Plus500 is a CFD trading platform that offers Forex trading and CFDs on indices, options, commodities, ETFs, shares and cryptocurrencies.

Plus500 was launched in 2008 and is authorized by multiple jurisdictions including New Zealand, Australia, the UK, Singapore, Seychelles, Cyprus, and South Africa.

In this review, we will look at safety, trading conditions, fees, tradable instruments, and customer support at Plus500.

| Plus500 Review Summary | |

|---|---|

| 🏢 Broker Name | Plus500AU Pty Ltd |

| 📅 Establishment Date | 2008 |

| 🌐 Website | https://www.plus500.com/en-NZ/ |

| 🏢 Address | Plus500AU Pty Ltd, P.O. Box H339, Australia Square, Sydney NSW 1215, Australia. |

| 🏦 Minimum Deposit | NZD 200 |

| ⚙️ Maximum Leverage | 1:30 |

| 📋 Regulation | FMA, ASIC, FCA, CySEC, FSCA, MAS, FSA Seychelles |

| 💻 Trading Platforms | Plus500 Trader for PC, Mac, Web, Android, & iOS |

| Visit Plus500 | |

Plus500 Pros

- Regulated in New Zealand

- Has 24/7 live chat support

- Offers negative balance protection for retail clients

- Offers a wide range of instruments to trade

- Has NZD account currency

- Offers commission-free trading on all accounts

- Does not charge any fees for deposits or Withdrawals

Plus500 Cons

- No phone support

- Does not support MT4, MT5 or EAs

- Charges dormant account fees

- Slow processing of deposits & withdrawals

Is Plus500 trusted?

Plus500 is considered safe for traders, has low risks, and is highly trusted. This is because of their high level of regulation: they are regulated in New Zealand by the FMA along with multiple jurisdictions by top-tier regulators.

Plus500 Ltd is the parent company of Plus500. Registered in Israel, Plus500 Ltd has subsidiaries in the UK, Europe, Asia, and Africa.

Plus500 Ltd is a publicly listed UK company, listed on the London Stock Exchange since 2018. The company’s subsidiaries and their main regulatory bodies are listed below.

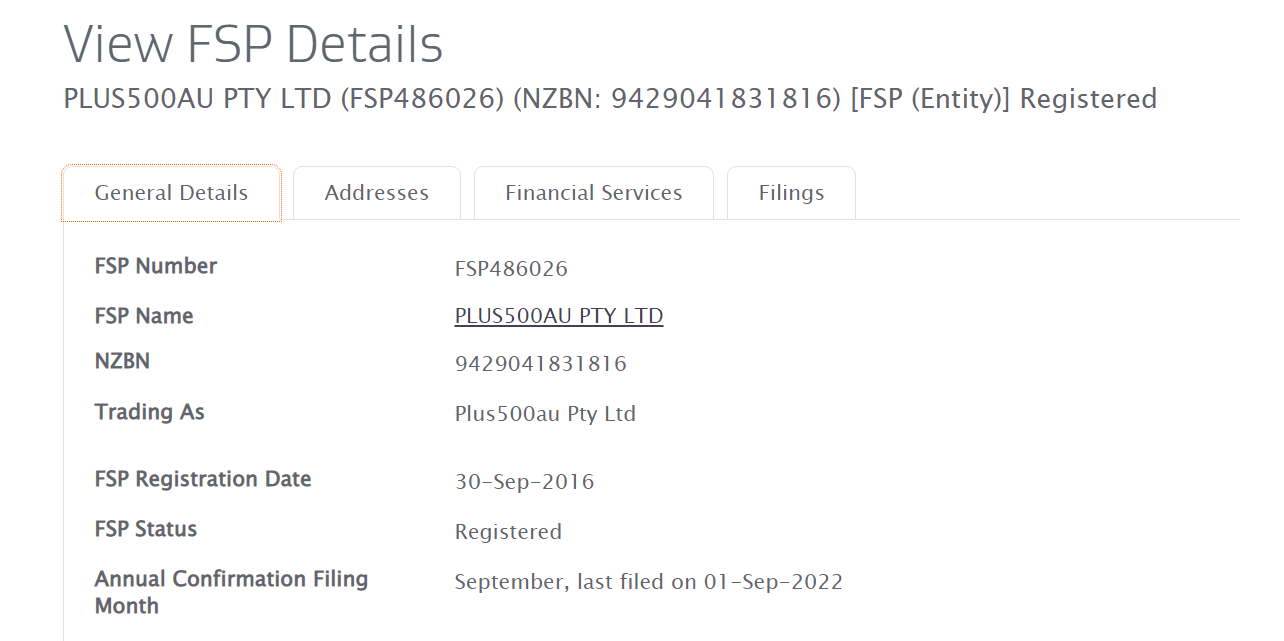

1) Financial Markets Authority: Plus500AU Pty Ltd is regulated by the FMA of New Zealand. The company has been registered since 2016 with FSP No. 486026.

2) Australian Securities & Investments Commission (ASIC): Plus500 is regulated by ASIC as Plus500AU Pty Ltd. The company registered in 2011 with ACN (Australian Company Number) 153 301 681.

3) Financial Conduct Authority (FCA), United Kingdom: Plus500 is regulated in the UK as Plus500UK Ltd since 2010. The company is authorised to provide investment services in CFDs (Contracts for Differences) trading by the FCA, Reference No. 509909.

4) Cyprus Securities and Exchange Commission (CySEC): Plus500 is licenced by CySEC as Plus500CY Ltd to provide investment services with licence number 250/14 issued in 2014.

5) Financial Sector Conduct Authority (FSCA) in South Africa: Plus500AU Pty Ltd. is authorized by the FSCA to offer financial services in South Africa with FSP No 47546, issued in 2017.

Plus500 Investor Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| New Zealand | Dispute Resolution | Financial Markets Authority | Plus500AU Pty Ltd |

| Australia | $20,000 | Australian Securities & Investments Commission (ASIC) | Plus500AU Pty Ltd |

| United Kingdom | £85,000 | Financial Conduct Authority (FCA) | Plus500UK Ltd |

| Cyprus (EU) | €20,000 | Cyprus Securities and Exchange Commission (CySEC) | Plus500CY Ltd |

| Singapore | Redress Framework | Monetary Authority of Singapore (MAS) | PLUS500SG PTE. LTD. |

Plus500 Leverage

Leverage on Plus500 is determined by the type of account you have and the asset you are trading.

The maximum leverage on Plus500 for traders in New Zealand is 1:30, which applies to major forex pairs while other instruments have lower limits of indices and commodities 1:20, shares, options, ETF’s 1:5 and crypto 1:2.

With leverage of 1:30, you can open a trade position worth 30 times the value of your deposit. For example, you can place a $30,000 trade on a major forex pair with a deposit of $1,000.

Note: Trading leveraged products involves risks and you can lose your money in the process. It is best to avoid trading CFDs unless you understand it and have experience. It is important that you do not use all the leverage available on your account as this increases the risk of capital loss.

Plus500 Account Types

Plus500 offers one main type of account: the Retail Account. Plus500 also offers Islamic and Premium accounts for special cases, as well as demo accounts to new traders for practice. A Premium Account qualifies you to receive premium services from the broker.

Find details about the different types of trading accounts on Plus500 below:

1) Retail Account: When you open an account with Plus500, you automatically have a Standard Account – it’s the default account assigned to new users. This account is designed for both experienced and new traders.

You can trade forex currency pairs and CFDs on indices, shares, commodities, exchange-traded funds (ETFs), cryptocurrency and options on this account.

The Plus500 Retail Account is a spread-only account, with zero commission charges when you open or close trade positions. However, swap fees apply for holding a position overnight, and spreads start from around 0.6 pips.

The Retail Account on Plus500 has negative balance protection, which means that if you make a loss on a trade, you cannot lose more than the money in your trading account, as any negative balance on your account will be reset to zero.

2) Premium Account: Plus500 offers active traders the opportunity to upgrade to a Premium account. This account is offered by invitation only, after meeting certain criteria. As a Premium Account owner, you will have a personal account manager and priority support.

If you become eligible for a Premium Account, you will receive an email and you can choose to accept or reject the offer.

Plus500 Base Account Currency

When you sign up on Plus500 in New Zealand, your trading account currency is automatically set to New Zealand Dollars – NZD. You can change it to other currencies by contacting customer support.

Deposits, trades, and withdrawals will be measured in this currency.

Plus500 Overall Fees

To help you understand Plus500’s fees and charges, we have provided a summary below.

Trading fees

1) Spreads: Plus500 charges spread fees on trades. This represents the difference between the “ask” (sell) and “bid” (buy) prices of financial instruments. Spreads on Plus500 start from around 0.6 pips.

Plus500 uses a variable spread system that continuously updates throughout the day and is adjusted in line with market movement, liquidity, and volatility.

Below is a breakdown of the typical spreads charges on the major instrument pairs:

| Instrument/Pair | Plus500 Typical Spread |

|---|---|

| EUR/USD | 0.8 pips |

| GBP/USD | 1.3 pips |

| EUR/GBP | 1.5 pips |

| Gold | 1.11 pips |

2) Commission fees: Plus500 offers commission-free trading on all of its trading instruments and is applicable to all account types. This means you can trade without paying commission fees for opening or closing trade positions.

Plus500 Trading Fees Table

Here is a summary of the typical fees Plus500 charges on some instruments:

| CFD instrument | Spread | Commission |

|---|---|---|

| EUR/USD | 1.5 pips | None |

| GBP/USD | 1.9 pips | None |

| EUR/GBP | 1.7 pips | None |

| EUR/NZD | 8.4 pips | None |

| XAU/USD (Gold) | 0.28 pips | None |

| Crude oil | 0.04 pips | None |

| UK100 | 2 pips | None |

| S&P 500 | 0.7 pips | None |

*Note that swap fees fluctuate as the market moves.

3) Swap fees: Whenever you keep a trade position open past the market’s closing time Plus500 charges swap fees (overnight funding fees). The fee is deducted from your profit or loss when you close the trade position.

The fee is determined based on the size of the trade, the leverage, the instrument being traded, the number of nights the trade was open and whether your trade position is long swap (buy) or short swap (sell).

4) Currency Conversion fees: When trading instruments denominated in a currency different from the currency of your account, Plus500 charges a currency conversion fee. For example, your account base currency is NZD and you trade GBP/USD, you will incur a currency conversion fee.

The fee is automatically added to the unrealized profit or loss of an open position.

Non-trading fees

1) Deposit and Withdrawal fees: You do not pay any fees when you deposit money into your Plus500 account or withdraw money from it. This applies to all payment methods supported by Plus500.

Be aware that some payment methods may charge additional/independent processing fees, and If you request a withdrawal for an amount less than the minimum amount, your account may be charged a service fee.

2) Account Inactivity charges: If you do not log into your trading account for 3 months, Plus500 will charge US$10 (NZD 16) in inactive account fees per month from the balance in your account. If you have no money in your account, no fees will be charged.

Plus500 Non-trading Fees Table

| Fee | Amount |

|---|---|

| Inactivity fee | US$10 per month |

| Deposit fee | Free* |

| Withdrawal fee | Free* |

*Note that your payment processing company may charge some independent transaction fee.

How to Open Plus500 Account in New Zealand?

To start trading with Plus500, follow the steps below to create a Plus500 trading account.

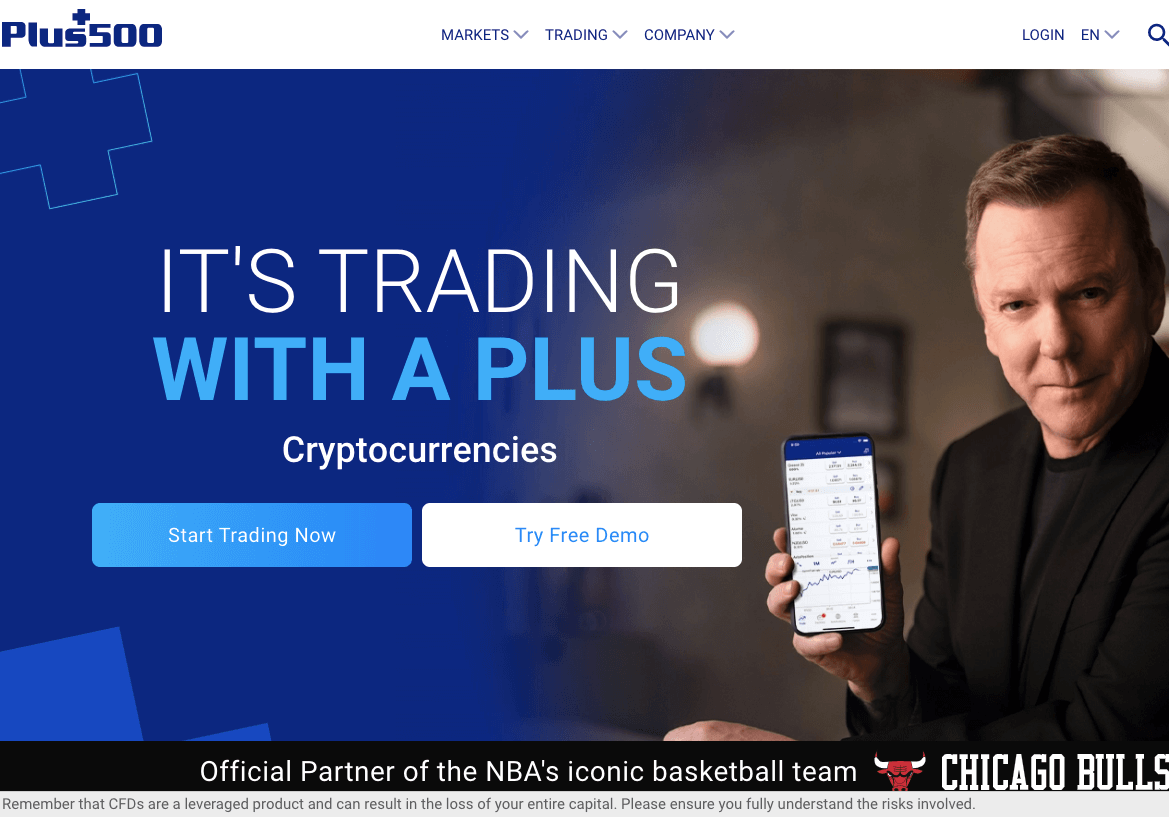

Step 1) Go to the Plus500 website homepage via www.plus500.com and Click the ‘Start Trading Now’ button.

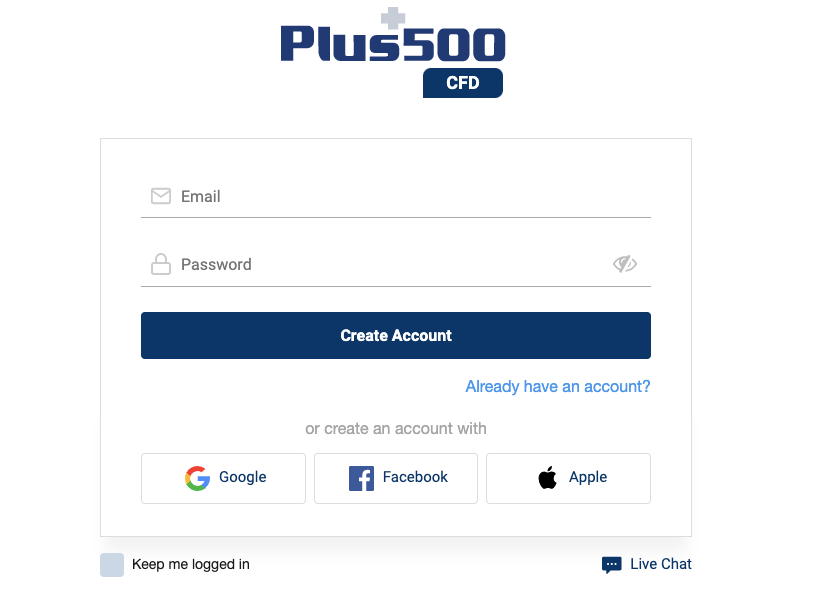

Step 2) Input your email and create a password on the form that appears then click ‘Create Account’. You will be redirected to the Plus500 WebTrader.

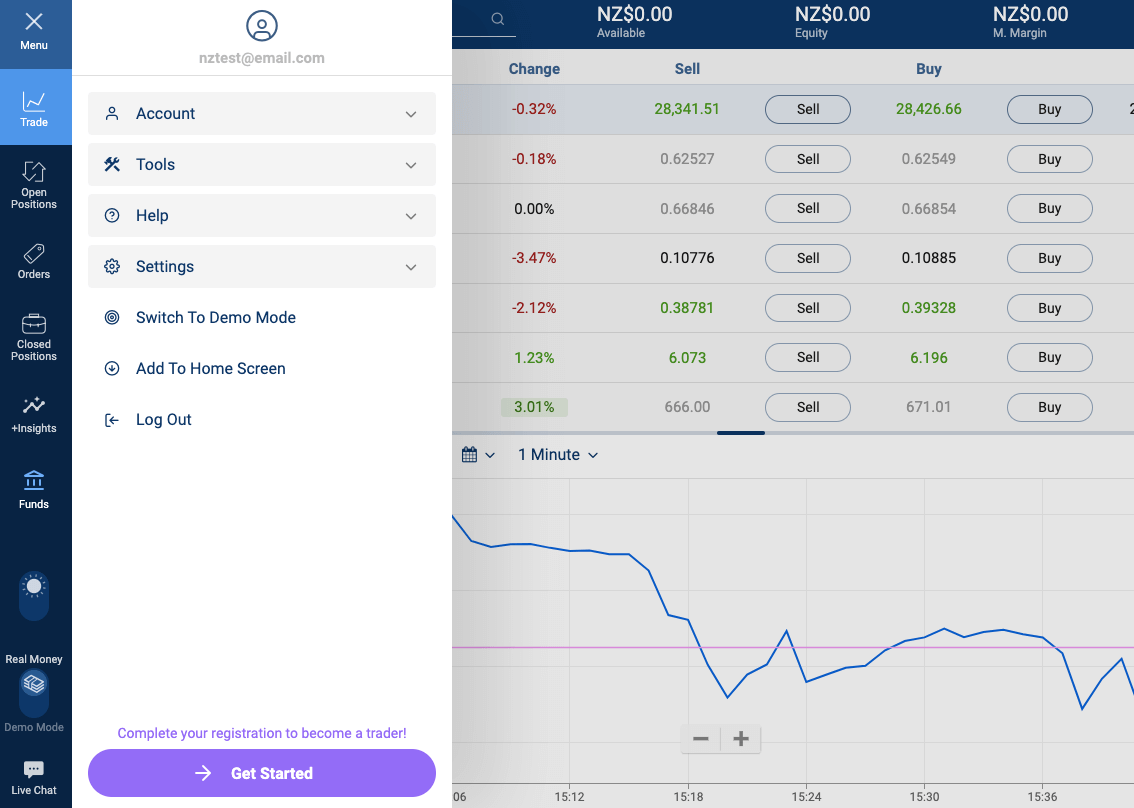

Step 3) To complete your registration, click on the three bars on the left side of the WebTrader, then click the ‘Get Started’ button.

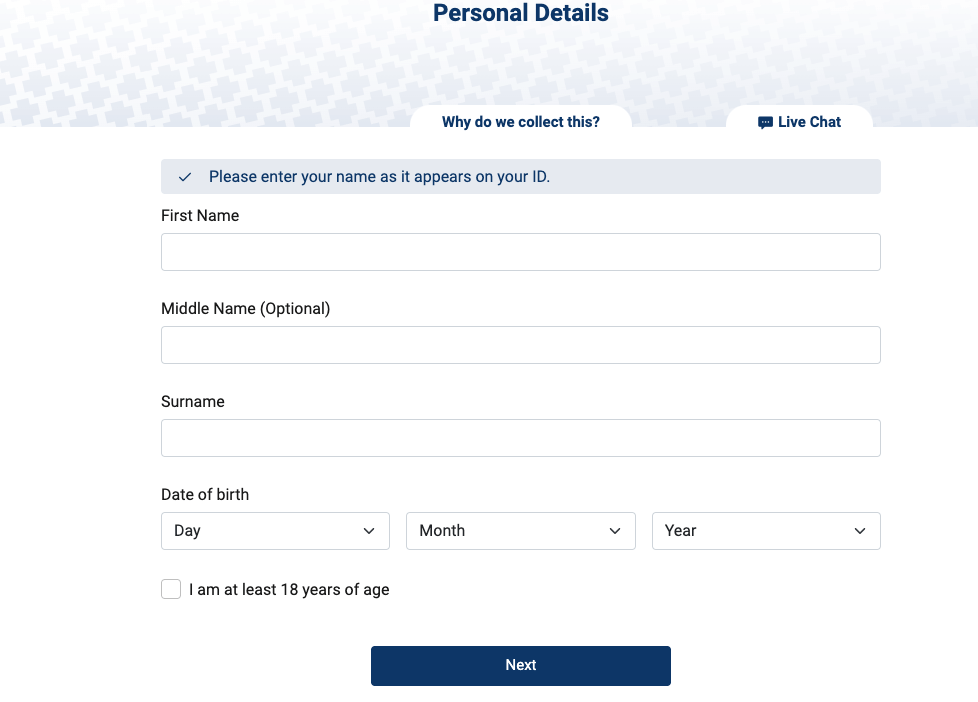

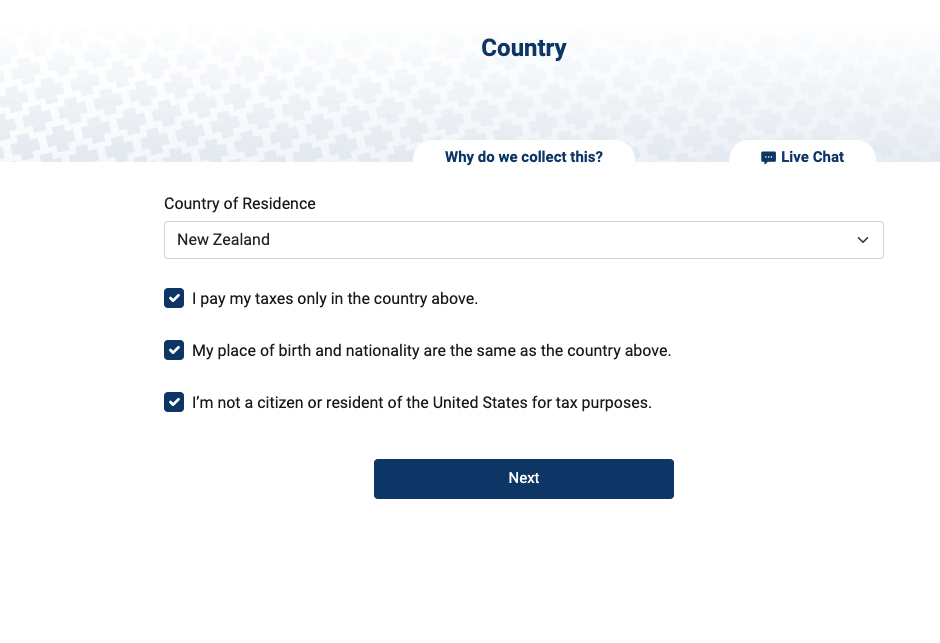

Step 4) Type your full name and date of birth on the personal details form provided, then click Next. Fill out the address information and click ‘NEXT’.

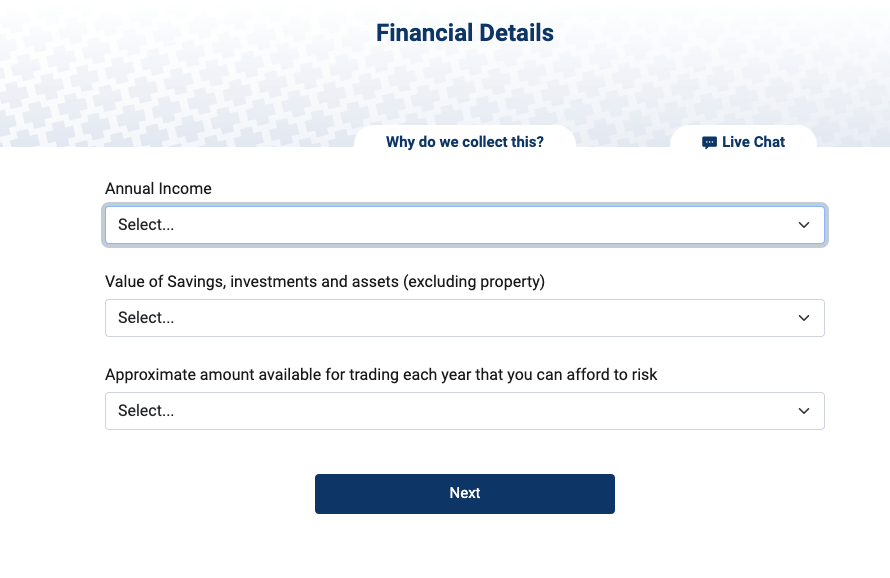

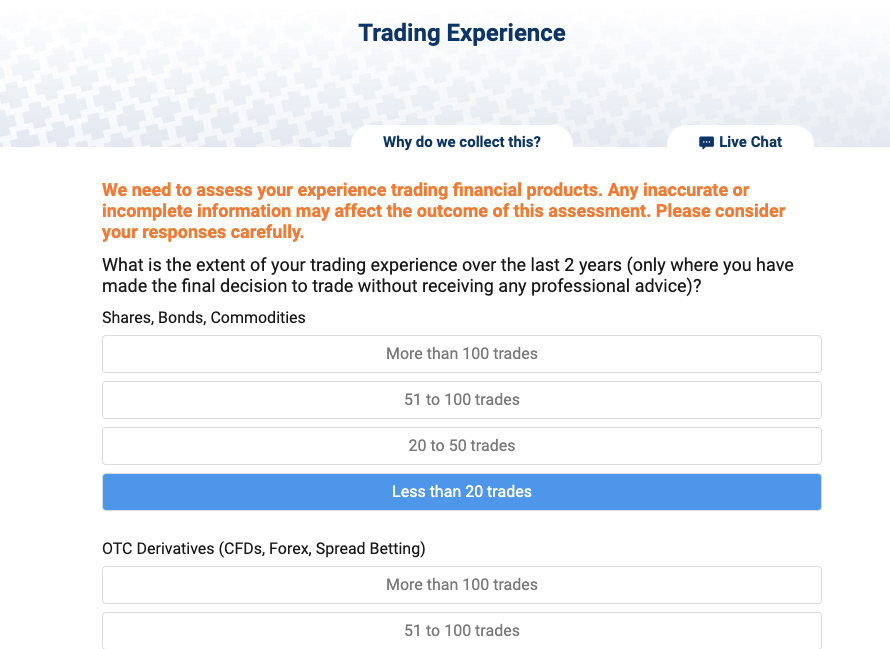

Step 5) Answer questions about your financial status, CFDs trading experience, and knowledge of trading.

After that, check the box to agree to the terms and conditions and click ‘Finish’.

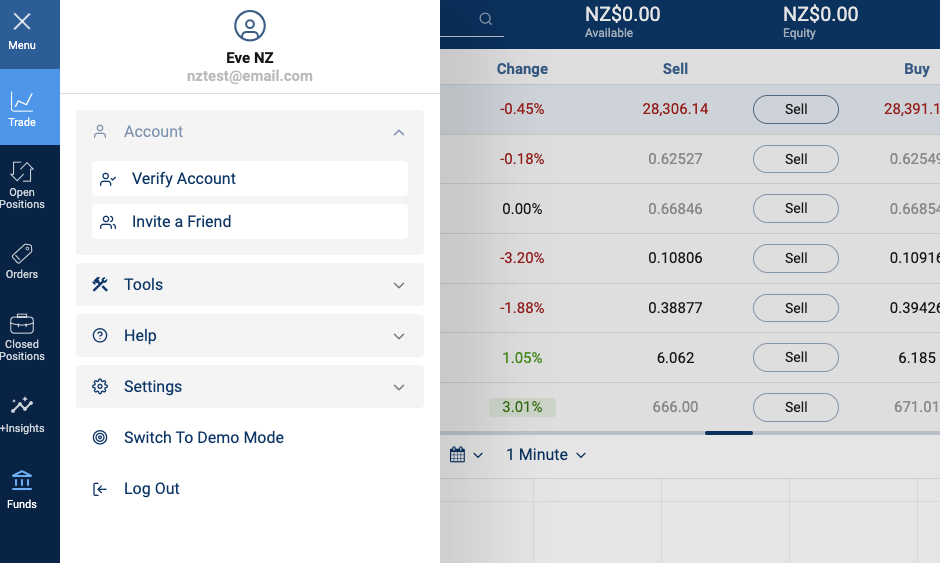

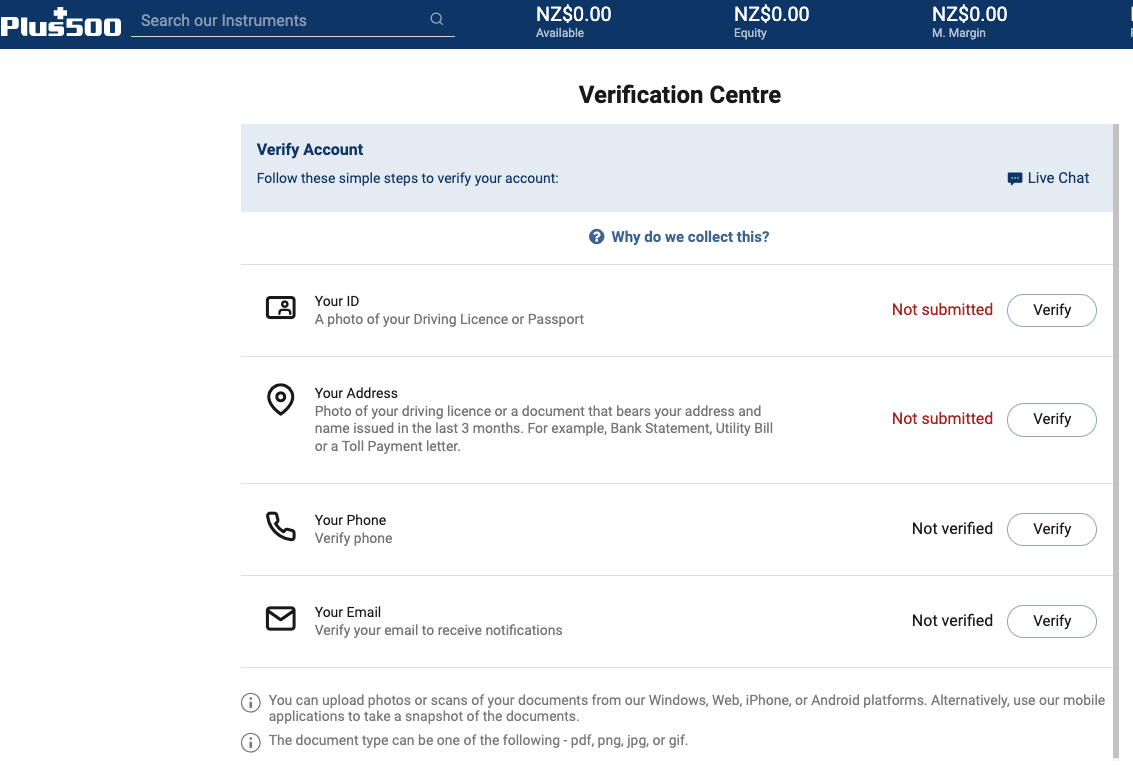

Step 6) To verify your account, click on the menu (three bars) on the left, then select ‘Account’ and click on ‘Verify Account’. You will be required to upload some documents to verify your identity and address.

After your account is verified, you can make deposits, trade, and withdraw funds.

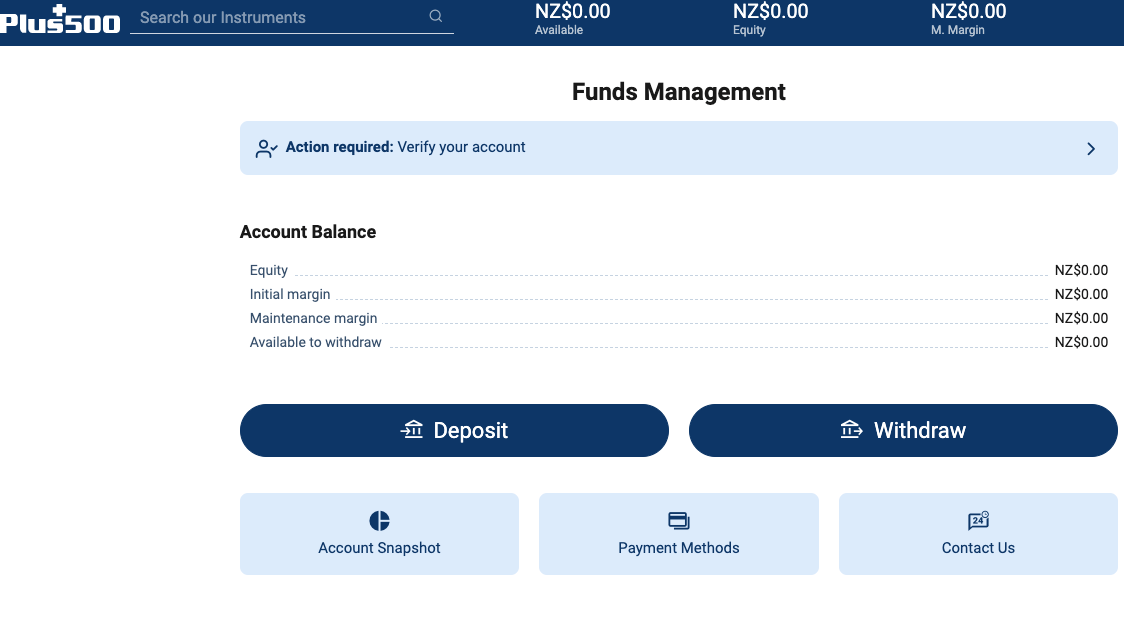

Plus500 Deposits & Withdrawals

Plus500 offers several ways to deposit and withdraw funds, including bank transfers, debit/credit cards (Visa, MasterCard, & Maestro), and e-wallets like Skrill and PayPal.

Plus500 Deposit Methods

Here is a summary of payment methods accepted by Plus500 for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Transfer | Yes | Free | Up to 5 business days |

| Cards | Yes | Free | Instant |

| E-wallet | Yes (Skrill, PayPal) | Free | 24 hours |

Plus500 Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on Plus500.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Transfer | Yes | Free | 1 to 5 business days |

| Cards | Yes | Free | 1 to 5 business days |

| E-wallets | Yes (Skrill, Paypal) | Free | 1 to 5 business days |

What is Plus500 Minimum deposit?

The minimum deposit on Plus500 depends on the payment method you are using. Plus500 requires a minimum deposit of NZD 200 for cards, and e-wallets and NZD 500 for Bank transfers.

Deposits via bank transfer on Plus500 are credited within 5 business days while e-wallets and card deposits are credited instantly.

How do I Deposit Funds?

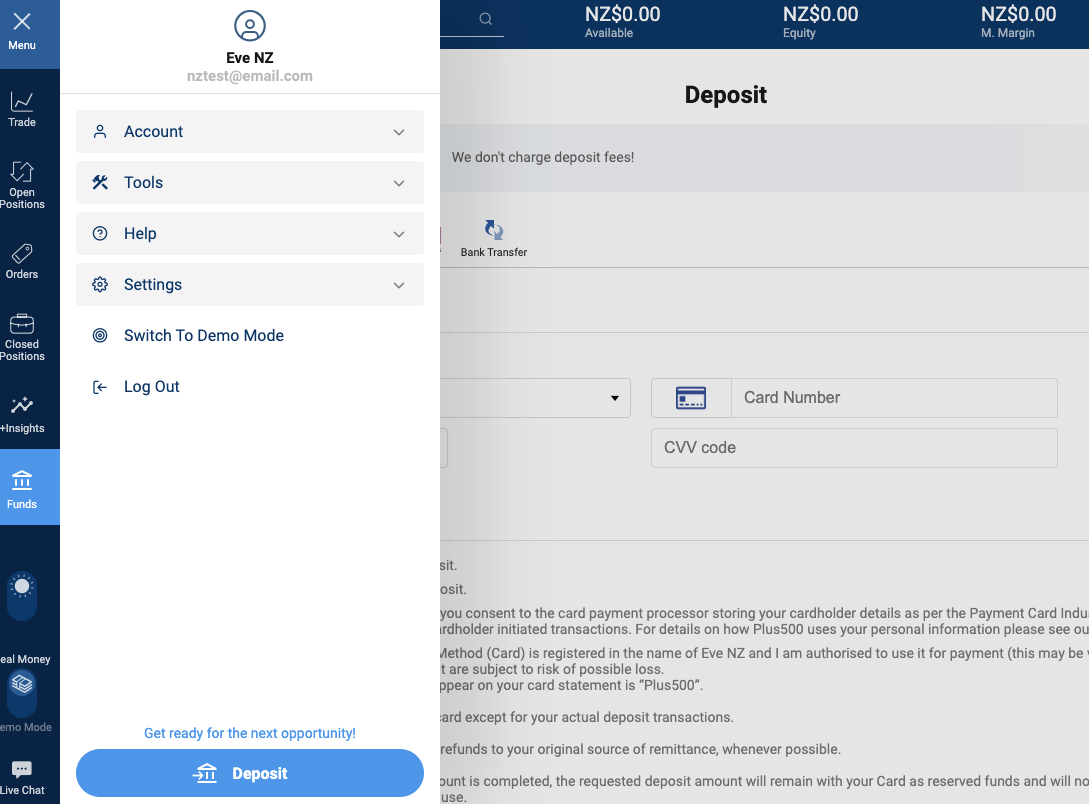

To deposit funds to your Plus500 trading account and start trading, follow these steps:

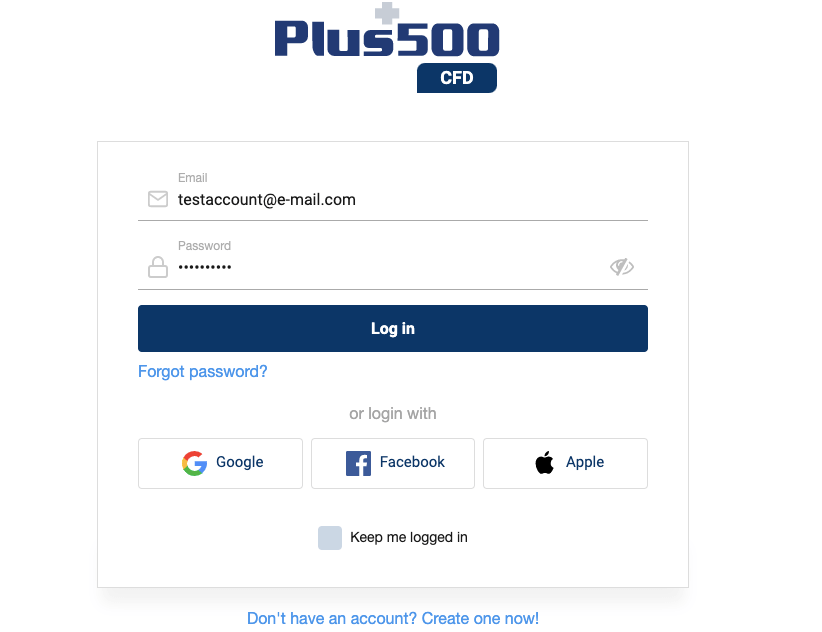

Step 1) Log in to your Plus500 account at www.plus500.com by clicking on Login at the top bar menu, input your email address and password, and click ‘Login’.

Step 2) After you log in, click the 3 lines on the left-side menu tab and then select the ‘Deposit’ link.

Step 3) Select your preferred payment method, enter the amount you want to deposit, and follow the on-screen instructions to complete your deposit.

What is Plus500 Minimum withdrawal?

The minimum withdrawal amount on Plus500 is NZD 200 for cards and bank transfers, while e-wallets have a minimum withdrawal amount of NZD 100.

Your withdrawal to all payment methods will be processed within 3 business days and may take 3-7 business days for you to receive the funds depending on the payment method you are using.

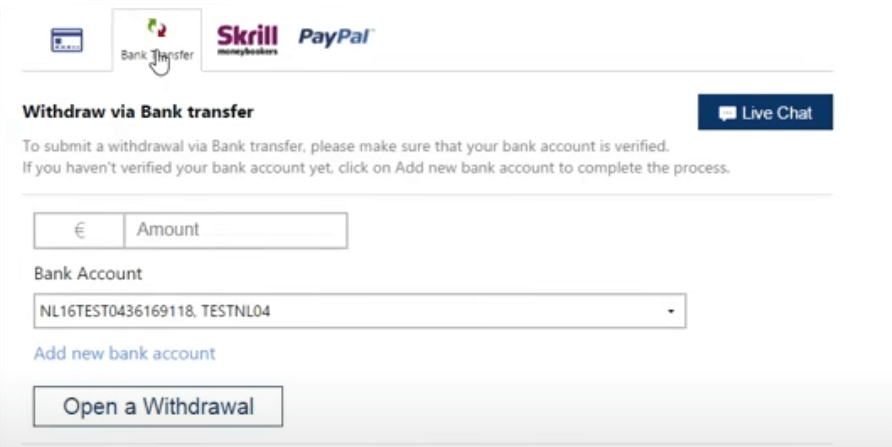

How to Withdraw Funds from Plus500 in New Zealand?

You can follow these steps to withdraw your money from Plus500 New Zealand.

Step 1) Log in to your dashboard, then click the left side menu, and select ‘Funds’.

Step 2) Click Withdraw on the main menu and select a withdrawal method.

Step 3) Next, fill in the amount you want to withdraw and other fields required.

Then click ‘Open a Withdrawal’ and follow the instructions shown to complete the transaction.

Be aware that withdrawal payments can only be made to the same source that was used to make the deposit, and the payment methods must match the name on the trading account.

Also, you need to verify your account before you can initiate any withdrawals.

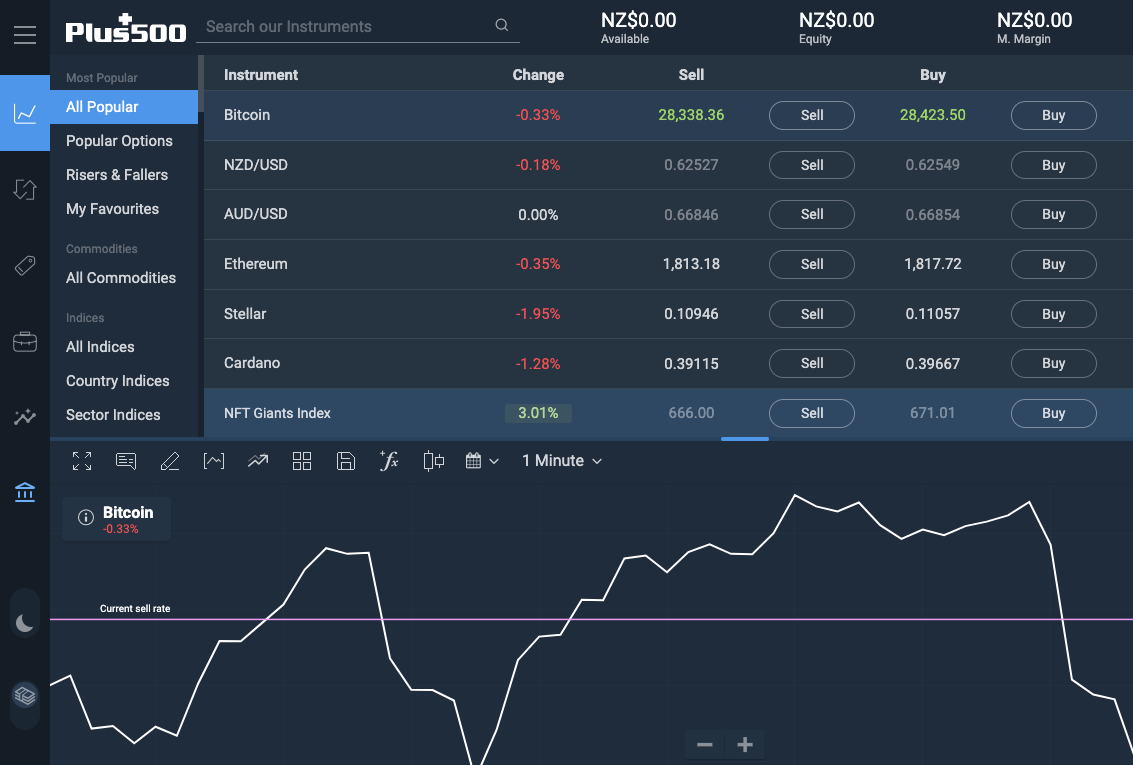

Plus500 Trading Instruments

You can trade more than 2000 financial instruments with Plus500. The products are distributed among the following categories.

| Instrument | Availability | Number |

|---|---|---|

| Forex | Yes | 66 currency pairs on Plus500 (including majors & minors) |

| Commodities | Yes | 22 spot commodities on Plus500 (including oil, gas, coffee, and others) |

| Shares | Yes | 1,655 shares on Plus500 (From 24 countries including the UK, USA, Japan, Sweden, South African shares and others) |

| Indices | Yes | 27 spot indices on Plus500 (US-TECH 100, UK100, GER40, and others) |

| Options | Yes | 356 Options on Plus500 |

| ETFs | Yes | 96 ETFs on Plus500 |

| Crypto | Yes | 19 Cryptocurrencies on Plus500 |

Plus500 Trading Platforms

The Plus500 Trader is the only trading platform supported by Plus500. The platform is owned by Plus500 Ltd and allows you to trade a large variety of financial instruments.

MetaTrader 4, MetaTrader 5. EAs cannot be integrated into the platform.

You can use Plus500 Trader on the web, macOS, and Windows desktops, as well as Android and iOS devices.

Plus500 Trader comes with risk management tools that protect you from extreme losses. They have the conventional stop loss but it is liable to slippage. To reduce this risk, Plus500 provided guaranteed stop loss orders on the platform. With this tool, your stop loss will not be exceeded no matter how volatile the market is. The only downside is that it is not available for all CFDs on Plus500 Trader.

In addition, Plus500 Trader has a good charting display. It has various chart types like candlestick charts, bar charts, etc. You will also have access to historical price movements, trading volumes, baseline, etc. The platform also has top technical indicators like the MACD, Bollinger bands, moving averages, and relative strength index.

Plus500 Promotions

Plus500 offers a bonus to clients in New Zealand on your first deposit.

Note that Terms and Conditions apply to the bonus offerings on Plus500.

Plus500 Execution Policy

Plus500 automatically processes your orders via Straight Through Processing. They are an STP broker with no dealing desk. There is no conflict of interest issue between Plus500 and their clients. When you open a position, Plus500 hedges the risk with a counterparty. This way, they have no personal gains from your losses. It is a key component of their execution.

Price quotes are supplied by liquidity providers and other third-party sources. This confirms that Plus500 is not a market maker. Their execution policy strives to secure the best tradable prices from these sources. Though there are rare occasions where you might not the best price, Plus500’s execution is good enough for an STP broker.

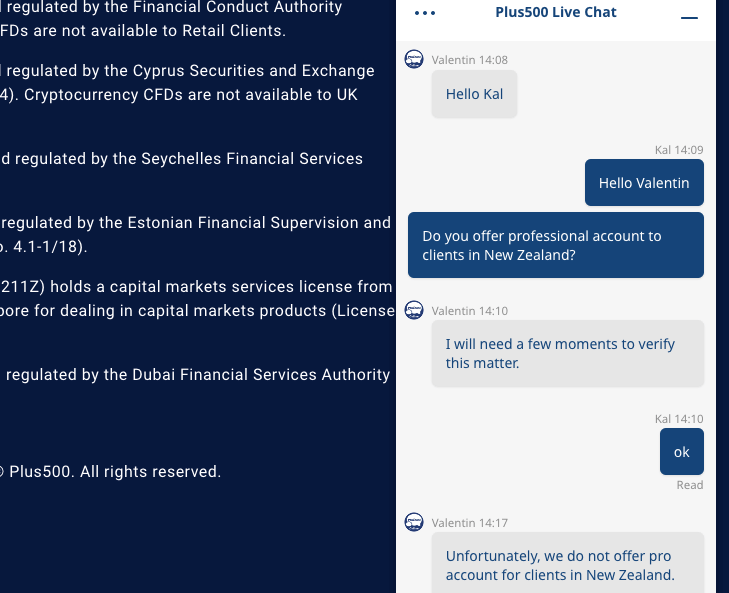

Plus500 New Zealand Customer Service

Plus500 customer support is available 24 hours a day via these channels:

1) Live chat support: Plus500 offers live chat support through their website. Plus500 Live Chat agents respond quickly, and a chat agent was able to answer our questions correctly in less than a minute when we tested the service by starting a chat.

Plus500 live chat is available 24/7 and can be found on the bottom right corner of their website on desktop. In order to start chatting, you have to enter your name and email address.

2) Email support: Plus500 offers email support that is also available 24 hours a day, 7 days a week, and responds to customer enquiries promptly.

When we tested the email customer support, we got an auto-generated response acknowledging receipt of our email, then a customer representative replied within 1 hour with the answer to our question.

To send an email inquiry, you may use the form on their website or send an email directly to Plus500 email address via [email protected].

3) Phone support: Plus500 does not provide a phone support line for enquiries, but they have a WhatsApp account that works in a similar way to the live chat feature which can be used for enquiries. You can find the link to the WhatsApp chat on the FAQ page.

Do we Recommend Plus500 New Zealand?

Yes, we recommend Plus500 for trading CFDs because they are regulated by top-tier regulators worldwide such as MAS, FCA, CySEC, ASIC, FSCA and FSA Seychelles. This means that they have to follow strict rules to protect the funds of traders.

The Plus500 proprietary trading platform is easy to get the hang of, which means even new traders can use it and the account opening process is simple and fast. The fees are moderate and there is no commission charged for any trade on the platform, although they charge currency conversion and inactive account fees.

Plus500 offers New Zealand Dollars (NZD) as an account currency, which will make deposit, withdrawal and measuring trade easier.

The Plus500 customer service is fair, which is an important factor when choosing a broker because fast responses ensure that any issues you encounter will be resolved quickly. Although they do not offer phone support, the company responds quickly to emailed and live chat questions.

Plus500 New Zealand FAQs

Is Plus500 good for beginners?

Plus 500’s retail account has been designed keeping the needs of beginners in mind. They do not charge a commission per trade which is suitable for beginners. Further, their trading platform has several beginner-friendly technical indicators which can be used to make successful trades.

Is Plus500 app legitimate?

Plus500 is legitimate because they are regulated by Tier-1 regulators such as ASIC in Australia and FCA in the UK, Tier-2 regulators like MAS in Singapore, FSCA in South Africa and CySEC in Cyprus. Further, they are also regulated in New Zealand. Make sure that you download the correct Plus500 from Google Play store or App store to ensure a safe trading experience.

Also, the company has physical offices in Australia, and online customer support and is also publicly listed on the London stock exchange.

Is Plus500 good in New Zealand?

Yes, we recommend Plus500 to traders from New Zealand. This is because they are a trusted broker which is regulated in New Zealand, they provide a wide range of trading instruments, they have an intuitive trading app which can be used on the go, and their overall fees is quite reasonable.

is plus500 good for beginners?

Plus500 can be a decent starting point for absolute beginners to forex trading for several reasons.

Its user-friendly platform ensures easy navigation and the Plus500 demo account offers you risk-free practice opportunities. Plus500 educational resources are designed to help you understand trading concepts.

Plus500 regulatory compliance and fractional shares offer security and flexibility. They also have a negative balance protection to ensure you do not lose more than your capital if you suffer a loss. However, trading CFDs with leverage carries risks, so caution is advised, particularly for inexperienced traders.

What are the account types for Plus500?

Plus500 offers 2 account types, the Retail account which has minimum deposit requirement of NZD 200 and maximum leverage of 1;30 and the demo account you can use to practice. Plus500 also offers Islamic account option for muslim traders.

Note: Your capital is at risk