overview of IC Markets trading accounts for example.

IC markets have a Raw Spread Account and a Standard Account. You can see from the image that the trading conditions in the accounts are different. Spreads, commissions, etc all vary per account. The image below gives you even more info.

Do you see why you need to compare trading accounts? If your broker offers more than a single trading account, you have to compare them to choose the best trading conditions.

3) Products Available: When we say products here, we are talking about CFD instruments. Some forex trading platforms do not put all of their CFDs on certain platforms.

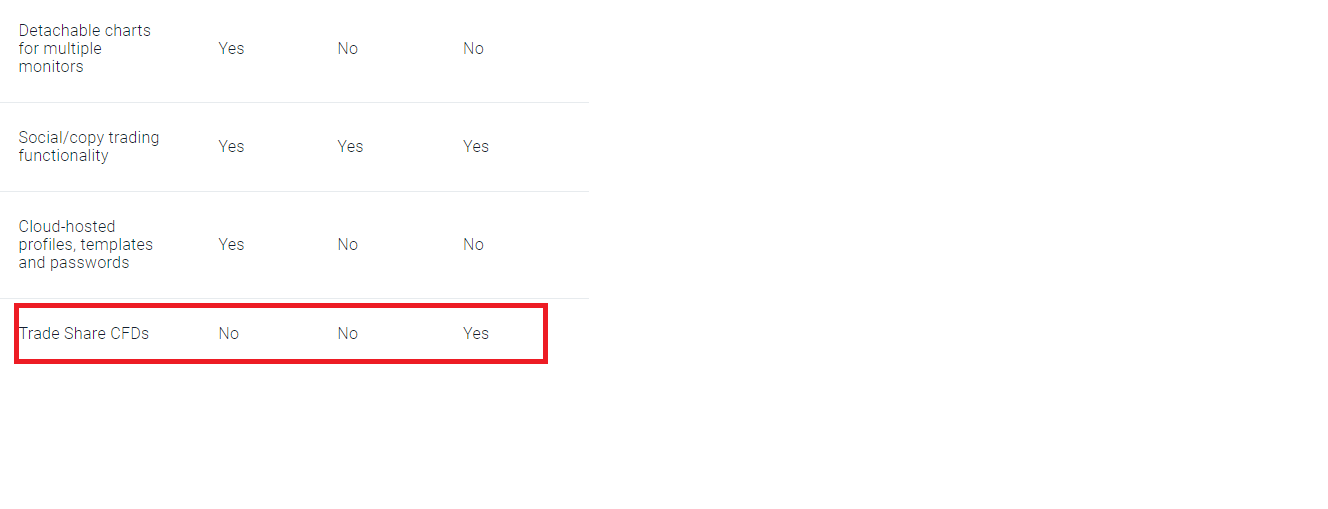

Forex trading platforms like CMC Markets and Pepperstone do not offer shares CFDs on some of their platforms. CMC Markets offer it on their Next Generation platform only. While Peperstone only offer it on their MT5

Here is a screenshot below:

The two ‘Nos” in the picture represent the absence of shares CFDs on cTrader and MT4 respectively. To find more details, you might have to click on each trading CFD markets offered and read about them. You will be able to know the CFD products that are available and the ones that are not.

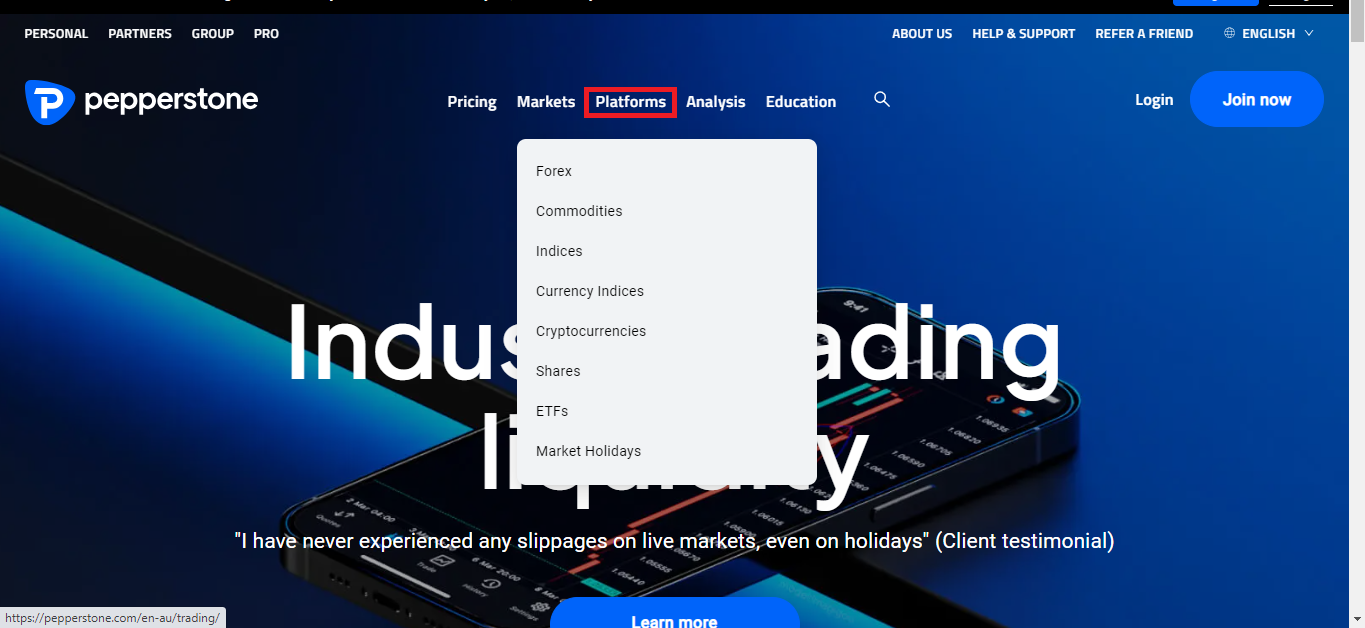

Here is a another example from Pepperstone’s homepage. When you click ‘Markets’, you will see the different CFDs available as shown below.

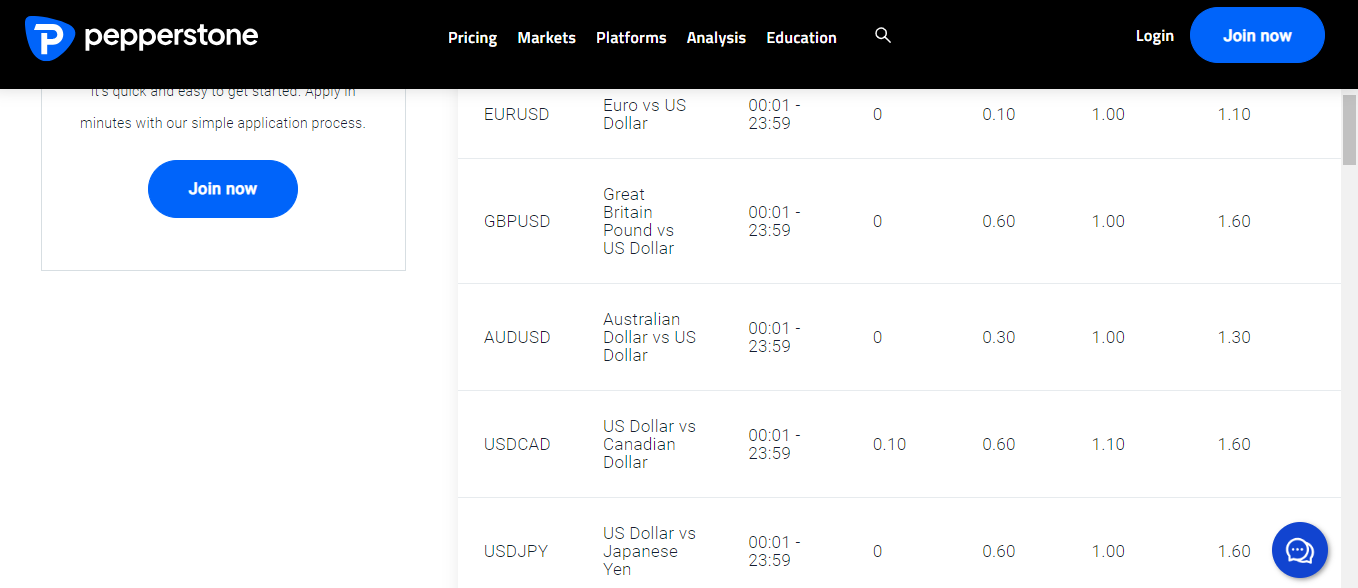

There is forex, commodities, indices, etc. For a breakdown of each class, all you need do is click any of them. If you click ‘Forex’, you will find details about each currency pair (spreads, trading time, etc).

4) Funding/Withdrawals: Transactions should be easy, convenient, and fast. The first thing you want to look out for is deposit/withdrawal via local banks. Then you want to check if local options like Bpay skrill and POLi are also available. For more flexibility, you should also consider confirming if other e-wallets like skrill are available.

After you have confirmed the methods available, it is important to check how long transactions take per method. Deposits are instant for most methods while withdrawals can take 1-3 business days. Checking these will help you choose the best option that works for you.

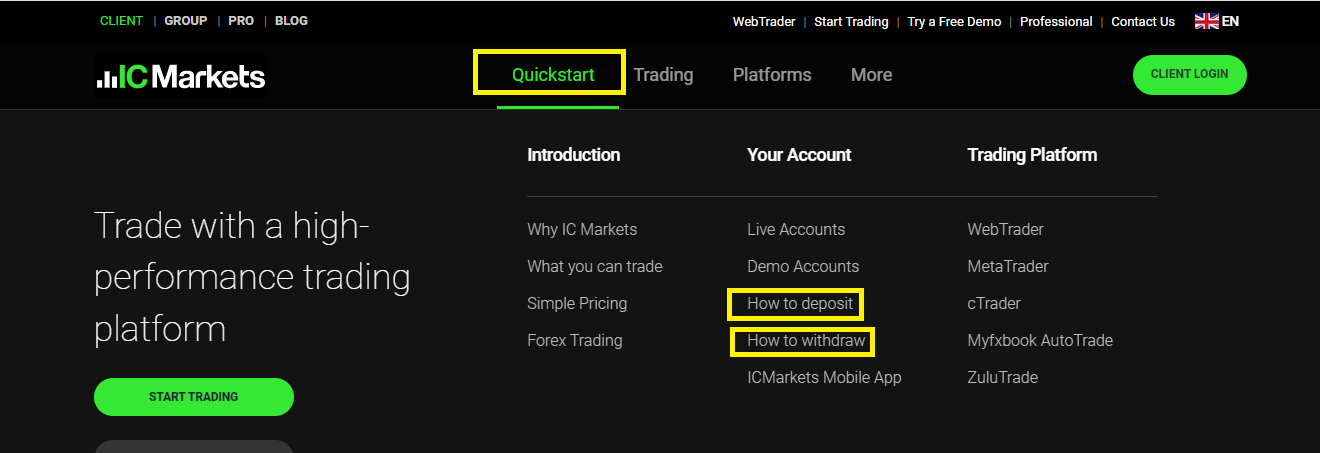

Let us see an example with IC Markets. From the homepage, click ‘Quickstart’. A dropdown will appear with different options. From there click ‘How to deposit’ or ‘How to withdraw. The illustration below will help you understand

When you click ‘How to deposit’, you will see all of IC Markets’ deposit methods, the currency allowed, and the time it takes to process the funding.

If you scroll down the page above, you will see other deposit methods like Skrill, UnionPay, BPay, and POLi. The same methods are available for withdrawing your funds.

5) Trading Software and Apps: Before choosing a trading platform, you should check the kind of trading software supported by your broker. MT4 and MT5 are popular globally. You want to make sure your broker has one or both of them.

A broker with both of them is better because MT5 has some advanced features that are lacking in MT4. Furthermore, you should check if your broker’s MT4 and MT5 are available on multiple devices (desktops and mobile phones). They should also be compatible with major operating systems like macOS, android, windows, and iOS.

6) Customer Support: This also is a crucial factor. Though you can research a forex trading platform on your own, it is possible to miss or not find crucial info. This is where customer support comes in. First, there should be an FAQ section where precise answers are available for inquiries.

In addition to this, there should be email support, live chat, and an Australian mobile number. Some forex brokers also receive clients in their office so a physical presence in the country is good too.

To know if the customer support is quick, you have to test it yourself. This way, you get a first-hand experience. You can use the live chat feature or send an email. You can grade the speed of the customer support this way. A local phone number could also be helpful. If your broker has one, you can give them a call and see how quickly they respond.

7) Platform key features: When choosing a forex trading platform, there are some key features you want to look for that will make trading smoother and efficient. First, check if the platform has customisable charting tools. You will want the ability to personalise your charts with different indicators, and timelines.

If they have chart types like candlestick or Renko, even better. From experience, advanced tools like Fibonacci retracements and moving averages help you make technical analysis.

Another thing to look out for is Fast order execution, this is important as it helps you avoid slippage, and having various order types—like market, limit, and stop orders—gives you more control over your trades. A good platform will typically also offer research tools, such as an economic calendar to track key events as well as fundamental analysis for market news and company reports.

If you are serious about strategy, make sure to choose a platform that allows you to backtest your trades using historical data. Finally, if you are interested in social trading, then choose a platform with copy trading features that let you follow and replicate successful traders’ moves.

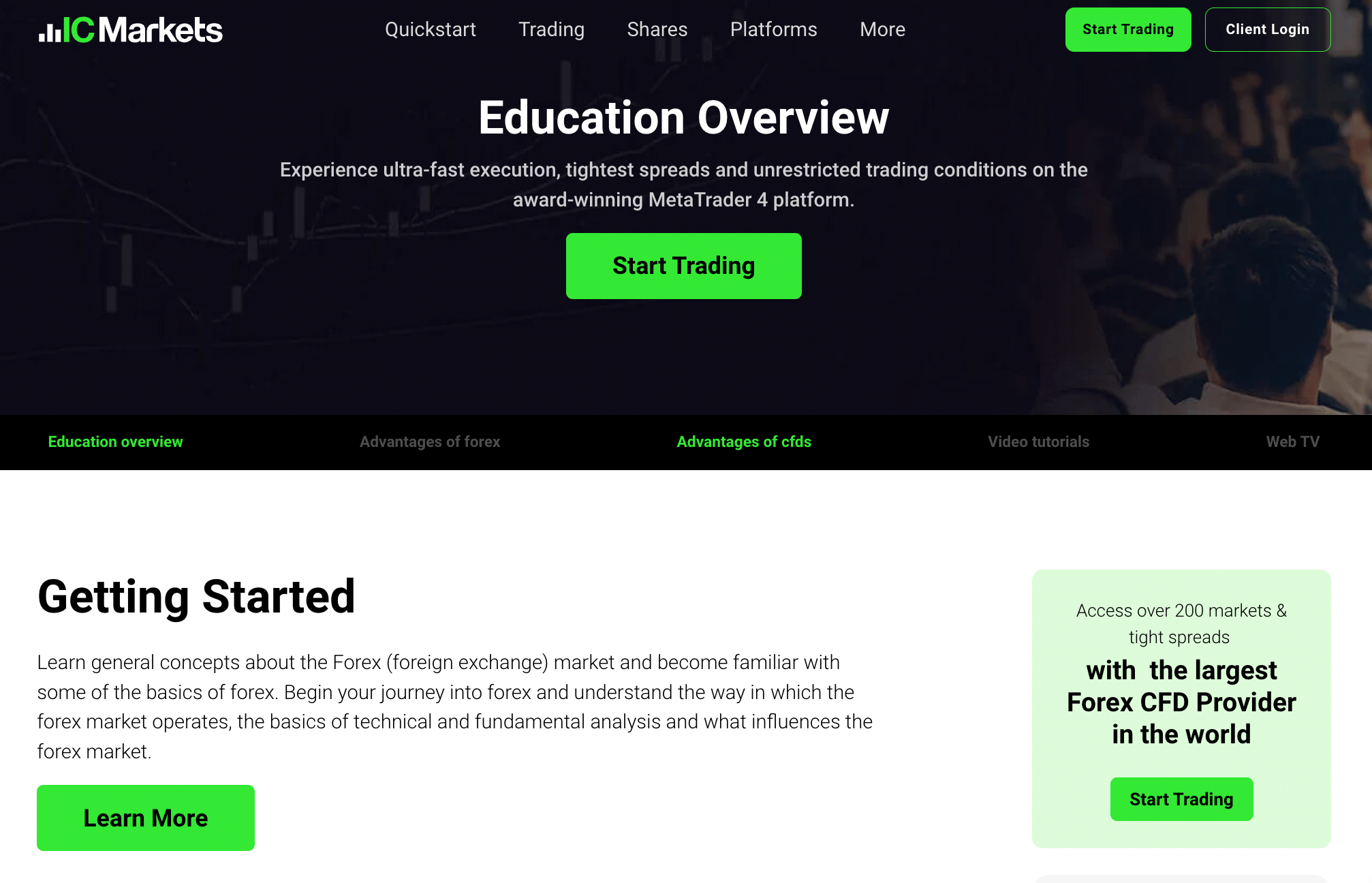

8) Educational resources: Starting a successful forex trading journey often depends on having the right knowledge. A good trading platform should offer the tools and resources you need to learn the ropes, improve your skills, and experience. So, make sure to choose a trading platform with comprehensive educational resources such as:

-

Tutorials and Guides: A good platform should break down forex trading concepts in a way that’s easy to understand, especially for beginners; and

Webinars and Seminars: Live webinars and seminars hosted by experienced traders or analysts can provide real-time insights and strategies. Good trading platforms usually host these sessions and they are great for learning from the pros and staying up-to-date with market trends.

How to Start with the Best Forex Trading Platforms in Australia

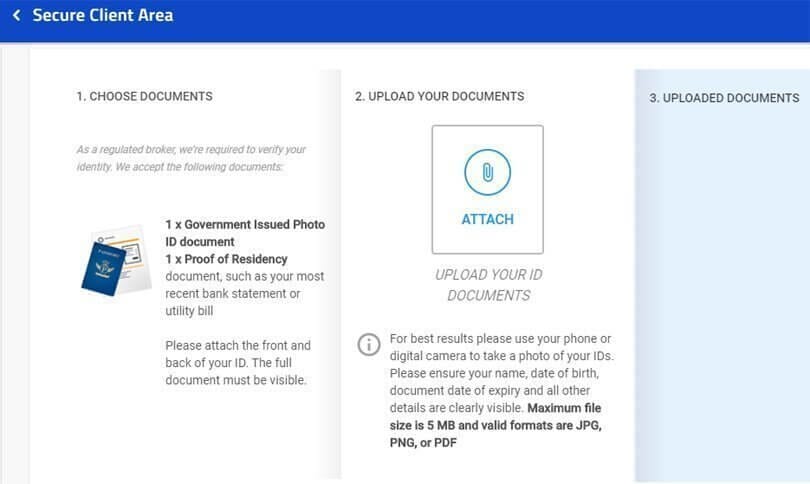

In this section, we will be showing you how to open a trading account with the best forex trading platforms in Australia. There are quite a number of them so we will be using one of them as an example (Pepperstone).

1) The first step is to go to their homepage. Pepperstone’s website for Australia is www.pepperstone.com/en-au. On the homepage, click on ‘join now’

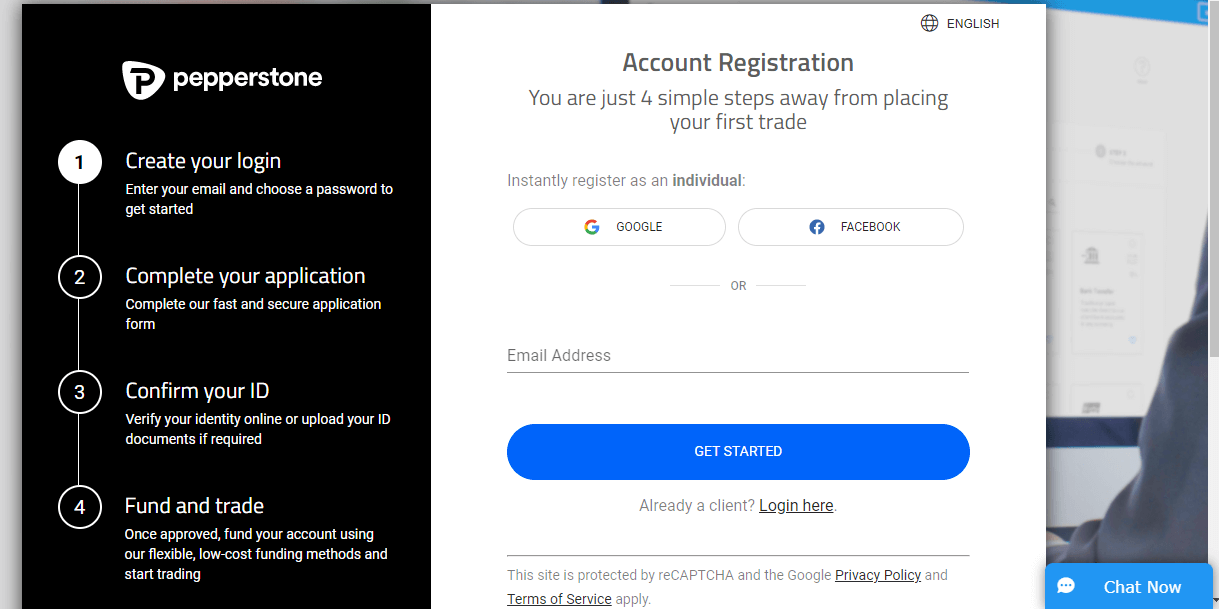

2) Enter your email to register. Then click on ‘Get Started’

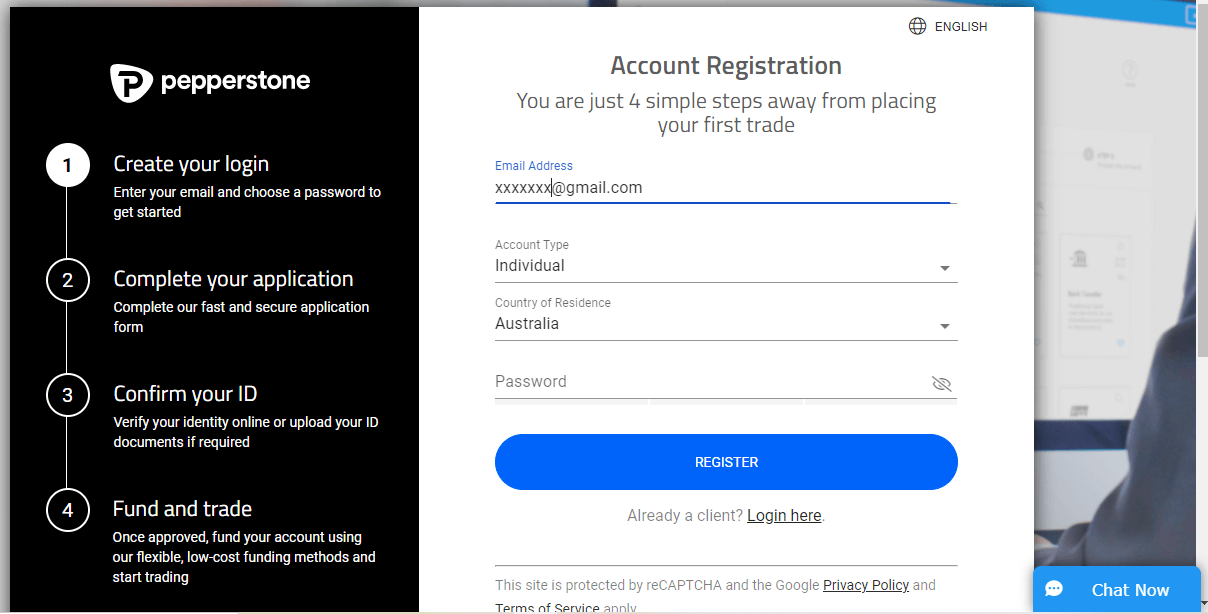

3)You will enter your email address again, create a password and choose an account type. Note here that you are choosing between an ‘individual’ or ‘corporate’ account. Not necessarily the trading accounts.

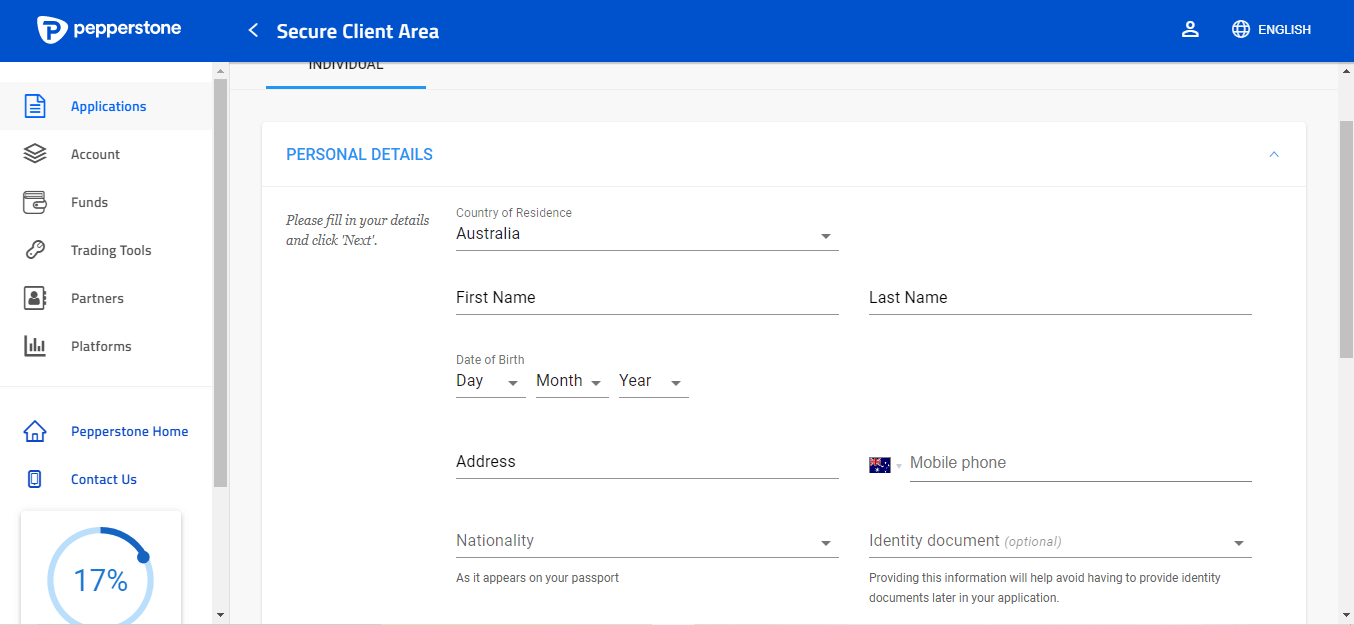

4) After these steps, you will have access to your ‘secure client area’. Here, you will need to give more personal details. Like your nationality, date of birth, residential address, etc.

5) When you scroll further down in the client area, you will be able to choose your account base currency, trading account type, and preferred trading platform.

6) The final step will require uploading your ID document for verification. You will also have to declare your employment and source of income.

7) Once your ID is verified, you can begin trading with Pepperstone.

What is the Difference Between Trading Tools and Technical Indicators?

Trading tools help forex traders make trading decisions. It could be any form of technology or application. Beyond trading decisions, these tools also aid forex traders in portfolio management. These tools could be as simple as tutorials and videos for trading education.

However, they could also be complex tools for backtesting your strategies, optimizing your portfolio, analyzing your portfolio, etc. Trading tools also might also include risk management tools.

You might confuse trading tools with technical indicators but they are not the same. Technical indicators are used to identify bullish or bearish trends. You can use them to identify how strong these trends are and how far with they might last.

These indicators are not perfect. However, traders tend to integrate two or more of these indicators to confirm their analysis. The most common indicators include the relative strength index (RSI), stochastic, moving average convergence divergence (MACD), fractals, Fibonacci retracements, etc.

FAQs on Best Forex Trading Platforms in Australia

What is the best website to trade forex?

According to our review, the best trading platforms for Australians are the ASIC regulated ones. Pepperstone, IC Markets, eToro, and CMC Markets are all regulated in Australia.

Is forex legal in Australia?

Yes, forex trading is legal in Australia and is regulated by the Australian Securities and Investments Commission (ASIC). It is best to trade with only forex brokers that are regulated by ASIC, this is because ASIC offers some level of protection when you trade with regulated brokers.

Can you get rich trading forex?

Forex trading is risky and a large percentage of retail traders lose all of their money when trading CFDs with forex brokers. It is best to avoid forex trading unless you understand how it works and have experience. It is also advisable that you no use all the leverage available, because although it increases the potential of profit, it also amplifies your losses and you can lose all your money in forex trading.

Which trading platform is best for beginners in Australia?

eToro, Pepperstone, and CMC Markets have good educational content that is useful for beginners. They have demo accounts you can use for practice before putting in your real money and their trading platforms are available on web, desktop and mobile apps. They also have accounts that do not charge extra commissions.

Which platform is best for trading in forex?

MetaTrader 4 and 5 are the most popular trading platforms. They have good charting tools that are ideal for trading. cTrader follows them closely and is growing in popularity too.

Is forex trading allowed in Australia?

Yes, you can trade forex in Australia. Forex brokers that offer a platform for trading forex in Australia are regulated by the Australian Securities and Investment Commission (ASIC).

Do forex traders pay tax in Australia?

In Australia, forex trading is regarded as an income source. If you make money from trading the markets, the money is subjected to tax.