Forex Trading is legal in Nigeria but it is unregulated and there are no locally regulated Forex brokers. All the forex brokers that are operating in Nigeria are regulated by foreign regulators like Cyprus Securities & Exchange Commission (CySEC) & Financial Conduct Authority (FCA) in the United Kingdom. These are the major statutory regulatory bodies that oversee financial markets including the forex market. They also issue licenses to market participants like the forex brokers that accept retail traders.

For ensuring that your funds are safe, traders in Nigeria must only trade via Tier-1 regulated CFD & forex brokers.

Also, it is important to understand that forex & CFD trading is very risky, and almost 70-80% of retail traders lose their money when trading at different CFD brokers in Nigeria. Hence, if you are thinking about trading forex, then you must learn about the risks as well.

5 steps to start Forex Trading for beginner traders in Nigeria

Below are some of the points that you need to know for learning everything about forex trading:

- Learn about the Basics of Forex Market

- Understand how Currency Pairs work

- Learn the Forex Trading Terminology

- Open your Forex Trading Demo Account

- Lean about all the Risks Involved in Forex Trading

In this guide, we will mostly discuss the point of view of retail traders in the forex market. We will try to cover some of the topics that can help you decide if you should trade, and learn about the risks involved. Or simply learn about forex trading.

Show More

Summary & Comparison of Best Forex Brokers Nigeria

| Broker |

Regulations |

EUR/USD Spread (pips) |

Min. Deposit |

Visit |

|

|

FCA, CySEC, DFSA, FSCA & FSA

|

1.4

|

₦4,000

|

Visit Broker

|

|

|

SVGFSA, CySEC

|

0.9

|

₦15,000

|

Visit Broker

|

|

|

FCA, CySEC, FSCA, FSA & FSC

|

1

|

$10

|

Visit Broker

|

AvaTrade

|

ASIC, FSCA, CySEC, FRSA, Japan FSA & FSC

|

0.9

|

$100

|

Visit Broker

|

XM

|

ASIC,DFSA, CySEC & IFSC

|

1.6

|

$5

|

Visit Broker

|

|

|

FCA, FSCA, CMA, CySEC & FSC

|

1.9

|

₦10,000

|

Visit Broker

|

Note: The spread data on minimum deposit is the typical/minimum spread as per information on these brokers’ websites in January 2024.

What is the Forex Market?

The foreign exchange market alias forex or FX market is a global, online over-the-counter (OTC) market where currencies of about 170 countries are bought and sold. It is open 24 hours a day. It is the biggest financial market in the world and has very high liquidity.

According to the Bank of International Settlement (BIS) survey conducted every three years, the UK accounts for about 43% of forex turnover globally. The forex market participants include businesses, banks, speculators, institutions, etc.

Most of the trading is from banks, businesses & institutional investors. Some of the trade in the forex market are speculative in nature, and a part of them is from retail traders. Retail traders come to the forex market to speculate, hedge against currency and interest rate risk, etc.

The activities that take place in the forex market are what determine the exchange rate of any currency pair. The higher the demand for a currency, the higher its exchange rate.

Forex market participants

The forex market ecosystem teems with a lot of participants. Let us discuss some of them.

1) The forex broker

The forex broker is a regulated participant who acts as a bridge between the forex trader and the market.

The broker is a middleman who places buy and sell orders for retail traders and some brokers also offer research services as well if required by the trader. The forex broker charges a fee for their services. That being said, retail traders need to pass through a forex broker that accepts retail traders if they are to access the market. There are several forex brokers in the Nigeria to choose from.

However, traders in Nigeria should check the regulatory website for a list of regulated forex brokers to avoid patronizing fraudulent/scam brokerages.

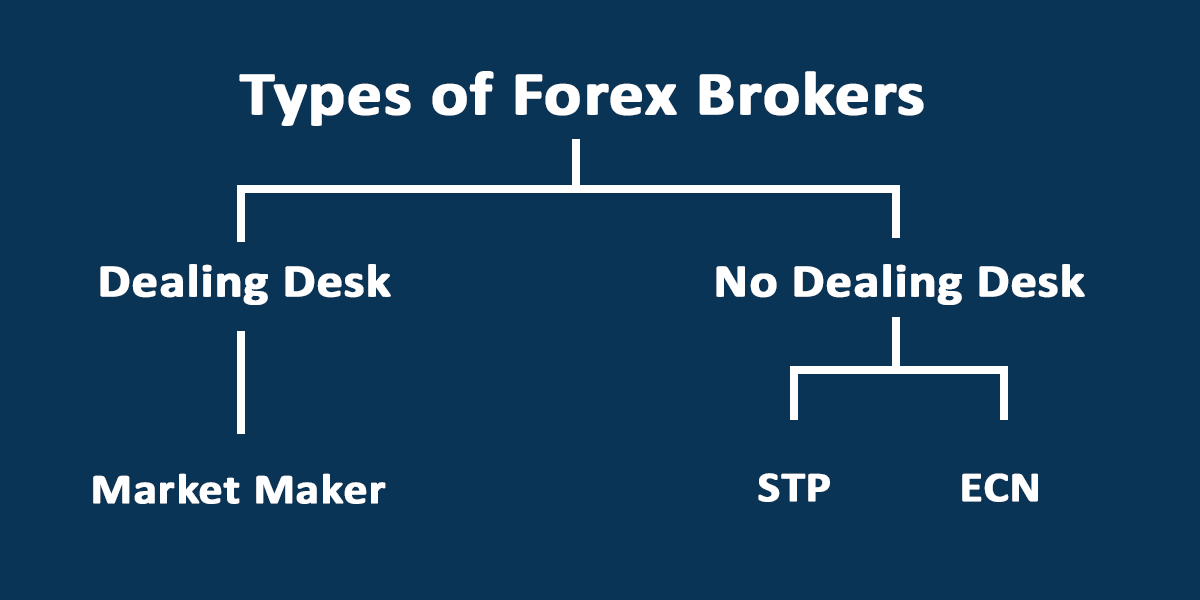

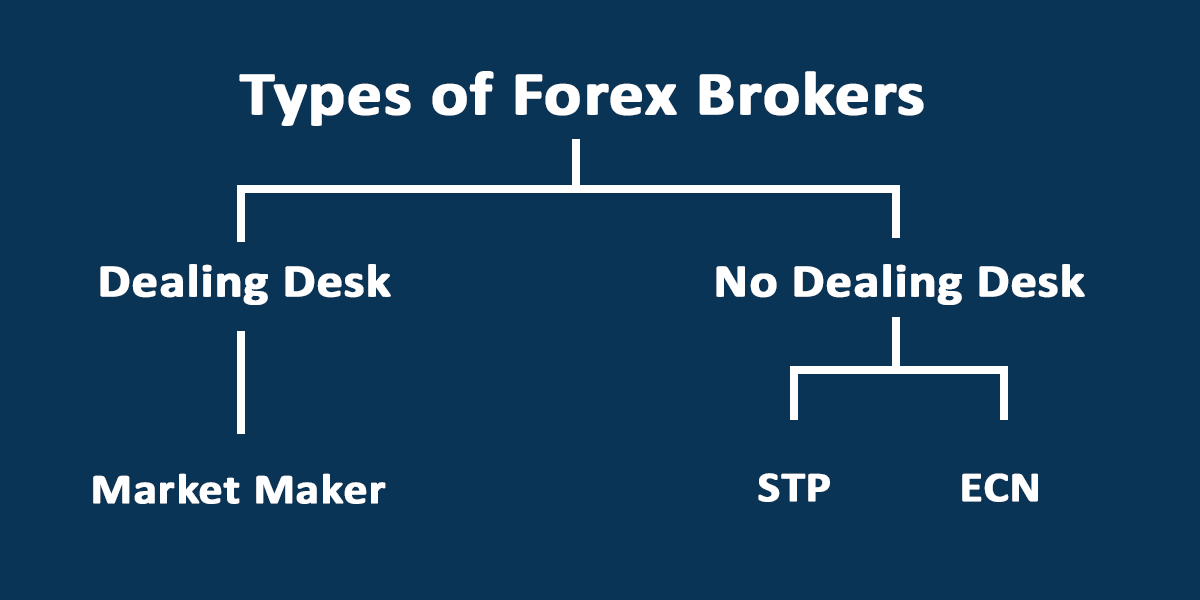

There are two types of brokers. They are classified based on their execution model. Here is the breakdown

Dealing Desk Broker: Dealing desk brokers take the opposite side of your trades. When you buy a currency pair, they sell. When you sell, they buy. Because of this, when you lose a trade, they make money off it, leading to a conflict of interest. This is why traders tend to prefer non-dealing desk brokers.

Dealing Desk brokers are also known as market makers.

Non-dealing Desk (NDD) Broker: NDD brokers do not take the opposite sides of your trades and they are divided into two. There are NDD brokers that use computerized networks to connect you to buyers/sellers in the market. This type is referred to as an ECN broker.

The second type is the STP brokers. They connect your trades to buyers/sellers via their liquidity pool.

2) The Retail Forex Trader

Retail forex traders are individual investors who wish to trade in the forex market for personal gain. They don’t trade on behalf of an organization or company. They account for an estimated 5.5% of the global forex market as per BIS data.

Retail traders are in the market mostly for speculative reasons. They hope to profit from differences in exchange rates between currencies.

3) Central Banks

Their presence in the forex market is to create policies that can affect the currency, intervene and stabilize the currency through increasing or decreasing interest rates, performing Open market operations in some situations etc.

Central banks can also devalue their currency to make exports of their country more competitive to international buyers. In short, the Central bank plays a major role in deciding the value of a currency.

4) Commercial Banks

Commercial Banks make up the interbank market where they trade forex with other banks in very large volumes. These volumes are large enough to dictate the bid and ask prices for any currency. They trade on behalf of themselves and their customers.

5) Multinationals

Big companies that operate in different parts of the world have to trade in the forex market to hedge risk and also for business purposes.

A company hoping to buy raw materials from another part of the world may need to convert its currency to be able to pay the supplier at the other end.

Big companies that have business operations in other parts of the world may also want to convert and repatriate their profits in a stronger currency to hedge against the risk of currency depreciation.

Forex Market Time Zones

The forex market operates in four different time zones-

- Sydney (10pm GMT to 7am GMT)

- Tokyo (11pm GMT to 8am GMT)

- London (7am GMT to 4pm GMT)

- New York (12pm GMT to 9pm GMT)

Depending on the currency that you want to trade, some sessions can be better than others. Most of the trading is carried out in the London & New York sessions.

The best time to trade the majors is when some of the major sessions overlap. At this time, market participation and liquidity are high, and spreads are at their lowest.

For example, the ideal time to trade the GBP/USD currency pair, is during the London & New York sessions, because at that time liquidity in the market is highest.

If you are trading JPY-based pairs, then you will also find liquidity during the Asian session.

What are Currency Pairs?

All the countries participate in the forex market and their currencies are represented as three-letter codes.

However, we will focus on the popular currencies here. The popular currencies and their codes are listed below:

- U.S Dollar – USD

- Great Britain Pound- GBP

- Euro- EUR

- Japanese Yen- JPY

- Swiss Franc- CHF

Forex Currency Pairs

Forex currencies are traded in pairs written as Base Currency/Quote Currency – GBP/USD

Currency pairs could be major, minor, or exotic. Let us discuss them below.

1. Major currency pairs

The major currency pairs quote the USD alongside another major currency.

They usually have the USD on one side of the quote either as the base or quote currency. Examples in order of popularity are:

- EUR/USD

- USD/JPY

- GBP/USD

- USD/CHF

- AUD/USD

- USD/CAD

- NZD/USD

2. Minor Currency pairs

These are currency pairs of strong economies that do not contain the USD. Examples are

- EUR/GBP

- GBP/JPY

- GBP/CHF

- EUR/CHF

- EUR/JPY

- CHF/JPY

3. Exotic Currency pairs

These are currency pairs involving a major currency and a currency of a smaller economy. These smaller economies are often referred to as emerging economies. Examples are

- USD/SEK- USD/Swedish Krona

- USD/DKK- USD/Danish krone

- USD/ZAR- USD/South African Rand

- USD/KES- USD/Kenyan Shilling

- USD/NGN- USD/Nigerian Naira

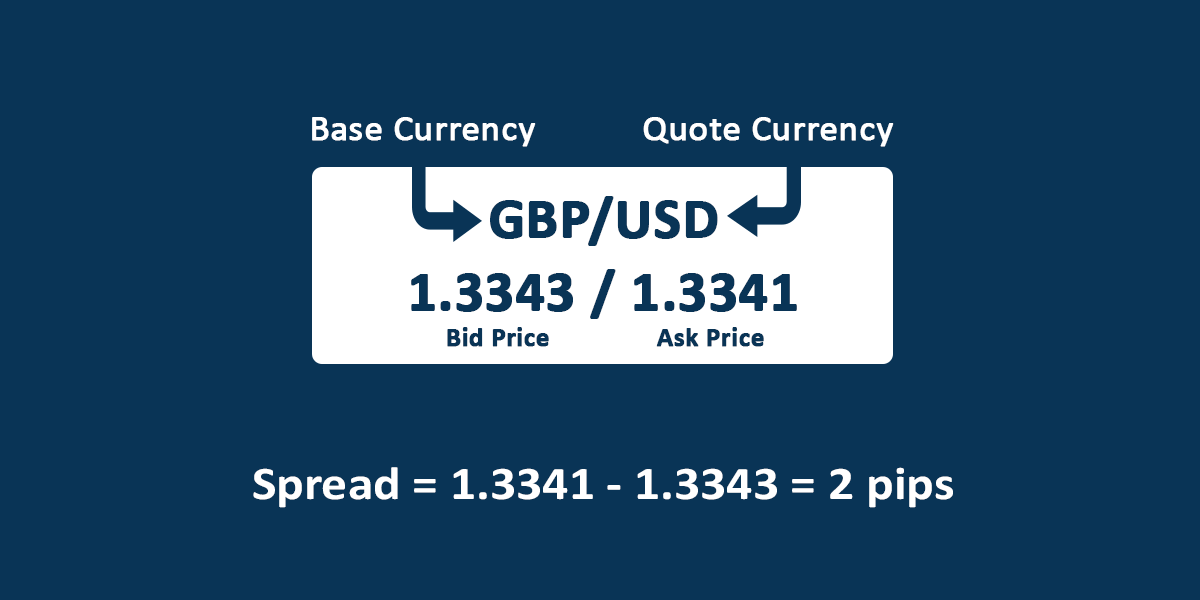

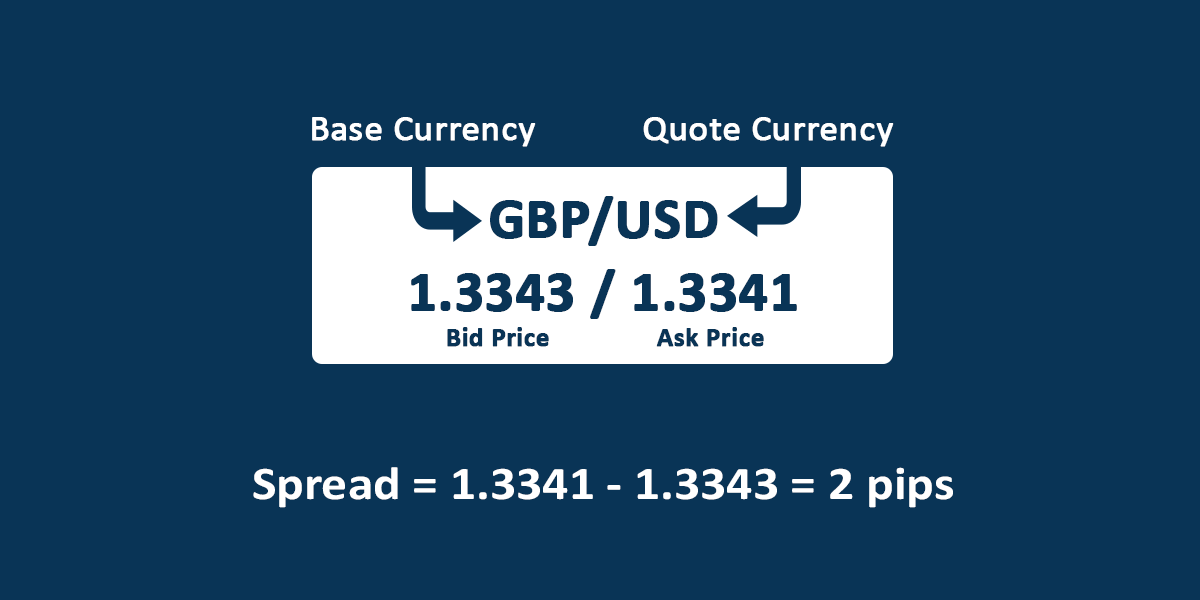

Reading a Forex Quote

Forex currencies are traded in pairs written as Base Currency/Quote Currency i.e. GBP/USD. The base currency is usually on the left while the quote currency will be on the right. Here is an illustration below

When you go long (buy) on a currency pair, the base currency is being bought while the quote currency is being used to pay for the base currency. It is the other way around when you go short (sell) on a currency pair.

Currencies are always traded in pairs at an exchange rate. The exchange rate is how much of the quoted currency is required to buy the base currency.

Assume the GBP/USD exchange rate = 1.2

This means that it will take $1.2 to buy one GBP and vice versa.

While trading forex, we use one currency to buy another hence we can also quote the currencies in terms of BID/ASK prices

The Bid price is the highest price a forex trader is willing to pay to buy the base currency from the broker.

The Ask price is the lowest price the forex broker is willing to sell the currency. Below is an illustration to help you understand

Forex Trading Terminology

Certain terms are widely used in forex trading and understanding is very important. We shall discuss some common terms below.

1) Spread

Spread is the difference between the bid price and the Ask price of a currency pair.

As seen in the image above the GBP/USD currency pair with a Bid/Ask price of 1.3089/1.3091 has a spread of 1.3089-1.3091 = 0.0002

Your forex broker may not always charge you a commission but makes their profit from the spread.

A spread of 0.0002 means if you are trading in a standard lot of 100,000 units of GBP/USD currency, the forex broker makes $20 on every standard lot traded i.e. 0.0002 x 100,000

There are two types of spreads in forex:

Variable spreads: As the name implies, variable spreads are spreads that fluctuate. This fluctuation is due to changes in the condition of the market like high or low volatility. This type of spread is usually offered by NDD brokers as they try to get the best market price for your trades.

Fixed Spreads:These are spreads that remain the same regardless of market conditions. They are usually offered by market makers. Market makers determine the price of the currency pairs they offer. So they can keep the bid and ask price stable no matter the market condition.

2) Pips

Percentage in point alias “pips” is the unit of measurement for the spread.

As seen in the example above, if the spread is 0.0002 it is conventionally expressed as 2 pips. This is for a currency up to the fourth decimal.

3) Lots

Forex currency pairs are traded in lots at forex brokers.

Since the currencies don’t move by a lot, the traders tend to trade a higher number of units. Remember, the higher the traded volume, the larger the profit & loss.

Currency pairs are divided into various lots as seen in the table below.

| Lot |

Number of units of currency |

| Standard |

100,000 |

| Mini |

10,000 |

| Micro |

1,000 |

Standard lot example:

For a GBP/USD currency pair with details below-

Exchange rate = $1.36

Standard lot = 100,000 units

The margin needed for trading 1 standard lot will be $136,000 (i.e., $1.36 x 100,000)

Mini lot example:

For a GBP/USD currency pair with details below-

Exchange rate = $1.36

Mini lot = 10,000 units

The balance required for trading a Mini lot will be $13,600 (i.e. $1.36 x 10,000)

So, the margin that you need to trade depends on the total lots or units that you are trading. If you are trading 2.5 Mini Lots, this means that you are trading 25,000 units of a currency.

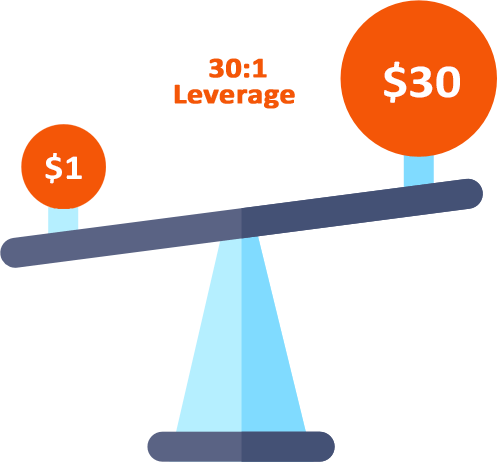

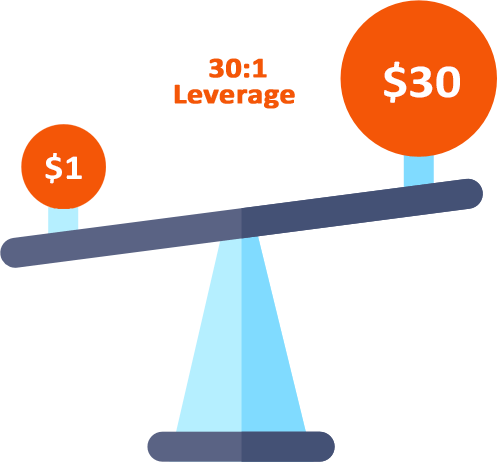

4) Leverage

Leverage in forex trading is essentially taking a loan from your forex broker to trade most lots. The loan is repaid after you sell and make a profit or a loss.

Most retail forex traders don’t have the required capital to buy or sell thousands of units of currency pair, so they leverage their position. But this is very risky and can result in huge losses.

Leverage of 30:1 means for every $1 a forex trader can trade up to a $30 position using margin money.

Leverage is inversely proportional to margin.

Example:

If margin is 3.33%, then leverage is 1/3.33 = 30 (also expressed as 1:30)

Since leveraging means taking a loan, it is a double-edged sword.

For example, if you lose big on a trade, and if the forex broker does not have Negative balance protection in place, the trader may have to repay more than the initial capital if the losses exceed capital.

This is why the leverage that brokers can offer to retail traders in the UK for CFDs & forex is set between 30:1 and 2:1 (depending on the instrument) by the FCA to avoid abuse by traders and brokers.

Normally almost all regulated brokers are offering negative balance protection to their traders.

5) Margin

This is a good faith deposit a trader must keep in his trading account. It is expressed as a percentage and is inversely proportional to leverage.

Margin % = 1/Leverage

For leverage of 30:1, the margin is 1/30 = 3.33%

Example:

If a forex trader uses leverage to place a buy order of 1 standard lot of GBP/USD currency pair

GBP/USD Exchange rate = $1.33

Margin = 3%

Required deposit without margin = $133,000 (i.e. 100,000 units x $1.33)

Required deposit with 3.33% margin= $4428.9 (i.e. 3.33% of $133,000)

After the forex trader deposits $4,428.9 in his or her account, then the 1 standard lot trade on GBP/USD can be placed.

6) Negative Balance protection

This is a system put in place by forex brokers to ensure your account doesn’t go into negative when the market moves against you quickly.

Once you lose the deposits in your CFD trading account, the brokerage system automatically closes all your positions.

It limits your loss to just your capital and ensures that the forex broker does not take the risk of your position. Negative balance protection is offered to only retail traders and not institutional traders.

Regulated forex brokers in Nigeria like HF Markets offer negative balance protection to clients.

7) CFDs

CFDs are derivatives, and these are contracts between the broker & trader. Derivatives are complex financial instruments that derive their value from other underlying assets such as Stock, Currency, and Commodities like Gold, precious metals, etc.

When trading CFDs, a trader does not own the underlying asset and is only speculating on the price of the instrument.

8) Hedging

This is the act of managing risk.

Traders sometimes trade derivative instruments such as currency futures and currency options to hedge against currency and interest rate fluctuation risk.

9) Day Trader

This is a trader who opens and closes trading positions on the same day.

Day traders are usually speculators and use derivative products like CFDs to try to profit from the rise or fall of the price of an asset.

How to Open Forex Trading Account?

To open a forex trading account, you need to first choose a reputed broker that is regulated by Top-Tier regulators like the FCA, ASIC, FSCA, CySEC, FSC BVI, etc.

Many brokers are regulated, so you should compare forex brokers by checking their regulation and safety of funds, trading and non-trading fees, trading application platforms supported, instruments, customer support, ease of deposits/withdrawals, etc.

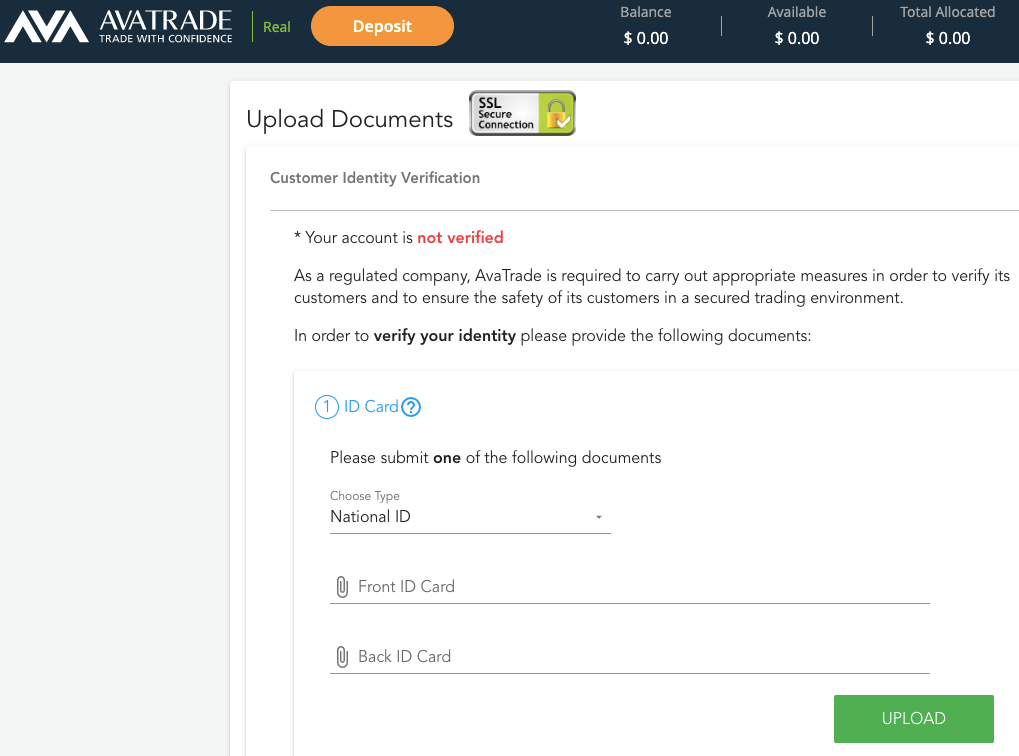

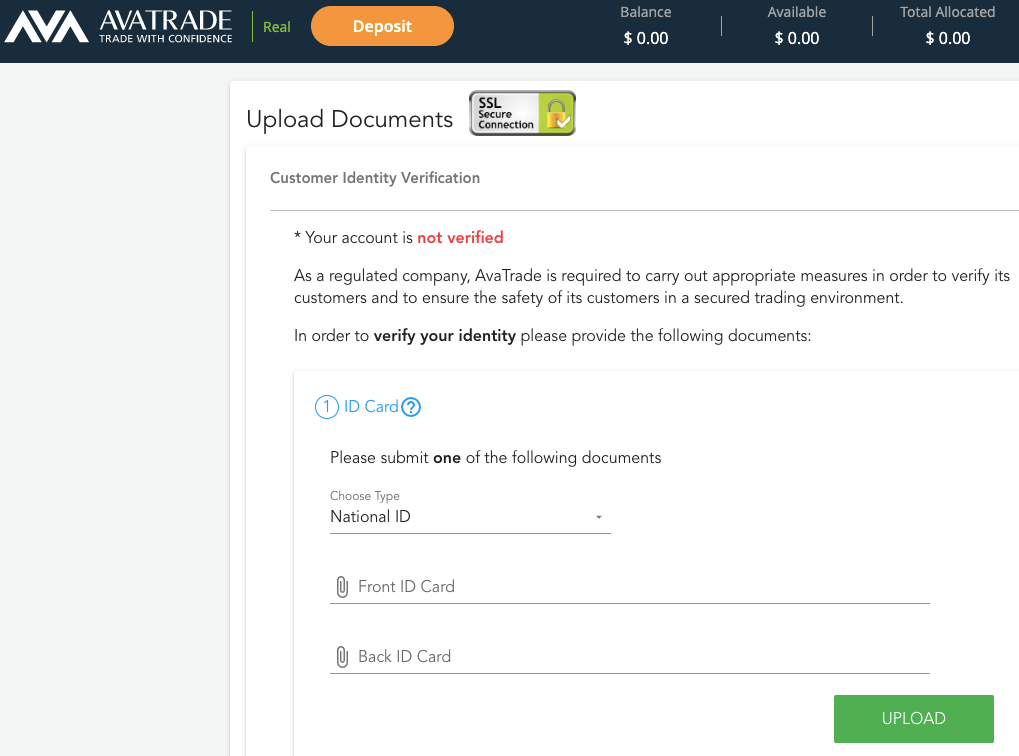

After you have done your research and decided on the forex broker that you want to choose, then you should proceed with opening your trading account. We will take AvaTrade as an example. The steps involved are generally the same for all forex brokers.

To start forex trading in Nigeria, follow the basic steps below to open a live forex trading account.

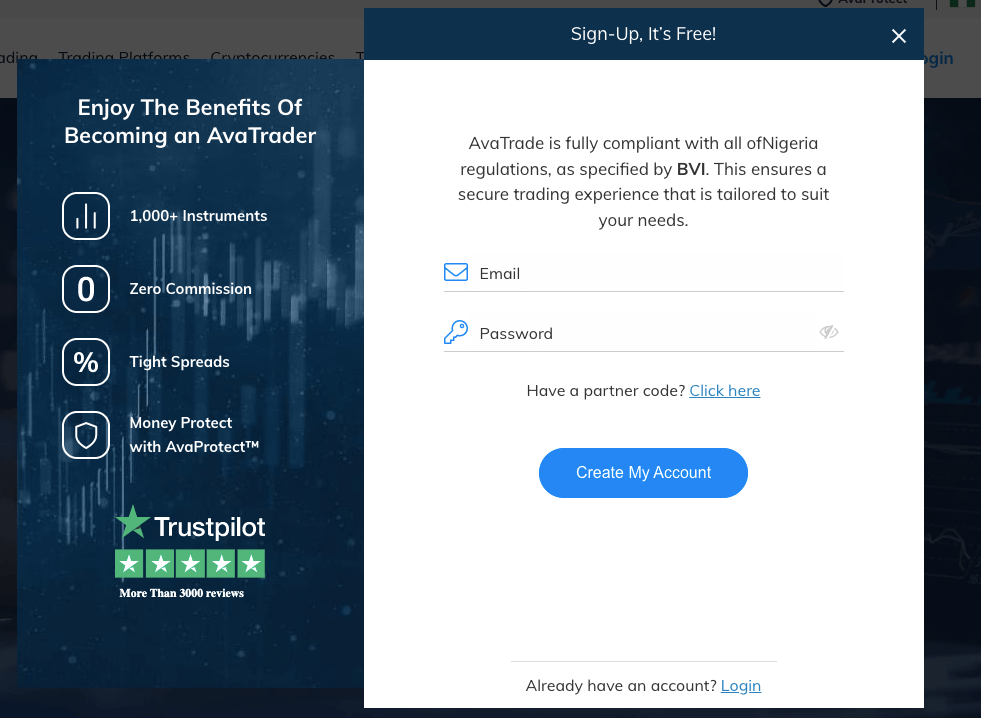

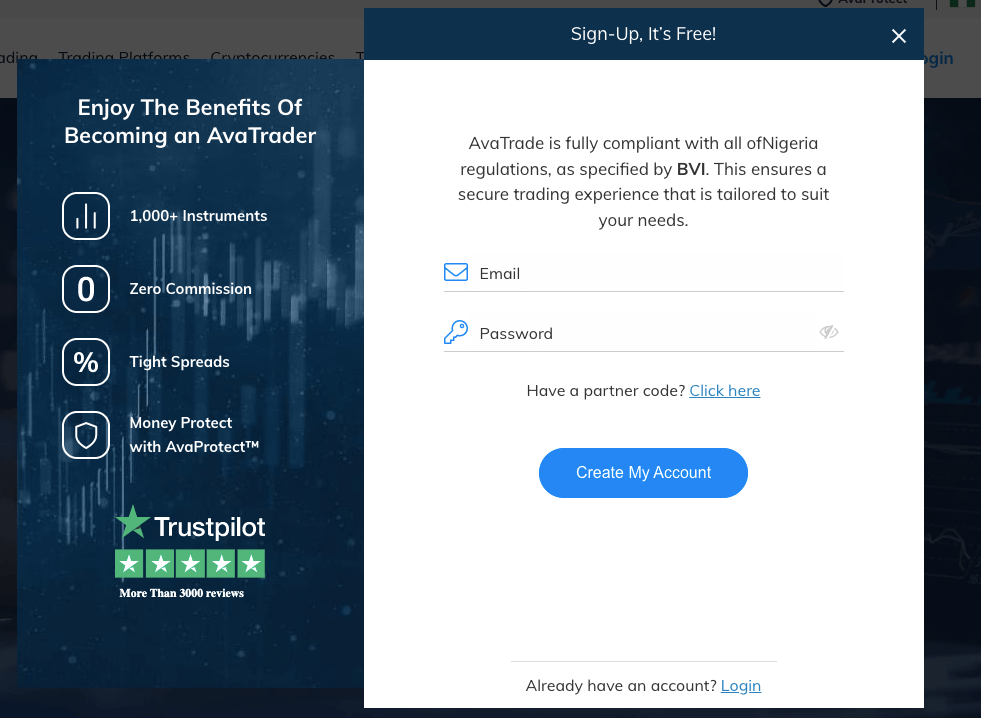

Step 1: Visit AvaTrade’s website, www.avatrade.com, and click the ‘Register Now’ button highlighted in orange. If you do not want to open a real trading account yet, click on ‘Demo Account’ below ‘Register Now’.

Step 2: Type in your email address and create a password on the form that appears. Then click ‘Create Account’ to continue.

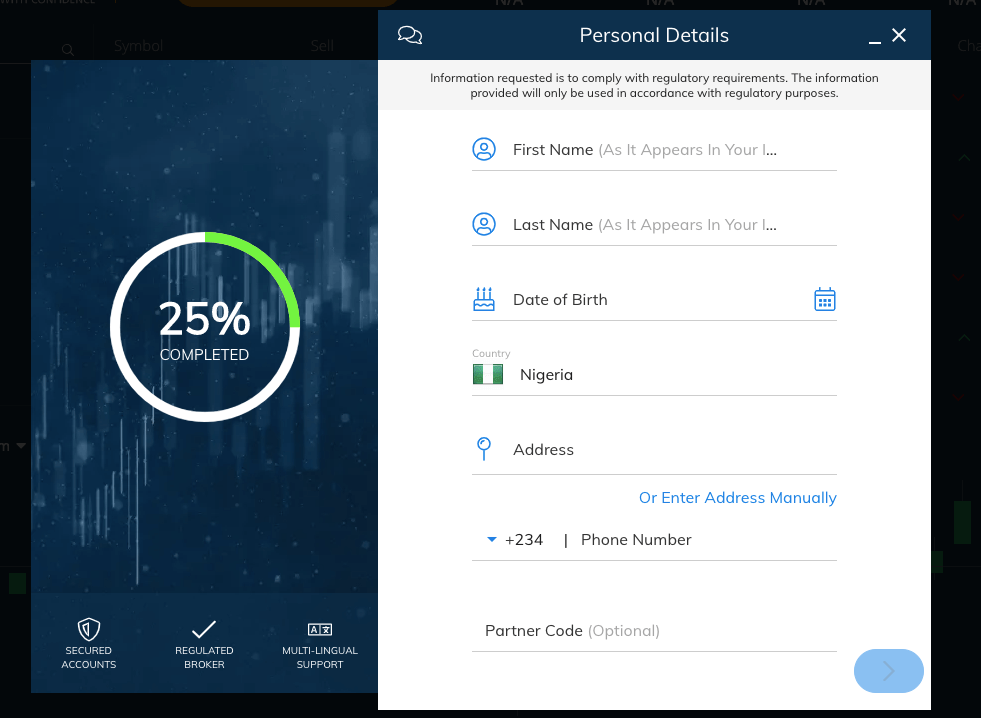

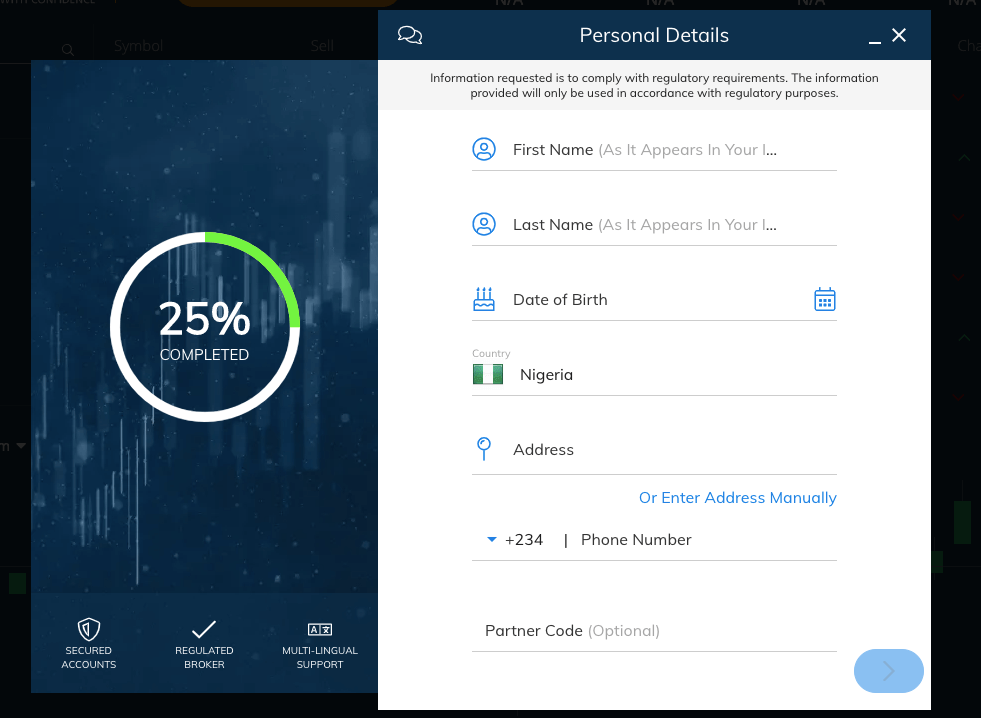

Step 3: After you click Create Account, you will be taken to the AvaTrade dashboard and asked to provide some personal details like date of birth, phone number, and full name.

Supply this information and then click the blue arrow button at the end of the form to go to the next page of the registration.

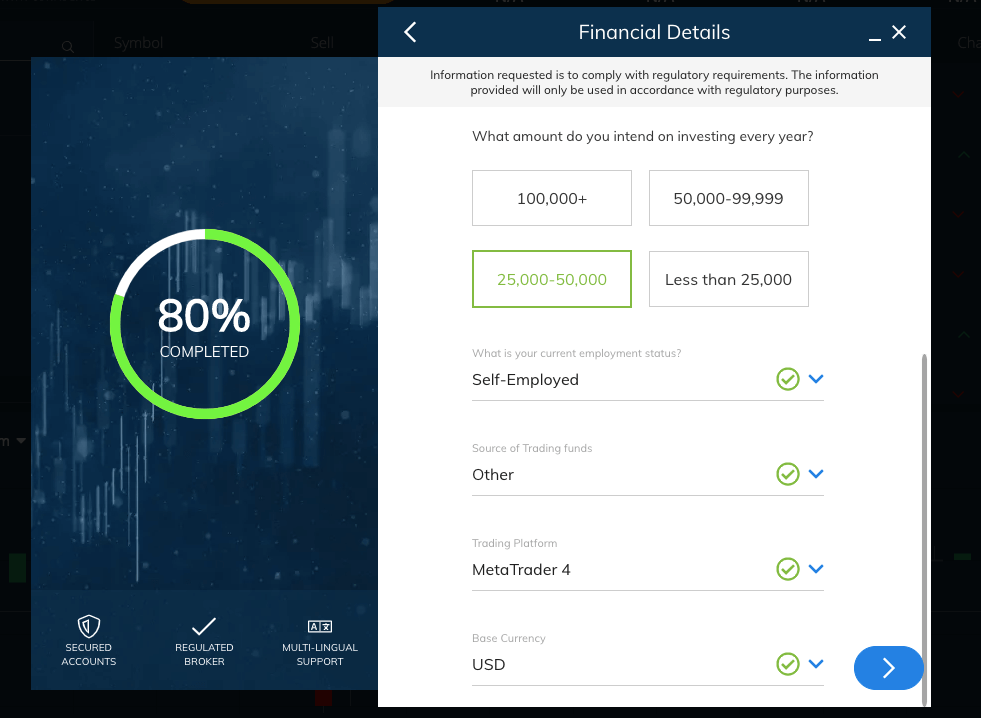

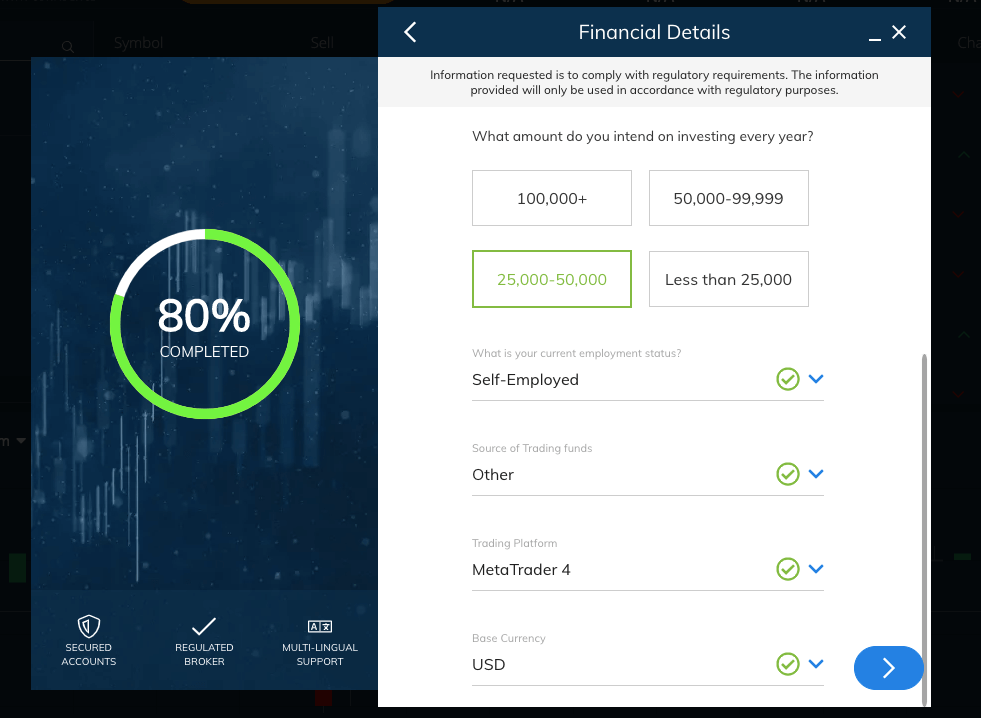

Step 4: Now you will be asked to provide some information about your income and employment status.

You will need to select a preferred trading platform (MT4 or MT5) and a base currency for your account. You can choose USD or EUR, then click on the blue arrow button to continue.

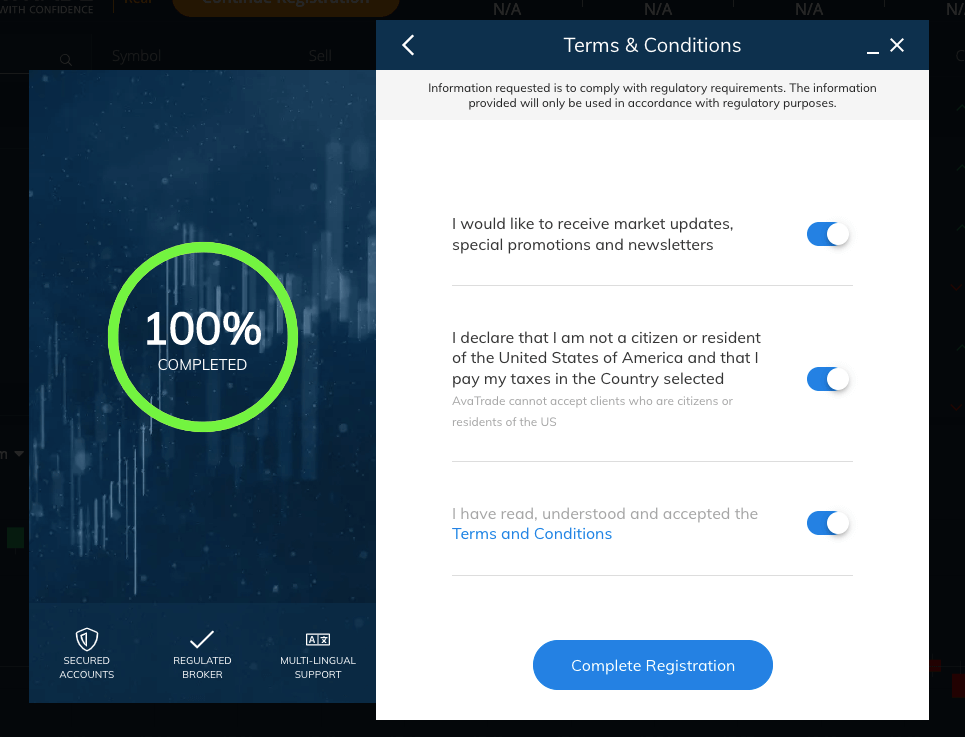

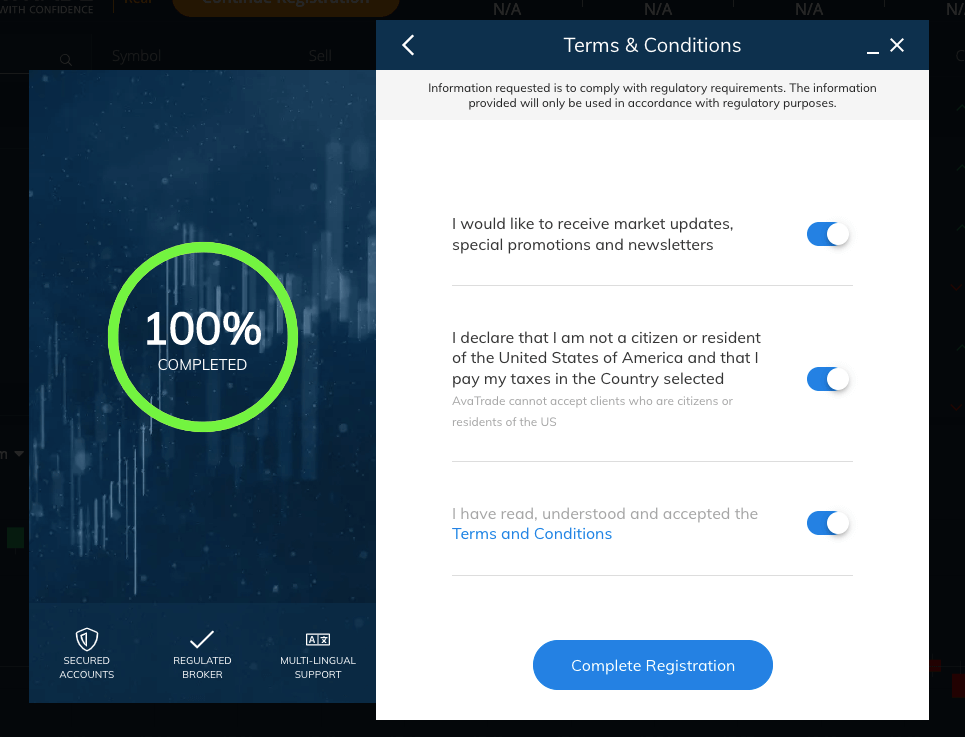

Step 5: Check the boxes to declare that you are not a US citizen, that you have read, understood and agree to the terms, conditions, and privacy policy of the broker, and then click on ‘Complete Registration’.

Step 6: Once you complete registration, you will be redirected to the AvaTrade dashboard.

Here you will upload identity and address verification documents to verify your account. Click on the menu (three bars) in the top right corner, then select ‘Upload Docs’.

Once you verify your account, you can add money to your trading account, begin to trade, and withdraw funds.

It is advisable that you only choose a forex & CFD broker that is regulated. Trading with unregulated brokers would mean that you could lose all your deposited funds.

Also, avoid any brokers that charge excessive withdrawal fees. Some brokers claim to charge low trading fees, while charging excessive charges on withdrawals & deposits, making their overall fees very high.

Risks Involved in Forex Trading

The forex market is very liquid and this liquidity has caused a lot of traders to throw caution to the wind and even become greedy.

Most retail traders trade forex because of leverage, and this can cause losses to escalate very quickly.

Let us discuss some risks.

1) Risk of Unlicensed Forex Brokers

There are lots of unlicensed brokers who lure unsuspecting traders with promises of huge returns with low investments.

Some of them claim to hold licenses from regulators in countries that are not known for strong regulatory supervision.

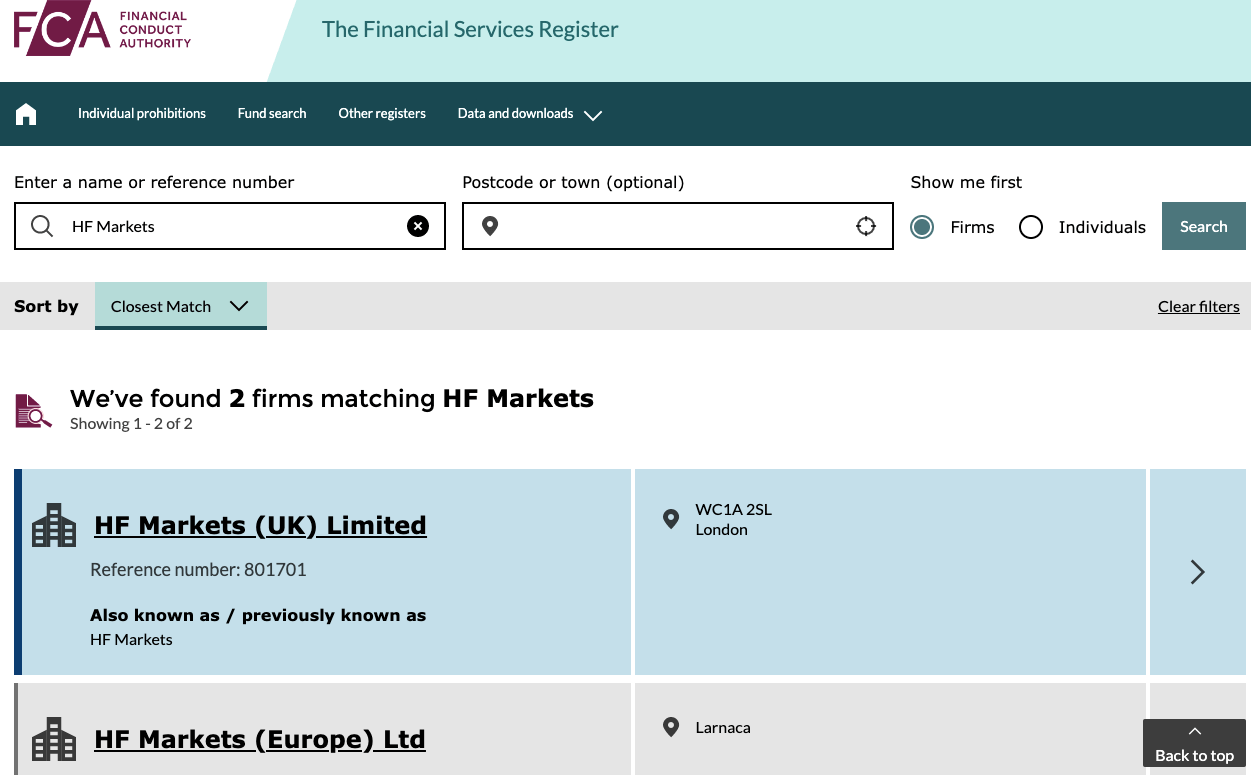

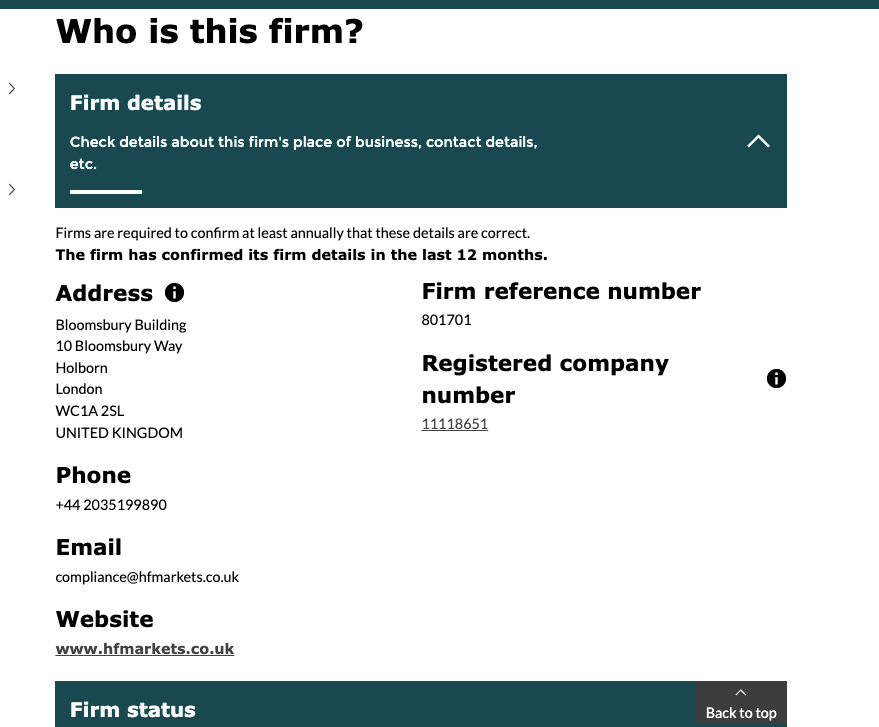

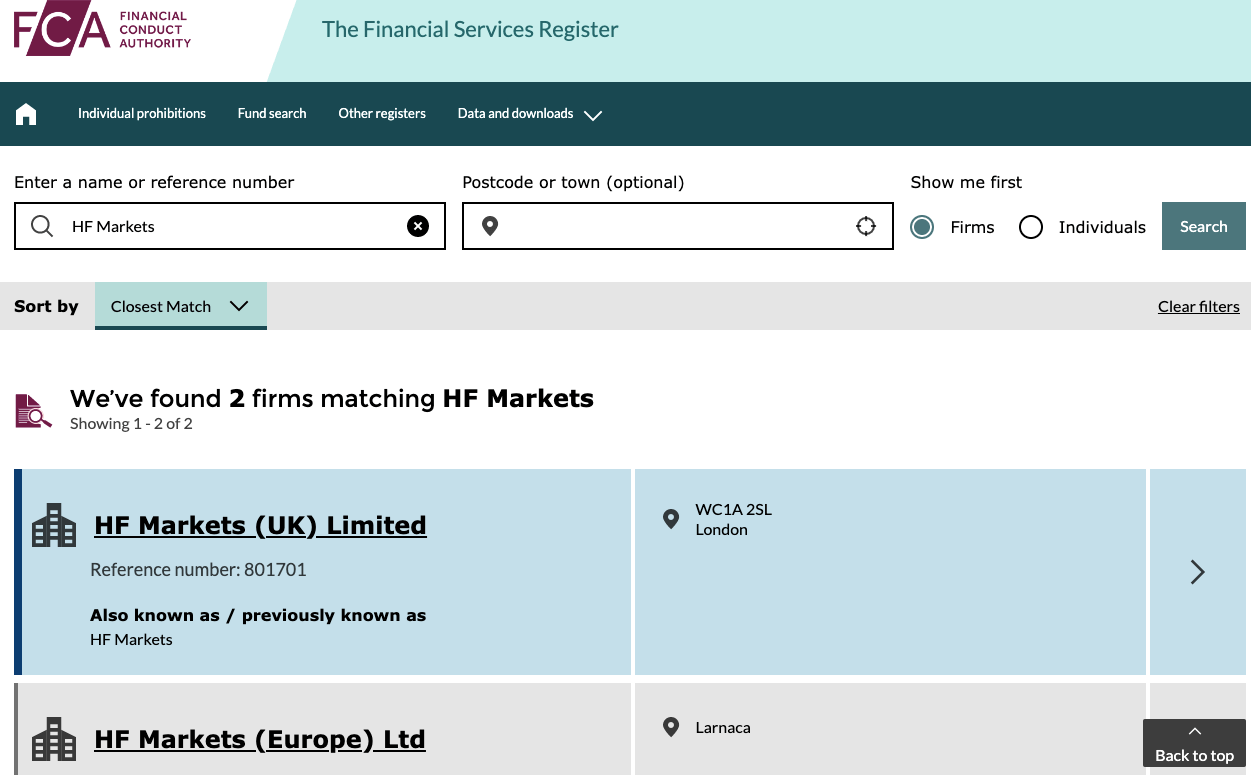

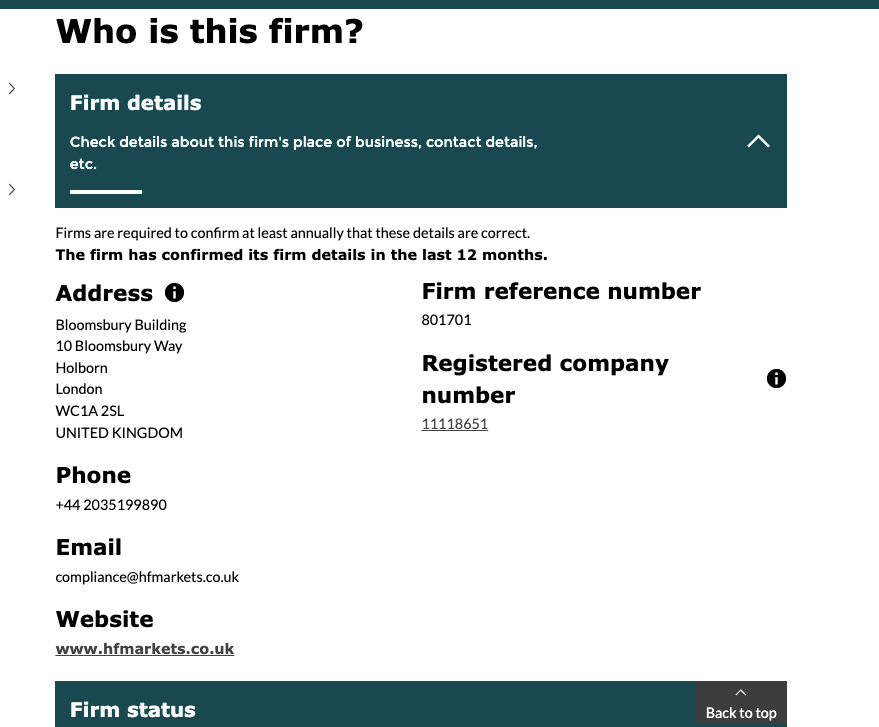

Forex traders in Nigeria can trade via FCA-licensed forex brokers. Traders should go to the FCA website at https://register.fca.org.uk/s/ and check if a broker is on the list of licensed forex brokers.

While at it they should check the phone number on the FCA website related to the forex broker and call the number to be sure they are dealing with a legitimate broker.

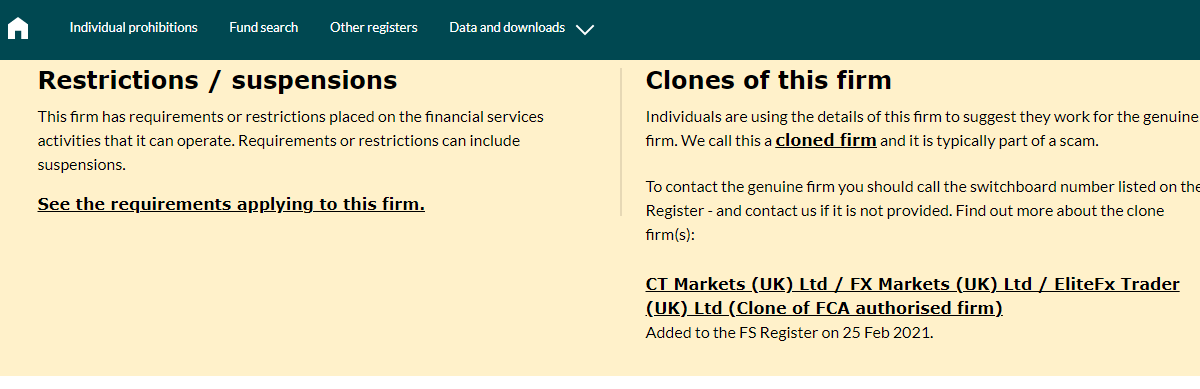

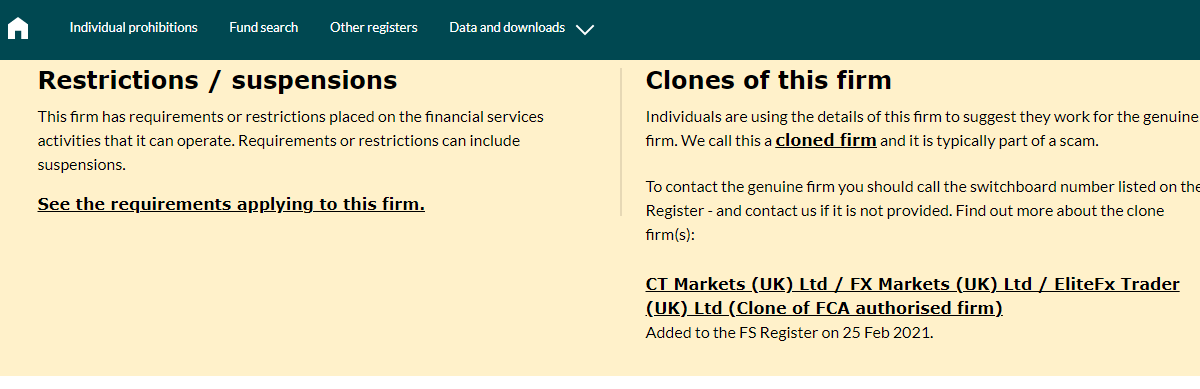

2) Risk of Cloned Forex Brokers

Some scam forex brokers go ahead and clone other licensed brokers.

They go as far as hosting websites with logos and registration numbers to deceive unsuspecting targets. The image below shows the FCA issuing a notice to the public about a cloned HF Markets forex broker website.

Scam brokers do exist so you should be wary of them and report anyone you come across to the FCA.

The first two risks that we discussed are associated with the risk due to a third party I.e. your broker. We will now talk about the risks that you face with actual trading.

3) Leverage risk

The FCA has set leverage restrictions on the maximum leverage that brokers in the UK can offer to traders. This is set to a maximum of 30:1 for forex.

Although forex brokers offer higher leverage to traders outside the UK, like Nigerian traders, it is advisable that forex traders should resist the urge to open positions with high leverage as this can increase your risk exposure.

Reports state that even with the leverage restrictions, 70 to 80% of retail forex traders lose money. The actual percentage depends on the broker-to-broker.

This is mainly because of over-leveraging a position. Traders must avoid using more than 1:10 leverage on any forex trade.

For example, let’s say you place a buy order on EUR/USD at 1.1000 targeting 1.1100, which is 100 pips. You have $10,000 in your trading account & you decide to use 1:10 leverage to place 1 Standard lot trade.

If the price does go in your direction, then you can make a profit of $1000 on this trade. But if the price goes against you by let’s say 100 pips, then you would lose $1000, which is 10% of your capital. If you had used 1:30 leverage, then the losses would have been $3000, which is 30% of your capital on a single trade.

Hence, you must remember that trading with excessive leverage can cause big losses.

The use of leverage should be done responsibly as it amplifies both gains and losses. You should find out if your broker offers negative balance protection so as to stop your account from going negative.

You can also use Stop Loss orders to automatically exit a position if the loss exceeds a certain level. Stop-loss orders are automated instructions a trader gives the broker to exit his trading position once the price goes below a predetermined amount. Stop-loss orders could be used to manage risk.

4) Risk of Losses from your trades

The forex market is very volatile and should be approached with caution. For example, it is not uncommon for some currency pairs to move 4-5% in a day.

Normally, even majors like EUR/USD can move 1-2% in a single day. If you are risking too much on a single trade, then you can lose very quickly.

In fact, most of the retail traders trading in the forex market lose their money. It is really hard to be profitable with forex trading, mostly because traders trade with gamblers’ nature of risking excessively.

It is really important to practice risk management on a demo account for some months before going live. Also do not risk more than 2% of your trading capital on one trade.

is forex trading halal?

Whether forex trading is halal depends on the specific practices involved and how they align with Islamic financial principles. Here’s a breakdown:

Prohibited elements in forex trading:

1) Riba (interest): Traditional forex trading often involves rollover fees or interest charges on overnight positions, which are strictly prohibited in Islam.

2) Maysir (gambling): Excessive speculation and high leverage can be seen as gambling, also forbidden in Islam.

3) Gharar (excessive uncertainty): Trading on margin involves borrowing money with a guaranteed return to the broker, which could be considered as an unfair exchange.

Compatible practices for halal forex trading:

1) Swap-free accounts: These accounts avoid rollover fees by closing open positions at the end of each trading day, eliminating interest-based charges.

2) Fixed fees: Some brokers offer fixed fees for each trade, removing the element of uncertainty associated with variable spreads and commissions.

3) Profit-sharing: Profit-sharing agreements between traders and brokers can replace interest-based income with a Sharia-compliant revenue model.

4) Limited leverage: Reducing leverage minimizes the risk of excessive speculation and debt.

Popular options for halal forex trading:

1) Islamic forex accounts: Many online forex brokers offer specific accounts that comply with Sharia law, often incorporating swap-free trading, fixed fees, or profit-sharing structures. Such forex brokers include HF Markets, Octa, AvaTrade, and XM Trading among others.

Things to consider:

1)Not all forex brokers offer halal alternatives. Ensure the platform and account structure adhere to Sharia principles.

2)Fees and structures may vary. Compare different brokers to find one that offers competitive fees and a Sharia-compliant structure that aligns with your preferences.

FAQs on Forex Trading Nigeria

What is forex trading How does it work?

Forex trading involves buying and selling currency pairs like EUR/USD, GBP/USD, EUR/GBP etc. A forex trader speculates on the prices of currencies. For example, if a trader thinks that the USD is going to be weaker in the next few weeks against the GBP, then that trader can buy GBP, that is the GBP/USD pair.

If the trader is right and the USD becomes weaker, the trader makes profits from the difference. Forex trading generally involves leverage, which is very risky as we explained in our guide.

Is Forex Trading Legal in Nigeria?

Forex trading in Nigeria is legal but it is not regulated. Traders are trading at their own risk. So, you must only choose reputed & well-regulated Tier-1 forex brokers.

Can I trade forex with Naira?

You can trade forex with Naira. It is possible via brokers that have accounts with Naira as the base currency. Examples of brokers that have Naira as account currency are FXTM and HF Markets (HotForex).

How do I start trading forex?

To start forex trading, you need to open a live trading account with a forex broker. Scroll up to find a step-by-step guide on how to start trading forex in Nigeria.

How much money do you need for forex trading?

The cost of starting forex trading depends on the minimum deposit of the trading account you are opening. For example, you can start trading with $5 or ₦4,000 on HF Markets with their Micro Account.