Many forex brokers accept traders from Nigeria, but most of these brokers are not safe & are considered risky. For this review, we checked 50+ brokers, including all the major forex brokers that are regulated with Tier-1 regulations like FCA, ASIC & CySEC.

We have meticulously curated the best Forex brokers in Nigeria based on factors including protection of client’s funds (regulation), trading fees/commission, ease of withdrawals, and trading conditions as judgment parameters.

Show More

Comparison of Best Forex Brokers in Nigeria

| Broker |

Regulations |

EUR/USD Spread (pips) |

Min. Deposit |

Visit |

|

|

FCA, CySEC, DFSA, FSCA & FSA

|

1.4

|

₦4,000 (or $5)

|

Visit Broker |

|

|

FCA, CySEC, FSCA, FSA & FSC

|

1

|

$10

|

Visit Broker |

XM

|

IFSC Belize, FCA, ASIC

|

1.6

|

$5

|

Visit Broker |

Octa

|

SVGFSA, CySEC

|

0.9

|

₦15,000 ($50)

|

Visit Broker |

AvaTrade

|

ASIC, FSCA, CySEC, FRSA, Japan FSA & FSC

|

0.9

|

$100

|

Visit Broker |

|

|

FCA, FSCA, CMA, CySEC & FSC

|

1.9

|

₦10,000 ($10)

|

Visit Broker |

FBS

|

ASIC, FSC Belize, & CySEC

|

0.9

|

$5

|

Visit Broker |

Best Forex Brokers in Nigeria

Here is the list of our Best Forex Brokers for traders in Nigeria that are considered safe & low risk as per our reviews.

- HF Markets – Overall Best Forex Broker in Nigeria

- Exness – Good Forex Broker with NGN Account

- XM Trading – Low Spread with Ultra Low Account

- Octa – Forex Broker with Low spread & no commission

- AvaTrade – Well Regulated Forex broker with Fixed Spread

- FXTM – Well Regulated Forex Broker

- FBS – Forex Broker With MT4 and MT5 Platforms

- IC Markets – Broker with Low fees & ECN Type Trading Accounts

- Pepperstone – Well Regulated Forex Broker with Raw Spreads

- FxPro – Forex Broker with cTrader platform

If you need more information, we now cover below the detailed breakdown of features like safety, fees, trading conditions, support & more of each above-listed broker one by one for comparison.

#1 HF Markets – Best Forex Broker in Nigeria

EUR/USD Benchmark:

1.4 pips on average with Premium Account

Trading Platforms:

MT4, MT5, HFM Trader

Account Minimum:

$5 or ₦4,000

HF Markets was established in 2010 as a MetaTrader broker that provides the standard MetaTrader features. HF Markets was formerly called HotForex

The most important question a trader should ask is whether your funds are safe and which regulatory body oversees the activities of HF Markets to protect your funds in the event of misappropriation.

Safety of Funds: HF Markets is a well-regulated CFDs broker (forex and other instruments).

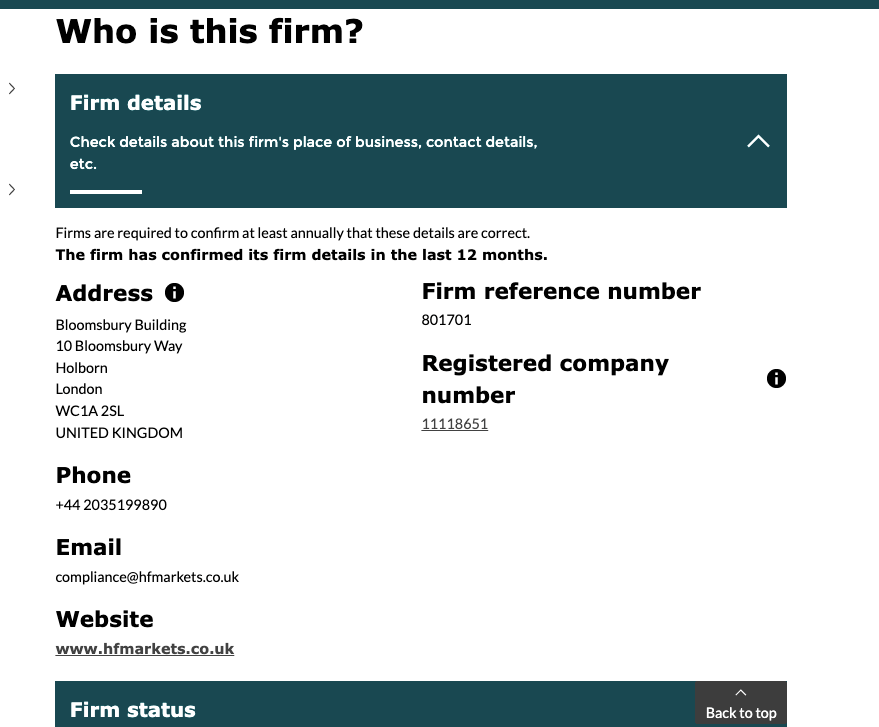

HF Markets is regulated by a Tier-1 jurisdiction authority in the United Kingdom with the Financial Conduct Authority (FCA). This denotes a high level of trust and acceptability internationally.

HF Markets is also regulated by 3 Tier-2 regulators i.e. FSCA in South Africa, CySEC in Cyprus & DFSA in Dubai.

But traders based in Nigeria are registered under its offshore regulation in St. Vincent & Grenadine. HF Markets is registered with registration number- 227471BC 2015.

Low Fees: HF Markets offers one of the lowest rates in terms of trading fees among its counterpart brokers in the industry.

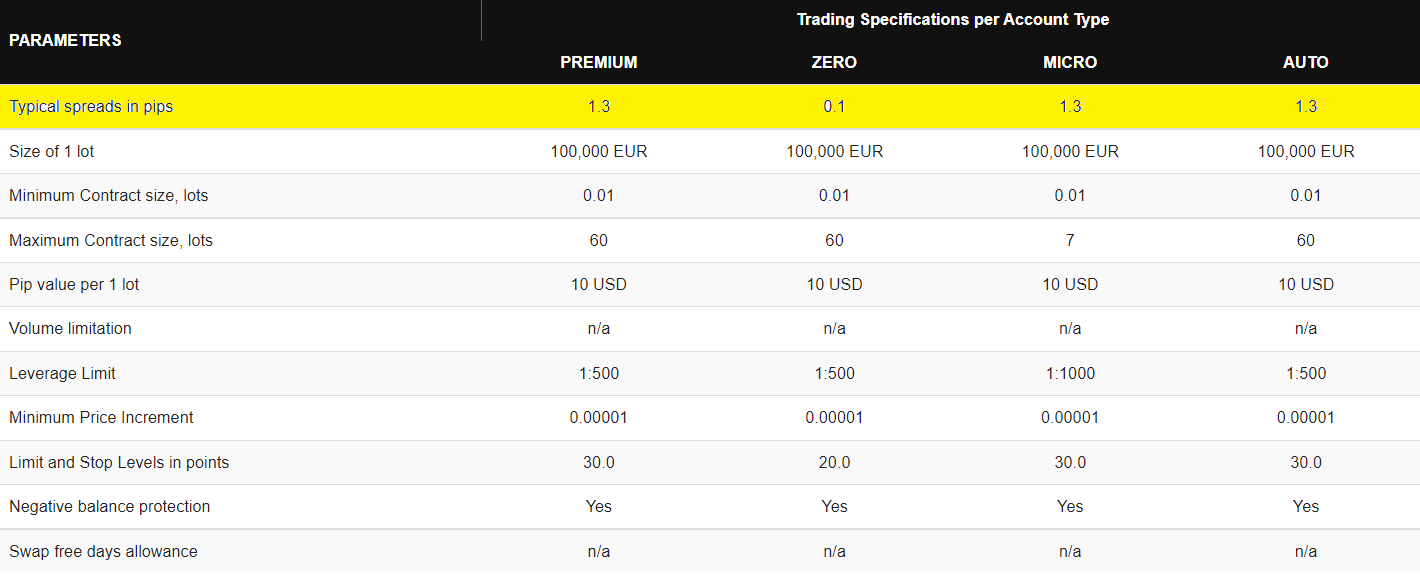

It offers typical spreads of 1.4 pips on major pairs such as EUR/USD on Micro and Premium accounts, and as low as 0.1 pips with zero account in normal market trading conditions. But there is a $6 commission per lot with Zero Account for majors (it is $8 for minors). Maximum leverage on HF Markets is 1:1,000.

Typical swap fees on EURUSD are -0.20 USD for short trades and -2.30 USD for long trades.

Aside from its low trading rates, HF Markets does not have charges on deposits and withdrawals. Clients get the total of their deposits and withdrawals. Plus, they have the option to fund accounts & withdraw in Naira via local bank transfer without any extra fees.

HF Markets charges a dormant account fee of $5 per month if you do not log into your account or perform any activity for 6 months.

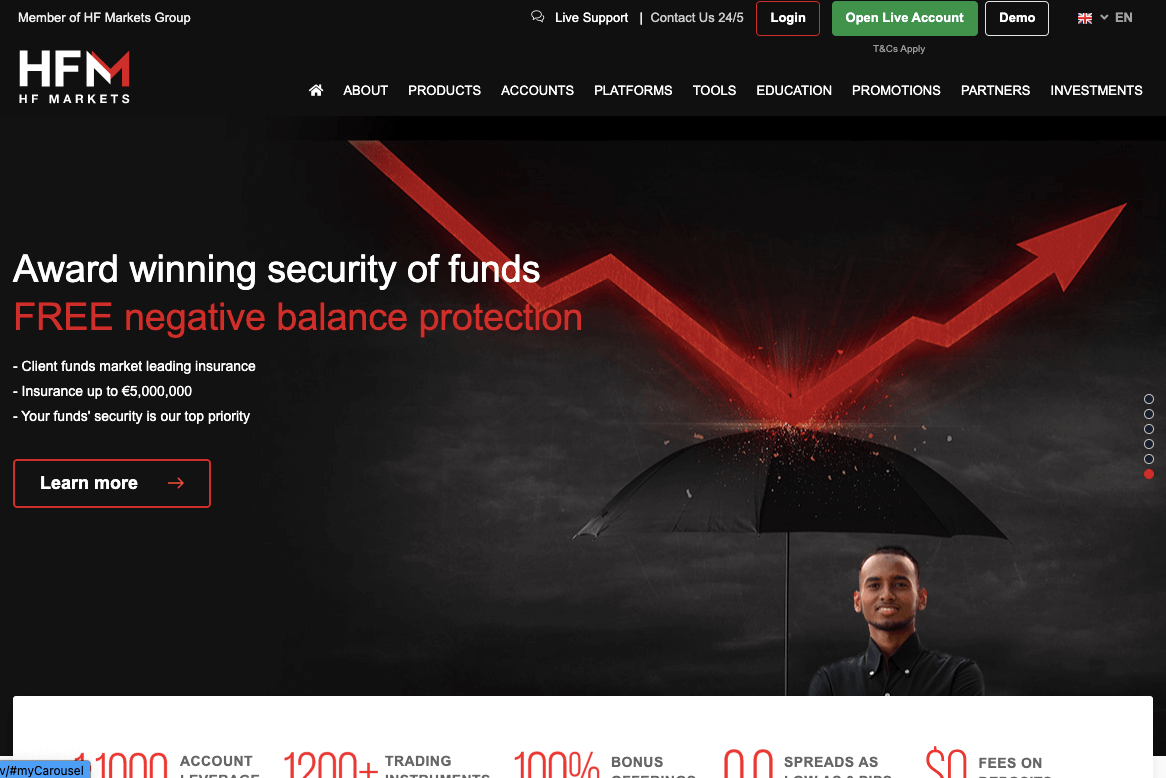

Trading Conditions are Okay: They have a variety of account types which number up to four. These include Pro, Premium, Zero, and Cent. They also have a swap-free Islamic Account option. HF Markets has negative balance protection, which means you cannot lose more than the money in your trading account even if you suffer a loss.

HF Markets provides clients with over 1,000 instruments including CFDs on commodities metals like gold, oil and agriculture, CFDs on Indices like NASDAQ, etc., ETFs, bonds, cryptocurrencies and 53 currency pairs on offer.

HF Markets also has a very low minimum deposit for naira account holders at just $5 or ₦4,000. The minimum withdrawal is $5. You can deposit & withdraw funds via your Bank Transfer in Naira, HF Markets also allows customers the freedom to choose their base account currency which includes NGN, USD & EUR.

HF Markets trading platforms include the MT4 and MT5 which are available on PC, web, Android, and Mac devices. The HF Markets proprietary platform HFM WebTrader and HFM App which is available on mobile devices.

Good Customer Support: In Nigeria, HF Markets office is in Lagos where customers can visit. They also have an available customer support system with live chat, emails, phone numbers, and other contact details on display on their website. Their support is available 24hrs per day and 5 days per week.

They also hold sessions to teach customers the basics of Forex trading in different cities in Nigeria.

Read our HF Markets Review for complete details.

HF Markets Pros

- Regulated by Top tier regulators including FCA, FSCA, CySEC.

- Availability of HF Markets Naira accounts with NGN Base Currency.

- Deposits/withdrawals via Bank Transfers in Nigeria.

- Availability of MT4 and MT5 trading devices for Android, Mac and PC.

- Offers a wide range of instrument.

- Low minimum deposit.

HF Markets Cons

- Up to $8 commission per lot on Forex with Zero Account.

- Charges dormant account fees.

- Customer support not available 24/7.

#2 Exness – Good Forex Broker with NGN Account Currency

EUR/USD Benchmark:

1 pip on average with Standard Account

Trading Platforms:

MT4, MT5, Exness Trader

Exness was founded in 2008 and offers Forex & CFDs trading via the MetaTrader application.

Exness is one of the low-cost beginner-friendly CFD brokers that accept traders based in Nigeria.

Safety of Funds: Exness is registered in Seychelles as Nymstar Limited. Traders from Nigeria are registered under this offshore regulation.

Exness Group is also licensed by the FSCA, FCA & CySEC.

Low Fees: The spread for the majority of CFD instruments starts from 0.3 pips, with an average for majors like EURUSD being 1 pip with Standard Account with maximum leverage of 1:2,000. Exness also charges swap fees for overnight positions.

Exness offers zero commission on trades with Standard Account. They have low spreads and commissions with Pro Accounts starting at $0.2 per lot side for Zero Account and up to $3.5 per lot (which makes it $7 for a round turn) on Raw Spread Account.

Exness does not have charges on deposits and withdrawals. Clients get the total of their deposits and withdrawals. Plus, they have the option to fund accounts & withdraw in Naira via local bank transfer without any extra fees.

Exness does not charge dormant account fees.

Trading Conditions: Exness is a MetaTrader-based CFD trading platform with MetaTrader 4 and 5, which provides standard and professional account types. The broker also has a swap-free Islamic Account offering. Exness has negative balance protection on all accounts to ensure you do not lose more money than your deposits.

Exness offers CFDs on multiple financial instruments including 99 currency pairs, CFDs on stocks and indices assets, cryptocurrencies, metals, and energies.

Traders can instantly fund their accounts with online bank transfers in Nigeria at zero fees. The minimum deposit amount is $10 with a maximum of $45,000, while $3 is the minimum withdrawal amount and a maximum of $12,000 per transaction.

Exness supports MT4 and MT5 trading applications which allows you to manage multiple accounts, place new orders, allocate lots across various accounts simultaneously and monitor real-time positions. The web trading platform is available on all devices, while the mobile app is available for download from the App Store and Google Play Store.

You can run your custom scripts for automated trading on their MetaTrader platform.

The app has a Margin Calculator that easily determines your margin size, swap rates, and pip values before placing a trade. It also has a converter to help you calculate the currency’s exchange rate. The Calculator is also available on their website.

The broker also has a proprietary Exness Trader that is available in both web and mobile versions.

Customer Support: Exness has customer support via email and live chat, as well as a knowledge base with information on how to navigate and use the website and app. The Exness customer support is available 24/7.

Read our complete Exness Review for detailed research of the 12 important points related to Exness.

Exness Pros

- Licensed by Top-Tier Regulators

- Accepts deposits/withdrawals via Nigerian banks

- No inactive account fees

- Offers commission-free trading

- 24/7 live chat support

Exness Cons

- Slow email support

- Has unlimited leverage, which means higher risk

- Has a limited range of instruments

#3 XM- Low Spread with Ultra Low Account

EUR/USD Benchmark:

1.6 pips on average with Standard Accounts

Trading Platforms:

MT4, MT5, XM App

XM was founded in 2009 & is considered a moderate-risk forex broker for traders in Nigeria.

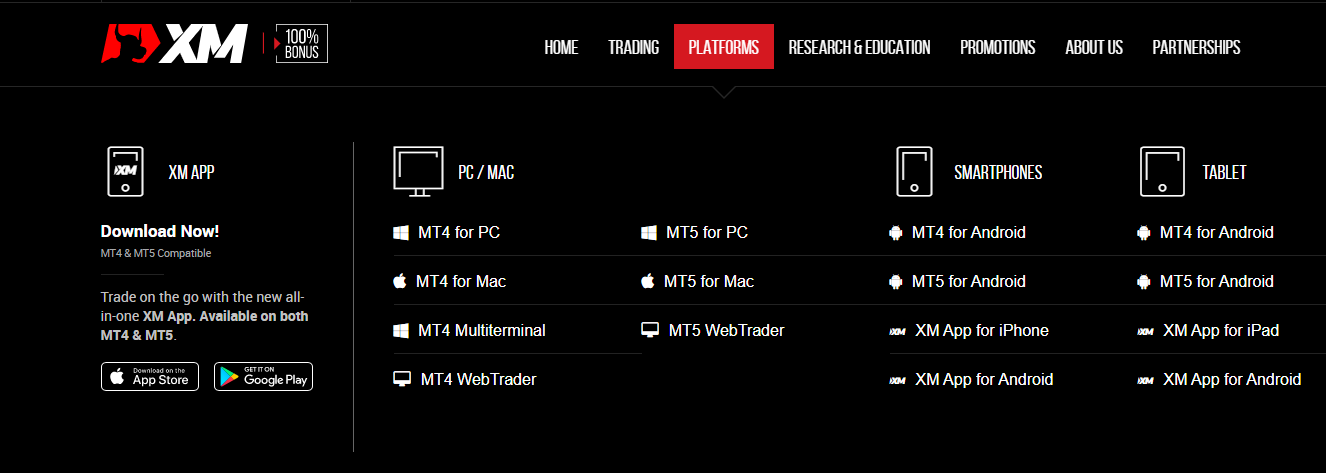

XM is one of the online Forex brokers offering standard MT4 & MT5-based apps for all devices (web, android, and iOS).

Safety of Funds: XM is licensed by the International Financial Services Commission (IFSC), Belize. Nigerian traders are registered under this offshore regulation in Belize as XM Global Limited.

Although XM Global Limited is regulated by a Tier-3 regulator, FSC Belize, their parent XM Group is regulated with ASIC & FCA, so they are considered a moderate risk forex broker with a medium trust score.

Fees: They have low spreads with Ultra-Low Account, starting at 0.6 pips with a maximum leverage of 1:1,000. Major currency pairs like EUR/USD has an average spread of 1.6 pips with Micro Account. Their overall trading fees are high as they have high Swap Fees for most instruments.

XM does not charge deposit and withdrawal fees, and no commissions for opening positions or closing them, except for shares trades which start from $1, with an average of $5.

The broker charges dormant account fees after 90 days of inactivity on your account. They charge $5 monthly.

Trading Conditions: XM has 4 trading account types and an Islamic account option that features zero swaps. XM has negative balance protection that prevents you from losing more money than you have in your XM account.

XM offers CFD trading on 1000+ financial instruments, including forex (55 currency pairs), CFD indices, stocks, commodities (energies and agriculture), futures, energies, cryptocurrencies, and metals.

Traders can make direct wire transfers to their trading accounts and have them credited within a few days. Cards and e-wallets (like Skrill, and Webmoney) deposits are credited instantly or within a few hours. The minimum deposit and withdrawal on XM is $5.

Withdrawals can be made via transfers to bank accounts and received within a few days or to cards and e-wallets and received within a few minutes.

XM supports transfers to local banks in Nigeria, although they don’t have Naira trading accounts.

Trading platforms supported by XM are MT4 and MT5 applications available on the web, desktop, tablets, and mobile devices as well as the XM App for mobile.

XM currently offers promotional bonuses of 50% deposits up to $500 and 20% up to $5000. They also give Free Virtual Private Servers (VPS) to traders who have deposited up to $5000 in their accounts.

Customer Support: XM has email, live chat, and international phone number support. You can reach them 24 hours Monday through Friday.

The education and research section of the XM website is very informative and helpful for new traders to learn from forex webinars, trade ideas, economic calendars, and tutorials among others.

Read our XM Broker Review for more information about the broker.

XM Pros

- Well regulated by Tier 1 and Tier 3 regulators.

- Accepts deposits/withdrawals to Nigerian banks.

- No commissions are charged on trades except for shares.

- Supports MT4 and MT5 trading applications on all devices (Android, Mac and PC).

- Offers negative balance protection.

XM Cons

- Charges dormant account fees.

- Customer support not available 24/7.

#4 Octa- Forex Broker with Low spreads

EUR/USD Benchmark:

0.9 pips on average with MT5 and MT4 Account

Trading Platforms:

MT4, MT5, Octa Trading App

Account Minimum:

$50 or ₦15,000

Octa is a forex broker that launched in 2012, offering Forex & CFDs trading.

Octa is a Forex broker that offers competitive spreads, flexible leverage, and copy trading. They offer Forex trading and CFDs on indices, cryptos, metals, and energies through MT4 and MT5 platforms.

Safety of Funds: Octa is licensed by two tier-2 regulator i.e. CySEC in Cyprus (their EU website) and FSCA in South Africa.

Octa is incorporated in St. Vincent and the Grenadines as Octa Markets Incorporated, and traders from Nigeria are registered under this regulation.

Fees: Octa spreads starts at 0.6 pips and 1:500 Leverage for currencies. Octa offers commission-free trading for all account types, as well as zero swap fees.

Deposits and withdrawals are free of charge on Octa. There are also no account inactivity fees.

Trading Conditions: Octa has two basic account types, MT4 and MT5 Accounts. The broker offers negative balance protection on both accounts to prevent you from losing more money than you have deposited.

Octa offers foreign currency exchange trading services on CFDs on 35 currency pairs (forex), indices, stocks, cryptos, metals, and energies through the MT4 and MT5 trading applications.

The platform supports transfers from Nigerian banks with a minimum deposit of ₦15,000 or $50 with cards. Deposits can also be made in cryptocurrencies like bitcoin, dogecoin, and a few others, which are credited within 30 minutes.

Traders can withdraw to Nigerian bank accounts, with a minimum withdrawal amount of ₦3,000. The minimum amount is $5 if you are withdrawing to Skrill and cryptocurrencies wallets.

Octa supports MetaTrader 4 and MetaTrader 5 trading software, available on web-platform (web-trader), desktop (Windows and macOS), and mobile devices (android and iOS). The Octa Trading App is available for iOS and Android devices.

Octa has online tools for analysis like market insights, economic calendars, converters, and calculators. The platform has educational resources for traders in form of webinars, articles, and video tutorials along with 24/7 live chat support for traders.

Customer Support: Octa has two customer support options for traders, our team tested the live chat and email support. Their email and live chat support are available 24 hours Monday through Sunday.

Read our in-depth Octa Review for full details of our research on this broker, which includes 12 important comparison factors.

Octa Pros

- The Customer support at Octa is good & is available 24/7.

- Supports deposits & withdrawals in Naira via Bank transfer.

- Octa does not charge any extra commission with their accounts.

- Platforms are available across all devices.

- They have a currency converter on their website to see the exact amount that you will pay in Naira.

- Has the availability of Copy Trading, and auto trading via Expert Advisor (EA) and cBot.

- Offers swap-free trading.

Octa Cons

- Octa is regulated by one Tier-2 regulator i.e. CySEC. Traders from Nigeria are registered under Offshore regulation.

- Total number of CFD Trading instruments are relatively few compared to other brokers.

- Only USD & EUR base account currency options are available. There are no Naira accounts.

#5 AvaTrade – Well Regulated Forex broker with Fixed Spread

EUR/USD Benchmark:

0.9 pips on average with MT4/MT4 Accounts

Trading Platforms:

MT4, MT5, AvaTradeGo App, AvaTrade WebTrader

AvaTrade is an online forex and CFD broker that was established in 2006 as AvaFX.

AvaTrade is an online CFD & forex trading platform that supports the MT4, MT5, and AvaTradeGo mobile trading platforms for iOS and Android.

Safety of Funds: AvaTrade is licensed by a Tier-1 regulator – ASIC and 2 Tier-2 regulators – FSCA and Japan FSA. So they are considered low-risk and have a high trust score.

Traders from Nigeria are registered under ‘Ava Trade Markets Ltd’, regulated by BVI Financial Services Commission, which is an offshore regulator in the British Virgin Islands.

Fees: CFD Trading at AvaTrade is commission-free, and there are no deposit or withdrawal fees. Spread accounts are fixed with a competitive spread. The benchmark spread is 0.9 pips for pairs like EUR/USD with maximum leverage of 1:400. But their Swap fees are not the lowest.

When there is no trading activity in your account for 3 months, AvaTrade will charge you an inactivity fee of $50 and this fee will be recurrent after every 3 months of inactivity.

Trading Conditions: AvaTrade offers only one account for traders along with Islamic account options and a negative balance protection feature is available.

They have no Naira accounts, and Nigerians can choose USD, GBP, or EUR as their base account currency.

AvaTrade broker offers their customers a range of markets to trade, including CFDs on assets like stocks, cryptocurrencies, forex (55 currency pairs), commodities, bonds and treasuries, ETFs, FX options, metals, energies, and indices.

You can start trading with a minimum deposit of $100. Deposits with cards are credited instantly. The minimum withdrawal on AvaTrade is $1 for cards and e-wallets while wire transfers require a minimum of $100.

AvaTrade supports MT4 and MT5 trading applications and their own proprietary trading applications AvaWebTrader and AvaTradeGo App all of which are available on both desktop and mobile devices.

AvaTrade also has a social trading app (AvaSocial) that supports trade copying by allowing new traders to chat with expert traders and benefit from their expertise by copying their trades. They also support DupliTrade and ZuluTrade.

AvaTrade app features a user-friendly design, offering trading tools to newbies and experienced traders alike. Regular news updates, useful e-books, video tutorials, indicators, and educational materials are available on the platform for those who are just diving into the world of online forex trading.

There is no local bank deposit/withdrawal for Nigerians. And the withdrawals are also slow as reported by multiple users.

AvaTrade is currently running a referral promotion that allows you to earn cash rewards by referring a friend. The amount you can earn depends on your friend’s initial deposit. If your friend deposits between $500 to $2,000, you can earn up to $50, and up to $250 if they deposit up to $20,001. However, your friend must open a minimum-sized trade after opening their account to receive your reward.

Customer Support: Their chat, phone & email support is only available during the company’s European business hours. They have a Nigerian phone number for support but that is available during business hours only. They have Frequently Asked Questions on their website to answer many questions traders may have regarding their services.

Read our AvaTrade Review for more details on AvaTrade Nigeria.

AvaTrade Pros

- Regulated by one Tier-1 Regulator.

- AvaTrade has negative balance protection.

- Offers wide range of CFD trading instruments.

- Has multiple platforms and supports copytrading.

- Offers commission-free trading.

AvaTrade Cons

- No NGN Accounts.

- No deposits/withdrawals to Nigerian bank accounts.

- Slow customer support.

- Customer support is not available for 24 hours on any day.

#6 FXTM- Well Regulated Forex Broker

EUR/USD Benchmark:

1.9 pips on average with FXTM Micro Account

Trading Platforms:

MT4, MT5, FXTM Trader

Account Minimum:

$10 or ₦10,000

The FXTM brand was founded in 2011 and offers Forex & CFDs trading services.

FXTM offer over 250 trading instruments, including CFDs for commodities, shares, cryptocurrencies, metals, indices, and around 59 currency pairs.

Safety of Funds: FXTM is registered as ForexTime Limited in Cyprus and is well-regulated by CySEC, FCA, and FSCA. Clients in Nigeria are registered under their company Exinity Limited in the Republic of Mauritius and regulated by the Financial Services Commission (FSC) in Mauritius.

High Fees with Micro Accounts: The average spread fee is around 1.9 pips for a major currency pair like EURUSD with a Micro account, which is relatively higher than most brokers. Maximum leverage on FXTM is 1:2,000.

Advantage account holders are charged spreads from 0 pips plus a $4.88 commission on trades with Majors.

All account types on FXTM have swap-free options, except for those who want to trade exotic currency pairs.

There are zero deposits or withdrawal fees on FXTM, although the broker charges inactive account fees of $5 monthly after 6 months of your account being dormant without any trade or if you do not login.

Trading Conditions: FXTM has 3 account types, Micro, Advantage, and Advantage Plus Accounts. All account types have negative balance protection to ensure you do not lose more money than the balance in your trading account.

FXTM offer over 1,000 trading instruments including CFDs on commodities (energies and metals), indices, FX Indices, stock baskets. They also offer stocks trading and has 60 forex pairs on offer.

FXTM supports bank transfers in Nigeria, e-wallets, and cards for deposits. The minimum amount of deposit is ₦10,000. The minimum withdrawal amount is ₦1,000.

The platform has multi-platform support, meaning you can trade on the web or use their mobile apps available on iOS and Android devices via the FXTM Trader or MetaTrader 4 & 5.

FXTM provides loyalty cashback bonuses to their traders from time to time. These loyalty bonuses can be withdrawn to your bank account if you reach the target amount.

Customer Support: FXTM also offers a range of education resources on their website, and 24/5 customer support via live chat, email, and Nigerian phone numbers. This includes personal account managers, who can assist and offer you priority support for issues.

FXTM has offices in Lagos, Abuja, and Port Harcourt. Occasionally, they hold physical seminars and webinars to educate traders, asides from the educational resources on their website.

Read our FXTM Review for in-depth research on FXTM broker.

FXTM Pros

- Accepts deposits/withdrawals to Nigerian bank accounts.

- Licensed by 3 Top-Tier regulators.

- Has easy to navigate website.

- Fast processing of deposits and withdrawals.

- Offers referral bonus.

- Has offices in Nigeria.

- Negative Balance protection is available.

- Offers NGN base account currency.

FXTM Cons

- Customer support not available 24/7.

- Charges withdrawal fee for some methods.

- Charges account Inactivity Fees.

#7 FBS- Forex Broker With MT4 and MT5 Platforms

EUR/USD Benchmark:

0.9 pips on average with FBS Standard Account

Trading Platforms:

MT4, MT5

FBS is an online Forex broker that launched in 2009. They offer CFDs and Forex trading solely through the MetaTrader platform..

FSB is an online CFD broker that provides floating spreads and flexible leverage on CFDs for Stocks, Forex (28 currency pairs), Indices, Energies, Metals, and Forex Exotics.

Safety of Funds: FBS is regulated by one Tier 1 regulator (ASIC) and two Tier 2 regulators (FSC Belize, and CYSEC). However, when you open an account with FBS, it will be registered under FSC Belize where FBS is licensed as FBS Markets Inc. with license number 000102/6.

Fees: FBS offers a floating spread that starts from 0.7 pip, and a flexible leverage of up to 1:3000 on their standard account. They charge no commission and do not have any fees for deposits and withdrawals.

Swap-free trading is also available on the Islamic account, but typical swap fees applied for EUR/USD on the standard account are -5.46 swap long and 0.61 swap short. FBS also does not charge any inactivity fee.

Trading Conditions: FBS offers Standard accounts with USD and EUR account base currency to Nigerian clients, the minimum deposit for this account is $5, however, FBS recommends that you deposit at least $100.

You can deposit funds into your trading account through Local bank transfer, Perfect money, and Cryptocurrencies. Withdrawals are available through local bank transfers, Perfect money, cryptocurrencies, MasterCard, Visa Card, Skrill, and SticPay.

MT4 and MT5 are the trading platforms available on FBS and they are accessible on Android, iOS, macOS, Windows, and Web.

On the official FBS website, you can access trading tools like the Economic calendar, Trading calculator, and currency converter.

They also offer analytics tools like Market Analytics and VIP analytics on the website. To qualify for VIP analytics, you must make a cumulative deposit of at least $500. Once you are eligible, you will get exclusive market analytics for the next 30 days. After 30 days, your trading activities will be reviewed and if you have not deposited up to $500 and opened at least one trade within the last 30 days, you will be disqualified.

Customer Support: You can reach FBS customer support via live chat or call back. Customer support agents are available 24/7. However, every time we try FBS live chat, there is always a long queue and you may need to wait for up to 5 minutes before a customer support agent speaks to you.

FBS Pros

- Supports local bank transfer.

- Licensed by Tier 1 and Tier 2 regulators.

- Cryptocurrency is available for deposit and withdrawal.

- MT4 and MT5 trading platforms are accessible on all devices (Andriod, Apple, Mac, and PC).

- No inactivity fee.

- Customer Support is available 24/7.

FBS Cons

- Copy trading is not available.

- No Proprietary trading platform.

- No NGN account base currency, only USD and EUR accounts are available.

- Slow customer support.

What is a Forex Broker?

A forex broker offers brokerage services to retail and professional traders who want to speculate on currency pairs & other markets as CFDs, by going long (buy) or short (sell).

A forex broker could be a market maker which means they could be taking the opposite sides of your trades or a no-dealing desk broker that connects you to buyers/sellers through their liquidity providers via computerized networks.

How to Choose the Best Forex Broker

Forex trading in Nigeria is unregulated & it is carried out through online platforms. Today, a broker is just a click away. This situation has led to the proliferation of Forex brokers consisting of the good, the bad, and the outright scam brokers.

If we rope the scam Forex brokers with those that abide by the rules, we commit a fallacy of generalization. Hence, we have carefully created this list of questions that you must ask when choosing a Forex Broker.

1. Is the Forex Broker regulated by multiple Top-Tier Regulators?

As Nigerian online traders, one understanding we must have is that no rules and regulations are guiding the activities of online Forex brokers in Nigeria. The average Nigerian Forex trader is not protected by any government agency in Nigeria in case of any dispute with unlicensed brokers.

This brings us to the idea of international regulators and registration. We have global Tier-1, Tier-2, and Tier-3 regulators.

Global Tier-1 regulatory licenses such as the ASIC, FCA, CFTC, etc are more complex and expensive to acquire, hence are more important and offer greater protection than others.

Tier-2, Although still important, is not compared to those Tier-1. These include regulations like FSCA, DFSA, CMA (Kenya), etc.

Tier-3 usually deals with offshore countries in the Caribbean such as Belize, St. Vincent & Grenadines, etc where financial laws are very lax.

An online trader needs to ensure the broker is registered with at least a Tier-1 regulator to protect his/her investment. Else, the losses might not come from your ignorance of the instrument traded or market dynamics but from an unregulated broker.

It is not enough for a broker to post on their website they’re registered with this and that regulator. Some might manufacture a number and use such to hoodwink gullible investors.

There is a way to verify if truly these brokers are registered under the regulator they claim.

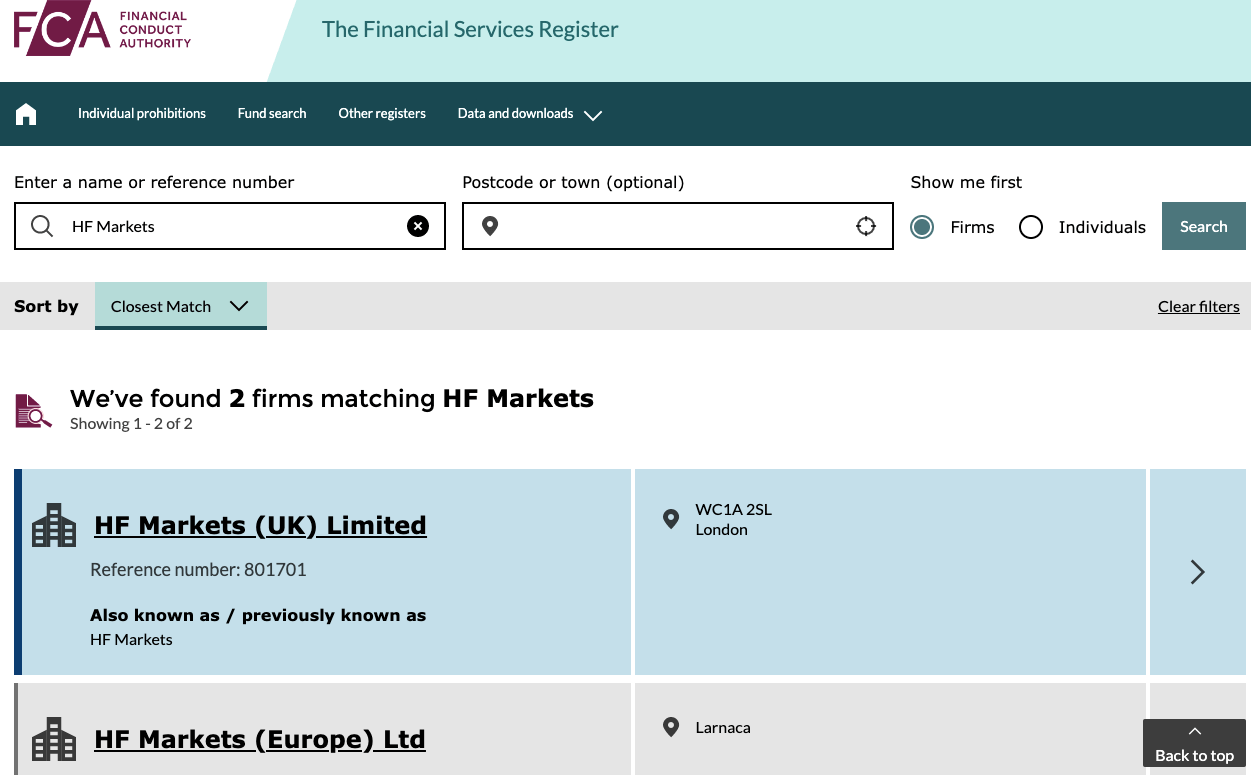

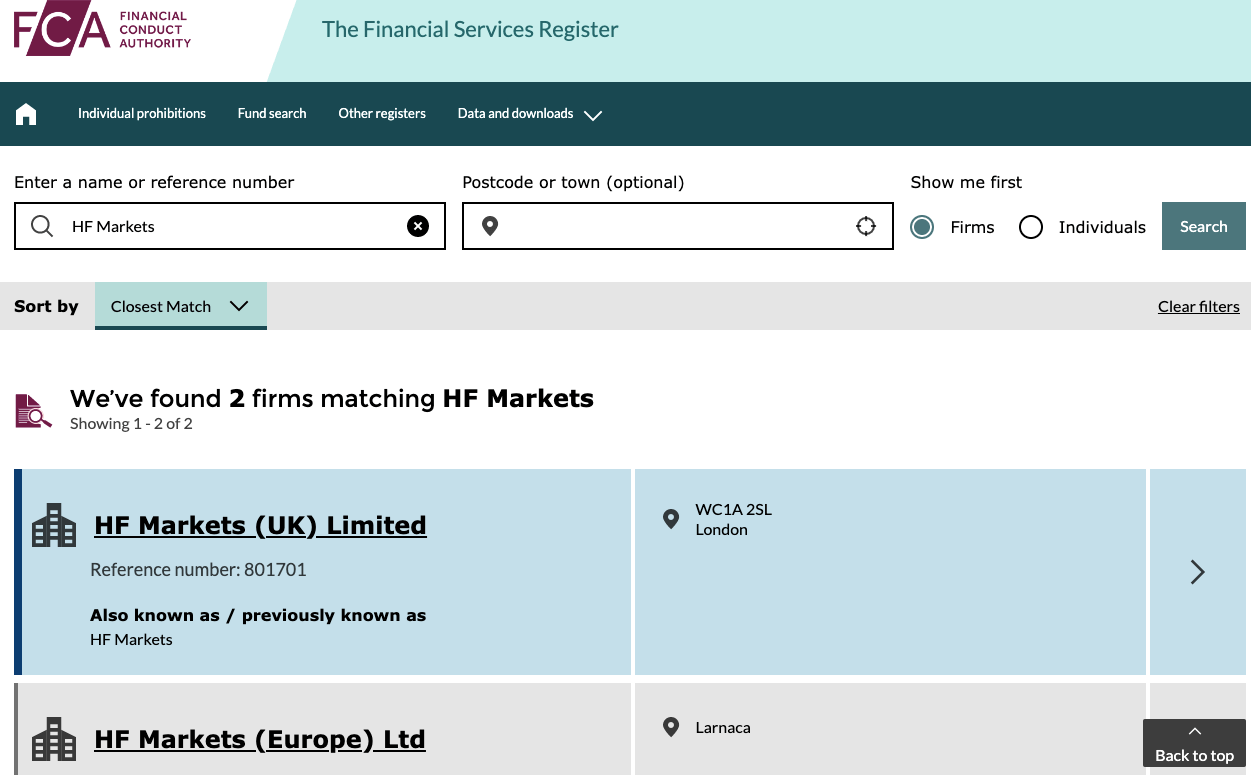

In this example, we will verify the broker’s regulation with FCA. This is a Tier-1 regulator, and it is considered safe for traders based in Nigeria to signup with forex brokers that are regulated by Tier-1 regulations. This is because the regulators usually mandate the brokers to segregate deposited client funds from operations funds, aimed at protecting client funds. This however does not reduce the risk of losing your money when you trade with it.

Let’s see the general steps involved.

Go to the website of the financial service register of the financial conduct authority. There they have a list of all financial service activities and the firms that are registered with them.

You can also search for yourself to confirm, from the FCA Register for example.

Below is a step-by-step guide to confirming the status of your forex broker.

-

- Check for the presence of the firm on the FCA register at .fca.org.uk/s/

-

- Confirm if the firm has the same right to offer the services you are offered.

-

- Confirm the contact details on the register and those on their website if they match especially the broker’s license number.

- Check whether you’re protected by the service being offered.

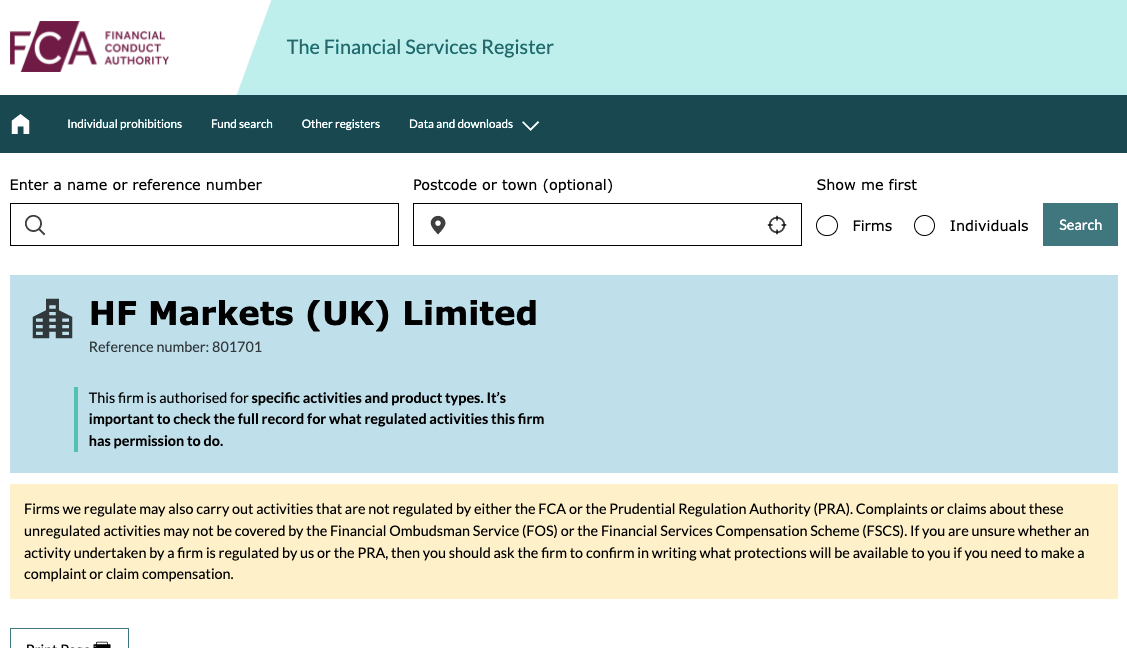

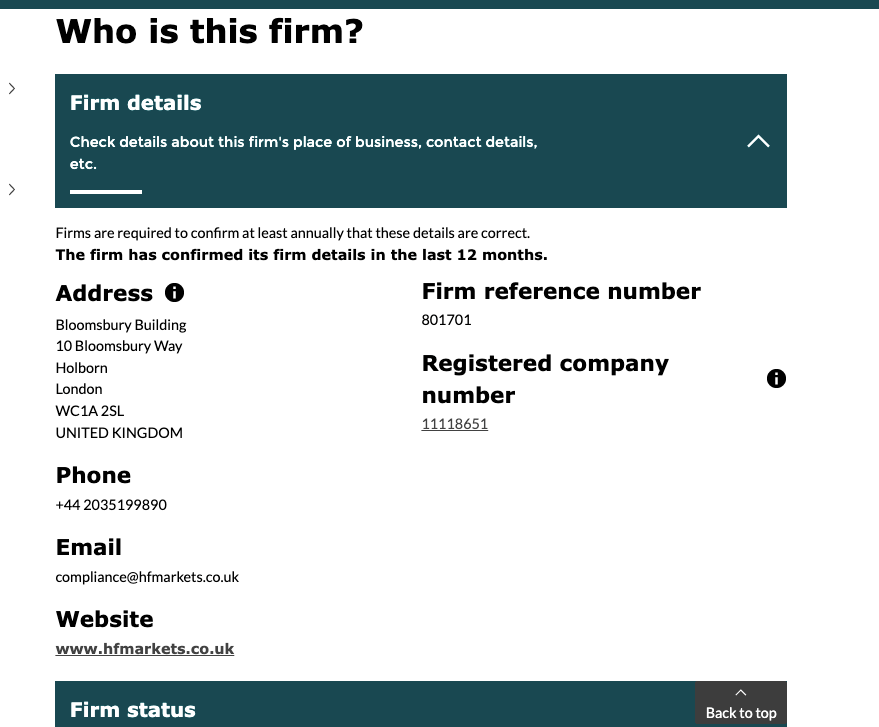

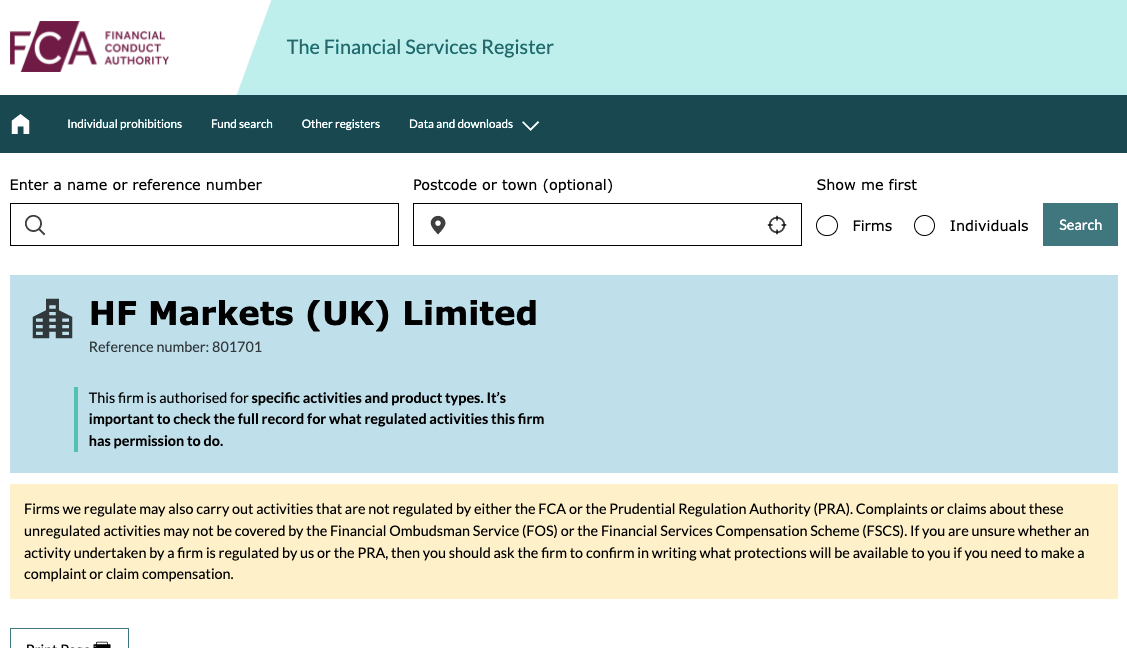

The above is the example of verification of “HF Markets (UK) Ltd.” which is the company of HF Markets Group. Similarly, you can verify the license no. of the broker with other regulatory bodies. All the regulators have a public search to verify the license number.

Since there is no regulation for retail forex brokers in Nigeria, make sure to choose a broker that multiple top-tier regulators authorize. This will ensure that your funds are protected.

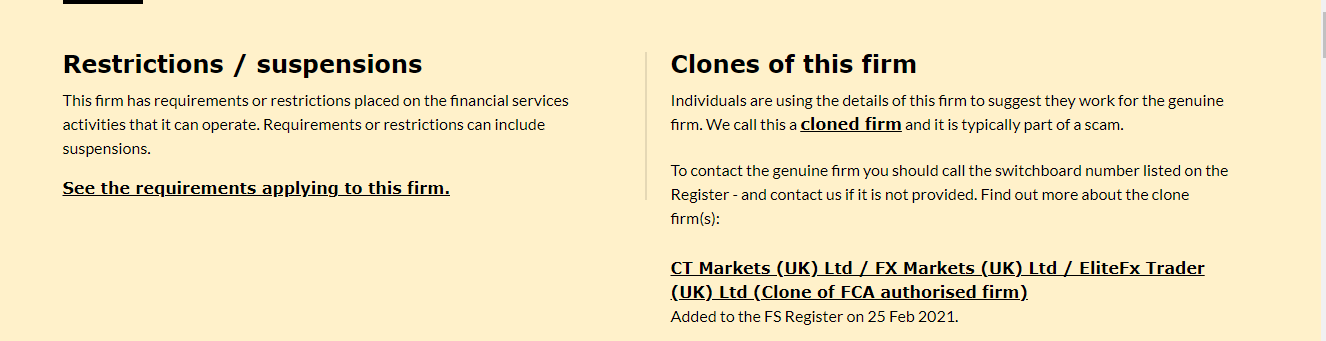

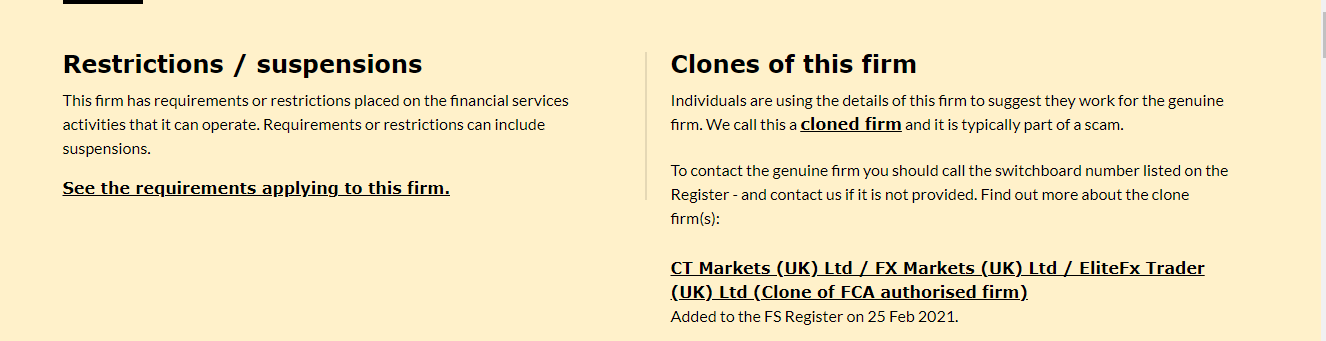

Here is an extra note of caution. If you are checking a forex broker’s regulation on the FCA website, you want to make sure you note clone firms. Clone firms tend to use details close to the original broker’s details. Clone brokers are scammers and can dupe unsuspecting traders.

So, after confirming a broker’s regulation on the FCA website, take time to check if there are clones of the firms too. How do you clone firms? It’s simple. You only need to scroll further down the page that displays the broker’s FCA regulation.

Here is a screenshot of how the clone firms are displayed

Finally, you should know that forex brokers operating in Nigeria do not register Nigerian traders under their tier-1 and tier-2 licenses. You will likely be registered under their tier-3 licenses (usually offshore regulations). Offshore regulators only place mild restrictions on forex brokers.

This is why you should choose CFD brokers with tier-1 licenses with the FCA (UK) or ASIC (Australia). Only such brokers can be considered low-risk.

2. Is the Trading Fees Low & Transparent?

A forex trader should also look into the overall trading fees, which include the spreads, commission charged by the broker, and deposit and withdrawal charges when deciding on a broker to use as these charges can eat deeply into one’s funds and profits.

Some brokers also charge for dormancy in accounts between 3-6 months.

We break down the fees charged by forex brokers in Nigeria into 2 components:

a. Trading Fees: These are the fees that you will have to pay for actual trading. It includes the spread & commissions per lot.

Depending on your Account type, you may be charged commissions. For example, if you are trading via Premium Account at HF Markets, there are no extra commissions per lot. The only fee you will be charged is the variable spread. This depends on the instrument that you are trading.

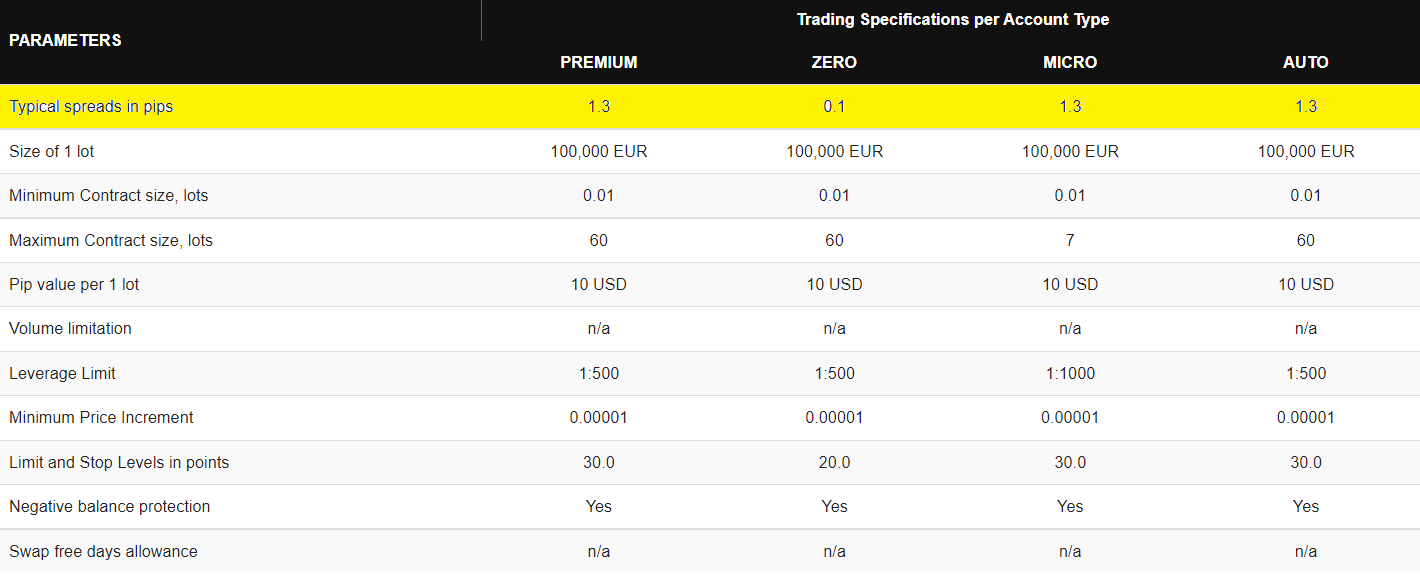

For example, on average, HF Markets charges 1.3 pips spread for majors like EUR/USD with Micro & Premium Account types, But HF Markets also has a Zero Account type, with which you will have to pay near 0 pips spreads, but there is an extra commission of $6/lot for majors.

Here is an example of the spread for EUR/USD at HF Markets with their various account types.

As you will notice, the spread with Zero Account is lower at 0.1 pips, compared to 1.3 pips with other accounts. In return, there is an extra commission of $6/lot with the Zero Account at the HF broker.

But if you calculate the overall trading fees, it is lower by almost 40% with the Zero account compared to their other accounts. So, you should choose the commission-based & low-spread account type for lower trading fees.

b. Non-Trading Charges: These include other charges like withdrawal fees and inactivity fees. Some brokers can charge a lot of money with this type of charge.

Also, ease of funding one’s account should be a factor when considering a broker. Some brokers do not accept payment from or withdrawals from Nigerian banks. While some do, it usually comes with charges either from the bank, from the broker, or both in some cases.

3. Suitability of Trading Platforms

The user interface of the broker’s platform is also important when deciding on the broker to use. Some brokers’ platforms either web or app, have poor user interfaces, some come with ads, and so on. These can slow down the execution of trades.

Online trading is a fast-paced business where every second is important. Entering or leaving a trade one second late can be very costly. It is also important the platform is compatible with different devices such as Android, Mac, etc.

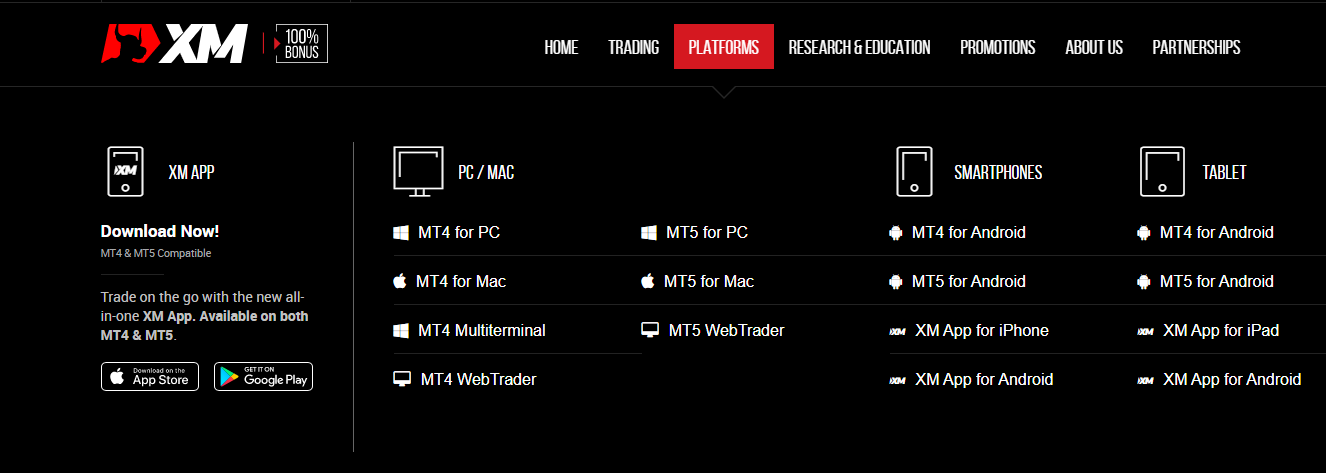

Here is how to check the platforms available with your forex broker. We will use XM as our example. First, you go to their homepage and click ‘PLATFORMS’ (highlighted red)

At a glance, you can see the different platforms with XM and the devices they support. You can see MT4 and MT5 which are available on PC (Mac and windows). The platforms are also available on smartphones, and tablets and work well on Android and iOS systems.

In addition, the XM trading app is also available on both systems. While MT4 and MT5 are third-party platforms, the XM trading app is owned by the broker. This is how most brokers operate, supporting their own app and third-party platforms.

4. Trading Conditions

Perhaps the most important factor a Nigerian trader should consider when choosing a broker should be the trading conditions.

Such trading conditions include the availability of naira accounts, a policy on negative balance protection to check against huge losses due to volatility, whether brokers have quick order executions, the number of instruments traded, leverage, etc.

5. What is the Percentage of Losing Traders?

Remember that forex trading is not regulated in Nigeria. However, if you choose a broker that is regulated in the UK, you can check the percentage of traders that lose with the broker.

This factor is important because there is an industry benchmark of around 75% for losing traders. If a forex broker has a percentage higher than this, then something could be wrong. So, how do you check it? Go to the UK version of the broker’s website. You will find the percentage in the header of the website. That is where most brokers display it.

If you don’t find it there, then scroll down to the footer. Brokers like AvaTrade display it at the footer

6. Is the Support Readily Available?

Brokers should always have a reliable support system as traders will always have complaints and problems. This system should be fast as in some cases, money is on the line.

One way for traders to know the effectiveness of the broker’s support system is by trying them before registering.

For Nigerian traders, always check if brokers have a Nigerian number as that will ease communication when support is needed. Live chat is also important.

Some brokers might also have personal account managers that you can reach out to. From our research, we know HF Markets is one such broker.

7. Other trading conditions

a. Order types: Varying order types help give you options in the market. Limit and stop orders can come in handy in entering the market at the right time and price. Your chosen broker must have these orders available on their platform.

Guaranteed stop-loss orders close your trades at specified prices. This order is executed regardless of market conditions. It is important your broker has this service in place because it is key for risk management. In addition, GSLOs are not free. So check with your broker to know if they have it, and much they charge for it.

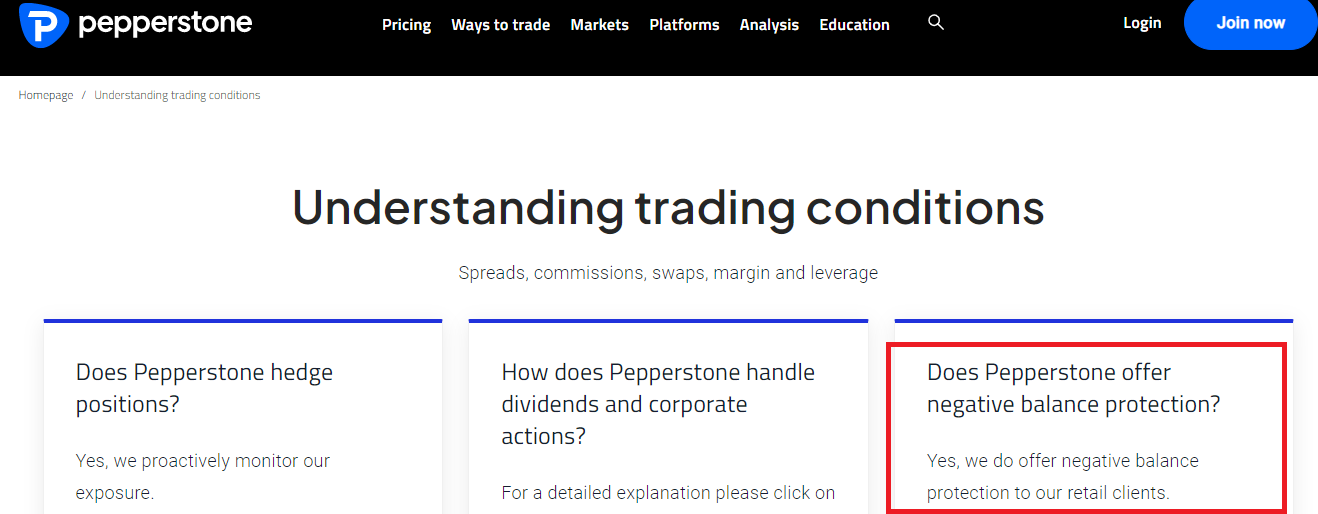

b. Negative balance protection: Without negative balance protection, you can lose more than the funds in your trading account. There is no local regulatory body that mandates forex brokers to offer negative balance protection in Nigeria. However, if the broker is regulated by African regulators like the FSCA (South Africa) and CMA (Kenya), they likely offer it.

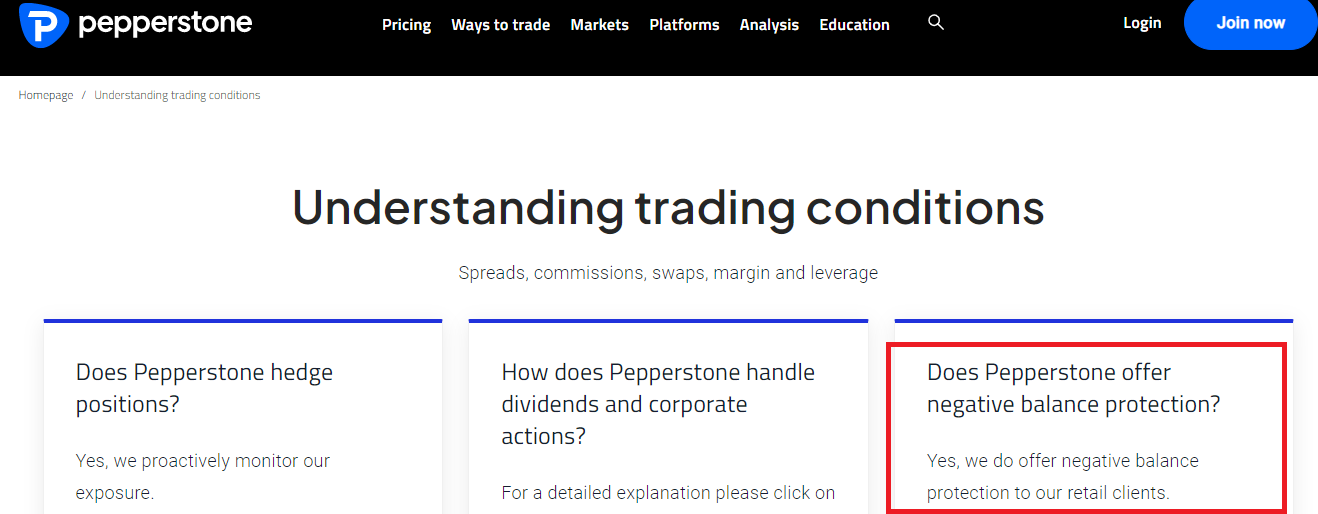

You can even confirm with your broker if they provide negative balance protection. By contacting their support, you can verify. However, some brokers have FAQs on their websites. You can use it to verify if they have this risk management tool without waiting for an email or live chat response.

Here is an example on Pepperstone’s website

c. Deposit/Withdrawals:

c. Deposit/Withdrawals: Quick processing, multiple deposit/withdrawal methods, and low charges are the factors to keep a close eye on here. You should also be able to deposit and withdraw through your local bank. Most forex brokers do not charge extra fees for deposits/withdrawals. However, you can incur charges from your bank or e-wallet providers. Your broker does not receive any of these fees.

Summarily, what you want here is a broker with fast processing with little to no fees. In conclusion, you should be able to deposit in Naira. A naira base currency account is not too popular in Nigeria so your money will be converted to the currency you choose. Most traders in Nigeria prefer the US dollar as their account’s base currency.

d. Education: Education is key. A forex broker should be friendly to beginners. Structured online courses, webinars, articles, and free research tools a forex broker should offer. These should be offered free of charge without extra costs.

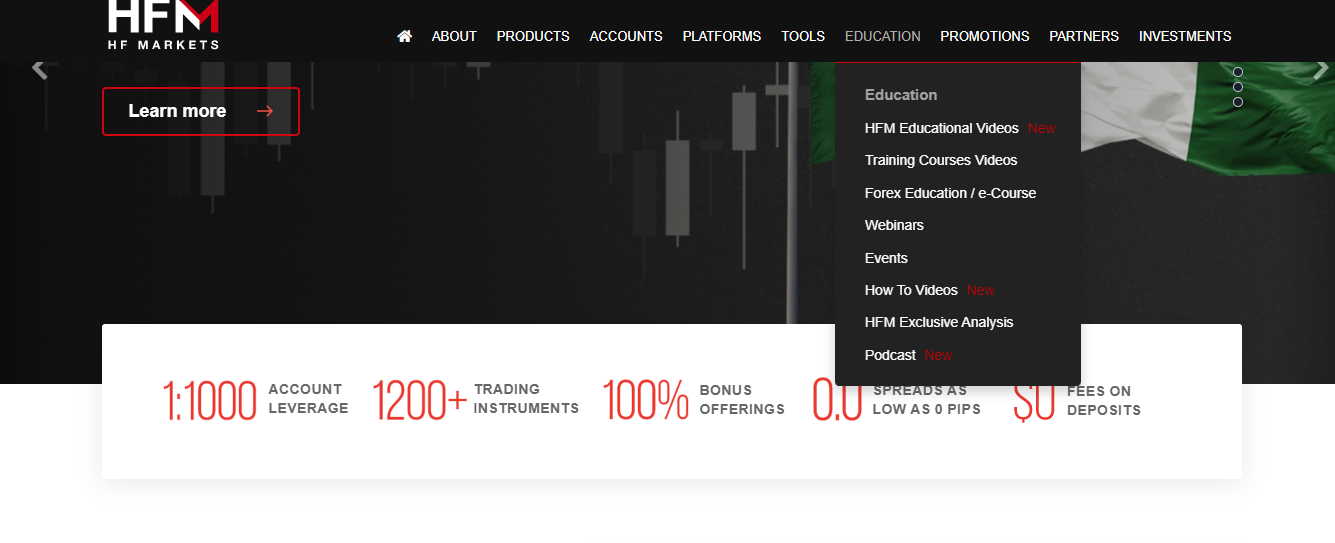

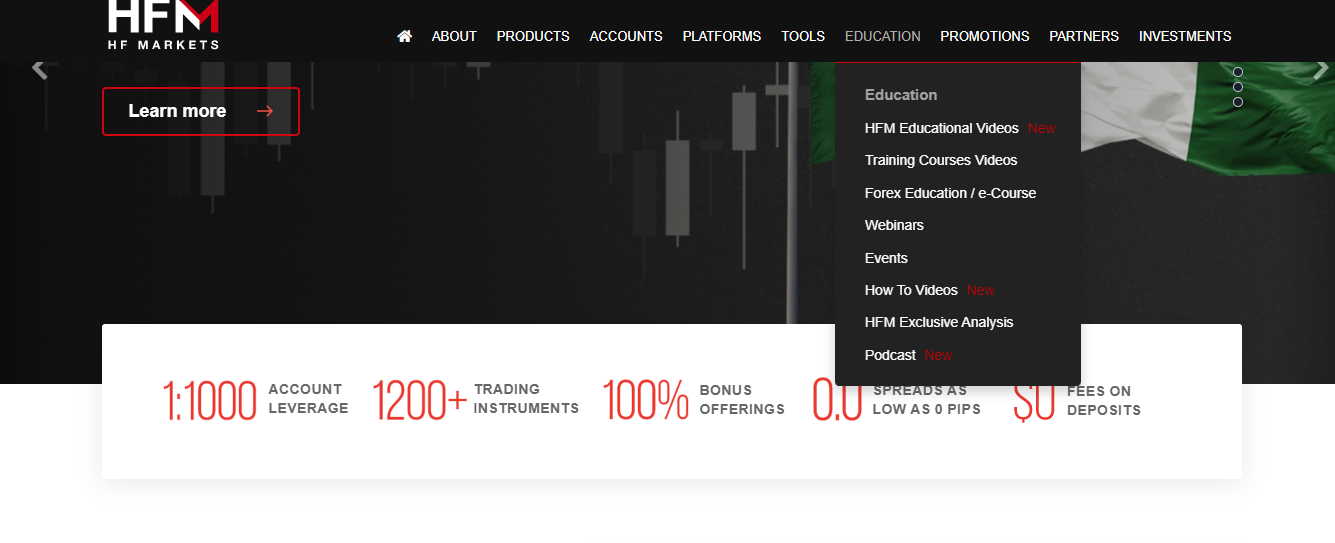

Finding a broker’s education is easy. It is usually on their homepage. With a few clicks, you can access quality courses for your learning. Let us show you how you can do this (HF Markets is our example). On HF Market’s homepage, click on ‘Education’ (underlined red). Here is an illustration below.

From the image, you can see that HF Markets has webinars, tutorials, podcasts, forex e-course, educational videos, etc. You can use any of these resources to expand your knowledge about forex and CFD trading.

How to open Account with a Forex Broker?

To start trading, you need to open a live trading account with a forex broker.

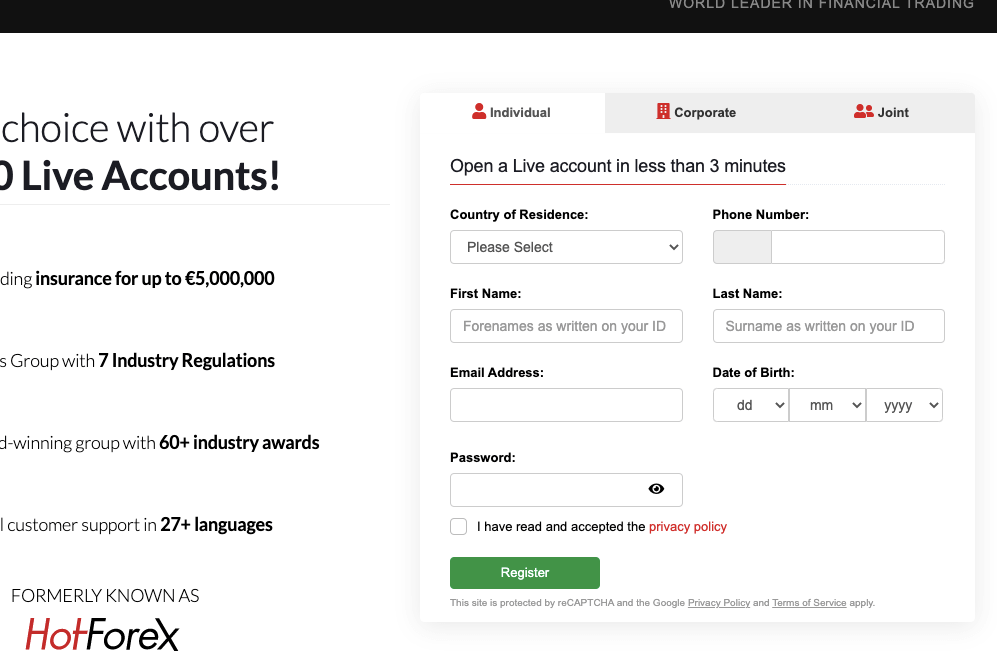

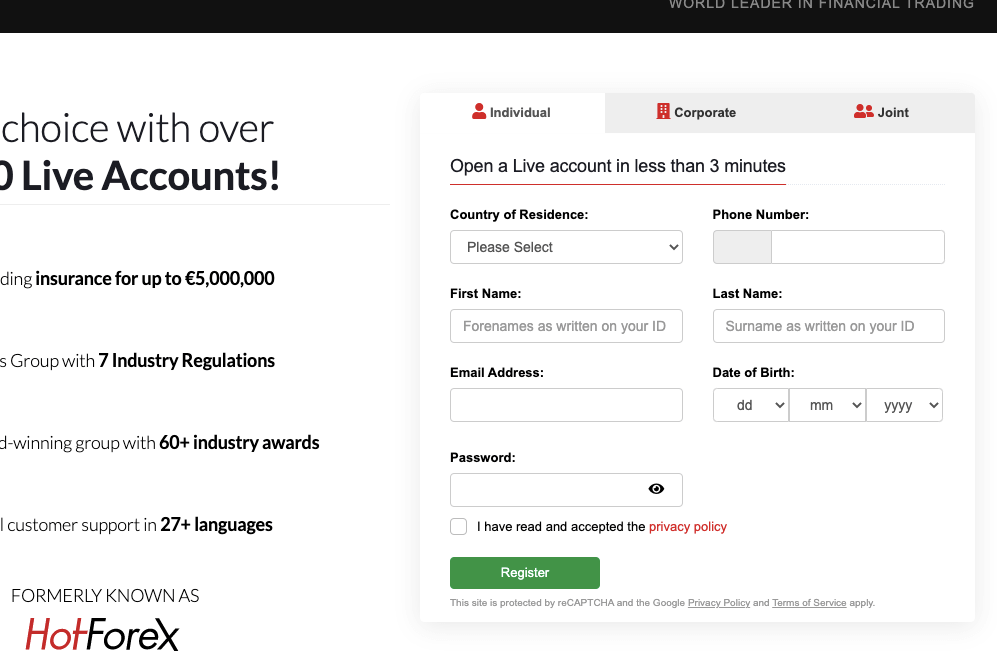

Follow the steps below to open an account with a forex broker in Nigeria, where we will use HF Markets (HotForex) as an example. Generally, the steps involved as the same with each broker, so you can follow these generic steps as references.

Step 1) Go to the HF Markets website at www.hfm.com and click on the ‘Open Live Account’ button, highlighted in green colour, at the top right side of the page.

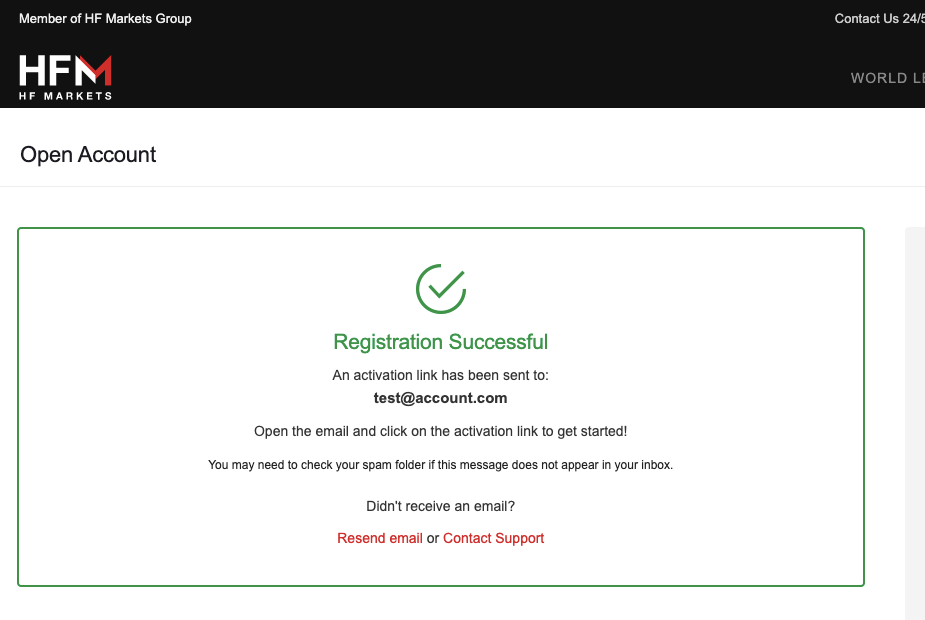

Step 2) Select the client type, either as an individual, corporate or joint, then fill in your information, create a password, select Nigeria as your country of residence, check the terms and conditions box after reading, and click on register.

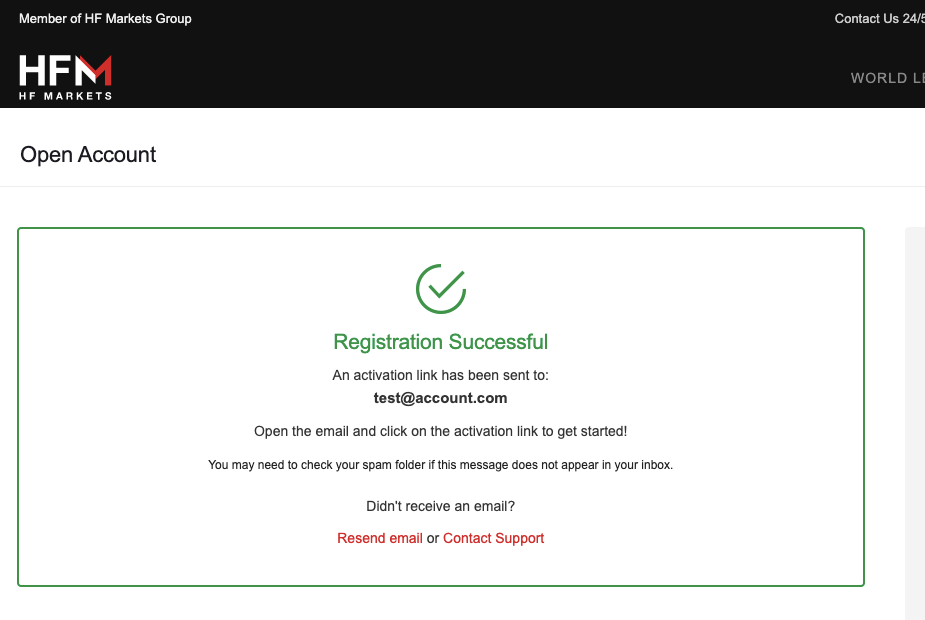

Step 3) A verification link will be sent to your email address. Go to your email inbox and click the ‘Activate Account’ link to continue with your registration.

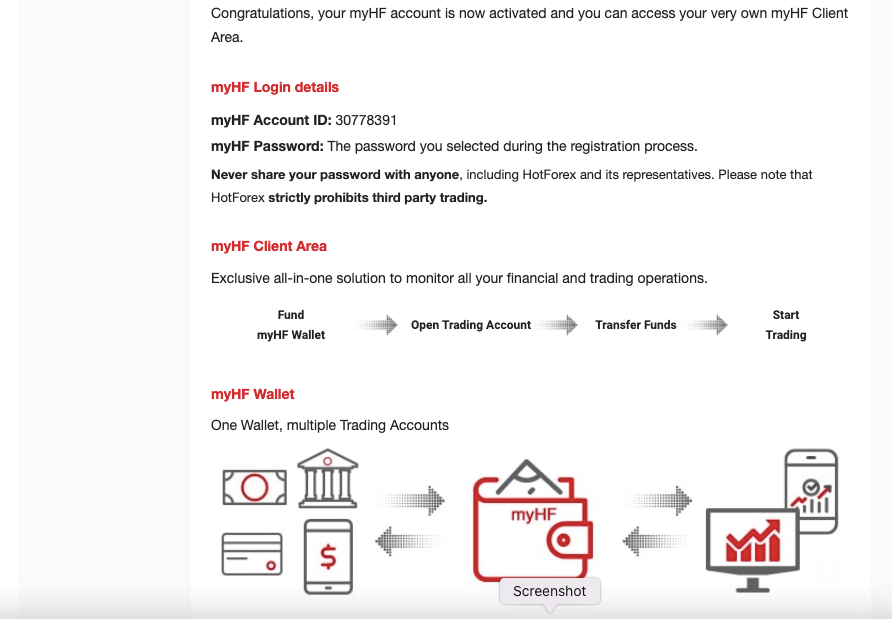

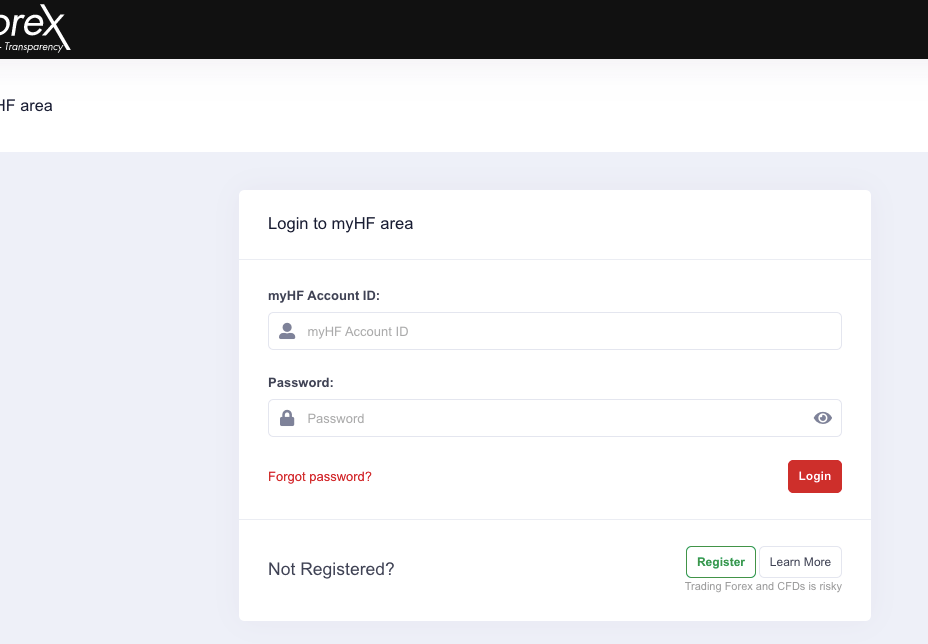

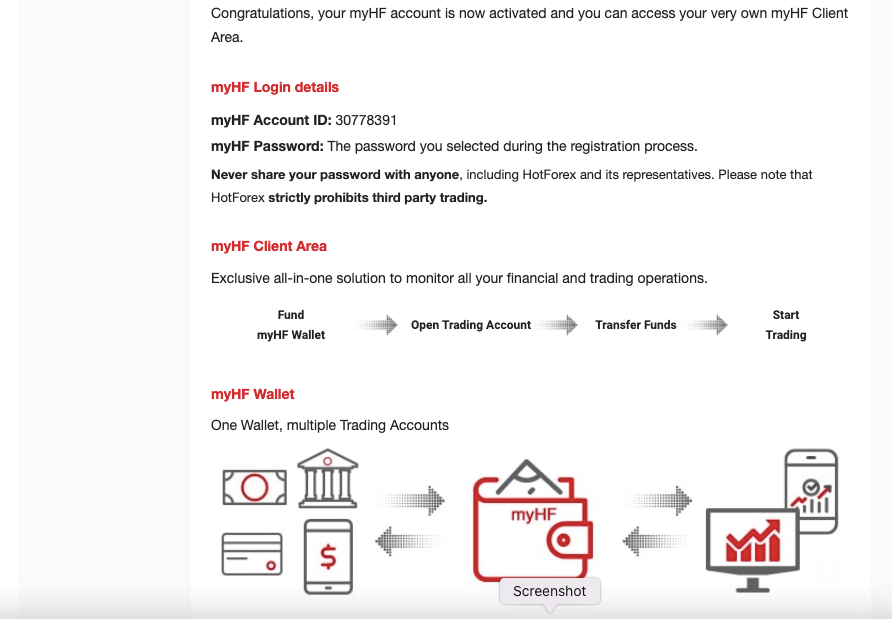

Step 4) You will get a confirmation email with your ‘myHF account ID’ after the account is activated.

Step 5)

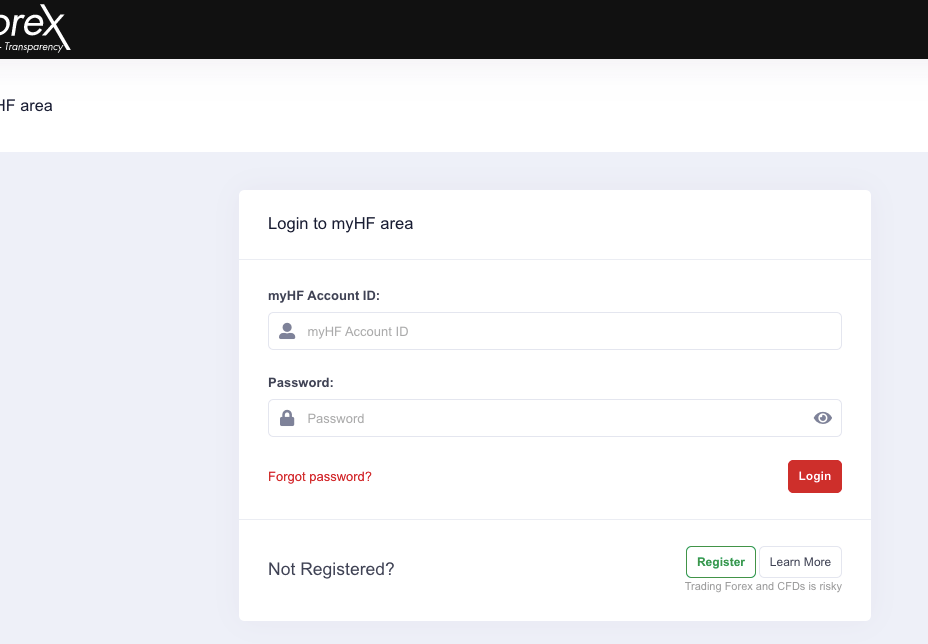

Step 5) Now you can proceed to login, and on your dashboard, you will be required to complete registration/profile by supplying some personal and economic information, including your experience level with Forex trading.

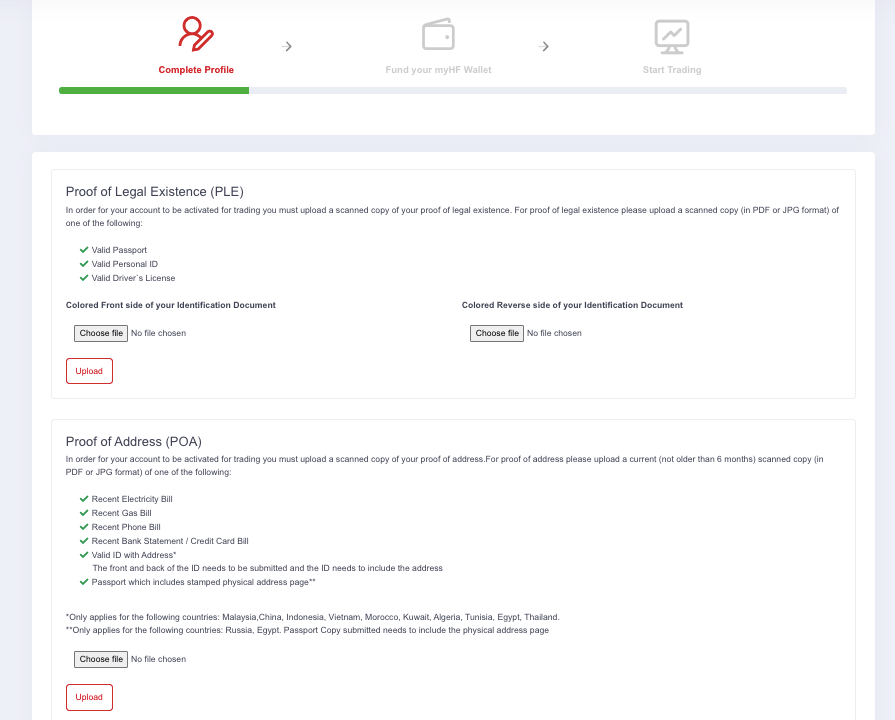

Step 6)

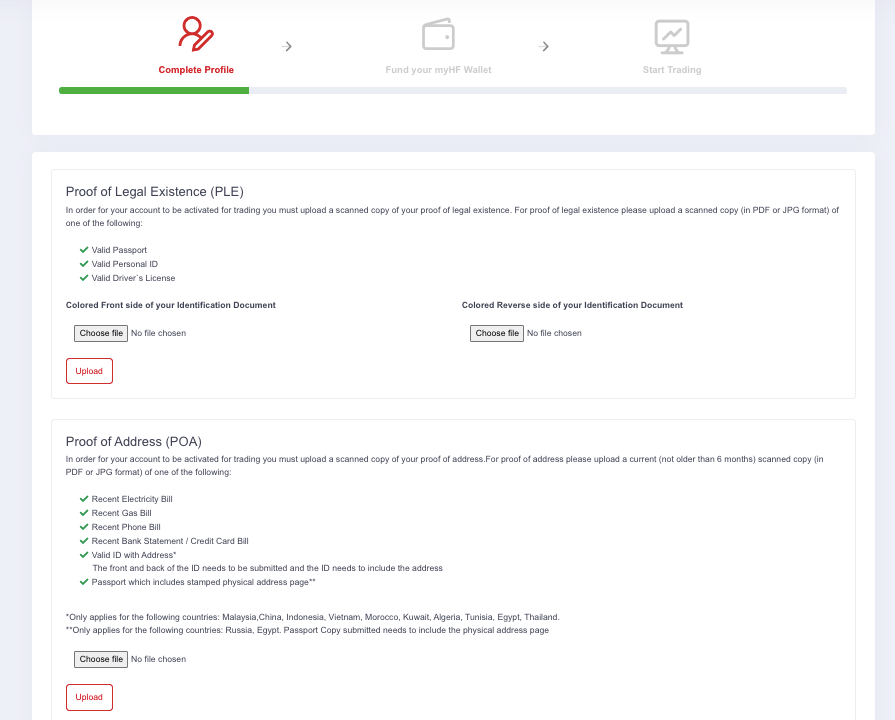

Step 6) Next, you will be required to upload a valid ID to verify your identity and a proof of address to verify your address. Then wait for the approval.

Step 7)

Step 7) After your account is approved, you can make deposits, start trading, make transfers and withdrawals.

Note that if your account is not approved, you can only make a limited amount of deposit, and you cannot withdraw any money.

Although HF Markets was used for this example, the process and requirements to open an account with a forex broker are about the same for all brokers.

What is a forex broker?

A Forex broker, also known as a foreign exchange broker or FX broker, acts as a middleman between you and the massive, global market for trading currencies.

Here’s what they do:

They provide access to the Forex market:

Think of them as your gateway to buying and selling different currencies.

They offer trading platforms where you can execute your trades and monitor currency prices.

They facilitate currency exchange:

You don’t directly interact with other traders. The broker matches your buy orders with sell orders from other clients or directly fulfills them (depending on the broker type).

They ensure smooth and secure transactions, eliminating the need to worry about counterparty risk.

They make money through fees:

They typically charge spreads (the difference between the buy and sell price of a currency pair) or commissions on your trades.

Do I need a broker for Forex Trading?

Yes, you generally need a forex broker to trade in the foreign exchange market. They act as an intermediary between you and the vast interbank market where currencies are actually traded. Here’s why:

1) Access to the Market: Retail traders like you and me can’t directly access the interbank market. Forex brokers have the licenses and relationships to do so, and they provide you with a platform to place your buy and sell orders.

2) Order Execution: Your broker takes your order and finds a counterparty to match it with on the interbank market. They handle the execution of the trade, ensuring it’s done efficiently and at the best available price.

FAQs on Best Forex Brokers in Nigeria

What is the best forex broker in Nigeria?

The best forex brokers in Nigeria are those that are regulated with one or more Top-tier regulations, accept deposits in Naira from Nigerian bank accounts, and support withdrawals to local banks in Nigeria.

In our guide, we have included HF Markets, FXTM, and Exness as best as they are well regulated, have local deposit & withdrawal options in Naira & even have NGN (Nigerian Naira) as base account currency, which makes them a good choice of local traders.

Which Forex broker is best for Beginners?

Based on our research, HF Markets is best for beginners because they offer negative balance protection, offer a free demo account, have moderate fees with spread-only trading accounts, have some educational material on their website, offer webinars to new traders, and is regulated by 1 Tier-1 regulator FCA & 2 Tier-2 regulations FSCA, CySEC.

Avoid any forex brokers that are not regulated with any Top-tier regulation.

Which forex broker has the lowest minimum deposit?

HF Markets & Exness are brokers that have low minimum deposits & are well regulated with multiple Tier-1 regulations. HF Markets has a minimum deposit of $5 & you can deposit via local bank transfer in Naira (₦4,000). Whereas Exness has a minimum deposit of $10, you can also deposit via Online Bank Transfer.

What points should you check in a forex broker?

First, for the safety of your funds, you must make sure that the forex broker is regulated with multiple Top-tier regulations like FCA, ASIC, CySEC, FSCA, etc. No forex brokers are regulated by CBN or SEC in Nigeria, so, if a broker is regulated with many of these regulations, it is considered low risk.

Second, make sure to check the overall fees, which we have explained above in this guide.

Is forex trading Legal in Nigeria?

Online Forex Trading in Nigeria is unregulated, and currently, there is no regulation by SEC. All the forex brokers operating in Nigeria are unregulated, so the traders are trading at their own risk. That is why it is really important to make sure that you only trade via forex brokers that are licensed by multiple Top-tier regulators. This will ensure that your funds are safe.