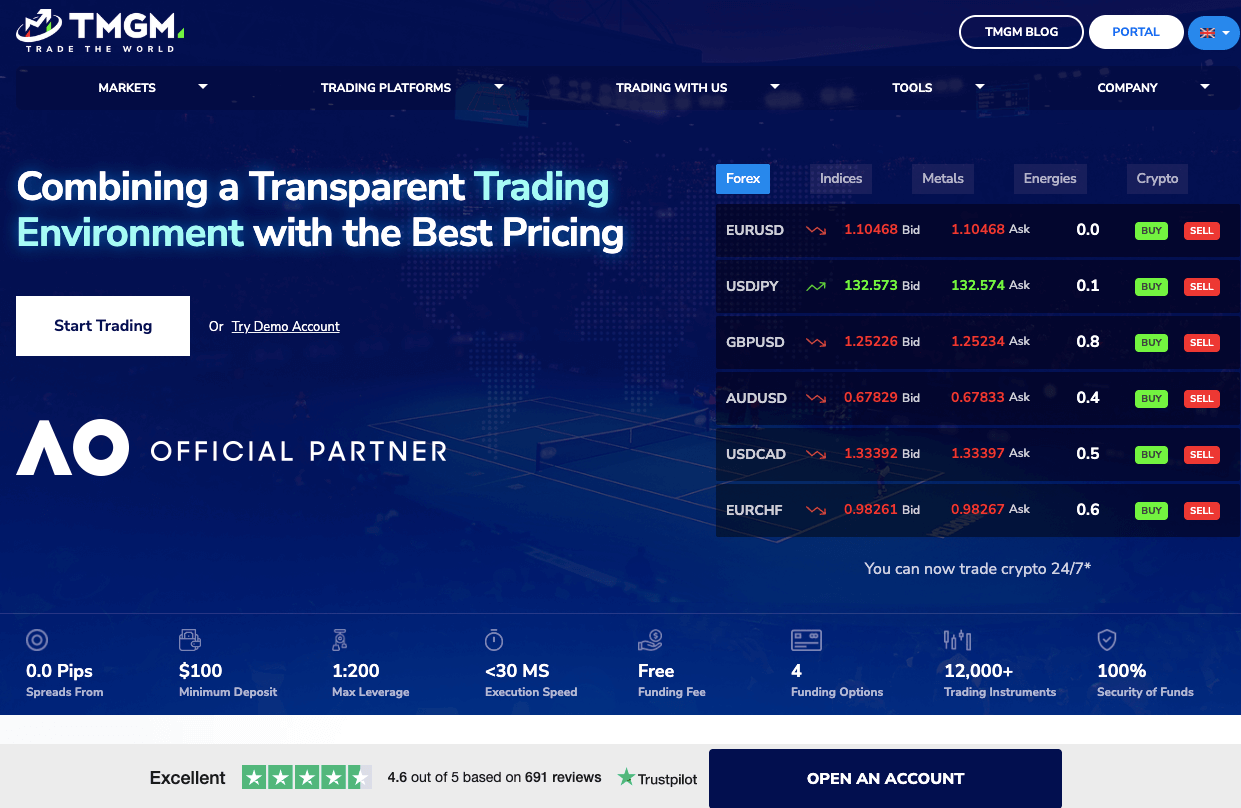

TMGM is a forex and CFD trading broker that has been operating since 2013. This broker has first started in Australia and has since built a presence in more than 150 countries, executed more than $220 billion in trading volume, and entered into a partnership with 7 top-tier liquidity providers.

TMGM is regulated by the FMA of New Zealand and is regulated in Australia and Vanuatu.

TMGM offers more than 12,000 trading instruments which include stocks, currency pairs, precious metals, cryptocurrencies, indices, and more.

In this review, we’ll discuss TMGM’s safety, overall fees, trading conditions, customer support, pros and cons, and provide our assessment on whether you should trade through them.

| TMGM Review Summary | |

|---|---|

| 🏢 Broker Name | Trademax Global Markets Limited |

| 📅 Establishment Date | 2014 |

| 🌐 Website | https://www.tmgm.com/en |

| 🏢 Address | 151 Queen Street, Auckland CBD, Auckland 1010, New Zealand. |

| 🏦 Minimum Deposit | NZD 100 |

| ⚙️ Maximum Leverage | 1:200 |

| 📋 Regulation | FMA, ASIC, VFSA |

| 💻 Trading Platforms | MT4, MT5, IRESS Viewpoint |

| Visit TMGM | |

TMGM Pros

- Regulated in New Zealand and Australia

- Has 24/7 live chat support

- Offers negative balance protection for retail clients

- Has NZD account currency

- Offers commission-free trading on Classic account

- Does not charge any fees for deposits or Withdrawals

TMGM Cons

- Educational material is limited

- Limited number of stocks

- No social trading or copytrading

Is TMGM regulated?

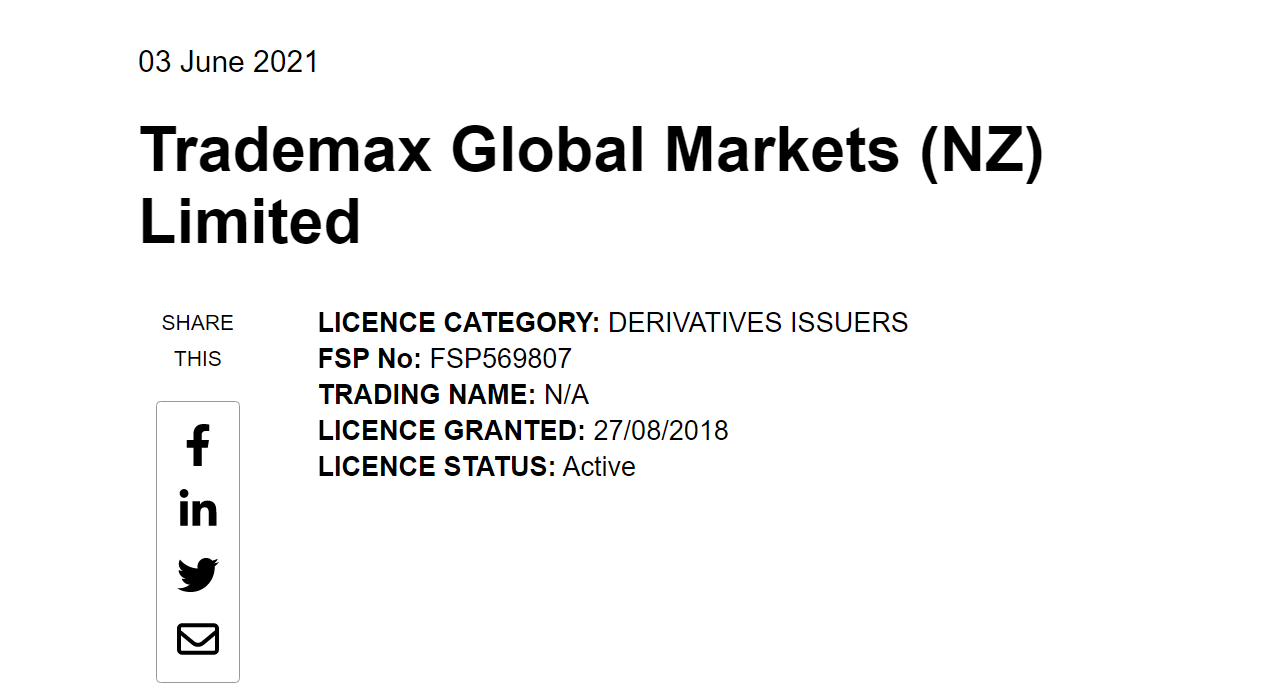

Even though TMGM is a relatively new broker, they are locally regulated in New Zealand by the Financial Markets Authority (FMA). Being locally regulated means that the broker needs to follow the rules and regulations laid out by the FMA and all their operations in the country are subject to the laws of New Zealand.

Further, they are also regulated by the ASIC of Australia which is a tier-1 regulatory authority respected around the globe.

Here is a breakdown of the licenses held by TMGM and its group companies:

1) Financial Markets Authority: Trademax Global Markets (NZ) Limited is regulated by the FMA of New Zealand and holds the FSP No. 569807.

2) Australian Securities and Investment Commission: Trademax Australia Limited is regulated by the ASIC of Australia and holds the license number 436416.

3) Vanuatu Financial Services Commission: Trademax Global Limited is regulated by the VFSC of Vanuatu and holds the license number 40356.

Further, in addition to being regulated by the above regulators, TMGM also follows other safety practices such as negative balance protection and segregation of funds.

TMGM Leverage

The leverage offered by TMGM depends on the asset class being traded by the trader and the trading platform. The maximum leverage offered by TMGM is 1:200, this applies to major currency pairs which generally attract the highest leverage from brokers.

With a leverage of 1:200, you can open a trade position worth 200 times the value of your deposit. For example, you can place a $200,000 trade on a major forex pair with a deposit of $1,000.

Note that the TMGM maximum leverage of 1:200 applies to major forex pairs and metals, other instruments have lower margins such as indices and energy 1:100, equities (stocks) 1:20 and crypto 1:5.

You can increase your leverage on TMGM in New Zealand by upgrading your account, on the portal, click the button to complete the questionnaire to upgrade your accounts. And the upgraded account would be able to access higher leverage of 1:400.

However, it is recommended that traders use lower leverage in order to reduce the risk associated with their trades. It is best for you to avoid trading leveraged products if you don’t understand them or have experience, leveraged products are risky and you can lose all your money.

TMGM Account Types

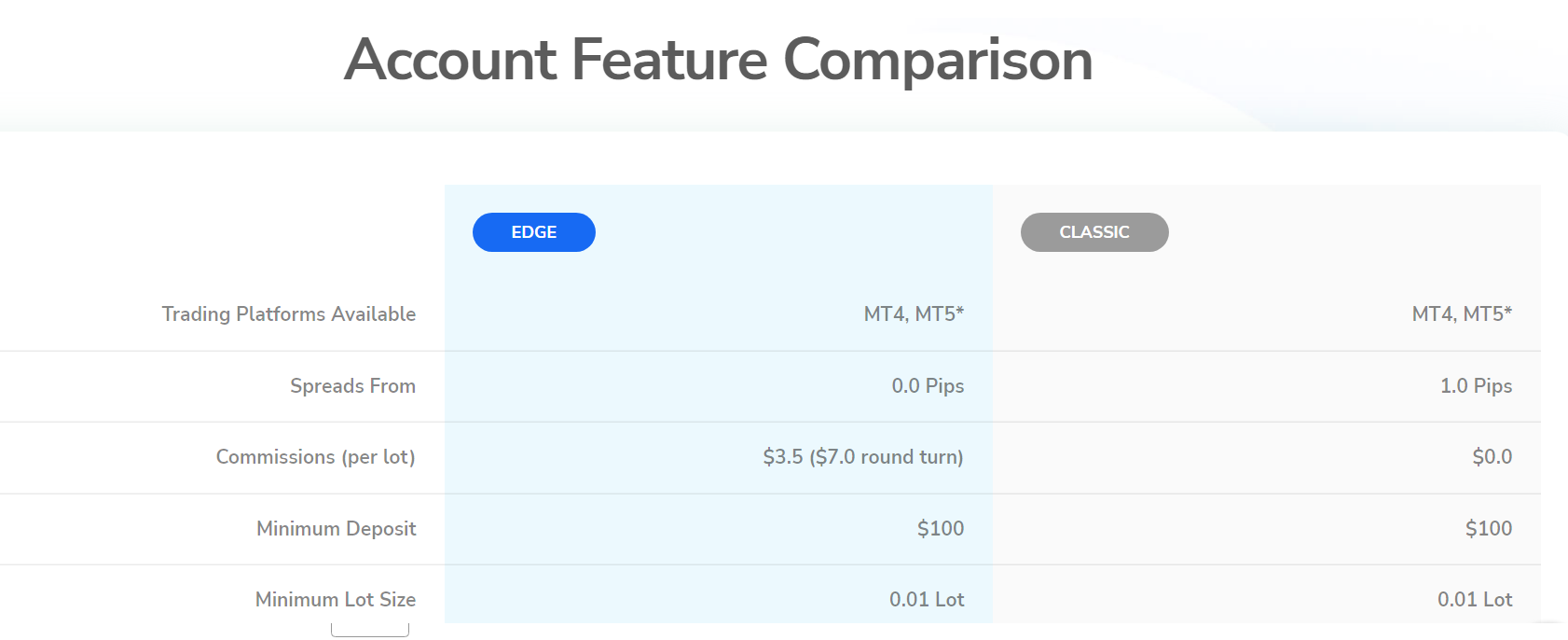

TMGM offers two primary types of accounts to its traders from New Zealand.

1) Classic account: The Classic account offers spreads starting from 1.0 pips (which is slightly on the higher side). The Classic account is a spread-only account which doesn’t charge a commission. Traders need to make a minimum deposit of $100 in order to open such an account. The maximum leverage can be 1:200. Traders can use the MetaTrader 4 or MetaTrader 5 trading platform with this type of account. The Classic account is meant for low-volume traders who are relatively new to trading.

2) Edge account: The Edge account offers spreads starting from 0.0 pips. Additionally, the Edge account charges a commission of US$3.5 per lot per trade (NZD 5.7). Traders need to make a minimum deposit of $100 in order to open such an account. The maximum leverage can be 1:200. Traders can use the MetaTrader 4 or MetaTrader 5 trading platform with this type of account. The Edge account is meant for high-volume traders who are experienced in trading.

3) Islamic Account: Both the Classic account and the Edge account can be converted into an Islamic account. The Islamic account will have the same trading conditions as the underlying account, with the only difference that traders will not be charged a swap-fee. A swap fee is illegal under Islamic law, hence, this type of account has been created solely for Islamic traders. You need to be a follower of Islam in order to be eligible to open such an account.

4) Demo Account: A demo account can be opened free of cost in order for beginners to check out TMGM’s services as well as practice their trading strategies and learn how to trade. A demo account mimics real-world trading conditions. A demo account runs on virtual money and is solely meant for practicing purposes without any real money involved.

TMGM Base Account Currency

The base account currency is the currency in which your deposits, withdrawals, and trades will be measured. TMGM offers a wide variety of base currencies: USD, EUR, GBP, AUD, NZD, and CAD.

For traders from New Zealand, we recommend using NZD as a base currency so that you don’t have to pay currency conversion charges to your financial services provider.

TMGM Overall Fees

One of the first things that you need to check when evaluating a broker is how much they charge. A broker should charge reasonable fees and not have any hidden fees. We’ll be discussing both trading fees and non-trading fees charged by TMGM.

Trading fees

1) Average Spreads: TMGM charges a spread on every trade. Their spreads are average when compared other similar brokers operating in New Zealand. The spread depends on the type of account being used by the trader.

Under their Classic account, they charge a minimum spread of 1 pip on every trade.

Under their Edge account, they charge a minimum spread of 0 pips on every trade.

This spread can vary depending on the timing of the trade and the instrument being traded.

2) Average Commissions: TMGM charges a commission through their Edge account (where the spreads are much lower) while the Classic account is commission-free (but the spreads are much higher). Paying a commission and opting for low spreads makes financial sense for high-volume traders.

Under the Edge account, traders are charged a fixed commission of $3.5 per lot per trade (NZD 5.7). This commission is fixed and does not vary.

3) Swap fees: For traders using an Islamic account, there is no swap-fee. However, for everyone else, TMGM charges a swap-fee. This is a fee which is charged when traders hold an open position overnight. The swap-fee is cut from your profit or loss when you close the trade.

The amount of swap fee depends on the instrument being traded and the size of the trade.

4) Currency Conversion Fee: A currency conversion fee is charged whenever you trade an instrument which is not denominated in the base currency of your account.

For example, if the base currency of your trading account is NZD and you trade the EUR/USD, then you will be charged a currency conversion fee by TMGM.

Non-trading fees

1) Deposit and Withdrawal fees: TMGM does not charge any fees when a trader makes a deposit or a withdrawal from their trading account. However, the trader may be charged a fee from their payment service provider for executing the fund transfer.

2) Account Inactivity charges: TMGM does not charge any inactivity fee. Traders can choose to not trade through their account for any length of time without incurring a fee.

How to Open TMGM Account in New Zealand?

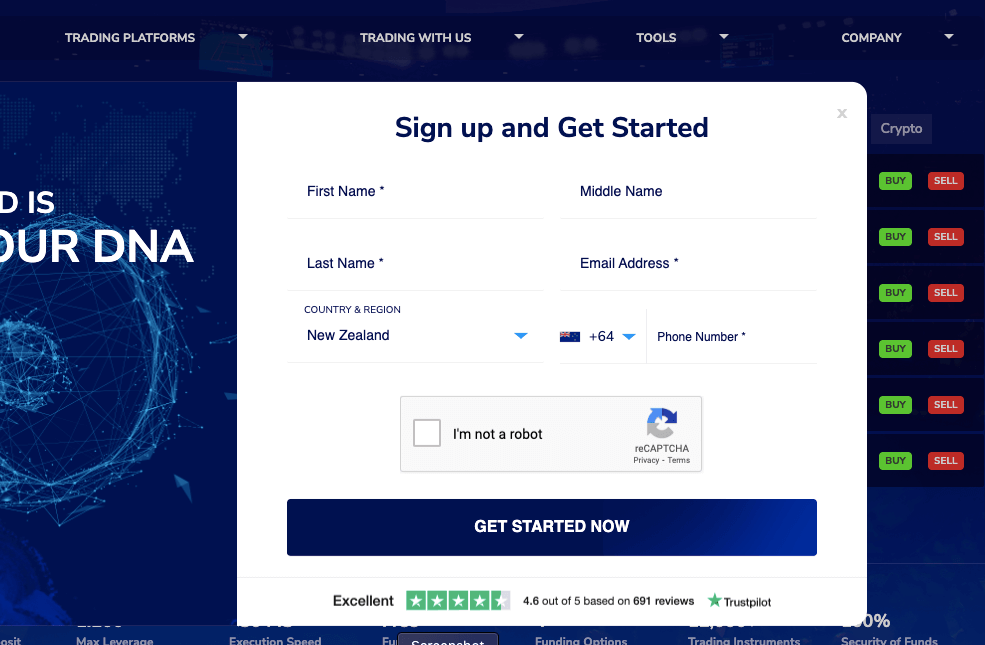

To start trading with TMGM, follow the steps below to create a TMGM trading account.

Step 1) Go to the TMGM website homepage via www.tmgm.com and Click the ‘Start Trading’ or ‘OPEN AN ACCOUNT’ button.

Step 2) Input your name, email, and phone number on the form that appears then click ‘GET STARTED NOW’. You will be redirected to the TMGM dashboard.

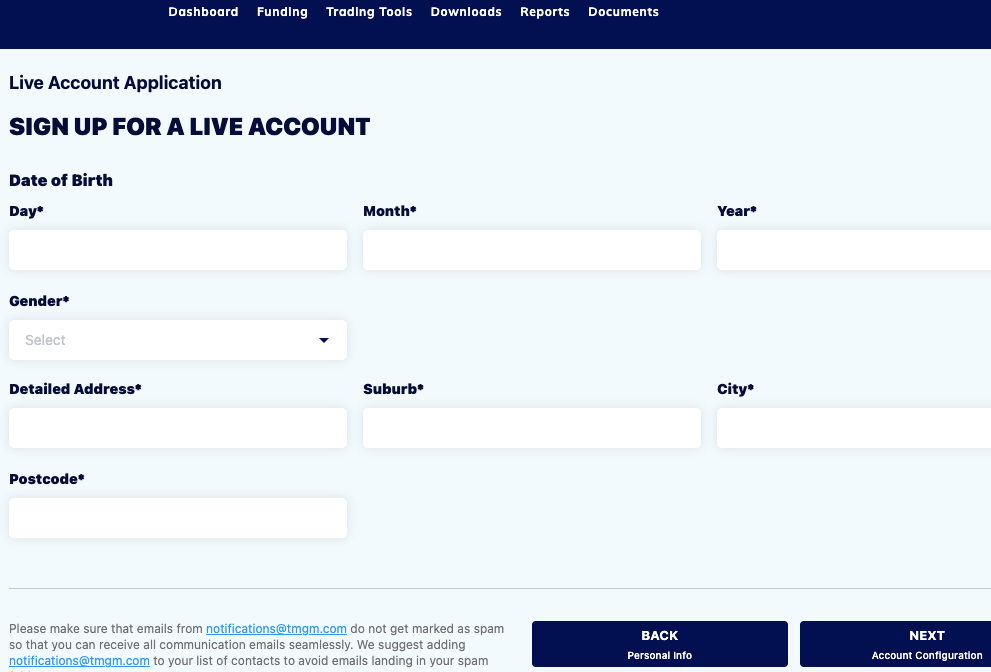

Step 3) On the dashboard, provide your date of birth and address then click ‘NEXT’.

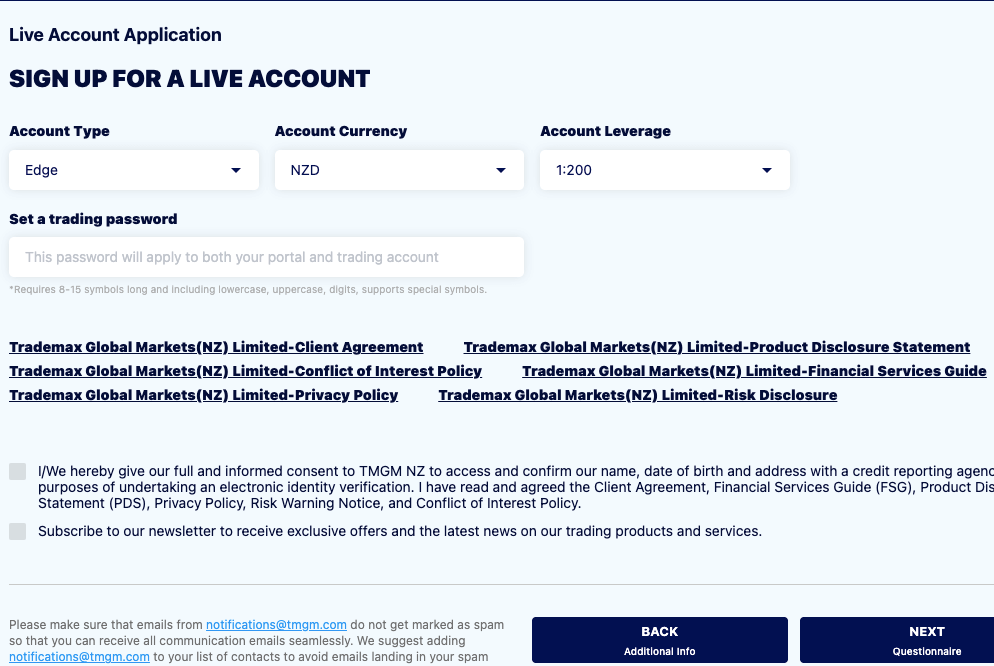

Step 4) Select your preferred account type and account currency, set your preferred maximum leverage, set a password and agree to the terms and conditions then click ‘NEXT’.

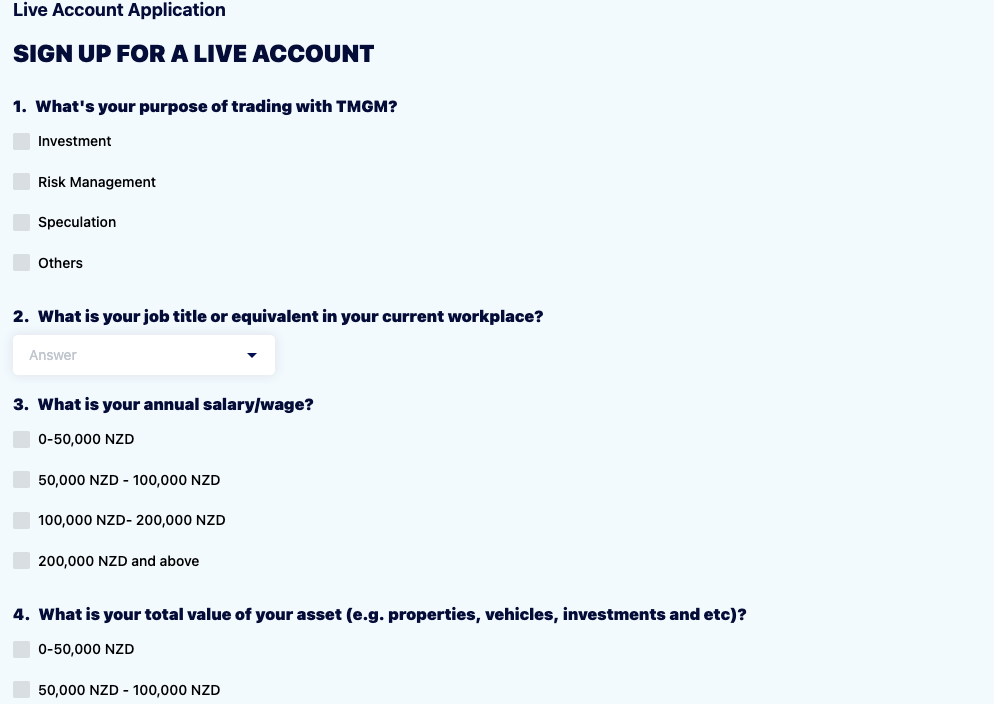

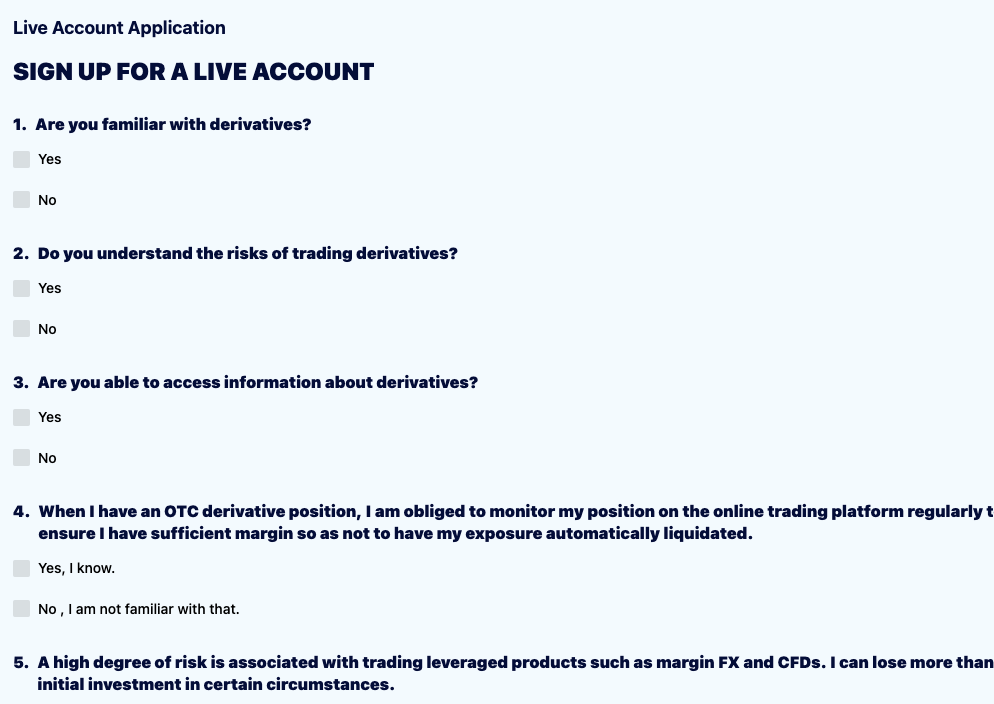

Step 5) Answer questions about your financial status, CFDs trading experience, and knowledge of trading, provide your Tax information then click ‘NEXT’

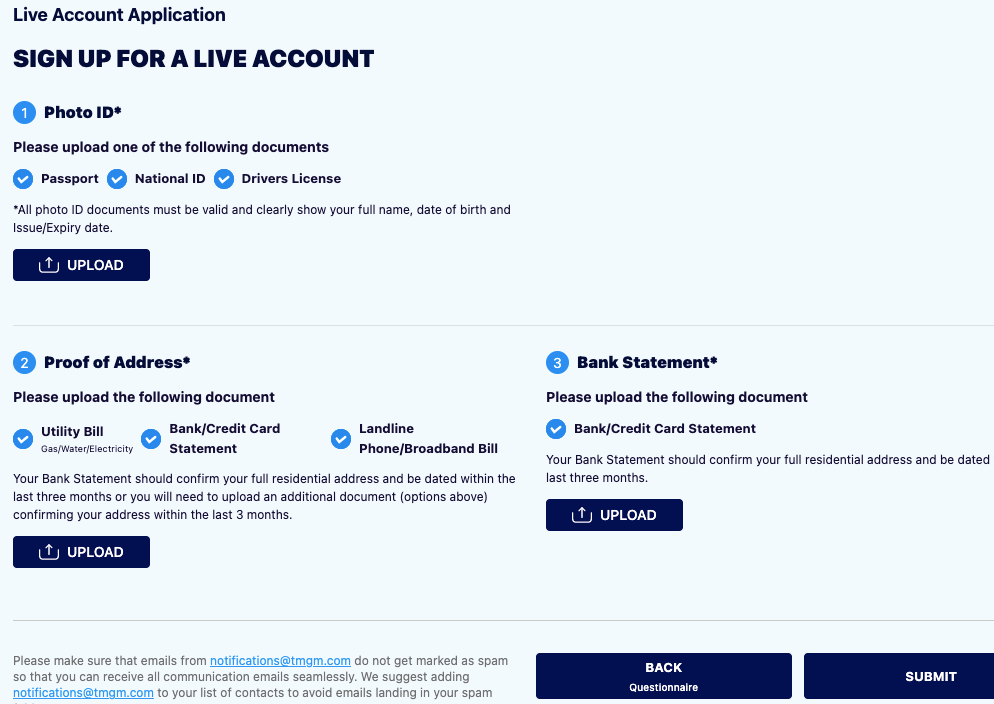

Step 6) To verify your account, Upload your identity document, proof of address and bank statement then click ‘SUBMIT’. You will receive an email once your account is verified then you can can make deposits, trade, and withdraw funds.

TMGM Deposits & Withdrawals

Traders from New Zealand can deposit and withdraw funds in a variety of ways. Here is a breakdown:

TMGM Deposit Methods

Here is a summary of payment methods accepted by TMGM for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Transfer | Yes | Free | 1 to 3 business days |

| Cards | Yes | Free | Instant |

| E-wallet | Yes (Skrill, Neteller) | Free | Instant |

TMGM Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on TMGM.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Transfer | Yes | Free | 1 to 3 business days |

| Cards | No | N/A | N/A |

| E-wallets | Yes (Skrill, Paypal) | Free | Instant |

What is the TMGM Minimum Deposit?

TMGM requires a minimum deposit of NZD 100 at the time of opening your trading account. This minimum deposit remains the same regardless of which type of account (Classic or Edge) you open.

What is TMGM Minimum withdrawal?

The minimum withdrawal amount on TMGM is NZD 100 for bank transfers and while e-wallets.

To deposit or withdraw funds on TMGM NZ, login to your account dashboard, click the ‘Funding’ tab, Select ‘Add Funds’ or ‘Withdraw Funds’ and follow the onscreen instruction to complete your deposit or withdrawal.

TMGM Trading Instruments

The variety of trading instruments offered by TMGM is are shown on the table below:

| Instrument | Availability | Number |

|---|---|---|

| Forex CFDs | Yes | 50 currency pairs on TMGM (including majors & minors) |

| Precious Metals CFDs | Yes | 3 metal commodities on TMGM (Gold, Silver, and Platinum) |

| Shares CFDs | Yes | 12,000+ shares on TMGM (US, Australia and Hong Kong shares) |

| Indices CFDs | Yes | 15+ spot indices on TMGM (US-TECH 100, UK100, GER40, and others) |

| Energies Commodities CFDs | Yes | 3 Energies on TMGM (Brent and WTI oil and Natural Gas) |

| Crypto CFDs | Yes | 12 Cryptocurrencies on TMGM (BTc, LTC, and others) |

TMGM Trading Platforms

TMGM does not offer any proprietary trading platform. Instead, they offer the highly popular MetaTrader 4 and MetaTrader 5 trading platforms along with the IRESS platform.

1) MetaTrader 4: This is one of the most commonly used trading platforms in the world. This platform allows you to trade with fast execution and intuitive technical indicators. You can use the platform on your Windows, iOS, MacOS, and Android devices. You can even access the platform through any web browser.

2) MetaTrader 5: The MetaTrader 5 is a more advanced version of the MT4. This platform has more technical indicators along with several advanced features meant for sophisticated traders. This platforms on all the devices on which MT4 works.

3) IRESS Viewpoint: The IRESS Viewpoint is a web-based trading platform. You do not need to download any software or app in order to use this platform. The platform allows you to set up a workspace which can make trading more convenient and quicker. It offers real-time price discovery and advanced charting solutions.

TMGM New Zealand Customer Service

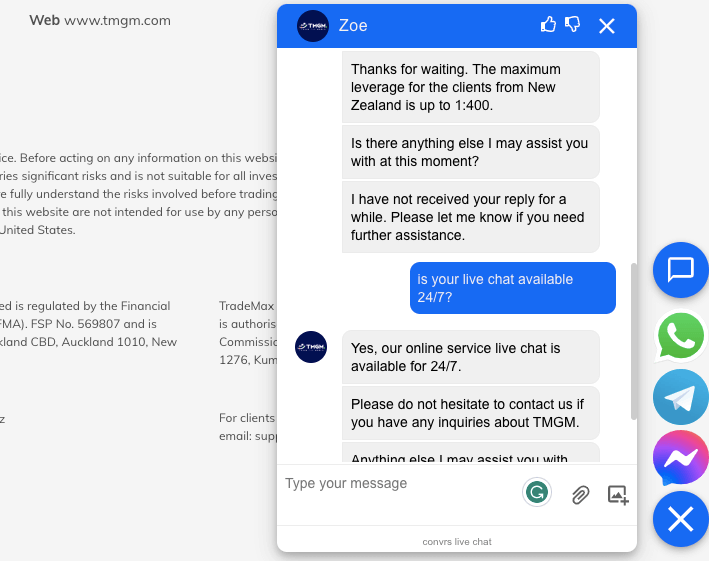

TMGM offers customer support through phone call, email, and live chat. You can reach their customer support team at any time (including weekends).

1) Live Chat: Their live chat option is available 24/7 on their website. Traders can get very quick responses to their queries and their support team is quite knowledgeable, helpful, and polite. It took us around 2 minutes to receive a response for our query.

2) Email: They can be contacted on their dedicated customer support email address which is [email protected]. This option is suitable for more lengthy and complicated user queries. When our team tested it, we got a reply within 20 minutes and the answer was relevant.

3) Phone Call: They have a dedicated phone line which can be contacted by people who prefer to use the phone. Regular calling charges may apply as they do not have a toll-free number. The TMGM phone number for customer support is +61 2 8036 8388.

Overall, we found their customer support to be quite excellent. They offer a variety of ways to get in touch with them and they have extensive and organized FAQs section.

Do we Recommend TMGM to traders from New Zealand?

TMGM is an excellent broker for traders from New Zealand (No, we are not affiliated with them), because they are not only regulated by the FMA of New Zealand but also the ASIC of Australia (which is a tier-1 financial authority respected around the world). Which means they are mandated to protect deposited client funds.

Further, TMGM offers a decent range of trading instruments which includes cryptocurrencies that will appeal to younger traders. They offer both the MT4 and MT5 trading platforms (which are highly popular and used by traders around the world) along with the intuitive IRESS Viewpoint.

TMGM charges reasonable fees and they have no hidden fees. They do not charge any deposit, withdrawal, or inactivity fee.

Additionally, their customer support is helpful and responsive and you can get in touch with them through a variety of ways.

There are some drawbacks to trading through TMGM such as the fact that their educational material for new traders is quite limited. They also do not provide copy trading or social trading services. Further, they offer a very low number of stocks for trading.

Based on these details about TMGM, we recommend that you check out their website to confirm the information we have shared here and see if they are a right fit for your trading needs.

TMGM New Zealand FAQs

Is TMGM a legit broker?

Yes, TMGM is a legit broker. TMGM is regulated by the FMA of New Zealand and the ASIC of Australia. Make sure that you access the correct website of TMGM (tmgm.co.nz) as their may be fake websites out there.

Who is TMGM?

TMGM is a CFD broker that offers derivative trading services. They are highly reputed and cater to clients across the globe. They are well-regulated in New Zealand and Australia and have offices in both countries. They have been operating since 2014.

What does TMGM mean?

The full form of TMGM is Trade Max Global Markets. TMGM is regulated in New Zealand as a financial service provider.

How long does it take to withdraw money from TMGM?

It takes 1-3 business days for withdrawals via bank transfers and it is instant for e-wallets such paypal and skrill.

Is TMGM an ECN?

Yes, TMGM offers trading services through ECN. ECN allows traders to trade without worrying about a conflict of interest with the broker.

Note: Your capital is at risk