Exness is a Forex and CFD broker offering CFDs on forex, precious metals, energies, indices, stocks and cryptocurrencies for both individual and institutional traders. Exness was founded in 2008 and regulated in Seychelles.

As a regulated Forex broker, Exness is authorized by Multiple Top-Tier Financial Regulators to provide services for trading Forex & CFDs on financial instruments. Their website provides access to real-time charts for all instruments.

This review covers the Exness platform features including regulation, available tradable instruments, leverage, customer support, trading and non-trading fees, account types, and deposits/withdrawals options.

| Exness Review Summary | |

|---|---|

| 🏢 Broker Name | Exness (SC) Ltd |

| 📅 Establishment Date | 2008 |

| 🌐 Website | www.exness.com |

| 🏢 Address | Exness (SC) Ltd, 9A CT House, 2nd floor, Providence, Mahe, Seychelles. |

| 🏦 Minimum Deposit | $10 |

| ⚙️ Maximum Leverage | 1:2,000 |

| 📋 Regulation | FSA Seychelles, FCA, CySEC, FSCA, FSC Mauritius |

| 💻 Trading Platforms | MT4 & MT5 for PC, Mac, Web, Android, iOS and Exness Trader for Web, iOS and Android |

| Start Trading with Exness | |

Exness Pros

- Licensed by Top-Tier Regulators

- Accepts deposits/withdrawals via Nigerian banks

- No inactive account fees

- Offers commission-free trading

- Has negative balance protection

- 24/7 live chat support

- Offers NGN account currency

Exness Cons

- Slow email support

- Has high leverage, which means higher risk

- Has a limited range of instruments

Is Exness broker legit?

Exness is considered a low-risk Forex broker for Nigerian traders because they are licensed in multiple jurisdictions under different names and authorized by Top-Tier financial regulatory organizations. Some of the regulations of Exness are listed below:

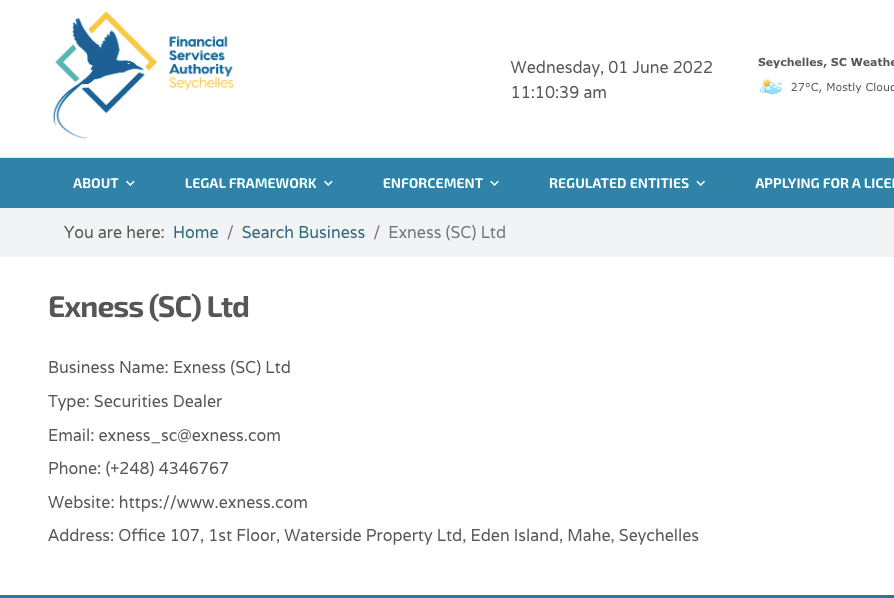

1) Seychelles Financial Services Authority (FSA): Exness is a registered Securities Dealer in Seychelles and regulated by the FSA in Seychelles as Exness (SC) Ltd with license number. Traders from Nigeria are registered under this Offshore regulation.

Note that because the broker is not regulated in Nigeria, you are trading at your own risk and the offshore regulation protection for customers may not cover you.

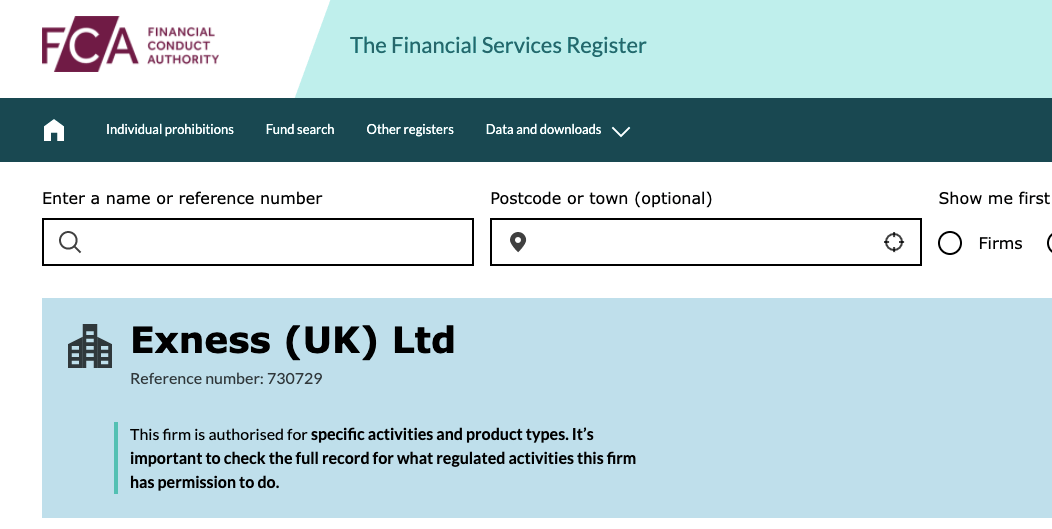

2) Financial Conduct Authority (FCA), United Kingdom: Exness is licensed by FCA, a Tier 1 regulator, in the United Kingdom of Great Britain (UK) as Exness (UK) Ltd, which is registered as an Investment firm with Financial Services Register number 730729. The Exness UK website is www.exness.uk.

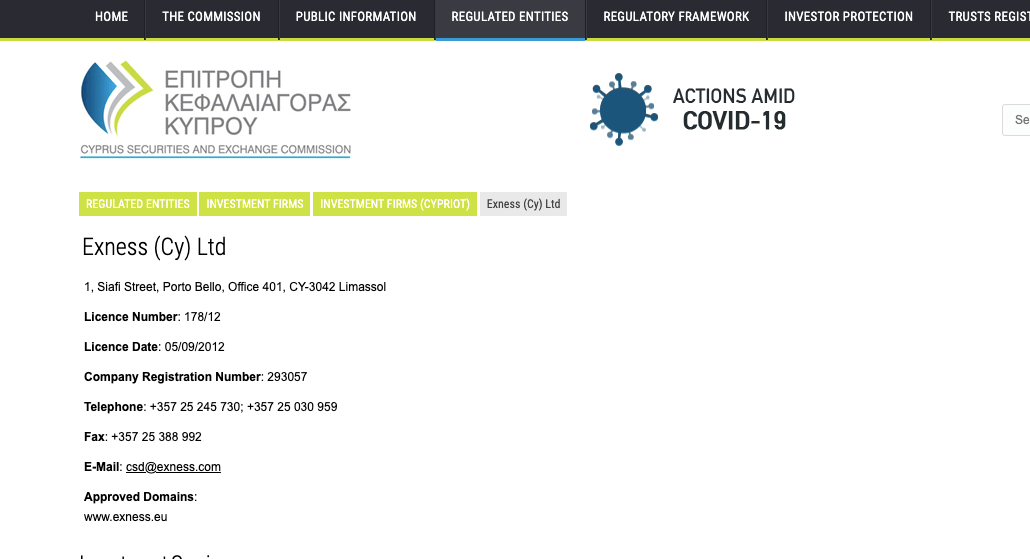

3) Cyprus Securities and Exchange Commission (CySEC): Exness is authorized by CySEC, a Tier 2 regulator, in Cyprus as an Investment Firm with license number 178/12. Registered as Exness (Cy) Ltd, and their website of operations is www.exness.eu.

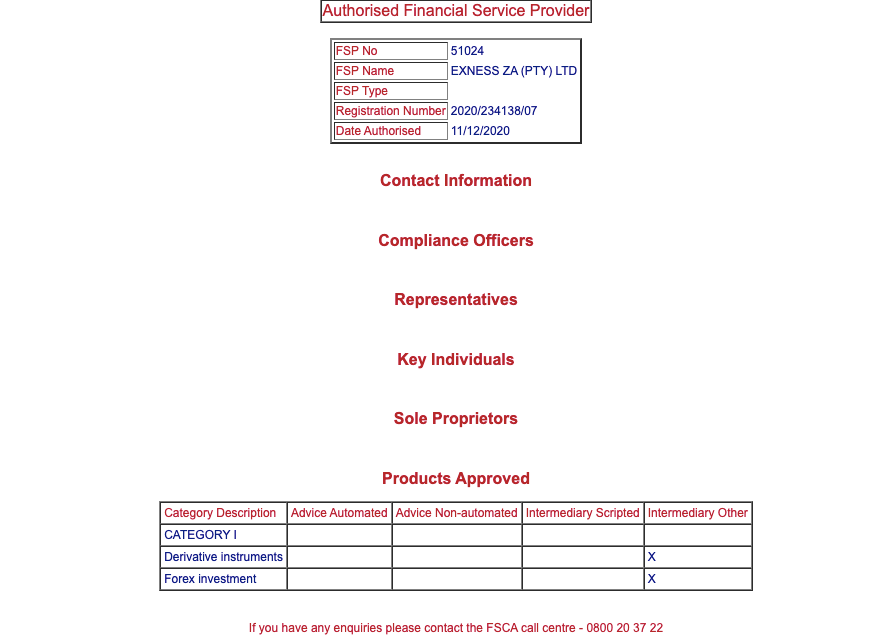

4)Financial Sector Conduct Authority (FSCA) in South Africa: Exness is regulated in South Africa as Exness ZA (Pty) Ltd, by the FSCA and authorised as a Financial Service Provider (FSP), with FSP registration number 51024, issued in 2020.

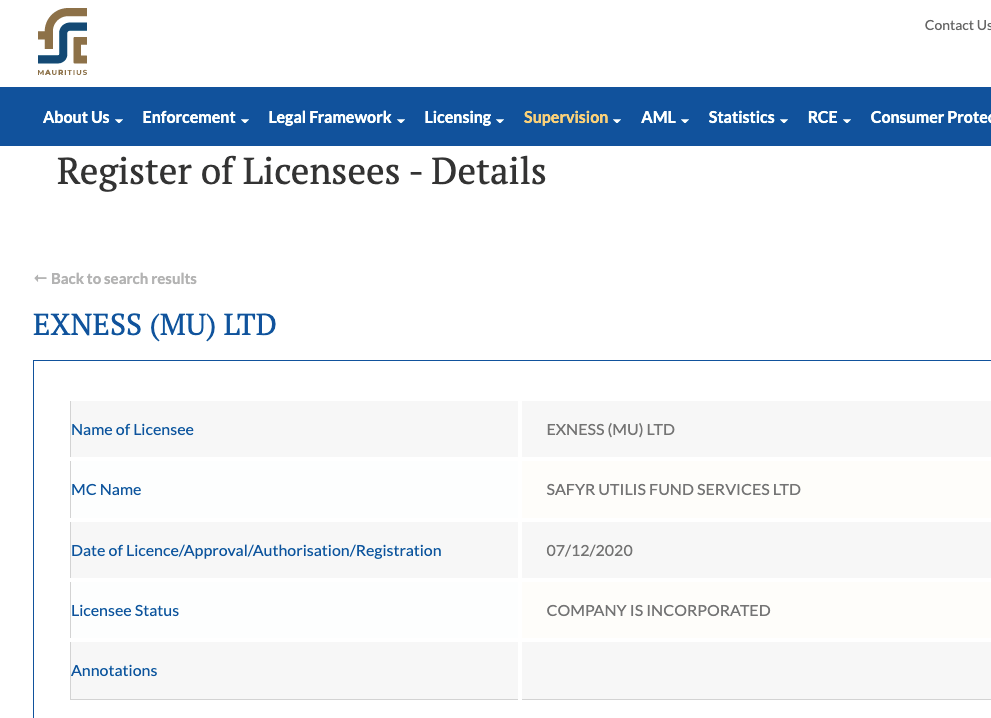

5) Financial Services Commission (FSC): Exness is regulated by FSC in Mauritius as Exness (MU) Ltd, an investment dealer.

Exness Investor Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| United Kingdom | £85,000 | Financial Conduct Authority (FCA) | Exness (UK) Ltd |

| South Africa | No Compensation | Financial Sector Conduct Authority (FSCA) | Exness ZA (Pty) Ltd |

| Cyprus (EU) | €20,000 | Cyprus Securities and Exchange Commission (CySEC) | Exness (Cy) Ltd |

| Nigeria | No Protection | Seychelles Financial Services Authority (FSA) | Exness (SC) Ltd |

Exness Leverage

Exness offers unlimited leverage for trading for all account types, including 2 Standard Accounts and 3 Professional Accounts. This means that you can open a trade position worth 1,000 times or more of your deposit.

For example, with a deposit of $100, you can open a trade position worth $100,000 or more, without any limits on the leverage. Depending on your risk appetite and the amount of leverage you want to use, higher leverage means that the chances of loss are higher too.

However, some instruments have preset leverage, which is fixed and you cannot change it. Before you access the unlimited leverage, you must close at least 10 trades, otherwise, you will have a maximum leverage of 1:2,000.

Leverage on Exness depends on your equity as well. Accounts with equity of less than $1,000 have unlimited leverage, while accounts with equity of up to $4,999 have maximum leverage of 1:2,000, accounts with equity between $5,000 and $29,999 have a maximum leverage of 1:1,000, and accounts with more than $30,000 have a leverage limit of 1:500.

Note: All instruments on Exness trade at a maximum leverage of 1:200 during weekends and holidays. It is important that you do not use high leverage as it increases your risk and you can lose all your money. You should avoid CFDs and leveraged products trading unless you understand them and have experience.

Exness Account Types

Exness trading account types are categorised into 2; Standard and Professional Accounts, accessible with the MT4, MT5, and Exness Trader trading applications.

Your account type on Exness determines the tradeable instruments available to you and the fees you will pay. Both the Standard and Professional Accounts have sub-categories of accounts. Details of the different account types offered by Exness are described below:

Exness Standard Accounts

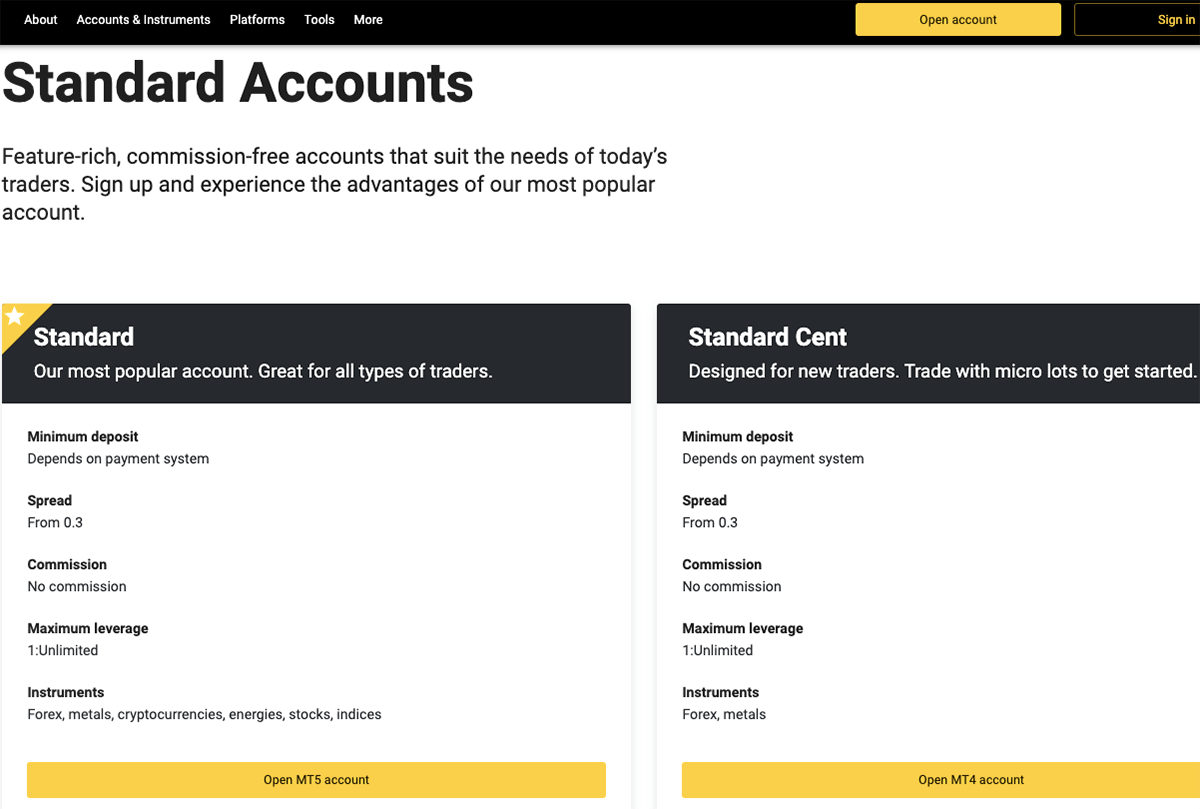

Exness offers 2 Standard Account types, the Standard Account and Standard Cent account.

1) Standard Account: This account type is designed for all types of traders, and the tradeable instruments on Standard Accounts are Forex, metals, energies, stocks, indices, and cryptocurrencies, accessible on the MT5 platform.

There are no commission charges with this account, spreads start at 1 pip for majors like EURUSD, and you pay swap fees whenever you keep a trade position open past the market closing time.

You can trade with unlimited leverage, a maximum trade lot size of 200 and a minimum of 0.01, and unlimited open orders. The minimum deposit on this type of account is $10.

This account has negative balance protection which means you cannot lose more than the money deposited. If you suffer a loss on a trade position and your account balance goes negative, the negative balance will be reset to zero.

2) Standard Cent Account: The Exness Standard Cent Account is a subcategory of the Exness Standard Account, designed to suit new traders. This account allows you to trade only Forex and metals and is accessible only on the MT4 platform.

Standard Cent Account is also commission-free, spreads start at 1 pip for majors like EURUSD, and you pay swap fees if your open trade rolls over to the next trading day before you close it.

The account has unlimited leverage as well. The minimum trade lot size is 0.01 and the maximum is 200 with 1,000 maximum open orders.

The required minimum deposit is $10 and the account also has negative balance protection.

Exness Professional Accounts

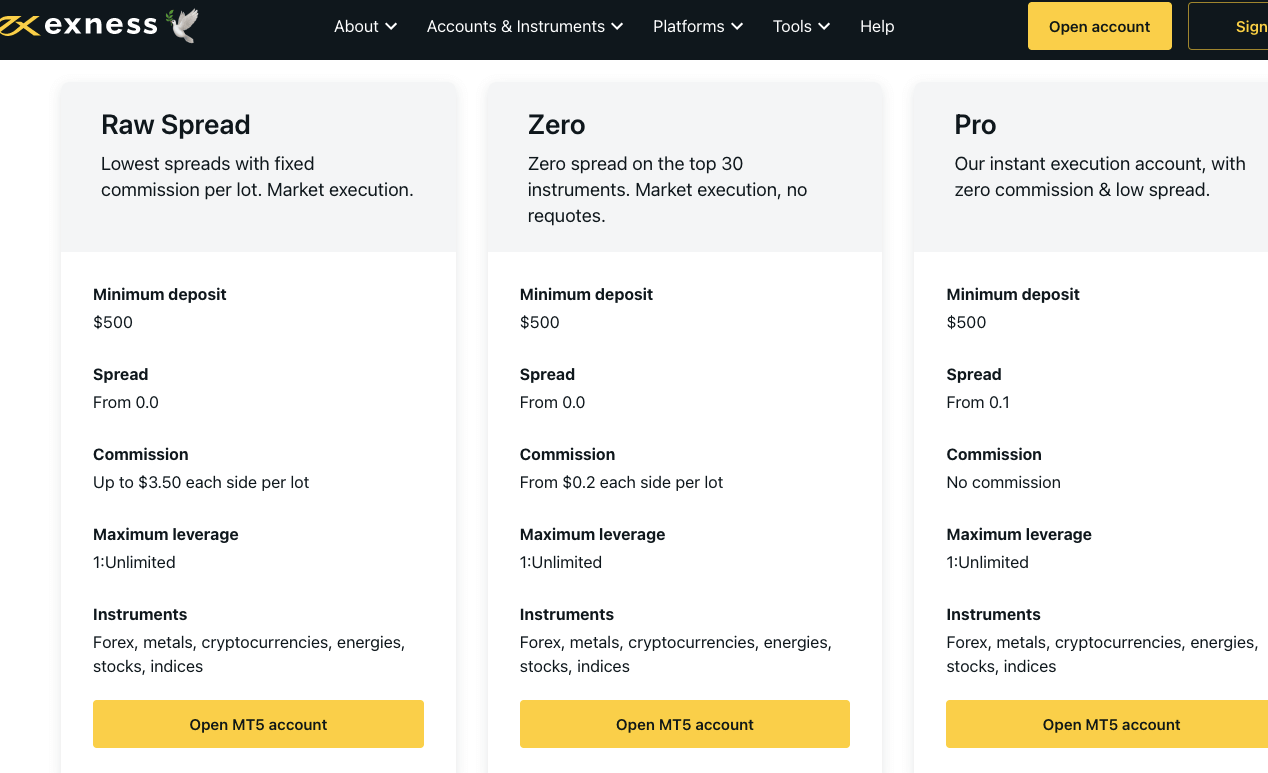

The Exness Professional Accounts are designed for experienced traders, this account type has 3 subcategories. The features of Exness Professional Account types are shown below:

3) Raw Spread Account: The Exness Raw Spread Account can be accessed on all trading platforms. Tradeable instruments on this account are Forex, cryptoсurrencies, energies, metals, stocks, and indices.

Spreads start at 0.0, and commission charges are about $3.5 per side lot (which makes it $7 for a round turn) for major pairs like EURUSD. You also pay swap fees for overnight positions.

The account features unlimited leverage, and an unlimited number of open positions, with minimum and maximum lot sizes of 0.01 and 200 respectively and requires a minimum deposit of $500.

This account also has negative balance protection on Exness.

4) Zero Account: The Exness Zero Account can be accessed on all trading platforms and features zero spreads for the 30 major instruments. Tradeable instruments on this account are Forex, cryptoсurrencies, energies, metals, stocks, and indices.

Commission charges on Exness Zero Account are from $0.2 per side lot and up to $3.5 per side ($7 per round turn) for major pairs like EURUSD. Spreads start from 0.0 pips, and you pay swap fees for keeping a position open past the market closing time.

The Zero Account on Exness has the lowest spread. They are fixed spreads at 0.0 pips for 95% of the trading day.

There is no maximum leverage on this account and no limit to the number of open orders. You need to trade a minimum lot size of 0.01 lot and a maximum of 200, with a minimum deposit of $500 and you have negative balance protection as well.

5) Pro Account: The Exness Pro Account can also be accessed on all trading platforms. Tradeable instruments on this account are Forex, cryptoсurrencies, energies, metals, stocks, and indices.

This is a spreads-only account, with no commission charges for opening or closing trade positions. Spreads start from 0.1 pips for major and you will be charged overnight funding costs if you keep a trade position open overnight into a new trading day.

The maximum lot size is 200 with a minimum of 0.1, with unlimited leverage and a required minimum deposit from traders of $500.

This account offers unlimited open positions and negative balance protection.

6) Swap-free Account: Exness offers Interest-free Islamic Accounts to Muslim traders for all account types. With this account, you do not pay any swap fees for keeping a trade position open overnight.

If you want a swap-free Islamic Account on Exness, first open a standard or professional account, then contact customer support to change the status of your account to an Islamic Account.

Note that for countries that have Islam as the predominant religion, swap-free status is applied automatically.

7) Portfolio Management accounts: Exness offers a Portfolio Management accounts to clients who manage funds for others. There are 2 types of these accounts, Social Pro which requires a minimum deposit of $500 and Pro (Portfolio Manager) which requires no minimum deposit.

With the Exness portfolio management accounts, you can forex, metals, cryptoсurrencies, energies, stocks, and indices. This account type has zero commission fees, spreads start from 0.4 pips with maximum leverage of 1:200.

Exness Base Account Currency

Exness supports many base account currencies, depending on the account type. The standard cent account has the lowest number of supported currencies.

Exness has NGN (Naira) as the base account currency for all account types except the Standard Cent account. Nigerians can open Exness Naira accounts, make deposits in Naira, and withdraw in Naira to their Nigerian bank accounts.

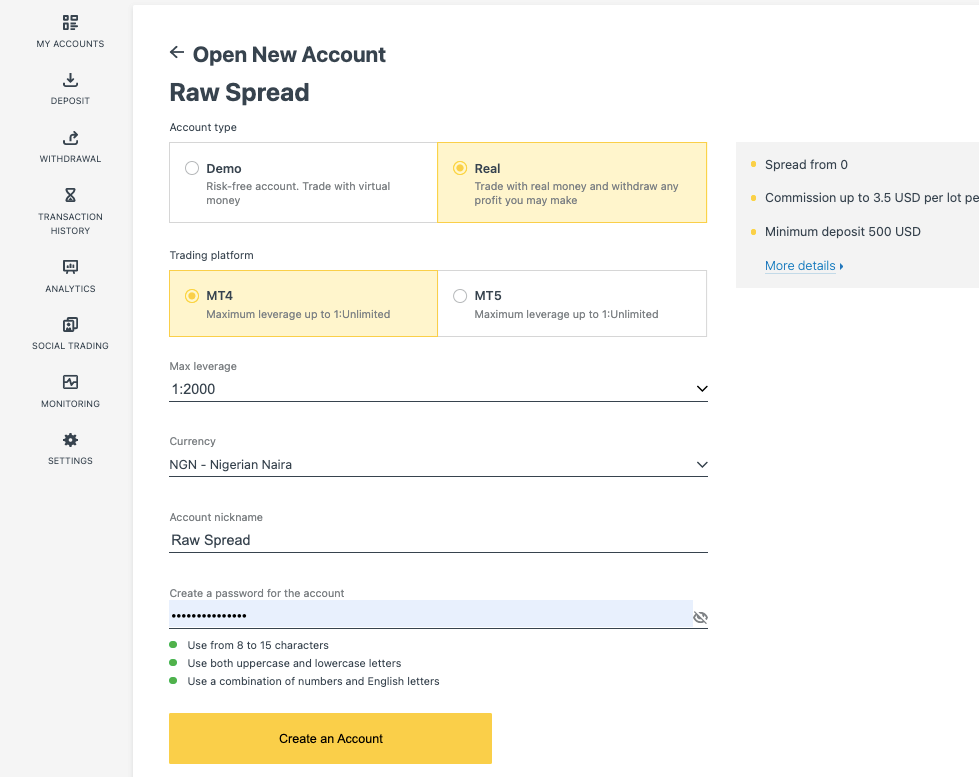

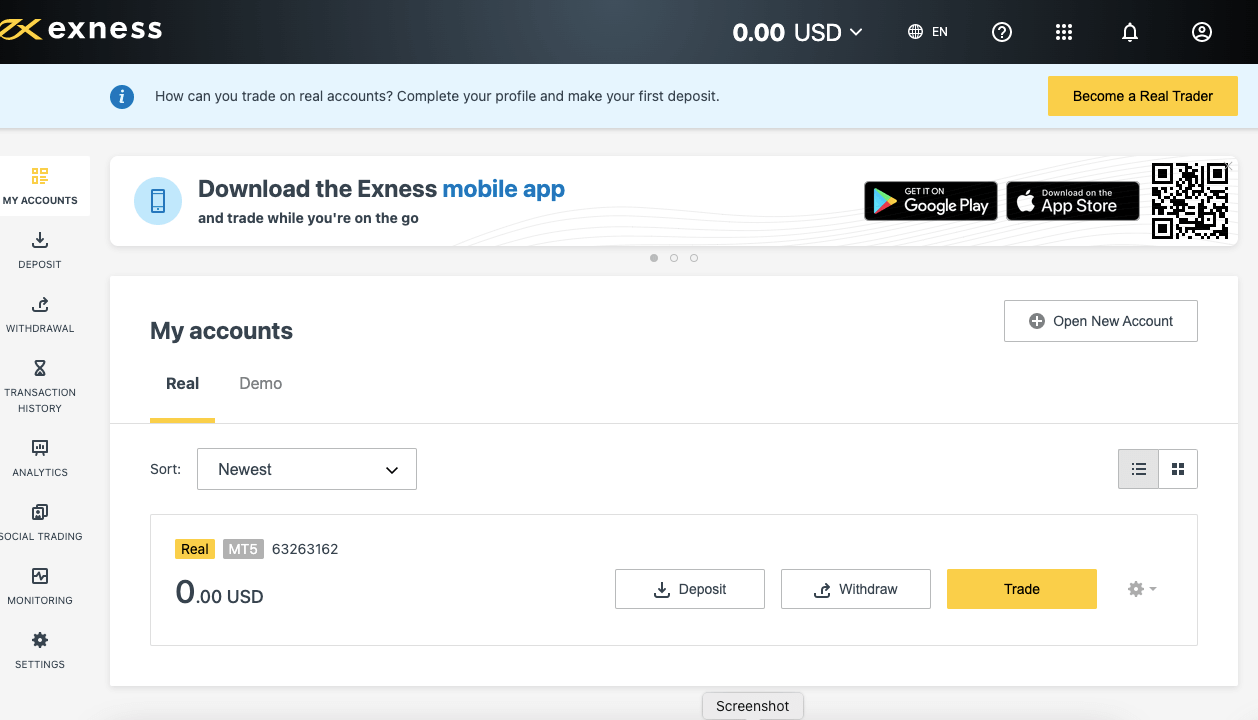

It is important to note that when you first open an Exness account, you are assigned a general account that has United States Dollar (USD) as base account currency, you will have to click on Open New Account on your dashboard, to open a specific type of standard or Professional Account, and then select NGN as your base currency. See a screenshot of this below:

Exness Overall Fees

Fees on Exness depend on the account type, although there are some general fee rules. Details of the trading and non-trading of Exness are shown below:

1) Spreads: Typical spread starts from 0.0 pips for the Professional Account types and 0.3 for the Standard Account types. The typical average spread for majors like EURUSD on the Standard Account is 1 pip. Note that the spreads on Exness are dependent on the account type of the trader and the instrument you are trading.

Exness operates a floating spread system, which means spreads can change at any time of the day. Find the average spreads for majors on Exness as of February 2024 on the table below:

2) Commission fees: Most account types on Exness charge no commission on trades. Only the Professional Account (Raw Spread and Zero) have commission charges starting from $0.2 and up to $3.5 for each side lot for major pairs like EURUSD, which makes it $0.4 to $7 for a round turn. Other pairs have higher commissions on the Zero Account while Raw Spread has a fixed commission per side lot of $3.50.

Commission fees are charged whenever you open and close a trade position with the Raw Spread and Zero Accounts.

Exness Trading fees Table

Here is a summary of the average fees Exness charges on some instruments:

| CFD instrument | Spread (Standard Account) | Commission (Zero Account) |

|---|---|---|

| EUR/USD | 1 pip | $3.5 per lot |

| GBP/USD | 1.2 pips | $4.5 per lot |

| EUR/GBP | 1.6 pips | $9 per lot |

| XAU/USD (Gold) | 20 pips | $8 per lot |

| Crude oil | $0.03 over market | $3.5 per lot |

| UK100 | 57.8 pips | $1.25 per lot |

| SPX500 | 16.5 pips | $0.5 per lot |

3) Swap fees: Anytime you keep a trade position open past the closing time of the market closing time (10 PM GMT +0), you are charged swap fees which are added to your profit or loss at the time you close the trade.

The swap fee is calculated based on the size of the instrument you are trading, the spread, the number of days you keep the position open, and whether your position is a long swap (buy) or short swap (sell).

If your position is a buy (long swap), you may get interest added to your profit instead of a fee. You can estimate the fees you will pay by using the calculator on the Exness website.

Note that Islamic Accounts do not pay swap fees, and some instruments like cryptocurrencies, stocks, indices, and XAUUSD (Gold) are not charged swap fees for all account types.

Non-trading fees

4) Deposit and Withdrawal fees: Exness charges zero deposit fees and zero fees for withdrawals from the platform. This applies to all account types. Although Exness does not charge any deposit/withdrawal fees, your credit card provider, bank, or payment method may apply a transaction fee or commission.

5) Account Inactivity charges: No inactivity fees are charged on Exness accounts that have been inactive or dormant for any period of time.

Exness Non-trading fees

| Fee | Amount |

|---|---|

| Inactivity fee | None |

| Deposit fee | Free* |

| Withdrawal fee | Free* |

*Note that your payment processing company may charge some independent transaction fee.

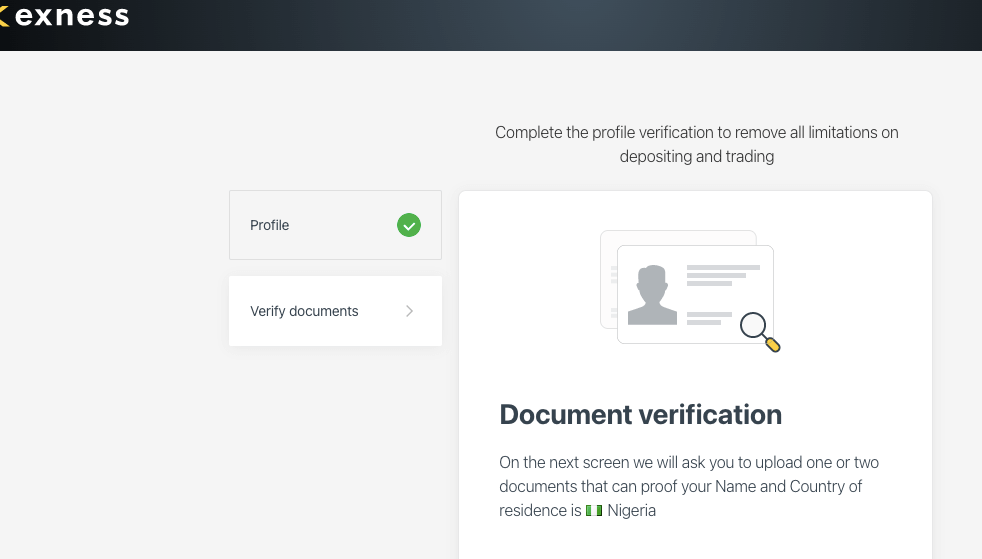

How to Open Exness Account in Nigeria

To start trading on the Exness platform, you must open a live account. Follow these steps to open an account on Exness:

Step 1) Go to the Exness website home page at www.exness.com and click on the ‘Open Account’ button, highlighted in yellow colour at the middle of the page or the golden colour button at the top right side of the home page.

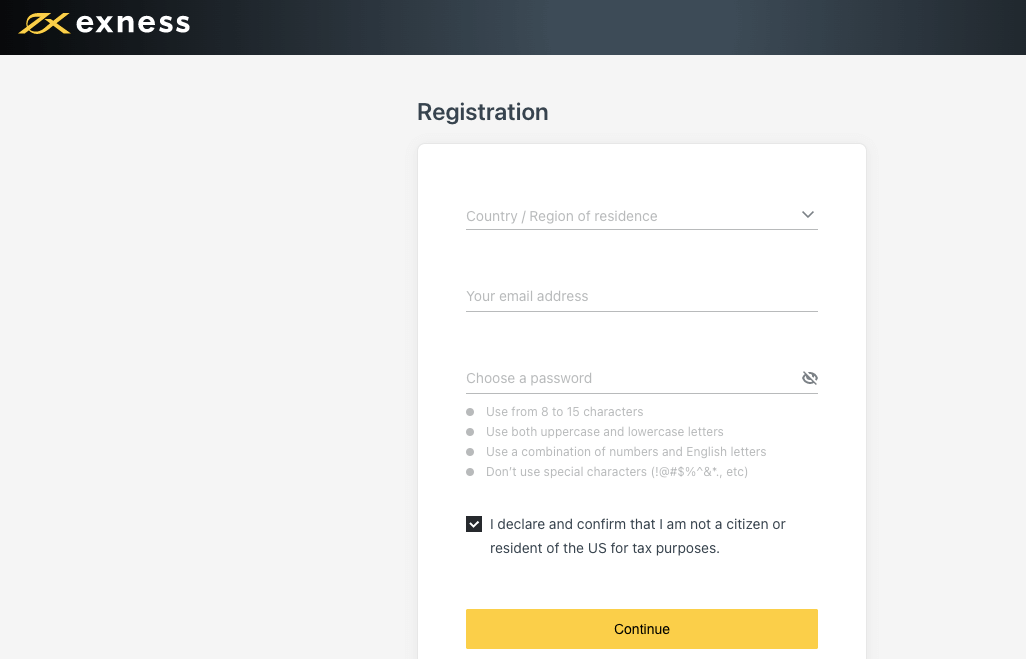

Step 2) Select your country of residence, fill out your email address and create a password for your account, check the box below the form fields to confirm you are not a US citizen or resident, then click ‘Continue’ to proceed.

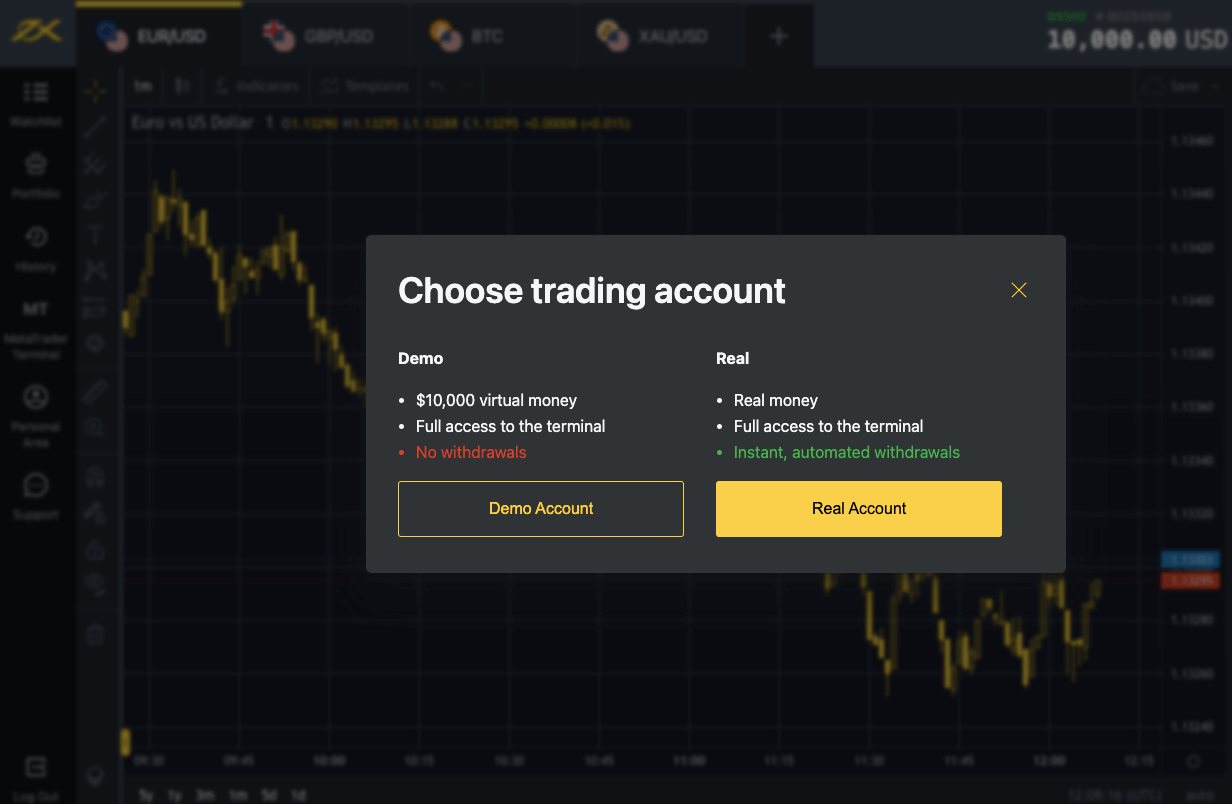

Step 3) You will be required to choose if you are opening a live account or demo account, select ‘Real Account’.

Step 4) You will be taken to your dashboard/personal area page that shows deposit options, and a notification highlighted in blue, requesting that you complete your profile to make deposits and start trading. Click on ‘Become a Real Trader’ to proceed.

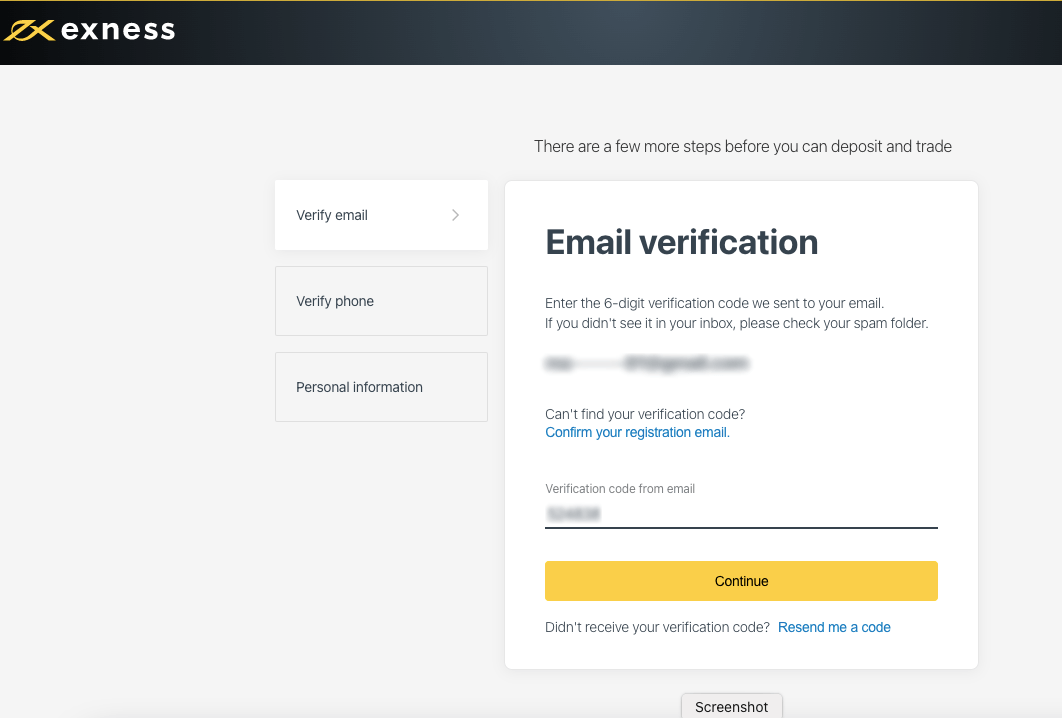

Step 5) Next requirement is to verify your email address, click on send me code, to get a code that you can use to verify your email address. The code is sent to your email immediately, get the code from your email inbox, type it in the field provided, and click on ‘Continue’ to proceed.

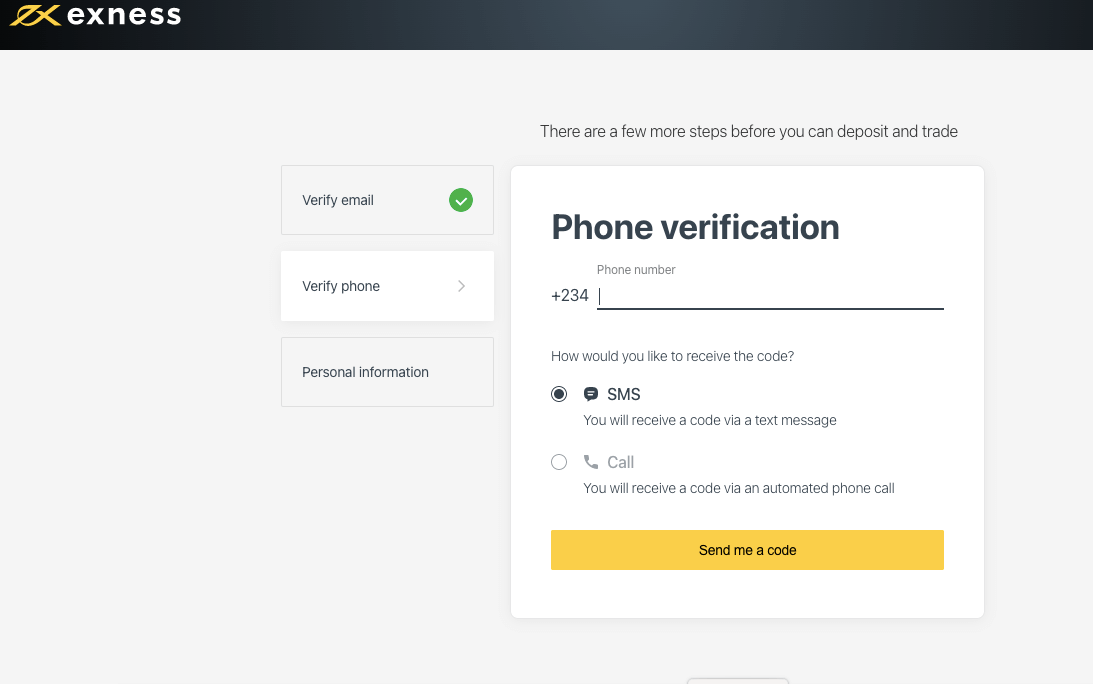

Step 6) You will be required to verify your phone number too via a text or call, where they will text or tell you a code to use for the verification.

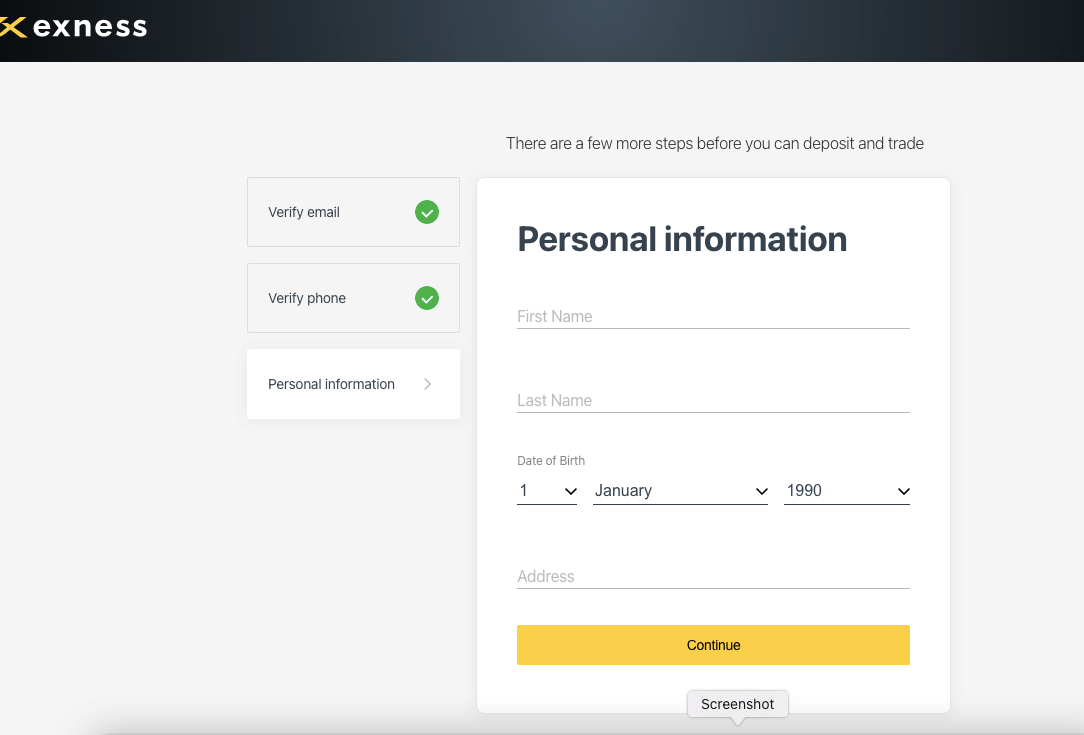

Step 7) After your phone number is verified, you will then be asked to fill in some personal information like name, date of birth, and address, then click continue to complete your registration.

After the registration is complete, you can choose to make a deposit immediately, this will take you to your Exness personal area or you can choose to complete verification by uploading some identity documents.

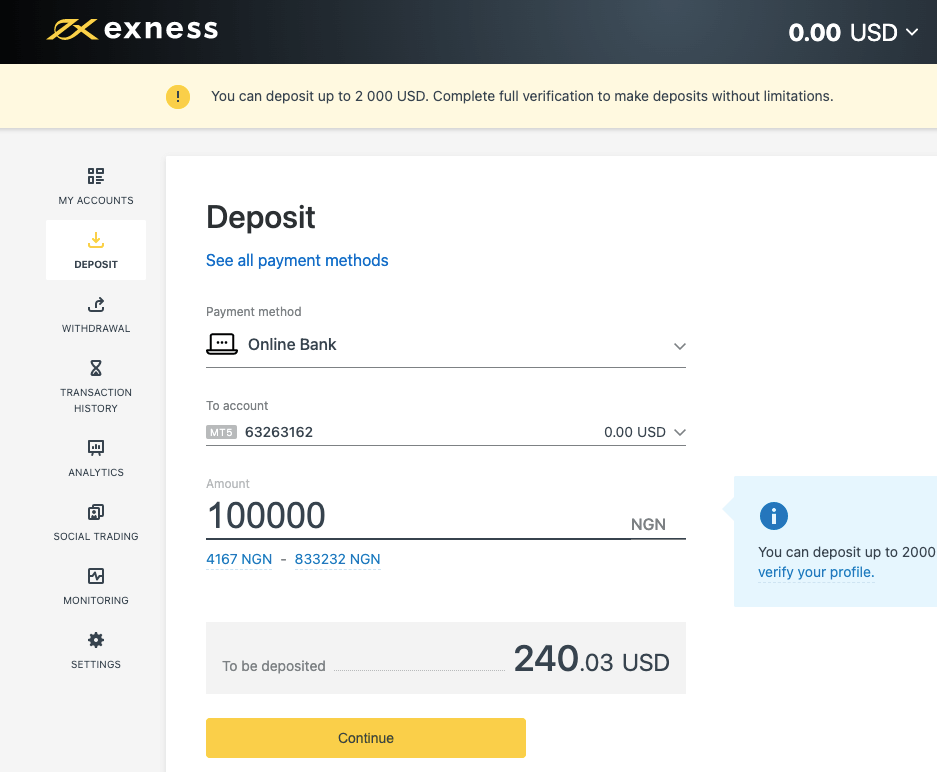

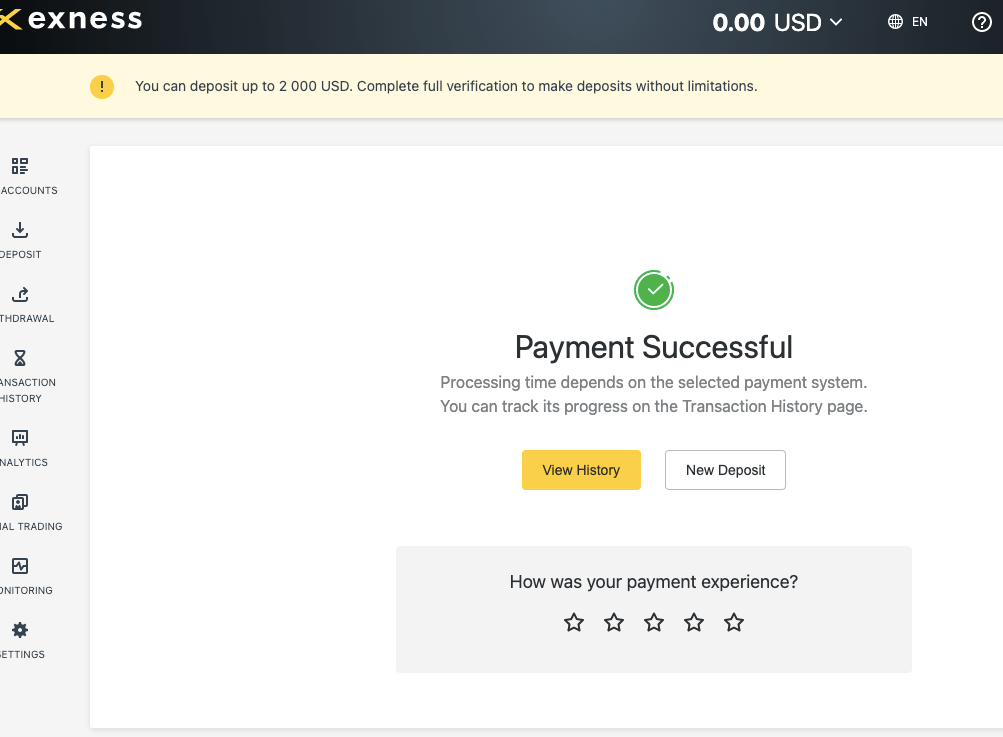

If you proceed to deposit without completing verification, you have a maximum deposit limit of $2,000.

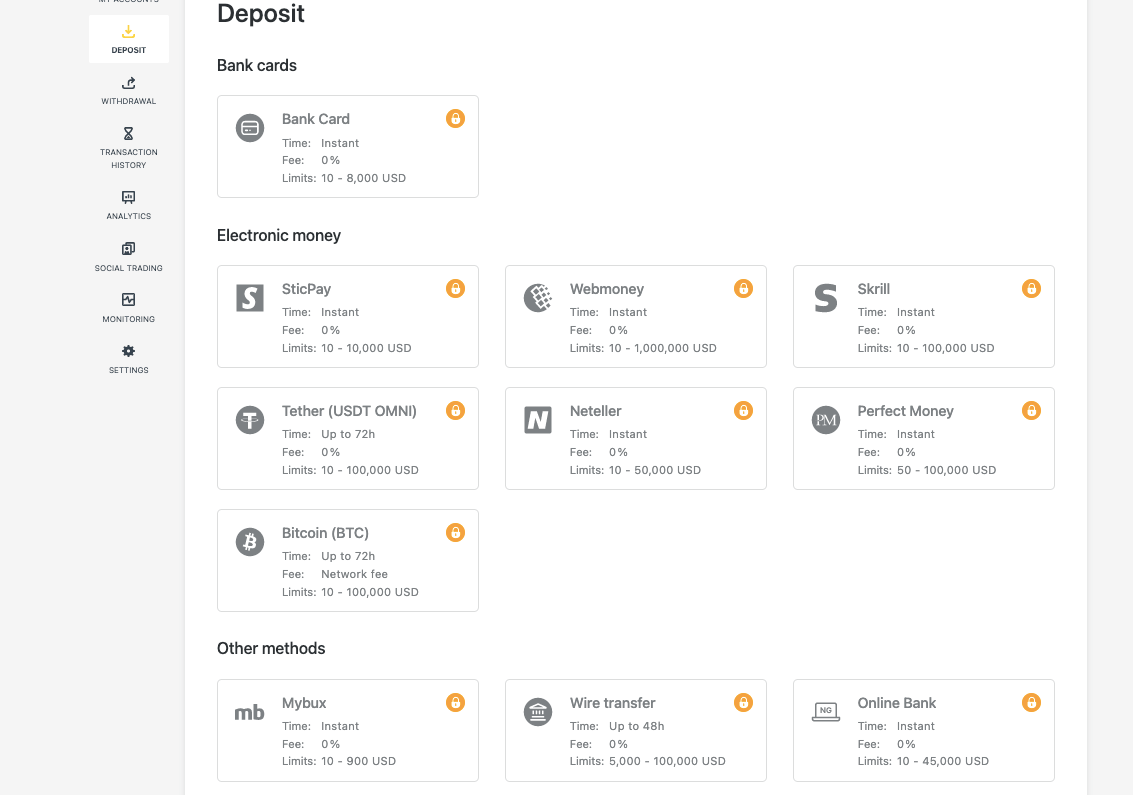

Exness Deposits & Withdrawals

Payment methods supported by Exness for deposits and withdrawals are bank transfers and cards. Here is the summary of the deposits and withdrawal options on Exness in Nigeria.

Exness Deposit Methods

Here is a summary of payment methods accepted by Exness for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Internet Banking/Online Bank Transfer | Yes (NGN) | Free | within 24 hours and up to 7 business days |

| Cards | Yes | Free | within 30 minutes to 5 business days |

| E-wallet | Yes (Skrill, Neteller, and others) | Free | within 30 minutes to 3 business days |

| Cryptocurrency | Yes (USDT & BTC) | Free | 24 hours to 3 business days |

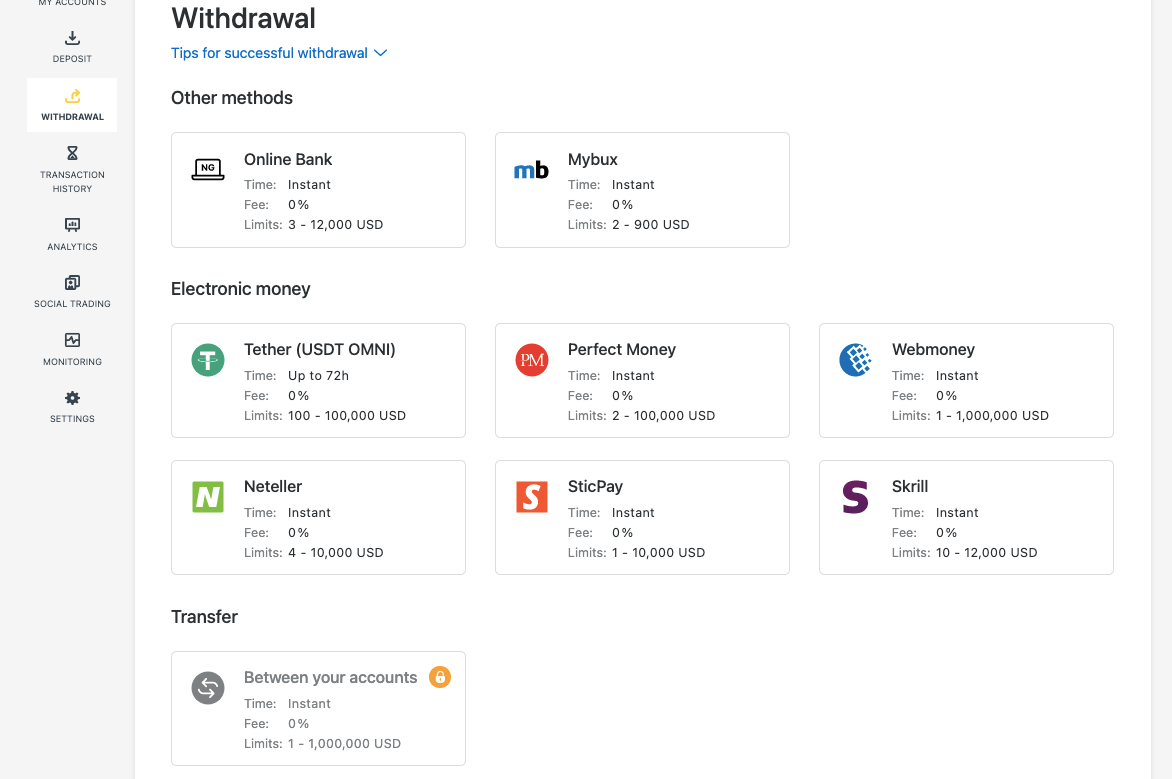

Exness Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on Exness.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Internet Banking/Online Bank Transfer | Yes (NGN) | Free | 24 hours |

| Cards | Yes | Free | up to 10 business days |

| E-wallets | Yes (Skrill, Neteller, and others) | Free | 8 hours to 5 business days |

| Cryptocurrency | Yes (USDT & BTC) | Free | up to 3 business days |

What is the minimum deposit for Exness?

The minimum deposit on Exness is $10 for NGN online bank transfers, e-wallets, crypto, and bank cards. Wire transfers require a minimum deposit of $10,000 and are processed within 48 hours.

How do I Deposit Funds?

To deposit funds into your Exness Account in Naira, follow the steps below:

Step 1) Log in to your Exness Personal Area by visiting www.exness.com and clicking ‘Sign In’ on the top right side to log in or go to my.exness.com/accounts/sign.

Step 2) Once you’re logged into your personal area (dashboard), click on ‘DEPOSIT’, which is on the left side column menu, and select Online Bank.

Step 3) Next, you select the trading account you want to deposit funds into and enter the amount of money you want to deposit then click ‘Next’ to proceed.

Step 4) You will be taken to a page where you will select the Bank Transfer option, and then a Nigerian Wema Bank account number will be displayed for you to make the transfer and to it, after making the transfer, you can close the page and return to your dashboard, you will be notified when the payment is received.

Step 5) After you complete the steps above, your Exness trading account is credited with the deposited funds.

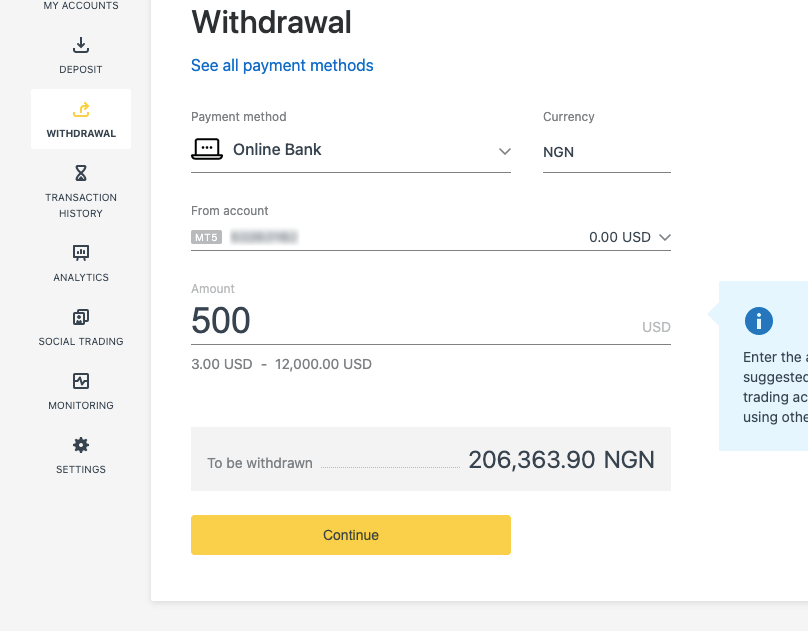

What is the Exness Minimum withdrawal?

The minimum withdrawal on Exness is $1 for Webmoney, $2 for PerfectMoney, $4 for Neteller, $10 for Skrill, BTC, and bank cards, $3 for NGN online bank, and $100 for USDT.

How to Withdraw Funds from Exness in Nigeria?

To withdraw funds from your Exness account to your bank account in Nigeria, follow the steps below:

Step 1) Go to the Exness website home page at https://www.exness-trade.pro and click ‘Sign In’ on the top right side to log in.

Step 2) Once you’re logged into your personal area (dashboard), click on ‘WITHDRAWAL’, which is on the left side column menu, and select Online Bank.

Step 3) Select the trading account you would like to withdraw funds from, then enter the amount of money you want to withdraw in the field provided.

Step 4) You will be shown a summary of the withdrawal transaction details, and a code will be sent to you either by email or text, for you to confirm the withdrawal, enter the code received and click on ‘Confirm’ to proceed to the next page.

Step 5) After confirming the withdrawal, you will be asked to fill in your Nigerian bank account number, the bank name, the name on the account and your phone number.

Step 6) Next thing is to click ‘Confirm’ after putting in the information, and you will get a pop-up screen saying the withdrawal process is complete.

Exness Trading Instruments

You can trade any of the following instruments with Exness.

| Instrument | Availability | Number |

|---|---|---|

| Forex CFDs | Yes | 99 currency pairs (8 majors, 26 minors, and 65 exotics) |

| Energies CFDs | Yes | 3 Energies on Exness (Brent, Crude Oil, and NatGas) |

| Metals CFDs | Yes | 10 pairs of Metals on Exness (including pairs of Gold, Silver, Platinum, and Palladium to USD and EUR) |

| Indices CFDs | Yes | 10 Indices on Exness (Dow Jones, S&P 500, US Wall Street, France 40, EU Stocks, and others) |

| Stocks CFDs | Yes | 98 Stocks on Exness (including, Google, Apple, Alibaba, Adobe, Cisco Systems, Amazon, etc) |

| Cryptocurrencies CFDs | Yes | 35 pairs of Cryptocurrencies on Exness (including ETH, Litecoin, Dogecoin, Ripple, Houbi, BTC, etc.) |

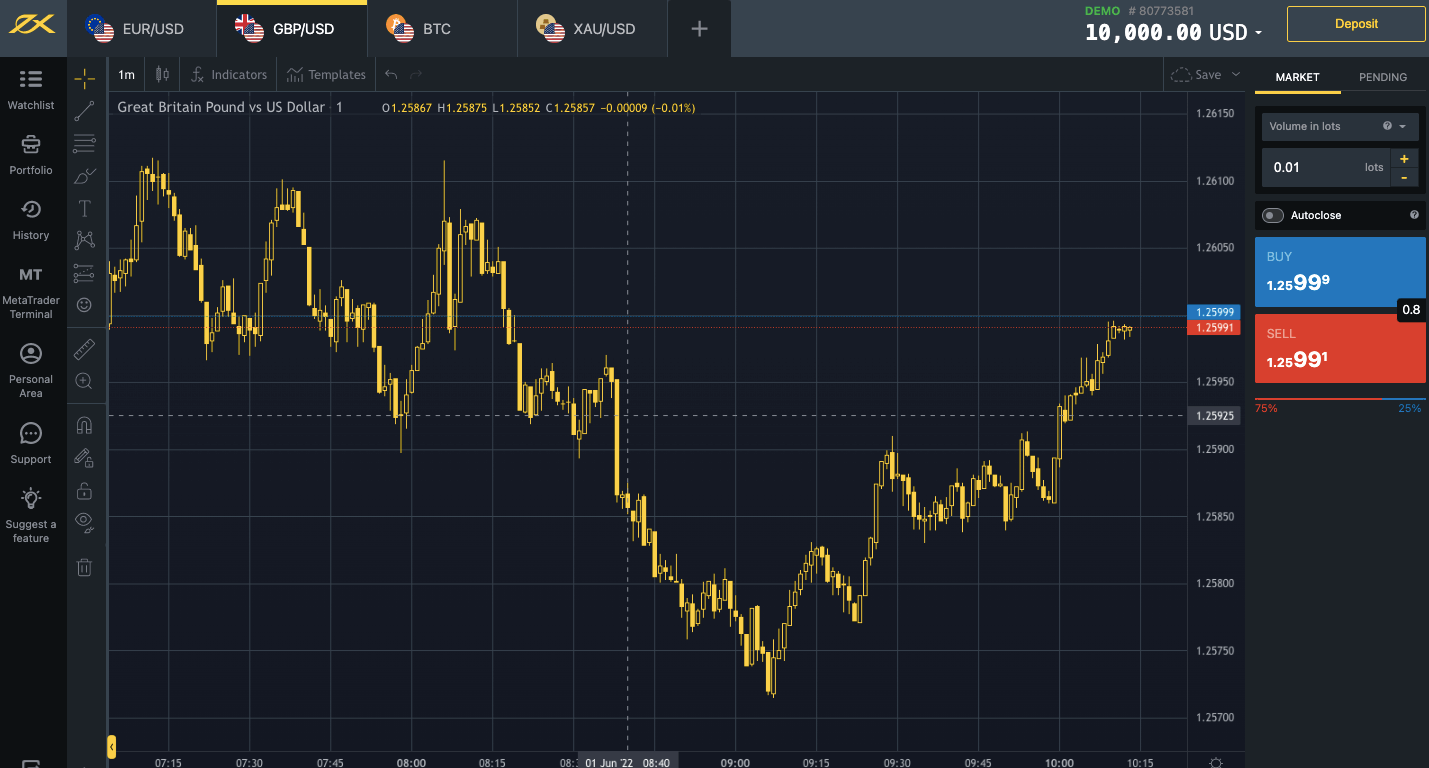

Exness Trading Platforms

Exness supports the following trading platforms:

- MetaTrader 4 & MetaTrader 5: Exness supports the MT4 and MT5 trading applications for trading financial markets. You can access the applications on the web, desktop and mobile devices (Android & iOS).

- Exness Trader: This is the proprietary Exness trading platform, developed by Exness. You can access it via the Exness Terminal on the web and mobile Exness Trader App for Android and iOS devices.

Exness Nigeria Customer Service

The Exness customer care service is fair, it has a number of channels for support to customers. They include:

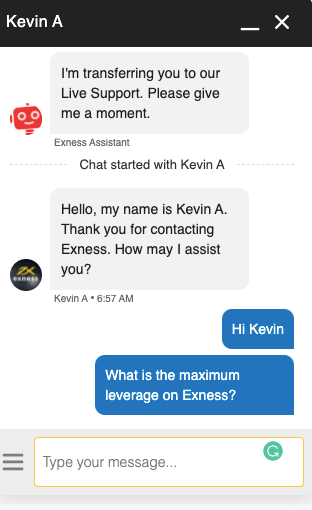

1) Live chat support: Exness has a 24/7 live chat that is not very fast, sometimes they have long waiting queues. When you first click the live chat button, the Exness Virtual Assistant bot starts by sending you quick messages about account types and other Exness related info, you can then type ‘chat agent’, to be transferred to a chat agent.

Note that the Exness Assistant will request your email address before transferring you to a live chat agent. If left idle for a while, the chat closes automatically.

2) Email support: The email support is relatively slow, compared to the email support of other brokers. When our team sent them an email, it was replied to after several hours, a follow-up email was sent, and it also took hours to get a response.

The answer provided was relevant and they recommended live chat for faster response in the mail, with a link to it. The Exness email address is [email protected].

3) Physical office: Exness has physical office addresses in the jurisdictions where it is regulated, London, the UK, Johannesburg, in South Africa, among others. Exness does not have a physical office location in Nigeria.

4) Phone support: Exness does not have phone support for traders in Nigeria. It has international phone support is in Cyprus. The Exness phone number is +357-2503-0959. When our team tried calling, it did not connect.

Exness Trading Tools

Exness has some tools that traders can use to improve their experience. You can use the following tools on the Exness Platform in Nigeria to analyze markets, plan trades, and manage risk effectively:

Analytic Tools on Exness

1) Trading Central Signals: You can use this tool to receive actionable trading signals generated by professional analysts on Trading Central platform. This is designed to help you stay informed and potentially spot favorable entry and exit points.

2) Market news by FXStreet: Exness has integrated the FXStreet forex news into their platform and you can access news about the latest updates and trends in the market.

3) Economic Calendar: The Exness Economic Calendar is designed to show upcoming economic events in various countries and regions that can impact currency movements. This tool is designed to help you anticipate and adjust your trading strategies accordingly.

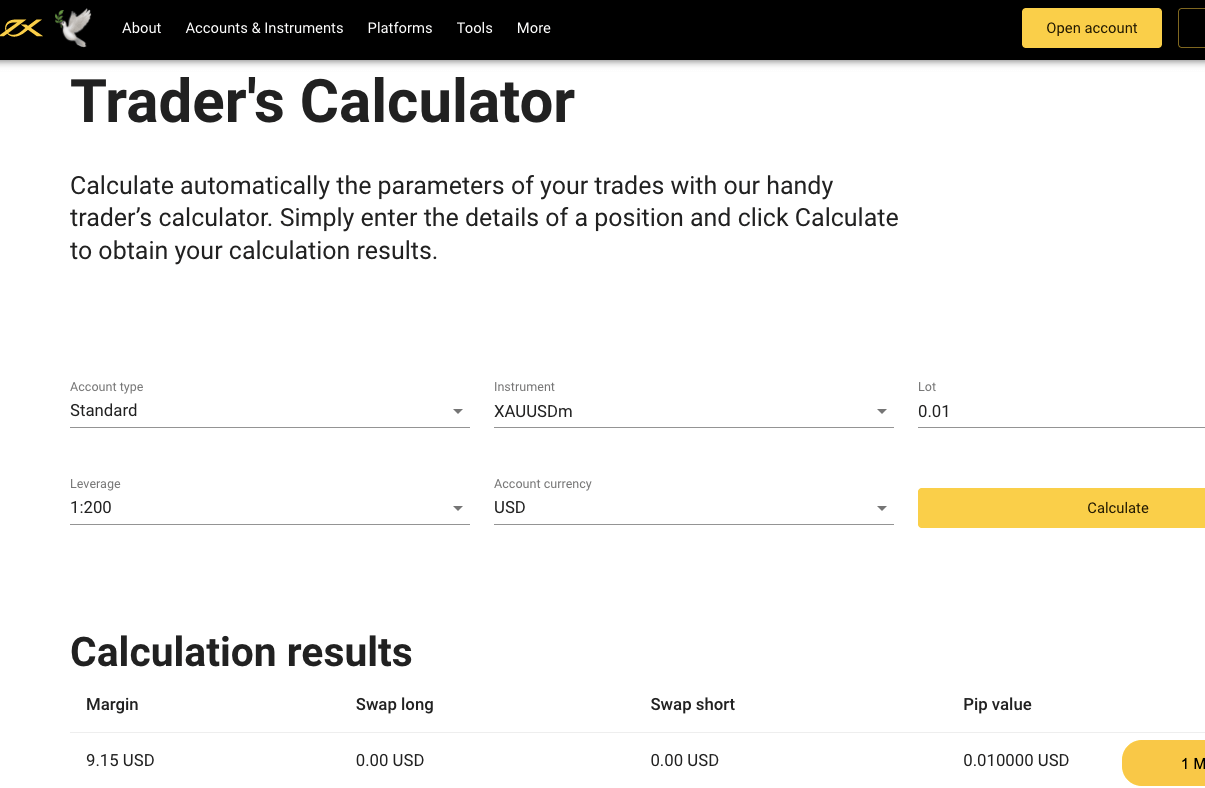

Investment Calculator

The investor calculator on Exness is designed to help you do the following things:

1) Estimate Margin: The tool allow you to estimate the margin requirement for your desired trade size, which will help you ensure you have sufficient funds to avoid margin calls.

2) Calculate Pip Value: The tool also helps you calculate the potential profit or loss per pip movement for a specific trade, helping you assess risk and reward potential.

3) Calculate Profit: The Exness investor calculator can you estimate the potential profit or loss for a given trade you are considering to enter, based on entry and exit price, leverage, and commission fees.

Do we Recommend Exness in Nigeria?

Exness is considered low-risk because the broker is multi in Top-tier regulations jurisdictions, like FCA, FSCA, and CySEC. The broker also offers negative balance protection which makes the platform safer for trading as you cannot lose more than your deposit.

The fees on Exness are moderately low when compared to some brokers, but are not the lowest. You can choose from the different account types depending on whether you prefer to pay more spreads or commissions.

The customer support of Exness is not robust, as their live chat is the most reliable contact medium. Exness website is easy to navigate with lots of information and the account creation process was fast.

We recommend that you visit the broker’s website and probably chat with live agents to answer your questions to help you decide if the broker is right for you and the account type you prefer.

Exness Nigeria FAQs

Which Exness account is best?

The best Exness account would be the Standard account, which has no commission fees, allows you trade multiple instruments and has competitive spreads. If you prefer to pay commissions with lower spreads, then the Exness Zero or Raw spread account will be best for you.

Thus the best Exness Account depends on your preference of the fees to pay and the instruments to trade.

Is Exness a good forex broker?

Exness is considered a good broker because they are regulated by Tier 1 and Tier 2 financial regulators to protect client funds. Exness also has negative balance protection and offers commission-free trading with some account types.

Which country is Exness from?

Exness is authorised to offer their services in multiple countries including South Africa, the United Kingdom, Cyprus, Mauritius and Seychelles. The broker has offices in these countries and is regulated by their financial regulators. Exness works in Nigeria and accept traders from Nigeria.

How long do Exness withdrawals take?

Exness withdrawals take about 24 hours for withdrawals to a Nigerian bank account via online transfer. Withdrawals to e-wallets take up to 5 business, while withdrawals to crypto wallets take 3 business days, and bank cards take up to 10 business days.

What is the minimum deposit of Exness?

The minimum deposit for Exness is $10 or the equivalent in NGN, applicable for cards, e-wallets, and online bank transfers.

Note: Your capital is at risk