There are pros and cons of forex trading. If you are planning to trade in the forex market as a trader based in Kenya, you need to choose a licensed forex broker.

Licensed brokers are approved & authorized by government regulators. They follow guidelines that protect traders and reduce the risks of losing traders’ money.

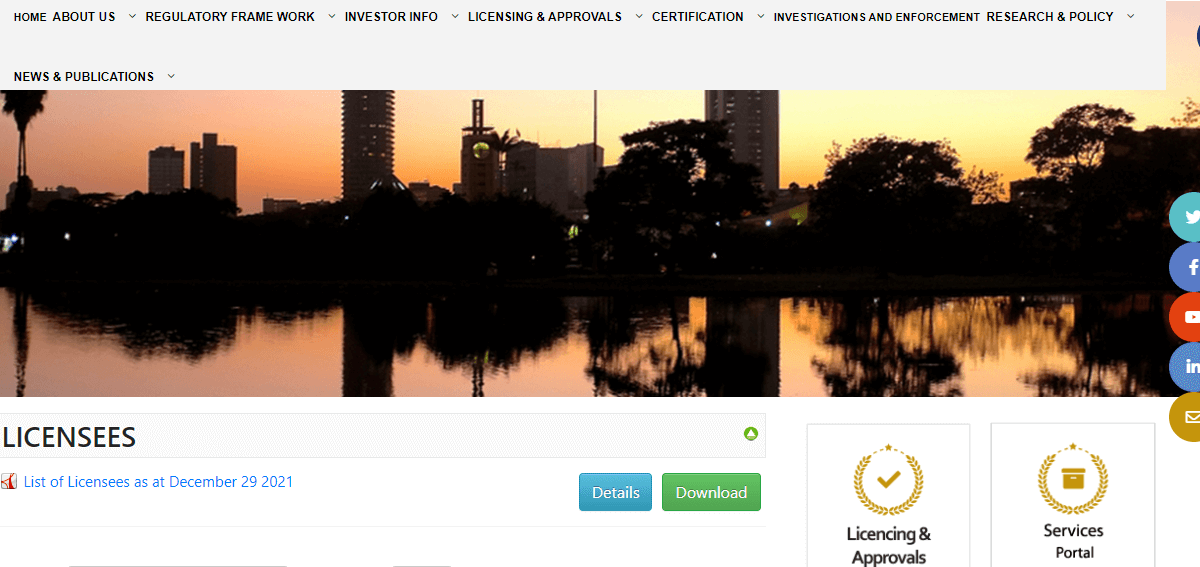

In Kenya, forex brokers are regulated by the Capital Markets Authority (CMA). There are currently 6 online forex brokers licensed by the CMA.

After thorough research reviewing brokers’ platforms, feedback from traders, and testing their support, we have compiled all our findings and put together a list of the 6 best forex brokers in Kenya.

Show More

Comparison of Best Forex Brokers in Kenya 2023

| Forex Broker |

Regulation |

EUR/USD Spread |

Minimum Deposit |

Visit |

| FxPesa

|

CMA,FCA

|

0 pips with Premiere Account

|

$5 for Executive Account

|

Visit Broker |

| HF Markets

|

CySEC, CMA, FCA, FSCA

|

1.4 pips

|

$5

|

Visit Broker |

| Exness

|

FSCA, FCA, CySEC

|

1.5 pips (average on major pairs)

|

$1

|

Visit Broker |

| Scope Markets

|

CMA

|

0.2 pips with Silver account

|

$5

|

Visit Broker |

| Pepperstone

|

CMA, FCA, ASIC

|

1.0 – 1.3 pips (Standard account)

|

$200

|

Visit Broker |

| FXTM

|

FSCA, FCA, CySEC

|

1.5 pips (Standard account)

|

$50

|

Visit Broker |

Best Forex Brokers in Kenya

Below is the list of best forex brokers in Kenya based on review & testing:

- FXPesa – Overall Best Forex Broker in Kenya

- HF Markets – CMA Regulated Forex Broker in Kenya

- Exness – Forex Broker with Low Fees

- Scope Markets – Regulated Forex Broker in Kenya with Low Fees

- PepperStone Kenya – Best Broker with Free Deposit & Withdrawal

- FXTM – Best Forex Broker with Competitive Spreads

- XM Trading – Forex Broker with Spread Only Accounts & Zero commissions

- Windsor Brokers – Regulated Forex Broker with MT4

We highlighted the important details for the six best online forex brokers in Kenya. With this information, you can compare several brokers and find the one that’s right for you.

#1 FXPesa – Overall Best Forex Broker in Kenya

EUR/USD Benchmark:

0 pips with Premiere Account

Account Minimum:

$5 for Executive Account

Compared to the commission-free Executive Account, for Forex and metal trading, the Premiere Account attracts a $7 commission fee for every 1 lot, round turn, and trades on Future CFDs attract a $10 commission fee for every 1 lot, round turn.

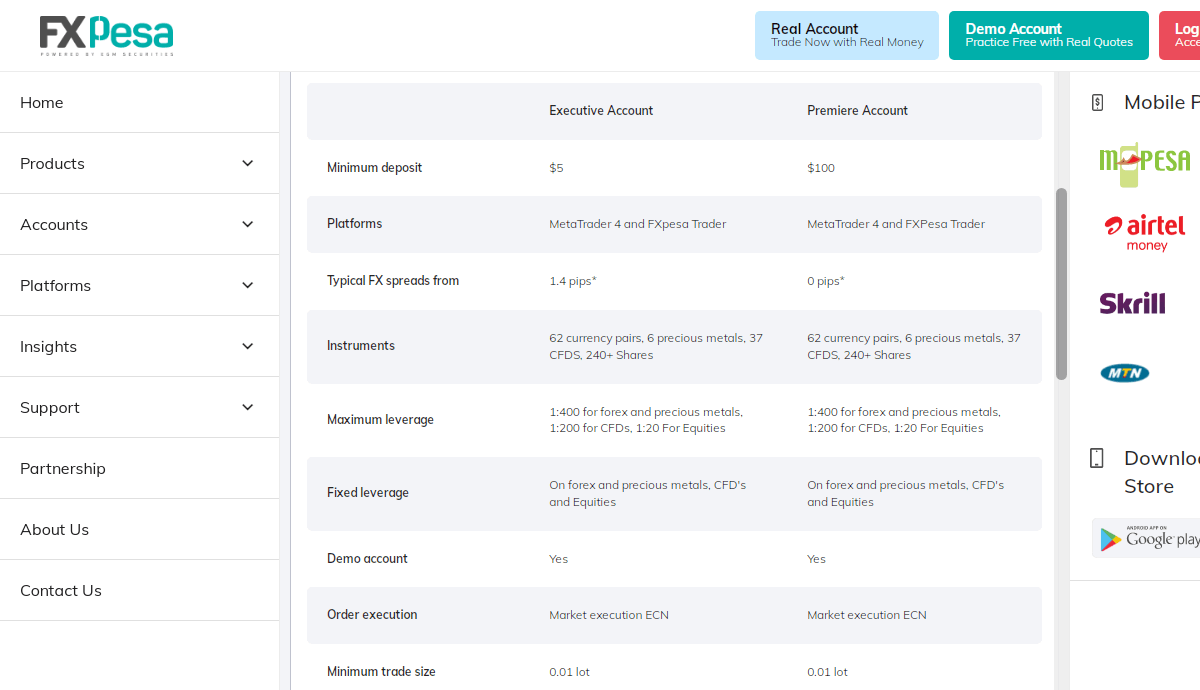

Regulation: FXPesa is the brand of EGM Securities Limited which is licensed by CMA, and their parent company “Equiti Group” (Equiti Capital UK Limited) is also licensed by the Financial Conduct Authority (FCA) in the UK. So, we consider FXPesa a safe forex broker for traders in Kenya.

Tradeable instruments: FXPesa offers a range of trading instruments, including Forex and CFDs on over 60 currency pairs, indices, shares, and commodities.

Platforms: FXPesa uses the MT4 trader application, and it is available on the web, iOS, and Android for traders.

Minimum deposit: FXPesa has a minimum deposit of $5 for an Executive Account and $100 for their Premiere Accounts.

Payment methods/deposit time: For deposits to the FXPesa trading account, Wire/Bank Transfer take 1-3 days to be credited, while Debit/Credit Cards, E-Wallet like Skrill, and Mobile Payments like MPesa are credited instantly.

Supported currencies: The account currency supported on FXPesa is USD.

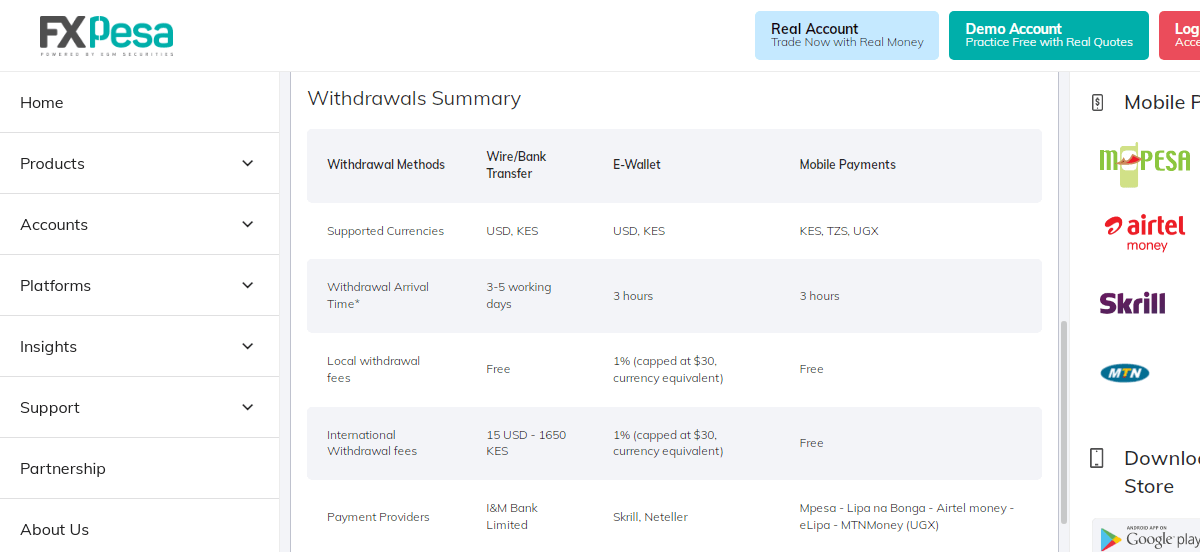

Fees: FXPesa charges zero deposits and withdrawal fees for all payment methods except for withdrawal to e-wallets that attract a 1% charge, capped at $30.

Spreads for majors like EUR/USD: On average their typical Spreads for majors like EUR/USD is 1.4 pips with Executive account & 0 pips (plus USD7 per lot) with Premiere Account. Also has a maximum leverage of 1:400.

Withdrawal methods/time: Withdrawals to local bank accounts are processed within 3-5 days, while e-wallet and mobile payments are processed in 3 hours.

Support: FXPesa offers its customers support via email and live chat. The live chat agent responded within 5 minutes when our team chatted them up, It’s available all week except Saturday. They also have toll-free phone numbers for callers in Kenya.

Read more on FXPesa here.

FXPesa Pros

- ECN execution on their accounts

- Regulated by the CMA

- Information is easy to find on their website

- No deposit charges

- You can fund and withdraw in KES

FXPesa Cons

- Withdrawal charges on eiwallets

- $100 minimum deposit on Premiere Account

- High leverage

- Limited shares CFDs

#2 HF Markets – CMA Regulated Forex Broker in Kenya

EUR/USD Benchmark:

1.4 pips

Trading Platforms:

MT4, MT5

HotForex is licensed as HFM Investments Limited with the CMA & were approved in 2021.

Regulation: HF Markets is also regulated by the Financial Services Authority (Seychelles) as HF Markets (Seychelles) Ltd, the FCA as HF Markets (UK) Ltd, the Dubai Financial Services Authority (DFSA) as HF Markets (DIFC) Ltd, and the Financial Sector Conduct Authority (FSCA) in South Africa as HF Markets SA (PTY) Ltd. HotForex is considered a safe Forex broker for depositing funds and has low risk.

Tradeable instruments: HF Markets offers Forex & CFD trading on 57 currency pairs (including majors & minors), CFDs on 56 shares, 7 crypto assets, commodities, indices, energies, and ETFs.

Platforms: Platforms supported by HF Markets are MT4 & MT5 trader, available on the web, iOS, iPad, and Android.

Minimum deposit: The general minimum deposit on HF Markets is $5, which applies to Micro Accounts. Different payment methods and account types also have different minimum deposits.

Payment methods/deposit time: With HF Markets, deposits via bank transfers are credited within 2-7 business days while cards, e-Wallet (skrill), mobile payments like MPesa, and cryptocurrencies (through bitpay) are credited within 10 minutes.

Supported currencies: Base account currencies on HotForex are USD, EUR, JPY, and NGN.

Fees: HF Markets charges zero deposit and withdrawal fees for all payment methods except for withdrawal to cryptocurrency wallets that attract a 1% charge.

Spreads for majors like EUR/USD: Typical spreads start at 1 pip for majors on HF Markets. While their Zero Account type has zero spreads. The maximum leverage on HotForex is 1:500.

Withdrawal methods/time: Withdrawals to bank accounts and cards are processed within 2-10 business days, while e-wallet and mobile payments are processed in 10 minutes and cryptocurrency withdrawals take 2 business days.

Support: HF Markets has 24 hours, 5 days a-week support via email, phone, and a fast live chat. There was no wait time before a representative answered our team.

Read our in-depth HF Markets review for our complete research on this forex broker.

HF Markets Pros

- Licensed with the CMA

- Multiple account type

- You can open have KES as your account’s base currency

- MT4 and MT5 are supported

- You can fund and withdraw in KES

HF Markets Cons

- Inactivity fees

- High minimum deposit on some account types

#3 Exness – Forex Broker with Low Fees

EUR/USD Benchmark:

1.5 pips (average on major pairs)

Trading Platforms:

MT4, MT5

With Exness MPesa deposits are credited instantly while others are processed within 24 hours.

Regulation: Exness is not regulated with CMA. They are licensed by FCA as an investment firm in the UK as Exness (UK) Ltd.

Also registered as Vlerizo (Pty) Ltd with FSCA, and Exness (Cy) Ltd by Cyprus Securities and Exchange Commission (CySEC). Exness is considered a moderate risk for Kenyan traders because they are not regulated in the country.

Tradeable instruments: Exness offers trading and CFDs on stocks, currency pairs, cryptocurrencies, indices, metals, and energies.

Platforms: The trading platforms used by Exness are MT4 & MT5 trader, available on the web, with mobile apps that can be downloaded on the Apple App Store and Google Play Store.

Minimum deposit: Exness requires $10 as the minimum deposit with cards and bank transfers for traders to open a trading account.

Payment methods/deposit time: Payment methods supported by Exness are bank transfers, card, skrill, Neteller, WebMoney, perfect money, mybux, bitcoin, and tether.

Supported currencies: Exness supports a wide range of base account currencies. Your trading account type determines the base currencies you can select from. The most popular currencies from all account types are USD, EUR, AUD, and KES, among others.

Fees: There are zero deposits and withdrawal fees on Exness, and traders pay no commissions on trades.

Spreads for majors like EUR/USD: Average spread on Exness for major pairs is 1.5 pips. Exness has no maximum leverage.

Withdrawal methods/time: Exness supports withdrawal via Kenya MPesa which are processed instantly and require a minimum withdrawal amount of $10. Card and cryptocurrency withdrawals are credited in 72 hours.

Support: Exness has email support, a centralized international phone number (no local phone in Kenya), and a 24/7 live chat with a response time of under 2 minutes.

Read more on Exness’ trading conditions here.

Exness Pros

- Top-tier regulation (FCA)

- KES base currency

- Multiple account types with dynamic pricing

- Zero commission on currency pairs (Pro Account)

Exness Cons

- Not regulated with the CMA

- High minimum deposit on some account types

- Leverage for currency pairs is too high

- Considerably high commissions on some accounts

#4 Scope Markets – Regulated Forex Broker in Kenya with Low Fees

EUR/USD Benchmark:

0.2 pips with Silver account

Trading Platforms:

MT4, MT5

Scope Markets is a local regulated broker in Kenya which offers a wide range of trading instruments. They also have a wide variety of account types and offer 24/7 support to their customers.

Regulation: Scope Markets is licensed by the CMA as SCFM Limited. They are also regulated with the IFSC in Belize. We consider Scope Markets a safe forex broker for traders in Kenya, as they are incorporated here.

Tradeable instruments: Brokers can trade shares, forex, indices, commodities, and CFDs on them on the Scope Markets platform.

Platforms: Exness uses the MT5 trader application, which is available for traders on the web, android, and iOS devices.

Minimum deposit: Scope Markets requires $100 as the minimum deposit from traders.

Payment methods/deposit time: Scope Markets supported payment methods are cards, e-wallets, MPesa, and direct bank transfers. Deposits made via MPesa are credited instantly, while bank transfers take up to 24 hours.

Supported currencies: Scope Markets supported account currencies are EUR, GBP, and USD.

Fees: Zero deposits and withdrawal fees are charged on Scope Markets.

Spreads for majors like EUR/USD: Scope Markets Gold Account has commission charges of $3.5 per side and 0.2 spread while Silver Accounts charges spread only, starting at 1.1 pips for pairs like EURUSD. Scope Markets has a maximum leverage of 1:500 on their instruments.

Withdrawal methods/time: The minimum withdrawal amount via mobile money like Airtel Money, T-Money, and MPesa is $5 and processed within 24 hours while bank transfer withdrawals are processed over 2 days with a minimum amount of $1,500.

Support: Scope Markets has 24/5 support via email, phone, and live chat that has no wait time. They also have offices in Westlands and Nairobi, Kenya, where customers can walk in for inquiries.

Scope Markets Pros

- Regulated in Kenya

- Zero commission

- Free premium signals package

- You get an account manager

- Low leverage compared to other brokers

Scope Markets Cons

- $100 minimum deposit

- No multiple accounts

#5 PepperStone Kenya – Best broker with free deposit & withdrawal

EUR/USD Benchmark:

0.84 pips (Standard account)

Trading Platforms:

MT4, MT5, cTrader

Account Minimum:

$200 (recommended)

Pepperstone is a regulated forex broker in Kenya which offers negative balance protection to their traders. They offer low spreads and do not charge any fees for deposits & withdrawals.

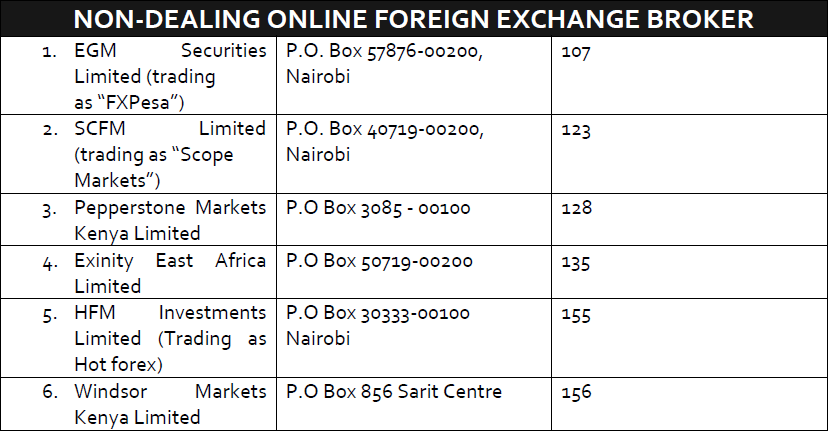

Regulation: PepperStone Kenya is a CMA regulated forex broker, licensed as Pepperstone Markets Kenya Limited. Also licensed by Tier-1 regulator, FCA as PepperStone Limited. They are rated as safe brokers for traders in Kenya.

Tradeable instruments: PepperStone offers trades and CFDs on shares, forex (over 60 currency pairs), indices, and commodities.

Platforms: PepperStone trading platforms are MT4, MT5, and cTrader, available to traders on multiple devices (macOS, iOS, Android, Windows, and tablets).

Minimum deposit: The official minimum deposit for PepperStone is $200, but traders can start trading by depositing any amount.

Payment methods/deposit time: PepperStone accepts payments through Visa, Mastercard, PayPal, and MPesa which are credited instantly, while deposits via bank transfers take up to 2-3 days.

Supported currencies: The base currencies on PepperStone accounts is USD and GBP.

Fees: All deposits have zero fees on PepperStone, but withdrawals via bank wire transfers attract fees of $20 per transaction. Withdrawals via PayPal, MPesa, and cards are fees.

Spreads for majors like EUR/USD: PepperStone charges commission on Razor accounts with a typical average spread of 0.9 pips and Standard accounts are charged an average spread of 1.9 pips. PepperStone has a maximum leverage of 1:400 for its instruments.

Withdrawal methods/time: PepperStone takes 3-5 to process withdrawals to bank accounts and requires a minimum withdrawal amount of $80 while card withdrawals take 2-5 days with a minimum amount of $10. Withdrawals to PayPal accounts are processed within 2 days.

Support: PepperStone has Kenyan phone support that is available 24/5. They have 24/7 email support and live chat that had no wait time when our team tested it. The chat starts with a chatbot, but you can transfer to an agent anytime. There is WhatsApp support too, but it did not respond.

Pepperstone Pros

- Regulated by the CMA

- Raw Spread ECN Account

- Zero commission on Standard Account

- Zero inactivity fee

- MT4, MT5, and cTrader

Pepperstone Cons

- Swap is only accessible on their trading platforms

- No multiple accounts

- Leverage for currency pairs is too high

- Considerably high commissions on some accounts

#6 FXTM – Best Forex Broker with competitive spreads

EUR/USD Benchmark:

1.5 pips

Trading Platforms:

MT4, MT5

FXTM is regulated forex broker in Kenya. They offer commission-free trading accounts to traders. They have a wide variety of tutorials and various trading tools.

Regulation: FXTM is a regulated forex broker in Kenya, registered with the CMA as Exinity East Africa Limited. The broker is registered as ForexTime Limited in Cyprus and licensed by CySEC, also registered as Exinity UK Ltd., and licensed by the FCA. We consider FXTM to be safe brokers for customers because of their multiple registration and regulators.

Tradeable instruments: FXTM offers traders CFDs on currencies, cryptocurrencies, stocks, indices, metals, and commodities.

Platforms: FXTM applications for trade are MT4 & MT5 Webtrader, which can be accessed on iOS and Android devices.

Minimum deposit: The minimum deposit for micro accounts is $10 on FXTM, while Advantage and Advantage Plus Accounts require a $500 minimum deposit.

Payment methods/deposit time: FXTM accepts various payments for deposits. Card deposits are processed instantly while bank transfers take up to 1 day to be credited. FXTM accepts MPesa for deposits under the African local solutions method, which can be seen on the dashboard.

Supported currencies: Base account currencies offered by FXTM are GBP, EUR, NGN, and USD.

Fees: FXTM offers traders zero deposits fees and commission-free trading, but charges $1 for each withdrawal.

Spreads for majors like EUR/USD: Micro and Advantage plus accounts on FXTM have zero commission while spreads start from 1.5 pips. The Advantage account has commission fees from $0.2 to $2 and ultra-tight spreads starting at 0.0 pips. Maximum leverage on FXTM is 1:200 which reduces as the notional value increase.

Withdrawal methods/time: Withdrawals are processed within 24 hours.

Support: FXTM has email and phone number support. With a live chat virtual assistant that answers basic questions.You can request to be transferred to a live agent which typically responds in 1 minute on working days. They also have WhatsApp support that responded in under 3 minutes when we tested, which is relatively slower than the live chat.

Read our detailed FXTM review for our in-depth research about FXTM broker.

FXTM Pros

- Top-tier regulators

- Good customer support

- Deposits and withdrawals are processed quickly

FXTM Cons

- FXTM is not regulated by the CMA

- No KES-based account

- You cannot fund via local banks

#7 XM Trading – Forex Broker with Spread Only Accounts & Zero Commissions

EUR/USD Benchmark:

1.7 pips

Trading Platforms:

MT4, MT5, XM App, XM WebTrader

XM is not regulated with the CMA in Kenya. They offer three trading accounts with an extra account for shares trading.

Regulation: Though XM is not regulated locally, XM holds tier-1 license with the FCA (UK) and ASIC (Australia). They are also licensed with CySEC which is another top-tier regulation. Therefore, we consider XM low risk for Kenyan traders.

Tradeable instruments: FXTM offers traders CFDs on currencies (55), cryptocurrencies (31), stocks (1261), indices (14), metals (4), energies (5), and commodities (8).

Platforms: XM supports MT4 and MT5. Their proprietary trading platform is also available as a mobile app and webtrader.

Minimum deposit: The minimum deposit for all accounts on XM is $5. You need a minimum deposit of $10,000 for Shares Account.

Payment methods/deposit time: accepts conventional deposit/withdrawal methods via local bank transfers, debit/credit cards, and e-wallets. XM also supports MPesa.

Supported currencies: Base account currencies offered by XM are GBP, EUR, JPY, RUB, CHF, ZAR, and USD. There is no KES base account.

Fees: FXTM offers traders zero deposits fees and commission-free trading, but charges $1 for each withdrawal.

Spreads for majors like EUR/USD: Spread for EUR/USD is 1.7 pips. XM does not charge extra commissions on trades. However, you might have to pay rollover charges if you hold trades overnight. Islamic and shares accounts are swap-free.

Withdrawal methods/time: Withdrawals are processed within 24 hours for e-wallets. For other methods, it takes up to 2-5 business days to process withdrawals.

Support: XM has email and phone support. The phone number is not local. However, you can also contact XM via live chat.

Read our in-depth XM review for more on this broker.

XM Pros

- Top-tier regulations

- Low minimum deposit

- Deposits and withdrawals are processed quickly

- No commissions

XM Cons

- No local CMA regulation

- No KES-based account

What is a Forex Broker?

A forex broker offers brokerage services to retail and professional traders who want to speculate on currency pairs & other markets as CFDs, by going long (buy) or short (sell). Through a forex broker, your profit or loss from trading CFDs is cash settled in a brokerage account you have opened with the broker.

A forex broker could be a market maker which means they could be taking the opposite sides of your trades or a no-dealing desk broker that connects you to buyers/sellers through their liquidity providers via computerized networks.

How to Choose Best Forex Broker in Kenya?

Forex brokers are a great resource for online traders. But, knowing which forex broker to choose can be a challenge.

This guide explains some of the important things to look out for before choosing a forex broker in Kenya, by answering some fundamental questions.

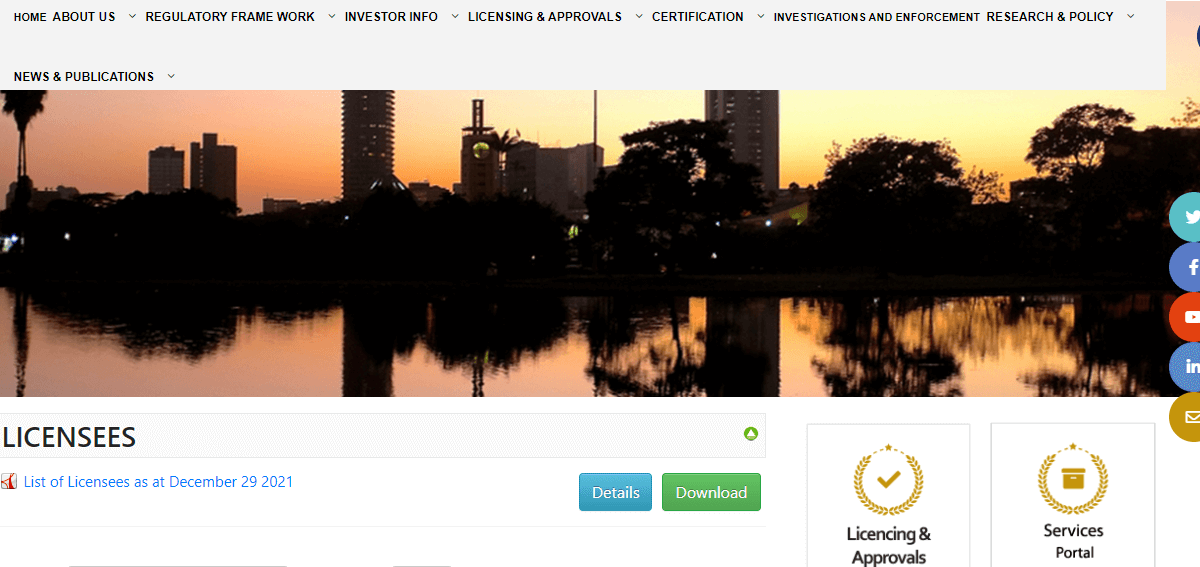

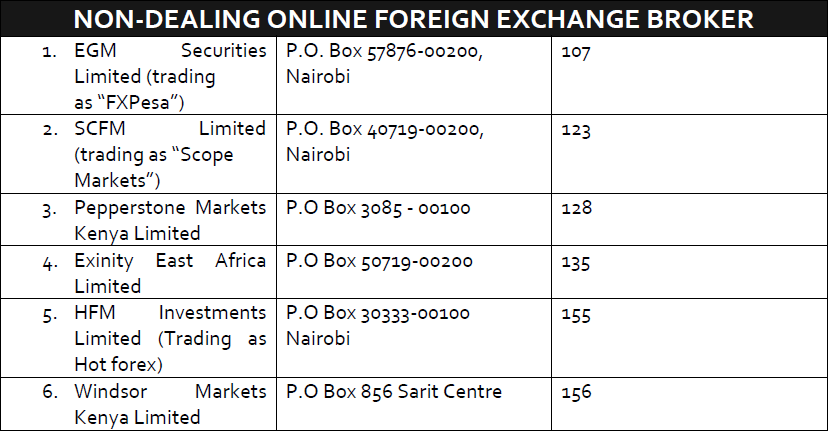

1) Is the Forex Broker Regulated by CMA?

The first step in choosing a broker in Kenya is to verify that they are regulated. You can verify their license on the CMA website or any other regulator’s website.

Let us take HotForex for example:

To verify their license with the CMA in Kenya, you go to the CMA website and download the ‘list of licenses’ pdf file, as shown below:

Then you search for HotForex, it would appear under the ‘Non-dealing Online Foreign Exchange Broker’ section. See the screenshot below:

Another way to know if a forex broker is low-risk is to check if they are licensed with top-tier regulatory bodies. Forex brokers in Kenya have the local CMA regulation. However, there are other top licenses that make a broker reputable.

These bodies include the FCA (UK) and ASIC (Australia). You can also consider CySEC (Cyprus). If your broker is regulated with CMA plus one or more of these regulatory entities, the risk of fraud is lower.

Pepperstone is an example of such a broker in Kenya. From the image above, you can see that they are regulated with two of the bodies we mentioned. We easily found this on their homepage but it is not like that for all brokers. The easiest way to find this out is to speak with your broker’s customer support.

2) What are their Trading Charges?

The next thing you need to consider after verifying a broker’s license is to check out their trading fees.

For example, while trading with HotForex, the average spread for a major pair like EUR/USD trade is 1.3 pips with their Premium Account type. This means that the trader would pay $1.3 for 1 Mini Lot trade (and $13 for Standard Lot) whose bid price is, for instance, $1.100.

While HF Markets Premium accounts do not charge any commission, their Zero accounts charge commissions starting from $3 per lot (which is a $6 round turn amount) for majors. But their spreads are close to 0 pips with this account type, so the overall trading fees are lower.

You should check out these trading fees before you start trading on any platform, to be sure you understand the fees and that there are no hidden charges.

You can see the trading fees of brokers on the accounts description section of their website.

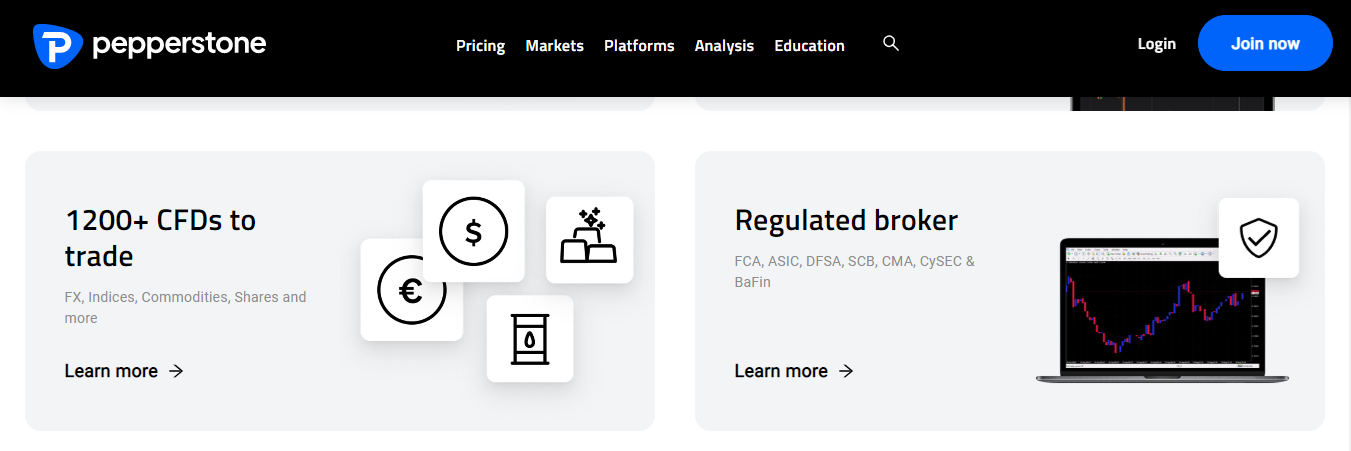

Let’s see an example of FXPesa trading fees below:

The above example is the comparison of 2 account types at FXPesa. You will notice that their typical spreads with the Executive Account start from 1.4 pips, and 0 pips with Premiere Account. What is not mentioned in the screenshot is that there is a $7 round-turn commission per standard lot with an Executive Account.

But, even with the commission, the overall fee is around 50% lower, depending on the forex pair or other CFD instrument that you are trading. So, you should carefully check the overall trading fees which you will be paying. Use the above check as your guide to verify how much trading fees you will be paying for each instrument you want to trade.

3) What is their Range of Market?

When you sign up with a forex broker, you want to be sure that they offer the CFD or CDs you want to trade. Usually, forex brokers will have a market range that includes currency pairs, stocks, indices, and commodities. However, if you love to trade ETF CFDs, then you need to find a broker that offers the usual markets and ETFs too.

This is why you should always check the markets offered by the broker you want to choose. They should offer the instruments you prefer to trade. To check for a forex broker’s instruments, you will need to visit their website.

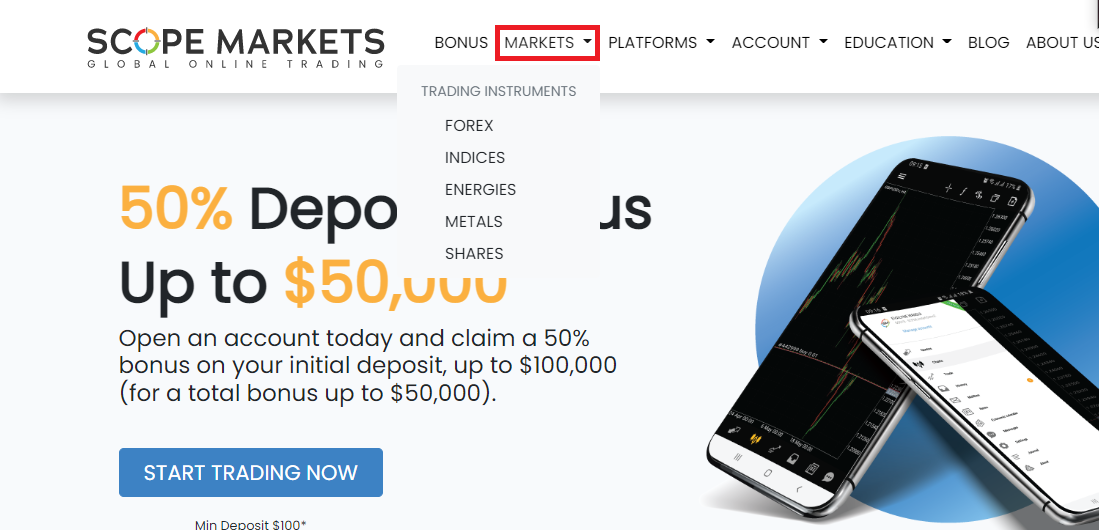

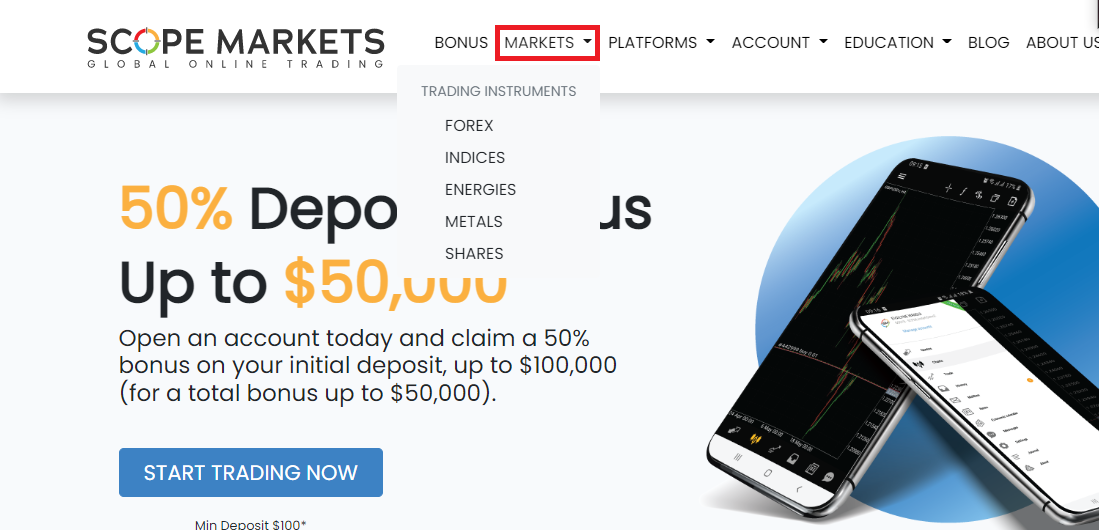

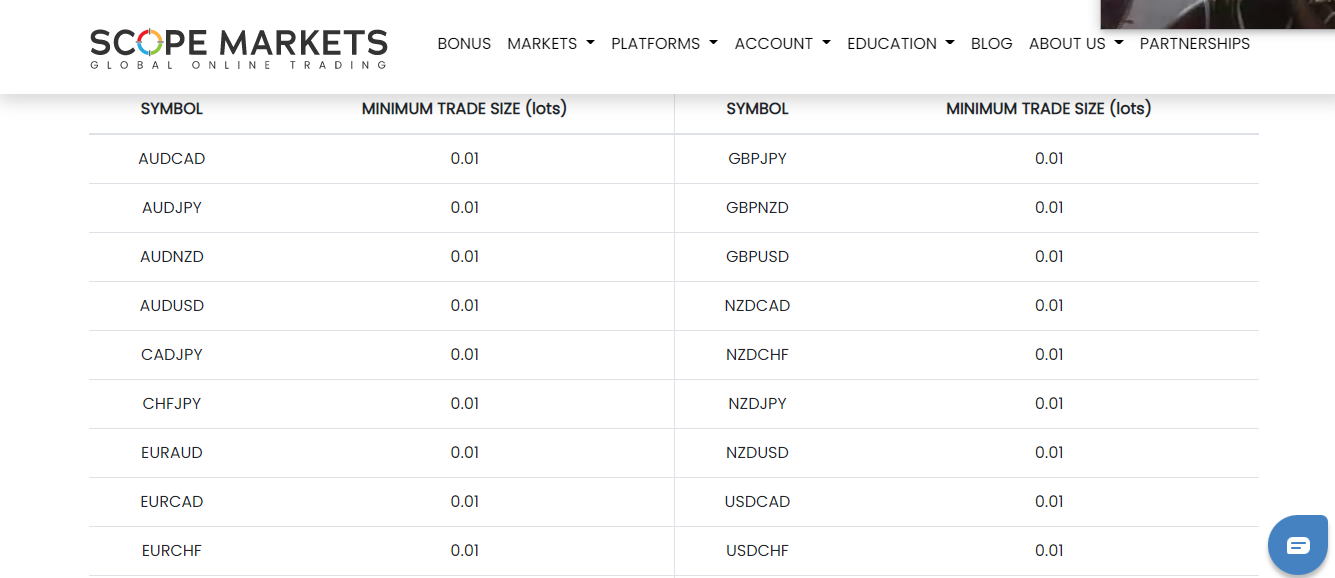

Here is how you can check with Scope Markets (example broker). First, go to their website and click ‘MARKETS’, you will see their range of CFDs displayed in a dropdown as shown below

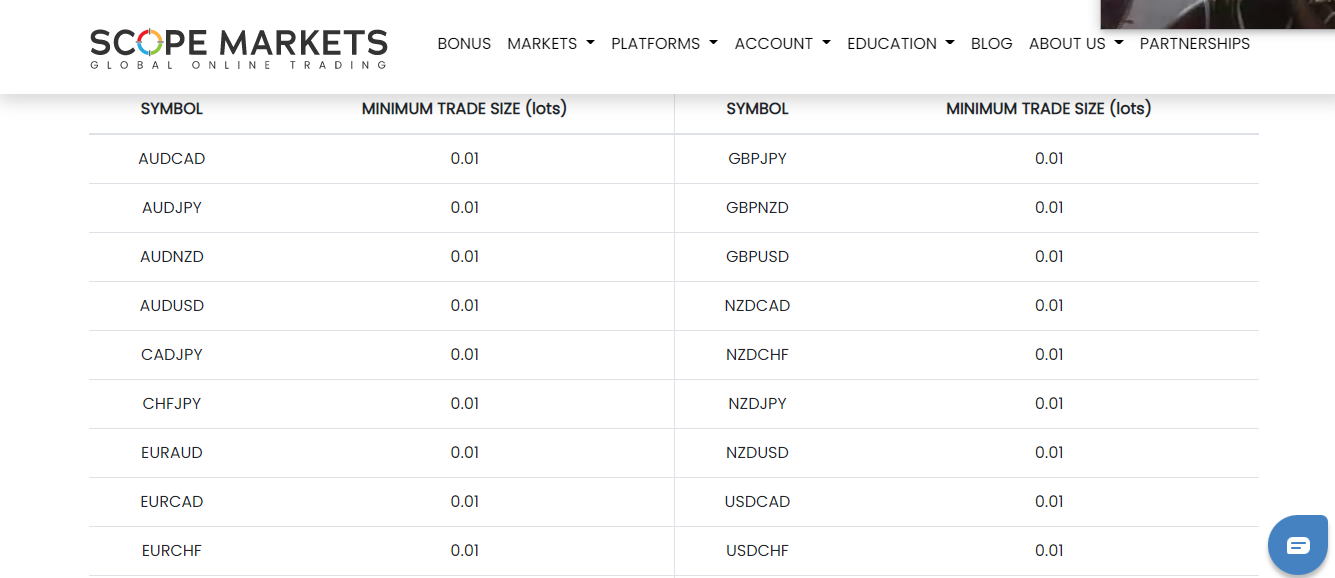

You can see that Scope Markets have 5 CFD classes which are Forex, Indices, Energies, Metals, and Shares. To see the individual CFDs in each class, click any of the CFD classes. If you click on ‘FOREX’ for example, you will see the currency pairs offered by Scope Markets.

With this step, you can know if a forex broker has your favorite CFDs before you sign up with them.

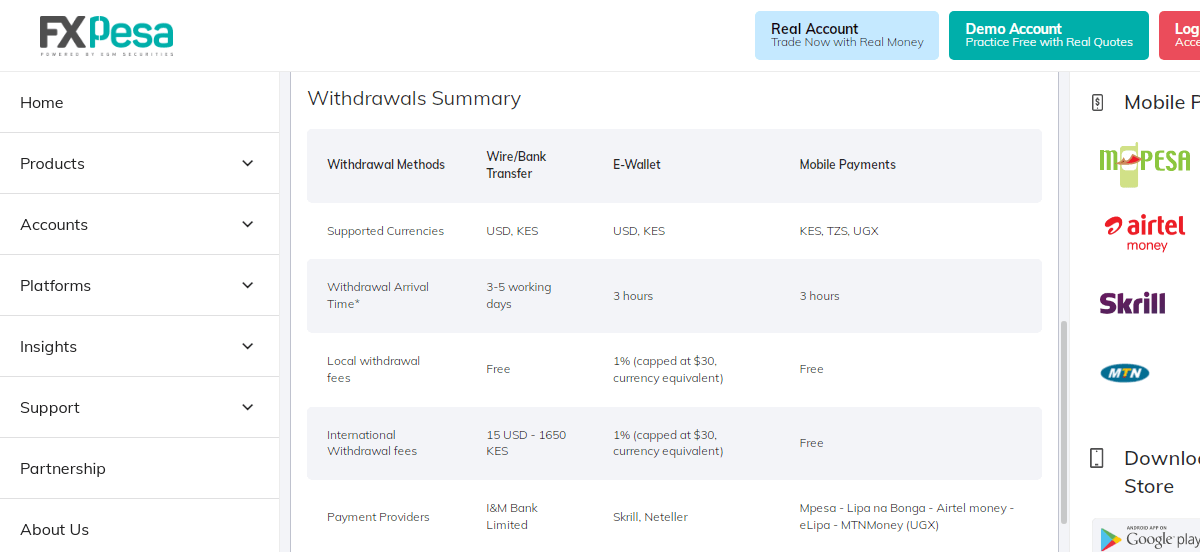

4) Ease of Withdrawals via Local Methods

Another question when it comes to choosing forex trading platforms is whether or not your broker will make things complicated for you.

Do they accept MPesa and allow deposits and withdrawals via Kenyan bank accounts? Do they charge deposits or withdrawal fees? If yes, how much?

The best forex brokers are those that offer ease of local withdrawals via bank transfers, accept MPesa, and process withdrawals and deposits quickly.

To see the supported withdrawal methods and the time it takes to receive your money, simply go to the deposits/withdrawals section of their websites.

For example, on the FXPesa website, on the left column where they have a menu for sections, you can click on ‘Support’ when it drops down, you will select ‘Deposit & Withdrawals’ to see their deposits and withdrawals. For mobile devices, click on the 3 strokes beside the FXPesa logo to see the support section.

See a screenshot below:

In the above example of FXPesa, you can see all the available withdrawal methods & deposit methods at this forex broker.

You should be asking yourself these important questions related to deposits & withdrawals: ‘is your preferred method available?’, ‘what is the minimum deposit & withdrawal for that method?’, ‘how much time does the withdrawal & deposit take?’.

5) Account types

Brokers usually give a breakdown of account types on their websites. You will also find in this breakdown the key features of the accounts. You want to look for an account with low spreads and low commissions. This is a major factor to consider when choosing your trading account.

Having multiple account types can offer you the flexibility to trade, and generally, brokers have different fee structures for different account types.

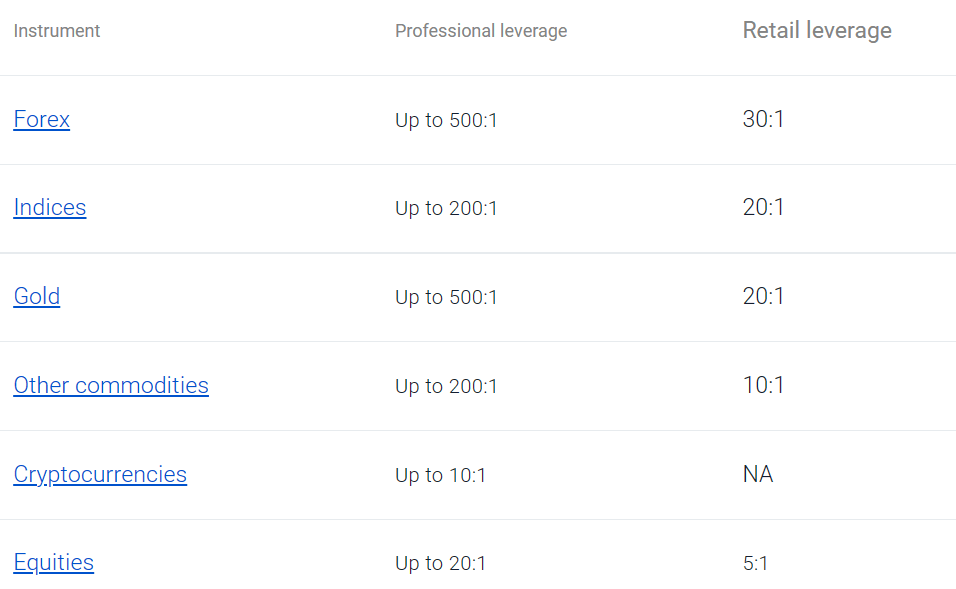

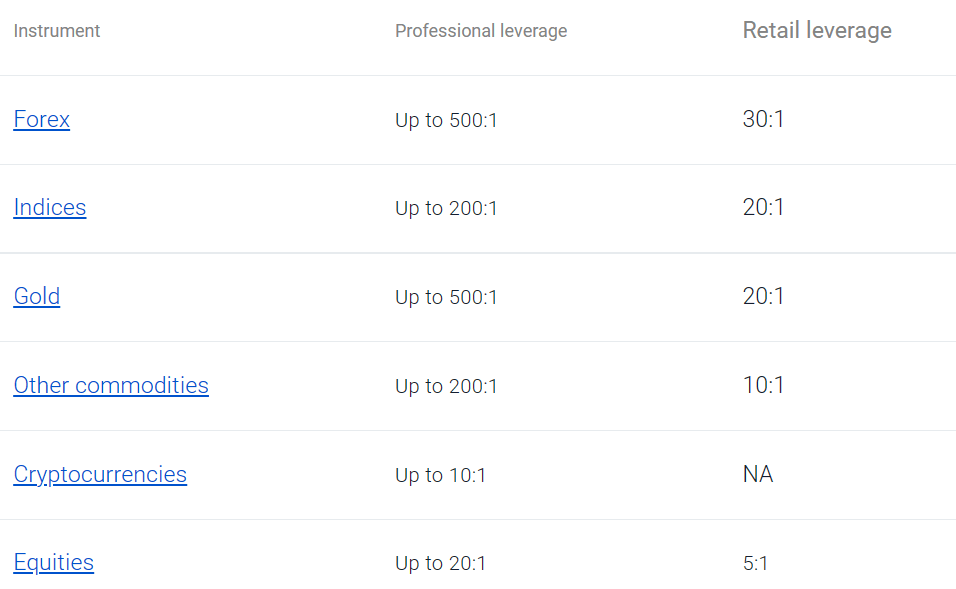

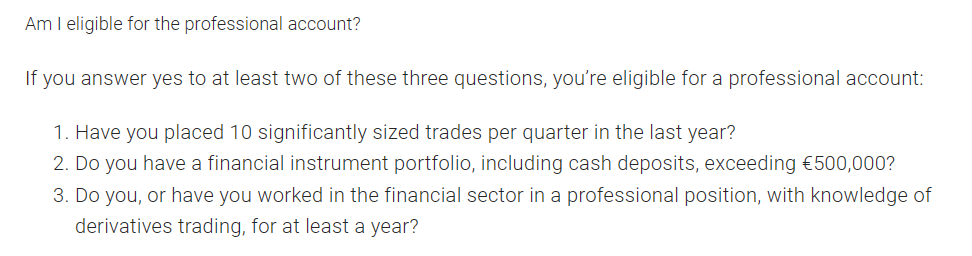

Let’s understand this with an example. Forex brokers generally have Pro accounts (for Professional traders) & Standard Accounts (for Retail traders). The difference can be in terms of leverage & lower fees for large-volume traders.

The Standard accounts are basic account types with standard fee structures, generally as spreads. Although some brokers also have Standard accounts with low spreads, some commission is involved for each trade (depending on your lot size).

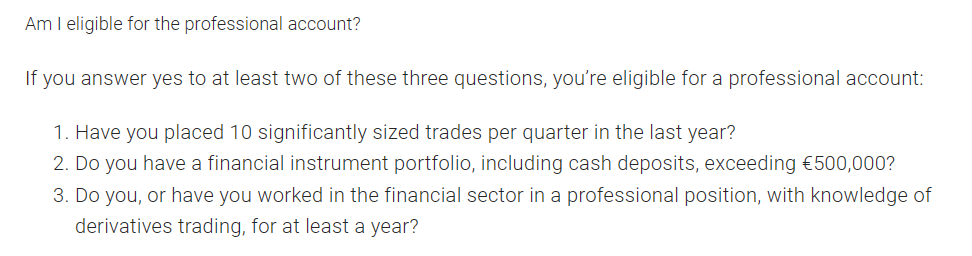

For example, below is the screenshot from Pepperstone UK’s website where they highlight the difference in leverage for Professional clients.

But the eligibility for opening Pro Account is much higher, including having a large trading volume & adequate knowledge of derivatives trading.

So, if you are indeed a Professional trader with experience, then how do you choose your account?

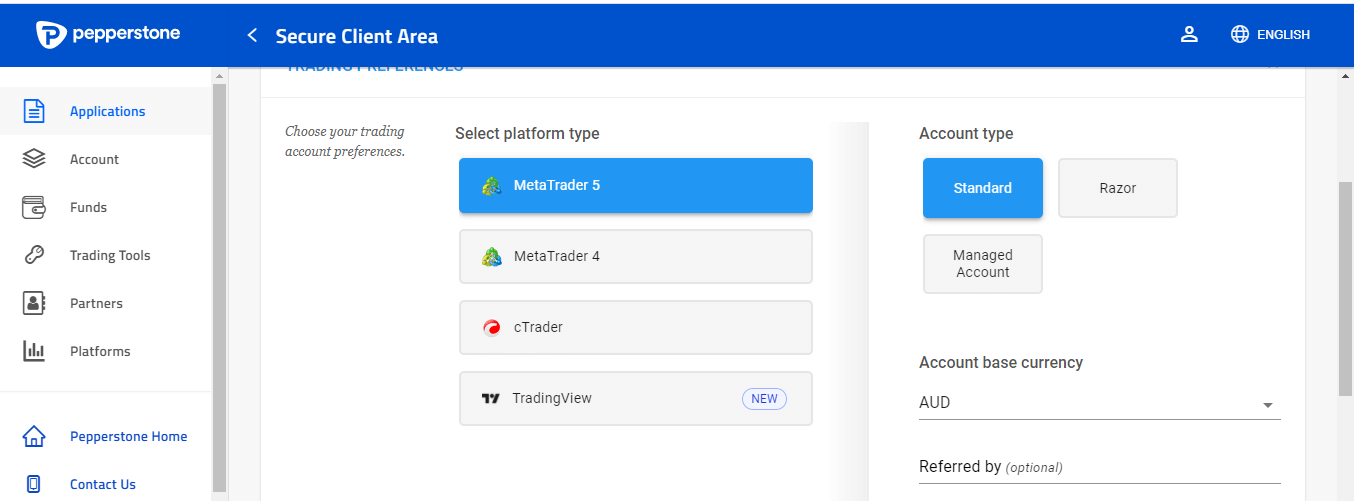

It is simple. As you continue your signing-up process, the account types available at the broker will be presented to you. All you have to do is select your choice with one click.

So, how do you choose your account?

It is simple. As you continue your signing-up process, the account types available at the broker will be presented to you. All you have to do is select your choice with one click.

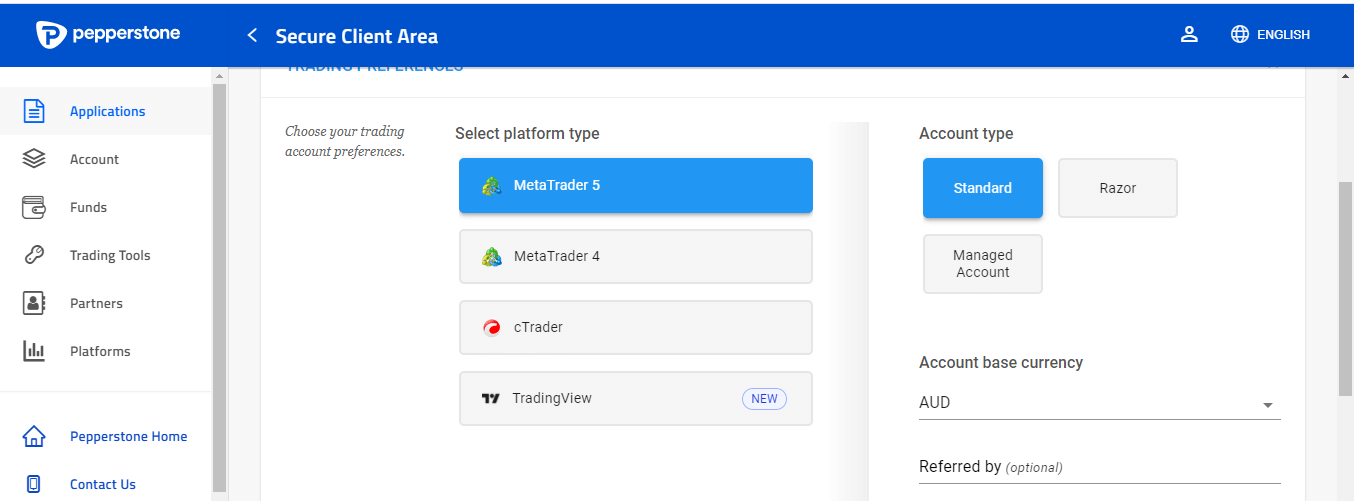

Let us see what it looks like at Pepperstone (example broker).

Here is a screenshot of Pepperstone UK’s account & platform selection.

At the top right of the page, you can see the account type section. You only need to select out of the three options there. You will find that section with every broker. It might not look like this exactly. But you will be the one to decide regardless.

You should also know that there are brokers with one single account type. There isn’t any choice to make here. You open an account and you are good to go.

6) Available Trading Platforms

The ability of the forex broker to make their trading applications available on multiple platforms is another factor to consider when choosing.

Do they support mobile versions as well as the web? You should check if their app is available for iPhone, iPad, Tablets, and Android users.

Multiple trading platforms make trading easier. You can trade on the go and easily take opportunities or close your trading positions to stop a loss.

Further options like MetaTrader 4, MetaTrader 5, and cTrader come with some functionalities and tools.

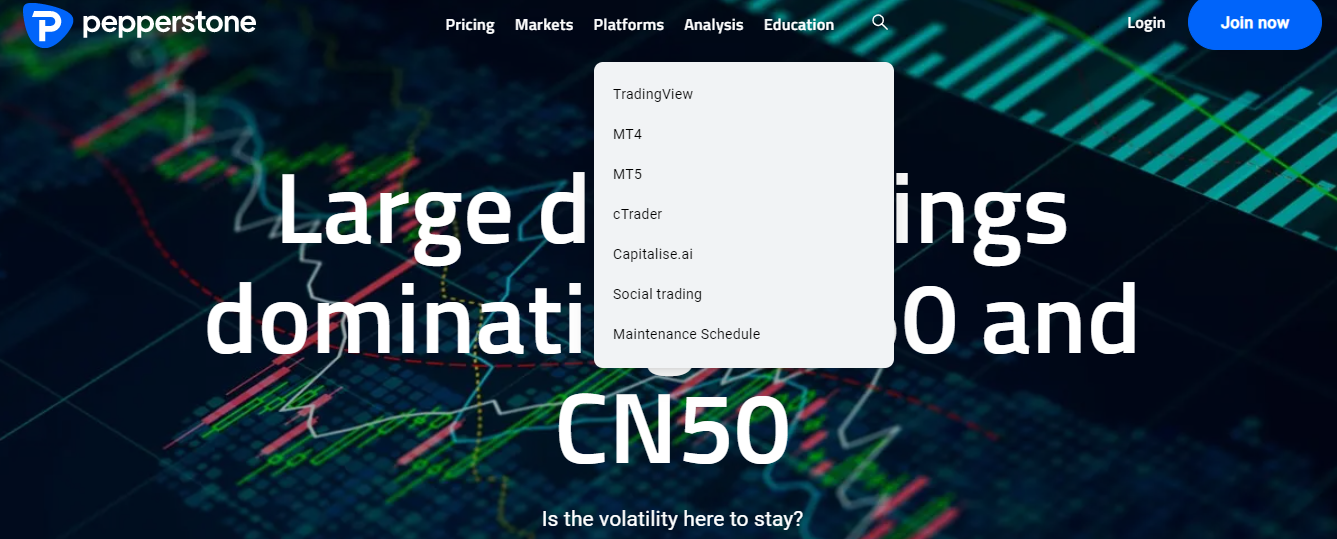

You would want to choose a forex broker who has multiple trading platforms and applications. Let us take the example of Pepperstone Kenya. If you click on ‘Platforms’ on their homepage, you can see they have multiple trading platforms as displayed below.

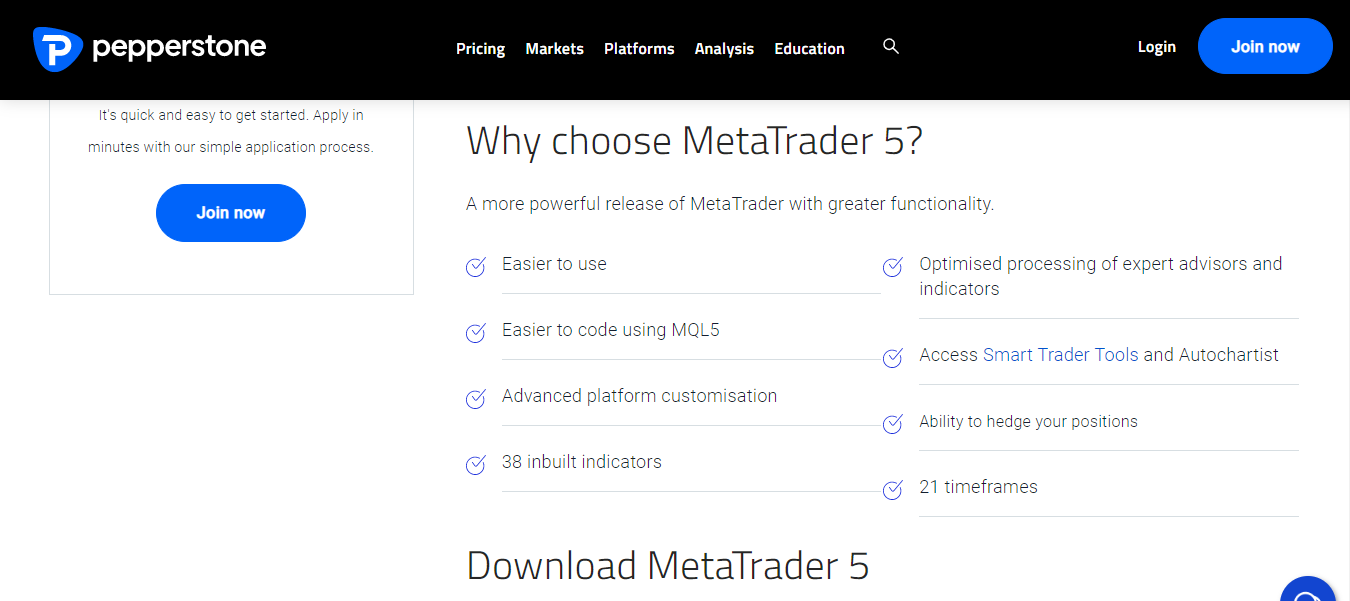

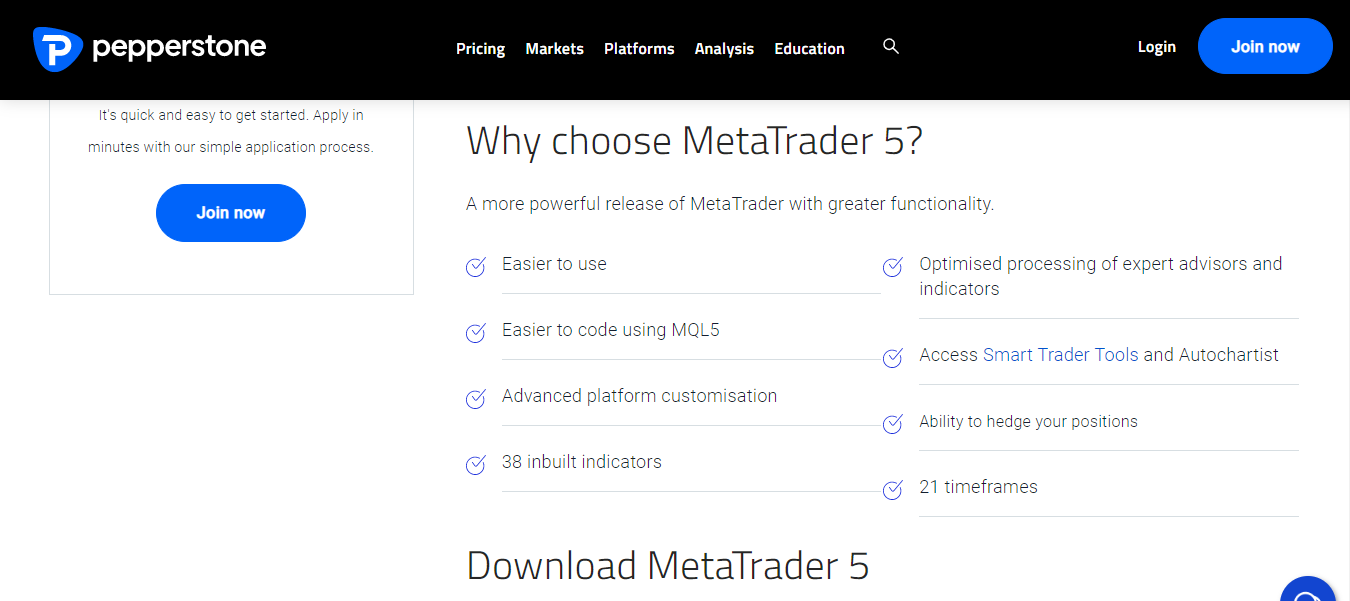

If you click on one of the platforms, you can find more details. We clicked on MT5 and found more useful info shown below

Pepperstone MT5 comes with smart trader tools, autochartist, etc which is good for your trading. Other brokers have some extra add-ins too. All you have to do is check.

Furthermore, some forex brokers also have their proprietary forex trading platforms. These platforms are developed by the company for the company. Traders hardly use these platforms for varying reasons. One of them is because of poor interface. However, brokers have greatly improved their platforms over the years with good trading conditions that may or may not be available on their third-party platforms.

Since they are owned by your broker, these platforms might even be named after your broker in some cases. HFM Platform, Exness Trading App, Exness Terminal, and FXTM App are examples. Traders favor MT4 and MT5. However, it is possible your broker’s platform has some features, indicators or trading tools that might not be on MT4/MT5. So you might want to give your broker’s platform a try. The only downside is that your broker’s platform might not be available on all devices.

For example, FXTM, and HF Markets only support trading apps. On the other hand, Exness supports their trading app and a trading terminal for desktop users.

7) What is the Percentage of Losing Traders?

The CMA regulates forex trading in Kenya. However, they do not make it mandatory for forex brokers to disclose the percentage of retail traders that lose their money. Only brokers regulated in the UK are mandated to reveal this.

This factor is important because there is an industry benchmark of around 75% for losing traders. If a forex broker has a percentage higher than this, then something could be wrong. So, how do you check it? Go to the UK version of your chosen broker’s website. You will find the percentage in the header of the website. That is where most brokers display it. If you don’t find it there, then scroll down to the footer. Brokers like AvaTrade display it at the footer.

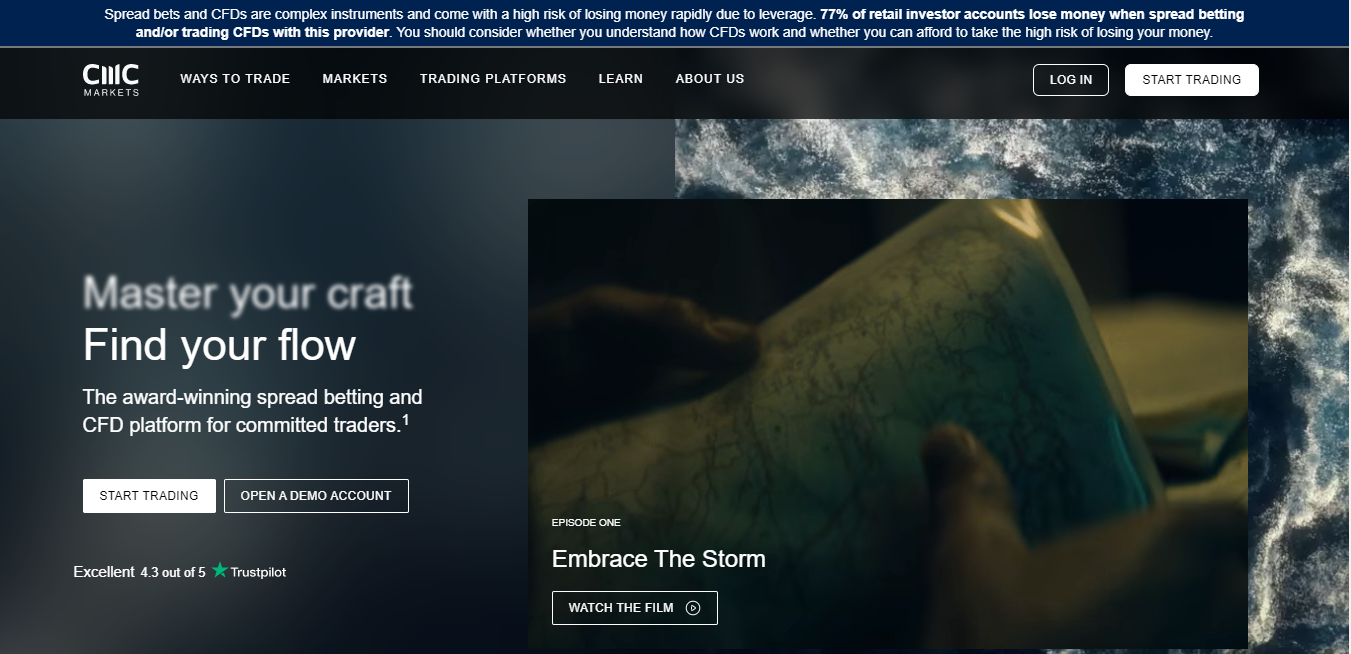

Let us cover how you can check the percentage of losing traders. Since only FCA regulated brokers, have this percentage displayed openly, you have to go to the broker’s UK website. For CMC Markets, for example, you go to www.cmcmarkets.com/en-gb. At the header, you will find the percentage as displayed below.

77% of retail traders lose their money with CMC Markets. With this simple step, you can verify this factor before choosing a broker.

8) Other trading Conditions

a. Order types: Varying order types help give you options in the market. Limit and stop orders can come in handy in entering the market at the right time and price. Your chosen broker must have these orders available on their platform.

Guaranteed stop-loss orders close your trades at specified prices. This order is executed regardless of market conditions. It is important your broker has this service in place because it is key for risk management. In addition, GSLOs are not free. So check with your broker to know if they have it, and much they charge for it.

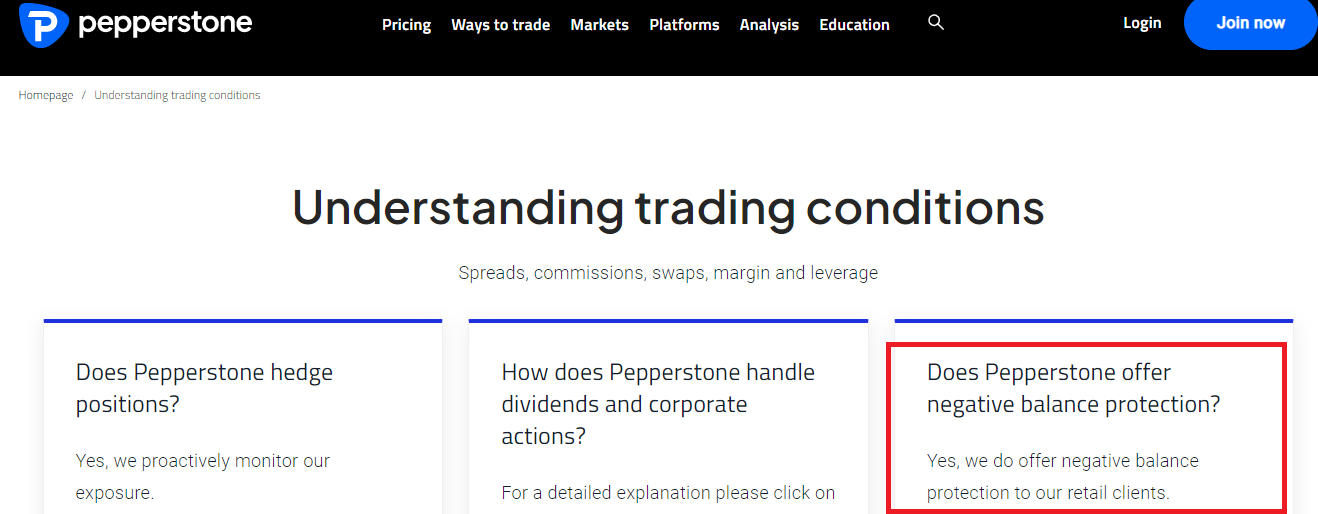

b. Negative balance protection: Without negative balance protection, you can lose more than the funds in your trading account. Choosing a broker that offers negative balance protection prevents you from experiencing this.

If your chosen broker is regulated with the CMA, you can be sure that they offer negative balance protection. Can you see why trading with a regulated broker is important?. You can even confirm with your broker if they provide negative balance protection. By contacting their support, you can verify. However, some brokers have FAQs on their websites. You can use it to verify if they have this risk management tool without waiting for an email or live chat response.

Here is an example on Pepperstone’s website

Finally, forex brokers are not mandated to provide negative balance protection if you are a professional trader. However, retail traders are guaranteed to get it.

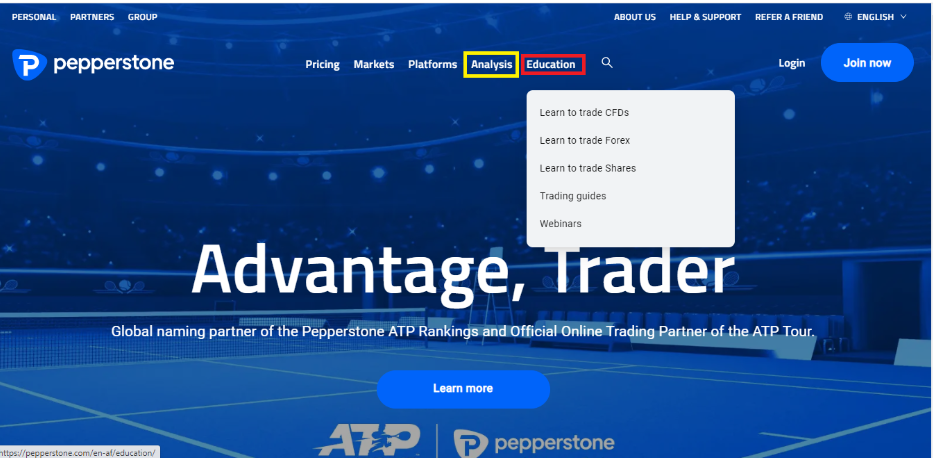

c. Education: Education is key. A forex broker should be friendly to beginners. Structured online courses, webinars, articles, and free research tools a forex broker should offer. These should be offered free of charge without extra costs.

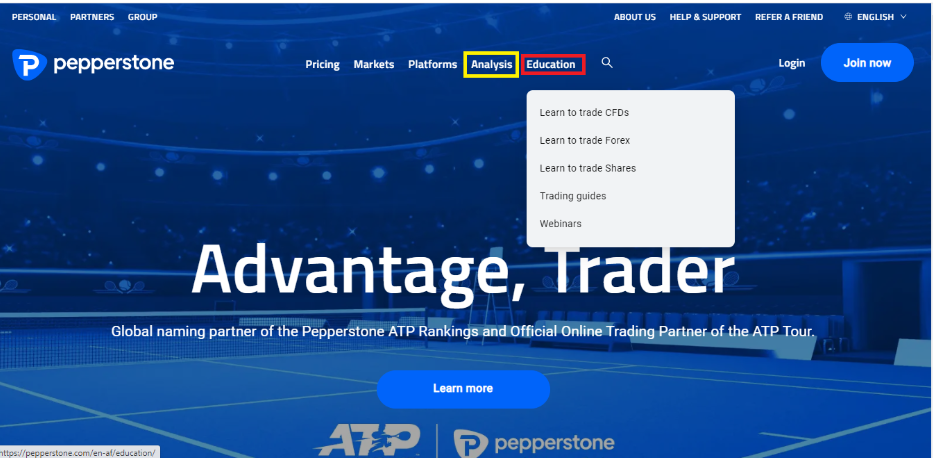

Finding a broker’s education is easy. It is usually on their homepage. With a few clicks, you can access quality courses for your learning. Let us show you how you can do this (Pepperstone is our example). On Pepperstone’s homepage, click on ‘Education’ (in the red box). Here is an illustration below.

From the image, you can see that Pepperstone has webinars, trading guides, and how to trade CFDs. Looking to the left, you can click on the analysis tab for in-depth knowledge of market analysis and trading tools.

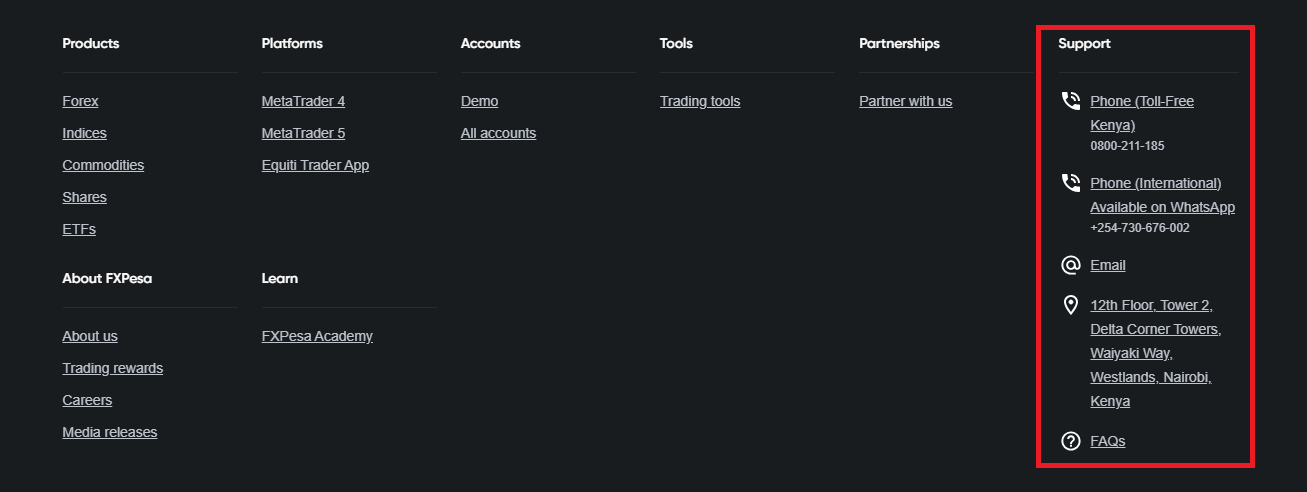

d. Customer support: Customer support is enjoyable with quick responses. A live chat feature and a Kenyan mobile number are also key. To know how quickly a broker responds to inquiries, send their customer support email.

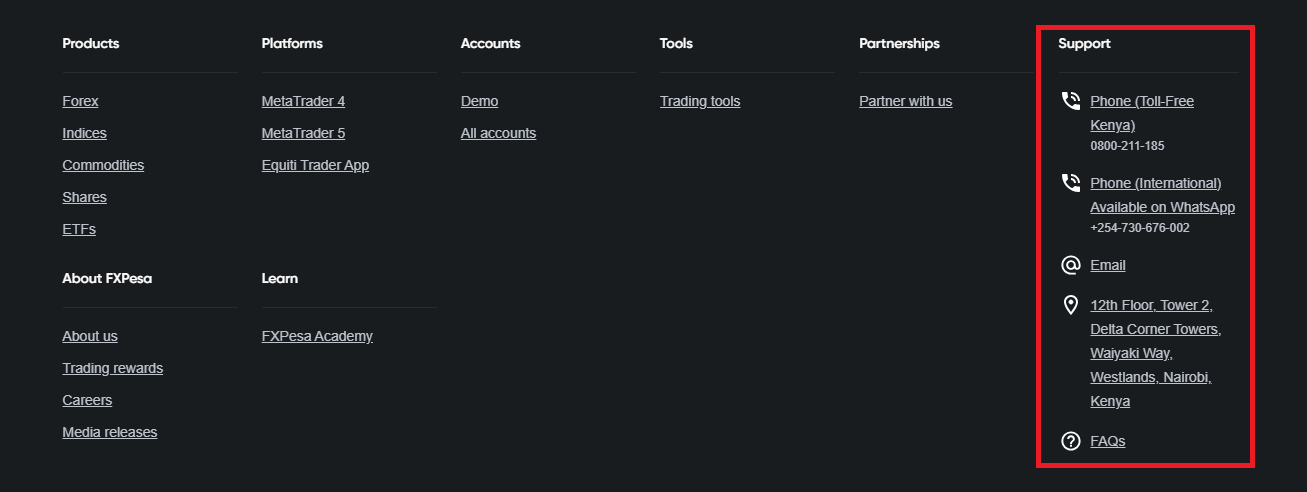

In addition, you chat with them if they are on WhatsApp. Carrying out this test gives you a good knowledge about a broker’s customer support. To find your broker’s support, you can find them at the footer of their website. Some brokers place it at the top right corner while some denote it with a ‘chat’ icon.

With a few clicks, you can test emails, live chat, and instant messaging support like WhatsApp and Facebook messenger. You can also go through the FAQs to see if they answer important questions.

The screenshot above is from FXPesa’s website. Under their support (highlighted red), they have a mobile number dedicated to Kenyan traders, there is a link to their email, and an FAQ too. Multiple supports like this is what you should look out for.

How to Open an Account with Forex broker in Kenya

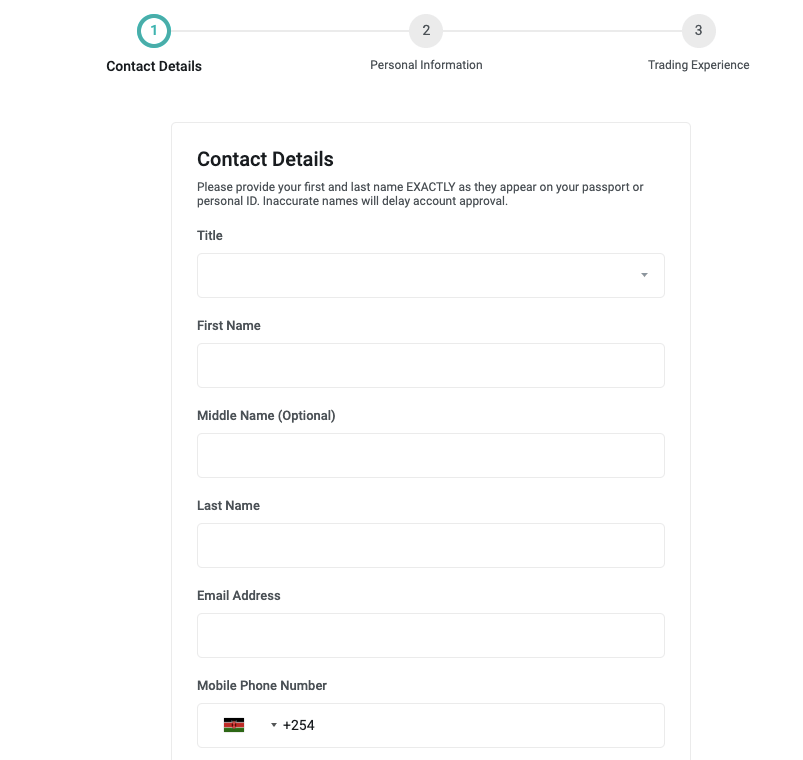

To start trading forex, you need to open a live account with a forex broker. Since we have used ‘FXPesa’ as the example in our guide, we will continue to use them as an example of how to open your account.

These steps are typically the same at all the forex brokers and are very straightforward, so once you know them at one broker, you can signup with pretty much any other broker.

Follow these steps to open a live trading account with FXPesa:

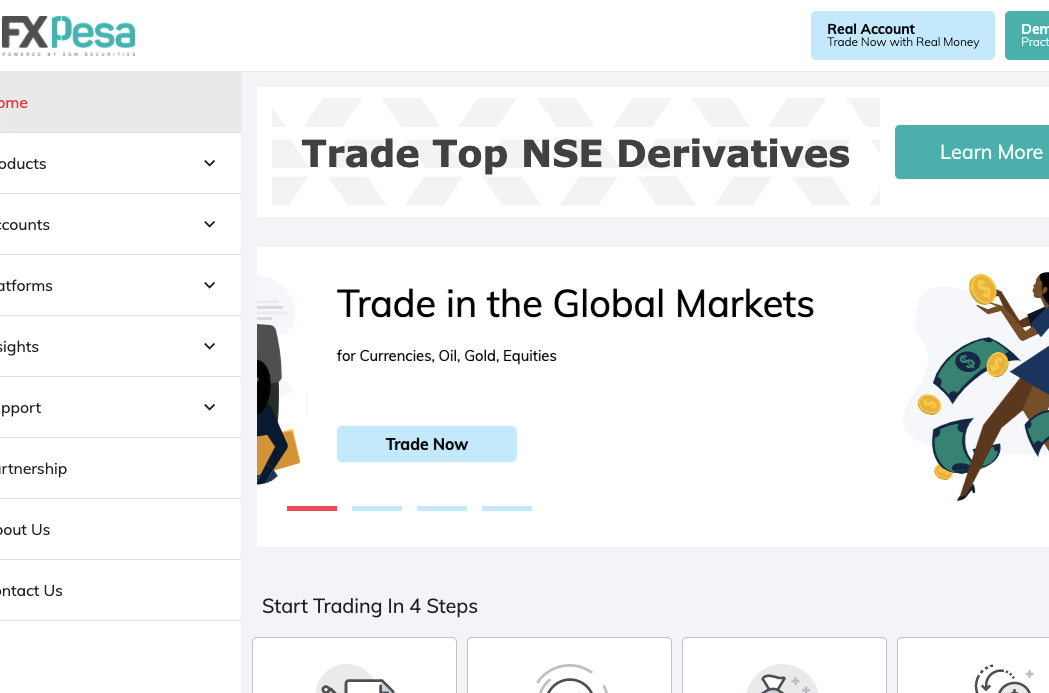

Step 1) Go to FXPesa website homepage via www.fxpesa.com.

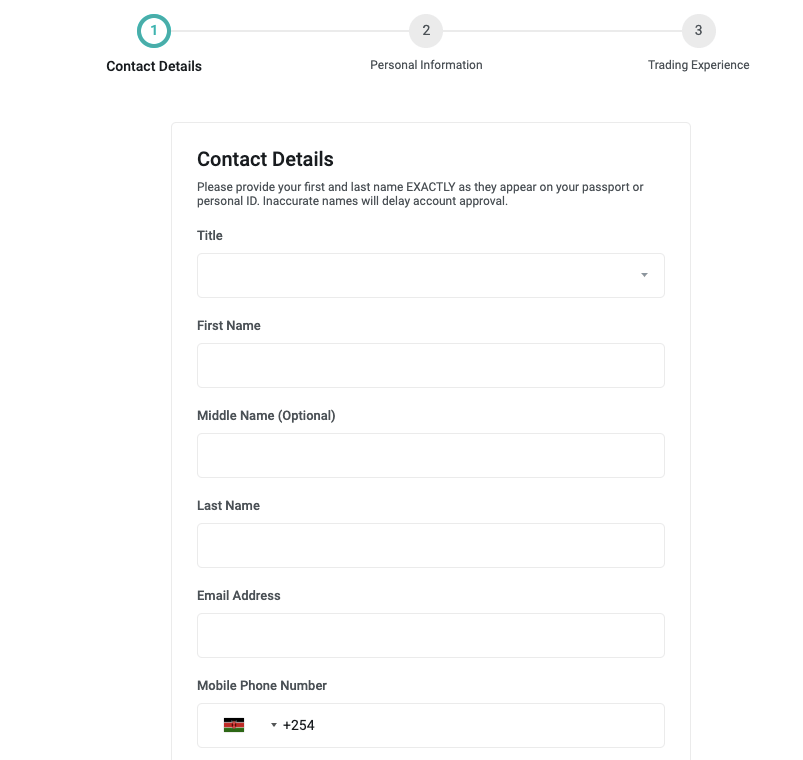

Step 2) Click on ‘Real Account’ on the top right side of the homepage, then fill out the form that appears.

You need to provide your name, email address, and phone number. A 4-digit code will be sent to your phone; after you enter the code, click ‘NEXT’ to continue the registration.

Step 3) To proceed, fill out your personal information, create a password and choose the type of account that you want.

Step 4) After that, you need to provide some information about your trading experience, and then you will need to read the legal declaration online and check the box beside it to show you have read and agreed with it.

Step 5) Once you complete steps 2-4, you will receive an FXPesa confirmation email.

To approve your account for trading, you will need to verify your identity by uploading a government-issued ID and an address verification document like a water bill.

Step 6) When your documents are reviewed and your account is approved, you will receive an email with login details and a link to download the app.

Step 7) You can deposit money into your account and start trading once you download the app.

What is a forex broker?

A Forex broker, also known as a foreign exchange broker or FX broker, acts as a middleman between you and the massive, global market for trading currencies.

Here’s what they do:

They provide access to the Forex market:

Think of them as your gateway to buying and selling different currencies.

They offer trading platforms where you can execute your trades and monitor currency prices.

They facilitate currency exchange:

You don’t directly interact with other traders. The broker matches your buy orders with sell orders from other clients or directly fulfills them (depending on the broker type).

They ensure smooth and secure transactions, eliminating the need to worry about counterparty risk.

They make money through fees:

They typically charge spreads (the difference between the buy and sell price of a currency pair) or commissions on your trades.

Do I need a broker for Forex Trading?

Yes, you generally need a forex broker to trade in the foreign exchange market. They act as an intermediary between you and the vast interbank market where currencies are actually traded. Here’s why:

1) Access to the Market: Retail traders like you and me can’t directly access the interbank market. Forex brokers have the licenses and relationships to do so, and they provide you with a platform to place your buy and sell orders.

2) Order Execution: Your broker takes your order and finds a counterparty to match it with on the interbank market. They handle the execution of the trade, ensuring it’s done efficiently and at the best available price.

You can see this process play out on their forex trading platforms.

The brokers have access to liquidity providers, or a market maker may act as the counterparty themselves to your trades.

Let’s understand through an example. Let’s assume that you want to buy GBP/USD. First of all you need quote (Bid & Ask prices), which you can check on the broker’s platform. When you place a ‘market order’, the broker finds the fill for you by send it to their liquidity providers or directly acting as the counterparty.

All of this happens in real time within a few micro seconds. Without a broker, retail or professional traders cannot trade currencies directly.

FAQs on Best Forex Brokers in Kenya

What forex brokers are regulated in Kenya??

As of December 2021, the only 6 CMA regulated forex brokers in Kenya are FXPesa, Scope Markets, PepperStone, FXTM, HotForex, and Windsor Brokers (registered as Windsor Market Kenya Limited).

Which Forex Brokers accept MPesa??

There are many forex brokers that accept MPesa as per our research & 6 CMA regulated forex brokers in Kenya all accept the MPesa payment method for deposits. These brokers also have MPesa for withdrawals.

Which is the Best Forex broker in Kenya?

Overall best forex broker in Kenya based on this post is FXPesa, because of their regulation, relatively lower fees, availability on all devices, multiple trading applications, and ease of use.

Which Forex Brokers has the lowest minimum deposit in Kenya?

The lowest minimum deposit at regulated forex brokers in Kenya is $5 at FXPesa. HotForex has 600 KES as their minimum deposit. Pepperstone has a high minimum recommended deposit of $200. Other forex brokers have minimum deposits from $5-100.

Which Forex Broker has the lowest spreads in Kenya?

In Kenya, HotForex, FXPesa & Pepperstone offer low to zero spread accounts, which have commission fees per lot.

For example, you pay a commission fee of $7 per trade on FXPesa with the Premiere Account, $6 per trade for majors, $8 per lot for minors at HotForex with Zero Account, and $7 per lot for a round turn trade on Pepperstone Razor Account.