The volatility 75 index, which is also known as VIX, is an index that tracks the volatility in the US stock market. The index has been operating since 1993 and it has since grown into the primary indicator of stock market volatility in the United States.

The index is also known as the “fear gauge” since it allows stock markets to judge the level of investor confidence or fear in the markets. The higher the value of the index, the more fear there is in the markets.

Since 2003, this index has been based on the wider S&P 500 which has increased the accuracy of the index.

Traders in South Africa can trade the Volatility 75 index as a CFD. This CFD is offered by several FSCA-regulated international forex brokers, the best of which will be discussed in this article.

Comparison of Best Volatility 75 Index Brokers

| Forex Broker | VIX Spread | Minimum Deposit | |

|---|---|---|---|

| HF Markets |

0.14 pips

|

R100 or $5

|

Visit Broker |

| Plus500 |

0.23 pips

|

R1,500 or $100

|

Visit Broker |

| IC Markets |

0.49 pips

|

$200

|

Visit Broker |

| FXCM |

5 pips

|

R889 or $50

|

Visit Broker |

| Pepperstone |

1.6 pips

|

$0

|

Visit Broker |

Best Volatility 75 Index Brokers

Below is the top list of best volatility 75 index brokers in South Africa.

- HF Markets – Best Volatility 75 Index Broker in South Africa

- Plus500 – Good Platform with Vix 75 CFD

- IC Markets – Volatility 75 Index Broker with MetaTrader 4

- FXCM – Well-regulated CFD Broker With VIX 75

- Pepperstone – Reliable Broker with VIX 75 Index

Now we are going to a detailed breakdown of all the above-listed volatility 75 index brokers of South Africa using key points like regulation, trading fees, support, and many more.

#1 HF Markets – Best Volatility 75 Index Broker in South Africa

HF Markets has been active in the global CFD trading scenario since 2010 and it has garnered a good reputation over a period of more than 10 years.

Regulation: HF Markets is a well-regulated broker and it is licensed by the South African financial regulator Financial Sector Conduct Authority (FSCA). HF Markets holds FSP No. 46632. The company is also regulated by the Tier-1 Financial Conduct Authority (FCA) of the United Kingdom.

VIX Spread and Leverage: HF Markets offers the VIX index at a typical spread of 0.14 per unit. The leverage can be up to 1:100.

ZAR Account: HF Markets offers ZAR-denominated accounts to South African traders. A ZAR account means that you can trade, deposit, and withdraw your money in the local ZAR currency. Hence, your trading costs will be lower since you will not be charged for currency conversion.

Deposit and Withdrawal: HF Markets allows South African traders to deposit or withdraw money from their trading account through local bank transfer or EFT. Other ways to deposit or withdraw money include wire transfers, debit and credit cards from Visa or Mastercard, and a limited number of payment wallet services including Skrill and Neteller.

Account Types: HF Markets offers a choice between 4 different types of accounts. These accounts are – Pro, Premium, Zero, and Cent. The fees charged, minimum deposit, and maximum leverage depend on the type of account held by the trader.

Before opening an account with them, you should compare the features of each account type. Some accounts may charge a commission and a tight spread or no commission and a wider spread.

Customer Support: HF Markets is known for providing good customer support. You can reach them through email, phone call, or through a live chat option available on their website. Their customer service operatives work at all hours during weekdays.

Read our HF Markets Review

#2 Plus 500 – Good Platform with VIX 75 CFD

Plus500 was introduced in 2008 and has received several awards such as Best Trading App 2019 and Best Forex Broker 2019.

Regulation: Plus 500 is regulated by the FSCA and holds FSP No. 47546. You can check their regulation on the FSCA website to ensure that it is correct. Additionally, the broker is regulated by the FCA of the UK (tier-1 financial authority), CySEC of Cyprus, MAS of Singapore, and the FSA of Seychelles.

VIX Spread and Leverage: The typical spread charged by Plus500 for trading the VIX index is 0.23 as noted on their website. You can take advantage of leverage up to 1:10 which is quite low when compared to other similar brokers, however, it makes your trades less risky.

ZAR Account: Yes, Plus 500 offer ZAR as account currency, so you don’t have to pay a currency conversion fee every time you make a trade or deposit money into your account.

Deposit and Withdrawal: Plus500 supports local bank transfers for residents of South Africa. However, you can also make a bank wire transfer from your local bank account. In addition, you can deposit funds through your Visa or Mastercard credit card or debit card. Lastly, Plus500 also supports PayPal and payment wallets like Skrill of Neteller.

Trading Accounts: Plus 500 offers just one type of account which is called the Live account. This means that while you don’t have to spend time researching which type of account to open, you don’t have any choice when it comes to your trading conditions.

For new traders, Plus 500 also offers a demo account through which you can practice trading and check Plus 500’s services.

Customer Support: Plus 500 offers customer support through WhatsApp, email, and live chat that is available 24/7, although they do not have provision for phone call support.

Read our Plus500 review

# 3 IC Markets – Volatility 75 Index Broker with MetaTrader 4

IC Markets was founded in 2007 and is an Australian company based in Sydney. They offer CFD trading services to traders around the world.

Regulation: IC Markets is not licensed by the FSCA. However, it is regulated and licensed by the ASIC of Australia which is one of the strictest financial regulators in the world. It’s group entities are also regulated by the CySEC of Cyprus and the FSA of Seychelles. The company also practices segregation of trader funds from company funds to protect deposited client funds.

VIX Spread and Leverage: IC Markets offers VIX as US500 (US SPX 500 Index) with an average spread of 0.49 pips and leverage of up to 1:200.

ZAR Account: IC Markets does not offer ZAR-denominated accounts yet. They do offer accounts in the following currencies – USD, EUR, AUD, CAD, HKD, CHF, JPY, NZD, SGD, and GBP. This means that traders from South Africa will have to convert their currency in order to use IC Market’s services, and they will also have to pay the conversion fee.

Deposit and Withdrawal: IC Markets does not accept local bank transfers for making deposits. If you want to deposit funds, you will need to use a debit or credit card from Visa or Mastercard. Further, you can also opt for an international wire transfer. IC Markets also accepts PayPal and a variety of other payment wallets.

Trading Accounts: IC Markets just offers two types of accounts Raw Spread (For either cTrader or for MetaTrader 4) or a Standard MetaTrader account. The main difference between the two types of accounts is that you are charged a commission under the Raw Spread account while there is no commission under the Standard account (however, the spread is much higher).

Customer Support: IC Markets provide 24/7 online customer support through live chat, email, and phone call. You can request a call back through their website. They also have an extensive FAQs section from which you can find the answer to a lot of questions.

Read our IC Markets review

#4 FXCM – Well-regulated CFD Broker With VIX 75

FXCM started in 1999 and is one of the oldest CFD brokers operating globally.

Regulation: FXCM is regulated by the FSCA of South Africa and holds FSP No. 46534. The company is also regulated by the FCA of the UK (Tier-1), the ASIC of Australia (Tier-1), and the CySEC of Cyprus (Tier-2).

VIX Spread and Leverage: FXCM offers the E-Mini VIX Future with the symbol SPX500 to its traders. The typical spread is around 4 pips. They offer a leverage of up to 1:20.

ZAR Account: FXCM does not offer accounts denominated in ZAR. Hence, South African traders will need to open an account in USD, GBP, EUR, or CHF to trade through FXCM.

Deposit and Withdrawal: FXCM accepts deposits through bank transfers from South African banks. You can also deposit money using your debit card or credit card, which will be much faster than a bank transfer. They do not charge any fees for making a deposit. However, you will need to pay a currency conversion fee charged by your bank since the account is not denominated in ZAR.

Trading Accounts: FXCM offers two types of accounts – Standard and Active Trader. The Standard account is more suitable for beginners whereas the Active Trader is more suitable for high-volume traders. You will need to make a minimum deposit of $50 or approximately 889 to open either type of account.

Customer Support: FXCM provides customer support through live chat. The chatbot is available 24/7, while live chat agents are available 24/5. You can also get in touch with FXCM through WhatsApp, email, or phone calls. They also have an extensive FAQ section that answers many questions.

# 5 Pepperstone – Reliable Broker with VIX 75 Index

Pepperstone has been in operation since 2010 and has a good reputation.

Regulation: Pepperstone is not regulated by the FSCA. However, it is regulated by reputed financial authorities such as the FCA of the UK, CySEC of Cyprus, and ASIC of Australia. Additionally, the company is regulated in UAE, Kenya, The Bahamas, and Germany.

VIX Spread and Leverage: Pepperstone offers the Volatility index with the symbol VIX with a typical spread of 1.6 pips for those who want to trade the VIX instrument. They offer a leverage of up to 1:10 for the instrument for retail clients.

ZAR Account: Pepperstone does not offer accounts denominated in ZAR. South African traders have to choose either USD or GBP to serve as the base currency of their accounts.

Deposit and Withdrawal: Pepperstone supports deposits/withdrawals via bank transfers, credit cards, debit cards, or wallets (PayPal). The broker does not charge any deposit or withdrawal fees.

Trading Accounts: Pepperstone offers a choice between their Standard account and their Razor account. The fee structure is quite different between the two accounts. The Standard account charges a wide spread and no commission, while the Razor charges a commission and a tighter spread. Pepperstone does not require a minimum deposit in order to open an account. This makes it quite attractive for new traders.

Customer Support: Pepperstone has 24/5 customer support via live chat, email, and international phone number. The live chatbot is available 24/7 while live agents are available 24/5.

What is the Volatility 75 Index (VIX)?

The Volatility 75 index, or VIX, is run by the Chicago Board of Options Exchange (CBOE). This index is meant to help traders and investors gauge the volatility in the US stock market. It is especially effective in tracking the market sentiments held by institutional investors. The index looks forward. This means that it predicts the “implied volatility” of the stock market for the next 30 days.

The higher the value of the VIX index, the more fear there is in the stock market and it is more likely that the stock market will fall. In contrast, when the VIX index is lower, it means that investor confidence is high and the stock market is expected to be bullish. The neutral value of the VIX index is set at 30.

Since the VIX index has a negative correlation to the S&P 500, contrarian investors use it to hedge their bets. However, numerous traders and investors also use the VIX for speculative and diversification purposes. Even though the VIX is only based on the S&P 500, it is often seen as being an indicator of the entire US stock market.

Any CFD trader that is involved in US securities should be aware of the VIX and use it to inform their trades. The VIX plays a key role in gauging the markets and can help a trader predict future market movements. Traders can also directly trade the VIX if they want to bet on the future direction of the US equity market.

The VIX is available as a CFD instrument offered by numerous global CFD brokers. The VIX is offered by each of the brokers mentioned above in this article. If a South African CFD trader is involved with the US markets, then they can use the VIX for hedging or speculative purposes.

Why You Might Want to Trade Volatility 75?

There are a few reasons traders go long or short on VIX 75

One of the main reasons why traders use the volatility index is to hedge their positions. When the market is falling, the value of the index rises. This means that if you have both a stock position and a position in the volatility index, the rise in the value of the latter can offset the losses from the former. This approach is common with traders with a huge portfolio of individual stocks. Usually, they will sell off the stocks in their portfolio when the market is tanking so they can buy later.

However, this might not be effective because the price might change too quickly and the advantage of entering the market at a lower price can be lost. This is why such traders use the VIX 75 which measures the volatility of the S&P 500 companies to hedge their trading.

In addition, many investors use the volatility index to profit from its changes. One of the most popular options for this is to trade on the movement of the market’s volatility. With the help of a South Africa-based volatility broker, you can easily predict the future direction of the market.

Furthermore, trading the VIX 75 allows for flexibility. You can open a position and close it when you want. From a few seconds to a whole day, or even overnight. This flexibility allows you to deploy different trading strategies. Scalping, day trading, and swing trading can be used when trading the CFD.

Is trading the VIX Risky?

Trading CFDs is generally risky. Since the VIX is a CFD, it definitely has its own risks. Some of these risks are generic while some are specific due to the nature of the VIX. Let us dive deeper into some of these risks.

Risk of leverage: Leverage is the reason there are many retail traders. It allows you to borrow money from your broker to trade your positions. However, it is a double-edged sword. While it has the potential for huge profits, it can cause devastating losses if abused.

To mitigate this risk, trade VIX 75 with the lowest of leverages. This way, there is a little chance that your account will enter a margin call or you losing all of your money.

Excess Volatility: VIX 75 is quite volatile and the price can change quickly. This alone makes trading the VIX risky. However, the possibility of gapping makes it even riskier. With volatility, the price moves quickly but gradually. Gapping, on the other hand, is when the price ‘jumps’ higher or lower without a gradual movement. Here is what gapping looks like

Can you see the colored boxes? Those are spots where gapping took place. Can you see how the price jumped those spots? This can trigger your stop-loss orders prematurely or skip your pending orders thereby increasing your risk.

Broker Risk: This a risk associated with the broker you choose. They could default on the deal or not execute it properly. To reduce this risk, only trade with FSCA regulated brokers.

Volatility 75 Trading Strategies

It is important you understand that the VIX is not an asset in itself. Therefore, it is not moved by demand and supply. Rather, it is moved by the psychological (fear and greed) behavior of sellers and buyers in the market. Because of this, it can be quite tricky to trade. Even for the most experienced of traders.

There are different strategies you can deploy to trade the VIX 75 successfully. Here are some of them.

The Bollinger Strategy: It involves the use of Bollinger Bands to find buying and selling opportunities. Essentially, the bands act like a sort of boundary. When the price reaches the upper boundary, you can buy. When it touches the lower boundary, you can sell.

This simple strategy can be combined with other strategies like candlestick patterns and market structure for greater effectiveness.

The Moving Average Strategy: This strategy combines a short-term and a long-term moving average. The short-term moving average is used to determine entry and exit. When it crosses the long-term moving average upward or downward, it means there is a change in the previous trend. With this, you can buy or sell based on the last prevailing trend.

How to Open An Account with a Volatility 75 Index Broker?

The process of opening an account with a CFD broker is quite straightforward and doesn’t take more than a few days (24-48 hours normally), usually.

In this guide, we’ll be using the example of HF Markets to demonstrate how to open an account with such a broker. In general, the steps involved in opening an account with a broker that offers VIX CFD are the same.

Here are the steps involved in opening an account for trading Volatility 75 Index CFDs:

Step 1) Choose a Regulated CFD Broker: The first step is to select a broker that you want to work with. The most important aspect of choosing a broker is to check whether it is safe. This means that it is a reputed broker that offers genuine services. The broker should also be regulated in the country of your residence.

So, South African traders should ensure that the broker is regulated by the FSCA. Apart from the FSCA, you should also check whether the broker is regulated by tier-1 financial regulators which are the FCA of the UK and the ASIC of Australia.

If your CFD broker is regulated with multiple regulators, including FSCA, then that broker is considered low risk for trading CFDs on VIX & other Indices.

For example, HF Markets (our example broker for this guide) is regulated by the FSCA and it is also regulated by the FCA of the UK. You can see that this information is available on their website and you can cross-check it with the regulator’s website.

So, we can consider HF Markets as a low-risk broker for depositing funds for trading CFDs. If your broker of choice is multi-regulated with ‘Tier-1’ & ‘Tier-2’ regulations, then you can safely choose that broker.

Further, there are other factors that you should consider before choosing a broker. We will not cover these in detail in this guide, but here are some factors that you should check.

You should check the overall fees charged by the broker (such as spread, commission for trading VIX, overnight fees, deposit fees, and inactivity fees). Other factors include customer support, instruments available, trading platform, trading conditions, and so on.

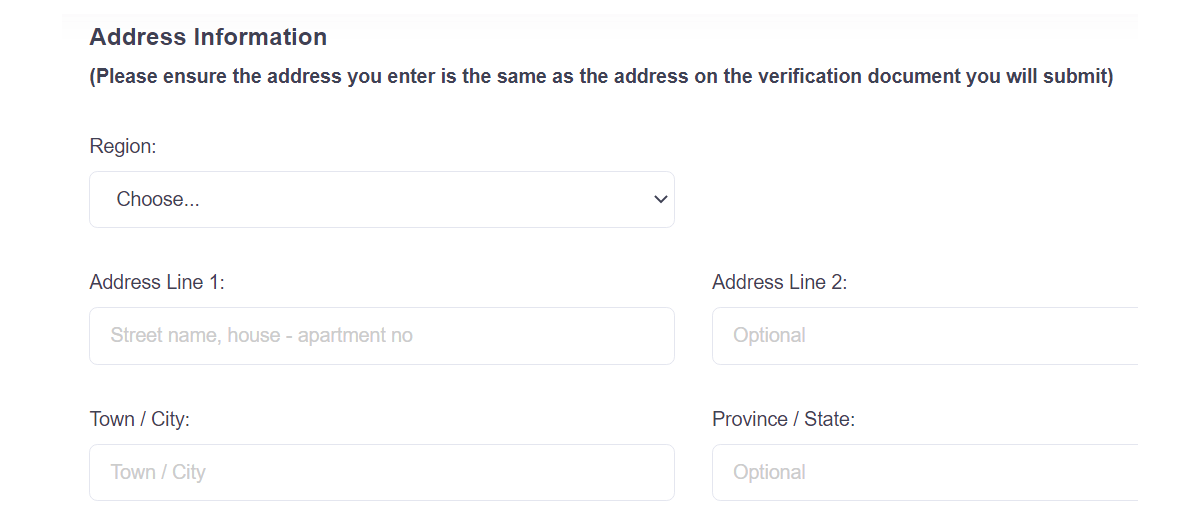

Step 2) Complete KYC Formalities: Brokers ask for your KYC details because they are legally required to do so. This helps in preventing cases of fraud and money laundering.

Before registering with any reputed broker, you will be asked to provide KYC details. These details will be in the form of identity proof, address proof, and government-issued photo ID to ascertain how you look.

In general, you are required to submit 2 documents, your Identity Proof, and second is your Address Proof. You cannot complete KYC without any of these documents.

For example, before registering with HF Markets, you will need to provide address proof.

After completing the KYC, the next step is to download the platform & deposit funds.

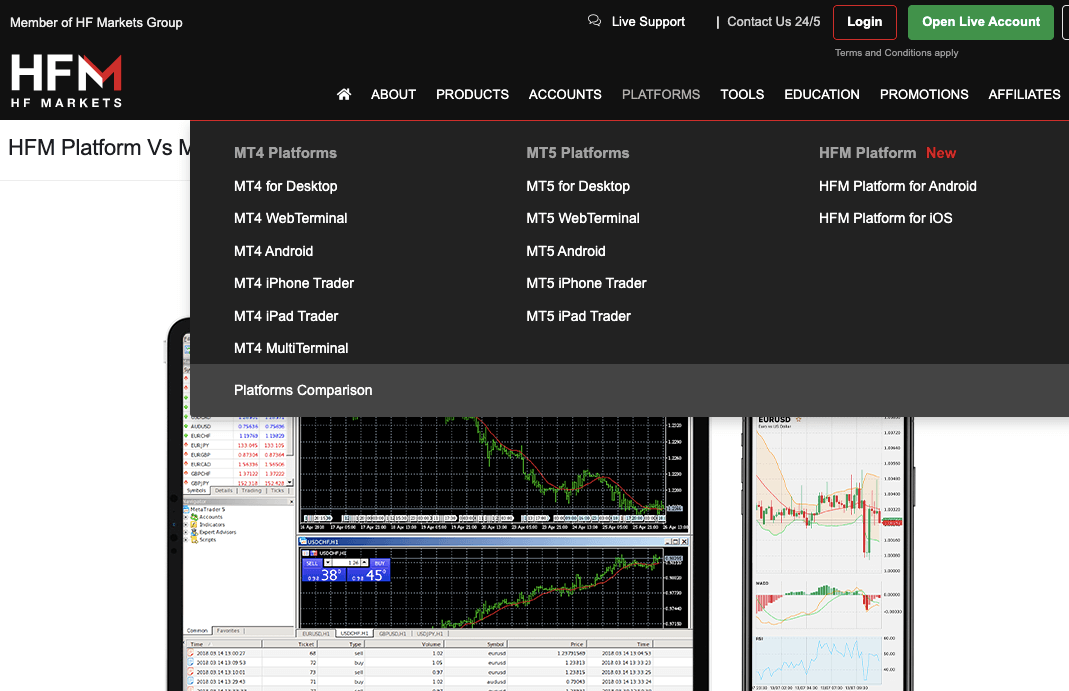

Step 3) Download Platform: In order to actually start trading, you will need a trading platform. Different brokers offer different trading platforms, however, the most popular with CFD traders is the MetaTrader 4.

For example, HF Markets offers both the MetaTrader 4 and the MetaTrader 5 platforms to its traders.

You can download the platform directly from the HF Markets website, from your client panel & login using the detail provided to you with your trading account.

If you do not want to download any software, then you can also use MetaTrader for the web directly through your web browser.

Some brokers like Plus500 offer their own ‘proprietary platforms and no third-party platforms like MetaTrader or cTrader. So, if you are not comfortable using a platform that is not MT4 or cTrader, then you must carefully verify that your CFD broker does indeed offer MetaTrader & cTrader for example.

A simple way to do that would be to ask your CFD broker via Live chat, and they will tell you whether they have your preferred platform available or not. You can usually also find the supported platforms listed on the broker’s website.

Step 4) Place Your Trade on VIX CFD: That’s it, this is where you begin to trade. Once you’ve set up your account, you are free to make trades through the trading platform. Select ‘VIX’ in order to place a long or short trade.

Depending on your trading order & price movement of the VIX, you will make a profit or a loss.

It is important to know that these are steps that have been covered in basic, whereas in actual trading, you must fully understand the risks involved & have a proper working strategy.

How to Choose the Best Volatility 75 Index Broker in South Africa

Holding an FSCA license is the topmost criterion for choosing a VIX 75 broker. We have covered how to verify this but there are other essential criteria to consider. Here are some of them

Does the broker have VIX?

Though forex brokers are regulated, there is no rule that makes it mandatory that they offer all CFDs. It is very possible that a broker does not have VIX 75. If this is the case, you cannot sign up with that broker. Checking the indices under your broker’s ‘Instruments’, ‘Products’, or ‘Markets’ section is how you verify if VIX is offered.

But there is a downside to this approach. The downside is that brokers have different names for VIX 75 index. If you check by yourself, you might miss it if your broker uses an unpopular name. For a better result, contact your broker’s customer support and ask if they offer Volatility 75.

Are the trading fees high or low?

Spreads, swaps, and commissions are the fees you incur from trading. Check with your broker for the pricing of VIX. Confirm if there are extra commissions, and what the overnight charges are. Furthermore, you should compare this factor for different brokers. For example, FXCM’s spread for VIX is 5 pips which is way higher than that of other brokers in this review. HF Markets has the lowest at 0.14 pips.

Furthermore, some forex brokers have fees that change with trading platforms. That is, the spread for VIX 75 might vary on MT4, MT5, and the broker’s proprietary platform. Usually, the fees are the lowest on the broker’s proprietary trading platform. You should consider this factor before carefully before choosing a VIX 75 broker.

Which Brokers Have Volatility 75 Index?

IC Markets, Plus500, HF Markets, Pepperstone, and FXCM all have volatility 75 index brokers in South Africa. Do not forget to trade with regulated brokers only.

FAQs on Best Volatility 75 Index Brokers in South Africa

What is the Volatility 75 Index?

The Volatility 75 Index, also known as VIX, is an index that measures the US stock market volatility and investor confidence. The VIX is run by the CBOE and has been in operation since 1997. it can be traded as a CFD as well, and investors and traders use it for hedging, diversification, and speculation purposes.

Does XM Broker offer the Volatility 75 Index as a tradable CFD?

Yes, XM broker offer the VIX index as a CFD with minimum spread of 0.5 pips and maximum leverage of 1:100.

Can I trade VIX 75 on MT4?

Yes, you can trade VIX on MT4 if the broker you choose supports MT4. Brokers like HF Markets and FXCM offer VIX and support the MT4 trading platform.

What is the best time to trade volatility 75 index in South Africa?

The best time to trade VIX (Volatility index) depends on the time most convenient for you in the trading window. While several brokers offer it for about 23 hours a day, most of them have different timing. For example, VIX is available for trading on HF Markets from 01:00 AM on Monday to 11:59 PM on Friday, with a daily break period from to 11:14 PM to 11:29 PM .

Which broker has volatility 75 index on MT4?

Both HF Markets and FXCM offer the MetaTrader 4 trading platform to trade the VIX instrument.