FBS is an online Forex and CFDs broker offering trading services for financial markets such as foreign exchange (forex) currency pairs, indices, cryptocurrencies, metals, stocks and commodities.

FBS was founded in 2009. The broker is regulated in South Africa, Australia, Cyprus and Belize.

This review of FBS will examine the fees, trading instruments, account opening process, customer support, deposit/withdrawal options and trading platforms offered by the broker.

| FBS Review Summary | |

|---|---|

| 🏢 Broker Name | Mitsui Markets Ltd. |

| 📅 Establishment Date | 2009 |

| 🌐 Website | www.fbs.com |

| 🏢 Address | 9725, Fabers Road Extension, Unit 1, Belize City, Belize |

| 🏦 Minimum Deposit | $5 |

| ⚙️ Maximum Leverage | 1:3000 |

| 📋 Regulation | FSC Belize, VFSC, FSCA, ASIC, CySEC |

| 💻 Trading Platforms | MT4, MT5 and FBS Trader available on PC, Mac, Web, Android, & iOS |

| Visit FBS | |

FBS Pros

- Regulated in multiple jurisdictions

- Offers commission-free trading

- Has 24/7 live chat support

- Does not charge dormant account fees

- Supports mobile money deposits/withdrawals in GHS

- Has negative balance protection for all accounts

FBS Cons

- Few tradable instruments available

- Has high leverage

- Not regulated in Ghana

- Charges withdrawal fees on all payment methods

Is FBS good broker?

FBS is the trading name of the FBS brand which is licensed in various countries by Top-Tier financial regulators under different names. The multiple regulations of FBS make them a legit broker for traders in Ghana.

Here are the various jurisdictions in which FBS is authorised:

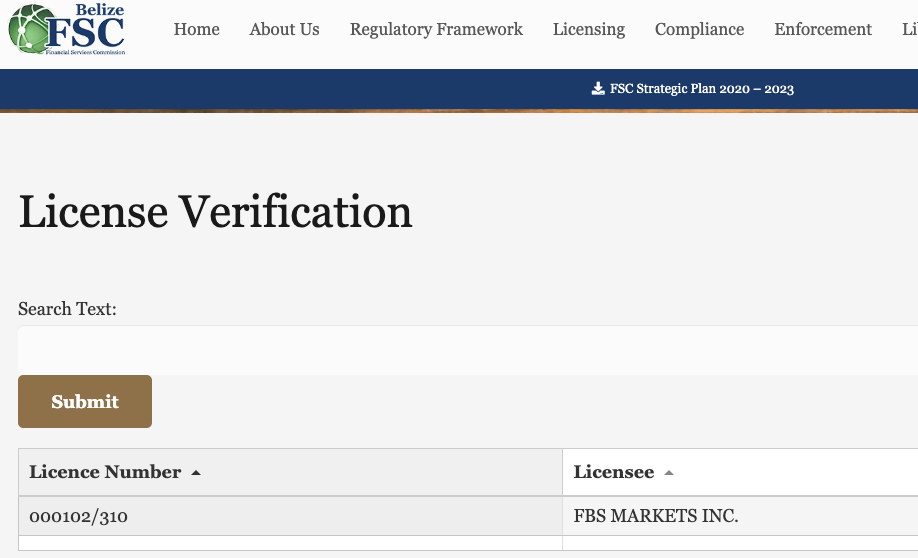

1) Financial Services Commission (FSC), Belize: FBS is also licensed in Belize as ‘FBS Markets Inc.’ with license number 000102/310. Traders in Ghana are registered under this regulation.

Note that it is best to avoid forex trading as it is not regulated in Ghanaian. This is because with offshore regulation, the consumer protection of the foreign countries may not cover traders from Ghana.

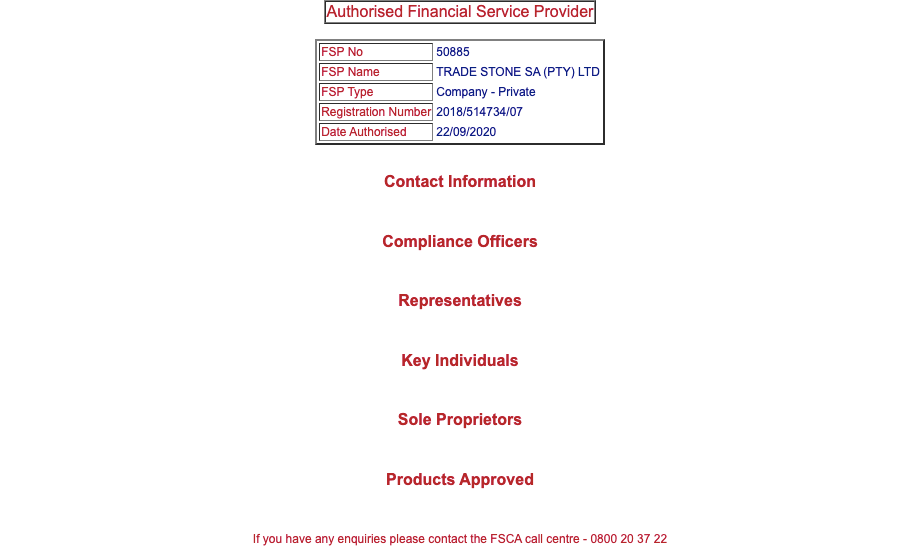

2) Financial Sector Conduct Authority (FSCA), South Africa: FBS is regulated in South Africa by FSCA as ‘Trade Stone SA (Pty) Ltd’ and authorized to provide financial services, with FSP (Financial Services Provider) number 50885, issued in 2020.

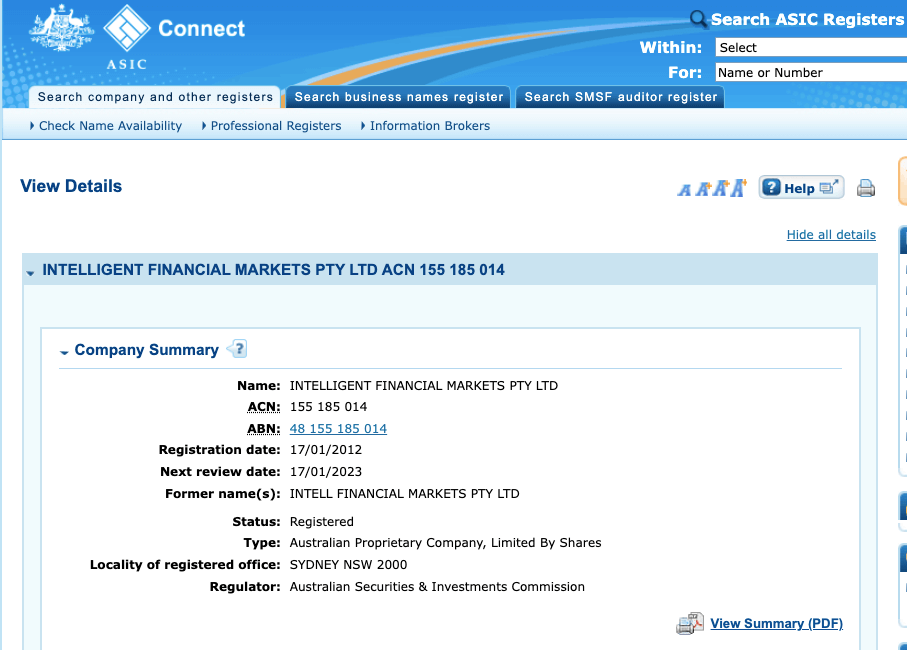

3) Australian Securities & Investments Commission (ASIC): FBS is regulated in Australia by ASIC as ‘Intelligent Financial Markets Pty Ltd’, and licensed to offer financial services, with ACN (Australia Company Number) 155 185 014, issued in 2012. The broker uses ‘FBS Oceania’ as a trading name in Australia.

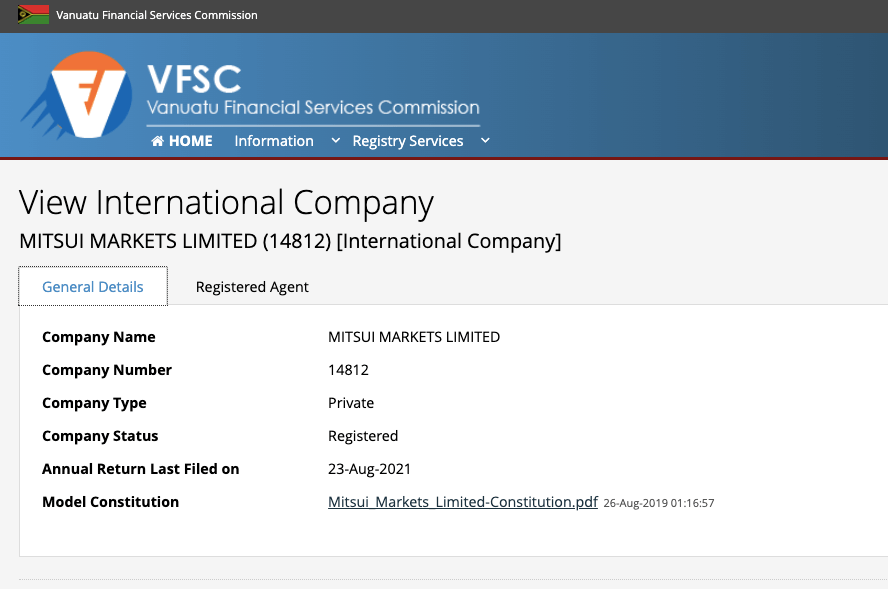

4) Vanuatu Financial Services Commission (VFSC): FBS is regulated in the Republic of Vanuatu by the VFSC as an international business under the name ‘Mitsui Markets Limited’, with registration number 14812, issued in 2016.

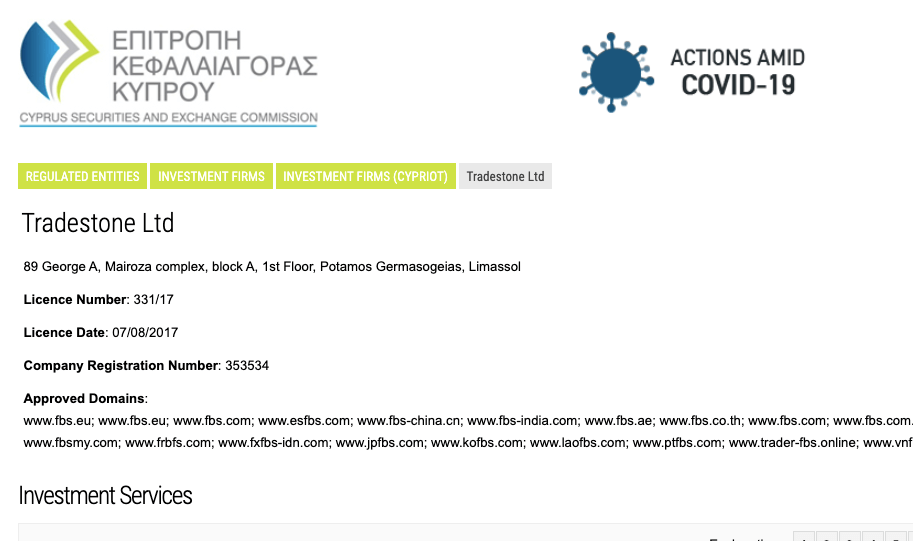

5) Cyprus Securities and Exchange Commission (CySEC): FBS is regulated in Europe by CySEC and licensed to offer investment services under the name ‘Tradestone Ltd’, with license number 331/17, issued in 2017. FBS serves clients in the EU area through this license.

FBS Investor Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| Australia | $20,000 | Australian Securities & Investments Commission (ASIC) | Intelligent Financial Markets Pty Ltd |

| Cyprus (European Union Area) | €20,000 | Cyprus Securities and Exchange Commission (CySEC) | Tradestone Ltd |

| South Africa | No compensation | Financial Sector Conduct Authority (FSCA), South Africa | Trade Stone SA (Pty) Ltd |

| Ghana | No protection | Financial Services Commission (FSC), Belize | FBS Markets Inc. |

FBS Leverage

The leverage on FBS depends on the account equity balance and the instrument you are trading. The maximum leverage on FBS is 1:3000, which applies to forex pairs when your account equity is under $200.

Accounts with equity of $200-1,999 have a maximum leverage of 1:2,000, those with account equity of $2,000-4,999 have leverage of 1:1,000, if your account equity is $5,000-29,999, max leverage is 1:500. Equity of $30,000-149,999 have max leverage of 1:200. If your account equity is over $150,000 your leverage is capped at 1:100 and can be as little as 1:1. All of these apply to forex pairs.

The maximum leverage for indices and metals is 1:500, energies is 1:200, while stocks is 1:100.

With a leverage of 1:1000, you can open a trade position worth 1,000 times your deposit. For example, if you deposit $100 you can place a trade worth $100,000.

Note; do not use all the available leverage in your trade as it will increase your risk and you can lose all your money. Leveraged products trading involves risk and you should not trade them unless you understand them and have experience.

FBS Account Types

FBS offers one account type, the Standard Account, which combines the features of the previous 3 account types. You can request an Islamic Account or open a demo account on FBS to practice trading with virtual money before putting your real money.

Here is an overview of the trading account conditions on FBS.

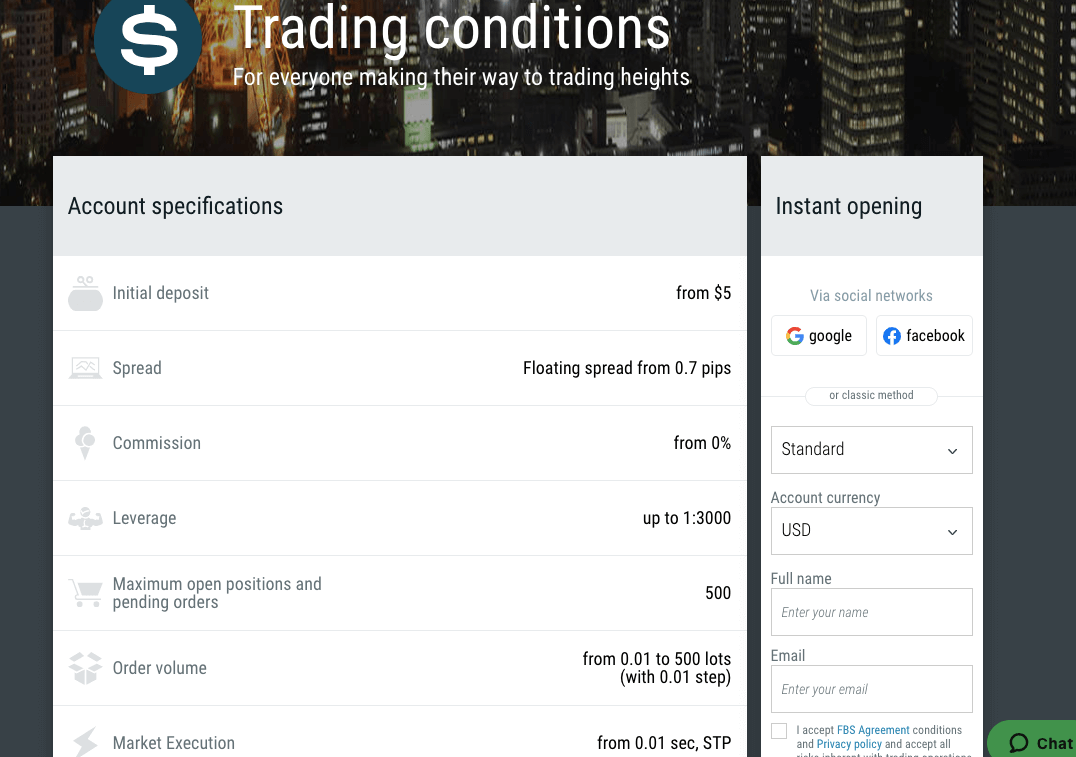

1) Standard Account: The FBS Standard Account is designed for more experienced traders who trade large lots of instruments and is accessible on the MT4 and MT5 trading platforms.

This is the default account you get when you first sign up on FBS, it allows you to trade, forex pairs, forex exotics, indices, metals, energies and stocks. and you can also open a demo version of this account type for practice.

This account has floating spreads starting from 0.7 pips, you do not pay commission charges for opening and closing trade positions, but pay swap fees if you keep a trade position open past the market’s closing time.

This account requires a minimum deposit of $5, with a minimum trade size of 0.01 lots and maximum open positions of 500, with maximum leverage of 1:3000 for major forex. This account also has negative balance protection.

This account has negative balance protection, which means that if a trade position is unsuccessful and you make a loss, any negative balance on your account will be reset to zero and you don’t have to deposit additional funds to clear it.

2) Islamic Account: FBS offers Swap-free Islamic Accounts to traders in Ghana. The account is designed for Muslim traders who want to abide by the sharia law of no-riba.

You can convert your account to an Islamic status. To activate swap free for your account you should check the box upon creating your account or send a request to support with:

1) The copy of your identity document you used for verification of your account.

2) The account number you want to activate Swap Free option for.

You can send a request to [email protected] to activate the swap free status.

Be kindly informed that Swap-free is not available for Crypto trading.

The swap-free account on FBS does not charge any swap fees or interest for keeping a trade position open past the market’s closing time.

If you keep a position open for more than 2 days, the broker may charge a fixed fee for the number of days the trade position remained open.

The Swap Free option is available for all trading instruments; however, when trading Forex Exotic, you will be charged a commission once a week instead of the swap.

FBS Base Account Currency

FBS offers 2 account base currencies for you to choose from when creating an account on the platform. They are Euros – EUR and United States Dollars – USD. Although you can deposit GHS and it will be converted to the base currency of your account.

All your deposits, trades, profits, losses, and withdrawals are measured in your chosen account currency.

FBS Overall Fees

Fees on FBS Ghana depend on the account type you have, and the instrument you are trading. Find a summary of the trading and non-trading fees on FBS below:

Trading fees

1) Spread: Whenever you trade an instrument on FBS, the broker adds a markup to the market (ask) price of the instrument. This markup is called spread, it is the difference between the ask (sell) price and bid (buy) price of financial instruments and is measured in pips.

The spreads you pay on FBS depend on your account type, the instrument you are trading, and the size of your trade. Find the typical spread you will pay for major instrument pairs on FBS Ghana per standard lot (trade size of 100,000 units) below:

2) Commission fees: FBS does not charge commission fees on trades. FBS offers commission-free trading on all accounts.

FBS Trading fees Table

Here is a summary of the typical fees (minimum spread and commission) FBS charges on some instruments:

| CFD instrument | Spread | Commission |

|---|---|---|

| EUR/USD | 0.9 pips | None |

| GBP/USD | 1.0 pips | None |

| EUR/GBP | 1.6 pips | None |

| (XAUUSD) Gold | 0.23 pips | None |

| Oil(Brent) | 0.03 pips | None |

| UK100 | 1.8 pips | None |

| US30 | 3.0 pips | None |

3) Swap fees: The closing time of the market on FBS is 11:59 PM trading platform time, if you keep a trade position open past the closing time, the trade will roll over to the next day and you will incur overnight funding costs also called rollover fees or swap fees.

The swap fees will depend on the instrument you are trading, the size of the trade, the spread, leverage, and whether your trade position is a long swap (buy) or short swap (sell). Islamic Accounts do not pay swap fees, because they are swap-free.

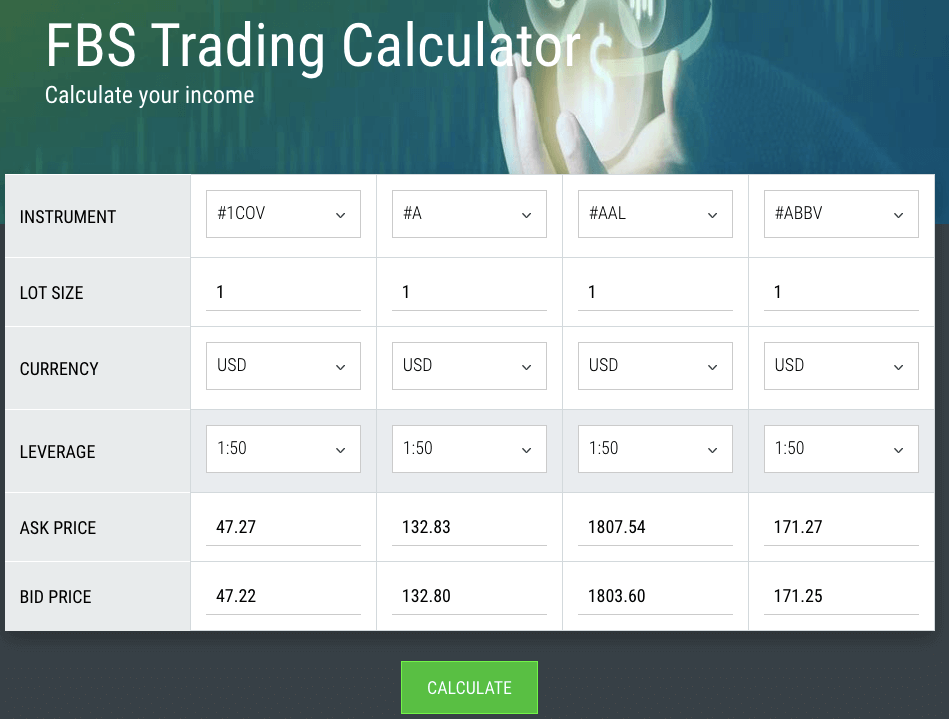

You can use the Trader’s Calculator on the FBS website to calculate the likely swap fees you will pay on a trade.

1) Deposit and Withdrawal fees: FBS offers free deposit on all payment methods when you deposit above the minimum deposit, except for STICPAY which attracts a deposit fee of 2.5% plus US$0.3.

Withdrawal fees of $1 per transaction for cards, 2% for Neteller capped at $30, 2.5% plus US$0.3 for STICPAY, 1% plus $0.32 for Skrill, and 0.5% for PerfectMoney, while bank transfer withdrawal charges can be seen when you are about to withdraw on the portal, based on the amount.

2) Account Inactivity charges: FBS does not charge inactive account fees. If you do not log in to your account or do not perform any trade, no fees will be incurred, and any funds in your account will not be touched.

FBS Non-Trading fees Table

| Fee | Amount |

|---|---|

| Inactivity fee | None |

| Deposit fee | 3.5% for mobile money |

| Withdrawal fee | 2.5% per transaction for mobile money, €2 for cards |

*Note that your payment processing company may charge some independent transaction fee.

How to Open FBS Account in Ghana?

Follow these steps to open a trading account on FBS.

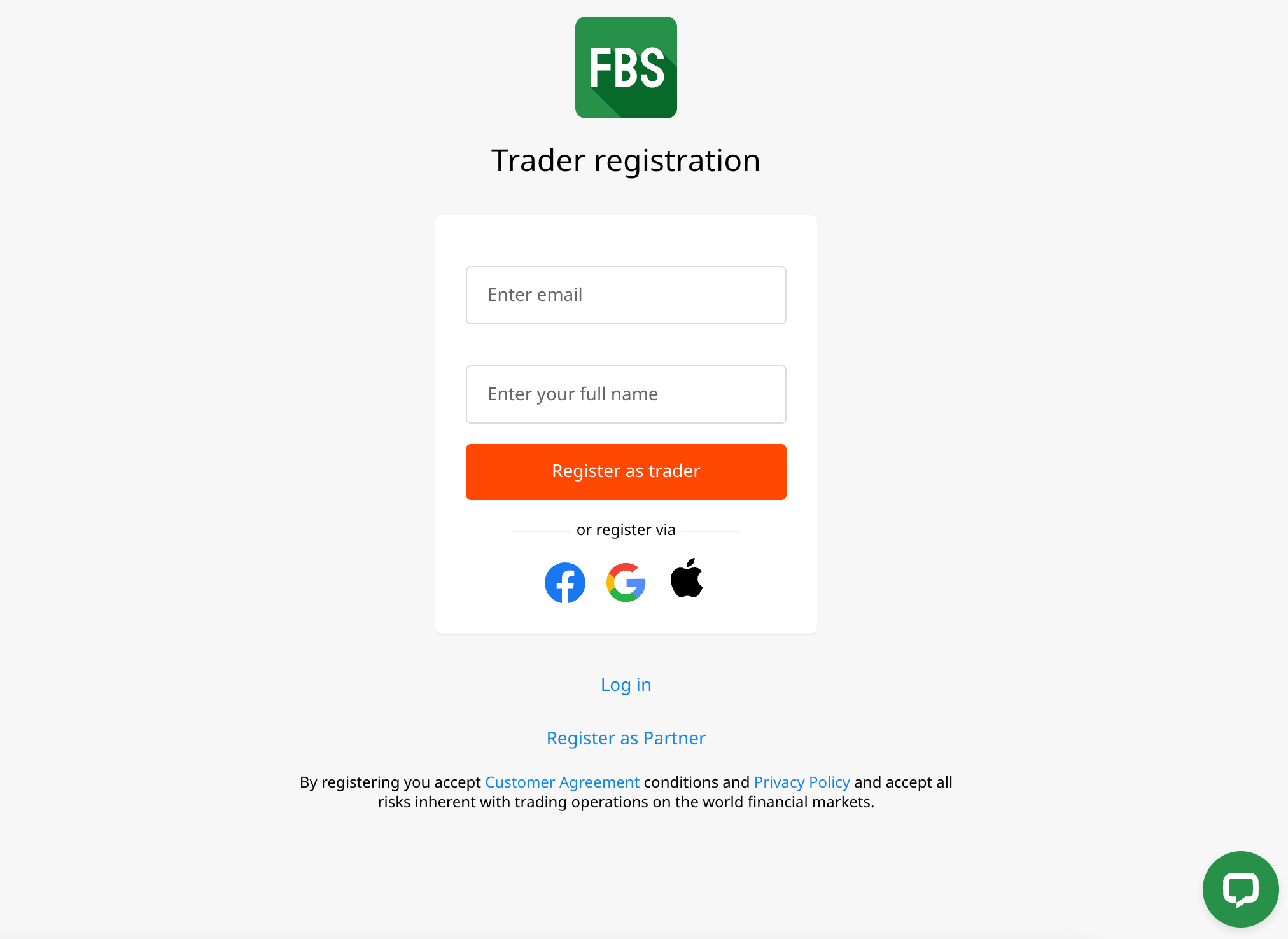

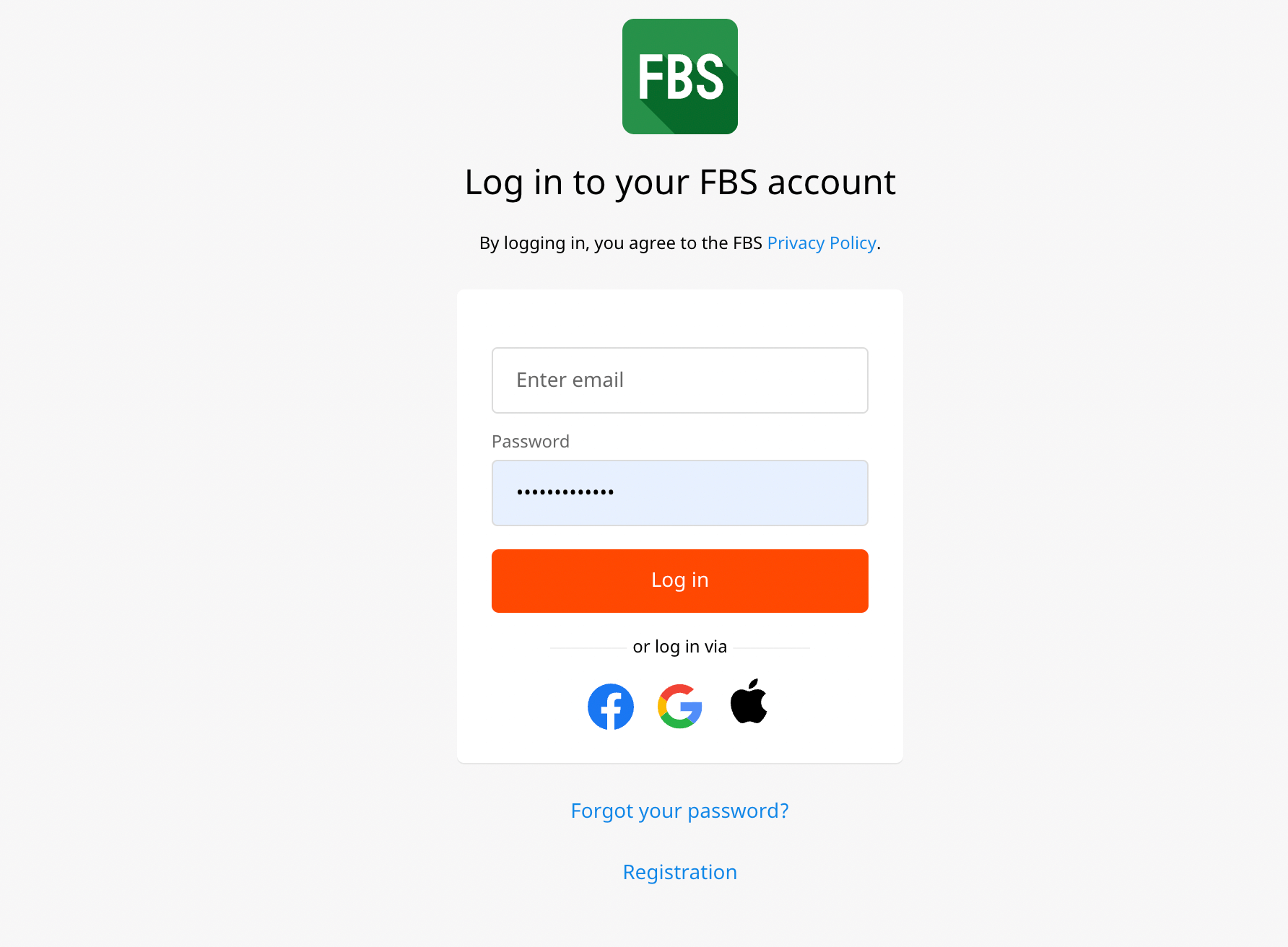

Step 1) Go to the FBS website at www.fbs.com and click on the ‘OPEN ACCOUNT’ button.

Step 2) Enter your full name and email on the form that appears, then click ‘Register as Trader’.

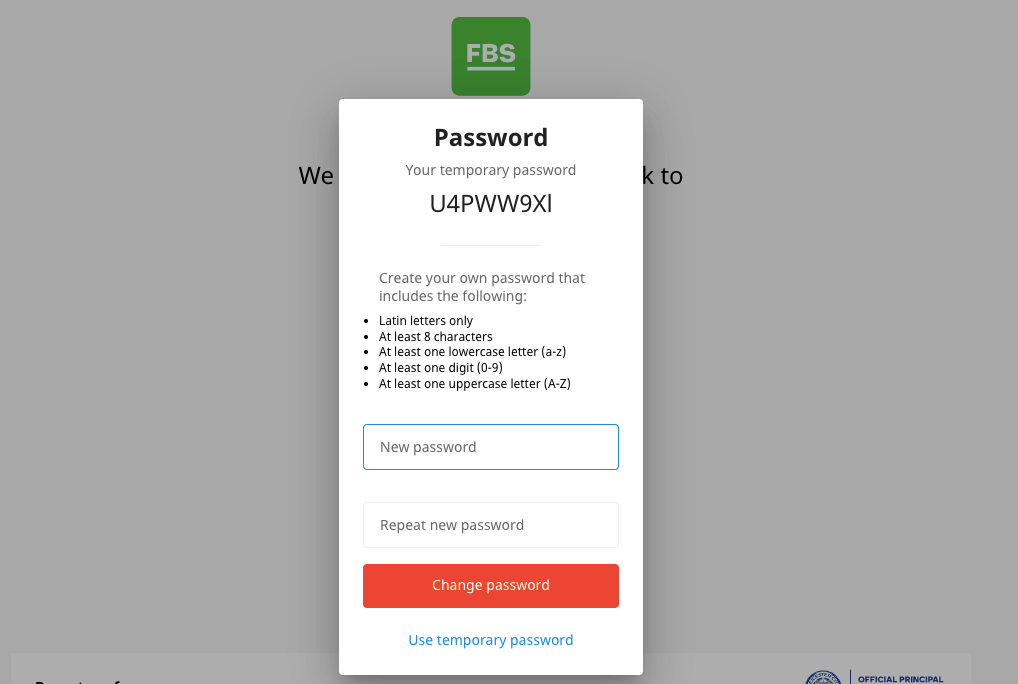

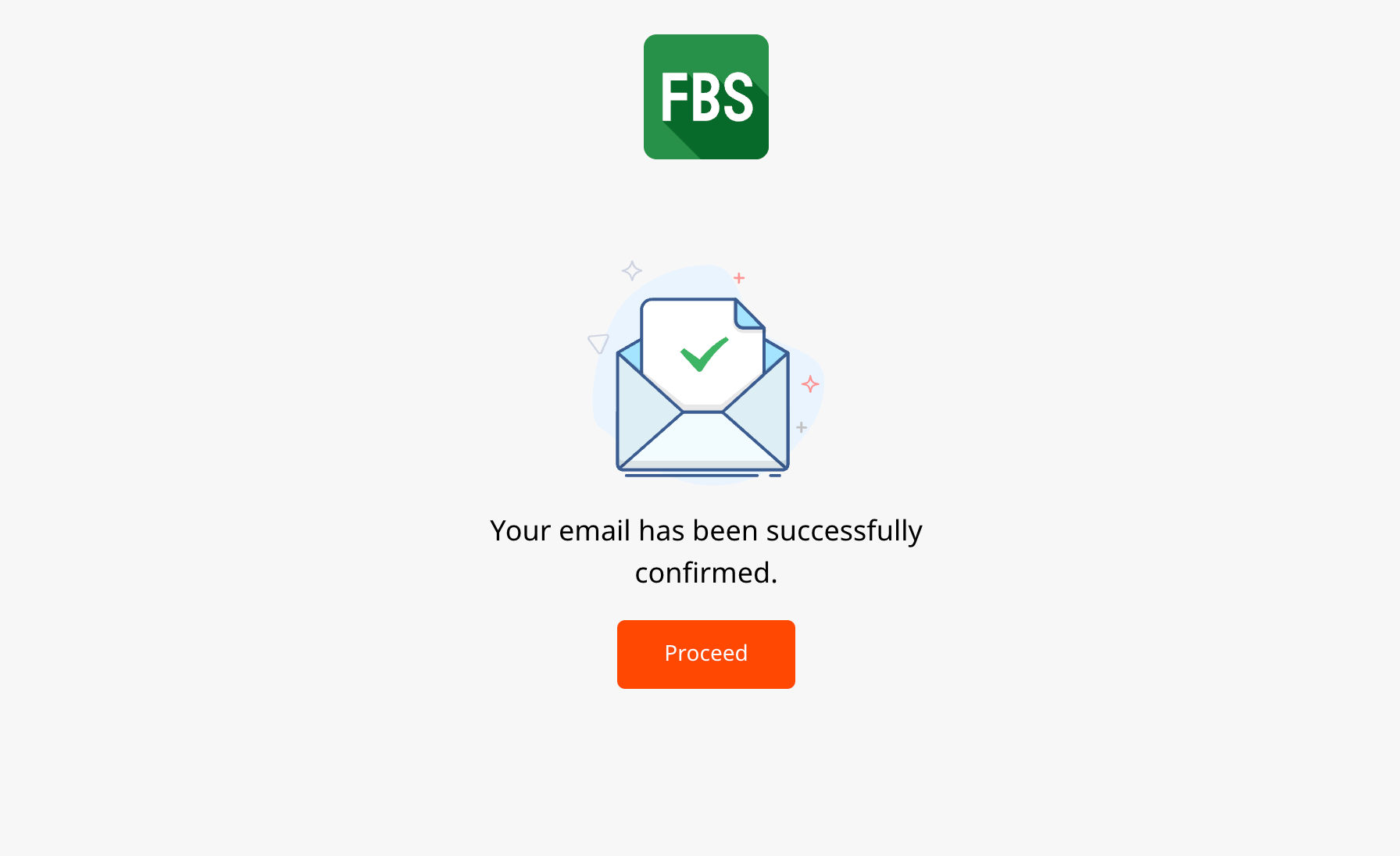

Step 3) Create a password for your account and click ‘Change password’, then go to your email inbox and click the verification link sent.

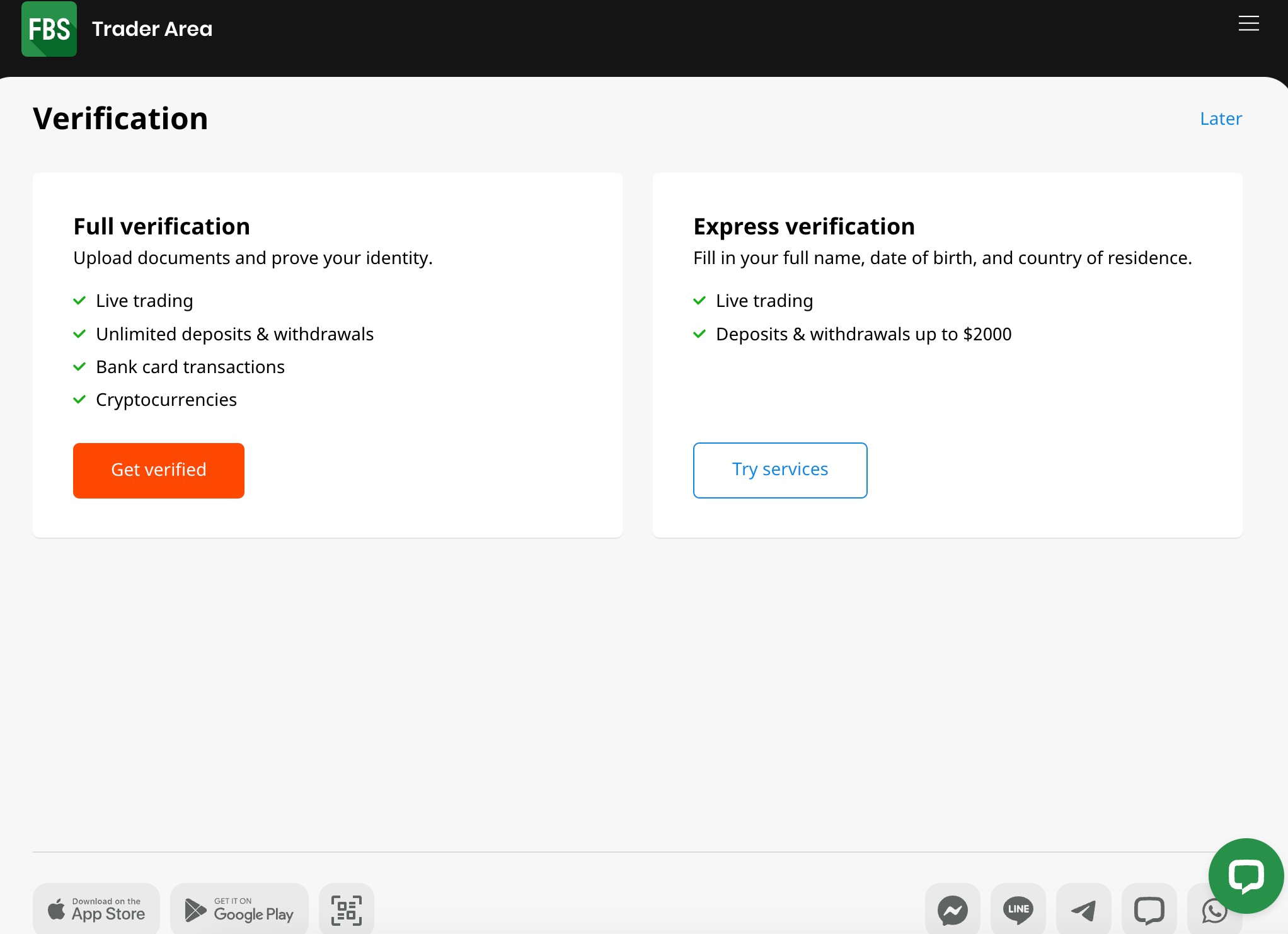

Step 4) After confirming your email, click ‘Proceed’ on the page that appears, click on ‘Try Services’ to continue registration.

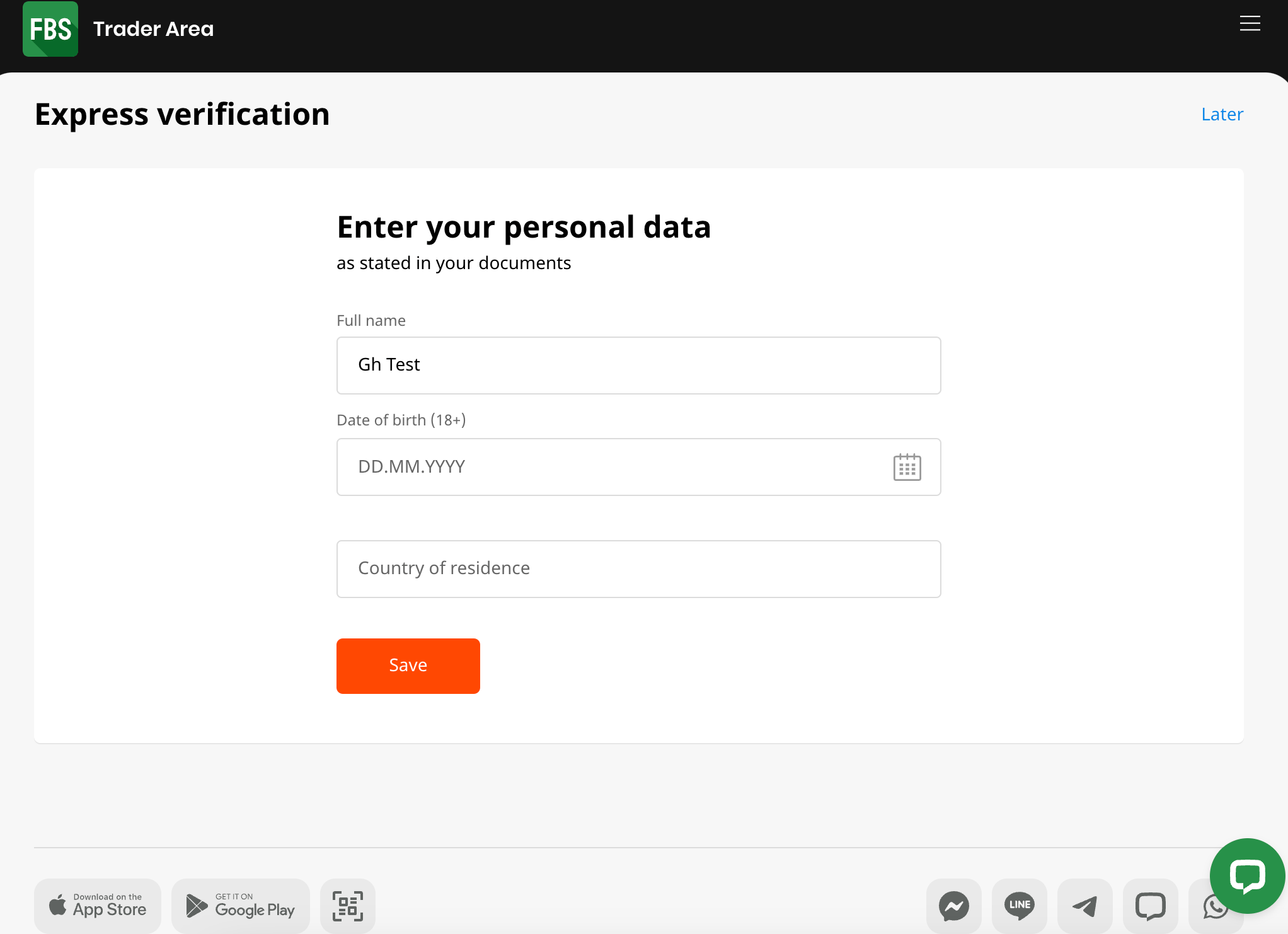

Step 5) Enter your full name, date of birth and country of residence then click ‘Save’.

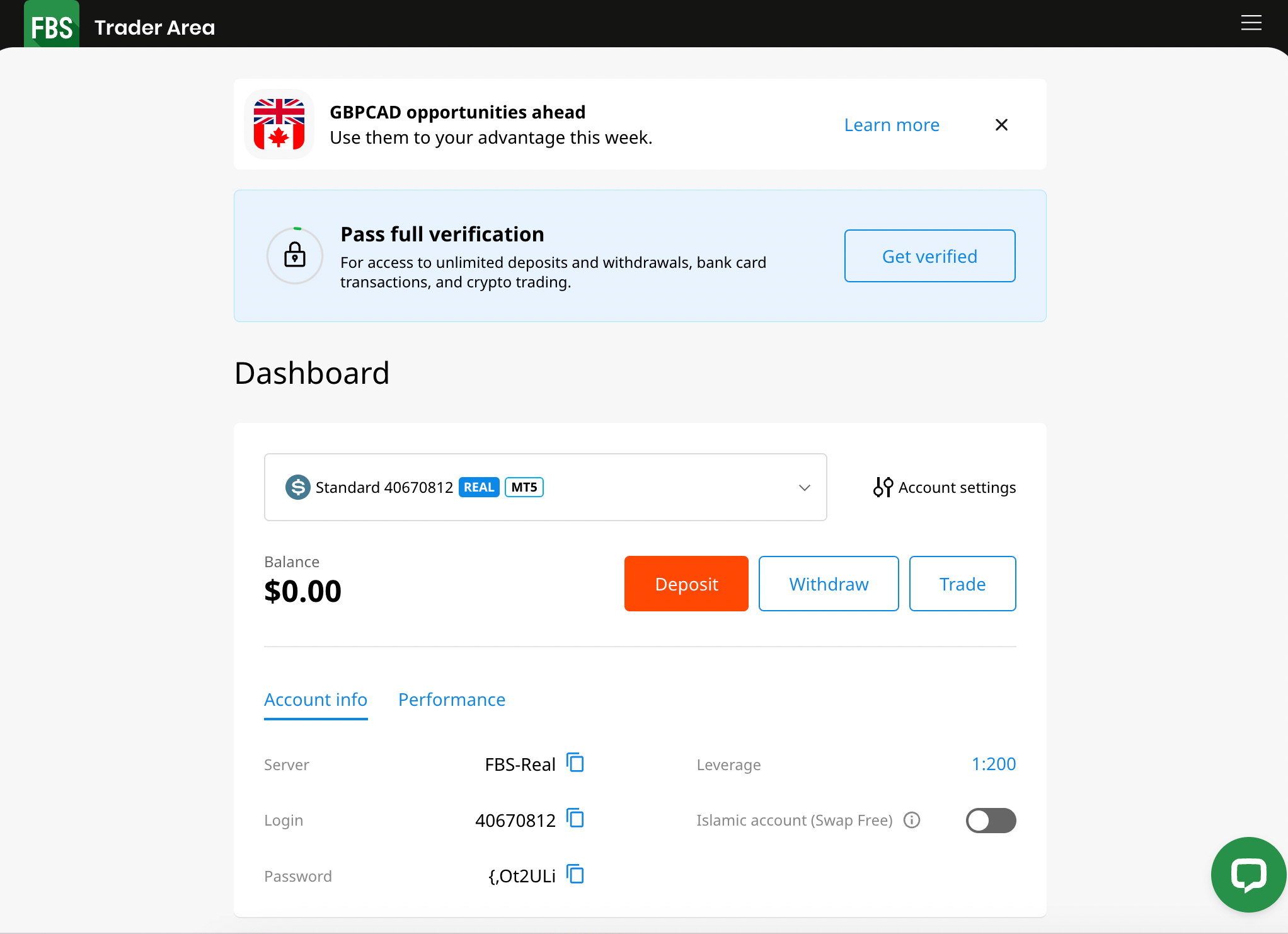

Step 6) You will be redirected to your account dashboard where a standard account has been created for you.

Click on ‘Get Verified’ button to enable you access the full account features.

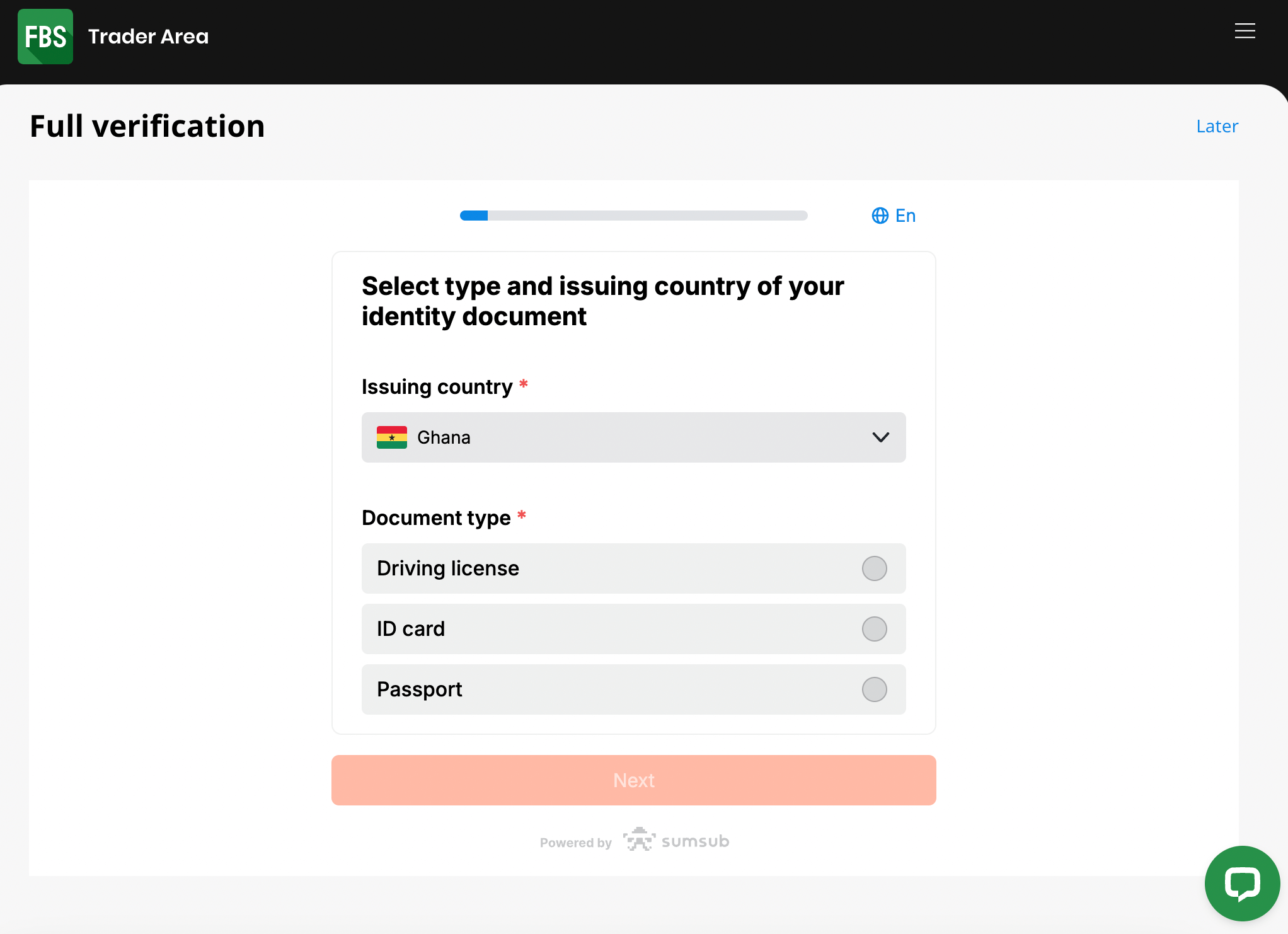

Step 7) Select your country of citizenship, whose ID card you will use to verify your account. Then upload the ID and verify your account. You will also need to verify your phone number.

After verifying your account, you will be able to make deposit, place trades, and withdraw funds from your FBS account.

FBS Deposits & Withdrawals

Payment methods supported by FBS for deposits and withdrawals are mobile money (MTN, Vodafone), cards, and e-wallets (Skrill, Neteller, Sticpay, PerfectMoney). The account/card used for deposit and withdrawal must have the same name as the one on your FBS trading account.

Here is the summary of the deposits and withdrawals on FBS Ghana.

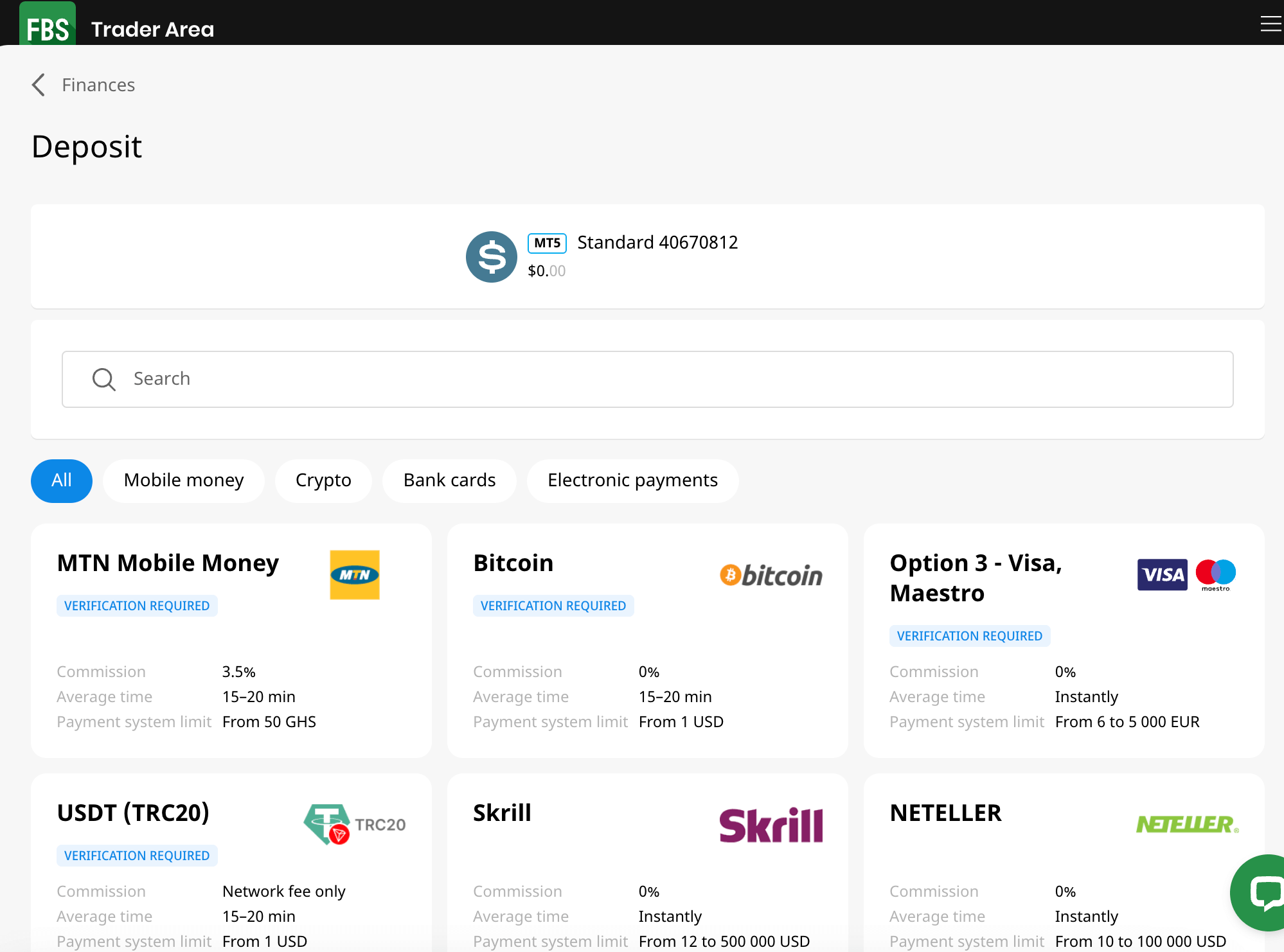

FBS Deposit Methods

Here is a summary of payment methods accepted by FBS for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Mobile Money (GHS – MTN) | Yes | 3.5% per transaction | 15-20 minutes |

| Cards | Yes | Free | Instantly |

| E-wallets | Yes, (Neteller, Skrill, etc) | Free | Instantly |

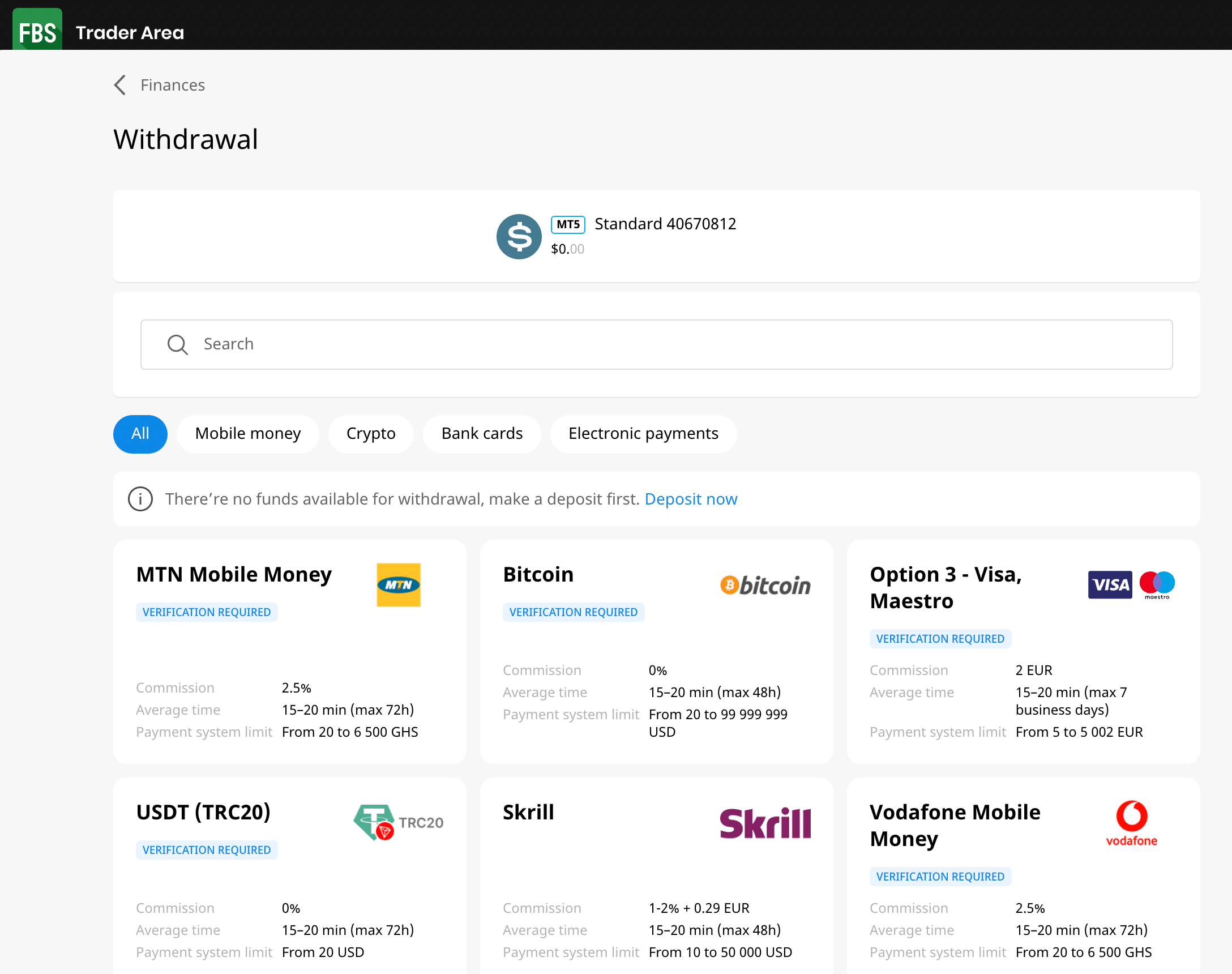

FBS Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on FBS.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Mobile Money (GHS – MTN & Vodafone) | Yes | 2.5% per transaction | 15-20 minutes |

| Cards | Yes | €2 per transaction | 15-20 minutes |

| E-wallets | Yes, (Neteller, Skrill, etc) | 2.5% + $0.3 for SticPay, 2% for Neteller with a mininum of $1 & max. of $30, 1% + $0.32 for Skrill, 0.5% for PerfectMOney | 15-20 minutes |

What is the minimum deposit for FBS?

The minimum deposit on FBS is depends on your account type and payment method you are using. Mobile money (MTN MoMo and Vodafone Money) requires a minimum of GHS 50, cards require €6 and $10 for e-wallets.

How do I deposit money into FBS?

Follow these steps to add money to your FBS account

Step 1) Log into your FBS dashboard via www.fbs.com/cabinet/login

Step 2) Click the ‘Deposit’ on the dashboard and choose the payment method you want to use.

Step 3) Enter the amount you want to add, click the ‘Deposit’ button and follow the on-screen instructions to complete your deposit.

What is FBS Minimum withdrawal?

The minimum withdrawal amount on FBS varies depending on the payment method you are using, although it starts from $1. When withdrawing to mobile money (MTN and Vodafone), the minimum amount is GHS 20.

How much can I withdraw money from FBS?

To withdraw funds from Trade Nation, follow these steps.

Step 1) Log into your FBS dashboard via www.fbs.com/cabinet/login

Step 2) Click ‘Withdraw’ on the dashboard and choose the payment method you want to use.

Step 3) Enter the amount you want to withdraw and follow the on-screen instructions to complete your withdrawal.

FBS Trading Instruments

You can trade over the following financial instruments on FBS:

| Instrument | Availability | Number |

|---|---|---|

| Forex CFDs | Yes | 72 currency pairs on FBS (28 majors and 44 Forex Exotics) |

| Commodities CFDs | Yes | 3 spot Energies on FBS (Brent, Crude, NatGas) |

| Metals CFDs | Yes | 8 pairs of Metals on FBS (Gold, Palladium and Silver paired to USD and EUR) |

| Indices CFDs | Yes | 11 spot indices on FBS (AU200, UK100, US30, and others) |

| Stocks CFDs | Yes | 127 stocks on FBS (US stocks) |

| Cryptos CFDs | Yes | 5 pairs of cryptocurrencies on FBS (BTC, ETH, BCH, XRP, and LTC paired to USD) |

FBS Trading Platforms

Trading platforms supported by FBS are:

1) MetaTrader 4 and MetaTrader 5: FBS supports the MT4 and MT5 trading applications as platforms for trading the financial markets. You can access the platform via the web, and download it on desktop (Windows and Mac) and on mobile devices (iOS and Android).

2) FBS Trader: The FBS Trader is a proprietary trading platform developed by FBS and is available on mobile devices only. You can download it from the Apple App Store or Google Play Store.

FBS Trading Tools

FBS has some trading tools that you can use alongside the trading platform, they are:

1. FBS Economic Calendar: The FBS Economic Calendar Feature helps you keep tabs on important economic events. The built-in Economic Calendar is like a friendly fortune teller for the markets, highlighting key dates like interest rate changes, inflation reports, and job data.

Remember, these events can cause currencies to jump or dive, so being prepared is key! FBS’s calendar help you know what’s coming up and can potentially plan your trades accordingly.

2. FBS Trader’s Calculator: The FBS Trader’s Calculator is a built feature you can access on the FBS website in Australia. You can use it to know how much you could win or lose on a trade. You can also use the calculator to check your margin requirements or the value of each pip movement. You can also access the calculator on their website under the Tools section.

3. FBS Currency Converter: The FBS Currency Converter is your instant translator when trading different currencies. It shows you the exact exchange rate between any two currencies in a flash. Whether you’re dealing with euros, yen, or something else entirely, this tool takes the guesswork out of international trades. It helps you know exactly how much you’re getting and can make sure you are securing the best deals.

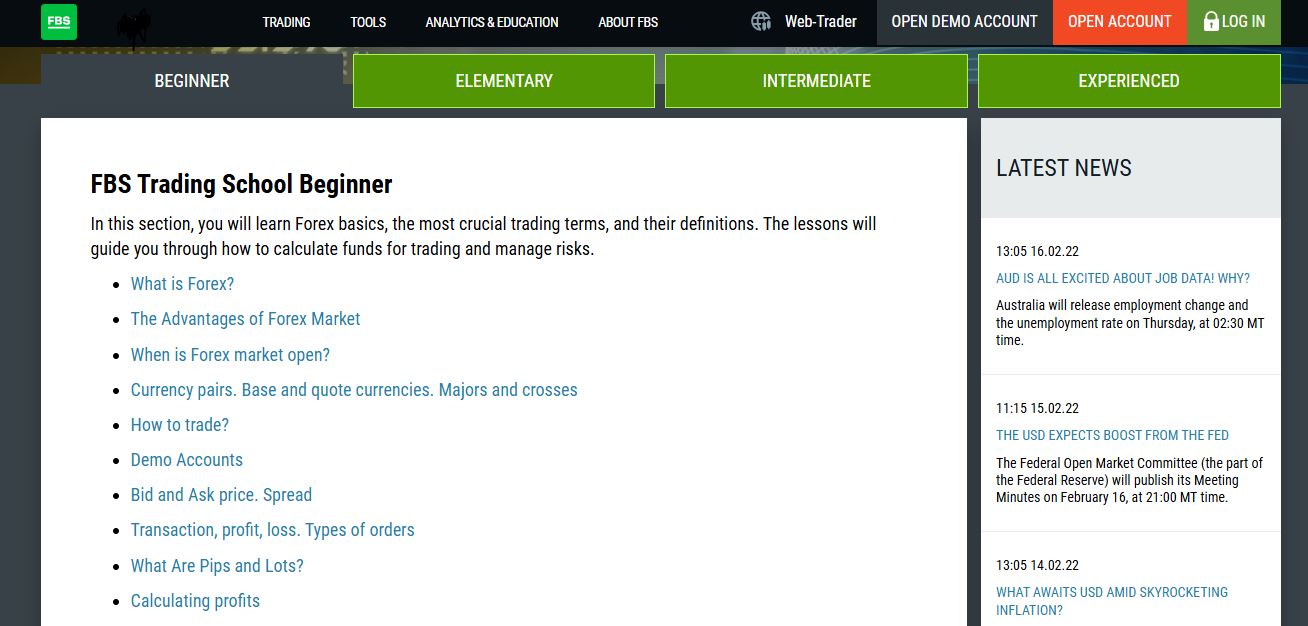

FBS Education

1) Forex guidebook: The forex guidebook is a comprehensive forex trading course. The course has 4 levels: Beginner, Elementary, Intermediate and Experienced. The materials are well structured and you can learn systematically.

It covers the definition of forex, technical analysis, fundamental analysis, terminologies, how to calculate your profit, etc.

FBS Promotions

FBS offers a number of promotions to traders in Ghana registered under FBS Markets Inc, regulated in Belize. Find a summary of various FBS bonuses below:

- 100% Deposit Bonus: This bonus is offered to new traders on their first deposits. You get double the amount you deposit, you can use it to trade and withdraw the profits.

- Cashback: FBS rewards traders with cash rebates on trades of up to $15 per lot traded. You can withdraw this cashback or use it to trade and then withdraw the profits.

Note that you will have to activate these bonuses in your Personal Area to enjoy them. Also, check the Terms and Conditions to be sure you want to activate the bonus on FBS. You can also check out the broker’s website for other bonuses.

At the time of this update, FBS has discontinued all bonuses.

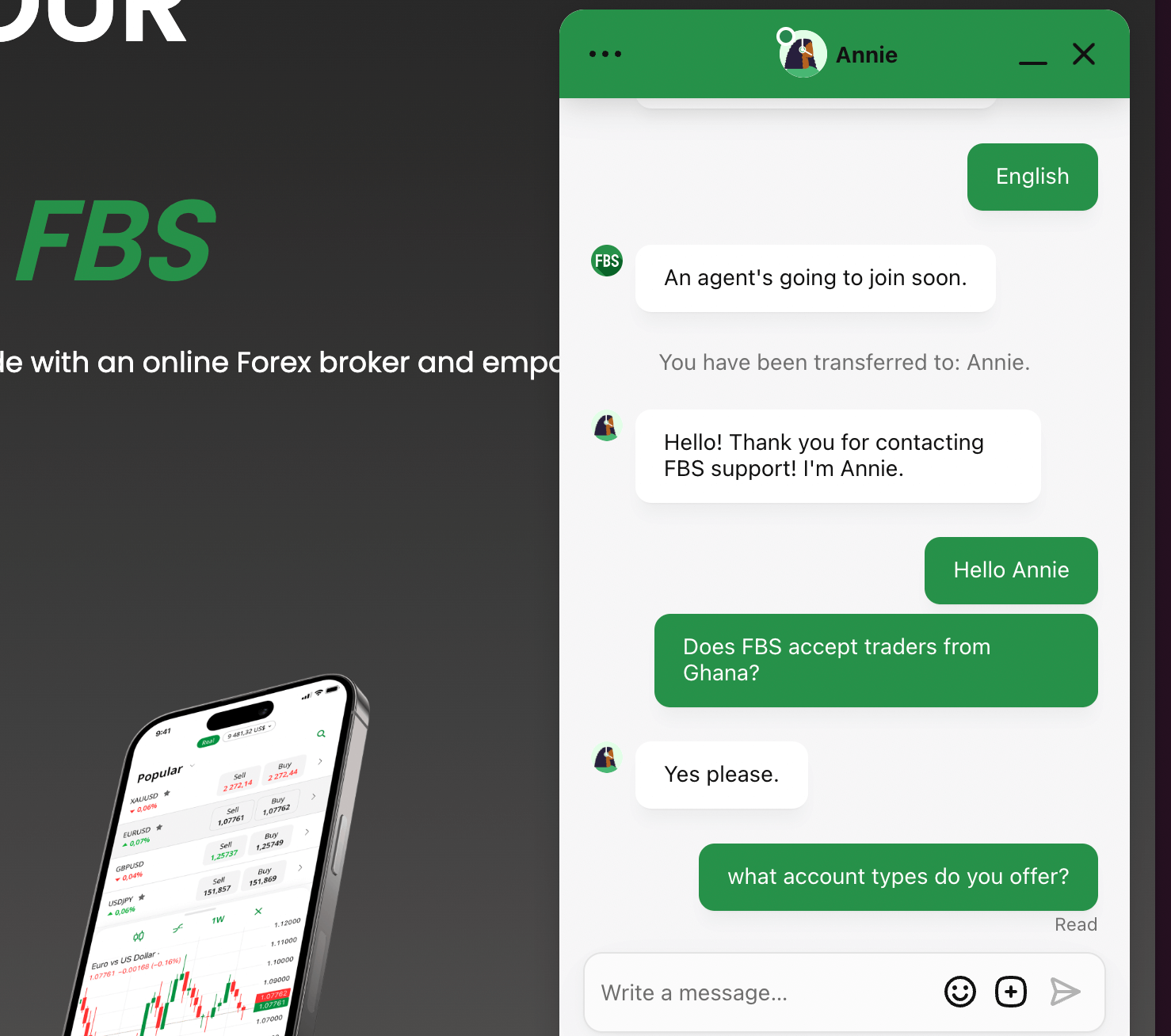

FBS Customer Service

1) Live chat support: The FBS live chat is available 24 hours every day and can be accessed on the broker’s website.

When you first initiate the chat, a chatbot will suggest likely answers in articles to you. Click on ‘Get in touch’ to transfer to a live agent. You will be required to submit your email and name to start the chat.

When our team tested the live chat on the FBS website, the wait time was under 2 minutes before a live agent responded to our chat and the answers to our questions were relevant and prompt.

2) Email support: FBS also offers email support to clients in Ghana. The email is available 24/7 as well. We sent an enquiry to the FBS email support and got an auto-response acknowledging receipt of our enquiry but no live agent replied after several hours. The FBS email address for enquiries in Ghana is [email protected].

3) Phone support: FBS does not offer phone line supports to clients in Ghana, although you can request a call back from the support team via live chat by providing your phone number and the customer support representative will call you within 7 days.

Does FBS Allow Scalping?

Yes, FBS permits Scalping. FBS is an Electronic Communication Network (ECN) broker, which implies that they connect buyers and sellers using electronic communication networks. This feature enables them to offer a tight spread and fast execution speed.

To commence scalping on FBS, they suggest using the ECN account available on MT4. However, it’s essential to remember that scalping is risky, and you must have robust risk management strategies to avoid or mitigate losses.

Do we Recommend FBS Ghana?

FBS is regulated by Tier-1 and Tier-2 financial regulators. This means the broker is obliged to protect clients’ funds. FBS also offers negative balance protection for all clients.

The fees on the platform are moderate as they offer commission-free trading and competitive spreads, and zero inactive account fees, although the broker charges withdrawal fees on all payment methods.

FBS offers a variety of account types to choose from, including demo and Islamic Accounts. This means both beginners and expert traders can sign up on the platform and find an account that is right for them. Although they offer few tradable instruments.

FBS customer support is fair, as they respond fast to enquiries via live chat alone and it is available 24/7.

We recommend that you try FBS after reviewing the instruments available on the platform to be sure they have the assets you want to trade.

FBS Ghana FAQs

What is the minimum deposit for FBS?

GHS 50 is the minimum deposit on FBS via mobile money (MTN & Vodafone) in Ghana. Deposits via cards require a minimum deposit of $5.

Is FBS available in Ghana?

FBS is available in Ghana, and Ghanaian traders are registered under the broker’s regulation in Belize by the Financial Services Commission, Belize as FBS Markets Inc.

How many days does FBS withdrawal take?

15-20 minutes if you are withdrawing to mobile money in Ghana. Other methods may take longer.

Does FBS charge inactivity fee?

FBS does not charge account inactivity fee. If you do not log into your account or perform any trade for any amount of time, no fees will be charged on the funds in your account.

Note: Your capital is at risk