FxPro is an online broker that provides trading services for CFDs on forex pairs, indices, metals, stocks, energies, and futures via the MT4, MT5, and cTrader trading applications.

FxPro was established in 2006 in the UK and is regulated by the FSCA (Financial Services Conduct Authority) in South Africa. They do not have a local office in South Africa.

In our review of FxPro, we examine the fees, deposits/withdrawal options, trading conditions, account types, account opening process, tradeable instruments, and customer support of the broker.

| FxPro Review Summary | |

|---|---|

| 🏢 Broker Name | FxPro Financial Services Ltd |

| 📅 Establishment Date | 2006 |

| 🌐 Website | www.fxpro.com |

| 🏢 Address | FxPro Global Markets Ltd, Albany Financial Center, South Ocean Boulevard, New Providence, The Bahamas |

| 🏦 Minimum Deposit | R200 |

| ⚙️ Maximum Leverage | 1:200 |

| 📋 Regulation | FSCA, CySEC,FCA, SCB |

| 💻 Trading Platforms | MT4, MT5, cTrader, and FxPro Edge available on PC, Mac, Web, Android, & iOS |

| Visit FxPro | |

FxPro Pros

- FxPro is regulated in South Africa

- Offers commission-free trading accounts

- Free deposits and withdrawals

- Has ZAR account currency

- Has negative balance protection

FxPro Cons

- Charges dormant account fees

- Has relatively fewer instruments to trade

- They do not have a local office in South Africa

- Do not offer 24/7 customer support

Is FxPro a good broker?

FxPro is considered a good broker because they are regulated in multiple jurisdictions by Tier 1 and Tier 2 financial regulators. This means that clients’ funds are safer and the risk of fraud is lower because they have to comply with the regulations.

Find the various regulations of FxPro in different countries below:

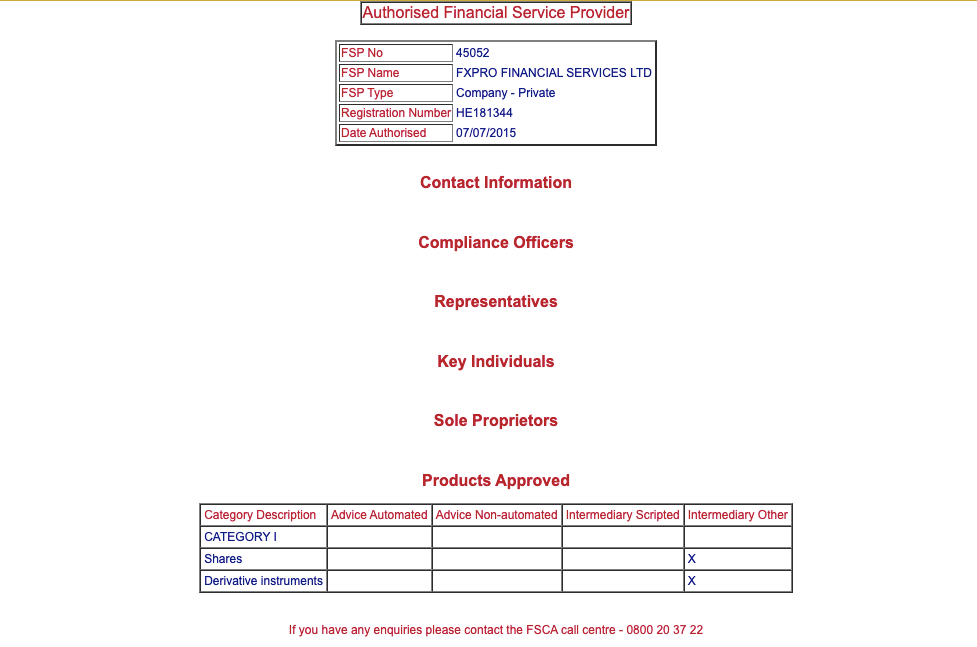

1) Financial Sector Conduct Authority (FSCA), South Africa: FxPro is authorized in South Africa by the FSCA as ‘FxPro Financial Services Ltd’ and licensed as a financial services provider (FSP), with FSP number 45052, issued in 2015.

Although FxPro is regulated in South Africa, traders from South Africa are registered under Prime Ash Capital Limited, which is regulated by the Financial Services Commission of Mauritius and authorised to trade as FxPro by FxPro Global Markets Ltd, which is licensed by the Securities Commission of The Bahamas (SCB) as a securities dealer.

Note that trading with this broker is at your own risk as the offshore regulation consumer protection may not cover South African traders.

2) Securities Commission of The Bahamas (SCB): FxPro is authorized and licensed in The Bahamas by the SCB. They are registered as FxPro Global Markets Ltd under the Securities Investment Act, making the broker an SIA registrant. Their SIA license number is SIA-F184

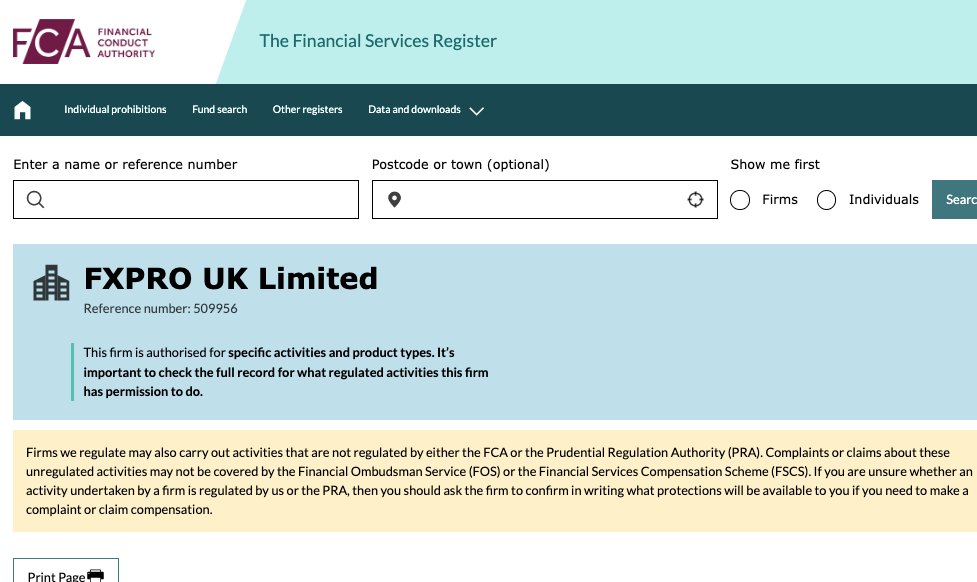

3) Financial Conduct Authority (FCA): FxPro is regulated by the FCA as ‘FxPro UK Limited’ and authorized to offer financial services in the UK, with reference number 509956, issued in 2010.

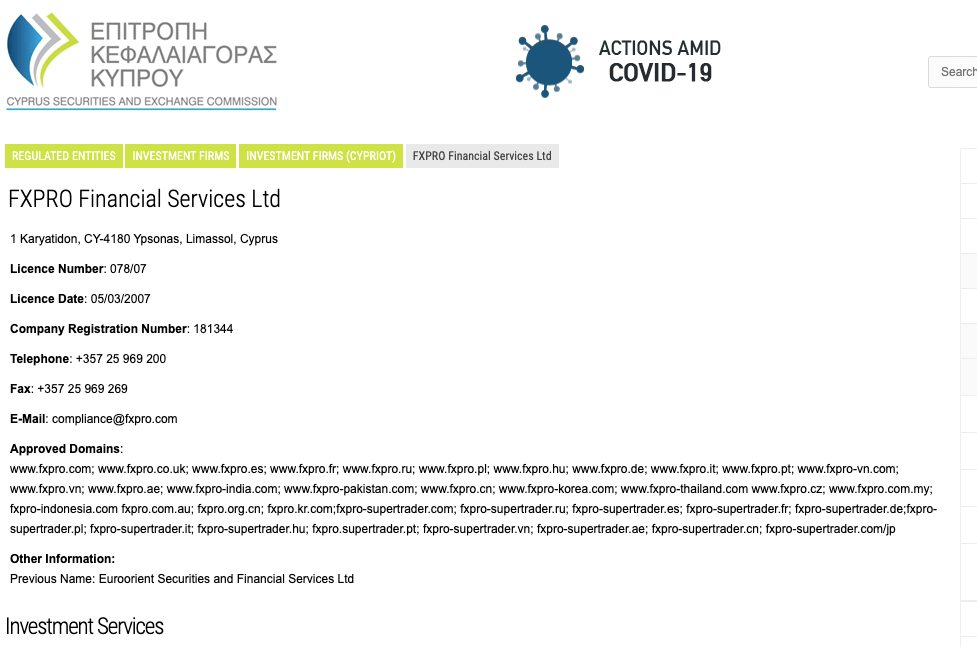

4) Cyprus Securities and Exchange Commission (CySEC): FxPro is regulated by CySEC as ‘FXPRO Financial Services Ltd’ and licensed to offer investment services in Cyprus and other European Union countries, with license number 078/07, issued in 2007. FxPro serves clients in EEA (European Economic Area) with this license.

FxPro Investor Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| UK | £85,000 | Financial Conduct Authority (FCA) | FxPro UK Limited |

| EEA Countries | €20,000 | Cyprus Securities and Exchange Commission (CySEC) | FxPro Financial Services Ltd |

| South Africa | No Protection | Financial Sector Conduct Authority (FSCA) | FxPro Financial Services Ltd |

| The Bahamas | No Protection | Securities Commission of The Bahamas (SCB) | FxPro Global Markets Ltd |

With FxPro, you cannot lose more than your initial deposit. Negative balance protection is provided for all UK clients. In addition, UK clients can have their money protected up to £85,000 via the Financial Services Compensation Scheme (FSCS). This means your money is protected should FxPro go bankrupt.

South African clients trade under FxPro’s regulation in the Bahamas. There is no compensation fund arrangement with the SCB. However, negative balance protection is provided in accordance to the SCB rule book for CFDs. It says “the liability of a retail client for all CFDs connected to the retail client’s account is limited to the funds in that account.” Simply put, you cannot lose more than the money you have in your account.

Furthermore, your money is protected if you open a ZAR trading account. Your money will be kept in South Africa and protected by South African laws.

FxPro Leverage

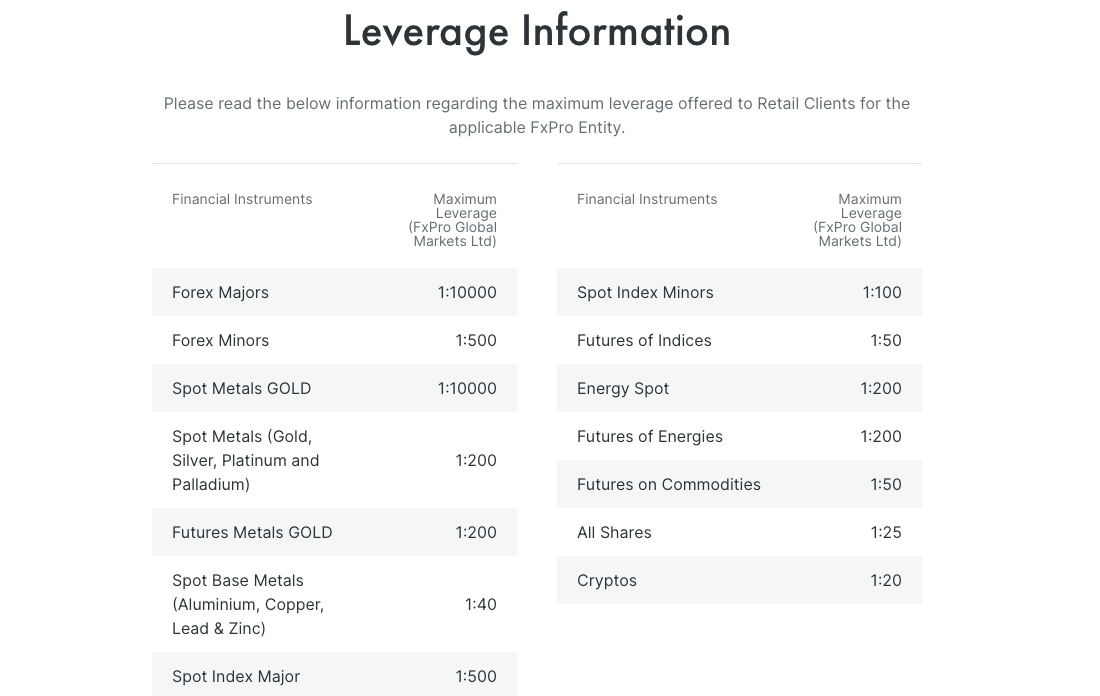

FxPro operates a variable leverage system, and the leverage on FxPro depends on the instrument you are trading and whether you are a retail or professional client.

Retail clients on FxPro have a maximum leverage of 1:200 which applies to some instruments. With leverage of 1:200, you can open a trade position worth 200 times your deposit. For example, if you deposit R100, you can open a trade position worth R20,000.

The maximum leverage on FxPro for Professional clients is 1:500, which is for major forex pairs, other instruments have lower leverages. Traders can also access leverage of 1:10,000 for major forex pairs and spot metals (Gold).

Note that your maximum leverage on FxPro becomes less as you open more lots. See a breakdown of the leverage limits applicable to clients in South Africa below.

It is important that you do not use all the leverage available as this increases your risk and you can lose all your money. It is best to avoid trading CFDs and leveraged products unless you understand it and have experience.

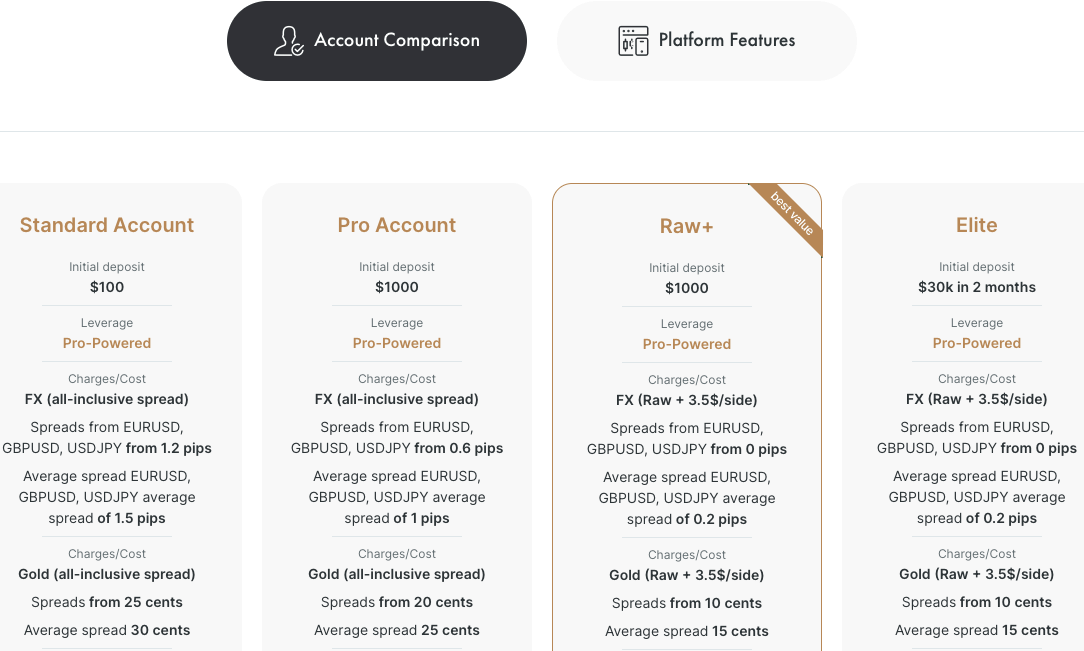

FxPro Account Types

FxPro offers four main account types to retail clients, each based on the trading platform that you access the account through, fees, and the order execution type. You can open an individual account on FxPro or as a corporate body.

FxPro also offers Professional Account and VIP Account status to some clients. Swap-free Islamic Accounts are available for Muslim traders, and beginners can open demo accounts to practice trading before putting real money on the line.

Find an overview of the various account types on FxPro below:

1) Standard Account: The FxPro Standard Account is designed for retail traders and can be accessed on the MT4, MT5 and FxPro trading applications. You can trade forex pairs, indices, futures, metals, energies, cryptocurrencies, and shares.

This account is spread only and you do not pay any commissions when you open or close trade positions. Spreads start from 1.2 pip for major forex pairs and you pay swap fees whenever you keep a trade position open past the closing time of the market.

This account recommends a minimum deposit of US$100 (ZAR 1,780), a minimum trade size is 0.01 micro-lots and maximum leverage is 1:500.

You have negative balance protection with this account, which means you cannot lose more than the amount of money in your trading account if a trade position is unsuccessful.

2) Pro Account: The FxPro Pro Account is accessible on the MT4 and FxPro trading applications. It allows you to trade currency pairs, indices, futures, metals, energies, and shares.

This account doesn’t charge commissions when you open or close trade positions. The spread on this account starts from 0.6 pip for major forex pairs, and you’ll pay a swap fee whenever you keep a trade position open past the market’s closing time.

This account recommends a minimum deposit of US$1,000 (ZAR 17,800), the minimum trade size is 0.01 micro-lots.

Maximum leverage on this account is 1:500 and you have negative balance protection with this account.

3) MT4 Raw+ Account: The FxPro Raw+ Account is accessible on the MT4 and FxPro trading applications. It allows you to trade currency pairs, indices, futures, metals, energies, futures, cryptocurrencies and shares.

This account benefits from zero spreads for about 90% of the day. Spreads start from 0.10 pips for major forex pairs with an average of 0.2 pips and you pay commission fees when you open or close forex and gold trade positions with this account, starting from US$3.5 per side ($7 for a round turn).

You also pay swap fees when you keep a trade position open past the closing time of the market

This account recommends a minimum deposit of US$1,000 (ZAR 17,800), the minimum trade size is 0.01 micro-lots.

Maximum leverage with the Raw+ Account on FxPro is 1:500 and you have negative balance protection.

4) MT4 Elite Account: The FxPro Elite Account is also accessible on the MT4 and FxPro trading applications. It allows you to trade currency pairs, indices, futures, metals, energies, futures, cryptocurrencies and shares.

This account benefits from zero spreads for about 90% of the day. Spreads start from 0.10 pips for major forex pairs with an average of 0.2 pips and you pay commission fees when you open or close forex and gold trade positions with this account, starting from US$3.5 per side ($7 for a round turn).

You also pay swap fees when you keep a trade position open past the closing time of the market

This Elite account also earns rebates of up to 21% of commission charges.

This account recommends a minimum deposit of US$30,000 (ZAR 5,340,000) in 2 months, the minimum trade size is 0.01 micro-lots.

Maximum leverage with the Elite Account is 1:500 and you have negative balance protection.

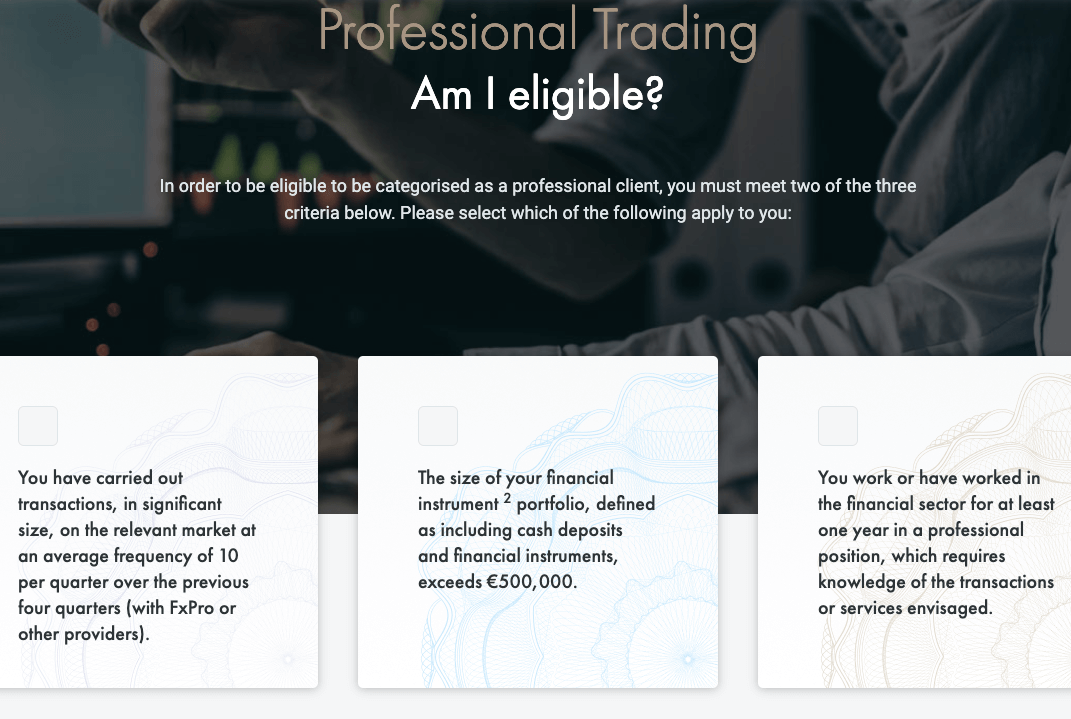

5) Professional Account: FxPro offers experienced traders Professional Account status, which enables you to trade financial markets with higher leverage of up to 1:500. You can trade forex, indices, energies, metals, futures, cryptocurrencies, and shares.

This account type can be based on any of the trading platforms, depending on your preference, and the regular spread fees and commissions on such platforms will apply.

Professional Accounts on FxPro require a minimum deposit of US$1,000 (ZAR 17,800) and a minimum trade lot of 0.01. Professional traders do not have guaranteed negative balance protection, which means you can lose more than the money in your account. You will also not be eligible for any financial compensation in the event that the broker cannot pay up their obligations.

To get a professional account, you have to apply in writing to customer support. To qualify for a professional account, you need to meet at least 2 of the 3 criteria below:

- You must have worked in the financial sector for at least 1 year

- You must have carried out a minimum of 10 significant transactions each quarter for the past year

- You must have a financial instruments portfolio exceeding €500,000

Note that as a professional trader you can also apply to be recategorized as a retail client, by writing to customer support to downgrade your account.

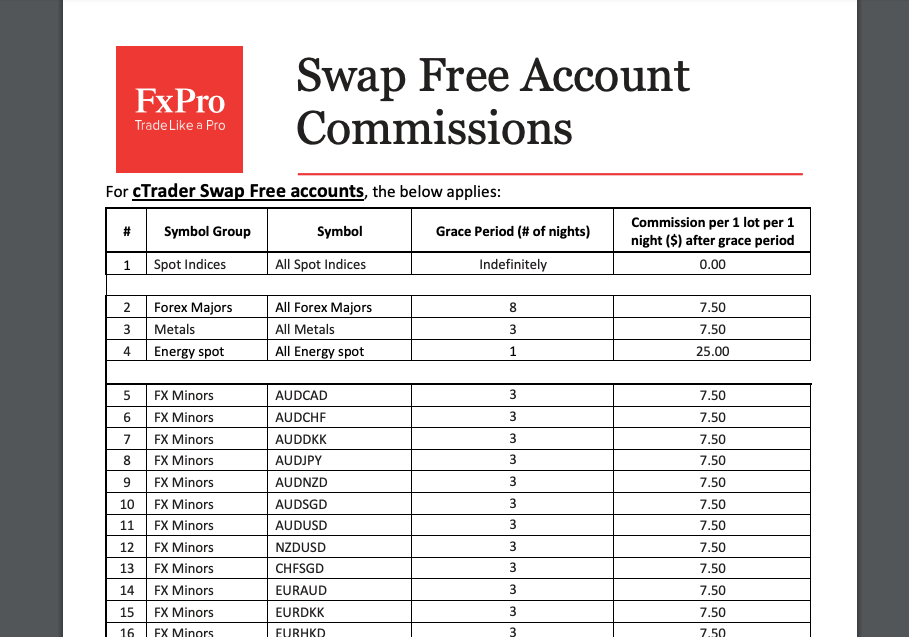

6) Islamic Account: FxPro offers Islamic Accounts to Muslim traders that are in compliance with sharia law. These accounts are swap-free (interest-free), which means they do not pay any rollover fees for keeping a trade position open during the closing time of the market within a grace period.

Although the FxPro Islamic Account is swap-free, you start to pay fixed swap fees per lot each night after keeping a trade position open consecutively past the market closing time beyond the grace period days.

The grace period days vary based on the instrument being traded and start from 1 day for energies spot, 3 days for metals, crypto assets, and minor forex pairs, and can be up to 8 days for major forex pairs.

The fixed swap fees start from $7.50 (ZAR 133) and can be up to $80 (ZAR 1,400) per lot each night. Spot indices, futures, and shares have an indefinite grace period.

You can have a swap-free Islamic Account on FxPro as a retail or professional client by sending an application to customer support via email. You will be required to submit some documents before your application is approved.

Note that a swap-free Islamic Account is not supported with the MT5 Account type.

8) VIP Account: FxPro offers VIP Account status to traders who deposit more than US$50,000 (ZAR 8,90,000) or its equivalent in ZAR and actively trade large volumes. This applies to all account types and whether you are a retail or professional client.

With the FxPro VIP Account, you get up to 30% discounts on spreads and commissions. You can also use EAs (Expert Advisors) like cBots to trade.

Once you meet the requirement, a manager from FxPro will reach out to you to activate your VIP premium account status. You can also submit an Application for FxPro Premium Account if no one reaches out to you automatically.

FxPro Base Account Currency

You can choose from 8 currencies when signing up to serve as your account base currency on FxPro. Your trades, deposits, profits, and withdrawals will be measured in your base account currency.

The available currencies are Australian Dollars – AUD, Swiss Franc – CHF, Euros – EUR, British Pound sterling – GBP, Japanese Yen – JPY, Polish Zloty – PLN, the United States Dollar – USD, and South African Rand – ZAR.

FxPro Overall Fees

FxPro charges different fees depending on the instrument you trade size and whether you are a retail or professional client or have VIP account status. Here’s an overview of the broker’s trading and non-trading fees.

Trading fees

1) Spreads: FxPro charges spread fees whenever you trade a financial instrument on the platform. Spreads are the difference between the ask and bid prices of the tradeable instruments and serve as revenue for the broker. Spreads on FxPro depend on the instrument you are trading and your account type.

The following table shows the average spreads that FxPro charges for major instrument pairs as of April 2023.

| Instrument/Pair | MT4 | MT4 Raw+ | MT5 | cTrader |

|---|---|---|---|---|

| EUR/USD | 1.70 pips | 0.46 pips | 1.99 pips | 0.57 pips |

| GBP/USD | 2.18 pip | 0.77 pips | 2.92 pips | 0.83 pips |

| EUR/GBP | 1.54 pips | 0.55 pips | 2.33 pips | 0.84 pips |

| Gold | 40.74 pips | 31.82 pips | 33.22 pips | 35.41 pips |

*Note that the spread fees on the platform changes during trades and are updated automatically. The figures above are for reference purposes only.

2) Commission fees: FxPro offers commission-free trading for all instruments on the Standard and Pro Accounts. You do not have to pay commission fees when entering or exiting a trade position.

FxPro charges commissions on the Raw+ and Elite Account when trading FX & Gold. The commission fee is $3.5 (ZAR 62.3) per lot (100,000 units) traded upon opening a position and $3.5 (ZAR 62.3) upon closing the position, making it $7 (ZAR 124.6) for a round turn.

When trading a volume of less than 1 lot (100,000 units), the fee is prorated and you pay a fraction of the $3.5 (ZAR 62.3).

3) Swap fees: The market closing time on FxPro is 9:59 PM UK time. If you keep a trade position open past this time, you will incur rollover fees also called swap fees or overnight funding costs. This fee will be added to your profit or loss when you close the position.

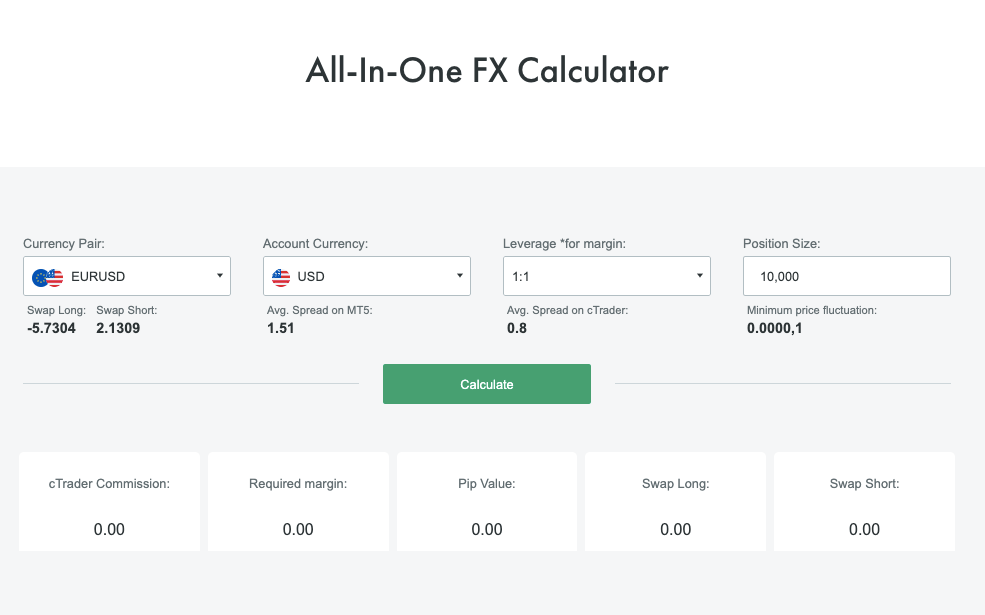

Swap fees on FxPro are calculated based on the size of your trade, the spread cost of the trade, the prevailing swap rate, the number of days you keep it open, and whether your position is a buy (long) or sell (short). No swap fees are charged on futures contracts.

You can calculate the cost of a swap by using the Cost Calculation Tool on the ‘Tools’ page of the FxPro website.

Non-trading fees

1) Deposit and Withdrawal fees: FxPro offers free deposits and withdrawals. You do not pay any fees when you deposit funds to your account or withdraw from it. This applies to all account types and payment methods.

| Fee | Amount |

|---|---|

| Inactivity fee | $15 (one-time), $5 (monthly) |

| Deposit fee | None |

| Withdrawal fee | None |

Note that your payment processor may charge an independent fee.

2) Account Inactivity charges: If you do not perform any trade on your account for 6 months, your account will be categorized as inactive and any balance in your account will be charged a one-time fee of $15 (ZAR 266), then $5 (ZAR 88.8) monthly subsequently. If you do not have any funds in your account, no negative balance will accumulate on the account.

If your account remains inactive for 6 years and the broker is unable to reach you, any funds in the account will no longer be considered clients’ funds and will be given to charity or used for any such thing as the broker deems fit.

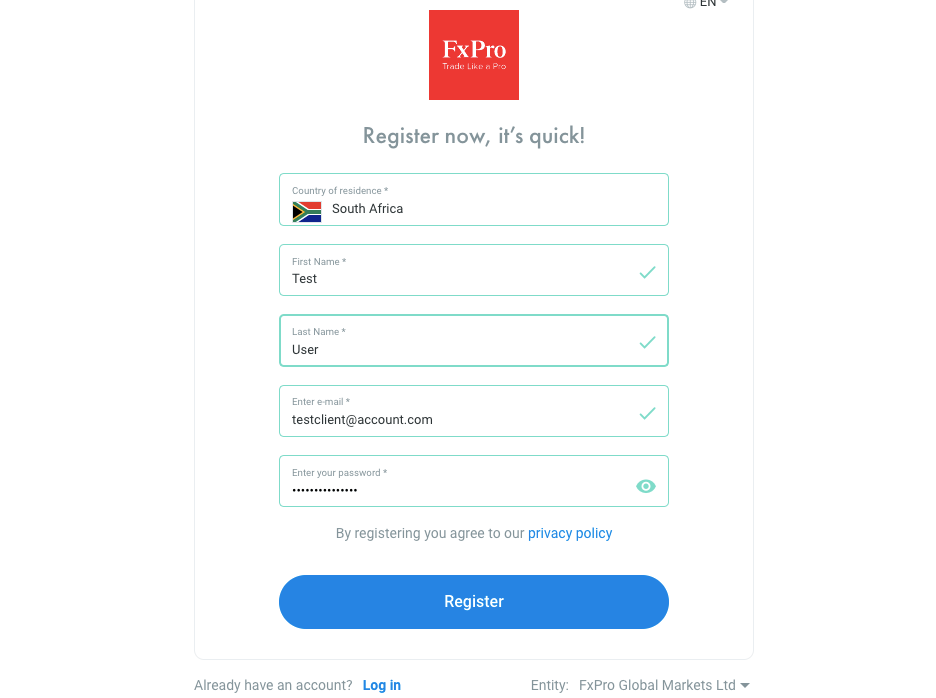

How to Open FxPro Account in South Africa?

Follow these steps to open a trading account on FxPro.

Step 1) Visit the Fxpro website at www.fxpro.com and click on the ‘Open Trading Account’ or ‘Register’ button.

Step 2) Fill out your name and email, create a password then click on ‘Register’.

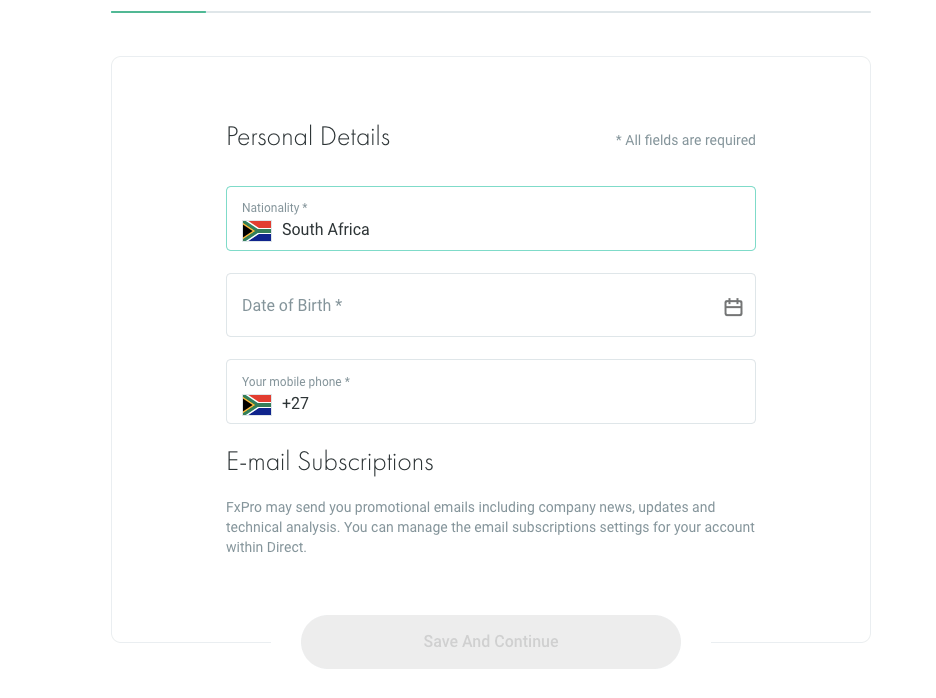

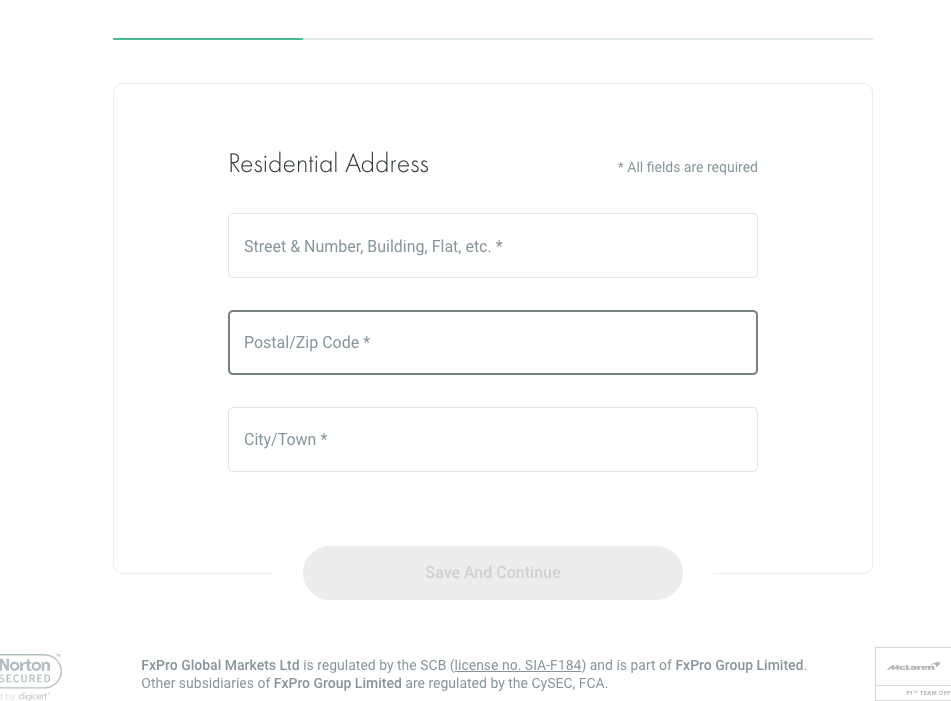

Step 3) Provide your date of birth, phone number, and address then click ‘Save and Continue’.

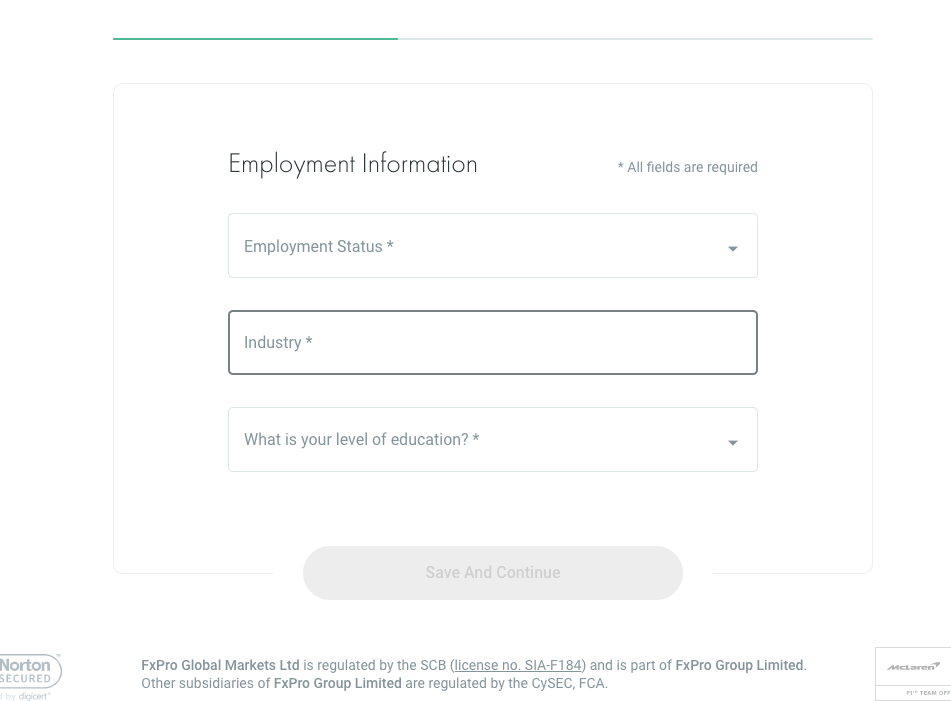

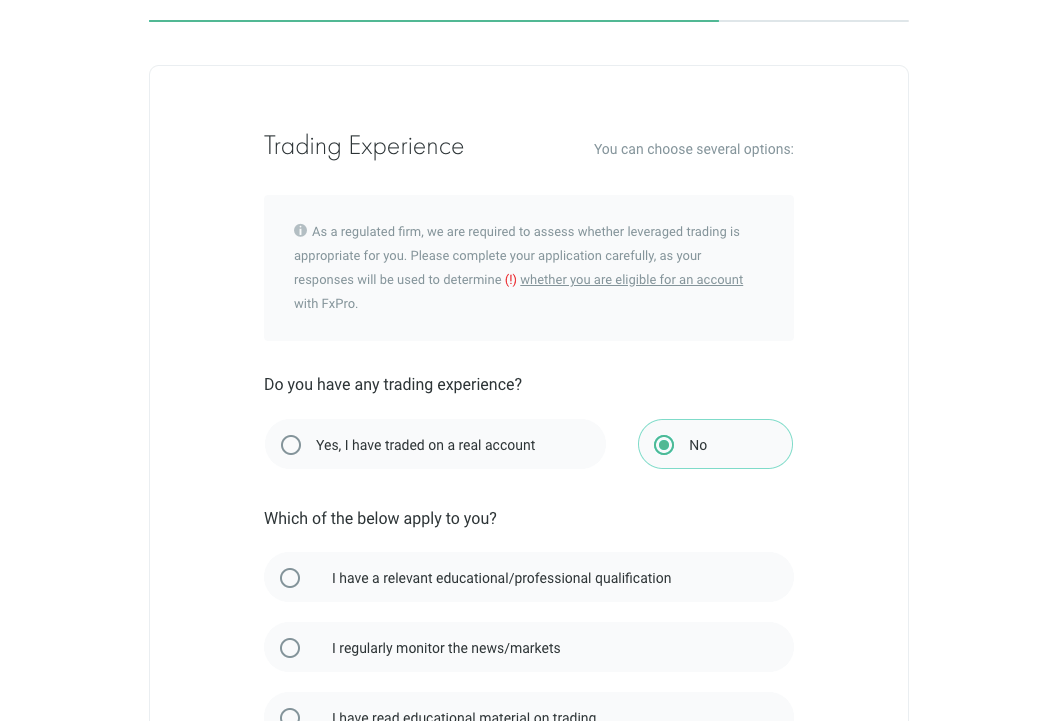

Step 4) Answer some questions about your employment status, education level, financial information, and trading experience.

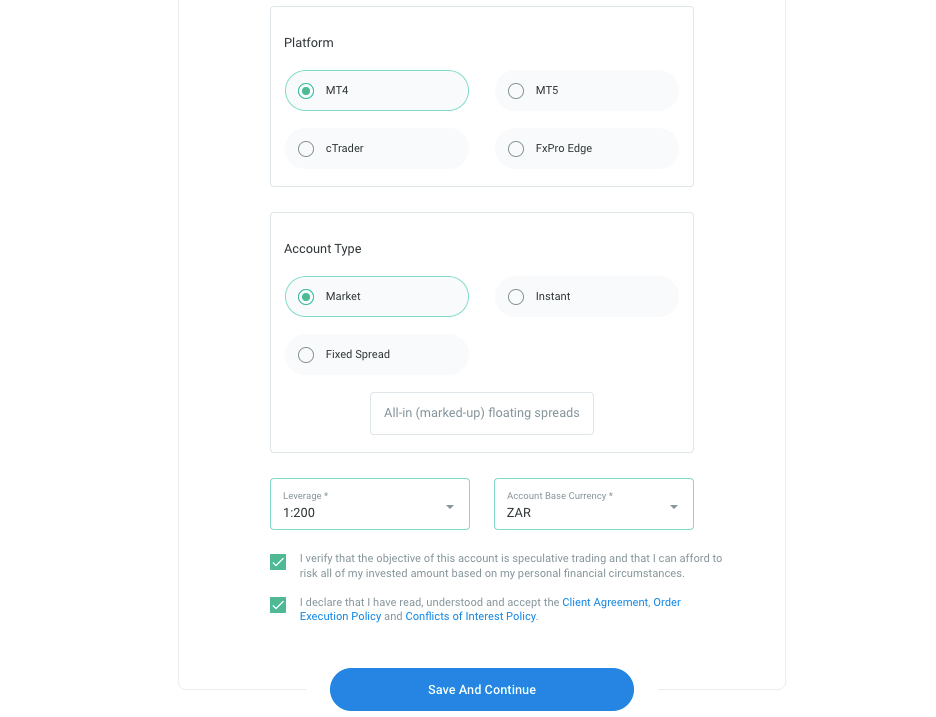

Step 5) Choose your preferred trading platform, set maximum leverage, and select your base account currency, then check the privacy policy and client agreement and ‘Save and Continue’ to proceed with your account registration.

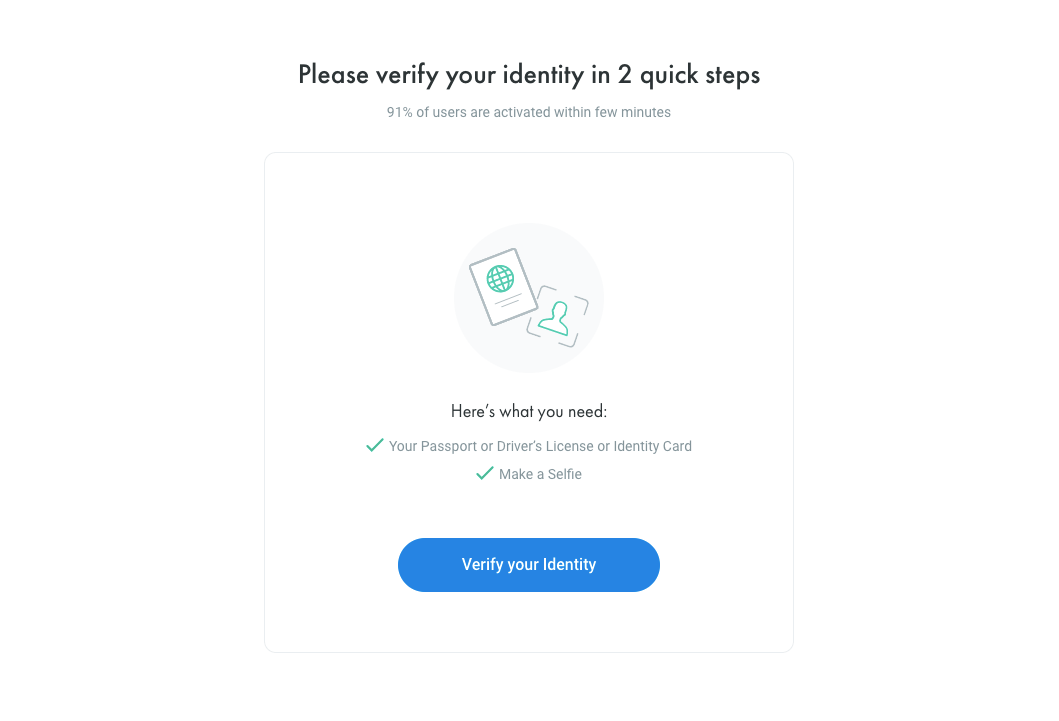

Step 6) Upload verification documents like ID Card for identity and utility bill or bank statements for address. This will enable the broker to verify your account.

FxPro Deposits & Withdrawals

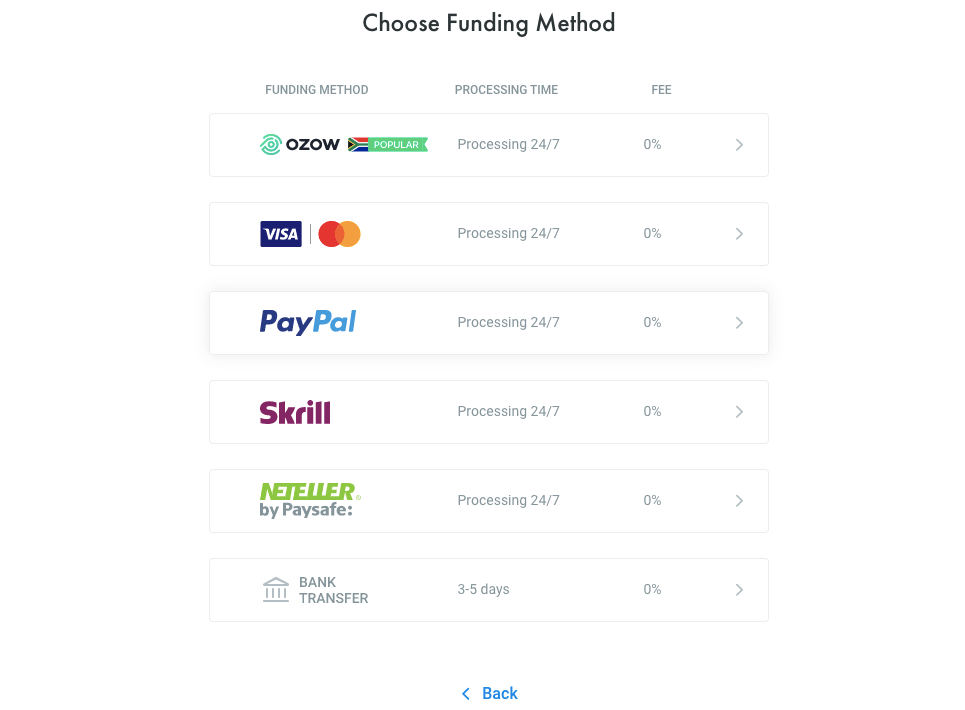

Payment methods accepted on FxPro for deposits and withdrawals are bank transfers, e-wallets like Skrill, Neteller, and OZOW and Credit/Debit cards. Find an overview of deposits and withdrawals on FxPro South Africa below:

FxPro Deposit Methods

Here is a summary of payment methods accepted by FxPro for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Internet Banking/Bank Wire Transfer | Yes | Free | 1-3 business days |

| Cards | Yes | Free | Within 10 minutes to 1 hour |

| E-wallets | Yes | Free | Within 10 minutes to 1 hour |

FxPro Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on FxPro.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Internet Banking/Bank Wire Transfer | Yes | Depends on the amount of withdrawal, fee can be seen on withdrawal page. | 1-2 business days |

| Cards | Yes | Free | 5-7 business days |

| E-wallets | Yes | Free | 1-7 business days |

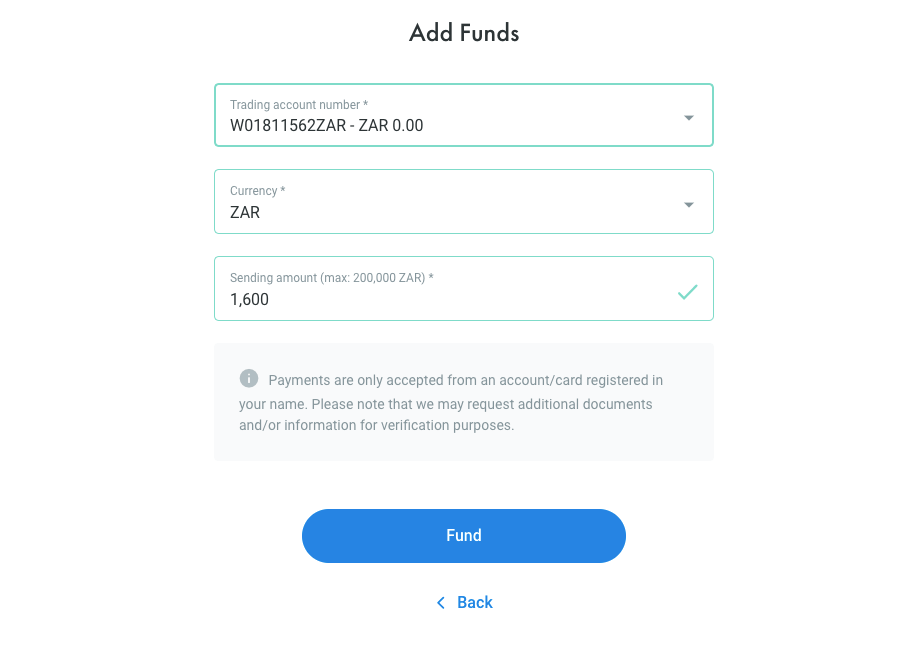

What is the minimum deposit for FxPro in ZAR?

The minimum deposit on FxPro is R200 for cards and R1,600 for bank transfer or US$100. Although the broker recommends a minimum deposit of R17,000 or US$1,000 for all account types and both retail and professional clients because it will enable you to open larger trade sizes, you can actually deposit R1,600 via cards or bank transfers.

Note that you can only deposit a maximum of ZAR 200,000 per transaction via card. Bank transfers have no maximum deposit amount.

How do I deposit money into FxPro?

Follow these simple steps to deposit funds into FxPro Account:

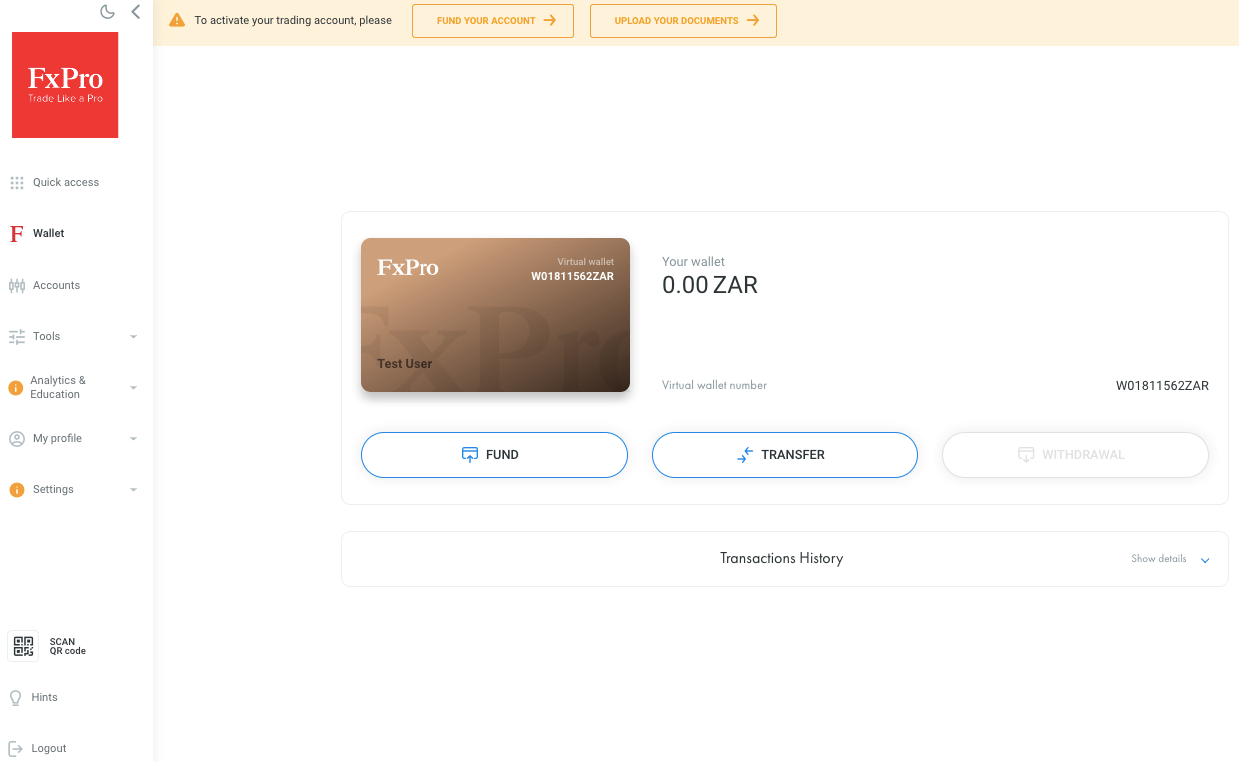

Step 1) Log in to your FxPro dashboard via direct.fxpro.group/en/login.

Step 2) Click on the ‘Wallet’ tab on the left side menu, then select ‘FUND’.

Step 3) Choose a payment method.

Step 4) Select the currency you want to deposit and enter the amount, then click ‘Fund’ and follow the on-screen instructions to complete your deposit.

What is the FxPro Minimum withdrawal?

There is no mandatory minimum withdrawal amount on FxPro. Although if you are withdrawing funds via card, you can only withdraw as much as you have deposited via the card, while withdrawals by bank transfers have no maximum amount.

Withdrawal requests on FxPro are processed within 1 working day and may take additional days for your to receive funds depending on your financial institution.

How do I withdraw money from FxPro?

Follow these simple steps to withdraw money from your FxPro Account:

Step 1) Log in to your FxPro dashboard.

Step 2) Click on the ‘Wallet’ tab on the left side menu, then select ‘WITHDRAWAL’.

Step 3) Choose a withdrawal method and follow the on-screen instructions to complete your withdrawal.

FxPro Trading Instruments

You can trade over 2,000 financial instruments on FxPro, find a breakdown of the instruments below:

| Instrument | Availability | Number |

|---|---|---|

| Forex CFDs | Yes | 70 currency pairs on FxPro (15 majors and 55 minors)) |

| Energies CFDs | Yes | 3 spot energies on FxPro (Brent, WTI, and NatGas) |

| Precious Metals CFDs | Yes | 14 pairs of Metals on FxPro (including Gold, Palladium and Silver) |

| Indices CFDs | Yes | 19 spot indices on FxPro (AUS200, UK100, Germany40, and others) |

| Shares CFDs | Yes | 2,126 shares on FxPro (US, UK, French shares and others) |

| Futures CFDs | Yes | 21 Futures on FxPro (including some indices, agric commodities, and oil) | Cryptocurrencies CFDs | Yes | 28 Cryptos on FxPro (including BTC, LTC and others paired to USD) |

FxPro Trading Platforms

Trading platforms supported by FxPro are:

1) MetaTrader 4 and MetaTrader 5: FxPro supports the MT4 and MT5 trading applications for trading financial markets. This is available on the web, desktop, and mobile devices (Android & iOS).

2) cTrader: You can also trade financial markets on FxPro with the cTrader platform, which has the web trader, desktop trader, and mobile app versions on Apple App Store and Google Play Store.

3) FxPro Edge: This is the proprietary FxPro trading platform, developed by Fxpro for trading financial markets. The FxPro Edge has web trader and mobile app versions for Android and iOS.

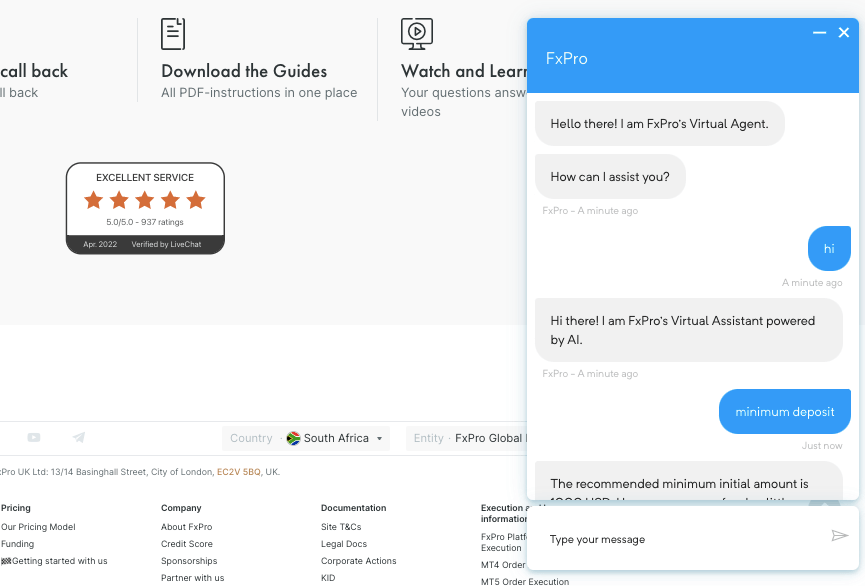

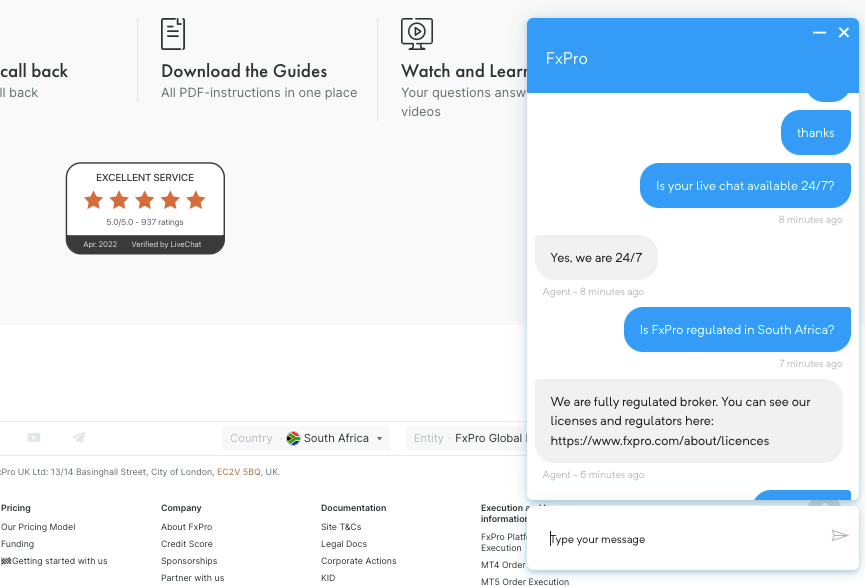

FxPro South Africa Customer Service

FxPro offers 24/5 online customer support to traders via the following channels:

1) Live chat support: The FxPro live chat can be accessed on the ‘Contact Us’ page of the FxPro website and is available 24/5. When our team tested the online live chat support, we got a response from a live agent under 10 minutes.

When you start the chat, the FxPro Virtual assistant will first suggest answers to your questions, and you can transfer to a live agent by typing live agent in the chat. The FxPro chatbot will request your email address and name. The live agents respond quickly and the answers to our questions were relevant.

Note that live agents are available 24/5 while the chatbot is available 24/7.

2) Email support: FxPro offers email support to traders. When we tested the FxPro email support, we got an autogenerated reply acknowledging our inquiry and then received a reply from a customer support representative 20 minutes later.

The FxPro email address for inquiries is [email protected].

3) Phone support: FxPro offers phone support to traders, and you can request a call back from the global office. This channel is also available 24/5.

Do we Recommend FxPro South Africa?

FxPro is regulated by Top-Tier regulators in the UK, Cyprus, and South Africa and are obligated to protect deposited client funds.

The fees on FxPro are also moderate as you can trade commission-free on all instruments with some account types. If you trade large volumes, you can become a VIP client and have discounts on the fees. You can also apply for a professional account to access more leverage and trade crypto assets.

FxPro’s customer service is responsive on all channels and available 24/5. The account opening process is fast and simple, and the broker’s website is easy to navigate and contains up-to-date information about the company and its trading platforms/conditions.

The broker is also good for beginners as you have negative balance protection and demo account option for practice although the minimum deposit of R1,600 is relatively high compared to some brokers.

It is also important for you to take into account that about 84% of retail clients lose money trading with this broker by using leverage as displayed on their website. You should not use all the leverage offered, you can use a demo account to get familiar with the platform before putting in real money.

We recommend that you visit FxPro website to read up more about them and chat with a customer support agent to help you make up your mind.

FxPro South Africa FAQs

How long does FxPro withdrawal take?

Withdrawal requests on FxPro are processed within 1 working day and may take 3 to 7 days to receive funds for card withdrawal and about 2 working days for withdrawals to local bank accounts.

Is FxPro regulated in South Africa?

FxPro is authorized in South Africa by the FSCA as ‘FxPro Financial Services Ltd’ and licensed as a financial services provider (FSP), with FSP number 45052, issued in 2015.

Does FxPro have a zar account?

FxPro has ZAR account currency for clients in South Africa. You can select it while creating an account and all your trades, deposits, withdrawals and profits will be measured in ZAR.

What is the minimum deposit for FxPro in Zar?

The FxPro minimum deposit in ZAR is R1,600 via cards or bank transfers in South Africa.

Does FxPro work in South Africa?

FxPro is authorised in South Africa by the FSCA (Financial Services Conduct Authority) as ‘FxPro Fianancial Services Ltd’ and licensed as a financial services provider (FSP), with FSP number 45052, issued in 2015.

Note: Your capital is at risk