HotForex is a Forex Broker that offers Forex Trading & CFD Trading on metals, stocks, energies, bonds, cryptocurrency commodities, indices, ETF, and physical stocks.

HotForex is licensed with multiple Top-Tier regulations in the UK, South Africa, and Europe. In May 2022, HotForex rebranded into HFM, which is short for HF Markets.

This review of HotForex will cover their account types, available tradable instruments, deposit/withdrawal options, trading/non-trading fees, and customer support.

| HF Markets Review Summary |

| 🏢 Broker Name |

HF Markets (SV) Ltd. |

| 📅 Establishment Date |

2010 |

| 🌐 Website |

www.hfm.com |

| 🏢 Address |

HF Markets (SV) Ltd., Suite 305, Griffith Corporate Centre, P.O. Box 1510, Beachmont, Kingstown, St. Vincent and the Grenadines |

| 🏦 Minimum Deposit |

20,000 UGX |

| ⚙️ Maximum Leverage |

1:2,000 |

| 📋 Regulation |

SVGFSA, FCA, FSCA, DFSA |

| 💻 Trading Platforms |

HF Markets App, MT4 and MT5 for PC, Mac, Web, Android |

| Start Trading with HF Markets |

HF Markets Pros

- Regulated in multiple jurisdictions

- A wide range of available products

- Allows deposits/withdrawals via Ugandan mobile money

- Has low minimum deposit and negative balance protection

- Has responsive 24/5 customer support via email, local phone call and live chat

HF Markets Cons

- Not regulated by any agency in Uganda

- Customer service is not available 24/7

- Charges dormant account fees

- Has high leverage, which increases risk of funds loss

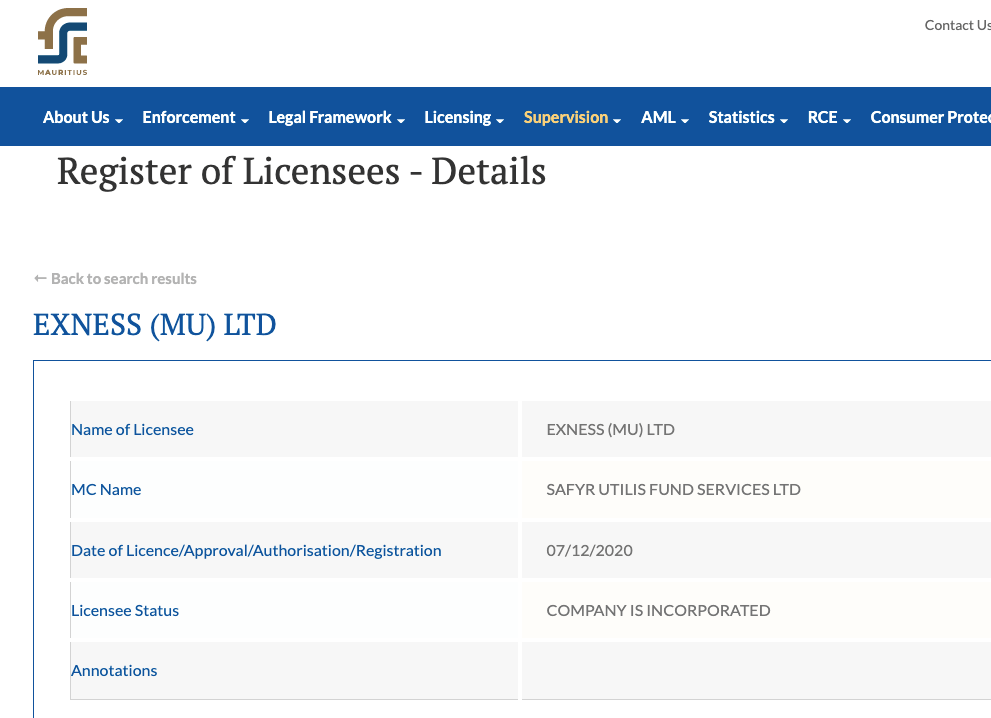

Regulation and Safety of Funds

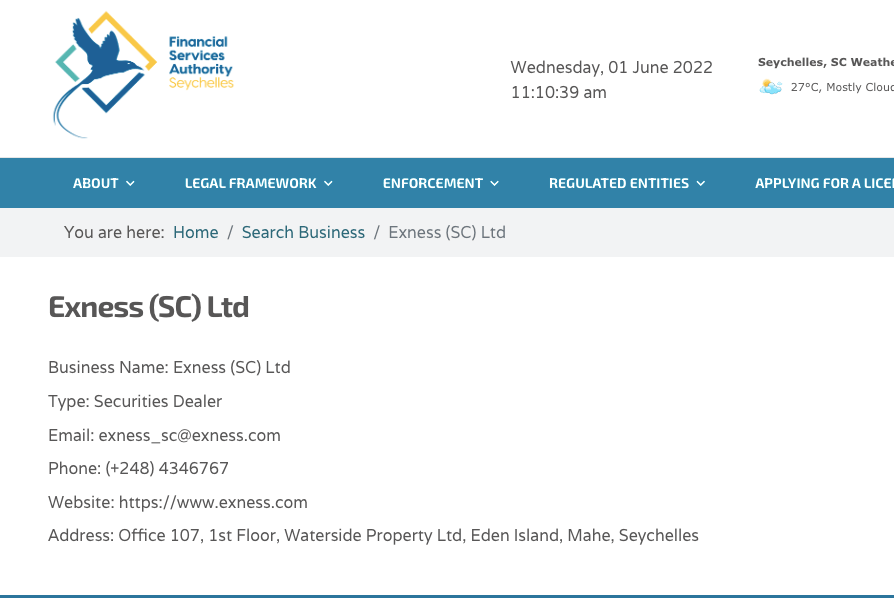

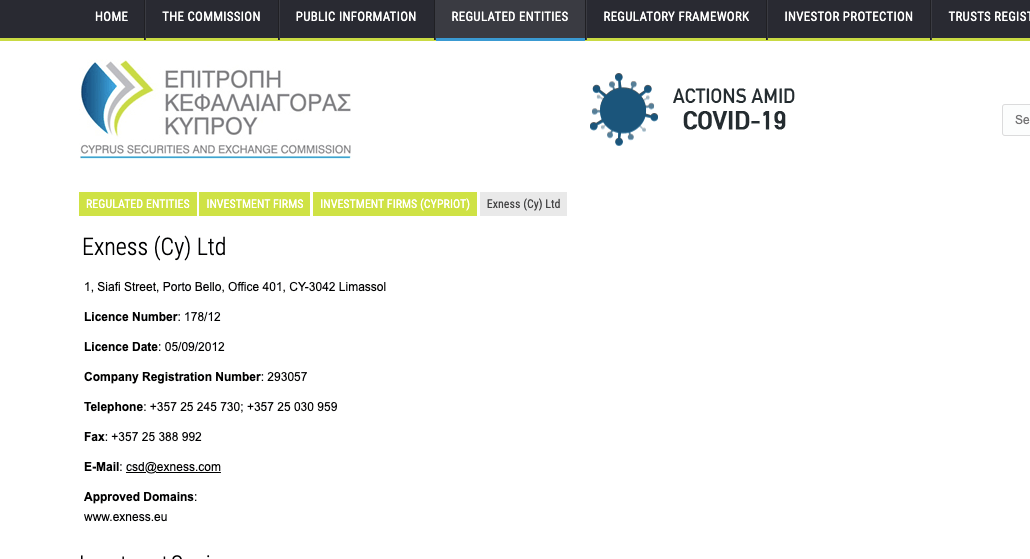

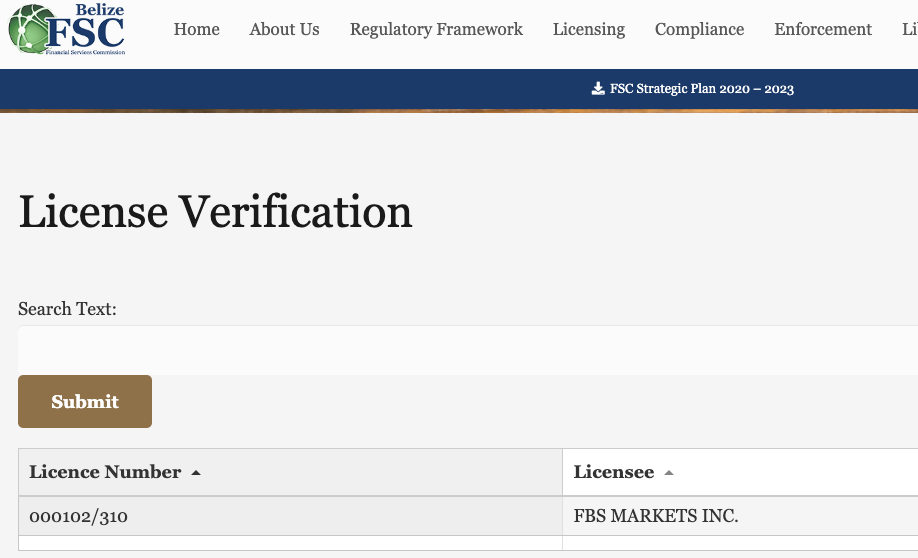

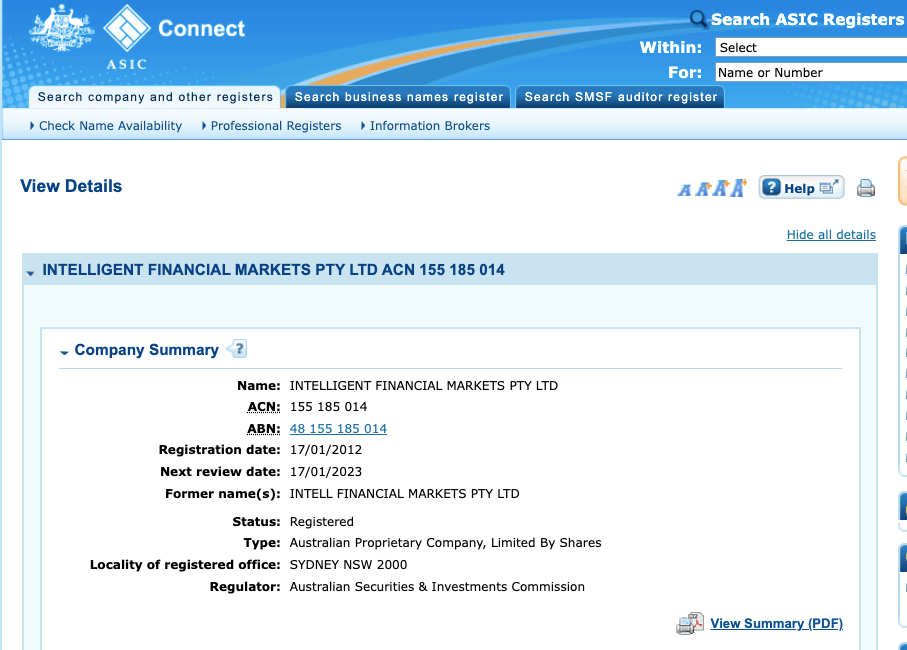

HF Markets is considered low-risk for traders based in Uganda because its parent company ‘HF Markets Group’ has been licensed by multiple Top-Tier regulators. They have been authorized by the following regulators:

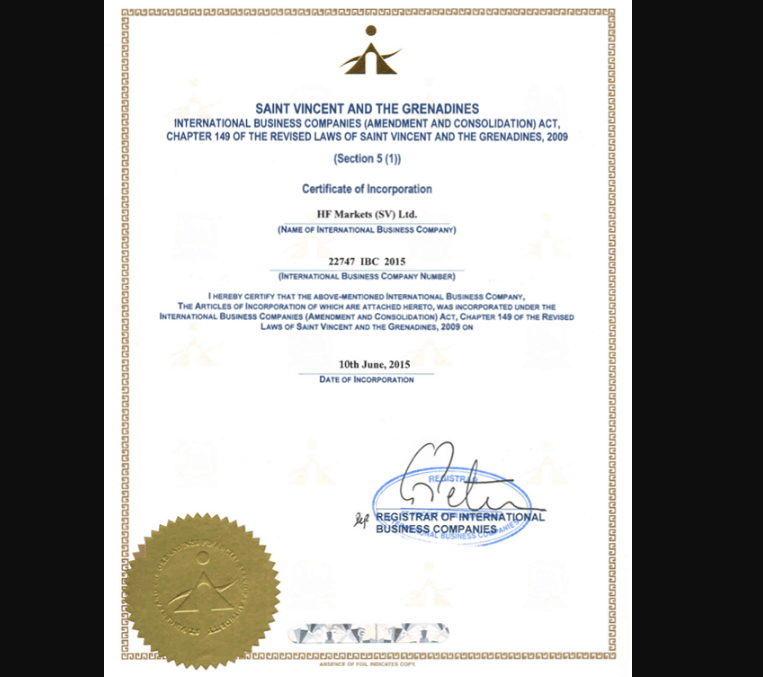

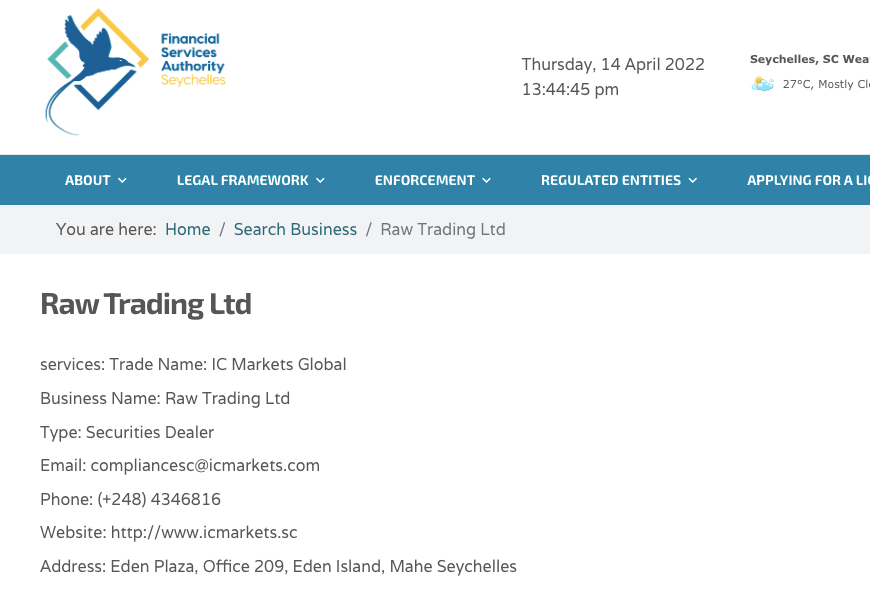

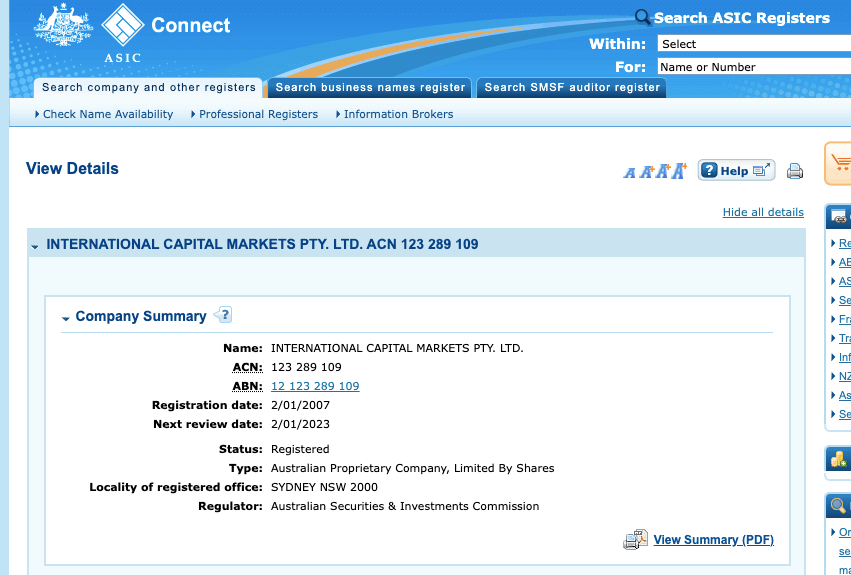

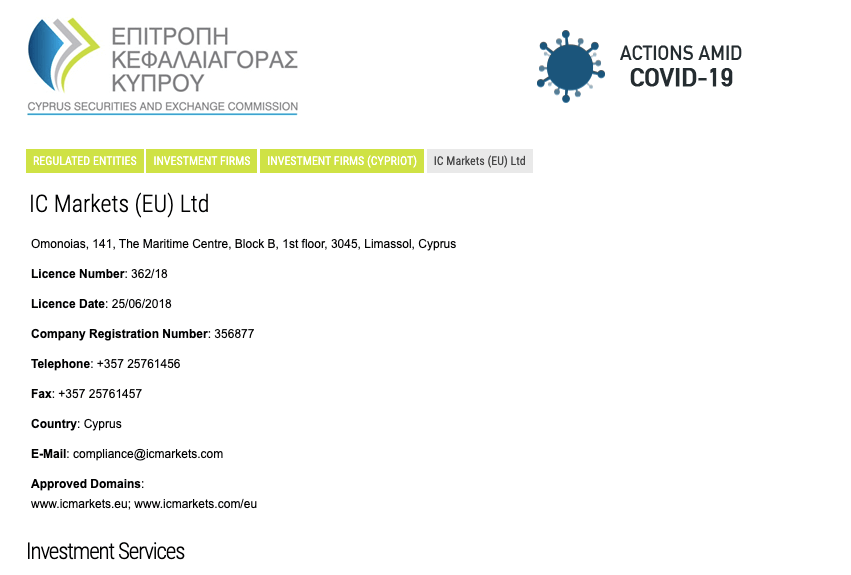

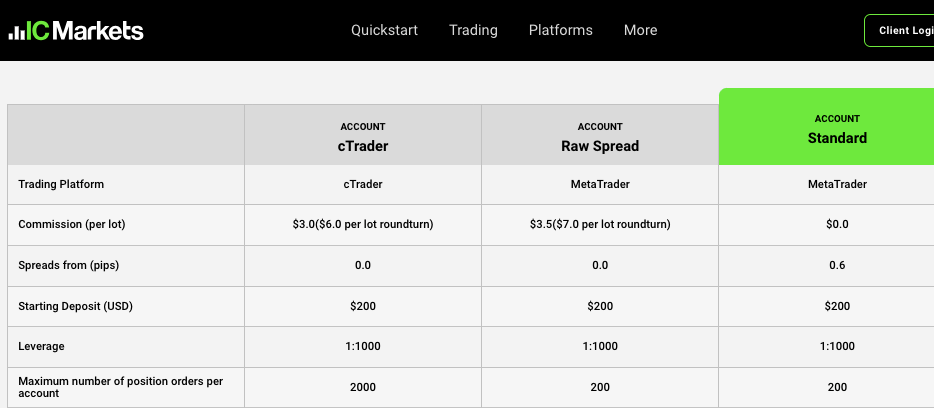

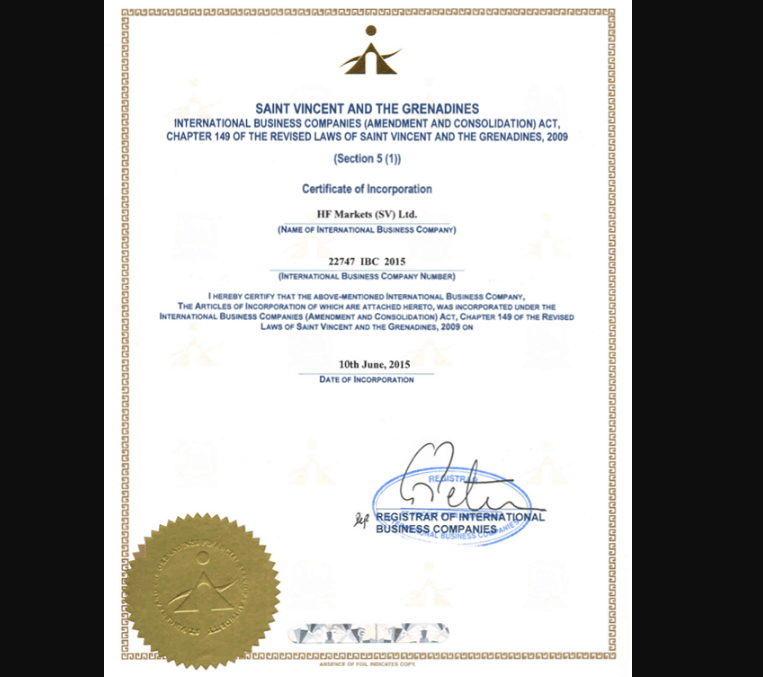

1) FSA SVG: HF Markets is incorporated in St. Vincent and the Grenadines as ‘HF Markets (SV) Ltd’ and regulated by the Financial Services Authority (FSA) as an International Business Company with registration number 22747 IBC, since 2015. Traders in Uganda are registered under this regulation.

Note that HF Markets is not regulated in Uganda and this means that trading with the broker in Uganda is at your own risk as foreign regulations customer protection provisions may not cover clients in Uganda.

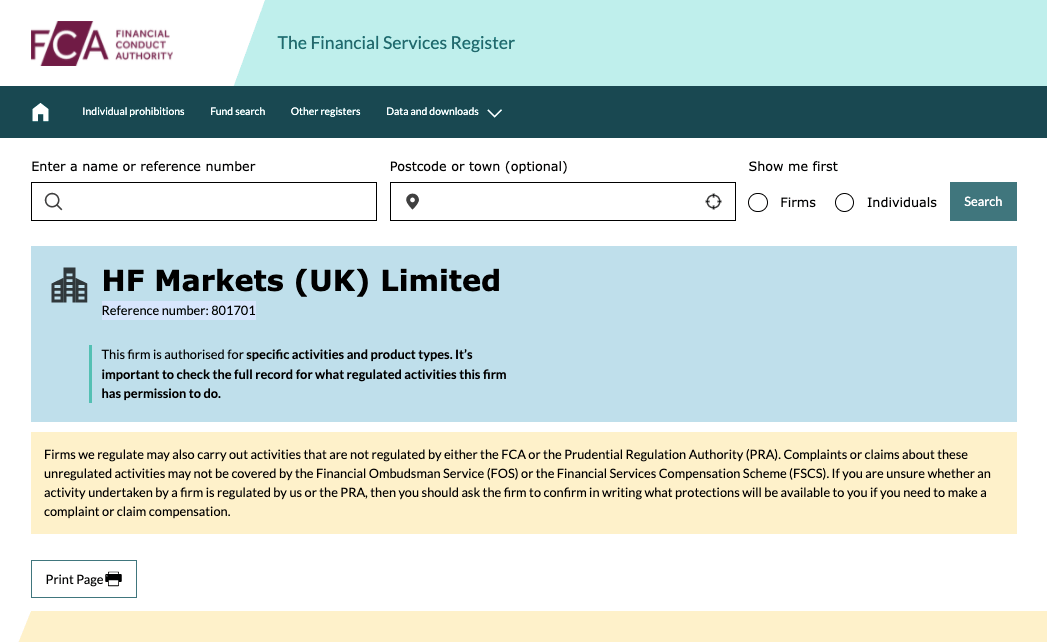

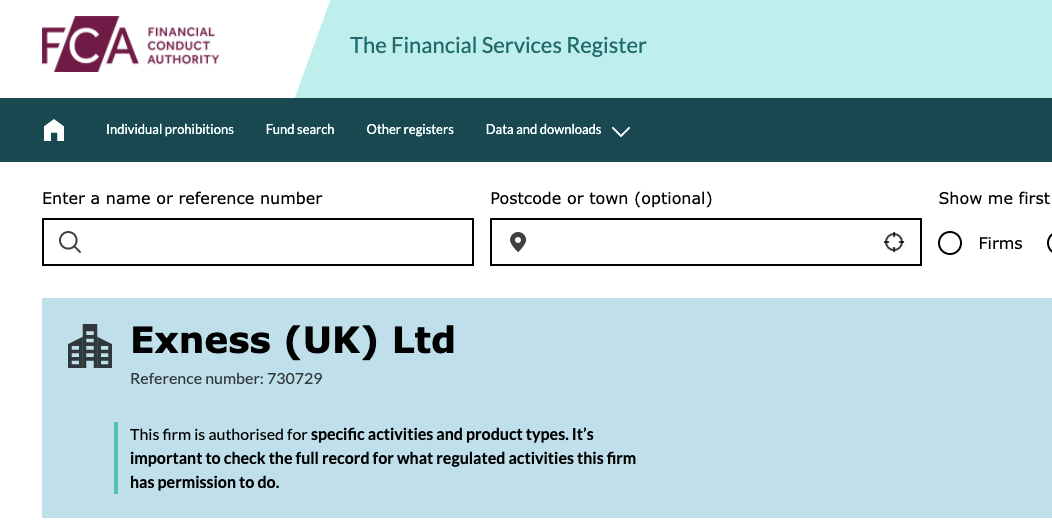

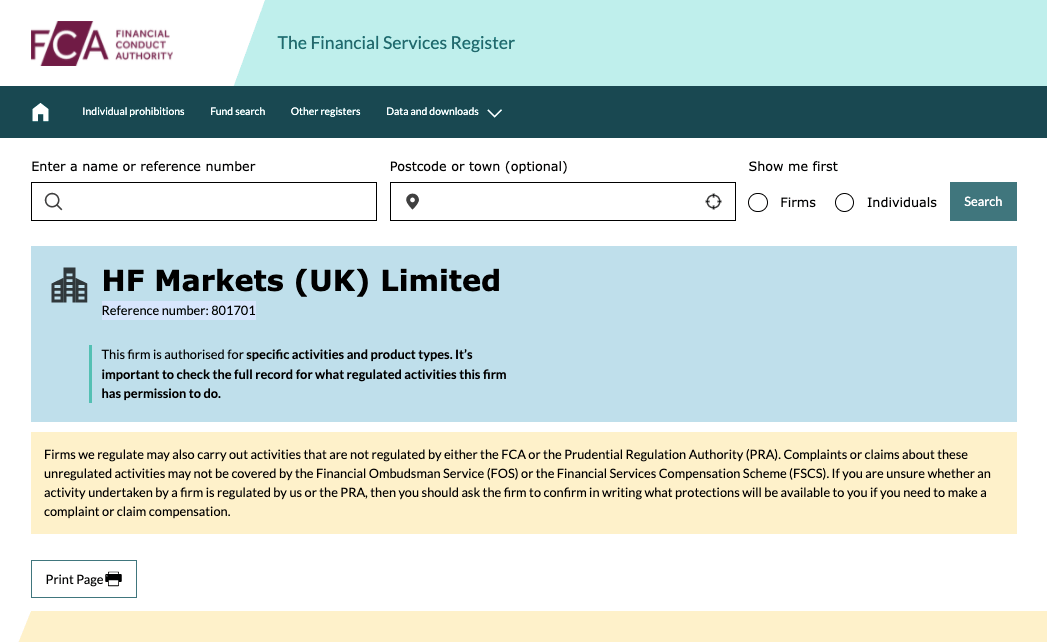

2) FCA: The Financial Conduct Authority (FCA) in the United Kingdom has authorised ‘HF Markets (UK) Limited’ to provide financial products and services with Reference number 801701.

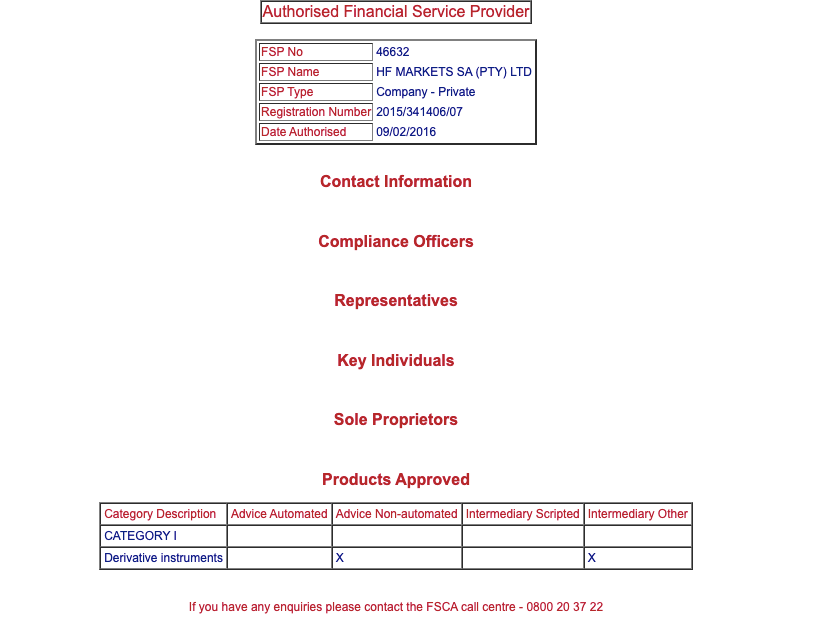

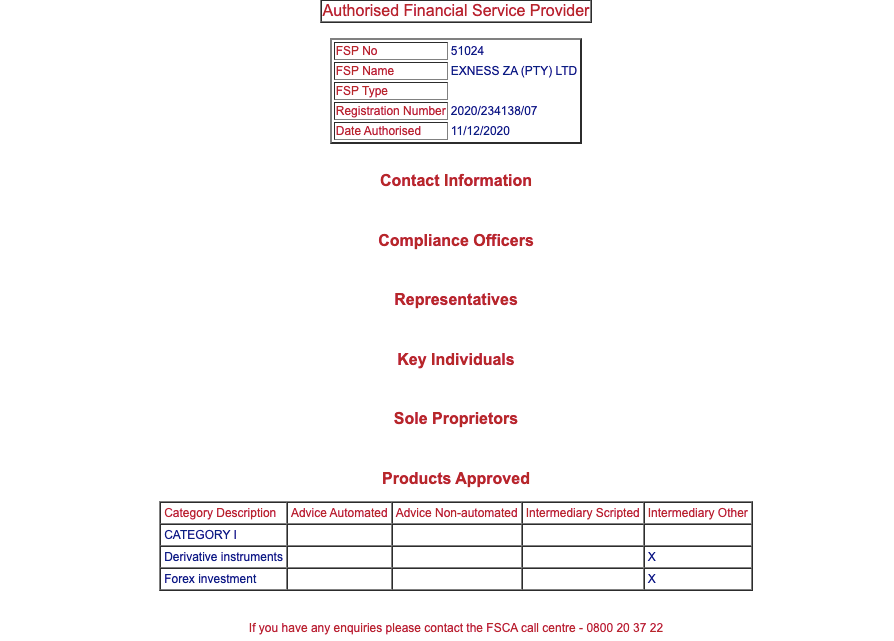

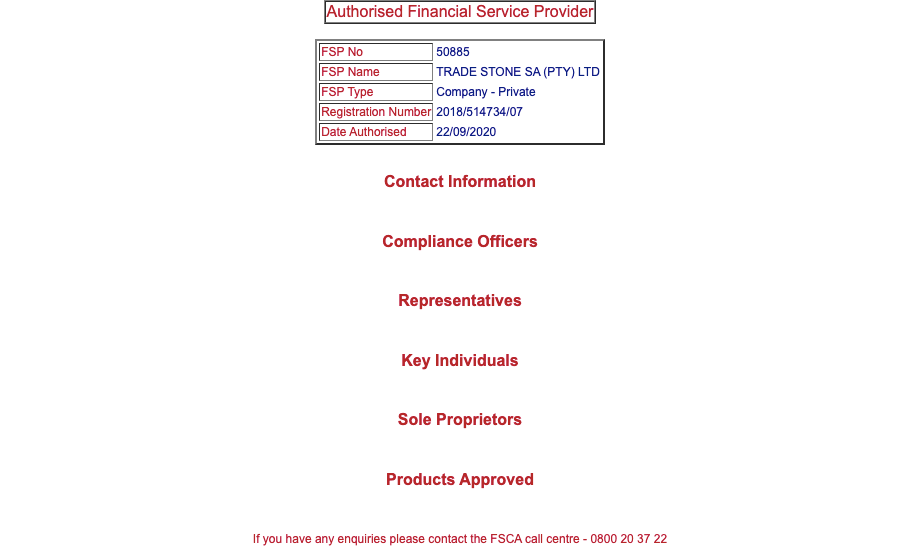

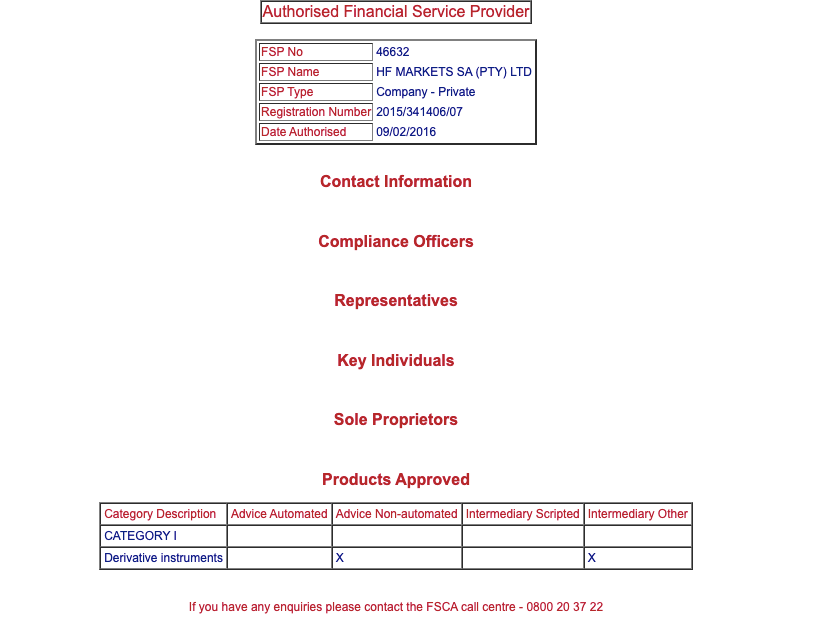

3) FSCA: The Financial Sector Conduct Authority (FSCA), South Africa has licensed HotForex as ‘HF Markets SA (PTY) Ltd’. Hotforex is registered as a Financial Service Provider (FSP) in South Africa, with FSP number 46632.

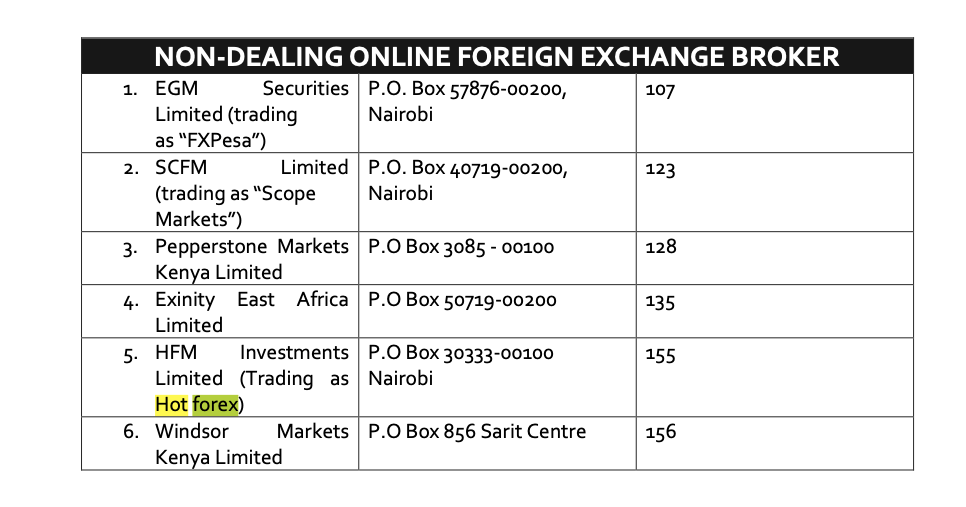

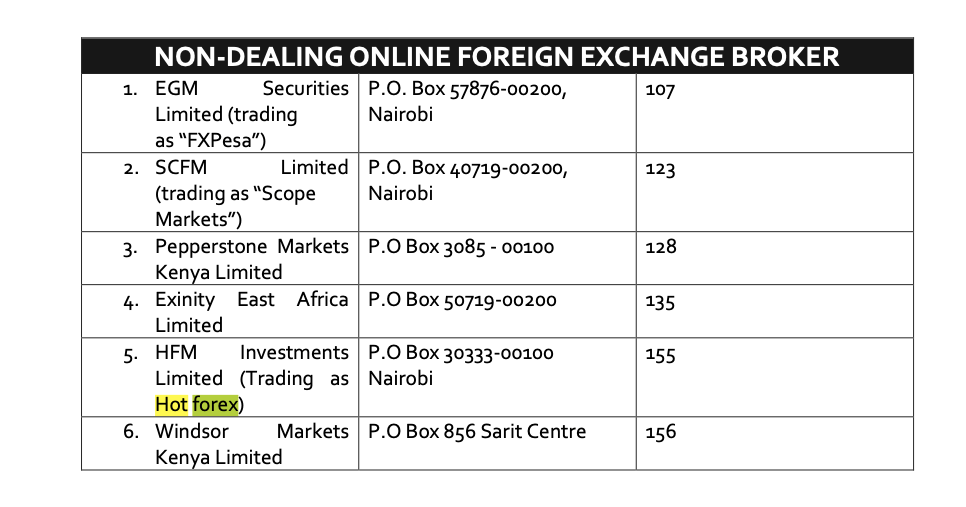

4) CMA: Capital Markets Authority (CMA) Kenya has licensed HotForex as a non-dealing online foreign exchange broker under the name ‘HFM Investments Limited’ with CMA license number 155.

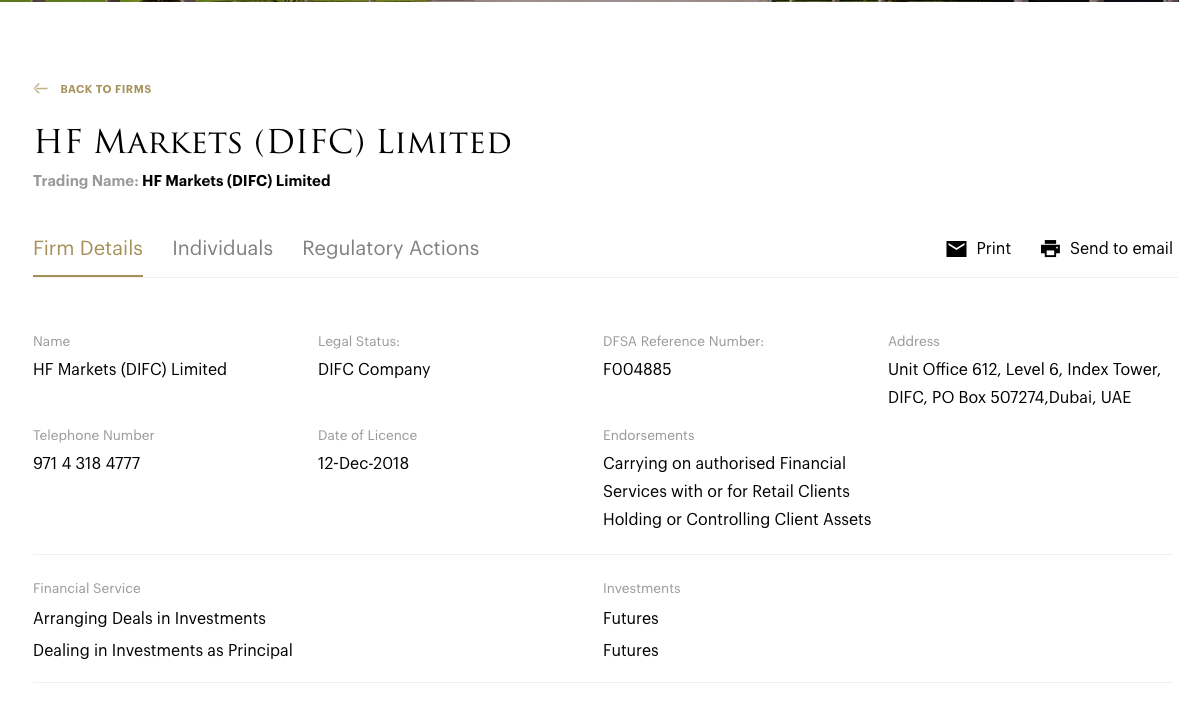

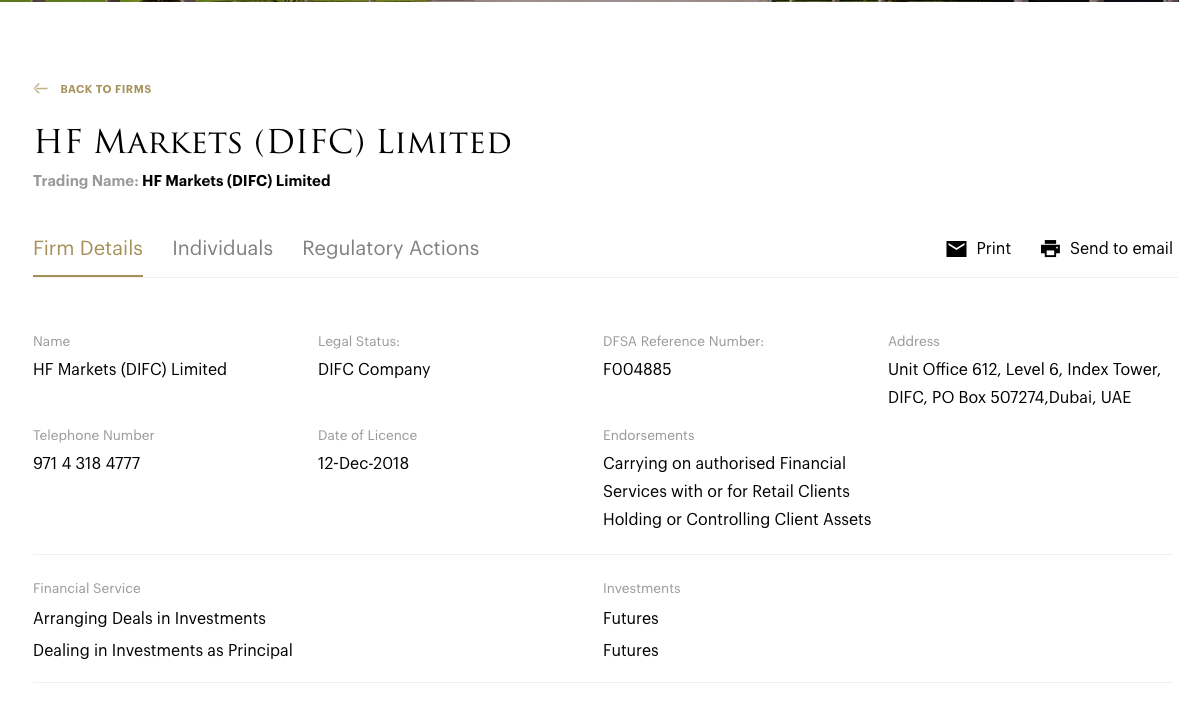

5) DFSA: Dubai Financial Services Authority (DFSA) in the United Arab Emirates (UAE) has authorised ‘HF Markets (DIFC) Ltd’ to carry on financial services in the UAE.

HF Markets Investor Protection

| Client Country |

Protection |

Regulator |

Legal name |

| UK |

£85,000 |

Financial Conduct Authority (FCA) |

Axi Financial Services (UK) Limited |

| Kenya |

No Protection |

Capital Markets Authority (CMA) |

HFM Investments Ltd. |

| Uganda |

No Protection |

St Vincent and the Grenadines Financial Services Authority (SVGFSA) |

HF Markets (SV) Ltd. |

| South Africa |

No Protection |

Financial Service Conduct Authority (FSCA) |

HF Markets SA (PTY) Ltd. |

Negative balance protection is available for all of HFM’s retail clients. Ugandan traders are registered under SVGFSA regulation which has no provision for compensation. In addition, HF Market is not regulated in Uganda so there is no local regulation that protects you.

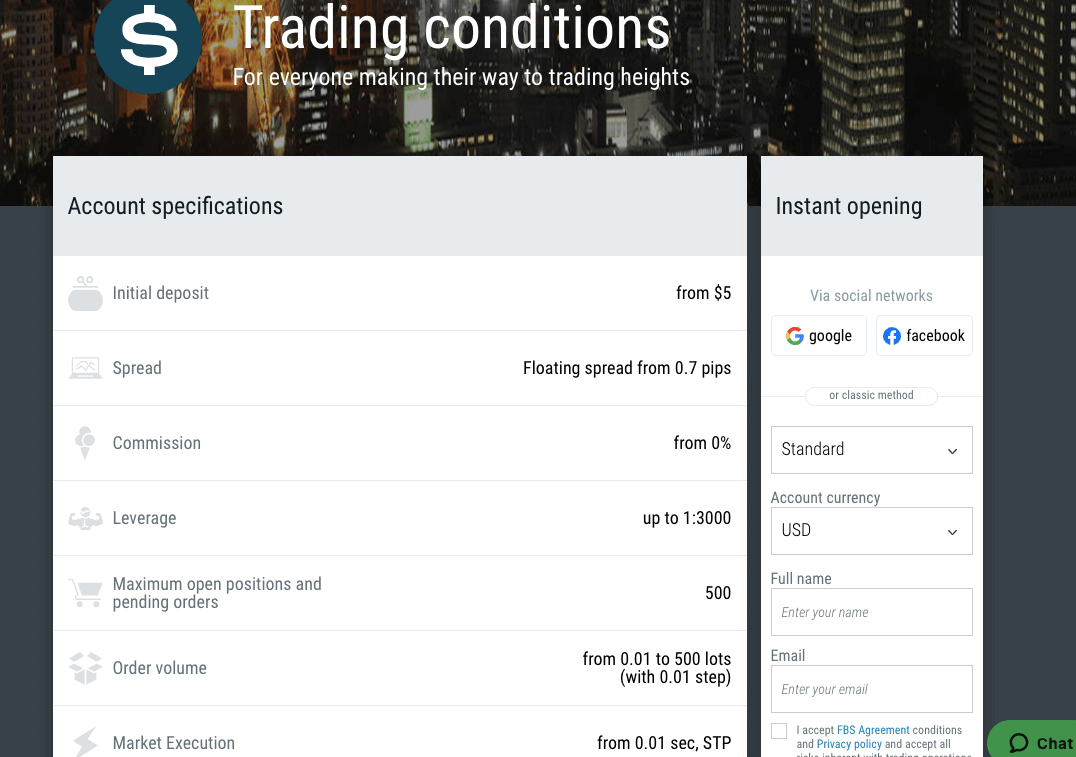

Typical leverage on HF Markets can be up to 1:2,000, depending on the account type. Traders can choose floating leverage or fixed leverage option to operate with. The maximum leverage of 1:2,000 applies only to major forex pairs, other instruments have lower leverage limits.

With leverage of 2,000, you can open a trade position worth up to 2,000 times the value of your deposit. For example, with a deposit of $100, you can place a trade of $200,000.

Note: Trading with leverage is very risky, and you must avoid using more than 1:30 leverage on forex. The availability of a floating leverage option is an advantage, and you must never use 1:1000 leverage. As a caution by HF Markets, leverage is adjusted when your equity exceeds $300,000.

Note that trading leverage products involves risk and you can lose all your money. It is best to avoid trading unless you understand it or have experience. It is important that you do not use all the leverage available as it increases your risk and the chance of losing your money.

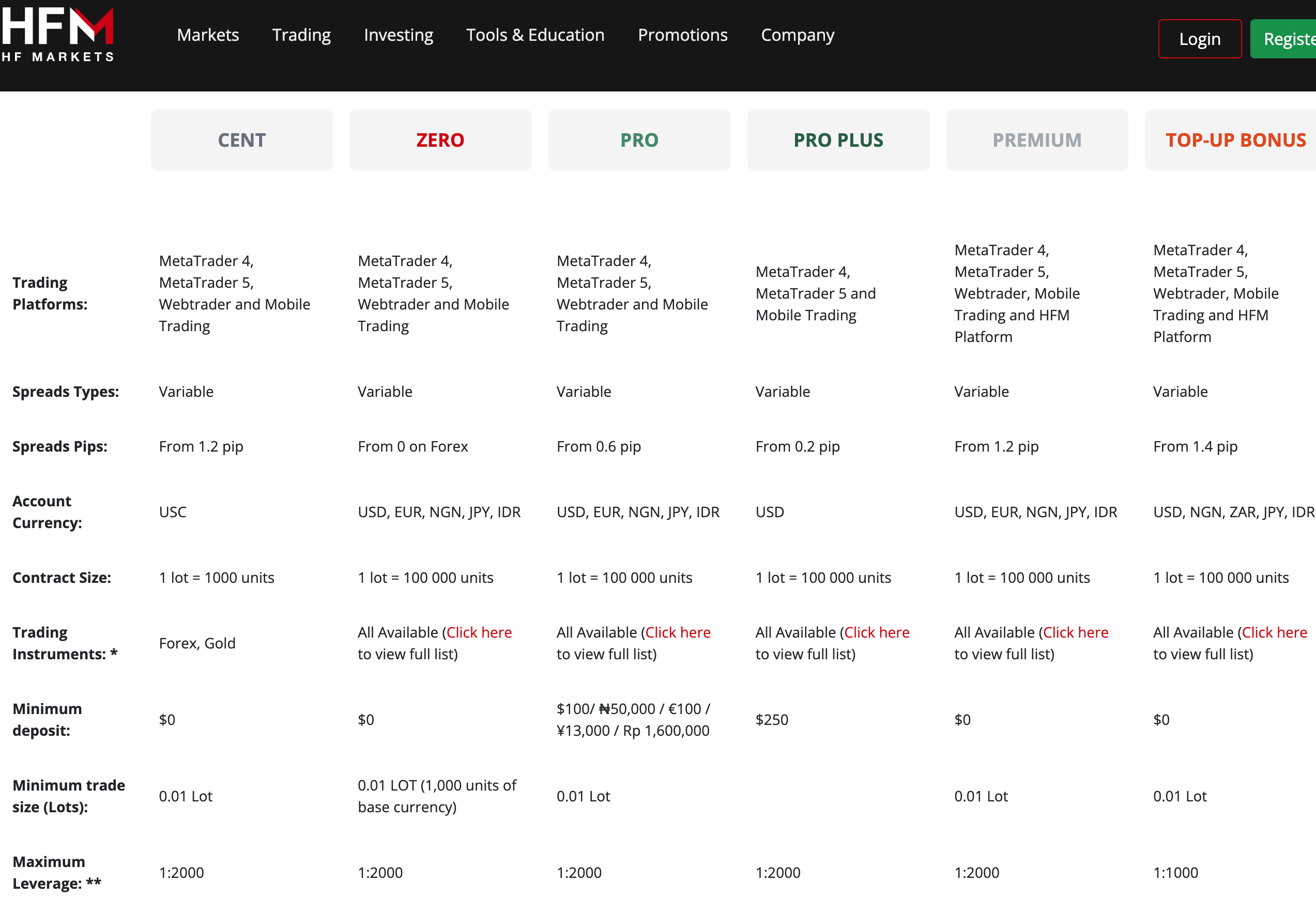

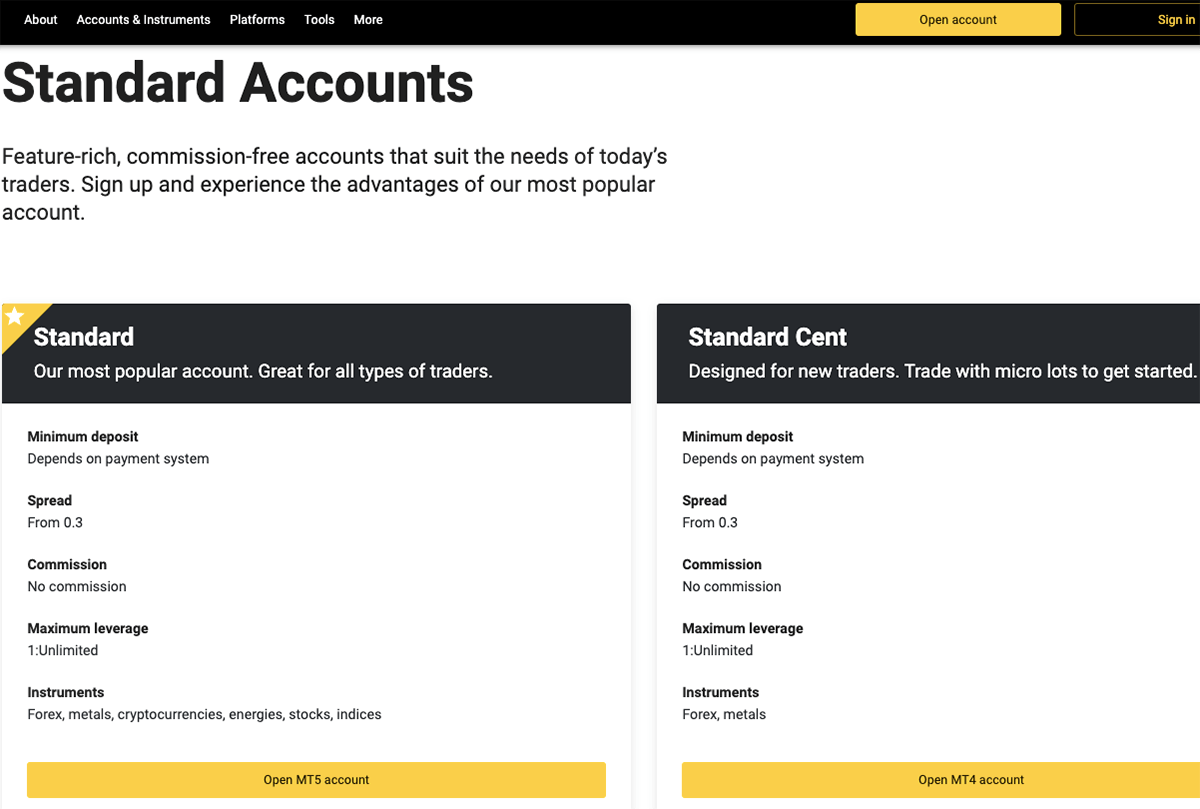

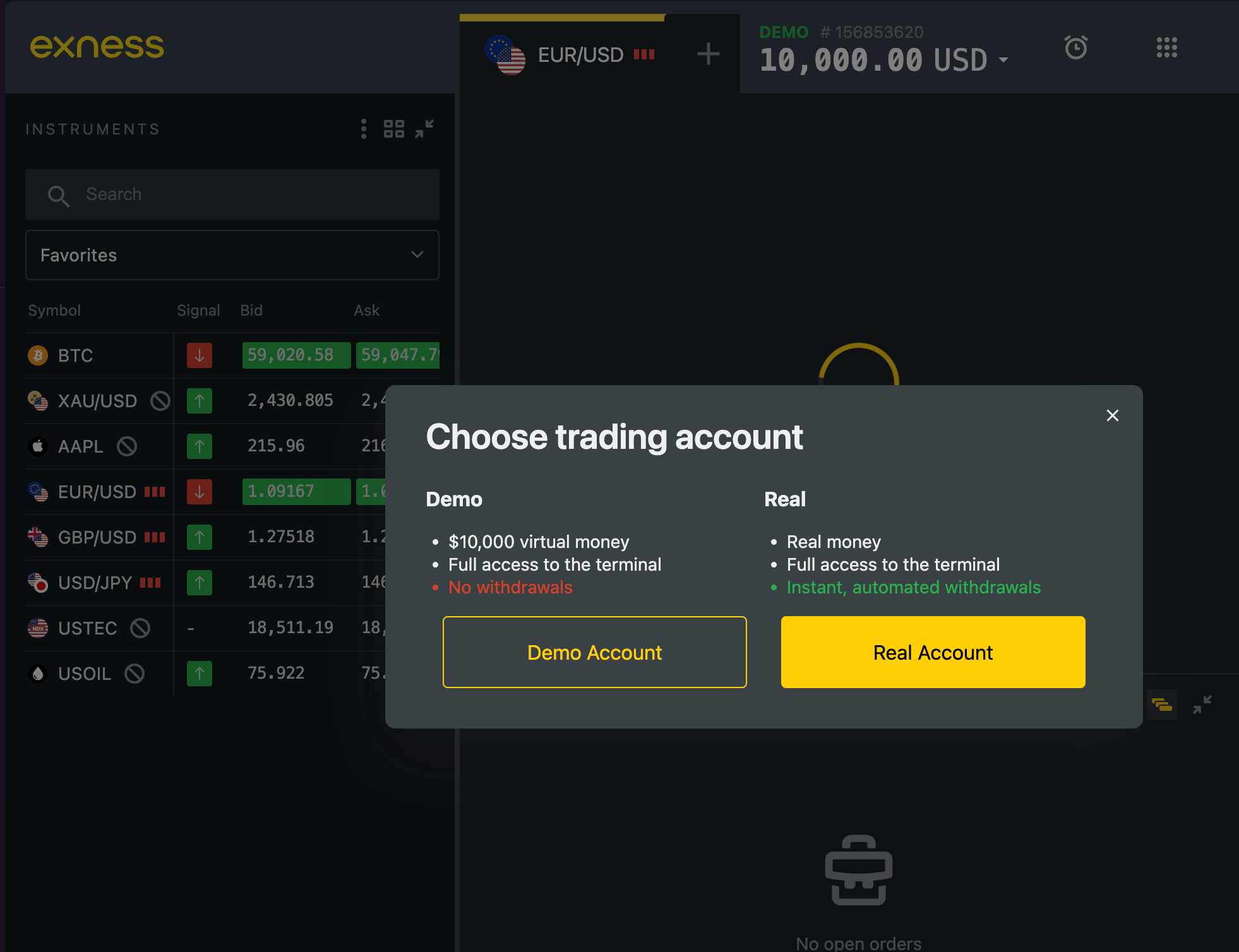

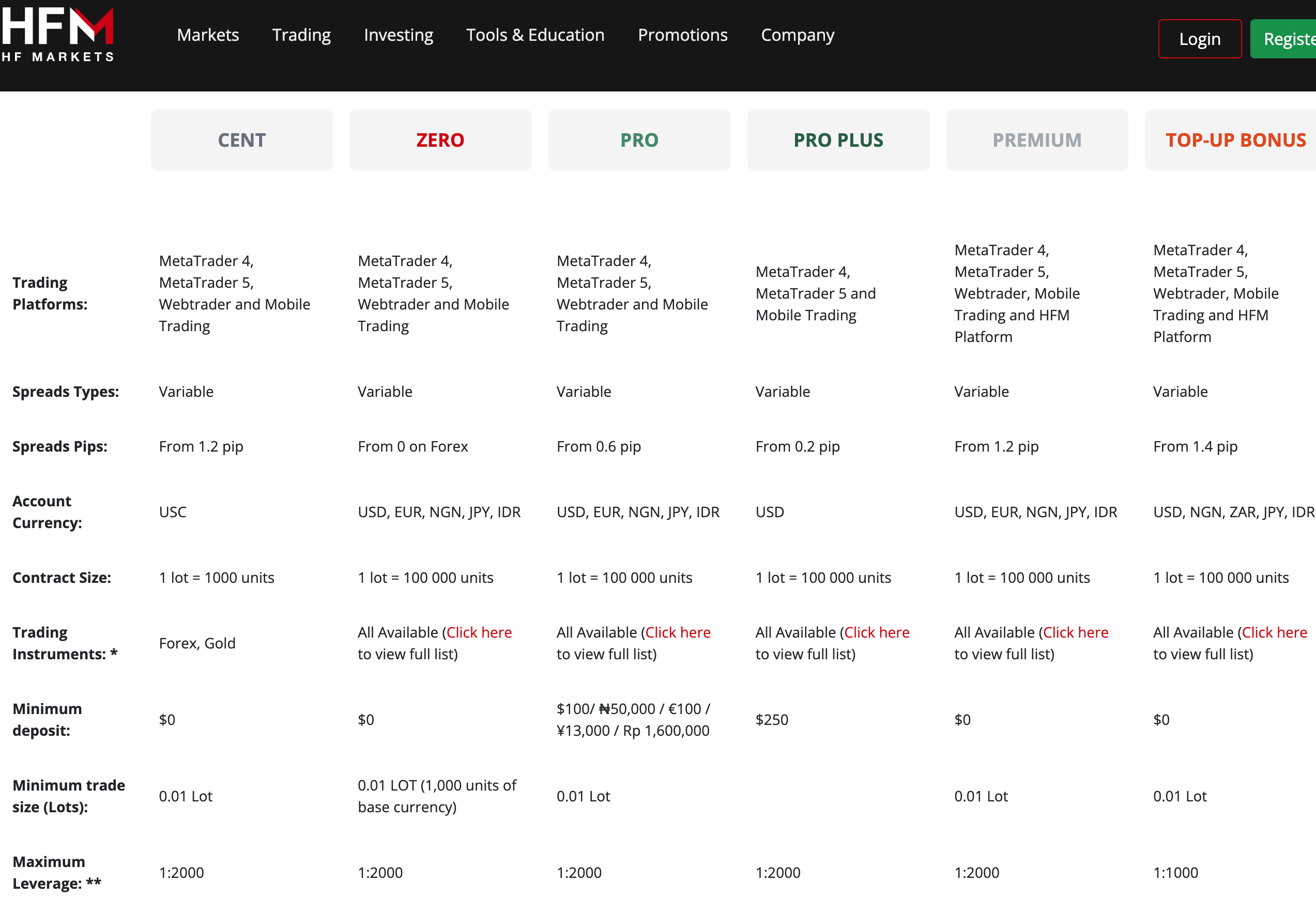

HF Markets has 6 main account types for traders and 2 investment account types. HF Markets also offers Swap-free Islamic Account and a demo account which features unlimited options and is risk-free for beginners to use and familiarise themselves with the trading platform before they open live accounts.

The account types on HF Markets and their basic features are:

1) Premium Account: The HF Markets Premium Account is designed for retail clients. This account allows you to trade forex and CFDs on metals, energies, bonds, commodities, indices, ETFs, cryptocurrencies and stocks.

This account does not require you to pay any commissions when you open or close trade positions on forex pairs. Spreads start from 1.2 pip and you pay swap fees whenever you keep a trade position open past the market’s closing time, this applies to most instruments except shares.

The Premium Account on HF Markets does not have a mandatory minimum deposit, the required minimum trade size is 0.01 lot and a maximum of 60 standard lots per position, 500 maximum open orders, and maximum leverage of 1:2,000.

You have negative balance protection with this account, which means you cannot lose more than the amount of money in your trading account. If a trade position is unsuccessful and you have a loss, any negative balance on your account will be reset to zero.

You can access this account on MT 4 and MT 5 (Desktop, Webtrader, and Mobile Trading), as well as HFM Platform.

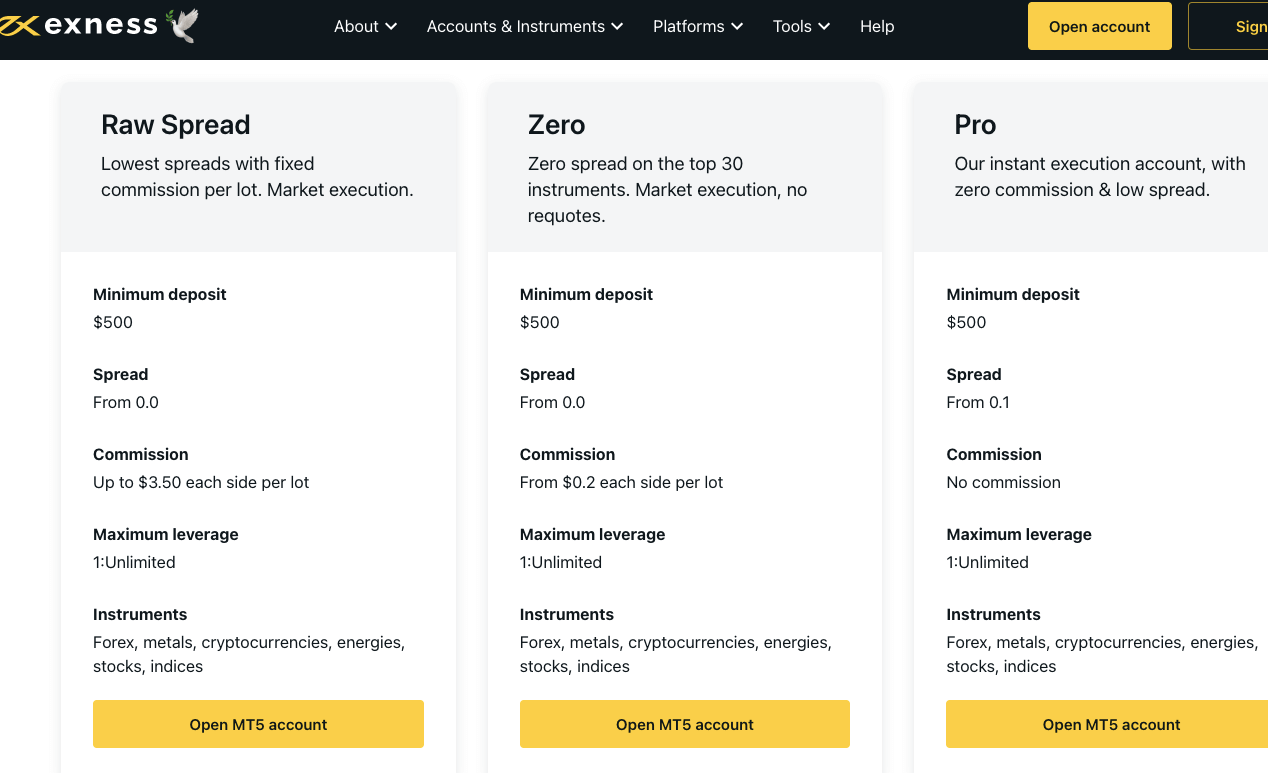

2) Pro Account: The HF Markets Pro Account is also designed for retail traders who are experienced and allows you to trade forex and CFDs on metals, energies, bonds, commodities, indices, ETFs, cryptocurrencies and stocks.

This account is spread only and you do not pay any commissions when you open or close trade positions on forex pairs. Spreads start from 0.6 pips and you pay swap fees whenever you keep a trade position open past the market’s closing time.

The Pro Account on HF Markets requires a minimum deposit of UGX 372,460 ($100), with a minimum trade size of 0.01 and a maximum of 60 standard lots per position, 500 maximum open orders, and maximum leverage of 1:2,000.

You have negative balance protection with this account, which means you cannot lose more than the amount of money in your trading account.

This account is also accessible on MT 4 and MT 5 (Desktop and Webtrader).

3) Pro Plus Account: The HF Markets Pro Plus Account is also designed for retail traders who are experienced and allows you to trade forex and CFDs on metals, energies, bonds, commodities, indices, ETFs, cryptocurrencies and stocks.

This account does not commissions when you trade forex pairs. Spreads start from 0.2 pips and you pay swap fees whenever you keep a trade position open past the market’s closing time.

The Pro Plus Account on HF Markets requires a minimum deposit of UGX 931,150 ($250), with a minimum trade size of 0.01 and a maximum of 60 standard lots per position, 500 maximum open orders, and maximum leverage of 1:2,000.

You have negative balance protection with this account, which means you cannot lose more than the amount of money in your trading account.

This account is also accessible on MT 4, MT 5, (Desktop and Mobile Trading).

4) Zero Account: The HF Markets Zero Account is designed for retail clients who trade high volumes, use EAs and want to pay lower spreads. This account allows you to trade forex and CFDs on metals, energies, bonds, commodities, indices, ETFs, cryptocurrencies and stocks.

You pay commissions for opening and closing trades per side on this account. Commission charges for 1 lot is $3 (making $6 for a round turn) for majors and $4 for others (making $8 for a round turn). The Shillings commission charge equivalent is UGX 11,174 per side (making UGX 22,348 for a round turn) for majors and UGX 14,898 for others (making UGX 29,796 for a round turn). The spreads on this account start from 0.1 pips for forex, with limits and stops at 2 pips.

The Zero Account on HF Markets does not require a mandatory minimum deposit, minimum trade size of 0.01 is required and a maximum of 60 standard lots per position, 500 maximum open orders, and maximum leverage of 1:2,000.

This account offers swap-free trading on select instruments, for a grace period of 7 days, shares trading will still attract swap-fees.

You have negative balance protection with this account, which means you cannot lose more than the amount of money in your trading account.

You can access this account on MT 4 and MT 5 (Desktop, Webtrader, and Mobile Trading).

5) Cent Account: The HF Markets Cent Account is designed for new traders and allows you to trade forex and gold only.

This account does not commissions when you trade forex pairs. Spreads start from 1.2 pips and swap fees apply when you keep a trade position open past the market’s closing time.

The Cent Account on HF Markets does not have a mandatory minimum deposit, account balance is shown in Cents (United States Cents), that is $10 will be shown as 1,000 cents.

This account requires a minimum trade size of 0.01, a maximum of 200 cents lots per position, 150 maximum open orders, and maximum leverage of 1:2,000.

You have negative balance protection with this account, which means you cannot lose more than the amount of money in your trading account.

You can access this account on MT 4 and MT 5 (Desktop, WebTrader and Mobile Trading).

6) Top-up Bonus Account: The HF Markets Top-up Bonus Account is designed for retail clients. This account allows you to trade forex and CFDs on metals, energies, bonds, commodities, indices, ETFs, cryptocurrencies and stocks.

This account charges spread, but no commissions trade certain instruments like forex pairs. Spreads start from 1.2 pip and you pay swap fees whenever you keep a trade position open past the market’s closing time.

The Top-up Bonus Account on HF Markets does not have a mandatory minimum deposit, the required minimum trade size is 0.01 lot and a maximum of 60 standard lots per position, 500 maximum open orders, and maximum leverage of 1:1,000.

With the Top-up Bonus Account, you get bonus for every deposit you make from 20% and can be up to 50% of your deposited amount. The maximum bonus you can get per deposit is UGX 18.6 million ($5,000).

While you cannot withdraw the bonus amount, you can use it to trade and you can withdraw any profits realised from the trade.

You have negative balance protection with this account, which means you cannot lose more than the amount of money in your trading account.

To get the Top-up bonus account, you must first create a trading account on HFM then request the Top-up bonus account from the client area.

You can access this account on MT 4 and MT 5 (Desktop, Webtrader, and Mobile Trading), as well as HFM Platform.

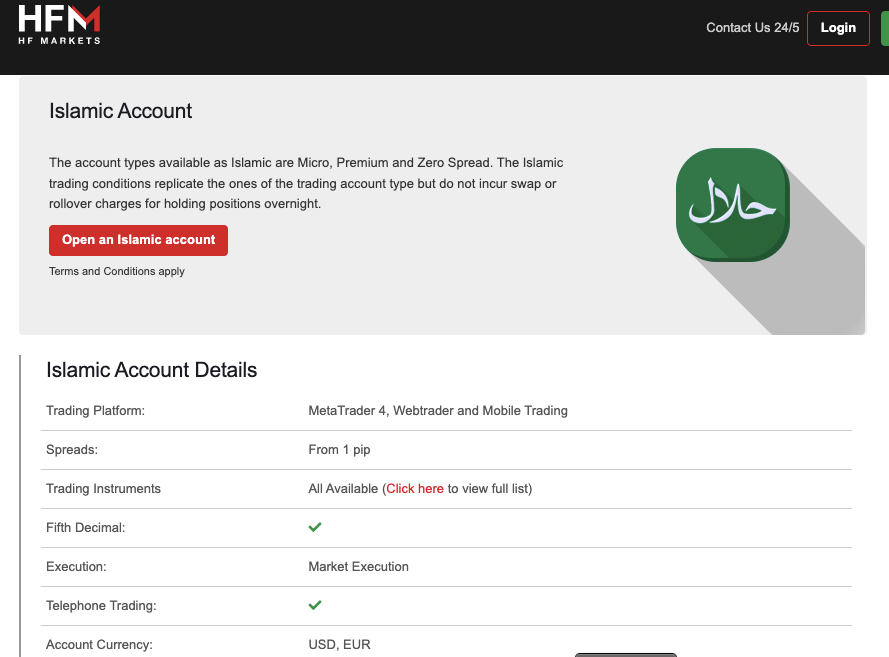

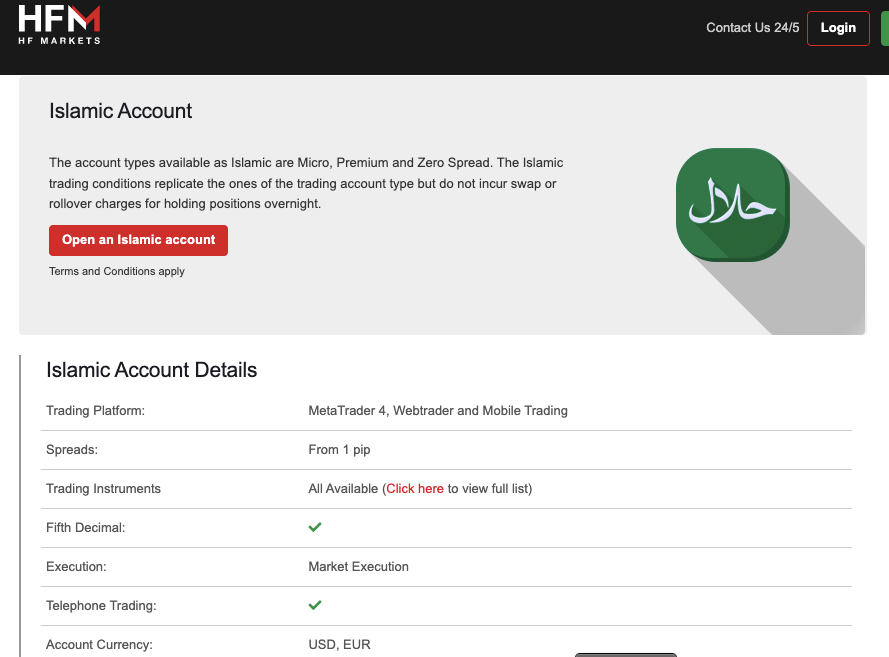

7) Swap-free Islamic Account: HF Markets offers Islamic Accounts to Muslim traders that are in compliance with the sharia law of no-riba. These accounts are swap-free (interest-free), which means you do not pay any interest for keeping a trade position open past the market’s closing time.

You can convert your Pro, Premium or Zero Accounts to Islamic status and the same features and fees will apply except for the swap fees. This account also supports only USD or EUR as the base currency.

Note that the HF Markets Swap-fee Islamic Account have a grace period of 7 days, during which no rollover fees are charged. If you keep a position open for more than 7 days, you will incur carry charges on some instruments.

To get a swap-free Islamic Account on HF Markets, first, create a Pro, Premium or Zero Account then contact the HF Markets customer support team to convert your account to a swap-free status.

Currently, the Premium, Zero and Cents Account offer swap free trading, which translates to Islamic Account features, so you may not need to convert to a special Islamic Account.

We also noticed from our research that Islamic accounts are not allowed to trade certain instruments, like exotic forex pairs. You should read up the terms and conditions to learn more about the account features.

HF Markets Investing Accounts:

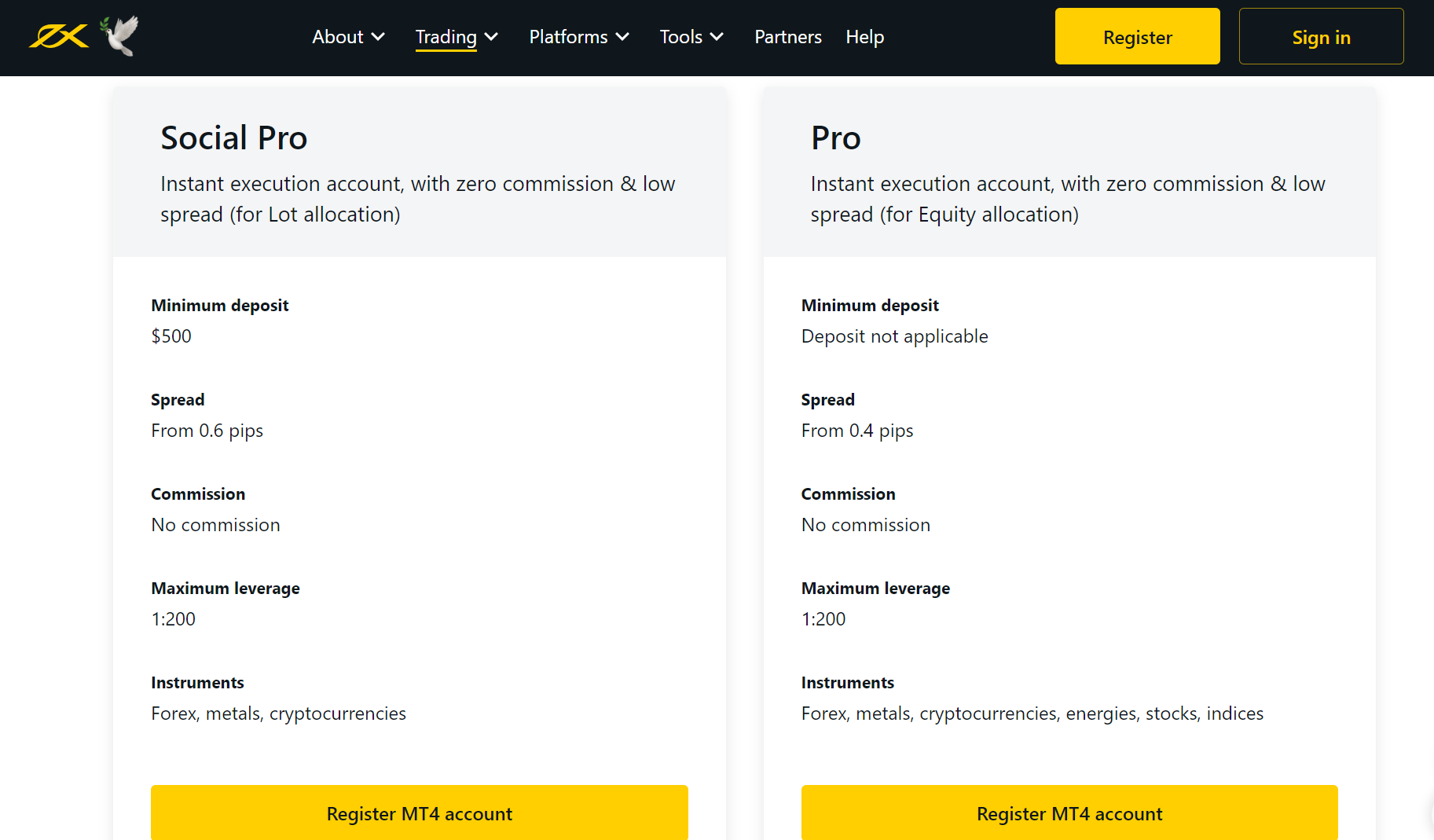

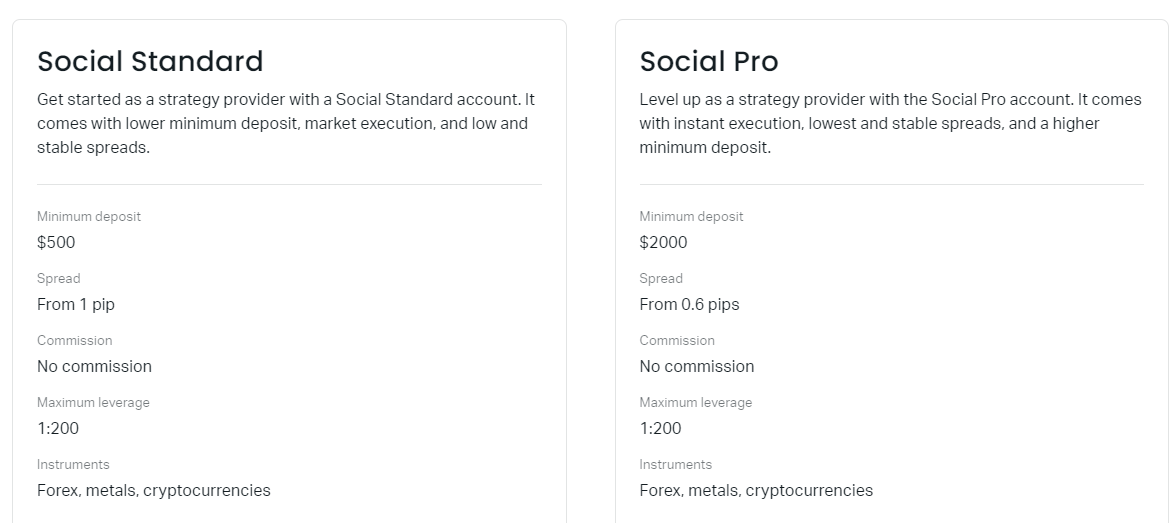

1) HFCopy Account: HF Markets HFCopy Account is designed for traders who want to copy the trades of experienced and professional traders. Both professionals who allow others to copy their trades, known as; strategy providers’ or those who copy trades, referred to as ‘followers’ can open this account type.

The maximum number of followers per strategy provider is 1,000. Strategy providers earn a performance fee for letting others copy their trades.

This account type supports only USD as the account currency and requires a minimum deposit of $500 for strategy providers and $100 for followers.

You can find the terms and conditions to copy-trading on HF Markets HFCopy Account via this dedicated domain copy.hfm.com.

2) PAMM Account: The HF Markets PAMM Account program is designed for experienced traders who are fund managers (either individual or corporate). This program allows you to trade on behalf of clients by opening multiple trading accounts and manage them.

The PAMM Account on HF Markets requires a minimum investment of $250. The account supports automated trading using bots.

You can find the terms and conditions to participate in this program via this dedicated domain pamm.hfm.com.

HF Markets Base Account Currency

Your trades, deposits, profits, losses, and withdrawals on the platform are measured in your base account currency.

The available account base currencies on HF Markets Uganda are the United States Dollar – USD, Euros – EUR, Japanese Yen – JPY, Nigerian Naira – NGN, South African Rand – ZAR, and Indian Ruppees.

Based on our research, some account types have limited number of currencies they can set as their account base currency.

HF Markets is transparent about its fees and you can find details on their website. Some trading fees have been reviewed below:

1) Spread: Spreads on HF Markets start from around 0.1 pips and can be up to 1.2 pips, depending on your account type. The spreads are considered moderate compared to other brokers. HF Markets has no fixed spread and operates a variable spread system, which means the spread can change during the day as the market moves and also depending on the size of your trade.

An example of their spreads with the Premium and Pro Accounts are shown on the table below:

| Instrument/Pair |

Premium Accounts |

Pro Accounts |

| EUR/USD |

1.4 pips |

0.4 pips |

| GBP/USD |

1.6 pips |

0.6 pips |

| EUR/GBP |

1.4 pips |

0.6 pips |

| XAU/USD |

0.25 pips |

0.16 pip |

Crude Oil |

0.09 pips |

0.09 pip |

Wall Street |

2.9 pips |

2.9 pip |

US 500 |

0.4 pips |

0.4 pip |

2) Commissions: HF Markets offers commission-free trading for forex pairs on all account types except the Zero Account. The Zero Account charges low spreads, but has relatively high commission fees, starting at $3 per 1 lot for majors, which is $6 for a round turn, and $4 per 1 lot for others, which is $8 for a round turn. The Shillings commission charge equivalent is UGX 11,174 per side (making it UGX 22,348 for a round turn) for majors and UGX 14,898 for others (making UGX 29,796 for a round turn).

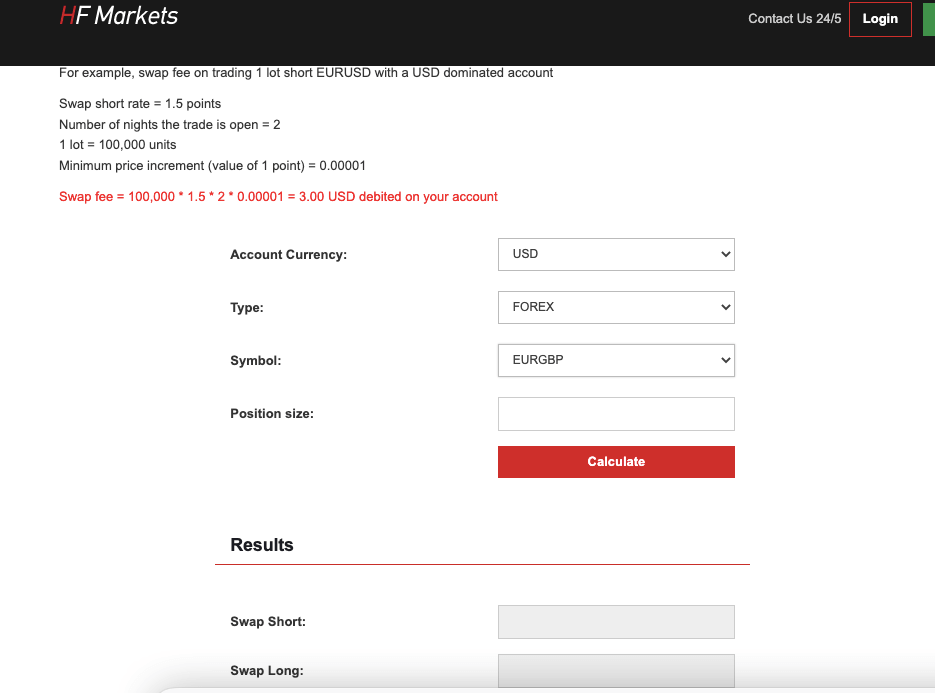

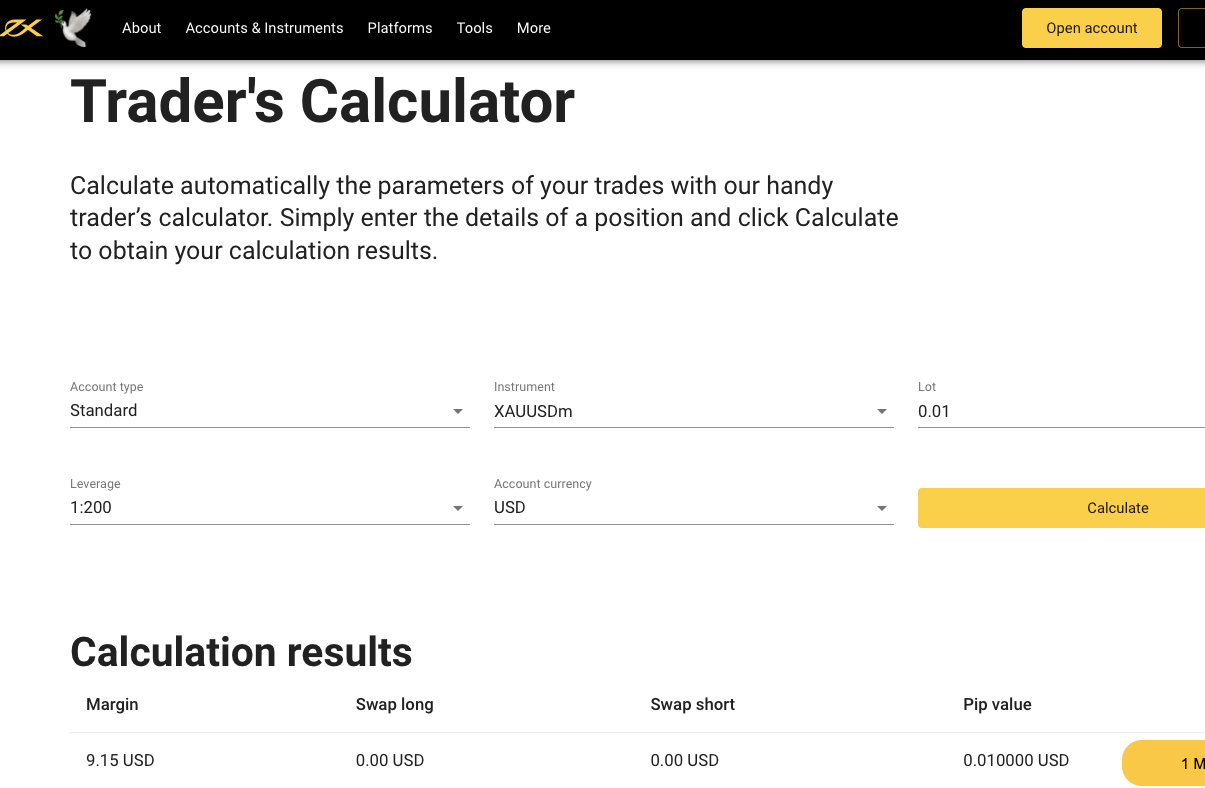

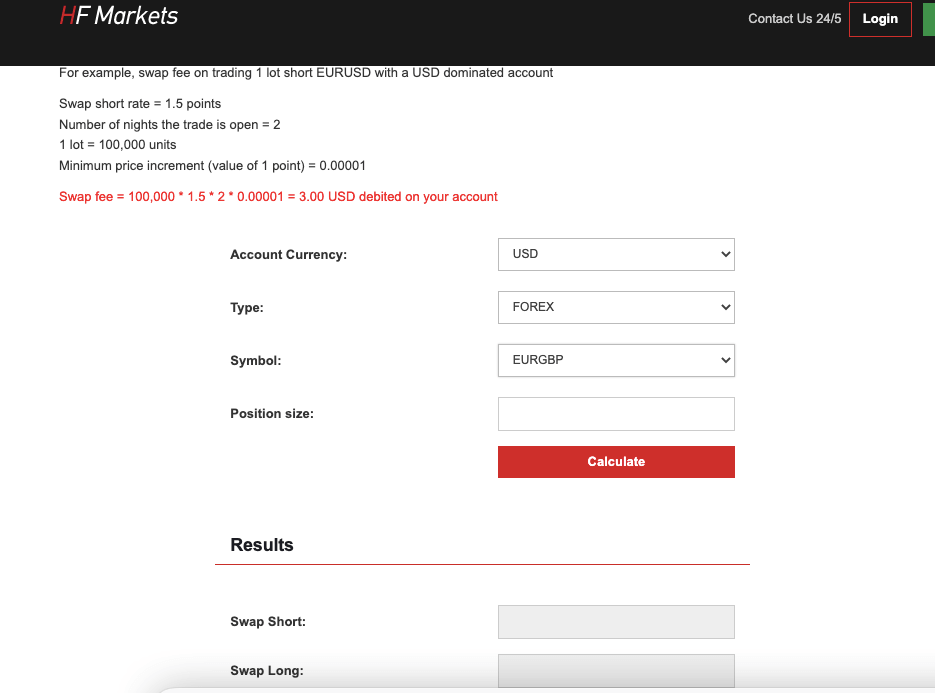

3) Overnight Fees (Swap): HF Markets charges swap fees if you keep a trade position open past the market closing time, this applies to all instruments on the Top-Up Bonus Account. Other Accounts including Islamic Accounts are swap-free for a grace period of 7 days for select instruments (most forex pairs), after which admin charges apply. Note that shares attract swap fees on all account types. The size of the swap will depend on whether the trade position is a short or long and the size of the trade.

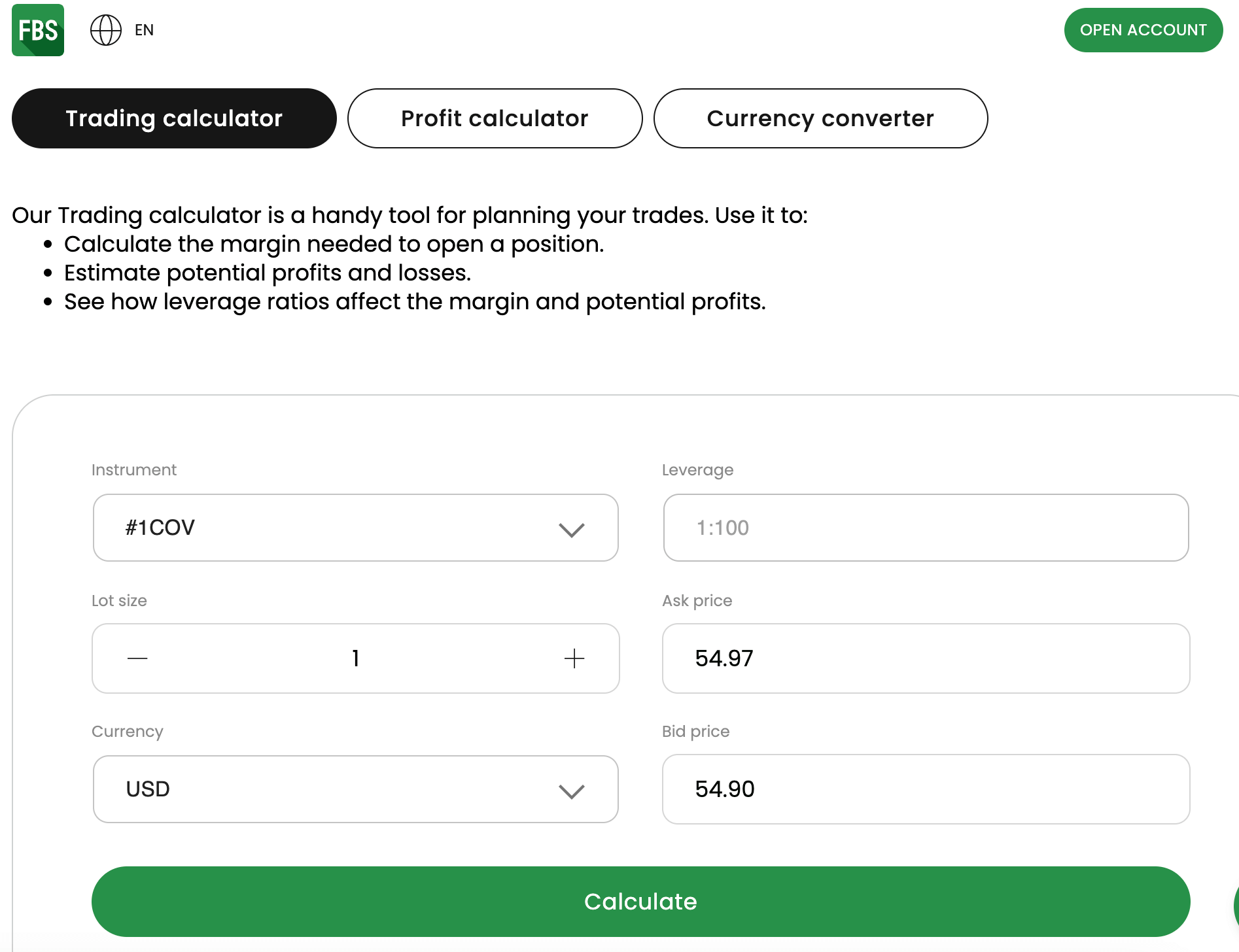

It is important to note that HF Markets uses a floating swap policy, which means swap rates change daily. You can use the swaps calculator on the HF Markets website to determine your exact swap fees.

Non-trading fees

1) Deposit and Withdrawal fees: HF Markets offers free deposits and withdrawals. You do not pay any fees when you deposit funds to your account or withdraw from it. This applies to all account types and payment methods. Note that if you deposit less than $100 via bank transfers, you might incur some deposit fees.

2) Account Inactivity charges: HF Markets charges inactive account fees if you do not perform any trade on your account for 6 months. Any balance in your account will be charged a monthly fee of $5. If you do not have any funds in your account, no fees will be charged.

| Fee |

Amount |

| Inactivity fee |

$5 |

| Deposit fee |

None* |

| Withdrawal fee |

None* |

*For withdrawals, there is a 1% transaction fee if you are funding your account through bitpay. There are fees for deposits below $100 if you are funding your account via bank transfer.

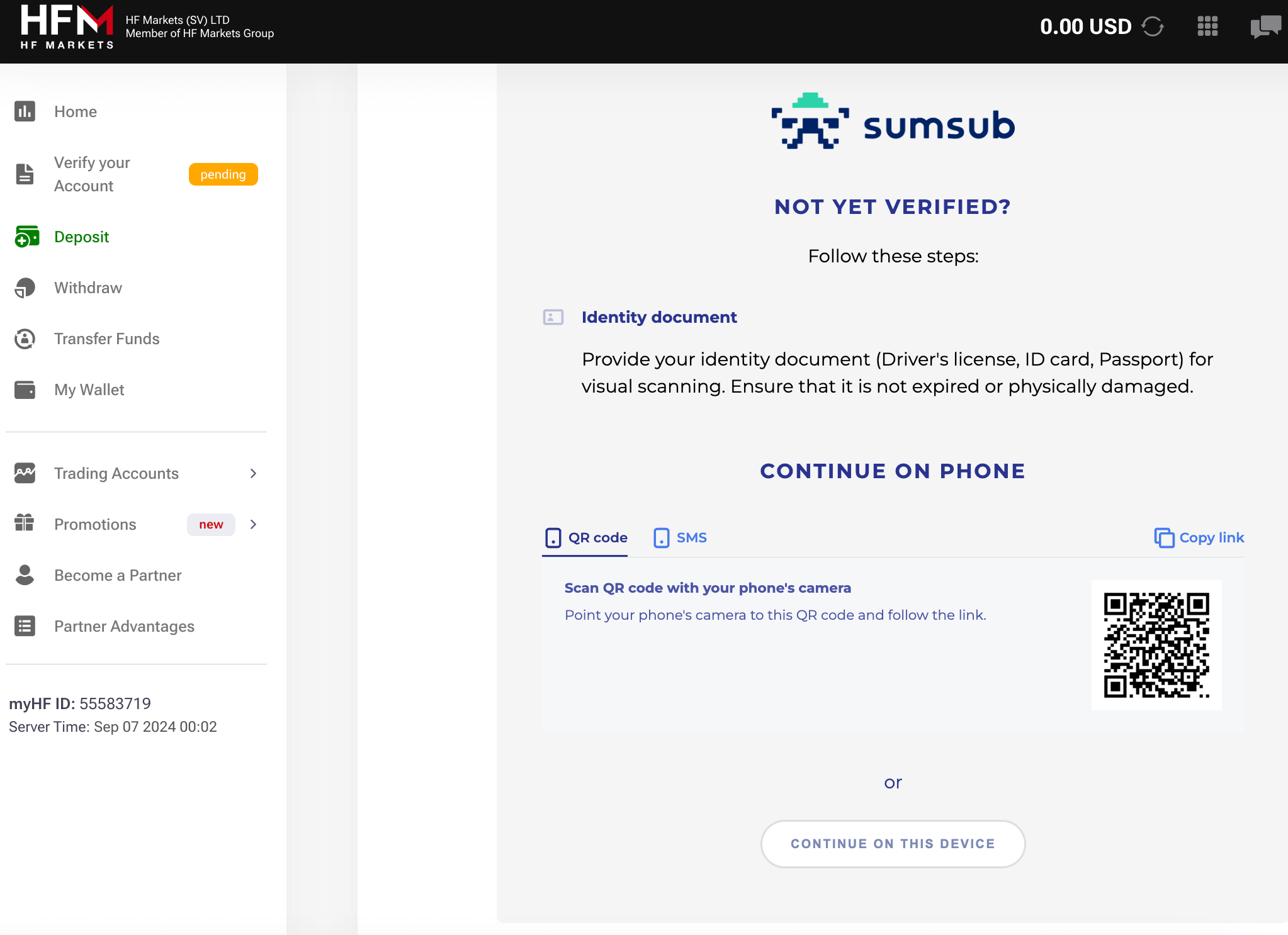

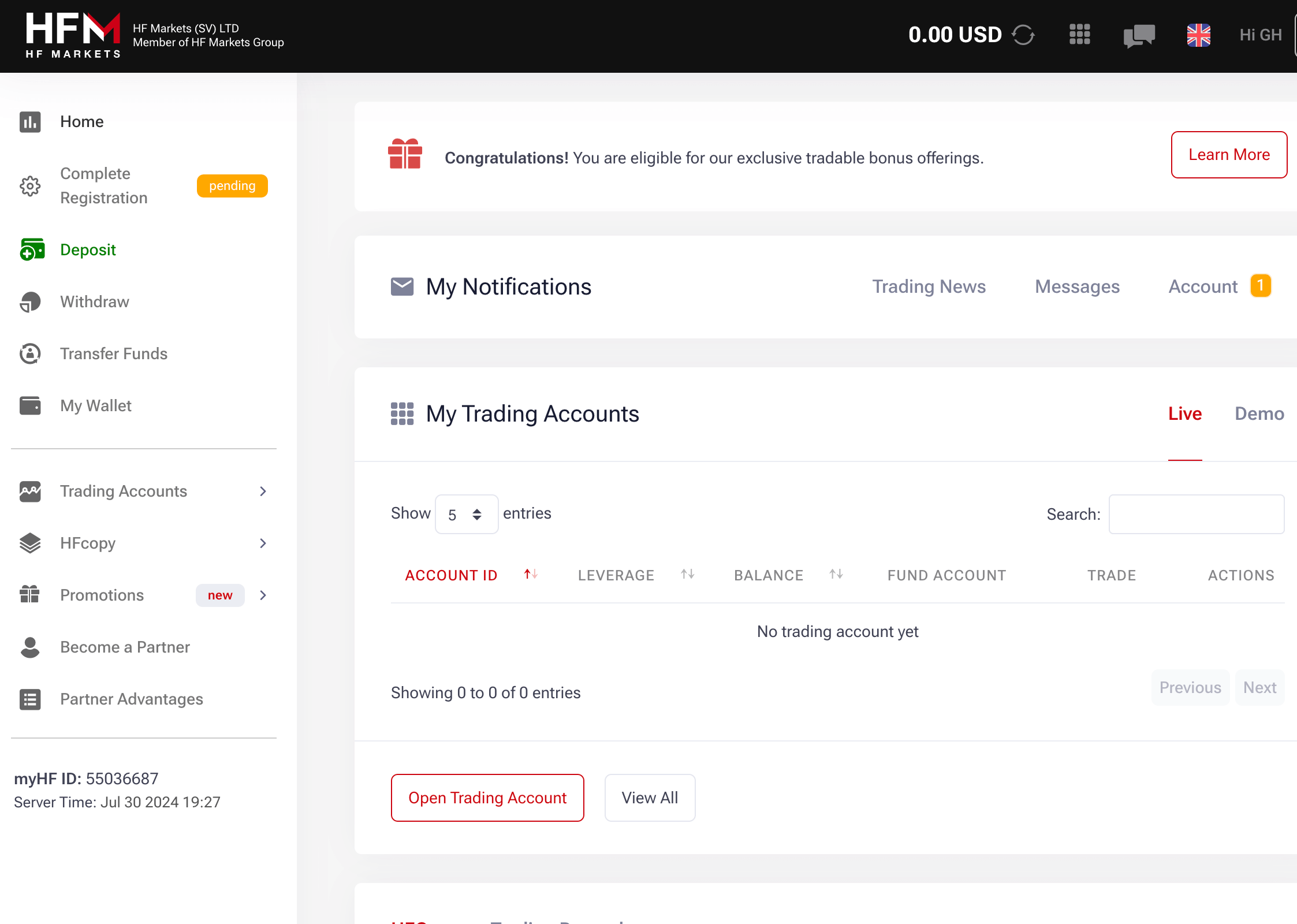

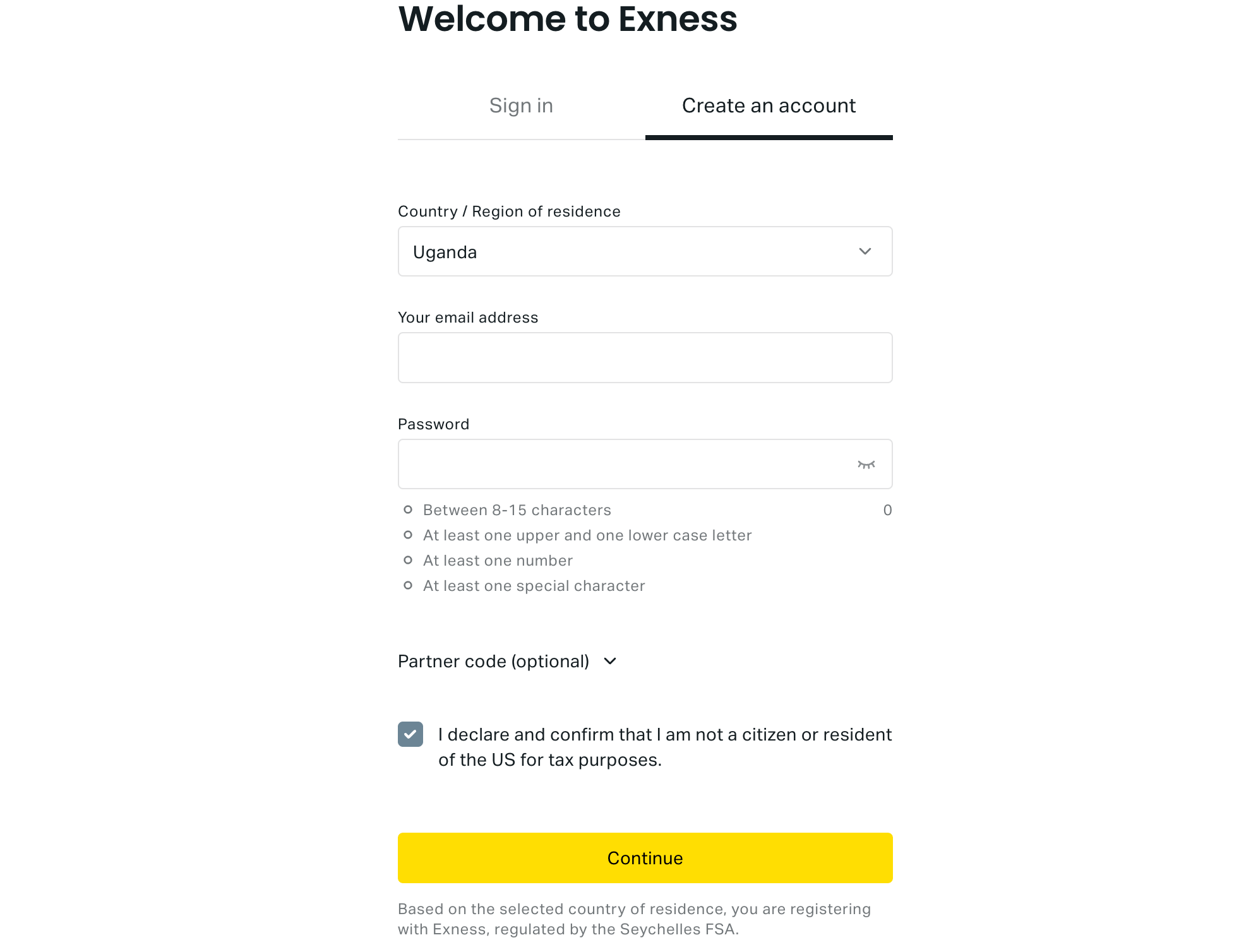

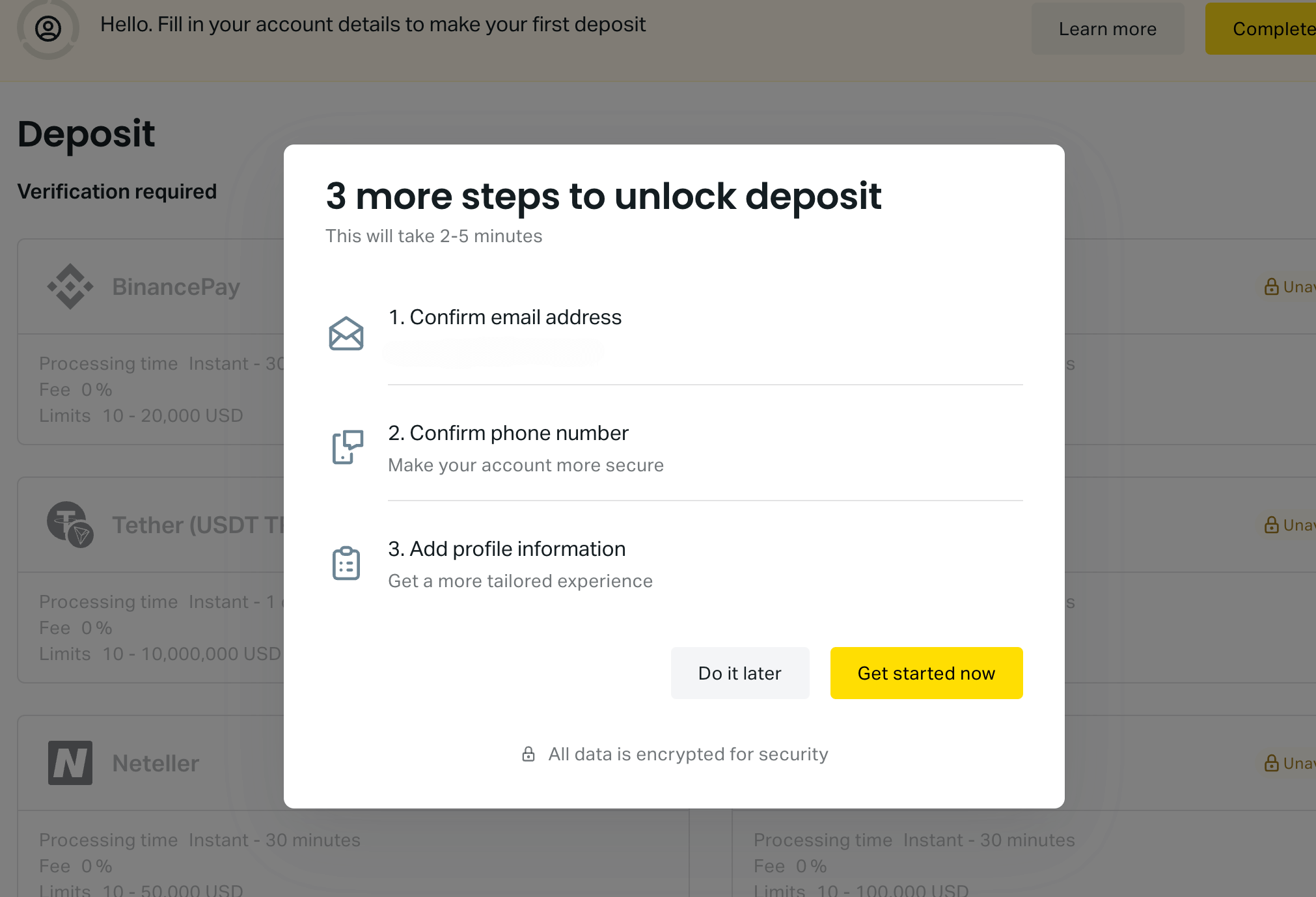

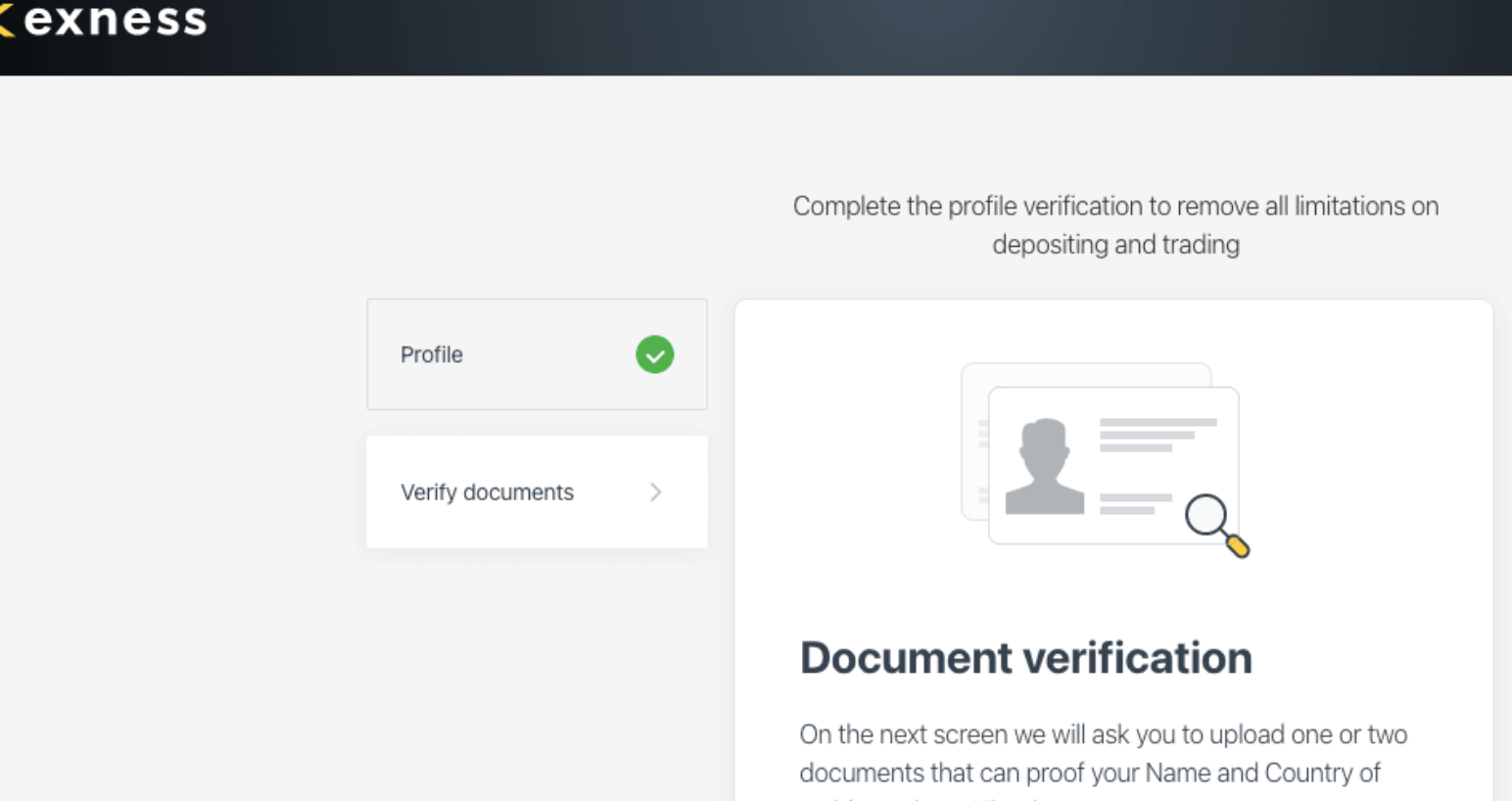

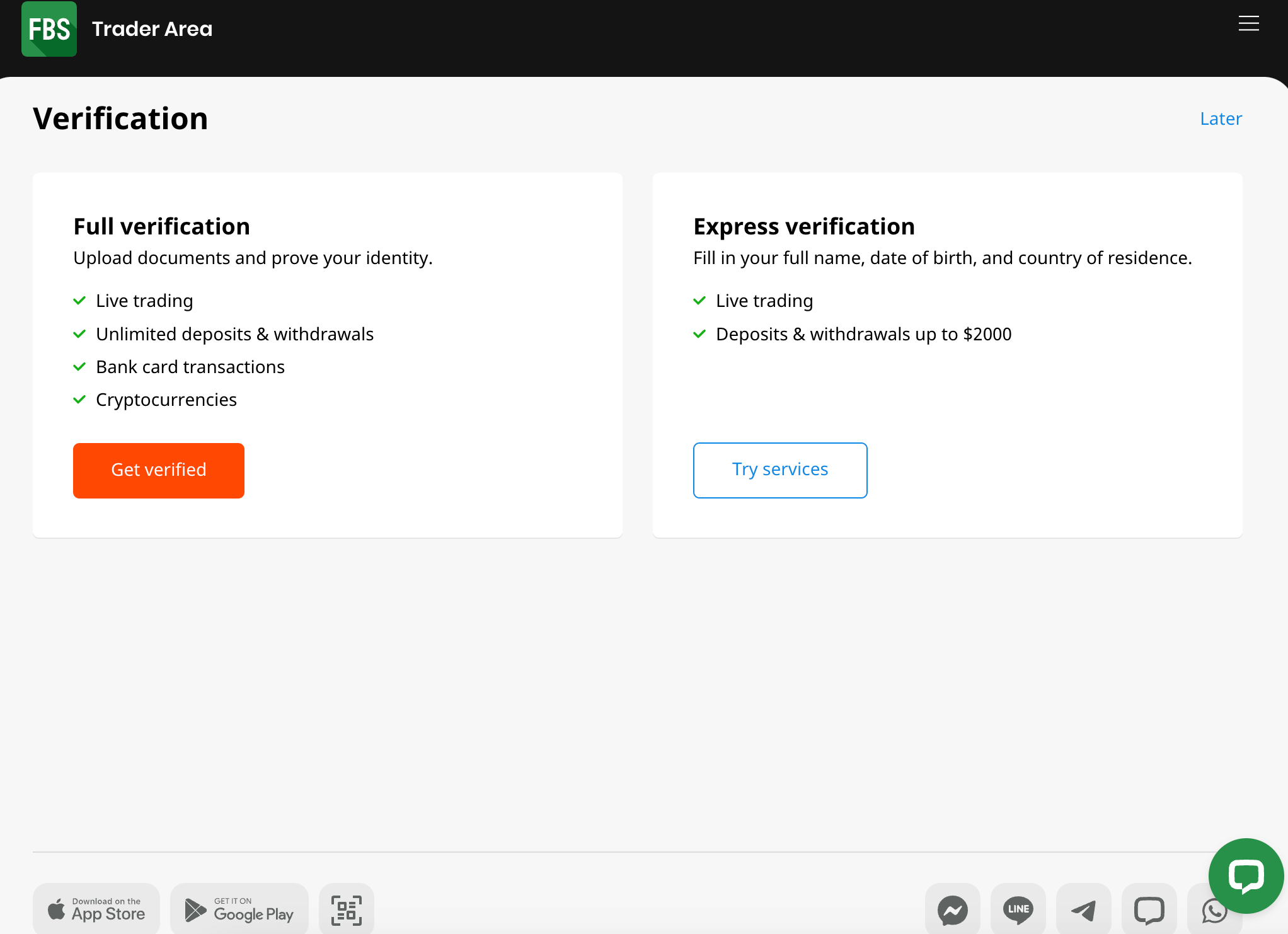

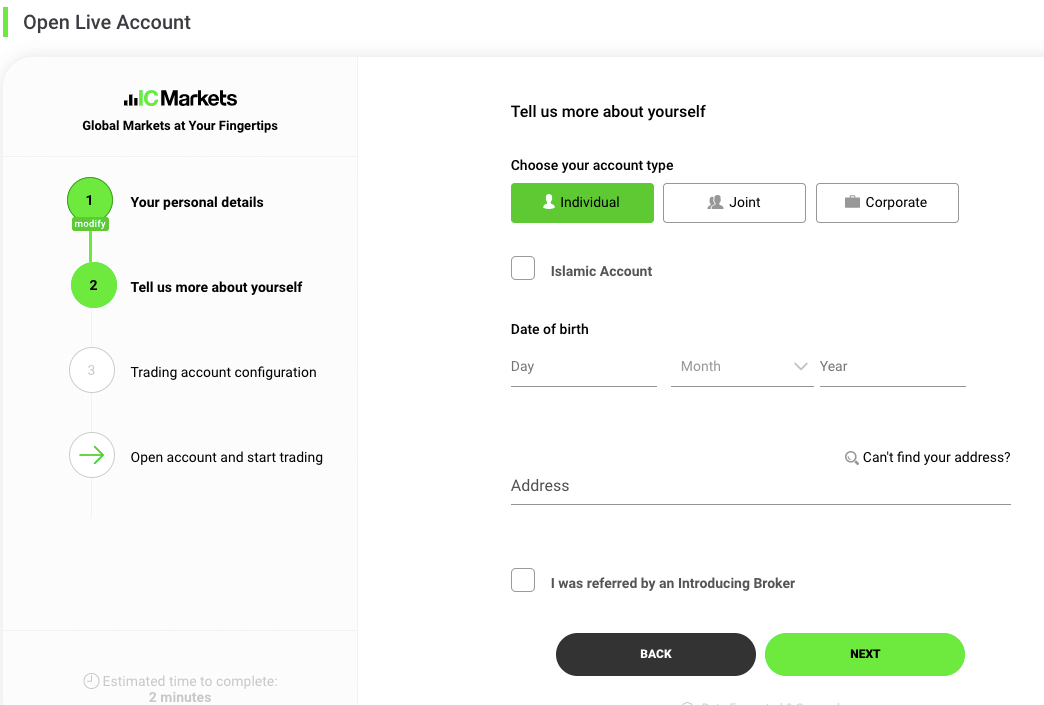

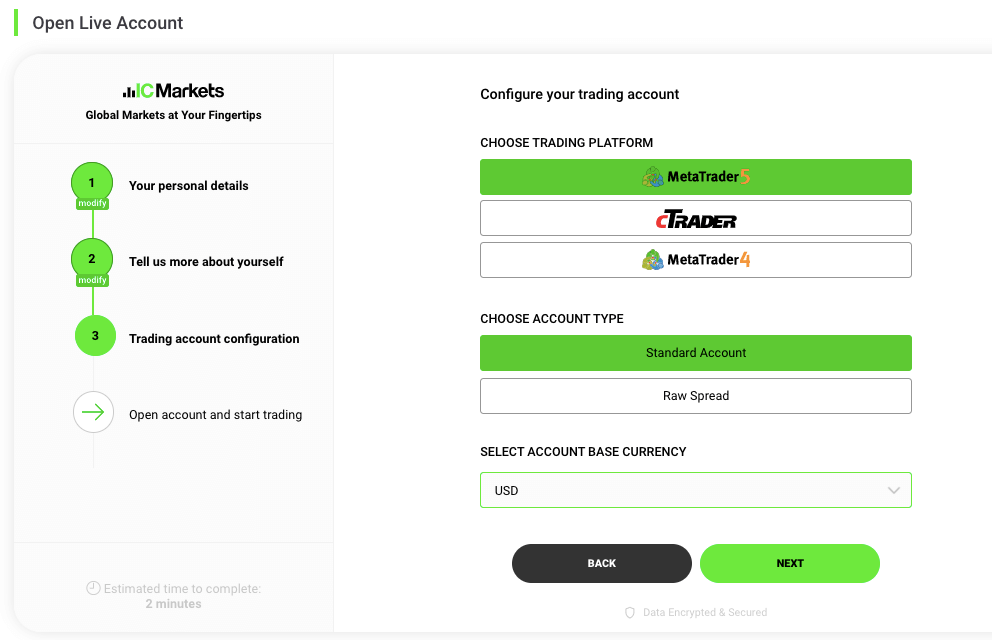

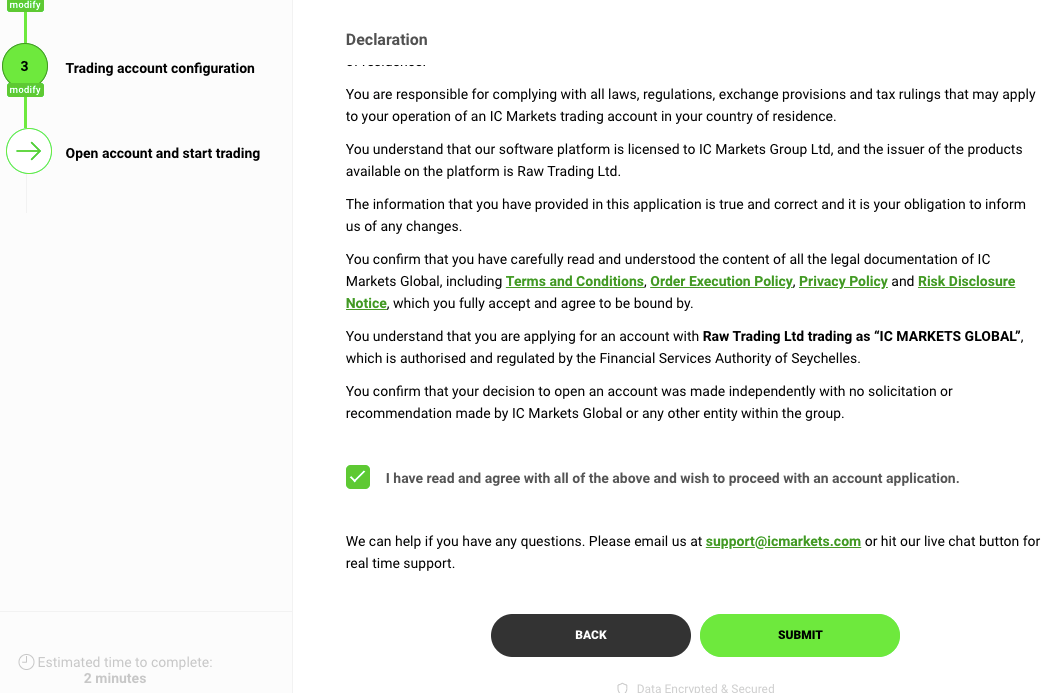

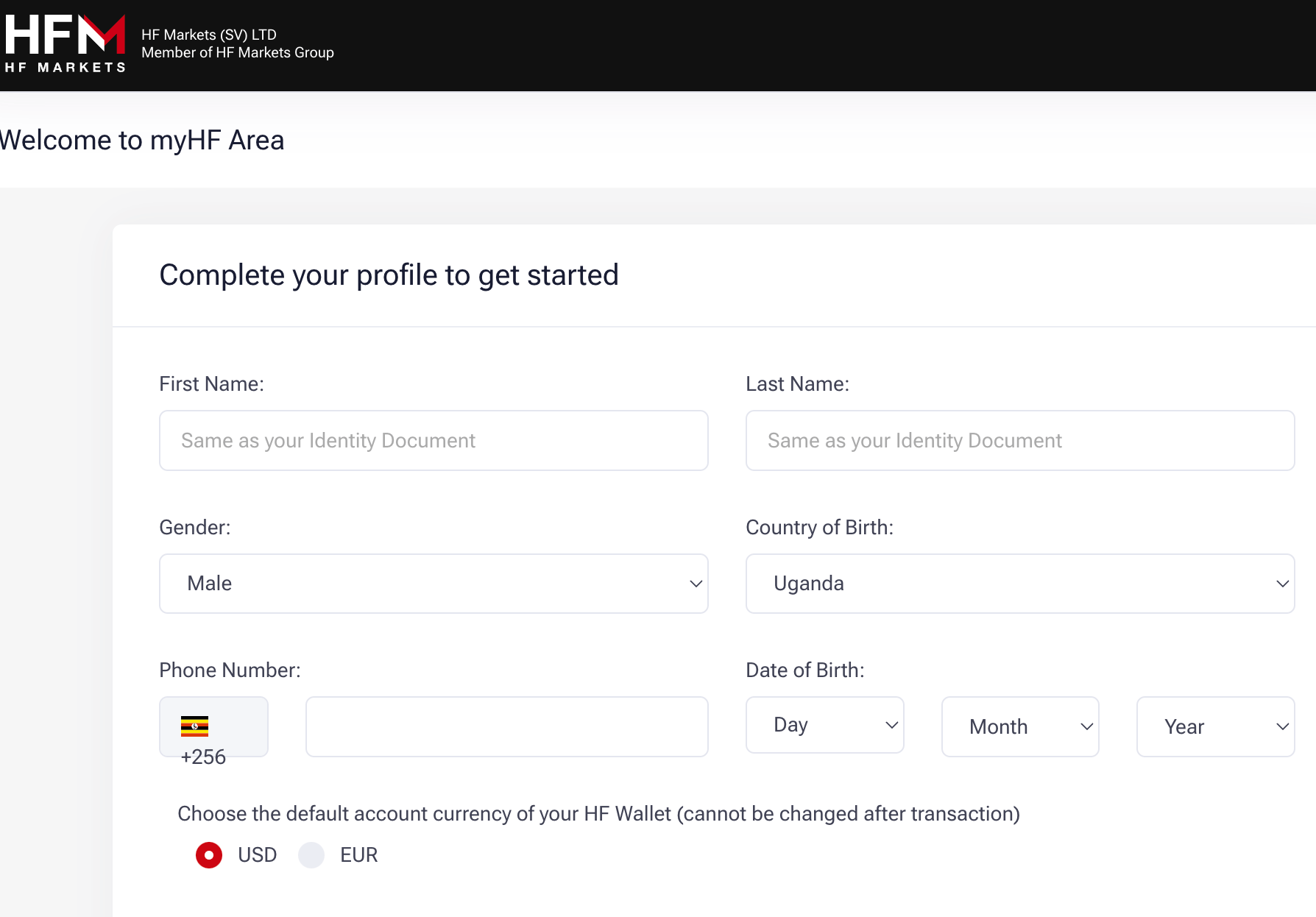

How to Open HotForex Account in Uganda (Basic steps)

To start trading on the HF Markets platform, you need to open a live account. Follow the steps below to open your trading account.

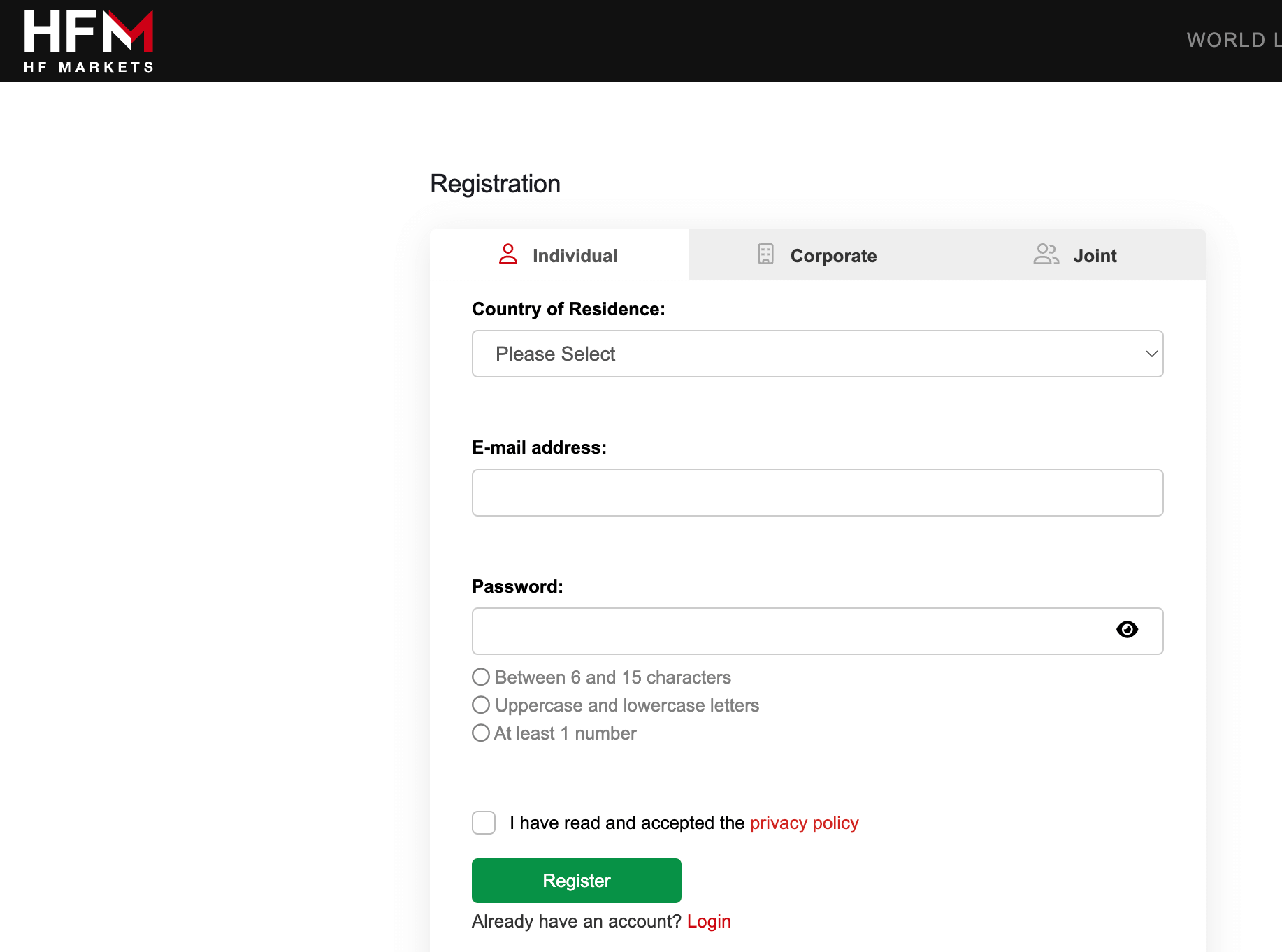

Step 1) Go to the HF Markets website at www.hfm.com and click on the ‘Register’ button, highlighted in green colour, at the top right side of the page.

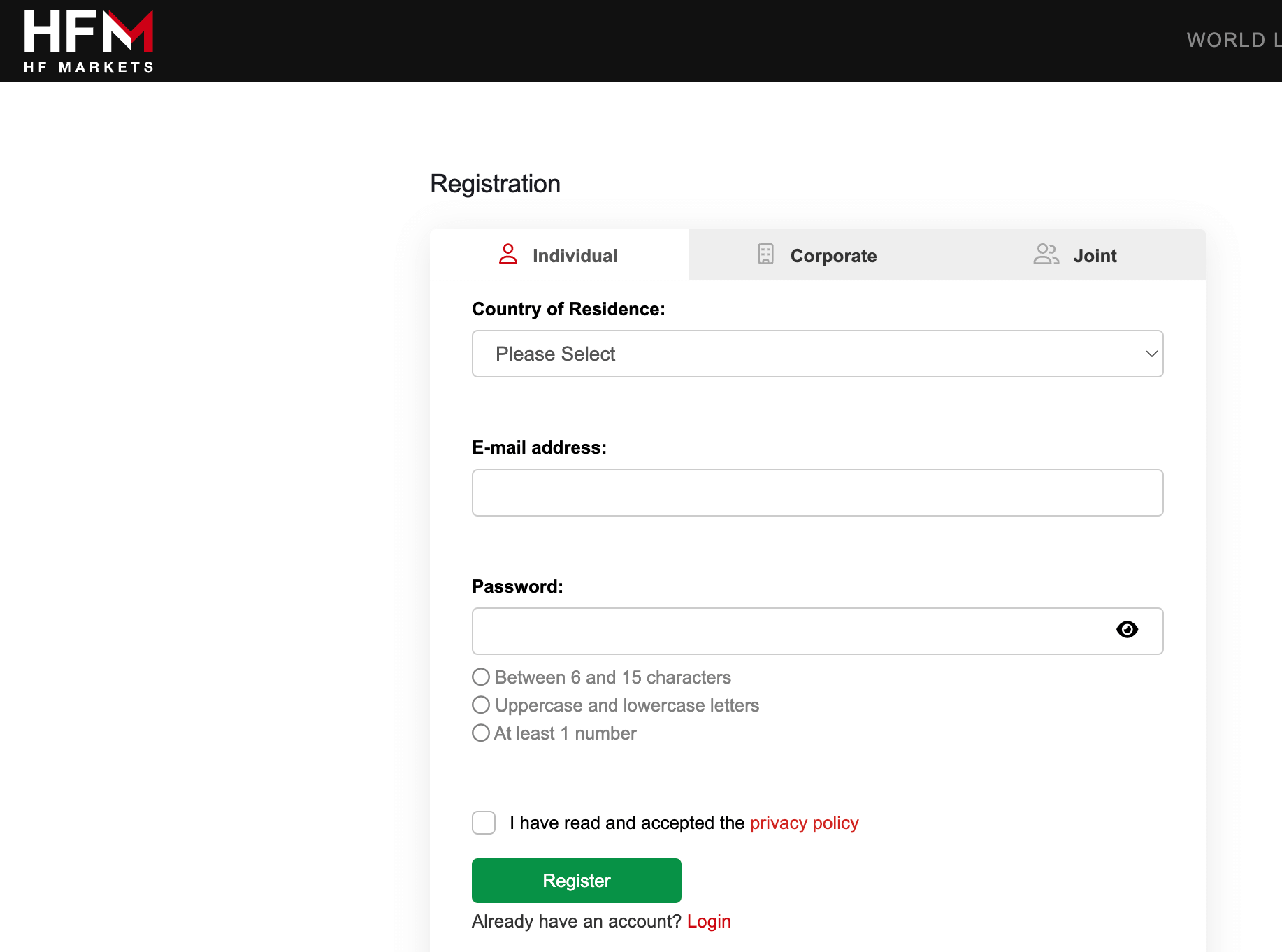

Select your country of residence, then enter your email address, create a password and click on ‘Register’.

Step 2) Select your country of residence, then enter your email address, create a password, check the terms and conditions box after reading, and click on ‘Register’.

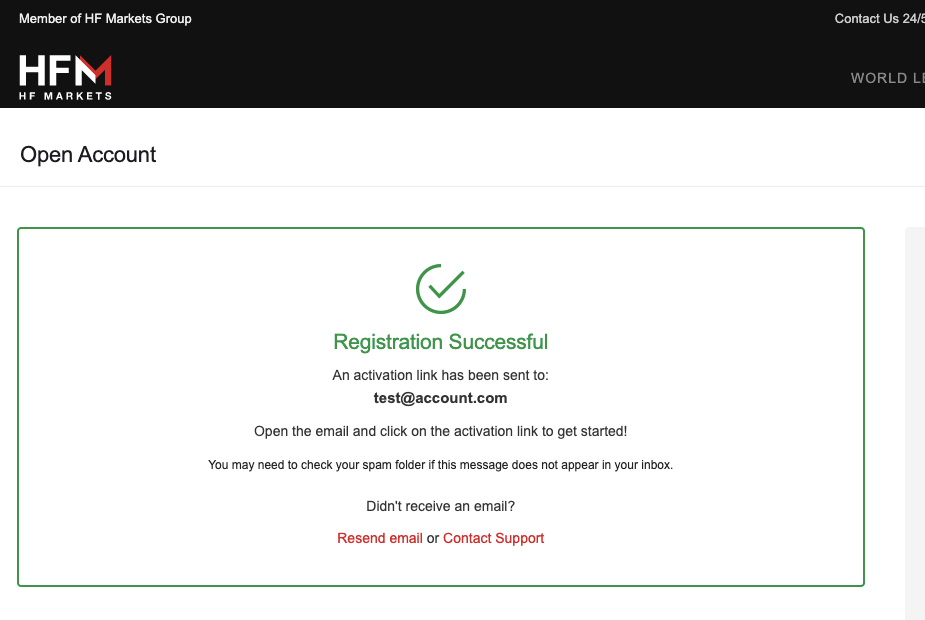

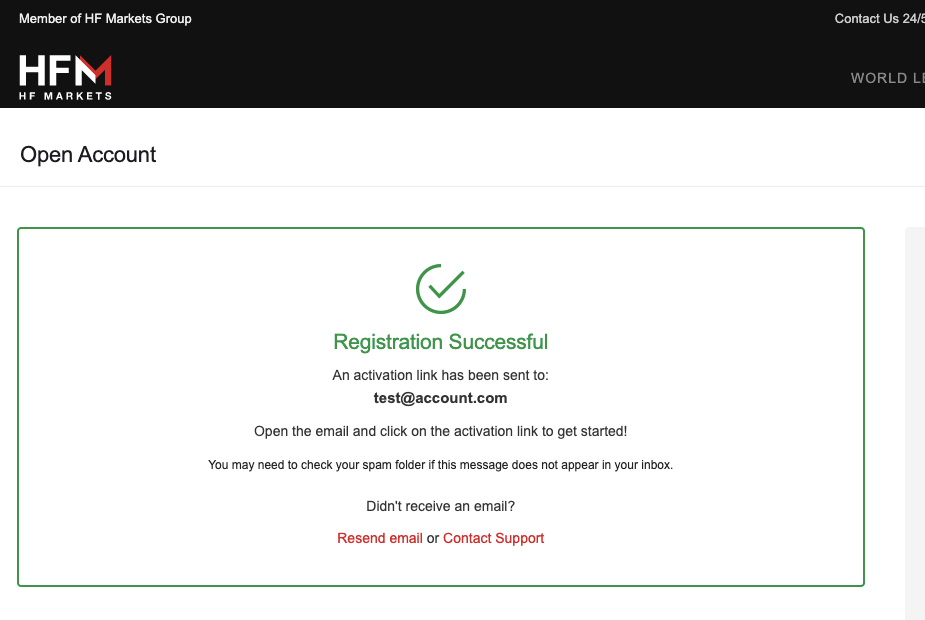

Step 3) A verification link will be sent to your email address. Go to your email inbox and click the ‘Activate Account’ link to continue with your registration.

Once you click the link to verify your email, you will be redirected to your account area to complete registration.

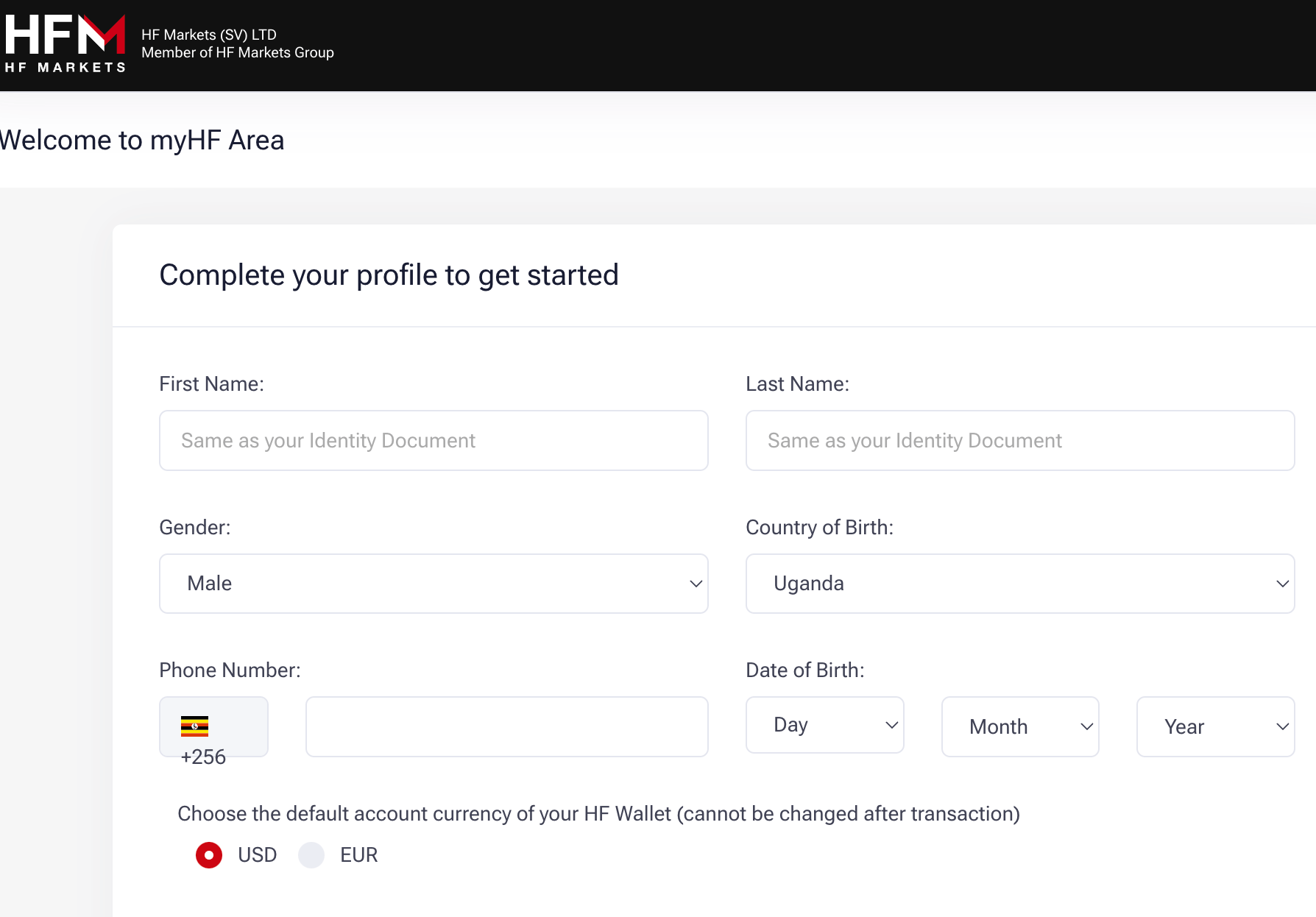

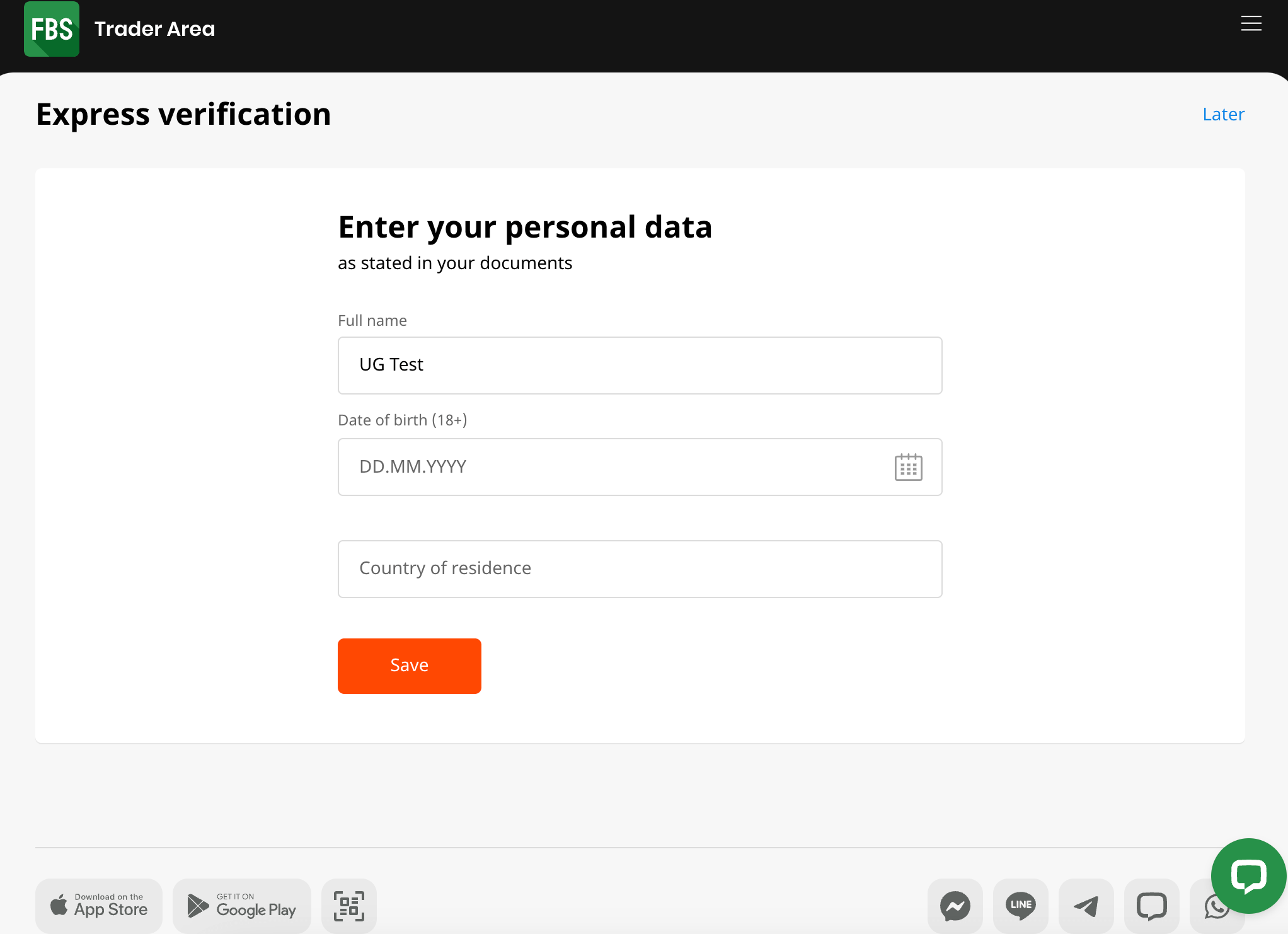

Step 4) Provide your full name, phone number, date of birth, and select your preferred account currency, then click on ‘continue’.

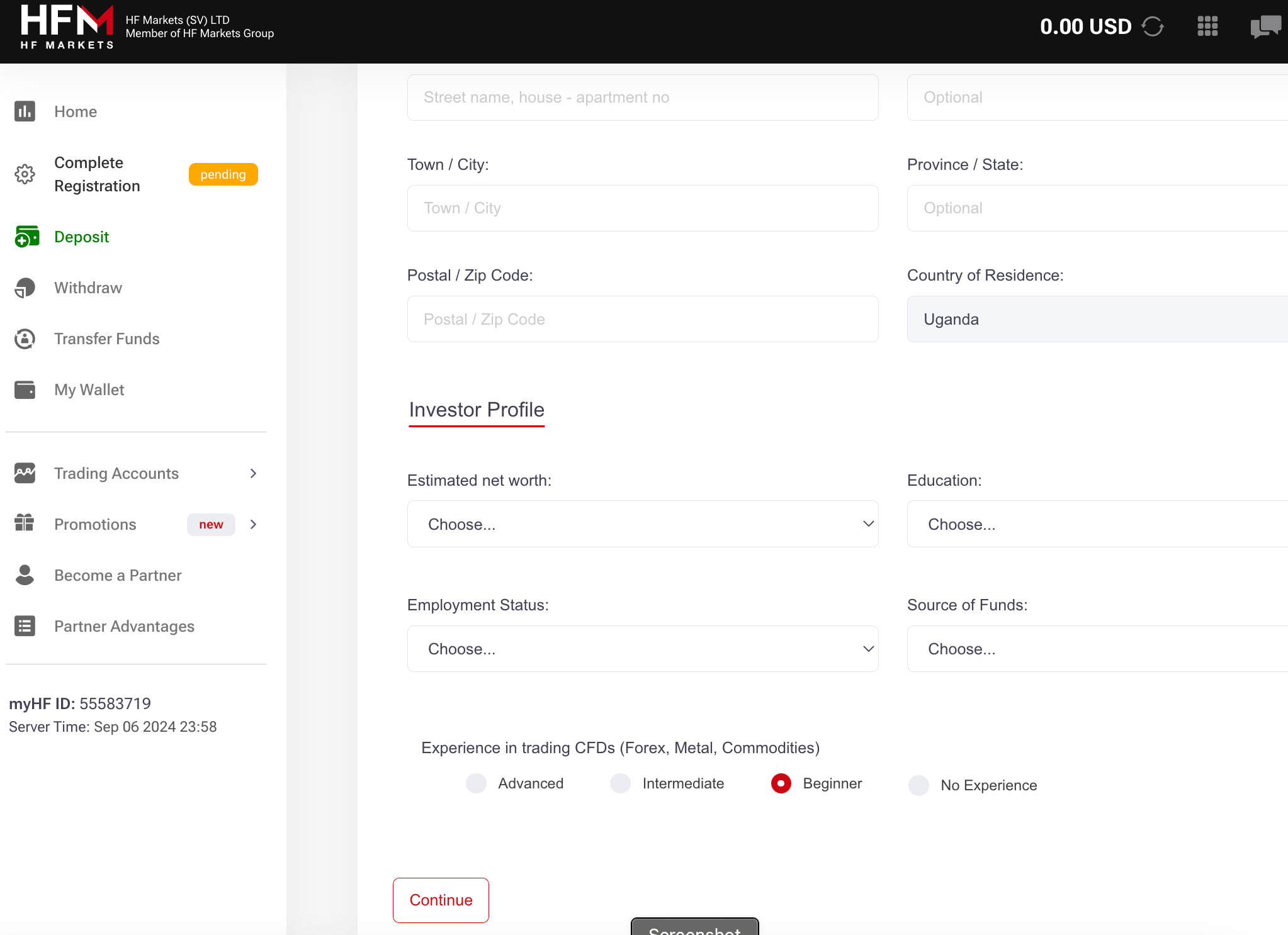

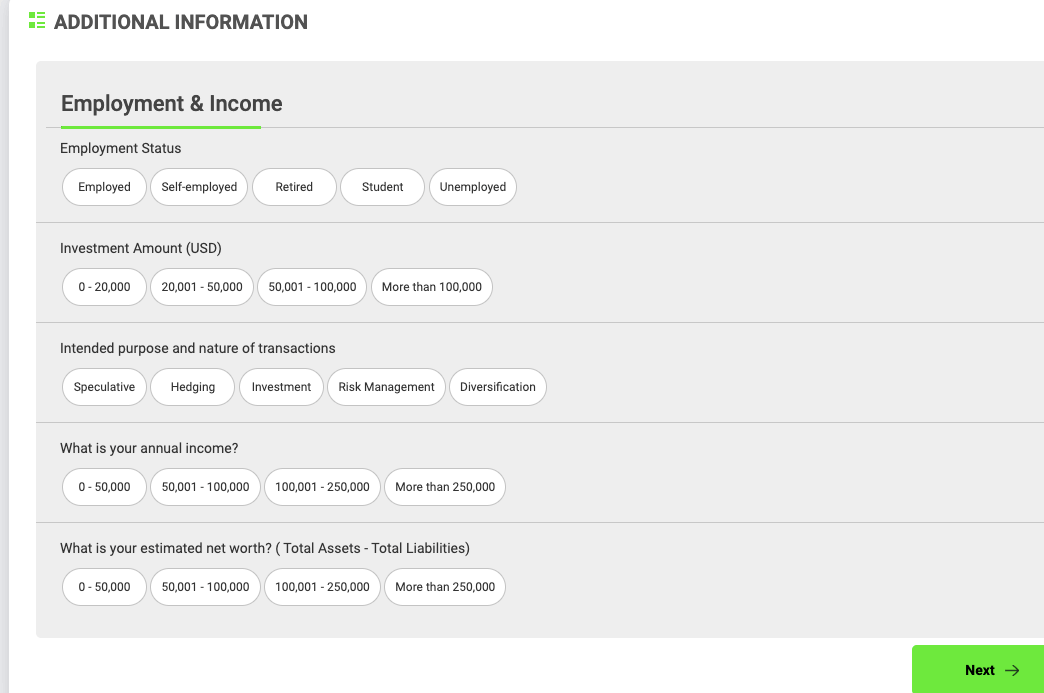

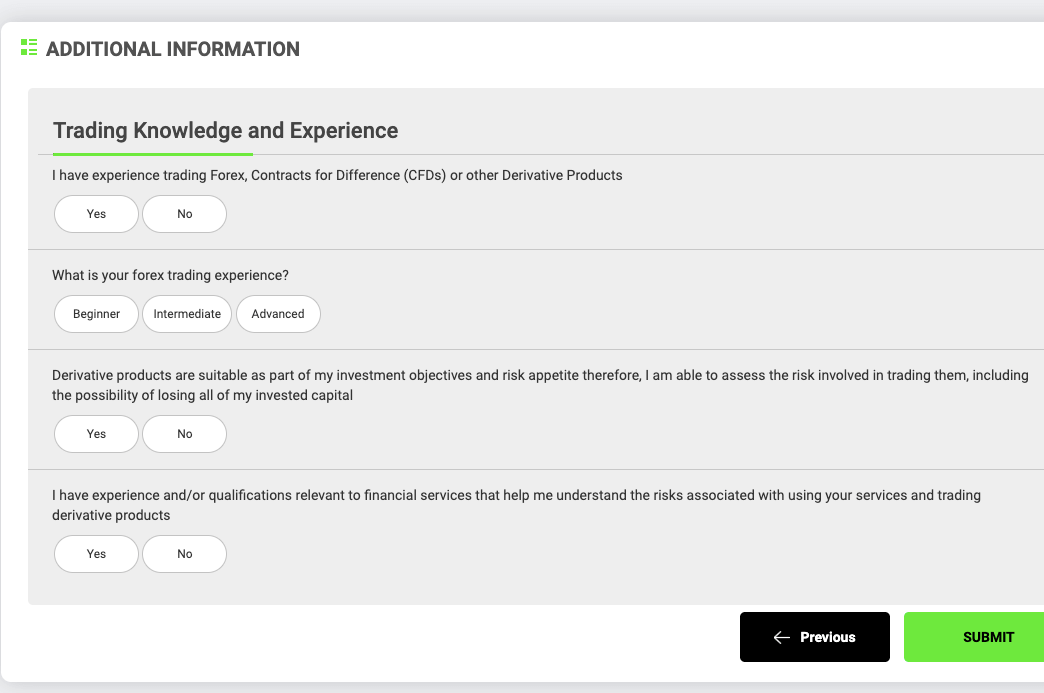

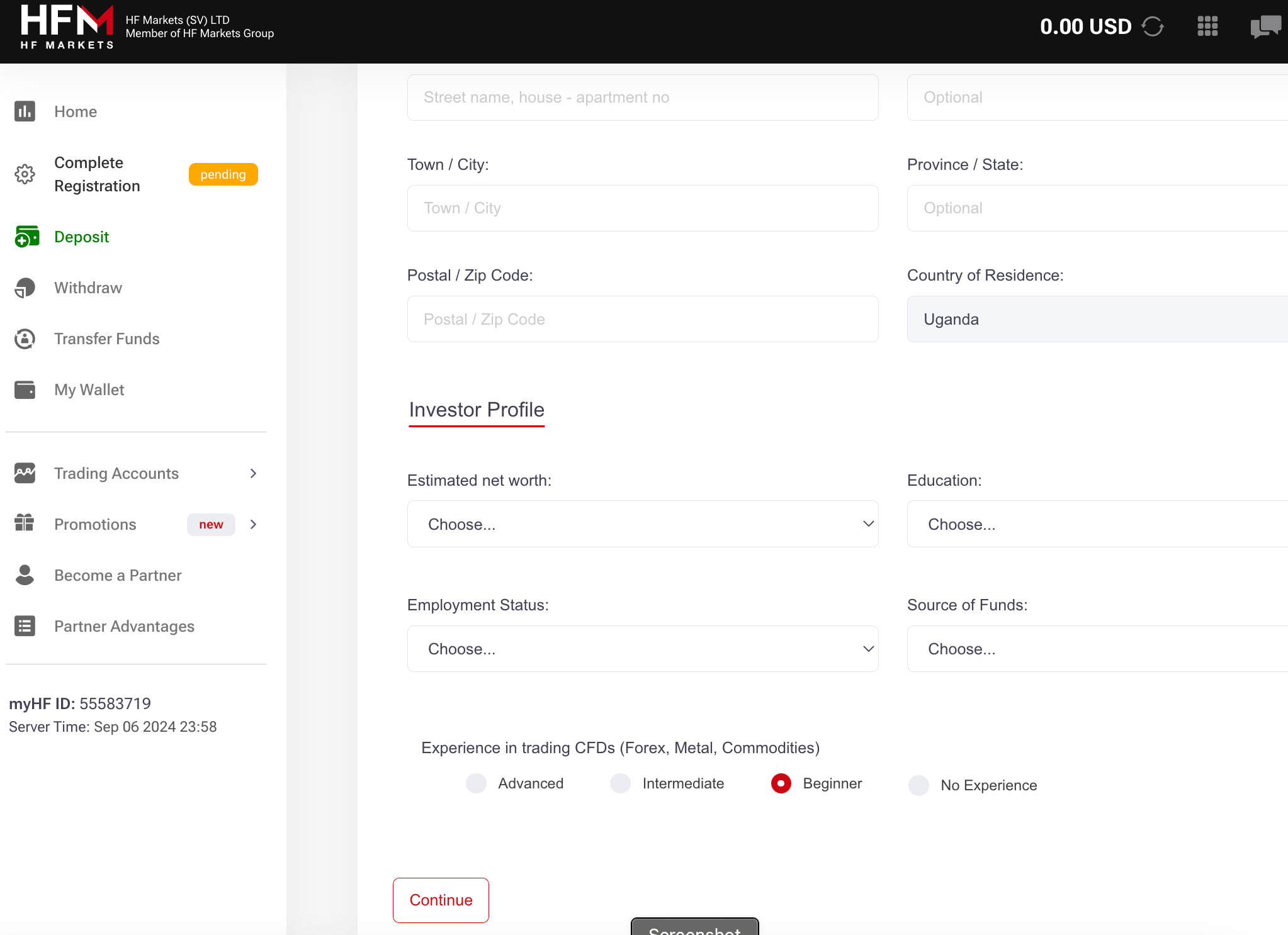

Step 5) Provide your address and answer some questions about your trading experience and income source. Then click ‘Continue’.

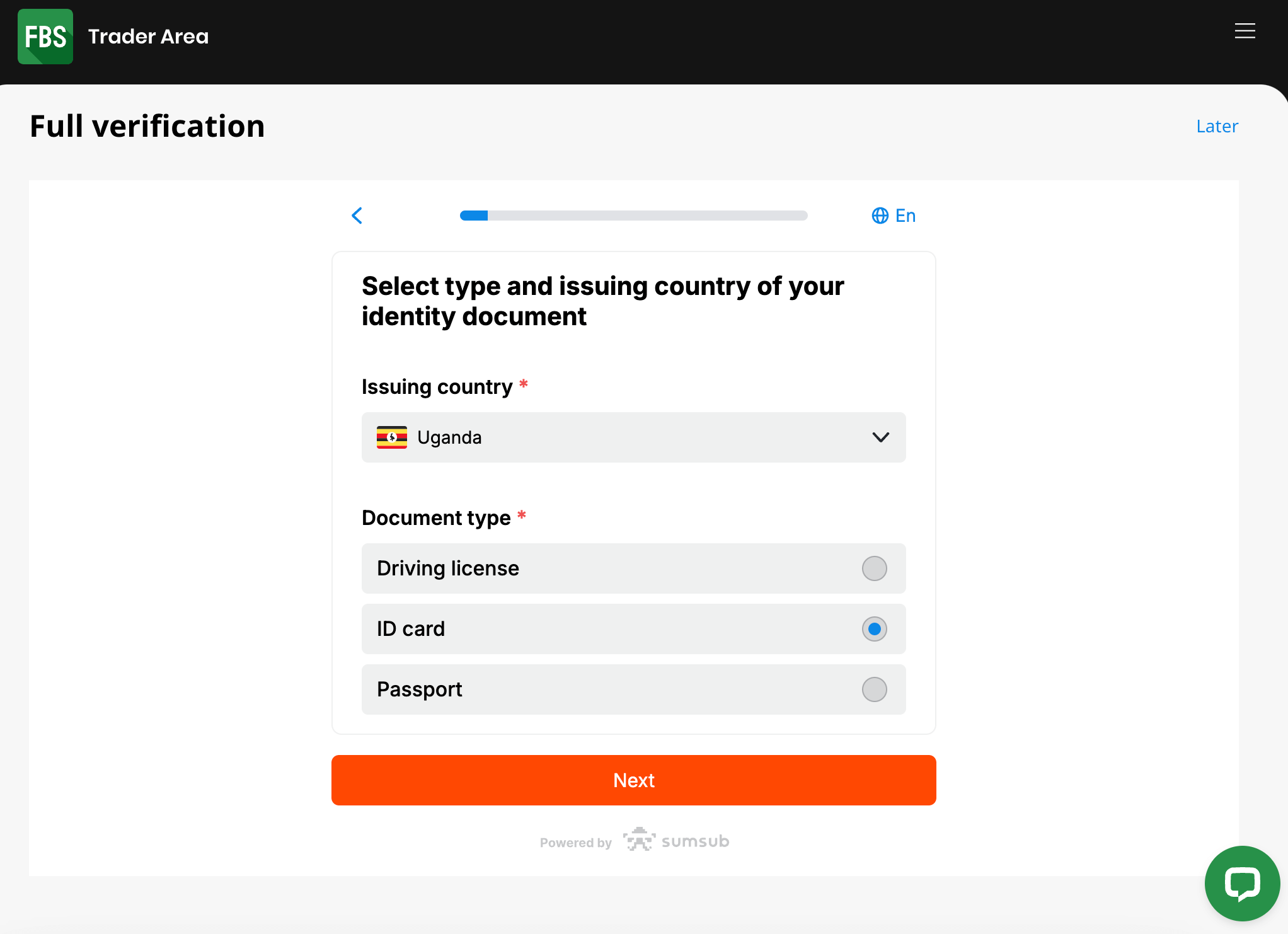

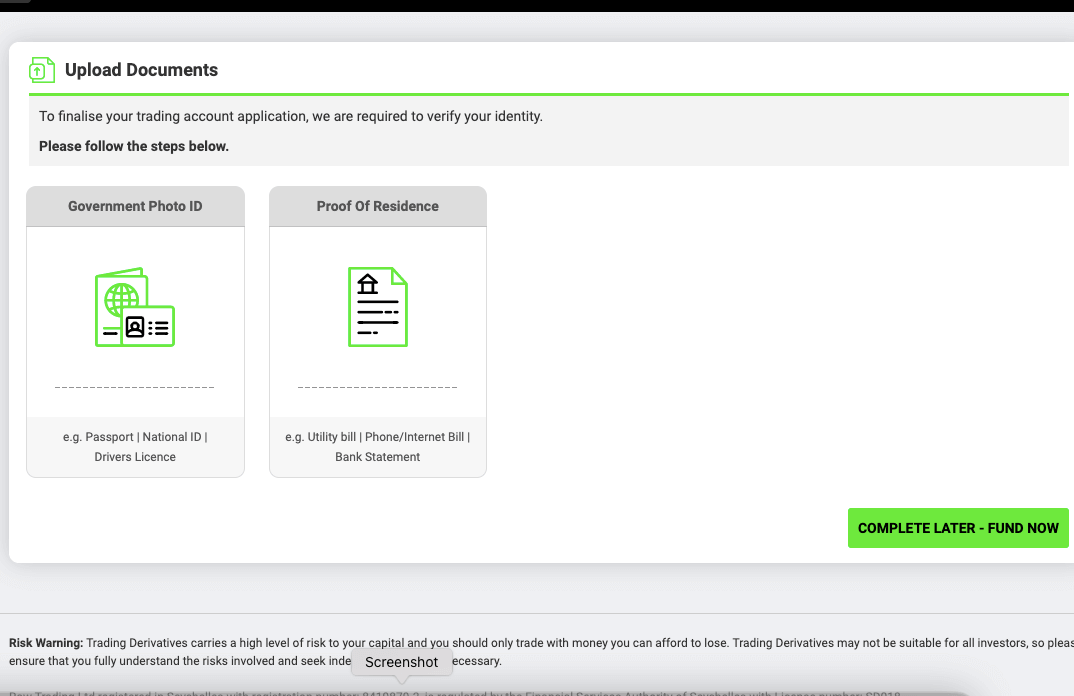

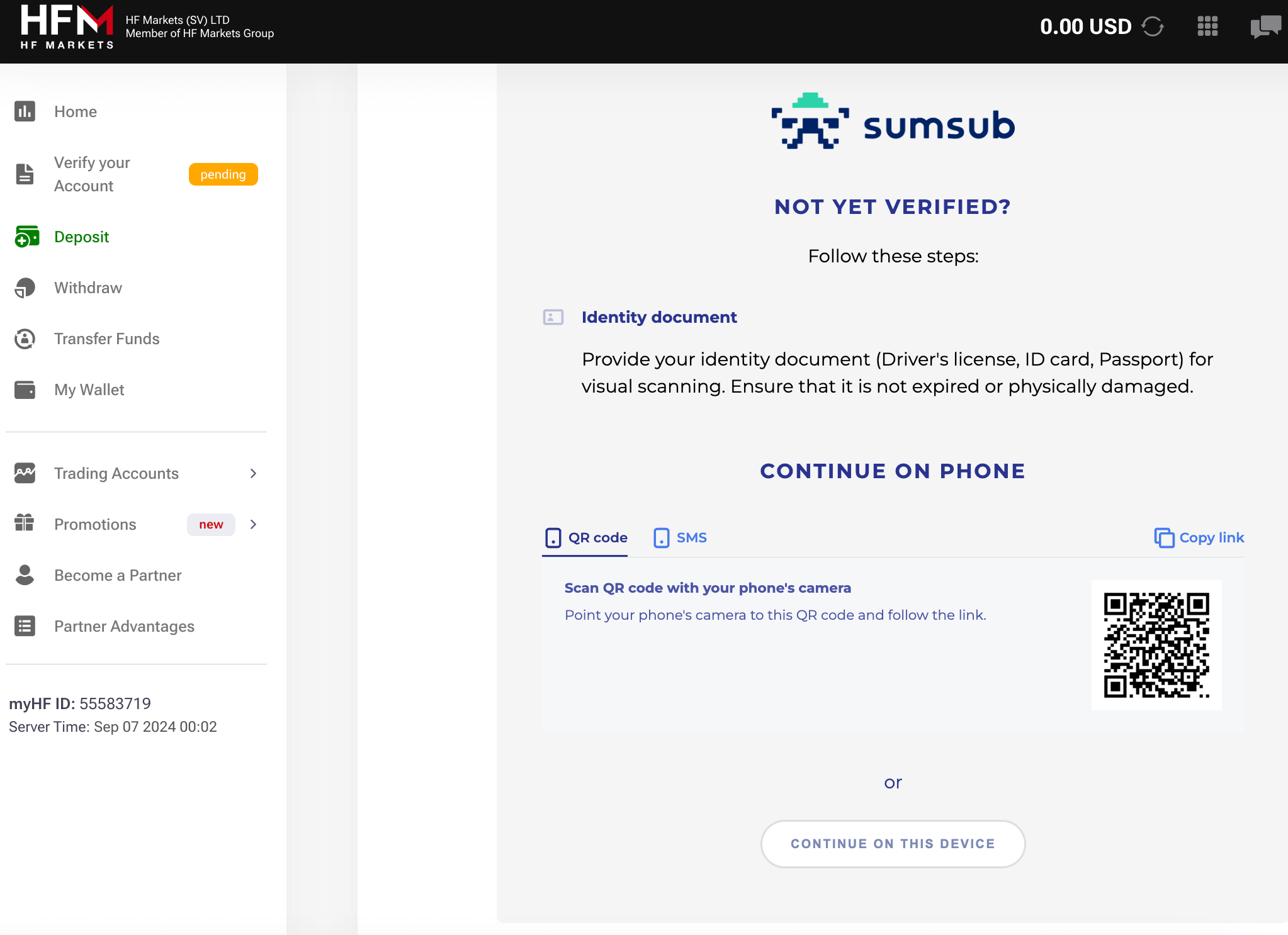

Step 6) Upload your government issued ID card and verify your phone number to verify your account.

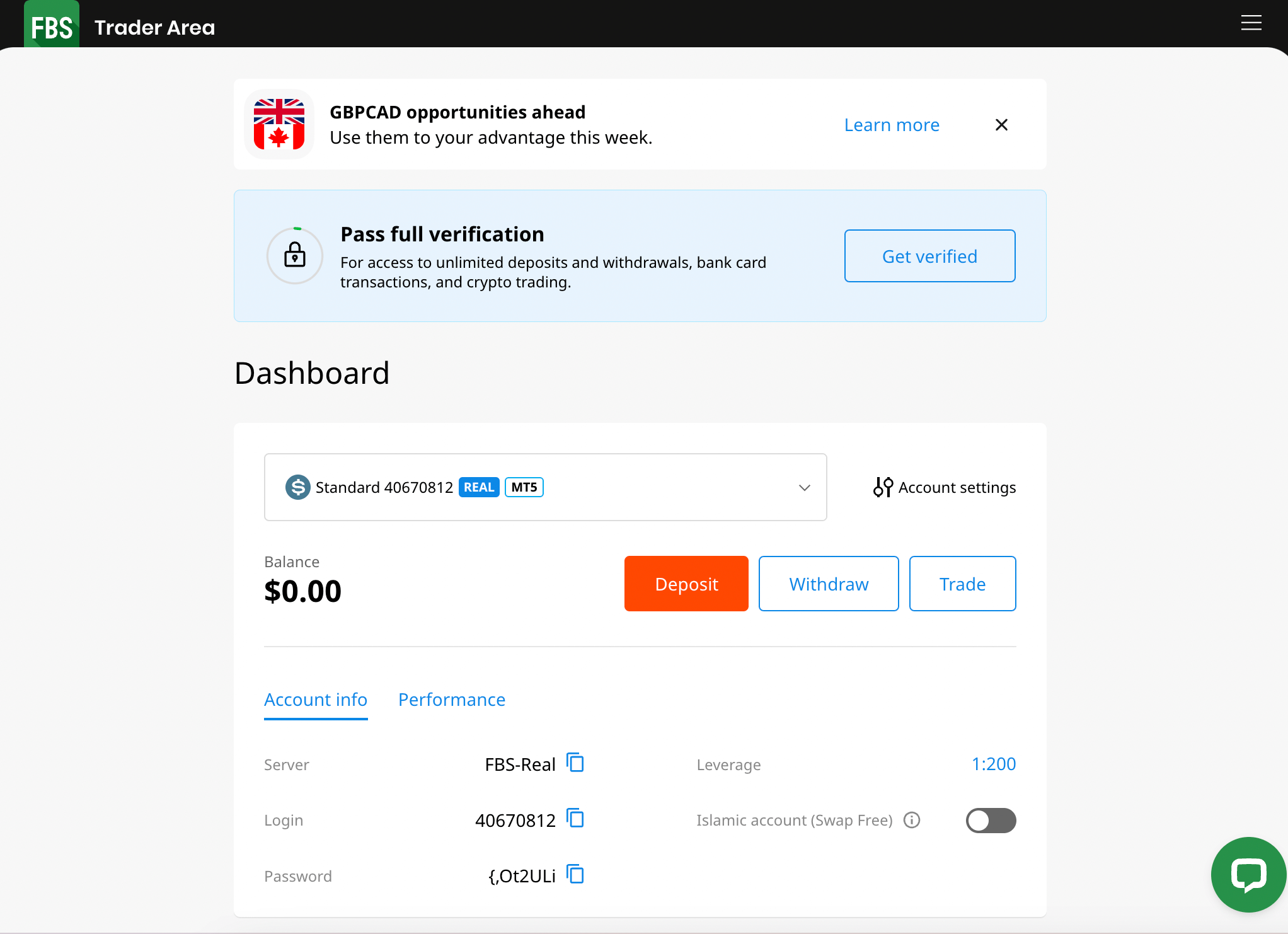

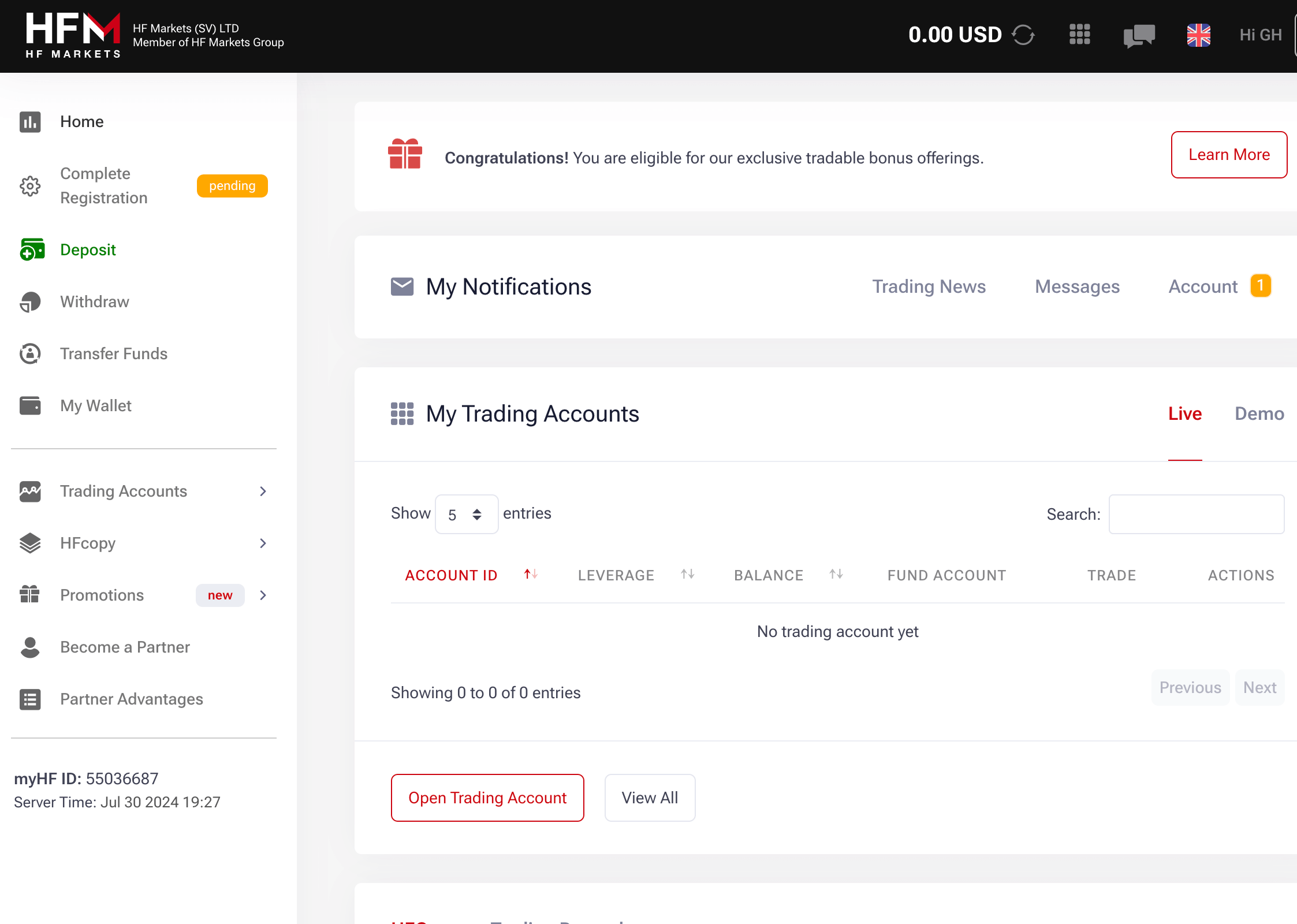

Step 7) Once your account is verified, you will redirected to the dashboard where you can make deposits and start trading.

HF Markets Deposits & Withdrawals

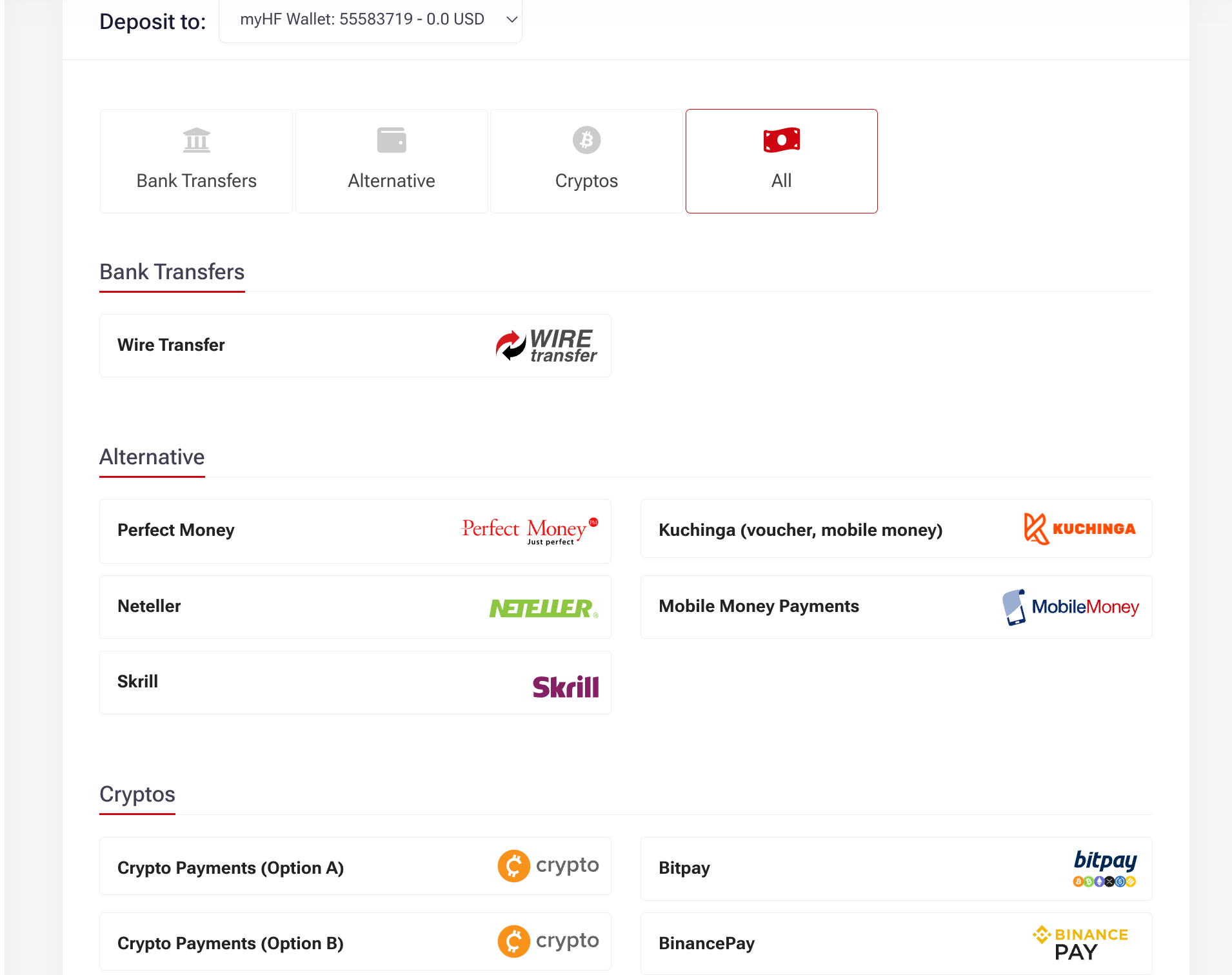

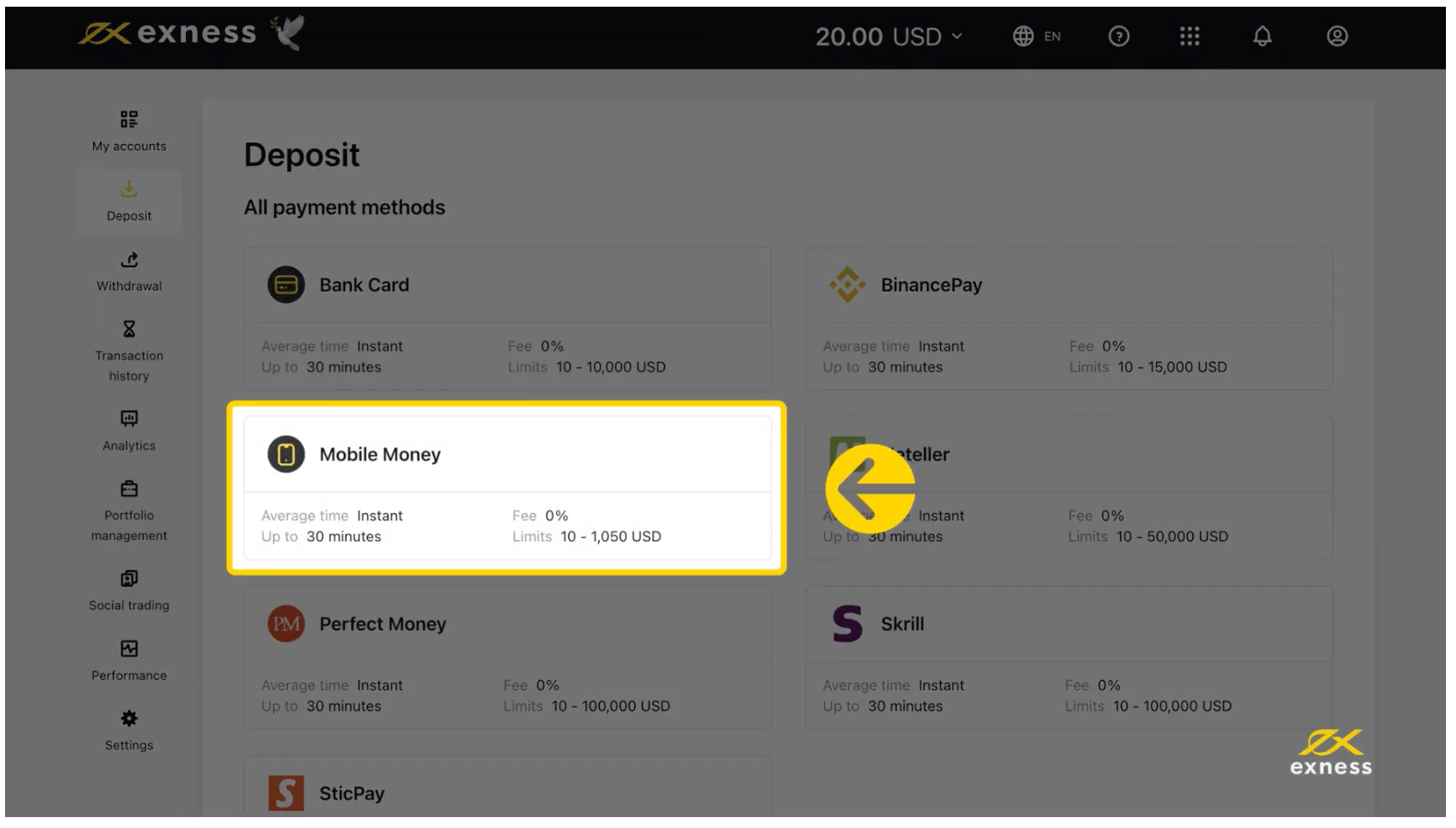

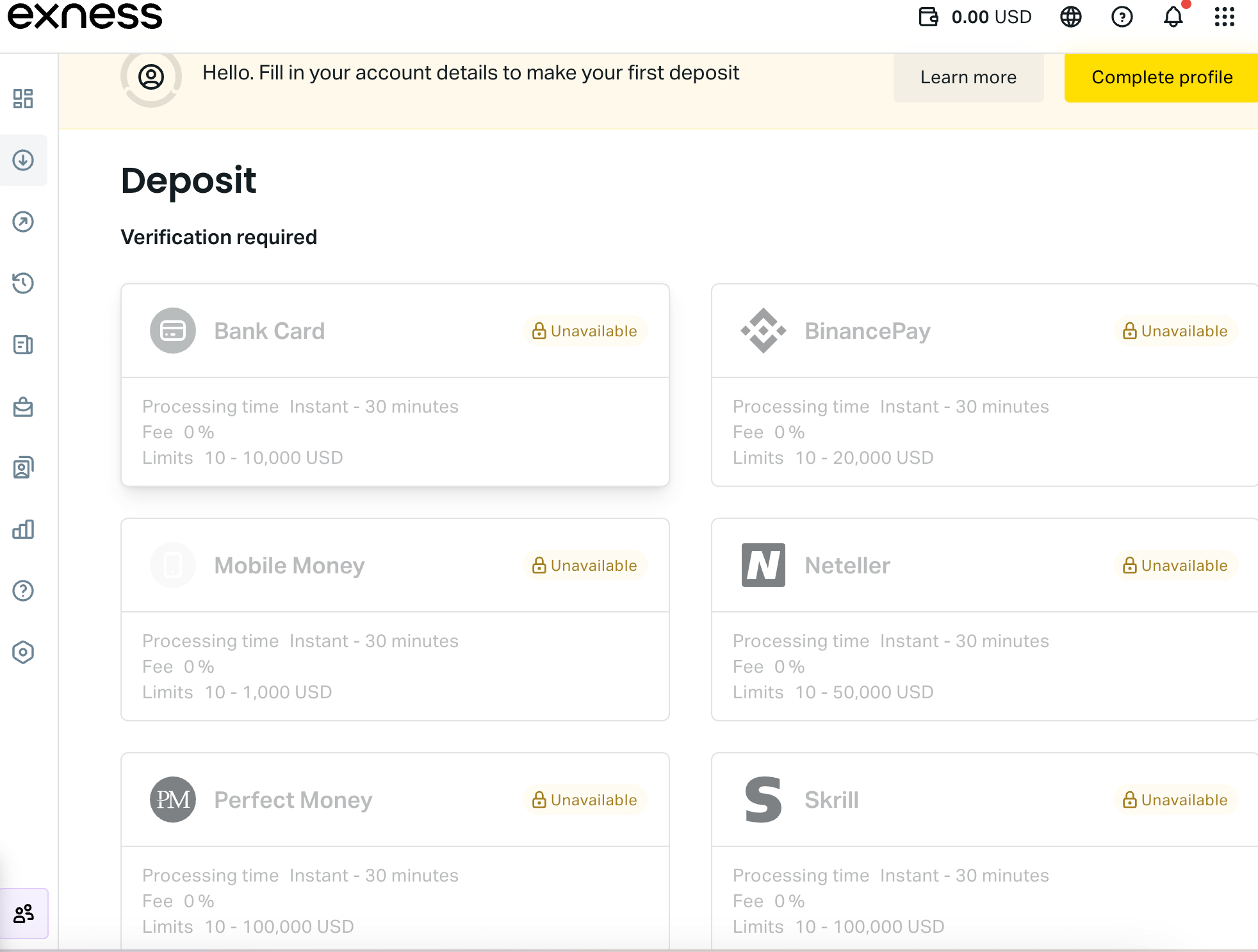

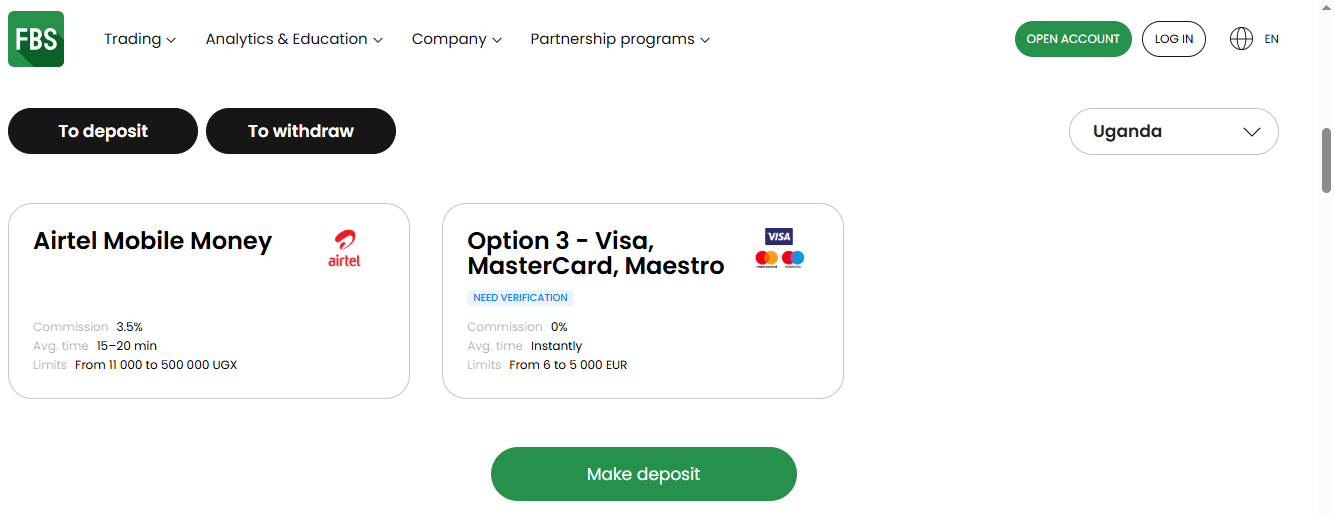

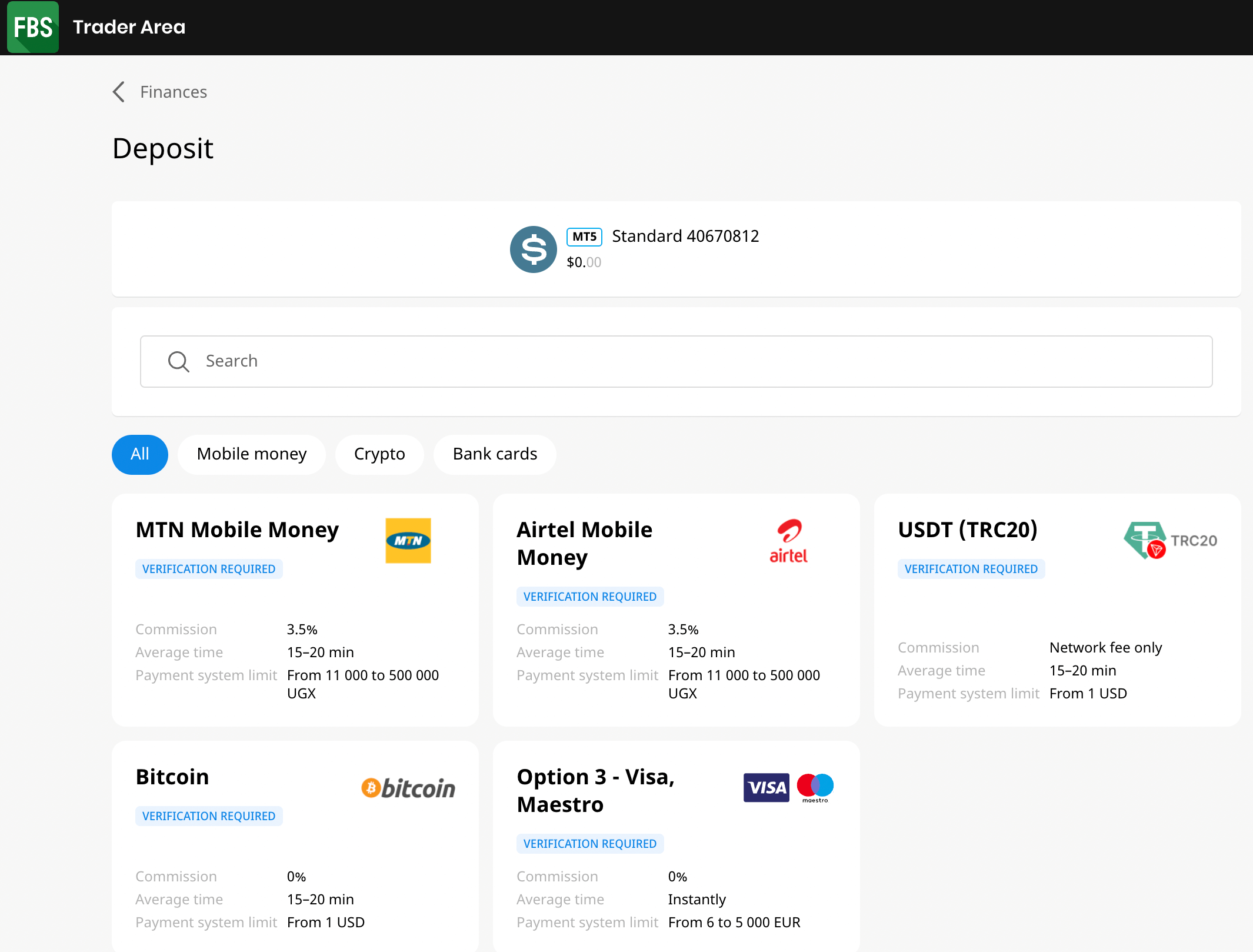

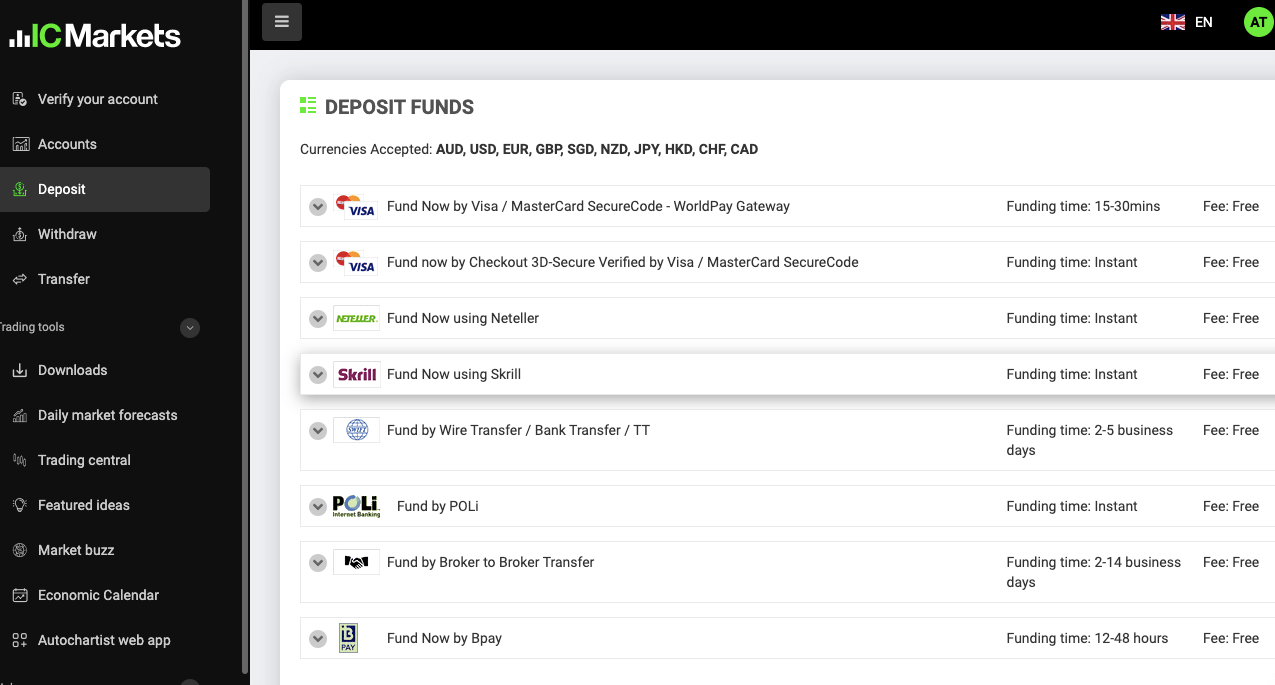

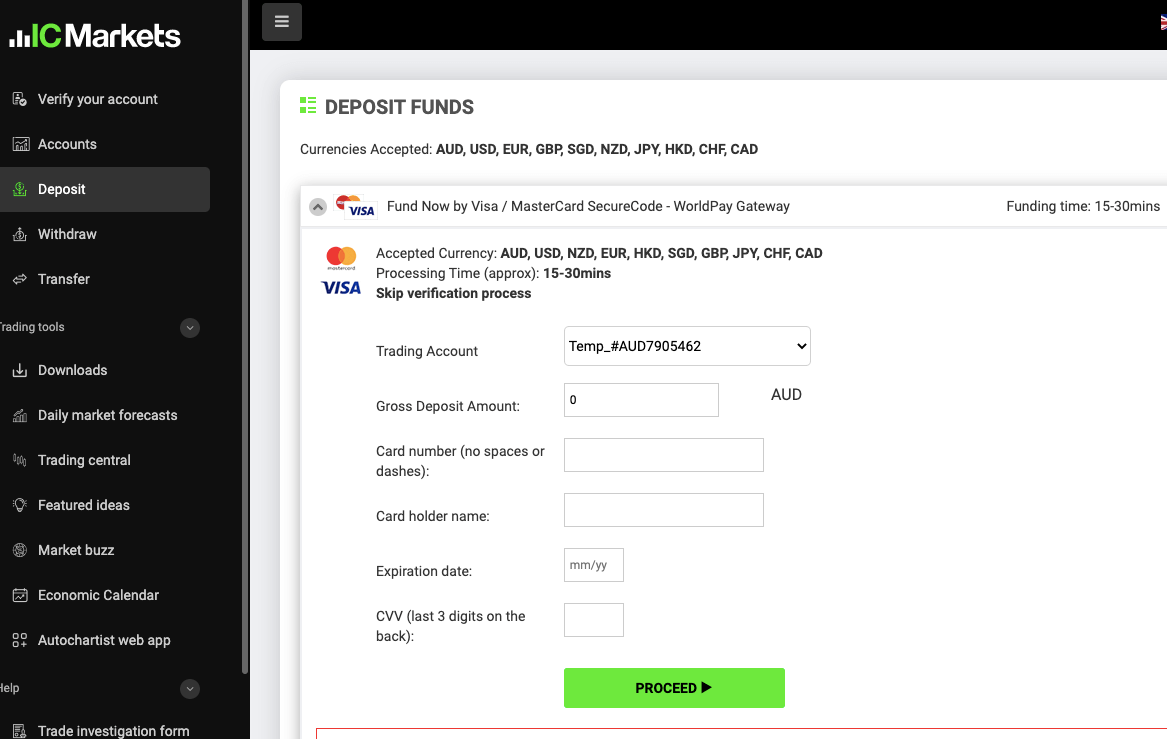

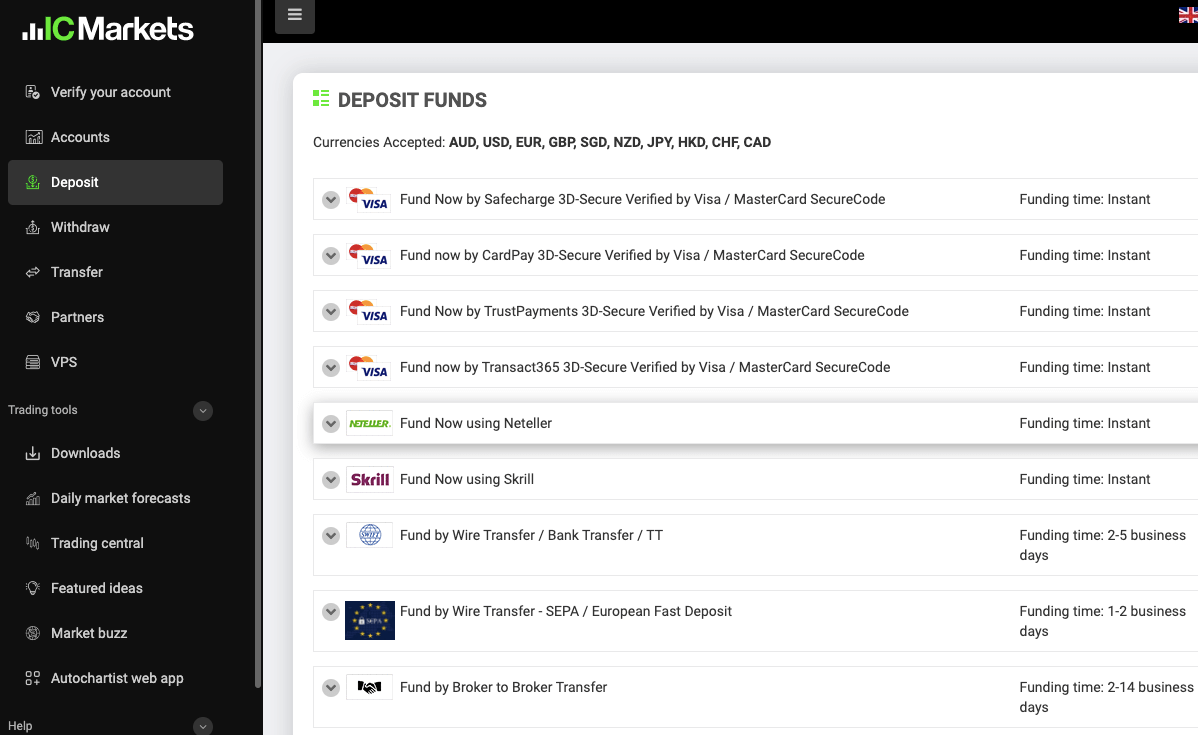

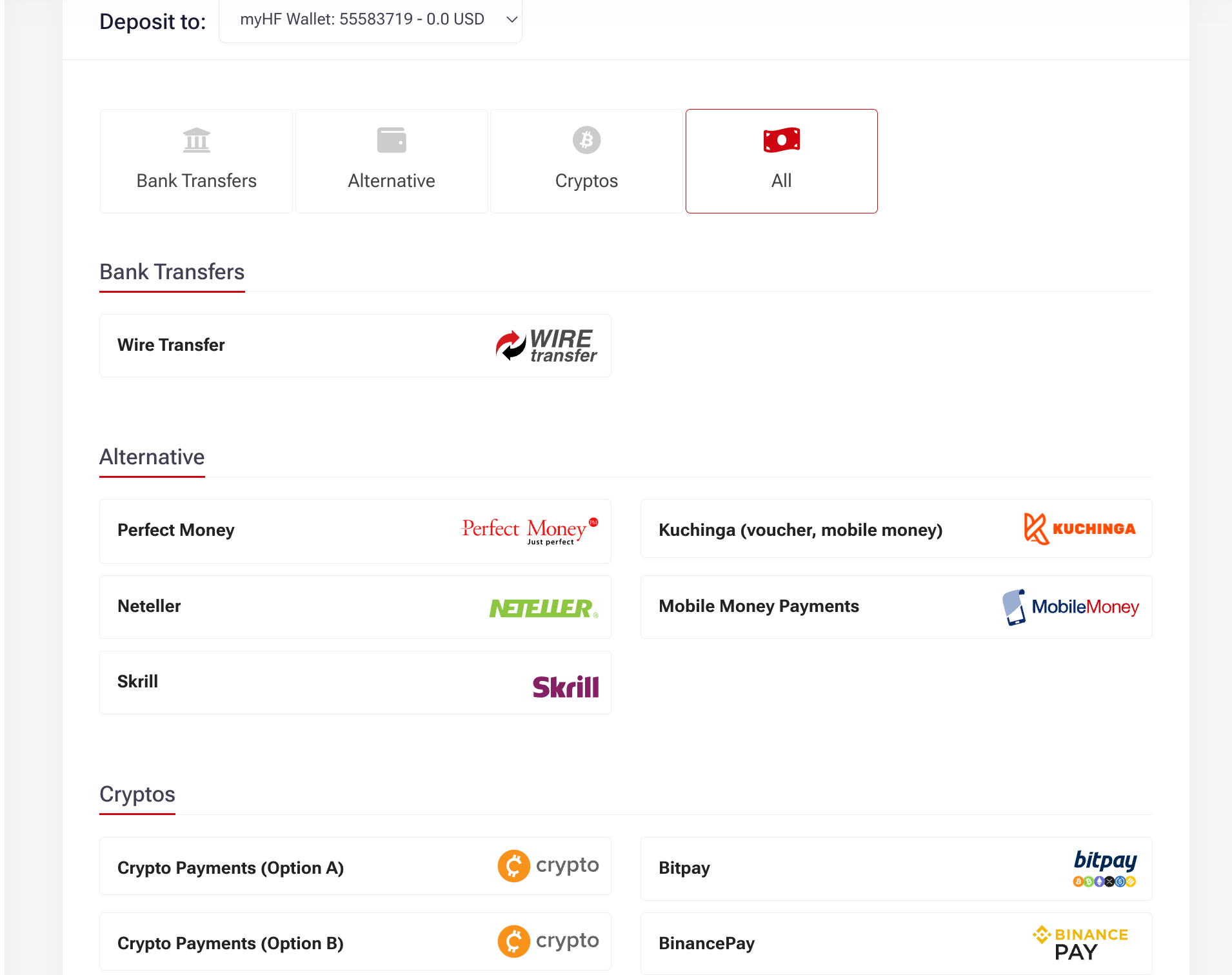

Payment methods supported by HF Markets for deposits and withdrawals are mobile money, cards, e-wallets and international bank wire transfers. Here is the summary of the deposits and withdrawal options on HF Markets in Uganda.

HF Markets Deposit Methods

Here is a summary of payment methods accepted by HF Markets for deposits.

| Deposit Methods |

Availability |

Charges |

Processing time |

| Mobile Money |

Yes |

Free |

Instant |

| Cards |

Yes |

Free |

10 minutes |

| E-wallet |

Yes (Skrill & Neteller) |

Free |

10 minutes |

| Crypto |

Yes (BTC, ETH, XRP, LTC) |

Free |

10 minutes |

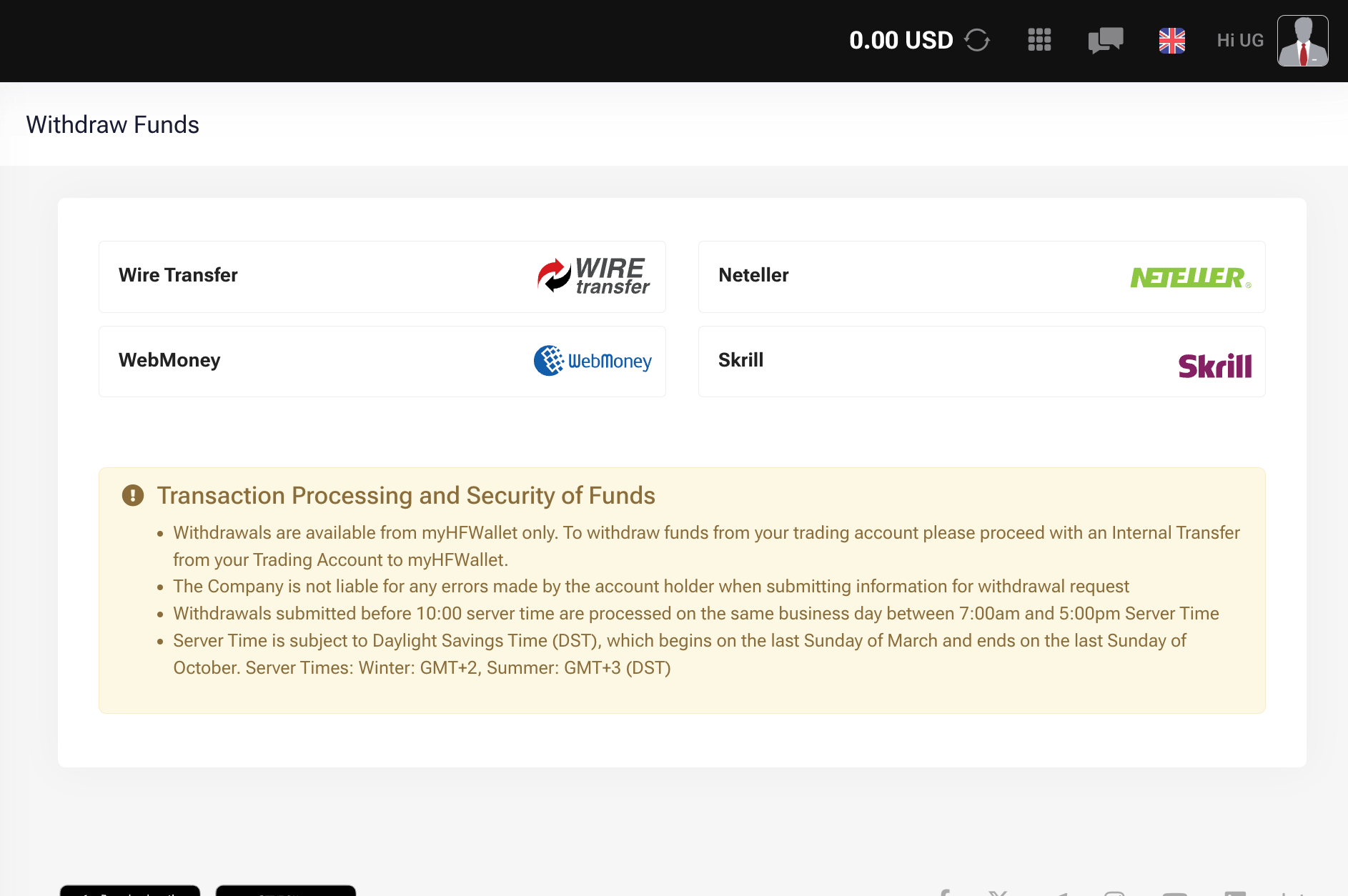

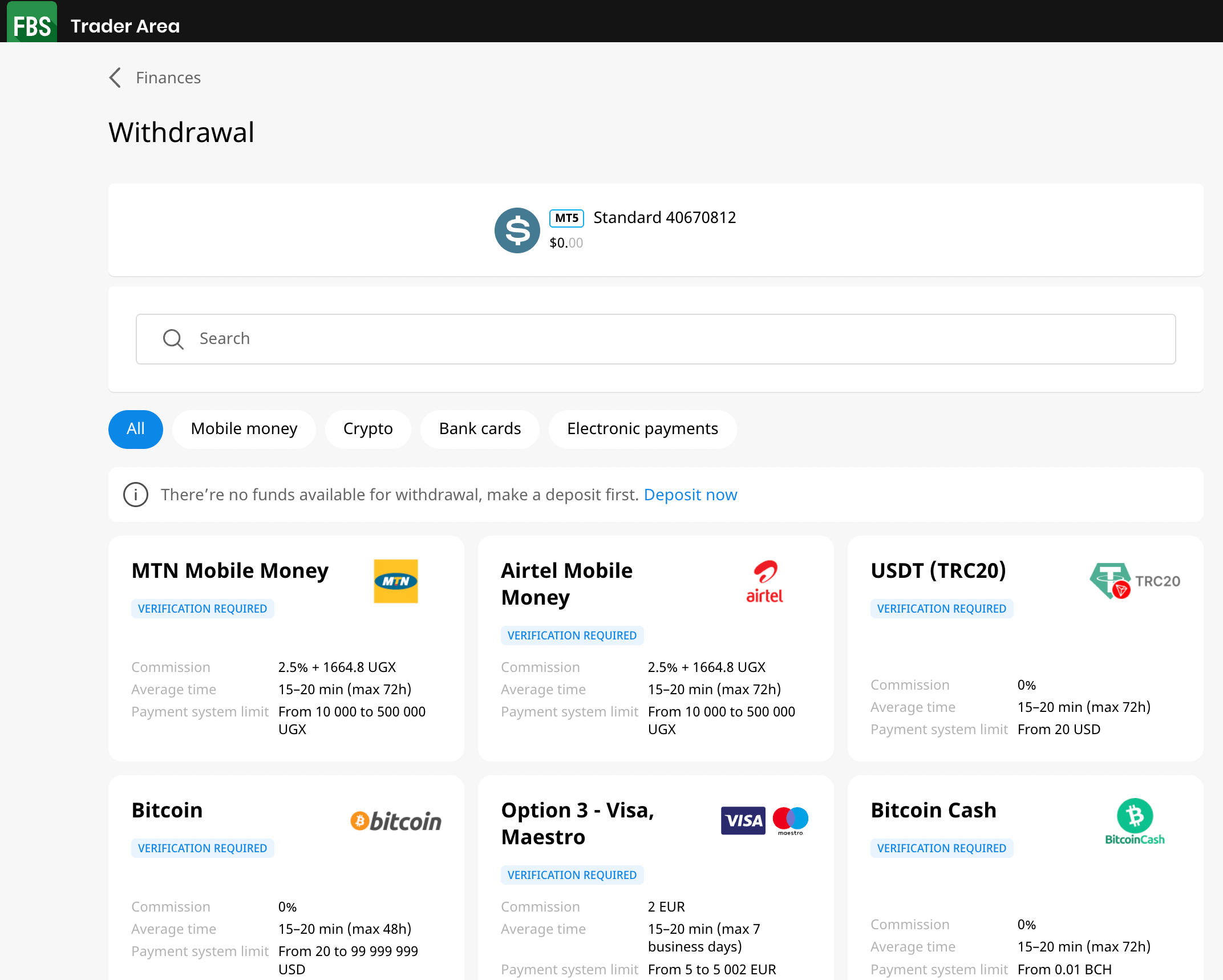

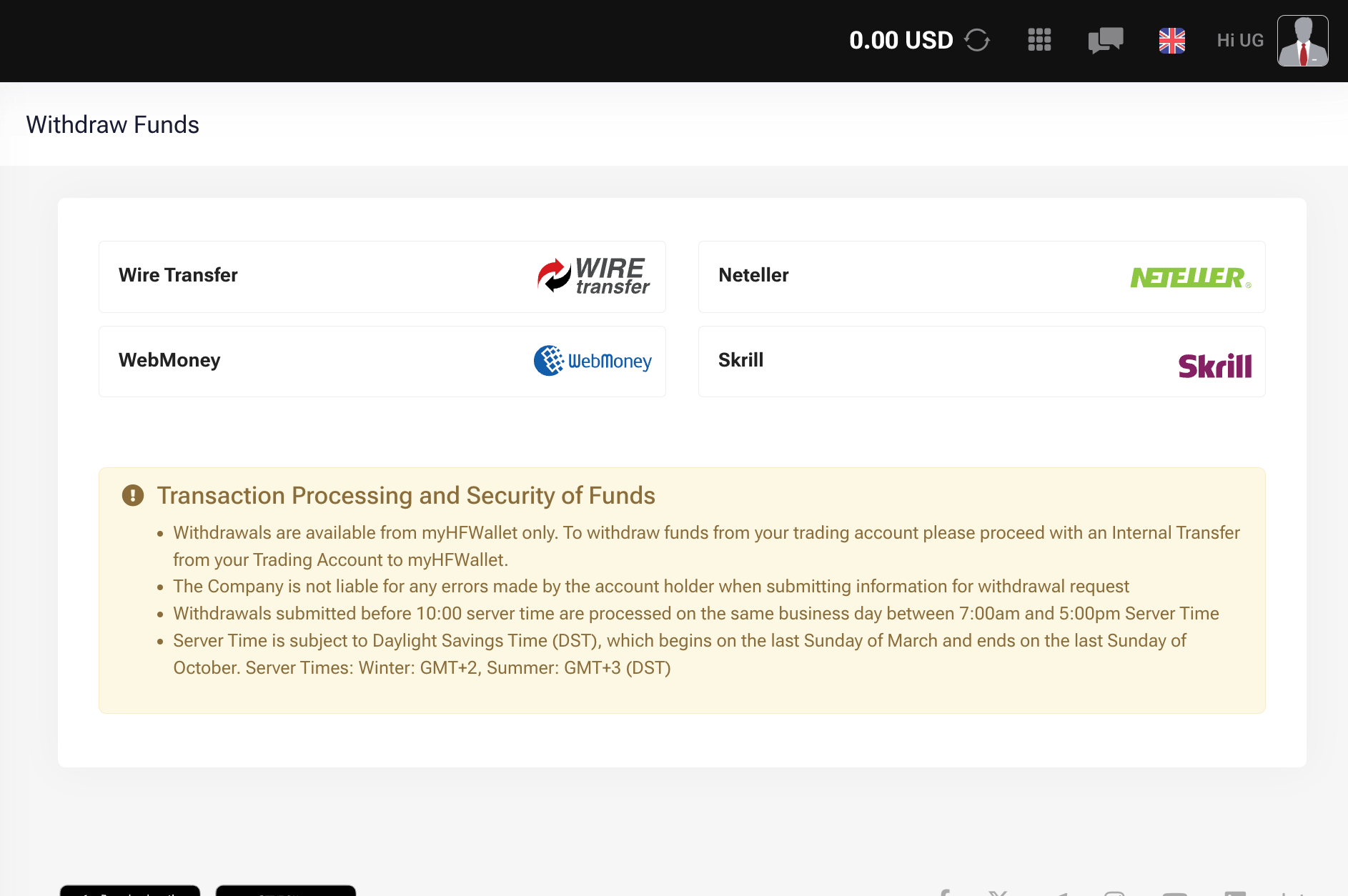

HF Markets Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on HF Markets.

| Withdrawal Methods |

Availability |

Charges |

Processing time |

| Mobile Money |

Yes |

Free |

Instant |

| Cards |

Yes |

Free |

2-10 business days |

| E-wallets |

Yes (Skrill) |

Free |

Instant |

| Crypto |

Yes (BTC, ETH, XRP, LTC) |

Free |

Up to 2 business days |

What is the minimum deposit for HF Markets?

The minimum deposit on HF Markets is $5 with cards or e-wallets (Skrill & Neteller) with a maximum deposit amount of $10,000. Cryptocurrency deposits require a minimum amount of $30 with a maximum amount of $10,000 per transaction. The also support deposits via bank transfers via an international bank account.

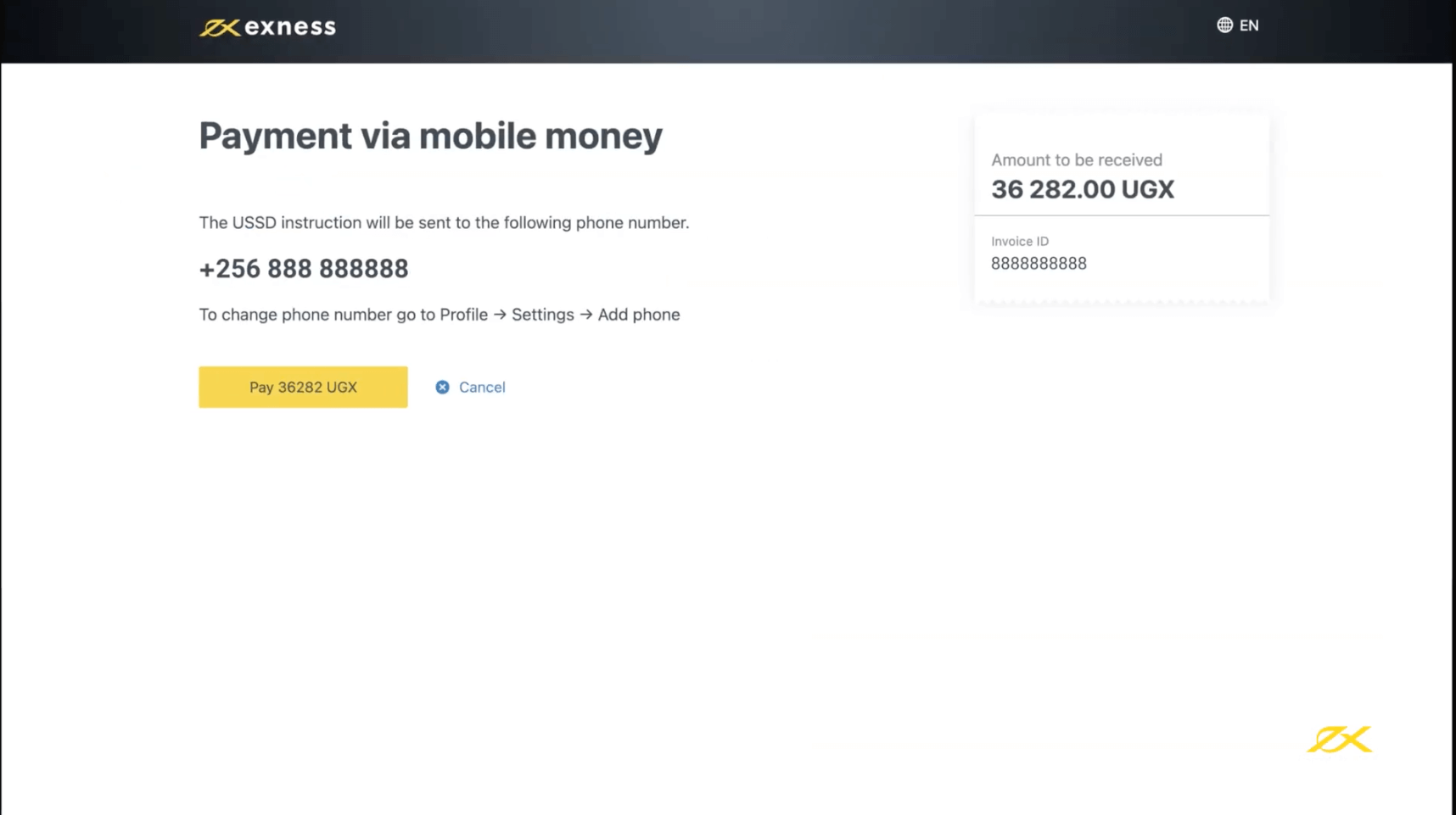

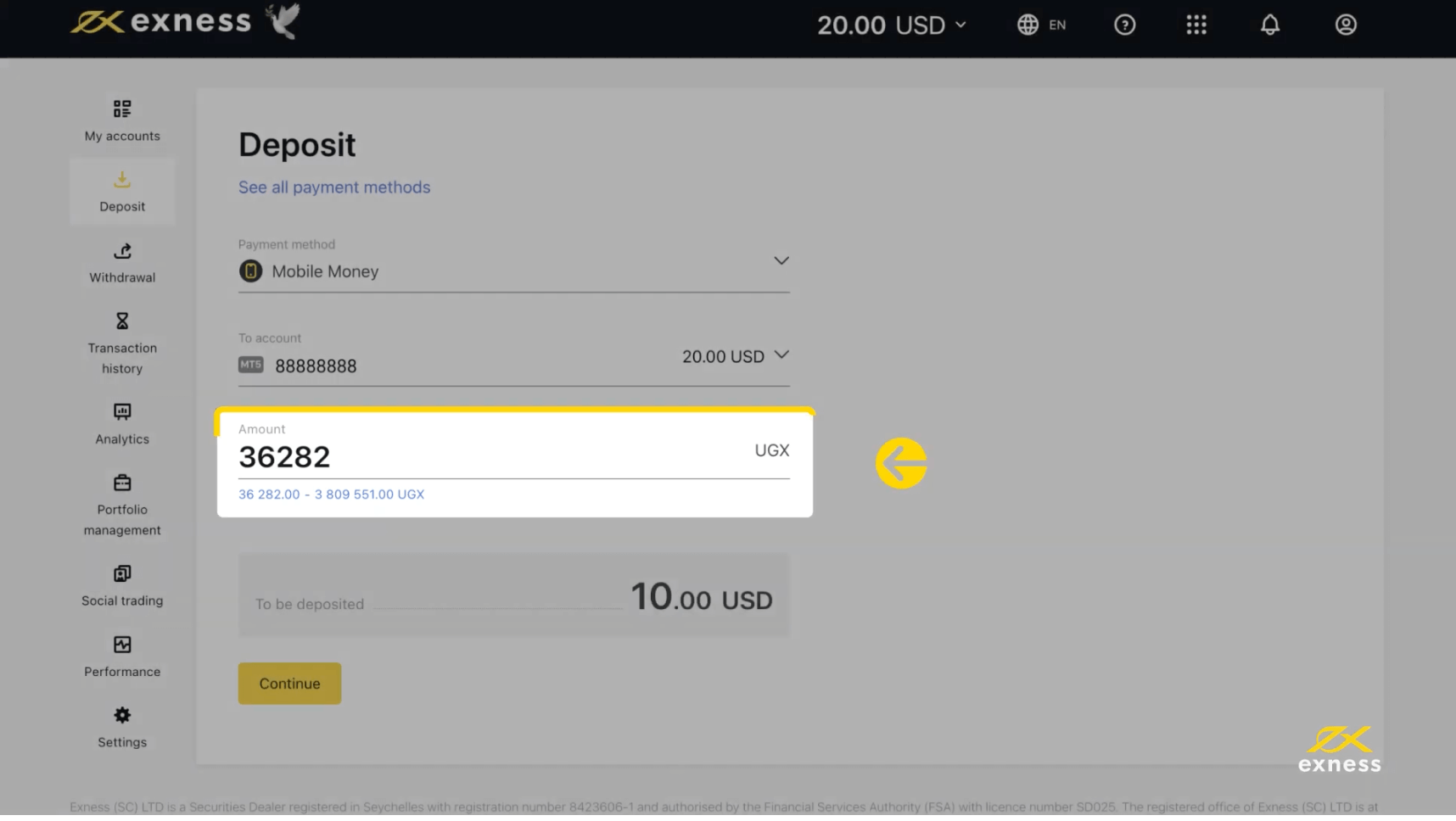

The minimum deposit for UGX on HF Markets is 20,000 UGX via mobile money with a maximum deposit amount of 500,000 per deposit.

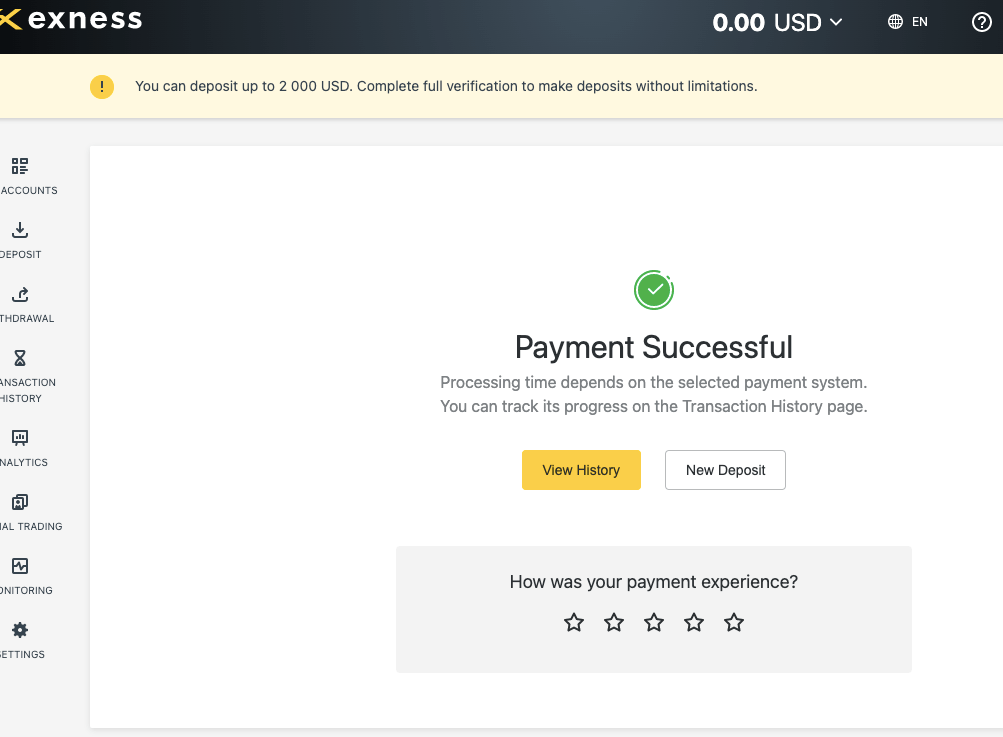

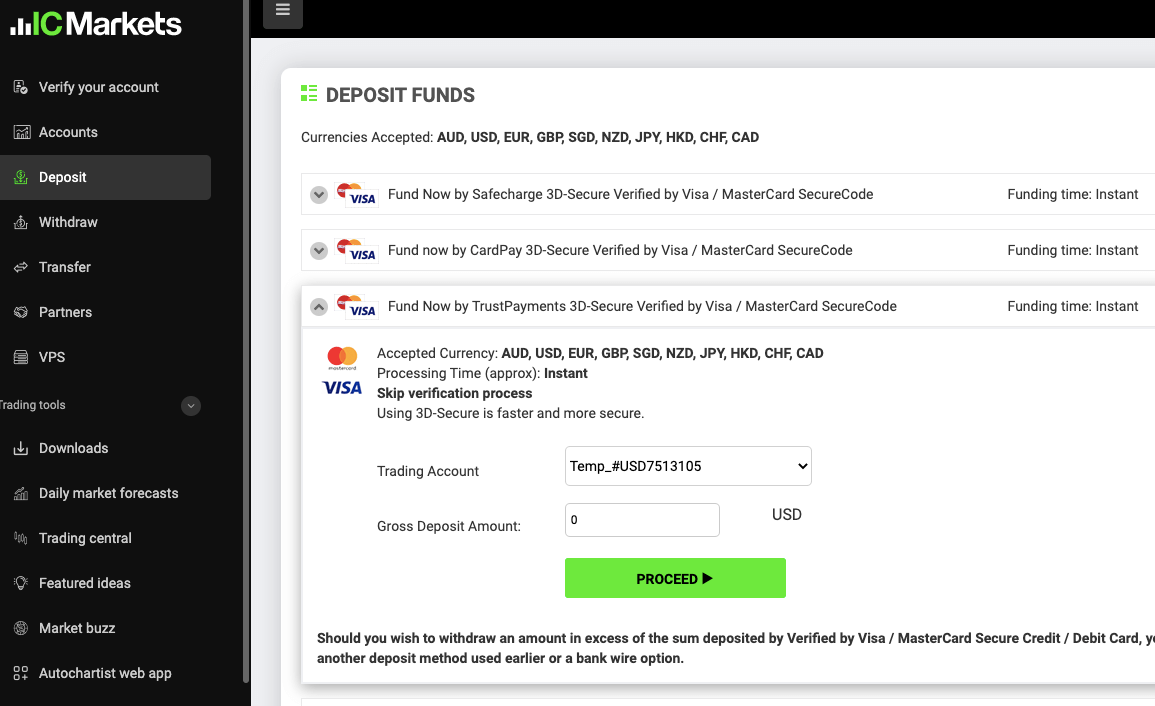

How do I Deposit Funds?

Step 1) Log in to your dashboard by visiting the HF Markets website or via my.hfm.com/sv/login.

Step 2) On your dashboard, you will see ‘Deposit’ on the left column menu (desktop view), click on it, select ‘Alternative’ then select ‘Mobile Money Payments’.

Step 3) Enter the amount you want to deposit, provide the phone number for payment and click ‘Deposit’ then follow the prompts to complete the deposit.

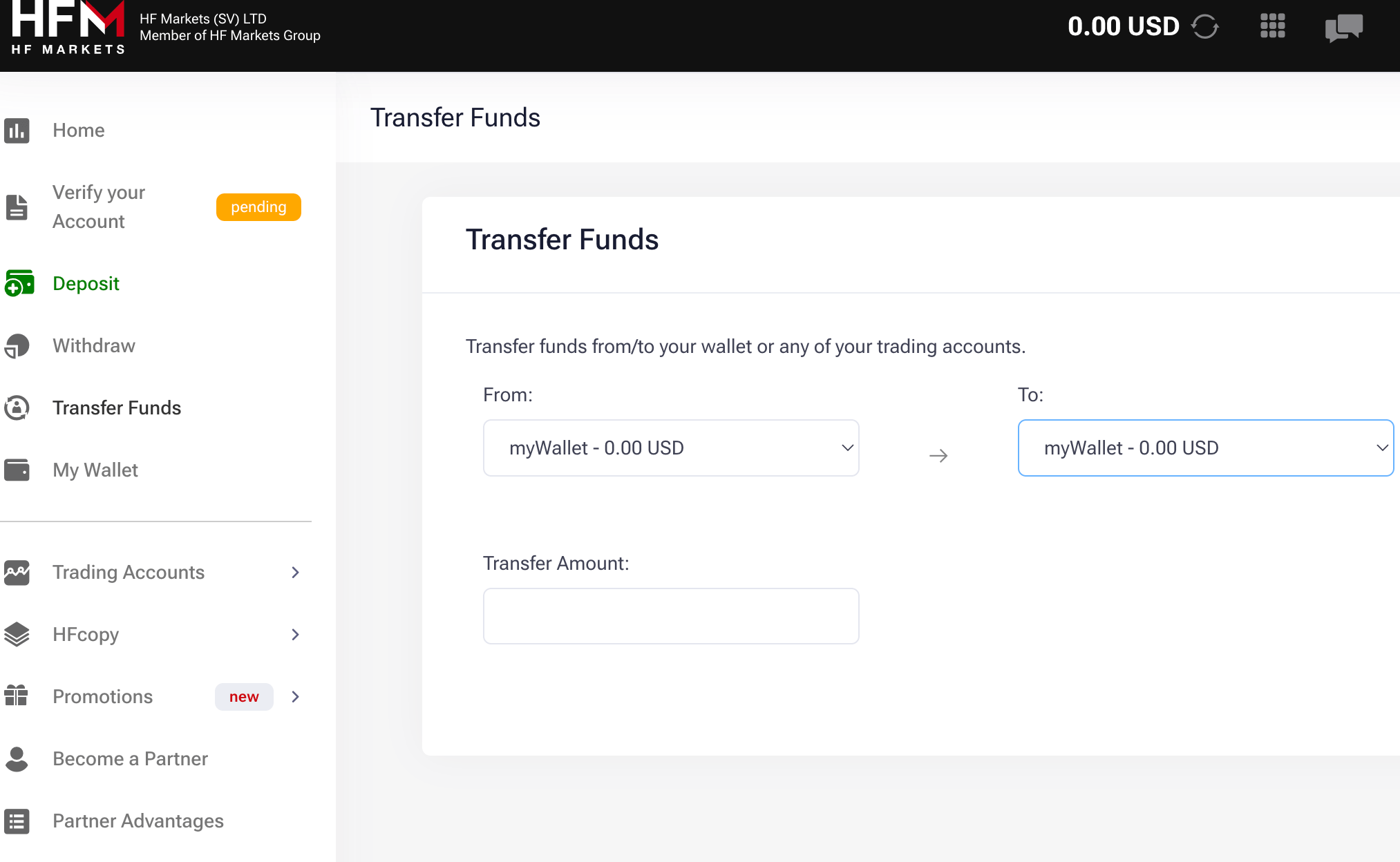

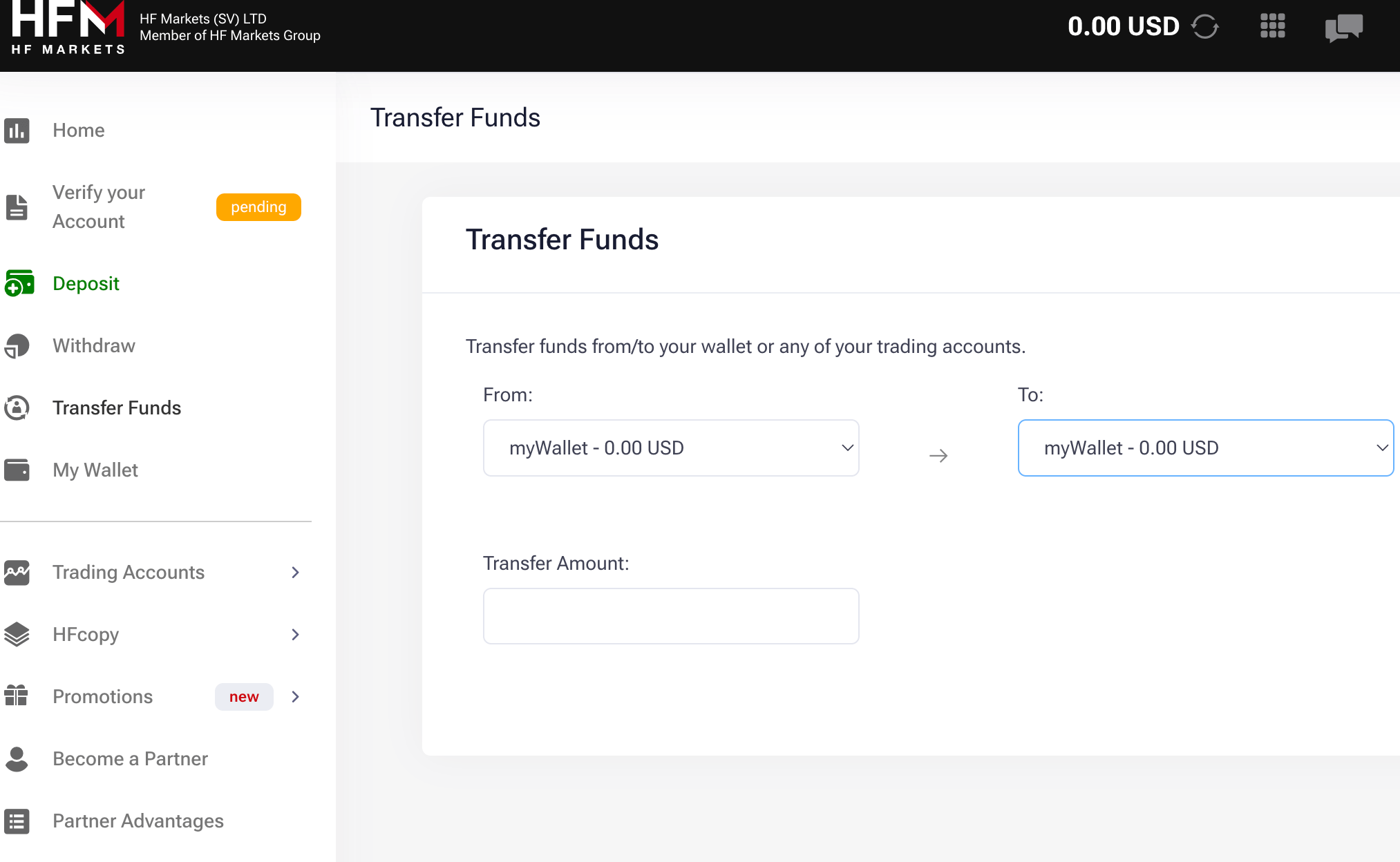

Step 4) On the left side of your dashboard, locate ‘Transfer Funds’ on the left side menu, and click on it to transfer funds from myWallet to a live trading account or from a trading account to your myWallet. After entering the amount you want to transfer, click on start transfer and follow the instructions to complete the transfer.

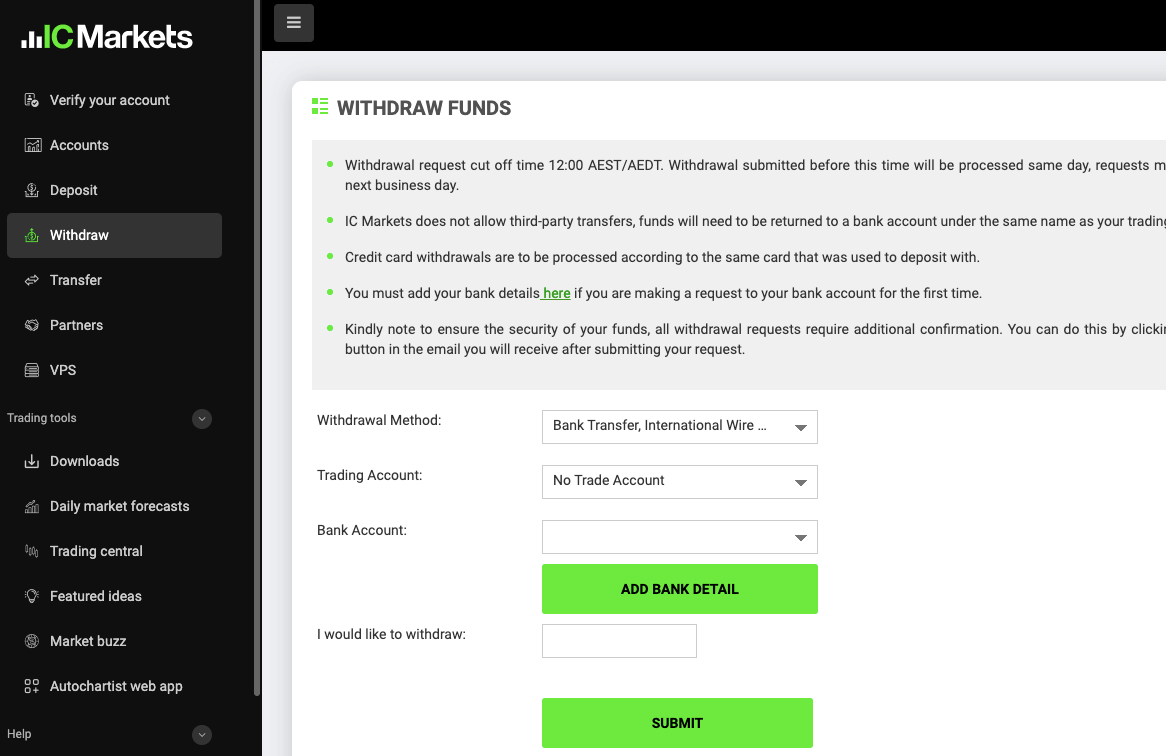

What is the minimum withdrawal amount on HotForex?

The minimum withdrawal from HF Markets is UGX 18,623 ($5) for cards and e-wallets. Mobile money like MoMo have a minimum withdrawal amount of UGX 37,246 ($10). The minimum withdrawal for crypto is UGX 37246 ($10).

HotForex only approves withdrawals to the same method/source from which the deposit was made. This means if you deposit funds through a mobile money payments, you can only withdraw through a mobile money payments to the same phone number. The same thing applies to other payment methods.

How to Withdraw Funds from HotForex Uganda?

Step 1) Log in to your dashboard by visiting the HF Markets website or via my.hfm.com/sv/login.

Step 2) On your dashboard, you will see ‘Withdraw’ on the left column menu (desktop view), click on it, then select your preferred method and follow the instructions to withdraw funds in to your card or mobile money wallet.

How many Trading Instruments are available at HotForex?

HotForex offers over 1,200 trading instruments, all of which are CFD instruments, find their categories below:

| Instrument |

Availability |

Number |

| Forex CFDs |

Yes |

53 currency pairs on HF Markets (15 majors & 38 minors) |

| Commodities CFDs |

Yes |

5 Commodities Futures on HF Markets |

| Energies CFDs |

Yes |

4 Energies Spot and Futures Energies on HF Markets |

| Metals CFDs |

Yes |

6 CFDs on Metals spot on HF Markets |

| Indices CFDs |

Yes |

23 Indices Spot and Futures on HF Markets |

| ETFs CFDs |

Yes |

34 ETFs Spots on HF Markets |

| Stocks CFDs |

Yes |

53 CFDs Stocks on HF Markets |

| Bonds CFDs |

Yes |

3 Bonds Contracts on HF Markets |

| Cryptocurrencies CFDs |

Yes |

40 Cryptocurrencies on HF Markets |

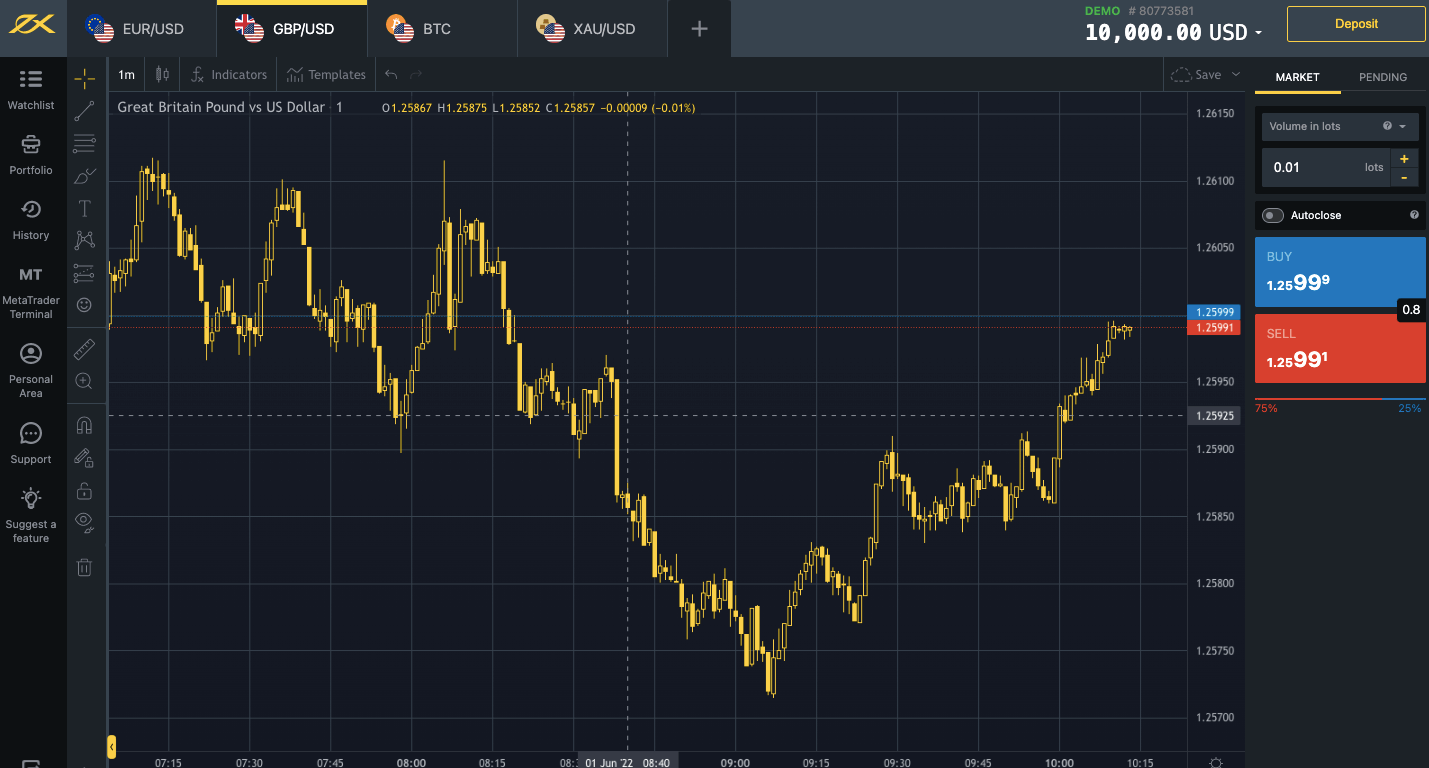

HF Markets Trading Platforms

1) HFM WebTrader: This is a trading application developed by HF Markets and is available on desktops for web trading.

2) HFM App: This is a trading application developed by HF Markets and is available on mobile devices only. You can download it from the Google Play Store or Apple App Store.

3) MetaTrader 4 and MetaTrader 5: HF Markets supports the MT4 and MT5 trading applications for trading financial markets. The applications are available on the web, desktop, and mobile devices (Android & iOS). You can also use EAs as professional clients or other tools.

HF Markets Execution Policy

HF Markets takes all reasonable steps to ensure the best possible when executing your orders. Here are some of their best execution factors:

Price: The price for a given financial instrument is provided by HF Markets and it is updated as frequently as possible. Prices are not quoted outside of the broker’s operation times. With HF Markets, there is no guarantee that your orders will be executed at a favourable price. To ensure fairness, HF Markets ensures that their liquidity provider calculates the spread.

Costs: HF Markets charges commission and financing fees. They can be found on their website under contract specifications. These fees are not calculated with the bid/ask spread. They are charged explicitly to your trading account and deducted from your balance.

Speed of Execution: HF Markets strives to offer a high speed of execution within prevailing technological limits. If the reason for a delay in order transmission is due to a poor network connection from your end, your market order might become out of date. In this situation, such an order is declined.

Likelihood of execution: HF Markets reserves the right to decline any type of order. Especially if there is not enough liquidity to execute it. Stop Loss, Take Profit, Buy Limit, Buy Stop, Sell Limit, and Sell Stop Orders on financial instruments offered by the broker are executed at your requested price. In a situation where this is not possible, these orders are executed at the first available price.

Podcasts: HF Markets launched trading education podcasts in 2023. It is free and you can listen to it on multiple streaming platforms. According to our review, HFM’s podcast is available on 18 streaming platforms. Here are the platforms in one glance.

At the time of this writing, there are up to 26 different podcasts on HFM’s podcast list. Here are the latest ones.

How To Videos: If you need help downloading/installing any of HF Market’ mobile app, this is what you need. These videos guide you on how to download, HFM App, MT4, and MT5 on your phone (android or iPhone). The guide also covers PC installation.

Live Webinars: HF Markets holds live webinars that can improve your FX knowledge. It does not matter if you are a beginner, intermediate, or an expert trader. There is a webinar for every level. These webinars will improve your trading skills and increase your confidence in forex trading.

Since the webinars are live, you will need to register to book your slot. There are no extra charges for the webinar. On the webinar page, you will find the schedule for each month. You can also select your experience level so that only relevant webinars are recommended for you.

Finally, all webinars end with a Q&A session so you get the opportunity to get answers to your questions from industry expert.

Online Trading Courses Videos: HFM in conjunction with their groups of experts put together this online trading course. It contains a beginner course that covers essential information that every trader must know. It covers the forex market, basic forex terms, and type of orders. There is a glossary in there as well.

There is also a trading tools section that covers capital management, trading psychology, basic and advanced technical analysis. This will be useful as you develop your trading skills.

Furthermore, there are videos on MetaTrader and trading strategies. You will learn how to install MetaTrader, how to add indicators to your charts, and about five rare trading strategies.

Earnings Calendar: Earnings reports are quarterly financial statements issued by publicly traded companies. They are essential if you prefer to trade shares CFDs. Earnings report affect market sentiment because it shows a company’s profit, losses, and other important financial metric.

With HFM’s earnings calendar, you can track when these reports will be released and utilize it for trading. This is not a guarantee of profitable performance, but you will find it useful for your research.

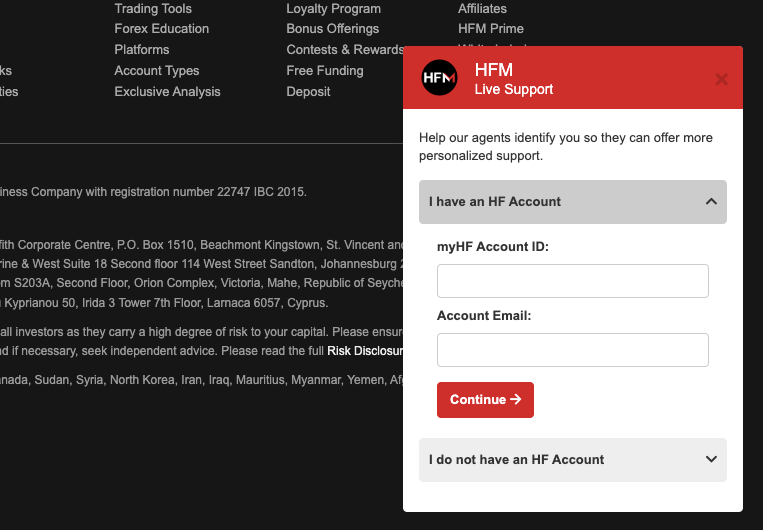

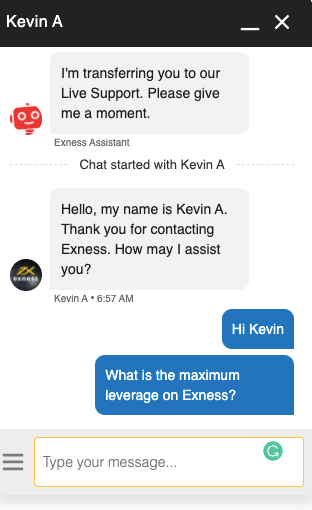

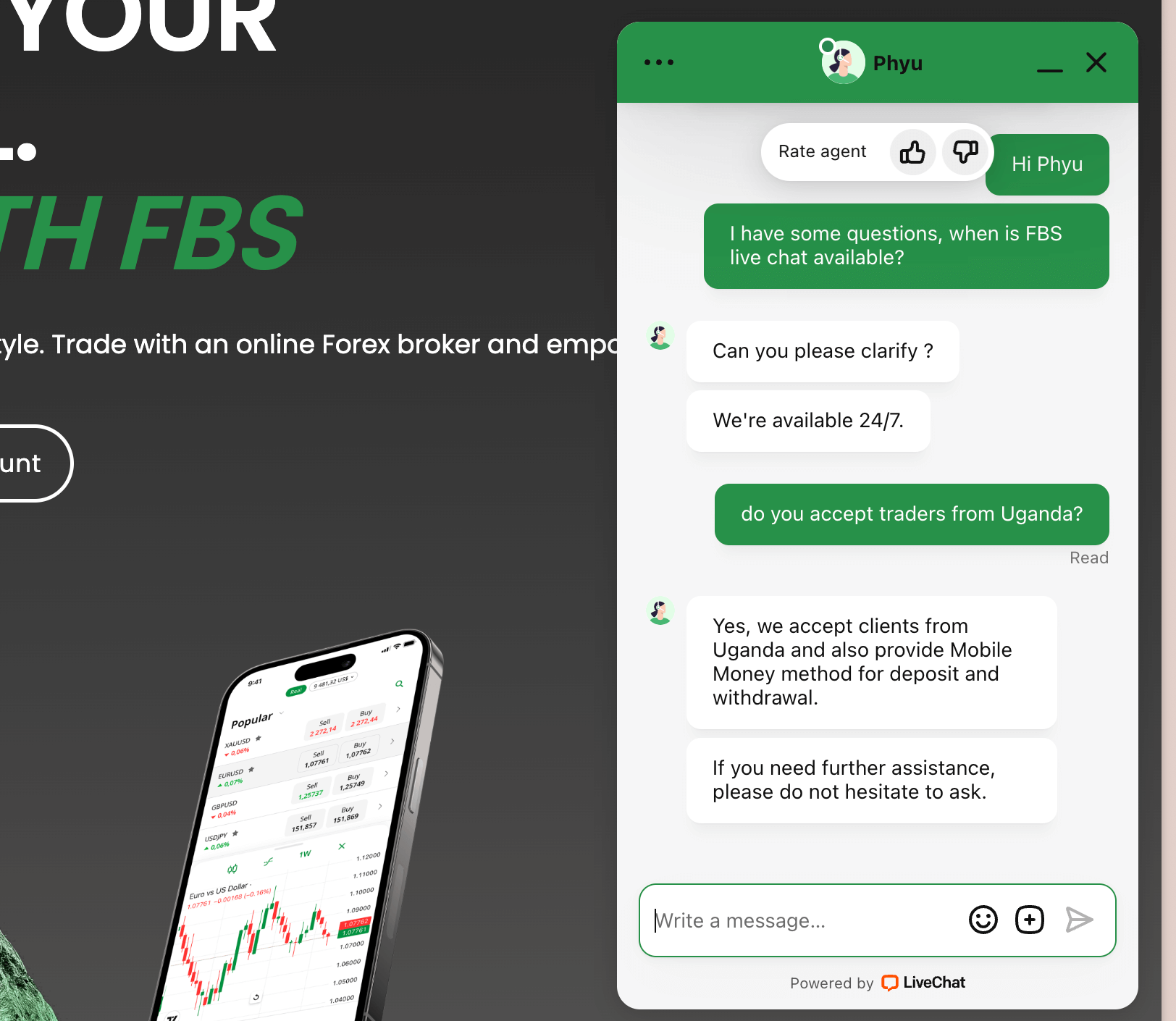

HF Markets Uganda Customer Service

HF Markets has responsive customer service support that is available 24/5. Traders can reach HF Markets support via any of the means below during working days:

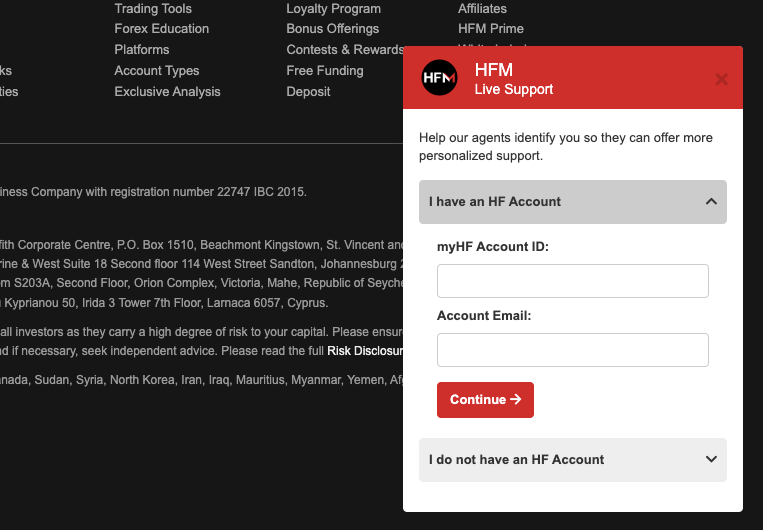

1) Live chat: HF Markets live chat is fast, their representative responds within 2 minutes when a chat is initiated and provides relevant answers to questions asked.

Whether you are a registered user or not, you can access the live chat. You can request a call back via their live chat, and a representative will call you, you will have to submit a valid phone number and email address for this to work. Our team submitted a request but didn’t get a callback.

When our team tested the live chat, we got response within 2 minutes. The live chat is available 24 hours from Monday to Friday.

2) Phone number support: HF Markets has an active international phone number support, and the call centre agents responded in less than 1 minute when we tested it. The answers to questions were relevant. The phone line is active from 9:00 AM to 6:00 PM on working days.

The HF Markets global support phone number is +44-20-3097-8571, available 24 hours for 5 business days (Monday – Friday).

3) Email Support is fair: You can reach HF Markets via email support at [email protected]. Once you send an inquiry email, you will receive an auto-generated response to show that a ticket has been created for your inquiry.

A representative replied in about 9 minutes, we sent another question and got a reply in less than 10 minutes. The answers to our questions were relevant and satisfactory.

HF Markets offers bonuses for different activities. Each category of bonuses has its terms and conditions to qualify. Current bonus offerings are

1)20% Top-up Bonus: HF Markets also offers deposit bonus of 20% which is capped at US$5,000 (UGX 18.6 million). You cannot withdraw the bonus but you can use it to trade and withdraw the profits. You still need to meet the trading requirement before the profits can be withdrawn.

Do we Recommend HF Markets Uganda?

HF Markets is regulated in multiple jurisdictions which means they are mandated to protect client funds. HF Markets customer support is available in Uganda and they respond quickly to enquiries on business days.

HF Markets has negative balance protection, have low fees compared to some brokers, and offers bonuses to traders. They also have many account types, so you can choose an account with features that work best for you.

One downside to trading with HF Markets is that they charge account inactivity fees after 6 months, but you can avoid this if you withdraw all funds, leaving your balance at zero.

Based on these details, we recommend that you check out HF Markets website to see their full details, also chat with the live support to answer any questions you may have to help you make up your mind.

HF Markets Uganda FAQs

What’s the minimum deposit for HF markets?

20,000 UGX is the minimum deposit on HF Markets if you are using mobile money payments like. Other payment methods require a higher amount, like deposits via cards require a minimum deposit of 37,246 UGX ($10). Some account types require upto $100.

Ultimately, based on our review of the several methods for deposits and account types, the minimum deposit depends on the payment method used and your trading account type.

Is HotForex regulated in the UK?

Yes, HF Markets is regulated in the UK by the FCA as ‘HF Markets (UK) Limited’ to provide financial products and services with Reference number 801701.

How long does it take to withdraw from HF markets?

Instant for Mobile Money Payments, up to 2-10 business days for cards and bank transfers, and up to 2 business days for cryptocurrencies. The amount of time it takes to withdraw from HF Markets depends on your payment method.