IC Markets is a CFDs broker offering trading services for foreign exchange, commodities, bonds, digital currencies, indices and stocks.

IC Markets was established in 2007 and is regulated in Seychelles and other top-tier jurisdictions. Traders from Ghana are registered under IC Markets Seychelles entity.

In this post, we take a look at the trading fees, deposit and withdrawal options, account opening process, customer support and safety of IC Markets to help you get to know more about this broker.

| IC Markets Review Summary | |

|---|---|

| 🏢 Broker Name | Raw Trading Ltd |

| 📅 Establishment Date | 2007 |

| 🌐 Website | www.icmarkets.com |

| 🏢 Address | Raw Trading Ltd, Eden Plaza, Office 209, Eden Island, Mahe, Seychelles |

| 🏦 Minimum Deposit | $200 (3,082GHS) |

| ⚙️ Maximum Leverage | 1:1,000 |

| 📋 Regulation | ASIC, CySEC, FSA Seychelles |

| 💻 Trading Platforms | MT4, MT5 and cTrader available on PC, Mac, Web, Android, & iOS |

| Visit IC Markets | |

IC Markets Pros

- No inactive account fees

- Offers commission-free trading

- No fees for deposit/withdrawals

- Online customer support available 24/7

IC Markets Cons

- Few products available for trading

- Does not offer GHS account currency

- No funds compensation for non-EU clients

- Has high leverage of 1:1000, which increases your risk if used

How Safe is IC Markets?

Although IC Markets is not regulated in Ghana as such it is best to avoid them. However, the broker is licensed by tier-1 and tier-2 financial regulators.

Below are the major regulations with which IC Markets are regulated.

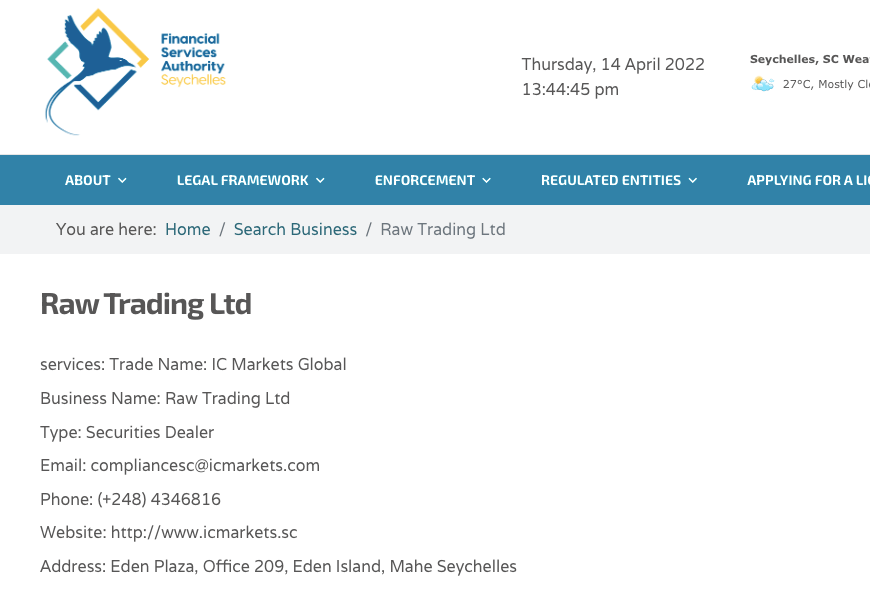

1) Financial Services Authority (FSA), Seychelles: IC Markets is incorporated in Seychelles as Raw Trading Ltd and is regulated by the FSA with license number SD018, authorised as a securities dealer in 2020.

They operate under the trading name IC Markets Global with a dedicated website www.icmarkets.sc.

Traders from Ghana are registered under this offshore regulation. It is important to know that the broker is not regulated in Ghana and their offshore regulation may not cover Ghanaian traders. Trading with them is at your own risk.

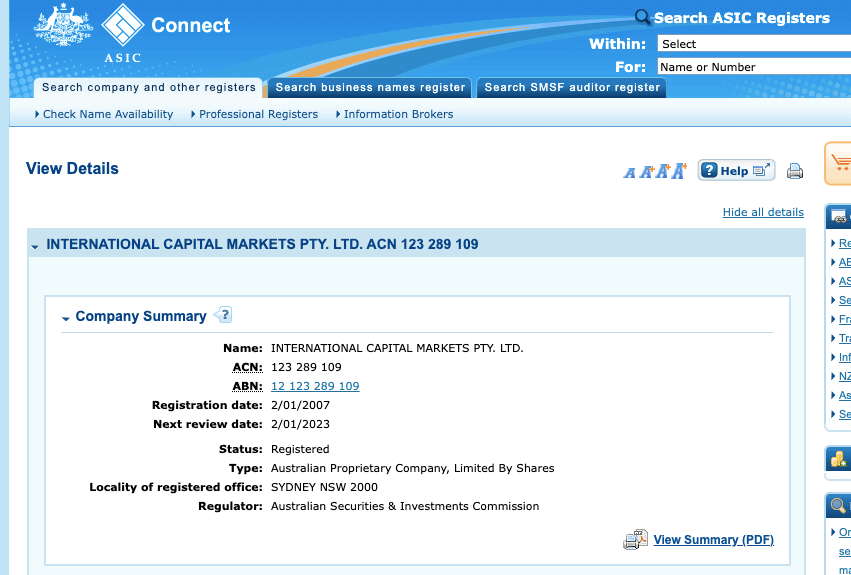

2) Australian Securities & Investments Commission (ASIC): IC Markets is registered in Australia as International Capital Markets Pty Ltd with ACN (Australian Company Number) 123-289-109 since 2007 and is regulated by ASIC.

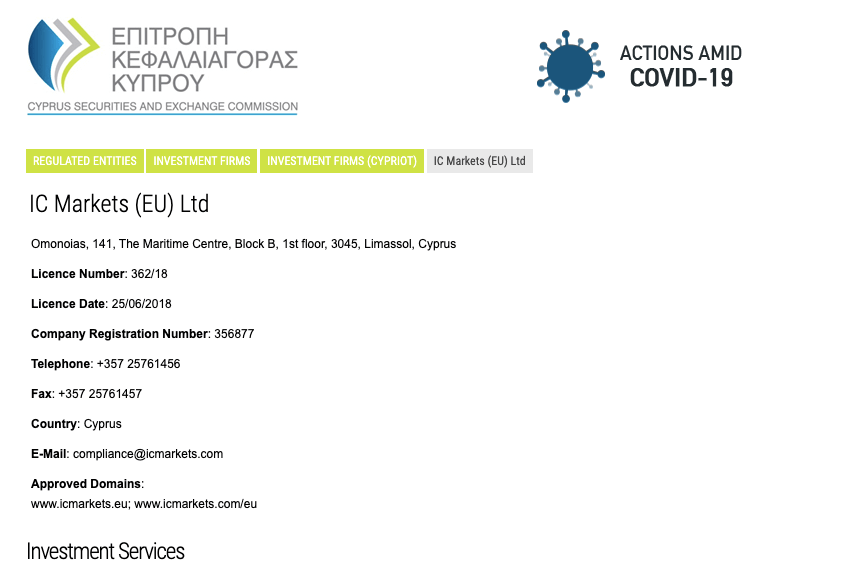

3) Cyprus Securities and Exchange Commission (CySEC): IC Markets is also regulated in Europe by CySEC as IC Markets (EU) Ltd and authorized to offer investment service, license number 362/18 issued in 2018. The broker serves European clients through this license and a dedicated website, www.icmarkets.eu.

IC Markets Investor Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| Australia | No Protection | Australian Securities and Investments Commission (ASIC) | International Capital Markets Pty Ltd |

| EU Countries | €20,000 | Cyprus Securities Exchange Commission (CySEC) | IC Markets (EU) Ltd |

| Seychelles | No Protection | Financial Services Authority (FSA) | IC Markets Global |

Ghanaian clients are registered under IC Markets’ Seychelles entity. Therefore, there is no negative balance protection for traders based in Ghana. Here is a statement from IC markets website that confirms this.

“Events such as markets gapping over the weekend or on major holidays, where liquidity is thin, can increase the chance of your positions being stopped out and a negative equity situation occurring. In case you lose more than your current account balance, you should be aware that you will bear the negative consequences of such adverse events.”

IC Markets Leverage

The maximum leverage on IC Markets is 1:1,000 for forex and commodities, 1:200 for indices, bonds, and futures, and 1:20 for stocks, while cryptocurrencies have a maximum leverage of 1:5 on cTrader and 1:200 on MT4/MT5. You can change your maximum leverage in your account client area.

With a leverage of 1:1,000, you can open a trade position worth 1,000 times the value of your deposit. For example, if you deposit $100, you can place a trade worth a notional value of $100,000.

Note that some instruments have lower leverage limits than the stated maximum.

It is important to know that trading leveraged products involves risk and you can lose all your money. It is best to only trade if you understand it and do not use high leverage.

IC Markets Account Types

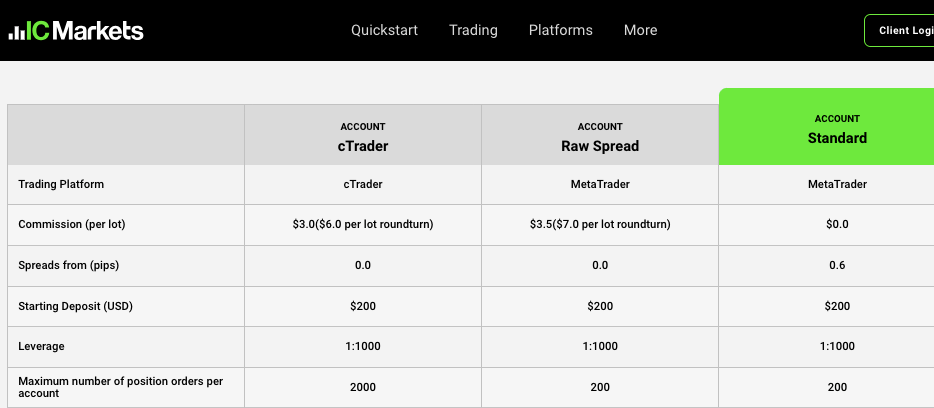

IC Markets offer two main types of trading accounts for clients: Raw Spread and Standard Accounts, along with a Raw Spread Account for cTrader only. Each type of account has varying fees and some trading conditions.

They also offer Islamic Accounts for Muslim traders that are swap-free and demo accounts to help beginners get familiar with the platform.

Below are details of the various account types currently available on IC Markets and their features:

1) Raw Spread Account (MetaTrader): The IC Markets Raw Spread Account (MetaTrader) is only available on the MetaTrader trading application and allows you to trade CFDs on Forex, indices, bonds, cryptocurrencies, commodities and stocks.

This account attracts a commission of up to $3.50 per side lot traded, which amounts to up to $7 for a round turn. Spreads on this account start from 0.0 pips, and swap fees are applied for keeping a position open overnight.

This account requires a minimum deposit of $200 with a minimum trade lot size of 0.01, a maximum number of position orders of 200 and maximum leverage of 1:1,000.

2) Raw Spread Account (cTrader): The IC Markets Raw Spread Account (cTrader) is only available on the cTrader platform and allows you to trade CFDs on Forex, indices, bonds, cryptocurrencies, commodities and stocks.

A commission of up to $3 per side lot traded is charged on this account, which amounts to up to $6 for a round turn. Spreads start from 0.0 pips, and swap fees are applied for keeping a position open overnight.

In order to trade on this account, you must have a minimum of $200 in your account with a minimum trade lot size of 0.01. The maximum number of open positions is 2,000 and the maximum leverage is also 1:1,000.

3) Standard Account: The IC Markets Standard Account is available exclusively on the MetaTrader platform and lets you trade CFDs on Forex, indices, bonds, cryptocurrencies, commodities and stocks.

This account is spread only and charges no commission for opening or closing trade positions. Spreads start from 0.8 pips and usually have a markup because you pay no commissions. You also pay swap fees for keeping a position open overnight on the Standard Account.

You must have at least $200 in your account, with a trade lot size of 0.01, to trade on this account. The maximum number of open positions is 200 and the leverage limit is 1:1,000.

4) Islamic Account: The Islamic Account at IC Markets is a swap-free account for Muslim traders who want to adhere to the Sharia law of no-riba.

This account is similar to the Raw Spread & Standard Accounts, with the same spreads, commission fees, leverage, and minimum deposit, except that it does not charge swap fees.

Note that you will pay a flat rate financing fee if you keep the trade position open for more than one night.

If you want an Islamic account, you will have to select the Islamic Account Option while creating your account.

IC Markets Base Account Currency

The 10 base account currencies supported on IC Markets are AUD – Australian Dollar, USD – United States Dollar, EUR – Euro, CAD – Canadian Dollar, GBP – British Pound Sterling, SGD – Singapore Dollars, NZD – New Zealand Dollars, JPY – Japanese Yen, CHF – Swiss Franc and HKD – Hong Kong Dollar.

You can select any of these during account registration, but cannot change it once the account is opened.

IC Markets Overall Fees

IC Markets fees vary based on currencies traded, account type, and trading instruments. Find an overview of IC Markets fees here:

Trading fees

1) Spreads: IC Markets charges spread fees whenever you trade instruments, which is the difference between the bid and ask prices. The lowest spreads start at 0.0 pips for Raw Spread Account and 0.8 pips for the Standard Account. Here are the average spreads on IC Markets for Raw Spread & Standard Accounts:

| Instrument/Pair | Raw Spread Account | Standard Account |

|---|---|---|

| EUR/USD | 0.02 pips | 0.80 pips |

| GBP/USD | 0.23 pips | 0.80 pips |

| EUR/GBP | 0.27 pips | 1.27 pips |

| Gold/USD | 0.0 pips | 1.083 pips |

2) Commission fees: IC Markets offers commission-free trading for Standard Accounts, and Raw Spreads accounts incur commission fees for opening and closing trade positions. The Raw Spreads (MetaTrader) round-turn commission fee is $7 and Raw Spread (cTrader) is $6.

3) Swap fees: If you keep a trade position open overnight, you will pay either a swap fee or gain swap interest, this is applicable to all account types on IC Markets except Islamic Accounts.

Typical swap fees for major pairs like EURUSD on MetaTrader are $-4.35 for long (buy) swap and $1.34 short (sell).

Islamic Accounts are swap-free and won’t pay any swap fees for holding a position overnight. However, if you hold the position open for more than one night, you will start to pay a flat financing fee based on the instruments you are trading.

Non-trading fees

1) Deposit and Withdrawal fees: IC Markets does not charge any fees for deposits and withdrawals on all payment methods for all account types.

Some international banking institutions may charge independent fees.

2) Account Inactivity charges: IC Markets does not charge inactive account fees, which means that you won’t be charged anything if you don’t log into your account or trade. Any funds in your account will be untouched.

| Fee | Amount |

|---|---|

| Inactivity fee | None |

| Deposit fee | None |

| Withdrawal fee | None |

How to Open IC Markets Account in Ghana

To start trading on IC Markets, follow these steps to open an account.

Step 1: Visit the IC Markets website homepage at www.icmarkets.com and click on ‘Start Trading’ tab on the top right corner of the home page.

Step 2: Fill out your name, email, and phone number on the form that appears and click the ‘NEXT’ button.

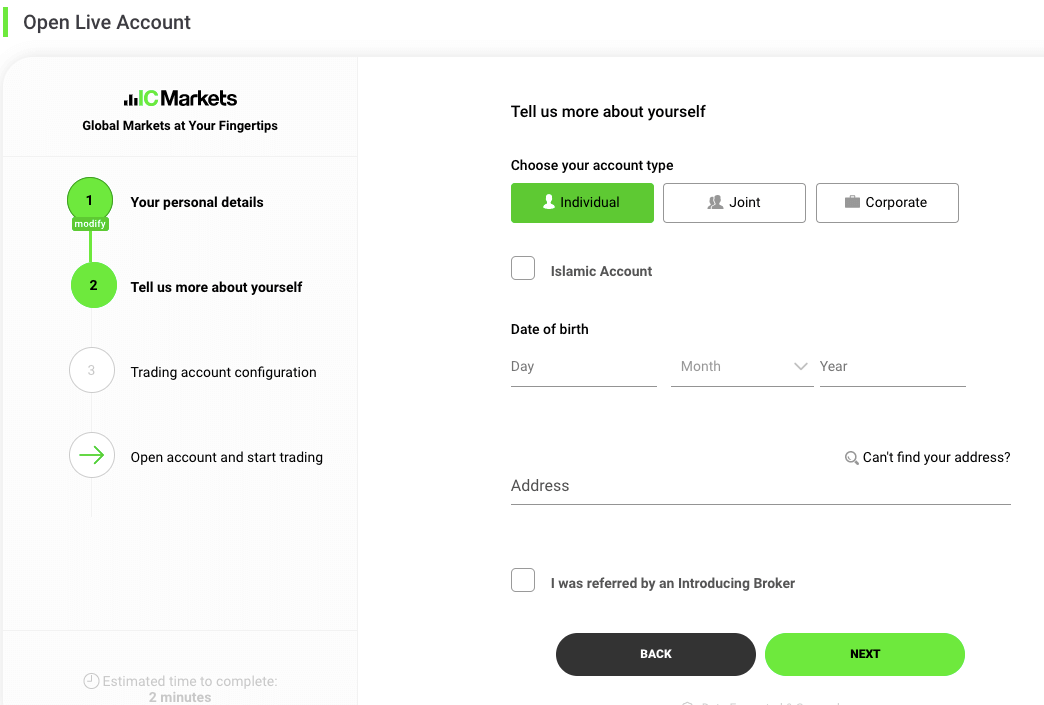

Step 3: Select whether you are opening an individual, joint or corporate account, check the box beside Islamic Account, if you are a Muslim, then provide your date of birth and fill in your address. Check the referral box if you were referred and click on ‘NEXT’.

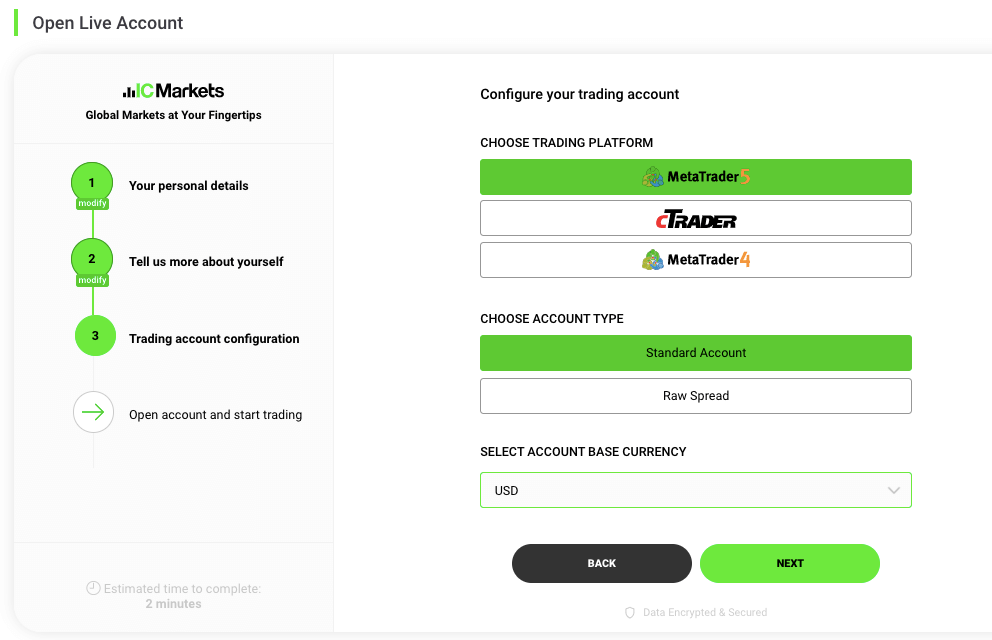

Step 4: Now, choose your preferred trading platform and the account type you want, and select a base account currency. Then click on ‘NEXT’ to proceed.

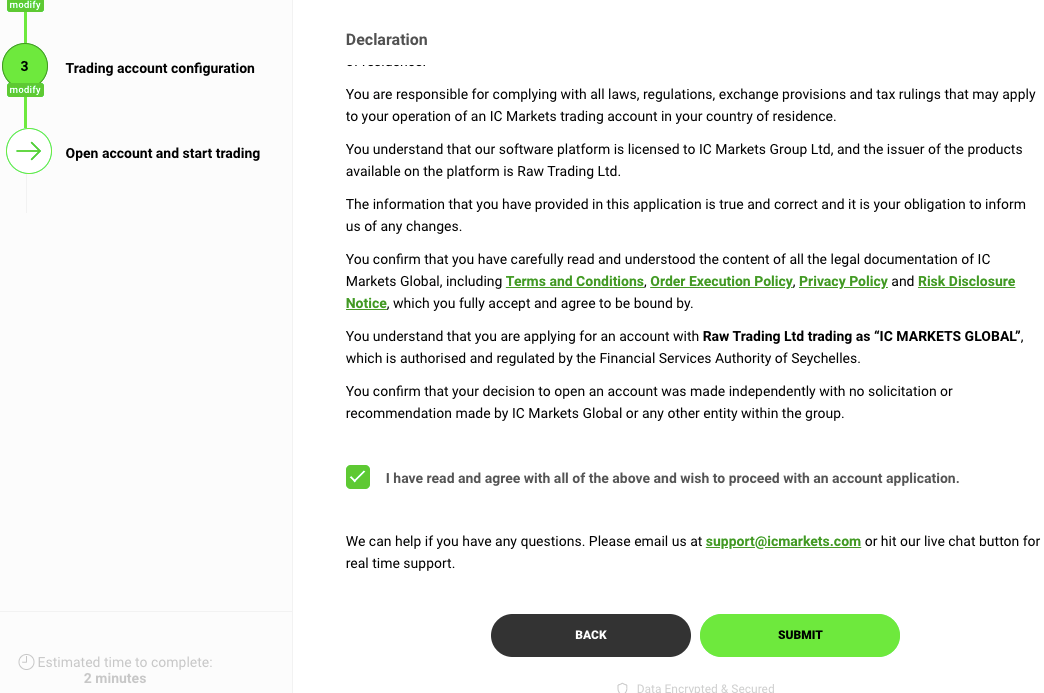

Step 5: You will be required to set a security question and the answer. After that, check the box to show you have read and agree with the terms and conditions, then click ‘SUBMIT’ to continue with the account registration.

Step 6: You will be redirected to the IC Markets Secure Client Area where you will be required to answer some questions to complete the registration and verify your account.

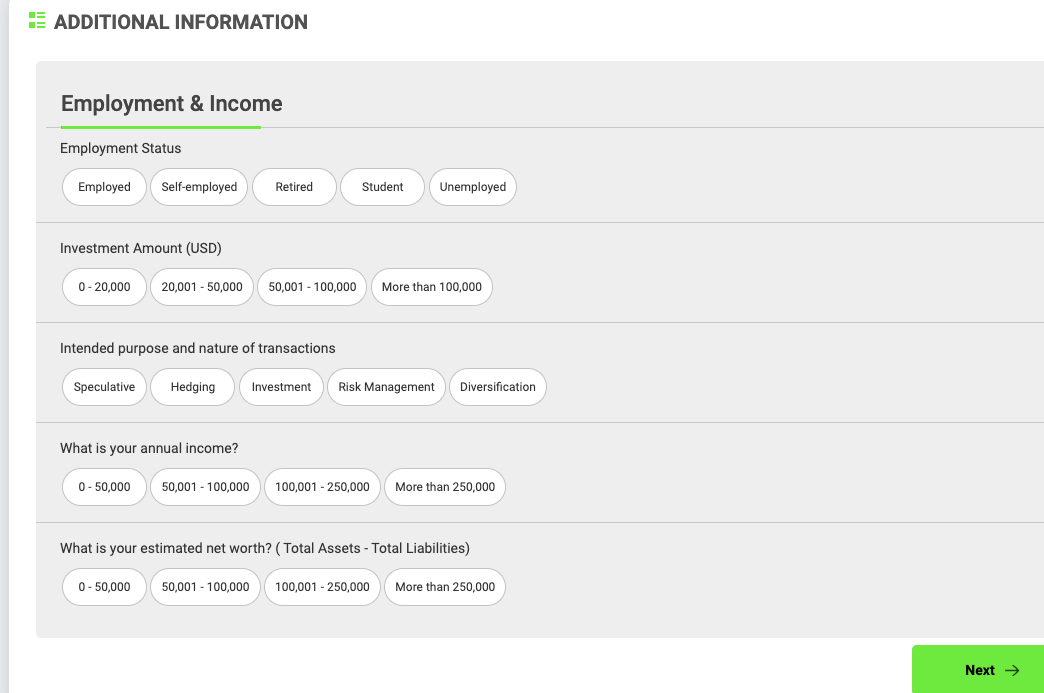

Answer the questions about your employment & income then click ‘NEXT’.

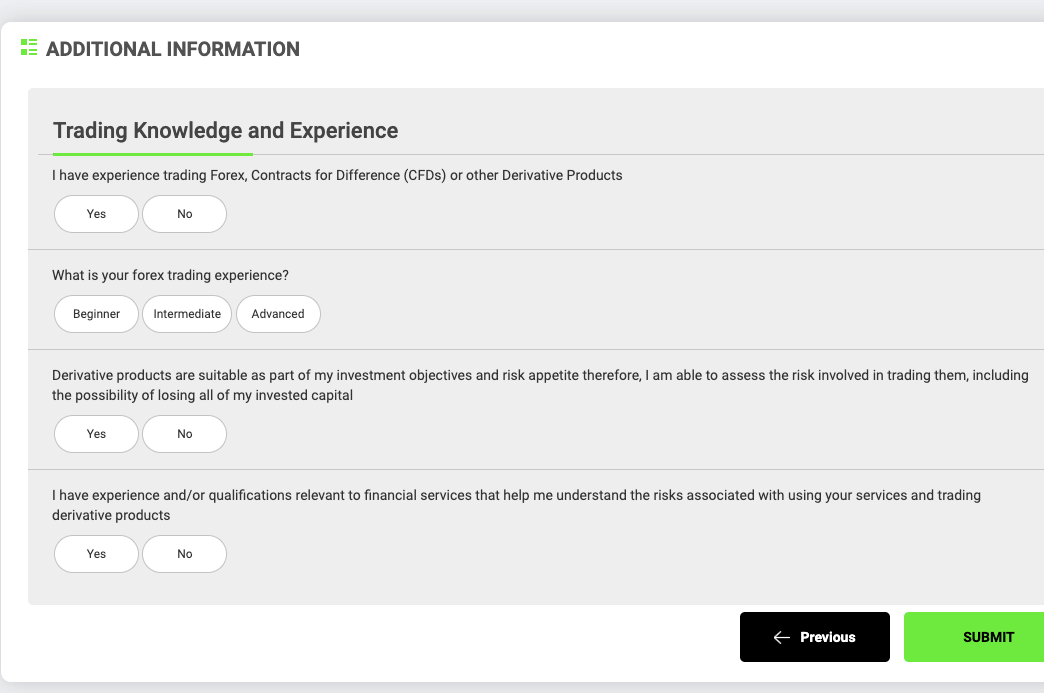

Answer the questions regarding your trading knowledge and experience then click ‘SUBMIT’.

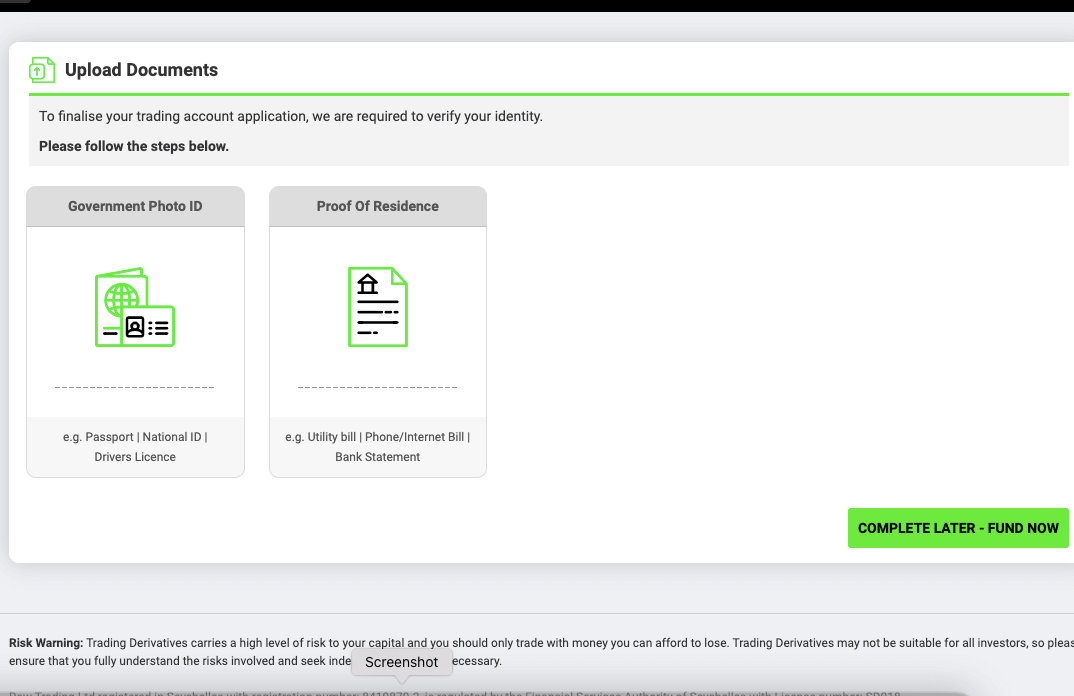

Step 7: You will be required to upload your identity and address documents to verify your account.

You can choose to do this later and fund your account instead.

IC Markets Deposits & Withdrawals

Payment methods accepted for deposits and withdrawals on IC Markets include cards, e-wallets (Skrill, Neteller, PayPal, & AstroPay), and bank wire transfers.

Learn about the minimum amount and the time it takes to process deposits and withdrawals from IC Markets below:

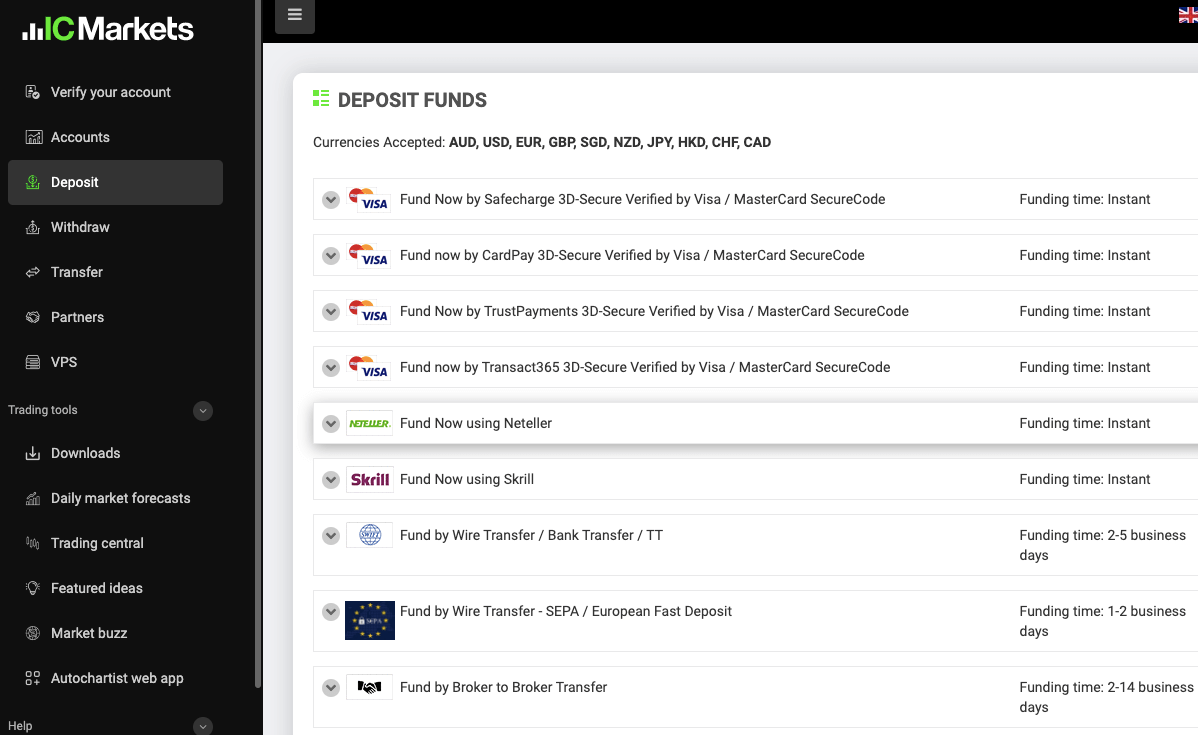

IC Markets Deposit Methods

Here is a summary of payment methods accepted by IC Markets for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Wire Transfer | Yes | Free | 2-5 business days |

| Cards | Yes | Free | Instant |

| E-wallet | Yes (PayPal, Skrill, Neteller, Bpay) | Free | Instant |

IC Markets Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on IC Markets.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Wire Transfer | Yes | Free | 3-5 business days |

| Cards | Yes | Free | 3-5 business days |

| E-wallets | Yes (PayPal, Skrill, Neteller) | Free | Instant |

What is IC Markets Minimum deposit?

The recommended minimum deposit on IC Markets Ghana is $200 (3,082GHS) for all payment methods. You may make a deposit of less than $200, but this may limit the types of trades you can execute and the volume you can trade.

What is the IC Markets Minimum withdrawal?

The minimum withdrawal on IC Markets is $1 (15GHS) for cards and e-wallets while bank transfers require a minimum withdrawal amount of $50 (770GHS).

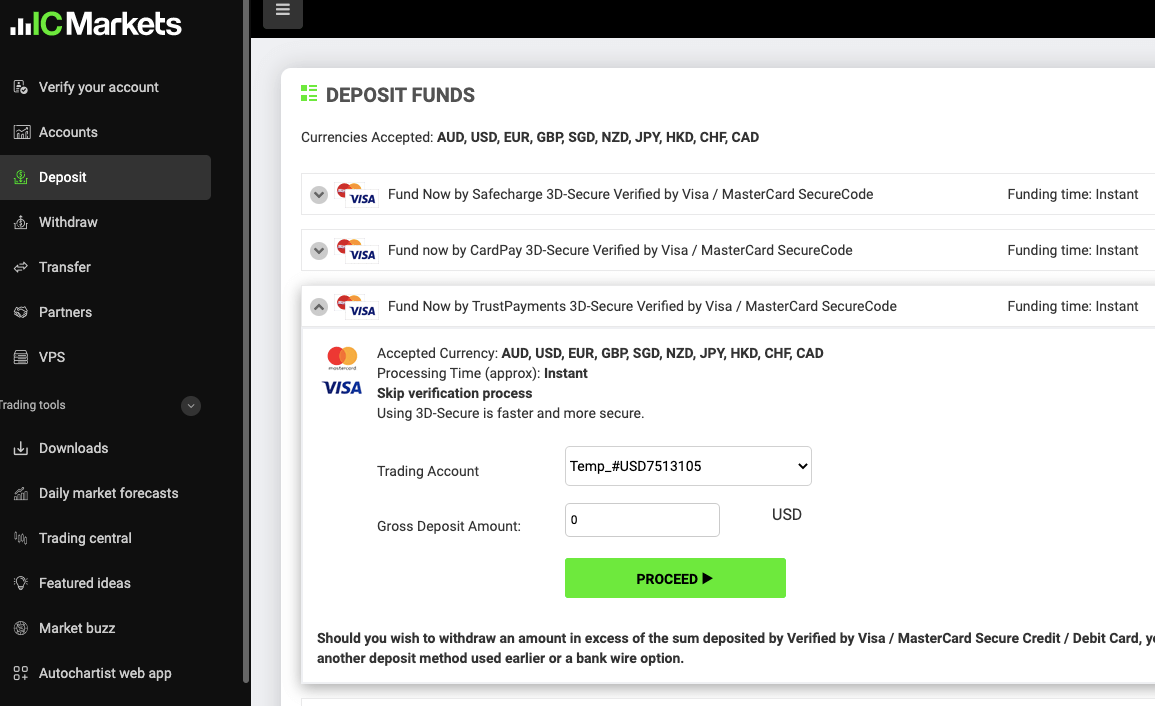

How do I deposit on IC Markets in Ghana?

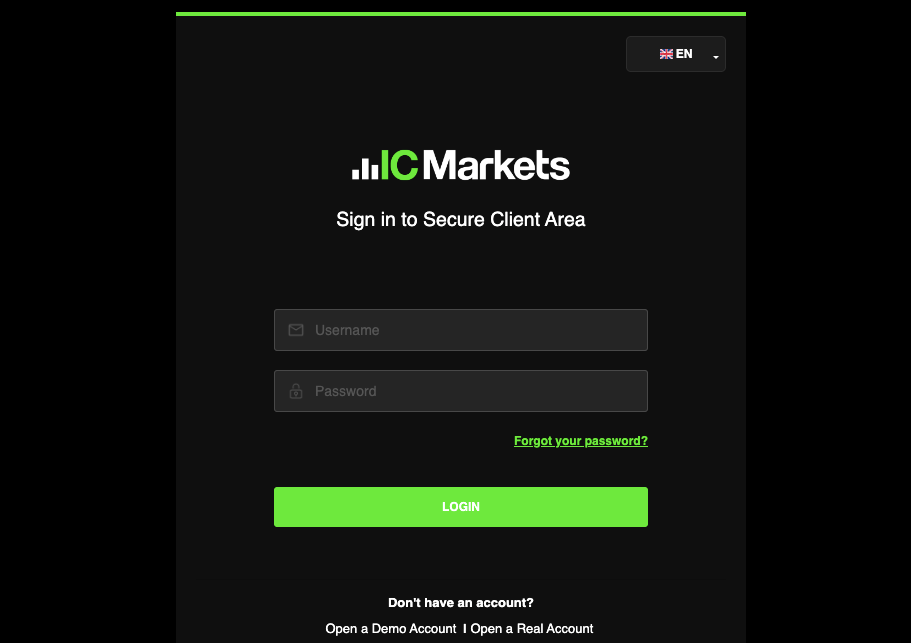

Step 1: Log in to your account Client Area through the IC Markets website or by visiting https://secure.icmarkets.com/, type in your email as username and enter the password that was sent to your email after registration then click ‘LOGIN’.

Step 2: Once you are logged in, click on Deposit on the left side menu and select a payment method you would like to use for your deposit.

Step 3: Enter the amount you want to deposit and provide other information required then click ‘PROCEED’ and follow the on-screen instructions to complete the deposit.

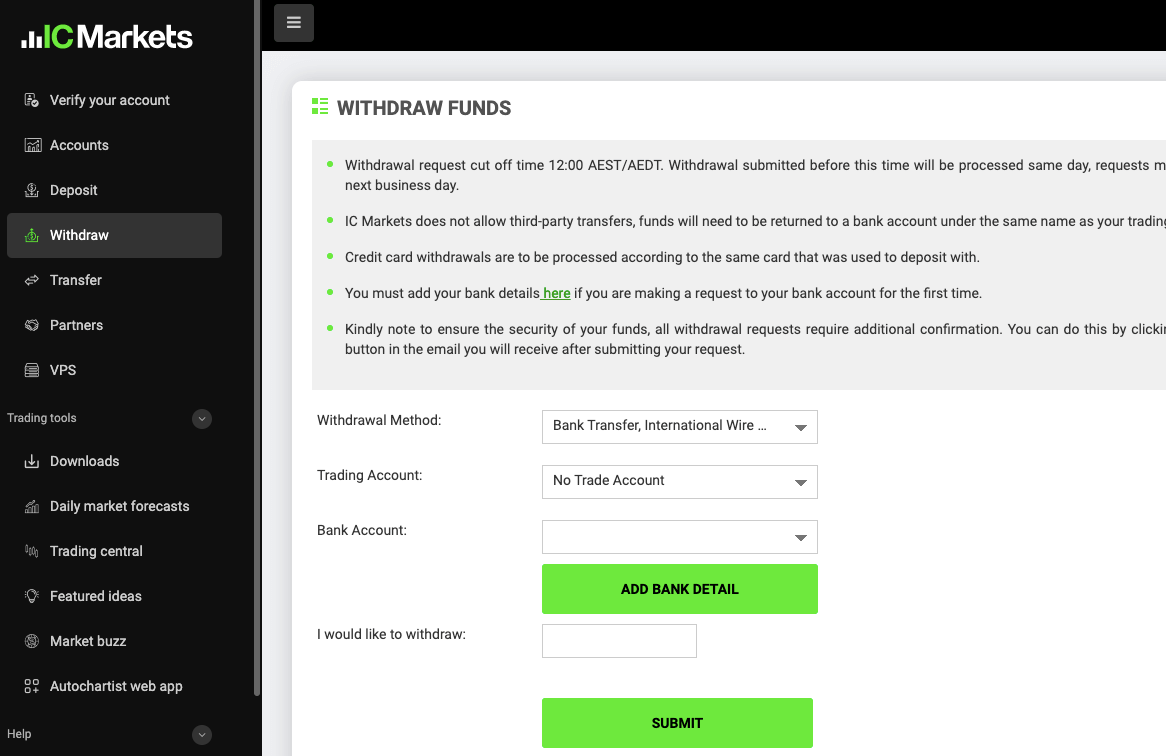

How to Withdraw Funds from IC Markets in Ghana?

You can follow these steps to withdraw your money from IC Markets Ghana.

Step 1: Log in to your IC Markets clients area (dashboard).

Step 2: Click on withdraw on the left side menu.

Step 3: Select a withdrawal method and the trading account you wish to withdraw from, enter the amount you want to withdraw, click on ‘SUBMIT’ and follow the on-screen instructions to complete your funds’ withdrawal on IC Markets.

IC Markets Trading Instruments

Below are financial instruments that can be traded on IC Markets

| Instrument | Availability | Number |

|---|---|---|

| Forex CFDs | Yes | 61 currency pairs on IC Markets (6 majors, 21 minors and 34 exotics) |

| Commodities CFDs | Yes | 24 spot commodities on IC Markets (Energy, Metals, Agriculture) |

| Indices CFDs | Yes | 25 spot indices on IC Markets (AUS200, UK100, DE40, and others |

| Bonds CFDs | Yes | 9 bonds on IC Markets (EURBOBL, EURBUND, UKGB, and others) |

| Stocks CFDs | Yes | 2,100+ stocks on IC Markets (ASX, Nasdaq & NYSE and others) |

| Cryptocurrencies CFDs | Yes | 21 cryptocurrencies on IC Markets (Bitcoin, Litecoin, Dogecoin and others) |

| Futures CFDs | Yes | 4 Futures on IC Markets |

IC Markets Trading Platforms

Trading platforms supported by IC Markets are:

1) MetaTrader 4 and MetaTrader 5: The MT4 & MT5 trading applications are supported by IC Markets for trading and can be accessed via the web, desktop and mobile devices (Android & iOS).

The MetaTrader is supported for The Raw Spread and Standard Account.

2) cTrader: IC Markets supports cTrader for trading using only the Raw SPread Account. The cTrader is available on the web, desktop (Windows & macOS) as well Google Play Store and App Store.

The cTrader copy trading app is also supported on IC Markets.

IC Markets Trading Tools

IC Insights: IC Insights is an investment research and analysis platform. You will data on it that will help your trading decision. It is focused majorly on stocks.

You can catch all the news at once and track trending stocks. You get to keep up with stocks that analysts are focusing on. In addition, you will also get investment insights from experts and pros. These insights are backed by thorough research.

Finally, IC Insights has a community called Crowd Wisdom. You can connect with fellow traders and identify opportunities together.

Trading Central: Trading Central has seven features. Economic calendar, Alpha generation, Newsletter, Featured ideas, TC videos, Technical view, and Market buzz.

Market buzz is the most exciting of these tools. Instead of having information overload, market buzz creates data visualisations that improve your trading decisions.

With Alpha Generation, you get three innovative indicators. These indicators capture market psychology. The indicators are integrated with MT4/MT5. They help you identify trading opportunities with potential entry and exit points.

Does IC Markets have a mobile app?

No, IC Markets does not have a proprietary mobile trading app. However, there is IC Social for copy trading. IC Social is powered by Pelican Trading and it is available on the Play Store and App Store.

IC Markets Education and Research

IC Markets have different education channels. We look at them in detail below:

1. Demo Account: IC Markets, like many forex brokers, have a demo account. It is free to open with zero risk. You will get an account with virtual funds that support all IC Markets account types, products, and platforms.

You can use the account to backtest your strategy, and get acquainted with the trading platforms, and the trading fees. In addition, IC Markets’ demo account does not expire so it is easy tracking your progress.

2. Video Tutorials: IC Markets’ video tutorials are largely about trading platforms. We found 17 videos that cover all about how to use and log in on the trading platforms, how to place an order, upload a credit card, and much more.

3. IC Markets’ Blog: There are a lot of educational articles on the broker’s blog. The blog is well structured with a good user interface. At a glance, you can see the technical analysis section and fundamental analysis section.

Also, there is an ‘education section’ with topics like trading psychology, risk management, and how to develop a trading plan.

4. Podcast: This is good for you if you are interested in understanding macroeconomics. The podcast is hosted by Pamela Ambler, Head of Investor Intelligence & Strategy, Asia Pacific at JLL. Different guests are invited to talk about economic movements in different companies and how it might affect the forex market. Old episodes are also available if you want to watch them again.

IC Social

IC Social is a trading app created by IC Markets that lets you copy the trades of other traders. So, if you’re new to trading or want to learn from the experts, you can follow the trades of experienced traders and potentially make a profit.

To start copying trades, you need to have a live account with IC Markets and sign up with your registered email address. However, keep in mind that this feature is only available for the IC Markets MT4 account.

If you find a trader whose performance you like, you may have to pay a fee to copy their trades. But the fees will vary depending on the trader you’re copying.

You can find more information about copy trading on IC Markets on their website.

IC Markets Execution Policy

IC Markets is not a market maker. They are the issuers of CFDs they offer and do not have a proprietary trading book. This means they do not determine the bid-ask prices of trading instruments. Since we have established this, the question is – what type of broker is IC Markets?

IC Market is an ECN broker. Their pricing model is ECN as well. This is made clearer with their Raw Spread Account. The average spreads on the account are raw and low. The prices they stream to traders are from IC Market’s liquidity providers with no price manipulations or requotes.

Furthermore, their execution model ensures fast execution speed. IC Markets achieve this by not hedging each of your positions with their hedge counterparties. In simple words, they do not open the opposite side of your trades with counterparties. Consequently, your trades are executed quickly.

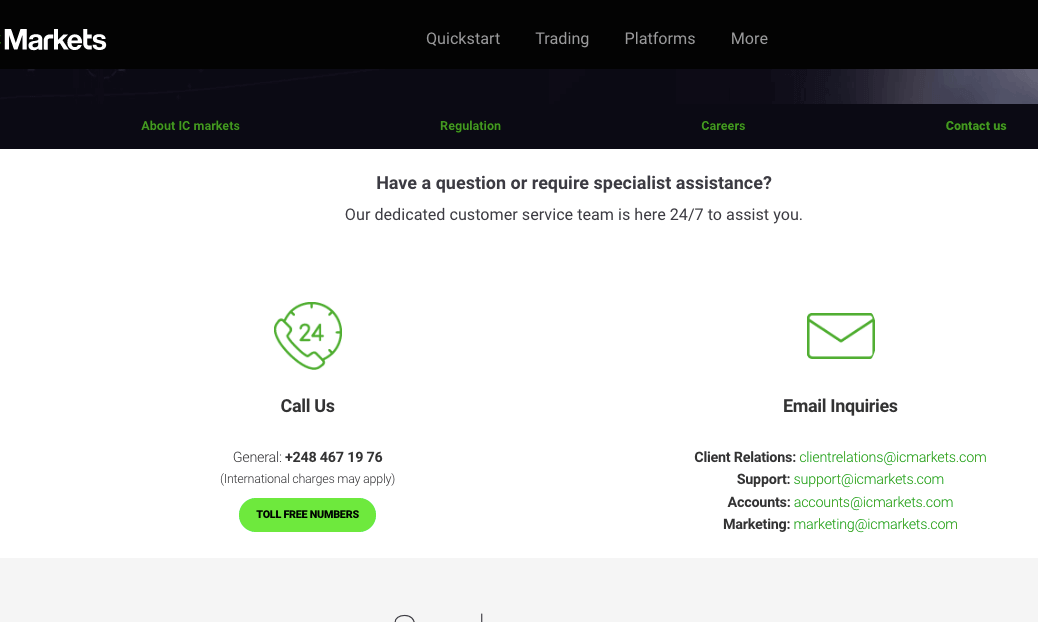

IC Markets Ghana Customer Service

IC Markets offers 24 hours a day, 7 days a week online customer support to clients via the following channels.

1) Live chat support: The IC Markets live chat is available 24/7 for client enquiries and can be accessed on their website. When you start the live chat, the IC Markets chatbot will respond first and show you quick option answers to some questions.

You can switch to a live agent by typing ‘chat with an agent’ in the chat, and the bot will show you options that will connect you to a live support agent.

When our team tested, the wait time for a live agent to connect was under 2 minutes and the answers provided were relevant. Although the live agent seemed to have delays of up to 3 minutes before answering some questions.

You will need to provide your email and name to start the chat.

2) Email support: IC Markets offers email support for clients, you can find the email on the contact us page of their website. You can fill in an enquiry to quickly send them a message or type a message in your email app and send it to the IC Markets email address at [email protected].

When our team tested their email support, we got a response in 10 minutes and the answer to our questions were correctly answered. The email support is available from 10:00 PM on Sundays to 10:00 PM on Fridays (GMT).

3) Physical Office: IC Markets has no physical office in Ghana, the headquarters of IC Markets is Level 4 50 Carrington Street, Sydney NSW, 2000 Australia.

4) Phone support: IC Markets offers international phone support for clients that is also available from 10:00 PM on Sundays to 10:00 PM on Fridays (GMT). The phone number is +248-467-1976.

Do we Recommend IC Markets Ghana?

IC Markets is licensed by ASIC which is a tier-1 financial regulator as well as CySEC a tier-2 financial regulator, and FSA which is a tier-3 financial regulator. This means broker is obligated to protect deposited clients’ funds based on the regulation and can be sanctioned in the event of a default. However, because they are not regulated in Ghana, Ghanaian traders may not be protected by the offshore regulations.

IC Markets have moderate spreads and swap fees, offers commission-free trading on some account and charges zero dormant account fees. They also process deposits relatively faster than some brokers.

The customer support of IC Markets is good, they have 24/7 live chat and responsive email and phone support for 6 days (Sundays to Mondays).

The website of IC Markets is easy to navigate and has details about the account types, fees, trading conditions and other information that clients might have. The FAQ section of their website is highly informative.

We recommend that you visit their website to see if their conditions match your needs, you can also chat with their support to answer any questions you have. Remember that trading CFDs involves risk and only experienced traders should engage in it.

IC Markets Ghana FAQs

Can I use IC Markets from Ghana?

Yes, IC Markets accepts traders from Ghana. If you are a resident of Ghana, you can open a trading account on IC Markets. You can use IC Markets in Ghana.

How long does it take to withdraw money from IC market?

It takes 3-5 days for card withdrawals, and sometimes up to 10 business days, e-wallets are processed instantly, and bank wire transfers take up to 3-5 business days to receive funds.

Is IC Markets Regulated in Ghana?

IC Markets is not regulated in Ghana. Traders from Ghana are registered under IC Markets regulation in Seychelles. Note that trading with the broker is at your own risk and you are not protected by the Ghanaian law and the laws of Seychelles may not cover you.

What is the minimum deposit for IC Markets?

$200 (3,082GHS) is the minimum deposit on IC Markets Ghana for all accounts. This is the recommended amount and you can deposit a smaller amount, but this may limit the types of trades you can execute and the volume you can trade.

Note: Your capital is at risk