Tickmill is a regulated Forex and CFDs broker that provides services for trading financial instruments such as foreign exchange currencies, commodities, stock indices, oil, precious metals, cryptocurrencies, and bonds.

Tickmill was launched in 2014, they are registered in Seychelles and are also regulated in multiple jurisdictions to provide financial services. Tickmill accepts traders from Nigeria.

This Tickmill review will explore the trading conditions, trading fees, deposit/withdrawal options and regulations, and customer support offered by the Forex broker.

| Tickmill Review Summary | |

|---|---|

| 🏢 Broker Name | Tickmill Ltd |

| 📅 Establishment Date | 2014 |

| 🌐 Website | www.tickmill.com |

| 🏢 Address | Tickmill Ltd, 3, F28-F29 Eden Plaza, Eden Island, Mahe, Seychelles |

| 🏦 Minimum Deposit | $100 |

| ⚙️ Maximum Leverage | 1:500 |

| 📋 Regulation | FSA Seychelles, FCA, CySEC, FSCA |

| 💻 Trading Platforms | MT4 and MT5 for PC, Mac, Web, Android, & iOS, Tickmill App |

| Visit Tickmill | |

Tickmill Pros

- Authorised by Top – Tier regulators

- Does not charge dormant account fees

- Low trading fees with tight spreads

- Supports bank transfer in Nigeria

- Offers commission-free trading account

Tickmill Cons

- Customer support is not available for 24 hours on any day

- Does not have Naira as Account Currency

- Negative balance protection is not guaranteed

Is Tickmill Safe for Traders?

Tickmill, which is the trading name of the Tickmill Group, is among the regulated forex and CFDs brokers and they are licensed by Tier-1 and Tier-2 financial regulators.

Below is a list of the various regulations of the Tickmill Group:

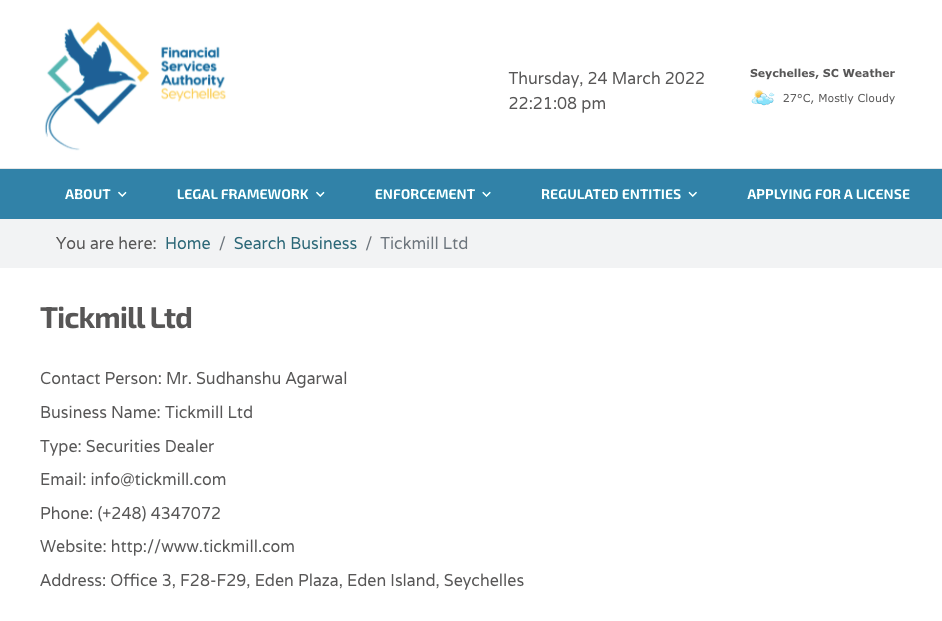

1) Financial Services Authority (FSA), Seychelles: Tickmill Ltd is registered with the Seychelles Financial Services Authority and licensed to operate as a securities dealer with license number SD008.

Nigerian traders are registered under this offshore regulation.

Note that the broker is not regulated in Nigeria which means trading with them is at your own risk, this is because the foreign regulation consumer protection policies may not cover traders based in Nigeria.

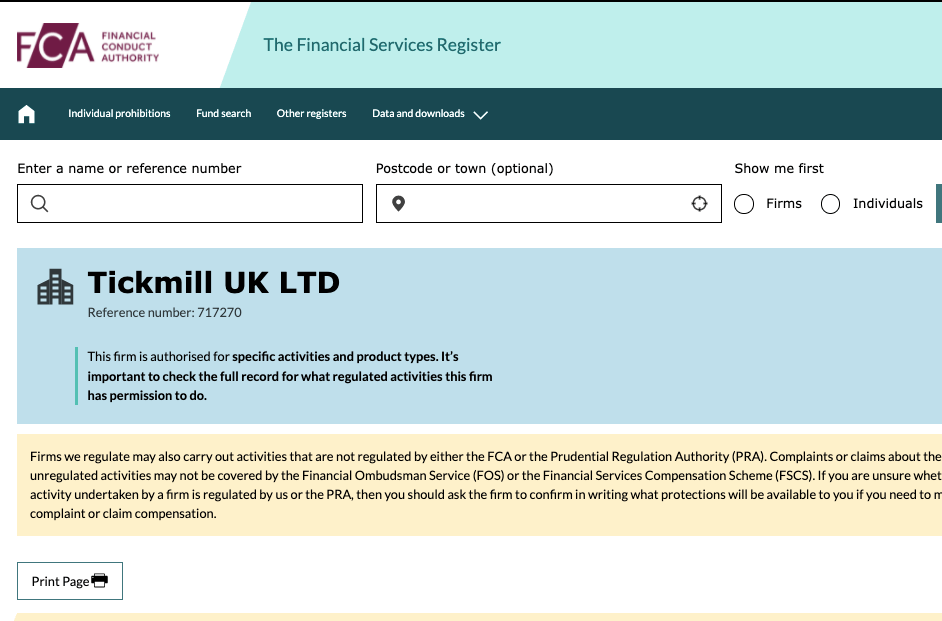

2) Financial Conduct Authority (FCA), United Kingdom: Tickmill is authorised and regulated by the (FCA) as Tickmill UK Ltd and licensed to offer financial services with license number 717270. Tickmill has an office in London through which they serve UK clients.

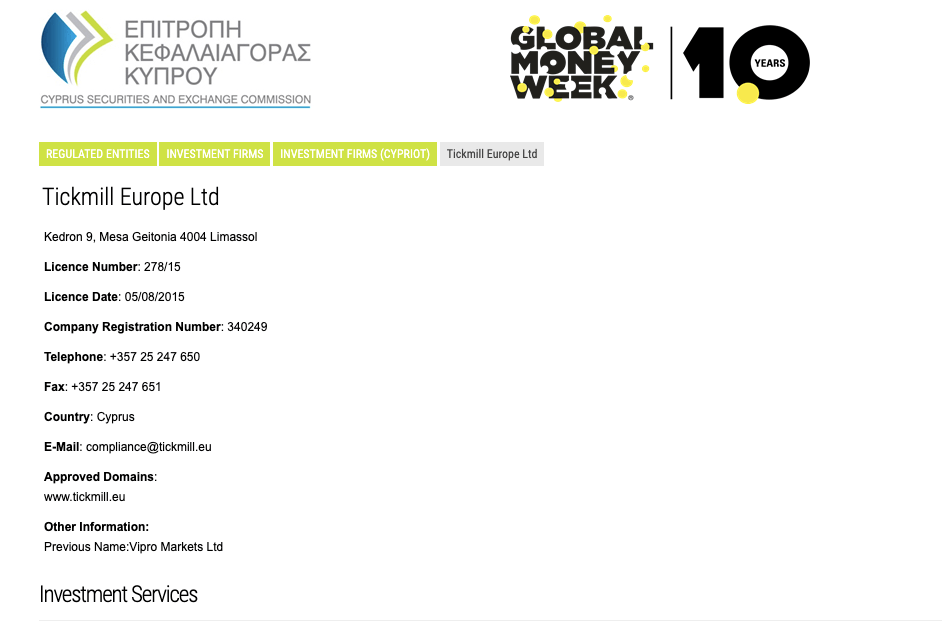

3) Cyprus Securities and Exchange Commission (CySEC): Tickmill is also registered as Tickmill Europe Ltd, with license number 278/15, in Cyprus. Tickermill is authorised by CySEC to provide investment services to European-based clients.

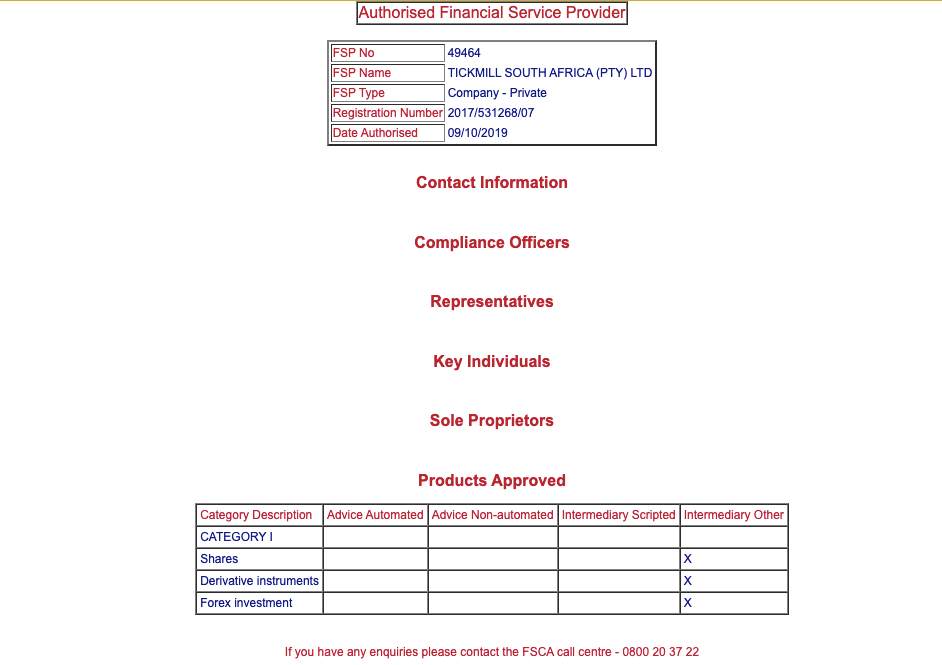

4)Financial Sector Conduct Authority (FSCA) in South Africa: Tickmill is authorised and regulated by the FSCA as Tickmill South Africa (Pty) Ltd. Tickmill is licensed as a financial service provider with FSP number 49464.

Tickmill Investor Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| UK | £85,000 | Financial Conduct Authority (FCA) | Tickmill UK Ltd |

| EU Countries | €20,000 | Cyprus Securities and Exchange Commission (CySEC) | Tickmill Europe Ltd |

| Malaysia | No Protection | Labuan Financial Services Authority (Labuan FSA) | Tickmill Asia Ltd |

| South Africa | No Protection | Financial Sector Conduct Authority (FSCA) | Tickmill South Africa (Pty) Ltd |

| Seychelles | No Protection | Financial Services Authority (FSA) | Tickmill Ltd |

Nigerian traders are registered under Tickmill Ltd (Seychelles). Though there is no compensation fund, your account is protected from negative balance. If you trade with high risk, Tickmill may choose not to grant you negative balance protection. hey can also reduce the leverage on your account because of high risk trading.

Tickmill Leverage

The maximum leverage on Tickmill is 1:500, regardless of the type of account that you use. Tickmill lets customers open and maintains positions on all account types with Leverage up to 500 times their own money.

For example, with leverage of 1:500, you can place a trade of $50,000 with a deposit of $100.

The maximum leverage of 1:500 applies to major forex pairs and gold. Leverage limits are lower for other tradable instruments. The Tickmill maximum leverage for indices, bonds and oil is 1:100, silver is 1:125, other commodities are 1:50, and cryptocurrency is 1:20, although some crypto pairs can have a leverage of up to 1:200.

Note that that trading leverage products involves risk and you can lose all your money. It is best to avoid trading unless you understand it or have experience. It is important that you do not use the leverage available as it increases your risk and the chance of you losing your money.

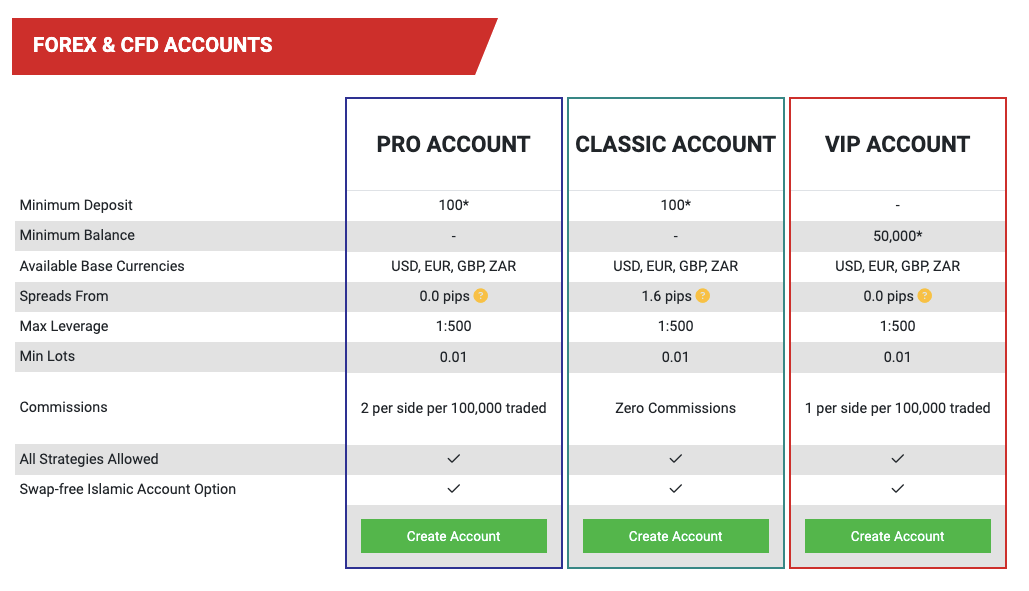

Tickmill Account Types

Tickmill offers three (3) types of accounts for you to choose from, each account has different features.

Tickmill demo accounts provide new traders with a basic idea of how to use the trading platform. They also offer Islamic account options for Muslim traders.

To help you choose the account that is right for your trading style, we described the features of the different account types on Tickmill below.

1) Pro Account: The Tickmill Pro Account is available on the MT4 & MT5 trading application and is suitable for experienced traders.

Pro Account lets you trade Forex and CFDs on currency pairs, cryptocurrencies, stock indices, precious metals, oil, and bonds.

Tickmill Pro Accounts operates with floating spreads starting from an initial 0.0 pips. The account also attracts commission charges of 2 EUR per side per lot (100,000) traded which makes it 4 EUR for a round turn when you trade forex pairs and metals.

This account does not charge commissions when you trade CFDs on Stock Indices, Cryptocurrencies, Oil and Bonds.

The Pro Account does not have maximum stop and limit levels and uses market execution for orders on forex trades.

The minimum deposit on the Tickmill Pro Account is $100 and requires a minimum trade volume of 0.01 lots. The maximum leverage available on this account is 1:500. This account has negative balance protection to ensure you do not lose more money than you deposited.

2) Classic Account: The Tickmill Classic Account is available on the MT4 & MT5 trading application and is designed to fit the needs of new traders.

With a Classic Account, you can trade Forex, and CFDs on currencies, cryptocurrencies, stock indices, precious metals, oil, and bonds.

Tickmill Classic Accounts offers variable spreads, starting at 1.6 pips. The account charges zero commissions for all trades.

The Tickmill Classic Account has a $100 minimum deposit requirement and a minimum trade size of 0.01 lots (equivalent to $10). The maximum leverage available on this account is 1:500 and you have negative balance protection.

3) VIP Account: The Tickmill VIP Account is available on the MT4 & MT5 trading platforms and is designed for high-volume forex traders.

VIP Account allows you to trade Forex and CFDs on currencies, cryptocurrencies, indices, gold and silver, oil, and bonds.

Tickmill VIP Accounts offers floating spreads starting at 0.0 pips, plus commission fees of 1 EUR per side per lot (100,000) traded, for a total of 2 EUR per round-turn on forex and metals trades.

This account features zero commission fees when you trade CFDs on Stock Indices, Cryptocurrencies, Oil and Bonds.

The VIP Account does not have stop or limit levels. It uses market execution for all orders.

To create a VIP Account must have a minimum balance of 50,000 units of your account currency. A minimum trade volume of 0.01 lot is required on this account, the maximum leverage available is 1:500 and you also have negative balance protection with this account.

4) Swap-free Islamic Account: Tickmill offers Islamic Account options to traders on all account types. Thus, the accounts feature no riba (usury) in accordance with Islam’s Sharia law.

The main feature of this account type is that you are not charged any fees for holding a position overnight.

On the Tickmill Islamic Account, you can hold a position open for 3 consecutive nights without being charged swap fees. After that, a handling fee will be applied.

You can create any account type (Pro, Classic, or VIP), request that it be converted to an Islamic Account, and your future accounts will be Islamic Accounts.

The conversion will usually be completed within a day of making the request and you will receive an email confirmation for it.

Tickmill Base Account Currency

The base account currencies on Tickmill are EUR, GBP, ZAR and USD. These currencies are available on all account types.

Tickmill does not offer Nigerian Naira (NGN) as a base currency. Any deposits made in Naira will be converted to one of the existing account currencies.

Tickmill Overall Fees

How much fees you pay to trade on Tickmill depends on which type of account you choose and the instruments you trade. The various Tickmill fees are summarised below:

Trading fees

1) Spreads: Tickmill uses a variable spreads system, and its spreads start from 0.0 pips on the Pro Account and VIP Account, and from 1.6 pips on the Classic Account.

On the table below you can find the typical spread fees for major currency pairs traded on Tickmill per lot size of 100,000 EUR on a Pro Account.

| Instrument/Pair | Tickmill Typical Spread |

|---|---|

| EUR/USD | 0.1 pips |

| GBP/USD | 0.3 pips |

| EUR/GBP | 0.4 pips |

| XAU/USD | 0.09 pips |

2) Commission fees: Tickmill offers commission-free trading to Classic Account users but charges Pro Account holders a commission fee for opening and closing trade positions, starting from 2 currency units (either EUR, GBP, or USD) per side lot when they trade forex pairs, which makes it 4 units per round turn; VIP Account holders pay a commission fee of 1 currency unit per lot side and 2 units per round turn on forex trades as well.

If your account currency is USD, the commission fee for Pro accounts will be $2 per lot side and $4 for a round turn; for VIP accounts, it will be $1 per lot side and $2 for a round turn.

Note that 1 lot size is 100,000. If you trade less than this the fee will be prorated.

3) Swap fees: Tickmill charges an overnight/rollover swap fee on all account types if your position remains open overnight. This is a charge for holding a trading position open overnight after the market’s closing time, and it is based on your leverage, trade size, spread and whether your position is a long swap (buy option) or a short swap (sell option).

Islamic Accounts do not pay swap fees because they are swap-free. All trading account types can be set up with Swap-Free status. This account setting is available for Muslim traders with Islamic Accounts.

A handling fee per lot applies on Islamic accounts after holding a position overnight for more than three days consecutively. The fee depends on the instrument being traded.

Non-trading fees

1) Deposit and Withdrawal fees: There are no fees charged when you deposit funds into your Tickmill trading account or request withdrawals from it. Although Tickmill only covers deposit fees for bank wire transfers for deposit amounts above $5,000.

2) Account Inactivity charges: Tickmill does not charge any dormant account fees, which means that your money will not be affected when you do not log into your account for a prolonged period of time.

Although all inactive trading accounts (as a result of no trading, deposit/withdrawal activity and/or failure to log in to the trading platform) for at least 60 calendar days and with a balance of equal or less than 50 USD or equivalent in other currency, will be subject to disablement.

| Fee | Amount |

|---|---|

| Inactivity fee | None |

| Deposit fee | None |

| Withdrawal fee | None |

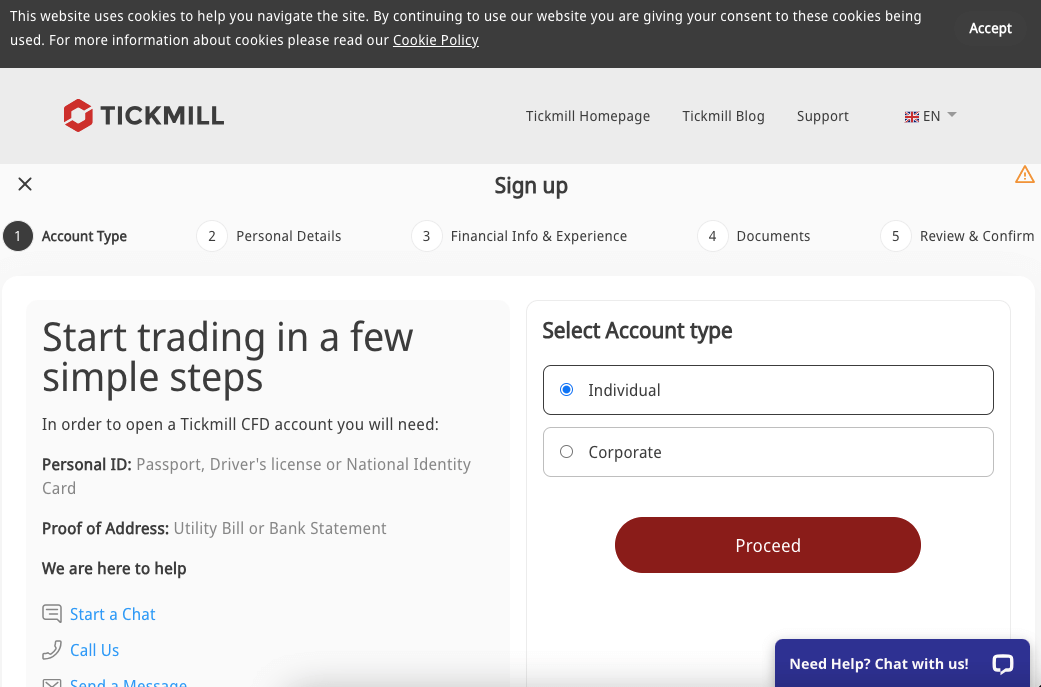

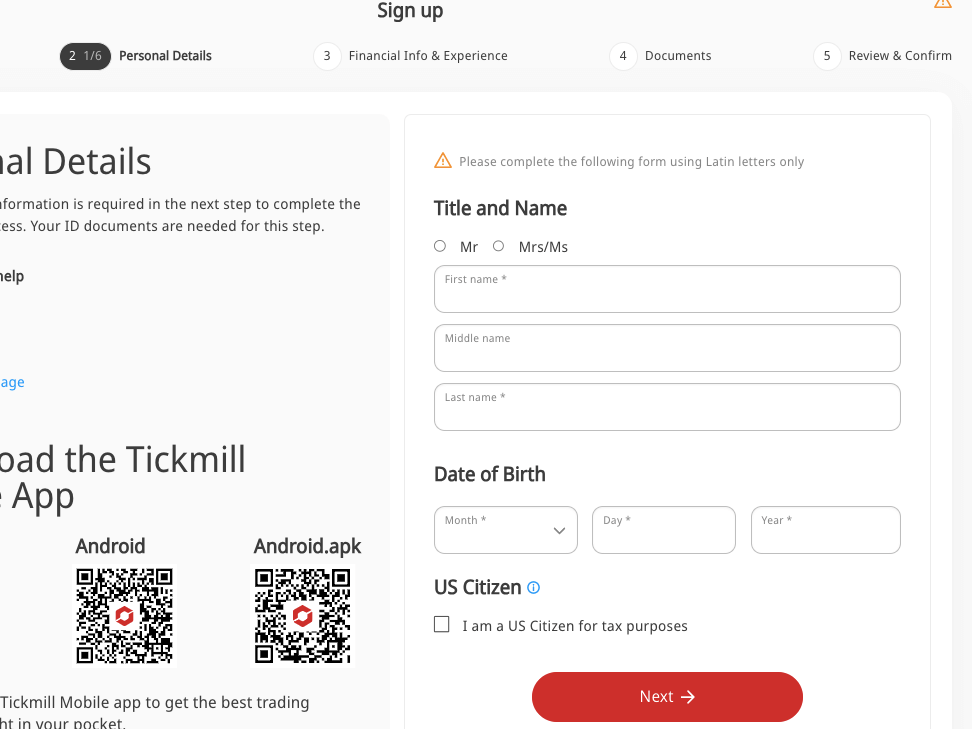

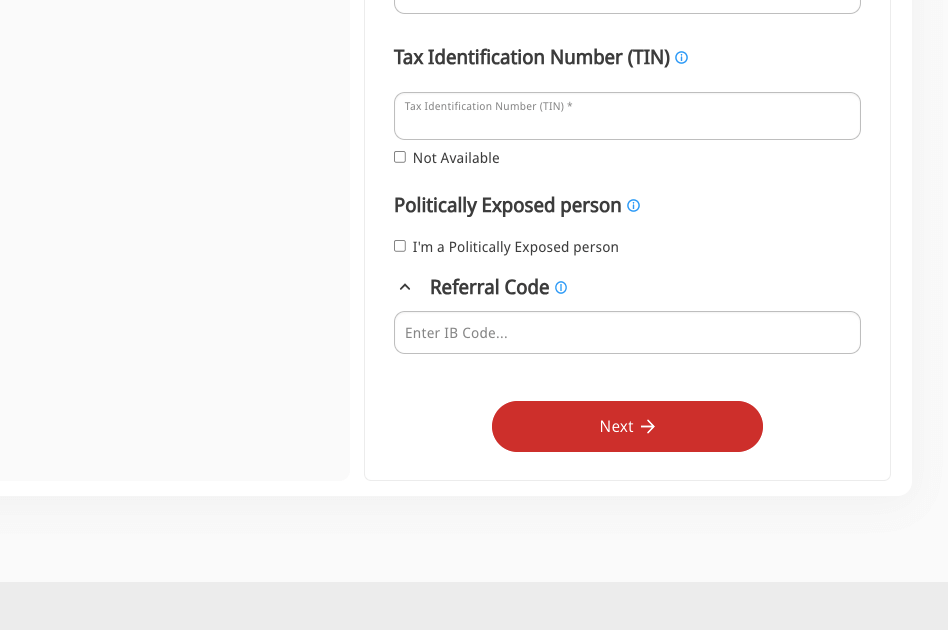

How to Open Tickmill Account in Nigeria

To trade Forex & CFDs on Tickmill, you need to open a live trading account. Follow these steps to sign up for an account with Tickmill.

Step 1: Go to the Tickmill website homepage via www.tickmill.com and click on ‘Create Account’. This is highlighted in the green button at the top right side. Select individual account type then click ‘Proceed’.

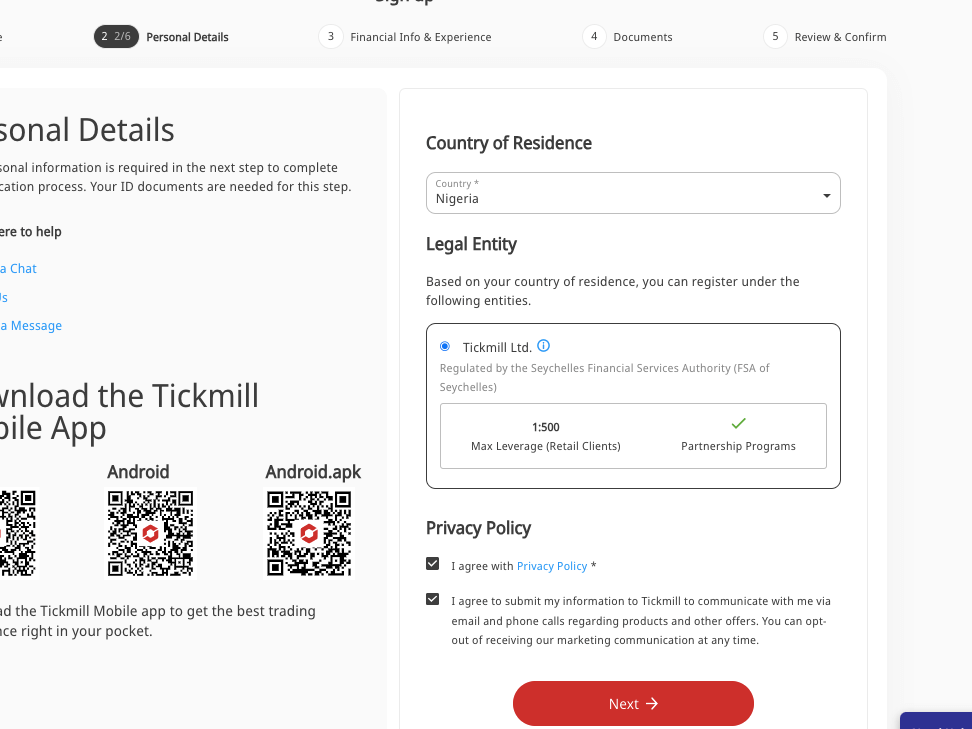

Step 2: Provide your name and date of birth, select your country of residence and check the box to agree to the privacy policy then click ‘Next’.

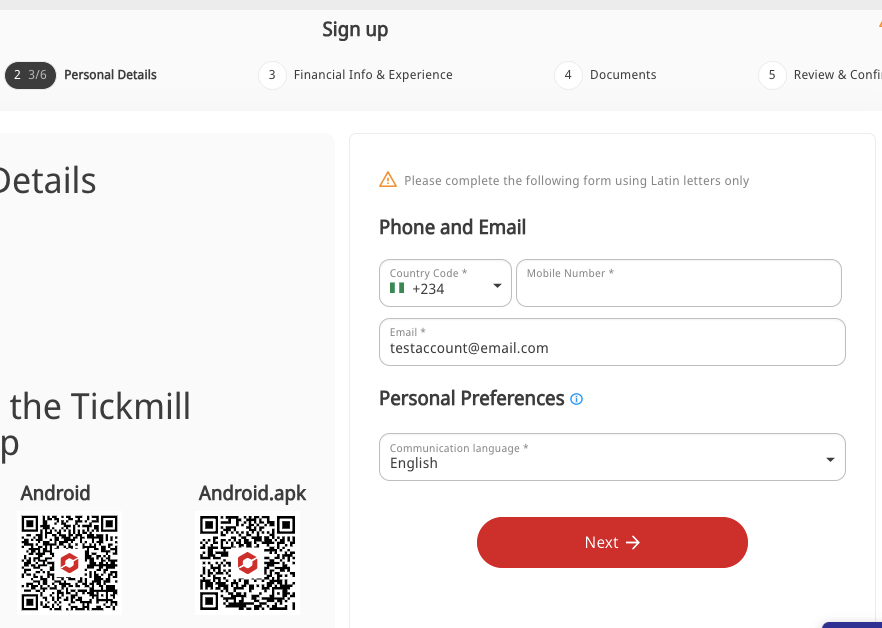

Step 3: Provide your phone number and email address. You will receive an email with a link to verify your email address. Click on the ‘Verify email’ button to validate your email and proceed with the registration.

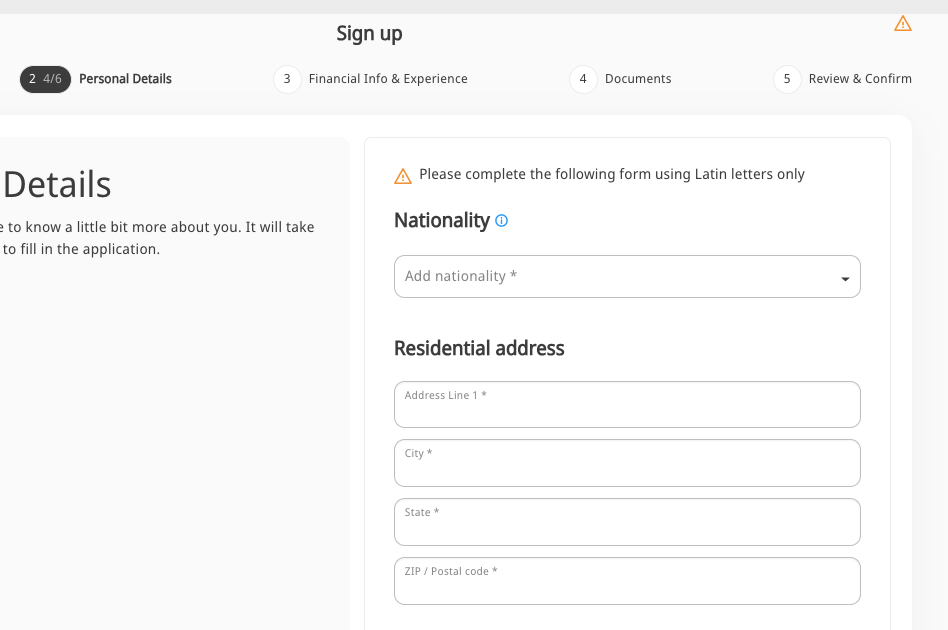

Step 4: After verifying your email address, provide further personal information like your residential address and tax information, then click ‘Next’.

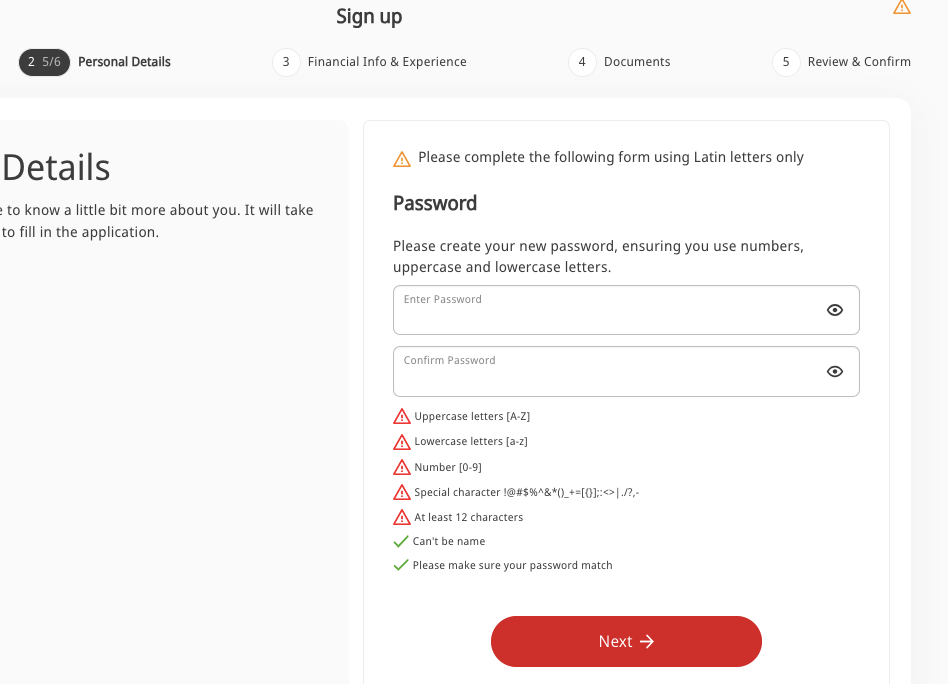

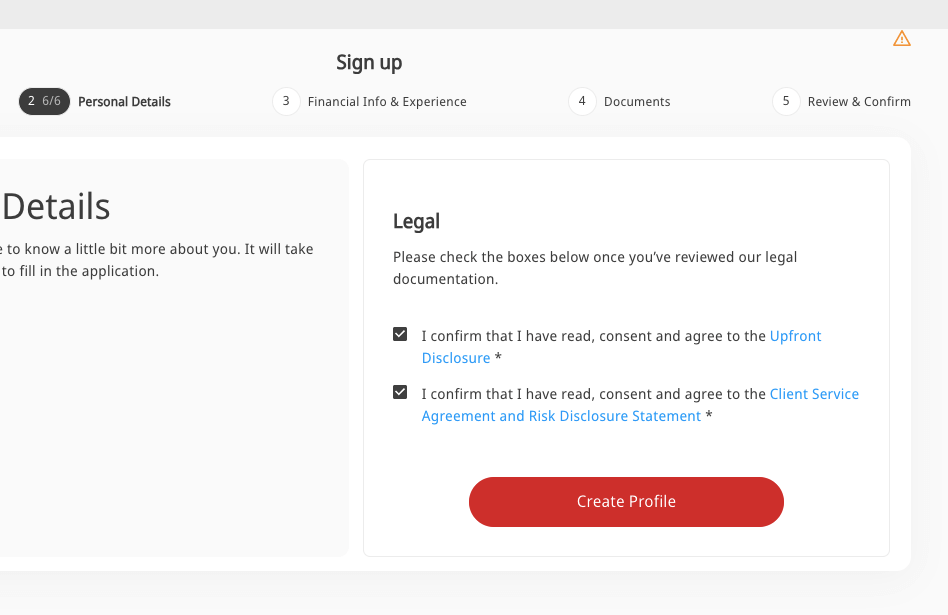

Step 5: Create a password for your account, and click Next. Then check the boxes to agree to the terms and condition and click ‘Create Profile’.

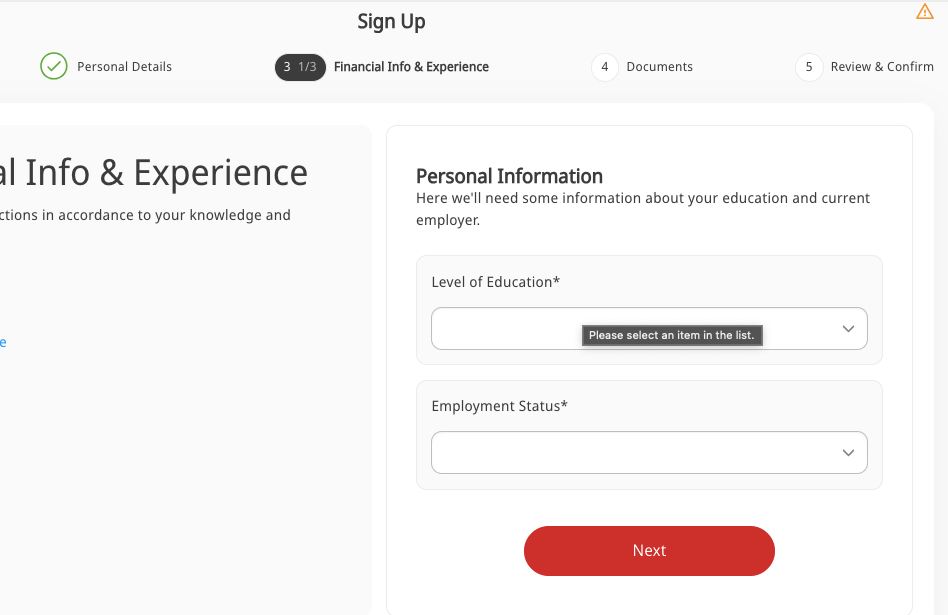

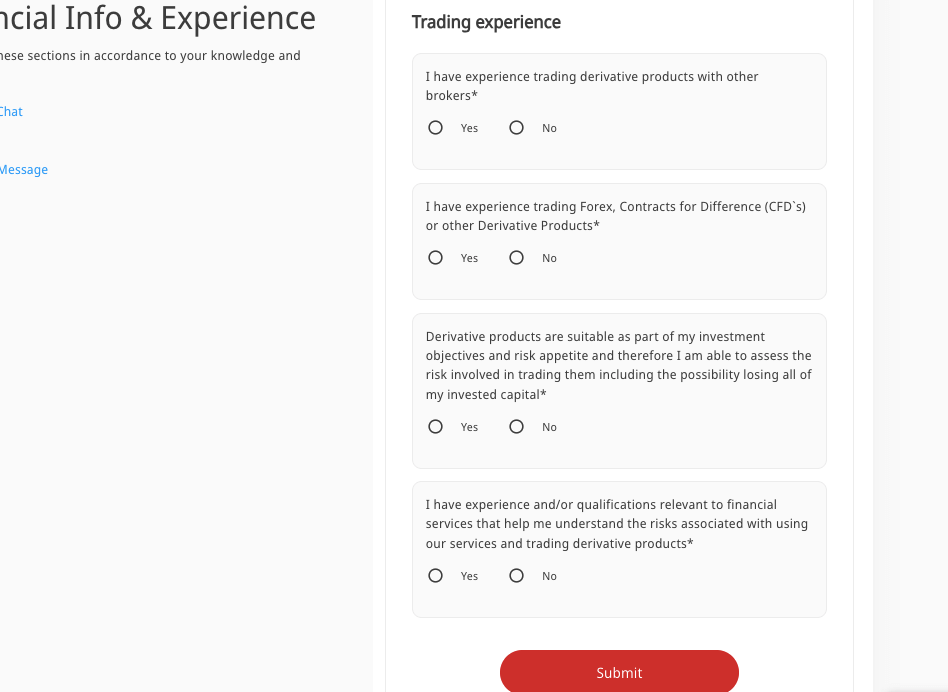

Step 6: Answer some questions about your trading experience and income level then click ‘Submit’. Your account is now created and you need to log in with the email used for registering and the password you created, then you will be redirected to your Tickmill Dashboard.

Step 7: It will take you to the login page to sign into your Tickmill account dashboard.

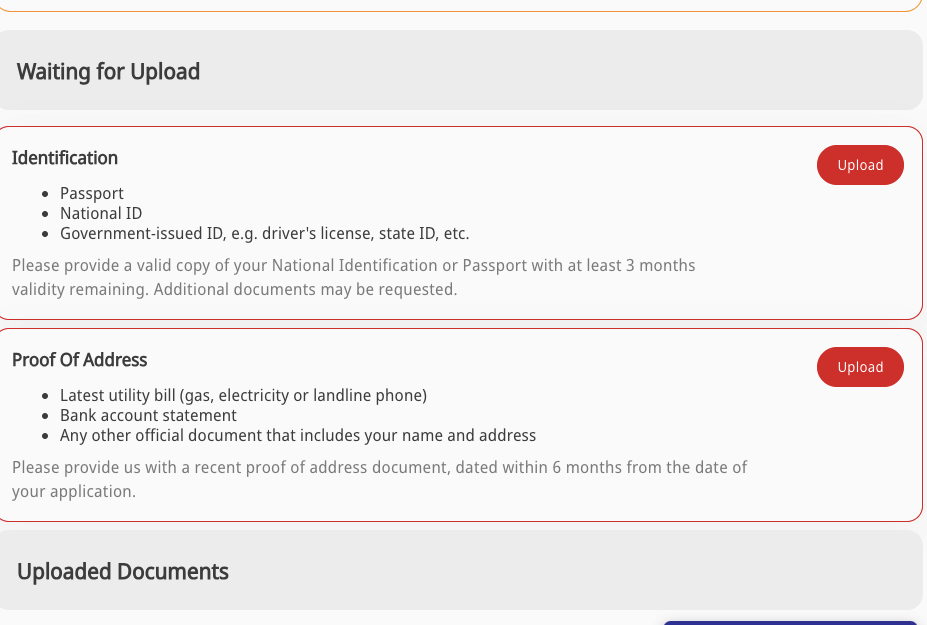

For your new account, you will be required to upload some identification documents like a National ID card and utility bill to verify your identity and personal address before your account is approved. The approval process can take up to 24 hours, and they will send a confirmation message when its done. After approval you can make any deposit, withdrawal or any other trading activity.

Tickmill Deposits & Withdrawals

Payment methods supported by Tickmill for deposits and withdrawals are cards (MasterCard & Visa), local bank transfers, e-wallets (Skrill, Neteller, and others). Here is the summary of the deposits and withdrawal options on Tickmill in Nigeria.

Tickmill Deposit Methods

Here is a summary of payment methods accepted by Tickmill for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Bank Transfer | Yes | Free | 2-7 business days |

| Cards | Yes | Free | Instant |

| E-wallet | Yes (Skrill, Neteller) | Free | Instant |

| Crypto Payments | Yes | Free | Instant |

Tickmill Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on Tickmill.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Bank Transfer | Yes | Free | 2-7 business days |

| Cards | Yes | Free | 1-8 business days |

| E-wallets | Yes (Skrill, Neteller) | Free | 1 business day |

| Crypto Payments | Yes | Free | 1 business day |

What is the minimum deposit for Tickmill?

The minimum deposit on Tickmill is $100 for all payment methods with a choice of base account currencies. This means if your base account currency is EUR, your minimum deposit will be €100 or £100 for GBP account currency.

What is Tickmill Minimum withdrawal?

The minimum withdrawal on Tickmill is 25 units of your account currency, which could be EUR, USD, ZAR, or GBP.

You can initiate deposits and withdrawals by logging into your account, and on the Tickmill client area or dashboard, click on deposit or withdrawal on the left side menu.

Note that you can only make a deposit or withdrawal after uploading documents for identity verification and proof of address. It takes about 24 working hours for the documents to be verified and your trading account approved.

Tickmill Trading Instruments

You can trade the following financial instruments on Tickmill:

| Instrument | Availability | Number |

|---|---|---|

| Forex | Yes | 62 currency pairs on Tickmill |

| Stock Indices | Yes | 16 indices on Tickmill(including UK100, US30, SWISS 20, SPAIN35 among others) |

| Oil Commodities | Yes | 3 Oil on Tickmill (Brent, WTI, NATGAS) |

| Metals | Yes | 3 metals on Tickmill (Gold, Copper and Silver) |

| Cryptocurrencies | Yes | 9 pairs of cryptocurrencies on Tickmill (including BTC, ETH, LTC, and others paired to USD) |

| Bonds | Yes | 4 bonds on Tickmill (EURBOBL, EURBUND, EURBUXL, and EURSCHA) |

Tickmill Trading Platforms

1) MetaTrader 4 and MetaTrader 5: Tickmill supports both MT 4 and MT 5 trading applications, which can be accessed via webtrader, Windows, macOS, Android Google Play Store and iOS Apple App Store for mobile trading.

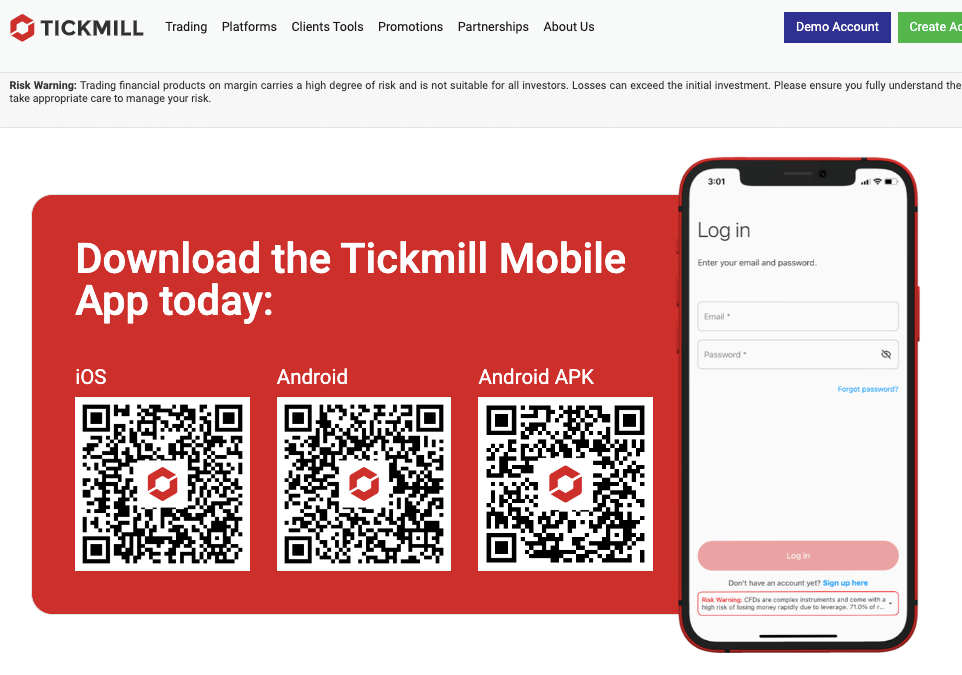

2) Tickmill Mobile App: Tickmill offers a proprietary mobile app for trading on the go which is available for both Android and iOS devices.

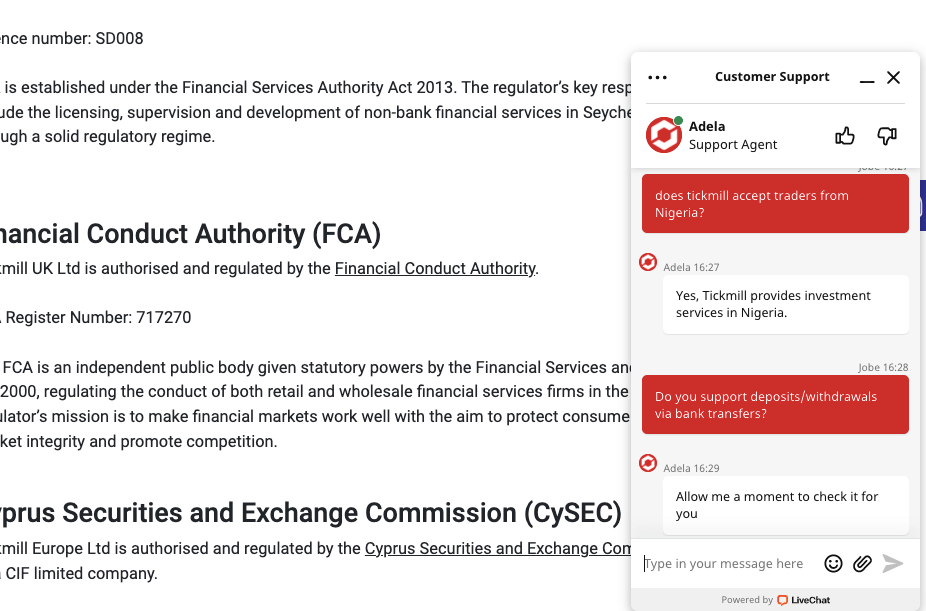

Tickmill Nigeria Customer Service

Tickmill supports clients from Monday through Friday via email, live chat and phone. See our review of their customer service.

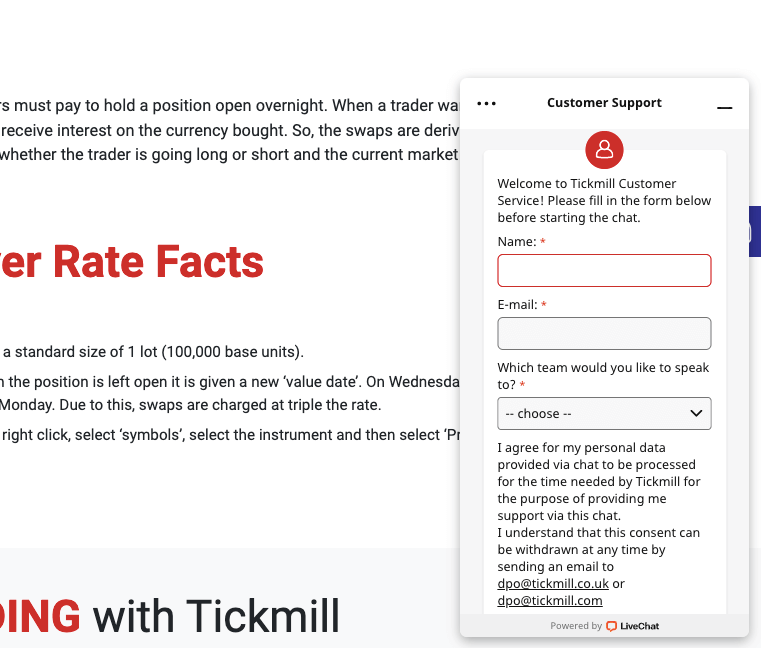

1) Live chat support: Traders can reach the customer support of Tickmill via live chat by visiting the Tickmill website and clicking on the live chat option on the contact us page.

The Tickmill live chat is only available from 9 AM GMT +3 to 10 PM GMT +3 on working days and is available in various languages including English, Arabic, Chinese and others.

The live chat is responsive and the wait time before a representative attended to our team when we tested it was under 1 minute. The answers to the questions asked were relevant.

You will need to provide your email address and name, then select the language team, in our case English, to start talking with a Tickmill support agent via the live chat.

2) Email support: The email support of Tickmill is fair, our team got feedback after 5 hours, and there was no autogenerated message to acknowledge the receipt of our enquiry. The answer to our enquiry was relevant.

The active customer support email of Tickmill is [email protected] and it is available 24 hours on a business day, although some brokers respond faster.

3) Physical office: Tickmill does not have a physical office in Nigeria. Tickmill has offices in all the countries where it is regulated, the Tickmill headquarters is located at 3, F28-F29 Eden Plaza, Eden Island, Mahe, Seychelles.

4) Phone support: Tickmill’s phone number for customer support is +852 5808 292. The number is available during working hours from Monday to Friday. There is no local phone number for support in Nigeria.

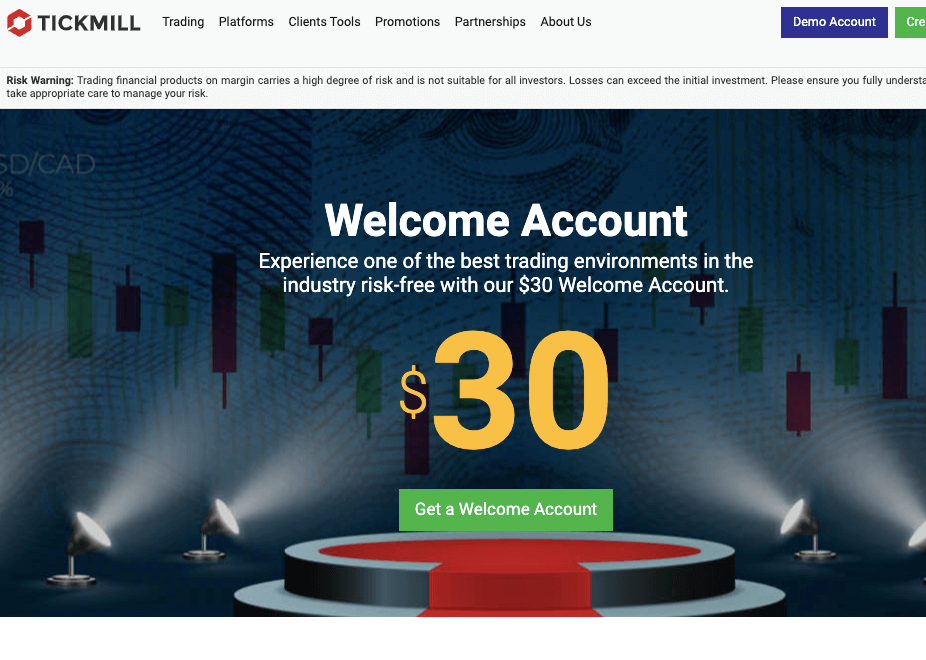

Tickmill Bonus

New traders on Tickmill are eligible to receive a $30 bonus upon successful signup and account approval. The bonus will be made available on your account, you can use it to trade and will be able to withdraw the profits.

Upon account approval, log in details to the Tickmill Welcome Account will be created and sent to you automatically. The account will be active for trading for 60 days only, afterwards, an additional 14 days will be given for you to withdraw any profits from it. The maximum profit you can withdraw from the Welcome Account is $100.>

Note that some countries are not eligible for the bonus, although the Tickmill bonus is available for Nigerian traders.

Do we Recommend Tickmill Nigeria?

Based on the regulation and safety of funds, they are regulated by Tier-1 and Tier-2 regulators which mandate them to protect deposited clients’ funds.

Although Tickmill trading fees for currency pairs and other instruments are low compared to some brokers’ fees, the spreads are tight and they offer commission-free trading on the Classic Account, the tradeable instruments on Tickmill are few compared to other brokers.

The registration process on Tickmill is simple, their website interface is easy to navigate and Tickmill supports deposit/withdrawal via bank transfers in Nigeria.

The negative balance protection on Tickmill is not guaranteed, as you may have to apply to customer support before it is granted. The broker may also decide to charge an account maintenance fee at any point.

We recommend that you check out Tickmill’s website to ensure they have the instruments you want to trade and chat with their support if you have any questions to help you decide if you want to open an account with them.

Tickmill Nigeria FAQs

Is Tickmill online legit?

Tickmill is considered a legit broker for trading financial instruments because of its regulations in many jurisdictions with top financial regulators.

Tickmill trading conditions fees and support are fair so they are considered good for both new and experienced traders.

How long does it take to withdraw from Tickmill?

Withdrawal takes about 1 business day via crypto payments and e-wallets, bank transfers take 2-7 business days while cards take 1-8 business days.

How much does Tickmill charge for forex?

Tikmill charges Pro Account holders a commission fee of 2 currency units (either EUR, GBP, or USD) per side lot when they trade forex pairs, which makes it 4 units per round turn; VIP Account holders pay a commission fee of 1 currency unit per lot side and 2 units per round turn on forex trades as well. Tickmill offers commission-free trading to Classic Account.

Is Tickmill on MT4?

Yes, Tickmill supports the MT4 trading application. The broker also offers a proprietary Tickmill Mobile App.

Which Tickmill account is best?

The best Tickmill account for trading would depend on your preferences. If you prefer to trade without commission fees, then Tickmilll Classic Account will be the best for you as it is a spreads only account.

If you prefer to trade with lower spreads and commission fees, then the Tickmill Pro Account will be the best for you.

Note: Your capital is at risk